UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark one)

☑☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20162018

or

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 1-33818

ENTEROMEDICSRESHAPE LIFESCIENCES INC.

(Exact name of registrant as specified in its charter)

| |

Delaware | 48-1293684 |

(State or other jurisdiction of incorporation) | (IRS Employer Identification No.) |

2800 Patton Road, St. Paul, Minnesota 551131001 Calle Amanecer, San Clemente, California 92673

(Address of principal executive offices, including zip code)

(651) 634-3003

(949) 429-6680

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Class | Trading Symbol | Name of Exchange on which Registered |

Common stock, $0.01 par value per share | RSLS | The NASDAQ CapitalOTCQB Market

|

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ◻ No ☑☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ◻ No ☑☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑☒ No ◻

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑☒ No ◻

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ◻☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer”filer,” “smaller reporting company” and “smaller reporting“emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer ◻ | Accelerated filer ◻ |

Non-accelerated filer ◻ (Do not check if a smaller reporting company)☒ | Smaller Reporting Company ☑reporting company ☒ |

| Emerging growth company ◻ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ◻ No ☑☒

At June 30, 2016,2018, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant, based upon the closing price of a share of the registrant’s common stock as reported by the NASDAQ Capital Market on that date was $3,672,097.$7,608,535.

As of February 28, 2017, 6,873,878April 22, 2019, 8,895,233 shares of the registrant’s Common Stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCEDocuments Incorporated by Reference

Specified portionsPortions of the registrant’s Definitive Proxy Statement, which will be filed withregistrant's proxy statement for the Commission pursuant to Regulation 14A in connection with the registrant’s 20172019 Annual Meeting of Stockholders to(to be held May 3, 2017 (the Proxy Statement),filed within 120 days of December 31, 2018) are incorporated by reference into Part III, as indicated herein.

ENTEROMEDICSRESHAPE LIFESCIENCES INC.

FORM 10-K

TABLE OF CONTENTS

Registered Trademarks and Trademark Applications:In the United States we have registered trademarks for vBLOC®LAP-BAND®, ENTEROMEDICS®LAP-BAND AP®, LAP BAND SYSTEM®, RAPIDPORT®, RESHAPE® and MAESTRO®RESHAPE MEDICAL®, each registered with the United States Patent and Trademark Office, and trademark applications for vBLOC POWER TO CHOOSERESHAPE VEST, and vBLOC POWER TO CHOOSE AND DESIGN.RESHAPE LIFESCIENCES. In addition, some or all of the marks vBLOC, ENTEROMEDICS, MAESTRO, MAESTROLAP-BAND, LAP-BAND AP, LAP BAND SYSTEM, ORCHESTRATING OBESITY SOLUTIONS, vBLOC POWER TO CHOOSERAPIDPORT, RESHAPE, RESHAPE MEDICAL, RESHAPE VEST, and vBLOC POWER TO CHOOSE AND DESIGNRESHAPE LIFESCIENCES are the subject of either a trademark registration or an application for registration in Australia, Brazil, China,Canada, the European Community, India, Kuwait, Mexico, Saudi Arabia, SwitzerlandSouth Korea, and the United Arab Emirates. We believe that we have common law trademark rights to RESHAPE VEST. This Annual Report on Form 10-K contains other trade names and trademarks and service marks of EnteroMedicsReShape Lifesciences and of othercompanies.

PART I.

ITEM 1.BUSINESS

This Annual Report on Form 10-K contains forward-looking statements. These forward-looking statements are based on our current expectations about our business and industry. In some cases, these statements may be identified by terminology such as “may,” “will,” “should,” “expects,” “could,” “intends,” “might,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or “continue,” or the negative of such terms and other comparable terminology. These statements involve known and unknown risks and uncertainties that may cause our results, levels of activity, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. Factors that may cause or contribute to such differences include, among others, those discussed in this report in Item 1A “Risk Factors.” Except as may be required by law, we undertake no obligation to update any forward-looking statement to reflect events after the date of this report.

Our Company

We areThe Company is a developer of minimally invasive medical devices that advance bariatric surgery to treat obesity and metabolic diseases. The Company’s current portfolio includes the LAP-BAND® Adjustable Gastric Banding System and the ReShape VestTM, an investigational device, companyto help treat more patients with approvalsobesity. Our vision is to commercially launch our product, the vBloc Neuromodulation System (vBloc System). We arebe recognized as a leading medical technology company focused on the design, development and developmentcommercialization of devices that use neuroblockingtransformative technology to treat obesity and metabolic diseases and other gastrointestinal disorders. diseases.

Our proprietary neuroblocking technology,Product Portfolio

Lap-Band System

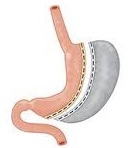

The Lap-Band System, which we refer to as vBloc Therapy,acquired from Apollo Endosurgery, Inc. (“Apollo”), in December 2018, is designed to intermittently block the vagus nerve using high frequency, low energy, electrical impulses. We have a limited operating historyprovide minimally invasive long-term treatment of severe obesity and only recently received U.S. Food and Drug Administration (FDA) approvalis an alternative to sell our product in the United States. In addition, we have regulatory approval to sell our product in the European Economic Area and other countries that recognize the European CE Mark and do not have any other source of revenue. We were incorporated in Minnesota on December 19, 2002 and later reincorporated in Delaware on July 22, 2004. We have devoted substantially all of our resources to the development and commercialization of the vBloc System, which was formerly knownmore invasive surgical stapling procedures such as the Maestrogastric bypass or vBloc Rechargeable System.

sleeve gastrectomy. The vBlocLap-Band System our initial product, uses vBloc Therapy to limitis an adjustable saline-filled silicone band that is laparoscopically placed around the expansionupper part of the stomach help control hunger sensations between meals, reducethrough a small incision, creating a small pouch at the frequencytop of the stomach, which slows the passage of food and intensitycreates a sensation of stomach contractionsfullness. The procedure can normally be performed as an outpatient procedure, where the patient is able to go home the day of the procedure without the need for an overnight hospital stay.

The Lap-Band System has been in use in Europe since 1993 and produce a feeling of early and prolonged fullness. We believereceived the vBloc System offers obese patients a minimally-invasive treatment that can resultCE mark in significant, durable and sustained weight loss. We believe that our vBloc System allows bariatric surgeons to offer a new option to obese patients who are concerned about the risks and complications associated with currently available anatomy-altering, restrictive or malabsorptive surgical procedures.

We received1997. FDA approval on January 14, 2015 for vBloc Therapy, delivered via the vBloc System, for the treatment of adultLap-Band System in the U.S. was obtained in 2001 and the Lap-Band System has been approved in many countries around the world. More than 860,000 Lap-Band Systems have been distributed worldwide.

The Lap-Band System was approved for use in the U.S. for patients with obesity who have a Body Mass Index (BMI)(“BMI”) greater than or equal to 40 or a BMI greater than or equal to 35 with one or more severe comorbid conditions. In 2011, the U.S. FDA granted approval for an expanded indication for the Lap-Band System to include patients with a BMI in the range of at least 4030 to 45 kg/m2,35 and with one or more comorbid conditions.

The Lap-Band System has been subject to more than 400 peer-reviewed publications and extensive real-world experience. Adjustable gastric banding using the Lap-Band System has been reported to be significantly safer than gastric bypass while statistically producing the same weight loss five years after surgery when accompanied by an appropriate post-operative follow-up and adjustment protocol. Studies have reported sustained resolution or improvement in type 2 diabetes, gastroesophageal reflux, obstructive sleep apnea, asthma, arthritis, hypertension and other pre-existing obesity related comorbidities following gastric banding. The gastric banding surgical procedure is generally reimbursed by most payors and insurance programs that cover bariatric surgery.

