PART I

Our Business

At Block, Inc. (together with its subsidiaries, "Block" or "we"), we are building an ecosystem of ecosystems, each focused on distinct customer audiences. We define an ecosystem as a set of tools and services that work together cohesively, often positively reinforcing one another. This helps create resilient relationships with customers as they use our tools and services to satisfy multiple needs. Our ecosystems are united by our shared purpose of economic empowerment, with each ecosystem serving different people — sellers, consumers, artists, fans, and developers. As we scale, we are focused on investing in developing connections between our ecosystems and by creating more connections to increase the resilience of our overall company.

On December 1, 2021, we changed our corporate name from Square, Inc. to Block, Inc. Block is the name for the company as a corporate entity. Since our start in 2009 with the Square business, we have added Cash App, TIDAL, and TBD as businesses.

Our two reportable segments are Square, formerly referred to as Seller, and Cash App, which reflects our two primary ecosystems and the manner in which the Company's chief operating decision maker ("CODM") reviews and assesses performance. We have historically allocated the financial results from our buy now, pay later ("BNPL") platform equally to the Cash App and Square segments. In the fourth quarter of 2023, we changed our management reporting structure and moved the business activities and management of our BNPL platform fully under Cash App. We believe that this transition will allow us to better focus on consumer based commerce as well as the development of its financial tools within Cash App.

Square Ecosystem

We started Block with the Square ecosystem in February 2009 to enable businesses (sellers)("sellers") to accept card payments, an important capability that was previously inaccessible to many businesses. However,As our company grew, we recognized that sellers also need innovativea variety of solutions to thrive and saw how we could apply our strength in technology and innovation to help sellers. We have since expanded to provide additional products and services to give these businesses access to the same tools as large businesses. This approach aligns with our purpose of economic empowerment, as everything we do should give sellers accessible, affordable tools to grow their businesses and participate in the economy.

Square isinto a cohesive commerce ecosystem that helpsprovides more than 30 distinct products and services to help our sellers start, run, and grow their businesses. We combine sophisticated software, with affordable hardware, to enable sellers to turn mobile and computing devices into powerful payment and point-of-sale solutions. We have high seller acceptance rates and fast onboarding, while maintaining low risk and fraud losses as a result of our approach to risk management that emphasizes data science and machine learning. We focus on technology and designfinancial services to create products and services that are cohesive, fast, self-serve, and dependable.elegant. These attributes differentiate usSquare in a fragmented industry that traditionally forces sellers to stitch together hardware, software,products and payments services from multiple vendors.vendors, and often rely on inefficient non-digital processes and tools. Our ability to add new sellers efficiently, help them grow their business, and cross-sell our products and services has historically led to continued and sustained long-term growth.

Cash App provides an ecosystem of financial products and services for individuals. Currently, ourto help consumers manage their money. Cash App’s goal is to redefine the world’s relationship with money by making it more relatable, instantly available, and universally accessible. While Cash App offers individuals access to a fast, easy waystarted with the single ability to send and receive money, electronically to and from individuals and businesses. We also offer Cash App customers the ability to useit now provides an ecosystem of financial services focused on helping consumers make their funds via a Visa debit card. We have also recently added functionality to Cash App to enablemoney go further by enabling customers to buystore, send, receive, spend, invest, borrow or save their money with Cash App.

Emerging Ecosystems

We are also making modest investments in two relatively nascent and sell bitcoin.emerging ecosystems related to TIDAL and bitcoin, in order to serve new audiences.

TIDAL Ecosystem

In 2021, we completed the acquisition of a majority ownership interest in TIDAL, expanding our purpose of economic empowerment to artists. TIDAL is a global platform for musicians and their fans that uses unique content, experiences, and features to bring fans closer to artists and to provide artists with tools to succeed as entrepreneurs. TIDAL offers an extensive catalog of more than 132 million songs and 774,000 high-quality videos. TIDAL has a global presence with listeners in more than 60 countries and relationships with more than 200 labels and distributors.

4

Bitcoin Ecosystem

Our commercebitcoin ecosystem also includes powerful point-of-sale software and services that help sellers make informed business decisions through the use of analytics and reporting. As a result, sellers can manage orders, inventory, locations, employees, and payroll; engage customers and grow their sales ; and gain access to business loans through our Square Capital service. We monetize these features through either a per transaction fee, a subscription fee, or a service fee. Some of these advanced point-of-sale features are broadly applicable to our seller base and include Employee Management and Customer Engagement. We have also extended our ecosystem to serve sellers with more specific needs. Our Build with SquareTBD, which is an open developer platform (application programming interface or APIs) allows businessesfocused on making the decentralized financial world accessible for everyone, our bitcoin hardware projects, which include Bitkey, a self-custody bitcoin wallet, a bitcoin mining system, Spiral, an independent team focused on contributing to bitcoin open source work. We believe our bitcoin ecosystem can help address inefficiencies in the current financial system, especially with individualized needsrespect to customize their business solutions, including integration with third-party applications, while processing payments onidentity and trust.

Our Customers

Our Square and taking advantage of all the services in our ecosystem. In addition, certain verticals, such as services and retailSellers

Square sellers benefit from specific features such as Invoices, Appointments, and Square for Retail. We also serve sellers through Caviar, a food ordering service for pickup and delivery that helps restaurants reach new customers and increase sales without additional overhead.

