NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements included in this Annual Report on Form 10-K and the documents incorporated into this document by reference contain certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such forward-looking statements include statements regarding our plans and objectives, including, among other things, our future financial condition, anticipated capital expenditures, anticipated dividends and other matters. Forward-looking statements are typically identified by the use of terms such as “may,” “will,” “should,” “expect,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “predict,” “potential” or the negative of such terms and other comparable terminology. These statements are only predictions and are not historical facts. Actual events or results may differ materially.

The forward-looking statements included herein are based on our current expectations, plans, estimates and beliefs that involve numerous risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Any of the assumptions underlying the forward-looking statements contained herein could be inaccurate. Although we believe the expectations reflected in such forward-looking statements are based on reasonable assumptions, we cannot assure readers that the forward-looking statements included in this filing will prove to be accurate. The accompanying information contained in this Annual Report on Form 10-K, including, without limitation, the information set forth under the section entitled “Risk Factors” in Item 1A, identifies important additional factors that could materially adversely affect actual results and performance. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of certain unanticipated events or changes to future operating results.

All dollar amounts in this Form 10-K are stated in thousands with the exception of share and per share amounts, unless otherwise indicated.

GENERAL

Sterling Real Estate Trust (“we,” “us,” “our,” “Company”“Company,” “Trust” or “Sterling”) is a real estate investment trust (“REIT”),. Sterling was registered in North Dakota as an unincorporated business trust onin December 4, 2002. References in this Annual Report on Form 10-K to the “Company,” “Sterling,” “Trust,” “we,” “us,” or “our” include consolidated subsidiaries, unless the context indicates otherwise. As a REIT, we are not subject to U.S. federal income taxation as long as we satisfy certain requirements, principally relating to the nature of our income, the level of our dividends and other factors. AtAs of December 31, 2017,2022, we owned directly or through our operating partnership, 166185 properties in twelve (12)12 states.

UPREIT Structure

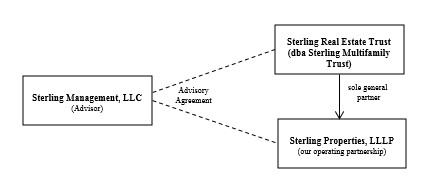

We operateThe Trust operates as an Umbrella Partnership Real Estate Investment Trust, which is a REIT that holds all or substantially all of its assets through a partnership which the REIT controls as general partner. Therefore, we conductthe Trust conducts substantially all investment activities and holds substantially all of our investment activities and hold all or substantially all of ourthe Trust’s assets through ourthe operating partnership Sterling Properties, LLLP. We controlThe Trust controls the operating partnership as the general partner and ownowns approximately 32.64%36.60% of the operating partnership as of December 31, 2017.2022. For purposes of satisfying the asset and income tests for qualification as a REIT for tax purposes, ourthe proportionate shares of the assets and income of ourthe operating partnership are deemed to be ourthe assets and income.income of the Trust.

3

3

Operating Partnership

OurThe UPREIT structure is used to facilitate acquisitions of real estate properties. A sale of property directly to a REIT is generally a taxable transaction to the property seller. However, in an UPREIT structure, if a property seller exchanges the property for limited partnership units, the seller may defer taxation of gain in such exchange until the seller resells its limited partnership units or exchanges its limited partnership units for the REIT’s common stock. By offering the ability to defer taxation, the Trust may gain a competitive advantage in acquiring desired properties over other buyers who cannot offer this benefit. In addition, investing in the operating partnership, rather than directly in the Trust, may be more attractive to certain institutional or other investors due to their business or tax structure. If an investor is interested in making a substantial investment in our operating partnership, the structure provides the Trust the flexibility to accommodate different terms for each investment, while applicable tax laws generally restrict a REIT from charging different fee rates among its shareholders. Finally, if the Trust’s shares become publicly traded, the former property seller may be able to achieve liquidity for the investment in order to pay taxes.

Operating Partnership

Sterling Properties, LLLP, was formed as a North Dakota limited liability limited partnership onin April 25, 2003 to acquire, own and operate properties on ourthe Trust’s behalf. The operating partnership holds a diversified portfolio of multifamily dwellings and commercial properties located principally in the upper and central Midwest United States.

Since our formation, ourthe Trust’s focus has consisted of owning and operating income-producing real estate properties. In 2006, wethe Trust held 23 total properties approximating $56,265 in total assets.assets, in the operating partnership. Between 2007 and 2017, we2022, the Trust focused extensively on strengthening the multifamily component of ourthe portfolio, acquiring properties directly or through UPREIT transactions. A majority of these multifamily properties wereare located in North Dakota. OurThe portfolio has grown to 166185 properties, approximating $691,605$888,723 in total assets, and book equity, including noncontrolling interests, of approximately $273,775$323,466 as of December 31, 2017.2022. As of December 31, 2017, our2022, the portfolio contained approximately 9,40111,300 apartment units and 1,691,0001,498,000 square feet of leasable commercial space.

As of December 31, 2017, approximately 71.0% (based on cost) of the properties were apartment communities located primarily in North Dakota and Minnesota with others located in Missouri and Nebraska. Most multifamily dwelling properties are leased to a variety of tenants under short-term leases.

As of December 31, 2017, approximately 29.0% (based on cost) of the properties comprised industrial, office, retail and medical commercial properties located primarily in North Dakota with others located in Arkansas, Colorado, Iowa, Louisiana, Michigan, Mississippi, Minnesota, Nebraska, Texas and Wisconsin. Most commercial properties are leased to a variety of tenants under long-term leases.

OUR PEOPLE

We do not have any employees. Instead, we rely on our external Advisor to conduct our day-to-day affairs.

Our Advisor to the Trust

Our external Advisor is Sterling Management, LLC, a North Dakota limited liability company formed onin November 14, 2002. Our2002, is the external Advisor to the Trust. The Advisor is responsible for managing our day-to-day affairs and for identifying, acquiring and disposing investments on our behalf. The Advisor is 100% owned by Trustmark Enterprises, Inc., formerly known as Alloy, a North Dakota corporation (“Trustmark”). Trustmark is owned in part by Kenneth P. Regan, a trusteeTrustee and our Chief Executive Officer by an entity controlledof the Trust, by James S. Wieland, also onea Trustee of our trustees andthe Trust, by Joel S. Thomsen, our Chief Investment Officer.President of the Trust. In addition, Messrs. Regan, Wieland, Thomsen and ThomsenGleave serve on the Advisor’s Board of Governors of the Advisor. From 2007 to 2017, ourGovernors. The Advisor’s staff increasedemployee base has seen considerable growth, both in number and expertise, growing from 4since its inception.

Audit and Disclosure Committee

The Audit and Disclosure Committee was established by the Board of Trustees to 19 full-time employeesassist the Board in fulfilling its fiduciary duties and oversight responsibilities. The Audit and Disclosure Committee assists the Board by overseeing the integrity of the Trust’s financial statements, financial reporting and disclosure processes, internal accounting and financial controls and the annual independent audit of the Trust’s financial statements. The Audit and Disclosure Committee also oversees the establishment and maintenance of processes to assure the Trust’s compliance with all applicable laws, regulations, and Trust policy, including a president, chief accounting officer, chief investment officer, controller, accounting supervisor,compliance with filing requirements under the Exchange Act and the rules and regulations promulgated thereunder. In performing its work, it is the Audit and Disclosure Committee’s responsibility to foster free and open means of communication between the Trustees, the independent auditors and the Trust’s financial accountants, asset managers, directormanagers. Our Audit and Disclosure Committee is currently comprised of investor relations,Trustees Timothy A. Hunt (Chair of the Committee), Ann L. Christenson, Timothy L. Haugen, Michelle L. Korsmo, and directorMark T. Polovitz.

