| | | | | Large accelerated filer ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company ☐ | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒ If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐ Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐ Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒ As of February 21, 2020,13, 2023, there were outstanding 38,788,65239,684,473 shares of Common Stock par value $.69-4/9 per share, and 26,253,04928,606,918 shares of Class B Common Stock par value $.69-4/9 per share. As of June 30, 20192022 the aggregate market value of the Common Stock (based upon the closing price of the stock on the New York Stock Exchange on such date) held by non-affiliates was approximately $651,380,000.$611,433,000. Class B Common Stock is not traded on any exchange, is restricted as to transfer or other disposition, but is convertible into Common Stock on a share-for-share basis. Upon such conversion, the resulting shares of Common Stock are freely transferable and publicly traded. Assuming all 26,301,60228,622,730 shares of outstanding Class B Common Stock were converted into Common Stock, the aggregate market value of Common Stock held by non-affiliates on June 30, 20192021 (based upon the closing price of the stock on the New York Stock Exchange on such date) would have been approximately $815,198,000.$768,227,000. Determination of stock ownership by non-affiliates was made solely for the purpose of this requirement, and the Registrant is not bound by these determinations for any other purpose. DOCUMENTS INCORPORATED BY REFERENCE Portions of the Company’s Definitive Proxy Statement for the Company’s Annual Meeting of Shareholders (the “2020 Proxy“Proxy Statement”) scheduled to be held on May 4, 20201, 2023 are incorporated by reference in Part III of this report. Forward-Looking Information From time to time, in the Company’s statements and written reports, including this report, the Company discusses its expectations regarding future performance by making certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the use of words such as “anticipate,” “believe,” “expect,” “intend,” “estimate,” “project,” and other words of similar meaning in connection with a discussion of future operating or financial performance and are subject to certain factors, risks, trends and uncertainties that could cause actual results and achievements to differ materially from those expressed in the forward-looking statements. These forward-looking statements are based on currently available competitive, financial and economic data and management’s views and assumptions regarding future events. Such forward-looking statements are inherently uncertain, and actual results may differ materially from those expressed or implied herein. Consequently, the Company wishes to caution readers not to place undue reliance on any forward-looking statements. Factors, among others, which could cause the Company’s future results to differ materially from the forward-looking statements, expectations and assumptions expressed or implied herein include general factors, such as economic conditions, political developments, currency exchange rates, interest and inflation rates, accounting standards, taxes, and laws and regulations affecting the Company in markets where it competes and those factors described in Item 1A “Risk Factors” and elsewhere in this Form 10-K and in other Company filings with the Securities and Exchange Commission. The Company does not undertake to update any of these forward-looking statements. PART I ITEM 1. Business. Tootsie Roll Industries, Inc. and its consolidated subsidiaries (the “Company”) have been engaged in the manufacture and sale of confectionery products for over 100 years. This is the only industry segment in which the Company operates and is its only line of business. The majority of the Company’s products are sold under the registered trademarks TOOTSIE ROLL, TOOTSIE FRUIT ROLLS, FROOTIES, TOOTSIE POPS, TOOTSIE MINI POPS, CHILD’S PLAY, CARAMEL APPLE POPS, CHARMS, BLOW-POP, CHARMS MINI POPS, CELLA’S, DOTS, JUNIOR MINTS, CHARLESTON CHEW, SUGAR DADDY, SUGAR BABIES, ANDES, FLUFFY STUFF, DUBBLE BUBBLE, RAZZLES, CRY BABY, NIK-L-NIP, and TUTSI POP (Mexico). The Company’s products are marketed in a variety of packages designed to be suitable for display and sale in different types of retail outlets. They are sold through approximately 30 candyfood and grocery brokers andor directly by the Company itself to approximately 2,000 customers throughout the United States.States, Canada and Mexico. These customers include wholesale distributors of candy, food and groceries, supermarkets, variety stores, dollar stores, chain grocers, drug chains, discount chains, cooperative grocery associations, mass merchandisers, warehouse and membership club stores, vending machine operators, e-commerce merchants, the U.S. military and fund-raising charitable organizations. The Company’s principal markets are in the United States, Canada and Mexico. The majority of production from the Company’s Canadian plants is sold in the United States. The majority of production from the Company’s Mexican plant is sold in Mexico. The domestic confectionery business is highly competitive. The Company competes primarily with other manufacturers of confectionery products sold to the above mentioned customers. Although accurate statistics are not available, the Company believes it is among the ten largest domestic manufacturers in this field. In the markets in which the Company competes, the main forms of competition comprise brand recognition, as well as competition for retail shelf space and a fair price for the Company’s products at various retail price points. The Company did not have a materialCompany’s backlog of firm orders atas of December 31, 2022 was approximately $16 million and is consistent with the end of the calendar years 2019 or 2018.prior year. The Company has historically hedged certain of its future sugar and corn syrup needs with derivatives at such times that it believes that the forward markets are favorable. The Company’s decision to hedge its major ingredient requirements is dependent on the Company’s evaluation of forward commodity markets and their comparison to vendor quotations, if to vendor quotations, if available, and/or historical costs. The Company has historically hedged some of these major ingredients with derivatives, primarilygenerally entered into commodity futures contracts before the commencement of the next calendar year to better ascertain the need formanage product pricing changes or product weight decline (indirect price change) adjustments to its product sales portfolio and better manage ingredient costs. The Company will generally purchase forward derivative contracts (i.e., “long” position) in selected future months that correspond to the Company’s estimated procurement and usage needs of the respective commodity in the respective forward periods.

From time to time, the Company will increase its sales prices to recover higher input costs, primarily ingredients, packaging materials, and freight and delivery. The Company may also changeschange the size and weight of certain of its products in response to significant changes in ingredient and other input costs. The Company does not hold any material patents, licenses, franchises or concessions. The Company’s major trademarks are registered in the United States, Canada, Mexico and in many other countries. Continued trademark protection is of material importance to the Company’s business as a whole. Although the Company does research and develops new products and product line extensions for existing brands, it also improves the quality of existing products, improves and modernizes production processes, and develops and implements new technologies to enhance the quality and reduce the costs of products.products in order to provide value to its consumers. The Company does not expend material amounts of money on research or development activities. The manufacture and sale of consumer food products is highly regulated. In the United States, the Company’s activities are subject to regulation by various government agencies, including the Food and Drug Administration, the Department of Agriculture, the Federal Trade Commission, the Department of Commerce and the Environmental Protection Agency, as well as various state and local agencies. Similar agencies also regulate the businesses outside of the United States. The Company maintains quality assurance, food safety and other programs to help ensure that all products the Company manufactures and distributes are safe and of high quality and comply with all applicable laws and regulations. The Company’s compliance with federal, state and local regulations which have been enacted or adopted regulating the discharge of materials into the environment, or otherwise relating to the protection of the environment, has not had a material effect on the capital expenditures, earnings or competitive position of the Company nor does the Company anticipate any such material effects from presently enacted or adopted regulations. The Company employs approximately 2,000 persons.

2,300 full-time persons at all locations. Our business has seasonality which results in bringing on some additional employees to meet seasonal production demands principally in advance of the Halloween selling season in the third quarter each year. The Company has found that itsexperiences a relatively consistent sales normally maintain a consistent level throughout the year except for a substantialan increase in the third quarter which reflects pre-Halloween and back-to-school sales. In anticipation of this highseasonal sales period, the Company generally begins building inventories, and its seasonal workforce, in the second and third quarter of each year. Although Halloween is the most significant season in sales and related production, other seasons, including Christmas, Valentines, and Easter also have some impact on workforce levels. The Company’s union labor agreement at its Chicago plant was executed in 2018 and expired in September 2022. The Company historically offers extended credit terms for sales made under seasonal sales programs, including Halloween. Each year, after accounts receivables relatedand the union have agreed to third quarter sales have been collected,continue the Company invests such funds in various marketable securities.existing contract on a month to month basis while negotiations continue (see also risk factor below), which is consistent with past contract negotiation timelines. Sales revenuesWe believe our employees are among our most important resources and are critical to our continued success. We focus significant attention on attracting and retaining talented and experienced individuals to manage and support our operations. We pay our employees competitively and offer a broad range of company-paid benefits, which we believe are competitive with others in our industry. Our management teams and all of our employees are expected to exhibit and promote honest, ethical and respectful conduct in the workplace. All of our employees must adhere to a code of conduct that sets standards for appropriate behavior. A copy of our code of conduct can be found on our website, Tootsie.com. We have prioritized the safety of our employees and therefore implemented safety protocols during 2020 and continuing into 2023, to respond to the Covid-19 pandemic as needed.

Our net product sales from Wal-Mart Stores, Inc. aggregated approximately 24.2%23.0%, 24.1%22.7%, and 24.0%23.5% of net product sales during the years ended December 31, 2019, 20182022, 2021 and 2017,2020, respectively. Sales revenuesOur net sales from Dollar Tree, Inc. (which includes net sales from Family Dollar which was acquiredis owned by Dollar Tree) aggregated approximately 11.3%12.4%, 11.2%12.1%, and 10.9%11.7% of net product sales during the years ended December 31, 2019, 20182022, 2021 and 2017,2020, respectively. Some of the aforementioned sales to Wal-Mart and Dollar Tree arewere sold to McLane Company, a large national grocery wholesaler, which services and delivers certain of the Company’s products to Wal-Mart, Dollar Tree and other retailers in the U.S.A. Net product sales revenues from McLane, which includes these Wal-Mart and Dollar Tree sales as well as sales and deliveries to other Company customers, were 17.7%20.4% in 20192022 and 17.4%21.0% in 20182021 and 16.9%22.1% in 2017.2020. At December 31, 20192022 and 2018,2021, the Company’s three largest customers discussed above accounted for approximately 30%39% and 31%36% of total accounts receivable, respectively. Although no customer, other than McLane Company, Inc., Wal-Mart Stores, Inc. and Dollar Tree, accounted for more than 10% of net product sales, the loss of one or more significant customers could have a material adverse effect on the Company’s business. The Company historically offers extended credit terms for sales made under seasonal sales programs, including Halloween. Each year, after accounts receivables related to third quarter sales have been collected, the Company invests such funds in various marketable securities. For a summary of sales and long-lived assets of the Company by geographic area see Note 98 of the “NotesNotes to Consolidated Financial Statements”Statements which is incorporated herein by reference. Information regarding the Company’s Form 10-K, Form 10-Q, current reports on Form 8-K, and any amendments to these reports, will be made available, free of charge, upon written request to Tootsie Roll Industries, Inc., 7401 South Cicero Avenue, Chicago, Illinois 60629, Attention: Barry Bowen, Treasurer and Assistant Secretary. The Company does not make all such reports available on its website at www.tootsie.com because it believes that they are readily available from the Securities Exchange Commission at www.sec.gov, and because the Company provides them free of charge upon request. The information on our website is not incorporated into this Annual Report on Form 10-K. Interested parties, including shareholders, may communicate to the Board of Directors or any individual director in writing, by regular mail, addressed to the Board of Directors or an individual director, in care of Tootsie Roll Industries, Inc., 7401 South Cicero Avenue, Chicago, Illinois 60629, Attention: Ellen R. Gordon, Chairman and Chief Executive Officer. If an interested party wishes to communicate directly with the Company’s non-employee directors, it should be noted on the cover of the communication. ITEM 1A. Risk Factors. Significant factors that could impact the Company’s financial condition or results of operations include, without limitation, the following: Risk factors which we believe affect all competitors in our industry | ● | Our business and financial results may be negatively impacted by changes in confectionary trade practices and consumer patterns, or operational challenges associated with the actual or perceived effects of a disease or pandemic outbreak, such as the Covid-19 pandemic including variants and sub variants, and other public health concerns, consumer spending levels, shopping habits and behaviors (including changes in impulse purchase behaviors), consumer activities, work routines, events and traditions where confectionary products are consumed, the availability of our products at retail, including at large retail customers, and our ability to manufacture and distribute products to our customers and consumers in an effective and efficient manner. Government mandates to “shelter in place” or “closing of the economy”, public health guidelines, or fear of exposure or actual effects of a disease or pandemic, such as the Covid-19 pandemic, could negatively impact our overall business and financial results. Specific factors that may impact our operations, some of which have had, and in the future could have, an unfavorable impact on our operations as a result of Covid-19, include, but are not limited to: |

a. Significant reductions in demand for one or more of our products - Changes in demand may be caused by, among other things, the temporary inability of consumers to purchase our products due to illness, quarantine, travel restrictions, financial hardship, “shelter in place” directives, or overall fear to return to past behaviors. Shifts in demand for one or more of our products, changes in trade and distribution patterns, or changes in consumer buying habits, if prolonged, could negatively impact our results. b. The inability to meet our customers’ needs and achieve efficient production of finished products - Disruptions in our manufacturing operations or supply chain delivery disruptions caused by the loss or disruption of essential manufacturing ingredients, materials, supplies and services, transportation resources, workforce availability, or other manufacturing and distribution capability could have significant adverse effects on our business and financial results. c. Significant adverse changes in the political conditions and government mandates or directives - In markets in which we manufacture, sell or distribute our products, governmental or regulatory actions in response to pandemics, including Covid-19, closures or other restrictions such as quarantine or travel restrictions, that limit or close our manufacturing, distribution or office facilities, or otherwise prevent our third-party suppliers, sales brokers, or customers from achieving the level of operations necessary for the production, distribution, sale, and support of our products, could negatively impact our results. d. Risk related to Halloween and other seasonal sales - The Company’s net product sales are highest during the Halloween season which have historically comprised approximately 50% of third quarter domestic net product sales. Changes in consumer behavior, traditions, behaviors, and interest in Halloween activities and events, or changes mandated or recommended by government or health officials, as well as negative media coverage, could significantly affect the Company’s seasonal sales. e. Risks relating to potential employer liability - The effects of Covid-19 relating to employer liability remains uncertain, and if it is determined that employers are to have liability for employee or other matters related to Covid-19, this could have significant adverse effects on our financial results. | ● | Risk of changes in the price and availability of ingredients and raw materials - The principal ingredients used by the Company are subject to price volatility. Although the Company engages in commodity hedging transactions and annual supply agreements as well as leveraging the high volume of its annual purchases, the Company may experience price increases in certain ingredients, packaging materials, operating supplies, services, and wages and benefits, including the effects of higher inflation, that it may not be able to offset, which could have an adverse impact on the Company’s results of operations and financial condition. In addition, although the Company has historically been able to procure sufficient supplies of its ingredients, packaging materials, and other supplies, supply chain disruptions and market conditions could change such that adequate suppliesmaterials might not be available or only become available at substantially higher costs. Adverse weather patterns, including the effects of climate change or supply interruptions, could also significantly affect the cost and availability of ingredients.ingredients and other needed materials to manufacture products for sale. |

| ● | Risk of changes in product performance and competition - The Company competes with other well-established manufacturers of confectionery products. A failure of new or existing products to be favorably received, a failure to retain preferred shelf space at retail or a failure to sufficiently counter aggressive promotional and price competition could have an adverse impact on the Company’s results of operations and financial condition. |

| ● | Risk of discounting and other competitive actions - Discounting and pricing pressure by the Company’s retail customers including the effects of import tariffs, and other competitive actions could make it more difficult for the Company to maintain its operating margins. Actions taken by major customers and competitors may make shelf space less available for the confectionery product category or some of the Company’s products. |

| ● | Risk of pricing actions - Inherent risks in the marketplace, including uncertainties about trade and consumer acceptance of pricing actions, including related trade discounts, or product weight changes (indirect price increases), could make it more difficult for the Company to maintain its sales and operating margins. Higher costs for ingredients and materials, and other input costs may be difficult to pass onto customers and |

| | consumers of Company products through price increases, and therefore may adversely affect the Company’s profit margins. |

| ● | Risk related to seasonality of sales - The Company’s sales are highest during the Halloween season.season, although Christmas, Easter and Valentine’s Day are also key seasons for the Company. Circumstances surrounding Halloween, such as, widespread adverse weather or other widespread events that affect consumer behavior and related media coverage at that time of year or general changes in consumer interest in Halloween, could significantly affect the Company’s sales. |

| ● | Risk of dependence on large customers - The Company’s largest customers, Wal-Mart Stores, Inc., Dollar Tree, and the McLane Company accounted for approximately 37.1% of net product sales in 2019, and other large national chains are also material to the Company’s sales. The loss of any of these customers, or one or more other large customers, or a material decrease in purchases by one or more large customers, could result in decreased sales and adversely impact the Company’s results of operations and financial condition. |

| ● | Risk of changes in consumer preferences and tastes - Failure to adequately anticipate and react to changing demographics, consumer trends, consumer health concerns and product preferences, including product ingredients and packaging materials, could have an adverse impact on the Company’s results of operations and financial condition. |

| ● | Risk of economic conditions on consumer purchases - The Company’s sales are impacted by consumer spending levels and impulse purchases which are affected by general macroeconomic conditions, consumer confidence, employment levels, disposable income, inflation, availability of consumer credit and interest rates on that credit, consumer debt levels, energy costs and other factors. Volatility in food and energy costs, rising unemployment and/or underemployment, declines in personal spending, recessionary economic conditions or other adverse market conditions, could adversely impact the Company’s revenues, profitability and financial condition. |

| ● | Risks related to environmental matters - The Company’s operations are not particularly impactful on the environment, but increased government environmental regulation or legislation including various “green” initiatives could adversely impact the Company’s profitability. |

| ● | Risks relating to participation in the multi-employer pension plan for certain Company union employees - As outlined in the Notes to the Consolidated Financial Statements and discussed in the Management’s Discussion and Analysis , the Company participates in a multi-employer pension plan (Plan) which is currently in “critical and declining status”, as defined by applicable law. A designation of “critical and declining status” implies that the Plan is expected to become insolvent within the next 20 years. Under terms of a rehabilitation plan, the Company is to be assessed 5% annual compounded surcharges on its contributions to the Plan until such time as the Plan emerges from critical status. Should the Company withdraw from the Plan, it would be subject to a significant withdrawal liability which is discussed in Note 7 of the Company’s Notes to Consolidated Financial Statements and Management’s Discussion and Analysis. The Company is currently unable to determine the ultimate outcome of this matter and therefore, is unable to determine the effects on its consolidated financial statements, but, the ultimate outcome could be material to its consolidated results of operations in one or more future periods. |

| ● | Risk of new governmental laws and regulations - Governmental laws and regulations, including those that affect food advertising and marketing to children, use of certain ingredients in products, new labeling requirements, income and other taxes and tariffs, including the effects of changes to international trade agreements, new taxes targeted toward confectionery products and the environment, both in and outside the U.S.A., are subject to change over time, which could adversely impact the Company’s results of operations and ability to compete in domestic or foreign marketplaces. |

| ● | Risk of labor stoppages - To the extent the Company experiences any significant labor stoppages and disputes, labor organizing efforts, strikes or possible labor shortages, could negatively affect overall operations including production or shipments of finished product to customers. The Company’s union labor agreement at its Chicago plant was executed in 2018 and will continue through September 2022. |

| ● | Risk of impairment of goodwill or indefinite-lived intangible assets - In accordance with authoritative guidance, goodwill and indefinite-lived intangible assets are not amortized but are subject to an impairment evaluation annually or more frequently upon the occurrence of a triggering event. Other long-lived assets are likewise tested for impairment upon the occurrence of a triggering event. Such evaluations are based on assumptions and variables including sales growth, profit margins and discount rates. Adverse changes in any of these variables could affect the carrying value of these intangible assets and the Company’s reported profitability. |

| ● | Risk of the cost of energy increasing and overall inflation - Higher energy costs as well as overall inflation would likely result in higher plant overhead, distribution, freight and delivery, and other operating costs. The Company may not be able to offset these cost increases or pass such cost increases onto customers in the form of price increases, which could have an adverse impact on the Company’s results of operations and financial condition. In addition, higher energy costs also adversely affect the cost of many resins which are used as a foundation material for many of our packaging materials. |

| ● | Risk of a product recall - Issues related to the quality and safety of the Company’s products could result in a voluntary or involuntary large-scale product recall. Costs associated with a product recall and related litigation or fines, and marketing costs relating to the re-launch of such products or brands, could negatively affect operating results. In addition, negative publicity associated with this type of event, including a product recall relating to product contamination or product tampering, whether valid or not, could negatively impact future demand for the Company’s products. |

| ● | Risk of operational interruptions relating to computer software or hardware failures, including cyber-attacks - The Company is reliant on computer systems to operate its business and supply chain. Software failure or corruption, including cyber-based attacks or network security breaches, or catastrophic hardware or software |

| | failures or other disasters could disrupt communications, supply chain planning and activities relating to sales demand forecasts, materials procurement, production and inventory planning, customer orders, shipments, and collections, and financial and accounting, all of which could negatively impact sales and profits. |

| ● | Risk of releasing sensitive information - Although the Company does not believe that it maintains a large amount of sensitive data, a system breach, whether inadvertent or perpetrated by hackers, could result in identity theft, ransomware and/or a disruption in operations which could expose the Company to financial costs and adversely affect profitability. |

| ● | Disruption to the Company’s supply chain could impair the Company’s ability to produce or deliver its finished products, resulting in a negative impact on operating results - Disruption to the manufacturing operations or supply chain, some of which are discussed above, could result from, but are not limited to adverse tariffs which could effectively limit supply or make supply more costly, natural disasters, pandemics, weather, fire or explosion, earthquakes, terrorism or other acts of violence, unavailability of ingredients or packaging materials which could result if our suppliers are unable to obtain certain raw materials or make timely deliveries, labor strikes or other labor activities, labor shortages to meet higher demand for Company products, including the staffing of seasonal labor needs, logistical delays including materials from foreign locations, operational and/or financial instability of key suppliers, and other vendors or service providers. Although precautions are taken to mitigate the impact of possible disruptions, if the Company is unable, or if it is not financially feasible to effectively mitigate the likelihood or potential impact of such disruptive events, the Company’s results of operations and financial condition could be negatively impacted. |

| ● | Risks associated with climate change and other environmental impacts and regulations, and increased focus and evolving views of our customers and consumers of our products could negatively affect our business and operations -Climate-related changes can increase variability in, or otherwise impact, natural disasters, including weather patterns, with the potential for increased frequency and severity of significant weather events, natural hazards, rising mean temperature and sea levels, and long-term changes in precipitation patterns. Climate change or weather-related disruptions to agricultural crop yields and our supply chain can impact the availability and cost of materials needed for manufacturing and could increase commodity prices and our operating costs. Increased focus on climate change has led to legislative and regulatory efforts to combat both potential causes and adverse impacts of climate change, including regulation of greenhouse gas (GHG) emissions. New or increasing laws and regulations related to GHG emissions and other climate change related concerns may adversely affect us, our suppliers and our customers, and may require additional capital investments. Our global supply chain faces similar challenges as our products rely on agricultural ingredients some of which are sourced from a global supply chain. Climate change poses a significant and increasing risk to global food production systems and to the safety and resilience of the communities where we source certain of our ingredients. Additionally, any non-compliance with legislative and regulatory requirements could negatively impact our reputation and ability to do business. Customers, consumers, and government regulators have increasingly focused on the environmental or sustainability practices of companies. New legislation or an enforcement action in this area could harm our reputation and financial results. |

Risk factors which we believe are principally specific to our Company (although some may apply to varying degrees to competitors in our industry) | ● | Risks relating to participation in the multi-employer pension plan for certain Company union employees - As outlined in the Note 7 of the Company’s Notes to Consolidated Financial Statements and discussed in the Management’s Discussion and Analysis, the Company participates in a multi-employer pension plan (Plan) which is currently in “critical and declining status”, as defined by applicable law. A designation of “critical and declining status” implies that the Plan is expected to become insolvent within the next 20 years. Should the Company withdraw from the Plan, it would be subject to a significant withdrawal liability which is discussed in Note 7 of the Company’s Notes to Consolidated Financial Statements and Management’s Discussion and Analysis. The Company is currently unable to determine the ultimate outcome of this matter |

| | and therefore, is unable to determine the effects on its consolidated financial statements, but the ultimate outcome could be material to its consolidated results of operations in one or more future periods. |

| ● | Risk of impairment of goodwill or indefinite-lived intangible assets - In accordance with authoritative guidance, goodwill and indefinite-lived intangible assets are not amortized but are subject to an impairment evaluation annually or more frequently upon the occurrence of a triggering event. Other long-lived assets are likewise tested for impairment upon the occurrence of a triggering event. Such evaluations are based on assumptions and variables including sales growth, profit margins and discount rates. Adverse changes in any of these variables could affect the carrying value of these intangible assets and the Company’s reported profitability. |

| ● | Risk of production interruptions - The majority of the Company’s products are manufactured in a single production facility on specialized equipment. In the event of a disaster, such as a fire or earthquake, at a specific plant location, or other disruption, including labor shortages, it would be difficult to transfer production to other facilities or a new location in a timely manner, which could result in loss of market share for the affected products. In addition, from time to time, the Company upgrades or replaces this specialized equipment. In many cases these are integrated and complex installations. A failure or delay in implementing such an installation could impact the availability of one or more of the Company’s products which would have an adverse impact on sales and profits. |

| ● | Risk related to international operations - To the extent there are political leadership or legislative changes, social and/or political unrest, civil war, pandemics such as the Coronavirus, terrorism or significant economic or social instability in the countries in which the Company operates, the results of the Company’s business in such countries could be adversely impacted. Currency exchange rate fluctuations between the U.S. dollar and foreign currencies could also have an adverse impact on the Company’s results of operations and financial condition. The Company’s principal markets are the U.S.A., Canada, and Mexico. |

| ● | Risk related to investments in marketable securities - The Company invests its surplus cash in a diversified portfolio of highly rated marketable securities, includingprincipally corporate and tax exempt municipal bonds, with maturities generally of generally upthree to three years, and variable rate demand notes with weekly resets of interest rates and “puts’ to redeem the investment each week. Nonetheless, suchfive years. Such investments could become impaired in the event of certain adverse economic and/or geopolitical events which, if severe, would adversely affect the Company’s financial condition. |

| ● | DisruptionRisk of further losses in Spain - The Company has continued to restructure its Spanish subsidiary and is exploring a variety of programs to increase sales and profitability. Nonetheless, if our efforts are not successful, additional losses and impairments may be reported in the future. See also Management’s Discussion and Analysis. |

| ● | Risk of dependence on large customers - The Company’s largest customers, McLane Company, Wal-Mart and Dollar Tree, accounted for approximately 37% of net product sales in 2022, and other large national chains are also material to the Company’s supply chain could impair the Company’s ability to producesales. The loss of any of these customers, or deliver its finished products, resultingone or more other large customers, or a material decrease in a negative impact on operating results - Disruption to the manufacturing operationspurchases by one or supply chain, some of which are discussed above,more large customers, could result from, but are not limited to adverse tariffs which could effectively limit supply or make supply more costly, natural disasters, pandemics, weather, fire or explosion, earthquakes, terrorism or other acts of violence, unavailability of ingredients or packaging materials, labor strikes or other labor activities, operational and/or financial instability of key suppliers,in decreased sales and other vendors or service providers. Although precautions are taken to mitigate theadversely impact of possible disruptions, if the Company is unable, or if it is not financially feasible to effectively mitigate the likelihood or potential impact of such disruptive events, the Company’s results of operations and financial condition could be negatively impacted.condition. |

| ● | Risk related to acquisitions - From time to time, the Company has purchased other confectionery companies or brands. These acquisitions generally come at a high multiple of earnings and are justified based on various |

| | assumptions related to sales growth, and operating margins. Were the Company to make another acquisition and be unable to achieve the assumed sales and operating margins, it could have an adverse impact on future sales and profits. In addition, it could become necessary to record an impairment which would have a further adverse impact on reported profits. |

| ● | Risk of further losses in Spain - The Company has restructured its Spanish subsidiary and is exploring a variety of programs to increase sales and profitability. These efforts thus far are resulting in reductions in operating losses, and our efforts are continuing. Nonetheless, if our efforts are not successful, additional losses and impairments may be reported from in the future. See also Management’s Discussion and Analysis. |

| ● | Risk of “slack fill” or other product label litigation - The Company, as well as other confectionery and food companies, have experienced a number of plaintiff claims that certain products are sold in boxes that are not completely full, and therefore such “slack filled” products are misleading, and even deceptive, to the consumer. Although the Company believes that these claims and other product labeling claims are without merit and has generally been successful in litigation and court decrees, the Company could be exposed to significant legal fees to defend its position, and in the event that it is not successful, could be subject to fines and costs of settlement, including class action settlements. |

| ● | Risk related to international operations - To the extent there are political leadership or legislative changes, social and/or political unrest, civil war, pandemics such as the Coronavirus, terrorism or significant economic or social instability in the countries in which the Company operates, the results of the Company’s business |

| | in such countries could be adversely impacted. Currency exchange rate fluctuations between the U.S. dollar and foreign currencies could also have an adverse impact on the Company’s results of operations and financial condition. The Company’s principal markets are the U.S.A., Canada, and Mexico. |

| ● | Risk of union labor stoppages, slowdowns or strikes- The Company’s union labor agreement at its Chicago plant was executed in 2018 and expired in September 2022. The Company has been in negotiations with the union, and the parties agreed to extend the prior contract on a month-to-month basis and continue negotiations in good faith. These post-contract negotiations are consistent with past contract negotiations and timelines. In the event that the parties are unable to reach an agreement, a work stoppage or strike could result at the Company’s Chicago manufacturing plant and distribution center which could have a material effects on the Company’s sales and profits. |

| ● | The Company is a controlled company due to the common stock holdings of the Gordon family - The Gordon family’s share ownership represents a majority of the combined voting power of all classes of the Company’s common stock as of December 31, 2019.2022. As a result, the Gordon family has the power to elect the Company’s directors and approve actions requiring the approval of the shareholders of the Company. |

The factors identified above are believed to be significant factors, but not necessarily all of the significant factors, that could impact the Company’s business. Unpredictable or unknown factors could also have material effects on the Company. Additional significant factors that may affect the Company’s operations, performance and business results include the risks and uncertainties listed from time to time in filings with the Securities and Exchange Commission and the risk factors or uncertainties listed herein or listed in any document incorporated by reference herein. ITEM 1B. Unresolved Staff Comments. None. ITEM 2. Properties. The Company owns its principal manufacturing, warehousing and distribution, and offices facilities which are locatedoffice facilities. The Company’s largest operating facility in Chicago, Illinois also serves as the Corporate headquarters. The Company also owns domestic manufacturing, warehousing and distribution facilities in a building consisting of approximately 2,354,000 square feet.Tennessee (Covington), Massachusetts (Cambridge), and Wisconsin (Delavan) and international manufacturing facilities in Mexico (Mexico City), Spain (Barcelona) and two in Canada (Concord, Ontario). In addition, the Company leases manufacturing and warehousing facilities at a second location in Chicago which comprises 137,000 square feet.Chicago. The lease is renewable by the Company every five years through June 2041.

The Company’s other principal manufacturing, warehousing and distribution facilities, all of which are owned, are:

| | | | Location

|

| Square Feet (a)

|

|

|

|

|

| Covington, Tennessee

| | 685,000

|

| Cambridge, Massachusetts

| | 142,000

|

| Delavan, Wisconsin

| | 162,000

|

| Concord, Ontario, Canada

| | 280,500

| (b)

| Hazleton, Pennsylvania

| | 240,000

| (c)

| Mexico City, Mexico

| | 90,000

|

| Barcelona, Spain

|

| 93,000

| (d)

|

(a)Square footage is approximate and includes production, warehousing and office space.

(b)Two facilities; a third owned facility, comprising 225,000 square feet of warehousing space, and which is excluded from the reported totals above, is leased to a third party.

(c)Warehousing only.

(d)Excludes 9,500 square feet of unused office space in a separate facility which is leased to a third party.

The Company owns substantially all of the production machinery and equipment located in its plants, warehouses and distribution centers. The Company also holds four commercial real estate properties for investment which were acquired with the proceeds from a sale of surplus real estate in 2005.2005 as well as two warehouse facilities (in Concord, Ontario, Canada, and Hazelton, Pennsylvania, U.S.A.) that are currently leased to third parties. ITEM 3. Legal Proceedings. In the ordinary course of business, the Company is, from time to time, subject to a variety of active or threatened legal proceedings and claims. While it is not possible to predict the outcome of such matters with certainty, in the Company’s opinion, both individually and in the aggregate, they are not expected to have a material effect on the Company’s financial condition, results of operations or cash flows. ADDITIONAL ITEM. Executive Officers of the Registrant. See the information on Executive Officers set forth in the table in Part III, Item 10. ITEM 4. Mine Safety Disclosures. None. PART II ITEM 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. The Company’s common stock is traded on the New York Stock Exchange. The Company’s Class B common stock is subject to restrictions on transferability. The Class B common stock is convertible at the option of the holder into shares of common stock on a share-for-share basis. As of February 28, 202013, 2023 there were approximately 2,5002,300 and 1,000800 registered holders of record of common and Class B common stock, respectively. In addition, the Company estimates that as of February 28, 202013, 2023 there were 17,500124,500 and 1,000 beneficial holders of common and Class B common stock, respectively. The following table sets forth information about the shares of its common stock the Company purchased on the open market during the fiscal quarter ended December 31, 2019:

Issuer Purchases of Equity Securities

| | | | | | | | | | | | | | | | | | Total Number of | | Maximum Number (or | | | | Total | | Average | | Shares Purchased | | Approximate Dollar Value) | | | | Number | | Price | | as Part of Publicly | | of Shares that May Yet | | | | of Shares | | Paid per | | Announced Plans | | be Purchased Under the | | Period | | Purchased | | Share | | or Programs | | Plans or Programs | | | | | | | | | | | | | Oct 1 to Oct 31 | | 118,083 | | $ | 35.52 | | Not Applicable | | Not Applicable | | Nov 1 to Nov 30 | | 78,404 | | | 34.19 | | Not Applicable | | Not Applicable | | Dec 1 to Dec 31 | | — | | | — | | Not Applicable | | Not Applicable | | Total | | 196,487 | | $ | 34.99 | | | | | |

While the Company does not have a formal or publicly announceddividend policy, but has historically issued quarterly dividends and in 2022 issued a quarterly dividend of $0.09 per share. The Company commonhas also historically distributed an annual 3% stock purchase program,dividend. While the Company repurchases its commonplans to continue to issue quarterly cash dividends and the annual stock ondividend there can be no assurance that it will continue to do so in the open market from time to time as authorized by the Board of Directors.future.

Quarterly Stock Prices and Dividends

The high and low quarterly prices for the Company’s common stock, as reported on the New York Stock Exchange and quarterly dividends in 2019 and 2018 were:

| | | | | | | | | | | | | | | | | | | | | | | | | | | 2019 | | 2018 | | | 4th | | 3rd | | 2nd | | 1st | | 4th | | 3rd | | 2nd | | 1st | | | | Quarter | | | Quarter | | | Quarter | | | Quarter | | | Quarter | | | Quarter | | | Quarter | | | Quarter | | | | | | | | | | | | | | | | | | | | | | | | | | High | | $ | 36.93 | | $ | 38.44 | | $ | 40.43 | | $ | 37.80 | | $ | 35.71 | | $ | 32.35 | | $ | 31.45 | | $ | 36.20 | Low | | | 33.33 | | | 35.24 | | | 36.48 | | | 31.57 | | | 28.41 | | | 28.55 | | | 27.75 | | | 28.75 | Dividends per share | | | 0.09 | | | 0.09 | | | 0.09 | | | 0.09 | | | 0.09 | | | 0.09 | | | 0.09 | | | 0.09 |

NOTE: In addition to the above cash dividends, a 3% stock dividend was issued on April 5, 2019 and April 6, 2018.

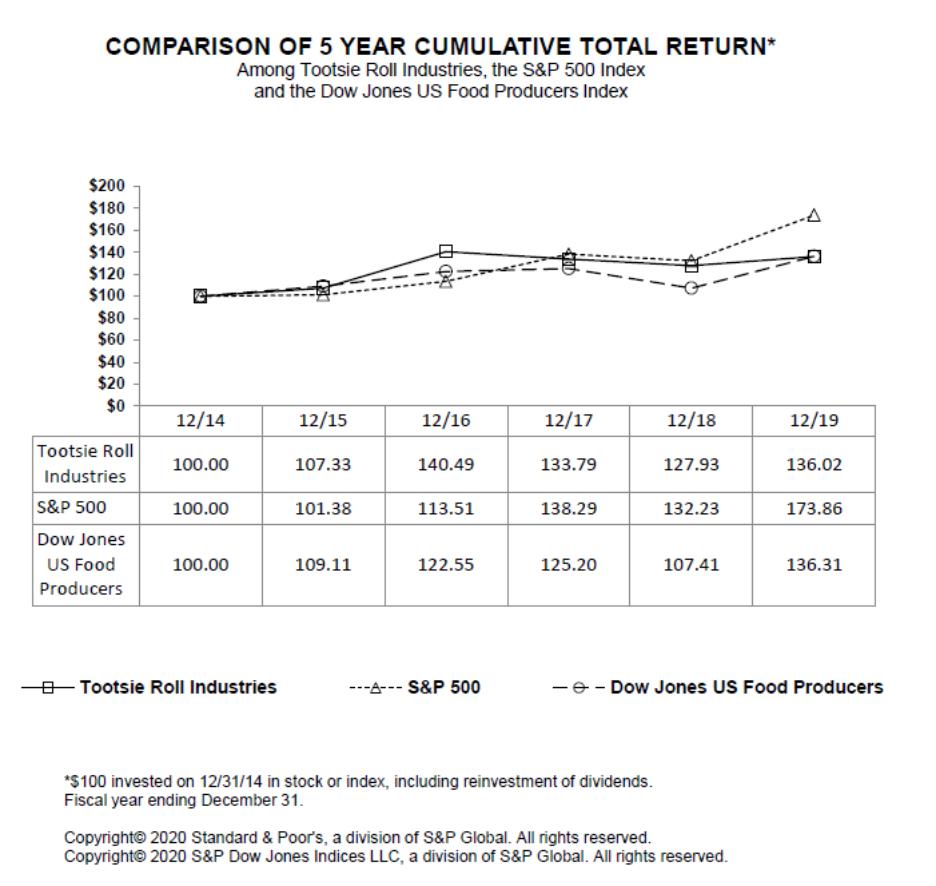

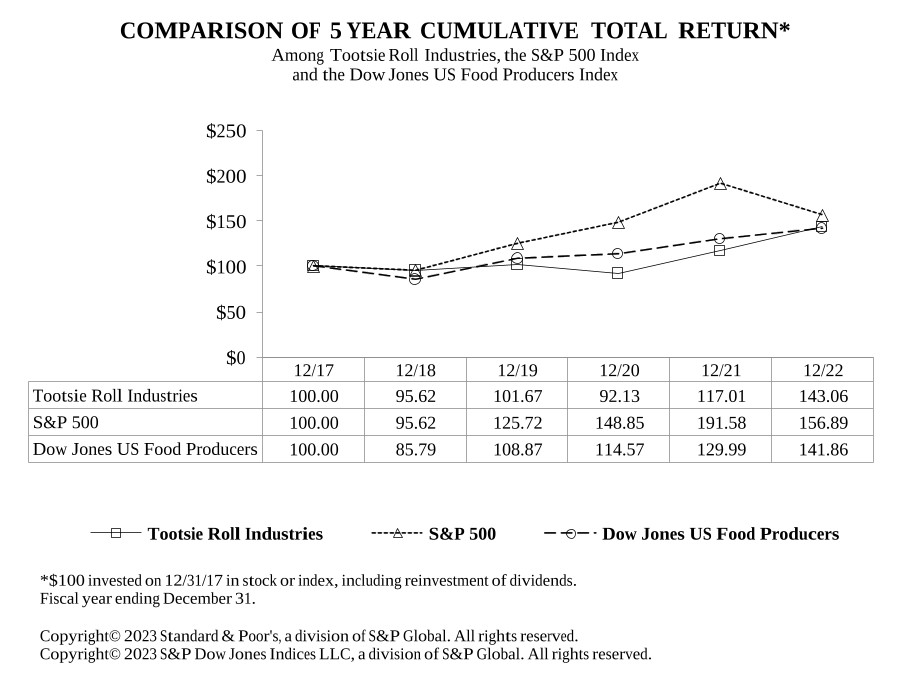

Performance Graph The following performance graph compares the cumulative total shareholder return on the Company’s common stock for a five-year period (December 31, 20142017 to December 31, 2019)2022) with the cumulative total return of Standard & Poor’s 500 Stock Index (“S&P 500”) and the Dow Jones Industry Food Index (“Peer Group,” which includes the Company), assuming (i) $100 invested on December 31 of the first year of the chart in each of the Company’s common stock, S&P 500 and the Dow Jones Industry Food Index and (ii) the reinvestment of cash and stock dividends.

ITEM 6. Selected Financial Data.

Five Year Summary of Earnings and Financial Highlights

(Thousands of dollars except per share, percentage and ratio figures)

| | | | | | | | | | | | | | | | | | | 2019 | | 2018 | | 2017 | | 2016 | | 2015 | | Sales and Earnings Data | | | | | | | | | | | | | | | | | Net product sales | | $ | 523,616 | | $ | 515,251 | | $ | 515,674 | | $ | 517,373 | | $ | 536,692 | | Product gross margin | | | 194,514 | | | 185,371 | | | 189,263 | | | 196,504 | | | 196,118 | | Interest expense | | | 220 | | | 181 | | | 144 | | | 105 | | | 76 | | Provision for income taxes | | | 20,565 | | | 16,401 | | | 3,907 | | | 30,593 | | | 26,451 | | Net earnings attributable to Tootsie Roll Industries, Inc. | | | 64,920 | | | 56,893 | | | 80,864 | (2) | | 67,510 | | | 66,089 | | % of net product sales | | | 12.4 | % | | 11.0 | % | | 15.7 | % | | 13.0 | % | | 12.3 | % | % of shareholders’ equity | | | 8.5 | % | | 7.6 | % | | 11.0 | % | | 9.5 | % | | 9.5 | % | Per Common Share Data (1) | | | | | | | | | | | | | | | | | Net earnings attributable to Tootsie Roll Industries, Inc. | | $ | 0.99 | | $ | 0.86 | | $ | 1.21 | (2) | $ | 0.99 | | $ | 0.96 | | Cash dividends declared | | | 0.36 | | | 0.36 | | | 0.36 | | | 0.36 | | | 0.35 | | Stock dividends | | | 3 | % | | 3 | % | | 3 | % | | 3 | % | | 3 | % | Additional Financial Data (1) | | | | | | | | | | | | | | | | | Working capital | | $ | 273,786 | | $ | 242,655 | | $ | 207,132 | | $ | 235,739 | | $ | 221,744 | | Net cash provided by operating activities | | | 100,221 | | | 100,929 | | | 42,973 | | | 98,550 | | | 91,073 | | Net cash provided by (used in) investing activities | | | (15,009) | | | (44,510) | | | (9,320) | | | (51,884) | | | (9,672) | | Net cash used in financing activities | | | (57,187) | | | (42,353) | | | (56,881) | | | (51,387) | | | (53,912) | | Property, plant & equipment additions | | | 20,258 | | | 27,612 | | | 16,673 | | | 16,090 | | | 15,534 | | Net property, plant & equipment | | | 188,455 | | | 186,101 | | | 178,972 | | | 180,905 | | | 184,586 | | Total assets | | | 977,864 | | | 947,361 | | | 930,946 | | | 920,101 | | | 908,983 | | Long-term debt | | | 7,500 | | | 7,500 | | | 7,500 | | | 7,500 | | | 7,500 | | Total Tootsie Roll Industries, Inc. shareholders’ equity | | | 759,854 | | | 750,622 | | | 733,840 | | | 711,364 | | | 698,183 | | Average shares outstanding | | | 65,474 | | | 66,130 | | | 66,962 | | | 67,869 | | | 68,886 | |

(1) | Per common share data and average shares outstanding adjusted for annual 3% stock dividends. |

(2) | The 2017 net earnings and earnings per share includes $20,318 or $0.32 per share relating to a favorable accounting adjustment to revalue the Company’s deferred income tax liabilities resulting from the enactment of the U.S. Tax Cuts and Jobs Act in December 2017. |

ITEM 6. [RESERVED] ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations. (Thousands of dollars except per share, percentage and ratio figures) The following discussion should be read in conjunction with the other sections of this report, including the consolidated financial statements and related notes contained in Item 8 of this Form 10-K. This section of this Form 10-K generally discusses the twelve months ended December 31, 2022 as compared to the same period of 2021. Discussions comparing the results of the twelve months ended December 31, 2021 as compared to same period of 2020 can be found in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 of the Form 10-K for the year ended December 31, 2021. FINANCIAL REVIEW This financial review discusses the Company’s financial condition, results of operations, liquidity and capital resources, significant accounting policies and estimates, new accounting pronouncements, market risks and other matters. It should be read in conjunction with the Consolidated Financial Statements and related Notes that follow this discussion. FINANCIAL CONDITION The Company’s overall financial position remains strong given that aggregate cash, cash equivalents and investments is $392,435$396,926 at December 31, 2019,2022, including $76,183$71,208 in trading securities discussed below. Cash flows from 20192022 operating activities totaled $100,221$72,051 compared to $100,929$85,298 in 2018,2021, and are discussed in the section entitled Liquidity and Capital Resources. During 2019,2022, the Company paid cash dividends of $23,460,$24,629, purchased and retired $34,116$31,910 of its outstanding shares, and made capital expenditures of $20,258.$23,356. The Company’s net working capital was $273,786$218,894 at December 31, 20192022 compared to $242,655$188,333 at December 31, 20182021. This increase principally reflects the effects of increased short-term investments and inventories which reflects higher aggregate cash, cash equivalents and short-term investments.is discussed below. As of December 31, 2019,2022, the Company’s total cash, cash equivalents and investments, including all long-term investments, in marketable securities, was $392,435$396,926 compared to $356,448$436,983 at December 31, 2018, an increase2021, a decrease of $35,987.$40,057. See Liquidity And Capital Resources section below for discussion. The aforementioned includes $76,183$71,208 and $62,260$89,736 of investments in trading securities as of December 31, 20192022 and 2018,2021, respectively. The Company invests in trading securities to provide an economic hedge for its deferred compensation liabilities, as further discussed herein and in Note 79 of the Company’s Notes to Consolidated Financial Statements. Shareholders’ equity increased from $750,622$769,042 at December 31, 20182021 to $759,854$783,171 as of December 31, 2019,2022, which principally reflects 20192022 net earnings of $64,920,$75,937, less cash dividends of $23,460$24,629 and share repurchases of $34,116.$31,910. The Company has a relatively straight-forward financial structure and has historically maintained a conservative financial position. The Company has no special financing arrangements or “off-balance sheet” special purpose entities. Cash flows from operations plus maturities of short-term investments are expected to be adequate to meet the Company’s overall financing needs, including capital expenditures, in 2020.2023. Periodically, the Company considers possible acquisitions, and if the Company were to pursue and complete such an acquisition, that could result in bank borrowings or other financing. RESULTS OF OPERATIONS 20192022 vs. 20182021

Twelve months 20192022 consolidated net product sales were $523,616$681,440 compared to $515,251$566,043 in twelve months 2018,2021, an increase of $8,365$115,397 or 1.6%20.4%. Fourth quarter 20192022 net product sales were $134,663$188,180 compared to $127,264$166,598 in fourth quarter 2018,2021, an increase of $7,399$21,582, or 5.8%13.0%. Successful marketing andThe sales programs contributed to the increasesgrowth in sales for both fourth quarter and twelve months 2019 compared2022 was driven by an overall increase in demand and higher sales price realization. Effective sales and marketing programs, including Halloween and other seasonal sales programs, contributed to higher sales volumes in fourth quarter and twelve months 2022. Consumers returned to more activities and lifestyles during 2021 and throughout 2022 that they experienced prior to the corresponding periodsCovid-19 pandemic. These activities include planned purchases of the Company’s products for “sharing” and “give-a-way” occasions. Many of the Company’s products are consumed at group events, outings, and other gatherings, including Halloween events, which had been curtailed or in some cases eliminated in response to the prior year. Fourth quarter 2019Covid-19 pandemic. Twelve months 2022 sales also benefited from the timing of sales between the third and fourth quarters of 2019, however, foreign currency translation had some adverse effects on consolidated sales for theexceeded twelve months 2019 period comparedsales by 30% which provides a sales comparison prior to 2018.the pandemic. Product cost of goods sold were $329,102$452,552 in 20192022 compared to $329,880$370,105 in 2018, a decrease2021, an increase of $778$82,447 or 0.2%22.2%. Product cost of goods sold includes $408$(893) and $(39)$687 in certain deferred compensation (credits) expenses (credits) in 20192022 and 2018,2021, respectively. These deferred compensation expenses principally result from changes in the market value of investments and investment income from trading securities relating to compensation deferred in previous years and are not reflective of current operating results. Adjusting for the aforementioned, product cost of goods sold decreasedincreased from $329,919$369,418 in 2018 to $328,694 in 2019, a decrease of $1,225$84,027 or 0.4%22.7%. As a percent of net product sales, these adjusted costs decreasedincreased from 64.0%65.3% in 20182021 to 62.8%66.5% in 2019,2022, a 1.3 favorable1.2 unfavorable percentage point change.

