TABLE OF CONTENTS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Annual Report”) contains forward-looking statements that involve substantial risks and uncertainties. The forward-looking statements are contained principally in Part I, Item 1: “Business,” Part I, Item 1A: “Risk Factors,” and Part II, Item 7: “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” but are also contained elsewhere in this Annual Report. In some cases, you can identify forward-looking statements by the words “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “objective,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue”, “target”, “seek”, “contemplate”, and “ongoing,” or the negative of these terms, or other comparable terminology intended to identify statements about the future. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. Although we believe that we have a reasonable basis for each forward-looking statement contained in this Annual Report, we caution you that these statements are based on a combination of facts and factors currently known by us and our expectations of the future, about which we cannot be certain. All statements other than statements of historical fact could be deemed forward‑looking,forward-looking, including but not limited to statements about:

|

|

| our ability to maintain regulatory approval and CE Certificates of Conformity of Eversense and Eversense |

| the success of our collaboration and commercialization agreement with Ascensia Diabetes Care Holdings AG, or Ascensia; |

● | the timing of product launches, including Eversense E3; |

| ● | the clinical utility of Eversense; |

| our ability to develop future generations of Eversense; |

| our ability to |

| the timing and availability of data from our clinical trials; |

| the timing of our planned regulatory |

| our future development priorities; |

| our ability to obtain adequate reimbursement and third-party payor coverage for Eversense; |

| our expectations about the willingness of healthcare providers to recommend Eversense to people with diabetes; |

| our commercialization, marketing and manufacturing capabilities and strategy; |

| our ability to comply with applicable regulatory requirements; |

| our ability to maintain our intellectual property position; |

| our estimates regarding the size of, and future growth in, the market for |

| effects of the COVID-19 pandemic; |

● | our estimates regarding the period of time for which our current capital resources will be sufficient to fund our continued operations; and |

| our estimates regarding our future expenses and needs for additional financing. |

Forward-looking statements are based on our management's current expectations, estimates, forecasts and projections about our business and the industry in which we operate, and our management's beliefs and assumptions are not guarantees of future performance or development and involve known and unknown risks, uncertainties and other factors that are in some cases beyond our control. You should refer to “Item 1A. Risk Factors” in this Annual Report for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Annual Report will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. The forward-looking statements in this Annual Report represent our views as of the date of this Annual Report. We anticipate that subsequent events and developments may cause our views to change.

3

However, while we may elect to update these forward-looking statements at some point in the future, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this Annual Report.

You should read this Annual Report and the documents that we reference in this Annual Report and have filed as exhibits to this Annual Report completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

ABOUT THIS ANNUAL REPORT

We were originally incorporated as ASN Technologies, Inc. in Nevada on June 26, 2014. On December 4, 2015, we were reincorporated in Delaware and changed our name to Senseonics Holdings, Inc. Also, on December 4, 2015, we entered into a merger agreement with Senseonics, Incorporated and SMSI Merger Sub, Inc., or the Merger Agreement, to acquire Senseonics, Incorporated. The transactions contemplated by the Merger Agreement were consummated on December 7, 2015, referred to throughout this Annual Report as the Acquisition. Pursuant to the terms of the Merger Agreement, (i) all issued and outstanding shares of Senseonics, Incorporated's preferred stock were converted into shares of Senseonics, Incorporated common stock, $0.01 par value per share, or the Senseonics Shares, (ii) all outstanding Senseonics Shares were exchanged for 57,739,953 shares of our common stock, $0.001 par value per share, or the Company Shares, reflecting an exchange ratio of one Senseonics Share for 2.0975 Company Shares, or the Exchange Ratio, and (iii) all outstanding options and warrants to purchase Senseonics Shares, or the Senseonics Options and Senseonics Warrants, respectively, were each exchanged or replaced with options and warrants to acquire shares of our common stock, or the Company Options and Company Warrants, respectively. Accordingly, Senseonics, Incorporated became our wholly-owned subsidiary. In connection with the closing of the Acquisition, the directors and executive officers of Senseonics, Incorporated became directors and executive officers of the Company.

Following the closing of the Acquisition, the business of Senseonics, Incorporated became our sole focus and all of our operations following the closing of the Acquisition consist of the historical Senseonics, Incorporated business. Unless otherwise indicated or the context otherwise requires, all references in this Annual Report to "the Company," "we," "our," "ours," "us" or similar terms refer to (i) Senseonics, Incorporated prior to the closing of the Acquisition, and (ii) Senseonics Holdings, Inc. and its subsidiaries subsequent to the closing of the Acquisition.

PRESENTATION OF FINANCIAL INFORMATION

On December 7, 2015, ASN Technologies, Inc. acquired all of the outstanding capital stock of Senseonics, Incorporated. While ASN Technologies, Inc. was the legal acquirer of Senseonics, Incorporated in the transaction, Senseonics, Incorporated was deemed to be the acquiring company for accounting purposes. As such, the transaction was accounted for as a reverse recapitalization in accordance with accounting principles generally accepted in the United States of America, and ASN Technologies, Inc.'s historical financial statements have been replaced with Senseonics, Incorporated's historical financial statements. The historical financial statements of ASN Technologies, Inc. are not included in this Annual Report because the assets, liabilities and operations of ASN Technologies, Inc. were minimal. All common share, additional paid-in capital and per share amounts in the consolidated financial statements and related notes have been retrospectively adjusted to reflect the Exchange Ratio.

TRADEMARKS

"Senseonics,subsidiary. "Senseonics," the Senseonics logo, Eversense, Eversense XL and other trademarks or service marks of Senseonics Holdings, Inc. appearing in this Annual Report are the property of Senseonics Holdings, Inc. This Annual Report contains additional trade names, trademarks and service marks of others, which are the property of their respective owners.

PART I

Overview

We are a medical technology company focused on the design, development and commercializationmanufacturing of glucose monitoring products designed to improvetransform lives in the lives of peopleglobal diabetes community with diabetes by enhancing their ability to manage their disease with relative easedifferentiated, long term implantable glucose management technology. Our Eversense, Eversense XL and accuracy. OurEversense E3 continuous glucose monitoring, or CGM systems Eversense and Eversense XL, are reliable, long-term, implantable CGM systems that we have designed to continually and accurately measure glucose levels in people with diabetes via an under-the-skin sensor, a removable and rechargeable smart transmitter, and a convenient app for real-time diabetes monitoring and management for a period of up to 90 and 180 days, respectively,six months, as compared to sixseven to fourteen14 days for currently availablenon-implantable CGM systems. We believe that Eversense and Eversense XL will provide people with diabetes withprovides a more convenient method to monitor their glucose levels in comparisonof CGM by providing longer duration, superior accuracy, wireless communication, on-body vibratory alerts, gentle-on-the-skin adhesive patch, data sharing capability, and a removable smart transmitter. We affixed the CE mark to the traditional method of self-monitoring of blood glucose,original Eversense CGM system in June 2016, which marked the first certification for the product to be sold within the European Economic Area, or SMBG, as well asEEA. Subsequently, we affixed the CE mark to the extended life Eversense XL CGM system in September 2017 which is currently available CGM systems. In our U.S. pivotal clinical trial, we observed that Eversense measured glucose levels over 90 days with a degree of accuracy superior to that of other currently available CGM systems. Our Eversense and Eversense XL systems are currently approved for salein select markets in Europe and we submitted our pre-market approval, or PMA, application for Eversense tothe Middle East. In June 2018, the U.S. Food and Drug Administration, or FDA, approved the Eversense CGM system. In June 2019, we received FDA approval for the non-adjunctive indication (dosing claim) for the Eversense system. With this approval and the availability of a new app in October 2016. The FDA Clinical Chemistry and Clinical Toxicology Devices Panel is scheduled to reviewDecember 2019, the PMA for Eversense on March 29, 2018. We intend to initiate commercial launchsystem can now be used as a therapeutic CGM in the United States promptly followingto replace fingerstick blood glucose measurement to make treatment decisions, including insulin dosing. In February 2022, the extended life Eversense E3 CGM system was approved by the FDA and we expect Ascensia Diabetes Care Holdings AG, or Ascensia, to begin commercializing Eversense E3 in the United States in the second quarter of 2022.

