Substantial competition could reduce our market share and may negatively affect our business.

The direct marketing industry and the computer products retail business, in particular, are highly competitive. We compete with other national solutions providers of hardware and software and computer related products, including CDW Corporation and Insight Enterprises, Inc., each of which is much larger than we are.who are the current leaders in the space. Certain hardware and software vendors, such as Apple, Dell Inc., Lenovo, and HP Inc., who provide products to us, also sell their products directly to end users through their own direct sales force, catalogs, stores, and via the Internet. We also compete with computer retail stores and websites, who are increasingly selling to business customers and may become a significant competitor.competitor, including e-tailers, such as Amazon, with more extensive commercial online networks. As we continue to expand and mature our AI services, we compete with other companies that develop and deliver on bespoke AI projects, such as Palantir and Scale.ai. We compete not only for customers, but also for advertising support from IT product manufacturers. Some of our competitors have larger customer bases and greater financial, marketing, and other resources than we do. In addition, some of our competitors offer a wider range of products and services than we do and may be able to respond more quickly to new or changing opportunities, technologies, and customer requirements. Many current and potential competitors also have greater name recognition, engage in more extensive promotional activities, and adopt pricing policies that are more aggressive than ours. We expect competition to increase as retailers and solution providers who have not traditionally sold computers and related products enter the industry.

In addition, product resellers and national solutions providers are combining operations or acquiring or merging with other resellers and national solutions providers to increase efficiency. Moreover, current and potential competitors have established or may establish cooperative relationships among themselves or with third parties to enhance their products and services. Accordingly, it is possible that new competitors or alliances among competitors may emerge and acquire significant market share. We may not be able to continue to compete effectively against our current or future competitors. If we encounter new competition or fail to compete effectively against our competitors, our business market share, results of operations or cash flows may be harmed.adversely impacted.

We face and will continue to face significant price competition.competition, which could result in a reduction of our profit margins.

Generally, pricing is very aggressive in our industry, and we expect pricing pressures to escalate should economic conditions deteriorate.deteriorate or inflationary pressures increase in excess of the amounts our customers are willing to pay. An increase in price competition could result in a reduction of our profit margins. We may not be able to offset the effects of price reductions with an increase in the number of customers we serve, higher sales to existing customers, cost reductions, or otherwise. Such pricing pressures could result in anthe erosion of our market share, reduced sales, and reduced operating margins, any of which could have a material adverse effect on our business.business, financial position, results of operations, and cash flows.

Inflation may adversely impact our business, financial condition and results of operations.

Inflation has the potential to adversely affect our business, financial condition and results of operations by increasing our overall cost structure, including cost of products and selling, general and administrative, or SG&A, expenses. In an inflationary environment, we may be unable to raise the prices of our products sufficiently to keep up with the rate of inflation, which would reduce our profit margins and cash flows. Other inflationary pressures could affect wages, and other inputs and our ability to meet our customer demand. Inflation may further exacerbate other risk factors, including supply chain disruptions, the recruitment and retention of qualified employees.

1116

The interruption of the flow of products from suppliers could disrupt our supply chain.

Our business depends on the timely supply of products in order to meet the demands of our customers. Manufacturing interruptions or delays, including as a result of the financial instability or bankruptcy of manufacturers, significant labor disputes such as strikes, armed conflicts, natural disasters, political or social unrest, pandemics or other public health crises, or other adverse occurrences affecting any of our suppliers’ facilities, could disrupt our supply chain. We could experience product constraints due to the failure of suppliers to accurately forecast customer demand, or to manufacture sufficient quantities of product to meet customer demand (including as a result of shortages of product components), among other reasons. Additionally, the relocation of key distributors utilized in our purchasing model could increase our need for, and the cost of, working capital and have an adverse effect on our business, results of operations or cash flows.

Our supply chain is also exposed to risks related to international operations. While we purchase our products primarily in the markets we serve (for example, products for US customers are sourced in the US), our vendor partners manufacture or purchase a significant portion of the products we sell outside of the US, primarily in Asia. Political, social or economic instability in Asia, or in other regions in which our vendor partners purchase or manufacture the products we sell, could cause disruptions in trade, including exports to the US. Other events related to international activities that could cause disruptions to our supply chain include:

| ● | the imposition of additional trade law provisions or regulations, the adoption or expansion of trade restrictions, including new or expanded economic sanctions in response to the ongoing conflicts between Russia and Ukraine and in the Middle East; |

| ● | the imposition of additional duties, tariffs and other charges on imports and exports, including any resulting retaliatory tariffs or charges and any reductions in the production of products subject to such tariffs and charges; |

| ● | foreign currency fluctuations; and |

| ● | restrictions on the transfer of funds. |

We cannot predict whether the countries in which the products we sell, or any components of those products, are purchased or manufactured will be subject to new or additional trade restrictions or sanctions imposed by the United States or foreign governments, including the likelihood, type or effect of any such restrictions. Trade restrictions, including new or increased tariffs or quotas, embargoes, sanctions, safeguards and customs restrictions against the products we sell, could increase the cost or reduce the supply of product available to us and adversely affect our business, results of operations or cash flows. In addition, our supply chain and our cost of goods also may be negatively impacted by unanticipated price increases due to factors such as inflation, including wage inflation, or to supply restrictions beyond our control or the control of our suppliers.

Failure to provide high quality services to our clients could adversely affect our reputation, brand, business, results of operations or cash flows.

Our services include end-to-end technical configuration services related to the design, configuration, and implementation of IT solutions as well as warranties. In addition, we deliver and manage mission critical software, systems and network solutions for our customers. We also offer certain services, such as asset assessment, implementation, maintenance, and disposal services, to our customers through various third-party service providers engaged to perform these services on our behalf. If we or our third-party service providers fail to provide high quality services to our customers or such services result in an unplanned disruption of our customers’ businesses, this could, among other things, result in legal claims and proceedings and liability for us. As we expand our services and solutions offerings and provide increasingly complex services and solutions, we may be exposed to additional operational, regulatory and other risks. We could also incur liability for failure to comply with the rules and regulations applicable to new services and solutions we provide to our customers. The occurrence of any such failure could adversely affect our reputation, brand, business, results of operations or cash flows.

17

General economic and political conditions, including unfavorable conditions in a business or industry sector, may lead our clients to delay or forgo investments in IT hardware, software and services.

Our business has been affected by changes in economic conditions that are outside of our control, including reductions in business investment, loss of consumer confidence, and fiscal uncertainty. Weak economic conditions generally or any broad-based reduction in IT spending would further adversely affect our business, operating results and financial condition. A prolonged slowdown in the global economy, including the possibility of recession or financial market instability or similar crisis, or in a business or industry sector, or the tightening of credit markets, could cause our clients to have difficulty accessing capital and credit sources, delay contractual payments, or delay or forgo decisions to upgrade or add to their existing IT environments, license new software or purchase products or services (particularly with respect to discretionary spending for hardware, software and services). For example, our customers exercised greater caution and selectivity with their short-term IT investment plans during 2023, which resulted in lower than anticipated sales across our customer base. Such events have in the past had and may in the future have a material adverse effect on our business, financial condition and results of operations. Economic or industry downturns could result in longer payment cycles, increased collection costs and defaults in excess of our expectations. A significant deterioration in our ability to collect on accounts receivable could also impact the cost or availability of financing under our credit facility.

