registrant held by non-affiliates of the registrant was $2.4 billion.

The Company’s definitive proxy statement relating to

which this Report relates.

| |||||||||

| Item 9C. | |||||||||

i

EXPLANATORY NOTE

Forward‑

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ii

•availability and cost of skilled and qualified workers and our ability to recruit and retain employees and managers;

|

|

|

|

|

|

|

|

|

|

|

|

Should one or more of the risks or uncertainties described in this Annual Report occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward‑looking statements.

Except as otherwise required by applicable law, we disclaim any duty to update any forward‑looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this Annual Report.

EMERGING GROWTH COMPANY STATUS

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act (the “JOBS Act”). For as long as we are an emerging growth company, unlike public companies that are not emerging growth companies under the JOBS Act, we will not be required to:

|

|

|

|

|

|

|

|

We will cease to be an emerging growth company upon the earliest of the:

|

|

|

|

|

|

|

|

In addition, Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”), for complying with new or revised accounting standards, but we have irrevocably opted out of the extended transition period and, as a result, we will adopt new or revised accounting standards on the relevant dates in which adoption of such standards is required for other public companies.

For a description of the qualifications and other requirements applicable to emerging growth companies and certain elections that we have made due to our status as an emerging growth company, see “Risk Factors—Risks Related to Our Class A Common Stock—For as long as we are an emerging growth company, we will not be required to comply with certain reporting requirements, including those relating to disclosure about our executive compensation, that apply to other public companies.”

iv

You should read this entire report carefully, including the risks described under Part 1, Item 1A. Risk Factors and our consolidated financial statements and the notes to those consolidated financial statements included elsewhere in this Annual Report on Form 10‑K. Except as otherwise indicated or required by the context, all references in this Annual Report to the “Company,” “Cactus,” “we,” “us” and “our” refer to (i) Cactus Wellhead, LLC (“Cactus LLC”) and its consolidated subsidiaries prior to the completion of our initial public offering and (ii) Cactus, Inc. (“Cactus Inc.”) and its consolidated subsidiaries (including Cactus LLC) following the completion of our initial public offering on February 12, 2018, unless we state otherwise or the context otherwise requires. References in this Annual Report to “Cadent” are to Cadent Energy Partners II, L.P., an affiliate of Cadent Energy Partners. References in this Annual Report to “Cactus WH Enterprises” are to Cactus WH Enterprises, LLC. Cadent, Cactus WH Enterprises and Mr. Lee Boquet are collectively referred to herein as the “Pre-IPO Owners.”