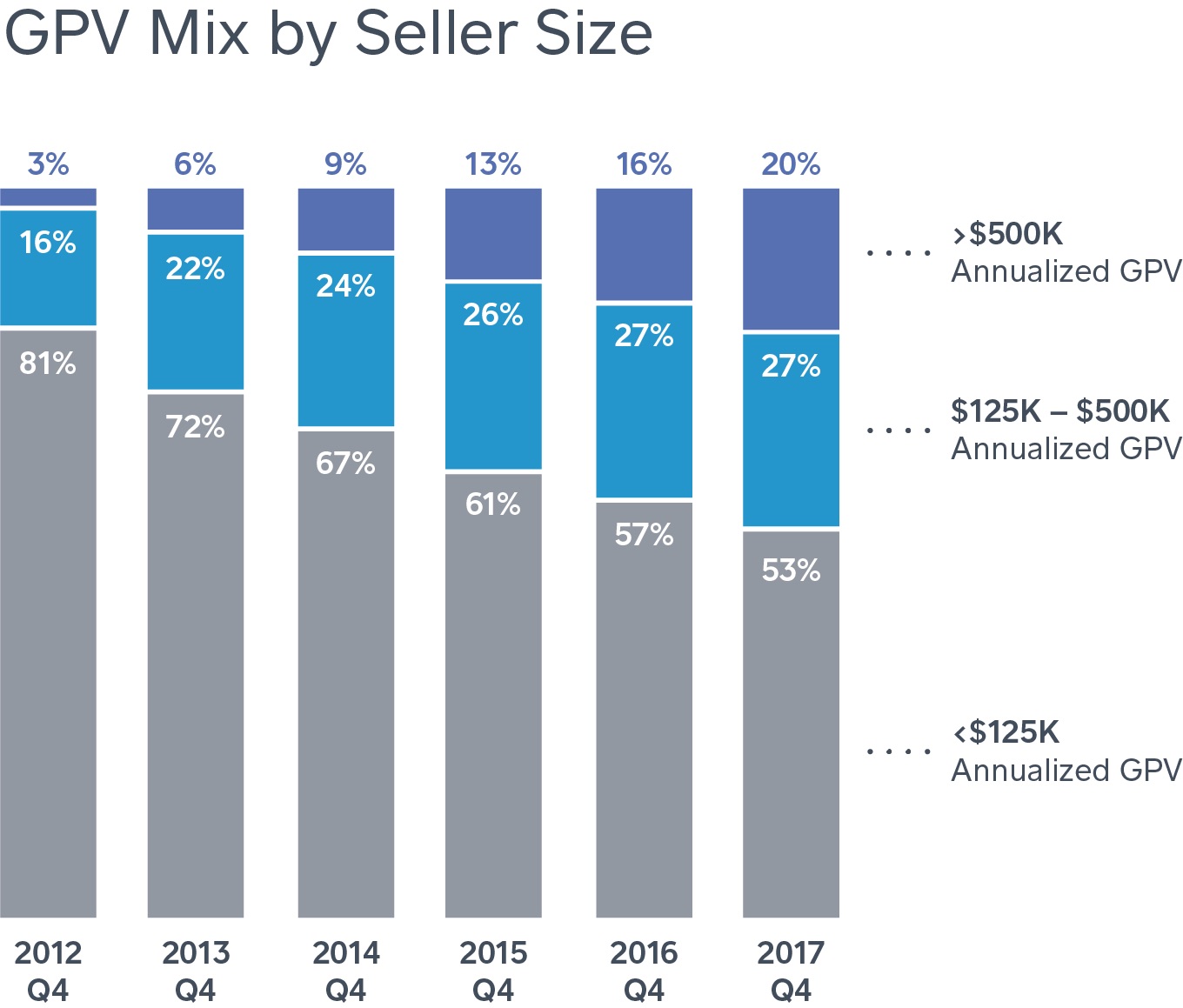

In the year ended December 31, 2017, we processed $65.32023, more than 4 million sellers used the Square ecosystem to make 4.0 billion individual sales transactions totaling $209.6 billion of Gross Payment Volume (GPV), which was generated by 1.4 billion card paymentsSquare GPV. These sales transactions originated from approximately 287733 million payment cards. We processed $49.7 billioncards, across 271 million buyer profiles.

The charts below show the percentage mix of our Square GPV by seller industry and $35.6 billion of GPV in 2016 and 2015, respectively.seller size for the year ended December 31, 2023:

5

Our Cash App Customers

As of December 2023, Cash App had 56 million monthly transacting actives across the United States and the U.K. In 2023, across the iOS App Store and Google Play, Cash App was the number one finance app and the number ten app overall in thousands, except for GPV, percentagesthe United States, based on downloads. Cash App has a diverse mix of customers, and perin the United States, Cash App had monthly transacting actives in each of the 50 states and nearly every county as of December 2023.

In 2023, Cash App transacting actives brought more than $248 billion in inflows into Cash App. Customers can fund their Cash App accounts with inflows in a variety of ways, including by receiving money from another Cash App customer through the app’s core peer-to-peer transfer service, transferring money from a bank account, depositing mobile checks, adding physical cash at participating retailers, and receiving a recurring paycheck by direct deposit. In 2023, each Cash App monthly transacting active brought in an average of $384 of inflows in a given month during the year. A transacting active is a Cash App account that has at least one financial transaction using any product or service within Cash App during the specified period. Examples of transactions include sending or receiving a peer-to-peer payment, transferring money into or out of Cash App, making a purchase using Cash App Card, earning a dividend on a stock investment, and paying back a loan, among others. Certain of these accounts may share data)an alias identifier with one or more other transacting active accounts. This could represent, among other things, one customer with multiple accounts or multiple customers sharing one alias identifier (for example, families).

6

| Year Ended December 31, | 2016 to 2017 | 2015 to 2016 | |||||||||||||||

| 2017 | 2016 | 2015 | % Change | % Change | |||||||||||||

| Gross Payment Volume (GPV) (in millions) | $ | 65,343 | $ | 49,683 | $ | 35,643 | 32 | % | 39 | % | |||||||

| Total net revenue | $ | 2,214,253 | $ | 1,708,721 | $ | 1,267,118 | 30 | % | 35 | % | |||||||

| Adjusted Revenue | $ | 983,963 | $ | 686,618 | $ | 452,168 | 43 | % | 52 | % | |||||||

| Net loss attributable to common stockholders | $ | (62,813 | ) | $ | (171,590 | ) | $ | (212,017 | ) | ||||||||

| Adjusted EBITDA | $ | 139,009 | $ | 44,887 | $ | (41,115 | ) | ||||||||||

| Net loss per share attributable to common stockholders: | |||||||||||||||||

| Basic | $ | (0.17 | ) | $ | (0.50 | ) | $ | (1.24 | ) | ||||||||

| Diluted | $ | (0.17 | ) | $ | (0.50 | ) | $ | (1.24 | ) | ||||||||

| Adjusted Net Income (Loss) Per Share: | |||||||||||||||||

| Basic | $ | 0.30 | $ | 0.04 | $ | (0.39 | ) | ||||||||||

| Diluted | $ | 0.27 | $ | 0.04 | $ | (0.39 | ) | ||||||||||

7

Our Products and Services

Strategic Priorities: Our focus for Square is on four priorities: maintaining our secure, and flexible multi-product platform, providing a “local” experience to sellers of all sizes, growing with artificial intelligence (“AI”), and further developing our banking offering.

•Platform: It is critical that we have a strong foundation to build upon to serve external customers through our developer platform and partner ecosystem, and our internal team's first party products. This includes increasing reliability of our platform and also introducing products and features that are most important to our customers.

•Local: Our go-to-market strategy is focused on verticals with a local approach, specifically restaurants and services-based businesses. Growing upmarket has shown us that even larger sellers want to feel authentic to their buyers. We can enable this type of robust offering through our technology and by improving the onboarding process through sales and account management.

•Artificial Intelligence (AI): We are focused on enabling growth by leveraging AI to increase productivity and outcomes for our sales and marketing, customer service, and engineering efforts, in addition to building features that help sellers grow their businesses.

•Banking: Our robust banking offering primarily helps our sellers manage cash flow and grow their business through our lending capabilities. We will continue to drive trust with our sellers, and build products and features that help with sellers accessing funds securely and timely.

8

Commerce

Square's commerce products help sellers make sales and track orders, inventory, and fulfillment across in-person and online channels, as well as first-party and third-party channels. Most of our Square software products have a free tier (without a subscription fee), which we monetize only through transaction fees on card payments. Most software products also have premium tiers with additional functionality, which we monetize through subscription fees in addition to transaction fees on payments.

•Square for Restaurants is a fullvertical solution tailored for both quick-service and full-service restaurants. It includes table, order, and course management; a kitchen display system; and revenue and cost reporting.

•Square Appointments is a vertical solution tailored for appointment-based businesses that need a point-of-sale application with integrated booking capabilities. Square Appointments includes a free online booking site so buyers can easily schedule appointments and select their preferred time, service, and staff member. It is also integrated with Square Assistant, an AI-enabled automated messaging tool that responds to buyers efficiently and professionally, saving sellers' time and helping prevent missed appointments.

•Square for Retail is a vertical solution tailored for sellers in the retail industry. It includes advanced inventory management, cost of goods sold reporting, purchase orders, vendor management, and barcode scanning.

•Square Point of Sale is a general purpose point-of-sale application for businesses that need an easy-to-use, customizable point-of-sale solution that adapts across business types and stages.

•Square Online makes it easy to build a website and online store as well as sell on Instagram and Facebook. The online store is mobile responsive, delivering an app-like ordering experience on a buyer’s phone. With integrated support for QR code ordering, sellers can also streamline their in-store operations by posting the QR code and having their buyers order from their own phones. Fulfillment options include pickup, delivery managed by our sellers, and integrations with partner delivery platforms. Orders, items, inventory, and customer data stay in sync when selling both online and in-person.

•Square Online Checkout makes it easy to sell online without a website by allowing sellers to create a checkout link with only a name and price for their good or service.

9

•Square Invoices is a customizable digital invoicing solution with integrated and secure online payment acceptance. This eliminates the need to print and mail statements to customers and wait for checks to arrive. Sellers use Square Invoices for upcoming, recurring, or previously delivered goods and services, such as catering orders, contractor services, lessons, and retail orders. Square Invoices also lets sellers send estimates and collect partial payments offering. Sellers can onboard to Square in minutesfor goods and once onboarded, accept payments in person via swipe, dip, or tap of a card; online via services.

