SECURITIES AND EXCHANGE COMMISSION

FORM 10-K

| | | | | |

þ

☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year endedApril 30, 2017 2022 |

or

| | | | | |

¨

☐ | TRANSITIONREPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from ___________ to ___________ |

Commission file number000-55107001-38175 (Exact Name of Registrant as Specified in Its Charter) | | |

Delaware

| | 27-1933597

| | | | | | |

Delaware | | 27-1933597 |

| State or Other Jurisdiction of Incorporation or Organization | | I.R.S. Employer Identification No. |

| | |

1660 South Albion Road,276 Fifth Avenue, Suite 525, Denver, CO

505, New York, New York | | 80222

10001 |

Address of Principal Executive Offices | | Zip Code |

(303) 333-4224

(646) 448-5144

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 | ASPU | The Nasdaq Stock Market (The Nasdaq Global Market) |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No þ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes

þ☑ No

¨☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of the Form 10-K or any amendment to the Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging“emerging growth company”company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | |

| Large accelerated filer ¨ | Accelerated filer ¨ | |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company)☑ | Smaller reporting company þ ☑ | |

| Emerging growth company ¨☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨☐ No þ State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. Approximately

$30.4$112 million based on

$3.00. a closing price of $4.75 on October 29, 2021.

The number of shares outstanding of the registrant’s classes of common stock, as of July

24, 201722, 2022 was

13,612,35425,202,278 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Proxy Statementproxy statement for the 20172022 Annual Meeting of Shareholders are incorporated herein by reference in Part III of this Annual Report on Form 10-K to the extent stated herein. Such Proxy Statement will be filed with the Securities and Exchange Commission within 120 days of the registrant's fiscal year ended April 30, 2017.

INDEX

TABLE OF CONTENTS | | | | | | | | |

| | Page Number |

|

| | |

| | |

| | 18

|

| | 38

|

| | 38

|

| | 39

|

| | 39

|

| | |

| | |

| | |

| | 40

|

| | 40

|

| | 41

|

| | 52

|

| | 52

|

| | 52

|

| | 52

|

| | 52

|

| | |

| | |

| | |

| | 53

|

| | 53

|

| | 53

|

| | 53

|

| | 53

|

| | |

| | |

| | |

| | 54

|

| | |

PART I

Aspen Group, Inc., or Aspen Group, owns 100% of is an education technology holding company. AGI has two subsidiaries, Aspen University Inc., a Delaware corporation, ("Aspen University" or Aspen"AU") organized in 1987 and United States University Inc. ("United States University" or Aspen University. "USU").

All references to the

“Company,” “we,”“Company”, “AGI”, “Aspen Group”, “we”, “our” and “us” refer to Aspen Group,

Inc., unless the context otherwise indicates.

AGI leverages its education technology infrastructure and expertise to allow its two universities, Aspen

Group, Inc. (“Aspen Group”) is a post-secondary education company with an overarchingUniversity and United States University, to deliver on the vision of making

higher educationcollege affordable

again in America. To date, Aspen Group’s sole operating subsidiary has been Aspen University, Inc., doing business as Aspen University. On May 18, 2017, Aspen Group announced it had entered into a definitive agreement to acquire United States University (“USU”), a regionally accredited for-profit university based in San Diego, California for a total purchase price of $9 million. The transaction is subject to customary closing conditions and regulatory approvals by the U.S. Department of Education (“DOE”), WASC Senior College and University Commission, and state regulatory and programmatic accreditation bodies. The earliest that Aspen Group would receive required regulatory approvals would be December 2017.

The remainder of this management discussion will focus on Aspen University.

Founded in 1987, Aspen University’s mission is to offer any motivated college-worthy student the opportunity to receive a high quality, responsibly priced distance-learning education for the purpose of achieving sustainable economic and social benefits for themselves and their families. Aspen is dedicated to providing the highest quality education experiences taught by top-tier professors - 54% of our adjunct professors hold doctorate degrees.

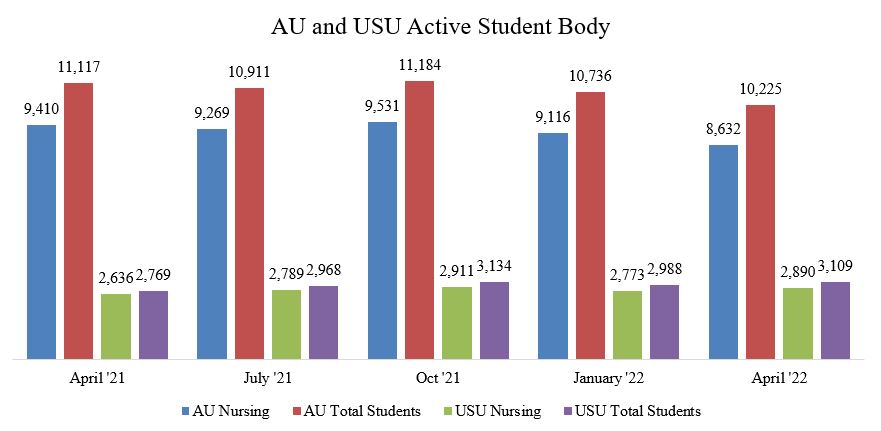

again. Because we believe higher education should be a catalyst to our students’ long-term economic success, we exert financial prudence by offering affordable tuition that is one of the greatest values in online higher education. In March 2014,AGI’s primary focus relative to future growth is to target the high growth nursing profession. As of April 30, 2022, 11,522 of 13,334 or 86% of all active students across both universities are degree-seeking nursing students. Of the students seeking nursing degrees, 9,562 are RNs studying to earn an advanced degree, including 6,672 at Aspen University unveiledand 2,890 at USU. In contrast, the remaining 1,960 nursing students are enrolled in Aspen University’s BSN Pre-Licensure program in the Phoenix, Austin, Tampa, Nashville and Atlanta metros.

Aspen University has been offering a monthly payment plan

aimed at reversingavailable to all students across every online degree program offered by Aspen University, since March 2014. The monthly payment plan is designed so that students will make one fixed payment per month, and that monthly payment is applied towards the

college-debt sentence plaguing working-class Americans.total cost of attendance (tuition and fees, excluding textbooks). The monthly payment plan offers

bachelor’s degreeonline undergraduate students

(except RN to BSN) the opportunity to pay

their tuition and fees at $250/month,

for 72 months ($18,000), nursing bachelor’s degree students (RN to BSN) $250/month for 39 months ($9,750), master’s degreeonline master students $325/month,

for 36 months ($11,700) and

online doctoral students

$375 per $375/month,

for 72 months ($27,000), interest free, thereby giving students a monthly payment

tuition option versus taking out a federal financial aid loan.

Since the March 2014

USU has been offering monthly payment

education announcement, 65%plans since the summer of

courses are now paid for through2017. Today, USU monthly payment

methods (basedplans are available for the online RN to BSN program ($250/month), online MBA/MAEd/MSN programs ($325/month), online hybrid Bachelor of Arts in Liberal Studies, Teacher Credentialing tracks approved by the California Commission on

courses started over the last 90 days). Aspen offers two monthly payment programs, a monthly payment plan described above in which students make payments every month over a fixed period (36, 39 or 72 months depending on the degree program)Teacher Credentialing ($350/month), and

a monthly installment plan in which students pay three monthly installments (day 1, day 31 and day 61 after the

start of each course). As of April 30, 2017, Aspen has 3,060 students paying tuition through either of the monthly payment methods. Of those, 2,801 of those students are paying tuition through a monthly payment plan representing total contractual value of $26.5 million, which today equates to approximately $780,000 of monthly recurring tuition revenue.