Moreover, an adverse change in government spending policies (such as budget cuts or limitations or temporary shutdowns of government operations), shifts in budget priorities or reductions in revenue levels, could cause our Public Sector Solutions customers to reduce or delay their purchases or to terminate or not renew their contracts with us, which could adversely affect our business, results of operations or cash flows. These possible actions or the adoption of new or modified procurement regulations or practices could have a material adverse effect on our business, financial position and results of operations.

Worldwide economic conditions and market volatility as a result of political leadership in certain countries and other disruptions to global and regional economies and markets, including continuing increases in inflation and interest rates, the possibility of recession, or financial market instability, may impact future business activities. External factors, such as potential terrorist attacks, acts of war, geopolitical and social turmoil or epidemics and other similar outbreaks in many parts of the world, could prevent or hinder our ability to do business, increase our costs and negatively affect our stock price. More generally, these geopolitical, social and economic conditions could result in increased volatility in the United States and worldwide in financial markets and in the economy, as well as other adverse impacts. For example, on February 24, 2022, Russian forces launched significant military actions against Ukraine, and sustained conflict and disruption in the region remains ongoing. Potential impacts related to the conflict include further market disruptions, including significant volatility in commodity prices, credit and capital markets, supply chain and logistics disruptions, adverse global economic conditions resulting from escalating domestic and geopolitical tensions, volatility and fluctuations in foreign currency exchange rates and interest rates, inflationary pressures on raw materials and heightened cybersecurity threats, all of which could adversely impact our business.

18

We acquire a majority of our products for resale from a limited number of vendors. The loss of any one of these vendors could have a material adverse effect on our business.

We acquire a majority of our products for resale from a limited number of vendors. The loss of any one of these vendors could have a material adverse effect on our business. We acquire products for resale both directly from manufacturers and increasingly indirectly through distributors and other sources. Although we purchase from a diverse vendor base, product purchases from Ingram Micro, Inc., TD Synnex Corporation, and Microsoft Corporation accounted for approximately 21%, 19%, and 11%, respectively, of our total product purchases in 2023. No other singular vendor supplied more than 10% of our total product purchases in the year 2023. If we are unable to acquire products, or if we experienced a change in business relationship with any of these vendors, we could experience a short-term disruption in the availability of products, and such disruption could have a material adverse effect on our results of operations and cash flows.

Products manufactured by Microsoft Corporation, HP Inc., and Dell Inc. represented approximately 15%, 13%, and 11%, respectively, of our total product purchases in 2023. No other singular product manufacturer produced more than 10% of our total product purchases in the year 2023. We believe that in the event we experience either a short-term or permanent disruption of supply of Microsoft Corporation, HP Inc., or Dell Inc. products, such disruption would likely have a material adverse effect on our results of operations and cash flows.

We typically do not have long-term contracts with our vendor partners. As such, substantially all of these arrangements with partners are easily terminable, and there can be no assurance that manufacturers and publishers will continue to sell or will not limit or curtail the availability of their product to resellers like us. Most of our product vendors provide us with trade credit, of which the amount outstanding at December 31, 2023 was $263.7 million. Termination, interruption, or contraction of relationships with our vendors, including a reduction in the level of trade credit provided to us, could have a material adverse effect on our financial position.

Some product manufacturers either do not permit us to sell the full line of their products or limit the number of product units available to national solutions providers such as us. An element of our business strategy is to continue increasing our participation in first-to-market purchase opportunities. The availability of certain desired products, especially in the direct marketing channel, has been constrained in the past due to these limits imposed by product manufacturers. We could experience a material adverse effect to our business if we are unable to source first-to-market purchases or similar opportunities, or if significant availability constraints reoccur.

Virtualization of IT resources and applications, including networks, servers, applications, and data storage may disrupt or alter our traditional distribution models.

Our customers can access, through a cloud-based platform, business-critical solutions without the significant initial capital investment required for dedicated infrastructure. Growing demand for the development of cloud-based solutionsand other virtual services including SaaS, IaaS, PaaS, DaaS, and other emerging technologies, including IoT and AI, may reduce the demand for someproducts and services we sell to our customers. Cloud offerings may influence our customers to move workloads to cloud providers, which may reduce the procurement of our existing hardware products. Ifproducts and services from us. Changes in the transition to an environment characterized by cloud-based computing and software being delivered as a service progresses, we will likely increase investments in this area before knowing whether our sales forecasts will accurately reflect customerIT industry may also affect the demand for theseour advanced professional and managed services. We have invested a significant amount of capital in our strategy to provide certain products and services, and solutions. Wethis strategy may notadversely impact our financial position due to competition or changes in the industry or improper focus or selection of the products and services we decide to offer. If we fail to react in a timely manner to such changes, our results of operations may be able to effectively compete using these virtual distribution models.adversely affected. Our inability to compete effectively with currentsales can be dependent on demand for specific product categories, and any change in demand for or future virtual distribution model competitors, or adapt to a cloud-based environment,supply of such products could have a material adverse effect on our business.results of operations.

The methods of distributing IT products are changing, and such changes may negatively impact us and our business.

The manner in which IT hardware and software is distributed and sold is changing, and new methods of distribution and sale have emerged, including distribution through cloud-based and other virtual solutions. In addition, hardware and software manufacturers have sold, and may intensify their efforts to sell, their products directly to end users. From time

19

to time, certain manufacturers have instituted programs for the direct sales of large order quantities of hardware and software to certain major corporate accounts. These types of programs may continue to be developed and used by various manufacturers. Some of our vendors, including Apple, Dell Inc., HP Inc., and Lenovo, currently sell some of their products directly to end users and have stated their intentions to increase the level of such direct sales. In addition, manufacturers may attempt to increase the volume of software products distributed electronically to end users. An increase in the volume of products sold through or used by consumers of any of these competitive programs, or our inability to effectively adapt our business to increased electronic distribution of products and services to end users could have a material adverse effect on our results of operations.

We depend heavily on third-party shippers to deliver our products to customers and would be adversely affected by a service interruption by these shippers.

Many of our customers elect to have their purchases shipped by an interstate common carrier, such as United Parcel Service, Inc., or UPS, or FedEx Corporation. A strike or other interruption in service, including, among other things, inclement weather experienced could adversely affect our ability to market or deliver products to customers on a timely basis.

We may experience increases in shipping and postage costs, which may adversely affect our business if we are not able to pass such increases on to our customers.

Shipping costs are a significant expense in the operation of our business. Increases in postal or shipping rates could significantly impact the cost of shipping customer orders and mailing our catalogs. Postage prices and shipping rates increase periodically, and we have no control over future increases. We have a long-term contract with UPS and believe that we have negotiated favorable shipping rates with our carriers. While we generally invoice customers for shipping and handling charges, we may not be able to pass on to our customers the full cost, including any future increases in the cost, of commercial delivery services, which would adversely affect our business.

We may experience a reduction in the incentive programs offered to us by our vendors.