•Square Virtual Terminal or theallows sellers to use a computer as a card terminal. Sellers can take a payment, set up recurring billing, record sales, and send digital receipts for payments, including those made by check and bank transfer.

•Risk Manager gives sellers insight into online payment fraud patterns and enables them to set custom rules and alerts to manage risk. Machine-learning algorithms automatically identify fraud patterns and adapt to fit a seller's operations.

•Order Manager allows sellers to manage online orders that originate from Square Online, their own website on another platform, and third-party websites including online marketplaces such as DoorDash. Order Manager enables tracking open orders, managing prep times and busy times, and marking orders as completed.

•Payment APIs (application programming interfaces) and SDKs (software development kits) support in-person, online, and mobile payments. Square Reader SDK enables developers to seamlessly integrate Square hardware with a seller’s custom point of sale, allowing them to build unique checkout experiences such as self-ordering kiosks powered by Square’s managed payments service. With Square's online payments APIs, developers can integrate Square payments into a seller’s e-commerce website or app; oronline store. Square's In-App Payments SDK enables developers to build consumer mobile apps that use Square to process payments. These products are monetized primarily through transaction fees on payment volumes.

•Commerce APIs: Square offers more than 30 commerce APIs, through which developers can create and manage orders, subscriptions, product catalogs, inventory, customer profiles, employees, loyalty programs, gift cards, and more to build applications that enrich and integrate with Square's ecosystem of products. In addition, these APIs enable developers to build integrations with their existing business systems such as accounting, customer relationship management (“CRM”), employee management, and enterprise resource planning (“ERP”) software.

For card payments, Square acts as the Cash App. By payingmerchant of record for the transaction as well as the payment service provider (“PSP”). As the merchant of record, Square is the party responsible for settling funds with the seller and helps manage transaction risk loss on behalf of the seller. Square’s managed payments offering for sellers includes payment dispute management, data security, and PCI compliance for a transparent transaction fee paid by sellers. Square has negotiated terms and entered into contractual arrangements directly with other service providers of transaction processing services, including the acquiring processors and card networks, and indirectly with issuing banks. These contracts include negotiated terms, such as more favorable pricing, that are generally not available to sellers receive technologyif they were to contract directly with these sub-service providers. Square's position as the merchant of record helps us better serve our sellers. For example, as the merchant of record, we can more efficiently onboard new sellers through our website, leveraging our risk assessment models, and featureswe have insights into transaction-level data that allow themwe use to manage the entire payment lifecycle, including reportinginform our sellers and analytics, next-day settlements (or instant settlement for an additional transaction fee via Instant Deposit), digital receipts, payment dispute and chargeback management, security, and PCI compliance. Transaction-based revenue as a percentage of GPV was 2.94%, 2.93%, and 2.95% in the years ended December 31, 2017, 2016, and 2015, respectively.launch new products.

Hardware

Square custom-designs hardware that can process all major card payment forms, including magnetic stripe, EMV chip, and NFC technology.(contactless). Sellers canare able to accept cards issued by Visa, MasterCard,Mastercard, American Express, or Discover, for one transaction fee. Additionally,JCB, Interac Flash (in Canada), e-Money (in Japan), and eftpos (in Australia). Square hardware can be integrated with additional accessories such as cash drawers, receipt printers, scales, and barcode scanners to provide sellers in Canada can accept Interac Flash, and sellers in Japan can accept JCB. Ourwith a comprehensive point-of-sale solution. Square's hardware portfolio includes the following products:following:

10

•Square Terminal is a portable, all-in-one payments device and receipt printer to replace traditional keypad terminals. It accepts tap, dip, and swipe payments and has a battery that lasts all day, enabling payments anywhere in the store.

•Square PointStand enables an iPad to be used as a payment terminal or full point-of-sale solution. It features an integrated contactless and chip reader.

•Square Reader for contactless and chip accepts EMV chip cards and NFC payments, enabling acceptance via Apple Pay, Google Pay, and other mobile wallets.

•Square Reader for magstripe enables swiped transactions of Sale is our point-of-sale software that can be downloaded tomagnetic-stripe cards by connecting with an iOS or Android device, is pre-installed on Square Register, and is designed to get a seller (and their employees) up and running quickly. It consists of managed payments solutions and advanced software products, all of which are integrated with one another to provide both sellers and their buyers with a cohesive experience that is fast, self-serve, and dependable. Square Point of Sale includes Square Dashboard, our cloud-based reporting and analytics tool that provides sellers with real-time data and insights about sales, items, customers, and employees. This enables sellers to make informed decisions about their business.smartphone or tablet via the headphone jack or Lightning connector.

Square’s Customer Directory and synced across Square Point of Sale and Square Dashboard, allowing the seller to easily track invoices, send payment reminders to the customer, and set recurring billing. Sellers may use Square Invoices for upcoming or previously-delivered goods and services, such as catering orders, contractor services, and retail orders. Sellers pay only a transparent transaction fee for this managed payments solution.

•Square Loyalty helps sellers keep their buyers coming back. Buyers that enroll in a Square Loyalty program are twice as likely to be repeat customers and spend 50% more, on average.

•Square Marketing helps sellers drive traffic by sending emails or texts to promote in-store events, new products, last-minute deals, or seasonal offers. Sellers can createset up recurring automated campaigns to welcome new customers, wish them a seamless experience from bookinghappy birthday, send abandoned-cart reminders, or reach out to payment. Customers can easilylapsed customers.

•Square Gift Cards help sellers bring in new buyers when their customers purchase gift cards for their friends and family.

Staff

Square's staff management products give sellers digital tools to streamline their operations. These tools seamlessly integrate with other Square products eliminating the latent, time-consuming, and error-prone processes typically used to copy and sync data between disparate systems. We typically monetize these products via software fees.

•Square Team Management makes it easy to schedule appointments with their preferred time, service,staff and staff member,view team performance and sellers can send invoices to their customer’s email address. With Square for Retail, sellerssales analytics in the retail industry have an end-to-end point-of-sale solution with sophisticated inventory management that fully integrates with our managed payments and hardware.real time. It has a search-based user interface and fast barcode scanning; advanced inventory management that supports tens of thousands of items, cost of goods sold, purchase orders, vendor management; and employee management capabilities that allow retail sellers to better understand their customers’ habits.

•Square is our developer platform, consisting of APIs that allow sellers and their developers to customize business solutions. Our Point-of-Sale APIPayroll allows sellers to integrate any iOS or Android pointpay wages and associated employee taxes, and offer employee benefits (e.g. 401(k) accounts). The Square ecosystem drives competitive differentiation for our Payroll product with the ability to use Payroll in conjunction with our point-of-sale products, Team Management, and Cash App.

Banking

We offer a growing number of sale with Square to accept payments and access all otherbanking services in the ecosystem. This is particularly useful for sellers with highly-individualized point-of-sale needs. With our e-commerce API, sellers can integrate Square with their e-commerce website or app.

11

•Square Lending provides a platform of lending products to their online sales. This generates integrated reporting across sales channels,qualified Square sellers. Square Loans (formerly Square Capital) facilitates loans to qualified Square sellers through our subsidiary Square Financial Services, Inc. (“SFS Financial Services”), which is especially important for businesses that sell online and in person and share inventory between channels. Build with Square also has APIs for sellers to integrate Square with other business solutions such as accounting, CRM software, customer databases, employee management and ERP software. And through the Square App Marketplace, sellers can integrate Square with third-party apps, such as QuickBooks or BigCommerce, that create extensions to our point-of-sale functionality and other back office solutions, and enables sellers to integrate all of their business data.

collections, which mitigates risks. Generally, loan repayment occurs automatically through a fixed percentage of every card transaction a seller takes. ByLoans are sized to be less than 20% of a seller's expected annual Square GPV and, by simply running their business, sellers repayhistorically have repaid their loanloans within an average of nine months.months on average. We currently fund a majority of these loans from arrangements with institutional third-party investors who purchase these loans on a forward-flow basis. This funding significantly increases the speed withbasis, which we can scale Square Capital services and allows us to mitigatemitigates our balance sheet and liquidity risk.