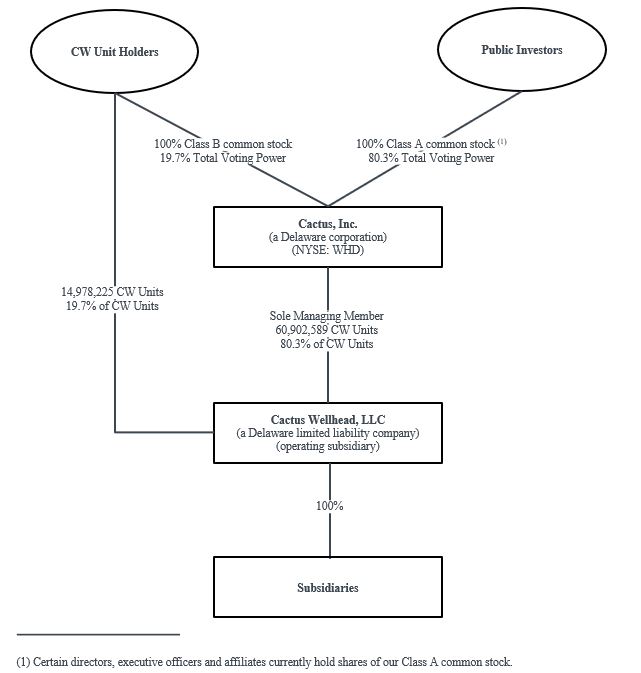

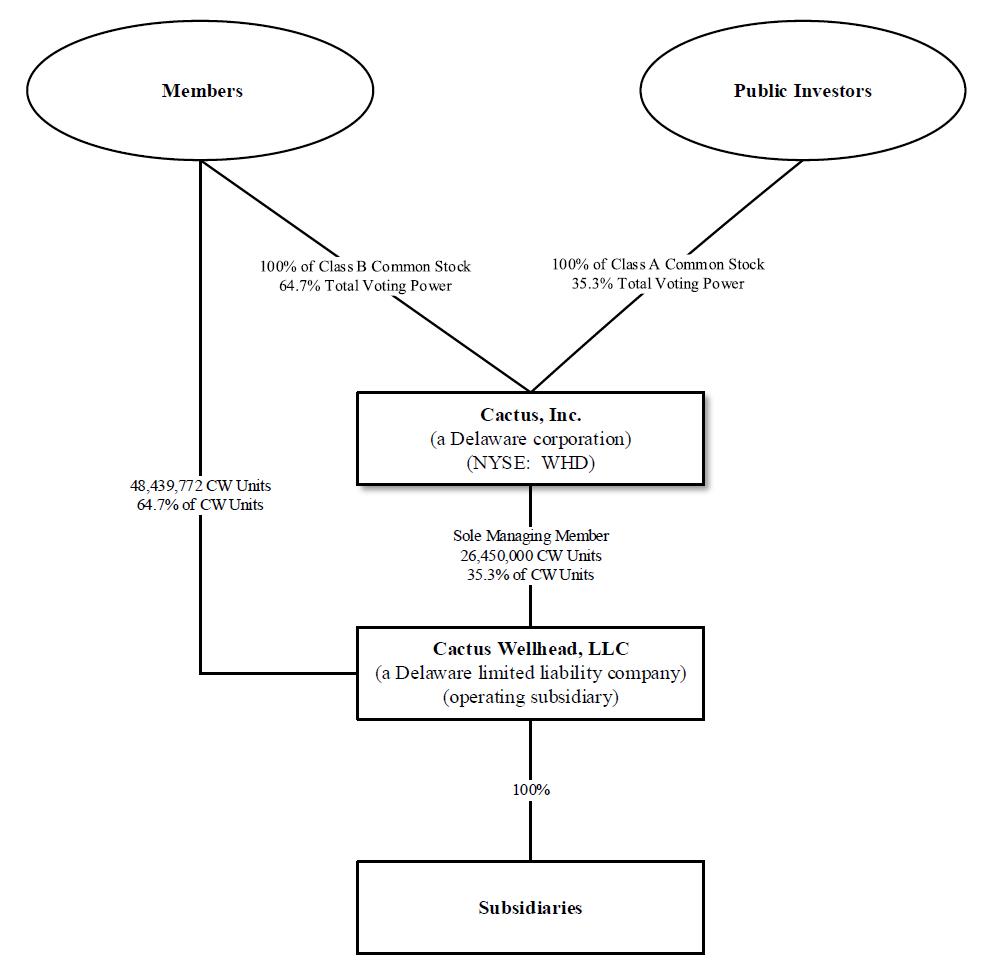

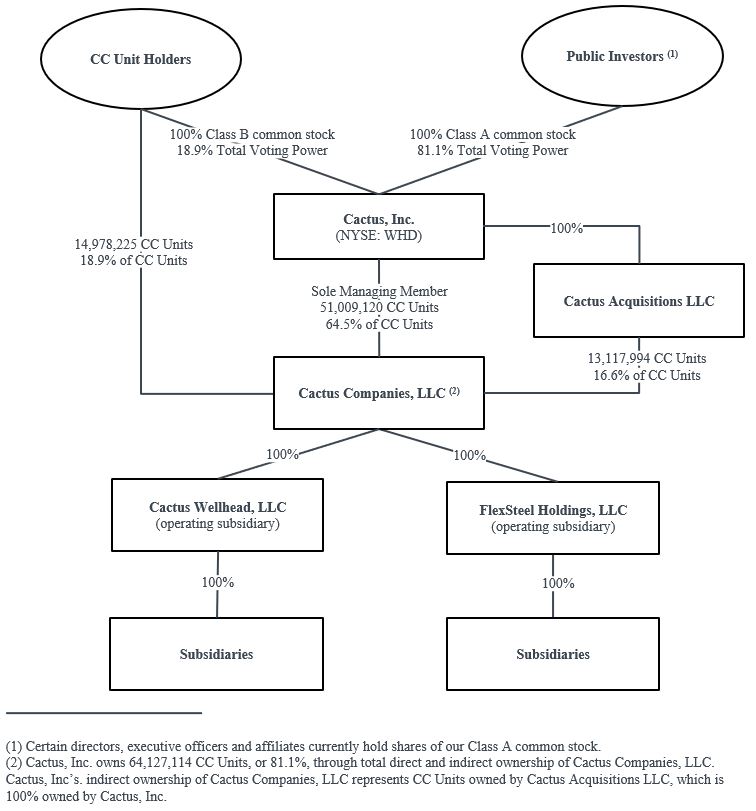

The following diagram indicates our simplified ownership Our Products Our innovative wellhead products and pressure control equipment are developed internally. We also conduct rental and field service operations in the Kingdom of Saudi Arabia. Our are the direct and indirect costs to manufacture and supply the product, including labor, materials, machine time, tariffs and duties, freight and lease expenses related to our facilities. The principal elements of cost of sales for rentals are the direct and indirect costs of supplying rental equipment, including We believe extended deliveries. Our production facility in China is configured to efficiently produce our range of pressure control products and components for less dependable deliveries. Patents currently have additional patent applications pending. We also rely on trade secret protection for our confidential and proprietary information. To protect our information, we customarily enter into confidentiality agreements with our employees and suppliers. There can be no assurance, however, that others will not independently obtain similar information or otherwise gain access to our trade secrets. Declines, as well as anticipated declines, in oil and gas prices could negatively affect the level of these activities and capital spending, which could adversely affect demand for our products and services and, in certain instances, result in the Hydraulic Fracturing. Although we do not conduct hydraulic fracturing, position. In addition, our business could be impacted by initiatives to address greenhouse gases and climate change and incentives to conserve energy or use alternative energy sources. For example, in August 2022, the Inflation Reduction Act good. Our Available Information gas and availability of capital. Declines, as well as anticipated declines, in oil and gas prices could negatively affect the level of these activities and capital spending, which could adversely affect demand for our products and services and, in certain instances, result in the cancellation, modification or rescheduling of existing and expected orders and the ability of our customers to pay us for our products and services. These factors could have an adverse effect on our The oil and gas industry is cyclical and has historically experienced periodic downturns, which have been characterized by diminished demand for regions in which we operate. We may be unable to employ a sufficient number of skilled and qualified workers to sustain or expand our current operations. cash flows. We are dependent on a relatively small number of customers in a single industry. The loss of an important customer could adversely affect our results of operations and financial condition. Our business, Additionally, the E&P industry is characterized by frequent consolidation activity. Changes in ownership of our customers may result in the loss of, or reduction in, business from those customers which could materially and adversely affect our business, results of operations and or other third parties. The requirements for such permits or authorizations vary depending on the location where such drilling and which could result in active price competition. Many contracts are awarded on a bid basis, which may further increase competition based primarily on price. In addition, adverse market conditions lower demand for well servicing equipment, which results in excess equipment and lower utilization rates. If market conditions in our New technology may cause us to become less competitive. Our operations are subject to hazards inherent in the oil and natural gas industry, which could expose us to substantial liability and cause us to lose customers and substantial revenue. business, results of operations and cash flows. impact on our ability to operate our business and on our results of operations. We have also experienced, and could continue to experience, disruption and volatility in our supply chain, which has resulted, and may continue to result, in increased costs for certain goods. The spread of COVID-19 has also disrupted and may continue to disrupt logistics necessary to import, export and deliver products to us and our customers. Further, we might experience temporary shortages of labor, making it difficult to provide field service technicians to install or service our equipment. The extent of the adverse impact of COVID-19 on general economic conditions and on our business, operations and results of operations remains uncertain. expenses and pay dividends to holders of our Class A Common Stock. In addition, our ability to pay dividends to holders of our Class A common stock depends on receipt of distributions from Cactus Companies. Our amended and restated certificate of incorporation and amended and restated bylaws, as well as Delaware law, contain provisions that could discourage acquisition bids or merger proposals, which may adversely affect the market price of our Class A common stock. In addition, certain change of control events have the effect of accelerating the payment due under the We cannot predict the size of future issuances of our Class A common stock. apply to the increase in tax basis, the amount and timing of taxable income we generate in the future and the U.S. federal income tax rates then applicable, and the portion of our payments under the TRA. TRA. member of Cactus funds legally available for such payments. We are was incorporated as a Delaware corporation on February 17, 2017 for the purpose of completing an initial public offering of equity (our “IPO”(“Cactus Inc.”) and related transactions. On February 12, 2018,its consolidated subsidiaries (the “Company,” “we,” “us,” “our” and “Cactus”), including Cactus Wellhead, LLC (“Cactus LLC”), are primarily engaged in connection with our IPO, Cactus Inc. became a holding company whose sole material assets are units in Cactus LLC (“CW Units”). Cactus Inc. became the managing member of Cactus LLCdesign, manufacture and is responsible for all operational, management and administrative decisions relating to Cactus LLC’s business.On February 12, 2018, we completed our initial public offering of 23,000,000 shares of Class A common stock, par value $0.01 per share (“Class A Common Stock”), at a price to the public of $19.00 per share. We received net proceeds of $405.8 million after deducting underwriting discounts and commissions and estimated offering expenses of our IPO. On February 14, 2018 we completed the sale of an additional 3,450,000 shares of Class A Common Stock pursuant to the exercise in full by the underwriters of their option to purchase additional shares of Class A Common Stock (the “Option”), resulting in $61.6 million of additional net proceeds. We contributed all of the net proceeds of the IPO to Cactus LLC in exchange for CW Units. Cactus LLC used (i) $251.0 million of the net proceeds to repay all of the borrowings outstanding under its term loan facility, including accrued interest and (ii) $216.4 million to redeem CW Units from certain direct and indirect owners of Cactus LLC.We design, manufacture, sell and rent a range of highly‑engineered wellheadswellhead and pressure control equipment. Our products are sold and rented principally for onshore unconventional oil and gas wells and are utilized during the drilling, completion (including fracturing) and production phases of our customers’ wells. In addition, weWe also provide field services for all of our products and rental items to assist with the installation, maintenance and handling of the wellhead and pressure control equipment.Organizational StructureIn connection with Additionally, we offer repair and refurbishment services. We operate through 15 U.S. service centers located in Texas, New Mexico, Pennsylvania, North Dakota, Louisiana, Oklahoma, Colorado, Utah and Wyoming as well as three service centers in Eastern Australia. We also provide rental and field service operations in the completionKingdom of Saudi Arabia. Our corporate headquarters are located in Houston, Texas. We also have manufacturing and production facilities in Bossier City, Louisiana and Suzhou, China.IPO,purpose of completing an initial public offering of equity and related transactions, which was completed on February 12, 2018 (our “IPO”). We began operating in August 2011 following the formation of Cactus LLC in part by Scott Bender and Joel Bender, who have owned or operated wellhead manufacturing businesses since the late 1970s. Cactus Inc. is a holding company whose only material asset is an equity interest consisting of units representing limited liability company interests in Cactus LLC (“CW Units”). Cactus Inc. became the sole managing member of Cactus LLC upon completion of our IPO and is responsible for all operational, management and administrative decisions relating to Cactus LLC’s business and consolidatesbusiness. Pursuant to the financial results of Cactus LLC and its subsidiaries. The Limited Liability Company Operating Agreement of Cactus LLC was amended and restated as the FirstSecond Amended and Restated Limited Liability Company Operating Agreement of Cactus LLC (the “Cactus Wellhead LLC Agreement”), owners of CW Units are entitled to among other things, admit Cactus Inc. as the sole managing memberredeem their CW Units for shares of Cactus LLC.1In connection with our IPO, we completed a seriesshares of reorganization transactions, including the following:(a)all of the membership interests in Cactus LLC were converted into a single class of CW Units;(b)Cactus Inc. contributed the net proceeds of the IPO to Cactus LLC in exchange for 23,000,000 CW Units;(c)Cactus LLC used the net proceeds of the IPO that it received from Cactus Inc. to repay the borrowings outstanding, plus accrued interest, under its term loan facility and to redeem 8,667,841 CW Units from the owners thereof;(d)Cactus Inc. issued and contributed 51,747,768 shares of its Class BClass A common stock, par value $0.01 per share (“Class B Common Stock”) equal to the number of outstanding CW Units held by the Pre-IPO Owners following the redemption described in (c) above to Cactus LLC;(e)Cactus LLC distributed to each of the Pre-IPO Owners that continued to own CW Units following the IPO one share of Class B Common Stock for each CW Unit such Pre-IPO Owner held following the redemption described in (c) above;(f)Cactus Inc. contributed the net proceeds from the exercise of the Option to Cactus LLC in return for 3,450,000 additional CW Units; and(g)Cactus LLC used the net proceeds from the Option to redeem 3,450,000 CW Units from the owners thereof, and Cactus Inc. canceled a corresponding number of shares of Class B Common Stock.In connection with the IPO, Cactus Inc. granted 0.7 million restricted stock unit awards, which will vest over one to three years, to certain directors, officers and employees of Cactus. In this Annual Report, weoutstanding. We refer to the owners of CW Units, other than Cactus Inc. (along with their permitted transferees), as “CW Unit Holders.” CW Unit Holders own one share of our Class B common stock, par value $0.01 per share (“Class B common stock”) for each CW Unit such CW Unit Holder owns. Holders of Class A common stock and Class B common stock vote together as a single class on all matters presented to our stockholders for their vote or approval, except as otherwise required by applicable law or our amended and restated certificate of incorporation. Cactus WH Enterprises, LLC (“Cactus WH Enterprises”) is the largest CW Unit Holder. Cactus WH Enterprises is a Delaware limited liability company owned by Scott Bender, Joel Bender, Steven Bender and certain other employees. Cadent Energy Partners II, L.P. (“Cadent”), an affiliate of Cadent Energy Partners LLC, owned more than 10% of issued and outstanding CW Units until March 2021, when it redeemed 4,111,250 of the CW Units (together with an equal number of shares of Class B common stock) owned by it in connection with the March 2021 offer and sale by certain selling stockholders of Class A common stock. Subsequently, in a series of additional transactions throughout 2021, Cadent and its affiliates transferred or redeemed the remainder of its CW Units. The redeemed CW Units were redeemed for Class A common stock, with such shares being distributed to their owners pro rata.CW Units (in thousands) CW Units held by legacy CW Unit Holders as of December 31, 2019 27,958 CW Unit redemptions (303) CW Units held by legacy CW Unit Holders as of December 31, 2020 27,655 Follow-on equity offering in March 2021 (6,273) Cadent redemption in June 2021 (3,292) Cadent redemption in September 2021 (715) Other CW Unit redemptions (701) CW Units held by legacy CW Unit Holders as of December 31, 2021 16,674 CW Unit redemptions (1,696) CW Units held by legacy CW Unit Holders as of December 31, 2022 14,978