Benefits. Lap-Band System offers the following benefits:

| · | | Minimally Invasive. The Lap-Band System does not change anatomy and is removable or reversible. |

| · | | Lifestyle Enhancing. The Lap-Band System helps patients lose weight and live a more comfortable life and potentially reduces co-morbidities from excess weight. |

| · | | Durable Weight Loss. The Lap-Band System offers a sustainable solution that helps patients achieve long-term success. |

ReShape Vest

The ReShape Vest is an investigational, minimally invasive, laparoscopically implanted medical device being studied for weight loss in morbidly obese adults with a BMI of at least 3535. The device wraps around the stomach, emulating the effect of conventional weight loss surgery, and is intended to 39.9 kg/m2 with a related health condition such as high blood pressureenable gastric volume reduction. This device is designed to restrict the intake of food and provide the feeling of fullness without cutting or high cholesterol levels, and who have tried to lose weight in a supervised weight management program and failed within the past five years. In 2015 we began a controlled commercial launch at select surgical centers in the United States and had our first commercial sales. During 2015, we initiated a controlled expansion of our commercial operations and started the process of building a sales force. In January 2016, we hired new executives to oversee this expansion. Our direct sales force is supported by field clinical engineers who provide training, technical and other support services to our customers. Throughout 2016, our sales force called directly on key opinion leaders and bariatric surgeons at commercially-driven surgical centers that met our certification criteria. Additionally, in 2016, through a distribution agreement with Academy Medical, LLC, U.S. Department of Veterans Affairs (VA) medical facilities now offer the vBloc System as a treatment option for veterans at little to no cost to veterans in accordance with their veteran healthcare benefits. We plan to build on these efforts in 2017 with self-pay and veteran focused direct-to-patient marketing, key opinion leader and center-specific partnering, and a multi-faceted reimbursement strategy. To date, we have relied on, and anticipate that we will continue to rely on, third-party manufacturers and suppliers for the productionpermanently removing portions of the vBloc System.stomach, or bypassing, any portion of the gastrointestinal tract. The implantation of the device mimics a traditional weight‑loss surgery without permanently altering the anatomy and may not require vitamin supplementation.

In 2016, we sold 62 units for $787,000 in revenue, and in 2015 we sold 24 units for $292,000 in revenue. We have incurred and expect to continue to incur significant sales and marketing expenses prior to recording sufficient revenue to offset these expenses. Additionally, our selling, general and administrative expenses have increased since we commenced commercial operations, and we expect that they will continue to increase as we continue to build the infrastructure necessary to support our expanding commercial sales, operate as a public company and develop our

intellectual property portfolio. For these reasons, we expect to continue to incur operating losses for

In a small pilot study conducted outside the next several years. We have financed our operations to date principally through the sale of equity securities, debt financing and interest earned on cash investments.

Data from our ReCharge trial was used to support the premarket approval (PMA) application for the vBloc System, submitted to the FDA in June 2013. The ReCharge trial is a randomized, double-blind, sham-controlled, multicenter pivotal clinical trial testing the effectiveness and safety of vBloc Therapy utilizing our vBloc System. All patients in the trial received an implanted device and were randomized in a 2:1 allocation to treatment or sham control groups. The sham control group received a non-functional device during the trial period. All patients were expected to participate in a standard weight management counseling program. The primary endpoints of efficacy and safety were evaluated at 12 months. As announced, the ReCharge trial met its primary safety endpoint with a 3.7% serious adverse event rate. The safety profileUnited States, at 12 months, was further supported by positive cardiovascular signals includingReShape Vest patients demonstrated a 5.5 mmHg drop in systolic blood pressure, a 2.8 mmHg drop in diastolic blood pressure and a 3.6 bpm drop in average heart rate.

Additionally, the trial demonstrated in the intent to treat (ITT) population (n=239) a clinically meaningful and statistically significantmean percent excess weight loss (EWL)(“%EWL”) of 24.4% (approximately 10%85% and a mean percent total body weight loss (TBL))of 30.2%, an average drop in HbA1c (Hemoglobin A1c) of 2.1 points, an average decrease of systolic blood pressure of 13mmHg, an average waist circumference reduction of 38 centimeters, or approximately 15 inches, and an average increase in HDL “good cholesterol” of 29 mg/dl.

Benefits. The ReShape Vest, if approved for vBloc Therapy-treated patients, with 52.5% of patients achieving at least 20% EWL, although it did not meet its co-primary efficacy endpoints duesale, would allow us to higher than expectedoffer an additional weight loss levels insolution that emulates the sham control group. In the per protocol population, the trial demonstrated an EWLeffect of 26.3% for vBloc Therapy-treated patients, with 56.8% of patients achieving at least 20% EWL. We subsequently announced that vBloc Therapy-treated patients were maintaining theirconventional weight loss at 18 months and 24 months with an EWL of 23.5% and 21.1%, respectively.surgery through a procedure that is minimally invasive. The trial’s positive safety profile also continued throughout this reported time period.

InReShape Vest potentially offers the ReCharge trial, two-thirds of vBloc Therapy-treated patients achieved at least 5% TBL at 12 months. According to the Centers for Disease Control and Prevention (CDC), 5% TBL can have significant health benefits on obesity related risk factors, or comorbidities, including reduction in blood pressure, improvements in Type 2 diabetes and reductions in triglycerides and cholesterol. Further analysis of our data at 12 months showed a meaningful impact on these comorbidities as noted in the below table showing the improvements seen at 10% TBL, the average weight loss in vBloc Therapy-treated patients.

following benefits:

| · | |

Risk Factor

| | 10% TBLMinimizes Changes to Normal Anatomy. The ReShape Vest emulates the effects of conventional weight‑loss surgery without stapling, cutting or removing any portion of the stomach.

|

Systolic BP (mmHg)

| | (9) |

Diastolic BP (mmHg)·

| | (6) |

Heart Rate (bpm)

| Minimally Invasive Procedure. Unlike conventional weight loss surgery, which typically is performed in a hospital setting under general anesthesia and requires a hospital stay of up to four days, the ReShape Vest may result in shorter hospital stays. | |

(6)Total Cholesterol (mg/dL)

| | (15) |

LDL (mg/dL)·

| | (9) |

Triglycerides (mg/dL)

| Removable/Reversible. The ReShape Vest is designed to be removed laparoscopically, permitting the removal of the device at a later time, if that is desired. | |

(41)HDL (mg/dL)

| | 3 |

Waist Circumference (inches)·

| | (7) |

HbA1c (%)

| Allows Continued Ingestion and Digestion of Foods Found in a Typical, Healthy Diet. Because the ReShape Vest also leaves the digestive anatomy largely unaltered, patients are able to maintain a more consistent nutritional balance compared to conventional surgical approaches, thus allowing them to effect positive changes in their eating behavior in a non‑forced and potentially more consistent way. | (0.5) |

We obtained European CE Mark approval for our vBloc System in 2011 for the treatment of obesity. The CE Mark approval for our vBloc System was expanded in 2014 to also include use for the management of Type 2 diabetes in obese patients. Additionally, the final vBloc System components were previously listed on the Australian Register of Therapeutic Goods by the Therapeutic Goods Administration. The costs and resources required to successfully commercialize the vBloc System internationally are currently beyond our capability. Accordingly, weReShape Vest will continue to devote our near-term efforts toward mounting a successful system launchbe studied in upcoming trials in the United States.US and internationally. In the U.S., we are currently planning a non-randomized trial enrolling approximately 250 patients at approximately 15-20 investigational sites with a 12-month primary endpoint (weight loss and safety) and 24 to 36-month follow-up. We intend to explore select international marketsinitiate that study in 2020 and our goal is to have FDA premarket approval (“PMA”) in the second half of 2022. Internationally, we initiated a non-randomized trial enrolling up to 95 patients at investigational sites in five countries (Germany, Netherlands, Belgium, Spain and Czech Republic) with a 12-month primary endpoint (weight loss and safety) and 24-month follow-up. We expect to obtain the CE mark by the third quarter of 2021.

ReShape vBloc

ReShape vBloc uses vBloc Therapy to block the gastrointestinal effects of the vagus nerve using high‑frequency, low‑energy electrical impulses to intermittently interrupt naturally occurring neural impulses on the vagus nerve between the brain and the digestive system. We are not currently actively marketing ReShape vBloc, although we continue to support existing patients and their physicians. We are also currently investigating a proprietary technique that would utilize our vBloc technology to stimulate nerves feeding into the pancreas while simultaneously blocking nerves feeding into the liver. The goal of the procedure is to increase release of the body’s natural insulin and to prevent glucose release from the liver into the blood stream.