Aspen offers certificate programs and associate, bachelor’s, master’s and doctoral degree programs in a broad range of areas, including nursing, business, education, technology, and professional studies. In terms of student body growth during fiscal year 2017, Aspen’s active degree-seeking student body grew by 1,749 students or 60%, from 2,932 to 4,681 students.

One of the key differences between Aspen and other publicly-traded, exclusively online for-profit universities is the fact that the majority of our degree-seeking students (72% as of April 30, 2017 compared to 54% as of April 30, 2016) were enrolled in Aspen’s School of Nursing. Aspen’s School of Nursing grew during fiscal year 2017 by 1,481 students or 79%, from 1,882 to 3,363 students, which represents 85% of Aspen’s student body growth.

On November 10, 2014, Aspen University announced that the Commission on Collegiate Nursing Education (“CCNE”) had awarded accreditation to its Bachelor of Science in Nursing program (RN to BSN) through December 31, 2019. CCNE is officially recognized by the DOE and is a nongovernmental accrediting agency, which provides specialized accreditation for nursing programs by ensuring the quality and integrity of nursing education in preparing effective nurses.

Since 2008, Aspen’shybrid Master of Science in Nursing-Family Nurse Practitioner (“FNP”) program ($375/month).

Fiscal 2022 Overview

For Fiscal Year 2022, the Company achieved and experienced the following key developments:

Aspen 2.0 Business Plan and Other Trends

In Fiscal Year 2022, the Company implemented its ‘Aspen 2.0’ business plan. Aspen 2.0 is designed to deliver maximum efficiency as defined by revenue earned from each marketing dollar spent. Under the plan, growth spending has been re-focused on our highest efficiency businesses in an effort to accelerate the growth in these units, with decreased spending in our lowest efficiency unit (an area where high growth is not essential). Specifically, we have reduced marketing spending in our traditional AU Nursing Program has held CCNE accreditation. The Master+ Other unit. In addition, we have suspended spending in our Phoenix metro BSN Pre-Licensure, as it was nearing capacity and also more recently due to regulatory issues described beginning at page 1 of Sciencethis Report. Those marketing dollars have been redirected towards high LTV programs, specifically our four new BSN Pre-Licensure metros, AU’s online doctoral programs, and USU's MSN-FNP program. Additionally, due to a requirement to collateralize a new surety bond required by the Arizona State Board for Private Postsecondary Education, the Company reduced marketing spend in the fourth quarter of fiscal year 2022 compared to immediately preceding periods. While this resulted in improved operating results for that quarter, we may see negative trends in future periods if the decrease in marketing spend results in a decline in enrollments. In the Phoenix metro, which was profitable, we cannot currently matriculate pre-professional nursing students into the two-year core nursing program. See Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Arizona State Board of Nursing program most recently underwent accreditation reviewProbation

Because Aspen University’s first-time pass rates for our BSN pre-licensure students taking the NCLEX-RN exam in Arizona fell from 80% in 2020 to 58% in 2021, which is below the minimum 80% standard set by CCNEthe Arizona State Board of Nursing (“AZ BON”) in March 2011. At that time,2022, AU entered into a Consent Agreement for Probation and a Civil Penalty (the “Consent Agreement”) with the program’s accreditationAZ BON pursuant to which AU’s Provisional Approval was reaffirmed,revoked, with a new accreditation term to expire December 30, 2021. We currently offer a varietythe revocation stayed pending

AU’s compliance with the terms and

Management, Master of Science in Nursing – Forensic Nursing, Master of Science in Nursing –Public Health, Master of Science in Nursing – Informatics, and Bachelor of Science in Nursing.

Aspen’s School of Nursing is responsible for the vast majorityconditions of the new student enrollment and overall active student body growth. Specifically, Aspen’s SchoolConsent Agreement. The minimum probationary period is 36 months from the date of Nursing is now on pace to grow on an annualized basis by approximately 1,500 Active Nursing students – netthe Consent Agreement. In June 2022, the AZ BON granted approval of student graduations and withdrawals (or ~125/month). Aspen’s BSN program accountsAspen University’s request for 72% of that growth,provisional approval as thatlong as the program is on pace to increase on an annualized basis by approximately 1,080 students – net (or ~90/month).

in compliance with the consent agreement through March 31, 2025. Aspen University expects its total active degree-seeking student body to continue its rapid growth and reach approximately 7,000is not currently enrolling students in the BSN Pre-licensure program in Arizona.

Because the pre-licensure program is comprised of two components, a one-year pre-requisite Pre-Professional Nursing (“PPN”) requirement followed by the enda two-year core program, one effect of the fiscal year,foregoing events was to prevent PPN students from matriculating into the core program until after the probation stipulation is met.

See “State Professional Licensure” on page 10 for more information on the Consent Agreement and Civil Penalty, and “Item 3 - Legal Proceedings” for more information on a class action lawsuit filed after disclosure of the Consent Agreement.

Stipulated Agreement and Surety Bond

In connection with the above developments with respect to the AZ BON, Aspen University has also entered into a Stipulated Agreement with the Arizona State Board for Private Postsecondary Education (the “Arizona Board”) which required us to post a surety bond for $18.3 million. Aspen University posted the surety bond on April 30, 2018. Therefore,22, 2022. Aspen University is not currently enrolling students in the university is on pace to increase its active student body by ~2,300 students on an annualized basisBSN Pre-licensure program in Arizona, a condition of the Stipulated Agreement.

Certain Financing and Related Developments

Set forth below are descriptions of certain transactions and developments involving funding and capital that occurred in fiscal year 2018 versus2022. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations - “Liquidity and Capital Resources” on page 61 for more information on our liquidity and capital resources.

a.On March 14, 2022, we raised $10 million in gross proceeds from the previous paceissuance of ~1,750 activeconvertible notes. We also issued two lenders a total of $20 million in Revolving Promissory Notes which have not been drawn upon. Subsequently, the two Revolving Promissory Notes and $5 million of the proceeds from the convertible notes were pledged as collateral for the $18.3 million surety bond (see discussion above). For the fourth quarter 2022, the Company reduced marketing spend sequentially by $1.0 million, primarily to ensure sufficient collateral for the surety bond required by the Arizona State Board for Private Postsecondary Education.

b.On August 31, 2021, AGI entered into a letter agreement with The Leon and Toby Cooperman Family Foundation (“Cooperman”). On September 1, 2021, the Company borrowed $5 million from The Leon and Toby Cooperman Family Foundation (“Cooperman”) under a Credit Facility Agreement.

c.On July 21, 2021, AGI received a payment of $498,120 as a final distribution by the bankruptcy trustee in the previously disclosed Higher Education Management Group, Inc. bankruptcy proceedings. The bankruptcy filing occurred after AGI obtained a $772,793 judgment against Higher Education Management Group, Inc. No further assets are available for distribution.

Atlanta, GA Campus Approvals

On January 20, 2022, the Company announced that Aspen University received the final required state and board of registered nursing regulatory approvals for their new BSN Pre-Licensure campus location in Atlanta, Georgia. The Atlanta site was occupied by the University of Phoenix, located at 859 Mt. Vernon Highway NE, Suite 100, which is situated just off Interstate 285 in the Sandy Springs suburb in the inner ring of Atlanta. Aspen University began enrolling first-year PPN students

a year ago, an improvement of 30% year-over-year.