Since its public launch in May 2014, Square CapitalLoans has facilitated over 400,000more than 2.2 million loans and advances, representing $2.5 billion.more than $16.2 billion in principal amount loaned or advanced. This includes approximately 150,000 loans to small businesses representing more than $1.5 billion of Paycheck Protection Program (“PPP”) loans facilitated in 2020 and 2021, excluding canceled loans. We launched Square Credit Card in 2023 to provide another lending option.

•Square Savings is a high-yield business savings account, with no monthly fees or minimums, designed to make cash flow management easier for sellers. With Square Savings, sellers can easily and automatically put aside a portion of industries, including retail,their sales in their savings account while also organizing their money within folders, streamlining the process of saving funds for specific goals and priorities, such as quarterly tax obligations.

Cash App Ecosystem

With Cash App, we are building an ecosystem of financial products and services that helps consumers manage their money by making it more relatable, instantly available, and food-related businesses. We serve sellers of various sizes, ranging from a single vendor at a farmers’ market to multi-location businesses. These sellers also span geographies includinguniversally accessible. Cash App is primarily in the United States Canada, Japan, Australia,and has a diverse set of customers across demographics and regions. We use our inflows framework to assess the performance of Cash App across actives, inflows per active, and the United Kingdom.monetization rate on inflows.

Strategic Priorities

Cash App sits at the intersection of three traditionally-distinct use cases: financial services, community based transactions (peer-to-peer payments) and commerce. Our approach for Cash App is to combine these three areas together in a unique manner to define a new product category and reinvent banking for our customers. Our primary focus with Cash App, in alliance with our bank partners, is on earning the primary banking relationship of our existing customer base in the U.S.

12

Customers can use Cash App to inflow funds in a variety of ways, including by receiving money from another Cash App customer through the app’s core peer-to-peer transfer service, transferring money from a bank account, depositing mobile checks, adding physical cash at participating retailers, receiving a recurring paycheck by direct deposit, and through other inflow channels. These funds can then be sent to another customer through the app, spent anywhere that accepts Visa cards or Cash App Pay, withdrawn from an ATM using the Cash App Card, invested in stocks or exchange-traded funds (“ETFs”), used to buy bitcoin, or transferred to a bank account (either instantly for a fee or for free in one to three days).

Financial Services

We serve our customers through a broad suite of financial services, and earning their trust is a key factor in how we can deepen our financial relationship with them. The breadth of our financial service offerings allows us to increase our share of wallet as well as expand our customer base to serve a wider variety of demographics. We develop trust with customers by offering reliable, easy, and secure access to their accounts and convenient support. We also adapt the amount of funds a customer can bring in through specific channels based on risk profile, and as we improve our understanding of a customer’s identity. We believe building and maintaining deep trust with our customers will drive greater product adoption and increased inflows into our ecosystem.

Banking Services

•Cash App Card is a debit card, issued by our bank partner, and linked directly to a customer’s Cash App balance. Customers can order a Cash App Card for free and use it anywhere that accepts Visa cards to make purchases, drawing down from the diversityfunds stored in their Cash App balance. Cash App earns interchange fees when individuals make purchases with their Cash App Card. Customers can select new or promotional Cash App Card designs for a fee, and can also withdraw funds from an ATM using the Cash App Card. Customers can also purchase and send gift cards at specific merchants to other customers, and recipients can spend them with their Cash App Card.

•Direct deposit capabilities, in alliance with our partner bank and system processor, allow customers to receive their recurring paycheck, tax refund, or government disbursement into their Cash App account, which they can then use to send, spend, store, or invest.

13

•Savings allows customers to hold a separate savings balance at our bank partner, and easily set and track towards financial goals. Customers can add money to Savings using their Cash App balance, a linked debit card, or through Round Ups on purchases with Cash App Card.

•Cash Boost is a free and instant rewards program that offers customers discounts at specific businesses (e.g., 10% off a purchase on DoorDash) or at certain business types (e.g., grocery stores). Customers can select the Cash Boost they want to apply to their Cash App Card, and the discount is instantly applied to their Cash App balance for eligible transactions. Some Cash Boosts are selected and funded by Cash App, while others are funded by our partners. Costs related to the Cash Boost rewards program that are funded by Cash App are recognized as reductions to revenue.

Lending

We believe credit is an area within our financial services offerings where we can provide simple, fair, and accessible products that promote financial health. Cash App Borrow, our first credit product for consumers, allows customers to access short-term loans for a small fee. The product offers eligible Cash App customers up to $500 during a given month that they can pay back in scheduled installments or as a percentage of what they receive into Cash App. We determine a Cash App customer’s eligibility based on prudent risk management by using our unique data set that includes a customer’s inflows and engagement on Cash App. The average Cash App Borrow loan was repaid in less than four weeks in 2023.

Tax Preparation

Cash App Taxes provides a seamless, mobile-first solution for consumers to file their taxes for free.

Stock Brokerage

Customers can also use Cash App to invest their funds for free in U.S. listed stocks and ETFs. We believe this makes investing more accessible by giving customers access to hundreds of listed stocks and ETFs that they can purchase using their Cash App balance or a linked debit card for as little as $1. Once the order is filled, all investments are viewable through the stocks applet.

Bitcoin

We have a simple bitcoin exchange and custody solution that provides customers with an onramp and offramp to buy and sell bitcoin with Cash App for as little as $1 and a custodial account to store it securely without needing to keep track of any private keys. Our solution offers features that allow customers to complete auto buys and custom limit orders, as well as direct deposit to auto-convert their paycheck into bitcoin and earn instant bitcoin rewards on Cash App Card purchases.

We have also focused on payments through bitcoin. Given our network scale, we believe Cash App can help bitcoin evolve beyond an asset class to an investment that possesses real transactional utility, which is why we launched our offering in 2018 with the ability to deposit and withdraw bitcoin across the blockchain. We have since added the ability for customers to send bitcoin across the Cash App network to any phone number or $Cashtag, creating an easy-to-use off-chain network for bitcoin payments that settles instantly between transacting actives. We also allow U.S. actives to send and receive bitcoin to/from anyone with a compatible wallet via the Lightning Network. The Lightning Network is a second layer technology applied to the bitcoin blockchain that enables faster transactions with little to no fees.

Community

Peer-to-peer payments form the basis of our sellers underscoresCommunity development pillar because customers engage in financial transactions with other members of the accessibilityCash App community. When customers use peer-to-peer, they are inviting their friends, family, and flexibilitycoworkers to download Cash App so that they can send each other money. Peer-to-peer becomes more useful for our customers as their communities expand, so our customers are naturally incentivized to bring more people into their networks. We offer the peer-to-peer service to our Cash App customers for free when a linked debit account is used to fund a transaction, as we consider peer-to-peer to be a marketing tool to encourage Cash App usage. We charge a fee to the sender when transactions are funded using a credit card, and a fee to the recipient if it is a business account.

14

Instant Deposit was the first feature we started monetizing on Cash App. Customers are able to instantly transfer funds from Cash App to a bank account for a small fee. We believe our customer base values fast access to funds, and this speed is one example of how we differentiate our ecosystem.

Commerce

Cash App is focused on driving greater commerce between consumers and merchants. Our BNPL platform facilitates commerce between retail merchants and consumers by allowing its retail merchant clients to offer their customers the ability to buy goods and services on a BNPL basis. Our BNPL platform serves as a connection point between our Square and Cash App ecosystems as we build out a marketplace that acts as a shopping destination for consumers to search for merchants and find offers. Our BNPL platform provides consumers the ability to get desired items now but pay for them later, while simultaneously helping merchants increase sales and order values. We have a range of products across our BNPL platform.