4

Our Board of Trustees and Executive Officers

We operateThe Trust operates under the direction of our Board of Trustees, the members of which are accountable to usboth the Trust and ourits shareholders. Our trusteesThe Trustees are elected annually by our shareholders. In addition, the Board has a duty to supervise our relationship with the Advisor and evaluatesevaluate the performance of and fees paid to the Advisor on an annual basis. The Advisory Agreement was approved by the Board of Trustees (including all the independent trustees) on March 24, 2022, effective April 6, 2017, effective January 1, 2017. Our2022 until March 31, 2023. The Board of Trustees has provided investment guidance for the Advisor to follow and must approve each investment recommended by the Advisor. Currently, we have ninethe Advisor has eight members on our board, seventhe Board, six of whom are independent.

Although we havethe Trust has executive officers, we doit does not have any paid employees. OurThe President, Chief Executive Officer, Chief Investment Officer, Chief AccountingFinancial Officer and Treasurer, and General Counsel and Secretary of the Trust, are also officers, employees, owners, or governors of our Advisor. Among others, such executive officers oversee ourthe Advisor’s day-to-day operations with respect to us.the Trust. However, when doing so, such executive officers are acting on behalf of ourthe Advisor in performing the Advisor’s obligations under the Advisory Agreement. Generally, the only services performed by ourthe Trust’s executive officers are those

4

required by law or regulation, such as executing documents as required by North Dakota law and providing certifications required by the federal securities laws.

Organizational Structure

On January 1, 2021, the advisor was acquired by Trustmark Enterprises, Inc. in an equity transfer.

The following chart shows our structure:the relationship structure with the advisor:

| (1) |

|

|

| (2) |

|

|

| (3) |

|

|

OUR

5

CORE INVESTMENT OBJECTIVES AND STRATEGY

Investment Objectives

OurThe Trust’s primary investment objectives are to:

|

|

|

|

|

|

WeThe Trust may change ourthe investment objectives only with the approval of holders of a majority of the outstanding common shares.

Investment Guidance

The Board of Trustees has provided investment guidance to the Advisor to direct the investment strategy of the Trust. Changes to the investment guidance must be approved by the Board. The Advisor has been authorized to execute:

| ● | Commercial and multifamily real estate property acquisitions and dispositions, |

| ● | Investments in other real estate related assets, in each case so long as such investments are approved by our Board, |

| ● | Acquisitions of property or land for the purposes of future development; and |

| ● | Capital investments in the portfolio’s current properties through capital improvements. |

The Board will have ultimate oversight over the Trust’s investments and may change from time to time the scope of authority delegated to the Advisor with respect to acquisition and disposition transactions.

Investment Strategy

PriorSterling’s current investment strategy and focus is on multifamily properties. Our Advisor monitors industry trends and invests in property believed to January 1, 2016,provide the most favorable return balanced with risk. We attempt to manage our real estate portfolio by evaluating changes or trends in the industries in which our tenants operate, the creditworthiness of our tenants and changes or trends in the area demographics surrounding our properties for evidence that our properties will continue to meet our investment strategy was primarily to acquireobjectives of cash flow, preservation of capital and hold a diverse portfolio of commercial real estate properties or portfolios or real estate properties in various sectors, including multifamily residential, industrial, retail, office, medical and other commercial properties, including restaurants, primarily located in the central corridor of the contiguous 48 states. Effective January 1, 2016, the Trust’s investment strategy is to acquire and hold ownership interests

5

in real estate properties in multifamily residential properties located in these markets.capital appreciation. There is no current plan for the existing commercial properties (industrial, medical, office and retail) in regards toregarding retention, acquisition, or disposition.

The majority of our acquisitions are locatedTrust will primarily invest in existing or near metropolitan areas. However, there is no limitation on the geographic areasnewly developed real estate properties. The Trust may also invest in which we may acquire targeted investments.

We may acquire portfolios ofinterests in real estate properties held by individual owners and real estate properties held by funds, including hedge funds. We anticipate such property owners will primarily sell the properties in exchange for limited partnershipacquiring direct ownership or ownership interests of the operating partnership.

We may make investments alone or together with other investors, including with affiliates of the Advisor, through holding company structures or joint ventures, real estate partnerships, tenant-in-common deals, REITs, or other collective investment vehicles.

Investment Guidance

Our Board of Trustees has provided investment guidance to the Advisor to direct our investment strategy. Changes to our investment guidance must be approved by our Board. The Advisor has been authorized to execute (1) commercial real estate property acquisitions and dispositions and (2) investments in other real estate related assets, in each case so long as such investments are approved by our Board. Our Board will at all times have ultimate oversight over our investments and may change from time to time the scope of authority delegated to our Advisor with respect to acquisition and disposition transactions. Effective January 1, 2016, our investment guidance is that future real estate investments be limited to multifamily apartment properties. We currently have no plans with respect to our commercial properties in regards to retention or disposition.

Investments in Real Estate Properties

Our investment guidance provides we will primarily invest in existing or newly constructed real estate properties and interests in real estate properties in multifamily residential, apartment and senior housing properties by acquiring direct ownership or ownership interests through equity interests or other joint venture structures. WeTrust may also invest in other real estate property types, including undeveloped land or other development opportunities if the land is acquired for the purpose of producing rental or other operating income and either development or construction is in process or development or construction is planned. Wethe future. The properties the Trust primarily investinvests in real estate properties withhave existing rent and expense schedules, or the properties are newly constructed properties with predictable cash flows. We concentrate our efforts on real estate properties located primarily in North Dakota and Minnesota, the central corridor of the contiguous 48 states and

Most current acquisitions are in or near metropolitan areas.

Investments However, there is no limitation on the geographic areas in Real Estate Related Assets

Our guidelines providewhich we may invest in real estate related assets. These assets include securities of other companies engaged in real estate activities, mortgage-backed securities and conventional mortgage loans. However, to date, our investment in such assets have been nominal. We may increase such investments in the future, but do not anticipate such investment amounts to be material or long term. acquire targeted investments.

Investments in Cash, Cash Equivalents and Other Short-Term Investments

We may invest in cash, cash equivalents and other short-term investments. Consistent with the rules applicable to qualification as a REIT, such investments may include investments in the following: money market instruments; short-term debt instruments, such as commercial paper, certificates of deposit, bankers’ acceptances, repurchase agreements, interest-bearing time deposits and corporate debt securities; corporate asset-backed securities; and U.S. government or government agency securities. However, to date, our investment in such assets have not been material, and we do not expect to increase such investments in the near future.

6

CONFLICTS OF INTEREST

We are subject to various conflicts of interest arising out of our relationship with our trustees, executive officers, key personnel and our Advisor and its affiliates. Some of the conflicts of interest in our transactions with our Advisor and others are described below.