In additionin Atlanta starting in February 2022, and expects to the specialized CCNE programmatic accreditation, sinceenroll Nursing Core students (Years 2-3) in Fall 2022.

Accreditation

Since 1993, Aspen University has been accredited by the Distance Education Accrediting Commission

(“DEAC”("DEAC"),

a nationalan institutional accrediting agency recognized by the

U.S. United States Department of Education

(“DOE”(the "DOE")

.Accreditation by an accrediting commission recognized by and the DOE is requiredCouncil for an institution to become and remain eligible to participate in the federal programs of student financial assistance administered pursuant to Title IV of the Higher Education Act of 1965, as amended (the “Title IV Programs”Accreditation ("CHEA").On February 25,

2015,2019, the DEAC informed Aspen University that it had renewed its accreditation for five years

throughto January

2019. Aspen University’s accreditation is further discussed in the Accreditation Section of this Form 10-K.

Aspen2024.

Since 2009, USU has been accredited by WASC Senior College and University also maintains approvals from professional associations, such as its approval as a Global Charter Education Provider from the Project Management Institute (“PMI”Commission ("WSCUC"), an institutional accrediting agency recognized by the DOE and asthe Council for Higher Education Accreditation ("CHEA"). Its current accreditation period extends through 2030.

As a

Registered Education Provider (R.E.P.)result of

the PMI. The PMI recognizes select Aspen Project Management Courses as Professional Development Units. These courses help prepare individualstheir respective accreditations, both universities are qualified to

sit for the Project Management Professional (“PMP”), certification examination. PMP certification is the project management profession’s most recognized and respected certification credential. Project management professionals may take the PMI approved Aspen courses to fulfill continuing education requirements for maintaining their PMP certification.

Similarly, in connection with our Bachelor and Master degrees in Psychology of Addiction and Counseling, the National Association of Alcoholism and Drug Abuse Counselors, (“NAADAC”), has approved Aspen as an “academic education provider.” NAADAC-approved education providers offer training and education for those who are seeking to become certified, and those who want to maintain their certification, as alcohol and drug counselors. In connection with the approval process, NAADAC reviews all educational training programs for content applicability to state and national certification standards.

Aspen also is a participant in theTitle IV Programs.At the federal level,participate under the Higher Education Act of 1965 as amended (the “HEA”("HEA") and the regulations promulgated under theFederal student financial assistance programs (Title IV, HEA by the DOE set forth numerous, complex standards that institutions must satisfyprograms).

Our operations are organized in

order to participate in the Title IV Programs.

one reporting segment.

Competitive Strengths - We believe that we have the following competitive strengths:

Exclusively

Proprietary Education Technology Platform – Traditionally, a University or Online Program Manager (OPM) offering online education has three core systems that serve as the backbone of their technology stack: (i) a Customer Relationship Management (CRM) system used by the enrollment team to manage prospective students; (ii) a student information system (or SIS) that the university uses to manage its student body, and (iii) a learning management system (or LMS) which serves as the online classroom.

In each of these categories, there are a number of software as a service ("SaaS") companies that offer solutions for higher education. Most universities and OPMs license one or all of these systems. In studying these systems, we concluded that there was no reasonable way to have these three separately licensed systems fluently communicate with to each other to achieve our end goal of having real-time data on every aspect of a student's career – whether it be academic in nature or personal, financial or other behavioral aspects.

As a result, several years ago we built an in-house Student Information System and connected it to our Learning Management System, D2L. We subsequently built and launched the first phase of an in-house CRM system that was designed for the enrollment departments at Aspen University and USU.

The first-phase CRM included an algorithm that recommends to Enrollment Advisors (EAs), in priority order, the follow-up calls that should be made in a given day to complete the enrollment process for prospective students in that EAs individually designated database. The algorithm was created by studying the daily habits and activities of the three most productive EAs in AGI history. This recommendation engine then automatically updates in real-time after each follow-up/action is conducted by an EA. To our knowledge, these advanced features are not offered by any CRM software company in the industry. This recommendation engine has boosted our lead conversion rates for our online nursing programs to approximately 12% vs. <10% prior to launch.

Emphasis on Online Education - We haveThe curriculum for all courses at AGI's universities is designed our courses and programs specificallyprimarily for online delivery,delivery. Two nursing degree programs at AGI's universities require clinical practice: Aspen University's BSN Pre-Licensure hybrid (online/on-campus) nursing program and USU’s MSN-FNP hybrid (online/on-campus) nursing program. In addition, USU's Bachelor of Arts in Liberal Studies degree, Teacher Credentialing tracks require field experience/student teaching. Online, we recruit and train faculty exclusively for online instruction. We provide students the flexibility to study and interact at times that suitssuit their schedules. We design our onlineonline/on-campus sessions and materials to be interactive, dynamic and user friendly.

Debt Minimization - We are committed to offering among the lowest tuition rates in the sector, which to datesector. Our tuition rates combined with our monthly payment plan payment option for our post licensure online nursing programs has alleviated the need for a significant majority of our students to borrow moneytake out federal financial aid loans to fund Aspen’s tuition requirements. Aspen’s course-by-course tuition rates are $150/credit hour for degree-seeking undergraduate programs, $325/credit hour for all master programs and the Bachelor of Science in Nursing (BSN) program and $450/credit hour for all doctoral degree programs. These tuition rates are designed to allow students to pay their tuition through monthly payment plans, thereby having the opportunity to earn their degree debt free.

and fees requirements.

Commitment to Academic Excellence - We are committed to continuously improving our academic programs and services, as evidenced by the level of attention and resources we apply to instruction and educational support. We are committed to achieving high course completion and graduation rates compared to competitive distance learning, for-profit schools. Fifty-four percent of our adjunct faculty members hold a doctorate degree. One-on-oneRegular and substantive interaction and one-on-one student contact with our highly experienced faculty brings knowledge and great perspective to the learning experience. Faculty members are available by telephone, video conference and email to answer questions, discuss assignments and provide help and encouragement to our students.

Highly Scalable and Profitable Business Model - We believe our online education model, our relatively low student acquisition costs, and our variableflexible faculty cost model will enable us to expand our operating margins. As we increase student enrollments, we are able to scale our online business on a variable basis through growing the number of full-time and adjunct faculty members after we reach certain enrollment metrics (not before). A single adjunct faculty member can work with as little as two studentsone student or as many as 3050 at any given time.

A full-time faculty member works with a maximum of 110 students at any given time.

We also believe our hybrid BSN Pre-Licensure Program has significant potential since there are large waiting lists of applicants at many public universities that offer BSN Pre-Licensure programs in major U.S. metropolitan areas. According to AACN’s report on 2019-2020 Enrollment and Graduations in Baccalaureate and Graduate Programs in Nursing, U.S. nursing schools turned away 80,407 qualified applicants from baccalaureate and graduate nursing programs in 2019 due to an insufficient number of faculty, clinical sites, classroom space, clinical preceptors and budget constraints.

(https://www.aacnnursing.org/Portals/42/News/Factsheets/Faculty-Shortage-Factsheet.pdf).