•Pay in 4: Through the use of our offerings.BNPL platform, consumers can split their purchases into generally three or four installments, typically due in two-week increments, without paying fees (if payments are made on time). We pay retail merchants the full order value up front (less a percentage fee) and assume the risk of non-payment from the consumer.

•Monthly Payment Solution:We are increasingly servingalso offer the ability for consumers to pay for larger sellers,transaction sizes over a six- or twelve-month period using a monthly payment option. The structure of the product includes no late fees and no compounding interest with a cap on total interest owed.

•Advertising and affiliate: Our BNPL platform generates hundreds of millions of leads each year for merchants and has channeled this demand towards scaling an ads and affiliate program for its merchants: for affiliate relationships, we receive a commission when a consumer begins their shopping journey in the Afterpay App and makes a purchase. We may also receive digital advertising revenue based on clicks to a merchant site from the Afterpay App as well as flat fees for premium ad placements.

•Shop directory: We operate an online shop directory, which we defineallows consumers to search by product category for stores that offer Afterpay as a payment option.

•Afterpay Card, Afterpay Plus Card: We offer two in-store cards that allow consumers to pay in 4 for in-person transactions at a merchant’s point of sale. The Afterpay Card allows consumers to shop in-store at Afterpay merchants and is free for the consumer. The Afterpay Plus Card is currently available to select Afterpay consumers for a monthly fee and allows them to shop in-store anywhere that Apple Pay or Google Pay is accepted.

Cash App Pay

Cash App Pay is a simple, mobile-friendly way for Cash App customers to pay at merchants across online and in-person channels. As of December 2023, Cash App Pay is enabled for a subset of Square sellers that generate more than $125,000 in annualized GPV. GPV from larger sellers represented 48%are using certain Square hardware and software products, as well as a subset of total GPV in the fourth quarter of 2017, up from 43% in the fourth quarter of 2016Afterpay merchants, and 39% in the fourth quarter of 2015. For the years ended December 31, 2017most recently launched with large payment service providers who can offer it to their merchants. With Cash App Pay, Cash App customers can pay by simply scanning a QR code or tapping a button on their mobile device at checkout.

Business Accounts

Cash App allows business accounts to collect payments for their business by accepting peer-to-peer transactions for a fee, while allowing higher weekly limits and 2016, we had no customer who accountedproviding relevant tax reporting forms.

15

Sales and Marketing

The Square ecosystem has a strong brand and continue to increase awareness of Squareaffinity among sellers by enhancing our services and fostering rapid adoption through brand affinity, direct marketing, public relations, and strategic partnerships.its sellers. Our Net Promoter Score (NPS)(“NPS”) has averaged nearly 7054 over the past four quarters, which is nearly double the average score for banking providers. Our high NPS means ourSquare sellers recommend our services to others, strengthening ourwhich we believe strengthens the Square brand and helping tohelps drive efficient customer acquisition.

Direct marketing, online and offline, has also been an effective customer acquisition channel. This includesThese tactics include online search engine optimization and marketing, online display advertising, direct mail campaigns, direct response television advertising, mobile advertising, and affiliate and seller referral programs. Total advertising costs for the years ended December 31, 2017, 2016, and 2015 were $81.9 million, $58.3 million, and $58.3 million, respectively. Additionally, Square hardware products, such as our contactless and chip reader or Square Stand, are available at over 30,000 retail stores (including Apple, Amazon, Best Buy, Staples, Target, and Walmart). Our direct sales and account management teams also contribute to the acquisition and support of larger sellers. In addition to direct channels, we work with third-party partners and developers who offer our solutions to their customers.

Our direct, ongoing interactions with our sellers help us tailor offerings to them, at scale, and in the context of their usage. We use various scalable communication channels such as email marketing, in-appin-product notifications and messaging, dashboard alerts, and Square Communities, our online forum for sellers, to increase the awareness and usage of our products and services with little incremental sales and marketing expense. Our customer support team also helps increase awareness and usage of our products as part of helping sellers address inquiries and issues.

In addition to direct channels, we work with third-party developers and other partners who offer our solutions to their customers. Partners expand our addressable market to sellers with individualized or industry-specific needs. Through the Square App Marketplace, Square partners are able to expand their own addressable market by reaching the millions of sellers using Square. As of December 31, 2023, Square had nearly 1,000 managed partners connected to its platform.

Cash App Ecosystem

Cash App has also developed a strong brand, which can be traced back to our compelling features, self-serve experience, unique design, and engaging marketing.

Peer-to-peer transactions serve as the primary acquisition channel for Cash App. Peer-to-peer transactions have powerful network effects as every time a customer sends or requests money, Cash App can potentially acquire a new customer or re-engage an existing customer. We have enhanced the efficiency of peer-to-peer transfers by streamlining the onboarding process for Cash App, enabling customers to sign up in minutes. We offer the peer-to-peer service to our Cash App customers for free, and we consider it to be a marketing tool to encourage the usage of Cash App. We do not generate revenue on the majority of peer-to-peer transactions and for these transactions we characterize card issuance costs, peer-to-peer costs, and risk loss as a sales and marketing expense.

Cash App also uses paid marketing, including referrals, advertising spend, partnerships, and social media campaigns, to expand its network, as these programs help reach new customers, enhance its brand, and improve retention among existing customers.

Additionally, we see the launch and advertising of new Cash App features as an important way to attract new customers and engage existing customers. Features such as Cash App Card and Boost rewards, bitcoin buying and selling, investing in stocks and ETFs, cross-border payments, Cash App Pay, and a tax preparation service enhance Cash App’s utility for customers and provide reasons for consumers to try Cash App.

Product Development and Technology

We design both our Square and Cash App products and services to be cohesive, fast, self-serve, and dependable,elegant, and we organize our product teams accordingly, combining individuals from product management, development and engineering, data science, analytics, design, and design.

product marketing. Our products and services are mobile-firstplatform-agnostic with most supporting iOS, Android, and platform-agnostic, and we are able to continuously optimize them because our hardware, software, and payments processing are integrated.web. We frequently update our software products and have a regularrapid software release schedule with improvements deployed generally twice a month, ensuring our sellers get immediate access to the latest features.regularly. Our services are built on a scalable technology platform, and we place a strong emphasis on data analytics and machine learning to maximize the efficacy, efficiency, and scalability of our services. This

16

In our Square ecosystem, this technology platform enables us to capture and analyze over a billionbillions of transactions per year and automate risk assessment for more than 99.95% of all transactions. Our hardware is designed and developed in-house, and we contract with third-party manufacturers for production. Our product development expenses were $321.9 million, $268.5 million and $199.6 million for the years ended December 31, 2017, 2016, and 2015, respectively.

Our Competition

Square Ecosystem

The markets in which we operateour Square ecosystem operates are competitive and evolving. Our competitors range from large, well-established vendors to smaller, earlier-stage companies.

We seek to differentiate ourselves from competitors primarily on the basis of our extensive commerce ecosystem and our focus on building remarkable products and services that are cohesive, fast, self-serve, and dependable.elegant. In addition, we differentiate ourselves by offering transparent pricing, no long-term contracts, and our ability to innovate and reshape the industries we operate in to expand access to traditionally unserved or underserved sellers. With respect to each of these factors, we believe that we compare favorably to our competitors.

•Business software providers such as those that provide point of sale, website building, inventory management, analytics,employee management, customer relationship management and marketing, e-commerce,invoicing, and appointment booking solutions;

•Payment terminal vendors;

•Merchant acquirers;

•Banks that provide payment processing, checking, savings, loans, and payroll;

•Pen and paper, manual processes, and paper currency;

•Payroll processors; and

•Established or new alternative lenders;lenders.

