NOTE 14 – RELATED PARTY TRANSACTIONSThomsen. In addition, Mr. Regan serves as the Executive Chairman of the Advisor, and Messrs. Wieland, and Thomsen serve on the Board of Governors of both the Advisor and GOLDMARK Property Management, Inc.

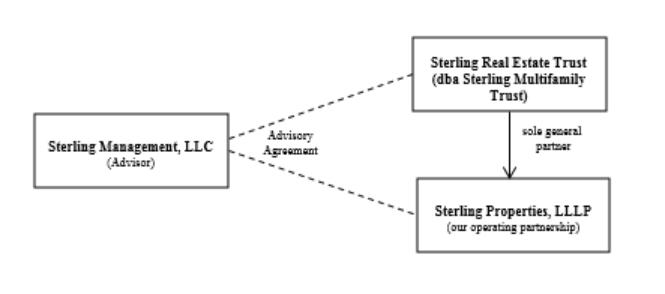

Sterling Management, LLC (the “Advisor”), is a North Dakota limited liability company formed in November 2002. The Advisor is responsible for managing day-to-day affairs, overseeing capital projects, and identifying, acquiring, and disposing investments on behalf of the trust.

GOLDMARK Property Management, Inc., is a North Dakota corporation formed in 1981. GOLDMARK Property Management, Inc. performs property management services for the Trust.

We have a historical and ongoing relationship with Bell Bank. Bell Bank has provided the Trust certain financial services throughout the relationship. Mr. Wieland, a Trustee, also serves as a Board Member of Bell Bank. Mr. Wieland could have an indirect material interest in any such engagement and related transactions.

The Trust has a historical and ongoing relationship with Trumont Group and Trumont Construction. Trumont Group provides development services for current joint venture projects in which the Operating Partnership is an investor. Trumont Construction has been engaged to construct the properties associated with these joint ventures. Mr. Regan, Chief Executive Officer and trustee, is a partner in both Trumont Group and Trumont Construction and has a direct material interest in any engagement or related transaction, the Trust enters into, with these entities.

Property Management Fee

During the years ended December 31, 2020, 20192022, 2021 and 2018,2020, we paid property management and administrative fees to GOLDMARK Property Management, in an amount equal to approximatelyInc. of $13,833, $12,836, and $12,796, respectively. Management fees which approximate 5% of net collected rents, account for $5,499, $5,271, and $4,851 of the properties managed. GOLDMARK Property Management is owned in part by Kenneth Regan, James Wieland and Joel Thomsen. Forthese fees during the years ended December 31, 2020, 20192022, 2021 and 2018, we paid management fees, on-site staff costs, and other miscellaneous fees required to run the properties of $12,796, $12,486, and $11,827 respectively, to GOLDMARK Property Management.2020. In addition, during the years ended December 31, 2020, 20192022, 2021, and 2018,2020, we paid repair and maintenance related payrollexpenses, and payroll related expenses to GOLDMARK Property Management, Inc. totaling $7,744, $6,536, and $6,549, $6,076 and $5,217, respectively.

Board of Trustee Fees

We incurred Trustee fees of $62, $57 and $68 during the years ended December 31, 2020, 2019 and 2018, respectively. As of December 31, 2020, and 2019 we owed our Trustees $27 and $29 for unpaid board of trustee fees, respectively. There is no cash retainer paid to Trustees. Instead, we pay Trustees the following specific number of shares for meetings attended:

|

|

|

|

|

|

|

Board Chairman – Board Meeting

|

|

| 105 shares/meeting

|

Trustee – Board Meeting

|

|

| 75 shares/meeting

|

Committee Chair – Committee Meeting

|

|

| 30 shares/meeting

|

Trustee – Committee Meeting

|

|

| 30 shares/meeting

|

Common shares earned in accordance with the plan are calculated on an annual basis. Shares earned pursuant to the Trustee Compensation Plan are issued on or about July 15 for Trustees’ prior year of service. Non-independent Trustees are not compensated for their service on the Board or Committees. respectively

Advisory Agreement

We are an externally managed trust and as such, although we have a Board of Trustees and executive officers responsible for our management, we have 0no paid employees. The following is a brief descriptionAdvisor may receive fees related to management of the currentTrust, acquiring, disposing, or developing real estate property, project management fees, and compensation that may be received by the Advisorfinancing fees related to lending relationships, under the Advisory Agreement, which must be renewed on an annual basis and approved by a majority of the independent trustees. The Advisory Agreement was approved by the Board of Trustees (including all the independent Trustees) on March 26, 2020,24, 2022, and is effective until March 31, 2021. 2023.

The below table summarizes the fees incurred to our Advisor.

Management Fee: 0.35% of our total assets (before depreciation and amortization), annually. Total assets are our gross assets (before depreciation and amortization) as reflected on our consolidated financial statements, taken as of the end of the fiscal quarter last preceding the date of computation. The management fee will be payable monthly in cash or our common shares, at the option of the Advisor, not to exceed one-twelfth of 0.35% of the total assets as of the last day of the immediately preceding month. The management fee calculation is subject to quarterly and annual reconciliations. The management fee may be deferred at the option of the Advisor, without interest.

| | | | | | | | | |

| | Year Ended December 31, |

| | 2022 | | 2021 | | 2020 |

|

| | (in thousands) |

Fee: | | | | | | | | | |

Advisory | | $ | 3,683 | | $ | 3,348 | | $ | 3,116 |

Acquisition | | $ | 1,321 | | $ | 375 | | $ | 708 |

Disposition | | $ | 703 | | $ | 146 | | $ | 319 |

Financing | | $ | 83 | | $ | 224 | | $ | 133 |

Project Management | | $ | 450 | | $ | 572 | | $ | 365 |

During the years ended December 31, 2020, 2019 and 2018, we incurred advisory management fees of $3,116, $2,996 and $2,909 with Sterling Management, LLC, our Advisor. As of December 31, 2020 and 2019, we owed our Advisor $278 and $503, respectively, for unpaid advisory management and operational fees. There were 0 fees owed to the Advisor as of December 31, 2018. These fees cover the office facilities, equipment, supplies, and staff required to manage our day-to-day operations.

Acquisition Fee: For its services in investigating and negotiating acquisitions of investments for us, the Advisor receives an acquisition fee of 2.5% of the purchase price of each property acquired, capped at $375 per acquisition. The total of all acquisition fees and acquisition expenses cannot exceed 6% of the purchase price of the investment, unless approved by a majority of the trustees, including a majority of the independent trustees, if they determine the transaction to be commercially competitive, fair and reasonable to us.