On February 26, 2020, we announced that the FDA approved a subgroup of PROMISE trial participants to continue for a total of 365 days to gather feasibility data on the safety and accuracy of a 365-day sensor. This sub-set of 30 participants were left undisturbed for 365-days with the goal of measuring accuracy and longevity over the full 365 days. Following information gathered from this sub-set and continued development efforts and pending developments at the FDA relating to the ongoing COVID-19 pandemic, in the first half of 2022 we plan to seek Investigational Device Exemption, or IDE, from the FDA to explore the 365 day sensor in a clinical trial. If the IDE is approved in a timely manner, we would target to begin enrollment of a clinical trial, which we also intend to include a pediatric population, in the second half of 2022.

During 2020, we initiated a new commercialization strategy and collaboration to bring our product to market. As described in detail below, in August 2020, we entered into a collaboration and commercialization agreement, or Commercialization Agreement, with Ascensia pursuant to which we granted Ascensia the exclusive right to distribute

4

our 90-day Eversense CGM system and our 180-day Eversense CGM system worldwide, with certain initial exceptions. While Ascensia is responsible for sales, marketing, market access, patient and provider onboarding and first level customer support, we remain responsible for product development and manufacturing, including regulatory submissions, approvals, conformity assessment and requests for CE Certificates of Conformity and registrations and second level customer support.

2021 and Significant Recent Developments

Eversense E3 CGM System Regulatory Approval

In February 2022, the U.S. Food and Drug Administration (“FDA”) approved the Eversense E3 CGM system for marketing and sale in the U.S. As described in this report, Ascensia has the exclusive right to distribute the Company’s 90-day Eversense CGM system and the six-month Eversense E3 system worldwide for people with diabetes, with certain initial exceptions. The Company and Ascensia have been designing the go-to-market strategy for the U.S. six-month product, and the Company expects that Ascensia will begin commercializing Eversense E3 in the U.S. in the second quarter of 2022.

As with any new product, the success of the commercial launch of the Eversense E3 product in the U.S. will be subject to significant uncertainty and risks, and will require time to ramp up. Key areas of strategic focus in the U.S. commercial launch of the six month product where performance will impact the success of the launch will be: (1) growing the installed base of users, (2) increasing patient awareness of Eversense above current levels in order to expand the population of Eversense users, through driving sales and marketing efforts on the Eversense E3 system, (3) increasing awareness and adoption of Eversense by healthcare providers, including high volume CGM prescribers, through expanded targeted marketing efforts, (4) educating patients and prescribers regarding the six-month product and its benefits relative to the 90-day product, (5) continuing to grow the base of the authorized inserters through geographically targeted efforts so that potential users locating a qualified inserter of Eversense is not an impediment to adoption, (6) timely establishing and maintaining favorable payor coverage for the product, including transitioning commercial payors from 90-day coverage to six month coverage, and (7) Ascensia’s continued organizational development of its U.S. sales and marketing capabilities relative to CGM.

The Company and Ascensia are also developing plans for the roll-out of the Eversense E3 next generation six-month product in Europe, which, subject to receipt of PMA approval.regulatory approval or certification, including CE Certificates of Conformity and affixing the CE mark for the EEA, is expected to offer reduced calibration requirements from the Eversense XL six-month product currently marketed in Europe. The roll-out of this next generation product in Europe is similarly subject to uncertainties and potential delays, including regulatory approval and certification and launch timing, and European revenues are dependent, among other things, on success of the following: (1) Ascensia’s continued organizational development of its European sales and marketing capabilities relative to CGM, and (2) more effective tender participation, particularly in Italian markets which favor an integrated offering. The U.S. and European commercialization plans are being designed with a goal of minimizing the impact to patients, providers, and ongoing sales of Eversense CGM systems.

COVID-19

On January 30, 2020, the World Health Organization, or the WHO, announced a global health emergency because of a new strain of coronavirus, or COVID-19, and the risks to the international community as the virus spreads globally. On March 11, 2020, the WHO classified the COVID-19 outbreak as a pandemic, based on the rapid increase in exposure globally. In response to the pandemic, many states and jurisdictions have issued stay-at-home orders and other measures aimed at slowing the spread of the coronavirus. The state of Maryland, where we are headquartered, has been affected by COVID-19. The Governor of Maryland issued an order closing all non-essential businesses, which took effect on March 23, 2020. Beginning with the initial outbreak and through 2021 substantially all of our workforce is still working from home either all or substantially all of the time. Additionally, because our sensor requires an in-clinic procedure, we saw a reduction in access to clinics and sensor insertions during multiple periods during the pandemic.

5

The COVID-19 pandemic infection rates in the United States are still high, vaccine distribution is ongoing, and it is difficult to predict the longevity and severity COVID-19 will have on our business.

Restructuring and Transition of Commercial Strategy

As a result of the COVID-19 pandemic’s disruption to our operations, suppliers, employees, and the healthcare community in which we sell to and support, and our limited cash resources, we made significant reductions in our cost structure and operations to improve cash flow and generate future expenditure savings to ensure the long-term success of Eversense. Specifically, in the first quarter of 2020, we temporarily suspended commercial sales and marketing of the Eversense CGM System in the United States to new patients to solely focus our resources on supporting existing users, including ensuring broader insurance coverage for Eversense, and the development and regulatory submission of our new 180-day Eversense product in the United States. In connection with these actions, on March 26, 2020, we reduced our workforce by approximately 60%, over half of which were sales personnel.

As discussed further below, on August 9, 2020, we entered into the Commercialization Agreement with Ascensia pursuant to which we granted Ascensia the exclusive right to distribute our 90-day Eversense CGM system and our 180-day Eversense CGM system worldwide for people with diabetes. Pursuant to the Commercialization Agreement, in the United States, Ascensia began providing sales support for the 90-day Eversense product on October 1, 2020 and assumed commercial responsibilities in the second quarter of 2021. In February 2022, the extended life Eversense E3 CGM system was approved by the FDA and we expect Ascensia to begin commercializing Eversense E3 in the United States in the second quarter of 2022.

Background

Diabetes is a chronic, life-threatening disease for which there is no known cure. The disease is caused by the body's inability to produce or effectively utilize the hormone insulin, which prevents the body from adequately regulating blood glucose levels. If diabetes is not managed properly, it can lead to serious health conditions and complications, including heart disease, limb amputations, loss of kidney function, blindness, seizures, coma and even death. According to the 20172021 International Diabetes Federation, or IDF, Atlas, an estimated 425537 million people worldwide had diabetes as of the date of the report. The number of people with diabetes worldwide is estimated to grow to 629783 million by 2045, driven primarily by growth in Typetype 2 diabetes and due to various reasons, including changes in dietary trends, an aging population and increased prevalence of the disease in younger people. Diabetes is typically classified into two primary types. Type 1 diabetes is an autoimmune disorder that usually develops during childhood and is characterized by the inability of the body to produce insulin, resulting from destruction of the insulin producing beta cells of the pancreas. Type 2 diabetes is a metabolic disorder that results when the body is unable to produce sufficient amounts of insulin or becomes insulin resistant. People with Typetype 1 diabetes must administer insulin, either by injection or insulin pump, to survive. People with Typetype 2 diabetes may require diet and nutrition management, exercise, oral medications or the administration of insulin to regulate blood glucose levels. In the next few years, we expect the growth in sales of CGM systems to be driven primarily by increased penetration of CGM in the Typetype 1 diabeticpatient population.