Cash App competes with other companies in peer-to-peer payments, debit and prepaid cards, credit card rewards, stock trading, tax filing, digital wallet, bitcoin exchanges, BNPL providers, and shopping and consumer demand generation. Our competitors include money transfer apps, prepaid debit card offerings, brokerage firms, tax firms, financial technology apps, banks, and crypto trading services.

Intellectual Property

We seek to protect our intellectual property rights by relying on a combination of federal, state, and common law rights in the United States and other countries, as well as on contractual measures. It is our practice to enter into confidentiality, non-disclosure, and invention assignment agreements with our employees and contractors, and into confidentiality and non-disclosure agreements with other third parties, in order to limit access to, and disclosure and use of, our confidential information and proprietary technology. In addition to these contractual measures, we also rely on a combination of trademarks, trade dress, copyrights, registered domain names, trade secrets, and patent rights to help protect our brand and our other intellectual property.

We have developed a patent program and strategy to identify, apply for, and secure patents for innovative aspects of our products, services, and technologies where appropriate. AsWe also actively pursue registration of December 31, 2017, we had 379 issued patents in forceour trademarks, logos, service marks, trade dress, and 605 filed patent applications pendingdomain names in the United States and in foreign jurisdictions relating to a variety of aspects of our technology. Our issued patents in force will expire between 2032 and 2042.other jurisdictions. We intend to file additional patent applications as we continue to innovate through our research and development efforts and to pursue additional patent protection to the extent we deem it beneficial and cost-effective.

17

Government Regulation

Foreign and domestic laws and regulationslegal requirements apply to many key aspects of our business. Any actual or perceived failure to comply with these requirements may result in, among other things, revocation of required licenses or registrations, loss of approved status, private litigation, regulatory or governmental investigations, administrative enforcement actions, sanctions, civil and criminal liability, monetary penalties, and constraints on our ability to continue to operate. It is also possible that current or future laws or regulations could be interpreted or applied in a manner that would prohibit, alter, or impair our existing or planned products and services, or that could require costly, time-consuming, or otherwise burdensome compliance measures from us.

Payments Regulation

Various laws and regulations govern the payments industry in the United States and globally. For example, certain jurisdictions in the United States require a license to offer money transmission services, such as ourCash App’s peer-to-peer payments, product, Cash App, and we maintain a license in each of those jurisdictions and comply with new license requirements as they arise. We are also registered as a “Money Services Business” with the U.S. Department of Treasury’s Financial Crimes Enforcement Network.Network ("FinCEN"). These licenses and registrations subject us, among other things, to record-keeping requirements, reporting requirements, bonding requirements, limitations on the investment of customer funds, and inspectionexamination by state and federal regulatory agencies.

Outside the United States, we provide localized versions of some of our services to customers, including through various foreign subsidiaries. For example, in Canada, Japan, Australia and the United Kingdom, Square Point of Sale is the sole payments service we offer. The activities of those non-U.S. entities are, or may be, supervised by regulatory authorities in the jurisdictions in which they operate. For instance, we are registered withhold an Australian Financial Services License issued by the Australian Transaction ReportsSecurities and Analysis Centre (AUSTRAC), as required by anti-money laundering rules,Investments Commission to provide non-cash payments services in Australia, and we are licensed as an Authorised PaymentElectronic Money Institution to provide payments services and electronic money in the United Kingdom by the Financial Conduct Authority to provide payments servicesand in the United Kingdom.European Union by the Central Bank of Ireland and the Bank of Lithuania.

Our payments services may be or become subject to regulation by other authorities, and the laws and regulations applicable to the payments industry in any given jurisdiction are always subject to interpretation and change.

Consumer Financial Protection

The Consumer Financial Protection Bureau and other federal, local, state, and foreign regulatory and law enforcement agencies regulate financial products and enforce consumer protection laws, including those applicable to credit, deposit, and payments services, and other similar services. These agencies have broad consumer protection mandates, and they promulgate, interpret, and enforce rules and regulations that affect our business.

Anti-Money Laundering, Anti-Corruption, and Sanctions

We are subject to anti-money laundering (AML)("AML"), anti-corruption, and economic, trade and sanctions laws and regulations in the United States and other jurisdictions. We have implementedjurisdictions in which we operate. The anti-corruption laws, such as the U.S. Foreign Corrupt Practices Act and the U.K. Bribery Act, generally prohibit companies from making or offering improper payments to foreign government officials and political figures for the purpose of obtaining or retaining business or to gain an AML program designed to prevent our payments network from being used to facilitate money laundering, terrorist financing,unfair business advantage. Economic and other illicit activity. Our program is also designed to prevent our network from being used to facilitate business in countries, or with persons or entities, included on designated lists promulgatedtrade sanctions programs that are administered by the U.S. Department of the Treasury’s Office of Foreign Assets Controls and equivalent applicable foreign authorities. Our AML compliance program includes policies, procedures, reporting protocols,authorities prohibit or restrict transactions to or from, or dealings with, specified countries, governments, individuals and internal controls,entities that are specially designated nationals of those countries, including the designation ofnarcotics traffickers and terrorists or terrorist organizations. We have implemented an AML program designed to comply with the laws and regulations to which we are subject.

Bank Regulation

We obtained approval from the Federal Deposit Insurance Corporation ("FDIC") and the Utah Department of Financial Institutions to open an ILC. The opening of Square Financial Services, Inc., our ILC, in March 2021 subjects us to direct state and federal regulatory supervision and requires compliance officer,with applicable banking regulations and requirements.

18

Lending Regulation

Various laws and regulations govern lending in the United States and internationally. In the United States, Square Capital, LLC holds and maintains lending and collections licenses with state regulators to support lending products offered across the United States. Afterpay US Services, LLC holds and maintains lending licenses to support its product offerings. These lending licenses subject us to the supervision and examination authority of state regulators, and our partnerships with FDIC-insured financial institutions to offer certain lending products to customers subjects us to federal regulatory supervision.

Outside the United States, we provide localized versions of some of our lending services to customers, including through our various foreign subsidiaries. The activities of our foreign subsidiaries are, or may be, supervised by regulatory authorities in the jurisdictions in which they operate. For example, we hold an Australian Credit Licence issued by the Australian Securities and Investments Commission.

Our lending services may be, or may become, subject to regulation by other applicable authorities or jurisdictions, and the laws and regulations applicable to the lending industry in any given jurisdiction are always subject to interpretation and change.

Broker-Dealer Regulation

Our subsidiary, Cash App Investing LLC ("Cash App Investing"), operates as a broker-dealer and is designedtherefore registered with the Securities and Exchange Commission ("SEC") and a member of the Financial Industry Regulatory Authority ("FINRA"). As a broker-dealer, Cash App Investing is subject to address these legalSEC and FINRA laws and regulations including, without limitation, how it markets its services, handles customer assets, keeps records, and reports to the SEC and FINRA. Cash App Investing is also registered in each state where we conduct business, and subject to those states’ securities laws and regulations.

Virtual Currency Regulation

We are subject to certain licensing and supervisory frameworks as a result of our Cash App offering, through which customers can use their stored funds to buy, hold and sell bitcoin, and transfer bitcoin to and from Cash App. We currently hold a New York State BitLicense and a Virtual Currency Business License in Louisiana. The laws and regulations applicable to virtual currency are evolving and subject to interpretation and change. Therefore, our current and future virtual currency services may be or become subject to additional licensing, regulatory requirements and to assist in managing risk associated with money launderingoversight by other state and terrorist financing.federal authorities.

Protection and Use of Information

We collect and use a wide variety of information for various purposes in our business, including to help ensure the integrity of our services and to provide features and functionality to our customers. This aspect of our business, including the collection, use, disclosure, and protection of the information we acquire from our own services as well as from third-party sources, is subject to laws and regulations in the United States, the European Union, and elsewhere. Accordingly, we publish our privacy policies and terms of service, which describe our practices concerning the use, transmission, and disclosure of information. As our business continues to expand in the United States and worldwide, and as laws and regulations continue to be passed and their interpretations continue to evolve in numerous jurisdictions, additional laws and regulations may become relevant to us.