Our Strategic Focus

Develop and Commercialize a Differentiated Portfolio of Products/Therapies

An overarching strategy for our company is to develop and commercialize a product portfolio that is differentiated from our competition by offering transformative technologies to bariatric surgeons that consists of a selection of patient friendly, non-anatomy changing, lifestyle enhancing alternatives to traditional bariatric surgery that help patients achieve durable weight loss. With the vBlocLap-Band System as our resources permit, using direct, dealer and distributor sales models as the targeted market best dictates.

To date,ReShape Vest (if approved for commercial use), we believe we have not observed any mortality related to our device or any unanticipated adverse device effects in our human clinical trials.two compelling and differentiated medical devices. We have also not observed any long-term problematic clinical side effects in any patients. In addition, data from our VBLOC-DM2 ENABLE trial outsidebelieve that we are well positioned for the United States demonstrate that vBloc Therapy mayexisting market

hold promiseand can serve more of the overweight and obese population with our solutions and thereby help expand the addressable market for obesity.

Drive the Adoption of Our Portfolio through Obesity Therapy Experts and Patient Ambassadors

Our clinical development strategy is to collaborate closely with regulatory bodies, healthcare providers, obesity therapy experts and others involved in improving obesity-related comorbidities such asthe obesity management process, patients and their advocates and scientific experts. We have established relationships with obesity therapy experts and healthcare providers, including physicians and hospitals, and have identified Lap-Band patient ambassadors and we believe these individuals will be important in promoting patient awareness and gaining widespread adoption of the Lap-Band and the ReShape Vest.

Expand and Protect Our Intellectual Property Position

We believe that our issued patents and our patent applications encompass a broad platform of therapies focused on obesity, diabetes, hypertension and hypertension.other gastrointestinal disorders. We are conducting, or planintend to continue to pursue further intellectual property protection through U.S. and foreign patent applications.

Leverage our vBloc Technology for Other Disease States

We intend to continue to conduct further studiesresearch and development for other potential applications for our vBloc Therapy and believe we have a broad technology platform that will support the development of additional clinical applications and therapies for other metabolic and gastrointestinal disorders in each of these comorbiditiesaddition to assess vBloc Therapy’s potential in addressing multiple indications.obesity.

EnrollmentAlternative Weight Loss Solutions

If we are able to commercialize the ReShape Vest, we believe that we will be able to offer two distinct weight loss treatment solutions that may be selected by the physician depending on the severity of the VBLOC-DM2 ENABLE trial began in 2008. The VBLOC-DM2 ENABLE trial is designed to evaluatepatient’s BMI or condition. Together, the efficacyLap-Band and safetyReShape Vest provide a minimally-invasive continuum of vBloc Therapy on obese subjects as well as its effect on glucose regulation in approximately 30care for bariatric patients who are using the vBloc System. The trial is an international, open-label, prospective, multi-center study. At each designated trial endpoint the efficacy of vBloc Therapy is evaluated by measuring average percentage EWL, HbA1c (blood sugar), FPG (fasting plasma glucose), blood pressure, calorie intake, appetite and other endpoints at one week, one month, three, six, 12 and 18 months and longer. The following results were reported at 12 month intervals.

| ·

| | Percent EWL (from implant, Company updated interim data):

|

| | | | |

Visit (post-device activation) | | % EWL | | N |

12 Months | | (24.5) | | 26 |

24 Months | | (22.7) | | 22 |

36 Months | | (24.3) | | 18 |

| ·

| | HbA1c change in percentage points (Baseline HbA1c = 7.8 + 0.2%) (Company updated interim data):

|

| | | | |

| | % HbA1c | | |

Visit (post-device activation) | | change | | N |

12 Months | | (1) | | 26 |

24 Months | | (0.5) | | 24 |

36 Months | | (0.6) | | 17 |

| ·

| | Fasting Plasma Glucose change (Baseline 151.4 + 6.5 mg/dl average) (Company updated interim data):

|

| | | | |

| | Glucose | | |

| | change | | |

Visit (post-device activation) | | (mg/dl) | | N |

12 Months | | (27.6) | | 25 |

24 Months | | (20.3) | | 24 |

36 Months | | (24) | | 17 |

| ·

| | Change in mean arterial pressure (MAP) in hypertensive patients (baseline 99.5 mmHg) (Company updated interim data):

|

| | | | |

| | MAP | | |

| | change | | |

Visit (post-device activation) | | (mmHg) | | N |

12 Months | | (7.8) | | 14 |

24 Months | | (7.5) | | 12 |

36 Months | | (7.3) | | 10 |

To date, no deaths related to our device or unanticipated adverse device effects have been reported during the VBLOC-DM2 ENABLE trial and the safety profile is similar to that seen in the other vBloc trials.

Caloric Intake Sub-study: A sub-study, conducted as part of the VBLOC-DM2 ENABLE trial, evaluated 12-month satiety and calorie intake in 10 patients with Type 2 diabetes mellitus enrolled in the trial. Follow-up measures among patients enrolled in the sub-study included EWL, 7-day diet records assessed by a nutritionist, calorie calculations and visual analogue scale (VAS) questions to assess satiety by 7-day or 24-hour recall at the following time periods: baseline, 4 and 12 weeks and 6 and 12 months post device initiation. A validated program, Food Works™, was used to determine calorie and nutrition content. Results include:

| ·

| | Mean EWL for the sub-study was 33+5% (p<0.001) at 12 months;

|

their care providers.

| ·

| | Calorie intake decreased by 45% (p<0.001), 48% (p<0.001), 38% (p<0.001) and 30% (p=0.02), at 4 and 12 weeks, 6 months and 12 months, respectively, from a baseline of 2,062 kcal/day; and

|

| ·

| | VAS recall data, using a repeated measures analysis, documented fullness at the beginning of meals (p=0.005), less food consumption (p=0.02) and less hunger at the beginning of meal (p=0.03) corroborating the reduction in caloric intake.

|

Our Product

The vBloc System, our initial product, uses vBloc Therapy to limit the expansion of the stomach, help control hunger sensations between meals, reduce the frequency and intensity of stomach contractions and produce a feeling of early and prolonged fullness. We believe the vBloc System offers obese patients a minimally-invasive treatment that can result in significant, durable and sustained weight loss. We believe that our vBloc System allows laproscopically trained surgeons to offer a new option to obese patients who are concerned about the risks and complications associated with currently available anatomy-altering, restrictive or malabsorptive surgical procedures.

The vBloc System delivers vBloc Therapy via two small electrodes that are laparoscopically implanted and placed in contact with the trunks of the vagus nerve just above the junction between the esophagus and the stomach, near the diaphragm and connected to a neuroregulator, which is subcutaneously implanted. The vBloc System is powered by an internal rechargeable battery. The vBloc System is implanted by a laproscopically trained surgeon using a procedure that is typically performed within 60-90 minutes as an outpatient procedure. The physician activates the vBloc System after implantation. vBloc Therapy is then delivered intermittently through the neuroregulator each day as scheduled (recommended during the patient’s waking hours when food is consumed). The scheduled delivery of the intermittent pulses blocking the vagus nerve is customized for each patient’s weight loss and overall treatment objectives. The physician is able to download reports to monitor patient use and system performance information. This information is particularly useful to physicians to ensure that patients are properly using the system.

Our Market

The Obesity and Metabolic Disease Epidemic

Obesity is a disease that has been increasing at an alarming rate with significant medical repercussions and associated economic costs. Since 1980, the worldwide obesity rate has more than doubled, with about 13% of the world’s adult population now being obese. The World Health Organization (WHO)(“WHO”) currently estimates that as many as 600 million people worldwide are estimated to be obese and more than 1.92.1 billion adults, are estimated to be overweight. Being overweight or obese is also the fifth leading risk for global deaths, with approximately 3.4 million adults dying each year as a result.