In an attempt to maintain blood glucose levels within the normal range, many people with diabetes seek to actively monitor their blood glucose levels. The traditional self-monitoring of blood glucose, or SMBG, method of glucose monitoring requires lancing the fingertips, commonly referred to as fingersticks, multiple times per day and night to obtain a blood drop to be applied to a test strip inside a blood glucose meter. This method of monitoring glucose levels is inconvenient and can be painful and, because each measurement represents a single blood glucose value at a single point in time, it provides limited information regarding trends in blood glucose levels. In contrast, CGM systems are generally less painful and involve the insertion of sensors into the body to measure glucose levels in the interstitial fluid throughout the day and night, providing real-time data that shows trends in glucose measurements. Since CGM measurements from interstitial tissue are inherently less accurate than test-strip measurements made directly from the blood,As a result, CGMs improve glycemic control and quality of life, particularly in patients with type 1 diabetes treated with continuous subcutaneous insulin infusion or multiple daily insulin injection therapy, and support avoidance of hypoglycemia.

Historically, the FDA and other device regulators historically haveforeign regulatory authorities required that CGMs be labeled and marketed as "adjunctive" to test-strip measurements, with instructions that patients confirm CGM measurements with test-strip measurements using blood obtained from fingersticks prior to self-medicating. Recent improvements inHowever, given the accuracybroader clinical

6

indications for the use of CGM systems, have led toincluding real-time alerts and multi-device integration, the FDA issuingissued the first “non-adjunctive” label in 2016. We expectIn June 2019, an updated Eversense CGM system received a non-adjunctive label from the FDA and can now be used as a replacement to fingerstick glucose testing for treatment decisions. This non-adjunctive indication also enabled our pathway to access patients on Medicare.

In November 2019, the Centers for Medicare and Medicaid Services, or CMS, finalized a national payment rate for Eversense that the approval of the Eversense PMA will have an “adjunctive” label initially. Our plans will be to pursue a “non-adjunctive” label as soon as possible. Currently available CGM systems are often inconvenient, requiring frequent sensor replacement and an extra device, called a receiver, to monitor glucose readings, and have limited safety features.

2

We have designed Eversense and Eversense XL to continually and accurately measure glucose levels under the skin for up to 90 and 180 days, respectively, as compared to six to fourteen days for currently available CGM systems. Eversense also includes additional safety features that warn the user before the occurrence of adverse events and provide distinct on-body vibrations in a number of situations, such as when low or high glucose levels are reached. We believe that Eversense provides a more convenient method of continuous glucose monitoring by providing longer duration, equal or superior accuracy, state of the art communications and analytical capabilities, on-body alarms and alerts and the convenience of being able to take the transmitter on and off with no loss of the sensor.

According to the National Diabetes Statistics Report, as of the end of 2015, there are approximately 23 million patients diagnosed with diabeteswas published in the United States. We estimatecalendar year 2020 Physician Fee Schedule Final Rule. The Eversense CGM system became the first CGM technology to be reimbursed through the Part B Medical Services benefit for Medicare beneficiaries and expands access to our product. In August 2020, the Centers for Medicare and Medicaid Services, or CMS, released its Calendar Year 2021 Medicare Physician Fee Schedule that 6.9 million of these diabetes patients take insulin.

In 2016, we completed our Precise II pivotal clinical trial inestablishes global payment for the device cost and procedure fees for healthcare providers across the United States. This trial,includes the establishment of national payment amounts for the three CPT© Category III codes describing the insertion (CPT 0446T), removal (0447T), and removal and insertion (0048T) of an implantable interstitial glucose sensor, which was fully enrolled with 90 subjects, was conducted at eight sites indescribes our Eversense CGM systems, as a medical benefit, rather than as part of the United States.Durable Medical Equipment channel that includes other CGMs. In December 2021, CMS released its Calendar Year 2022 Medicare Physician Fee Schedule that updates global payment for the trial, we measured the accuracy of Eversense measurements through 90 days after insertion. We also assessed safety through 90 days after insertion or through sensor removal. In the trial, we observed a mean absolute relative difference, or MARD, of 8.5% utilizing two calibration points for Eversense across the 40-400 mg/dL range when compared to YSI blood reference values during the 90-day continuous wear period. We also observed a MARD of 9.5% utilizing one calibration point for Eversense across the 40-400 mg/dL range when compared to YSI blood reference values during the 90-day continuous wear period. Based on the data from this trial, in October 2016 we submitted a pre-market approval, or PMA, application to the FDA to market Eversense in the United States for 90-day use. The FDA Clinical Chemistrydevice cost and Clinical Toxicology Devices Panel is scheduled to review the PMA for Eversense on March 29, 2018. We anticipate that an approval decision from the FDA might occur within two to four months following the panel. However, the ultimate timing of PMA approval is uncertain and will depend on many factors, including the logistics of convening the panel, the degree and nature of questions raised by the FDA in its review process, and our ability to submit additional data or other information that adequately addresses questions raised by the FDA. Accordingly, we cannot guarantee the timing of receipt of PMA approval, if at all.procedure fees.

From its inception in 1996 until 2010, Senseonics, Incorporated devoted substantially all of its resources to researching various sensor technologies and platforms. Beginning in 2010, the company narrowed its focus to designing, developing and refining a commercially viable glucose monitoring system. We are headquartered in Germantown, Maryland. The members of our management team have held senior leadership positions at a number of medical technology and biopharmaceutical companies, including Abbott Diabetes Care, TheraSense, LifeCellMedtronic and Medtronic.

Johnson and Johnson. Members of our team have contributed to the development, regulatory approval and commercialization of several glucose monitoring systems and insulin pumps.

Commercial Strategy

Historically, we have sold our product directly to our network of distributors and strategic fulfillment partners, who provide the Eversense CGM system to healthcare providers and patients through a prescribed request and invoice insurance payors for reimbursement. As noted above, we have now transitioned to selling our product globally through Ascensia and we expect Ascensia to begin commercializing Eversense E3 in the United States in the second quarter of 2022. Sales of the Eversense CGM system are widely dependent on the ability of patients to obtain coverage and adequate reimbursement from third-party payors or government agencies. Ascensia is leveraging and targeting regions where we have coverage decisions for patient device use and provider insertion and removal procedure payment.

As a result of the COVID-19 pandemic, in the first quarter of 2020, we temporarily suspended commercial sales and marketing of the Eversense CGM System in the United States to new patients to solely focus our resources on supporting existing users. In connection with these actions, on March 26, 2020, we reduced our direct sales organization that consists of sales representatives, clinical trainers, customer care, and other specialists to educate, train, and support the patient and healthcare provider in their diabetes management with CGM systems.

In the third quarter of 2020, we announced the formation of a strategic partnership with Ascensia, pursuant to which Ascensia became the exclusive worldwide distribution partner for Senseonics CGM systems, including Eversense®, Eversense® XL and future generations products. In the fourth quarter of 2020, Ascensia initiated U.S. marketing and sales activities and full transition of commercial activities took place in the second quarter of 2021 and included full marketing, market access, sales, healthcare provider training and frontline patient and provider support responsibilities.

Addressing reimbursement and access barriers has been a top priority for us and during 2021, we reached over 200 million covered lives in the U.S. through positive insurance payor coverage decisions. In 2020, we continued the Eversense Bridge Program, a patient access program in the U.S. that provides financial assistance to eligible patients whose insurance coverage either does not yet cover Eversense, or in cases where Eversense is covered but the patient’s co-insurance is limiting their ability to adopt Eversense. Having played an important role in our journey to obtain broader payor policy and long-term patient retention, the Eversense Bridge Program ended on December 31, 2020. In 2021, Ascensia initiated to a patient assistance program to provide financial assistance to patients on Eversense. In 2022,

7

we expect Ascensia, in consultation with us, to initiate a broad patient assistance program for patients adopting Eversense E3.

In our overseas markets, we had entered into distribution agreements that allow third-party collaborators with direct sales forces and established distribution systems to market and promote Eversense XL primarily in the EMEA. These distribution arrangements have been replaced by our Commercialization Agreement with Ascensia. Our exclusive distribution agreement for sales in Scandinavia with Rubin Medical and our exclusive distribution agreement with Roche Diabetes Care for sales in the rest of the EMEA, excluding Israel and Scandinavia, and in 17 additional countries, including Brazil, Russia, India, and China, as well as select markets in the Asia Pacific and Latin American regions expired in 2021. Upon conclusion of each of these agreements, Ascensia assumed commercialization activities in select countries where Eversense XL has already launched, beginning February 1, 2021 for Germany, Italy, Switzerland, Spain, Poland, and Netherlands. The transition of Rubin markets began in June 2021.

Our net revenues are derived from sales of the Eversense CGM system which is sold in two separate kits: the disposable Eversense Sensor Pack which includes the sensor, insertion tool, and adhesive patches, and the durable Eversense Smart Transmitter Pack which includes the transmitter and charger.

Collaboration and Commercialization Agreement with Ascensia Diabetes Care Holdings AG

On August 9, 2020, we entered into a Commercialization Agreement with Ascensia Diabetes Care Holdings AG pursuant to which we have granted Ascensia the exclusive right to distribute the Company’s 90-day Eversense CGM system and our 180-day Eversense CGM system worldwide for use in people with diabetes, with the following initial exceptions: (i) until January 31, 2021, the territory did not include countries covered by our then existing distribution agreement with Roche Diagnostics International AG and Roche Diabetes Care GmbH, which are the Europe, Middle East and Asia, excluding Scandinavia and Israel, and 17 additional countries, including Brazil, Russia, India and China, as well as select markets in the Asia Pacific and Latin American regions; (ii) until September 13, 2021, the territory did not include countries covered by our current distribution agreement with Rubin Medical, which are Sweden, Norway and Denmark; and (iii) until May 31, 2022, the territory does not include Israel. Pursuant to the Commercialization Agreement, in the United States, Ascensia began providing sales support for the 90-day Eversense product on October 1, 2020 and Ascensia ramped up sales activities and assumed commercial responsibilities for the 90-day Eversense product during the second quarter of 2021. In February 2022, the extended life Eversense E3 CGM system was approved by the FDA and we expect Ascensia to begin commercializing Eversense E3 in the United States in the second quarter of 2022. Ascensia will receive a portion of net revenue at specified tiered percentages ranging from the mid-teens to the mid-forty’s based on levels of global net revenues. Ascensia is obligated to achieve specified minimum annual revenue targets and meet specified levels of sales and marketing spend. Ascensia will purchase Eversense products from us at prices which have been negotiated based on parameters set forth in the commercialization agreement. We are responsible for product development and manufacturing, including regulatory submissions, approvals, certifications and registrations and second level customer support, and Ascensia is responsible for sales, marketing, market access, patient and provider onboarding and level one customer support. We have agreed to establish a joint alliance committee and joint marketing committee, each with equal representation from each party, in order to collaborate.

Prior Distribution Agreement with Roche Diabetes Care

On May 24, 2016, we entered into an exclusive distribution agreement with Roche Diagnostics International AG and Roche Diabetes Care GmbH, or collectively, Roche. Pursuant to the agreement, as amended, we granted Roche the exclusive right to market, sell and distribute Eversense in the EMEA, excluding Scandinavia and Israel. In addition, Roche had exclusive distribution rights in 17 additional countries, including Brazil, Russia, India and China, as well as select markets in the Asia Pacific and Latin American regions.

On December 12, 2019, we amended the distribution agreement to lower minimum volumes for 2020 and increase pricing for the remaining period of the contract.

On November 20, 2020, we amended the distribution agreement and entered into a settlement agreement to facilitate transition to Ascensia as Roche sales concluded on January 31, 2021, including final purchases and transition

8

support activities, and Roche’s obligation to purchase certain quantities of products at certain prices under the distribution agreement have now terminated.

The distribution rights under the agreement expired January 31, 2021, subject to Roche providing certain transition and wind-down services for approximately six months in markets where Ascensia was not initiating distribution.

Clinical Development and Regulatory Pathway

Overview

In support of our regulatory submissions, we have expended considerable resources designing, developing and refining a glucose monitoring system. We have completed both our European and U.S. pivotal trials.affixed the CE mark to the Eversense XL CGM system in the EEA in September 2017. The Eversense and Eversense XL systems have received a CE Mark in Europe and are currentlyCGM system is also being sold commercially.commercially in our overseas markets. Our Precise IIPromise U.S. pivotal trial was completed during 20162020. We received a Premarket Approval, or PMA, from the FDA for the Eversense E3 system in February 2022 for up to six months and we submitted our PMAexpect Ascensia to begin commercializing Eversense E3 in the FDAUnited States in October 2016. the second quarter of 2022.

We are also continuing to conduct a number of post-approval and feasibility studies in which we are evaluating various configurations of our CGM system. These studies are intended to assess the performance of different system configurations in a small population of subjects before enrolling a large clinical trial. studies.

United States Pivotal TrialTrials

PRECISE II Trial

In January 2016, we began enrollment for theconducted our U.S. 90-day pivotal trial. Enrollment was completed before the end of March and the last patient completed the trial in July 2016. The trial was a prospective, single-arm, multi-center trial designed to determine the accuracy and safety of the Eversense system. Ninety subjects were enrolled in eight centers

3

across the United States. Eighty-seven of the ninety enrollees completed the 90-day trial. During the trial the subjects were blinded to the real time glucose displays and alarms. The participants were also required to calibrate the system with two blood glucose measurement readings per day.

The subject clinical trial population consisted of subjects at least 18 years of age who had a clinically confirmed diagnosis of diabetes. Subjects who had a history of severe hypoglycemia, defined as hypoglycemia resulting in loss of consciousness or seizure, or diabetic ketoacidosis, in the six months prior to the trial, were excluded from participation in the clinical trial. At the initial visit, our sensor was inserted and initial accuracy measurements were taken. Additional accuracyAccuracy measurements were taken at 1 day, 30 days, 60 days, and 90 days post-insertion. These sensor measurements were continued through the earlier of the failure of the sensor or 90 days post-insertion.

The purpose of this clinical trial was to evaluate the accuracy of Eversense measurements, measured by the Mean Absolute Relative Difference, or MARD, when compared with in vitrobed-side blood glucose measurements obtained using the YSI glucose analyzer over successive periods of 30 days through 90 days, as well as to assess the safety of Eversense. YSI in vitro analyzers are bed-side instruments used in hospitals and clinics to accurately measure blood glucose levels and are commonly used as comparators of glucose monitoring systems in clinical trials. MARD is a statistical calculation that measures the average absolute value of the differences, expressed as a percentage, between glucose measurements taken from interstitial fluid based on our CGM system and blood glucose measurements from YSI. The lower the MARD of a glucose monitoring system, the more accurate the system and, therefore, the more reliable the system's readings.

During the trial, 75 subjects underwent unilateral sensor insertions and 15 subjects underwent bilateral sensor insertions in the clinic and used Eversense’s smart transmitter and mobile app at home for the next 90 days. Subjects were blinded to the real-time glucose readings and trends during home-use and sensor readings were not used to adjust their treatment. Clinic visits were scheduled at approximately 30-day intervals in order to obtain lab reference glucose values for comparison with the sensor values and to evaluate hyperglycemic and hypoglycemic challenges in a controlled setting.

In the trial, we observed a mean absolute relative difference, or MARD of 8.5% utilizing two calibration points8.8% for Eversense across the 40-400 mg/dL range when compared to YSI blood reference values during the 90-day continuous wear period. We conducted a second study, the PRECISION study, to collect supplementary data early in sensor life with two additional in-clinic visits in the first 30 days after insertion.

9

Study participants were able to see their real-time glucose readings during this study. The accuracy and safety observed in PRECISE II was confirmed in this study. In addition, the data from PRECISE II study was also observed aanalyzed using an updated glucose calculation algorithm which improved the MARD of 9.5% utilizing one calibration point for Eversense across the 40-400 mg/dL range when compared to YSI blood reference values during the 90-day continuous wear period.8.5%. Based on the data from this trial,both of these trials, we submitted a PMA application to the FDA to market Eversense in the United States for 90-day use. In connection with its review of theOn June 21, 2018, we received PMA the FDA Clinical Chemistry and Clinical Toxicology Devices Panel is scheduled to review the PMA for Eversense on Thursday, March 29, 2018. We anticipate that an approval decision from the FDA might occur within two to four months followingfor the panel. However,Eversense system. We are distributing the ultimate timing of PMA approval is uncertain and will depend on many factors, including the degree and nature of questions raised by the FDA in its review process, and our ability to submit additional data or other information that adequately addresses questions raised by the FDA. Accordingly, we cannot guarantee the timing of receipt of PMA approval, if at all. For commercializationEversense system directly in the United States we intend to distribute our product through our own direct sales and marketing organization. We have received Category III CPT codes for the insertion and removal of the Eversense sensor.

PROMISE Trial

In December 2018, we began enrollment for the U.S. 180-day pivotal trial. The trial is a prospective, single-arm, multi-center trial designed to evaluate the accuracy and safety of the Eversense system up to six months using the methods described above for the 90-day system. Over 180 subjects were enrolled in eight centers across the United States. We completed enrollment in September 2019 and had our last patient complete their 180-day visit during the first quarter of 2020.

The clinical trial population consists of subjects at least 18 years of age who have had a clinically confirmed diagnosis of diabetes for at least one year. Subjects with a history of unexplained severe hypoglycemia, defined as hypoglycemia resulting in loss of consciousness or seizure, or diabetic ketoacidosis, in the six months prior to the trial were excluded from participation in the clinical trial. After screening, sensor(s) were inserted and accuracy measurements were taken at multiple visits during the first 30 days and then every 30 days to 180 days post-insertion or until sensor failure, if earlier than 180 days post-insertion. In the trial, we observed performance matching that of the current Eversense 90-day product available in the United States, with a mean absolute relative difference, or MARD, of 8.5%-9.6%. This result was achieved with reduced calibration, down to one per day, while also doubling the sensor life to 180 days. Following the results of the PROMISE trial, on September 30, 2020 a Premarket Approval Application Supplement, or PMA supplement to extend the wearable life of the Eversense CGM System to six months was submitted to the FDA. As described elsewhere, we received PMA approval from the FDA for the Eversense E3 CGM system in February 2022, and we expect Ascensia to begin commercializing Eversense E3 in the United States in the second quarter of 2022.

On February 26, 2020, we announced that the FDA approved a subgroup of PROMISE trial participants to continue for a total of 365 days to gather feasibility data on the safety and accuracy of a 365-day sensor. This sub-set of 30 participants who all had sensors with the modified chemistry were left undisturbed for 365 days with the goal of measuring accuracy and longevity over the full 365 days. Following information gathered from this sub-set and continued development efforts, and pending developments at the FDA relating to the ongoing the ongoing COVID-19 pandemic, in the first half of 2022 we plan to seek Investigational Device Exemption, or IDE, from the FDA. If the IDE is approved in a timely manner, we would target to begin enrollment of a clinical trial, in which we also intend to pursueinclude a Category I CPT codepediatric population, in the future.second half of 2022.

410

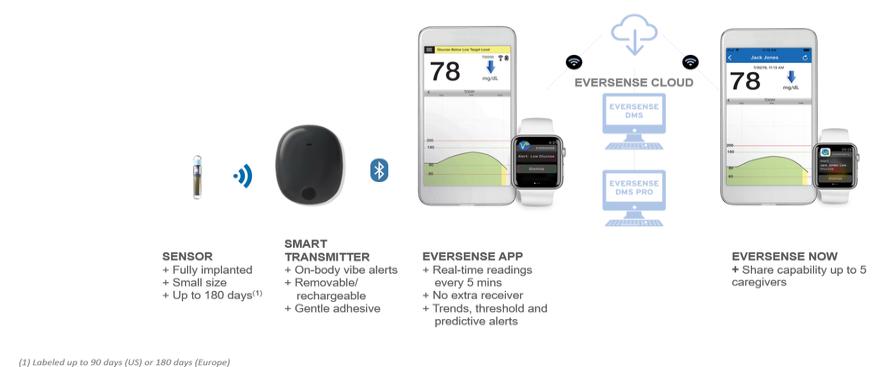

Our Technology

Eversense consists of three primary components: a small sensor inserted subcutaneously under the skin by a healthcare provider; an external removable smart transmitter that receives, assesses and relays data from the sensor and provides vibratory alerts; and a mobile app that receives data from the transmitter and provides real-time glucose readings, alerts and other data on the person's mobile device. All of these components work together to provide sensor glucose values, trends and alerts to a user's mobile device within 20 milliseconds. We have designed this reliable, long-term and implantable CGM system to continually and accurately measure a person's glucose levels for up to 180 days. As with most currently available CGM systems,six months. Eversense will initially requirerequires twice daily fingerstick calibrations through day 21 and then primarily once daily fingerstick calibrations. Further, upon receiving an alert fromIn June 2019, we received FDA approval for the non-adjunctive indication for the Eversense system. With this approval, the Eversense system can be used as a therapeutic CGM a patient should confirmto replace fingerstick blood glucose measurement for dosing decisions and was launched in December 2019.

We believe our implantable CGM measurements with test-strip measurements priorsystem offers the following advantages to self-medicating, as noted insupport the CGM's label and instructions. management of diabetes:

| ● | Accuracy: Exceptional accuracy particularly in the low glucose range throughout the sensor life. |

| ● | Duration: Longest available sensor duration at up to six months. |

| ● | Convenience: Our Eversense CGM system supports the patient’s lifestyle; the smart transmitter is water resistant, rechargeable and can be removed and replaced without disturbing the sensor, strong but gentle-on-skin adhesive patches, wireless communication to patient’s mobile device or Apple Watch ®, including readings every five minutes whether the patient has their mobile device or not, remote monitoring that can be shared with up to five people, including health care providers, and tracking of meals and workouts for further diabetes treatment management. |

| ● | Vibe Alerts: Added safety of an on-body vibration alert when low or high glucose threshold is reached, or importantly before low or high threshold is reached, even when the mobile device is not nearby. |

| ● | Continuous Support: Patient and healthcare provider hotline support 24/7. |

Sensor

The sensor is designedapproved and CE marked to be inserted under the skin, either in the back of the upper arm, or in the abdomen, and measures the glucose in the interstitial fluid. These glucose levels are then communicated wirelessly to the smart transmitter. We have designed the sensor to last up to 180 days,six months, as compared to other currently available CGM sensors labeled for use for between fiveseven and fourteen14 days.

The sensor consists of an optical system, known as a micro-fluorometer, encased in a rigid, translucent polymer capsule, which is 3.3 mm in diameter and 15 mm in length. The capsule is coated with a glucose-indicating hydrogel that

11

is bound to the surface of the capsule through polymerization. This hydrogel is energized, or excited, by a light-emitting diode, or LED, contained in the optical system of the sensor, causing the hydrogel to fluoresce, or glow. Two photodiodes within the optical system of the sensor measure the degree of fluorescence of the hydrogel, which is proportional to the level of glucose present in the interstitial fluid. The sensor then communicates the amount of fluorescence via a near field communication, or NFC, interface to the transmitter. NFC is a high frequency wireless communication technology that enables the exchange of data and energy between devices over a short range. The entire capsule is coated by a glucose-permeable membrane for biocompatibility.

The sensor does not containhave a battery or other stored power source. Instead,source and remains electrically dormant (powered off) between readings every five minutes, and it is remotely and discretely powered, as needed, by an inductive NFC link between the sensor and the transmitter. On power-up, the LED source is energized for approximately five milliseconds to excite the hydrogel. Between readings every five minutes, the sensor remains electrically dormant and fully powered down.

Smart Transmitter

The removable smart transmitter is a rechargeable, external device that is worn over the sensor implantation site using a daily adhesive patch or band, such as an armband or waistband.patch. The transmitter supplies wireless power to the sensor through an inductive NFC link, which activates a measurement sequence every five minutes. The transmitter then receives data from the sensor and calculates glucose concentrations and trends. Based on these calculations and on the user's individual settings for glucose levels, the transmitter determines if an alert condition exists, in which case the transmitter communicates the condition to the user through the mobile app and through on-body vibration. The information from the transmitter is

5

also transmitted for display to the user's mobile device via Bluetooth.Bluetooth Low-Energy, or BLE. Our transmitter is functional for at least 3624 hours without rechargingfollowing a full charge and can be fully charged in fifteen minutes.

Mobile App

Our mobile app is a software application that runs on both platforms; iOS mobile devices, including iPhones, iPads and Apple Watches, and Android mobile devices. The mobile app receives information from the transmitter via BluetoothBLE and displays that information discreetly to the user. This user-friendly, intuitive app provides real-time glucose readings, alerts, trends, graphs and alarms.graphs. Within the mobile app, users can set alarmsalerts based on, among other things, glucose levels. The mobile app also allows for cloud-based storage.

Future Product Development

Following the approval of Eversense and Eversense XL in Europe, weWe intend to continue to expand our line of product offerings to benefit both people with diabetes and healthcare providers. We expect these product development initiatives to include system modifications and next generation enhancements that we believe will further increase the convenience and appeal of our products to the diabetes community.

We are focusing our future development efforts on enhancing current product offerings by reducing the once or twice daily calibrations towards a once per week calibration. Our next generation sensor under feasibility testing now is designed to extend the sensor duration even longer at up to 365 days. We expect the next generation sensor to support our goal of extending the market for long-term implantable CGM to include Type 2 patients not on intensive insulin therapy. We are also developing our “Freedom” product variation to allow for a 2-in-1 glucose monitoring system combining the functionality of CGM and Flash Glucose Monitoring, or FGM, in an implantable sensor that may be utilized with a smart transmitter to get continuous glucose readings and alerts, or be utilized through a swipe over the sensor with a smart phone to get on-demand glucose reading without a smart transmitter. We are seeking to ensure that we meet the growing and unique needs of people with diabetes utilizing our core and proprietary sensor technology. The company’s technology also has potential applications measuring analytes other than glucose, such as oxygen, and the company may consider opportunities for the development or out-licensing of such applications.

Sales and Marketing

We are in the early commercialization stages of Eversense and are focused on driving awareness and adoption of our CGM system amongst intensively managed patients and their healthcare providers.

12

Future developments include applyingAs described above, we are party to a commercialization agreement with Ascensia, pursuant to which we have granted Ascensia the exclusive right to distribute our 90-day Eversense CGM system and our six-month Eversense CGM system worldwide for a dosing claim, which would permit usersuse in people with diabetes, with certain exceptions. Pursuant to dose with insulin without first confirming the blood glucose measure via a fingerstick, submitting an IDE for a pediatric trialCommercialization Agreement, in the United States, launchingAscensia began providing sales support for the 180-day90-day Eversense product on October 1, 2020 and Ascensia ramped up sales activities and assumed commercial responsibilities for the 90-day Eversense product during the second quarter of 2021. In February 2022, the extended life Eversense E3 CGM system was approved by the FDA and we expect Ascensia to begin commercializing Eversense E3 in the United States significantly reducing calibration requirements, continuingin the second quarter of 2022. In anticipation of the launch, we and Ascensia have been designing the go-to-market strategy for the U.S. six-month product.

As a result of our strategic partnership, Ascensia is responsible for sales, marketing, market access, patient and provider onboarding and level one customer support. We have established a joint alliance committee and joint marketing committee, each with equal representation from each party, in order to improve accuracy, and initiating clinical trials for On-Demand, or “swipe”, technology for Type 1 users, and extending swipe technology to Type 2 users. Through our collaborationcollaborate.

Building strong adoption with TypeZero and Roche, we are also workingan implantable device requires a strong network of healthcare providers trained on a closed loop diabetes management system that would allow users to automatically and sustainably maintain tight glucose control while avoiding hypoglycemia.

Sales and Marketing

We are utilizing third-party distributors forthe Eversense sensor placement procedure. In the first few quarters of our commercial activities in Europe. We currently marketlaunch, our focus was ensuring the Endocrinology providers obtained the necessary training needed to support their diabetes patients. In 2019, we began our second phase of establishing a large network of Eversense in 14 European countries where there is an understanding and market acceptance of CGM. We have an exclusive arrangementproceduralists with Rubin Medical for sales in Scandinavia. We have an exclusive arrangement with Roche Diabetes Care for sales in the rest of Europe, the Middle East and Africa, excluding Israel and Finland.

Based on the size and maturity of the U.S. market, our plan is to invest in developing a direct sales force and infrastructure to support the launch of the product inCertified Eversense Specialist, or CES, network. This group of healthcare providers includes specialists who have strong familiarity with conducting in-office procedures such as dermatologists and plastic surgeons. The CES network offers an alternative for healthcare providers who want to prescribe Eversense for their patients but prefer to refer the United States and target what we estimateprocedure to be approximately 2,100 endocrinologists in the United States who are clinically active and diabetes-focused.a specialist.

As people with diabetes often consult with their healthcare providers about treatment options, we believe that educating healthcare providers regarding the benefits of Eversense compared to SMBG and other currently available CGM systems is an important step in promoting its use in people with diabetes. In a survey of 45 physiciansOur European experience and over 400 people with diabetes conducted by a prominent global strategy consulting firm that we commissionedour feedback in 2015,the United States indicates healthcare providers highly valuedvalue the accuracy and sensor duration of our CGM system and the majority of physicians surveyed considered the insertion process to be fairly simple or feasible. Approximately three out of four physicians preferred Eversense for their patients with intensively managed diabetes. In addition, approximately four out of five intensively managed non-CGM patients who preferred a CGM option over SMBG preferred Eversense over other currently available CGM systems. We intend to educatecontinue educating healthcare providers and people with diabetes on the advantages of Eversense compared to SMBG and other currently available CGM systems. We also intend to establish a customer care center to provide ongoing support to people with diabetes and healthcare providers.

Distribution Agreement with Rubin Medical

Reimbursement

In September 2015, we entered into a distribution agreement with Rubin Medical, or Rubin, pursuant to which we granted Rubin the exclusive right to market, sell and distribute Eversense in Sweden, Norway and Denmark. Pursuant to the agreement, Rubin is obligated to purchase from us specified minimum volumes of Eversense components at pre-

6

determined prices, which are subject to potential amendment upon the occurrence of specified events. Rubin is responsible for the promotion, sale and distribution of Eversense in Sweden, Norway and Denmark at such prices as Rubin determines in its sole discretion, subject to specified exceptions.

The distribution agreement has an initial term of five years and is subject to renewal for up to two additional five year periods if, at least 180 days prior to the expiration of a term, we and Rubin agree to minimum purchase requirements for the additional term and we do not increase the purchase price of Eversense components that are subject to existing publicly procured contracts unless Rubin can pass through the price increase to the customer.

The distribution agreement is terminable by us upon 30 days' notice under a number of circumstances, including if Rubin fails to make required payments, Rubin competes with us or Rubin seeks to distribute Eversense outside of Sweden, Norway or Denmark. The agreement is terminable by Rubin upon 30 days' notice under a number of circumstances, including if we breach the warranties of the agreement, fail to obtain marketing approval or fail to satisfy our supply obligations. The agreement is terminable by either party if the other party fails to comply with marketing laws, violates the confidentiality or intellectual property protection provisions of the agreement, becomes insolvent, or becomes subject to specified convictions, injections or enforcement actions. The termination rights contained in the agreement generally are subject to an opportunity to cure. Further, we may terminate the agreement upon a change of control of our company, subject to us providing 180 days written notice and paying a specified termination fee to Rubin.

Distribution Agreement with Roche Diabetes Care

On May 24, 2016, we entered into an exclusive distribution agreement with Roche Diagnostics International AG and Roche Diabetes Care GmbH, or collectively, Roche, pursuant to which we granted Roche the exclusive right to market, sell and distribute Eversense in Germany, Italy and the Netherlands. On November 28, 2016, we amended the distribution agreement to also grant Roche the exclusive right to market, sell and distribute Eversense in Europe, the Middle East and Africa, excluding Sweden, Norway, Denmark, Finland and Israel. Roche is obligated to purchase from us specified minimum volumes of Eversense components at pre-determined prices, which pricing is subject to renegotiation in certain circumstances.

The distribution agreement, as amended, has an initial term through December 31, 2018, which may be extended through December 31, 2019 if we and Roche agree upon the minimum purchase requirements for 2019. The distribution agreement is terminable by us under a number of circumstances, including if Roche materially breaches the terms of the agreement or fails to make certain minimum sales requirements. The agreement is terminable by Roche under a number of circumstances, including if we materially breach the agreement, if the distribution of Eversense is enjoined in the covered territories or in the case of certain intellectual property infringement claims. The agreement is terminable by either party if the other party becomes insolvent or subject to bankruptcy proceedings. The termination rights contained in the agreement are generally subject to advance notice requirements and an opportunity to cure. Further, Roche may terminate the agreement upon a change of control of our company with a transition period of the shorter of 18 months or the remaining term of the agreement.

Reimbursement

Coverage in the United States

ReimbursementIn the U.S. market, it is essential to obtain third-party payor coverage policies, coding mechanisms, and adequate payment for medical technology to expand market acceptance and adoption. CGM as a class of products has been broadly accepted by commercial third-party payors, such as health insurers and health maintenance organizations, and more recently by Medicare for patients who require the use of insulin to manage their diabetes. We approach the U.S. commercial third-party payor community in efforts to establish coverage for Eversense. To date, approximately 200 million people in the United States may have coverage and access to the Eversense 90-day product via commercial or government (i.e., Medicare) payors. We believe that transitioning commercial payors from private third-party healthcare payors and,90-day coverage to a lesser extent, Medicaresix-month coverage will be important for the successful commercialization of the Eversense E3 six-month CGM system.

Some commercial payors have denied coverage deeming Eversense as an important element“experimental and investigational” technology electing to wait for further clinical evidence, more safety data, or time in market. We disagree with this position as the CGM class has already proven to improve health outcomes and Eversense is another product that fits into the class. Additionally, in 2019 we published several sets of our success. The Centersreal-world data, which show Eversense provides the same clinical benefits as other CGM systems and has a favorable safety profile. However, until payment for Medicare and Medicaid Services, or CMS, established, effective 2008, Alpha-Numeric Healthcare Common Procedure Coding System codes thatthe Eversense sensor placement becomes consistent, some patients will be applicable to each of the components of Eversense. Recently Medicare adopted a national coverage determination with respect to one of the currently offered CGM systems. This national coverage determination was based on the decision by FDA to indicate the approved CGM system as a “non-adjunctive” device meaning that the user would not need to perform a confirmatory fingerstick prior to initiating treatment indicated by the information provided by the CGM system. Additionally, CMS does reimburse patients for the cost of certain related medical services such as data interpretation. Until such time as adequate coverage is extended by CMS and/or its contractors, as applicable, reimbursement of our products will generally be limited to customers covered by those third-party payors that have adopted policies recognizing coverage and reimbursement for

7

CGM devices. Currently most of the largest private third-party payors, in terms of the number of covered lives, have issued coverage policies for the category of CGM devices. These policies include varied requirements regarding patient condition and characteristics. Many of these coverage policies reimburse for CGM systems under durable medical equipment benefits, which are restrictive in nature and require the healthcare provider or supplier to comply with extensive documentation and other requirements. We intend to seek coverage for Eversense as a medical benefit, which could avoid some of these restrictions, although we may not be successful in doing so. In addition, customers who are insured by payors that do not offer coverage for our devices will haverequired to bear the financial cost for the placement of the products.

We have received Category III CPT codes for the insertionsensor by their healthcare provider. As a result, some patients and removal of Eversense. Following PMA approval, we intend to pursue a Category I CPT code.

We intend to commence negotiations with third-party payors in 2018. However, unless third-party and government payors provide coverage and adequate reimbursement for Eversense and the related insertion and removal procedures, people with diabetes mighttheir healthcare provider may choose not to use our productsEversense on a widespread basis. Our patient access programs and patient appeals support, including the Eversense Bridge Program, which was discontinued on December 31, 2020, have been key initiatives to expanding payor policy and acceptance through case-by-case review and eventual denial overturn and Ascensia has continued similar programs

13

for this purpose. This can be a long process with varying results in each case but is a prudent step to challenge payor positions of non-coverage given the strong evidence that supports CGM and Eversense.

Medicare, Medicaid, health maintenance organizations and other third-party payors are increasingly attempting to contain healthcare costs by limiting both coverage and the level of reimbursement of new medical devices, and, as a result, their coverage policies may be restrictive, or they may not cover or provide adequate payment for our products. In order to obtain reimbursement arrangements, we may have to agree to a net sales price lower than the net sales price we might charge in other sales channels. Our revenue may be limited by the continuing efforts of government and third-party payors to contain or reduce the costs of healthcare through various increasingly sophisticated means, such as requiring prospective reimbursement and second opinions, purchasing in groups, or redesigning benefits. Our future dependence on the commercial success of Eversense makes us particularly susceptible to any cost containment or reduction efforts. Accordingly, unless government and other third-party payors provide coverage and adequate reimbursement for our products and the related insertion and removal procedures, our financial performance may be limited.

Coverage Outside the United States

In countries outside the United States, coverage for CGM systems is obtained from various sources, including governmental authorities, national healthcare systems, private health insurance plans, and labor unions.hospital funds. Coverage systems in international markets vary significantly by country and, within some countries, by region. Coverage approvals must be obtained on a country-by-country, region-by-region or, in some instances, a case-by case basis. The responsibility for securing this coverage resides with our third-party distributors in the respective markets.

Manufacturing and Quality Assurance

We currently outsource the manufacturemanufacturing of all components of our system.the Eversense system to contract manufacturers across North America and Europe. We plan to continue with an outsourced manufacturing arrangement for the foreseeable future. Our contract manufacturers are all recognized in their field for their competency to manufacture the respective portions of our system and have quality systems established that meet FDA and, to the extent required, international regulatory requirements. We believe the manufacturers we currently utilize have sufficient capacity to meet our launch requirements and are able to scale up their capacity relatively quickly with minimal capital investment.requirements. We believe that, as we increase our demand in the future, our per unit costs will decrease materially.

We have received certification from BSI, our Notified Body to the International Standards Organization, or ISO, for our quality system. This ISO 13485:2016 certification includes design control requirements. As a medical device manufacturer, the facilities of our sterilization and other critical suppliers are subject to periodic inspection by the FDA and corresponding state and foreign agencies.regulatory agencies and Notified Bodies. We believe that our quality systems and those of our suppliers are robust and achieve high product quality.

Our suppliers are managed through our supplier management program that is focused on reducing supply chain risk. Key aspects of this program include managing component inventory at the supplier, contractual requirements for last time buy opportunities and second sourcing approaches for specific suppliers. Typically, our outside vendors produce the components to our specifications and in many instances to our designs. Our suppliers are audited periodically by our quality department to ensure conformity with the specifications, policies and procedures for our

8

devices. We believe that, if necessary, alternative sources of supply would be available in a relatively short period of time and on commercially reasonable terms. Most of the raw materials we use in our manufacturing operations are available from more than one source. However, we obtain certain raw materials principally from only one source. In the event one of these suppliers was unable to provide the materials or product, we generally seek to maintain sufficient inventory to supply the market until an alternative source of supply can be implemented. However, in the event of an extended failure of a supplier, it is possible that we could experience an interruption in supply until we established new sources or, in some cases, implemented alternative processes.

Research and Development

Competition

Our research and development team includes employees who specialize in chemistry, software engineering, electrical engineering, mechanical engineering and graphical user interface design, many of whom have considerable experience in diabetes-related medical devices. Our research and development team focuses on the products currently under development, including our clinical trials, as well as feasibility studies in which we are evaluating different design configurations to enhance product functionality for future generations of Eversense. Our research and development expenses were $30.1 million, $26.3 million and $18.3 million for the years ended December 31, 2017, 2016, and 2015, respectively.

Competition

The market for CGM systems is developing and competitive, subject to rapid change and significantly affected by new product introductions. We expect to compete with well-capitalized companies, some of which are publicly-traded,publicly traded, that manufacture CGM systems including Dexcom, Medtronic and Abbott. Each of these companies has received approval from the FDA to market their respective CGM system. Dexcom's Bluetooth-enabled CGM system is designed to be integrated with smartphones. Dexcom’s CGM system was the first CGM system to be approved by the FDA for marketing as a non-adjunctive device.device, and Abbott’s Freestyle Libre was also approved for non-adjunctive use. Both Dexcom (G6) and Abbott (Freestyle Libre) systems have factory calibration, and do not require user calibration.

Dexcom has also received the first FDA iCGM indication allowing its Dexcom G6 to be interoperable with other diabetes tech devices such as insulin pumps. As the industry evolves, we anticipate encountering increasing competition from companies that integrate CGM with insulin pumps. We are aware of twoAbbott also received an iCGM indication for their Freestyle Libre 2 product and we expect all other CGM companies Medtronic and Tandem Diabetes Care, Inc., which have received FDA approval for CGM-integrated insulin pumps.besides Dexcom to pursue an iCGM indication including Medtronic.

14

In addition to CGM providers, we will also compete with providers of traditional SMBG systems. FourThree companies currently account for substantially alla substantial share of the worldwide sales of SMBG systems: Roche Diabetes Care, a division of Roche Diagnostics; LifeScan, Inc., a division of Johnson & Johnson; Abbott; and Asencia, a Panasonic Healthcare Holdings company.Ascensia.

We may also compete with companies including Abbott,who are developing next generation real-time CGM orintermittent sensing devices, low cost transcutaneous CGM systems, fully implantable CGM devices and technologies, as well as several other companies that are evaluating non-invasive CGM productssystem to measure a user's blood glucose level. For example, Abbott has commercialized its FreeStyle Libre Flash Glucose Monitoring System, which eliminates the need for routine fingersticks by reading glucose levels through a transcutaneous sensor that can be worn for up to 10 days in the United States and 14 days in Europe. There are also a number of academic and other institutions involved in various phases of our industry's technology development.

Although we will face potential competition from many different sources, we believe that our technology, knowledge, experience and scientific resources will provide us with competitive advantages. The key competitive factors affecting the success of Eversense are likely to be: the accuracy, sensor duration, safety, convenience, adherencealert functionality, and price of treatment; the availability of coverage and reimbursement from government and other third-party payors; effective sales, marketing and distribution; brand awareness and acceptance by healthcare providers and people with diabetes; customer service and support and comprehensive education for people with diabetes and their healthcare providers; and rapid product innovation, including insulin pump integration.support.

Many of the companies against which we may compete in the futurewith have significantly greater financial resources and expertise in research and development, manufacturing, preclinical testing, conducting clinical trials, obtaining regulatory approvals, certifications and marketing approved products than we do. Mergers and acquisitions in the pharmaceutical, biotechnology and diagnostic industries may result in even more resources being concentrated among a smaller number of our competitors. Smaller or earlier stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. These competitors also compete with us in recruiting and retaining qualified scientific and management personnel and establishing clinical trial sites and

9

subject registration for clinical trials, as well as in acquiring technologies complementary to, or necessary for, our development.

Intellectual Property

Protection of our intellectual property is a strategic priority for our business. We rely on a combination of patents, trademarks, copyrights, trade secrets as well as nondisclosure and assignment of invention agreements, material transfer agreements, confidentiality agreements and other measures to protect our intellectual property and other proprietary rights.

Patents

As of December 31, 2017,2021, we held a total of approximately 390527 issued patents and pending patent applications that relate to our CGM system. Our intellectual property portfolio includes 50104 issued United States patents, 199250 patents issued in countries outside the United States and 141173 pending patent applications worldwide. Our patents expire between 20182021 and 2036,2043, subject to any patent extensions that may be available for such patents. If patents are issued on our pending patent applications, the resulting patents are projected to expire on dates ranging from 20212044 to 2038. 2060.

Our patents and patent applications cover certain aspects of our core sensor technologies and our product concepts for CGM systems. However, our patent applications may not result in issued patents, and any patents that have been issued or may be issued in the future may not protect the commercially important aspects of our technology. Furthermore, the validity and enforceability of our issued patents may be challenged by third parties and our patents could be invalidated or modified by the issuing governmental authority. Third parties may independently develop technology that is not covered by our patents that is similar to or competes with our technology. In addition, our intellectual property may be infringed or misappropriated by third parties, particularly in foreign countries where the laws and governmental authorities may not protect our proprietary rights as effectively as those in the United States.

The medical device industry in general, and the glucose testing sector of this industry in particular, are characterized by the existence of a large number of patents and frequent litigation based on assertions of patent infringement. We are aware of numerous patents issued to third parties that may relate to the technology used in our business, including the design and manufacture of CGM sensors and CGM systems, as well as methods for continuous glucose monitoring. Each of these patents contains multiple claims, any one of which may be independently asserted against us. The owners of these patents may assert that the manufacture, use, sale or offer for sale of our CGM sensors or CGM systems infringes one or more claims of their patents. Furthermore, there may be additional patents issued to third

15