The Company is currently operating five pre-licensure locations in the Phoenix, Austin, Tampa, Nashville and Atlanta metros. We started operating in Phoenix in 2018. The Company opened two additional new metro locations in Fiscal Year 2021 (Austin and Tampa) and in Fiscal Year 2022 (Nashville and Atlanta), the latter of which began enrolling first year students in February 2022). We stopped admitting students into our Phoenix locations in the fourth quarter of fiscal year 2022 in accordance with the AZ BON matter.

“One Student at a Time” personal carePersonal Care - We are committed to providing our students with highly responsive and personal individualized support. Every student is assigned an Academic Advisor who becomes an advocate for the student’s success. Our one-on-one approach assures contact with faculty members when a student needs it and monitoring to keep them on course. Our administrative staff is readily available to answer any questions and workswork with a student from initial interest through the application process and enrollment, and most importantly while the student is pursuing a degree ortheir studies.

In considering candidates for acceptance into any of our certificate or degree programs, we look for those who are serious about pursuing – or advancing in – a professional career, and who want to be both prepared and academically challenged in the process. We strive to maintain the highest standards of academic excellence, while maintaining a friendly learning environment designed for educational, personal and professional success. A desire to meet those standards is a prerequisite. Because our programs are designed for self-directed learners,

who know how to manage their time, successful students have a basic understanding of

time management principles and practices, as well as good writing and research skills. Admission to Aspen

University is based on

a thorough assessment of each applicant’s potential to complete

successfully the

program.

program successfully.

According to the DOE reports, among college students that study exclusively online, the percentage of students at private for-profit institutions was higher (60%), than that of students at public institutions (46%) and private nonprofit institutions (34%). In particular, the percentage of students who took distance education courses exclusively was highest at private for-profit four-year institutions (73%) which, despite enrolling only 4% of undergraduates, accounted for 6% of undergraduates who were enrolled exclusively in distance education courses.

In terms of the nursing sector, job opportunities for registered nurses are expected to grow about as fast as the average growth for all occupations, or approximately 9%, between 2020 and 2030, according to the U.S. marketBureau of Labor Statistics’ Occupational Outlook Handbook, 2020-30 Edition. However, despite the anticipated growth in job opportunities, over 80,400 qualified applications were not accepted by entry-level baccalaureate and graduate nursing programs according to the 2019-2020 Enrollment and Graduations in Baccalaureate and Graduate Programs in Nursing report from the American Association of Colleges of Nursing (https://www.aacnnursing.org/Portals/42/News/Factsheets/Faculty-Shortage-Factsheet.pdf). These statistics suggest there continues to be unmet demand from qualified students for postsecondary educationnursing educational programs. In fiscal year 2022, nursing shortages continued in part due to ongoing effects of the COVID-19 pandemic. A growing number of nurses are leaving the profession as they reach retirement age or due to pandemic-induced job fatigue. This supply-side trend, coupled with the rising demand for healthcare to support the aging U.S. population, is expected to perpetuate a large,nursing shortage through 2030. Given the growing market. demand for healthcare services across a multitude of specialties, reports project that 1.2 million new registered nurses (RNs) will be needed by 2030 to address the current shortage.

Competition

According to the most recent

publication by the National Center for2019 Digest of Education Statistics

(“NCES”)(nces.ed.gov),

the number of postsecondary learners enrolled as of 2012-13 in U.S. institutions that participate in Title IV Programs was approximately 27.8 million (including both undergraduate and graduate students). This number is up from 21 million in the fall of 2010, and from 18.2 million in the fall of 2007. We believe the growth in postsecondary enrollment is a result of a number of factors, including the significant and measurable personal income premium that is attributable to postsecondary education, and an increase in demand by employers for professional and skilled workers.

According to the Integrated Postsecondary Education Data System (“IPEDS”) data managed by the DOE, the number of students that took at least one online course in the most recent studies was about 5.5 million — roughly one-quarter of the total enrollment. Among those 5.5 million students, about 2.6 million were enrolled in fully online programs — the rest took some traditional courses, some online. Additionally, the share of graduate students enrolled in fully online programs was twice as high as the share of undergraduates — 22 to 11 percent.

Competition

Therethere are more than 4,2004,300 U.S. colleges and universities serving traditional college agecollege-age students and adult students. Any reference to universities herein also includes colleges. Competition is highly fragmented and varies by geography, program offerings, delivery method, ownership, quality level, and selectivity of admissions. No one institution has a significant share of the total postsecondary market. While we compete in a sense with traditional “brick and mortar” universities, our primary competitors are withuniversities that primarily enroll online universities.students. Our primarily online university competitors that are publicly traded include:include American Public Education, Inc. (Nasdaq: APEI), DeVryAdtalem Global Education (NYSE: ATGE), Apollo Education Group, Inc. (NYSE: DV), Grand Canyon Education, Inc. (Nasdaq: LOPE), CapellaStrategic Education, CompanyInc. (Nasdaq: CPLA)STRA), and Bridgepoint Education, Inc. (NYSE: BPI). American Public Education, Inc. and Capella Education Company are wholly online while the others are not. Based upon public information, Apollo Group, which includes University of Phoenix, is the market leader with University of Phoenix havingWestern Governors University.

We believe that these competitors have degreed enrollments of 135,900 in November 2016 (based upon APOL’s Form 10-Q filed on January 9, 2017 for the period ending November 30, 2016).ranging from approximately 38,000 to over 100,000 students. As of April 30, 2017, Aspen2022, AGI had 4,68113,334 active degree-seeking students enrolled. Because of COVID-19 which has caused most

educational institutions to transition to some extent to more online capabilities, we may face more online competition in the future. Further, COVID-19 caused nurses to seek graduate level courses to retrench as they were overwhelmed treating hospitalized patients. COVID-19 also significantly reduced the number of students enrolled

respectively. Thesein postsecondary education institutions in recent years, which limits the pool of prospective students for which we compete for enrollments with our competitors

have substantially more financial and other resources.

in the industry.

The primary mission of most traditional accredited four-year universities is to serve full-time students and conduct research. Most online universities serve working adults. Aspen Group acknowledges the differences in the educational needs between working and full-time students at “brick and mortar” schools and provides programs and services that allow our students to earn their degrees without major disruption to their personal and professional lives.

We also compete with public and private degree-granting regionally and nationally accredited universities. An increasing number of universities enroll working students in addition to the traditional 18 to

24 year-old24-year-old students, and we expect that these universities will continue to modify their existing programs to serve working learners more effectively, including by offering more distance learning programs. We believe that the primary factors on which we compete are the following:

·

•Active and relevant curriculum development that considers the needs of employers;·

•The ability to provide flexible and convenient access to programs and classes;·

•Cost of the program;

•Monthly payment plan options;

•High-quality courses and services;·

•Comprehensive student support services;·

•Breadth of programs offered;·

•The time necessary to earn a degree;·

•Qualified and experienced faculty;·

•Reputation of the institution and its programs;·

•The variety of geographic locations of campuses;·

Regulatory approvals;

·

Cost of the program;

·

•Convenience.

Curricula

Certificates

Certificate in Project Management

Certificate in eLearning Pedagogy

Associates Degrees

Associate

Academics

Aspen University

School of Applied Science Early ChildhoodNursing and Health Sciences

School of Education

Bachelor’s Degrees

Bachelor

School of Business and Technology

School of Arts

in Psychology and

Addiction CounselingBachelorSciences

United States University

College of

Science in Business AdministrationBachelor of Science in Business Administration, (Completion Program)

Bachelor of Science in Criminal Justice

Bachelor of Science in Criminal Justice, (Completion Program)

Bachelor of Science in Criminal Justice with specializations in Criminal Justice Administration and

Major Crime Scene Investigation Procedure

Bachelor of Science in Early Childhood Education

Bachelor of Science in Early Childhood Education, (Completion Program)

Bachelor of Science in Medical Management

Bachelor of Science in Nursing (Completion Program)

Master’s Degrees

Master of Arts Psychology and Addiction Counseling

Master of Science in Criminal Justice

Master of Science in Criminal Justice with specializations in Forensic Sciences, Law Enforcement Management, and

Terrorism and Homeland Security

Master of Science in Information Management

Master of Science in Information Systems with specializations in Enterprise Application Development and

Web Development

Master of Science in Information Technology

Master of Science in Information Technology and Innovation

Master of Science in Nursing with a specialization in Administration and Management

Master of Science in Nursing (RN to MSN Bridge Program) with a specialization in Administration and Management

Master of Science in Nursing with a specialization in Nursing Education

Master of Science in Nursing (RN to MSN Bridge Program) with a specialization in Nursing Education

Master of Science in Nursing (RN to MSN Bridge Program) with a specialization in Forensic Nursing

Master of Science in Nursing with a specialization in Forensic Nursing

Master of Science in Nursing with a specialization in Public Health

Master of Science in Nursing (RN to MSN Bridge Program) with a specialization in Public Health

Master of Science in Nursing with a specialization in Informatics

Master of Science in Nursing (RN to MSN Bridge Program) with a specialization in Informatics

Master in Business Administration

Master in Business Administration with specializations in Entrepreneurship, Finance, Information Management, Pharmaceutical Marketing and Management, and Project Management

Master in Education with specializations in Curriculum Development and Outcomes Assessment, Education Technology, Transformational Leadership, and eLearning Pedagogy

Doctorate Degrees

Doctorate of Science in Computer Science

Doctorate in Education Leadership and Learning with specializations in K-12, Higher Education, Organizational Leadership, Organizational Psychology, and Health Care Administration

DoctorSciences

College of

Nursing Practice

Business and Technology

College of Education

Following Mr. Michael Mathews becoming Aspen’sour Chief Executive Officer in May 2011, Mr. Mathewshe and his team made significant changes to Aspen’s sales and marketing program, specifically spending a significant amount of time, money and resources on our proprietary Internet marketing program. What is unique about Aspen’sour Internet marketing program is that we have not used and have no plans in the near future to utilizeacquire non-branded, non-exclusive leads from third-party online lead generation companies to attract prospective students. To our knowledge, most if not all for-profit online universities utilize multiple third-party online lead generation companies to obtain a meaningful percentage of their prospective student leads that are branded and exclusive in nature, and those leads are both non-branded and non-exclusive in addition to exclusive branded leads. Aspen’sOur executive officers have many years of expertise in the online lead generation and Internet advertising industry, which has and for the foreseeable future willis expected to continue to allow Aspenus to cost-effectively drive all prospective student leads internally. This isthat are branded and exclusive in nature.

We have invested in our technology infrastructure and believe our education technology platform enables us to achieve lower costs per enrollment as compared to our competition.

Human Capital

We recognize that our performance depends on the education, experiences, and efforts of our employees, and our ability to foster a

competitive advantage for Aspen because third-party leads are typically unbranded and non-exclusive (lead generation firms typically sell prospective student leads to multiple universities), thereforeculture that brings out the

conversion rate for those leads tends to be appreciably lower than internally generated, Aspen branded, proprietary leads.

Employees

best in each. As of July 24, 2017,April 30, 2022, we had 138312 full-time employees, including full-time faculty, and 133821 adjunct professors, of which 54%who are doctorally prepared.part-time employees. None of our employees are parties to any collective bargaining arrangement. We believe our relationships with our employees are good.

Our employees have diverse backgrounds, as evidenced by the fact that approximately 74% of our faculty and staff are female and approximately 48% of our employees self-identify as ethnically diverse.

Diversity and equity are at the heart of our culture, influenced in part by the communities we serve including but not limited to healthcare, the military, and veterans. In support of their respective missions, each of our universities have published diversity and equity statements that guide and support their actions to attract, retain and develop highly qualified administration, faculty, and staff:

Aspen University is committed to diversity, equity, and inclusion in its faculty, administration, and staff hiring practices, employee policies, and student admissions practices and policies. It is committed to non-discrimination in the delivery of its educational services and employment opportunities. The University does not discriminate on the basis of sex, race, color, national origin, religion, age, gender, sexual orientation, veteran status, physical or mental disability, medical condition as defined by law, or any basis prohibited by law.

As forged by its mission and vision and the University’s unique and distinctive character to serve the underserved community in California and the nation, United States University ensures an uncompromising commitment to offering access to affordable higher education to all individuals who meet the criteria for admission regardless of age, gender, culture, ethnicity, socio-economic class and disability. At all times, USU shall strive to ensure equitable representation of all diverse groups in its student body. USU’s diverse administration, faculty and staff shall be equally dedicated to the success of all students. The diversity of USU’s administration and faculty shall help enrich curricula, while a diverse staff shall serve students with sensitivity to special needs.

We have learned that an inclusive and positive workplace results in business growth and inspires increased academic and business innovation, the retention of exceptional talent, and a more involved workforce.

Talent Development and Retention

The Company is dedicated to attracting, retaining, and developing employees who adhere to high standards of business and personal integrity and who maintain a reputation for honesty, fairness, respect, responsibility, and trust. Our strategic initiatives require our leadership, management, faculty, and staff to perform at a consistently high level and to adapt and learn new skills and capabilities. Our employees must have a wide and diverse range of education, experience, background, and skill to anticipate and meet our business needs and exercise sound business judgment.

To promote retention, we offer comprehensive compensation and benefits packages that are competitive and performance-based. We have undertaken an analysis of market-competitive compensation and benefits practices to attract new and more culturally diverse employees and to reward current ones. We believe that continuous education aids in employee retention and so we provide a tuition benefit to them, their spouses, or their dependents. Full-time employees receive a 100% tuition discount on most programs offered by the universities. Spouses, legal partners, and legal dependents of full-time employees, as well as adjunct faculty, receive a 50% discount.

To promote career development among our leadership and staff, we provide job and leadership training as well as professional development opportunities. We financially support university administration and management as they seek professional development through professional organizations relevant to their fields and conference attendance. We financially support faculty professional development to stay current in their field of study through NurseTim© trainings (nursing faculty only) and conference attendance. The Faculty Speaker Series, Tuesday Teaching Tips, and Research Colloquium, all supported through the Center for Graduate Studies, also contribute to the professional development of faculty.

We believe that our well-educated and well-qualified faculty are the basis for the success of our students and our programs. Because our business is primarily nursing education, we expect our faculty to integrate their personal and professional nursing experiences into the education of our students. All nursing faculty maintain current, unencumbered state or multi-state compact RN licenses. All faculty are expected to have a degree one level above the degree level they are teaching and to maintain currency in their field. We train and develop our faculty through a formal onboarding process that includes orienting them to academic policies and procedures, pedagogical performance expectations, and responsibilities related to their faculty role. They

also receive training in tools for increasing student engagement and specific technologies they are required to use for various purposes. After their training, the universities regularly review the performance of their faculty by, among other things, monitoring the contact that faculty have with students, reviewing student feedback, and evaluating the learning outcomes achieved by students. As a result of our training and professional development practices for faculty, we have very little turnover and faculty retention is high.