According to the WHO, there are over 70 progressive obesity-related diseases and disorders associated with obesity, which are also known as comorbidities, including Type 2 diabetes, hypertension, infertility and certain cancers. Worldwide, 44%30% of the diabetes burden, 23%global population, are overweight. The global economic impact of the heart disease burdenobesity is approximately $2 trillion, or approximately 2.8% of global GDP. Healthcare costs for severely or morbidly obese adults are 81% higher than for healthy weight adults and between 7%obesity is responsible for 5% of deaths worldwide. We believe our products and 41% of certain cancer burdens are attributable to overweight and obesity.product candidates could address a $1.64 billion per year global surgical device market.

We believe that this epidemic will continue to grow worldwide given dietary trends in developed nations that favor highly processed sugars, larger meals and fattier foods, as well as increasingly sedentary lifestyles. Despite the growing obesity rate, increasing public interest in the obesity epidemic and significant medical repercussions and economic costs associated with obesity, there continues to be a significant unmet need for effective treatments.

The United States Market

Obesity has been identified by the U.S. Surgeon General as the fastest growing cause of disease and death in the United States.States, and according to a 2014 McKinsey Report is the leading cause of preventable death in the U.S. Currently, the Center for Disease Control (the CDC) estimatesit is estimated that 35.7% of U.S.approximately 160 million American adults (or approximately 73,000,000 people)are overweight or obese, 74 million American adults are overweight, 78 million American adults are obese having a BMI of 30 or higher. BMI is calculated by dividing a person’s weight in kilograms by the square of their height in meters.severely obese, and 24 million American adults are morbidly obese. It is estimated that if obesity rates stay consistent, 51% of the U.S. population will be obese by 2030. According to data from the U.S. Department of Health and Human Services, almost 80% of adults with a BMI above 30 have a co-morbidity,comorbidity, and almost 40% have two or more of these comorbidities. According to The Obesity Society and the CDC, obesity is associated with many significant weight-relatedweight‑related comorbidities including Type 2 diabetes, high blood-pressure,blood‑pressure, sleep apnea, certain cancers, high cholesterol, coronary artery disease, osteoarthritis and stroke. According to the American Cancer Society, 572,000 Americans die of

cancer each year, about one-thirdover one‑third of which are linked to excess body weight, poor nutrition and/or physical inactivity. Over 75% of hypertension cases are directly linked to obesity, and more than 90% of the approximately two-thirds of28 million U.S. adults with Type 2 diabetes are overweight or have obesity.

Currently, medical costs associated with obesity in the U.S. are estimated to be up to $210 billion per year and nearly 21% of medical costs in the U.S. can be attributed to obesity. An estimated approximately $1.5 billion was spent in 2015 alone in the U.S. on approximately 200,000 bariatric surgical procedures to treat obesity. By 2025, it is estimated that up to $3.8 billion will be spent in the U.S. on approximately 800,000 bariatric surgical procedures to treat obesity. Researchers estimate that if obesity trends continue, obesity related medical costs could rise by another $44-$44‑$66 billion each year in the U.S. by 2030. The medical costs paid by third-partythird‑party payers for people who are obese were $2,741 per year, or 42% higher than those of people who are normal weight and the average cost to employers is $6,627 to $8,067 per year per obese employee (BMI of 35 to 40 and higher).

Current Treatment Options and Their Limitations

We believe existing bariatric surgery and endoscopic procedural options for the treatment of obesity have seen limited adoption to date, with approximately 1% of the obese population qualifying for treatment actually seeking treatment, due to patient concerns and potential side effects including permanently altered anatomy and morbidity.

The principal treatment alternatives available today for obesity include:

• Behavioral modification. Behavioral modification, which includes diet and exercise, is an important component in the treatment of obesity; however, most obese patients find it difficult to achieve and maintain significant weight loss with a regimen of diet and exercise alone.

• Pharmaceutical therapy. Pharmaceutical therapies often represent a first option in the treatment of obese patients but carry significant safety risks and may present troublesome side effects and compliance issues.

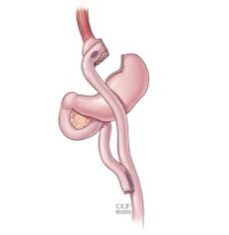

• Bariatric surgery. In more severe cases of obesity, patients may pursue more aggressive surgical treatment options such as gastric balloon, gastric banding, sleeve gastrectomy and gastric bypass. These procedures promote weight loss by surgically restricting the stomach’s capacity and outlet size. While largely effective, these procedures generally result in major lifestyle changes including dietary restrictions and food intolerances and they may present substantial side effects and carry short- and long-term safety and side effect risks that have limited their adoption.

Market Opportunity

Given the limitations of behavioral modification, pharmaceutical therapy and bariatric surgical approaches, we believe there is a substantial need for a patient-friendly, safer, effective and durable solution that:

| · | | preserves normal anatomy;Behavioral modification. Behavioral modification, which includes diet and exercise, is an important component in the treatment of obesity; however, most obese patients find it difficult to achieve and maintain significant weight loss with a regimen of diet and exercise alone.

|

| · | | is “non-punitive”Pharmaceutical therapy. Pharmaceutical therapies often represent a first option in that it supports continued ingestionthe treatment of obese patients but carry significant safety risks and digestion of foodsmay present troublesome side effects and micronutrients such as vitamins and minerals found in a typical, healthy diet while allowing the user to modify his or her eating behavior appropriately without inducing punitive physical restrictions that physically force a limitation of food intake; compliance issues.

|

| · | | enables non-invasive adjustability while reducing the need for frequent clinic visits; Bariatric Surgery and Endoscopic Procedures. In more severe cases of obesity, patients may pursue more aggressive surgical treatment options such as sleeve gastrectomy and gastric bypass. These procedures

|

| ·

| | minimizes undesirable side-effects;

|

| ·

| | minimizes the risks of re-operations, malnutrition and mortality; and

|

| ·

| | reduces the natural hunger drive of patients.

|

Obesity is a disease that has been increasing at an alarming rate with significant medical repercussions and associated economic costs. Since 1980, the worldwide obesity rate has more than doubled, with about 13% of the world’s adult population now being obese. The World Health Organization (WHO) currently estimates that as many as 600 million people worldwide are estimated to be obese and more than 1.9 billion adults are estimated to be overweight. Being overweight or obese is also the fifth leading risk for global deaths, with approximately 3.4 million adults dying each year as a result.

We believe that this epidemic will continue to grow worldwide given dietary trends in developed nations that favor highly processed sugars, larger meals and fattier foods, as well as increasingly sedentary lifestyles. Despite the growing obesity rate, increasing public interest in the obesity epidemic and significant medical repercussions and economic costs associated with obesity, there continues to be a significant unmet need for effective treatments.

Our Technology

vBloc Therapy is designed to block the gastrointestinal effects of the vagus nerve using high-frequency, low-energy electrical impulses to intermittently interrupt naturally occurring neural impulses on the vagus nerve between the brain and the digestive system. Our therapy controls hunger sensations between meals, limits the expansion of the stomach and reduces the frequency and intensity of stomach contractions, leading to earlier fullness. The resulting physiologic effects of vBloc Therapy produce a feeling of early and prolonged fullness following smaller meal portions. By intermittently blocking the vagus nerve and allowing it to return to full function between therapeutic episodes, our therapy limits the body’s natural tendency to circumvent the therapy, which can result in long-term weight loss.