CWCC Unit such CWCC Unit Holders own. After giving effectHolder owns and Cactus Companies is the sole member of Cactus LLC. Pursuant to our IPO and the related transactions,Cactus Companies LLC Agreement, owners of CC Units are entitled to redeem their CC Units for shares of Cactus Inc. owns an approximate 35.3%’s Class A common stock on a one-for-one basis, which would result in a correspondingLLC,Companies and an increase in the CW Unit Holders own an approximate 64.7% interest in Cactus LLC. These ownership percentages are based on 26,450,000number of shares of Class A Common Stockcommon stock outstanding.48,439,772Class B common stock continue to vote together as a single class on all matters presented to our stockholders for their vote or approval, except as otherwise required by applicable law or our amended and restated certificate of incorporation. Cactus WH Enterprises remains the largest CC Unit Holder following the completion of the CC Reorganization.Common Stockcommon stock issued and outstandingoutstanding. Cactus WH Enterprises held approximately 16.9% of our voting power as of March 13, 2018.February 28, 2023.2structure.

Our CompanyWe design, manufacture, sell and rentstructure immediately following the completion of the CC Reorganization:

range of highly‑engineered wellheads and pressure control equipment. Our products are sold and rented principally for onshore unconventional oil and gas wells and are utilized during the drilling, completions (including fracturing) and production phasespart of our customers’ wells. In addition, we provide field services for all ofbusiness prior to December 31, 2022. Additional details on the business can be found in our products and rental items to assistForm 8-K filed with the installation, maintenanceSecurities and handlingExchange Commission (“SEC”) on January 3, 2023 announcing the signing of the wellhead and pressure control equipment.3

Merger Agreement.SafeDrill™SafeDrill® wellhead systems as well as frac stacks, our Cactus SafeLink® monobore, SafeClamp® and SafeInject® systems, zipper manifolds and production trees that we design and manufacture. Every oil and gas well requires a wellhead system, which is installed at the onset ofthroughout the drilling process and which remains with the well through its entire productive life. The Cactus SafeDrill™SafeDrill® wellhead systems employ technology which allows technicians to land and secure casing strings more safely from the rig floor, reducing the need to descend into the cellar. We believe we are a market leader in the application of such technology, with thousands of our products sold and installed across the United States since 2011. During the completion phase of a well, we rent frac stacks, zipper manifolds and other high‑pressurehigh-pressure equipment including our SafeLink®, SafeClamp® and SafeInject® systems that are used for well control and for managing the transmission of frac fluids and proppants during the hydraulic fracturing process. These severe service applications require robust and reliable equipment. Cactus, through its proprietary equipment, digital offerings and services, reduces the need for human intervention in the exclusion zone, minimizing non-productive time and leading to inherently safer and more environmentally responsible operations. For the subsequent production phase of a well, we sell production trees that regulate hydrocarbon production,and equipment which are installed on the wellhead after the frac treestack has been removed. In addition, we provide mission‑criticalmission-critical field services for all of our products and rental items, including 24‑hour24-hour service crews to assist with the installation, maintenance, repair and safe handling of the wellhead and pressure control equipment. Finally, we provide repair services for all of the equipment that we sell or rent.close relationship with our customers provides us with insight into the specific issues encountered in the drilling and completions processes, allowing usproducts, among other reasons, due to provide them with highly tailored product and service solutions. We have achieved significant market share, as measured by the percentage of total active U.S. onshore rigs that we follow (which we define as the number of active U.S. onshore drilling rigs to which we are the primary provider of wellhead products and corresponding services during drilling), and brand name recognition associated with respect to our engineered products, which we believe is due to our focus on safety, reliability, cost effectiveness and time saving features. We optimize our products for pad drilling (i.e.(i.e., the process of drilling multiple wellbores from a single surface location) to reduce rig time and provide operators with significant efficiencies that translate tointo increased safety, reduced environmental impact and cost savings at the wellsite.Our manufacturing and production facilities are located in Bossier City, Louisiana and Suzhou, China. While both facilities can produce our full range of products, our Bossier City facility has advanced capabilities and is designed to support time‑sensitive and rapid turnaround orders, while our facility in China is optimized for longer lead time orders and outsources its machining requirements. Both our United States and China facilities are licensed to the latest API 6A specification for both wellheads and valves and API Q1 and ISO9001:2015 quality management systems.14through service centers in the United States, which are strategically located in the key oil and gas producing regions, including the Permian, SCOOP/STACK, Marcellus, Utica, Haynesville, Eagle Ford, Bakken and SCOOP/STACK, among other active oil and gas regions in the United States. We also have one service centerStates, and in Eastern Australia. These service centers support our field services and provide equipment assembly and repair services.HistoryWe began operating in August 2011, following the formation of Cactus LLC by Scott Bendermanufacturing and Joel Bender, who have owned or operated wellhead manufacturing businesses since the late 1970s, and by Cadent, as its equity sponsor. We acquired our primary manufacturing facilityproduction facilities are located in Bossier City, Louisiana and Suzhou, China.onethree sources: products, rentals, and field service and other. Product revenues are primarily derived from the sale of wellhead systems and production trees. Rental revenues are primarily derived from the rental of equipment used during the completion process, the repair of such equipment and the rental of tools used during drilling operations. Field service and other revenues are primarily earned when we provide installation and other field services for both product sales and equipment rental. Additionally, other revenues are derived from providing repair and reconditioning services to customers that have previously purchased wellheads or production trees. Items sold or rented generally have an associated service component. As a result, there is a close correlation between field service and other revenues and revenues from product sales and rentals.Pre-IPO Ownerstotal revenues from the sale of our products, 14% from rental and 20% from field service and other. In 2021, we derived 64% of our total revenues from the sale of our products, 14% from rental and 22% from field service and other. In 2020, we derived 59% of our total revenues from the sale of our products, 19% from rental and 22% from field service and other. We have predominantly domestic operations, with a small amount of sales in September 2011select international markets.establishedservices are most often priced in accordance with a preapproved price list. The actual pricing of our other production facility, locatedproducts and services is impacted by a number of factors including competitive pricing pressure, the value perceived by our customers, the level of utilized capacity in Suzhou, China, in December 2013. Since we began operating, we have grown to 14 U.S.the oil service centers located in Texas, Louisiana, Colorado, Wyoming, New Mexico, Oklahoma, Pennsylvaniasector, cost of manufacturing the product, cost of providing the service and North Dakota. In July 2014, we formed Cactus Wellhead Australia Pty, Ltd and established a service center to develop thegeneral market conditions.in Eastern Australia.machining services.machined components. We purchase a majority of these items and services from over 250 vendors bothprimarily located in the United States, China, India and China.4For the three years in the period ended December 31, 2017, 2016 and 2015, approximately $33.4 million, $10.8 million and $18.1 million, respectively, of machined component purchases were made from a2022, no vendor located in China, representing approximately 22%, 20% and 27%, respectively,represented 10% or more of our total third partythird-party vendor purchases of raw materials, finished products, components, equipment, machining and other services. Although we have historically made purchases from this vendor pursuant to a long term contract, such contract expired at the end of 2016. We are currently purchasing from this vendor on terms substantially similar to those contained in the expired agreement. We expect to negotiate a new agreement with such vendor on terms similar to those in the expired agreement. Although our relationships with our existing vendors, including the Chinese vendor referred to above, are important to us, we do not believe that we are substantiallyoverly dependent on any individual vendor to supply our required materials or services. The materials and services essential to our business are normally readily available and, where we use one or a few vendors as a source of any particular materials or services, we believe that we can, within a reasonable period of time, make satisfactory alternative arrangements in the event of an interruption of supply from any vendor. that our materials and services vendors have the capacity to meet additional demand should we require it.Impact of Section 232 of the Trade Expansion Act of 1962 (“Section 232”)On March 8, 2018, the President of the United States issued two proclamations imposing tariffs on imports of certain steelit, although at higher costs and aluminum products, effective March 23, 2018. The decision was made in response to the Department of Commerce’s findings and recommendations in its reports of its investigations into the impact of imported steel and aluminum on the national security of the United States pursuant to Section 232. Specifically, the President has imposed a 25% global tariff on certain imported steel mill products and a 10% global tariff on certain imported aluminum products from all countries except Canada and Mexico. The tariffs could cause the cost of raw materials to increase, although the impact to us of Section 232 remains uncertain.CustomersWe serve over 200 customers representing major independent and other oil and gas companies with operations in the key U.S. oil and gas producing basins including the Permian, Marcellus Shale/Utica, the SCOOP/STACK, the Eagle Ford, the Bakken and other active oil and gas basins, as well as in Australia. For the year ended December 31, 2017, Pioneer Natural Resources represented 11% of our total revenue and no other customer represented 10% or more of our total revenue. For each of the years ended December 31, 2016 and 2015, Devon Energy Corporation represented 12% of our total revenue, and no other customer represented 10% or more of our total revenue.WhileAlthough both facilities can produce our full range of products, our Bossier City facility has advanced capabilities and is designed to support time‑sensitivetime-sensitive and rapid turnaround orders,of made-to-order equipment, while our facility in China is optimized for longer lead time orders and outsources its machining requirements. Both our U.S. and ChinaThe facilities are API certifiedlicensed to the APIlatest American Petroleum Institute (“API”) 6A specification for both wellheads and valves and API Q1 and ISO9001:ISO 9001:2015 quality management systems.Our Bossier City facility is configured to provide rapid‑response production of made‑to‑order equipment. Where typicaltraditional manufacturing facilities are designed to run in batches with different machining processes occurring in stages, thisour Bossier City facility uses highly‑capableadvanced computer numeric 5 Axis control (“CNC”) machines to perform substantially allmultiple machining of the product in a single step.operations with fewer set-ups. We believe eliminating the setup and queue times between machining processesoperations allows us to offer significantly shorter order‑to‑delivery time for equipment thanorder-to-delivery times compared to our competitors, albeit at higher costs than our facility in China. Responsiveness to urgent needs strengthens our relationship with key customers.5Our The Bossier City manufacturing facility also functions as a repair and testing facility with its API 6A PSL3 certification and full QA/QC department. The facility also has the ability to perform hydrostatic testing, phosphate and oiling,oil coating, copper coating and frac valverental equipment remanufacturing.time‑sensitive, higher‑volumetime-sensitive, higher-volume orders. All employees in ourThe Suzhou facility areassembles and tests finished and semi-finished machined components before shipment to the United States, Australia and other international locations. Our Suzhou subsidiary is wholly-owned, and its facility is staffed by Cactus employees, which we believe is a key factor in ensuring high quality. Our Suzhou facility currently assemblesquality and tests some machined components before shipment to the United States or Australia.Other Intellectual PropertyAdditionally,The Company has numerous trademarks registered with the SafeDrillTM trademark is complementaryU.S. Patent and Trademark Office and has also applied for registration status of several trademarks which are pending. Once registered, our trademarks can be renewed every 10 years as long as we are using them in commerce. We also seek to protect our technology through use of patents, which affords us 20 years of protection of our proprietary inventions and technology, although we do not deem patents to be critical to our marketing effortssuccess. We have been awarded several U.S. patents and brand recognition. These trademarks are registered in the United States.hashave historically been volatile, and by the availability of capital and the associated capital spending discipline imposedexercised by customers.clients’customers’ budget cycles.Our operationsdomestic (including U.S. federal, statestringent governmental laws and local) and international regulations, with regard to air, land and water qualityboth in the United States and other environmental matters. We believe we are in substantial compliance with these regulations. Laws and regulationscountries, pertaining to minimize and mitigate risks toprotection of the environment and to workplaceoccupational safety continue to be enacted. Changesand health. Compliance with environmental legal requirements in standards of enforcement of existing regulations, as well as the enactment and enforcement of new legislation,United States at the federal, state or local levels may require usacquiring permits to conduct regulated activities, incurring capital expenditures to limit or prevent emissions, discharges and our customersany unauthorized releases, and complying with stringent practices to modify, supplement or replace equipment or facilities or to change or discontinue present methodshandle, recycle and dispose of operation. Our environmental compliance expenditures, our capital costs for environmental control equipment,certain wastes. These laws and the market for our products may change accordingly.Hazardous Substances and Waste. The Resource Conservation and Recovery Act (“RCRA”) and comparable state statutes, regulate the generation, transportation, treatment, storage, disposal and cleanup of hazardous and non‑hazardous wastes. Under the auspices of the Environmental Protection Agency (“EPA”), the individual states6administer some or all of •the provisions of RCRA, sometimes in conjunction with their own, more stringent requirements. We are required to manage the transportation, storage and disposal of hazardous and non‑hazardous wastes generated by our operations in compliance with applicable laws, including RCRA.The Comprehensive Environmental Response, Compensation, and Liability Act (“CERCLA”), also known as the Superfund law, imposes joint and several liability, without regard to fault or legality of conduct, on classes of persons who are considered to be responsible for the release of a hazardous substance into the environment. These persons include the current and former owner or operator of the site where the release occurred, and anyone who disposed of or arranged for the disposal of a hazardous substance released at the site. We currently own, lease, or operate numerous properties used for manufacturing and other operations. We also contract with waste removal services and landfills. In the event of a release from these properties, under CERCLA, RCRA and analogous state laws, we could be required to remove substances and wastes, remediate contaminated property, or perform remedial operations to prevent future contamination even if the releases are not from our operations. In addition, neighboring landowners and other third parties may also file claims for personal injury and property damage allegedly caused by releases into the environment. Any obligations to undertake remedial operations in the future may increase our cost of doing business and may have a material adverse effect on our results of operations and financial condition.Water Discharges. The Federal Water Pollution Control Act (the “Clean Water Act”);analogous stateLiability Act;restrictin Australia, the People’s Republic of China and control the dischargeKingdom of pollutants into watersSaudi Arabia.United States. Dischargessame laws and regulations relating to water associated with our operations require appropriate permits from state agenciesenvironmental protection and may add material costs to our operations. The adoption of more stringent criteriaoccupational safety and health in the future may also increaseUnited States and in foreign countries where we operate. Consequently, to the extent these environmental compliance costs, pollution mitigation costs or remediation costs are incurred by our costs of operation. The Clean Water Actcustomers, those customers could elect to delay, reduce or cancel drilling, exploration or production programs, which could reduce demand for our products and analogous state laws provide for administrative, civilservices and, criminal penalties for unauthorized discharges and, together with the Oil Pollution Act of 1990, impose rigorous requirements for spill prevention and response planning, as well as substantial potential liability for the costs of removal, remediation, and damages in connection with any unauthorized discharges. In addition, in 2015 the EPA and U.S. Army Corps of Engineers (“Corps”) finalized a rule that expanded the scope of waters subject to Clean Water Act jurisdiction. If implemented, this rule mayresult, have a material adverse effect on our business, financial condition, results of operations, or cash flows. Consistent with our quality assurance and Health, Safety & Environment (“HSE”) principles, we have established proactive environmental and worker safety policies in the operation costsUnited States and foreign countries for the management, handling, recycling or disposal of customers, thereby potentially reducing demand forchemicals andproducts. The rule was stayed nationwide in late 2015, however, and the EPA and the Corps have proposed to repeal the rule and reinstate the pre‑2015 rule. In a separate rulemaking, the EPA and the Corps have also proposed to delay the implementation of the 2015 rule until 2019. Neither of these proposals has been finalized and the rule remains stayed by the Sixth Circuit.Employee Health and Safety. We are subject to a number of federal and state laws and regulations, including OSHA and comparable state statutes, establishing requirements to protect the health and safety of workers. In addition, the OSHA hazard communication standard, the EPA community right‑to‑know regulations under Title III of the federal Superfund Amendment and Reauthorization Act and comparable state statutes require that information be maintained concerning hazardous materials used or produced in our operations and that this information be provided to employees, state and local government authorities and the public.operations. Substantial fines and penalties can be imposed and orders or injunctions limiting or prohibiting certain operations may be issued in connection with any failure to comply with laws and regulations relating to worker health and safety.APIcertifiedlicensed by the API as beingto monogram manufactured products in complianceaccordance with API 6A, 21st Edition product specification for both wellheads and valves andwhile the quality management system is certified to API Q1, 9th Edition and ISO9001:2015 quality management systems.ISO 9001:2015. These standardslicenses and certifications expire every three years and are renewed upon successful completion of annual audits. Cactus has also developed an API Q2 program specific to our service business. At this time, we have also been incorporated into regulations adopted bynot yet applied for API Q2 certification, but we are implementing the BureauAPI Q2 Quality Management System at select service locations to reduce well site non-productive time, improve service tool reliability and enhance customer satisfaction and retention. Our current API licenses and certifications are published on our website under the “Quality Assurance & Control” section of Safety and Environmental Enforcement (“BSEE”) that apply to the oil and gas industries that operate on the outer continental shelf.our website at www.CactusWHD.com. API’s standards are subject to revision, however, and there is no guarantee that future amendments or substantive changes to the standards would not require us to modify our operations or manufacturing processes to meet the new standards. Doing so may materially affect our operationoperational costs. We also cannot guarantee that changes to the standards would not lead to the rescission of our licenses should we be unable to make the changes necessary to meet the new standards. Furthermore, these facilities are subjected to annual audits by the API. Loss of our API licenses could materially affect demand for these products.7Climate Change. International, national and state governments and agencies are currently evaluating and/or promulgating legislation and regulations that are focused on restricting emissions commonly referred to as greenhouse gas (“GHG”) emissions. These regulatory measures include, among others, adoption of cap and trade regimes, carbon taxes, increased efficiency standards and incentives or mandates for renewable energy. Consideration of further legislation or regulation may be impacted by the Paris Agreement, which was announced by the Parties to the United Nations Framework Convention on Climate Change in December 2015 and which calls on signatories to set progressive GHG emission reduction goals. Although the United States became a party to the Paris Agreement in April 2016, the Trump administration announced in June 2017 its intention to either withdraw from the Agreement or renegotiate more favorable terms. However, the Paris Agreement stipulates that participating countries must wait four years before withdrawing from the agreement. Despite the planned withdrawal, certain U.S. city and state governments have announced their intention to satisfy their proportionate obligations under the Paris Agreement. These commitments could further reduce demand and prices for fossil fuels produced by our customers. In the United States, the EPA has made findings under the Clean Air Act that GHG emissions endanger public health and the environment, resulting in the EPA’s adoption of regulations requiring construction and operating permit reviews of both existing and new stationary sources with major emissions of GHGs, which reviews require the installation of new GHG emission control technologies. However, in October 2017, the EPA announced a proposal to repeal its regulation of GHG emissions from existing stationary sources. The EPA has also promulgated rules requiring the monitoring and annual reporting of GHG emissions from certain sources, including onshore and offshore oil and natural gas production facilities and onshore oil and natural gas processing, transmission, storage and distribution facilities. In addition, in May 2016, the EPA finalized a rule that set additional emissions limits for volatile organic compounds and established new methane emission standards for certain new, modified or reconstructed equipment and processes in the oil and natural gas source category, including production, processing, transmission and storage activities. In June 2017, the EPA issued an administrative stay of key provisions of the rule, but was promptly ordered by the D.C. Circuit to implement the rule. The EPA also published proposed 60‑day and two‑year stays of certain provisions in June 2017 and published a Notice of Data Availability in November 2017 seeking comment and providing clarification regarding the agency’s legal authority to stay the rule.It is too early to determine whether, or in what form, further regulatory action regarding greenhouse gas emissions will be adopted or what specific impact a new regulatory action might have on us or our customers. Generally, the anticipated regulatory actions do not appear to affect us in any material respect that is different, or to any materially greater or lesser extent, than other companies that are our competitors. However, to the extent our customers are subject to these or other similar proposed or newly enacted laws and regulations, the additional costs incurred by our customers to comply with such laws and regulations could impact their ability or desire to continue to operate at current or anticipated levels, which would negatively impact their demand for our products and services. In addition, any new laws or regulations establishing cap‑and‑trade or that favor the increased use of non‑fossil fuels may dampen demand for oil and gas production and lead to lower spending by our customers for our products and services. Similarly, to the extent we are or become subject to any of these or other similar proposed or newly enacted laws and regulations, we expect that our efforts to monitor, report and comply with such laws and regulations, and any related taxes imposed on companies by such programs, will increase our cost of doing business and may have a material adverse effect on our financial condition and results of operations. Moreover, any such regulations could ultimately restrict the exploration and production of fossil fuels, which could adversely affect demand for our products.Many Most of our customers utilize hydraulic fracturing in their operations. Environmental concerns have been raised regarding the potential impact of hydraulic fracturing and the resulting wastewater disposal on underground water supplies.supplies and seismic activity. These concerns have led to several regulatory and governmental initiatives in the United States to restrict the hydraulic fracturing process, which could have an adverse impact on our customers’ completions or production activities. For example, in December 2016, the EPA released its final report on the potential impacts of hydraulic fracturing on drinking water resources, concluding that “water cycle” activities associated with hydraulic fracturing may impact drinking water resources “under some circumstances,” including water withdrawals for fracturing in times or areas of low water availability; surface spills during the management of fracturing fluids, chemicals or produced water; injection of fracturing fluids into wells with inadequate mechanical integrity; injection of fracturing fluids directly into8groundwater resources; discharge of inadequately treated fracturing wastewater to surface waters; and disposal or storage of fracturing wastewater in unlined pits. In other examples, the EPA has issued final regulations under the U.S. Clean Air Act governing performance standards, including standards for the capture of air emissions released during hydraulic fracturing, though the EPA is currently reconsidering these standards, and published in June 2016 a final rule prohibiting the discharge of wastewater from hydraulic fracturing operations to publicly owned wastewater treatment plants. Also, the U.S. Bureau of Land Management finalized rules in March 2015 that imposed new or more stringent standards for performing hydraulic fracturing on federal and American Indian lands. While the agency subsequently published a final rule rescinding the 2015 rule in December 2017, this decision could be subject to legal challenge. In addition, in some instances, states and local governments have enacted more stringent hydraulic fracturing restrictions or bans on hydraulic fracturing activities. These and other similar state and foreign regulatory initiatives, if adopted, would establish additional levels of regulation for our customers that could make it more difficult for our customers to complete natural gas and oil wells and could adversely affect the demand for our equipment and services, which, in turn, could adversely affect our results of operations, financial condition and cash flows.State and federal regulatory agencies have also recently focused on a possible connection between the operation of injection wells used for oil and gas waste disposal and seismic activity. Similar concerns have been raised that hydraulic fracturing may also contribute to seismic activity. When caused by human activity, such events are called induced seismicity. Developing research suggests that the link between seismic activity and wastewater disposal may vary by region, and that only a very small fraction of the tens of thousands of injection wells have been suspected to be, or have been, the likely cause of induced seismicity. In March 2016, the United States Geological Survey identified six states with the most significant hazards from induced seismicity, including Oklahoma, Kansas, Texas, Colorado, New Mexico, and Arkansas. In light of these concerns, some state regulatory agencies have modified their regulations or issued orders to address induced seismicity. Increased regulation and attention given to induced seismicity could lead to greater opposition to, and litigation concerning, oil and gas activities utilizing hydraulic fracturing or injection wells for waste disposal, which could indirectly impact our business, financial condition and results of operations. In addition, these concerns may give rise to private tort suits from individuals who claim they are adversely impacted by seismic activity they allege was induced. Such claims or actions could result in liability for property damage, exposure to waste and other hazardous materials, nuisance or personal injuries, and require our customers to expend additional resources or incur substantial costs or losses. This could in turn adversely affect the demand for our products.increasedour products are used in hydraulic fracturing. Increased regulation and attention given to the hydraulic fracturing process could lead to greater opposition to oil and gas production activities using hydraulic fracturing techniques. In December 2021, the Texas Railroad Commission, which regulates the state’s oil and gas industry, suspended the use of deep wastewater disposal wells in four oil-producing counties in West Texas. The suspension is intended to mitigate earthquakes thought to be caused by the injection of waste fluids, including saltwater, that are a byproduct of hydraulic fracturing into disposal wells. The ban will require oil and gas production companies to find other options to handle the wastewater, which may include piping or trucking it longer distances to other locations not under the ban. In addition, the Texas Railroad Commission has overseen the development of well-operator-led response plans to reduce injection volumes in other portions of West Texas in order to reduce seismicity in these areas. The adoption of new laws or regulations at the federal, state, local or foreign level imposing reporting obligations on, or otherwise limiting, delaying or banning, the hydraulic fracturing process or other processes on which hydraulic fracturing and subsequent hydrocarbon production relies, such as water disposal, could make it more difficult to complete oil and natural gas wells,wells. Further, it could increase our customers’ costs of compliance and doing business, and otherwise adversely affect the hydraulic fracturing services for which they perform,contract, which could negatively impact demand for our products.Offshore Drilling. Various new regulations intendedimprove offshore safety systemsevaluate, and in some instances adopt, climate-related legislation and other regulatory initiatives that would restrict emissions of greenhouse gases. Changes in environmental protection have been issued since 2010 that have increasedrequirements related to greenhouse gases, climate change and alternative energy sources may negatively impact demand for our services. For example, oil and natural gas exploration and production may decline as a result of environmental requirements, including land use policies responsive to environmental concerns. In January 2021, the complexityActing Secretary of the Department of the Interior issued an order suspending new leasing and drilling permit processpermits for fossil fuel production on federal lands and may limitwaters for 60 days. President Biden then issued an executive order indefinitely suspending new oil and natural gas leases on public lands or in offshore waters pending completion of a comprehensive review and reconsideration of federal oil and gas permitting and leasing practices. While the opportunityUnited States Department of the Interior announced in April 2022 that it would resume oil and gas leasing on public lands, the topic of oil and gas leasing on public land remains politically fraught, as the announcement indicated that federal land available for some operatorsoil and gas leasing will be significantly reduced due to continue deepwater drillingenvironmental and climate concerns. To the extent that these developments or other initiatives to reform federal leasing practices result in the U.S. Gulfdevelopment of Mexico, whichadditional restrictions on drilling, limitations on the availability of leases, or restrictions on the ability to obtain required permits, it could have an adverse impact on our customers’ activities. For example, in April 2016, BSEE published a final blowout preventer systems and well control rule that focuses on blowout preventer requirements and includes reforms in well design, well control, casing, cementing, real‑time well monitoring and subsea containment. Additionally, in July 2016, the Bureau of Ocean Energy Management issued a notice to lessees (“NTL”), effective September 30, 2016, setting out new financial assurance requirements for offshore leases intended to ensure that leaseholders will be able to cover the costs of decommissioning. In January 2017, the Bureau extended the NTL implementation timeline for certain leases by an additional six months. In May 2017, the Bureau began a review of the NTL to determine whether it should be implemented. If these new financial assurance requirements remain in place, they may increase our customers’ operating costs and impact our customers’ ability to obtain leases, thereby reducingopportunities and reduce demand for our products. Additional regulation includes a third‑party certification requirement promulgated by the Bureau of Safetyproducts and Environmental9Enforcement (“BSEE”) in September 2016 under which offshore operators must certify through an independent third party that their critical safety and pollution prevention equipment is operational and will function as designedservices in the most extreme conditions. However,aforementioned areas.BSEE published a proposed rule in December 2017 to rescind this requirement, allowing equipment to demonstrate its adequacy through various industry standards, such as