| ● | actual or anticipated variations in our quarterly results of operations or dividends;Our Board of Directors, without stockholder approval, has the power under our charter to amend our charter to increase or decrease the aggregate number of shares of stock or the number of shares of stock of any class or series that we are authorized to issue. In addition, under our charter, our Board of Directors, without stockholder approval, has the power to authorize us to issue authorized but unissued shares of our common stock or preferred stock and to classify or reclassify any unissued shares of our common stock or preferred stock into one or more classes or series of stock and set the preference, conversion or other rights, voting powers, restrictions, limitations as to dividends and other distributions, qualifications or terms or conditions of redemption for such newly classified or reclassified shares. As a result, we may issue series or classes of common stock or preferred stock with preferences, dividends, powers and rights, voting or otherwise, that are senior to, or otherwise conflict with, the rights of holders of our common stock. Although our Board of Directors has no such intention at the present time, it could establish a class or series of preferred stock that could, depending on the terms of such series, delay, defer or prevent a transaction or a change of control that might involve a premium price for our common stock or that our stockholders otherwise believe to be in their best interests. Certain provisions of Maryland law could inhibit changes in control, which may discourage third parties from conducting a tender offer or seeking other change of control transactions that could involve a premium price for our common stock or that our stockholders otherwise believe to be in their best interests. Certain provisions of the Maryland General Corporation Law (the “MGCL”) may have the effect of inhibiting a third party from making a proposal to acquire us or of impeding a change of control under certain circumstances that otherwise could provide the holders of shares of our common stock with the opportunity to realize a premium over the then-prevailing market price of such shares, including: | ● | “business combination” provisions that, subject to limitations, prohibit certain business combinations between us and an “interested stockholder” (defined generally as any person who beneficially owns 10% or more of the voting power of our outstanding voting stock or any affiliate or associate of ours who, at any time within the two-year period immediately prior to the date in question, was the beneficial owner of 10% or more of the voting power of our then outstanding stock) or an affiliate thereof for five years after the most recent date on which the stockholder becomes an interested stockholder and thereafter impose fair price and/or supermajority voting requirements on these combinations; and |

| ● | “control share” provisions that provide that “control shares” of our Company (defined as shares which, when aggregated with other shares controlled by the stockholder, except solely by virtue of a revocable proxy, entitle |

| ● | changes in our funds from operations or earnings estimates; | | the stockholder to exercise one of three increasing ranges of voting power in electing directors) acquired in a “control share acquisition” (defined as the direct or indirect acquisition of ownership or control of issued and outstanding “control shares”) have no voting rights with respect to their control shares except to the extent approved by our stockholders by the affirmative vote of at least two-thirds of all the votes entitled to be cast on the matter, excluding all interested shares. |

By resolution of our Board of Directors, we have opted out of the business combination provisions of the MGCL and provided that any business combination between us and any other person is exempt from the business combination provisions of the MGCL, provided that the business combination is first approved by our Board of Directors (including a majority of directors who are not affiliates or associates of such persons). In addition, pursuant to a provision in our bylaws, we have opted out of the control share provisions of the MGCL. However, our Board of Directors may by resolution elect to opt in to the business combination provisions of the MGCL and we may, by amendment to our bylaws, opt in to the control share provisions of the MGCL in the future. Additionally, certain provisions of the MGCL permit our Board of Directors, without stockholder approval and regardless of what is currently provided in our charter or our bylaws, to implement takeover defenses, some of which (for example, a classified board) we do not currently employ. These provisions may have the effect of inhibiting a third party from making an acquisition proposal for our Company or of delaying, deferring, or preventing a change in control of our Company under circumstances that otherwise could provide the holders of our common stock with the opportunity to realize a premium over the then-current market price. Our charter contains a provision whereby we elect to be subject to the provisions of Title 3, Subtitle 8 of the MGCL relating to the filling of vacancies on our Board of Directors. Our charter, our bylaws and Maryland law also contain other provisions, including the provisions of our charter on removal of directors and the advance notice provisions of our bylaws, that may delay, defer, or prevent a transaction or a change of control that might involve a premium price for our common stock or otherwise be in the best interest of our stockholders. Certain provisions in the partnership agreement may delay or prevent unsolicited acquisitions of us. Provisions in the partnership agreement may delay, or make more difficult, unsolicited acquisitions of us or changes of our control. These provisions could discourage third parties from making proposals involving an unsolicited acquisition of us or change of our control, although some of our stockholders might consider such proposals, if made, desirable. These provisions include, among others: | ● | a requirement that the general partner may not be removed as the general partner of our Operating Partnership without our consent; |

| ● | transfer restrictions on Common units; |

| ● | our ability, as general partner, in some cases, to amend the partnership agreement and to cause our Operating Partnership to issue units with terms that could delay, defer or prevent a merger or other change of control of us or our Operating Partnership without the consent of the limited partners; and |

| ● | the right of the limited partners to consent to direct or indirect transfers of the general partnership interest, including as a result of a merger or a sale of all or substantially all of our assets, in the event that such transfer requires approval by our common stockholders. |

Our Board of Directors may change our strategies, policies and procedures without stockholder approval. Our investment, financing, leverage and distribution policies, and our policies with respect to all other activities, including growth, capitalization and operations, are determined exclusively by our Board of Directors, and may be amended or revised at any time by our Board of Directors without notice to or a vote of our stockholders. This could result in us conducting operational matters, making investments or pursuing different business or growth strategies than those contemplated in this Annual Report on Form 10-K. Further, our charter and bylaws do not limit the amount or percentage of indebtedness, funded or otherwise, that we may incur. Our Board of Directors may alter or eliminate our current policy on borrowing at any time without stockholder approval. If this policy changed, we could become more highly leveraged which could result in an increase in our debt service. Higher leverage also increases the risk of default on our obligations. In addition, a change in our investment policies, including the manner in which we allocate our resources across our portfolio or the types of assets in which we seek to invest, may increase our exposure to interest rate risk, real estate market fluctuations and liquidity risk. Changes to our policies with regards to the foregoing could materially adversely affect our financial condition, results of operations and cash flow. Our rights and the rights of our stockholders to take action against our directors and officers are limited, which could limit your recourse in the event that we take certain actions which are not in our stockholders' best interests. Maryland law provides that a director or officer has no liability in that capacity if he or she performs his or her duties in good faith, in a manner that he or she reasonably believes to be in our best interests and with the care that an ordinarily prudent person in a like position would use under similar circumstances. Under the MGCL, directors are presumed to have acted with this standard of care. As permitted by Maryland law, our charter eliminates the liability of our directors and officers to us and our stockholders for money damages, except for liability resulting from: | ● | actual receipt of an improper benefit or profit in money, property or services; or |

| ● | active and deliberate dishonesty by the director or officer that was established by a final judgment as being material to the cause of action adjudicated. |

Our charter and bylaws obligate us to indemnify each present and former director or officer, to the maximum extent permitted by Maryland law, in the defense of any proceeding to which he or she is made, or threatened to be made, a party by reason of his or her service to us. In addition, we may be obligated to advance the defense costs incurred by our directors and officers. We also have entered into indemnification agreements with our officers and directors granting them express indemnification rights. As a result, we and our stockholders may have more limited rights against our directors and officers than might otherwise exist absent the current provisions in our charter, bylaws and indemnification agreements or that might exist for other public companies. Our charter contains provisions that make removal of our directors difficult, which could make it difficult for our stockholders to effect changes to our management. Our charter contains provisions that make removal of our directors difficult, which could make it difficult for our stockholders to effect changes to our senior management and may prevent a change in control of our Company that is in the best interests of our stockholders. Our charter provides that a director may only be removed for cause upon the affirmative vote of holders of two-thirds of all the votes entitled to be cast generally in the election of directors. Vacancies may be filled only by a majority of the remaining directors in office, even if less than a quorum. These requirements make it more difficult to change our senior management by removing and replacing directors and may prevent a change in control of our Company that is in the best interests of our stockholders. Our Operating Partnership may issue additional Common units or one or more classes of preferred units to third parties without the consent of our stockholders, which would reduce our ownership percentage in our Operating Partnership and could have a dilutive effect on the amount of distributions made to us by our Operating Partnership and, therefore, the amount of distributions we can make to our stockholders. As of December 31, 2023, we owned approximately 97.6% of the outstanding Common units in our Operating Partnership (on a fully diluted basis). Since our initial public offering, we have issued a total of 8.0 million Common units and a total of 117,000 Series A preferred units as consideration in connection with our acquisition of properties, and we may issue additional Common units and Series A preferred units of one or more classes in connection with our acquisition of properties, as compensation or otherwise. Such issuances would reduce our ownership percentage in our Operating Partnership and could affect the amount of distributions made to us by our Operating Partnership and, therefore, the amount of distributions we can make to our stockholders. Our common stockholders do not have any voting rights with respect to any such issuances or other partnership level activities of our Operating Partnership. Certain aspects of our Series A preferred units may limit our ability to make distributions to our common stockholders. The distribution rate on our Series A preferred units is fixed, and no distributions can be paid to our common stockholders unless we have paid all cumulative dividends on our Series A preferred units. The distribution preference of our Series A preferred units could materially and adversely affect our cash flow and ability to make distributions to our common stockholders. U.S. Federal Income Tax Risks Failure to maintain qualification as a REIT for U.S. federal income tax purposes would subject us to U.S. federal income tax on our taxable income at regular corporate rates, which would substantially reduce our ability to make distributions to our stockholders. We elected to be taxed as a REIT for U.S. federal income tax purposes beginning with our short taxable year ended December 31, 2014. To maintain qualification as a REIT, we must meet various requirements set forth in the Code concerning, among other things, the ownership of our outstanding stock, the nature of our assets, the sources of our income and the amount of our distributions. The REIT qualification requirements are extremely complex, and interpretations of the U.S. federal income tax laws governing qualification as a REIT are limited. We believe that our current organization and method of operation will enable us to continue to qualify as a REIT. However, at any time, new laws, interpretations or court decisions may change the U.S. federal tax laws relating to, or the U.S. federal income tax consequences of, qualification as a REIT. It is possible that future economic, market, legal, tax or other considerations may cause our Board of Directors to determine that it is not in our best interest to qualify as a REIT and to revoke our REIT election, which it may do without stockholder approval. If we fail to qualify as a REIT for any taxable year, we will be subject to U.S. federal income tax on our taxable income at regular corporate rates. In addition, we generally would be disqualified from treatment as a REIT for the four taxable years following the year in which we lost our REIT status. Losing our REIT status would reduce our net earnings available for investment or distribution because of the additional tax liability. In addition, distributions would no longer qualify for the dividends paid deduction, and we would no longer be required to make distributions. If this occurs, we might be required to borrow funds or liquidate some investments in order to pay the applicable tax. As a result of all these factors, our failure to qualify as a REIT could impair our ability to expand our business and raise capital, and would substantially reduce our ability to make distributions to our stockholders. To qualify as a REIT and to avoid the payment of U.S. federal income and excise taxes, we may be forced to borrow funds, use proceeds from the issuance of securities, pay taxable dividends of our stock or debt securities or sell assets to make distributions, which may result in our distributing amounts that may otherwise be used for our operations. To obtain the favorable tax treatment accorded to REITs, we normally are required each year to distribute to our stockholders at least 90% of our REIT taxable income, determined without regard to the deduction for dividends paid and by excluding net capital gains. We will be subject to U.S. federal income tax on our undistributed taxable income and net capital gain and to a 4% nondeductible excise tax on any amount by which distributions we pay with respect to any calendar year are less than the sum of (1) 85% of our ordinary income, (2) 95% of our capital gain net income and (3) 100% of our undistributed income from prior years. These requirements could cause us to distribute amounts that otherwise would be spent on acquisitions of properties and it is possible that we might be required to borrow funds, use proceeds from the issuance of securities, pay taxable dividends of our stock or debt securities or sell assets in order to distribute enough of our taxable income to maintain our qualification as a REIT and to avoid the payment of U.S. federal income and excise taxes. Future sales of properties may result in penalty taxes or may be made through TRSs, each of which would diminish the return to you. It is possible that one or more sales of our properties may be “prohibited transactions” under provisions of the Code. If we are deemed to have engaged in a “prohibited transaction” (i.e., we sell a property held by us primarily for sale in the ordinary course of our trade or business), all income that we derive from such sale would be subject to a 100% tax. The Code sets forth a safe harbor for REITs that wish to sell property without risking the imposition of the 100% tax. A principal requirement of the safe harbor is that the REIT must hold the applicable property for not less than two years prior to its sale for the production of rental income. It is entirely possible that a future sale of one or more of our properties will not fall within the prohibited transaction safe harbor. If we acquire a property that we anticipate will not fall within the safe harbor from the 100% penalty tax upon disposition, we may acquire such property through a TRS in order to avoid the possibility that the sale of such property will be a prohibited transaction and subject to the 100% penalty tax. If we already own such a property directly or indirectly through an entity other than a TRS, we may contribute the property to a TRS. Though a sale of such property by a TRS likely would mitigate the risk of incurring a 100% penalty tax, the TRS itself would be subject to regular corporate income tax at the U.S. federal level, and potentially at the state and local levels, on the gain recognized on the sale of the property as well as any income earned while the property is operated by the TRS. Such tax would diminish the amount of proceeds from the sale of such property ultimately distributable to our stockholders. Our ability to use TRSs in the foregoing manner is subject to limitation. Among other things, the value of our securities in TRSs may not exceed 20% of the value of our assets and dividends from our TRSs, when aggregated with all other non-real estate income with respect to any one year, generally may not exceed 25% of our gross income with respect to such year. No assurances can be provided that we would be able to successfully avoid the 100% penalty tax through the use of TRSs. In addition, if we acquire any asset from a C corporation (i.e., a corporation generally subject to full corporate-level tax) in a merger or other transaction in which we acquire a basis in the asset determined by reference either to the C corporation’s basis in the asset or to another asset, we will pay tax, at the highest U.S. federal corporate income tax rate, on any built-in gain recognized on a taxable disposition of the asset during the 5-year period after its acquisition. As a result of the manner in which we acquired the Hudye Farm in 2014, a subsequent taxable disposition by us of any such assets generally would be subject to the foregoing built-in gain rules. In certain circumstances, we may be subject to U.S. federal and state income taxes as a REIT, which would reduce our cash available for distribution to our stockholders. Even if we qualify as a REIT, we may be subject to U.S. federal income taxes or state taxes. As discussed above, net income from a “prohibited transaction” will be subject to a 100% penalty tax and built-in gain recognized on the taxable disposition of assets acquired from C corporations in certain non-taxable transactions will be subject to tax at the highest applicable U.S. federal corporate income tax rate. To the extent we satisfy the distribution requirements applicable to REITs, but distribute less than 100% or our taxable income, we will be subject to U.S. federal income tax at regular corporate rates on our undistributed income. We may not be able to make sufficient distributions to avoid excise taxes applicable to REITs. We may also decide to retain capital gains we earn from the sale or other disposition of our properties and pay income tax directly on such income. In that event, our stockholders would be treated as if they earned that income and paid the tax on it directly. However, our stockholders that are tax-exempt, such as charities or qualified pension plans, would have no benefit from their deemed payment of such tax liability. We may also be subject to state and local taxes on our income or property, either directly or at the level of the companies through which we indirectly own our assets. Any U.S. federal or state taxes we pay will reduce our cash available for distribution to our stockholders. The ability of our Board of Directors to revoke or otherwise terminate our REIT qualification without stockholder approval may cause adverse consequences to our stockholders. Our charter provides that our Board of Directors may revoke or otherwise terminate our REIT election, without the approval of our stockholders, if it determines that it is no longer in our best interest to continue to qualify as a REIT. If we cease to qualify as a REIT, we would become subject to U.S. federal income tax on our taxable income at regular corporate rates and would no longer be required to distribute most of our taxable income to our stockholders, which may have adverse consequences on our total return to our stockholders. | ● | changes in government regulations or policies affecting our business or the farming business; |

| ● | publication of research reports about us or the real estate or farming industries; |

| ● | sustained decreases in agricultural commodity and crop prices; |

| ● | increases in market interest rates that lead purchasers of our common stock to demand a higher yield; |

| ● | increases in market interest rates that decrease demand for our Series B Participating Preferred Stock; |

| ● | changes in market valuations of similar companies; |

| ● | adverse market reaction to any additional debt we incur in the future; |

| ● | additions or departures of key management personnel; |

| ● | actions by institutional stockholders; |

| ● | speculation in the press or investment community; |

| ● | the realization of any of the other risk factors presented in this Annual Report on Form 10-K; |

| ● | the extent of investor interest in our securities; |

| ● | the general reputation of REITs and the attractiveness of our equity securities in comparison to other equity securities, including securities issued by other real estate-based companies; |

| ● | our underlying asset value; |

| ● | investor confidence in the stock and bond markets generally; |

| ● | future equity issuances; |

| ● | failure to meet earnings estimates; |

| ● | failure to meet and maintain REIT qualifications and requirements; |

| ● | low trading volume of our common stock or Series B Participating Preferred Stock; and |

| ● | general market and economic conditions, including conditions that are outside of our control, such as the impact of public health and safety concerns, such as the ongoing coronavirus pandemic and efforts to mitigate its spread. |

If our Operating Partnership were classified as a “publicly traded partnership” taxable as a corporation for U.S. federal income tax purposes, we would fail to qualify as a REIT and would suffer other adverse tax consequences. We intend for our Operating Partnership to be treated as a “partnership” for U.S. federal income tax purposes. If the IRS were to successfully assert our Operating Partnership was “publicly traded,” our Operating Partnership could be taxable as a corporation if less than 90% of its gross income consisted of certain qualifying passive income. In such event, we likely would fail to qualify as a REIT for U.S. federal income tax purposes, and the resulting corporate income tax burden would reduce the amount of distributions that our Operating Partnership could make to us. This would substantially reduce the cash available to pay distributions to our stockholders. Complying with the REIT requirements may cause us to forego otherwise attractive opportunities or sell properties earlier than we wish. To maintain our qualification as a REIT for U.S. federal income tax purposes, we must continually satisfy tests concerning, among other things, the sources of our income, the nature and diversification of our assets, the amounts we distribute to our stockholders and the ownership of shares of our stock. We may be required to make distributions to our stockholders at disadvantageous times or when we do not have funds readily available for distribution, or we may be required to forego or liquidate otherwise attractive investments in order to comply with the REIT tests. Thus, compliance with the REIT requirements may hinder our ability to operate solely on the basis of maximizing profits. You may be restricted from acquiring or transferring certain amounts of our common stock. Certain provisions of the Code and the stock ownership limits in our charter may inhibit market activity in our capital stock and restrict our business combination opportunities. In order to maintain our qualification as a REIT, five or fewer individuals, as defined in the Code, may not own, beneficially or constructively, more than 50% in value of our issued and outstanding stock at any time during the last half of a taxable year. Attribution rules in the Code determine if any individual or entity beneficially or constructively owns our capital stock under this requirement. Additionally, at least 100 persons must beneficially own our capital stock during at least 335 days of a taxable year. To help ensure that we meet these tests, our charter restricts the acquisition and ownership of shares of our stock. Our charter, with certain exceptions, authorizes our Board of Directors to take such actions as are necessary and desirable to preserve our qualification as a REIT. Unless exempted by our Board of Directors, our charter prohibits any person from beneficially or constructively owning more than 9.8% in value or number of shares, whichever is more restrictive, of the outstanding shares of any class or series of our capital stock. Our Board of Directors may not grant an exemption from these restrictions to any proposed transferee whose ownership in excess of such ownership limit would result in our failing to qualify as a REIT. Dividends paid by REITs generally do not qualify for the favorable tax rates available for some dividends. The maximum U.S. federal income tax rate applicable to qualified dividend income paid to U.S. stockholders that are individuals, trusts and estates currently is 20%. Dividends paid by REITs generally are not eligible for such reduced tax rate. Instead, our ordinary dividends generally are taxed at the higher tax rates applicable to ordinary income, the current maximum rate of which is 37%. Although the favorable tax rates applicable to qualified dividend income do not adversely affect the taxation of REITs or dividends paid by REITs, such favorable tax rates could cause investors who are individuals, trusts and estates to perceive investments in REITs to be relatively less attractive than investments in the stocks of non-REIT corporations that pay dividends, which could adversely affect the value of the shares of REITs, including our common stock. However, for taxable years prior to 2026, individual stockholders are generally allowed to deduct 20% of the aggregate amount of ordinary dividends distributed by us, subject to certain limitations, which would reduce the maximum marginal effective federal income tax rate for individuals on the receipt of such ordinary dividends to 29.6%. Changes to the U.S. federal income tax laws, including the enactment of certain tax reform measures, could have an adverse impact on our business and financial results. In recent years, numerous legislative, judicial and administrative changes have been made to the U.S. federal income tax laws applicable to investments in real estate and REITs. There can be no assurance that future changes to the U.S. federal income tax laws or regulatory changes will not be proposed or enacted that could impact our business and financial results. The REIT rules are regularly under review by persons involved in the legislative process and by the Internal Revenue Service and the U.S. Treasury Department, which may result in revisions to regulations and interpretations in addition to statutory changes. If enacted, certain of such changes could have an adverse impact on our business and financial results. We cannot predict whether, when or to what extent any new U.S. federal tax laws, regulations, interpretations or rulings will impact the real estate investment industry or REITs. Prospective investors are urged to consult their tax advisors regarding the effect of potential future changes to the federal tax laws on an investment in our shares. In the past, securities class action litigation has often been instituted against companies following periods of volatility in the price of their common stock. This type of litigation could result in substantial costs and divert our management's attention and resources, which could have a material adverse effect on us, including our financial condition, results of operations, cash flow and the per share trading price of our common stock.

Our common stock is subject to trading risks created by the spread of false information and manipulative trading.

Our common stock is widely traded and held by a diverse group of investors, including retail investors, and these investors are subject to the influence of information provided by third party investor websites and independent authors distributing information on the internet. This information is often widely distributed, in some cases anonymously, including through platforms that mainly serve as hosts seeking advertising revenue. These sites and internet distribution strategies create opportunities for individuals to pursue both “pump and dump” and “short and distort” strategies. We believe that many of these websites have little or no requirements for authors to have professional qualifications. While these sites sometimes require disclosure of stock positions by authors, as far as we are aware these sites do not audit the accuracy of such conflict of interest disclosures. In addition, we believe that many of these websites have few or lax editorial standards, and thin or non-existent editorial staffs. Despite our best efforts, we may not be able to obtain corrections to information provided on these websites about our Company, and any corrections that are obtained may not be achieved prior to the majority of audience impressions being formed for a given article. These conditions create volatility and risk for holders of our common stock and should be considered by investors. While we have sought to engage regulators to address activities that we believe are intentionally misleading, we can make no guarantees that regulatory authorities will take action on these types of activities, and we cannot guarantee that any action taken by regulators or legislators will timely address damage done by the activities of these websites and authors.

The number of shares of our common stock available for future issuance or sale may have adverse effects on the market price of our common stock.

As of December 31, 2020, approximately 30.6 million shares of our common stock were outstanding. In addition, as of the date of this Annual Report on Form 10-K, other than the Common units held by us, approximately 1.6 million

Common units in our operating partnership were outstanding, 1.6 million of which currently may be tendered for redemption by the holders, for cash, or at our option, for shares of our common stock, on a one-for-one basis. We have registered the issuance of 1.6 million of the shares issuable upon redemption of Common units, and we intend to register the issuance of additional shares that may be issued upon redemption of Common units so that such shares will be freely tradable under the securities laws.

We cannot predict whether future issuances or sales of shares of our common stock or the availability of shares for resale in the open market will decrease the per share trading price per share of our common stock. The per share trading price of our common stock may decline significantly when we register the shares of our common stock issuable upon redemption of outstanding Common units.

Future offerings of debt, which would be senior to our common stock upon liquidation, our Series B Participating Preferred Stock and other preferred equity securities, which may be senior to our common stock for purposes of dividend distributions or upon liquidation, and Common units in connection with future acquisitions may materially adversely affect us, including the per share trading price of our common stock.

In the future, we may attempt to increase our capital resources by making additional offerings of debt or equity securities (or causing our operating partnership to issue debt securities), including medium-term notes, senior or subordinated notes and classes or series of preferred stock. Upon liquidation, holders of our debt securities and shares of preferred stock, including our Series B Participating Preferred Stock, and lenders with respect to other borrowings will be entitled to receive payments prior to distributions to the holders of our common stock. Additionally, any convertible or exchangeable securities that we issue in the future may have rights, preferences and privileges more favorable than those of our common stock and may result in dilution to owners of our common stock. Holders of our common stock are not entitled to preemptive rights or other protections against dilution. Our Series B Participating Preferred Stock has a preference on liquidating distributions and a preference on dividend payments that could limit our ability to pay dividends to the holders of our common stock, as could any future series of preferred stock. Because our decision to issue securities in any future offering will depend on market conditions and other factors beyond our control, we cannot predict or estimate the amount, timing or nature of our future offerings. Thus, our stockholders bear the risk that our future offerings could reduce the per share trading price of our common stock and dilute their interest in us. In addition, the issuance of Common units in connection with future acquisitions and the redemption of such Common units for common stock may be dilutive to our stockholders and could have an adverse effect on the per share trading price of our common stock.

Our Series B Participating Preferred Stock is subordinate to our existing and future debt and other liabilities, and could be diluted by the issuance of additional preferred stock and by other transactions.

Our Series B Participating Preferred Stock is subordinate to all of our existing and future debt. Our existing debt restricts, and our future debt may include restrictions on, our ability to pay dividends to preferred stockholders in the event of a default under the debt facilities. Additionally, the issuance of additional shares of preferred stock on parity with or senior to the Series B Participating Preferred Stock would dilute the interests of the holders of the Series B Participating Preferred Stock, and any issuance of shares of preferred stock senior to the Series B Participating Preferred Stock or of additional indebtedness could affect our ability to pay dividends on, redeem or pay the liquidation preference on our Series B Participating Preferred Stock.

None of the provisions relating to the Series B Participating Preferred Stock relate to or limit our indebtedness or afford the holders of the Series B Participating Preferred Stock protection in the event of a highly leveraged or other transaction, including a merger or the sale, lease or conveyance of all or substantially all of our assets or business, that might adversely affect the holders of the Series B Participating Preferred Stock.

An increase in market interest rates may have an adverse effect on the market price of our common stock or Series B Participating Preferred Stock

One of the factors that investors may consider in deciding whether to buy or sell our common stock or Series B Participating Preferred Stock is our distribution yield, which is our distribution rate as a percentage of the share price of our common stock or Series B Participating Preferred Stock, relative to market interest rates. If market interest rates increase, prospective investors may desire a higher distribution yield on our common stock or Series B Participating

Preferred Stock or may seek securities paying higher dividends or interest. The market price of our common stock or Series B Participating Preferred Stock likely will be based primarily on the earnings that we derive from rental income with respect to our properties and our related distributions to stockholders, and not from the underlying appraised value of the properties themselves. As a result, interest rate fluctuations and capital market conditions are likely to affect the market price of our common stock and our Series B Participating Preferred Stock, and such effects could be significant. For instance, if interest rates rise without an increase in our distribution rate, the market price of our common stock or Series B Participating Preferred Stock could decrease because potential investors may require a higher distribution yield on our common stock or Series B Participating Preferred Stock as market rates on interest-bearing securities, such as bonds, rise.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

The information set forth under the caption “Our Properties” in Item 1 of this Annual Report on Form 10-K is incorporated by reference herein.

Item 3. Legal Proceedings

For information regarding legal proceedings as of December 31, 2020, see Note 8 to our Consolidated Financial Statements included in Part IV, Item 8 of this Annual Report on Form 10-K.

Item 4. Mine Safety Disclosures

Not Applicable.

PART II | | | |

Item 5. 5 | Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | 41 | Item 6 | [Reserved] | | 44 | Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 45 | Item 7A | Quantitative and Qualitative Disclosures About Market Risk | | 60 | Item 8 | Financial Statements and Supplementary Data | | 60 | Item 9 | Changes and Disagreements with Accountants on Accounting and Financial Disclosure | | 60 | Item 9A | Controls and Procedures | | 60 | Item 9B | Other Information | | 61 | Item 9C | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | | 61 | PART III | | | | Item 10 | Directors, Executive Officers and Corporate Governance | | 61 | Item 11 | Executive Compensation | | 61 | Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | 61 | Item 13 | Certain Relationships and Related Transactions, and Director Independence | | 61 | Item 14 | Principal Accountant Fees and Services | | 62 | PART IV | | | | Item 15 | Exhibits and Financial Statement Schedules | | 62 | Item 16 | Form 10-K Summary | | 62 | Signatures | | | 66 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS We make statements in this Annual Report on Form 10-K that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)). These forward-looking statements include, without limitation, statements concerning pending acquisitions and dispositions, projections, predictions, expectations, estimates or forecasts as to our business, financial and operational results, future stock repurchases and other transactions affecting our capitalization, our dividend policy, future economic performance, crop yields and prices and future rental rates for our properties, ongoing litigation, as well as statements of management’s goals and objectives and other similar expressions concerning matters that are not historical facts. When we use the words “may,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates” or similar expressions or their negatives, as well as statements in future tense, we intend to identify forward-looking statements. Although we believe that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, beliefs and expectations, such forward-looking statements are not predictions of future events or guarantees of future performance, and our actual results could differ materially from those set forth in the forward-looking statements. Some factors that might cause such a difference include the following: the ongoing war in Ukraine and the conflict in the Middle East and their impact on our tenants’ businesses and the farm economy generally, changes in trade policies in the United States and other countries who import U.S. agricultural products, high inflation and increasing interest rates, the onset of an economic recession in the United States and other countries that impact the farm economy, extreme weather events, such as droughts, tornadoes, hurricanes or floods, the impact of future public health crises on our business and on the economy and capital markets generally, general volatility of the capital markets and the market price of our common stock, changes in our business strategy, availability, terms and deployment of capital, our ability to refinance existing indebtedness at or prior to maturity on favorable terms, or at all, availability of qualified personnel, changes in our industry or the general economy, the degree and nature of our competition, the outcomes of ongoing litigation, our ability to identify new acquisitions or dispositions and close on pending acquisitions or dispositions and the other factors described in the risk factors described in Item 1A, “Risk Factors” of this Annual Report on Form 10-K and in other documents that we file from time to time with the SEC. Given these uncertainties, undue reliance should not be placed on such statements. We assume no obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by law. Summary Risk Factors Our business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flows and prospects. The following is an overview of the most significant risks to which we are exposed in the normal course of our business and which are discussed more fully in “Item 1A. Risk Factors” herein. These risks include, but are not limited to, the following: Market Information

| • | Our business is dependent in part upon the profitability of our tenants' farming operations, and a sustained downturn in the profitability of their farming operations could have a material adverse effect on the amount of rent we can collect and, consequently, our cash flow and ability to make distributions to our stockholders. |

Our common stock trades on

| • | We have a substantial amount of indebtedness outstanding, which may expose us to the NYSErisk of default under the symbol “FPI.”our debt obligations, restrict our operations and our ability to grow our business and revenues, and restrict our ability to pay distributions to our stockholders. |

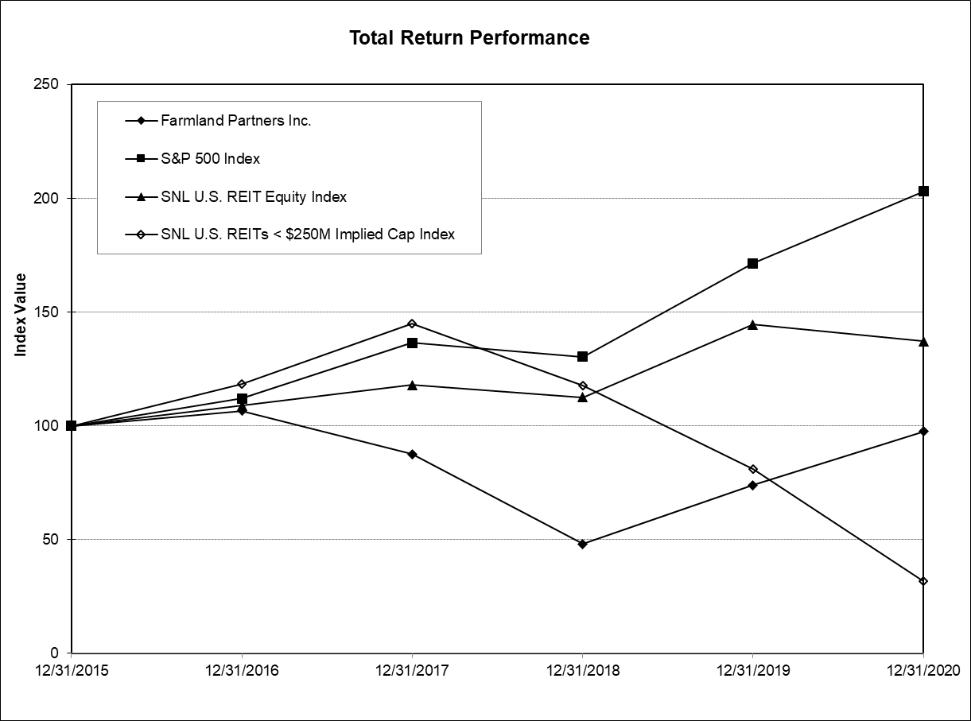

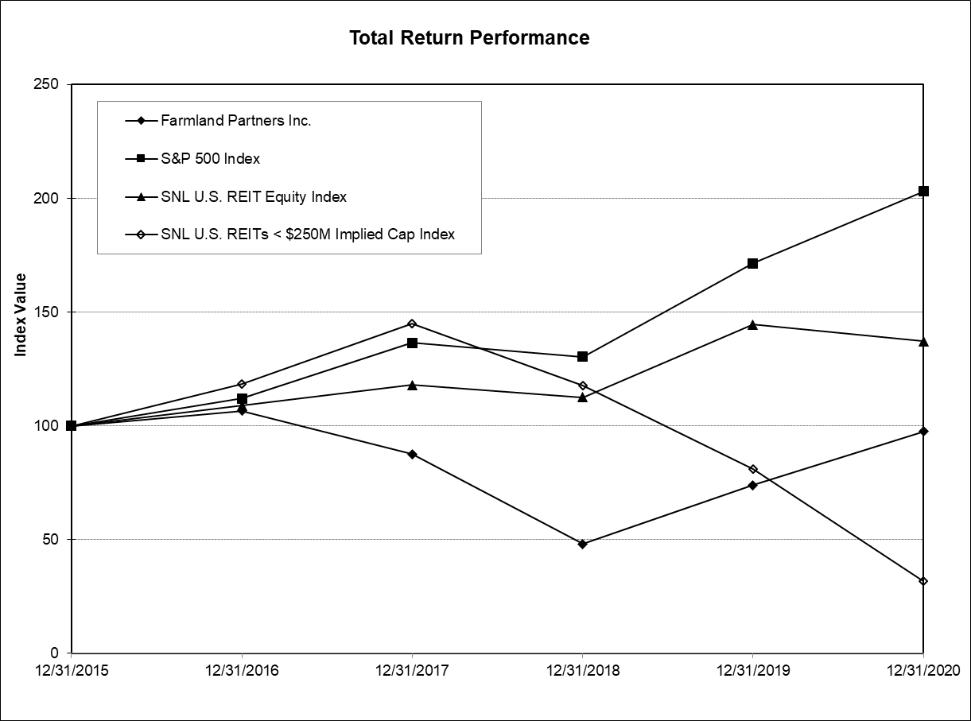

Stock Performance Graph

| • | Mortgage debt obligations expose us to the possibility of foreclosure, which could result in the loss of our investment in a property or group of properties subject to mortgage debt. |

The following graph compares the total stockholder return

| • | Increases in benchmark interest rates will increase our borrowing costs, which will negatively impact our financial condition, results of our common stock (assuming reinvestment of dividends) against the cumulative returns of the Standard & Poor’s Corporation Composite 500 Indexoperations, growth prospects and the SNL Financial REIT Index, or the SNLUS REITs for the period from April 16, 2014, the date of the initial listing of our common stock on the NYSE MKTability to December 31, 2020. Our common stock began trading on the NYSE on September 8, 2015.make distributions to stockholders.

|

| • | Increases in interest rates will increase our tenants’ borrowing costs and may make it more difficult for them to obtain credit. |

| | | | | | | | | Period Ending | | | | | Index | 12/31/15 | 12/31/16 | 12/31/17 | 12/31/18 | 12/31/19 | 12/31/20 | Farmland Partners Inc. | 100.00 | 106.52 | 87.51 | 48.02 | 73.87 | 97.58 | S&P 500 Index | 100.00 | 111.96 | 136.40 | 130.42 | 171.49 | 203.04 | SNL U.S. REIT Equity Index | 100.00 | 108.88 | 118.00 | 112.46 | 144.54 | 137.09 | SNL U.S. REITs < $250M Implied Cap Index | 100.00 | 118.33 | 145.11 | 117.85 | 81.04 | 31.67 |

| • | Global economic conditions, including inflation, supply chain disruptions and trade policies affecting imports and exports, could adversely affect our and our tenants’ operations. |

Distribution Information

| • | Approximately 70% of our portfolio is comprised of properties used to grow primary crops such as corn, soybeans, wheat, rice and cotton, which subjects us to risks associated with primary row crops. |

Since

| • | Our farms are exposed to the possibility of extreme weather events, such as droughts, tornadoes, hurricanes and floods, which could damage the farmland and equipment, adversely affect crop yields and the ability of farmers to pay rent to us or adversely impact the financing of such properties. |

| • | Investments in farmland used for permanent/specialty crops have a different risk profile than farmland used for annual row crops. |

| • | Our failure to continue to identify and consummate suitable acquisitions would significantly impede our initial quarter asgrowth and our ability to further diversify our portfolio by geography, crop type and tenant, which could materially and adversely affect our results of operations and cash available for distribution to our stockholders. |

| • | We do not intend to continuously monitor and evaluate tenant credit quality, and our financial performance may be subject to risks associated with our tenants' financial condition and liquidity position. |

| • | Our short-term leases make us more susceptible to any decreases in prevailing market rental rates than would be the case if we entered into longer-term leases, which could have a publicly traded REIT, we have made regular quarterlymaterial adverse effect on our results of operations and ability to make distributions to our stockholders. We intend to continue to declare quarterly distributions. However, beginning with the third quarter of 2018, we significantly reduced distribution amounts on our common stock, and we cannot provide any assurance as to the amount or timing of future distributions. |

Our

| • | We depend on external sources of capital that are outside of our control and may not be available to us on commercially reasonable terms or at all, which could limit our ability to, among other things, acquire additional properties, meet our capital and operating needs or make the cash distributions in the future will depend uponto our actual results of operations and earnings, economic conditions and other factors that could differ materially from our current expectations, including the impact of ongoing litigation. Our actual results of operations will be affected by a number of factors, including the revenue we receive from our properties, our operating expenses, interest expense, the ability of our tenants to meet their obligations and unanticipated expenditures. For more information regarding risk factors that could materially adversely affect our actual results of operations, see "Risk Factors." Any future distributions will be authorized by our Board of Directors in its sole discretion out of funds legally available therefor and will be dependent upon a number of factors, including restrictions under applicable law, the capital requirements of our company and the distribution requirementsstockholders necessary to qualify and maintain our qualification as a REIT. |

| • | Laws in certain states where we own property prohibit or restrict the ownership of agricultural land by business entities, which could impede the growth of our portfolio and our ability to diversify geographically. |

| • | We may be subject to unknown or contingent liabilities related to acquired properties and properties that we may acquire in the future, which could have a material adverse effect on us. |

| • | We may be required to fund distributions from working capitalpermit the owners of certain third-party access rights on our properties to enter and occupy parts of the properties, including owners of mineral rights and power generation and transportation infrastructure, which could materially and adversely impact the rental value of our properties. |

| • | We have previously been subject to, and may in the future be subject to, litigation or borrowthreatened litigation, which may require us to providepay damages and expenses or restrict the operation of our business. |

39

| • | Conflicts of interest may exist or could arise in the future between the interests of our stockholders and the interests of holders of units in our Operating Partnership, which may impede business decisions that could benefit our stockholders. |

funds

| • | Our charter contains certain provisions restricting the ownership and transfer of our stock that may delay, defer or prevent a change of control transaction that might involve a premium price for such distributions, or we may choose to make a portion of the required distributions in the form of a taxable stock dividend to preserve our cash balance or reduce our distribution. No distributions can be paid on our common stock unless we have paid all cumulative dividendsor that our stockholders otherwise believe to be in their best interests. |

| • | We could increase the number of authorized shares of stock, classify and reclassify unissued stock and issue stock without stockholder approval, which may delay, defer or prevent a transaction that our stockholders believe to be in their best interests. |

| • | Our Board of Directors may change our strategies, policies and procedures without stockholder approval. |

| • | Our charter contains provisions that make removal of our directors difficult, which could make it difficult for our stockholders to effect changes to our management. |

| • | Failure to maintain qualification as a REIT for U.S. federal income tax purposes would subject us to U.S. federal income tax on our Series A preferred units and Series B Participating Preferred Stock. The distribution preference of our Series A preferred units and Series B Participating Preferred Stock could limittaxable income at regular corporate rates, which would substantially reduce our ability to make distributions to our stockholders. |

| • | Complying with the holdersREIT requirements may cause us to forego otherwise attractive opportunities or sell properties earlier than we wish. |

| • | We may be unable to make distributions at expected levels, which could result in a decrease in the market price of our common stock. |

| • | We are subject to risks associated with public health crises, such as pandemics and epidemics, which may have a material adverse effect on our business. The nature and extent of future impacts are highly uncertain and unpredictable. |

PART I Item 1. Business Our Company Farmland Partners Inc. (“FPI”), collectively with its subsidiaries, is an internally managed real estate company that owns and seeks to acquire high-quality farmland located in agricultural markets throughout North America. FPI was incorporated in Maryland on September 27, 2013. FPI elected to be taxed as a real estate investment trust (“REIT”) under Sections 856 through 860 of the Internal Revenue Code of 1986, as amended (the “Code”), commencing with its short taxable year ended December 31, 2014. FPI is the sole member of the sole general partner of Farmland Partners Operating Partnership, LP (the “Operating Partnership”), which was formed in Delaware on September 27, 2013. All of FPI’s assets are held by, and its operations are primarily conducted through, the Operating Partnership and the wholly owned subsidiaries of the Operating Partnership. As of December 31, 2023, FPI owned a 97.6% interest in the Operating Partnership. See “Note 9—Stockholders’ Equity and Non-controlling Interests” for additional discussion regarding Class A Common units of limited partnership interest in the Operating Partnership (“Common units”), Series A preferred units of limited partnership interest in the Operating Partnership (“Series A preferred units”) and Series B participating preferred units of limited partnership interest in the Operating Partnership (“Series B participating preferred units”). Unlike holders of FPI’s common stock, par value $0.01 per share (“common stock”), holders of the Operating Partnership’s Common units and Series A preferred units generally do not have voting rights or the power to direct the affairs of FPI. References to the “Company,” “we,” “us,” or “our” mean collectively FPI and its consolidated subsidiaries, including the Operating Partnership. Our primary strategic objective is to utilize our position as a leading institutional acquirer, owner and manager of high-quality farmland located in agricultural markets throughout North America to deliver strong risk adjusted returns to investors through a combination of cash dividends and asset appreciation. As of December 31, 2023, we owned farms with an aggregate of approximately 132,800 acres in Arkansas, California, Colorado, Florida, Illinois, Indiana, Kansas, Louisiana, Mississippi, Missouri, Nebraska, North Carolina, Oklahoma, South Carolina and Texas. In addition, as of December 31, 2023, we owned land and buildings for four agriculture equipment dealerships in Ohio leased to Ag-Pro Ohio, LLC (“Ag Pro”) under the John Deere brand and served as property manager for approximately 38,300 acres, including farms in Iowa (see “Note 4—Related Party Transactions”). As of December 31, 2023, the Operating Partnership owned a 9.97% equity interest in Promised Land Opportunity Zone Farms I, LLC (the “OZ Fund”), an unconsolidated equity method investment, that holds 12 properties (see “Note 1, Convertible Notes Receivable”). As of December 31, 2023, approximately 70% of our owned portfolio (by value) was used to grow primary crops, such as corn, soybeans, wheat, rice and cotton, and approximately 30% was used to produce specialty crops, such as almonds, citrus, blueberries, and vegetables. We believe our portfolio gives investors the economic benefit of increasing global food demand in the face of growing scarcity of high-quality farmland and will continue to reflect the approximate allocation of U.S. agricultural output between primary crops and animal protein (whose production relies principally on primary crops as feed), on one hand, and specialty crops, on the other. In addition, we offer a loan program (the “FPI Loan Program”) pursuant to which we make loans to third-party farmers (both tenant and non-tenant) to provide financing for property acquisitions, working capital requirements, operational farming activities, farming infrastructure projects and for other farming and agricultural real estate related projects. FPI Agribusiness Inc., a wholly owned subsidiary (the “TRS” or “FPI Agribusiness”), is a taxable REIT subsidiary that was formed to provide volume purchasing servicesto the Company’s tenants and to directly operate farms under certain circumstances. As of December 31, 2023, the TRS performed direct farming operations on 2,103 acres of permanent crop farmland owned by the Company located in California. FPI strategically seeks opportunities to promote environmentally friendly usage of our farmland. We have long-term lease arrangements on certain farm properties pursuant to which operators engage in solar and wind energy production. As of December 31, 2023, 15 of our farms, which collectively comprised approximately 10,150 acres, had leases for operational or under-construction renewable energy production, and 16 of our farms, which collectively comprise approximately 12,875 acres, had options for potential future solar or wind development and operating lease. Refer to “–Sustainability” for more information. Our principal source of revenue is rent from tenants that conduct farming operations on our farmland pursuant to leases with terms ranging primarily from one to three years. The majority of the leases that are in place as of the date of this Annual Report on Form 10-K have fixed rent payments. Some of our leases have variable rents based on the revenue generated by our farm-operator tenants. We believe that a mix of fixed and variable rents will help insulate us from the variability of farming operations and reduce our credit-risk exposure to farm-operator tenants while making us an attractive landlord in certain regions where variable leases are customary. However, we may be exposed to tenant credit risk and farming operation risks, particularly with respect to leases that do not require advance payment of 100% of the fixed rent, variable rent arrangements and leases with terms greater than one year. Full Year 2023 Highlights During 2023: | ● | Net income increased 164.9% from $12.0 million for the year ended December 31, 2022 to $31.7 million for the year ended December 31, 2023; |

| ● | Adjusted Funds from Operation ("AFFO") decreased 48.4% from $15.8 million for the year ended December 31, 2022 to $8.1 million for the year ended December 31, 2023; |

| ● | We completed dispositions consisting of 74 properties in the Corn Belt, Delta and South, High Plains, Southeast and West Coast regions. We received $195.5 million in aggregate consideration, including $11.8 million in seller financing, and recognized an aggregate gain on sale of $36.1 million; |

| ● | We completed acquisitions consisting of four properties in the Corn Belt and Delta and South regions. Aggregate cash consideration for these acquisitions totaled $22.2 million; |

| ● | We repurchased 6,551,087 shares of our common stock at a weighted average price of $11.00 per share; |

| ● | Total indebtedness decreased $76.4 million from $439.5 million at December 31, 2022 to $363.1 million at December 31, 2023; |

| ● | We increased liquidity to $206.6 million as of December 31, 2023, compared to $176.7 million as of December 31, 2022; and |

| ● | We renewed fixed cash farm leases expiring in 2023 at average rent increases of approximately 20%. |

For a definition of AFFO and a reconciliation of net income to AFFO, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Non-GAAP Financial Measures.” Investment Focus We seek to invest in farmland that will give our stockholders exposure to a well-diversified portfolio of high-quality U.S. farmland, while offering an attractive risk-adjusted combination of stable rental income generation and value appreciation. Our principal investment focus is on farmland located in agricultural markets throughout North America; however, we may seek to acquire farmland outside of North America in the future. We also may acquire real estate assets related to farming, such as grain storage facilities, grain elevators, feedlots, cold storage facilities, controlled environment agriculture facilities, land and facilities leased to agriculture equipment dealerships, processing plants and distribution centers, as well as livestock farms or ranches. In addition, under the FPI Loan Program, we may provide loans to farm operators secured by farmland, properties related to farming, crops (growing or stored), and/or agricultural equipment. We may also invest in other agriculture-related business, typically through our TRS. Crop Categories Primary vs Specialty Crops Farm crops generally can be divided into two principal categories: primary crops and specialty crops. Primary crops include, among others, corn, soybeans, wheat, rice and cotton. Primary crops are generally grown in rows and are often referred to as row crops. Specialty crops can be divided into two categories: annual specialty crops (generally vegetables) and permanent specialty crops (fruits and nuts grown on trees, bushes or vines). Over the long term, we expect that our farmland portfolio will continue to be comprised of approximately 70% primary crop farmland and 30% specialty crop farmland by value, which we believe will give investors the economic benefit from increasing global food demand in the face of growing scarcity of high quality farmland and will reflect the approximate allocation of U.S. agricultural output between primary crops and animal protein (whose production relies principally on primary crops as feed), on one hand, and specialty crops, on the other. Primary Crops The most widely grown crop in the United States is corn, at approximately 93 million acres. The uses of corn projected for the 2023/2024 marketing year (September 2023 to August 2024) are as follows: animal feed and residual products (34%); ethanol and its animal feed byproducts known as distillers’ dried grains with solubles or DDGS (32%); exports (13%); other sugars, starches, cereals, seeds (8%); and ending stocks or inventory (13%). The second most widely grown crop in the United States is soybeans, at approximately 83 million acres. The uses of soybeans projected for the 2023/2024 marketing year (September 2023 to August 2024) are as follows: crushings (52%); exports (39%); seed and residual (3%); and ending stocks or inventory (6%). The process of crushing soybean produces soybean oil, soybean meal, hulls and waste. Soybean meal is used as animal feed both domestically and in the export market. Soybean oil is used for food, biofuel, and is exported. The third most widely grown crop in the United States is wheat, at approximately 51 million acres. The uses of wheat projected for the 2023/2024 marketing year (June 2023 to May 2024) are as follows: food (38%); exports (29%); seed, feed and residual (7%); and ending stocks or inventory (26%). Annual vs. Permanent Crops Our portfolio includes farms that produce both annual and permanent crops. Annual crops, such as wheat, corn and soybeans, are planted every year whereas permanent crops, such as trees, bushes and vines, are planted and bear crops over multiple years without replanting. We believe exposure to both annual and permanent crops is an attractive strategy and offers diversification benefits to our portfolio. Annual and permanent crops typically serve different end-markets and generally have uncorrelated pricing. U.S. Farmland Property We believe that the United States offers farmland investors exposure to financial benefits driven by the fundamentals of agricultural production and farmland appreciation without many of the risks that come with farmland investments in many other countries. In the United States, the farmland market is relatively liquid and there is virtually no land title risk. As an asset class, United States farmland has lower leverage compared to other real estate sectors. According to the United States Department of Agriculture (“USDA”) forecast data from February 2024, real estate debt on farms is $377 billion, compared to a real estate value of $3.6 trillion, representing a 10% debt-to-equity ratio. The United States has the largest, lowest-cost grain transportation infrastructure in the world, leaving more margin to the grain producer and landowner. Moreover, the United States is one of the largest domestic markets for primary crops, which are typically priced in U.S. dollars. Lastly, we believe that in most major U.S. agricultural markets, multiple quality farm-operator tenants compete for farmland lease opportunities. We may consider investing in farmland in other countries, such as Canada, Australia or New Zealand, that, like the United States, offer virtually no land title risk, a sophisticated farm-operator tenant environment and attractive rental rates. Leased Properties The business of farming carries materially more operating risk than owning and leasing farmland to farm operators, although such risk can be mitigated through crop insurance and other risk management tools. We expect to continue to lease a majority of our properties on a fixed-rent basis that does not depend on the success of the tenant's farming operations. Moreover, a majority of the leases in our portfolio provide that at least 50% (and sometimes 100%) of the annual fixed rent is due and payable in advance of each spring planting season, and we expect that a majority of the fixed-rent leases we enter into in the future will have a similar requirement, which reduces our credit-risk exposure in the event of operational issues with the farm-operator tenant. However, to the extent we enter into leases that do not require advance payment of 100% of the annual rent or have terms greater than one year, we may be subject to tenant credit risk and more susceptible to the risks associated with declines in the profitability of tenants’ farming operations, and we take such risk into consideration when evaluating the potential return on a farm. We may use variable-rent leases, which depend in part on crop yields and prices, in regions where such arrangements are prevalent or when we expect that such arrangements will be more profitable to us on a risk-adjusted basis. We also may utilize hybrid lease arrangements that provide for a combination of fixed rent and variable rent. We expect to continue to lease the majority of our primary crop farmland under leases that require the tenant to either pay or reimburse us for substantially all of the property’s operating expenses, including maintenance, water usage and insurance. Consistent with industry practices, we expect that we will generally be responsible for plantings and associated improvements on our permanent crop farmland while our tenants will be responsible for all operating costs. Many of our leases provide for the reimbursement by the tenant of the property’s real estate taxes that we pay in connection with the farms they rent from us. The rental payments we receive from the farm operators are the primary source of any distributions that we make to our stockholders. We expect that over time rental income will increase. Most farmland in the areas where we own or intend to acquire land is leased under short-term leases (typically five years or less), and we plan to lease our primary crop properties under short-term leases when possible. By entering into short-term leases, we believe we will be in a position to increase our rental rates when the leases expire. However, we can provide no assurances that we will be able to increase our rental rates, or even maintain them at the same level, when the leases are renewed or the land is re-leased. We believe quality farmland has a near-zero vacancy rate, and we believe that all high-quality farmland in an area with a competitive tenant environment is generally leased and farmed each year. In the event of a tenant's failure to pay rent due in advance of the spring planting season, we will seek to terminate the lease and rent the property to another tenant that could then plant and harvest a crop that year. As a result, we believe there is a reduced risk of vacancy on our properties when compared to most other types of commercial properties, such as office buildings or retail properties. Tenants We believe the areas where we own and intend to acquire farmland are characterized by a competitive farm-operator tenant environment, with multiple experienced farm operators seeking to expand their operations by leasing additional farmland. Farmers have long rented land to increase operations without having to invest the capital required to own the land. USDA data shows that rented land as a percentage of total farmland acres has been in the 35% to 45% range since the 1920s. Non-Farming Leases In addition to leases entered into in connection with farming operations, we seek additional sources of income from our properties that are either incremental, such as wind easements and recreational leases, or are higher than farming rents, such as leases for solar power installations. While we do not believe that such non-farming lease income will constitute a significant percentage of our total revenues, they offer opportunities to enhance returns to stockholders at little or no cost to us. Family-Owned Properties According to America’s Farms and Ranches at a Glance 2023 Edition, a USDA report, family farms accounted for approximately 97% of the total farms in the United States. As shown below, small family farms represent the greatest number of farms and amount of land, while large-scale family farms represent the greatest value of production. | | | | | | | | | | | | | | Farm Category | | Annual Gross Farm Cash Income | | Number of Farms | | Percent of Farms | | | Percent of Land Area | | | Value of Production | | Small Family Farms | | Less than $350,000 | | 1,756,441 | | 88.1 | % | | 46.5 | % | | 18.7 | % | Midsize Family Farms | | Less than $1,000,000 | | 115,595 | | 5.8 | % | | 21.4 | % | | 19.1 | % | Large-Scale Family Farms | | Greater than $1,000,000 | | 67,936 | | 3.4 | % | | 24.8 | % | | 51.8 | % | Nonfamily Farms | | | | 54,450 | | 2.7 | % | | 7.3 | % | | 10.4 | % | Total | | | | 1,994,422 | | 100.0 | % | | 100.0 | % | | 100.0 | % |

Farmland leases allow farm operators to unlock personal or family capital/net worth that would otherwise be tied up in land ownership while retaining the ability to conduct their livelihoods on land that is familiar to them. We believe that many farm families and individuals may wish to engage in sale-leaseback transactions to grow their farming operations or in other business endeavors, or for estate planning reasons, providing a continuous pipeline of prospective acquisitions. As an alternative to selling their farmland to us in an all-cash transaction, we believe that some farm owners may be interested in selling their farmland to us in exchange for Operating Partnership units in order to own a diversified portfolio of agricultural real estate in transactions that may qualify as tax-deferred contributions to a partnership under U.S. federal income tax laws. In addition, because we intend to make cash distributions quarterly or annually, Partnership unit holders would receive regular cash distributions, and their investment would be diversified across a much larger number of properties than the single property in which they were invested before such contribution. Finally, Partnership unit holders would have the flexibility to tender their Partnership units in the future for redemption by us for cash, or, at our election, shares of our common stock that they could then sell in the public market, thereby allowing these sellers to determine the timing of recognizing taxable gain. Because we expect the issuance of Partnership units in exchange for farmland generally will be driven by the desires of prospective sellers, we do not know how frequently we will issue Partnership units in exchange for farmland properties. However, we believe that using Partnership units as acquisition consideration can be a significant part of our property acquisition strategy. Other Investments In addition to farmland, we also may acquire real estate assets related to farming, such as grain storage facilities, grain elevators, feedlots, cold storage facilities, controlled environment agriculture facilities, land and facilities leased to agriculture equipment dealerships, processing plants and distribution centers, as well as livestock farms or ranches. Underwriting Criteria and Due Diligence Process Identifying and Selecting Attractive Properties We seek to acquire high-quality farmland that offers an attractive risk-adjusted balance of current income and value appreciation potential. We believe our management team’s deep understanding of agribusiness fundamentals and insight into factors affecting the value of farmland allow us to identify properties consistent with our investment criteria. We believe the following factors are important in the selection of farmland: Holders

| ● | Soil Quality—Soil quality is a fundamental determinant of farmland productivity and therefore of its value. In general, we focus on farmland with average or better-than-average soil. |

| ● | Water Availability—Appropriate water availability is an essential input to farming and a key consideration in determining the productivity and value of farmland. We seek to acquire farmland where water availability through precipitation and irrigation meets the agronomic needs of the crops expected to be grown. As part of our Series A preferred units are entitledacquisition due diligence process, we evaluate properties for water availability and any associated ground or surface water rights. Where appropriate, we may also invest in irrigation infrastructure to receive cash distributionsimprove the productivity |

| | of properties we own. Occasionally we may acquire farmland at prices that more than compensate us for any potential reduction in water availability, which, in the future, may result in a rateshift to different crops or production systems. |

| ● | Robust and Competitive Tenant Environment—We focus primarily on farmland located in areas characterized by a robust and competitive tenant environment, with a relatively large population of 3.00% per annum onexperienced farm operators as potential tenants. |

| ● | Market Access—Due to the $1,000 liquidation preferencehigher costs of road transportation, the location of primary crop farmland relative to points of demand (e.g., grain elevators, feedlots and ethanol plants) or access to low-cost transportation (e.g., river ports and rail loading facilities) determines the premium or discount in farm-gate commodity prices compared to the general market prices (also known as “basis”), and therefore is one of the Series A preferred units, which is payable annuallyfactors that impacts its value. We focus on acquiring primary crop farmland in arrears on January areas with substantial farming infrastructure and low transportation costs, including markets with access to river and rail transportation. |

| ● | Climate—Crops have particular climatic growing requirements. Accordingly, we seek to acquire properties in regions with climates conducive to the expected crops. We believe that diversification within and across core farming regions and crop types provides significant annual and long-term risk mitigation to our investors. Nevertheless, our farmland may experience periodic droughts and other significant weather events, such as tornadoes, hurricanes and floods. |