Our trustees and officers and the officers and key personnel of our Advisor (herein individually and collectively our “Leadership”) may spend a portion of their time on activities unrelated to us, which may significantly reduce the amount of time to be spent by one or more of our Leadership on Sterling activities. Each of our Leadership, including Messrs. Regan and Wieland, is currently expected to spend a significant portion of their time on our behalf, but may not always spend a majority of their time on our behalf.

One or more of our Leadership, including Messrs. Regan and Wieland,The Trust may also serve as trustees, directors, governors, members, officers or key personnel of other: (a) affiliated entities, including our Advisor; (b) real estate programs, real estate entities, or REITs; (c) advisors to other real estate programs, real estate entities or REITs; or (d) property managers to real estate programs, real estate entities or REITs (herein collectively “Other Real Estate Related Activities”). In addition, from time to time, members of our Leadership may purchase real estate or interests in real estate for themselves, which may conflict with Sterling’s activities or objectives. Leadership’s management of Other Real Estate Related Activities may significantly reduce the amount of time our Leadership is able to spend on Sterling related activities. Given Leadership is or may become involved in Other Real Estate Related Activities, there may be times where Sterling’s fundraising, acquisition, disposition and liquidation activities overlap with similar activities of Leadership’s Other Real Estate Related Activities. This overlap may cause conflicts of interest to arise with respect to, among other things, finding investors, locating and acquiring real estate investments, leasing activities and disposing of investments. The conflicts of interest faced could generally cause our operating results to suffer.

Certain members of Leadership will have fiduciary duties relating to their Other Real Estate Related Activities. These fiduciary duties may conflict with Leadership’s duties to Sterling and its shareholders. Leadership’s Other Real Estate Related Activities could result in actions or inactions detrimental to Sterling, which could harm the implementation of Sterling’s business strategies and Sterling’s investments. If Sterling does not successfully implement its business strategy, we may be unable to generate cash needed to pay dividends to shareholders and to maintain or increase the value of our assets.

Conflicts with Sterling’s business and interests are most likely to arise from Leadership’s involvement in activities related to: (a) allocation of new investments and management time and services between Sterling and Leadership’s Other Real Estate Related Activities, (b) allocation of time and services between Sterling and Leadership’s Other Real Estate Related Activities; (c) Sterling’s purchase of properties from, or sale of properties to, affiliated entities, (c) the timing and terms of the investment in or sale of an asset, (d) development of our properties by affiliates, (e) investments with or activities of affiliates of our Advisor and (f) compensation to our Advisor.

To the extent Leadership engages in future Other Real Estate Related Activities, Sterling may compete for investors with such activities. Any overlap of capital raising efforts of Other Real Estate Related Activities with Sterling’s capital raising efforts or other activities could adversely affect our ability to raise capital in the future and the amount of proceeds we have to spend on real estate investments.

Sterling may, in the future, purchase real estate investments at the same time as Leadership is purchasing real estate investments via Other Real Estate Related Activities. As a result, Leadership may owe duties to both Sterling and the Other Real Estate Related Activities, their members and limited partners and these investors, which duties may from time to time conflict with the duties they owe to Sterling and its shareholders.

Leadership may engage for their own account in business activities of the types conducted or to be conducted by Sterling or our subsidiaries. To the extent Leadership takes actions that are more favorable to other entities than to us, these actions could have a negative impact on Sterling’s financial performance and, consequently, on dividends to our shareholders and

7

the value of our stock. For a description of some of the risks related to these conflicts of interest, see the section of this periodic report captioned ‘‘Risk Factors — Risks Related to Conflicts of Interest.’’

Interests in Other Real Estate Programs

Leadership and entities owned by Leadership may, in the future, acquire real estate investments for their own accounts, and have done so in the past. Furthermore, Leadership and entities owned or managed by Leadership may form additional real estate investment entities in the future, including additional REITs, which can be expected to have the same or similar investment objectives and policies as we do and which may be involved in the same geographic areas. Leadership is not obligated to present to us any particular investment opportunity that comes to their attention, unless such opportunity is of a character that might be suitable for investment by us. Leadership likely will experience conflicts of interest as they simultaneously perform services for us and Other Real Estate Related Activities.

Any affiliated entity, whether or not currently existing, could compete with us in the purchase, sale or operationportfolios of real estate investments. Weproperties held by individual owners and real estate properties held by funds, including hedge funds. It is anticipated that such property owners will seek to achieve any operating efficiency or similar savings that may result from affiliated management of competitive investments. However, toprimarily sell the extent that affiliates own or acquire an investment that is adjacent or its underlying property is adjacent, orproperties in close proximity, to a property we own, our property may compete with the affiliate’s propertyexchange for tenants or purchasers. Every transaction that we enter into with Leadership is subject to an inherent conflict of interest. Leadership may encounter conflicts of interest in enforcing our rights against any affiliate in the event of a default by or disagreement with an affiliate or in invoking powers, rights or options pursuant to any agreement between us and our advisor or any of its affiliates.

Other Activities of Our Advisor and Its Affiliates

We rely on our Advisor for the day-to-day operation of our business. As a resultlimited partnership interests of the current and/or future interests of Leadership in any other program and the fact that they also are engaged, or may continue to engage, in Other Real Estate Related Activities, Leadership has conflicts of interest in allocating their time between us and any other programs and other activities in which they are involved. Our Advisor presently believes that it and its affiliates have sufficient personnel to discharge fully their responsibilities to all of the sponsored programs and other ventures in which they are or may become involved.operating partnership.

In addition, each of our executive officers also serves or may serve in the future as an officer of one or more affiliated entities, including our Advisor, and/or other affiliated entities. As a result, these individuals owe or will owe fiduciary duties to these other entities, which may conflict with the fiduciary duties that they owe to us and our shareholders.

We may purchase real estate investments from affiliates of our Advisor. The prices we pay to affiliates of our Advisor for these investments will not be the subject of arm’s-length negotiations, which could mean that the acquisitions may be on terms less favorable to us than those negotiated with unaffiliated parties.

Competition in Acquiring, Leasing and Operating of Properties

Conflicts of interest will exist to the extent Sterling acquires, or seeks to acquire, properties in the same geographic areas where properties owned by Leadership or Leadership’s Other Real Estate Related Activities are located. In such a case, a conflict could arise in the acquisition or leasing of properties if we and one of Leadership’s Other Real Estate Related Activities were to compete for the same properties or tenants in negotiating leases, or a conflict could arise in connection with the resale of properties if we were to attempt to sell similar properties at the same time.

Conflicts of interest also may exist at such time as we or our affiliates managing property on our behalf seek to employ developers, contractors or building managers, as well as under other circumstances. Leadership will seek to reduce conflicts relating to the employment of developers, contractors or building managers. Leadership will also seek to reduce conflicts that may arise with respect to properties available for sale or rent. However, these conflicts cannot be fully avoided in that there may be established differing compensation arrangements at different properties or differing terms for resales or leasing of the various properties.

8

6

Joint Ventures with Affiliates

We may enter into joint ventures with Leadership’s Other Real Estate Related Activities (as well as other parties) for the acquisition of real estate investments. Leadership may have conflicts of interest in determining whether its Other Real Estate Related Activity should enter into any particular joint venture agreement. The co-venturer may have economic or business interests or goals which are or which may become inconsistent with Sterling’s business interests or goals. In addition, should any such joint venture be consummated, Leadership may face a conflict in structuring the terms of the relationship between Sterling’s interests and the interest of the co-venturer and in managing the joint venture. Since Leadership may control both us and any affiliated co-venturer, agreements and transactions between the co-venturers with respect to any such joint venture may not have the benefit of arm’s-length negotiation of the type normally conducted between unrelated co-venturers.

Conflict Resolution

Every transaction that we enter into with Leadership will be subject to an inherent conflict of interest. Our Board of Trustees may encounter conflicts of interest in enforcing our rights or options against a member of Leadership in the event of a disagreement.

SEGMENT DATA

We report our results in two reportable segments: residential and commercial properties. Our residential properties include multifamily. Our commercial properties include retail, office, industrial restaurant and medical properties. We assess and measure operating results based on the non-GAAP financial measurement of net operating income (“NOI”), which we define as total real estate segment revenues less real estate expenses (which consist of real estate taxes, property management fees, utilities, repairs and maintenance, insurance and direct administrative costs). We believe NOI is an important measure of operating performance even though it should not be considered an alternative to net income or cash flow from operating activities. NOI is unaffected by financing, depreciation, amortization, legal and professional fees and othercertain general and administrative expenses.

COMPETITION

Our properties are located in highly competitive real estate markets. The number of competitive properties in a particular area could have a material adverse effect on our ability to lease space and the amount of rent we can charge at our properties. We compete with many property owners, such as corporations, limited partnerships, individual owners, other real estate investment trusts, insurance companies and pension funds.

Our competition also consists of other owners and developers of multifamily and commercial properties who are trying to attract tenants to their properties. We also compete with other real estate investors such as individuals, partnerships, corporations and other REITs to acquire properties that meet our investment objectives. This competition influences our ability to acquire properties and the prices that we may pay for those properties. We do not have a dominant position in any of the markets in which we operate and many of our competitors have greater financial and other resources than us and may have substantially more operating experience than either us or our Advisor. We believe, however, that the diversity of our investments, the experience and abilities of our management and the quality of our assets affords us some competitive advantages that have in the past, and should in the future, allow us to operate our business successfully despite the competitive nature of our business.

Generally, there are multifamily and other similar commercial properties within relatively close proximity to each of our properties. RegardingThe majority of our retail properties inare restaurants and pharmacies. In addition to competitor retail properties with similar business models, we and our tenants face increasing competition from outlet malls, internet shopping websites, discount shopping clubs, catalog companies, direct mail and telemarketing.

9

ENVIRONMENTAL MATTERS AND GOVERNMENT REGULATION

As an owner of real estate, we are subject to various environmental laws, rules and regulations adopted by various governmental bodies or agencies. These laws and regulations generally govern wastewater discharges, air emissions, the operation and removal of underground and above-ground storage tanks, the use, storage, treatment, transportation and disposal of solid hazardous materials, the remediation of contaminated property associated with the disposal of solid and hazardous materials and other health and safety-related concerns. Under these laws, a current or previous owner or operator of real estate may be liable for the costs of removal or remediation of certain hazardous or toxic substances released at a property and may be held liable to a governmental entity or to third parties for property damage or personal injuries and for investigation and clean-up costs incurred in connection with any contamination. We could be subject to liability in the form of fines or damages for noncompliance with these laws and regulations, and some environmental laws create a lien on a contaminated site in favor of the government for damages and costs it incurs in connection with the contamination. Some of these laws and regulations may impose joint and several liability on residents, owners, or operators for the costs of investigation or remediation of contaminated properties, regardless of fault or the legality of the original disposal. In addition, the presence of these substances, or the failure to properly remediate these substances, may adversely affect our ability to sell or rent the property or to use the property as collateral for future borrowing. Compliance with new or more stringent laws or regulations or stricter interpretation of existing laws may require material expenditures by us.

In addition, we are subject to many other laws and governmental regulations applicable to our properties, and changes in the laws and regulations, or in their interpretation by agencies and the courts, occur frequently. Under the Americans with Disabilities Act of 1990 (the “ADA”), all places of public accommodation are required to meet certain federal requirements related to access and use by disabled persons. The Fair Housing Amendments Act of 1988 (the “FHAA”) requires apartment communities first occupied after March 13, 1991, to be accessible to the handicapped and prohibits housing discrimination based upon familial status, which is commonly referred to as age-based discrimination. status.

7

The Housing for Older Persons Act (HOPA)(“HOPA”) provides age-based discrimination exceptions for housing developments qualifying as housing for older persons. Non-compliance with ADA, FHAA or HOPA could result in the imposition of fines, awards of damages to private litigants, payment of attorneys’ fees and other costs to plaintiffs, substantial litigation costs and substantial costs of remediation. We believe our properties which are subject to ADA, FHAA and/or HOPA are substantially in compliance with their present requirements.

Compliance with these laws, rules, and regulations has not had a material adverse effect on our business, assets, or results of operations, financial condition, or ability to pay dividends. We do not believe our existing portfolio as of December 31, 20172022 will require us to incur material expenditures to comply with these laws and regulations. However, we cannot assure that future laws, ordinances, or regulations will not impose any material liability, or that the current environmental condition of our properties will not be affected by the operations of tenants, by the existing condition of the land, by operations in the vicinity of the properties, such as the presence of underground storage tanks, or by the activities of unrelated third parties.

AVAILABLE INFORMATION

We electronically file our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy and information statements and all amendments to these filings with the Securities and Exchange Commission (“SEC”). The public may read and copy any materials filed by us with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549, on official business days during the operation of 10:00 am to 3:00 pm. The public may obtain information on the operation of the Public Reference Roominternet site maintained by calling the SEC at (800)-SEC-0330. The SEC maintains an Internet site at www.sec.gov that contains reports, proxy and information statements and other information regarding issuers that file electronically.

. We will make these reports available, free of charge, by responding to requests addressed to 1711 Gold Drive South, Suite 100, Fargo, North Dakota 58103. You may also request reports by calling the telephone number (701) 353-2720. Additionally, we maintain an internet site at www.sretrust.comwww.smftrust.com, which includes the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-Kreports and all amendments to those reports.other documents we file with the SEC. These reports are

10

available as soon as reasonably practicable after such material is electronically filed or furnished to the SEC. This reference to our website is not intended to incorporate information found on the website into this filing.

Risks Related to Sterling Real Estate Trust

Common shares of beneficial interest represent an investment in equity only, and not a direct investment in our assets. Therefore, common shareholders will hold only an indirect interest in our assets.

The common shares of beneficial interest represent an equity interest only in us, not in any of our assets or the real estate or real estate related investments made by our operating partnership. We will have no substantial assets other than our equity interest in the operating partnership. Neither the Advisor nor any of its managers or affiliates have any obligation with respect to the payment of dividends to our shareholders or the return of capital investments made to us by the shareholders.

Our results are dependent on amounts received from the leasing and resale of investments, which are subject to market and economic changes. If income is insufficient to meet our capital needs, our ability to carry out our business plans could be adversely affected.

Our purpose is to acquire and hold our real estate investments as long-term investments before we resell the investments to maximize anticipated appreciation for our shareholders.investments. The primary income that will be generated by us will be the profits, if any, from the operation or holding of the real estate and real estate related investments and upon the resale of the investments. If circumstances arise which cause an investment to become undesirable or remain at its current value or decrease in value, we may generate less income than anticipated.

We may raise additional funds in the future to fund our capital needs, which may not be available on acceptable terms if at all.

We may need to raise additional capital in the future in order to fulfill our business plans. The timing and amount of our future capital needs will depend on a number of factors, including the revenue generated by the operation of our real estate investments, when and if the properties will appreciate in value, the resale price of the properties and other real estate related investments, our future operating expenses and required capital outlays. There can be no assurance additional financing will be available when needed on terms favorable to us, if at all.

Further, we may be required to raise additional capital and sell additional securities in the future on terms which are more favorable to those investors than the terms under which our current shareholders purchased their common shares. If adequate funds are not available or are not available on acceptable terms, our ability to fund our current business plans and to acquire additional real estate and real estate related investments would be significantly limited. Such limitation could have a material adverse effect on our results.

Our success is based on continuing to locate and hold suitable real estate investments, and failure of our Advisor to locate additional suitable properties or the unsuccessful operation of our existing real estate investments could adversely affect our operations and our ability to pay dividends.

Our ability to achieve our investment objectives and to pay dividends to our shareholders and distributions to unitholders is dependent upon the performance of our Advisor in locating suitable investments and appropriate financing arrangements for us as well as on the successful management of our properties after acquisition. We currently own, through the operating partnership, the properties described under Item 2 –— Properties.

11

We cannot be sure our Advisor will be successful in locating suitable investments on financially attractive terms, or be certain that operation of the properties will avoid the risks attendant to real estate acquisitions, such as:

| The risk properties may not perform in accordance with expectations, including projected occupancy and rental |

| The risk we may have underestimated the cost of improvements or repairs required to bring or keep an acquired property up to or at standards established for its intended use or its intended market position. |

Our Board

8

We may have to make expedited decisions on whether to invest in certain properties, or real estate-related assets, including prior to receipt of detailed information.

Our Board of TrusteesWe may be required to make expedited decisions in order to effectively compete for the acquisition of desirable properties and other real estate-related assets. In such cases, our Advisor and Board of Trustees may not have access to detailed information regarding real estate investments such as physical characteristics, environmental matters, zoning regulations or other local conditions affecting the real estate investment, at the time of making an investment decision to pay a non-refundable deposit and to proceed with an acquisition. In addition, the actual time period during which our Advisor will be allowed to conduct due diligence may be limited. Therefore, there can be no assurance our Advisor and Board of Trustees will have knowledge of all circumstances that may adversely affect an investment.

We face competition from other real estate investors for suitable properties, and may not be successful in our attempts to acquire desirable properties.

The multifamily and commercial real estate industries are highly competitive, and we face competition for investment opportunities. These competitors may be real estate developers, real estate financing entities, real estate investment trusts, mutual funds, hedge funds, investment banking firms, institutional investors and other entities or investors that acquire real estate and may have substantially greater financial resources than we do. These entities or investors may be able to accept more risk than our Board of Trustees believes is in our best interest. This competition may limit the number of suitable investment opportunities offered to us. This competition also may increase the bargaining power of property owners seeking to sell to us, making it more difficult for us to acquire properties or interests in properties. In addition, we believe competition from entities organized for purposes similar to ours may increase in the future.

We may change our investment and operational policies without shareholder consent, and such changes could increase our exposure to additional risks.

Generally, the Board of Trustees may change our investment and operational policies, including our policies with respect to investments, acquisitions, growth, operations, indebtedness, capitalization and distributions, at any time without the consent of our shareholders, which could result in our making investments different from, and possibly riskier than investments made in the past. A change in our investment policies may, among other things, increase our exposure to interest rate risk, default risk and commercial real estate market fluctuations, all of which could materially affect our ability to achieve our investment objectives.

There can be no assurance dividends or distributions will be paid or increase over time.

There are many factors that can affect the availability and timing of cash dividends to our shareholders.shareholders and distributions to unitholders. Dividends and distributions will be based principally on cash available from our real estate and real estate relatedother investments. The amount of cash available for dividends will be affected by many factors, such as our ability to acquire profitable real estate investments, and successfully manage our real estate properties, and our operating expenses.expenses, and general economic conditions. We can give no assurance we will be able to pay or maintain dividends or distributions or that dividends or distributions will increase over time. Our actual results may differ significantly from the assumptions used by our Board of Trustees in establishing the dividend rate to our shareholders.

12

We may pay dividends from sources other than our cash flow from operations, which could subject us to additional risks.

We are permitted to pay distributions from any source. If we fund dividends from cash flow from operations or working capital, we will have less funds available for investment in real estate and real estate related investments and our shareholders’ overall return may be reduced. Actual cash available for dividends may vary substantially from the estimates of our Board of Trustees. Because we may receive income from interest or rents at various times during our fiscal year, dividends paid may not reflect our income earned in that particular dividend period. In these instances, we may obtain third party financing to fund our dividends, causing us to incur additional interest expense. We may also fund such dividends from the sale of assets or additional securities. Any of these actions could potentially negatively affect future results of operations.

Dividends may include a return of capital, and shareholders may be required to recognize capital gain on distributions.

Dividends payable to shareholders may include a return of capital. To the extent dividends exceed cash flow from operations, a shareholder’s basis in our shares will be reduced and, to the extent dividends exceed a shareholder’s basis, the shareholder may recognize capital gain and be required to make tax payments.

We depend on certain executive officers and trustees, and the loss of such persons may delay or hinder our ability to carry out our investment strategies.

Our future success substantially depends on the active participation of James Wieland, one of our trustees, Kenneth Regan, our Chief Executive Officer and a trustee, and Joel Thomsen, ourPresident, Damon Gleave, Chief Financial Officer and Treasurer, and Barry Schmiess, Chief Investment Officer. Messrs. Wieland, Regan, and Thomsen are also governors and owners of theour Advisor. Messrs. Wieland, and Regan, have over 3740 years of extensive experience each in the commercial real estate industry, and have been instrumental in setting our strategic direction, operating our business and arranging necessary financing, and through the Advisor, in locating desirable real estate investments and wherewere serving as property manager, managing our properties. Losing the services of Messrs. Wieland, Regan, Thomsen, Gleave, or ThomsenSchmiess without replacing their position with someone of the same competence and experience, could have a material adverse effect on our ability to successfully carry out our investment strategies and achieve our investment objectives. There can be no guarantee they will remain affiliated with us. See “Risks Related to Conflicts of Interest.”Interest”.

Our systems9

Cybersecurity risks and cyber incidents may not be adequate to support our growth, and our failure to successfully oversee our portfolio of real estate investments could adversely affect our business by causing a disruption to our operations, a compromise or corruption of our confidential information, and/or damage to our business relationships, all of which could negatively impact our financial results.

A cyber incident is considered to be any adverse event that threatens the confidentiality, integrity or availability of our information resources. These incidents may be an intentional attack or an unintentional event and could involve gaining unauthorized access to our information systems for purposes of misappropriating assets, stealing confidential information, corrupting data, or causing operational disruption. The result of these incidents may include disrupted operations, misstated or unreliable financial data, liability for stolen assets or information, increased cybersecurity protection and insurance costs, litigation, and damage to our investor relationships. As our reliance on technology has increased, so have the risks posed to our information systems, both internal and those provided by Sterling Management and service providers. Our and Sterling Management’s processes, procedures and internal controls that are designed to mitigate cybersecurity risks and cyber intrusions do not guarantee that a cyber incident will not occur or that our financial results, operations, or confidential information will not be negatively impacted by such an incident.

We are not required to comply with certain reporting requirements, including those relating to auditor’s attestation reports on the effectiveness of operation.our system of internal control over financial reporting, accounting standards and disclosure about our executive compensation, that apply to other public companies.

There can be no assuranceSo long as our shares of common stock are not traded on a securities exchange, we will be abledeemed to adaptbe a “non-accelerated filer” under the Exchange Act, and as a non-accelerated filer, we will be exempt from compliance with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act. In addition, so long as we are externally managed by the Advisor and we do not directly compensate our management,executive officers, or reimburse the Advisor or its affiliates for salaries, bonuses, benefits and severance payments for persons who also serve as one of our executive officers or as an executive officer of the Advisor, we do not have any executive compensation.

Many of our costs, such as operating and general and administrative accounting and operational systems, or hire and retain sufficient staff, to support any growth we may experience. Our failure to successfully oversee our current and futureexpenses, real estate investmentsacquisition, and constructions costs, could be adversely impacted by period of heightened inflation.

A sustained or developmentsfurther increase in inflation could have a materialan adverse effectimpact on our results of operationoperating expenses incurred in connection with, among others, the property-related services such as repairs and financial conditionmaintenance, janitorial, utilities, security and our ability to pay dividends to our shareholders.insurance. Our operating expenses may be recoverable through commercial lease arrangements.

Risks Related to Our Structure

There are limitations on ownership of our common shares of beneficial interest, which could discourage a takeover transaction even if it is beneficial to our shareholders.

Our Amended Declaration of Trust provides no person may own more than 9.9% of our outstanding common shares of beneficial interest. Even if a shareholder did not acquire more than 9.9% of our shares, the shareholder may become subject to such restrictions if redemptions by other shareholders cause the holdings to exceed 9.9% of our outstanding shares. This limitation may have the effect of delaying, deferring or preventing a transaction or a change in control of us, including an extraordinary transaction (such as a merger, tender offer or sale of all or substantially all of our assets) that might provide a premium price for our shareholders, even if it would be in the best interest of our shareholders. The ownership limits and restrictions on transferability will continue to apply until our Board of Trustees determines it is no longer in our best interest to continue to qualify or seek to qualify as a REIT.

13

Our shareholders may experience dilution if we or our operating partnership issues additional securities.

Our shareholders do not have preemptive rights to any shares issued by us in the future. If we sell or issue additional shares in the future to raise capital, issue additional shares pursuant to a dividend reinvestment plan or issue shares in exchange for limited partnership units pursuant to theour operating partnership’s Limited Liability Limited Partnership Agreement (“LLLP Agreement”) of our operating partnership,, our shareholders will experience dilution of their equity investment in us.investment. In addition, if our operating partnership sells additional securities or issues additional securities in connection with a property acquisition transaction, we would, and indirectly our shareholders would, experience dilution in their equity position in the operating partnership.position.

Our shareholderssecurityholders have limited control over our operation, and the Board of Trustees has the sole power to appoint and terminate the Advisor.

Our Board of Trustees has the sole authority to determine our major policies, including our policies regarding financing, growth, investment strategies, debt capitalization, REIT qualification, distribution, and to take certain actions including acquiring or disposing of real estate and real estate related investments, dividend declaration and the election or removal of the Advisor. Our shareholderssecurityholders do not have the right to remove the Advisor but have the right to elect and remove trustees.

10

Under theour Third Amended and Restated Declaration of Trust, our trustees may not do the following without the approval of the holders of a majority of the outstanding common shares of beneficial interest:

| Amend the Third Amended and Restated Declaration of Trust, except for amendments which do not adversely affect the rights, preference and privileges of |

| Sell all or substantially all of our assets other than in the ordinary course of business or in connection with a liquidation and |

| Conduct a merger or other reorganization of the trust; or |

| Dissolve or liquidate us. |

In addition, theOur shareholders have the right, without the concurrence of the Board of Trustees, to terminate the trust and liquidate our assets or amend the Third Amended and Restated Declaration of Trust.

Shareholders have no role in determining our investments and must rely on our Advisor and oversight by the Board of Trustees.

For future acquisitions or dispositions, the Board of Trustees has the authority to approve such investment acquisitions or dispositions without shareholder approval. Therefore, shareholders will not be able to evaluate the terms of future investment acquisitions or dispositions, their economic merit or other relevant financial data before we acquire or sell such investments. The shareholdersShareholders must rely entirely on the oversight of our Board of Trustees, the management ability of our Advisor and the performance of the property managers.

We may issue securities with more favorable terms than the outstanding shares without shareholder approval.

Under our Third Amended and Restated Declaration of Trust, our Board of Trustees has the authority to establish more than one class or series of shares and to fix the relative preferences and rights regarding conversion, voting powers, restrictions, limitations as to dividends and other distributions, and terms or conditions of redemption of such different classes or series without shareholder approval. Thus, our Board could authorize the issuance of a class or series of shares with terms and conditions that could have priority as to dividends and amounts payable upon liquidation over the rights of the holders of our outstanding common shares of beneficial interest. Such class or series of shares could also have the effect of delaying, deferring or preventing a change in control of us, including an extraordinary transaction (such as a merger, tender offer or sale of all or substantially all of our assets) that might otherwise provide a premium price to holders of our shares, even if it would be in the best interest of our shareholders.

14

Shareholders could incur current tax liability on dividends they elect to reinvest in our shares, and may have to use separate funds to pay their tax liability.

Shareholders that participate in our dividend reinvestment plan will be deemed to have received, and for income tax purposes will be taxed on, the amount reinvested in shares to the extent the amount reinvested was not a tax-free return of capital. In addition, our shareholders will be treated for tax purposes as having received an additional dividend to the extent the shares are purchased at a discount to fair market value. As a result, unless shareholders are a tax-exempt entity, they may have to use funds from other sources to pay their tax liability on the value of the shares received.

Our trustees, officers, Advisor and its affiliates have limited liability to us and our shareholders, and may have the right to be indemnified under certain conditions.

Our Amended Declaration

11

There may be conflicts of interest between us and our shareholders on one side and our operating partnership and its limited partners on the other side.

Our trustees and officers have duties to us and our shareholders in connection with their management of us. At the same time, we, as general partner will have duties to our operating partnership and its limited partners in connection with the management of the operating partnership. Our duties as general partner of the operating partnership may come into conflict with the duties of our trustees and officers to us and our shareholders. The LLLP Agreement of our operating partnership expressly limits our liability for monetary damages by providing we will not be liable for losses sustained, liabilities incurred or benefits not derived if we acted in good faith. In addition, our operating partnership is required to indemnify us and our trustees and officers from and against any and all claims arising from operations of our operating partnership, unless it is established: (1) the act or omission was material and committed in bad faith or was the result of active and deliberate dishonesty; (2) the indemnified party received an improper personal benefit in money, property or services; or (3) in the case of a criminal proceeding, the indemnified person had reasonable cause to believe the act or omission was unlawful. The LLLP Agreement also provides that we will not be held responsible for any misconduct or negligence on the part of any agent appointed by us in good faith.

If we are deemed to be an investment company under the Investment Company Act, our shareholders’ investment return may be reduced.

We are not registered as an investment company under the Investment Company Act of 1940, as amended (“Investment Company Act”) based on exemptions we believe are available to us. If we were obligated to register as an investment company, we would have to comply with a variety of substantive requirements under the Investment Company Act. Registration as an investment company would be costly, would subject us to a host of complex regulations, and would divert the attention of management from the conduct of our business. If the SEC or a court of competent jurisdiction were to find we are required, but in violation of the Investment Company Act had failed, to register as an investment company, possible consequences include, but are not limited to, the following: (i) the SEC could apply to a district court to enjoin the violation; (ii) our shareholders could sue us and recover any damages caused by the violation; (iii) any contract to which we are party made in, or whose performance involves a violation of the Investment Company Act would be unenforceable by any party to the contract unless a court were to find that under the circumstances enforcement would produce a more equitable result than non-enforcement and would not be inconsistent with the purposes of the Investment

15

Company Act; and (iv) criminal and civil actions could be brought against us. Should we be subjected to any or all of the foregoing, our operations and results of operations would be materially and adversely affected.

There is no public trading market for our shares, nor do we expect one to develop, which may negatively impact a shareholdersour shareholders’ ability to sell their shares and the price at which shares may be sold.

There is no public market for our shares and there is no assurance one may develop. In addition, the price shareholders may receive for the sale of their shares is likely to be less than the proportionate value of our investments. If our shareholders are able to find a buyer for their shares, they may have to sell them at a substantial discount from the price they purchased the shares. Consequently, shareholders may not be able to liquidate their investments in the event of emergency or for any other reason. Therefore, shareholders should consider our securities as illiquid and a long-term investment and should be prepared to hold their shares for an indefinite period of time.

The estimated value of our common stock is based on a number of assumptions and estimates that may not be accurate and is also subject to a number of limitations.

The current estimated value of our common stock equals $18.50as of January 1, 2023, is approximately $23.00 per share. The methodology used by our boardBoard to determine this value was based on estimates of the value of our real estate investments, cash and other assets and debt and other liabilities as of a date certain and no subsequentcertain additional information. No formal valuation has been undertaken by us. TheOur valuation process involves a number of estimates, assumptions and subjective judgments that may not be accurate and complete. Further, different parties using different assumptions and estimates could derive a different estimated value per share, which could be significantly different from our estimated value per share. The estimated value per share may not represent current market values or fair values as determined in accordance with U.S. generally accepted accounting principles. The estimated value of our real estate assets used in the analysis may not necessarily represent the value we would receive or accept if the assets were marketed for sale. Further, acquisitions and dispositions of properties will have an effect on the value of our estimated price per share, which is not reflected in the current estimated price. Moreover, the estimated per share value of the common stock does not reflect a liquidity discount for the fact that the shares are not currently traded on a public market, a discount for the non-assumability or prepayment obligations associated with certain loans and other costs that may be incurred in connection with the sale of assets. A shareholder should not rely on the estimated value per share as being an accurate or precise measure of the then-current value of the shares of our common stock in making a decision to buy or sell shares of our common stock, including whether to reinvest dividends by participating in the dividend reinvestment plan and whether to request redemption pursuant to our share redemption program.

Shareholders may not be able to have their shares redeemed under the Share Redemption Plan, and if shareholders do redeem their shares, they will not receive the current value of the shares.

We have adopted a share redemption plan. However, our Board of Trustees can limit, suspend, terminate or amend the plan at any time without shareholder approval, and there is no assurance we will have sufficient funds available at the time of any request to honor a redemption request for cash. Shares redeemed under this plan may be purchased at a discount to the current price of the shares or to the price paid for such shares by the shareholder. Therefore, shareholders may not receive the amount they paid for the shares and may receive less by selling their shares back to us than they would receive if they were to sell their shares to other buyers.

There are transfer restrictions on the shares, and we do not plan to register the shares for resale.

Other than shares issued under our dividend reinvestment plan, we have not registered our shares under federal or state securities laws, but rather we have sold the shares in reliance on exemptions under applicable federal and state securities laws. Therefore, the shares may be “restricted securities” and may not be resold unless they are subsequently registered under the Securities Act and applicable state securities laws or pursuant to exemption from such registration requirements or may have other transfer restrictions based on the exemption relied on for the sale of the shares. We are not obligated to, nor do we currently plan to, register any shares for resale.

16

Risks Related to Our Status as a REIT and Related Federal Income Tax Matters

If we fail to continue to qualify as a REIT, we would incur additional tax liabilities that would adversely affect our operations and our ability to make distributions and could result in a number of other negative consequences.

Although our management believes we are organized, have operated, and will be able to continue to be organized and to operate in such a manner to qualify as a real estate investment trust (REIT), as that term is defined under the Internal Revenue Code, we may not have been organized, may not have operated, or may not be able to continue to be organized or to operate in a manner to have qualified or remain qualified as a REIT. Qualification as a REIT involves the application of highly technical and complex Internal Revenue Code provisions for which there are only limited judicial or administrative interpretations. Even a technical or inadvertent mistake could endanger our REIT status.

12

The determination that we qualify as a REIT requires an ongoing analysis of various factual matters and circumstances, some of which may not be within our control, regarding our organization and ownership, distributions of our income and the nature and diversification of our income and assets. The fact we hold substantially all of our assets through our operating partnership and our ongoing reliance on factual determinations, such as determinations related to the valuation of our assets, further complicates the application of the REIT requirements for us.

If we lose our REIT qualification, we will face income tax consequences that will reduce substantially our available cash for dividends and investments for each of the years involved because:

| We would be subject to federal corporate income taxation on our taxable income, including any applicable alternative minimum tax, and could be subject to increased state and local |

| We would not be allowed a deduction for dividends paid to shareholders in computing our taxable income; and |

| Unless we are entitled to relief under applicable statutory provisions, we could not elect to be taxed as a REIT for four taxable years following the year during which we were disqualified. |

The increased taxes could reduce the value of the shares as well as cash available for dividends to shareholders and investments in additional assets. In addition, if we fail to continue to qualify as a REIT, we will not be required to pay dividends to shareholders. Our failure to continue to qualify as a REIT also could impair our ability to expand our business and to raise capital.

As a REIT, we may be subject to tax liabilities that reduce our cash flow.

Even if we continue to qualify as a REIT for federal income tax purposes, we may be subject to federal and state taxes on our income or property, including the following:

| To continue to qualify as a REIT, we must distribute annually at least 90% of our REIT taxable income (which is determined without regard to the dividends-paid deduction or net capital gains) to our shareholders. If we satisfy the distribution requirement but distribute less than 100% of our REIT taxable income, we will be subject to corporate income tax on the undistributed income. In such situation, shareholders will be treated as having received the undistributed income and having paid the tax directly, but tax-exempt shareholders, such as charities or qualified pension plans, will receive no benefit from any deemed tax payments. |

| We may be subject to state and local taxes on our income or property, either directly or indirectly, because of the taxation of our operating partnership or of other entities through which we indirectly own our assets. |

| If we have net income from the sale of foreclosure property we hold primarily for sale to customers in the ordinary course of business or other non-qualifying income from foreclosure property, we must pay a tax on that income at the highest corporate income tax rate. |

| If we sell a property, other than foreclosure property, we hold primarily for sale to customers in the ordinary course of business, our gain will be subject to the 100% “prohibited transaction” tax. |

| We will be subject to a 4% nondeductible excise tax on the amount, if any, by which the distributions we pay in any calendar year are less than the sum of 85% of our ordinary income, 95% of our capital gain net income, and 100% of our undistributed income from prior years. |

17

13

We may be forced to borrow funds on a short-term basis, to sell assets or to issue securities to meet the REIT minimum distribution requirement or for working capital purposes.

To qualify as a REIT, in general, we must distribute to our shareholders at least 90% of our net taxable income each year, excluding capital gains. However, we could be required to include earnings in our net taxable income before we actually receive the related cash. If we do not have sufficient cash to pay the necessary dividends to preserve our REIT status for any year or to avoid taxation, we may need to borrow funds, to sell assets or to issue additional securities even if the then-prevailing market conditions are not favorable for such actions.

In addition, we will require a minimum amount of cash to fund our daily operations. Due to the REIT distribution requirements, we may be forced to make distributions when we otherwise would use the cash to fund our working capital needs. Therefore, we may be forced to borrow funds, to sell assets or to issue additional securities at certain times for our working capital needs.

If our operating partnership does not qualify as a partnership, its income may be subject to taxation, and we would no longer qualify as a REIT.

The Internal Revenue Code classifies “publicly traded partnerships” as associations taxable as corporations (rather than as partnerships), unless substantially all of their taxable income consists of specified types of passive income. We structured our operating partnership to be classified as a partnership for federal income tax purposes. However, no assurance can be given the IRS will not challenge our position or will classify our operating partnership as a “publicly traded partnership” for federal income tax purposes. To minimize this risk, we have placed certain restrictions on the transfer and/or redemption of partnership units in the LLLP Agreement. If the IRS would assert successfully our operating partnership should be treated as a “publicly traded partnership” and substantially all of the operating partnership’s gross income did not consist of the specified types of passive income, the Internal Revenue Code would treat the operating partnership as an association taxable as a corporation. In such event, we would cease to qualify as a REIT. In addition, the imposition of a corporate tax on the operating partnership would reduce the amount of distributions the operating partnership could make to us and, in turn, reduce the amount of cash available to us to pay dividends to our shareholders.

We have transfer restrictions on our shares that may limit offers to acquire substantial amounts of the trust’sTrust’s shares at a premium.

To qualify as a REIT, our shares must be beneficially owned by 100 or more persons and no more than 50% of the value of our issued and outstanding shares may be owned directly or indirectly by five or fewer individuals. Currently, ourThird Amended and Restated Declaration of Trust prohibits transfers of our shares that would result in: (1) our shares being beneficially owned by fewer than 100 persons, (2) five or fewer individuals, including natural persons, private foundations, specified employee benefit plans and trusts, and charitable trusts, owning more than 50% of our shares, applying broad attribution rules imposed by the federal income tax laws, or (3) before our shares qualify as a class of publicly-offered securities, 25% or more of our shares being owned by ERISA investors. If a shareholder acquires shares in excess of the ownership limits or in violation of the restrictions on transfer, we:

| May consider the transfer to be void ab initio. |

| May not reflect the transaction on our books. |

| May institute legal action to enjoin the transaction. |

| May redeem such excess shares. |

| Automatically transfer any excess shares to a charitable trust for the benefit of a charitable beneficiary. |

If such excess shares are transferred to a trust for the benefit of a charitable beneficiary, the charitable trustee shall sell the excess shares and the shareholder will be paid the net proceeds from the sale equal to the lesser of: (1) the price paid by the shareholder or the “market price” of our shares if no value was paid or (2) the price per share received by the charitable trustee.

18

14

If shares are acquired in violation of the ownership limits or the restrictions on transfer described above:

| Transferee may lose its power to dispose of the shares; and |

| Transferee may incur a loss from the sale of such shares if the fair market price decreases. |

These limitations may have the effect of preventing a change of control or takeover of us by a third party, even if the change in control or takeover would be in the best interest of our shareholders.

Complying with REIT requirements may restrict our ability to operate in a way to maximize profits.

To qualify as a REIT, we must continually satisfy tests concerning, among other things, the sources of our income, the nature and diversification of our assets, the amounts we distribute to our shareholders, and the ownership of our common shares. For example, we may be required to pay dividends to our shareholders at disadvantageous times, including when we do not have readily available funds. Thus, compliance with the REIT requirements may hinder our ability to operate solely on the basis of maximizing profits.

Complying with REIT requirements may force us to forego or liquidate otherwise attractive investments which could negatively impact shareholder value.

To qualify as a REIT, at the end of each calendar quarter, at least 75% of our assets must consist of cash, cash items, government securities and qualified real estate assets. The remainder of our investments in securities (other than government securities and qualified real estate assets), in general, cannot include more than 10% of the voting securities of any one issuer or more than 10% of the value of the outstanding securities of any one issuer. In addition, no more than 5% of the value of our assets (other than government securities and qualified real estate assets) can consist of the securities of any one issuer, and no more than 25% of the value of our assets may be represented by securities of one or more taxable REIT subsidiaries. Therefore, we may be required to liquidate otherwise attractive investments or may be forced to forego attractive investments to satisfy these requirements. Such action or inaction could be adverse to our shareholder interests.

Gains from asset sales may be subject to a 100% prohibited transaction tax, which tax could reduce the trust’sTrust’s available assets and reduce shareholder value.

We may have to sell assets from time to time to satisfy our REIT distribution requirements and other REIT requirements or for other purposes. The IRS may posit one or more asset sales may be “prohibited transactions.” If we are deemed to have engaged in a “prohibited transaction,” our gain from such sale would be subject to a 100% tax. The Internal Revenue Code sets forth a safe harbor for REITs that wish to sell property without risking the imposition of the 100% tax, but we cannot assure you we will be able to qualify for the safe harbor. We will use reasonable efforts to avoid the 100% tax by: (1) conducting activities that may otherwise be considered a prohibited transaction through a taxable REIT subsidiary, (2) conducting our operations in such a manner so no sale or other disposition of an assetand we own, directly or through any subsidiary other than a taxable REIT subsidiary, will be treated as a prohibited transaction or (3) structuring certain sales of our assets to comply with a safe harbor available under the Internal Revenue Code. We do not intend to hold assets in a manner to cause their dispositions to be treated as “prohibited transactions,” but we cannot assure you the IRS will not challenge our position, especially if we make frequent sales or sales of assets in which we have short holding periods. Payment of a 100% tax would adversely affect our results of operations.