those established by the API. Third‑party challenges to industry operations in the U.S. Gulflevel of Mexico may also serve to further delay or restrict activities. Although our operations are predominately onshore, if the new regulations, policies, operating procedures and possibility of increased legal liability are viewed by our current or future customers as a significant impairment to expected profitability on projects or an unjustifiable increase in risk, they could discontinue or curtail their offshore operations, thereby adversely affecting the demand for our equipment and services, which, in turn could adversely affect our results of operations, financial condition and cash flows.Chinese Environmental Law. As we have manufacturing operations in the People’s Republic of China (“PRC”), we are regulated by various PRC national and local environmental protection laws, regulations and policies. Chinese PRC environmental laws and regulations include national and local standards governing activities that may impact human health and the environment. These laws and regulations set standards for emissions control, discharges to surface and subsurface water, and the generation, handling, storage, transportation, treatment and disposal of waste materials. Although we believe that our operations are in substantial compliance with current environmental laws and regulations, we may not be able to comply with these regulations at all times as the PRC environmental legal regime is evolving and becoming more stringent. Therefore, if the PRC government imposes more stringent regulations in the future, we will have to incur additional and potentially substantial costs and expenses to comply with new regulations, which may negatively affect our results of operations. If we fail to comply with any of the present or future environmental regulations in any material aspects, we may suffer from negative publicity and may be required to pay substantial fines, suspend or even cease operations.Companies must register or file an environmental impact report with the appropriate environmental bureau before starting construction or any major expansion or renovation of a new production facility. Before commencing operations, the agency must inspect the new or renovated facility and determine that all necessary equipment has been installed as required by applicable environmental protection requirements.Chinese PRC authorities have the power to issue fines and penalties for non‑compliance and can also require violators to cease operations until compliance has been restored. We cannot currently predict the extent of future capital expenditures, if any, required for compliance with environmental laws and regulations, which may include expenditures for environmental control facilities.Insurance and Risk ManagementWe provide products and systems to customers involved in oil and gas exploration, development and production. We also provide parts, repair services and field services associated with installation at all of our facilities and service centers in the United States and at our facility in Australia, as well as at customer sites. Our operations are subject to hazards inherentactivity in the oil and natural gas industry, including accidents, blowouts, explosions, cratering, fires, oil spillsexisting or future laws, regulations, treaties or international agreements related to greenhouse gases and hazardous materials spills. These conditions can cause personal injury or loss of life, damage to or destruction of property, equipment, the environment and wildlife, and interruption or suspension of operations, among other adverse effects. In addition, claimsclimate change, may reduce demand for loss of oil and natural gas production and damage to formations can occur. If a serious accident were to occur at a location where our equipment and services are being used, it could result in our being named as a defendant to lawsuits asserting significant claims.We have suffered accidents in the past, and we anticipate that we could experience accidents in the future. In addition to the property and personal losses from these accidents, the frequency and severity of these incidents affect our operating costs and insurability, as well as our relationships with customers, employees and regulatory agencies. Any significant increase in the frequency or severity of these incidents, or the general level of compensation awards, could10adversely affect the cost of, or our ability to obtain, workers’ compensation and other forms of insurance and could have othera negative impact on our business. Likewise, such restrictions may result in additional compliance obligations that could have a material adverse effectseffect on our business, consolidated results of operations and consolidated financial condition.officersofficers’ insurance. We also maintain a partially self-insured medical plan that utilizes specific and aggregate stop loss limits. Our insurance includes various limits and deductibles or self‑insured retentions, which must be met prior to, or in conjunction with, recovery. To cover potential pollution risks, our commercial general liability policy is endorsed with sudden and accidental coverage and our excess liability policies provide additional limits of liability for covered sudden and accidental pollution losses.Employees2017,2022, we employed over 880 people. Our future success will depend partially on our ability to attract, retain1,200 people worldwide (not including employees of FlexSteel), of which approximately 1,000 were employed in the United States. FlexSteel employed 350 people as of December 31, 2022, with 340 employed in the United States and motivate qualified personnel.10 in Canada. We are not a party to any collective bargaining agreements and have not experienced any strikes or work stoppages. We consider our relations with our employeesworkforce to be satisfactory.Facilitiescorporate headquartersbusiness’s success depends mainly on our ability to attract, retain and motivate a diverse population of talented employees at all levels of our organization, including the individuals who comprise our global workforce, executive officers and other key personnel. To succeed in a competitive industry, we have developed key recruitment and retention strategies, objectives and measures which we focus on as part of the overall management of our business.located in Houston, Texas. Please see “Item 2. Properties”focused on attracting the best talent and rewarding their performance while developing and retaining them. When hiring, we utilize employee referrals, a variety of social media platforms, regional job fairs and partner with educational organizations across the United States to find diverse, qualified, motivated and responsible candidates. Additionally, we work with local workforce commissions to ensure we are attracting a diverse and qualified pool of candidates for information with respect to our other facilities. We believe that our facilities are adequate for our current operations.CompetitionThe marketseach region in which we operateoperate.highly competitive.dedicated to our employees’ training and development, especially those in field and branch operations. Our internal training focuses on safety, corporate and personal responsibility, product knowledge, behavioral development and ethical conduct. Cactus maintains an internal database to track training progress and completion for all of our associates, with a particular interest in tracking the training and skill sets of our field service technicians and managers. This tracking tool enables us to take a holistic view of our strengths by branch and job title, which helps us to manage our operations and assign jobs to associates with the proper skills, training and experience to safely and efficiently meet or exceed customer demand. Other training courses offered outside of the company are attended by employees with specialized skills, knowledge or certifications as needed for their ongoing success and professional development. We believe our continued focus on training and development translates into a safer work environment, opportunities to promote within the organization, improved employee morale and increased employee retention.weexpectations for safety program procedures and training are onebeing met. We also engage in third party conformity assessments of our HSE processes to determine adherence to our HSE management system and to global health and safety standards. We monitor our Occupational Safety and Health Administration Total Recordable Incident Rate (“TRIR”) to assess our operation’s health and safety performance. TRIR is defined as the largest suppliersnumber of wellheadsincidents per 100 full-time employees that have resulted in a recordable injury or illness in the United States.pertinent period. During fiscal year 2022, we had a TRIR of 1.35, which compares to 1.29 in 2021. We competehad no work-related fatalities in either year. Based on the most recent statistics available from the International Association of Drilling Contractors, our TRIR statistics are in line with divisionsthe industry average.Schlumberger, Baker Hughes a GE company, Weirour employees. We provide our employees and TechnipFMCtheir families access to various flexible and convenient health and wellness programs. These programs include benefits that offer protection and security to have peace of mind concerning events that may require time away from work or impact their financial well-being. These tools also support their physical and mental health by providing resources to improve or maintain their health status. In response to the COVID-19 pandemic, we implemented additional safety measures for employees performing critical on-site work as well as with a number of smaller companies. We believe that the wellhead market is relatively concentrated, with Cactus, Schlumbergeroffering vaccination clinics and Baker Hughes representing over 50% of the market. Similar to Cactus, each of Schlumberger, Baker Hughes and TechnipFMC manufacture their own engineered products.We believe that the rental market for frac stacks and related flow control equipment is more fragmented than the wellhead product market. Cactus does not believe that any individual company represents more than 10% of the market. As is the case in the wellhead market, Cactus, Schlumberger, Baker Hughes and TechnipFMC rent internally engineered and manufactured products. Other competitors generally rent foreign designed and manufactured generic products.We believe that the principal competitive factors in the markets we serve are technical features, equipment availability, work force competency, efficiency, safety record, reputation, experience and price. Additionally, projects are often awarded on a bid basis, which tends to create a highly competitive environment. While we seek to be competitive in our pricing, we believe many of our customers elect to work with us based on product features, safety, performance and quality of our crews, equipment and services. We seek to differentiate ourselves from our competitors11by delivering the highest‑quality services and equipment possible, coupled with superior execution and operating efficiency in a safe working environment.We are required to file annual, quarterly and current reports, proxy statements and certain other information with the SEC. Any documents filed by us with the SEC may be inspected without charge at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Copies of these materials may be obtained from such office upon payment of a duplicating