Fourth quarter and twelve months 20192022 gross profit margins were adversely affected by increasing costs for ingredients, packaging materials, and certain manufacturing supplies and services. Fourth quarter and twelve months product cost of goods sold compared to the corresponding prior year periods, were also adversely impacted by inefficiencies caused by higher than expected sales demand, supply chain challenges and resultingdisruptions, longer supplier lead times, and some labor shortages. We also incurred additional costs, including overtime and extended operating shifts for plant manufacturing, to meet this higher demand in 2022. These factors resulted in additional costs related to our efforts to meet this higher demand. Certain cost and expense reductions, including Company initiatives to reduce costs did provide some benefit to 2022 gross profit margins. Although higher fourth quarter and twelve months 2022 sales, including sales price increases, contributed to improved net earnings compared to the corresponding prior year periods in 2021, significantly higher input costs substantially offset the benefits of these higher sales. Fourth quarter and twelve months 2022 gross profit margins benefitedand net earnings were adversely affected by significantly higher costs for ingredients, packaging materials, freight and delivery, and many manufacturing supplies and services. Our input unit costs moved significantly higher in 2022 compared to 2021 as most of our supply contracts for ingredients, packaging materials and manufacturing supplies and services expired at the end of 2021 and new supply agreements at higher prices became effective in early 2022. In certain instances, we expanded our annual commitments for some ingredients from our suppliers in 2022 to meet higher demand. However, certain markets were very tight and this incremental expansion resulted in even higher unit costs for these additional materials. Supplier and transportation delays also caused us to purchase some limited quantities of ingredients in the spot market which were at substantially higher unit costs than our contracted prices. Supply chain challenges and limited availability of certain ingredients and materials, as well as generally higher commodity markets, drove up our unit costs for many key ingredients and materials in 2022. The adverse effects of higher energy costs, including higher diesel fuel surcharges, have added to our input costs on both customer and supplier freight and delivery in 2022. These higher energy costs have also increased salesour costs for utilities to operate our manufacturing plants in 2022. Based on our 2023 supply contracts, we expect even higher unit costs for most ingredients and materials in 2023. The Company uses the Last-In-First-Out (LIFO) method of accounting for inventory and costs of goods sold which results in lower current income taxes during such periods of increasing costs and higher price realization which allowedinflation, but this method does charge the Companymost current costs to recover some margin decline resulting from increases in certain input costs in recent years. Plant efficiencies driven by capital investments and ongoing cost containment programs contributed to the above discussed decreases in adjusted cost of goods sold and thereby accelerates the realization of these higher costs. Our supply chain was extremely challenging in 2019. Prior year 2018 gross margin was adversely affected by the implementation2022, as our supplier lead times expanded greatly and start-up of new manufacturing packaging lines and resulting operational inefficiencies, as well as unfavorable experience from self-insurance programs. The Company is continuing its investments in its plant manufacturing operationssome suppliers were unable to meet new consumersome promised delivery dates. In some cases, we were unable to secure timely delivery of additional ingredients and packaging materials to meet our higher demand in 2022, and therefore had to limit our customer demands, achieve quality improvements, provide genuine valuesales order volumes of some products. We are continuing to consumers,focus on the supply chain and increase operational efficiencies.possible delays and disruptions, but this area continues to have much less predictability compared to past history. Although the supply chain continues to improve, it is possible that supply chain disruptions could result in the temporary shut-down of one or more manufacturing lines resulting in lost sales and profits in 2023. Labor shortages at some of our manufacturing plant locations also contributed to some production limitations and lost sales in 2022. We believe that these labor shortages will continue to have some adverse impact on the fulfillment of customer orders in 2023 and may limit our growth opportunities for certain products in 2023. Nonetheless, we were able to meet substantially all of our labor needs in 2022, including for our seasonal increases in production. However, the tight labor market has created much more uncertainty than in the past. Selling, marketing and administrative expenses were $127,802$121,976 in 20192022 compared to $117,691$132,108 in 2018, an increase2021, a decrease of $10,111$10,132 or 8.6%7.7%. Selling, marketing and administrative expenses include $10,884$(16,370) and $(1,064)$13,521 in certain deferred compensation (credits) expenses (credits) in 20192022 and 2018,2021, respectively. These deferred compensation (credits) expenses principally result from changes in the market value of investments and investment income from trading securities relating to compensation deferred in previous years and are not reflective of current operating results. Adjusting for the aforementioned, selling, marketing and administrative expenses decreasedincreased from $118,755$118,587 in 20182021 to $116,918$138,346 in 2019, a decrease2022, an increase of $1,837$19,759 or 1.5%16.7%. AsThis increase was principally driven by the increase in certain variable expenses, primarily freight and delivery and direct selling expenses, relating to the increase in sales as discussed above. However, as a percent of net product sales, these adjusted expenses decreased from 23.0%21.0% of net product sales in 20182021 to 22.3%20.3% of net product sales in 2019,2022, a 0.7 favorable percentage point change. Higher price realization, lower general and administrative expenses, primarily legal and professional fees, and lower freight and delivery unit costs were the principal drivers in these favorable reductions, including reductions as a percentage of sales, in selling, marketing and administrative expenses in fourth quarter and twelve months 2019. Selling, marketing and administrative expenses include freight, delivery and warehousing expenses. These expenses decreasedincreased from $49,527$55,289 in 20182021 to $49,288$67,342 in 2019, a decrease2022, an increase of $239$12,053 or 0.5%21.8%. As a percent of net product sales, these adjusted expenses decreasedincreased from 9.6%9.8% in 20182021 to 9.4%9.9% in 2019,2022, a 0.2 favorable0.1 unfavorable percentage point change. During 2019,Increasing energy costs and related effects on fuel surcharges, and the Company implemented additionaladverse effects of the continuing shortage of over-the-road drivers and high demand for carriers, were the principal drivers of these higher freight and delivery computer systemsexpenses in 2022 compared to 2021. In response to these higher input costs many companies in the consumer products industry have increased selling prices throughout 2021 and carrier selection processes, including enhanced competitive bidding, which facilitated this favorable unit cost reduction2022. We have followed with price increases as well with the objective of improving sales price realization and restoring some of our margin declines. Price increases were phased in principally beginning in second half 2021 and continued throughout 2022 and into 2023. The improvement in fourth quarter 2022 margins and twelve months 2019.net earnings reflects the cumulative benefits of this higher price realization. Although our price increases have generally reflected the overall price increases in our industry, they have not as yet resulted in fully restoring our margins to historical levels. The Company believes that we should be able to make more progress in restoring our margins in 2023 when all of our price increases take full effect. However, continuing increases in input costs and overall high inflation may not allow us to fully restore our margins to historical levels prior to the pandemic. Although the Company continues to monitor these higher input costs and price increases in the industry, we are mindful of the effects and limits of passing on all of the above discussed higher input costs to consumers of our products. The Company has foreign operating businesses in Mexico, Canada and Spain, and exports products to many foreign markets. Such foreign sales were $44,826 and comprised 8.6%The Company’s Spanish subsidiary (97% owned by the Company) incurred an operating loss of the Company’s consolidated net product sales$1,430 in 2019. In fourth quarter 2019 and 2018, the Company recorded a pre-tax impairment charge of $377 and $1,125, respectively, relating2022 compared to its Spanish operations. The Company had a 97% ownership of a Spanish company at both December 31, 2019 and 2018. During 2019 and 2018, this Spanish subsidiary incurred operating losses of $1,102 and $2,840, respectively, and the Company provided approximately $1,399 and $4,484, respectively, of additional cash to finance these losses and certain capital expenditures.$598 loss in 2021. Company management expects the competitive and business challenges in Spain to continue, but expects continued reductionhowever, Company management believes that we will make progress on reducing this operating loss in operating losses in 2020 compared to 2019.2023. Nonetheless, management believes that operating losses maywill likely continue beyond 20192023 and that these future losses, mayas well as some capital expenditures, will likely require some additional cash financing. The Company believes that the carrying values of its goodwill and trademarks have indefinite lives as they are expected to generate cash flows indefinitely. In accordance with current accounting guidance, these indefinite-lived intangible assets are assessed at least annually for impairment as of December 31 or whenever events or circumstances indicate that the carrying values may not be recoverable from future cash flows. No impairments were recorded in 2019, 20182022, 2021 or 2017.2020. Current accounting guidance provides entities an option of performing a qualitative assessment (a "step-zero" test) before performing a quantitative analysis. If the entity determines, on the basis of certain qualitative factors, that it is more-likely-than-not that the intangibles (goodwill and certain trademarks) are not impaired, the entity would not need to proceed to the two step impairment testing process (quantitative analysis) as prescribed in the guidance. During fourth quarter 20192022 (and fourth quarter 2018)quarters 2021 and 2020), the Company performed a “step zero” test of its goodwill and certain trademarks, and concluded that there was no impairment based on this guidance. For the fair value assessment of certain trademarks where the “step-zero” analysis was not considered appropriate, impairment testing was performed in fourth quarter 20192022 (and fourth quarter 2018)quarters 2021 and 2020) using discounted cash flows and estimated royalty rates. For these trademarks, holding all other assumptions constant at the test date, a 100 basis point increase in the discount rate or a 100 basis point decrease in the royalty rate would reduce the fair value of these trademarks by approximately 16%13% and 10%, respectively. Individually, a 100 basis point increase in the discount rate may result in potential impairment of up to $2 million. Aor a 100 basis point decrease in the royalty rate would not result in a potential impairment as of December 31, 2019.2022. Earnings from operations were $69,214$110,755 in 20192022 compared to $70,482$67,133 in 2018, a decrease2021, an increase of $1,268.$43,622. Earnings from operations include $11,292$(17,263) and $(1,103)$14,208 in certain deferred compensation (credits) expense (credits) in 20192022 and 2018,2021, respectively, which are discussed above. Adjusting for these deferred compensation expenses, adjusted earnings from operations increased from $69,379$81,341 in 20182021 to $80,506$93,492 in 2019,2022, an increase of $11,127$12,151 or 16.0%14.9%. Fourth quarter and twelve months results benefitted fromThe above discussed increase in net product sales was the principal driver of higher operating earnings in 2022 compared to 2021. Although higher 2022 sales contributed to improved operating earnings compared to the corresponding prior year periods, higher input costs mitigated much of the benefits of increased sales and higher price realization as well as reductions in certain costs and expenses discussed above.sales. Management believes the comparisons presented in the preceding paragraphs, after adjusting for changes in deferred compensation, are more reflective of the underlying operations of the Company. Other income (expense), net was $16,190$(12,614) in 20192022 compared to $2,724$18,596 in 2018, an increase2021, a decrease of $13,466.$31,210. Other income, net principally reflects $11,292$(17,263) and $(1,103)$14,207 of aggregate net (losses) gains (losses) and investment income on trading securities in 20192022 and 2018,2021, respectively. These trading securities provide an economic hedge of the Company’s deferred compensation liabilities; and the related net (losses) gains (losses) and investment income were offset by a like amount of (credit) expense in aggregate product cost of goods sold and selling, marketing, and administrative expenses in the respective years as discussed above. Other income (expense), net includes investment income on available for sale securities of $4,423$2,641 and $3,535$2,740 in 20192022 and 2018,2021, respectively. Other income, net also includes foreign exchange gains (losses) of $(533)$1,307 and $(659)$667 in 20192022 and 2018,2021, respectively. The Company’s effective income tax rate was 27.9%rates were 21.2% and 23.5%25.7% in fourth quarter 20192022 and 2018,2021, respectively, and 24.1%22.7% and 22.4%23.8% in twelve months 20192022 and 2018, respectively.2021, respectively The increasedecrease in the effective tax rates for the fourth quarter and twelve months 2019in 2022 generally reflects higher state income taxes, including increases in reserves for uncertain state tax benefits, and increases in valuation allowanceslower rates for state and international income tax credit carry-forwards which are not likely to be fully realized in the future.provisions. A reconciliation of the differences between the U.S. statutory rate and these effective tax rates is provided in Note 4 of the Company’s Notes to Consolidated Financial Statements. At December 31, 2019 and 2018, the Company’s deferred tax assets include $617 and $1,844 of income tax benefits relating to its Canadian subsidiary tax loss carry-forwards. The Company expects to fully utilize this deferred tax asset in 2020 (expiration dates are 2029 through 2031). The Company utilized $1,227 and $1,896 of these Canadian tax carry-forward benefits in 2019 and 2018, respectively. The Company has concluded that it is more-likely-than-not that it would realize these deferred tax assets relating to its Canadian tax loss carry-forwards because it is expected that sufficient levels of taxable income will be generated during the carry-forward periods. The Company has provided a full valuation allowance on its Spanish subsidiaries’ tax loss carry-forward benefits of $3,967$4,497 and $3,651$4,376 as of December 31, 20192022 and 2018,2021, respectively, because the Company has concluded that it is not more-likely-than-not that these losses will be utilized before their expiration dates. The Spanish subsidiary has a history of net operating losses and it is not known when and if they will generate taxable income in the future.

U.S. tax reform (US Tax Cuts and Jobs Act enacted in December 2017) included a one-time toll charge resulting from the mandatory deemed repatriation of undistributed foreign earnings and profits. The Company determined that there were no net undistributed foreign earnings and profits subject to this toll charge. U.S. tax reform also changed the United States approach to the taxation of foreign earnings to a territorial system by providing a one hundred percent dividends received deduction for certain qualified dividends received from foreign subsidiaries. These provisions of the U.S. tax reform significantly impact the accounting for the undistributed earnings of foreign subsidiaries, and as a result the Company distributed $8,200 of the earnings held in excess cash by its foreign subsidiaries in 2019.subsidiaries. The tax costs associated with a future distribution, including foreign withholding taxes, are not material to the Company’s financial statements. After carefully considering these facts, the Company determined that it would not be asserting permanent reinvestment of all of its foreign subsidiaries earnings as of December 31, 2017, and the Company continuescontinued to maketake this assertion.position as of December 31, 2022.