We have designed our vBloc System to address a significant market opportunity that we believe exists for a patient-friendly, safe, effective, less-invasive and durable therapy that is intended to address the underlying causes of hunger and obesity. Our vBloc System offers each of the following benefits, which we believe could lead to the adoption of vBloc Therapy as the surgical therapy of choice for obesity and its comorbidities:

| ·

| | Preserves Normal Anatomy. The vBloc System is designed to deliver therapy that blockspromote weight loss by surgically restricting the neural signals that influence a patient’s hungerstomach’s capacity and sense of fullness without altering digestive system anatomy. Accordingly, patients should experience feweroutlet size. While largely effective, these procedures generally result in major lifestyle changes, including dietary restrictions and less severefood intolerances, and they may present substantial side effects compared to treatmentsand carry short‑ and long‑term safety and side effect risks that incorporate anatomical alterations.have limited their adoption.

|

| ·

| | Allows Continued Ingestion and Digestion of Foods Found in a Typical, Healthy Diet. Because our therapy leaves the digestive anatomy unaltered, patients are able to maintain a more consistent nutritional balance compared to existing surgical approaches, thus allowing them to effect positive changes in their eating behavior in a non-forced and potentially more consistent way.

|

| ·

| | May be Implanted on an Outpatient Basis and Adjusted Non-Invasively. The vBloc System is designed to be laparoscopically implanted within a 60-90 minute procedure, allowing patients to leave the hospital or clinic on the same day. The implantable system is designed to be turned off and left in place for patients who reach their target weight. When desired, the follow-up physician can simply and non-invasively turn the therapy back on. Alternatively, the implantable system can be removed in a laparoscopic procedure.

|

| ·

| | Offers Favorable Safety Profile. We have designed our ReCharge and EMPOWER clinical trials to demonstrate the safety of the vBloc System. In our clinical trials to date, including the ReCharge and EMPOWER trials, we have not observed any mortality related to our device or any unanticipated adverse device effects. We have also not observed any long-term problematic clinical side effects in any patients, including in those patients who have been using vBloc Therapy for more than one year.

|

| ·

| | Targets Multiple Factors that Contribute to Hunger and Obesity. We designed vBloc Therapy to target the digestive, metabolic and information transmission functions of the vagus nerve and to affect the perception of hunger and fullness, which together contribute to obesity and its metabolic consequences.

|

vBloc Therapy, delivered via our vBloc System, is intended to offer patients an effective, safe, outpatient solution that minimizes complications. It enables patients to lose weight and maintain long-term weight loss while enjoying a normal, healthy diet. We also believe that the vBloc System will appeal to physicians based on the inherent physiological approach of vBloc Therapy and its favorable safety profile.

Our Commercialization Strategy

Our goal is to establish vBloc Therapy, delivered via our vBloc System, as the leading obesity management solution. The key business strategies by which we intend to achieve these objectives include:

Commercialize Our Products Using a Geography Focused Direct-to-Patient Marketing Effort Within the United States. Since we received FDA approval on January 14, 2015 for vBloc Therapy, delivered via the vBloc System, we have begun a controlled commercial launch at select bariatric centers of excellence in the United States. We had our first commercial sales in 2015 and sold 62 units in 2016. During 2015, we started the process of building a sales force and a controlled expansion of our operations and hired three new executives in January 2016 to oversee this expansion. The direct sales force is supported by field technical managers who provide training, technical and other support services to our customers. Throughout 2015 and 2016 our sales force called directly on key opinion leaders and bariatric surgeons at commercially-driven bariatric centers of excellence that met our certification criteria. Additionally, in 2016, through a distribution agreement with Academy Medical, VA medical facilities now offer the vBloc System as a treatment option to veteran healthcare benefits. We intend to continue to build on these efforts in 2017 through self-pay patient and veteran focused direct-to-patient marketing and key opinion leader and center specific partnering.

Account management and patient registration processes used during the clinical trial are being transitioned to a commercial registration structure. Centers responsible for implanting our product will be expanded and trained to perform patient selection, implant the vBloc System and manage appropriate follow-up procedures.

Our sales representatives are supported by field clinical experts who are responsible for training, technical support, and other support services at various implant centers. Our sales representatives implement consumer marketing programs and provide surgical centers and implanting surgeons with educational patient materials.

We market directly to patients but sell our product to select surgical centers throughout the United States that have patients that would like to use the vBloc System to treat obesity and its comorbidities. The surgical centers then sell our product to the patients and implant and administer vBloc Therapy. In 2015 and 2016, almost all the patients that purchased the vBloc System paid for the therapy themselves and did not receive reimbursement from an insurance provider, and we expect that most of our sales will come from self-pay patients and veterans in 2017. Additionally, through our distribution agreement with Academy Medical, VA medical facilities now offer the the vBloc System as a treatment option for veterans at little to no cost to veterans in accordance with their veteran healthcare benefits.

We are working to obtain coverage for our product from the U.S. Centers for Medicare and Medicaid Services (CMS), Medicare Administrative Contractors (MACs), major insurance carriers, local coverage entities and self-insured plans, including Integrated Delivery Networks (IDNs). We received coverage from one significant IDN in the northeast, Winthrop University Hospital, in 2016 and are in active discussions with other IDNs throughout the country.

Identify Appropriate Coding, Obtain Coverage and Payment for the vBloc System. While payers are not our direct customers, their coverage and reimbursement policies influence patient and physician selection of obesity treatment. We are employing a focused campaign to obtain payer support for vBloc Therapy. We are seeking specific and appropriate coding, coverage and payment for our vBloc System from private insurers and CMS. We plan to establish a market price for the vBloc System in the United States that is competitive with other available weight loss surgical procedures and comparable to other active implantable devices such as implantable cardioverter defibrillators, neurostimulation devices for chronic pain and depression, and cochlear implant systems.

CMS issued a national coverage determination for several specific types of bariatric surgery in 2006, which we view as positive potential precedent and guidance factors that CMS might use in deciding to cover our therapy. Although Medicare policies are often emulated or adopted by other third-party payers, other governmental and private insurance coverage currently varies by carrier and geographic location. We are actively working with major insurance carriers, local coverage entities and self-insured plans, as well as CMS, on obtaining coverage for procedures using our product. Initial coverage for vBloc will likely occur in self-contained healthcare systems that operate as IDNs, as these systems are able to evaluate risk-benefit ratios in a closed environment. For example, in the first quarter of 2016, we announced that the Winthrop Hospital System in New York, a significant IDN in the northeast, would cover our therapy for their employees. Other similar arrangements are in active discussion.

Drive the Adoption and Endorsement of vBloc Therapy Through Obesity Therapy Experts and Patient Ambassadors. Our Clinical Development strategy is to collaborate closely with regulatory bodies, obesity therapy experts and others involved in the obesity management process, patients and their advocates and scientific experts. We have established credible and open relationships with obesity therapy experts and have identified vBloc Therapy patient ambassadors and we believe these individuals will be important in promoting patient awareness and gaining widespread adoption of the vBloc System.

Expand and Protect Our Intellectual Property Position. We believe that our issued patents and our patent applications encompass a broad platform of neuromodulation therapies, including vagal blocking and combination therapy focused on obesity, diabetes, hypertension and other gastrointestinal disorders. We intend to continue to pursue further intellectual property protection through U.S. and foreign patent applications.

Leverage our vBloc Technology for Other Disease States. We intend to continue to conduct research and development for other potential applications for our vBloc Therapy and believe we have a broad technology platform that will support the development of additional clinical applications and therapies for other metabolic and gastrointestinal disorders in addition to obesity.

Concentrate Our Resources on the U.S. Market. We intend to devote our near-term efforts toward mounting a successful system launch in the United States. We intend to explore select international markets to commercialize the vBloc System as our resources permit, using direct, dealer and distributor sales models as the targeted market best dictates. Specifically, we are currently evaluating Canada as a market due to its relatively low barrier to entry and an established cash-pay bariatric patient market.

The vBloc System, Implantation Procedure and Usage

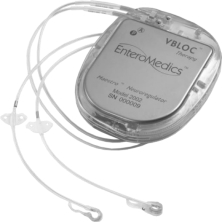

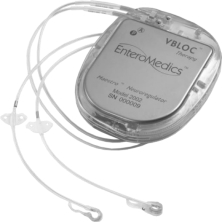

The vBloc System. Our vBloc System delivers vBloc Therapy via two small electrodes that are laparoscopically implanted and placed in contact with the trunks of the vagus nerve just above the junction between the esophagus and the stomach, near the diaphragm. The vBloc System (shown below) is powered by an internal rechargeable battery.

The major components of the vBloc System include:

| ·

| | Neuroregulator. The neuroregulator, a pacemaker-like device, is an implanted device that controls the delivery of vBloc Therapy to the vagus nerve. It is surgically implanted just below, and parallel to, the skin, typically on the side of the body over the ribs.

|

| ·

| | Lead System. Proprietary leads are powered by the neuroregulator and deliver electrical pulses to the vagus nerve via the electrodes. The leads and electrodes are similar to those used in traditional cardiac rhythm management products.

|

| ·

| | Mobile Charger. The mobile charger is an electronic device worn by the patient externally while recharging the device. It connects to the transmit coil and provides information on the battery status of the neuroregulator and the mobile charger.

|

| ·

| | Transmit Coil. The transmit coil is positioned for short periods of time on top of the skin over the implanted neuroregulator to deliver radiofrequency battery charging and therapy programming information across the skin into the device.

|

| ·

| | Clinician Programmer. The clinician programmer connects to the mobile charger to enable clinicians to customize therapy settings as necessary and retrieve reports stored in system components. The reports include patient use and system performance information used to manage therapy. The clinician programmer incorporates our proprietary software and is operated with a commercially available laptop computer.

|

Implantation Procedure. The vBloc System is implanted by a laproscopically trained surgeon using a procedure that is typically performed within 60-90 minutes. During the procedure, the surgeon laparoscopically implants the electrodes in contact with the vagal nerve trunks and then connects the lead wires to the neuroregulator, which is subcutaneously implanted. The implantation procedure and usage of the vBloc System carry some risks, such as the risks generally associated with laparoscopic procedures as well as the possibility of device malfunction. Adverse events related to the therapy, device or procedure may include, but are not limited to: transient pain at the implant site, heartburn, constipation, nausea, depression, diarrhea, infection, organ or nerve damage, surgical explant or revision, device movement, device malfunction and allergic reaction to the implant.

Usage of the vBloc System. The physician activates the vBloc System after implantation. vBloc Therapy is then delivered intermittently through the neuroregulator each day as scheduled (recommended during the patient’s waking hours when food is consumed) through the neuroregulator. The scheduled delivery of the intermittent pulses blocking the vagus nerve is customized for each patient’s weight loss and overall treatment objectives.

The physician is able to download reports to monitor patient use and system performance information. This information is particularly useful to physicians to ensure that patients are properly using the system. Although usage of our vBloc System generally proceeds without complications, as part of the therapy or intentional weight loss, patients in our clinical trials have observed side-effects such as transient pain at the implant site, heartburn, bloating, dysphagia, eructation, cramps, diarrhea, nausea, constipation, and excessive feelings of fullness, especially after meals. In addition, patient noncompliance with properly charging the vBloc System may render vBloc Therapy less effective in achieving long-term weight loss.

Our Clinical Experience

We have conducted a series of clinical trials to date, which have shown that vBloc Therapy offers physicians a programmable method to selectively and reversibly block the vagus nerve resulting in clinically and statistically significant EWL.

We have not observed any mortality related to our device or any unanticipated adverse device effects in any of our completed or ongoing studies. Reported events include those associated with laparoscopic surgery or any implantable electronic device. The effects of vBloc Therapy include changes in appetite, and, in some patients, effects that may be expected with decreased intra-abdominal vagus nerve activity, such as temporary abdominal discomfort and short episodes of belching, bloating, cramping or nausea.

Findings from our clinical trials have resulted in publication in numerous peer-reviewed journals including The Journal of the American Medical Association, Journal of Obesity, Obesity Surgery, Surgery for Obesity and Related Diseases, Journal of Diabetes and Obesity, Surgery and Journal of Neural Engineering, and data have been presented at several scientific sessions including the American Society for Metabolic and Bariatric Surgery, International Federation for Surgery of Obesity and Metabolic Disorders, the Obesity Surgery Society of Australia & New Zealand and The Obesity Society.

Below is a more detailed description of our ongoing clinical studies:

ReCharge Trial

In October 2010, we received an unconditional Investigational Device Exemption (IDE) Supplement approval from the FDA to conduct a randomized, double-blind, sham-controlled, multicenter pivotal clinical trial, called the ReCharge trial, testing the effectiveness and safety of vBloc Therapy utilizing our second generation vBloc System. Enrollment and implantation in the ReCharge trial was completed in December 2011 in 239 randomized patients (233

implanted) at 10 centers. All patients in the trial received an implanted device and were randomized in a 2:1 allocation to treatment or control groups. The control group received a non-functional device during the trial period. All patients were expected to participate in a standard weight management counseling program. The primary endpoints of efficacy and safety were evaluated at 12 months. The ReCharge trial met its primary safety endpoint with a 3.7% serious adverse event rate, significantly lower than the threshold of 15% (p<0.0001). The safety profile at 12 months was further supported by positive cardiovascular signals including a 5.5 mmHg drop in systolic blood pressure, a 2.8 mmHg drop in diastolic blood pressure and a 3.6 bpm drop in average heart rate.

Although the trial did not meet its predefined co-primary efficacy endpoints, it did demonstrate in the ITT population (n=239) a clinically meaningful and statistically significant EWL of 24.4% (approximately 10% TBL) for vBloc Therapy-treated patients, with 52.5% of patients achieving at least 20% EWL. In the per protocol population, the trial demonstrated an EWL of 26.3% for vBloc Therapy-treated patients, with 56.8% of patients achieving at least 20% EWL. As a result of the positive safety and efficacy profile of vBloc Therapy, we used the data from the ReCharge trial to support a PMA application for the vBloc System, which was submitted to the FDA in June 2013 and was accepted for review and filing in July 2013. An Advisory Panel meeting was held on June 17, 2014 to review our PMA application for approval of the vBloc System. The Advisory Panel voted 8 to 1 “in favor” that the vBloc System is safe when used as designed and voted 4 to 5 “against” on the issue of a reasonable assurance of efficacy. The final vote, on whether the relative benefits outweighed the relative risk, was 6 to 2 “in favor,” with 1 abstention. We received FDA approval on January 14, 2015 for vBloc Therapy, delivered via the vBloc System, for the treatment of adult patients with obesity who have a BMI of at least 40 to 45 kg/m2, or a BMI of at least 35 to 39.9 kg/m2 with a related health condition such as high blood pressure or high cholesterol levels, and who have tried to lose weight in a supervised weight management program and failed within the past five years.

Further analysis of the 12 month data show that in the primary analysis (ITT) population (n=239), vBloc Therapy-treated patients achieved a 24.4% average EWL (approximately 10% TBL) compared to 15.9% for sham control patients. This 8.5% difference demonstrated statistical superiority over sham control (p=0.002), but not super-superiority at the pre-specified 10% margin (p=0.705). In total, 52.5% of vBloc Therapy-treated patients had 20% or more EWL compared to 32.5% in the control group (p=0.004), and 38.3% of vBloc Therapy-treated patients had 25% or more EWL compared to 23.4% in the sham control group (p=0.02). While the respective co-primary endpoint targets of 55% and 45% were not met, the endpoint targets were within the 95% confidence intervals for the observed rates and therefore the observed rates were not significantly lower than these pre-specified rates. These efficacy data demonstrate vBloc Therapy’s positive effect on weight loss.

In the per protocol group, which included only those patients who received therapy per the trial design (n=211), the vBloc Therapy-treated patients had a 26.3% average EWL (approximately 10% TBL) compared to 17.3% for the sham control group (p=0.003). In total, 56.8% of vBloc Therapy-treated patients achieved at least 20% EWL, which was above the predefined threshold of 55% compared to 35.4% in the sham control group (p=0.004). 41.8% of vBloc Therapy-treated patients also achieved at least 25% EWL in this population, which is slightly less than the predefined threshold of 45%, compared to 26.2% in the sham control group (p=0.03).