fee. Please call the SEC at 1‑800‑SEC‑0330 for further information on the operation of the Public Reference Room.The SEC maintains a website at www.sec.gov that contains reports, proxy and information statements and other information regarding registrants that file electronically with the SEC. Any documents filed by us with the SEC, including this Annual Report, can be downloaded from the SEC’s website. Cobalt Center, 920 Memorial City Way, Suite 300, Houston, TX 77024, and our telephone number at that address is (713) 626‑8800. Our website address is www.CactusWHD.com. Our periodic reports and other information filed with or furnished to the SEC, including our Form 10-Ks, Form 10-Qs and Form 8-Ks, as well as amendments to such filings, are available free of charge through our website, as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on our website or any other website is not incorporated by reference into this Annual Report and does not constitute a part of this Annual Report.Common Stockcommon stock involves risks. You should carefully consider the information in this Annual Report, including the matters addressed under “Cautionary NoteStatement Regarding Forward‑Looking Statements,” and the following risks before making an investment decision. Our business, financial condition, prospects and results of operations and financial condition could be materially and adversely affected by any of these risks. Additional risks or uncertainties not currently known to us, or that we deem immaterial, may also have an effect on our business, financial condition, prospects or results of operations.operations and financial condition. The trading price of our Class A Common Stockcommon stock could decline due to any of these risks, and you may lose all or part of your investment.gas. natural gas companies. Oil and gas activity is in turn heavily influenced by, among other factors, current and anticipated oil and natural gas prices locally and worldwide, which have historically been volatile.revenueresults of operations, financial condition and profitability.12Factors affecting the prices of oil and natural gas include, but are not limited to, the following:·demand for hydrocarbons, which is affected by worldwide population growth, economic growth rates and general economic and business conditions;·changes in sentiment on environmental matters;·costs of exploring for, producing and delivering oil and natural gas;·political and economic uncertainty and sociopolitical unrest;·available excess production capacity within the Organization of Petroleum Exporting Countries (“OPEC”) and the level of oil and gas production by non‑OPEC countries;·oil refining capacity and shifts in end‑customer preferences toward fuel efficiency and the use of natural gas;·technological advances affecting energy consumption;·potential acceleration of the development of alternative fuels;·access to capital and credit markets, which may affect our customers’ activity levels and spending for our products and services;·the relative strength of the U.S. dollar;·changes in laws and regulations related to hydraulic fracturing activities;·changes in environmental laws and regulations (including relating to the use of coal in power plants); and·natural disasters.oilfieldour products and services and downward pressure on the prices we charge. The last downturn in the oil and gas industry that began in mid‑2014 resulted in a reduction in demand for oilfield services and adversely affected our financial condition, resultsTheseour operating results to fluctuate.We derive our revenues from companies in the oil and natural gas exploration and production industry, a historically cyclical industry with levels of activity that are significantly affected by the levels and volatility of oil and natural gas prices. We have experienced and may in the future experience significant fluctuations in operating results as a result of the reactions of our customers to changes in oil and natural gas prices. For example, prolonged low commodity prices during 2015 and 2016, combined with adverse changes in the capital and credit markets, caused many exploration and productionE&P companies to reduce their capital budgets and drilling activity. This resultedAny future downturn or expected downturn could result in a significant decline in demand for oilfield services and adversely impacted the prices we could charge, particularly for rentals of frac equipment.13If oil prices or natural gas prices decline, the demand foraffect our products and services could be adversely affected.The demand for our products and services is primarily determined by current and anticipated oil and natural gas prices and the level of drilling activity and related general production spending in the areas in which we have operations. Volatility or weakness in oil prices or natural gas prices (or the perception that oil prices or natural gas prices will decrease) affects the spending patterns of our customers and may result in the drilling of fewer new wells or lower production spending on existing wells. When this occurs, exploration and production (“E&P”) companies move to significantly cut costs, both by decreasing drilling and completions activity and by demanding price concessions from their service providers. This results in lower demand for our products and services and may cause lower rates and lower utilization of our equipment. If oil prices decline or natural gas prices continue to remain low or decline further, or if there is a reduction in drilling activities, the demand for our products and services and ourbusiness, results of operations could be materially and adversely affected.Additionally, the commercial development of economically viable alternative energy sources (such as wind, solar, geothermal, tidal, fuel cells and biofuels) could reduce demand for our products and services and create downward pressure on the revenue we are able to derive from such products and services, as they are dependent on oil and natural gas prices.Anticipated growthcash flows.completionscompletion activity, and our ability to benefit from such anticipated growth, could be adversely affected by any significant constraints in pressure pumpingequipment, labor or takeaway capacity in the industry.completionscompletion activity may be impacted by, among other things, pressure pumpingthe availability and cost of oil country tubular goods (“OCTG”), pipeline capacity, and pricing, which,material and labor shortages. Should significant growth in turn, is impacted by, among other things, theactivity continue, there could be concerns over availability of fracturingthe equipment, demand for fracturing equipmentmaterials and fracturing intensity per active rig. Also, longer lateralslabor required to drill and higher intensity fracturing result in greater wear and tear to the industry’s fracturing equipment, which has caused and will continue to cause attrition in the supply of fracturing equipment and shortages in the availability of pressure pumping services. In addition, rising fracturing intensity per rig and an overall increase in completions activity has increased the demand for fracturing equipment. During the completion phase ofcomplete a well, we rent frac stacks, zipper manifolds and other high‑pressure equipment used during the hydraulic fracturing process. For the subsequent production phase of a well, we sell production trees, which are installed on the wellhead after the frac tree has been removed. Any significant additional constraints in the availability of pressure pumping services, fracturing equipment ortogether with the ability to move the produced oil and natural gas to market. Should significant constraints develop that materially impact the efficiency and economics of fracturing service providers to deliver fracturing servicesoil and gas producers, growth in U.S. drilling and completion activity could be adversely affected. This would have an adverse impact on the demand for the products we sell and rent, which could have a material adverse effect on our business, results of operations financial condition and cash flows.We design, manufacture, sell, rent and install equipment that is used in oil and gas exploration and production activities, which may subject us to liability, including claims for personal injury, property damage and environmental contamination should such equipment fail to perform to specifications.We provide products and systems to customers involved in oil and gas exploration, development and production. Some of our equipment is designed to operate in high‑temperature and/or high‑pressure environments, and some equipment is designed for use in hydraulic fracturing operations. We also provide parts, repair services and field services associated with installation at all of our facilities and service centers in the United States and at our facility in Australia, as well as at customer sites. Because of applications to which our products and services are exposed, particularly those involving high pressure environments, a failure of such equipment, or a failure of our customer to maintain or operate the equipment properly, could cause damage to the equipment, damage to the property of customers and others, personal injury and environmental contamination and could lead to a variety of claims against us that could have an adverse effect on our business and results of operations.We indemnify our customers against certain claims and liabilities resulting or arising from our provision of goods or services to them. In addition, we rely on customer indemnifications, generally, and third‑party insurance as part14of our risk mitigation strategy. However, our insurance may not be adequate to cover our liabilities. In addition, our customers may be unable to satisfy indemnification claims against them. Further, insurance companies may refuse to honor their policies, or insurance may not generally be available in the future, or if available, premiums may not be commercially justifiable. We could incur substantial liabilities and damages that are either not covered by insurance or that are in excess of policy limits, or incur liability at a time when we are not able to obtain liability insurance. Such potential liabilities could have a material adverse effect on our business, results of operations, financial condition and cash flows.the supply is limited, and the cost to attract and retain qualified personnel has increased. During industry downturns, skilled workers may leave the industry, reducing the availability of qualified workers when conditions improve. In addition, a significant increase in the wages paid by competing employers both within and outside of our industry could result in increases in the wage rates that we must pay. If we are not able to employ and retain skilled workers, our ability to respond quickly to customer demands or strong market conditions may inhibit our growth, which could have a material adverse effect on our business, results of operations and financial condition.a facilityfacilities in Australia that sellssell and rentsrent equipment as well as providesprovide parts, repair services and field services associated with installation. Additionally, we provide rental and field service operations in the Kingdom of Saudi Arabia. Instability and unforeseen changes in any of the markets in which we conduct business could have an adverse effect on the demand for, or supply of, our products and services, ourbusiness, results of operations and our financial condition. These factors include, but are not limited to, the following: