(1) | On October 30, 2020, our Board of Directors authorized a stock repurchase program for the repurchase of up to $100.0 million of the Company’s Class A common stock, expiring on October 31, 2022. This program does not obligate the Company to acquire any particular amount of Class A common stock and the program may be extended, modified, suspended or discontinued at any time at the Board’s| (1) | On October 30, 2020, our Board of Directors authorized a stock repurchase program for the repurchase of up to $100.0 million of the Company’s Class A common stock, expiring on October 31, 2022. In August 2021 and January 2022, our Board of Directors authorized increases to the stock repurchase program for the repurchase of up to an additional $125.0 million and $152.7 million of the Company’s Class A common stock, respectively. Following these extensions, the stock repurchase program now expires on December 31, 2025. This program does not obligate the Company to acquire any particular amount of Class A common stock and the program may be extended, modified, suspended or discontinued at any time at the board’s discretion. |

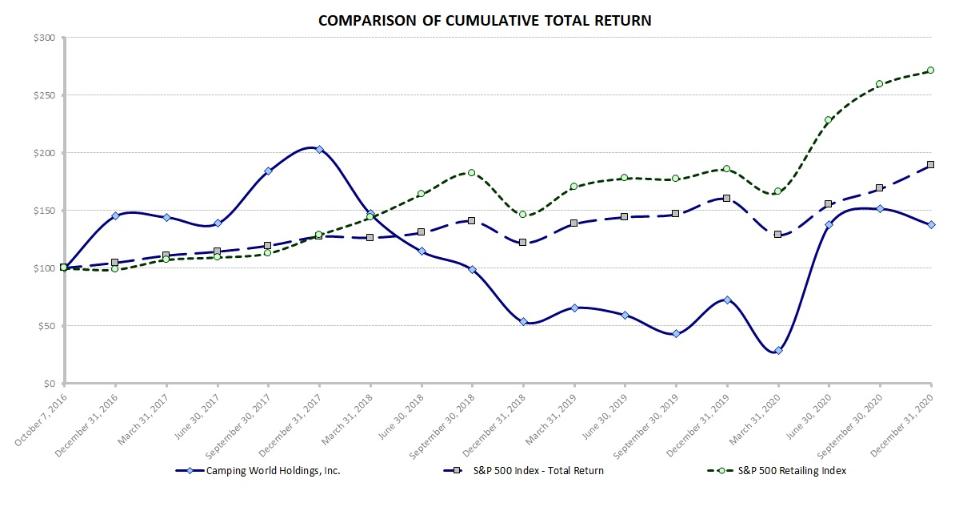

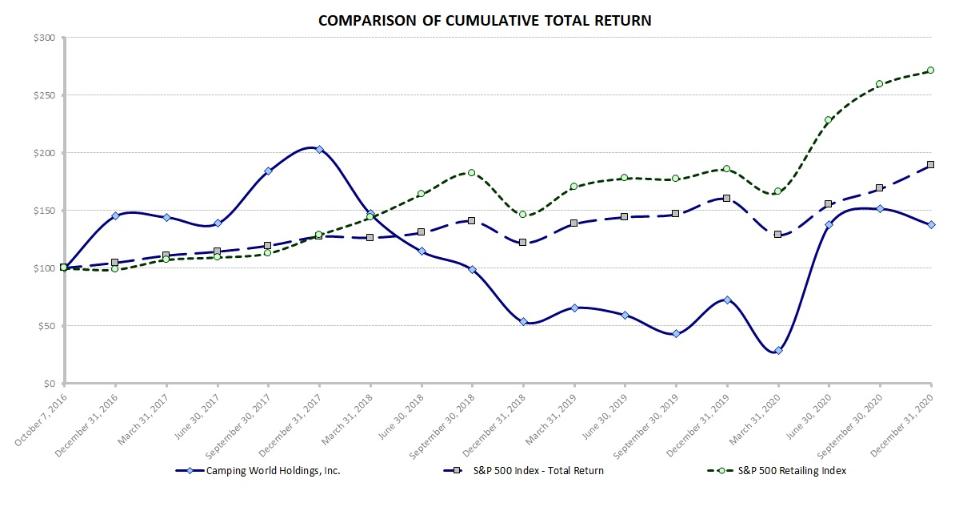

The table above excludes shares net settled by the Company in connection with tax withholdings associated with the vesting of restricted stock units as these shares were not issued and outstanding. Stock Performance Graph The following graph and table illustrate the total return from October 7, 2016,for the date our shares began trading on the NYSE, throughfive years ended December 31, 2020,2023 for (i) our Class A common stock, (ii) the Standard and Poor’s (“S&P”) 500 Index, and (iii) the S&P 500 Consumer Discretionary Distribution & Retail Index (formerly named the S&P 500 Retailing Index.Index). The comparisons reflected in the graph and table are not intended to forecast the future performance of our stock and may not be indicative of future performance. The graph and table assume that $100 was invested on October 7, 2016December 31, 2018 in each of our Class A common stock, the S&P 500 Index, and S&P 500 RetailingConsumer Discretionary Distribution & Retail Index and that any dividends were reinvested.

| | | | | | | | | | | | | | | | | | | October 7, | | December 31, | | December 31, | | December 31, | | December 31, | | December 31, | | 2016 | | 2016 | | 2017 | | 2018 | | 2019 | | 2020 | Camping World Holdings, Inc. Class A common stock | $ | 100.00 | | $ | 145.27 | | $ | 203.35 | | $ | 53.65 | | $ | 72.63 | | $ | 137.63 | S&P 500 Index | $ | 100.00 | | $ | 104.45 | | $ | 127.26 | | $ | 121.68 | | $ | 159.99 | | $ | 189.43 | S&P 500 Retailing Index | $ | 100.00 | | $ | 98.91 | | $ | 128.98 | | $ | 146.34 | | $ | 185.38 | | $ | 271.42 |

Recent Sales of Unregistered Securities

None.

ITEM 6. SELECTED FINANCIAL DATA

The following tables present the selected historical consolidated financial and other data for Camping World Holdings, Inc. The selected consolidated balance sheets data as of December 31, 2020 and 2019 and the selected consolidated statements of operations and statements of cash flows data for each of the years in the three-year period ended December 31, 2020 are derived from our audited consolidated financial statements contained in Part II, Item 8 of this Form 10-K. The selected consolidated balance sheets data as of December 31, 2018, 2017 and 2016, and the selected consolidated statements of operations and statements of cash flows data for the year ended December 31, 2017 and 2016 have been derived from our audited consolidated financial statements not included herein.

During the year ended December 31, 2019, we had a change to our reportable segments as described in Note 22 — Segment Information in Part II, Item 8 of this Form 10-K. Accordingly, certain components of revenue and gross profit for the years ended December 31, 2018, 2017 and 2016 have been reclassified to conform to our current segment reporting structure.

| | | | | | | | | | | | | | | | | | | | | As of December 31, | | | 2018 | | 2019 | | 2020 | | 2021 | | 2022 | | 2023 | Camping World Holdings, Inc. Class A common stock | | $ | 100.00 | | $ | 135.38 | | $ | 256.55 | | $ | 413.06 | | $ | 249.89 | | $ | 312.60 | S&P 500 Index | | $ | 100.00 | | $ | 131.49 | | $ | 155.68 | | $ | 200.37 | | $ | 164.08 | | $ | 207.21 | S&P 500 Consumer Discretionary Distribution & Retail Index | | $ | 100.00 | | $ | 126.67 | | $ | 185.47 | | $ | 221.29 | | $ | 145.42 | | $ | 207.08 |

Our financial statements for the year ended December 31, 2017 reflect the provisional impactSource: Zacks Investment Research, Inc. Used with permission. All rights reserved Copyright 1980-2024.

Index Data: Copyright Standard and Poor’s, Inc. Used with permission. All rights reserved. Recent Sales of the U.S. Tax Cuts and Jobs Act of 2017 that significantly revised the U.S. corporate income tax by, among other things, lowering the statutory corporate tax rate from 35% to 21% and eliminating certain deductions.Unregistered Securities Our financial statements for the year ended December 31, 2018 reflect the adoption of Accounting Standards Codification (“ASC”) No. 606, Revenue from Contracts with Customers as described in Note 2 — Revenue in Part II, Item 8 of this Form 10-K, which also removed the guidance for capitalization of direct response advertising that is now expensed as incurred.None.

Our financial statements for the year ended December 31, 2019 reflect the adoption of ASC No. 842, Leases as described in Note 1 — Summary of Significant Accounting Policies — Recently Adopted Accounting Pronouncements in Part II, Item 8 of this Form 10-K. Additionally, our financial statements for the year ended December 31, 2019 reflect long-lived asset impairments and restructuring charges as described in Note 5 — Restructuring and Long-lived Asset Impairment in Part II, Item 8 of this Form 10-K.ITEM 6. [Reserved]

Subsequent to the IPO and the related reorganization transactions, Camping World Holdings, Inc. has been a holding company whose principal asset is its equity interest in CWGS, LLC. As the sole managing member of CWGS, LLC, Camping World Holdings, Inc. operates and controls all of the business and affairs of CWGS, LLC, and, through CWGS, LLC, conducts its business. As a result, the Company consolidates CWGS, LLC’s financial results and reports a non-controlling interest related to the common units not owned by Camping World Holdings, Inc. Such consolidation has been reflected for all periods presented. Our selected historical consolidated financial and other data does not reflect what our financial position, results of operations and cash flows would have been had we been a separate, stand-alone public company during those periods.

Our selected historical consolidated financial and other data may not be indicative of our future results of operations or future cash flows. You should read the information set forth below in conjunction with our historical consolidated financial statements and the notes to those statements, “Item 1A. – Risk Factors,” and “Item 7. – Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this Form 10-K.

| | | | | | | | | | | | | | | | | | | Fiscal Year Ended | | | | December 31, | | December 31, | | December 31, | | December 31, | | December 31, | | ($ in thousands) | | 2020 | | 2019 | | 2018 | | 2017 | | 2016 | | Consolidated Statements of Operations Data: | | | | | | | | | | | | | | | | | Revenue: | | | | | | | | | | | | | | | | | Good Sam Services and Plans | | $ | 180,977 | | $ | 179,538 | | $ | 172,660 | | $ | 161,888 | | $ | 152,778 | | RV and Outdoor Retail | | | | | | | | | | | | | | | | | New vehicles | | | 2,823,311 | | | 2,370,321 | | | 2,512,854 | | | 2,435,928 | | | 1,862,195 | | Used vehicles | | | 984,853 | | | 857,628 | | | 732,017 | | | 668,860 | | | 703,326 | | Products, service and other | | | 948,890 | | | 1,034,577 | | | 949,383 | | | 652,819 | | | 540,019 | | Finance and insurance, net | | | 464,261 | | | 401,302 | | | 383,711 | | | 326,609 | | | 225,994 | | Good Sam Club | | | 44,299 | | | 48,653 | | | 41,392 | | | 33,726 | | | 31,995 | | Subtotal | | | 5,265,614 | | | 4,712,481 | | | 4,619,357 | | | 4,117,942 | | | 3,363,529 | | Total revenue | | | 5,446,591 | | | 4,892,019 | | | 4,792,017 | | | 4,279,830 | | | 3,516,307 | | Gross profit: | | | | | | | | | | | | | | | | | Good Sam Services and Plans | | | 108,039 | | | 101,484 | | | 96,619 | | | 88,269 | | | 82,611 | | RV and Outdoor Retail | | | | | | | | | | | | | | | | | New vehicles | | | 502,774 | | | 296,051 | | | 324,119 | | | 349,699 | | | 265,332 | | Used vehicles | | | 233,824 | | | 178,988 | | | 163,617 | | | 162,767 | | | 146,073 | | Products, service and other | | | 358,174 | | | 271,658 | | | 364,120 | | | 288,047 | | | 250,833 | | Finance and insurance, net | | | 464,261 | | | 401,302 | | | 383,711 | | | 326,609 | | | 225,994 | | Good Sam Club | | | 35,407 | | | 37,915 | | | 30,746 | | | 25,523 | | | 22,890 | | Subtotal | | | 1,594,440 | | | 1,185,914 | | | 1,266,313 | | | 1,152,645 | | | 911,122 | | Total gross profit | | | 1,702,479 | | | 1,287,398 | | | 1,362,932 | | | 1,240,914 | | | 993,733 | | Operating expenses: | | | | | | | | | | | | | | | | | Selling, general and administrative | | | 1,156,071 | | | 1,141,643 | | | 1,069,359 | | | 853,160 | | | 691,884 | | Debt restructure expense | | | — | | | — | | | 380 | | | 387 | | | 1,218 | | Depreciation and amortization | | | 51,981 | | | 59,932 | | | 49,322 | | | 31,545 | | | 24,695 | | Goodwill impairment | | | — | | | — | | | 40,046 | | | | | | — | | Long-lived asset impairment | | | 12,353 | | | 66,270 | | | — | | | — | | | — | | Lease termination | | | 4,547 | | | (686) | | | — | | | — | | | — | | Loss (gain) on disposal of assets | | | 1,332 | | | 11,492 | | | 2,810 | | | (133) | | | (564) | | Total operating expenses | | | 1,226,284 | | | 1,278,651 | | | 1,161,917 | | | 884,959 | | | 717,233 | | Operating income | | | 476,195 | | | 8,747 | | | 201,015 | | | 355,955 | | | 276,500 | | Other income (expense): | | | | | | | | | | | | | | | | | Floor plan interest expense | | | (19,689) | | | (40,108) | | | (38,315) | | | (27,690) | | | (18,854) | | Other interest expense, net | | | (54,689) | | | (69,363) | | | (63,329) | | | (42,959) | | | (48,318) | | Loss on debt restructure | | | — | | | — | | | (1,676) | | | (462) | | | (5,052) | | Tax Receivable Agreement liability adjustment | | | 141 | | | 10,005 | | | (1,324) | | | 100,758 | | | — | | Total other income (expense) | | | (74,237) | | | (99,466) | | | (104,644) | | | 29,647 | | | (72,224) | | Income (loss) before income taxes | | | 401,958 | | | (90,719) | | | 96,371 | | | 385,602 | | | 204,276 | | Income tax expense | | | (57,743) | | | (29,582) | | | (30,790) | | | (154,910) | | | (5,800) | | Net income (loss) | | | 344,215 | | | (120,301) | | | 65,581 | | | 230,692 | | | 198,476 | | Less: net (income) loss attributable to non-controlling interests | | | (221,870) | | | 59,710 | | | (55,183) | | | (200,839) | | | (9,591) | | Net income (loss) attributable to Camping World Holdings, Inc. | | $ | 122,345 | | $ | (60,591) | | $ | 10,398 | | $ | 29,853 | | $ | 188,885 | | Earnings per share of Class A common stock (1): | | | | | | | | | | | | | | | | | Basic | | $ | 3.11 | | $ | (1.62) | | $ | 0.28 | | $ | 1.12 | | $ | 0.08 | | Diluted | | $ | 3.09 | | $ | (1.62) | | $ | 0.28 | | $ | 1.12 | | $ | 0.07 | | Cash dividends declared per share of Class A common stock | | $ | 1.47 | | $ | 0.61 | | $ | 0.61 | | $ | 0.74 | | $ | 0.08 | | Consolidated Statements of Cash Flows Data: | | | | | | | | | | | | | | | | | Net cash provided by (used in) operating activities | | | 747,669 | | | 251,934 | | | 136,292 | | | (16,315) | | | 215,775 | | Net cash used in investing activities | | | (125,935) | | | (104,537) | | | (292,689) | | | (468,455) | | | (115,787) | | Net cash (used in) provided by financing activities | | | (603,183) | | | (138,433) | | | 70,791 | | | 594,737 | | | (77,817) | | Selected Other Data: | | | | | | | | | | | | | | | | | EBITDA (2) | | | 508,628 | | | 38,576 | | | 209,022 | | | 460,106 | | | 277,289 | | Adjusted EBITDA (2) | | | 564,989 | | | 166,015 | | | 312,502 | | | 394,187 | | | 286,467 | | Net income (loss) margin | | | 6.3% | | | (2.5)% | | | 1.4% | | | 5.4% | | | 5.6% | | Adjusted EBITDA Margin (2) | | | 10.4% | | | 3.4% | | | 6.5% | | | 9.2% | | | 8.1% | | Selected Other Operating Data: | | | | | | | | | | | | | | | | | Active Customers (3) | | | 5,314,104 | | | 5,118,413 | | | 5,051,439 | | | 3,637,195 | | | 3,344,959 | | Dealership locations (4) | | | 160 | | | 154 | | | 141 | | | 124 | | | 105 | |

| | | | | | | | | | | | | | | | | | | Fiscal Year Ended | | | December 31, | | December 31, | | December 31, | | December 31, | | December 31, | ($ in thousands) | | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | Consolidated Balance Sheets Data (at period end): | | | | | | | | | | | | | | | | Cash and cash equivalents | | $ | 166,072 | | $ | 147,521 | | $ | 138,557 | | $ | 224,163 | | $ | 114,196 | Total assets | | | 3,256,431 | | | 3,376,240 | | | 2,806,687 | | | 2,567,026 | | | 1,456,061 | Total debt (5) | | | 1,185,716 | | | 1,208,521 | | | 1,204,604 | | | 916,902 | | | 626,753 | Total noncurrent liabilities | | | 2,230,141 | | | 2,239,522 | | | 1,468,652 | | | 1,164,129 | | | 740,921 | Total stockholders' equity (deficit) | | | (9,231) | | | (159,236) | | | 32,917 | | | 71,763 | | | (161,007) |

(1) | Basic and diluted earnings per Class A common stock is applicable only for periods after the Company’s IPO. Prior to the IPO, the CWGS, LLC membership structure included membership units, preferred units, and profits units. During the period of September 30, 2014 to October 6, 2016, there were 70,000 preferred units outstanding that received a total preferred return of $2.1 million per quarter in addition to their proportionate share of distributions made to all members of CWGS, LLC. The Company analyzed the calculation of earnings per unit for periods prior to the IPO using the two-class method and determined that it resulted in values that would not be meaningful to the users of these consolidated financial statements. Therefore, earnings per share information has not been presented for periods prior to the IPO on October 6, 2016. The basic and diluted earnings per share period for the year ended December 31, 2016 represents only the period of October 6, 2016 to December 31, 2016. See Note 21 — Earnings Per Share to our audited consolidated financial statements included in Part II, Item 8 of this Form 10-K for additional information. |

(2) | EBITDA, Adjusted EBITDA, and Adjusted EBITDA Margin are supplemental measures of our performance that are not required by, or presented in accordance with, GAAP. EBITDA, Adjusted EBITDA, and Adjusted EBITDA Margin are not measurements of our financial performance under GAAP and should not be considered as an alternative to net income, net income margin, or any other performance measure derived in accordance with GAAP, or as an alternative to cash flows from operating activities as a measure of our liquidity. See “Non-GAAP Financial Measures” in Part II, Item 7 of this Form 10-K for additional information and a reconciliation to the most directly comparable GAAP financial measure. |

(3) | We define an “Active Customer” as a unique customer who has transacted with us in any of the eight most recently completed fiscal quarters prior to the date of measurement. |

(4) | Dealership location acquisitions have contributed to the growth in revenues. See Note 15 — Acquisitions to our audited consolidated financial statements included in Part II, Item 8 of this Form 10-K for additional information. |

(5) | Total debt consists of borrowings under our Senior Secured Credit Facilities, finance leases, the Company’s prior credit facilities, the revolving line of credit under our Floor Plan Facility, and the Real Estate Facility with CIBC Bank USA, as applicable, net of unamortized original issue discount and capitalized finance costs as of December 31, 2020, 2019, 2018, 2017 and 2016 of $3.2 million and $7.9 million, $4.3 million and $10.9 million, $5.4 million and $13.6 million, $6.0 million and $14.2 million, and $6.3 million and $11.9 million, respectively (as discussed under “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources” in Part II, Item 7 of this Form 10-K). See our consolidated financial statements included in Part II, Item 8 of this Form 10-K, which include all liabilities, including amounts outstanding under our Floor Plan Facility. |