Some product manufacturers and distributors provide us with incentives such as supplier reimbursements, payment discounts, price protection, rebates, and other similar arrangements. The increasingly competitive technology reseller market has already resulted in the following:

| ● |

| reduction or elimination of some of these incentive programs; |

| ● |

| more restrictive price protection and other terms; and |

| ● |

| reduced advertising allowances and incentives. |

Many product suppliers provide us with advertising allowances, and in exchange, we feature their products on our website and in our catalogs and other marketing vehicles. These vendor allowances, to the extent that they represent specific reimbursements of incremental and identifiable costs, are offset against SG&A expenses. Advertising allowances that cannot be associated with a specific program funded by an individual vendor or that exceed the fair value of advertising expense associated with that program are classified as offsets to cost of sales or inventory. In the past, we have experienced a decrease in the level of vendor consideration available to us from certain manufacturers. The level of such consideration we receive from some manufacturers may decline in the future. Such a decline could decrease our gross profit and have a material adverse effect on our earnings and cash flows.

Should our financial performance not meet expectations, we may be required to record a significant charge to earnings for impairment of goodwill and other intangibles.

We test goodwill for impairment each year and more frequently if potential impairment indicators arise. Although the fair value of our Enterprise Solutions and Business Solutions reporting units exceeded their carrying value at our annual impairment test, should the financial performance of a reporting unit not meet expectations due to the economy or

20

otherwise, we would likely adjust downward expected future operating results and cash flows. Such adjustment may result in a determination that the carrying value of goodwill and other intangibles for a reporting unit exceeds its fair value. This determination may in turn require that we record a significant non-cash charge to earnings to reduce the $73.6 million aggregate carrying amount of goodwill held by our Enterprise Solutions and Business Solutions reporting units, resulting in a negative effect on our results of operations.

We are exposed to inventory obsolescence due to the rapid technological changes occurring in the IT industry.

The market for IT products is characterized by rapid technological change and the frequent introduction of new products and product enhancements. Our success depends in large part on our ability to identify and market products that meet the needs of customers in that marketplace. In order to satisfy customer demand and to obtain favorable purchasing discounts, we have and may continue to carry increased inventory levels of certain products. By doing so, we are subject to the increased risk of inventory obsolescence. Also, in order to implement our business strategy, we intend to continue, among other things, placing larger than typical inventory stocking orders of selected products and increasing our participation in first-to-market purchase opportunities. We may also, from time to time, make large inventory purchases of certain end-of-life products, which would increase the risk of inventory obsolescence. In addition, we sometimes acquire special purchase products without return privileges. For these and other reasons, we may not be able to avoid losses related to obsolete inventory. Manufacturers have limited return rights and have taken steps to reduce their inventory exposure by supporting “configure-to-order” programs authorizing distributors and resellers to assemble computer hardware under the manufacturers’ brands. These actions reduce the costs to manufacturers and shift the burden of inventory risk to resellers like us, which could negatively impact our business.

We are exposed to accounts receivable risk and if customers fail to timely pay amounts due to us, our results of operations and/or cash flows could be adversely affected.

We extend credit to our customers for a significant portion of our net sales, typically on 30-day payment terms. We are subject to the risk that our customers may not pay for the products they have purchased or may pay at a slower rate than we have historically experienced. This risk is heightened during periods of global or industry-specific economic downturn or uncertainty, during periods of rising interest rates or, in the case of public sector customers, during periods of budget constraints. Any significant deterioration in our customers’ credit quality could, therefore, have a material adverse effect on our business, results of operations and financial condition.

Customer default risk is influenced by a number of factors outside of our control, including our customers’ financial strength, overall demand for our customers’ products and general macroeconomic conditions. Customers may also initiate payment disputes, including as a result of dissatisfaction with the product, IT solution or service they have purchased from us. We have established provisions for losses of receivables. However, actual losses on customer receivables could differ from those that we currently anticipate and, as a result, we may have to increase our provisions which may have a material adverse effect on our results of operations and financial condition.

We are dependent on key personnel and, more generally, skilled personnel in all areas of our business and the loss of key persons or the inability to attract, train and retain qualified personnel could adversely impact our business.

Our future performance will depend to a significant extent upon the efforts and abilities of our senior executives and other key management personnel. The current environment for qualified management personnel in the computer products industry is very competitive, and the loss of service of one or more of these persons could have an adverse effect on our business. Our success and plans for future growth will also depend on our ability to hire, train, and retain skilled personnel in all areas of our business, especially sales representatives and technical support personnel. Our inability to hire, retain, train and redeploy our professionals to successfully drive our business and keep up with ever-changing technologies, could limit our ability to meet our customers’ needs and attract new customers and jeopardize our competitive position. In addition, we may face wage inflation in the future, in particular due to the strong competition for qualified personnel in our sector. Failure to pass on these cost increases to our customers or mitigate the increase in wages by increasing our operational efficiency could have a material adverse effect on our profitability and results of operations.

21

We face various risks related to health epidemics, pandemics and similar outbreaks, which may have material adverse effects on our business, financial position, results of operations and/or cash flows.

We face a wide variety of risks related to health epidemics, pandemics and similar outbreaks, especially of infectious diseases. For example, the COVID-19 pandemic dramatically impacted the global health and economic environment, including millions of confirmed cases and deaths, business slowdowns or shutdowns, labor shortages, supply chain challenges, changes in government spending and requirements, regulatory challenges, inflationary pressures and market volatility. As discussed in our prior Form 10-K and Form 10-Q filings, our operations were impacted by the COVID-19 pandemic and its related economic challenges. However, we have worked hard to address and mitigate adverse impacts attributable to COVID-19, and we do not currently anticipate significant additional direct impacts from the pandemic itself on our operations. Nonetheless, we cannot predict the future course of events.

If, for example, a new health epidemic or outbreak were to occur, we likely would experience broad and varied impacts, including potentially to our workforce and supply chain, with inflationary pressures and increased costs (which may or may not be fully recoverable), schedule or production delays, market volatility and other financial impacts. If any or all of these items were to occur, we could experience adverse impacts on our overall performance, operations and financial results. Given the tremendous uncertainties and variables, we cannot at this time predict the impact of any future health epidemics, pandemics or similar outbreaks, but any one could have a material adverse effect on our business, financial position, results of operations and/or cash flows.

Risks Related to Our Technology, Data and Intellectual Property

Cyberattacks or the failure to safeguard personal information and our IT systems could result in liability and harm our reputation, which could adversely affect our business.

Our business is heavily dependent upon IT networks and systems. We have experienced attacks and attempted attacks that have generally been in the form of active intrusion attempts from the internet, passive vulnerability mapping from the internet, and internal malware and or phishing attempts delivered through user actions. Future internal or external attacks on our networks and systems could disrupt our normal operations centers and impede our ability to provide critical products and services to our customers and clients, subjecting us to liability under our contracts and damaging our reputation.

Our business also involves the use, storage and transmission of proprietary information and sensitive or confidential data, including personal information about our employees, our clients and customers of our clients. While we take measures to protect the security of, and prevent unauthorized access to, our systems and personal and proprietary information, the security controls for our systems, as well as other security practices we follow, may not prevent improper access to, or disclosure of, personally identifiable or proprietary information. Furthermore, the evolving nature of threats to data security, in light of new and sophisticated methods used by criminals and cyberterrorists, including computer viruses, malware, phishing, misrepresentation, social engineering, and forgery make it increasingly challenging to anticipate and adequately mitigate these risks. The risk of cyber incidents could also be increased by cyberwarfare in connection with the ongoing conflicts between Russia and Ukraine and in the Middle East, including potential proliferation of malware from the conflict into systems unrelated to the conflict.

Breaches in security could expose us, our supply chain, our customers or other individuals to significant disruptions, a risk of public disclosure, loss or misuse of this information. Security breaches could result in legal claims or proceedings, liability or regulatory penalties under laws protecting the privacy of personal information, as well as the loss of existing or potential customers and damage to our brand and reputation. Moreover, media or other reports of perceived vulnerabilities in our network security or perceived lack of security within our environment, even if inaccurate, could adversely impact our reputation and materially impact our business. The cost and operational consequences of implementing further data protection measures could be significant. Such breaches, costs and consequences could adversely affect our business, results of operations, or cash flows.

22

Our business could be materially adversely affected by system failures, interruption, integration issues, or security lapses of our information technologyIT systems or those of our third-party providers.

Our ability to effectively manage our business depends significantly on our information systems and infrastructure as well as, in certain instances those of our business partners and third-party providers. The failure of our current systems to operate effectively or to integrate with other systems, including integration of upgrades to better meet the changing needs of our customers, could result in transaction errors, processing inefficiencies, and the loss of sales and customers. In addition, cybersecurity threats are evolving and include, but are not limited to, malicious software, attempts to gain unauthorized access to company or customer data, denial of service attacks, the processing of fraudulent transactions, and other electronic security breaches that could lead to disruptions in critical systems, unauthorized release of confidential or otherwise protected information, and corruption of data. In our case, these attacks and attempted attacks have generally been in the form of active intrusion attempts from the internet, passive vulnerability mapping from the internet, and internal malware and or phishing attempts delivered through user actions. Although we have in place various processes, procedures, and controls to monitor and mitigate these threats, these measures may not be sufficient to prevent a material security threat or mitigate these risks for our customers. If any of these events were to materialize, they could lead to disruption of our operations or loss of sensitive information as well as subject us to regulatory actions, litigation, or damage to our reputation, and could have a material adverse effect on our financial position, results of operations, and cash flows. Similar risks exist with respect to our business partners and third-party providers. As a result, we are subject to the risk that the activities of our business partners and third-party providers may adversely affect our business even if an attack or breach does not directly impact our systems.

12

electronic commerce and Internet infrastructure development to grow our overall sales.

We continue to have increasing levels of sales made through our e-commerce sites. The on-line experience for our clients continues to improve, but the competitive nature of the e-commerce channel also continues to increase. Growth of our overall sales is dependent on customers continuing to expand their on-line purchases in addition to traditional channels to purchase products and services. We cannot accurately predict the rate at which on-line purchases will expand.

Our success in growing our Internet business will depend in large part upon our development of an increasingly sophisticated e-commerce experience and infrastructure. Increasing customer sophistication requires that we provide additional website features and functionality in order to be competitive in the marketplace and maintain market share. We will continue to iterate our website features, but we cannot predict future trends and required functionality or our adoption rate for customer preferences. As the number of on-line users continues to grow, such growth may impact the performance of our existing Internet infrastructure, which would adversely impact our business.

We could experience Internet and other system failures which would interfere with our ability to process orders.

We depend on the accuracy and proper use of our management information systems, including our telephone system. Many of our key functions depend on the quality and effective utilization of the information generated by our management information systems, including:

| ● |

| our ability to purchase, sell, and ship products efficiently and on a timely basis; |

| ● |

| our ability to manage inventory and accounts receivable collection; and |

| ● |

| our ability to maintain our operations. |

Our management information systems require continual upgrades to most effectively manage our operations and customer database. Although we maintain some redundant systems, with full data backup, a significant component of our computer and telecommunications hardware is located in a single facility in New Hampshire, and a substantial interruption in our management information systems or in our telephone communication systems, including those resulting from extreme weather and natural disasters, as well as power loss, telecommunications failure, or similar

23

events, would substantially hinder our ability to process customer orders and thus could have a material adverse effect on our business.

Privacy concerns with respect to list development and maintenance may materially adversely affect our business.

Should our financial performance not meet expectations, we may be required to record a significant charge to earnings for impairment of goodwill

We mail catalogs and other intangibles.promotional materials to names in our customer database and to potential customers whose names we obtain from rented or exchanged mailing lists. Public concern regarding the protection of personal information has subjected the rental and use of customer mailing lists and other customer information to increased scrutiny. Legislation enacted limiting or prohibiting the use of rented or exchanged mailing lists could negatively affect our business.

Risks Related to Regulatory and Legal Matters

We test goodwill for impairment each yearare exposed to risks from legal proceedings and more frequently if potential impairment indicators arise. Although the fair value of our Business Solutions and Enterprise Solutions reporting units substantially exceeded their carrying value at our annual impairment test, should the financial performance of a reporting unit not meet expectations due to the economy or otherwise, we would likely adjust downward expected future operating results and cash flows. Such adjustmentaudits, which may result in a determinationsubstantial costs and expenses or interruption of our normal business operations.

We are party to various legal proceedings that arise in the carrying valueordinary course of goodwillour business, which include commercial, employment, tort and other intangibles forlitigation.

We are subject to intellectual property infringement claims against us from time to time in the ordinary course of our business, either because of the products and services we sell or the business systems and processes we use to sell such products and services, in the form of cease-and-desist letters, licensing inquiries, lawsuits and other communications and demands. In our industry, such intellectual property claims have become more frequent as the complexity of technological products and the intensity of competition in our industry have increased. Increasingly, many of these assertions are brought by non-practicing entities whose principal business model is to secure patent licensing revenue, but we may also be subject to demands from inventors, competitors or other patent holders who may seek licensing revenue, lost profits and/or an injunction preventing us from engaging in certain activities, including selling certain products or services.

We also are subject to proceedings, investigations and audits by federal, state, international, national, provincial and local authorities, including as a reporting unit exceeds its fair value. This determination may in turn requireresult of our sales to governmental entities. We also are subject to audits by various vendor partners and large customers, including government agencies, relating to purchases and sales under various contracts. In addition, we are subject to indemnification claims under various contracts.

Current and future litigation, infringement claims, governmental proceedings and investigations, audits or indemnification claims that we record a significant non-cash chargeface may result in substantial costs and expenses and significantly divert the attention of our management regardless of the outcome. In addition, these matters could lead to earnings to reduceincreased costs or interruptions of our normal business operations. Litigation, infringement claims, governmental proceedings and investigations, audits or indemnification claims involve uncertainties and the $73.6 million aggregate carrying amounteventual outcome of goodwill held byany such matter could adversely affect our Business Solutions and Enterprise Solutions reporting units, resulting in a negative effect on ourbusiness, results of operations.operations or cash flows.

The failure to comply with our public sector contracts could result in, among other things, fines or liabilities.

Revenues from the Public Sector Solutions segment are derived from sales to federal, state, and local government departments and agencies, as well as to educational institutions, through various contracts and open market sales. Government contracting is a highly regulated area. Noncompliance with government procurement regulations or contract provisions could result in civil, criminal, and administrative liability, including substantial monetary fines or damages, termination of government contracts, and suspension, debarment, or ineligibility from doing business with the government. Our current arrangements with these government agencies allow them to cancel orders with little or no notice and do not require them to purchase products from us in the future. The effect of any of these possible actions by any government department or agency could adversely affect our financial position, results of operations, and cash flows.

We acquire a majority of our products for resale from a limited number of vendors. The loss of any one of these vendors could have a material adverse effect on our business.

We acquire products for resale both directly from manufacturers and increasingly indirectly through distributors and other sources. The five vendors supplying the greatest amount of goods to us constituted 61% of our total product purchases in the year ended December 31, 2017 and 59% and 61% in 2016 and 2015, respectively. Among these five suppliers, product purchases from Ingram, our largest supplier, accounted for approximately 22% of our total product purchases in 2017 and 21% in both 2016 and 2015. Purchases from Synnex comprised 12%, 13%, and 15% of our total product purchases in 2017, 2016, and 2015, respectively. Purchases from HP accounted for approximately 11% of our total product purchases in 2017 and 9% in both 2016 and 2015. Purchases from Tech Data comprised of 11% of our total product purchases in 2017 and 8% in both 2016 and 2015. No other vendor supplied more than 10% of our total

1324

product purchases in 2017, 2016, or 2015. If we were unable to acquire products from Ingram, Synnex, HP or Tech Data, we could experience a short-term disruption in the availability of products, and such disruption could have a material adverse effect on our results of operations and cash flows.

Products manufactured by HP represented 20% of our net sales in both 2017 and 2016, and 22% in 2015. We believe that in the event we experience either a short-term or permanent disruption of supply of HP products, such disruption would likely have a material adverse effect on our results of operations and cash flows.

Substantially all of our contracts and arrangements with our vendors that supply significant quantities of products are terminable by such vendors or us without notice or upon short notice. Most of our product vendors provide us with trade credit, of which the net amount outstanding at December 31, 2017 was $194.3 million. Termination, interruption, or contraction of relationships with our vendors, including a reduction in the level of trade credit provided to us, could have a material adverse effect on our financial position.

Some product manufacturers either do not permit us to sell the full line of their products or limit the number of product units available to national solutions providers such as us. An element of our business strategy is to continue increasing our participation in first-to-market purchase opportunities. The availability of certain desired products, especially in the direct marketing channel, has been constrained in the past. We could experience a material adverse effect to our business if we are unable to source first-to-market purchases or similar opportunities, or if significant availability constraints reoccur.

We are exposed to inventory obsolescence due to the rapid technological changes occurring in the IT industry.

The market for IT products is characterized by rapid technological change and the frequent introduction of new products and product enhancements. Our success depends in large part on our ability to identify and market products that meet the needs of customers in that marketplace. In order to satisfy customer demand and to obtain favorable purchasing discounts, we have and may continue to carry increased inventory levels of certain products. By so doing, we are subject to the increased risk of inventory obsolescence. Also, in order to implement our business strategy, we intend to continue, among other things, placing larger than typical inventory stocking orders of selected products and increasing our participation in first-to-market purchase opportunities. We may also, from time to time, make large inventory purchases of certain end‑of‑life products, which would increase the risk of inventory obsolescence. In addition, we sometimes acquire special purchase products without return privileges. For these and other reasons, we may not be able to avoid losses related to obsolete inventory. Manufacturers have limited return rights and have taken steps to reduce their inventory exposure by supporting “configure‑to-order” programs authorizing distributors and resellers to assemble computer hardware under the manufacturers’ brands. These actions reduce the costs to manufacturers and shift the burden of inventory risk to resellers like us, which could negatively impact our business.

We are dependent on key personnel.

Our future performance will depend to a significant extent upon the efforts and abilities of our senior executives and other key management personnel. The current environment for qualified management personnel in the computer products industry is very competitive, and the loss of service of one or more of these persons could have an adverse effect on our business. Our success and plans for future growth will also depend on our ability to hire, train, and retain skilled personnel in all areas of our business, especially sales representatives and technical support personnel. We may not be able to attract, train, and retain sufficient qualified personnel to achieve our business objectives.

The methods of distributing IT products are changing, and such changes may negatively impact us and our business.

The manner in which IT hardware and software is distributed and sold is changing, and new methods of distribution and sale have emerged, including distribution through cloud-based and SaaS solutions. In addition, hardware and software manufacturers have sold, and may intensify their efforts to sell, their products directly to end users. From time to time, certain manufacturers have instituted programs for the direct sales of large order quantities of hardware and software to certain major corporate accounts. These types of programs may continue to be developed and used by

14

various manufacturers. Some of our vendors, including Apple, Dell, HP, and Lenovo, currently sell some of their products directly to end users and have stated their intentions to increase the level of such direct sales. In addition, manufacturers may attempt to increase the volume of software products distributed electronically to end users. An increase in the volume of products sold through or used by consumers of any of these competitive programs, or our inability to effectively adapt our business to increased electronic distribution of products and services to end users could have a material adverse effect on our results of operations.

We depend heavily on third-party shippers to deliver our products to customers.

Many of our customers elect to have their purchases shipped by an interstate common carrier, such as UPS or FedEx Corporation. A strike or other interruption in service by these shippers could adversely affect our ability to market or deliver products to customers on a timely basis.

Natural disasters, terrorism, and other circumstances could materially adversely affect our business.

Natural disasters, terrorism, and other business interruptions have caused and could cause damage or disruption to international commerce and the global economy, and thus could have a negative effect on the Company, its suppliers, logistics providers, manufacturing vendors, and customers. Our business operations are subject to interruption by natural disasters, fire, power shortages, nuclear power plant accidents, terrorist attacks, and other hostile acts, and other events beyond our control. Such events could decrease demand for our products, make it difficult or impossible for us to deliver services or products to our customers, or to receive products from our suppliers, and create delays and inefficiencies in our supply chain. In the event of a natural disaster or other business interruption, significant recovery time and substantial expenditures could be required to resume operations and our financial condition, results of operations, and cash flows could be materially adversely affected.

We may experience increases in shipping and postage costs, which may adversely affect our business if we are not able to pass such increases on to our customers.

Shipping costs are a significant expense in the operation of our business. Increases in postal or shipping rates could significantly impact the cost of shipping customer orders and mailing our catalogs. Postage prices and shipping rates increase periodically, and we have no control over future increases. We have a long-term contract with UPS, and believe that we have negotiated favorable shipping rates with our carriers. While we generally invoice customers for shipping and handling charges, we may not be able to pass on to our customers the full cost, including any future increases in the cost, of commercial delivery services, which would adversely affect our business.

We rely on the continued development of electronic commerce and Internet infrastructure development.

We continue to have increasing levels of sales made through our e-commerce sites. The on-line experience for our clients continues to improve, but the competitive nature of the e-commerce channel also continues to increase. Growth of our overall sales is dependent on customers continuing to expand their on-line purchases in addition to traditional channels to purchase products and services. We cannot accurately predict the rate at which on-line purchases will expand.

Our success in growing our Internet business will depend in large part upon our development of an increasingly sophisticated e-commerce experience and infrastructure. Increasing customer sophistication requires that we provide additional website features and functionality in order to be competitive in the marketplace and maintain market share. We will continue to iterate our website features, but we cannot predict future trends and required functionality or our adoption rate for customer preferences. As the number of on-line users continues to grow, such growth may impact the performance of our existing Internet infrastructure.

We face uncertainties relating to unclaimed property and the collection of state sales and use tax.

We collect and remit sales and use taxes in states in which we have either voluntarily registered or have a physical presence. Various states have sought to impose on direct marketers the burden of collecting state sales and use taxes on

15

the sales of products shipped to their residents. Many states have adopted rules that require companies and their affiliates to register in those states as a condition of doing business with those state agencies. Our three sales companies are registered in substantially all states, however, if a state were to determine that our earlier contacts with that state exceeded the constitutionally permitted contacts, the state could assess a tax liability relating to our prior year sales. Various states have from time-to-time initiated unclaimed property audits

Risks Related to Our Common Stock

Our common stock price may be volatile and may decline regardless of our company escheatment practices. A multi-state unclaimed property audit continuesoperating performance, and holders of our common stock could lose a significant portion of their investment.

The market price for our common stock may be volatile. Our stockholders may not be able to resell their shares of common stock at or above the price at which they purchased such shares, due to fluctuations in the market price of our common stock, which may be caused by a number of factors, many of which we cannot control, including the risk factors described in process,this Annual Report on Form 10-K and total accruals for unclaimed property aggregated $0.9 million at December 31, 2017.the following:

| ● | changes in financial estimates by any securities analysts who follow our common stock, our failure to meet these estimates or failure of securities analysts to maintain coverage of our common stock; |

| ● | downgrades by any securities analysts who follow our common stock; |

Privacy concerns with respect

| ● | future sales of our common stock by our officers, directors and significant stockholders; |

| ● | market conditions or trends in our industry or the economy as a whole; |

| ● | investors’ perceptions of our prospects; |

| ● | announcements by us or our competitors of significant contracts, acquisitions, joint ventures or capital commitments; and |

| ● | changes in key personnel. |

In addition, the stock markets have experienced extreme price and volume fluctuations that have affected and continue to list development and maintenance may materially adversely affect our business.

We mail catalogs and other promotional materials to namesthe market prices of equity securities of many companies, including companies in our customer databaseindustry. In the past, securities class action litigation has followed periods of market volatility. If we were involved in securities litigation, we could incur substantial costs, and to potential customers whose namesour resources and the attention of management could be diverted from our business.

In the future, we obtain from rentedmay also issue our securities in connection with investments or exchanged mailing lists. Public concern regarding the protectionacquisitions. The number of personal information has subjected the rentalshares of our common stock issued in connection with an investment or acquisition could constitute a material portion of our then-outstanding shares of our common stock and usedepress our stock price.

25

We are controlled by twoone principal stockholders.

stockholder.

Patricia Gallup, and David Hall, our two principal stockholders,stockholder, beneficially ownowned or control,controlled, in the aggregate, approximately 55% of the outstanding shares of our common stock as of December 31, 2017.2023. Because of theirher beneficial stock ownership, these stockholdersthe stockholder can continue to elect the members of the Board of Directors and decide all matters requiring stockholder approval at a meeting or by a written consent in lieu of a meeting. Similarly, such stockholdersstockholder can control decisions to adopt, amend, or repeal our charter and our bylaws, or take other actions requiring the vote or consent of our stockholders and prevent a takeover of us by one or more third parties, or sell or otherwise transfer their stock to a third party, which could deprive our stockholders of a control premium that might otherwise be realized by themher in connection with an acquisition of our Company. Such control may result in decisions that are not in the best interest of our unaffiliated public stockholders. In connection with our initial public offering, the principal stockholders placed substantially all shares of common stock beneficially owned by them into a voting trust, pursuant to which they are required to agree as to the manner of voting such shares in order for the shares to be voted. Such provisions could discourage bids for our common stock at a premium as well as have a negative impact on the market price of our common stock.

Item 1B. Unresolved Staff Comments

None.

Item 1C. Cybersecurity

Cybersecurity Risk Management and Strategy

We have established processes, procedures, and controls to identify, manage, assess, and mitigate material risks from cybersecurity threats which are designed to help protect our information assets and operations from internal and external cyber threats by understanding and seeking to manage risk while ensuring business resiliency, protecting employee and customer information from unauthorized access or attack, and securing our networks, systems, devices, products, and services, or our Cybersecurity Risk Mitigation Practices. We conduct tests on our systems and incident simulations to help discover potential vulnerabilities and ensure the effectiveness of our Cybersecurity Risk Mitigation Practices. We engage external parties, including consultants, independent privacy assessors, computer security firms, and risk management and governance experts, to enhance our cybersecurity oversight. We also regularly consult with industry groups on emerging industry trends. In order to oversee and identify risks from cybersecurity threats associated with our use of third-party service providers, we have a third-party risk management program designed to help protect against the misuse of information technology by third parties and business partners.

As of the date of this Annual Report Form 10-K, we are not aware of any cybersecurity threats that have materially affected or are reasonably likely to materially affect us, including our business strategy, results of operations, or financial condition. However, as discussed under “Item 1A. Risk Factors,” specifically the risks titled “Cyberattacks or the failure to safeguard personal information and our IT systems could result in liability and harm our reputation, which could adversely affect our business” and “Our business could be materially adversely affected by system failures, interruption, integration issues, or security lapses of our IT systems or those of our third-party providers,” the sophistication of cyber threats continues to increase, and the preventative actions we take to reduce the risk of cyber incidents and protect our systems and information may be insufficient. Accordingly, no matter how well our controls are designed or implemented, we will not be able to anticipate all security breaches, and we may not be able to implement effective preventive measures against such security breaches in a timely manner.

Cybersecurity Governance and Oversight

Our Cybersecurity Risk Mitigation Practices are managed on a day-to-day basis by members of our Information Security Steering Committee, or the Committee, and are overseen by our Board of Directors. The Committee is composed of senior management, including our Chief Information Officer and Chief Financial Officer, and senior vice presidents from various areas of the organization including IT, compliance, legal, operations and human resources, including the Vice President of Information Security and Compliance. The Vice President of Information Security and Compliance has over 40 years of IT experience and is a certified information systems security professional.

As part of the administration of our Cybersecurity Risk Mitigation Practices, the Committee is tasked with managing and mitigating our exposure to cybersecurity threats, creating our cybersecurity policies, and establishing short and long-

26

term cybersecurity goals and objectives that are designed to protect our information systems. The Committee is also responsible for planning ordinary course security projects and initiatives aimed at ensuring that our organizational leaders are informing our employees about our cybersecurity policies and about cybersecurity basic practices. On a periodic basis, the Committee meets to review the performance and effectiveness of our Cybersecurity Risk Mitigation Practices.

Members of the Committee will present the results of the periodic performance and effectiveness review to our Board of Directors, who oversee our risk management processes directly and through its committees. These results, along with other cybersecurity topics including updates on previously identified material cybersecurity threats or incidents, are presented at regularly scheduled meetings. Members of the Committee will also notify our Board of Directors between such meetings regarding significant new cybersecurity threats or incidents.

WeIn December 1997, we entered into a lease agreement for our corporate headquarters located at 730 Milford Road, Merrimack, New Hampshire 03054-4631, fromwith an affiliated company, G&H Post, which is related to us through common ownership.ownership, or the Merrimack lease. The initial term of the fifteen-yearMerrimack lease ended in November 2013, and wewas most recently amended the lease in May 2014 to, among other things, extend the termexpiration date of the lease to November 2023. We have continued to occupy our corporate headquarters following the expiration of the lease and make rent payments to G&H Post in the amount provided for an additional five years. In additionin the amended Merrimack lease. We have also continued to pay the rent payable under the facility lease, we are required to pay real estate taxes, insurance, and common area maintenance charges. The amended lease has been recorded as an operating lease incharges which were required under the financial statements.Merrimack lease.

In August 2008, weWe also entered into a lease agreement with G&H Post, which is related to us through common ownership, for an office facility adjacent to our corporate headquarters.headquarters in August 2008 from the same affiliated company, G&H Post, or the Second Merrimack lease, which is used by our Public Sector Solutions Segment. The Second Merrimack lease has aincluded an initial term of ten years and providesprovided us withtwo options to extend the term of the Second Merrimack lease each for an optionadditional two years. We exercised both options to renewextend the Second Merrimack lease, extending the lease until July 2022. Following the expiration of the Second Merrimack lease, we have continued to occupy the office facility adjacent to our corporate headquarters and make rent payments to G&H Post in the amount provided for two additional two-year terms, atin the then comparable market rate. The lease requires usSecond Merrimack lease. We also have continued to pay our proportionate share ofthe real estate taxes, and common area maintenance charges, as either additional rent or directly to third parties and also to pay insurance premiums forwhich were required under the leased property. TheSecond Merrimack lease.

We lease has been recorded as an operating lease in the financial statements.

In August 2014, we entered into a ten-year lease for a facility in Wilmington, Ohio, which houses our distribution and order fulfillment operations.operations and services all three of our operating segments. We also operate sales and support offices throughout the United States and lease facilities at these locations. These leased facilities are utilized by all three of our operating segments. Leasehold improvements associated with these properties are amortized over the terms of the

16

leases or their useful lives, whichever is shorter. We believe that our physical properties will be sufficient to support our anticipated needs through the next twelve months and beyond.

We are subjectFrom time to audits by states on salestime and income taxes, unclaimed property, employment matters, and other assessments. While management believes that known and estimated liabilities have been adequately provided for, it is too early to determinein the ultimate outcomeordinary course of such audits, as formal assessments have not been finalized. Additional liabilities for this and other audits could be assessed, and such outcomes could have a material, negative impact on our financial position, results of operations, and cash flows.

Webusiness, we are subject to various legal proceedings and claims, including patent infringement claims, which have arisen during the ordinary course of business. In the opinion of management,claims. While we are unable to predict the outcome of these matters, we do not believe, based upon currently available facts, that the ultimate resolution of any such pending matters is not expected towill have a material adverse effect on our business,overall financial position,condition, results of operations, or cash flows.

Item 4. Mine Safety Disclosures

Not applicable.

Executive Officers of PC Connection

Our executive officers and their ages as of March 9, 2018 are as follows:

|

|

| ||

|

|

| ||

|

|

| ||

|

|

|

Patricia Gallup is a co-founder of PC Connection and has served as Chair of the Board since September 1994, and as Chief Administrative Officer since August 2011. Ms. Gallup has served as a member of our executive management team since 1982.

Timothy McGrath has served as Chief Executive Officer since August 2011, and as President since May 2010. Mr. McGrath has served as a member of our executive management team since he joined the Company in 2005.

G. William Schulze has served as Interim Treasurer and Chief Financial Officer since October 2016, and as Vice President and Corporate Controller since October 2011. From December 1998 to October 2011, Mr. Schulze served in various finance management roles at the Company.

1727

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities

Market Information

Our common stock commenced trading on March 3, 1998, on the Nasdaq Global Select Market and trades today under the symbol “CNXN.”“CNXN”. As of February 26, 2018,15, 2024, there were 26,852,78526,361,133 shares of our common stock outstanding, held by approximately 4837 stockholders of record. This figure does not include an estimate of the number of beneficial holders whose shares are held of record by brokerage firms.

Dividends

The following table sets forth for the fiscal periods indicated the rangesummarizes our 2023 quarterly dividends paid (in millions, except per share data):

| | | | | | | | | | |

Dividend per Share |

| Declaration Date |

| Record Date |

| Payment Date |

| Total Dividend | ||

$ | 0.08 | | February 9, 2023 | | February 21, 2023 | | March 10, 2023 | | $ | 2.1 |

$ | 0.08 | | May 4, 2023 | | May 16, 2023 | | June 2, 2023 | | $ | 2.1 |

$ | 0.08 | | August 2, 2023 | | August 15, 2023 | | September 1, 2023 | | $ | 2.1 |

$ | 0.08 | | October 31, 2023 | | November 14, 2023 | | December 1, 2023 | | $ | 2.1 |

On February 14, 2024, we announced that our Board of high and low sales prices forDirectors declared a quarterly cash dividend on our common stock on the Nasdaq Global Select Market.

|

|

|

|

|

|

|

|

2017 |

| High |

| Low |

| ||

Quarter Ended: |

|

|

|

|

|

|

|

December 31 |

| $ | 29.23 |

| $ | 25.72 |

|

September 30 |

|

| 28.19 |

|

| 24.33 |

|

June 30 |

|

| 29.64 |

|

| 25.65 |

|

March 31 |

|

| 29.79 |

|

| 26.68 |

|

|

|

|

|

|

|

|

|

2016 |

| High |

| Low |

| ||

Quarter Ended: |

|

|

|

|

|

|

|

December 31 |

| $ | 29.40 |

| $ | 22.81 |

|

September 30 |

|

| 26.89 |

|

| 23.46 |

|

June 30 |

|

| 25.48 |

|

| 22.55 |

|

March 31 |

|

| 25.81 |

|

| 20.02 |

|

In 2017, we declared a special cash dividend of $0.34$0.10 per share. The total cash payment of $9.1 million was madedividend will be paid on January 12, 2018March 15, 2024 to all stockholders of record atas of the close of business on December 29, 2017. In 2016, we declared a special cash dividend of $0.34 per share.February 27, 2024. The total cashdeclaration and payment of $9.0 million was made on January 12, 2017 to stockholders of record at the close of business on December 30, 2016. We have no current plans to pay additional cash dividends on our common stock in the foreseeable future, and declaration of any future cash dividends is at the discretion of our Board of Directors and will depend upon our financial position, strategic plans, and general business conditions.

Share Repurchase Authorization

On March 28, 2001, our Board of Directors authorized the spending of up to $15.0 million to repurchase our common stock. We consider block repurchases directly from larger stockholders, as well as open market purchases, in carrying out our ongoing stock repurchase program.

We did not repurchase any shares in 2016 or 2017. As of December 31, 2017, we have repurchased an aggregate of 1,682,119 shares for $12.2 million under our Board approved 2001 repurchase program. The maximum approximate dollar value of shares that may yet be purchased under this Board authorized program is $2.8 million.

