UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year endedDecember 31, 20202023

Commission File Number: 001-35039

BankUnited, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 27-0162450 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 14817 Oak Lane | Miami Lakes | FL | 33016 |

| (Address of principal executive offices) | | | (Zip Code) |

Registrant’s telephone number, including area code: (305) 569-2000

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Class | | Trading Symbol | | Name of Exchange on Which Registered |

| Common Stock, $0.01 Par Value | | BKU | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | Emerging growth company | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act o

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to Section 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant on June 30, 20202023 was $1,852,385,492$1,582,728,768.

The number of outstanding shares of the registrant common stock, $0.01 par value, as of February 24, 202116, 2024 was 92,862,055.74,371,130.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the registrant's definitive proxy statement for the 20212024 annual meeting of stockholders are incorporated by reference in this Annual Report on Form 10-K in response to Part II. Item 5 and Part III. Items 10, 11, 12, 13 and 14.

BANKUNITED, INC.

Form 10-K

For the Year Ended December 31, 20202023

TABLE OF CONTENTS

GLOSSARY OF DEFINED TERMS

The following acronyms and terms may be used throughout this Form 10-K, including the consolidated financial statements and related notes.

| | | | | | | | |

| ACI | | Loans acquired with evidence of deterioration in credit quality since origination (Acquired Credit Impaired)

| ACL | | Allowance for credit losses |

| AFS | | Available for sale |

| ALCO | | Asset/Asset Liability Committee |

ALLLALM | | Allowance for loan and lease lossesAsset Liability Management |

| AOCI | | Accumulated other comprehensive income |

| APY | | Annual Percentage Yield |

| ARM | | Adjustable rate mortgage |

| ASC | | Accounting Standards Codification |

| ASU | | Accounting Standards Update |

| | |

| | |

| Basel Committee | | International Basel Committee on Banking Supervision |

| BHC Act | | Bank Holding Company Act of 1956 |

| BHC | | Bank holdingHolding company |

| | |

| BKU | | BankUnited, Inc. |

| BOLI | | Bank Owned Life Insurance |

| BankUnited | | BankUnited, National Association |

| The Bank | | BankUnited, National Association |

| Bridge | | Bridge Funding Group, Inc. |

| | |

| Buyout loans | | FHA and VA insured mortgages from third party servicers who have exercised their right to purchase these loans out of GNMA securitizations |

| CAO | | Chief Accounting Officer |

| CARES Act | | Coronavirus Aid, Relief, and Economic Security Act |

| CCA | | Cloud Computing Arrangements |

| CCAR | | Comprehensive Capital Analysis and Review |

| CDARS | | Certificate of Deposit Account Registry Service |

| | |

| CD | | Certificate of Deposit |

| CECL | | Current expected credit losses |

| CET1 | | Common Equity Tier 1 capital |

| CFPB | | Consumer Financial Protection Bureau |

| C&I | | Commercial and Industrial loans, including owner-occupied commercial real estate |

| CFO | | Chief Financial Officer |

| CIO | | Chief Information Officer |

| CISO | | Chief Information Security Officer |

| CLO | | Collateralized loan obligations |

| CMBS | | Commercial mortgage-backed securities |

| CME | | Chicago Mercantile Exchange |

| CMOs | | Collateralized mortgage obligations |

| Commercial Shared-Loss Agreement | | A commercial and other loans shared-loss agreement entered into with the FDIC in connection with the FSB Acquisition

| | |

Covered loans | | Loans covered under the Loss Sharing Agreements |

| COVID-19 | | Coronavirus disease of 2019 |

| | |

| CRA | | Community Reinvestment Act |

| CRE | | Commercial real estate loans, including non-owner occupied commercial real estate and construction and land |

| CRO | | Chief Risk Officer |

| DFAST | |

| CVA | | Credit Valuation Adjustment |

| Dodd-Frank Act Stress Test | |

| | |

| DIF | | Deposit insurance fund |

| DSCR | | Debt Service Coverage Ratio |

EPSESG | | Earnings per common shareEnvironmental, social and governance |

| | |

| | | | | | | | |

| EVE | | Economic value of equity |

| | |

| | |

| FASB | | Financial Accounting Standards Board |

ExIm BankFCA | | Export–Import Bank of the United StatesThe Financial Conduct Authority |

| FDIA | | Federal Deposit Insurance Act |

| | | | | | | | |

| FDIC | | Federal Deposit Insurance Corporation |

| | |

| FHA | | Federal Housing Administration |

| FHFA | | Federal Housing Finance Agency |

| FHLB | | Federal Home Loan Bank |

| FICO | | Fair Isaac Corporation (credit score) |

| FinTech | | Financial Technology |

| | |

| FRB | | Federal Reserve Bank |

FSB Acquisition | | Acquisition of substantially all of the assets and assumption of all of the non-brokered deposits and substantially all of the other liabilities of BankUnited, FSB from the FDIC on May 21, 2009 |

| | |

| GAAP | | U.S. generally accepted accounting principles |

| GDP | | Gross Domestic Product |

| GLB Act | | The Gramm-Leach-Bliley Financial Modernization Act of 1999 |

| GNMA | | Government National Mortgage Association |

| | |

| HPI | | Home price indices |

| HTM | | Held to maturity |

| IPO | | Initial public offering

| | |

| | |

| | |

| ISDA | | International Swaps and Derivatives Association |

| | |

| LGD | | Loss Given Default |

| LIBOR | | London InterBank Offered Rate |

| | |

Loss Sharing AgreementsLIHTC | | Two loss sharing agreements entered into with the FDIC in connection with the FSB AcquisitionLow Income Housing Tax Credits |

| LTV | | Loan-to-value |

| MAT | | Materiality Assessment Team |

| MBS | | Mortgage-backed securities |

| MSA | | Metropolitan Statistical Area |

| | |

| | |

MSLFMWL | | Federal Reserve Main Street Lending FacilityMortgage warehouse lending |

| MSRs | | Mortgage servicing rights

| | |

| | |

| | |

| NRSRO | | Nationally recognized statistical rating organization |

| NSF | | Non-sufficient funds |

| NYSE | | New York Stock Exchange |

| | |

| OCC | | Office of the Comptroller of the Currency |

| | |

| | |

| OFAC | | U.S. Department of the Treasury's Office of Foreign Assets Control |

| | |

| OREO | | Other real estate owned |

| | |

OTTIPCAOB | | Other than temporary impairmentPublic Company Accounting Oversight Board |

| PCD | | Purchased credit-deteriorated |

| PD | | Probability of default |

| Pinnacle | | Pinnacle Public Finance, Inc. |

| PPNR | | Pre-tax, pre-provision net revenue

| PPP | | Small Business Administration’s Paycheck Protection Program

| PPPLF | | FRB Paycheck Protection Program Liquidity Facility

| Proxy Statement | | Definitive proxy statement for the Company's 20212023 annual meeting of stockholders |

| PSU | | Performance Share Unit |

| | |

| REIT | | Real Estate Investment Trust |

| | |

| | |

| ROU Asset | | Right-of-use Asset |

| RPA | | Risk Participation Agreement |

| RSA | | Restricted Share Award |

| RSU | | Restricted Share Unit |

| RWA | | Risk-weighted Assets |

| SAR | | Share Appreciation Right |

| SBA | | U.S. Small Business Administration |

| | |

| SEC | | Securities and Exchange Commission |

| | |

Single Family Shared-Loss Agreement | | A single-family loan shared-loss agreement entered into with the FDIC in connection with the FSB Acquisition |

| SOFR | | Secured Overnight Financing Rate |

| S&P 500 | | Standard & Poor's 500 Index |

| | |

TDR | | Troubled-debt restructuring |

| | | | | | | | |

| TDR | | | | | | | | Troubled-debt restructuring |

| Tri-State | | New York, New Jersey and Connecticut |

| UPB | | Unpaid principal balance |

| USDA | | U.S. Department of Agriculture |

| VA loan | | Loan guaranteed by the U.S. Department of Veterans Affairs |

| VIEs | | Variable interest entities |

| VIX | | CBOE Volatility Index

| WARM | | Weighted-average remaining maturity |

| 2010 Plan | | 2010 Omnibus Equity Incentive Plan |

| 2014 Plan | | 2014 Omnibus Equity Incentive Plan |

| 401(k) Plan | | BankUnited 401(k) Plan |

| | |

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as "anticipate," "expect," "intend," "plan," "believe," "seek," "estimate," "project," "predict," "will" and similar expressions identify forward-looking statements.

These forward-looking statements are based on management's current views with respect to future results, and are subject to risks and uncertainties. Forward-looking statements are based on beliefs and assumptions made by management using currently available information, such as market and industry materials,data, historical performance and current financial trends. These statements are only predictions and are not guarantees of future performance. The inclusion of forward-looking statements should not be regarded as a representation by the Company that the future plans, estimates or expectations contemplated by a forward-looking statement will be achieved. Forward-looking statements are subject to various risks and uncertainties and assumptions, including those relating to the Company's operations, financial results, financial condition, business prospects, growth strategy and liquidity, including as impacted by the COVID-19 pandemic.liquidity. If one or more of these or other risks or uncertainties materialize, or if the Company's underlying assumptions prove to be incorrect, the Company's actual results could differ materially from those contemplated by a forward-looking statement. These risks and uncertainties include, without limitation:

•impacts of the COVID-19 pandemic on the Company's business operations, financial condition and results of operations;

•strategic risk:

◦an inability to successfully execute our core business strategy;

◦competition;

◦natural or man-made disasters, social or health care crises or political unrest;

◦loss of executive officers or key personnel;

◦climate change or societal responses thereto;

•credit risk inherent in the business of making loans and embedded in our securities portfolio:

◦inadequate allowance for credit losses:

◦the accuracy and completeness of information about counterparties and borrowers;

◦real estate market conditions, real estate valuations and other risks related to holding loans secured by real estate or real estate received in satisfaction of loans;

◦geographic concentration of the Company's markets in Florida and the New York tri-state area;

◦fluctuations in demand for and valuation of equipment under operating lease;lease equipment;

•interest rate risk, including risks related to reference rate reform;

•liquidity risk;risk:

◦an inability to maintain adequate liquidityliquidity;

◦restrictions on the ability of BankUnited, N.A. to pay dividends to BankUnited, Inc.;

•risks related to the regulation of our industry;

•operational risk:

◦inadequate or inaccurate forecasting tools and models;

◦inability to successfully launch new products, services, or business initiatives;

◦susceptibility to fraud, risk or errors;

◦dependence on information technology and third party service providers and the risk of systems failures, interruptions or breaches of security or inability to keep pace with technological change;

•reputational risk;

•a variety of complianceregulatory, legal and legal risks;compliance;

•the impact of conditions in the financial markets and economic conditions generally;

•ineffective risk management or internal controls; and

•the selection and application of accounting policies and methods and related assumptions and estimates.

Additional factors are set forth in the Company's filings with the SEC, including this Annual Report on Form 10-K10-K.

Forward-looking statements speak only as of the date on which they are made. The Company expressly disclaims any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

As used herein, the terms the "Company," "we," "us," and "our" refer to BankUnited, Inc. and its subsidiaries unless the context otherwise requires.

PART I - FINANCIAL INFORMATION

Item 1. Business

Overview

BankUnited, Inc., with total consolidated assets of $35.0$35.8 billion at December 31, 2020,2023, is a bank holding company with one direct wholly-owned subsidiary, BankUnited, collectively, the Company. BankUnited, a national banking association headquartered in Miami Lakes, Florida, provides a full range of commercial lending and both commercial and consumer deposit services through banking centers located in Florida, and the New York metropolitan area.area and Dallas, Texas, and a comprehensive suite of wholesale products to customers through an Atlanta office focused on the Southeast region. The Bank also provides certain commercial lending and deposit products through national platforms and certain consumer deposit products through an online channel. Our core business strategy is to continue to build a leading regional commercial and small business bank with a distinctive value proposition based on strong service-oriented relationships, robust digital enabled customer experiences and operational excellence, and with an entrepreneurial work environment that empowers employees to deliver their best. To date, we have executed our strategy primarily through organic growth.

The Company was formed in 2009, when BankUnited entered into a Purchasegrowth and Assumption Agreement with the FDIC and acquired substantially all of the assets and assumed all of the non-brokered deposits and substantially all of the other liabilities of BankUnited FSB from the FDIC in the FSB Acquisition. Concurrently, BankUnited entered into the Single Family Shared-Loss Agreement and the Commercial Shared-Loss Agreement with the FDIC. The Commercial Shared-Loss Agreement terminated in 2014, and the Single Family Shared-Loss Agreement terminated in February, 2019. The Shared-Loss Agreements, assets formerly covered under the terms of those agreements, and transactions involving those assets have not had a material impact on the Company's financial condition or results of operations since the year ended December 31, 2018.anticipate that we will most likely continue to do so.

Our Products and Services

Lending and Leasing

General—Our primary lending focus is to serve small and middle-market and larger corporate businesses with a variety of financial products and services, while maintaining a disciplined credit culture. We offer a full array of lending products that cater to our customers' needs and have attracted and invested in experienced relationship management teams in our primary lending markets.

Commercial loans—Our commercial loans, which are generally made to growing small business, middle-market and larger corporate entities and non-profit organizations, include secured and unsecured lines of credit, formula-based lines of credit, equipment loans, owner-occupied commercial real estate term loans and lines of credit, mortgage warehouse lines, subscription finance facilities, letters of credit, commercial credit cards, SBA and USDA product offerings, Export-Import Bank financing products, trade finance and business acquisition finance credit facilities. The Bank is also supporting its customers through participation in government programs such as the Small Business Administration's PPP and the Federal Reserve's MSLF.

Through the Bank's two commercial lending subsidiaries, Pinnacle and Bridge, we provide municipal, equipment and franchise financing on a national basis. Pinnacle, headquartered in Scottsdale, Arizona, provides financing to state and local governmental entities directly and through vendor programs and alliances. Pinnacle offers a full array of financing structures including essential use equipment lease purchase and loan agreements and direct (private placement) bond refundings. Bridge, headquartered in Baltimore, Maryland, offers large corporate and middle marketmiddle-market businesses equipment loans and leases including finance lease and operating lease structures through its equipment finance division. Bridge offers franchise equipment, acquisition and expansion financing through its franchise finance division. These lines of business have been de-emphasized due to their risk/return and liquidity profiles in the current environment. We expect that related balances will continue to decline in the near term.

Commercial real estate loans—We offer term financing for the acquisition or refinancing of properties, primarily rental apartments, mixed-use commercial properties, industrial properties, warehouses, retail shopping centers, free-standing single-tenant buildings, office buildings and hotels. Other products that we provide include real estate secured lines of credit, lending to REITs and institutional asset owners, subscription lines of credit to real estate funds, and, to a limitedlesser extent, acquisition, development and construction loan facilities and construction financing. In the current environment, we have de-emphasized lending in the office sector and been more focused on warehouse/industrial, multi-family and selectively, the retail sectors.

Residential mortgages—We do not originate residential loans,mortgages, but do invest in residential loans originated through correspondent channels and community partners. Our residential loan portfolio is primarily comprised of loans purchased on a national basis through select correspondent channels. This national purchase program allows us to diversify our loan portfolio, both by product type and geography. Residential loans purchased are primarily closed-end, first lien jumbo mortgages for the purchase or re-finance of owner occupiedowner-occupied property. A limited portion of the portfolio is secured by investor-owned properties. We do not originate or purchase negatively amortizing or sub-prime residential loans. We also acquire non-performing FHA and VA insured mortgages from third party servicers who have exercised their right to purchase these loans out of GNMA

securitizations. Such loans that re-perform, either through modification or self-cure, may be eligible for re-securitization. The Company and the servicer share in the economics of the sale of these loans into new securitizations.

Other consumer loans—We do not originate, or currently intend to originate a significant amount of consumer loans. Home equity loans and lines of credit and other consumer loans are not significant components of our loan portfolio or of our lending strategy.

Credit risk management - —Credit is analyzed, approved and managed through our linethree lines of defense framework as prescribed in our credit policies and procedures as follows. Credit is:procedures.

•Analyzed withinFirst Line of Defense - Credit opportunities are sourced, analyzed, recommended and managed by our first linelines of defensebusiness in accordance with ourestablished credit procedures;procedures.

•ApprovedSecond Line of Defense - Our credit administration division, reporting to the Chief Risk Officer, is responsible for the evaluation and approval of recommended credit opportunities. Approval of credit and confirmation of risk ratings is performed within our second line of defense in accordance with oura risk-based delegated credit approval framework;framework. The credit administration division also provides governance and oversight of our credit policies and procedures.

•Managed by our first and second linesThird Line of defense based uponDefense - Credit Review, reporting directly to the credit’sRisk Committee of the Board of Directors, provides an independent assessment of credit risk and performance characteristics.the effectiveness of credit risk management processes across the organization. Credit Review performs risk-based testing through both examinations and ongoing monitoring.

Asset oversight committees meet at least quarterly and provide oversight of key credit governance, transactional and credit management functions. These committees include:

•Credit Risk Management Committee with responsibilities including credit governance policies and procedures and changes thereto and establishing and maintaining the delegated credit approval framework;

•Executive Credit Committee with responsibilities including transactional credit approval for large and/or complex credit exposures as well as the approval of periodic asset monitoring reports for large and/or complex credit exposures;

•Criticized Asset Committee with responsibilities including the evaluation and oversight of higher risk assets and oversight of workout and recovery functions; and

•Residential Credit Risk Management Committee with responsibilities including residential and consumer portfolio performance monitoring and certain bulk purchase transactional authorities.

Our In-house Lending Limits, ranging from $75$125 million to $150 million, are based upon loan type and are further limited by our risk-based Hold Limits that incorporate our assessment of the borrower’s financial condition and industry exposure. These limits are significantly below our legal lending limit. These limitslimit and are reviewed periodically by the Credit Risk Management Committee and approved annually by the Board of Directors.

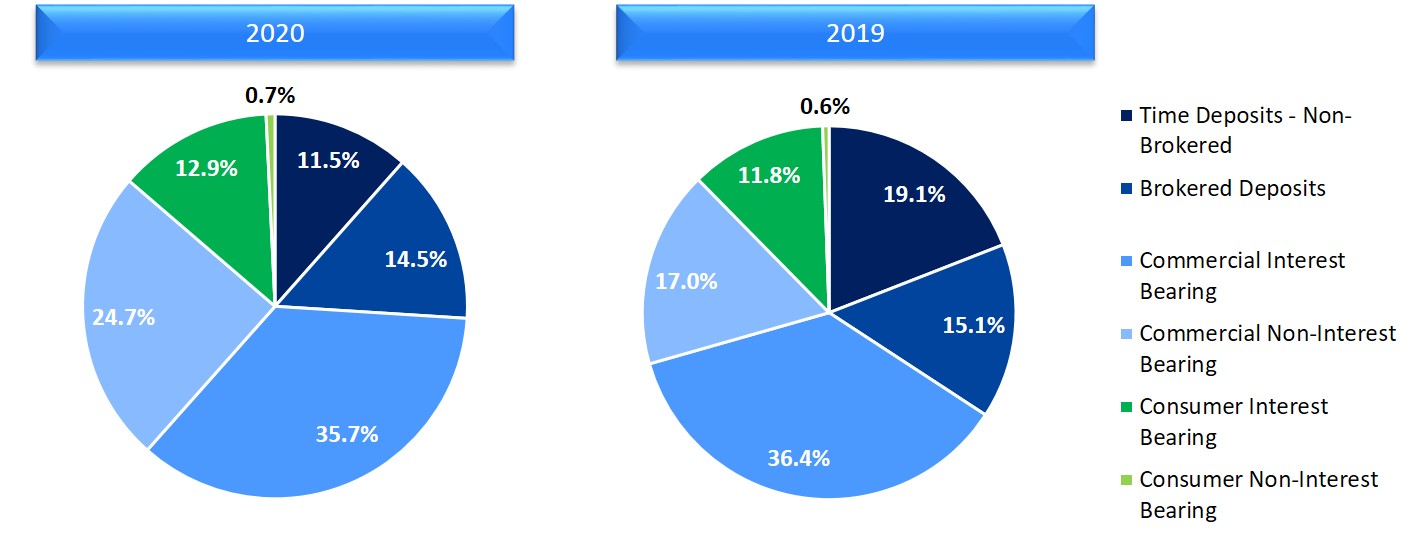

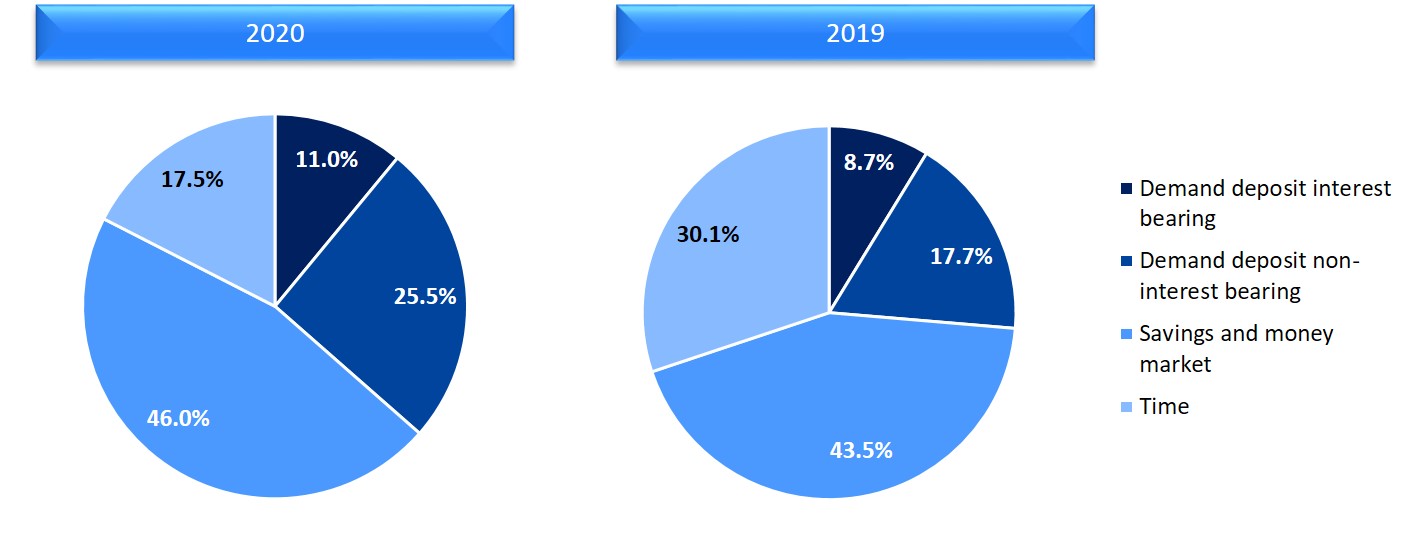

Deposit and Treasury Solutions Products

We offer traditional deposit products including commercial and consumer checking accounts, money market deposit accounts, savings accounts and certificates of deposit with a variety of terms and rates, as well as a robust suite of treasury, commercial payments and cash management services. We offer commercial and retail deposit products across our primary geographic footprint and certain commercial deposit, payments and treasury management products and services nationally. We offer the CDARS program, providing additional FDIC insurance to our customers. We also offer other insured cash sweep programs allowing customers the ability to insure deposits above standard FDIC deposit insurance limits by distributing funds among banks that participate in the network while providing competitive rates and easy access to funds. For our consumers, we also offer competitive money market and time deposit products through our online channel.channel as well as through our retail branch network. Demand deposit balances are concentrated in commercial and small business accounts and our deposit growth strategy is focused on small business and middle market companies generally, as well as select industry verticals. Our service fee schedule and rates are competitive with other financial institutions in our markets. We do not charge consumer overdraft or NSF fees.

Our Markets

Our primary banking markets are Florida and the Tri-State market of New York, New Jersey and Connecticut, concentrated in the New York Metropolitan area. We believe both represent long-term attractive banking markets. In Florida, our largest concentrationfocus is inon urban markets including the Miami metropolitan statistical area; however, we are also focused on growth in other urban Florida markets in which we have a presence, such as theMiami-Dade, Broward, Palm Beach, Tampa, Orlando and Jacksonville markets. According to estimates fromWe have more recently entered the Atlanta and Dallas markets, in Atlanta with a wholesale banking office focused on the Southeastern United States, Census Bureau and S&P Global Market Intelligence, from 2017 to 2020, Florida added approximately 800 thousand new residents, the second most of any U.S. state and hadin Dallas with a total population of 21.9 million. According to the FDIC,retail branch as well as full-service wholesale banking capabilities. Our future strategy may include organic expansion into other markets, but no specific additional markets have been identified at June 30, 2020, the Tri-State area had approximately $2.7 trillion in deposits, with the majority of the market concentrated in the New York metropolitan area. The Tri-State area had a total population of 31.8 million. We recently launched lending operations in Atlanta, which are not currently material to our business operations.this time.

Pinnacle and Bridge offer lending products and the Bank provides mortgage warehouse financing on a national basis. We also offer a suite of commercial deposit, treasury solutions and cash management products nationally, primarily focused on select industry verticals. We have historically engaged in SBA lending on a national basis, selling the government guaranteed

portion of our SBA and USDA loans on a servicing retained basis, and retaining the unguaranteed portion in portfolio. We have recently shifted our SBA lending strategy to an in-footprint strategy executed in partnership with our small business bankers and may retain the guaranteed portion of more of these loans in portfolio in the future.

Competition

Our primary markets are highly competitive, containing not only a large number of community and regional banks, but also a significant presence of the country's largest commercial banks. We compete with other state, national and international banks as well as savings associations, savings banks and credit unions with physical presence in our market areas or targeting our market areas digitally for deposits and loans. In addition, we compete with financial intermediaries, such as FinTech companies, consumer finance companies, mortgage banking companies, insurance companies, securities firms, mutual funds and several government agencies as well as major retailers, all actively engaged in providing various types of loans and other financial services. Our largest banking competitors in Florida and the Florida marketSoutheast include Truist, JPMorgan Chase, PNC, Regions Bank, TD Bank, Wells Fargo, Bank of America, First Horizon, Synovus, and a number of community banks. In the Tri-State market, we also compete with, in addition to the national and international financial institutions listed above, Capital One, Signature Bank, New York Community Bank, Valley National Bank, M&T Bank and numerous community banks.

Interest rates on both loans and deposits and prices of fee-based services are significant competitive factors among financial institutions generally. Other important competitive factors include convenience, quality of customer service, availability and quality of digital offerings, community reputation, continuity of personnel and services, and, in the case of larger commercial customers, relative lending limits and ability to offer sophisticated cash management and other commercial banking services. While we continue to provide competitive interest rates on both depository and lending products, we believe that we can compete most successfully by focusing on the financial needs of growing companies and small and middle-market businesses, offering them a broad range of personalized services, digital platforms and sophisticated cash management tools tailored to their businesses.

Regulation and Supervision

The U.S. banking industry is highly regulated under federal and state law. These regulations have a material effect on the operations of BankUnited, Inc. and its direct and indirect subsidiaries.

Statutes, regulations and policies limit the activities in which we may engage and the conduct of our permitted activities and establish capital requirements with which we must comply. The regulatory framework is intended primarily for the protection of depositors, borrowers, customers and clients, the FDIC deposit insurance fundsfund and the banking system as a whole, and not for the protection of our stockholders or creditors. In many cases, the applicable regulatory authorities have broad enforcement power over bank holding companies,BHCs, banks and their subsidiaries, including the power to impose substantial monetary fines and other penalties for violations of laws and regulations.regulations or engaging in unsafe and unsound banking practices. Further, the regulatory system imposes reporting and information collection obligations. We incur significant costs related to compliance with these laws and regulations. Banking statutes, regulations and policies are continually under review by federal and state legislatures and regulatory agencies, and a change in them, including changes in how they are interpreted or implemented, could have a material impact on our business.

The material statutory and regulatory requirements that are applicable to us are summarized below. The description below is not intended to summarize all laws and regulations applicable to us.us and is qualified in its entirety by reference to the full text of the statutes, regulations, policies and other written guidance that are described.

Bank and Bank Holding Company Regulation

BankUnited is a national bank. As a national bank organized under the National Bank Act, BankUnited is subject to ongoing and comprehensive supervision, regulation, examination and enforcement by the OCC.

Any entity that directly or indirectly controls a national bank must be approved by the Federal Reserve Board under the BHC Act to become a BHC. BHCs are subject to regulation, inspection, examination, supervision and enforcement by the Federal Reserve Board under the BHC Act. The Federal Reserve Board's jurisdiction also extends to any company that is directly or indirectly controlled by a BHC.

BankUnited, Inc., which controls BankUnited, is a BHC and, as such, is subject to ongoing and comprehensive supervision, regulation, examinationinspection and enforcement by the Federal Reserve Board.

Broad Supervision, Examination and Enforcement Powers

A principal objective of the U.S. bank regulatory system is to protect depositors by ensuring the financial safety and soundness of banking organizations. To that end, the banking regulators have broad regulatory, examination and enforcement

authority. The regulators regularly examine the operations of banking organizations. In addition, banking organizations are subject to periodic reporting requirements.

The regulators have various remedies available if they determine that the financial condition, capital resources, asset quality, earnings prospects, management, liquidity, sensitivity to market risk, compliance or other aspects of a banking organization's operations are unsatisfactory.less than satisfactory, or that the banking organization is operating in an unsafe or unsound manner. The regulators may also take action if they determine that the banking organization or its management is violating or has violated any law or regulation. The regulators have the power to, among other things:

•enjoin "unsafe or unsound" practices;

•require affirmative actions to correct any violation or practice;

•issue administrative orders that can be judicially enforced;

•refer significant compliance violations to the U.S. Justice Department;

•direct increases in capital;

•direct the sale of subsidiaries or other assets;

•limit dividends and distributions;

•restrict growth;

•assess civil monetary penalties;

•remove officers and directors; and

•terminate deposit insurance.insurance; and

The•appoint a conservator or receiver.

Engaging in unsafe or unsound practices or failing to comply with applicable laws, regulations and supervisory agreements could subject BankUnited, Inc., the Bank and their subsidiaries or their officers, directors and institution-affiliated parties to the remedies described above and other sanctions. In addition, the FDIC may terminate a depository institution's deposit insurance upon a finding that the institution's financial condition is unsafe or unsound or that the institution has engaged in unsafe or unsound practices or has violated any applicable rule, regulation, order or condition enacted or imposed by the institution's regulatory agency. Engaging in unsafe or unsound practices or failing to comply with applicable laws, regulations and supervisory agreements could subject BankUnited, Inc., the Bank and their subsidiaries or their officers, directors and institution-affiliated parties to the remedies described above and other sanctions.

Notice and Approval Requirements Related to Control

BankingBankUnited, Inc. must generally receive bank regulatory approval before it can acquire a financial institution. Specifically, as a BHC, BankUnited, Inc. must obtain prior approval of the Federal Reserve in connection with any acquisition that would result in BankUnited, Inc. acquiring substantially all the assets, or owning or controlling 5% or more of any class of voting securities, of a bank or another BHC. The statutory factors that the Federal Reserve is required to consider in considering an application include the financial and managerial resources of the parties and the future prospects of the combined organization, the effects of the transaction on competition, the convenience and needs of the community, including the record of performance of the parties under the CRA, the effectiveness of the acquiring company in combating money-laundering activities and the impact of the transaction on the financial stability of the U.S. banking or financial system.

In addition, federal and state banking laws impose notice, approval, and ongoing regulatory requirements on any stockholder or other party that seeks to acquire direct or indirect "control" of an FDIC-insured depository institution.institution or BHC. These laws include the BHC Act and the Change in Bank Control Act. Among other things, these laws require regulatory filings by individuals or companies that seek to acquire direct or indirect "control" of an FDIC-insured depository institution. The determination of whether an investor "controls" a depository institution is based on all of the facts and circumstances surrounding the investment. As a general matter, a party is deemed to control a depository institution or other company if the party owns or controls 25% or more of any class of voting stock. Subject to rebuttal, a party may be presumed to control a depository institution or other company if the investor owns or controls 10% or more of any class of voting stock. Except under limited circumstances, BHCs are prohibited

The BHC Act prohibits any entity from acquiring without prior approval,25% (as noted above, the BHC Act has a lower limit for acquirers that are existing BHCs) or more of a BHC’s or bank’s voting securities, or otherwise obtaining control of any other bank or a controlling influence over a BHC or substantially allbank without the assets thereof or moreapproval of the Federal Reserve. The Federal Reserve has rule-based standards for determining whether one company has control over another. These rules established four categories of tiered presumptions of non-control

that are based on the percentage of voting shares held by the investor (less than 5%, 5-9.9%, 10-14.9% and 15-24.9%) and the presence of other indicia of control. As the percentage of ownership increases, fewer indicia of control are permitted without falling outside of the presumption of non-control. These indicia of control include nonvoting equity ownership, director representation, management interlocks, business relationships and restrictive contractual covenants. Investors can hold up to 24.9% of the voting sharessecurities and 33% of the total equity of a bank or BHC which is not alreadycompany without necessarily having a subsidiary.controlling influence.

Permissible Activities and Investments

Banking laws generally restrict the ability of BankUnited, Inc. to engage in activities other than those determined by the Federal Reserve Board to be so closely related to banking or managing or controlling banks as to be a proper incident thereto. The GLB Act expanded the scope of permissible activities for a BHC that qualifies as a financial holding company. Under the regulations implementing the GLB Act, a financial holding company may engage in additional activities that are financial in nature or incidental or complementary to a financial activity. BankUnited, Inc. is not a financial holding company.

In addition, as a general matter, the establishment or acquisition by BankUnited, Inc. of a non-bank entity, or the initiation of a non-banking activity, requires prior regulatory approval. In approving acquisitions or the addition of activities, the Federal Reserve Board considers, among other things, whether the acquisition or the additional activities can reasonably be expected to produce benefits to the public, such as greater convenience, increased competition or gains in efficiency, that outweigh such possible adverse effects as undue concentration of resources, decreased or unfair competition, conflicts of interest or unsound banking practices.

Regulatory Capital Requirements and Capital Adequacy

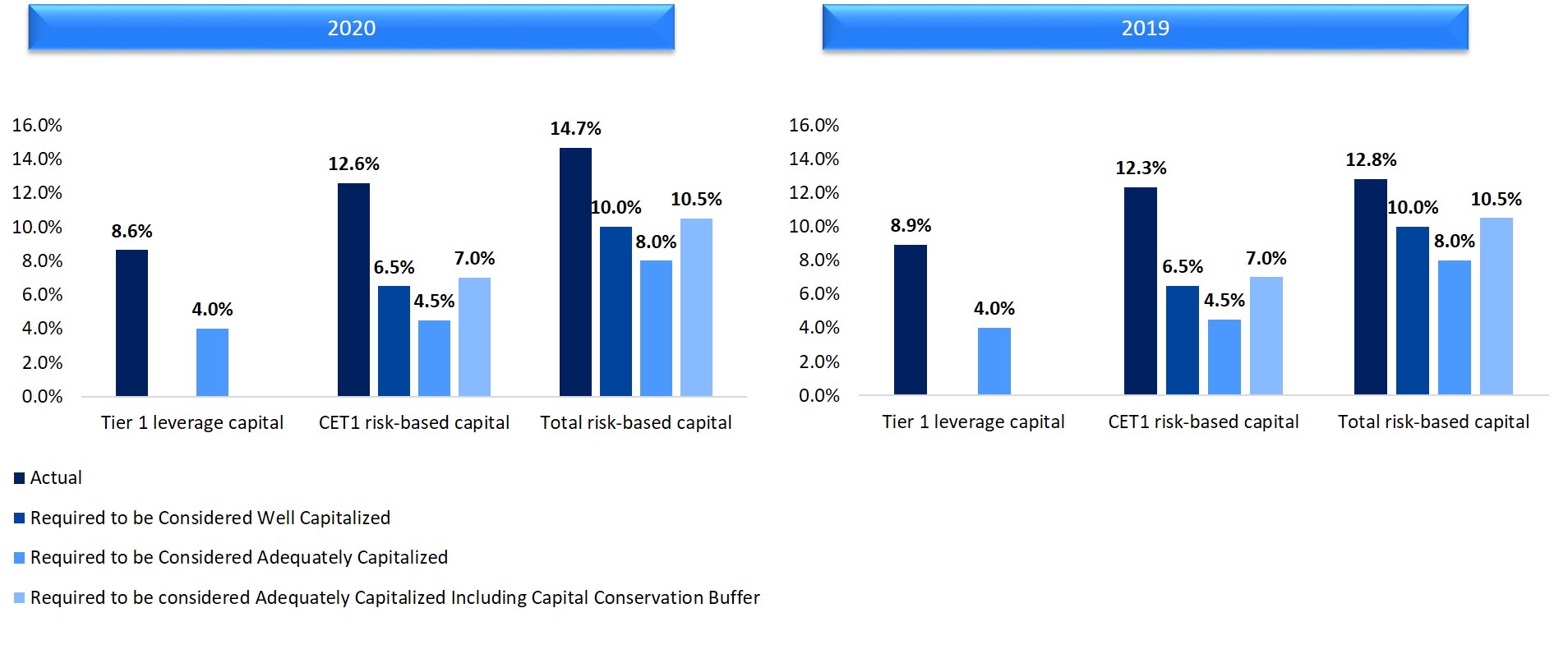

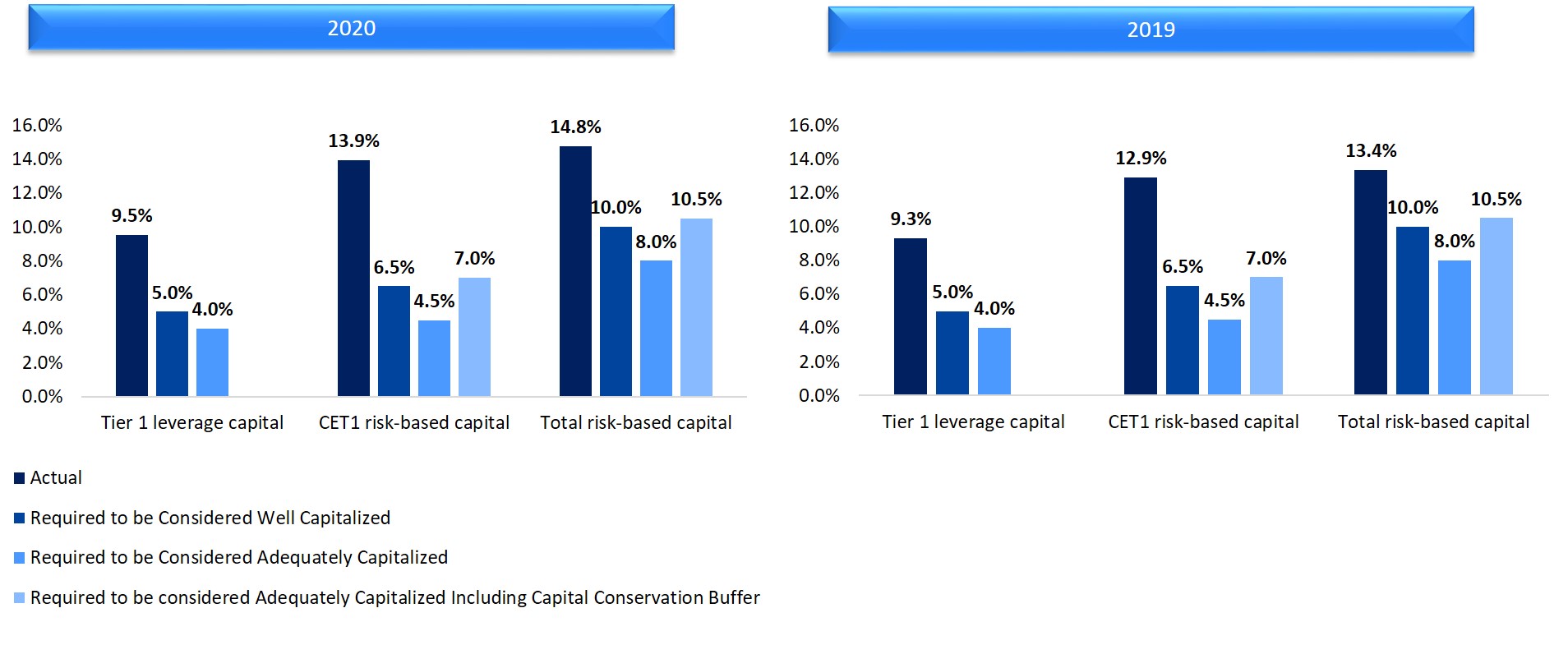

The federal bank regulators view capital levels as important indicators of an institution's financial soundness. As a general matter, FDIC-insured depository institutions and their holding companies are required to maintain minimum capital relative to the amount and types of assets they hold. The final supervisory determination on an institution's capital adequacy is based on the regulator's assessment of numerous factors. Both BankUnited, Inc. and BankUnited are subject to regulatory capital requirements.

The Federal Reserve Board has established risk-based and leverage capital guidelines for BHCs, including BankUnited, Inc. The OCC has established substantially similar risk-based and leverage capital guidelines applicable to national banks, including BankUnited. BankUnited, Inc. and BankUnited are subject to capital rules implemented under the framework promulgated by the International Basel Committee on Banking Supervision (the "Basel III Capital Rules"). While some provisions of the rules are tailored to larger institutions, the Basel III Capital Rules generally apply to all U.S. banking organizations, including BankUnited, Inc. and BankUnited.

The Basel III Capital Rules provide for the following minimum capital to risk-weighted assets ratios to be considered adequately capitalized:

(i)4.5% based upon CET1;

(ii)6.0% based upon tier 1 capital; and

(iii)8.0% based upon total regulatory capital.

The Basel III Capital Rules require institutions to retain a capital conservation buffer of 2.5% above these required minimum capital ratio levels. A minimum leverage ratio (tier 1 capital as a percentage of average total assets) of 4.0% is also required under the Basel III Capital Rules.

Banking organizations that fail to maintain the minimum required capital conservation buffer could face restrictions on capital distributions or discretionary bonus payments to executive officers, with distributions and discretionary bonus payments being completely prohibited if no capital conservation buffer exists, or in the event of the following: (i) the banking organization's capital conservation buffer was below 2.5% at the beginning of a quarter; and (ii) its cumulative net income for the most recent quarterly period plus the preceding four calendar quarters is less than its cumulative capital distributions (as well as associated tax effects not already reflected in net income) during the same measurement period. Further, the federal bank regulatory agencies may set higher capital requirements for an individual BHC or bank when circumstances warrant it.

The Federal Reserve, OCC and FDIC have issued a proposed rule to implement wide-ranging and significant changes to the current U.S. Basel III capital rules. Generally, the proposed rules would increase capital requirements and risk-weighted assets for Category I - IV banking organizations (generally banking organizations with $100 billion or more in total assets). The proposed rules include, among other provisions, changes to the calculation of RWA that would replace the current Advanced Approaches with an Expanded Risk-based Approach with respect to credit, market, operational and CVA risk, apply a new

Output Floor, and extend the countercyclical capital buffer and Supplementary Leverage Ratio to Category IV banking organizations. The proposed rules would also lower the threshold for recognition of AOCI in CET1 capital, lower limits on recognition of minority interests and lower capital deduction thresholds for Category III and IV banking organizations. Generally, these rules, if enacted as proposed, are not expected to apply directly to the Company, whose total assets are less than $100 billion; however, the impact of the proposed rules, if enacted, on the banking system and regulatory environment more broadly could indirectly impact the Company.

Prompt Corrective Action

Under the FDIA, the federal bank regulatory agencies must take "prompt corrective action" against undercapitalized U.S. depository institutions. U.S. depository institutions are assigned one of five capital categories: "well capitalized," "adequately capitalized," "undercapitalized," "significantly undercapitalized," and "critically undercapitalized," and are subjected to differential regulation corresponding to the capital category within which the institution falls. As of December 31, 2020, aA depository institution wasis deemed to be "well capitalized" if the banking institution hadhas a total risk-based capital ratio of 10.0% or greater, a tier 1 risk-based capital ratio of 8.0% or greater, a CET1 risk-based capital ratio of 6.5% and a leverage ratio of 5.0% or greater, and the institution wasis not subject to an order, written agreement, capital directive or prompt corrective action directive to meet and maintain a specific level for any capital measure. Under certain circumstances, a well-capitalized, adequately-capitalizedadequately capitalized or undercapitalized institution may be treated as if the institution were in the next lower capital category. A banking institution that is undercapitalized is required to submit a capital restoration plan. Failure to meet capital guidelines could subject the institution to a variety of enforcement remedies by federal bank regulatory agencies, including:including termination of deposit insurance by the FDIC, restrictions on certain business activities, and appointment of the FDIC as conservator or receiver. As of December 31, 2020,2023, BankUnited, Inc. and BankUnited were well capitalized.well-capitalized.

Source of strength

All companies, including BHCs, that directly or indirectly control an insured depository institution, are required to serve as a source of financial and managerial strength for the depository institution. Under this requirement, BankUnited, Inc. in the future could be required to provide financial assistance to BankUnited should it experience financial distress. Such support may be required at times when, absent this statutory and Federal Reserve Policy requirement, a BHC may not be inclined to provide it.

Under the prompt corrective action provisions, if a controlled bank is undercapitalized, then the regulators could require its BHC to guarantee a capital restoration plan. In addition, if the Federal Reserve believes that a BHC’s activities, assets or affiliates represent a significant risk to the financial safety, soundness or stability of a controlled bank, then the Federal Reserve could require the BHC to terminate the activities, liquidate the assets or divest the affiliates. Currently, the Company has no material activities, assets or affiliates other than those attributable to its ownership of the Bank.

Regulatory Limits on Dividends and Distributions

Federal law currently imposes limitations upon certain capital distributions by national banks, such as certain cash dividends, payments to repurchase or otherwise acquire its shares, payments to stockholders of another institution in a cash-out

merger and other distributions charged against capital. The Federal Reserve Board and OCC regulate all capital distributions by BankUnited directly or indirectly to BankUnited, Inc., including dividend payments.

BankUnited may not pay dividends to BankUnited, Inc. if, after paying those dividends, it would fail to meet the required minimum levels under risk-based capital guidelines and the minimum leverage capital ratio requirements, or in the event the OCC notified BankUnited that it was in need of more than normal supervision. Under the FDIA, an insured depository institution such as BankUnited is prohibited from making capital distributions, including the payment of dividends, if, after making such distribution, the institution would become "undercapitalized." Payment of dividends by BankUnited also may be restricted at any time at the discretion of the appropriate regulator if it deems the payment to constitute an unsafe and unsound banking practice.

BankUnited is subject to supervisory limits on its ability to declare or pay a dividend or reduce its capital unless certain conditions are satisfied.

In addition, it is the policy of the Federal Reserve Board that BHCs should pay cash dividends on common stock only out of income available over the past year and only if prospective earnings retention is consistent with the organization’s expected future needs and financial condition. The policy provides that BHCs should not maintain a level of cash dividends that undermines the BHC’s ability to serve as a source of strength to its banking subsidiaries. As a Delaware corporation, BankUnited, Inc. is also subject to certain limitations and restrictions under Delaware corporate law with respect to payment of dividends and other distributions.

Limits on Transactions with Affiliates and Insiders

Insured depository institutions are subject to restrictions on their ability to conduct transactions with affiliates and other related parties. Section 23A of the Federal Reserve Act imposes quantitative limits, qualitative requirements, and collateral requirements on certain transactions by an insured depository institution with, or for the benefit of, its affiliates. Transactions covered by Section 23A include loans, extensions of credit, investment in securities issued by an affiliate, and acquisitions of assets from an affiliate. Section 23B of the Federal Reserve Act requires that most types of transactions by an insured depository institution with, or for the benefit of, an affiliate be on terms at least as favorable to the insured depository institution as if the transaction were conducted with an unaffiliated third party. The Dodd-Frank Act generally enhances the restrictions on transactions with affiliates, including an expansion of what types of transactions are covered to include credit exposures related to derivatives, repurchase agreements and securities lending arrangements.

The Federal Reserve Board's Regulation O and OCC regulations impose restrictions and procedural requirements in connection with the extension of credit by an insured depository institution to directors, executive officers, principal stockholders and their related interests.

Examination Fees

The OCC currently charges fees to recover the costs of examining national banks, processing applications and other filings, and covering direct and indirect expenses in regulating national banks. Various regulatory agencies have the authority to assess additional supervision fees.

FDIC Deposit Insurance

The FDIC is an independent federal agency that insures the deposits of federally insured depository institutions up to applicable limits. The FDIC also has certain regulatory, examination and enforcement powers with respect to FDIC-insured institutions. The deposits of BankUnited are insured by the FDIC up to applicable limits. As a general matter, the maximum deposit insurance amount is $250,000 per depositor.

Additionally, FDIC-insured depository institutions are required to pay deposit insurance assessments to the FDIC.FDIC deposit insurance fund. The amount of a particular institution's deposit insurance assessment is based on that institution's risk classification under an FDIC risk-based assessment system. An institution's risk classification is assigned based on its capital levels and the level of supervisory concern the institution poses to the regulators.

The FDIC has authority to raise or lower assessment rates on insured deposits in order to achieve statutorily required reserve ratios in the DIF and to impose special additional assessments.

In November 2023, in the aftermath of certain bank failures earlier in 2023, the FDIC approved a final rule to implement a special assessment based on the amount of uninsured deposits reported in the banks' December 31, 2022 Call Reports. The special assessment will be collected for an anticipated eight quarterly assessment periods beginning in 2024. During the fourth quarter of 2023, the Bank recorded the entire special assessment levied of $35.4 million. There is a risk that BankUnited’s deposit insurance premiums will further increase if additional failures of insured depository institutions further deplete the DIF or if the FDIC changes its view of the risk BankUnited poses to the DIF or otherwise increases the assessment rate adjustment applicable to BankUnited’s deposits.

Depositor Preference

The FDIA provides that, in the event of the "liquidation or other resolution" of an insured depository institution, the claims of depositors of the institution (including the claims of the FDIC as subrogee of insured depositors) and certain claims for administrative expenses of the FDIC as a receiver will have priority over other general unsecured claims against the institution. Insured and uninsured depositors, along with the FDIC, will have priority in payment ahead of unsecured, non-deposit creditors, including BankUnited, Inc., with respect to any extensions of credit they have made to such insured depository institution.

Federal Reserve System and Federal Home Loan Bank System

As a national bank, BankUnited is required to hold shares of capital stock in a Federal Reserve Bank. BankUnited holds capital stock in the Federal Reserve Bank of Atlanta. As a member of the Federal Reserve System, BankUnited has access to the Federal Reserve discount window lending and payment clearing systems. Pursuant to the regulations of the Federal Reserve, all banks, including BankUnited, are required to maintain average daily reserves at mandated ratios against their transaction accounts. In addition, reserves must be maintained on certain non-personal time deposits. This reserve requirement may be met by holding cash in banking offices or on deposit at a Federal Reserve Bank.

BankUnited is a member of the Federal Home Loan Bank of Atlanta. Each FHLB provides a central credit facility primarily for its member institutions, as well as other entities involved in home mortgage lending. Any advances from aan FHLB must be secured by specified types of collateral. As a member of the FHLB, BankUnited is required to acquire and hold shares of capital stock in the FHLB of Atlanta. BankUnited is in compliance with this requirement.

Anti-Money Laundering and OFAC

Under federal law, financial institutions must maintain anti-money laundering programs that include established internal policies, procedures and controls; a designated compliance officer; an ongoing employee training program; a risk-based customer due diligence program; and testing of the program by an independent audit function. Financial institutions are also prohibited from entering into specified financial transactions and account relationships and must meet enhanced standards for due diligence, and customer identification and recordkeeping, including in their dealings with non-U.S. financial institutions and non-U.S. customers. Financial institutions must take reasonable steps to conduct enhanced scrutiny of account relationships to guard against money laundering and to report any suspicious transactions, and law enforcement authorities have been granted increased access to financial information maintained by financial institutions. Bank regulators routinely examine institutions for compliance with these obligations and they must consider an institution's compliance in connection with the regulatory review of applications, including applications for banking mergers and acquisitions. The regulatory authorities have imposed "cease and desist" orders and civil money penalty sanctions against institutions found to be violating these obligations.

The U.S. Department of the Treasury's OFAC is responsible for helping to insureensure that U.S. entities do not engage in transactions with certain prohibited parties, as defined by various Executive Orders and Acts of Congress. The OFAC publishes lists of persons, organizations, and countries suspected of money laundering or aiding, harboring or engaging in terrorist acts, known as Specially Designated Nationals and Blocked Persons. If BankUnited, Inc. or BankUnited finds a name on any transaction, account or wire transfer that is an affirmative match to one on an OFAC list, BankUnited, Inc. or BankUnited must freeze or block such account or transaction, file a suspicious activity report and notify the appropriate authorities.

Consumer Laws and Regulations

Banking organizations are subject to numerous laws and regulations intended to protect consumers. These laws include, among others:

•Truth in Lending Act;

•Truth in Savings Act;

•Electronic Funds Transfer Act;

•Expedited Funds Availability Act;

•Equal Credit Opportunity Act;

•Fair and Accurate Credit Transactions Act;

•Fair Housing Act;

•Fair Credit Reporting Act;

•Gramm-Leach-Bliley Act;

•Home Mortgage Disclosure Act;

•Right to Financial Privacy Act;

•Real Estate Settlement Procedures Act;

•laws regarding unfair and deceptive acts and practices; and

•usury laws.

Many states and local jurisdictions have consumer protection laws analogous to, and in addition to, those listed above. These federal, state and local laws regulate the manner in which financial institutions deal with customers when taking deposits, making loans, or conducting other types of transactions. Failure to comply with these laws and regulations could give rise to regulatory sanctions, customer rescission rights, action by state and local attorneys general, and civil or criminal liability.

Privacy and Information Security

Banking organizations are subject to many federal and state laws and regulations governing the collection, use and protection of customer information. For example, the Gramm-Leach-Bliley Act requires BankUnited to periodically disclose its privacy policies and practices relating to sharing nonpublic customer information and enables retail customers to opt out of our ability to share information with unaffiliated third parties under certain circumstances. Other federal and state laws and regulations impact our ability to share certain information with affiliates and non-affiliates for marketing and/or non-marketing purposes, or to contact customers with marketing offers. The Gramm-Leach-Bliley Act also requires BankUnited to implement a comprehensive information security program that includes administrative, technical and physical safeguards to ensure the security and confidentiality of customer records and information.

CFPB

The CFPB is tasked with establishing and implementing rules and regulations under certain federal consumer protection laws with respect to the conduct of providers of certain consumer financial products and services. The CFPB has rulemaking authority over many of the statutes governing products and services offered to bank and thrift consumers. For banking organizations with assets of $10 billion or more, such as BankUnited, Inc. and the Bank, the CFPB has exclusive rule making and examination, and primary enforcement authority under certain federal consumer protection financial laws. In addition, states are permitted to adopt consumer protection laws and regulations that are stricter than those regulations promulgated by the CFPB.

The Community Reinvestment Act

The CRA is intended to encourage banks to help meet the credit needs of their service areas, including low and moderate-income neighborhoods, consistent with safe and sound operations. The federal bank regulators examine and assign each bank a public CRA rating.

The CRA requires federal bank regulators to take into account the bank's record in meeting the needs of its service area when considering an application by a bank to establish or relocate a branch or to conduct certain mergers or acquisitions. The Federal Reserve Board is required to consider the CRA recordsperformance of a BHC's controlled banks when considering an application by the BHC to acquire a banking organization or to merge with another BHC. If BankUnited, Inc. or BankUnited applies for regulatory approval to make certain investments, the regulators will consider the CRA record of target institutions and BankUnited, Inc.'s depository institution subsidiaries. An unsatisfactoryA less than satisfactory CRA recordrating could substantially delay approval or result in denial of an application. The regulatory agency's assessment of the institution's recordCRA performance is made available to the public. Following its most recent CRA performance evaluation in September 2018,October 2021, BankUnited received an overall rating of "Satisfactory."

Human Capital Resources

At December 31, 2020,2023, we had 1,4651,588 full-time employees and 3028 part-time employees. None of our employees are parties to a collective bargaining agreement. We believe that our employees are our greatest asset and vital to our success. As such, we seek to hire and retain the best candidate for each position, without regard to age, gender, ethnicity, or other protected trait, but with an appreciation for a diversity of perspectives and experience. We have designed a compensation structure including an array of benefit plans and programs that we believe is attractive to our current and prospective employees. We have a Company sponsored 401(k) Retirement Savings Program, a tuition reimbursement program, flexible spending accounts and health savings accounts with Company contributions. BankUnited offers paid time off, paid parental leave for male and female employees, paid holidays, flexible work schedules and hybrid and remote job opportunities for some positions.

Diversity, Equity and Inclusion

Our missiongoal is to create a safe, diverse and inclusive workplace where individuals are valued, for their talents, feel free to express themselves, and are empowered to reach their fullest potential. In supportsucceed and are able to grow both personally and professionally. At December 31, 2023, 40% of this goal, BankUnited launched the members of our Board of Directors were female and 40% were of diverse nationality or ethnicity. Approximately 56% of our workforce was female. We offer diversity and inclusion training to all of our employees.

The following chart illustrates the diversity of our workforce at December 31, 2023:

iCARE™, which stands for

Under the umbrella of our iCARE™ ("Inclusive Community of Advocacy, Respect and Equality. ThroughEquality") initiative, we have a number of programs intended to foster a culture that promotes employee engagement in social justice, equal access, community development and opportunity. Our iCARE™, Council, consisting of 15 employees with diverse backgrounds and perspectives across different divisions in our organization, oversees the continued evolution of iCARE™ and 17 employees serving as iCARE™ ambassadors promote engagement in iCARE™ programs across the organization. Employees are encouraged to participate in interactive events, cultural celebrations, an enterprise-wide mentorship program and volunteer opportunities. In 2023, our employees reported a total of 3,501 volunteer hours, up 32% from 2022, serving 128 community forums and multiple volunteer and mentor opportunities. Further, allorganizations. Our employees are grantedgiven paid time to participate in community volunteer opportunities that are meaningfulopportunities.

BankUnited has partnered with six universities in our local markets to provide scholarships, internship, and other educational programs, with a primary focus on minority high school and college students. Since the inception of these initiatives in 2020, 109 college and high school students have participated and 36 of them within theirhave been hired for full time roles at the Bank. Through BankUnited's exclusive partnership with Florida International University, the ATOM Pink Tank program, a six-month leadership, mentorship, and research development program was created to empower female students pursuing STEM careers. The Pink Tank participants receive weekly guidance and mentorship by BankUnited employees throughout the ten-week research and competition stage. The students connect with BankUnited professionals of all levels and disciplines. Since the inception of this initiative, 46 students have completed the program and 20 new students have been selected for the 2023-2024 cohort. To date, BankUnited has hired seven female students and garnered participation of over 55 BankUnited employees representing 20 departments across the Bank.

Through iCARE™ we engage and encourage our employees to participate in various Bank sponsored community programs and events. These community programs include BankUnited's "Adopt A Neighborhood" in Florida focused on providing support to under-served predominantly minority communities, the "Entrepreneurship Program" in New York where we provide workforce development in partnership with a local university, and the communities"Heir’s Program" where we serve.brought together a consortium of expertise to provide legal services and education to predominantly minority families seeking to maintain property in family lineage. The Bank also launched the iCARE™ Council consists of 11 employees across different divisionsVentures program to support, promote and strengthen local entrepreneurship and small business growth to minority owned businesses in our organization.community.

Health, Wellness and Safety

BankUnited prioritizes employee health by focusing on ‘person centered’ wellnessOur award-winning Wellness Program incorporates initiatives that incorporateaddress the mental, physical, intellectual, occupational, social, emotional, financial and spiritual components of wellness. BankUnited’s robust Wellness Program providesThe BankUnited Corporate Center has an on-site fitness facility and we provide our employees with on-site health screenings, eye exams, dental exams, mammograms, and vaccine clinics;clinics. Employees can choose to participate in nutrition consultations;counseling, music and art therapy;therapy, live and streaming fitness classes, meditation sessions; an on-site fitness center; financial literacy courses;sessions, live and virtual learning opportunities with area wellness experts;experts. We offer safety programs including first aid and CPR and safety courses and much more.courses. For participation in our Wellness Program, we offer our employees a reduced premium rate for medical insurance coverage.

In recognition of our employee wellness programs, BankUnited received the 2020 Healthiest Employer Award from the South Florida Business Journal.

Additionally,Journal in response to2021 and 2022. In 2023, BankUnited was listed as number one among America's Top 100 Healthiest Employers by Springbuk HR Technology, and was awarded the COVID-19 pandemic, we invested heavily to help ensureWorksite Wellness Award by the healthFlorida Department of our employees by successfully transitioning nearly 80% of our workforce to a temporary work-from-home state; procuring and providing necessary personal protective equipment for employees unable to work from home; providing ongoing COVID-19 education and awareness efforts and increased virtual wellness initiatives; and establishing daily health check-in protocols.Health in 2021.

Career Growth and Development

At BankUnited, we aim to create an inclusive and diverse team of bold decision makers who are more than just average. In support of this, through theOur Go for More™More™ Academy we provide employees withprovides an extensive menu of training and resources that feed an entrepreneurial spirit, increase skillsetsenable employees to develop their skills and product knowledge,that promote collaboration and career development. BankUnited providesOur Rising Leaders, Situational Leadership and EXCELerate programs provide our employees with challenges and growth opportunities that advance personal and career goals. Examples include our Rising Leaders program and soon-to-be launched EXCELerate career development program.opportunities. Through our Discover Coaching program, we offer a personalized approach where employees meet one-on-one with an internal coach to promote individual growth, skill development, leadership development, and problem solving. A total of 204 employees participated and completed these programs in 2023. We believe mentoring is key to career growth and development. In 2023 280 employees enrolled in our mentoring programs and a total of 1,247 mentoring hours were reported. Our employees rated their overall mentorship program satisfaction with a score of 4.7 stars out of 5 stars.

Communication & Engagement

We strongly believe that communicationEmployee engagement is a key factorcontributor to our success. The Company solicits employee feedback through periodic employee engagement surveys conducted by an outside firm. 81% of employees participated in employeeour last engagement survey and 81% of participants responded favorably to questions designed to gauge the level of overall engagement. Toward this end, we utilize a varietyThe 81% overall engagement score favorably compared to an industry benchmark of channels to facilitate open and direct dialogue and communication, including: bi-weekly76%. The Company schedules regular CEO update video calls, weekly newsletters, town halls, social media updateshall meetings and employee surveys. Managers are encouragedother engagement programs. In 2023, we launched the Leadership Chat Series, a live and interactive webinar with BankUnited executives and our employees. Our Kudos Employee Recognition platform encourages employees to meet with their employees frequentlyrecognize one another's contributions and to establish an open door policy. Our iCARE™ program implemented affinity groups, mentorship programs and volunteering activities among others. Learning & Development activities include our Rising Leaders Program and a variety of product knowledge and soft skills training opportunities. Wellness activities include group exercise, seminars and a variety of interactive activities. All are designed to foster employee engagement.accomplishments.

Available Information

Our website address is www.bankunited.com. Our electronic filings with the SEC (including all Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and if applicable, amendments to those reports) are available free of charge on the website as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. The information posted on our website is not incorporated into this Annual Report. In addition, the SEC maintains a website that contains reports and other information filed with the SEC. The website can be accessed at http://www.sec.gov.

Item 1A. Risk Factors

An investment in our common stock is subject to risks inherent in our business. The material risks and uncertainties that management believes affect us are described below. Before making an investment decision, you should carefully consider the risks and uncertainties described below, together with all of the other information included or incorporated by reference herein. The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties that management is not aware of or focused on or that management currently deems immaterial may also impair our business operations.

If any of the events described in the risk factors should actually occur, our financial condition, and results of operations and the value of our securities could be materially and adversely affected. If this were to happen,

Strategic Risk

We may not realize the valueexpected benefits of our securities could decline significantly,business strategy.

Our fundamental business strategy is centered on building a leading regional commercial and you could lose all or partsmall business bank, focused on relationship-based granular and diversified business on both sides of your investment.the balance sheet. Our near-term strategic priorities include (i) improving the funding mix, primarily by growing core deposits, while maintaining ample liquidity; (ii) improving risk adjusted returns by re-positioning the balance sheet away from typically lower yielding transactional business such as

Strategic Risk

The COVID-19 pandemic

The COVID-19 pandemic has caused substantial disruption to the globalresidential mortgages and domestic economiessecurities and organically growing core commercial loans, which has adversely affected, and is expected to continue to adversely affect, the Company’s business, financial condition and results of operations. The future impactare generally higher-yielding, as a percentage of the COVID-19 pandemic onportfolio; (iii) managing credit quality; (iv) managing the global and domestic economies and the Company’s business, financial condition and resultsrate of operations remains uncertain.

In March 2020, the World Health Organization declared COVID-19 a global pandemic. The pandemic has resulted in governmental authorities implementing numerous measures attempting to contain the spread and impact of COVID-19 such as travel bans and restrictions, quarantines, shelter in place orders, and limitations on business activities, including in major markets in which the Company and its clients are located or do business. The COVID-19 pandemic, and governmental responses to the pandemic, have disrupted supply chains, lowered some equity market valuations including those of financial institutions such as the Company, created significant volatility and disruption in financial markets, and increased unemployment levels.

This macroeconomic environment has had, and could continue to have, an adverse effect on the Company’s business and operations as well as on the business and operations of the Company's borrowers, customers and counterparties. The actual, expected or potential impact of the pandemic on the Company's borrowers and their ability to repay their loans resulted in an increase in the Company's provision for credit lossesexpenses; and ACL and a corresponding reduction in the Company's net income for 2020 as well as a reduction in the level of demand for certain of the Company's products and services, particularly lending products. Should economic and social impacts of COVID-19 persist or further deteriorate, this macroeconomic environment could have a continued adverse effect on our business and operations, including, but not limited to, decreased demand for the Company’s products and services, protracted periods of lower interest rates which may negatively impact the Company's net interest margin, loss of income resulting from forbearances, deferrals and fee waivers provided by the Company to its borrowers, increased credit losses due to deterioration in the financial condition of our borrowers including declining asset and collateral values, which may continue to increase our provision for credit losses and net charge-offs and possible constraints on liquidity and(v) maintaining robust capital including those related to increases in risk-weighted assets related to supporting client activities or to regulatory actions. The business operations of the Company may also be disrupted if significant portions of its workforce or those of vendors or third-party service providers are unable to work effectively, including because of illness, quarantines, government actions, restrictions in connection with the pandemic, and technology limitations and/or disruptions. The Company also faces an increased risk of litigation and governmental and regulatory scrutiny as a result of the effects of the pandemic on market and economic conditions and actions taken by governmental authorities in response to those conditions. The Company may also face a risk of litigation related to participation in government programs such as PPP.

The extent to which the COVID-19 pandemic impacts the Company’s business, financial condition and results of operations, as well as its regulatory capital ratios and liquidity, will depend on future developments, which are highly uncertain, including the scope and duration of the pandemic and actions taken by governmental authorities and other third parties in response to the pandemic. Moreover, the effects of the COVID-19 pandemic may heighten many of the other risks described in this Form 10-K and any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K including, but not limited to, financial market conditions, economic conditions, credit risk, interest rate risk, risk of security breaches and technology changes.

We may not be successful in executing our fundamental business strategy.