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS The following discussion and analysis of our financial condition and results of operations should be read together with our Consolidated Financial Statements and related notes included in Part II, Item 8 of this Form 10-K. This discussion contains forward-looking statements based upon current plans, expectations and beliefs involving risks and uncertainties. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of various important factors, including those set forth under “Risk Factors” included in Part I, Item 1A of this Form 10-K, the “Cautionary Note Regarding Forward-Looking Statements” and in other parts of this Form 10-K. Except to the extent that differences among reportable segments are material to an understanding of our business taken as a whole, we present the discussion in Management’s Discussion and Analysis of Financial Condition and Results of Operations on a consolidated basis. For purposes of this Form 10-K, we define an "Active Customer" as a customer who has transacted with us in any of the eight most recently completed fiscal quarters prior to the date of measurement. Unless otherwise indicated, the date of measurement is December 31, 2020,2023, our most recently completed fiscal quarter. In this Item 7, we discuss the results of operations for the years ended December 31, 20202023 and 20192022 and comparisons of the year ended December 31, 20202023 to the year ended December 31, 2019.2022. Discussions of the results of operations for the year ended December 31, 20182021 and comparisons of the year ended December 31, 20192022 to the year ended December 31, 20182021 can be found in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 of our Annual Report on Form 10-K for the year ended December 31, 20192022 filed with the Securities and Exchange Commission (“SEC”) on February 28, 2020.23, 2023. Overview Camping World Holdings, Inc. (together with its subsidiaries) is America’sthe world’s largest retailer of recreational RVs and related products and services. Our vision is to build a long-term legacy business that makes RVing fun and easy, and our Camping World and Good Sam brands have been serving RV consumers since 1966. We strive to build long-term value for our customers, employees, and shareholdersstockholders by combining a unique and comprehensive assortment of RV products and services with a national network of RV dealerships, service centers and customer support centers along with the industry’s most extensive online presence and a highly-trained and knowledgeable team of associates serving our customers, the RV lifestyle, and the communities in which we operate. We also believe that our Good Sam organization and family of programsservices and servicesplans uniquely enables us to connect with our customers as stewards of the RV lifestyle. On December 31, 2020,2023, we operated a total of 171 retail202 store locations, with 170all of thesethem selling and/or servicing RVs. See Note 1 ─ Summary of Significant Accounting Policies ─ Description of the Business to our consolidated financial statements included in Part II, Item 8 of this Form 10-K. With the COVID-19 crisis (see “COVID-19” below) causing many state and local governments to issue “stay-at-home” and “shelter-in-place” restrictions in mid-to-late March, sales and traffic levels across the RV industry declined significantly in March 2020. In response to the COVID-19 pandemic, many RV manufacturers, including Thor Industries, Forest River, Inc., and Winnebago Industries, temporarily suspended production from late March to mid-May. This led to a 44.6% decrease in wholesale shipments of new RVs for the three month period of March, April, and May 2020, according to the RV Industry Association’s survey of manufacturers. The Company had taken steps to add new private label lines, expand its relationships with smaller RV manufacturers, and acquire used inventory from distressed sellers to help manage risks in its supply chain. In conjunction with the stay-at-home and shelter-in-place restrictions enacted in many areas, the Company saw significant sequential declines in its overall customer traffic levels and its overall revenues from the mid-March to mid-to-late April 2020 timeframe. In the latter part of April, the Company began to see significant improvements in its online web traffic levels and number of electronic leads, and in early May, the Company began to see improvements in its overall revenue levels. As the stay-at-home restrictions began to ease across certain areasA summary of the country,changes in quantities and types of retail stores and changes in same stores from December 31, 2022 to December 31, 2023, are in the Company experienced significant acceleration in its in-store and online traffic, lead generation, and revenue trends in May continuing throughout the remainder of 2020 and early indications appear to show favorable trends continuing into 2021.table below:

| | | | | | | | | | | | RV | RV Service & | Other | | | | Same | | Dealerships | Retail Centers | Retail Stores | | Total | | Store(1) | Number of store locations as of December 31, 2022 | | 189 | | 7 | | 1 | | 197 | | 166 | Opened | | 18 | | 1 | | — | | 19 | | — | Converted | | 1 | | (1) | | — | | — | | (1) | Closed | | (10) | | (3) | | (1) | | (14) | | (14) | Achieved designation of same store (1) | | | | | | | | — | | 15 | Number of store locations as of December 31, 2023 | | 198 | | 4 | | — | | 202 | | 166 | | | | | | | | | | | |

| (1) | Our same store revenue and units calculations for a given period include only those stores that were open both at the end of the corresponding period and at the beginning of the preceding fiscal year. |

58

On September 15, 2020 we announced a number of initiatives heading into 2021, including plans to launch a peer-to-peer RV rental service, and a mobile RV technician marketplace, as well as plans to acquire RV dealerships. These initiatives continue to keep RVs as the focal point while expanding our value proposition to the customer and, in particular, to our 2.1 million active Good Sam members.

Segments We operate two reportable segments: (i) Good Sam Services and Plans, and (ii) RV and Outdoor Retail. We identify our reporting segments based on the organizational units used by management to monitor performance and make operating decisions. The Company previously had three reportable segments: (i) Consumer Services and Plans; (ii) Dealership, and (iii) Retail. In the first quarter of 2019, we realigned the structure of our internal organization in a manner that caused the composition of our reportable segments to change. Our reportable segment financial information has been recast to reflect the updated reportable segment structure for all periods presented. See Note 1 — Summary of Significant Accounting Policies — Description of the Business and Note 2223 — Segment Information to our consolidated financial statements included in Part II, Item 8 of this Form 10-K for further information regarding our reportable segments. For the years ended December 31, 2020, 2019, and 2018, we generated 3.3%, 3.7%, and 3.6%The following table presents percentages of our total revenue and 6.4%, 7.9%, and 7.1% of our total gross profit from our Good Sam Services and Plans segment, respectively. For the years ended December 31, 2020, 2019, and 2018, we generated 96.7%, 96.3%, and 96.4% of our total revenue and 93.6%, 92.1%, and 92.9% of our total gross profit from our RV and Outdoor Retail segment, respectively.

COVID-19

As discussed in Note 1 ─ Summary of Significant Accounting Policies ─ COVID-19 to our consolidated financial statements included in Part II, Item 8 of this Form 10-K, the COVID-19 pandemic adversely impacted our business from mid-March through much of April 2020, but shifted to a favorable impact beginning primarily in May 2020.

In response to the pandemic, we have implemented preparedness plans to keep our employees and customers safe, which include social distancing, providing employees with face coverings and/or other protective clothing as required, implementing additional cleaning and sanitization routines, and work-from-home orders for a significant portion of our workforce. The majority of our retail locations have continued to operate as essential businesses and consequently have remained open to serve our customers through the pandemic, and we continue to operate our e-commerce business. As of December 31, 2020, we have temporarily closed two of our dealerships as a result of COVID-19 and branding changes. These two dealerships are expected to reopen in 2021. We temporarily reduced salaries and hours throughout the Company, including for our executive officers and implemented headcount and other cost reductions primarily from the middle of March 2020 through the middle of May 2020, in an attempt to better align expenses with the initially expected reduced sales resulting from the impact of COVID-19 on our business. Most of these temporary salary reductions ended in May 2020 as the adverse impacts of the pandemic began to decline and we increased hours for certain employees and reinstated many positions from the initial headcount reductions as the demand for our products increased.two reportable segments:

| | | | | | | | | | Year Ended December 31, | | 2023 | | 2022 | | 2021 | As percentage of total revenue: | | | | | | | | | Good Sam Services and Plans | | 3.1% | | | 2.8% | | | 2.6% | RV and Outdoor Retail | | 96.9% | | | 97.2% | | | 97.4% | As percentage of total gross profit(1): | | | | | | | | | Good Sam Services and Plans | | 7.2% | | | 5.3% | | | 4.4% | RV and Outdoor Retail | | 92.8% | | | 94.7% | | | 95.6% |

In conjunction with the stay-at-home and shelter-in-place restrictions enacted in many areas, we saw significant sequential declines in overall customer traffic levels and overall revenues from the mid-March to mid-to-late April 2020 timeframe. In the latter part of April, we began to see a significant improvement in online web traffic levels, and in early May, we began to see improvements in overall revenue levels. As the stay-at-home restrictions began to ease across certain areas of the country, we experienced significant acceleration in our in-store traffic and revenue trends in May and continuing throughout the remainder of 2020 and early indications appear to show favorable trends continuing into 2021. We believe that the demand will remain elevated as consumers continue to view RVs as an opportunity to work and school remotely.

| (1) | Gross profit is presented exclusive of depreciation and amortization, which is presented separately in operating expenses. |

We have been implementing marketing and operational plans to optimize our leadership position through the pandemic, regardlessCOVID-19

Within a few months of the ultimate timinginitial significant outbreaks of COVID-19 in the U.S. in 2020, we experienced elevated demand for RVs and slopemany of our related products and services. We believe that consumers view RVs as a safer alternative to many other travel and recreational activities, in addition to an opportunity to enjoy the outdoors after many consumers spent much of their time at home during portions of the recovery curve.pandemic. We have adaptedbelieve this led to an introduction of many new customers to the RV lifestyle and a greater appreciation of outdoor activities. For much of the COVID-19 pandemic, demand and interest in new and used vehicles outpaced vehicle supply. Beginning in September 2021, we were able to procure more new vehicles from our sales practices to accommodate customers’ safety concernssuppliers than were sold and new towables inventory levels, in this COVID-19 environment, such as offering virtual tours of RVs and providing home delivery options.particular, normalized in early 2022. As a consequence of COVID-19, we held fewer consumer shows and events during 2020 than in 2019 and we debuted our first virtual show in 2020. If stay-at-home and shelter-in-place restrictions are put back into place or as other modes of transportation and vacation options recoverhave mostly recovered from the impact of COVID-19, the increased demand for our products may not be sustained. Wehas dropped from the peak levels experienced in recent years.

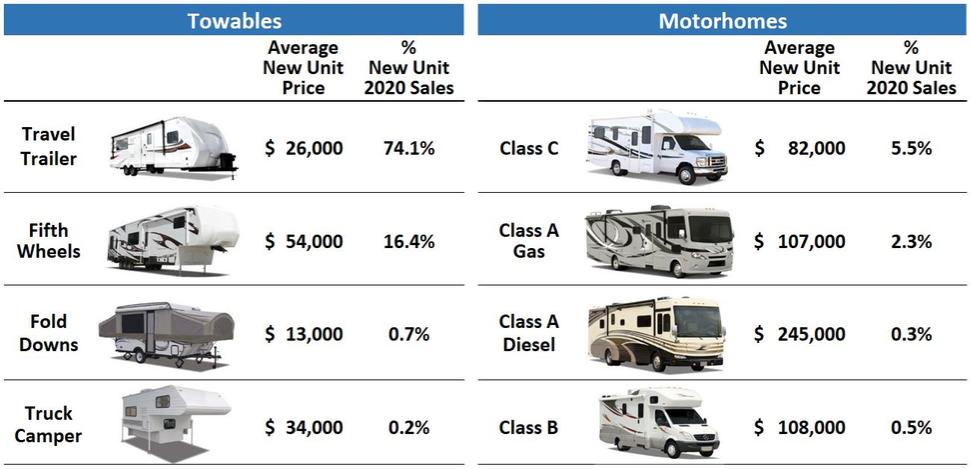

Strategic Review On January 17, 2024, we announced that we are unable to accurately quantify the future impact that COVID-19 may have onreviewing potential strategic alternatives for our Good Sam business, results of operations and liquidity due to numerous uncertainties, including the severitywhich could include a potential sale, spin off or other disposition of the disease,business. No decision has been made whether to proceed with any particular alternative. We have not set a deadline for the duration of the pandemic, including additional waves of infectionstrategic alternatives review process, and the effectiveness and availability of vaccines, the economic impact of the pandemic, actionsthere can be no assurance that may be taken by governmental authorities and other as yet unanticipated consequences. In addition, there could be weakening demand for items that are not basic goods, and our supply chain could be disruptedthis process will result in the future as a result of the outbreak, such as if Thor Industries, Inc. were to again close its North American production facilities as it did from late March to early May 2020. Any of these events could have a materially adverse impact on our operating results.any particular outcome. Key Performance Indicators We evaluate the results of our overall business based on a variety of factors, including the number of Active Customers and Good Sam members, revenue and same store revenue, vehicle units, and same store vehicle units, gross profit and gross profit per vehicle sold, gross margin, finance and insurance per vehicle (“PV”), vehicle inventory turnover, and Adjusted EBITDA and Adjusted EBITDA margin. Sales of new vehicles generally result in a lower gross profit margin than other areas of our business, including used vehicles, repair service and installation work, RV equipment and accessories, outdoor equipment and accessories and finance and insurance products. Same store revenue. Same store revenue measures the performance of a retailstore location during the current reporting period against the performance of the same retailstore location in the corresponding period of the previous year. Our same store revenue calculations for a given period include only those stores that were open both at the end of the corresponding period and at the beginning of the preceding fiscal year. As of December 31, 2020, 2019,2023, 2022, and 2018,2021, we had a base of 142, 132,166, 166, and 118158 same stores, respectively. For the years ended December 31, 2020, 20192023, 2022 and 20182021, our aggregate same store revenue was $4.5$5.2 billion, $3.7$5.9 billion, and $3.9$5.8 billion, respectively. With same store revenue driven by the number of transactions and the average transaction price, changes in our mix of new vehicle sales has in the past negatively impacted, and willin the future is likely continue to negatively impact, our new vehicle same store revenue. Over the past several years, we have seen a shift in our overall mix of new RV sales towards travel trailer vehicles, which tend to carry lower average selling prices than other classes of new RV vehicles. From 2015 to 2020,2023, total new vehicle travel trailer units have increased from 62% to 74%75% of total new vehicle unit sales and the average selling price of a new vehicle unit has declinedbut from $39,8532015 to $36,277. The increased popularity of new travel trailer vehicles and the lower price points of these units compared to other new vehicle classes such as motorhomes and fifth wheels could continue to lower2023 our average selling price of a new vehicle unit increased from $39,853 to $43,866. Due to lower industry supply of travel trailers and impactmotorhomes during much of 2020 and 2021, both average cost and average sales price increased. However, average sales price decreased in 2023 (see “Industry Trends” below), which impacted our same store revenue. Gross Profit and Gross Margins. Gross profit is our total revenue less our total costs applicable to revenue. Our total costs applicable to revenue primarily consists of the cost of goods and cost of sales, exclusive of depreciation and amortization. Gross margin is gross profit as a percentage of revenue. Our gross profit is variable in nature and generally follows changes in our revenue. Sales of new vehicles generally result in a lower gross margin than other areas of our business, including used vehicles, repair service and installation work, RV equipment and accessories, outdoor equipment and accessories and finance and insurance products. While gross margins for our RV and Outdoor Retail segment are lower than gross margins for our Good Sam Services and Plans, this segment generates significant gross profit and is our primary means of acquiring new customers, to whom we then cross sell our higher margin products and services with recurring revenue. We believe the overall growth of our RV and Outdoor Retail segments will allow us to continue to drive growth in gross profit due to our ability to cross sell our Good Sam Services and Plans to our increasing Active Customer base. Gross margin in our RV and Outdoor Retail segment was positively impacted in 2021 and, to a lesser extent, 2022 by increased demand for vehicles and reduced supply leading to higher average prices per unit. However, gross margins in 2023 and 2022 were negatively impacted by the higher cost of new vehicles that was driven largely from the reduced supply of new vehicles during much of 2021. Gross margins were also negatively impacted in 2018 and 20172023 by the opening of Gander Outdoors locations anddecline in 2019 by the 2019 Strategic Shift.average prices per unit. Adjusted EBITDA and Adjusted EBITDA Margin. Adjusted EBITDA and Adjusted EBITDA Margin are some of the primary metrics management uses to evaluate the financial performance of our business. Adjusted EBITDA and Adjusted EBITDA Margin are also frequently used by analysts, investors, and other interested parties to evaluate companies in our industry. Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP metrics. We use Adjusted EBITDA and Adjusted EBITDA Margin to supplement GAAP measures of performance as follows: | • | as a measurement of operating performance to assist us in comparing the operating performance of our business on a consistent basis, and remove the impact of items not directly resulting from our core operations; |

| • | for planning purposes, including the preparation of our internal annual operating budget and financial projections; and |

| • | to evaluate the performance and effectiveness of our operational strategies. |

For the definitions of Adjusted EBITDA and Adjusted EBITDA Margin, a reconciliation of Adjusted EBITDA to net income, a reconciliation of Adjusted EBITDA Margin to net income margin, and a further discussion of how we utilize these non-GAAP financial measures and their limitations, see “Non-GAAP Financial Measures” below. Industry Trends After several years of strong growth, the overall RV industry experienced decelerating demand for new vehicles in 2018 and 2019. Along with the decelerating demand trends, wholesale shipments of new RV vehicles declined 16.0% in 2019 according to the RV Industry Association’s survey of manufacturers. In late 2019, the demand for new RVs across the overall RV industry began improving. Wholesale shipments of new RVs increased 13.2% in the first two months of 2020 accordingAccording to the RV Industry Association’s survey of manufacturers, but then there was a six to eight week shutdown by RV manufacturers last spring which resulted in an 18.7% decrease in wholesale shipments for the first half of 2020. Wholesale shipments of RVs for the second half of 2020 increased 34.2% over the comparable period in 2019. For the year ended December 31, 2020 total RV shipments increased 6.0% versus the comparable period in 2019, with the travel trailer group showing the largest increase.

With the COVID-19 crisis causing many state and local governments to issue “stay-at-home” and “shelter-in-place” restrictions in mid-to-late March, sales and traffic levels across the RV industry declined significantly in April 2020. In response to the COVID-19 pandemic, many RV manufacturers, including Thor Industries, Forest River, Inc., and Winnebago Industries, temporarily suspended production from late March to mid-May. This led to a 44.6% decrease inalmost entirely focuses on North America, wholesale shipments of new RVs for 2023 were 313,174 units, 36.5% less than in 2022. RV shipments for the three month periodlast two months of March, April,2023 showed an increase over the previous year, and May 2020, accordingtheir projections indicate that they expect to continue to see increased shipments and retail sales in 2024, particularly in the latter half of the year.

Thor Industries, our largest supplier of RVs, disclosed in its Form 10-Q for the quarter ended October 31, 2023 as filed with the SEC on December 6, 2023 that its North American RV order backlog had declined 54% compared to October 31, 2022, primarily as a result of a reduction in orders from independent dealers. Thor Industries also disclosed that it believes that as of July 31, 2023, the North American RV independent dealer inventory levels were generally at, or slightly higher than, the levels dealers are comfortable stocking for most of their towable products and generally aligned with desired levels for its motorized products. The per unit cost of new vehicles has been significantly higher than we experienced prior to the COVID-19 pandemic, due to the RV Industry Association’s surveymanufacturers’ supply constraints during the pandemic, strong demand for new vehicles during the pandemic, higher inflation, and higher interest rates. These higher costs had been partially mitigated by the higher average selling prices on new vehicles initially, but we experienced a decrease in new vehicle gross margins during the year ended December 31, 2022, which continued in 2023, as a result of manufacturers. Longer term, however, we believe the increasethese higher costs. We experienced a 4.3% decrease in the numberaverage sale price of light-weight towable RV models offerednew vehicles during 2023 compared to 2022, driven by the manufacturers, the increasemore price sensitive customers in the number of pickup trucks and sport utility vehicles in operation, the ease of towing, the affordability of many of the light-weight RVs, the savings RVs offer on a variety of vacation costs, an increase in the pool of potential RV customers duehigher interest rate environment. We will continue to an aging baby boomer and millennial demographic,evaluate supplier pricing and the increased RV ownershipmix of our vehicle offerings, such as lower-priced towables, among younger consumers are positive long-term secular trends driving the growthother criteria, as part of the RV industry and the installed base of RV owners.