On February 11, 2014, our Board approved a new share repurchase program authorizing up to $15.0 million in share repurchases. There is no fixed termination date for this repurchase program. Purchases may be made in open-market transactions, block transactions on or off an exchange, or in privately negotiated transactions. We intend to complete the 2001 repurchase program before repurchasing shares under the new program. The timing and amount of any share repurchases will be based on market conditions and any other factors.

factors deemed relevant by our Board of Directors.

1828

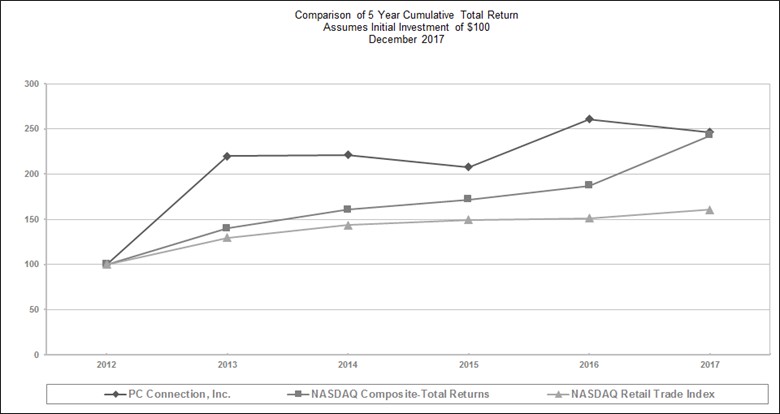

Stock Performance Graph

The following performance graph and related information shall not be deemed “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 (the “Securities Act”) or the Exchange Act, each as amended, except to the extent that we specifically incorporate it by reference into such filing.

The following stock performance graph compares our annual percentage change in cumulative total stockholder return on shares of our common stock forover the period from January 1, 2012 through December 31, 2017past five years with the cumulative total return for (i)of companies comprising the Nasdaq Stock MarketNASDAQ Composite Index and (ii) the Nasdaq Retail Trade Stocks (Peer Group) forNASDAQ US Benchmark TR Index. This presentation assumes that $100 was invested in shares of the period starting January 1, 2012 and endingrelevant issuers on December 31, 2017. This graph assumes the investment of $100 on January 1, 2012 in our common stock and in each of the two Nasdaq indices,2018, and that dividends are reinvested.received were immediately invested in additional shares of our common stock. The graph plots the value of the initial $100 investment at one-year intervals for the fiscal years shown. The NASDAQ US Benchmark TR Index replaces the NASDAQ US Benchmark Retail TR Index in this analysis and going forward, as we determined that this index is a more accurate representation of our peers. The NASDAQ US Benchmark Retail TR Index has been included with this analysis for 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Base |

|

|

| ||||||||

|

| Period |

| Years Ended |

| ||||||||

Company Name / Index |

| 12-Dec |

| 13-Dec |

| 14-Dec |

| 15-Dec |

| 16-Dec |

| 17-Dec |

|

PC Connection, Inc. |

| 100.00 |

| 219.88 |

| 221.03 |

| 207.51 |

| 260.61 |

| 246.30 |

|

Nasdaq Stock Market-Composite |

| 100.00 |

| 140.12 |

| 160.78 |

| 171.97 |

| 187.22 |

| 242.71 |

|

Nasdaq Retail Trade (Peer Index) |

| 100.00 |

| 129.59 |

| 143.32 |

| 149.25 |

| 150.96 |

| 160.58 |

|

| | | | | | | | | | | | | |

| | | | |

| ||||||||

| | Base Period | | Years Ended |

| ||||||||

Company Name / Index |

| Dec-18 |

| Dec-19 |

| Dec-20 |

| Dec-21 |

| Dec-22 |

| Dec-23 |

|

PC Connection, Inc. |

| 100.00 |

| 168.05 | | 160.01 | | 150.02 | | 164.12 | | 236.74 | |

Nasdaq Stock Market-Composite |

| 100.00 |

| 136.69 | | 198.10 | | 242.03 | | 163.28 | | 236.17 | |

Nasdaq US Benchmark TR Index |

| 100.00 |

| 131.17 | | 159.07 | | 200.26 | | 160.75 | | 203.23 | |

Nasdaq US Benchmark Retail TR Index |

| 100.00 |

| 125.41 | | 177.06 | | 210.50 | | 143.12 | | 197.92 | |

Item 6. [Reserved]

1929

Item 6. Selected Financial Data

The following selected financial data should be read in conjunction with our Consolidated Financial Statements and the Notes thereto, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other financial information included elsewhere in this Annual Report on Form 10-K.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Years Ended December 31, |

| |||||||||||||

|

| 2017 |

| 2016 |

| 2015 |

| 2014 |

| 2013 |

| |||||

|

| (dollars in thousands, except per share) |

| |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statement of Operations Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

| $ | 2,911,883 |

| $ | 2,692,592 |

| $ | 2,573,973 |

| $ | 2,463,339 |

| $ | 2,221,638 |

|

Cost of sales |

|

| 2,529,807 |

|

| 2,321,435 |

|

| 2,232,954 |

|

| 2,139,950 |

|

| 1,928,638 |

|

Gross profit |

|

| 382,076 |

|

| 371,157 |

|

| 341,019 |

|

| 323,389 |

|

| 293,000 |

|

Selling, general and administrative expenses |

|

| 304,549 |

|

| 290,637 |

|

| 262,465 |

|

| 251,935 |

|

| 233,604 |

|

Income from operations |

|

| 77,527 |

|

| 80,520 |

|

| 78,554 |

|

| 71,454 |

|

| 59,396 |

|

Interest income (expense) |

|

| 98 |

|

| (67) |

|

| (87) |

|

| (86) |

|

| (149) |

|

Income before taxes |

|

| 77,625 |

|

| 80,453 |

|

| 78,467 |

|

| 71,368 |

|

| 59,247 |

|

Income tax provision |

|

| (22,768) |

|

| (32,342) |

|

| (31,640) |

|

| (28,687) |

|

| (23,565) |

|

Net income |

| $ | 54,857 |

| $ | 48,111 |

| $ | 46,827 |

| $ | 42,681 |

| $ | 35,682 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share |

| $ | 2.05 |

| $ | 1.81 |

| $ | 1.77 |

| $ | 1.63 |

| $ | 1.37 |

|

Diluted earnings per share |

| $ | 2.04 |

| $ | 1.80 |

| $ | 1.76 |

| $ | 1.61 |

| $ | 1.35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| As of December 31, |

| |||||||||||||

|

| 2017 |

| 2016 |

| 2015 |

| 2014 |

| 2013 |

| |||||

|

| (dollars in thousands) |

| |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Balance Sheet Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Working capital |

| $ | 368,080 |

| $ | 328,917 |

| $ | 330,848 |

| $ | 293,449 |

| $ | 256,376 |

|

Total assets |

|

| 747,851 |

|

| 686,134 |

|

| 639,074 |

|

| 539,960 |

|

| 500,944 |

|

Total stockholders’ equity |

|

| 482,252 |

|

| 433,442 |

|

| 392,451 |

|

| 354,008 |

|

| 319,829 |

|

Cash dividends declared per share |

| $ | 0.34 |

| $ | 0.34 |

| $ | 0.40 |

| $ | 0.40 |

| $ | 0.40 |

|

20

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations