PART I

In this Annual Report on Form 10-K, or this Annual Report, we referreferences to “we,” “us,” “our,” “the Company,” “STORE” or “STORE Capital,” are references to STORE Capital Corporation, a Maryland corporation, prior to, and to STORE Capital LLC, a Delaware limited liability company, upon and following the completion of the Merger, and references to the “Merger” are references to the Merger as “we,” “us,” “our,” “the Company,” “S|T|O|R|E” or “STORE Capital,” unless we specifically state otherwise or the context indicates otherwise.defined in Item 1 below.

Forward-Looking Statements

This Annual Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. Such forward-looking statements include, without limitation, statements concerning our business and growth strategies, investment, financing and leasing activities and trends in our business, including trends in the market for long-term, triple-net leases of freestanding, single-tenant properties, and expected liquidity needs and sources (including the ability to obtain financing or raise capital). Words such as “estimate,” “anticipate,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “seek,” “approximately” or “plan,” or the negative of these words, and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters, are intended to identify forward-looking statements. You can also identify forward-looking statements by discussions of strategy, plans or intentions of management.

Forward-looking statements involve numerous risks and uncertainties, and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods that may be incorrect or imprecise, and we may not be able to realize them. The following risks, among others, which may be further heightened by the potential adverse effects of the ongoing COVID-19 pandemic and federal, state and/or local regulatory guidelines and private business actions to control it, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements:

1

|

You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of the document in which they are contained. While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. We undertake no obligation to publicly release the results of any revisions to any forward-looking statement that may be made to reflect events or circumstances after the date as of which that forward-looking statement speaks or to reflect the occurrence of unanticipated events, except as required by law.

Item 1. BUSINESSBUSINESS

OverviewThe Merger

On September 15, 2022, STORE Capital Corporation, a Maryland corporation, Ivory Parent, LLC, a Delaware limited liability company (“Parent”) and Ivory REIT, LLC, a Delaware limited liability company (“Merger Sub” and, together with Parent, the “Parent Parties”), entered into an Agreement and Plan of Merger (the “Merger Agreement”). The Parent Parties are affiliates of GIC, a global institutional investor, and funds managed by Blue Owl Capital. On February 3, 2023 (the “Closing Date”), pursuant to the terms and subject to the conditions set forth in the Merger Agreement, STORE Capital Corporation merged with and into Merger Sub (the “Merger”) with Merger Sub surviving (the “Surviving Entity”) and the separate existence of STORE Capital Corporation ceased. Immediately following the completion of the Merger, the Surviving Entity changed its name to STORE Capital LLC. References herein to “we”, the “Company,” “STORE,” or “STORE Capital” are references to STORE Capital Corporation prior to the Merger and to STORE Capital LLC upon and following the Merger. As of the Closing Date of the Merger, the common equity of the Company is no longer publicly traded.

Overview

General. S|T|O|R|ESTORE is an internally managed net-lease real estate investment trust, or REIT, that is a leader in the acquisition, investment and management of Single Tenant Operational Real Estate, or STORE Properties,"STORE Properties", which is our target market and the inspiration for our name. A STORE Property is a real property location at which a company operates its business and generates sales and profits, which makes the location a profit center and, therefore, fundamentally important to that business.

S|T|O|R|E is one of the largest and fastest-growing net-lease REITs and our Our portfolio is highly diversified. As of December 31, 2021,diversified and our 2,866 property locations were operated by 556 customers across the United States. Our customers operate across a wide variety of industries within the service, service-oriented retail and manufacturing sectors of the U.S. economy, with restaurants, early childhood education, metal fabrication, automotive repair and maintenance and health clubs representing the top industries in our portfolio.

2

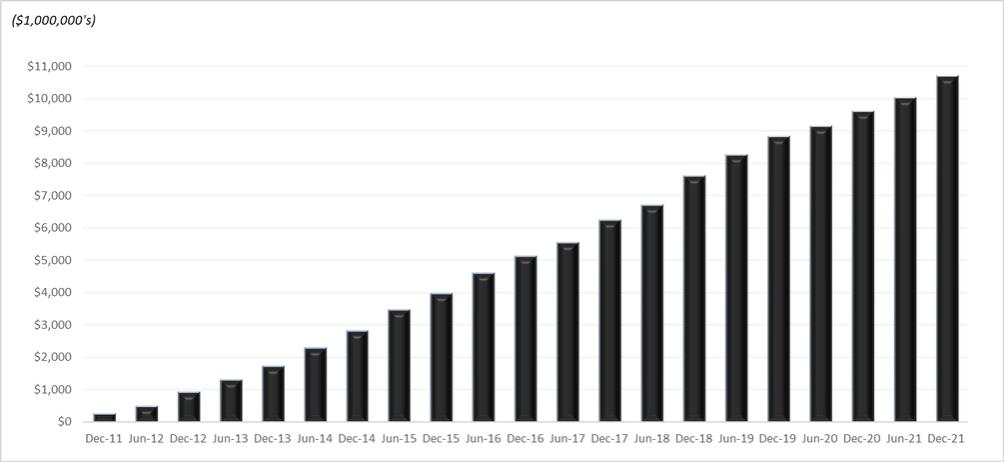

The following table depicts the growth in our investment portfolio since our inception in 2011.

Our Total Investment Portfolio at Period End

Taxation as a Real Estate Investment Trust. We haveSTORE Capital Corporation elected to be taxed as a real estate investment trust, or a REIT, under the Internal Revenue Code of 1986, as amended, or the Code, commencing with ourits initial taxable year ended December 31, 2011. STORE Capital LLC has elected to be taxed as a REIT under the Internal Revenue Code of 1986, as amended, commencing with its initial taxable year ended December 31, 2022. To continue to qualify as a REIT, we must continue to meet certain tests which, among other things, require that our assets consist primarily of real estate assets, our income be derived primarily from real estate assets, and that we distribute at least 90% of our REIT taxable income (other than our net capital gains) to our stockholdersmembers annually.

The Net-Lease Model and Sustainability. S|T|O|R|ESTORE is a net-lease REIT. Accordingly, we acquire STORE Properties from business owners, and then lease the properties back to the business owners under net-leases, substantially all of which are triple-net. Under a triple-net lease, our customer (the tenant) is solely responsible for operating the business conducted at the property subject to the lease, keeping the property and improvements in good order and repair, remodeling and updating the building as it deems appropriate to maximize business value, and paying the insurance, property taxes and other property-related expenses. Under the triple-net lease model, therefore, S|T|O|R|ESTORE is not a real estate operator; rather, we provide real estate financing solutions to customers seeking a long-term, lower-costmore efficient cost alternative to real estate ownership. Following our acquisition of a property, it is our customer, and not S|T|O|R|E,STORE, that controls the property, including with respect to decisions as to when and how to implement environmentally sustainable practices at a given property. However, as the property owner, we nevertheless recognize that the operation of commercial real estate assets can have a meaningful impact on the environment, particularly with respect to resource consumption and waste generation, and on the health of building occupants. Accordingly, at S|T|O|R|E, we believe that being conscious of, and seeking to address, environmental impacts within our control, and supporting our tenant customers to do the same in their businesses, plays a role in building and sustaining successful enterprises and, thus, is material to the success of our own business.

Our Corporate Responsibility. We define success by our ability to make a positive difference for all of our many stakeholders. S|T|O|R|E’sSTORE’s beginning was inspired by our belief that we could make a positive difference for real estate intensive businesses across the U.S. by delivering innovative and superior real estate capital solutions. That belief has guided our efforts to bring much needed capital and liquidity opportunities to middle-market and larger businesses which, in turn, have brought value creation and growth to our most integral stakeholders: our customers, stockholdersowners and employees. For our many customers, S|T|O|R|E’sSTORE’s real estate lease solutions have contributed to their prospects for wealth creation and to their ability to grow, create jobs and contribute to many communities across the country. In turn, meeting the needs of our customers provides an extraordinary investment opportunity that we believe holds the promise ofcreates sustainable long-term wealth creation for our many stockholders.wealth. We are committed to operating our business responsibly,

3

guarding our valuable reputation and creating long-term and sustainable value for our company through a robust business model and attentiveness to our many stakeholders. S|T|O|R|ESTORE is committed to playing an important

2

role for middle-market and larger companies across the U.S. in order to help them succeed, while making a positive impact on our collective communities, both today and for future generations.

2021 Highlights

Our Target Market and Asset Class

We are a leader in providingprovide real estate financing solutions principally to middle-market and larger businesses that own single tenant profit-center real estate locations on which they conduct their businesses and generate revenues and profits, which we refer to as Single Tenant Operational Real Estate or “STORE Properties.” Our customers operate these STORE Properties and operate within the broad-based service, service-oriented retail and manufacturing sectors of the U.S. economy. We have designed our net-lease solutions to provide a long-term, lower-costcost efficient way to improve our customers’ capital structures and, thus, be a preferred alternative to real estate ownership. We estimate the market for STORE Properties to approximate $3.9 trillion in market value and to include more than 2.0 million properties.

We define middle-market companies as those having approximate annual gross revenues of between $10 million and $1.0 billion, although approximately 21% of our customers have annual revenues in excess of $1.0 billion. At December 31, 2021, the median annual revenues of our 556 customers was approximately $62 million and, on a weighted average basis, our average customer had revenues of approximately $1 billion. Most of our customers do not have credit ratings, although some have ratings from rating agencies that service insurance companies or fixed-income investors. Most of these non-rated companies either prefer to be unrated or are simply too small to issue debt rated by a nationally recognized rating agency in a cost-efficient manner.

The financing marketplace for STORE Properties is highly fragmented, with few participants addressing the long-term capital needs of middle-market and larger non-rated companies. While we believe our net-lease financing solutions can add value to a wide variety of companies, we believe the largest underserved market and, therefore, our greatest opportunity, is non-rated, bank-dependent, middle-market and larger companies that generally have less access to efficient sources of long-term capital.

4

Our customers typically have the choice either to own or to lease the real estate they use in their daily businesses. They choose to lease for various reasons, including the potential to lower their cost of capital, as leasing supplants traditional financing options that tie up the equity in their real estate. Leasing is also viewed as an attractive alternative to our customers because it generally locks in scheduled payments, at lower levels and for longer periods, than traditional financing options; these factors are viewed favorably relative to the amounts funded.

Whether companies elect toBecause STORE Properties are profit-center locations, payment of rent or ownunder our lease contracts is supported not only by the credit quality of the tenant and the residual value of the real estate, they use in their businesses is most often a financial decision. For the few highly capitalized large companies that possess investment-grade credit ratings, real estate leasing tends to be viewed as a substitute for corporate borrowings that they could otherwise access (so long as they remain highly ratedbut also and equitized). With real estate leases often bearing rental costs that exceed corporate term borrowing costs, such companies elect to rent for strategic reasons. Such reasons may include the long-term flexibility to vacate properties that are no longer strategic, the permanence of lease capital which lessens potential refinancing risk should corporate credit ratings deteriorate, the lack of corporate financial covenants associated with leasing and the ability to harness developers to effectively outsource their real estate development needs. The primary motivations for S|T|O|R|E’s middle-market and larger customers tend to be different. For such companies, real estate leasing solutions offer the potential to lower their cost of capital. In addition to this primary economic motivation, our tenants also seek lease assignability, property substitution rights, property closure rights and S|T|O|R|E’s assistance with property expansion and lease contract modification. Our real estate leasing solutions offer tenants such flexibility, which, in turn, offers the potential for further tenant wealth creation. We believe that our customers select us as their landlord of choice principally as a result of our service, comparative business flexibility and the tailored net-lease solutions we provide.

We believe the demand for our net-lease solutions has grown, in part, as a result of the current bank regulatory environment. In our view, the increased scrutiny and regulation of the banking industry in response to the collapse of the housing and mortgage industries from 2007 to 2009, particularly the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, or the Dodd-Frank Act, and the Basel Accords issuedprimarily by the Basel Committee on Banking Supervision, have constrained real estate lending practices and limited desirable term debt real estate borrowing options. Real estate leasing today represents a highly desirable component of corporate capitalization strategies due, in part, to the unavailability of long-term, fixed rate commercial real estate mortgage financing with important features such as affordable prepayment and modification options or loan assignability.

S|T|O|R|E was formed to capitalize on a large market opportunity resulting from the widespread need amongst middle-market and larger companies for efficient corporate real estate capital solutions. We believe our opportunities include both gaining market share from the fragmented network of net-lease capital providers and growing the market by creating demand for our net-lease solutions that meet the long-term real estate capital needs of these companies.

The estimated $3.9 trillion market of STORE Properties is divided into three primary industry sectors and various industry sub-sectors. The primary sectors and their proportion of this market are service at 47%, retail at 42% and manufacturing at 11%. The sub-sectors included within each primary sector are summarized in the table below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5

Within the sub-sectors, the market for STORE Properties is further subdivided into a wide variety of industries within the service, retail and manufacturing sectors, such as:

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Although many of these industries are represented within our diverse property portfolio, S|T|O|R|E primarily targets service sector properties that represent a broad array of everyday services (such as restaurants and early childhood education facilities) that are not readily available online and that are located near customers targetedprofits produced by the business operating onoperations at the property. Although not our primary focus, the retail sector assetslocations we target are primarily located in retail corridors, also tend to be internet resistant and include a high experiential component, such as furniture and hunting and fishing stores. In the manufacturing sector, we typically target properties that represent a broad array of industries, are located in industrial parks near customers and suppliers, and are operated by businesses that produce everyday necessities. As of December 31, 2021, our portfolio of investments in STORE Properties was diversified across approximately 120 industries, of which 65% was in the service sector, 15% was in the retail sector and 20% was in the manufacturing sector, based on revenue.own (e.g. unit-level profitability).

Our Asset Class: STORE PropertiesCreating Superior Lease Contracts

STORE Properties are a unique asset class that inspired the formation of S|T|O|R|E and our company name. STORE (Single Tenant Operational Real Estate) Properties are profit-center real estate locations on which our customers conduct their businesses and generate revenues and profits. The defining characteristic of STORE Properties is the number of sources that support the payment of our rent: STORE Properties have the following three sources, whereas all other commercial real estate assets have just two.

6

Creating Investment-Grade Contracts

From our inception in 2011, we have emphasized and uniquely disclosed information regarding the net-lease contracts we create with our tenants. We believe that our net-lease contracts, and not simply tenant or real estate quality, are central to our potential to deliver superior long-term risk-adjusted rates of return to our stockholders.return. Contract quality embodies tenant and real estate characteristics, together with other investment attributes we believe are highly material. Contract attributes include the prices we pay for the real estate we own, inclusive of the prices relative to new construction cost. As of December 31, 2021, our average investment approximated 80% of replacement cost, a statistic that has been relatively stable since 2015. Other important contract attributes include the ability to receive unit-level financial statements, which allows us to evaluate unit-level cash flows relative to the rents we receive. As of December 31, 2021, the weighted average ability of the properties we own to cover our rents, which we refer to as the “4-wall coverage ratio,” approximated 4.6:1 (the median 4-wall coverage ratio approximated 3.1:1). In addition, we calculate a coverage ratio, inclusive of an allowance for indirect costs, for each of the properties we own which we refer to as the “unit fixed charge coverage ratio.” As of December 31, 2021, the weighted average unit fixed charge coverage ratio approximated 3.6:1 (the median unit fixed charge coverage ratio was 2.5:1). Likewise, over many years of providing real estate net-lease capital, we have determined that tenant alignments of interest are highly important. Such alignments of interest can include full parent company recourse, credit enhancements in the form of guarantees, cross default provisions and the use of master leases. Master leases, which comprise most of our multi-property net-lease contracts, are individual lease contracts that bind multiple properties and offer landlords greater security in the event of tenant insolvency and bankruptcy. Whereas individual property leases provide tenants with the opportunity to evaluate the desirability and viability of each individual property they rent in the event of a bankruptcy, master leases bind multiple properties, permitting landlords to benefit from aggregate property performance and limiting tenants’ ability to pick and choose which leases to retain. As of December 31, 2021, 94% of our multi-property net-lease contracts were in the form of master leases. Contract economic terms are also highly important because they can enhance margins of safety. During 2021, our weighted average initial lease rate was 7.5%, with annual contractual lease escalations averaging an added 1.9% of contract rents for new assets added during the year. We believe that our initial yields, on average, range from 10% to 15% above those expected by investors seeking real estate investment opportunities through the broker auction market, which provides us greater flexibility to preserve and enhance returns. Other important tenant contract considerations include contractual lease escalations, indemnification provisions, lease renewal rights, and the ability to sublease and assign leases, as well as qualitative considerations, such as alternative real estate use assessment and the composition of a tenant’s capitalization structure.

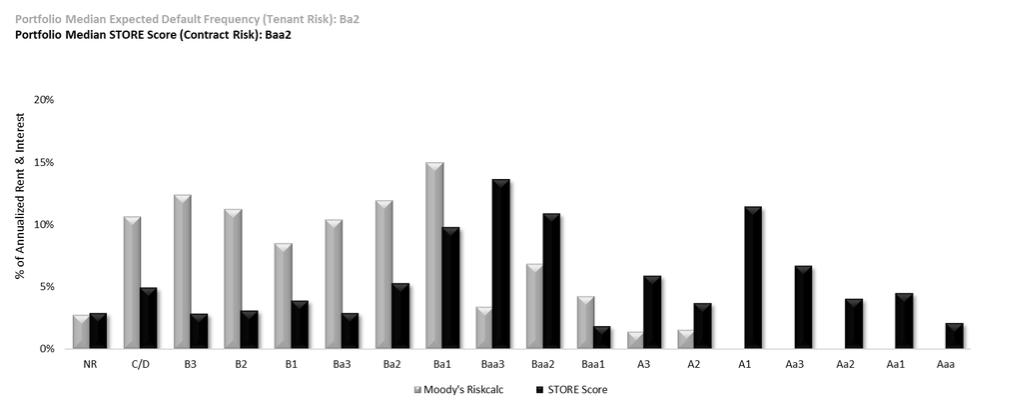

Since our November 2014 initial public offering, S|T|O|R|E’s extensive contract attribute disclosure has uniquely includedOur Business Process

We operate a tenant credit quality distribution chart, employing computed implied credit ratings applied to regularly received tenant financial statements using Moody’s Analytics RiskCalc. Since tenant credit ratings are merely one component of contract risk, we developed a means to deliver a base quantitative contract quality estimate. Our approach was to modify risk of tenant insolvency, as estimated by the Moody’s algorithm, by our own estimate of the likelihood of property closure, based on the regularly monitored profitability of the properties bound by each lease contract we create. To accomplish this, we established a simple range of property closure likelihood ranging from 10% to 100% based upon property profitability ranges from breakeven to a computed ability to cover our rents twice over. Multiplying tenant estimated insolvency probability (Moody’s Analytics RiskCalc) by our estimate of the probability of property closure results in a contract risk measurement that we call the STORE Score and which we regularly and uniquely disclose.

7

Our Competitive Strengths

We have a market-leading platform for the acquisition of, investment in and management of STORE Properties that simultaneously creates value for stockholdersthrough four core competencies.

83

Portfolio Management. Net-lease real estate investing requires active management of the investment portfolio to realize superior |

Our Business and Growth Strategies

Our objective is to continue to create stockholder value through sustained investment and management activities designed to increase distributable cash flows and deliver attractive risk-adjusted rates of return from a growing, diversereturn. STORE monitors unit-level profit and loss statements, customer corporate financial statements and the timely payment of property taxes and insurance in order to evaluate portfolio of STORE Properties. To accomplish this, our principal business and growth strategies are as follows:

9

Beyond our regular engagement with our customers on business matters, in 2019, we initiated a tenant outreach program designed to gauge our tenants’ current sustainability practices, provide them with sustainability education and support resources, and encourage them to engage in sustainable practices, including reducing power usage, saving water, assessing building equipment, and implementing other energy-efficiency upgrades. We believe that effective encouragement of sustainability initiatives, particularly related to energy, water and indoor environmental quality, can lead to the adoption of practices that can drive business and real estate value appreciation, decrease operating costs and mitigate regulatory risks.

Environmental Stewardship

We are committed to environmental sustainability and the mitigation of environmental risks in connection with the development of our property portfolio. This commitment reflects the fact that the properties we acquire are subject to both state and federal environmental regulations, but, more importantly, it aligns with our belief that being conscious of, and seeking to address and manage, environmental risks within our control, and supporting our customers to do the same in

10

their businesses, plays a role in building and sustaining successful enterprises; and, thus, is material to the success of our own business.

Our environmental initiatives and partnerships focus on energy savings and carbon footprint reduction in our customers’ facilities. As we are a triple-net lease REIT, without direct control of physical locations, our primary strategy includes educating ourselves and our customers on evolving environmental strategies, soliciting feedback, and gathering environmental data from our customers. This includes developing relationships between our customers and ESG vendor partners,vendors of sustainability solutions, and supporting our tenants in thetheir implementation of greensustainability programs including energy efficiency and carbon reduction programs.

As part of our attentiveness to environmental concerns, we:

Acquisition Process. Our commitment to environmental sustainability begins before we acquire a real estate asset and involves, among other factors, a consideration of the environmental risk associated with our tenants and with prior users of the real estate asset. We then analyze environmental matters in each step of our three-phase property acquisition process:

We may take additional actions in situations where a target property may be subject to risks associated with climate change, particularly as a result of being located in a geographic area susceptible to floods, hurricanes, tornados, earthquakes or other climate-related occurrences. These additional steps and actions may include: (i) maintaining comprehensive environmental insurance coverage for specified properties in our portfolio to ensure that there are financial resources available to conduct safe and timely remediation in the event of an unforeseen environmental issue; and (ii) preparing for climate-related natural disasters by requiring our tenants to carry insurance, including fire, wind/hail, earthquake, flood and other extended coverage where appropriate given the relative risk of loss, geographic location and industry best practices.

Building Sustainable Tenant Relationships. Despite owning our properties subject to triple-net leases, under which our tenants control all business operations at the properties, we strive to positively influence the sustainability practices of our tenants. We expect that such efforts will foster relationships with our tenants that effectively encourage sustainability initiatives, particularly related to energy, water and indoor environmental quality, which can lead to the adoption of

11

practices that should drive business and real estate value appreciation, decrease operating costs and mitigate regulatory risks.

Our primary strategy includes educating ourselves and our customers on evolving environmental strategies, soliciting feedback, and gathering environmental data from our customers. This includes developing relationships between our customers and ESG vendor partners, and supporting our tenants in the implementation of green programs including energy efficiency and carbon reduction programs. To advance this effort, we:

We supplement our annual property inspections with an annual tenant outreach survey from which we collect further data on sustainability features implemented by our participating tenants at their leased properties and assess our customers’ corporate responsibility priorities, progress and interest in partnering on projects. The data collected from our survey allows us to provide our tenants with education, ideas and support for property-level sustainability solutions, and provides us with a forum to encourage them to pursue sustainable practices and explore technological solutions. This survey has allowed us to engage directly with our tenants most interested in reducing their carbon footprint and related environmental impact and focus our discussions and consultant introductions to those that that best meet the needs and interests of those tenants.

In addition to the survey, we work with ESG vendors and consultants to identify real estate in our portfolio that meets requirements for select initiatives such as solar and electric car chargers. We then proactively reach out to targeted tenants to educate them about the benefits of the select initiative and to assess their interest in learning more and meeting with a consultant for a review of their options. We believe that ongoing tenant engagement and collaboration on environmentally focused property initiatives should create a long-term culture of sustainable tenant relationships.

Human Capital Management

We believe that to continue to deliverdelivering strong financial results, we must execute on a human capital strategy that prioritizes, among other things: (i) establishing a work environment that: attracts, develops, and retains top talent; (ii) affording our employees an engaging work experience that allows for career development and opportunities for meaningful civic involvement; (iii) evaluating compensation and benefits, and rewarding outstanding performance; (iv) engaging with, and obtaining feedback from, our employees on their workplace experiences; (v) enabling every employee at every level to be treated with dignity and respect, to be free from discrimination and harassment, and to devote their full attention and best efforts to performing their job to the best of their respective abilities; and (vi) communicating with our board of directors on key topics.

As part of our efforts to achieve these priorities:

• We seek to foster a diverse and vibrant workplace of individuals who possess a broad range of experiences, backgrounds and skills, starting at the top. |

12

As of December 31, 2021,2023, we had 117121 full-time employees, an increase of 10.4% over the total at December 31, 2020, all of whom are located in our single office in Scottsdale, Arizona. None of our employees are subject to a collective bargaining agreement. We consider our employee relations to be good.

Competition

We face competition in the acquisition and financing of STORE Properties from numerous investors, including, but not limited to, traded and non-traded public REITs, private equity investors and other institutional investment funds, as well as private wealth management advisory firms that serve high net worth investors (also known as family offices), some of which have greater financial resources than we do, a greater ability to borrow funds to acquire properties and the willingness to accept more risk. We also believe that competition for real estate financing comes from middle-market business owners themselves, many of whom maintain a preference to own, rather than lease, the real estate they use in their businesses. The competition we face may increase the demand for STORE Properties and, therefore, reduce the number of suitable acquisition opportunities available to us or increase the price we must pay to acquire STORE Properties. This competition will increase if investments in real estate become more attractive relative to other forms of investment..

Insurance

Our leases and loan agreements typically require our customers to maintain insurance of the types and in the amounts that are usual and customary for similar commercial properties, including commercial general liability, fire and extended loss insurance provided by reputable companies, with commercially reasonable exclusions, deductibles and limits, all as verified by our independent insurance consultant.

Separately, we purchase contingent liability insurance, in excess of our customers’ liability coverage, to provide us with additional security in the event of a catastrophic claim.

Regulations and Requirements

Our properties are subject to various laws and regulations, including regulations relating to fire and safety requirements, as well as affirmative and negative contractual covenants and, in some instances, common area obligations. We believe that each of our customers has the necessary permits and approvals to operate and conduct their businesses on our properties. Moreover, our properties are subject to Title III of the Americans with Disabilities Act of 1990 and similar state and local laws and regulations (collectively, the “ADA”

4

“ADA”). Our customers have primary responsibility for complying with these regulations and other requirements pursuant to our lease and loan agreements; however, we may have liability in certain circumstances if our tenants do not comply with such laws and regulations. As of January 31, 2022,2024, we are not aware of any ADA non-compliance that we believe would have a material adverse effect on the results of our operations.

Additionally, our properties are subject to environmental laws and regulations, which may give rise to liabilities related to the presence, handling or discharge of hazardous materials that may emanate from properties that we purchase, regardless of fault. We mitigate the possible liabilities from such laws and regulations by undertaking extensive environmental due diligence and by entering into leases with the sellers of our properties, pursuant to which the sellers agree to certain covenants and indemnities that typically require the sellers to comply with applicable environmental laws

13