In addition, we believe the growth in the number of U.S. camping households bodes well for the long-term growth of the RV industry. The 2020 North American Camping Report estimated that the total number of camping households in the U.S. has increased by more than 9.7 million over the past six years to 82 million. Campers are increasing the amount of time they camp each year, with the number of campers who camp three times or more each year increasing by 82% since 2014. Over the past six years, an increasing number of campers have said that they use an RV as their primary camping accommodation. From 2014 to 2019, the number of campers using an RV to camp increased from 21% to an estimated 27%.our vehicle procurement process.

Finally,Certain of our RV manufacturers have indicated that they expect new towable vehicle average selling prices to decline by up to 10% for model year 2024 vehicles. The decrease in average selling prices for new towable vehicles has led to additional discounting on new vehicles from prior model years, beginning primarily in the campingfourth quarter of 2023, which has negatively impacted our near-term new vehicle gross margins as we sell through our stock of pre-2024 model year vehicles. Additionally, these new vehicle price pressures have resulted, and RV industrymay continue to result, in a decline in residual values of used vehicles, which led us to discount used vehicle pricing in order to maintain our rate of sale and inventory turns, which has negatively impacted used vehicle gross margins. Certain finance and insurance and Good Sam services and plans revenues that are at least partially based on new and/or used vehicle pricing have been negatively impacted by new and used vehicle average selling price decreases.

Financial Institutions The Company maintains the majority of its cash and cash equivalents in accounts with major U.S. and multi-national financial institutions, and our deposits at certain of these institutions exceed insured limits. Market conditions can impact the viability of these institutions. In the event of failure of any of the financial institutions where we maintain our cash and cash equivalents, there can be no assurance that we will be able to access uninsured funds in a timely manner or at all. Inflation During 2023 we experienced the impact of inflation on our operations, particularly with the increased cost of new vehicles. The price risk relating to new vehicles includes the cost from the manufacturer, as well as freight and logistics costs. Each of these costs have been impacted, to differing degrees, by factors such as high demand for product, supply chain disruptions, labor shortages, and increased fuel costs, some of which were caused, in part, by the COVID-19 pandemic. These cost pressures began to recede during the third quarter of 2023 and we expect this trend to continue into 2024. We have increased employee compensation rates as a response to the generally higher cost of living experienced in much of the United States in recent quarters. While we regularly review our compensation arrangements to ensure that our pay practices are competitive, we made meaningful adjustments to labor rates, largely in the fourth quarter of 2022, which were mostly offset by other cost reductions which included reduced headcount in the fourth quarter of 2022 and the elimination or reduction of underperforming assets, locations, and business lines. Additionally, during September and October of 2023, we implemented employee headcount reductions and adjustments to employee variable compensation plans that are expected to benefitresult in approximately $60.0 million of annual cost savings, primarily for selling, general and administrative expenses. These cost savings exclude any additional employee headcount from Baby Boomers reaching retirement ageour expected expansion of store locations. Inflationary factors, such as increases to our product and Generation Xoverhead costs, may adversely affect our operating results if the selling prices of our products and Millennial consumers reaching their prime camping age, which is generally considered between the agesservices do not increase proportionately with those increased costs or if demand for our products and services declines as a result of 30price increases to address inflationary costs. We finance substantially all of our new vehicle inventory and 50. According to U. S. Census Bureau datacertain of our used vehicle inventory through revolving floor plan arrangements. Inflationary increases in the 2019 American Community Survey 1-Year Estimates,costs of new and/or used vehicles financed through the population for the ages of 20 and 34 were estimated at 67 million individuals and the population between the ages of 50 and 69 were estimated at 80 million individualsrevolving floor plan arrangement result in an increase in the United States.outstanding principal balance of the revolving floor plan arrangement. Additionally, our leases require us to pay taxes, maintenance, repairs, insurance and utilities, all of which are generally subject to inflationary increases. Further, the cost of remodeling acquired RV dealership locations and constructing new RV dealership locations is subject to inflationary increases in the costs of labor and material, which results in higher rent expense on new RV dealership locations. Finally, our credit agreements include interest rates that vary based on various benchmarks. Such rates have historically increased during periods of increasing inflation. Strategic ShiftRestructuring

In 2019, we made a strategic decision to refocus our business around our core RV competencies. In connection withcompetencies (the “2019 Strategic Shift”). On March 1, 2023, our management determined to implement plans (the “Active Sports Restructuring”) to exit and restructure operations of our indirect subsidiary, Active Sports, LLC, a specialty products retail business (“Active Sports”). As of December 31, 2023, the Company had substantially completed the activities under the 2019 Strategic Shift we recorded restructuringand Active Sports Restructuring except for the remaining potential ongoing charges of $27.7 million in the third quarter of 2019 and $19.5 million in the fourth quarter of 2019. In total, we expectrelated to incur costs relating to one-time employee termination benefits of $1.2 million, all of which has been incurred through December 31, 2020, lease termination costs of between $18.0 million and $32.0 million, incremental inventory reserve charges of $42.4 million all of which has been incurred through December 31, 2020, and other associated costs of between $28.0 million and $35.0 million. Through December 31, 2019, we incurred $21.2 million of such other associated costs primarily representing labor, lease, and other operating expenses incurred during the post-close wind-down period for the locations relatedrelating to the 2019 Strategic Shift.leases of certain previously closed locations and facilities. The additional amountprocess of $6.8 millionidentifying subtenants and negotiating lease terminations had been delayed, which initially was in part due to $13.8 million represents similar costs that may be incurred in the year ending December 31, 2021 for locations that continue in a wind-down period, primarily comprised of lease costs accounted for under ASC No. 842, Leases (“ASC 842”) prior to lease termination. We intend to negotiate terminationsCOVID-19 pandemic. The timing of these leases where prudentnegotiations will vary as both subleases and pursue sublease arrangements for the remaining leases. Lease costs may continue to be incurred after December 31, 2020terminations are contingent on these leases if we are unable to terminate the leases under acceptable terms or offset the lease costs through sublease arrangements. The foregoing lease termination cost estimate represents the expected cash payments to terminate certain leases, but does not include the gain or loss from derecognition of the related operating lease assets and liabilities, which is dependent on the particular leases that will be terminated.landlord approvals. See Note 5 — Restructuring and Long-livedLong-Lived Asset Impairment to our consolidated financial statements included in Part II, Item 8 of this Form 10-K. Comparison of Certain Trends to Pre-COVID-19 Pandemic Periods During 2023, we experienced a decrease in gross margin for new and used vehicles compared to 2022. However, 2023 new vehicle gross margins were higher than the pre-COVID-19 pandemic periods of 2016 to 2019, which we believe are more typical demand environments than during the COVID-19 pandemic. During 2023, as the procurement prices of model year 2024 new vehicles declined compared to model years 2022 and 2023, we actively discounted certain used vehicles to reduce inventory levels of aged used vehicles. This discounting had a negative impact on used vehicle gross margins during 2023. Additionally, the percentage of total unit sales relating to used vehicles was significantly higher in 2023 compared to the pre-COVID-19 pandemic periods of 2016 to 2019. We are continuing to execute on our used vehicle strategy, which differentiates us from the competition with proprietary tools, such as the RV Valuator, a focus on the development and retention of our service technician team, and investment in our service bay infrastructure. The following table detailspresents vehicle gross margin and unit sale mix for the costs incurred associatedyear ended December 31, 2023 and pre-COVID-19 pandemic periods of the years ended December 31, 2019, 2018, 2017, and 2016: | | | | | | | | | | | | | Year Ended December 31, | | | 2023 | | 2019(1) | | 2018(1) | | 2017(1) | | 2016(1) | Gross margin: | | | | | | | | | | | New vehicles | | 15.5% | | 12.5% | | 12.9% | | 14.4% | | 14.2% | Used vehicles | | 20.5% | | 20.9% | | 22.4% | | 24.3% | | 20.8% | | | | | | | | | | | | Unit sales mix: | | | | | | | | | | | New vehicles | | 50.8% | | 64.6% | | 68.6% | | 68.8% | | 60.9% | Used vehicles | | 49.2% | | 35.4% | | 31.4% | | 31.2% | | 39.1% |

(1) These periods were prior to the COVID-19 Pandemic. Our Corporate Structure Impact on Income Taxes Our corporate structure is commonly referred to as an “Up-C” structure and typically results in a different relationship between income before income taxes and income tax expense than would be experienced by most public companies with a more traditional corporate structure. More traditional structures are typically comprised predominately of Subchapter C corporations (“C-Corps”) and/or lacking significant non-controlling interests with holdings through limited liability companies or partnerships. Typically, most of our income tax expense is recorded at the CWH level, our public holding company, based on its allocation of taxable income from CWGS, LLC. More specifically, CWH is organized as a C-Corp and, as of December 31, 2023, is a 52.9% owner of CWGS, LLC. CWGS, LLC is organized as a limited liability company and treated as a partnership for U.S. federal and most applicable state and local income tax purposes and, as such is generally not subject to any U.S. federal entity-level income taxes (“Pass-Through”), with the 2019 Strategic Shift (in thousands)exception of Americas Road and Travel Club, Inc. and FreedomRoads RV, Inc., and their wholly-owned subsidiaries, which are C-Corps embedded within the CWGS, LLC structure. As discussed below, prior to 2023, Camping World, Inc. (“CW”) and its wholly-owned subsidiaries were also C-Corps embedded within the CWGS, LLC structure. By January 2, 2023, the “LLC Conversion” (see Note 12 — Income Taxes to our consolidated financial statements included in Part II, Item 8 of this Form 10-K) was completed. We expect that, beginning with the year ended December 31, 2023, the LLC Conversion will allow certain losses that previously would have been confined within the C-Corp portion of CWGS, LLC to instead offset a portion of income generated by the Pass-Through portion of CWGS, LLC, which would reduce the amount of income tax expense recorded by CWH. The LLC Conversion is also expected to reduce the amount of tax distributions required to be paid by CWGS, LLC to CWH and the non-controlling interest holders under the CWGS LLC Agreement beginning with the year ended December 31, 2023. CWH receives an allocation of its share of the net income of CWGS, LLC based on CWH’s weighted-average ownership of CWGS, LLC for the period. CWH recognizes income tax expense on its pre-tax income including its portion of this income allocation from CWGS, LLC primarily relating to Pass-Through entities. The income tax relating to the net income of CWGS, LLC allocated to CWH that relates to separately taxed C-Corp entities is recorded within the consolidated results of CWGS, LLC. No income tax expense is recognized by the Company for the portion of net income of CWGS, LLC allocated to non-controlling interest other than income tax expense recorded by CWGS, LLC. Rather, tax distributions are paid to the non-controlling interest holders, which are recorded as distributions to holders of LLC common units in the consolidated statements of cash flows. CWH is subject to U.S. federal, state and local income taxes with respect to its allocable share of any taxable income of CWGS, LLC and is taxed at the prevailing corporate tax rates. For the years ended December 31, 2023, 2022 and 2021, the Company used effective income tax rate assumptions between 25.0% and 25.5%, for income adjustments applicable to CWH when calculating the adjusted net income attributable to Camping World Holdings, Inc. — basic and diluted (see “Non-GAAP Financial Measures” in Part II, Item 7 of this Form 10-K). CWGS, LLC may be liable for various other state and local taxes. The following table presents the allocation of CWGS, LLC’s C-Corp and Pass-Through net income to CWH, the allocation of CWGS, LLC’s net income to non-controlling interests, income tax benefit (expense) recognized by CWH, and other items: | | | | | | | | | | | | | Year Ended December 31, | | ($ in thousands) | | 2023 | | 2022 | | 2021 | | C-Corp portion of CWGS, LLC net income (loss) allocated to CWH | | $ | 3,776 | | $ | (37,500) | | $ | (19,177) | | Pass-Through portion of CWGS, LLC net income allocated to CWH | | | 17,687 | | | 252,771 | | | 397,834 | | CWGS, LLC net income allocated to CWH | | | 21,463 | | | 215,271 | | | 378,657 | | CWGS, LLC net income allocated to noncontrolling interests | | | 19,557 | | | 214,084 | | | 363,614 | | CWGS, LLC net income | | | 41,020 | | | 429,355 | | | 742,271 | | Tax Receivable Agreement liability adjustment | | | 2,442 | | | 114 | | | (2,813) | | Income tax benefit (expense) recorded by CWH | | | 5,736 | | | (79,054) | | | (97,831) | | Other incremental CWH net income | | | 1,403 | | | 616 | | | 448 | | Net income | | $ | 50,601 | | $ | 351,031 | | $ | 642,075 | | | | | | | | | | | | |

The following table presents further information on income tax benefit (expense): | | | | | | | Year Ended | | December 31, 2020 | | December 31, 2019 | Restructuring costs: | | | | | | One-time termination benefits(1) | $ | 231 | | $ | 1,008 | Lease termination costs(2) | | 4,432 | | | 55 | Incremental inventory reserve charges(3) | | 543 | | | 41,894 | Other associated costs(4) | | 16,835 | | | 4,321 | Total restructuring costs | $ | 22,041 | | $ | 47,278 |

| | | | | | | | | | | | | Year Ended December 31, | | ($ in thousands) | | 2023 | | 2022 | | 2021 | | Income tax benefit (expense) recorded by CWH(1) | | $ | 5,736 | | $ | (79,054) | | $ | (97,831) | | Income tax (expense) benefit recorded by CWGS, LLC(2) | | | (4,537) | | | (20,030) | | | 5,707 | | Income tax benefit (expense) | | $ | 1,199 | | $ | (99,084) | | $ | (92,124) | |

(1) | These costs incurred in 2020 were primarily included in costs applicable to revenues – products, service and other in the consolidated statements of operations. These costs incurred in 2019 were primarily included in selling, general and administrative expenses in the consolidated statements of operations.

|

(2)

| These costs were included in lease termination charges in the consolidated statements of operations. This reflects termination fees paid, net of any gain from derecognition of the related operating lease assets and liabilities.

|

(3)

| These costs were included in costs applicable to revenue – products, service and other in the consolidated statements of operations.

|

(4)

| Other associated costs primarily represent labor, lease, and other operating expenses incurred during the post-close wind-down period for the locations related to the 2019 Strategic Shift. ForDuring the year ended December 31, 2020, costs2023, this amount included $3.1 million of approximately $0.4net income tax benefit related to the LLC Conversion and the realization of a portion of outside basis in CWGS, LLC, which previously had a valuation allowance. Additionally, the Company recorded an income tax benefit of $4.1 million wererelated to an entity classification election, which was filed in the third quarter of 2023 with an effective date of January 2, 2023. During the year ended December 31, 2022, this amount included $13.3 million of income tax expense related to the LLC Conversion. This income tax expense was primarily from the write-off of deferred tax assets, which was partially offset by the release of valuation allowance. See Note 12 – Income Taxes to our consolidated financial statements included in costs applicablePart II, Item 8 of this Form 10-K for additional information.

|

(2) | During the year ended December 31, 2023, this amount included $2.9 million of income tax benefit related to revenueCW state unitary net operating losses. During the year ended December 31, 2022, this amount included $15.2 million of income tax expense related to the LLC Conversion. This income tax expense was primarily from the write-off of deferred tax assets, which was partially offset by the release of valuation allowance. Additionally, during the year ended December 31, 2021, this amount included benefits to income tax of $15.2 million for the release of valuation allowance at CW, which, in 2021 and 2022 prior to the LLC Conversion, became available to offset state combined income in certain unitary states due to the Company’s increased ownership in CWGS, LLC. See Note 12 – products, service and other, and $16.4 million wereIncome Taxes to our consolidated financial statements included in selling, general, and administrative expenses in the consolidated statementsPart II, Item 8 of operations.this Form 10-K for additional information. |

Results of Operations Year Ended December 31, 20202023 Compared to the Year Ended December 31, 20192022 The following tables set forth information comparing the components of net income for the years ended December 31, 20202023 and 2019.2022. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Year Ended | | | | | | | | Year Ended | | | | | | | | | December 31, 2020 | | December 31, 2019 | | | | | December 31, 2023 | | December 31, 2022 | | | | | | | | | Percent of | | | | | Percent of | | Favorable/ (Unfavorable) | | | | | | Percent of | | | | | Percent of | | Favorable/ (Unfavorable) | | ($ in thousands) | | Amount | | Revenue | | Amount | | Revenue | | $ | | % | | | Amount | | Revenue | | Amount | | Revenue | | $ | | % | | | | | | | | | | | | | | | | | | | | Revenue: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Good Sam Services and Plans | | $ | 180,977 | | 3.3% | | $ | 179,538 | | 3.7% | | $ | 1,439 | | 0.8% | | | $ | 193,827 | | 3.1% | | $ | 192,128 | | 2.8% | | $ | 1,699 | | 0.9% | | RV and Outdoor Retail: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | New vehicles | | | 2,823,311 | | 51.8% | | | 2,370,321 | | 48.5% | | | 452,990 | | 19.1% | | | | 2,576,278 | | 41.4% | | | 3,228,077 | | 46.3% | | | (651,799) | | (20.2%) | | Used vehicles | | | 984,853 | | 18.1% | | | 857,628 | | 17.5% | | | 127,225 | | 14.8% | | | | 1,979,632 | | 31.8% | | | 1,877,601 | | 26.9% | | | 102,031 | | 5.4% | | Products, service and other | | | 948,890 | | 17.4% | | | 1,034,577 | | 21.1% | | | (85,687) | | (8.3)% | | | | 870,038 | | 14.0% | | | 999,214 | | 14.3% | | | (129,176) | | (12.9%) | | Finance and insurance, net | | | 464,261 | | 8.5% | | | 401,302 | | 8.2% | | | 62,959 | | 15.7% | | | | 562,256 | | 9.0% | | | 623,456 | | 8.9% | | | (61,200) | | (9.8%) | | Good Sam Club | | | 44,299 | | 0.8% | | | 48,653 | | 1.0% | | | (4,354) | | (8.9)% | | | | 44,516 | | 0.7% | | | 46,537 | | 0.7% | | | (2,021) | | (4.3%) | | Subtotal | | | 5,265,614 | | 96.7% | | | 4,712,481 | | 96.3% | | | 553,133 | | 11.7% | | | | 6,032,720 | | 96.9% | | | 6,774,885 | | 97.2% | | | (742,165) | | (11.0%) | | Total revenue | | | 5,446,591 | | 100.0% | | | 4,892,019 | | 100.0% | | | 554,572 | | 11.3% | | | | 6,226,547 | | 100.0% | | | 6,967,013 | | 100.0% | | | (740,466) | | (10.6%) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Gross profit (exclusive of depreciation and amortization shown separately below): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Good Sam Services and Plans | | | 108,039 | | 2.0% | | | 101,484 | | 2.1% | | | 6,555 | | 6.5% | | | | 134,436 | | 2.2% | | | 120,162 | | 1.7% | | | 14,274 | | 11.9% | | RV and Outdoor Retail: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | New vehicles | | | 502,774 | | 9.2% | | | 296,051 | | 6.1% | | | 206,723 | | 69.8% | | | | 400,459 | | 6.4% | | | 651,801 | | 9.4% | | | (251,342) | | (38.6%) | | Used vehicles | | | 233,824 | | 4.3% | | | 178,988 | | 3.7% | | | 54,836 | | 30.6% | | | | 405,394 | | 6.5% | | | 459,548 | | 6.6% | | | (54,154) | | (11.8%) | | Products, service and other | | | 358,174 | | 6.6% | | | 271,658 | | 5.6% | | | 86,516 | | 31.8% | | | | 336,413 | | 5.4% | | | 368,204 | | 5.3% | | | (31,791) | | (8.6%) | | Finance and insurance, net | | | 464,261 | | 8.5% | | | 401,302 | | 8.2% | | | 62,959 | | 15.7% | | | | 562,256 | | 9.0% | | | 623,456 | | 8.9% | | | (61,200) | | (9.8%) | | Good Sam Club | | | 35,407 | | 0.7% | | | 37,915 | | 0.8% | | | (2,508) | | (6.6)% | | | | 39,691 | | 0.6% | | | 39,113 | | 0.6% | | | 578 | | 1.5% | | Subtotal | | | 1,594,440 | | 29.3% | | | 1,185,914 | | 24.2% | | | 408,526 | | 34.4% | | | | 1,744,213 | | 28.0% | | | 2,142,122 | | 30.7% | | | (397,909) | | (18.6%) | | Total gross profit | | | 1,702,479 | | 31.3% | | | 1,287,398 | | 26.3% | | | 415,081 | | 32.2% | | | | 1,878,649 | | 30.2% | | | 2,262,284 | | 32.5% | | | (383,635) | | (17.0%) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Operating expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Selling, general and administrative expenses | | | 1,156,071 | | 21.2% | | | 1,141,643 | | 23.3% | | | (14,428) | | (1.3)% | | | | 1,538,988 | | 24.7% | | | 1,606,984 | | 23.1% | | | 67,996 | | 4.2% | | Depreciation and amortization | | | 51,981 | | 1.0% | | | 59,932 | | 1.2% | | | 7,951 | | 13.3% | | | | 68,643 | | 1.1% | | | 80,304 | | 1.2% | | | 11,661 | | 14.5% | | Long-lived asset impairment | | | 12,353 | | 0.2% | | | 66,270 | | 1.4% | | | 53,917 | | 81.4% | | | | 9,269 | | 0.1% | | | 4,231 | | 0.1% | | | (5,038) | | (119.1%) | | Lease termination | | | 4,547 | | 0.1% | | | (686) | | (0.0)% | | | (5,233) | | nm | | | | (103) | | (0.0%) | | | 1,614 | | 0.0% | | | 1,717 | | nm | | Loss on disposal of assets | | | 1,332 | | 0.0% | | | 11,492 | | 0.2% | | | 10,160 | | 88.4% | | | Loss (gain) on sale or disposal of assets | | | | (5,222) | | (0.1%) | | | 622 | | 0.0% | | | 5,844 | | nm | | Total operating expenses | | | 1,226,284 | | 22.5% | | | 1,278,651 | | 26.1% | | | (52,367) | | (4.1)% | | | | 1,611,575 | | 25.9% | | | 1,693,755 | | 24.3% | | | (82,180) | | (4.9%) | | Income from operations | | | 476,195 | | 8.7% | | | 8,747 | | 0.2% | | | 467,448 | | 5344.1% | | | | 267,074 | | 4.3% | | | 568,529 | | 8.2% | | | (301,455) | | (53.0%) | | Other income (expense): | | | | | | | | | | | | | | | | | | Other expense: | | | | | | | | | | | | | | | | | | Floor plan interest expense | | | (19,689) | | (0.4)% | | | (40,108) | | (0.8)% | | | 20,419 | | 50.9% | | | | (83,075) | | (1.3%) | | | (42,031) | | (0.6%) | | | (41,044) | | (97.7%) | | Other interest expense, net | | | (54,689) | | (1.0)% | | | (69,363) | | (1.4)% | | | 14,674 | | 21.2% | | | | (135,270) | | (2.2%) | | | (75,745) | | (1.1%) | | | (59,525) | | (78.6%) | | Tax Receivable Agreement liability adjustment | | | 141 | | 0.0% | | | 10,005 | | 0.2% | | | (9,864) | | (98.6)% | | | | 2,442 | | 0.0% | | | 114 | | 0.0% | | | 2,328 | | nm | | Total other income (expense) | | | (74,237) | | (1.4)% | | | (99,466) | | (2.0)% | | | 25,229 | | 25.4% | | | Income (loss) before income taxes | | | 401,958 | | 7.4% | | | (90,719) | | (1.9)% | | | 492,677 | | nm | | | Income tax expense | | | (57,743) | | (1.1)% | | | (29,582) | | (0.6)% | | | (28,161) | | (95.2)% | | | Net income (loss) | | | 344,215 | | 6.3% | | | (120,301) | | (2.5)% | | | 464,516 | | nm | | | Less: net (income) loss attributable to non-controlling interests | | | (221,870) | | (4.1)% | | | 59,710 | | 1.2% | | | (281,580) | | nm | | | Net income (loss) attributable to Camping World Holdings, Inc. | | $ | 122,345 | | 2.2% | | $ | (60,591) | | (1.2)% | | $ | 182,936 | | nm | | | Other expense, net | | | | (1,769) | | (0.0%) | | | (752) | | (0.0%) | | | (1,017) | | (135.2%) | | Total other expense | | | | (217,672) | | (3.5%) | | | (118,414) | | (1.7%) | | | (99,258) | | (83.8%) | | Income before income taxes | | | | 49,402 | | 0.8% | | | 450,115 | | 6.5% | | | (400,713) | | (89.0%) | | Income tax benefit (expense) | | | | 1,199 | | 0.0% | | | (99,084) | | (1.4%) | | | 100,283 | | nm | | Net income | | | | 50,601 | | 0.8% | | | 351,031 | | 5.0% | | | (300,430) | | (85.6%) | | Less: net income attributable to non-controlling interests | | | | (19,557) | | (0.3%) | | | (214,084) | | (3.1%) | | | 194,527 | | 90.9% | | Net income attributable to Camping World Holdings, Inc. | | | $ | 31,044 | | 0.5% | | $ | 136,947 | | 2.0% | | $ | (105,903) | | (77.3%) | | | | | | | | | | | | | | | | | | | |