Additionally, two-thirds of vBloc Therapy-treated patients achieved at least 5% TBL at 12 months. According to the CDC, 5% TBL can have significant health benefits on obesity related risk factors, or comorbidities, including reduction in blood pressure, improvements in Type 2 diabetes and reductions in triglycerides and cholesterol. Further analysis of our data at 12 months showed a meaningful impact on these comorbidities as noted in the below table showing the improvements seen at 10% TBL, the average weight loss in vBloc Therapy-treated patients.

| | |

Risk Factor

| | 10% TBL

|

Systolic BP (mmHg)

| | (9) |

Diastolic BP (mmHg)

| | (6) |

Heart Rate (bpm)

| | (6) |

Total Cholesterol (mg/dL)

| | (15) |

LDL (mg/dL)

| | (9) |

Triglycerides (mg/dL)

| | (41) |

HDL (mg/dL)

| | 3 |

Waist Circumference (inches)

| | (7) |

HbA1c (%)

| | (0.5) |

Approximately 93% of patients reached the 12 month assessment in the trial, consistent with a rigorously executed trial. vBloc Therapy-treated patients maintained their weight loss at 18 months and 24 months with an EWL of 23.5% and 21.1%, respectively. The trial’s positive safety profile also continued throughout this reported time period.

VBLOC-DM2 ENABLE Trial

Enrollment of the VBLOC-DM2 ENABLE trial began in 2008. The VBLOC-DM2 ENABLE trial is designed to evaluate the efficacy and safety of vBloc Therapy on obese subjects as well as its effect on glucose regulation in approximately 30 patients who are using the vBloc System. The trial is an international, open-label, prospective, multi-center study. At each designated trial endpoint the efficacy of vBloc Therapy is evaluated by measuring average percentage EWL, HbA1c (blood sugar), FPG (fasting plasma glucose), blood pressure, calorie intake, appetite and other endpoints at one week, one month, three, six, 12 and 18 months and longer. The following results were reported at 12 month intervals.

| ·

| | Percent EWL (from implant, Company updated interim data):

|

| | | | |

Visit (post-device activation) | | % EWL | | N |

12 Months | | (24.5) | | 26 |

24 Months | | (22.7) | | 22 |

36 Months | | (24.3) | | 18 |

| ·

| | HbA1c change in percentage points (Baseline HbA1c = 7.8 + 0.2%) (Company updated interim data):

|

| | | | |

| | % HbA1c | | |

Visit (post-device activation) | | change | | N |

12 Months | | (1) | | 26 |

24 Months | | (0.5) | | 24 |

36 Months | | (0.6) | | 17 |

| ·

| | Fasting Plasma Glucose change (Baseline 151.4 + 6.5 mg/dl average) (Company updated interim data):

|

| | | | |

| | Glucose | | |

| | change | | |

Visit (post-device activation) | | (mg/dl) | | N |

12 Months | | (27.6) | | 25 |

24 Months | | (20.3) | | 24 |

36 Months | | (24) | | 17 |

| ·

| | Change in mean arterial pressure (MAP) in hypertensive patients (baseline 99.5 mmHg) (Company updated interim data):

|

| | | | |

| | MAP | | |

| | change | | |

Visit (post-device activation) | | (mmHg) | | N |

12 Months | | (7.8) | | 14 |

24 Months | | (7.5) | | 12 |

36 Months | | (7.3) | | 10 |

To date, no deaths related to our device or unanticipated adverse device effects have been reported during the VBLOC-DM2 ENABLE trial and the safety profile is similar to that seen in the other vBloc trials.

Caloric Intake Sub-study: A sub-study, conducted as part of the VBLOC-DM2 ENABLE trial, evaluated 12-month satiety and calorie intake in 10 patients with Type 2 diabetes mellitus enrolled in the trial. Follow-up measures among patients enrolled in the sub-study included EWL, 7-day diet records assessed by a nutritionist, calorie calculations and visual analogue scale (VAS) questions to assess satiety by 7-day or 24-hour recall at the following time

periods: baseline, 4 and 12 weeks and 6 and 12 months post device initiation. A validated program, Food Works™, was used to determine calorie and nutrition content. Results include:

| ·

| | Mean EWL for the sub-study was 33+5% (p<0.001) at 12 months;

|

| ·

| | Calorie intake decreased by 45% (p<0.001), 48% (p<0.001), 38% (p<0.001) and 30% (p=0.02), at 4 and 12 weeks, 6 months and 12 months, respectively, from a baseline of 2,062 kcal/day; and

|

| ·

| | VAS recall data, using a repeated measures analysis, documented fullness at the beginning of meals (p=0.005), less food consumption (p=0.02) and less hunger at the beginning of meal (p=0.03) corroborating the reduction in caloric intake.

|

EMPOWER Trial

The EMPOWER trial is a randomized, double-blind, controlled pivotal study that began in 2006 and was designed to evaluate the safety and efficacy of our first-generation vBloc RF System in the treatment of obesity in 294 patients. The purpose of the EMPOWER trial is to measure the safety and efficacy of our vBloc RF System in obese patients after 12 months of vBloc Therapy. After all patients completed 12 months of follow up, the trial was unblinded and all patients, including those in the control group, had the option to receive ongoing vBloc Therapy. Patients will continue to be followed out to 60 months as part of the trial and we will continue to monitor average percentage EWL and safety during this extended period. At 12 months from implant, patients in the treated group who used the system for greater than or equal to 12 hours a day saw an average EWL of nearly 30%. The trial produced the following safety results:

| ·

| | No deaths, a one-year surgical revision rate of 4.8% and serious adverse event rate related to the device or implant/revision procedure of 3%;

|

| ·

| | No therapy-related serious adverse events in the entire study population through 12 months; and

|

| ·

| | No changes in intra-cardiac conduction, ventricular repolarization or ventricular arrhythmias were seen in either study group.

|

At the 36 month endpoint, EMPOWER EWL was approximately 20% in 45 subjects receiving at least 9 hours of therapy per day. In addition, a subgroup analysis of EMPOWER trial patients was conducted to determine if vBloc Therapy would improve blood pressure prior to significant weight loss in obese subjects with hypertension, as defined by elevated blood pressure at baseline by JNC-7 guidelines (n=37, Group A) or history of hypertension (n=58, Group B) at baseline. The analysis was performed in a subset of subjects receiving at least 9 hours of therapy per day to 12 months.

| ·

| | Change in systolic blood pressure (SBP) and diastolic blood pressure (DBP) from baseline:

|

| | | | | | | | |

| | Baseline

| | Week 2

| | Week 4

| | 12 Months

|

Group A (subjects with elevated blood pressure) (p<0.001)

| | | | | | | | |

SBP (mmHg)

| | 145+/-2

| | -17+/-3

| | -17+/-3

| | (18+/(3)

|

DBP (mmHg)

| | 89+/-2

| | -9+/-2

| | -8+/-2

| | (10+/(2)

|

% EWL

| | N/A

| | 9+/-2

| | 12+/-1

| | 21+/-4

|

Group B (subjects with history of hypertension) (p<0.001)

| | | | | | | | |

SBP (mmHg)

| | 134+/-2

| | -10+/-2

| | -9+/-2

| | (13+/(2)

|

DBP (mmHg)

| | 84+/-1

| | -6+/-1

| | -6+/-1

| | (7+/(1)

|

% EWL

| | NA

| | 9+/-1

| | 13+/-1

| | 23+/-3

|

Our Research and Development

Current R&D Focus

We have an experienced research and development team, including clinical, regulatory affairs and quality assurance, comprised of scientists electrical engineers, software engineers and mechanical engineers with significant clinical knowledge and expertise. Our research and development efforts are focused in the following major areas:

| · | | supporting the current vBlocLap-Band System; |

| · | | testing and developing the next-generation vBloc System; |

| ·

| | identifying the effect of vagal blocking on nerve and organ function;ReShape Vest; and

|

| · | | investigating theReShape vBloc platform for the treatment of gastrointestinal disorders and comorbidities in addition to obesity.type 2 diabetes, which, if marketed, would require additional FDA approval through the PMA process. |

We have spent a significant portion of our capital resources on research and development. Our research and development expenses from continuing operations were $5.1$5.7 million in 2016, $8.12018 and $5.4 million in 2015 and $11.0 million in 2014. Having obtained FDA approval in January 2015, our main focus has been on commercialization efforts, resulting in decreases in spending on research and development in each of 2015 and 2016 compared to 2014, when we were still working through the FDA approval process.