Communications Regulation

We send texts, emails, and other communications in a variety of contexts, such as when providing digital receipts.receipts and marketing. Communications laws and regulations, including those promulgated by the Federal Communications Commission, apply to certain aspects of this activity in the United States and elsewhere.

19

Additional Developments

Various legislative bodies and regulatory agencies in the United States and elsewhere in our international markets continue to examine a wide variety of issues that could impact our business, including products liability, import and export compliance, accessibility for the disabled, insurance, marketing, privacy, data protection, information security, virtual currencies, identity theft, tax, marketing, and labor and employment matters. As our business continues to develop and expand, additional laws, rules and regulations may become relevant. For example, if we choose

Seasonality

Historically, transaction-based revenue for our Square ecosystem has been strongest in our fourth quarter and weakest in our first quarter, as our sellers typically generate additional GPV during the holiday season. Subscription and services-based revenue generally demonstrates less seasonality than transaction-based revenue. Hardware revenue generally demonstrates less seasonality than transaction-based revenue, with most fluctuations tied to offer Square Payrollperiodic product launches, promotions, or other arrangements with our retail partners.

Historically, our Cash App ecosystem has experienced improvements in revenue and gross profit related to the distribution of government funds as customers have deposited more jurisdictions,funds into Cash App during these times, including during the first quarter when U.S. tax refunds are typically distributed. Certain products within Cash App may also experience stronger fourth quarters and weaker first quarters, such as our BNPL platform, which typically generates additional regulations, including tax rules, will apply.revenue and gross profit during the holiday season. Typical seasonality trends for the Cash App ecosystem are also impacted by bitcoin revenue, which is driven by customer demand and the current market price of bitcoin, and as such, may not be indicative of future performance and skew typical seasonality trends in the Cash App ecosystem.

Our Employees

employees are a driving force behind our purpose of economic empowerment. Attracting, developing, and retaining top talent remain a focus in the development of our human capital programs. As of December 31, 2017,2023, we had 2,33812,985 full-time employees.employees worldwide with 3,154 full-time employees outside the US. We also engage temporary employees and consultants as needed to support our operations. NoneIn November 2023, we announced we would implement an absolute cap of 12,000 on the number of employees we have at our company. We plan to operate below this cap through a combination of performance management, centralizing teams and functions to reduce duplication, and prioritization of our employees are either represented by a labor union or subjectscope. We expect to a collective bargaining agreement. keep this cap in place until we believe the growth of the business has meaningfully outpaced the growth of our company.

We have a purpose-driven culture, with a focus on employee input and well-being, which we believe enables us to attract and retain exceptional talent. We offer learning and development programs for all employees, as well as a robust manager training program. Employees have the opportunity to actively voice their questions and thoughts through many internal channels, including our company townhall meetings and bi-annual employee engagement surveys. Our distributed work model means that we no longer have a designated headquarters location and, for the vast majority of roles, employees have the flexibility to work within or outside a Block office space. Our distributed work model has unlocked opportunities to hire and retain talent in more locations, as we can hire employees in locations where we do not experienced anyhave office space, and employees can continue to work stoppages,for us if they need or want to relocate.

A key focus of our human capital management approach is our commitment to promoting inclusion and diversity in our workplace. In 2023, we considerequipped managers with tools to build and lead inclusive teams, expanded professional development opportunities for employees from traditionally underrepresented backgrounds, and continued to elevate diversity as a central component of our relationsrecruiting strategy. Each year, we publish our workforce demographics to show how far we have come, where there is room to grow, and how our workforce is evolving. The 2023 report is available at: https://block.xyz/inside/report-workforce-data-2023. The contents of the report and our websites are not incorporated by reference into this Annual Report on Form 10-K.

From a total rewards perspective, Block offers a competitive compensation and benefits package, which is reviewed and updated each year. Our annual compensation planning coincides with our feedback cycle during which employees and managers have performance conversations to be good.facilitate learning and career development. As part of our compensation review program, pay equity analyses are conducted annually.

20

Corporate Information

We use various trademarks and trade names in our business, including “Square”“Block,” “Square,” “Cash App” and Square®,“Afterpay,” which we have registered in the United States and in various other countries. This Annual Report on Form 10-K also contains trademarks and trade names of other businesses that are the property of their respective holders. We have omitted the ® and ™ designations, as applicable, for the trademarks we name in this Annual Report on Form 10-K.

Available Information

Copies of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (Exchange Act), are available, free of charge, on our investor relations website as soon as reasonably practicable after we electronically file or furnish such material electronically with or furnish it to the Securities and Exchange Commission (SEC)("SEC"). The SEC also maintains a website that contains our SEC filings. The address of the site is www.sec.gov. Further, a copy of this Annual Report on Form 10-K is located at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330.

We webcast our earnings calls and certain events we participate in or host with members of the investment community on our investor relations website. Additionally, we provide notifications of news or announcements regarding our financial performance, including SEC filings, investor events, press and earnings releases, and blogs as part of our investor relations website. We have used, and intend to continue to use, our investor relations website, as well as the TwitterX (formerly known as Twitter) accounts @Square@Blocks and @SquareIR,@BlockIR, as means of disclosing material non-public information and for complying with our disclosure obligations under Regulation FD. Further corporate governance information, including our board committee charters, code of business conduct and ethics, and corporate governance guidelines, is also available on our investor relations website under the heading “Governance Documents.” The contents of our websites are not intended to be incorporated by reference into this Annual Report on Form 10-K or in any other report or document we file with the SEC, and any references to our websites are intended to be inactive textual references only.

Investing in our securities involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this Annual Report on Form 10-K, including the section titled “Management’sManagement’s Discussion and Analysis of Financial Condition and Results of Operations”Operations and our consolidated financial statements and related notes, before making any investment decision with respect to our securities. The risks and uncertainties described below may not be the only ones we face. If any of the risks actually occur, our business could be materially and adversely affected. In that event, the market price of our Class A common stock could decline, and you could lose part or all of your investment.

Risk Factors Summary

Our business operations are subject to numerous risks and uncertainties, including those outside of our control, that could cause our actual results to be harmed, including risks regarding the following:

Risks related to our business and our industry:

•our ability to retain existing sellers and customers, attract new sellers and customers, and increase sales to both new and existing sellers and customers;

•our investments in our business and ability to maintain profitability;

•our ability to maintain, protect, and enhance our brands;

•our efforts to expand our product portfolio and market reach;

•our ability to develop products and services to address the rapidly evolving market for payments and financial services;

•competition in our markets and industry;

•risks related to disruptions in or negative perceptions of the cryptocurrency market;

•any acquisitions, strategic investments, new businesses, joint ventures, divestitures, and other transactions that we may undertake;

•the ongoing integration of Afterpay with our business;

•risks related to our majority interest in TIDAL;

•operating or expanding our business globally;

•risks related to our BNPL platform;

•risks related to the banking ecosystem, including through Square Financial Services, our bank partnerships, and FDIC and other regulatory obligations; and

•additional risks of Square Loans related to the availability of capital, seller payments, interest rate, deposit insurance premiums, and general macroeconomic conditions.

Operational risks:

•real or perceived improper or unauthorized use of, disclosure of, or access to sensitive data;

•real or perceived security breaches or incidents or human error in administering our software, hardware, and systems;

•systems failures, interruptions, delays in service, catastrophic events, and resulting interruptions in the availability of our products or services or those of our sellers;

•any failure to safeguard the bitcoin we hold on behalf of ourselves and other parties;

•our risk management efforts;

•our dependence on payment card networks and acquiring processors;

•our reliance on third parties and their systems for a variety of services, including the processing of transaction data and settlement of funds;

•our dependence on key management and any failure to attract, motivate, and retain our employees;

•our operational, financial, and other internal controls and systems;

•any shortage, price increases, tariffs, changes, delay or discontinuation of our key components;

•the integration of our services and our products with a variety of operating systems; and

•difficulties estimating the amount payable under TIDAL's license agreements.

22

Economic, financial, and tax risks:

•a deterioration of general macroeconomic conditions;

•any inability to secure financing on favorable terms, or at all, or comply with covenants in our existing credit agreement, the indentures, or future agreements;

•our ability to service our debt, including our convertible notes and our Senior Notes (as defined below);

•counterparty risk with respect to our convertible note hedge transactions;

•our bitcoin investments being subject to volatile market prices, impairment, and other risks of loss;

•foreign exchange rates risks; and

•any greater-than-anticipated tax liabilities or significant valuation allowances on our deferred tax assets.

Legal, regulatory, and compliance risks:

•extensive regulation and oversight in a variety of areas of our business;

•complex and evolving regulations and oversight related to privacy, data protection, and information security;

•litigation, including intellectual property claims, government investigations or inquiries, and regulatory matters or disputes;

•obligations and restrictions as a licensed money transmitter;

•regulatory scrutiny or changes in the BNPL space;

•regulation and scrutiny of our subsidiary Cash App Investing, which is a broker-dealer registered with the SEC and a member of FINRA, including net capital and other regulatory capital requirements;

•changes to our business practices imposed by FINRA based on our ownership of Cash App Investing;

•regulation and scrutiny of our subsidiary Square Financial Services, which is a Utah state-chartered industrial loan company, including the requirement that we serve as a source of financial strength to it;

•supervision and regulation of Square Financial Services, including the Dodd-Frank Act and its related regulations;

•any inability to protect our intellectual property rights;

•assertions by third parties of infringement of intellectual property rights by us; and

•increased scrutiny from investors, regulators, and other stakeholders relating to environmental, social, and governance issues.

Risks related to ownership of our common stock:

•the dual class structure of our common stock;

•volatility of the market price of our Class A common stock;

•the dual-listing of our Class A common stock on the NYSE and our CHESS Depositary Interests ("CDIs") on the Australian Securities Exchange ("ASX");

•our convertible note hedge and warrant transactions;

•anti-takeover provisions contained in our amended and restated certificate of incorporation, our amended and restated bylaws, and provisions of Delaware law; and

•exclusive forum provisions in our bylaws.

23

Risks Related to Our Business and Our Industry

Our business depends on a stronggrowth rate has slowed at times and trusted brand, and any failure to maintain, protect, and enhance our brand would hurt our business.

Our total net revenue grew from $1,267.1 million in 2015 to $1,708.7 million in 2016 and to $2,214.3 million in 2017. As our revenue has increased, our rate of revenue and gross profit growth has slowed at times and may decline in the future, and it may slow or decline more quickly than we expect for a variety of reasons, including the risks described in this Annual Report on Form 10-K. Additionally, our rate of revenue and gross profit growth may vary between our reporting segments. For example, in recent periods our Cash App segment revenue has grown at a high rate, which has varied and may continue to vary from the growth rate of our Square segment. Our sellers and customers have no obligation to continue to use our services, and we cannot assure you that they will. We generally do not have long-term contracts with our sellers and customers, and the difficulty and costs associated with switching to a competitor may not be significant for many of our services.the services we offer. Our sellers’ payment processing activity with us may decrease for a variety of reasons, including sellers’ level of satisfaction with our products and services, the effectiveness of our support services, our pricing and the pricing and quality of competing products or services, the effects of global economic conditions, or reductions in the aggregate spending of our sellers’ customers. Growth in transacting actives on Cash App and customers’ level of engagement with our products and services on Cash App are essential to our success and long-term financial performance. However, the growth rate of transacting actives has fluctuated over time, and it may slow or decline in the future. A number of factors have affected and could negatively affect Cash App customer spending levels. In addition,growth, inflows, and engagement levels, including our ability to introduce new products and services that are compelling to our customers and that they adopt, changes to our systems, processes or other technical or operational requirements that impact how customers use or access our products and services, the impact on our network of other customers choosing whether to use Cash App, our decision to expand into or exit certain markets, technical or other problems that affect customer experience, failure to provide sufficient customer support, fraud and scams targeting Cash App customers, and harm to our reputation and brand. Further, certain events or programs, such as government stimulus programs may correlate with periods of significant growth, but such growth may not be sustainable. Additionally, the growth rate of Cash App revenue may be distorted by the prices of bitcoin, as bitcoin revenue may increase or decrease due to changes in the price of, and demand for, bitcoin and may not correlate to customer or engagement growth rates.

The growth of our business depends in part on our existing sellers and customers expanding their use of our products and services. If we are unable to encourage sellers to broaden theirbroader use of our products and services within each of our ecosystems by our existing sellers and customers, our growth may slow or stop, and our business may be materially and

adversely affected. The growth of our business also depends on our ability to attract new sellers and customers, to encourage larger sellers and customers to use our products and services, and to introduce successful new products and services. We have invested and will continue to invest in improving our Square platformbusiness in order to offer better or new features, products, and services and to adjust our product offerings to changing economic conditions, but if those features, products, services, and serviceschanges fail to be successful on the expected timeline or at all, our growth may slow or decline.

2023, we generated a net income of $9.8 million. As of December 31, 2017,2023, we had an accumulated deficit of $842.7$528.4 million.

We intend to continue to make significant investments in our business, including with respect to our employee base;base, sales and marketing, including expenses relating to increased direct marketing efforts, referral programs, and free hardware and subsidized services; development of new products, services, and features; acquisitions; expansion of office space and other infrastructure; expansion of international operations;operations, and general administration, including legal, finance, and other compliance expenses related to being a public company.our business. If the costs associated with acquiring and supporting new or larger sellers, attracting and supporting new Cash App customers, or with developing and supporting our products and services materially riseincrease in the future, including the fees we pay to third parties to advertise our products and services, our expenses may rise significantly. In addition, increases in our seller base could cause us to incur increased losses because costs associated with new sellers are generally incurred up front, while revenue is recognized thereafterin future periods as sellers utilize our services.products and services are used by our sellers. Moreover, businesses we acquire may have different profitability than our existing business, which may affect our overall profitability, particularly until we are able to realize expected synergies. For example, prior to its acquisition, Afterpay historically generated net losses. If we are unable to generate adequate revenue growth and manage our expenses, we may continue to incur significant losses and may not achieve or maintain profitability.profitability on a consistent basis.

24

From time to time, we have made and may make decisions that will reducehave a negative effect on our short-term operating results if we believe those decisions will improve the experiences of our customers, which we believe will improve our operating results over the long term. For example, from time to time, we have implemented expense cuts and reduced the size of our workforce to, among other things, align our cost structure with our business and longer term strategies, which may increase expenses in the short term and impact our ability to grow or quickly develop and introduce products. These decisions may not be consistent with the expectations of investors and may not produce the long-term benefits that we expect, in which case our business may be materially and adversely affected.

Our business depends on our ability to maintain, protect, and enhance our brands.

Having a strong and trusted brand has contributed significantly to the success of our business. We believe that maintaining, promoting, and enhancing the Square, Cash App, TIDAL, Afterpay, and our other brands, in a cost-effective manner is critical to achieving widespread acceptance of our products and services and expanding our base of customers. Maintaining and promoting our brands will depend largely on our ability to continue to provide useful, reliable, secure, and innovative products and services, as well as our ability to maintain trust and be a technology leader. We may introduce, or make changes to, features, products, services, privacy practices, or terms of service that customers do not like, which may materially and adversely affect our brands. Our brand promotion activities may not generate customer awareness or increase revenue, and even if they do, any increase in revenue may not offset the expenses we incur in building our brands. If we fail to successfully promote and maintain our brands or if we incur excessive expenses in this effort, our business could be materially and adversely affected.