Over time, we have hired, retained, and developed a diverse leadership, management, and workforce that is a key component of our success and culture. We believe that our success is directly correlated to our ability to provide employees an interesting and engaging work experience. We value our rich, diverse employees and provide career and professional development opportunities that foster the success of our company.

Impact of COVID-19

The health and well-being of our employees is of utmost importance to the Company. Starting in March 2020, all employees transitioned to a remote workforce. Since that time, Company employees have demonstrated resilience, wisdom, commitment, and compassion in working with colleagues and students. Beginning on June 1, 2021, in an abundance of caution, employees in the U.S. were allowed to return to their offices after providing proof of full vaccination. As of July 6, 2021, all U.S. employees began returning to their offices in a hybrid work environment, meaning that employees now work 40% from home and 60% from the office. Each team within the Company has been given the flexibility to work with their management to determine which days and/or weeks will be worked from home vs. office. Employees are required to follow all Centers for Disease Control and Prevention and local guidelines and federal regulations. Finally, the Company has also introduced a fully-remote model for certain high-performance employees, what the Company calls the ‘Meritocracy Benefit’.

Corporate History

Aspen Group

The Company was incorporated on February 23, 2010 in

Florida as a home improvement company intending to develop products and sell them on a wholesale basis to home improvement retailers. In June 2011, Aspen Group changed its name to Elite Nutritional Brands, Inc. and terminated all operations.Florida. In February 2012, Aspen Group reincorporated in Delaware under the name Aspen Group, Inc.

Aspen University

Inc. was incorporated on September 30, 2004 in Delaware. Its predecessor was a Delaware limited liability company organized in

Delaware in 1999.Delaware. On March 13, 2012, Aspen Group,

which was then inactive, acquired Aspen

University Inc. in a transaction we refer to as the

Reverse Merger.

reverse merger. On December 1, 2017, Aspen Group acquired USU.

Available Information

Our corporate website is www.aspu.com. On our website under "SEC Filings", we make available access to our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements on Schedule 14A and amendments to those materials filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), free of charge.

Regulatory Environment

Students attending

Aspenour schools finance their education through a combination of individual resources, corporate reimbursement programs and federal student financial assistance funds available through

Aspen’sour participation in the Title IV Programs. The discussion which follows outlines the extensive regulations that affect our business. Complying with these regulations entails significant effort from our executives and other employees. Further, regulatory compliance is also expensive. Beyond the internal costs, compliance with the extensive regulatory requirements also involves engagement of outside regulatory professionals.

For the fiscal year ended April 30, 2017, approximately 21% of our cash-basis revenues for eligible tuition and fees were derived from the Title IV Programs.

To participate in Title IV Programs, a school must, among other things, be:

·

•Authorized to offer its programs of instruction by the applicable state education agencies in the states in which it is physically located (in our case, Colorado);·

Colorado, Arizona, Texas, Florida, Georgia, Tennessee and California) or otherwise have a physical presence as defined by the state and meet the state education agency requirements to legally offer postsecondary distance education

in any state in which the school is not physically located; •Accredited by an accrediting agency recognized by the Secretary of the DOE; and·

•Certified as an eligible institution by the DOE.

State Authorization

Based on regulations issued by

Collectively, state education agencies, accrediting agencies, and the DOE comprise the higher education regulatory triad. We cannot predict the actions that any entity in 2011, Title IV Programthe higher education regulatory triad, Congress, or Administration may take or their effect on our schools.

State Authorization

As institutions

like ours,of higher education that

offer postsecondarygrant degrees and certificates, we are required to be authorized by applicable state education

through distance education to studentsauthorities which exercise regulatory oversight of our schools. In addition, in

a state in which the institution is not physically located or in which it is otherwise subject to state jurisdiction as determined by that state, must meet any state requirements to offer postsecondary education to students in that state. The institution must be able to document state approval for distance education if requested by the DOE. This regulation was considered a significant departure from the state authorization procedures followed by most, if not all, institutions before its enactment. On July 12, 2011, a federal judge for the U.S. District Court for the District of Columbia vacated the portion of the DOE’s state authorization regulation that requires online education providers to obtain any required authorization from all states in which their students reside, finding that the DOE had failed to provide sufficient notice and opportunity to comment on the requirement. An appellate court affirmed that ruling on June 5, 2012 and therefore this regulation is currently invalid.

However, on July 25, 2016, the DOE issued a Notice of Proposed Rulemaking (“NPRM”) concerning new regulations governing the requirements for state authorization for distance education.Similar to the 2011 Rules, the proposed regulations required institutions to meet all state requirements for legally offering distance education in any state in which they are offering distance education courses as a condition of institutional eligibilityorder to participate in the Title IV Programs. If an institution does not hold authorization in a state that requires it to do so, students in that state would notPrograms, we must be eligible to receive Title IV Program funds for enrollment in distance education programs offeredauthorized by the institution in the state. The NPRM also proposed that Title IV Program eligibility and funding be contingent upon an institution being able to demonstrate that it is subject to an adequateapplicable state student complaint procedure. To date, the DOE has not indicated which state complaint procedures, if any, it considers to be inadequate. In addition, the NPRM required institutions to make a significant number of consumer disclosures regarding their distance education programs including disclosures regarding licensure and certification requirements, state authorization, student complaints, adverse actions by state and accreditation agencies, and refund policies. On December 16, 2016, DOE issued the final rule related to this NPRM. Although the final rule is similar to what DOE proposed on July 25, 2016, it surprisingly provides that the State Authorization Reciprocity Agreement (“SARA”) would not satisfy the basic authorization requirements of the rule. SARA is an agreement among member states, districts and territories that establishes comparable national standards for interstate offering of postsecondary distance education courses and programs. When the NPRM was released, there appeared to be broad consensus that the regulations would support the multi-state SARA arrangement as satisfying the requirement that institutions obtain authorization in each state where they are required to be authorized. However, the final rule effectively removes SARA from the definition of a “State authorization reciprocity agreement” for the purpose of complying with the new regulations. This is significant because we are an approved SARA institution.

The rest of the final rule remains largely unchanged from the NPRM. As in the proposed rule, the final rule requires institutions to meet all state requirements for legally offering distance education in any state in which institutions are offering distance education courses, but only to the extent the state has any such requirements. Also, while the language of the rule appears to make state authorization for distance learning a condition of institutional eligibility in the Title IV Programs, the preamble to the final rule clarifies that failure to hold a required authorization in a state will only result in inability to disburse Title IV Program funds to eligible students who are enrolled in distance learning programs while present in that state, rather than institution-wide. In addition, a state may impose penalties on an institution for failure to comply with state requirements related to an institution’s activities in a state, including the delivery of distance education to persons in that state.

agencies.

Because we are subject to extensive regulations by the states in which we become authorized or licensed to operate, we must abide by state laws that typically establish standards for instruction, qualifications of faculty, administrative procedures, marketing, recruiting, financial operations and other operational matters. State laws and regulations may limit our ability to offer educational programs and to award degrees. Some states may also prescribe financial regulations that are different from those of the DOE. If we fail to comply with state licensing requirements, we may lose our state licensure or authorizations.authorizations, which in turn would result in a loss of accreditation and access to Title IV funds.

The California Legislature is currently considering the reauthorization of the California Bureau for Private Postsecondary Education (“California Bureau”) as part of its sunset review cycle. There is currently a bill in process (SB1433) that would amend the existing Private Postsecondary Education Act, which governs private institutions operating in the state. On June 22, 2022, SB1433 was amended to include a number of updated definitions, substantive changes around minimum operating standards, and amended accreditation requirements for degree granting institutions, among other amendments. The Bill is set for a hearing in the Assembly Business and Professions committee on June 28th. We expect there will be additional amendments following the hearing, and we do not know what the final version of the bill will include or whether it will be approved by the Governor. In prior years, there have been multiple onerous bills proposed in California that have not become law, and we cannot predict whether similar proposals may be integrated into the current proposal as it moves through the legislative process. Other states in which AGI operates may also make material changes to their authority and structure at any time, so AGI must constantly assess its state oversight agencies to ensure compliance.

Licensure of Online Programs

On July 31, 2018, the DOE announced its intention to convene a negotiated rulemaking committee (the “Committee”) to consider proposed regulations for Title IV Programs, including revisions to the 2016 state authorization of distance education regulations. The Committee convened for several meetings from January to April 2019. On June 12, 2019, the DOE published a notice of proposed rulemaking, which included proposed regulations that would supplant the 2016 regulations. The DOE released final regulations on accreditation and state authorization of distance education on November 1, 2019, which took effect July 1, 2020 (the “Final Regulations”). Like the 2016 regulations, the Final Regulations require Title IV Program institutions, like ours, that offer postsecondary education through distance education to students in a state in which the institution is not physically located or in which it is otherwise subject to state jurisdiction as determined by that state, to meet any state requirements to offer postsecondary education to students who are located in that state.

Under the Final Regulations, institutions may meet the authorization requirements by obtaining such authorization directly from any state that requires it or through a state authorization reciprocity agreement, such as the State Authorization Reciprocity Agreement (“SARA”). SARA is intended to make it easier for students to take online courses offered by postsecondary institutions based in another state. SARA is overseen by a National Council (“NC-SARA”) and administered by four regional education compacts.

In May 2022, resulting from its formal move from Colorado to Arizona, Aspen University was removed as an approved institutional participant in NC-SARA through CO-SARA. An agreement with CO-SARA permits most currently enrolled students to be covered through early September 2022. Aspen University will be on the agenda for AZ-SARA in early September 2022 to obtain approval to become an institutional participant again in NC-SARA from its new primary location in Arizona. In the meantime, Aspen University is seeking individual state authorizations for its students. Aspen University is currently authorized in 30 states and is in the development process with 20 states and the District of Columbia. Aspen maintains its state authorizations through annual reporting and required renewals. The only state that does not participate in NC-SARA is California and it has imposed regulatory requirements on out-of-state educational institutions operating within its boundaries, such as those having a physical facility or conducting certain academic activities within the state. Aspen University is registered as an out-of-state institution with California until February 19, 2023, and plans to renew at that time. Aspen University currently enrolls students in all 50 states. While we do not believe that any of the states in which our schools are currently licensed or authorized, other than Arizona, Texas, Florida, Georgia, Tennessee and California, is individually material to our

operations, the loss of licensure or authorization in any state could prohibit us from recruiting prospective students or offering services to current students in that state, which could significantly reduce our enrollments.

On July 14, 2020, the Delaware DOE informed Aspen that an application for renewal was not necessary due to its active institutional membership with NC-SARA. With Aspen’s removal as an active institutional member of NC-SARA in May 2022, Aspen currently seeks renewal in the State of Delaware.

Because USU is based in California, which does not participate in NC-SARA, USU must obtain authorization in every state in which it intends to market and enroll online students, which was the standard method prior to the formation of NC-SARA. USU is currently authorized to offer one or more programs in 42 states and is in the application development process with 8 additional states and the District of Columbia. USU maintains its state authorizations through annual reporting and required renewals.

Individual state laws establish standards in areas such as instruction, qualifications of faculty, administrative procedures, marketing, recruiting, financial operations, and other operational matters, some of which are different than the standards prescribed by the Arizona Board, the Texas Board, the Florida Commission, the Tennessee Commission, the Georgia Commission, and the California Bureau. Laws in some states limit the ability of schools to offer educational programs and award degrees to residents of those states. Some states also prescribe financial regulations that are different from those of DOE, and many require the posting of surety bonds. Laws, regulations, or interpretations related to online education could increase our cost of doing business and affect our ability to recruit students in particular states, which could, in turn, negatively affect enrollments and revenues and have a material adverse effect on our business.

Licensure of Physical Locations

The Higher Education Opportunity Act ("HEOA") and certain state laws require our institutions to be legally authorized to provide educational programs in states in which our schools have a physical location or otherwise have a physical presence as defined by the state. Aspen University is authorized to provide educational programs in Arizona by the Arizona State Board for Private Postsecondary Education (“Arizona Board”), in Texas by the Texas Higher Education Coordinating Board (“Texas Board”), in Tennessee by the Tennessee Higher Education Commission (“Tennessee Commission”), in Georgia by the Georgia Nonpublic Postsecondary Education Commission (“Georgia Commission”), and in Florida by the Florida Commission on Independent Education (“Florida Commission”). USU is authorized to provide educational programs in California by the California Bureau. Failure to comply with state requirements could result in Aspen

University losing its authorization from the

ColoradoArizona Board, Texas Board, Tennessee Commission,

on Higher Education, a department ofGeorgia Commission, or Florida Commission; and USU losing its authorization from the

Colorado Department of Higher Education, (“CDHE”), itsCalifornia Bureau. In such event, the schools would lose their eligibility to participate in Title IV Programs, or

itstheir ability to offer certain

educational programs, any of which may force us to cease

the school’s operations.

Additionally, Aspen

is aUniversity and USU are Delaware

corporation.corporations. Delaware law requires an institution to obtain approval from the Delaware Department of Education, or Delaware DOE, before it may incorporate with the power to confer degrees. In July 2012, Aspen

University received notice from the Delaware DOE that it

iswas granted provisional approval status effective until June 30, 2015. On April 25, 2016, the Delaware DOE informed Aspen University it was granted full approval to operate with degree-granting authority in the State of

Delaware. On July 14, 2020, the Delaware

DOE informed Aspen that an application for renewal was not necessary due to its active institutional membership with NC-SARA. With Aspen’s removal as an active institutional member of NC-SARA in May 2022, Aspen currently seeks renewal in the State of Delaware. On June 6, 2018, the Delaware DOE granted an initial operating license to USU until

July 1, 2020.

Accreditation

June 30, 2023.

In March 2022, Aspen entered into a Consent Agreement with the AZ BON resulting primarily from concerns raised by the AZ BON stemming from NCLEX-RN pass rates below the state’s required threshold. The result of the Consent Agreement is that Aspen University remains approved with the AZ BON based on a stayed revocation and probationary period with certain conditions, including but not limited to, the cessation of enrollments in the core component of the pre-licensure nursing program and reporting to staff/board on a monthly basis. The cessation of enrollments into the core component of the pre-licensure nursing program will remain in effect until Aspen University complies with the conditions of its Consent Agreement with the AZ BON, which is more fully discussed under “State Professional Licensure” below. In April 2022, Aspen University entered into a Stipulated Agreement with the Arizona State Board for Private Postsecondary Education as an amendment to its 2022 Regular Vocational and Degree Granting Agreement for licensure. The Stipulated Agreement required the cessation of enrollments in both the pre-professional nursing and core components of the pre-licensure program in Arizona, the posting of a surety bond in the amount of $18,287,110 which has already been posted, the submission of student records on a monthly basis, and the removal of the Arizona pre-licensure nursing program start date information from its website and marketing materials. Aspen University is not currently enrolling students in the BSN Pre-licensure program in Arizona. The Stipulated Agreement can be amended in the future.

Accreditation

Aspen University is institutionally accredited by the DEAC, an accrediting agency recognized by

CHEA and the DOE, and USU is institutionally accredited by WSCUC, an accrediting agency also recognized by CHEA and the DOE. Accreditation is a non-governmental system for evaluating educational institutions and their programs in areas including student performance, governance, integrity, educational quality, faculty, physical resources, administrative capability and resources, and financial stability. In the U.S., this recognition comes primarily through private voluntary associations that accredit institutions and programs. To be recognized by the DOE, accrediting agencies must adopt specific standards for their review of educational institutions. Accrediting agencies establish criteria for accreditation, conduct peer-review evaluations of institutions and programs for accreditation, and publicly designate those institutions or programs that meet their criteria. Accredited institutions are subject to periodic review by accrediting agencies to determine whether such institutions maintain the performance, integrity and quality required for accreditation.

Accreditation by the DEAC is important to the Universityour schools for several reasons. Other institutions depend, in part, on accreditation in evaluating transfers of credit and applications to graduate schools. Accreditation also provides external recognition and status. Employers rely on the accredited status of institutions when evaluating an employment candidate’s credentials. Corporate and government sponsors under tuition reimbursement programs look to accreditation for assurance that an institution maintains quality educational standards. Other institutions depend, in part, on our accreditation in evaluating transfers of credit and applications to graduate schools.

Moreover, institutional accreditation awarded from an accrediting agency recognized by

the DOE is necessary for eligibility to participate in the Title IV Programs.

As part of the Final Regulations published on November 1, 2019, and which took effect July 1, 2020, the DOE amended regulations relating to the recognition of accrediting agencies. The Final Regulations amended the DOE’s process for recognition and review of accrediting agencies, including the criteria used by the DOE to recognize accrediting agencies, and the DOE’s requirements for accrediting agencies’ policies and standards that are applied to institutions and programs. Accrediting agencies are under heightened scrutiny due to perceived shortcomings of certain agencies and their oversight of closed institutions. In response, accreditors are increasing their scrutiny of institutions. From time to time,

DEAC adoptsaccrediting agencies adopt or

makesmake changes to

itstheir policies, procedures and standards. If

weour schools fail to comply with any of

DEAC’sthese requirements,

ourthe non-complying school’s accreditation status

and, therefore, our eligibility to participate in the Title IV Programs could be at risk.

On February 25, 2015, the DEAC informed Aspen University that it had renewed its accreditation for five years to January, 2019.

In addition to institutional accreditation, there are numerous specialized accrediting commissionsaccreditors that accredit specific programs or schools within their jurisdiction, many of which are in healthcare and professional fields. In our case, Aspen’s Master of ScienceUSU’s and Aspen University’s baccalaureate and master’s degree programs in nursing are accredited by the Commission on Collegiate Nursing Education (CCNE) and Bachelor of Science in Nursing programs hold specialized accreditation from the CCNE.Aspen University’s doctoral nursing degree is currently CCNE-accredited. CCNE is officially recognized by CHEA and the DOE and provides specialized accreditation for nursing programs. In our case, accreditation of specific nursing programsAccreditation by CCNE signifies that those programs have met the additional standards of that agency. We are also pleased that Aspen University’s School of Business and Technology has been awarded the status of Candidate for Accreditation by the International Accreditation Council for Business Education (IACBE) for its baccalaureate and master’s business programs. Finally, USU’s Bachelor of Arts in Liberal Studies has two Teacher Credentialing tracks: (1) Multiple Subject Credential Preparation track for students in California interested in teaching at the TK-6 level, and (2) General track for students interested in exploring a variety of topics, transfer students, or students outside of California. Both tracks are approved by the California Commission on Teacher Credentialing (CTC).

If we fail to satisfy the standards of

any of these specialized

accrediting commissions,accreditors, we could lose the specialized accreditation for the affected programs, which could result in materially reduced student enrollments in those programs and prevent our students from seeking and obtaining appropriate licensure in their fields.

State

EducationProfessional Licensure

and Regulation

As

States have specific requirements that an

institution of higher education that grants degrees and certificates, we are required to be authorized by applicable state education authorities which exercise regulatory oversight of our institution. In addition,individual must satisfy in order to

participatebe licensed or certified as a professional in

the Title IV Programs, we must be authorized by the applicable state education agencies.

Wespecific fields. For example, graduates from some USU and Aspen University nursing programs often seek professional licensure in their field because they are an approved institutional participantlegally required to do so in SARA. SARA is intendedorder to make it easier for students to take online courses offered by postsecondary institutions basedwork in another state. SARA is overseen by a National Council (NCSARA)that field or because obtaining licensure enhances employment opportunities. Success in obtaining licensure depends on several factors, including each individual’s personal and administered by four regional education compacts. There is a yearly renewal for participating in NC-SARA and CO-SARA and institutions must agree to meet certain requirements to participate. Some states that do not participate in SARA impose regulatory requirements on out-of-state educational institutions operating within their boundaries, such as those having a physical facility or conducting certain academic activities within the state. We currently enroll students in 49 states. Although we are currently licensed, authorized, in-process, or exempt in all non-SARA jurisdictions in which we operate, if we fail to comply with state licensing or authorization requirements for a state, or fail to obtain licenses or authorizations when required, we could lose our state license or authorization by that state or be subject to other sanctions, including restrictions on our activities in, and fines and penalties imposed by, that state,professional qualifications as well as fines, penalties,other factors related to the degree or program completed, including but not necessarily limited to:

•whether the institution and sanctions imposedthe program were approved by DOE. While we do not believe that any of the statesstate in which we are currently licensed or authorized, other than Colorado, are individually material to our operations, the loss ofgraduate seeks licensure, or authorization in anyby a professional association;

•whether the program from which the applicant graduated meets all state could prohibit us from recruitingrequirements; and

•whether the institution and/or the program is accredited by a CHEA and DOE-recognized agency.

Professional licensure and certification requirements can vary by state and may change over time.

In addition, the Final Regulations that took effect July 1, 2020 require institutions to make readily available disclosures to enrolled and prospective students

regarding whether programs leading to professional licensure or

offering servicescertification meet state educational requirements for that professional license or certification. These disclosures apply to both on-ground and online programs that lead to professional licensure or certification or are advertised as leading to professional licensure or certification. Under the Final Regulations, institutions must determine the state in which current and prospective students are located, and then must: (1) determine whether such program’s curriculum meets the educational requirements for licensure or certification in that state; (2) determine whether such program’s curriculum does not meet the educational requirements for licensure or certification in that state; or (3) choose not to make a determination as to whether such program’s curriculum meets the educational requirements for licensure or certification in that state. Institutions must also provide direct disclosures in writing to prospective students and current students under certain circumstances. Institutions must provide direct disclosures in writing to prospective students if the institution has determined the program in which the student intends to enroll does not meet the educational requirements for licensure or certification in the state in which the student is located or if the institution has not made any determination. Institutions must provide direct disclosures in writing to current students,