Other Diseases and Disorders

We believe that our vBloc Therapy may have the potential, if validated through appropriate clinical studies, to treat a number of additional gastrointestinal disorders or comorbidities frequently associated with obesity, including the following:

| ·

| | Type 2 Diabetes. Type 2 diabetes is an escalating global health epidemic often related to obesity that affects nearly 200 million people worldwide, 50 million in the United States alone. Those with diabetes are susceptible to cardiovascular morbidity and mortality, and up to two out of three people with diabetes have high blood pressure. We believe that vBloc Therapy has significant potential in treating metabolic syndrome (diabetes with high blood pressure). We have launched an international feasibility trial, VBLOC-DM2 ENABLE, to further explore the efficacy of vBloc Therapy in this patient population and have reported preliminary findings in the “Our Clinical Experience” section above.

|

| ·

| | Hypertension. Blood pressure normally rises and falls throughout the day. When it consistently stays too high for too long, it is called hypertension. Globally, nearly one billion people have high blood pressure (hypertension); of these, two-thirds are in developing countries. About one in three American adults has high blood pressure or hypertension. Hypertension is one of the most important causes of premature death worldwide and the problem is growing; in 2025, an estimated 1.56 billion adults will be living with hypertension. Hypertension kills nearly 8 million people every year worldwide. We believe that vBloc Therapy may improve mean systolic and diastolic blood pressure in hypertensive patients. We completed a subgroup analysis of EMPOWER trial patients and have included an evaluation of the blood pressure effects of vBloc Therapy in our international feasibility trial, VBLOC-DM2 ENABLE, to further explore the efficacy of vBloc Therapy in this patient population and have reported preliminary findings in the “Our Clinical Experience” section above.

|

| ·

| | Pancreatitis. Primary and recurrent cases of acute pancreatitis are estimated to number from 150,000 to 200,000 annually, resulting in approximately 80,000 hospital admissions each year in the United States. In animal studies, we have shown that vBloc Therapy suppresses pancreatic exocrine secretion, suggesting its potential efficacy in treating pancreatitis.

|

| ·

| | Other Gastrointestinal Disorders. We believe that vBloc Therapy may have potential in a number of other gastrointestinal disorders, including irritable bowel syndrome and inflammatory bowel disease.

|

None of the above conditions were included in our PMA application that was approved by the FDA on January 14, 2015, nor are they approved for sale internationally. Additional approvals will be required to market the vBloc System for these indications in the United States or internationally.

Medical Advisors

In addition to our collaboration with Mayo Clinic, we also have medical advisors who provide strategic guidance to our development programs, consult with us on clinical investigational plans and individual study protocols, and advise on clinical investigational site selection. Members of our medical advisory group also:

| ·

| | serve on our Data Safety Monitoring Board and Clinical Events Committee;

|

| ·

| | provide consultation on professional meeting presentations and journal manuscript submissions; and

|

| ·

| | develop and participate in clinical site training programs, including study surgical technique training and study subject follow-up training.

|

2017.

Our Competition

The market for obesity treatments is competitive, subject to technological change and significantly affected by new product development. Our primary competition in the obesity treatment market is currently from bariatric surgical obesity procedures and from various devices used to implement neurostimulationendoscopic procedures.

Our Lap-Band System competes, and gastric stimulation systems. We believe we are the first company having neuroblocking therapy for the treatment of obesity. There are currently no other FDA-approved neuromodulation or neuroblocking therapies for the treatment of obesity, but in the future we expect other new stimulation systems and neurotechnology devices to come on the market.

We expectthat our vBlocReShape Vest System will compete, with surgical obesity procedures, including gastric bypass, gastric balloon, gastric bandingballoons, sleeve gastrectomy and sleeve gastrectomy.the endoscopic sleeve. These current surgical procedures are performed in less than 1% of all eligible obese patients today. Current manufacturers of approved gastric balloon and bandingsuturing products that are approved in the United States include Apollo Endosurgery Inc. (Lap-Band and ORBERA(ORBERA Intragastric Balloon System and OverStitch Endoscopic Suturing System), ReShape Medical, Inc. (ReShape Integrated Dual Balloon System), and Obalon Therapeutics, Inc. (Obalon Balloon System) and Johnson & Johnson (Realize Adjustable Gastric Band).

In June of 2016, Aspire Bariatrics, Inc. received FDA approval onfor the Aspire Assist® System, an endoscopic alternative to weight loss surgery for people with moderate to severe obesity. We are also aware that GI Dynamics, Inc. has received approvals in various international countries to sell its EndoBarrier Gastrointestinal Liner.

We also compete against the manufacturers of pharmaceuticals that are directed at treating obesity and the 99% of obese patients eligible for surgery that are not willing to pursue a surgical option .option. We are aware of a number of drugs that are approved for long-term treatment of obesity in the United States: Orlistat, marketed by Roche as Xenical and GlaxoSmithKline as Alli, Belviq marketed by Arena Pharmaceuticals, Inc., Qsymia, marketed by VIVUS, Inc. and Contrave, marketed by Orexigen Therapeutics, Inc.

In addition, we are aware of a pivotal trial for GELESIS100 that is being conducted by Gelesis, Inc.

In addition to competition from surgical obesity procedures, we compete with several private early-stage companies developing neurostimulation devices for application to the gastric region and related nerves for the treatment of obesity. Further, we know of two intragastric balloon companies either in clinical trials or working toward clinical trials in the US: Spatz3 Adjustable Balloon and Allurion Technology’s Elipse Balloon. These companies may prove to be significant competitors, particularly through collaborative arrangements

with large and established companies. They also compete with us in recruiting and retaining qualified scientific and management personnel, establishing clinical trial sites and subject registration for clinical trials, as well as in acquiring technologies and technology licenses complementary to our programs or advantageous to our business.

In addition, there are many larger potential competitors experimenting in the field of neurostimulation to treat various diseases and disorders. For example, Medtronic Inc.,plc, which develops deep brain stimulators and spinal cord

stimulators, acquired TransNeuronix, which sought to treat obesity by stimulating the smooth muscle of the stomach wall and nearby tissue. St. Jude Medical, Inc., through its acquisition of Advanced Neuromodulation Systems, is developing spinal cord stimulators. LivaNova PLC is developing vagus nerve stimulators to modulate epileptic seizures and other neurological disorders. Boston Scientific Corporation, through its Advanced Bionics division, is developing neurostimulation devices such as spinal cord stimulators and cochlear implants. Ethicon-Endo Surgery acquired LivaNova PLC’s patents and patent applications pertaining to vagus nerve stimulation for the treatment of obesity and two related comorbidities, diabetes and hypertension, in overweight patients.

We believe that the principal competitive factors in our market include:

| · | | acceptance by healthcare professionals, patients and payers; |

| · | | published rates of safety and efficacy; |

| · | | reliability and high quality performance; |

| · | | effectiveness at controlling comorbidities such as diabetes and hypertension; |

| · | | invasiveness and the inherent reversibility of the procedure or device; |

| · | | cost and average selling price of products and relative rates of reimbursement; |

| · | | effective marketing, education, sales and distribution; |

| · | | regulatory and reimbursement expertise; |

| · | | technological leadership and superiority; and |

| · | | speed of product innovation and time to market. |

Many of our competitors are larger than we are and are either publicly-traded or are divisions of publicly-traded companies, and they enjoy several competitive advantages over us, including:

| · | | significantly greater name recognition; |

| · | | established relations with healthcare professionals, customers and third-party payers; |

| · | | established distribution networks; |

| · | | greater experience in research and development, manufacturing, preclinical testing, clinical trials, obtaining regulatory approvals, obtaining reimbursement and marketing approved products; and |

| · | | greater financial and human resources. |

As a result, we cannot assure you that we will be able to compete effectively against these companies or their products.

Market Opportunity

Given the limitations of behavioral modification, pharmaceutical therapy and traditional bariatric surgical approaches, we believe there is a substantial need for patient-friendly, safer, effective and durable solutions that:

| · | | preserves normal anatomy; |