nm- not meaningful

Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Year Ended December 31, | | Increase | | | Percent | | Year Ended December 31, | | Increase | | | Percent | | | 2020 | | 2019 | | (decrease) | | | Change | | 2023 | | 2022 | | (decrease) | | | Change | Unit sales | | | | | | | | | | | | | | | | | | | | | | | | | | | New vehicles | | | 77,827 | | | 66,111 | | | 11,716 | | | | 17.7% | | | 58,731 | | | 70,429 | | | (11,698) | | | | (16.6%) | Used vehicles | | | 37,760 | | | 36,213 | | | 1,547 | | | | 4.3% | | | 56,823 | | | 51,325 | | | 5,498 | | | | 10.7% | Total | | | 115,587 | | | 102,324 | | | 13,263 | | | | 13.0% | | | 115,554 | | | 121,754 | | | (6,200) | | | | (5.1%) | | | | | | | | | | | | | | | | | | | | | | | | | | | | Average selling price | | | | | | | | | | | | | | | | | | | | | | | | | | | New vehicles | | $ | 36,277 | | $ | 35,854 | | $ | 423 | | | | 1.2% | | $ | 43,866 | | $ | 45,834 | | $ | (1,969) | | | | (4.3%) | Used vehicles | | $ | 26,082 | | $ | 23,683 | | $ | 2,399 | | | | 10.1% | | | 34,839 | | | 36,583 | | | (1,744) | | | | (4.8%) | | | | | | | | | | | | | | | | | | | | | | | | | | | | Same store unit sales | | | | | | | | | | | | | | | | | | | | | | | | | | | New vehicles | | | 70,313 | | | 61,390 | | | 8,923 | | | | 14.5% | | | 51,858 | | | 66,610 | | | (14,752) | | | | (22.1%) | Used vehicles | | | 34,351 | | | 34,477 | | | (126) | | | | (0.4)% | | | 51,072 | | | 48,648 | | | 2,424 | | | | 5.0% | Total | | | 104,664 | | | 95,867 | | | 8,797 | | | | 9.2% | | | 102,930 | | | 115,258 | | | (12,328) | | | | (10.7%) | | | | | | | | | | | | | | | | | | | | | | | | | | | | Same store revenue ($ in 000's) | | | | | | | | | | | | | | | Same store revenue(1) ($ in 000s) | | | | | | | | | | | | | | | New vehicles | | $ | 2,567,103 | | $ | 2,223,696 | | $ | 343,406 | | | | 15.4% | | $ | 2,296,811 | | $ | 3,090,711 | | $ | (793,900) | | | | (25.7%) | Used vehicles | | | 911,315 | | | 828,312 | | | 83,004 | | | | 10.0% | | | 1,791,352 | | | 1,803,943 | | | (12,591) | | | | (0.7%) | Products, service and other | | | 594,060 | | | 523,328 | | | 70,732 | | | | 13.5% | | | 635,670 | | | 691,044 | | | (55,374) | | | | (8.0%) | Finance and insurance, net | | | 426,229 | | | 379,785 | | | 46,444 | | | | 12.2% | | | 504,315 | | | 599,435 | | | (95,120) | | | | (15.9%) | Total | | $ | 4,498,708 | | $ | 3,955,122 | | $ | 543,586 | | | | 13.7% | | $ | 5,228,148 | | $ | 6,185,133 | | $ | (956,985) | | | | (15.5%) | | | | | | | | | | | | | | | | | | | | | | | | | | | | Average gross profit per unit | | | | | | | | | | | | | | | | | | | | | | | | | | | New vehicles | | $ | 6,460 | | $ | 4,478 | | $ | 1,982 | | | | 44.3% | | $ | 6,819 | | $ | 9,255 | | $ | (2,436) | | | | (26.3%) | Used vehicles | | | 6,192 | | | 4,943 | | | 1,249 | | | | 25.3% | | | 7,134 | | | 8,954 | | | (1,819) | | | | (20.3%) | Finance and insurance, net per vehicle unit | | | 4,017 | | | 3,922 | | | 95 | | | | 2.4% | | | 4,866 | | | 5,121 | | | (255) | | | | (5.0%) | Total vehicle front-end yield(1)(2) | | | 10,389 | | | 8,564 | | | 1,825 | | | | 21.3% | | | 11,840 | | | 14,248 | | | (2,409) | | | | (16.9%) | | | | | | | | | | | | | | | | | | | | | | | | | | | | Gross margin | | | | | | | | | | | | | | | | | | | | | | | | | | | Good Sam Services and Plans | | | 59.7% | | | 56.5% | | | 317 | bps | | | | | | 69.4% | | | 62.5% | | | 682 | bps | | | | New vehicles | | | 17.8% | | | 12.5% | | | 532 | bps | | | | | | 15.5% | | | 20.2% | | | (465) | bps | | | | Used vehicles | | | 23.7% | | | 20.9% | | | 287 | bps | | | | | | 20.5% | | | 24.5% | | | (400) | bps | | | | Products, service and other | | | 37.7% | | | 26.3% | | | 1,149 | bps | | | | | | 38.7% | | | 36.8% | | | 182 | bps | | | | Finance and insurance, net | | | 100.0% | | | 100.0% | | | unch. | bps | | | | | | 100.0% | | | 100.0% | | | unch. | bps | | | | Good Sam Club | | | 79.9% | | | 77.9% | | | 200 | bps | | | | | | 89.2% | | | 84.0% | | | 511 | bps | | | | Subtotal RV and Outdoor Retail | | | 30.3% | | | 25.2% | | | 511 | bps | | | | | | 28.9% | | | 31.6% | | | (271) | bps | | | | Total gross margin | | | 31.3% | | | 26.3% | | | 494 | bps | | | | | | 30.2% | | | 32.5% | | | (230) | bps | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Inventories ($ in 000's) | | | | | | | | | | | | | | | RV and Outdoor Retail inventories ($ in 000s) | | | | | | | | | | | | | | | New vehicles | | $ | 691,114 | | $ | 966,134 | | $ | (275,020) | | | | (28.5)% | | $ | 1,378,403 | | $ | 1,411,016 | | $ | (32,613) | | | | (2.3%) | Used vehicles | | | 178,336 | | | 165,927 | | | 12,409 | | | | 7.5% | | | 464,833 | | | 464,311 | | | 522 | | | | 0.1% | Products, parts, accessories and misc. | | | 266,786 | | | 225,888 | | | 40,898 | | | | 18.1% | | | 199,261 | | | 247,906 | | | (48,645) | | | | (19.6%) | Total RV and Outdoor Retail inventories | | $ | 1,136,236 | | $ | 1,357,949 | | $ | (221,713) | | | | (16.3)% | | $ | 2,042,497 | | $ | 2,123,233 | | $ | (80,736) | | | | (3.8%) | | | | | | | | | | | | | | | | | | | | | | | | | | | | Vehicle inventory per location ($ in 000's) | | | | | | | | | | | | | | | Vehicle inventory per location ($ in 000s) | | | | | | | | | | | | | | | New vehicle inventory per dealer location | | $ | 4,319 | | $ | 6,274 | | $ | (1,954) | | | | (31.1)% | | $ | 6,962 | | $ | 7,466 | | $ | (504) | | | | (6.8%) | Used vehicle inventory per dealer location | | | 1,115 | | | 1,077 | | | 37 | | | | 3.4% | | | 2,348 | | | 2,457 | | | (109) | | | | (4.4%) | | | | | | | | | | | | | | | | | | | | | | | | | | | | Vehicle inventory turnover(2)(3) | | | | | | | | | | | | | | | | | | | | | | | | | | | New vehicle inventory turnover | | | 3.1 | | | 2.1 | | | 1.0 | | | | 44.9% | | | 1.8 | | | 1.9 | | | (0.2) | | | | (8.6%) | Used vehicle inventory turnover | | | 5.2 | | | 4.8 | | | 0.4 | | | | 9.0% | | | 2.9 | | | 3.4 | | | (0.5) | | | | (14.1%) | | | | | | | | | | | | | | | | | | | | | | | | | | | | Retail locations | | | | | | | | | | | | | | | | | | | | | | | | | | | RV dealerships | | | 160 | | | 154 | | | 6 | | | | 3.9% | | | 198 | | | 189 | | | 9 | | | | 4.8% | RV service & retail centers | | | 10 | | | 11 | | | (1) | | | | (9.1)% | | | 4 | | | 7 | | | (3) | | | | (42.9%) | Subtotal | | | 170 | | | 165 | | | 5 | | | | 3.0% | | | 202 | | | 196 | | | 6 | | | | 3.1% | Other retail stores | | | 1 | | | 10 | | | (9) | | | | (90.0)% | | | — | | | 1 | | | (1) | | | | (100.0%) | Total | | | 171 | | | 175 | | | (4) | | | | (2.3)% | | | 202 | | | 197 | | | 5 | | | | 2.5% | | | | | | | | | | | | | | | | | | | | | | | | | | | | Other data | | | | | | | | | | | | | | | | | | | | | | | | | | | Active Customers(3)(4) | | | 5,314,104 | | | 5,118,413 | | | 195,691 | | | | 3.8% | | | 4,959,723 | | | 5,265,939 | | | (306,216) | | | | (5.8%) | Good Sam Club members | | | 2,088,064 | | | 2,124,724 | | | (36,660) | | | | (1.7)% | | | 2,027,353 | | | 2,026,215 | | | 1,138 | | | | 0.1% | Service bays (5) | | | | 2,757 | | | 2,693 | | | 64 | | | | 2.4% | Finance and insurance gross profit as a % of total vehicle revenue | | | 12.2% | | | 12.4% | | | (24) | bps | | | n/a | | | 12.3% | | | 12.2% | | | 13 | bps | | | n/a | Same store locations | | | 142 | | | n/a | | | n/a | | | | n/a | | | 166 | | | n/a | | | n/a | | | | n/a |

| (1) | Our same store revenue and units calculations for a given period include only those stores that were open both at the end of the corresponding period and at the beginning of the preceding fiscal year. |

| (2) | Front end yield is calculated as gross profit from new vehicles, used vehicles and finance and insurance (net), divided by combined new and used vehicle unit sales. |

| (3) | Inventory turnover calculated as vehicle costs applicable to revenue over the last twelve months divided by the average quarterly ending vehicle inventory over the last twelve months. |

| (4) | An Active Customer is a customer who has transacted with us in any of the eight most recently completed fiscal quarters prior to the date of measurement. |

| (5) | A service bay is a fully-constructed bay dedicated to service, installation, and/or collision offerings. |

(1)Front end yield is calculated as gross profit from new vehicles, used vehiclesRevenue and finance and insurance (net), divided by combined new and used retail unit revenue.

(2)Inventory turnover calculated as vehicle costs applicable to revenue divided by the average of beginning and ending vehicle inventory.

(3)An Active Customer is a customer who has transacted with us in any of the eight most recently completed fiscal quarters prior to the date of measurement.

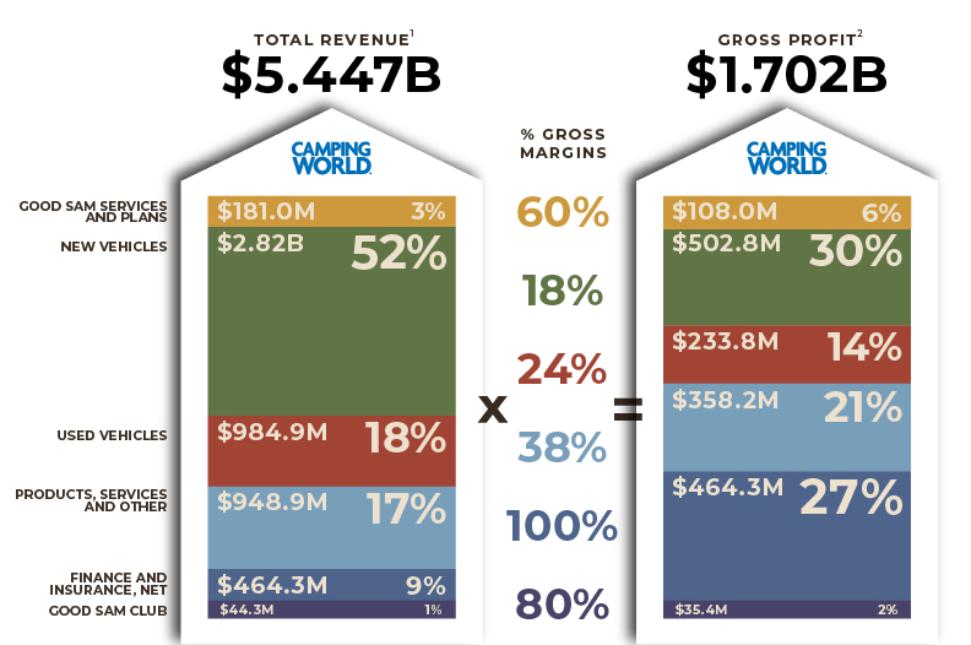

Total revenue was $5.4 billion for 2020, an increase of $554.6 million, or 11.3%, from $4.9 billion for 2019. The increase in total revenue was driven by a $553.1 million, or 11.7%, increase in RV and Outdoor Retail revenue, and a $1.4 million, or 0.8%, increase in Good Sam Services and Plans revenue.

Total gross profit was $1.7 billion for 2020, an increase of $415.1 million, or 32.2%, from $1.3 billion for 2019. The increase in total gross profit was driven by a $408.5 million, or 34.4%, increase in RV and Outdoor Retail gross profit, and a $6.6 million, or 6.5%, increase in Good Sam Services and Plans gross profit.

Income from operations was $476.2 million for 2020, an increase of $467.4 million from $8.7 million for 2019. The increase in income from operations was primarily driven by a $415.1 million increase in gross profit, a $53.9 million decrease in long-lived asset impairment, a decrease of approximately $10.1 million in loss on disposal of assets, and a decrease of approximately $7.9 million in depreciation and amortization, partially offset by an increase of $14.4 million in selling, general and administrative expenses, and a $5.2 million increase in lease termination expense.

Total other expenses were $74.2 million for 2020, a decrease of $25.2 million, or 25.4% from $99.5 billion for 2019. The decrease in other expenses was driven by a $20.4 million decrease in floor plan interest expense, and a $14.7 million decrease in other interest expense, partially offset by a $9.9 million favorable adjustment in Tax Receivable Agreement Liability in 2019, which did not reoccur in 2020.

As a result of the above factors, income before income taxes was $402.0 million for 2020 compared to loss before income taxes of $90.7 million for 2019. Income tax expense was $57.7 million for 2020, an increase of $28.2 million from $29.6 million for 2019. As a result, net income was $344.2 million for 2020 compared to net loss of $120.3 million for 2019.Gross Profit