SECURITIES AND EXCHANGE COMMISSION

| | | | | | | | |

| x | ☒

| ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the

Fiscal Year Endedfiscal year ended December 31,

2022

2023

| | | | | | | | |

| o | ☐

| TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from

________________ to

________________

Commission file number: 001-37564

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Nevada | | 8211 | | | 36-4794936 |

Nevada

| | 8211

| | 46-4116523

|

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial | | (I.R.S. Employer

|

incorporation or organization)

| |

Classification Code Number)

| | (I.R.S. Employer

Identification Number) |

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (678) (678)367-0809

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | |

Ticker Symbol(s) | |

Name of each exchange on which registered |

|

|

|

|

|

Common Stock, $0.0001 par value | |

BOXL | | BOXL

| The Nasdaq Stock Market LLC |

Securities registered pursuant to section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐o No ☒x Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐o No ☒x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒x No ☐o Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒x No ☐o Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☐o

| Accelerated filer | ☐o

| |

| | | | | |

| Non-accelerated filer | ☒x

| Smaller reporting company | ☒x

| |

| | | | | | |

| | | Emerging growth company | ☐o

| |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.. Act. ☐o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒o If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐o Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐o Indicate by check mark if the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter was

$43,784,486.Indicate by check mark if the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

$20,384,326.

The number of shares outstanding of the registrant’s common stock on March

13, 20238, 2024 was

74,774,556.

9,728,465.

DOCUMENTS INCORPORATED BY REFERENCE

Certain

Part III incorporates information by reference to certain portions of the registrant’s Definitive Proxy Statement for the 20232024 Annual Meeting of the Stockholders, which will be filed within 120 days of December 31, 2022.2023.

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K (including the section regarding Management’s Discussion and Analysis and Results of

Operations)Operations, the "Annual Report") contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements are based on our management’s belief and assumptions and on information currently available to our management. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Forward-looking statements include statements concerning the following:

| ● | our possible or assumed future results of operations; |

| ● | our business strategies; |

| ● | our ability to attract and retain customers; |

| ● | our ability to sell additional products and services to customers; |

| ● | our cash needs and financing plans; |

| ● | our competitive position; |

| ● | our industry environment; |

| ● | our potential growth opportunities; |

| ● | expected technological advances by us or by third parties and our ability to leverage them; |

| ● | our inability to predict, adapt to, or anticipate the duration or long-term economic and business consequences of the ongoing conflict between Ukraine and Russia or the COVID-19 pandemic; |

| ● | our ability to protect the Company against cybersecurity risks and threats; |

| ● | our ability to maintain the listing of our securities on a national securities exchange; |

| ● | the effects of future regulation; and |

| ● | our ability to protect or monetize our intellectual property. |

•our possible or assumed future results of operations;

•our business strategies;

•our ability to attract and retain customers;

•our ability to sell additional products and services to customers;

•our cash needs and financing plans;

•our competitive position;

•our industry environment;

•our potential growth opportunities;

•expected technological advances by us or by third parties and our ability to leverage them;

•our inability to predict, adapt to, or anticipate the duration or long-term economic and business consequences of the ongoing conflicts between Ukraine and Russia, and Israel and Hamas, or the COVID-19 pandemic;

•our ability to protect the Company against cybersecurity risks and threats;

•our ability to maintain the listing of our securities on a national securities exchange;

•the effects of future regulation; and

•our ability to protect or monetize our intellectual property.

In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward-looking statements, because they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond our control and which could materially affect results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed in the reports we file with the

SEC.Securities and Exchange Commission (the "SEC"). Actual events or results may vary significantly from those implied or projected by the forward-looking statements due to these risk factors. No forward-looking statement is a guarantee of future performance. You should read this Annual Report,

on Form 10-K, the documents that we reference in this Annual Report

on Form 10-K and the documentation we have filed as exhibits thereto with

the Securities and Exchange Commission, or the SEC, with the understanding that our actual future results and circumstances may be materially different from what we expect.

Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made, and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as may be required by applicable law. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

Unless the context otherwise requires, the terms “the Company,” “we,” “us,” and “our” in this reportAnnual Report refer to Boxlight Corporation and its consolidated direct and indirect subsidiaries, and the term “Boxlight” refers to Boxlight Inc., a Washington corporation and a wholly owned subsidiary of Boxlight Corporation. The terms “year” and “fiscal year” refersrefer to our fiscal year ending December 31st.

We are a technology company that develops, sells and services interactive solutions predominantly for the global education market, but also for the corporate and government sectors. We are seeking to become a worldwide leading innovator and integrator of interactive products and software solutions and improve collaboration and effective communication in meeting environments. We currently design, produce and distribute interactive technologies including our interactive and non-interactive flat panelflat-panel displays, LED video walls, media players, classroom audio and campus communication, cameras and other peripherals for the education market and non-interactive solutions including flat panels,flat-panels, LED video walls and digital signage.signage for the Enterprise market. We also distribute science, technology, engineering and math (or “STEM”) products, including our 3D printing and robotics solutions, and our portable science lab. All products are integrated into our classroom software suite that provides tools for whole class learning, assessment and collaboration. In addition, we offer professional training services related to our technology to our U.S. educational customers. To date, we have generated the majority of our revenue in the U.S. and internationally from the sale of interactive displays and related software to the educational market. We have sold our solutions into more than 70 countries and into more than 1.5 million classrooms and meeting spaces. We sell our products and software through more than 1,000 global reseller partners. We believe we offer the most comprehensive and integrated line of interactive display solutions, audio products, peripherals and accessories, software and professional development for schools and enterprises on the market today. The majority of our products are backed by nearly 30 years of research and development.Our website address is https://boxlight.com. Information available on our website is not a part of, and is not incorporated into, this Annual Report. Advances in technology and new options for the introduction of technology into the classroom have forced school districts to look for solutions that allow teachers and students to bring their own devices into the classroom, provide school districts with information technology departments with the means to access data with or without internet access, handle higher demand for video, as well as control cloud and data storage challenges. Our design teams are able to quickly customize systems and configurations to serve the needs of clients so that existing hardware and software platforms can communicate with one another. Our goal is to become a single source solution to satisfy the needs of educators around the globe and provide a holistic approach to the modern classroom.

We pride ourselves in providing industry-leading service and support and have received numerous product awards:

| ● | In 2022,•In 2023, Boxlight received Awards from various industry publications including Overall EdTech Company of the Year in the EdTech Breakthrough Awards, Tech and Learning Best of Show for ISTELive 22, multiple awards from various industry events and publications. Boxlight's Clevertouch brands were awarded three best of show awards from Tech & Learning’s Back to School Awards of Excellence, 4 awards for new products from THE Journal, multiple awards from Tech and Learning for Mimio, Clevertouch and FrontRow solutions and the Campus Technology New Product of the Year award for CleverLive digital signage. |

| ● | In 2021, Boxlight received Tech & Learning’s 2021 Awards of Excellence ‐ Best Tools for Back to School, in both Primary and Secondary levels for: MimioConnect® blended learning platform, MimioSTEM solutions, Boxlight‐EOS Professional Development Learning Solutions, and our ProColor interactive flat panel. Clevertouch was awarded for Best Business Growth and Corporate Social Responsibility by InAVation Awards and 4 AV Awards for Product, Manufacturer, Distributor, and Channel Team of the Year. |

| ● | In 2020, UX Pro won Collaboration Innovation of the Year from AV News Awards, Best in Show for InfoComm Awards, AvTechnology Europe, and “Best of Show” at ISE. IMPACT Plus won Innovation Design, high-quality, functionality, ergonomics and ecology from Plus X Awards in Germany, Collaboration Innovation from AV News Awards, Best in Show at InfoComm from Tech & Learning magazine, Best at Show at InfoComm from Installation magazine and best at ISE Show from Installation. |

| ● | In 2019, Clevertouch won Interactive Display of the Year at AV Magazine’s AV Awards, Keiba Awards, Best of Show from Installation and best of Show for IMPACT Plus at Best of Show Tech&Learning awards, as well as the Pro Series Technology for Conferencing and Collaboration at the Innovation Awards, and the AV Display Innovation of the Year at the AV News Awards. |

Over the past three years,ISE conference for LYNX Whiteboard, IMPACT Max and UX Pro 2. At the COVID-19 pandemic has hadEdTech awards, Attention!® was named winner of the EDTech Cool Tool Award and Clevershare was a significant impact on economies worldwide, resulting in workforce and travel restrictions, and supply chain and production disruptions across many sectors. While factors have had a significant impact on our supply chain, the financial performance of our business has actually improved substantially since the last quarter of 2020 and we anticipate that trend will continue throughout 2023 as demand for our products and solutionsfinalist in the education, governmentscreen mirroring software. At the 5th annual EdTech Breakthrough Awards, Boxlight received Best Technology Solution for Student Safety. Boxlight won 9 Tech and

Learning Best for Back to School Awards for its MimioWall, MimioDS, MyBot Recruit, IMPACT Lux and Teacher Action! Mic., while Clevertouch by Boxlight won signage Technology of the Year for the CleverLive products.•In 2022, Boxlight received awards from various industry publications including Overall EdTech Company of the Year in the EdTech Breakthrough Awards, Tech and Learning Best of Show for ISTELive 22, multiple awards from Tech & Learning’s Back to School Awards of Excellence, 4

•In 2021, Boxlight received Tech & Learning’s 2021 Awards of Excellence ‐ Best Tools for Back to School, in both Primary and Secondary levels for: MimioConnect® blended learning platform, MimioSTEM solutions, Boxlight‐EOS Professional Development Learning Solutions, and our ProColor interactive flat-panel. Clevertouch was awarded for Best Business Growth and Corporate Social Responsibility by Inavation Awards and 4 AV Awards for Product, Manufacturer, Distributor, and Channel Team of the Year.

corporate sectors increase. Indeed, we believe that the COVID-19 pandemic has accelerated the move toward unified communications, thus creating greater demand for our products and solutions.

For more detail, please refer to Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations for discussion of specific impacts on seasonality and liquidity and capital resources.

Our Company

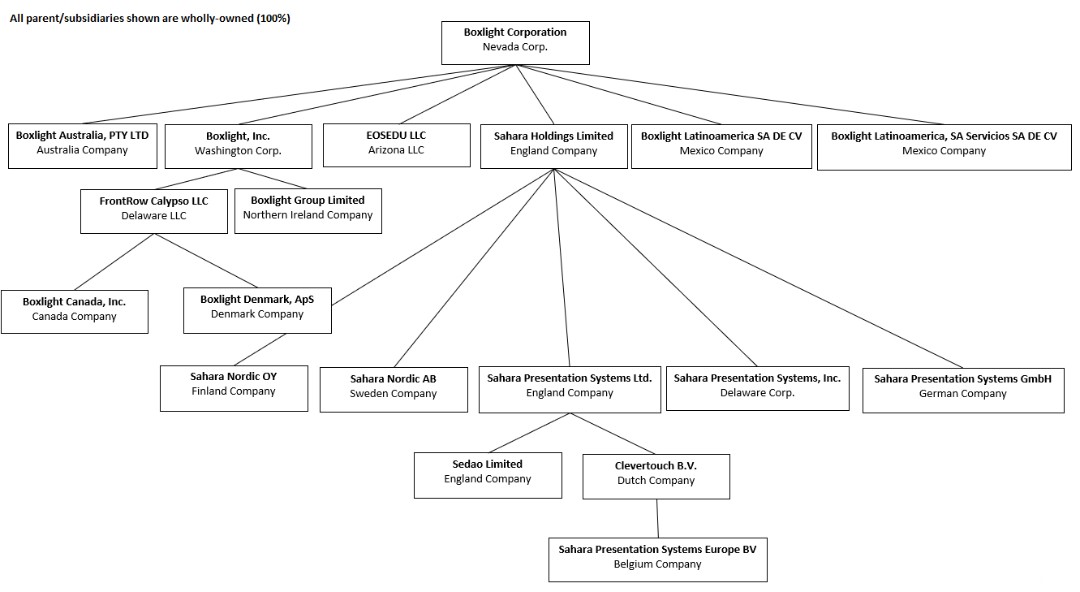

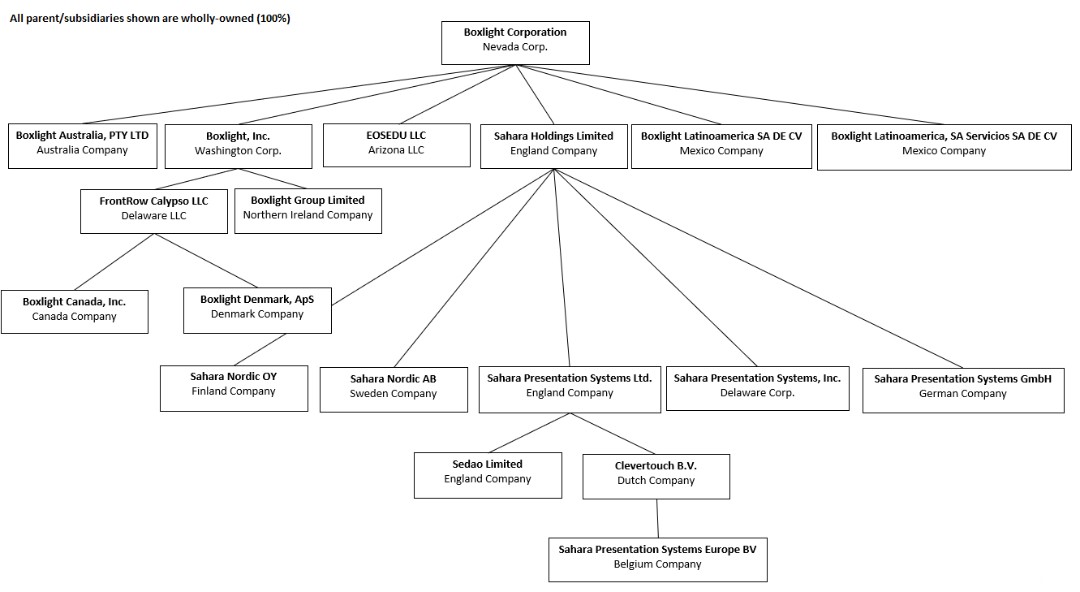

Boxlight Corporation was incorporated in Nevada on September 18, 2014 for the purpose of acquiring technology companies that sell interactive products into the education market. As of the date of this Annual Report, we have

sixfour subsidiaries, consisting of Boxlight Inc., a Washington State corporation,

Boxlight Australia, PTY LTD, an Australian Company, Sahara Holdings Limited, an England and Wales corporation

("Sahara"), Boxlight Latinoamerica, S.A. DE C.V. (“BLS”) and Boxlight Latinoamerica Servicios, S.A. DE C.V., (“BLA”), both

BLS and BLA are incorporated in

Mexico, and EOSEDU, LLC, an Arizona limited liability company (“EOS”).Mexico. BLS and BLA are currently inactive. Our Sahara Holding Limited subsidiary has eight directly and indirectly owned subsidiaries located in the United States, the United Kingdom, the Netherlands, Belgium, Sweden, Finland and Germany, and our subsidiary Boxlight Inc., in turn, has

foursix directly and indirectly owned subsidiaries located in the United States,

Australia, Northern Ireland, Canada and Denmark.

See the Boxlight Corporation organization chart on page 8 below.On December 31, 2021, we acquired FrontRow Calypso LLC, a California company and a leader in classroom and campus communication solutions for the education market.

On March 23, 2021, we acquired Interactive Concepts BV, a company incorporated and registered in Belgium and a distributor of interactive technologies

(Interactive) and subsequently renamed to Sahara Presentation Systems (Interactive) Europe BV. The company has been

Boxlight’sour key distributor in Belgium and Luxembourg.

On September 24, 2020,

the Companywe acquired

Sahara Holdings Ltd.Sahara., a leader in distributed AV products and a manufacturer of multi-award-winning touchscreens and digital signage products, including the globally renowned Clevertouch brand. Headquartered in the United Kingdom, Sahara and its subsidiaries have a strong presence in the EMEA interactive

flat panelflat-panel display (IFPD) market selling into education, health, government, military and corporate sectors.

On April 17, 2020, we acquired MyStemKits Inc. (“MyStemKits”). MyStemKits is in the business of developing, selling and distributing 3D printable science, technology, engineering and math curriculums incorporating 3D printed project kits for education, and owns the right to manufacture, market and distribute Robo 3D branded 3D printers and associated hardware for the global education market.

On March 12, 2019, we acquired Modern Robotics Inc. (“MRI”),

a company based in Miami, Florida. MRI is engaged in the business of developing, selling and distributing science, technology, engineering and math (STEM), robotics and programming solutions to the global education market.

On August 31, 2018, we purchased EOS, an Arizona limited liability company owned by Daniel and Aleksandra Leis. EOS is in the business of providing technology consulting, training, and professional development services to create sustainable programs that integrate technology with curriculum in K-12 schools and districts.

On June 22, 2018, we acquired Qwizdom, Inc. and its subsidiary Qwizdom UK Limited (together, the “Qwizdom Companies”). The Qwizdom Companies develop software and hardware solutions that are quick to implement and designed to increase participation, provide immediate data feedback, and, most importantly, accelerate and improve comprehension and learning. The Qwizdom Companies have offices outside Seattle, WA and Belfast, Northern Ireland and deliver products in more than 40 languages to customers around the world through a network of partners.

On May 9, 2018, we acquired Cohuborate, Ltd., a United Kingdom corporation based in Lancashire, England. Cohuborate produces, sells and distributes interactive display panels designed to provide new learning and working experiences through high-quality technologies and solutions through in-room and room-to-room multi-device multi-user collaboration.

On December 20, 2018, Cohuborate Ltd. transferred all of its assets and liabilities to Qwizdom UK Limited and changed its name to Qwizdom UK Limited. On December 20, 2018, Qwizdom UK Limited changed its name to Boxlight Group Ltd. On January 24, 2019, we merged Qwizdom, Inc. with and into Boxlight, Inc.

The businesses previously conducted by Cohuborate Ltd. and Qwizdom UK Limited are now operated by the Boxlight Group Ltd., a wholly owned subsidiary of Boxlight, Inc.

On May 9, 2016, we acquired Genesis. Genesis Collaboration LLC, a Georgia limited liability company (“Genesis”),. Genesis, is a value-added reseller of interactive learning technologies, selling into the K-12 education market in Georgia, Alabama, South Carolina, northern Florida, western North Carolina and eastern Tennessee. Genesis also sells our

interactive solutions into the business and government markets in the United States. Effective August 1, 2016, Genesis was merged into our Boxlight Inc. subsidiary.

On April 1, 2016, we acquired Mimio LLC, a Delaware limited liability company (“Mimio”). Mimio designs, produces and distributes a broad range of Interactive Classroom Technology products primarily targeted at the global K-12 education market. Mimio’s core products include interactive projectors, interactive

flat panelflat-panel displays, interactive touch projectors,

touchboardstouch boards and MimioTeach, which can turn any whiteboard interactive within 30 seconds. Mimio’s product line also includes an accessory document camera, teacher pad for remote control and an assessment system. Manufacturing is by ODMs and OEMs in Taiwan and

Mainland China. Mimio products have been deployed in over 600,000 classrooms in dozens of countries. Mimio’s software is provided in over 30 languages. Effective October 1, 2016, Mimio was merged into our Boxlight Inc. subsidiary.

For a description of the terms of our recent acquisitions see “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Recent Acquisitions” elsewhere in this Annual Report.

The organizational structure of our companies

as of the date of this Annual Report is as follows:

We believe that the global interactive technology education industry is undergoing a significant transition, as primary and secondary school districts, colleges and universities, as well as governments, corporations and individuals around the world are increasingly recognizing the importance of using technology to more effectively educate,

communicate and collaborate. Across the globe, state governments along with local communities continue to make sustained investments in education.

The K-12 education sector represents one of the largest industry segments. The

USU.S. sector is comprised of approximately 15,600 public school districts across the 50 states and 132,000 public and private elementary and secondary schools. In addition to its size, the U.S. and certain EMEA K-12 education markets are highly decentralized and are characterized by complex content adoption processes. We believe this market structure underscores the importance of scale and industry relationships and the need for broad, diverse coverage across states, districts and schools. Even while we believe certain initiatives in the education sector, such as the Common Core State Standards, a set of shared math and literacy standards benchmarked to international standards, have increased standardization in K-12 education content, we believe significant state standard specific customization still exists, and we believe the need to address customization provides an ongoing need for companies in the sector to maintain relationships with individual state and district policymakers and expertise in state-varying academic standards.

According to

a December 2023 report by FutureSource Consulting Ltd.

("Futuresource"), the U.S. display market is expected to reach

$37$44 billion

in 2022 and increase to $49 billion in 2026 while the global display market is forecast to approximate $10.5 trillion in 2022 while holding constant at approximately $9.8 trillion for 2023 through 2026.by 2027. While the education sector has historically represented the majority of displays sold, growth in the corporate sector continue to outpace the education sector with sales to the corporate sector expected to reach approximately

47%44% of the global display market in

2026. The2027. We believe the growth in both the education and corporate sectors provides the Company with significant growth opportunities. In addition, the display market is highly fragmented allowing the Company to position itself for increased market share in each of these sectors.

According to “All Global Market Education & Learning,” an industry publication, the market for hardware products is growing due to increases in the use of interactive whiteboards and simulation-based learning hardware. Educational institutions have become more receptive to the implementation of high-tech learning tools. The advent of technology in the classroom has enabled multi-modal training and varying curricula. In general, technology-based tools help develop student performance when integrated with the curriculum. The constant progression of technology in education has helped educators create classroom experiences that are interactive, developed and collaborative.

Our Opportunity

We believe that our Connected Classroom™ solution uniquely positions Boxlight to be the leading provider of EdTech products within our categories in the global education technology market. Our holistic solution of hardware, software, content and professional development improves learning progression by increasing student engagement and timely interventions. Coupled with our innovations, we have a strong brand, operations and supply-chain; our channel into the US and EMEA remains strong and the global market is growing year-on-year; with our global 24/7 technical and customer services team which retains a high satisfaction rating.

Globally it is widely acknowledged that long-term economic growth is closely correlated to investment in education and educational technology, thus sustaining long-term growth in the market, even during periods of economic downturn. Further details of our solution and favorable macro-economic analysis are set forth below:

Growth in U.S. K-12 Market Expenditures

Significant resources are being devoted to primary and secondary education, both in the United States and abroad. As set forth in

the Executive Office of the President, Council of Economic Advisersa December 2023 report

U.S. education expenditure has been estimated at approximately $1.3 trillion (~6% of U.S. GDP), with K-12 education accountingby Futuresource, US Schools are budgeting for

close to half ($625 billion) of this spending. Global spending is roughly triple U.S. spending for K-12 education.more IT in their classrooms.

The market for K-12 services and technology has historically grown above the pace of inflation, averaging 7.2% growth annually since 1969. Deviations around this mean occur during periods of economic growth and recession causing peaks and troughs in the K-12 market, albeit below other sectors.

HolonIQ reported in the Global EdTech Venture Capital Report that there has been some $32 billion in venture capital investment in the education/technology sector in the last decade (approximately 33% within the US) and predicts nearly triple that investment through to 2030. Further, the Reportreport estimates that the global “expenditure on education and training from governments, parents, individuals and corporates continues to grow to historic levels and is expected to reach USD $10 trillion by 2030.”

Increasing Focus on Accountability and the Quality of Student Education

U.S. K-12 education has come under significant political scrutiny in recent years, with findings that American students rank far behind other global leaders in international tests of literacy, math and science, with the resulting conclusion that the current state of U.S. education severely impairs the United States’ economic, military and diplomatic security as well as broader components of America’s global leadership. We believe this scrutiny will cause there to be increased investment into the education sector.

Trends in Tech-Savvy Education

While industries from manufacturing to health care have adopted technology to improve their results, according to Stanford Business School in its Trends in Tech-Savvy Education, the education field remains heavily reliant on “chalk and talk” instruction conducted in traditional settings; however, that is changing as schools and colleges adopt virtual classrooms, data analysis, online games, highly customized coursework, and other cutting-edge tools to help students learn.

The delivery of digital education content is also driving a substantial shift in the education market. In addition to interactive

flat panels,flat-panels, other technologies are being adapted for educational uses on the Internet, mobile devices and through cloud-computing, which permits the sharing of digital files and programs among multiple computers or other devices at the same time through a virtual network. We intend to be a leader in the development and implementation of these additional technologies to create effective digital learning environments.

Growth in the E-learning Market

According to the “E-learning Market – Global Outlook and Forecast 2020-2025,” the e-learning market is expected to display significant growth opportunities in the next five years. While the growth curve is uniform in terms of the number of users, the same is not the case by revenues; the average cost of content creation and delivery with the same is undergoing a consistent decline. However, the advent of cloud infrastructure, peer-to-peer problem solving, open content creation, and rapid expansion of the target audience has enabled e-learning providers to rein in economies of choice and offer course content at a competitive price. While the growth prospects of the e-learning market remain stable, the rise of efficient sub-segments is changing the learning and training landscape gradually. Vendors are also focusing on offering choices on the course content at competitive prices to gain

themarket share in the global e-learning

market.space. The exponential growth in the number of smartphone users and internet connectivity across emerging markets is driving the e-learning market in these regions. The introduction of cloud-based learning and Augmented/Virtual reality mobile-based learning is likely to revolutionize the e-learning market during the forecast period.

Major vendors are introducing technology-enabled tools that can facilitate user engagement, motivate learners, and help in collaborations, thereby increasing the market share and attracting new consumers to the market. The growing popularity of blended learning that enhances the efficiency of learners will drive the growth of the e-learning market. The e-learningAccording to an article by Futuresource in December 2023, the education market for interactive flat-panel displays is expected to generate revenuecomprise of $65.41 billion56% by 2023, growing at a compounded annual growth rate2027.

Our Portfolio of

7.07% during the forecast period.Our Portfolio

Products

We currently offer products within the following categories:

| ● | Front-of-Class Display (Mimio and Clevertouch brands) |

| ● | FrontRow Classroom Audio and IP-based school-wide communication systems for bells, paging, intercom, and alerting |

•FrontRow Classroom Audio and IP-based school-wide communication systems for bells, paging, intercom, and alerting

| ● | Educational Software & Content (Mimio Connect, LYNK Whiteboard, OKTOPUS, MimioStudio) |

| ● | Peripherals and Accessories |

| ● | Professional Development |

•Educational Software & Content (Mimio Connect, LYNK Whiteboard, OKTOPUS, MimioStudio)•Peripherals and Accessories

•Professional Development

The Boxlight portfolio of solutions is designed to create dynamic teaching, learning, and presentation experiences. When integrated, our innovative solutions provide opportunity for a holistic approach to in-person or virtual learning experiences, meetings and professional learning, campus wide communication, or any situation where presentation, interaction, or engagement occurs.

Front-of-Class Display Category

Boxlight offers a choice of Interactive

Flat PanelFlat-Panel Displays (IFPD), Interactive Whiteboards (IWB), and Non-Interactive

Flat PanelFlat-Panel Displays. Each comes with licensed copies of our software, access to prepared content and Professional Development modules.

There areThese present upsell opportunities for our software and Professional Development modules.

The IMPACT Plus interactive LED

flat panels deliversflat-panels deliver a truly intuitive experience and

isare available in four sizes

55”, 65”, 75”55,” 65,” 75,” and 86”. With 4K resolution, 20 points of touch and

builtbuilt-in collaboration screen sharing with touchback capabilities, IMPACT Plus is built with teacher requirements for a new generation of front of class displays. Running Android 8 with an optional slot in PC, Clevertouch is designed to run and fit into any technology set up. Standard features include built in line array microphones for distance learning, proximity sensors that boot up the screen or shuts down the screen when the room is not in use, built in app store with hundreds of educational apps, enhanced USB-C connectivity and device charging, cloud accounts to log into personal settings and cloud drives; built in digital signage, to display messaging a cloud-based LYNX Whiteboard for lesson planning and deployment and Snowflake software. Every screen runs Over-the-Air (OTA) updates and comes with Mobile Device Management to run diagnostics on each screen.

The Clevertouch IMPACT is the perfect all-around solution for the modern classroom. Featuring high precision technology, LYNX Whiteboard, Cleverstore, and Snowflake – IMPACT helps save time lesson planning with lots of resources. Available in three sizes 65”, 75” and 86”, each panel is 4K with 20 points of touch, comes with an optional slot in PC and runs on Android 8. All IMACT screens have Cleverstore, which has hundreds of educational apps to keep young minds learning. Also included is the cloud-based LYNX Whiteboard for lesson planning and deployment and Snowflake software as standard. Every screen runs OTA updates and comes with Mobile Device Management to run diagnostics on each screen.

UX Pro interactive LED flat panelsflat-panels are designed for the modern meeting space and isare available in four sizes - 55”, 65”, 75” and 86”. With 4K resolution, 20 points of touch and built-in collaboration screen sharing with touchback capabilities, the UX Pro is built around meeting requirements with Stage software to enable remote meetings in which participants can annotate on documents, while the launcher will give instant access to favorite unified communication apps at the touch of a button. Running Android 8 with an optional slot in PC, the UX Pro is designed to run and fit into any technology set up. Key features include built-in line array microphone for meetings; proximity sensors that boot up the screen or shuts down the screen when the room is not in use; enhanced USB-C connectivity and device charging; cloud accounts to log into personal settings and cloud drives; built-in digital signage to display messages; every screen runs OTA updates and comes with Mobile Device Management to run diagnostics on each screen; and Clevershare to enable instant screen sharing through the app or dongle to engage and enhance collaboration.

ClevershareClevershare

Clevershare allows users to share content with any device from either the dongle and the USB C connection or the Clevershare app. Up to 50 devices can connect with the Clevertouch screen and share content – images, video, and audio with touch-back for two-way control. The presenter has full control over what is shared and can show up to four device screens simultaneously, increasing collaboration and participation within every session.

CleverLive Digital Signage

CleverLive is a unique cloud-based cloud management platform (or CMP) for managing all Clevertouch device endpoints, designed to customize the user interface based on device functionality, CleverLive combines simplicity of use with feature rich functionality. The platform comes

as standard with 200+ editable templates enabling a mix of multimedia content. Features include built-in presentation creation tools for designing bespoke layouts, wayfinding screens and touch interfaces, scheduling, grouping, instant emergency messaging, and QR code creation and display for an audience interactive experience. Rounding off the unique features is the built-in Cleverstore from which users can download apps for their touch screens.

The CM Series non-touch large format professional display for meeting presentations and digital signage is available in six sizes - 43′′, 49′′, 55′′, 65′′, 75′′, and 86′′. This 4K UHD, non-touch meeting room collaboration screen has wireless display connectivity and RS232 control for professional meeting room integration with control systems. The built-in Android system includes the CleverLive app for managing digital signage content of full screen capacity or can be

packaged with a Clevertouch Media Player to enhance digital signage playout multimedia functionality. With 16/7 display, the CM Series has a built-in scheduler to manage on/off timing of messages, including instant messaging when needed. The CleverLive digital signage feature sets this display apart from screens in the marketplace.

Live Rooms is a room booking solution that simplifies the meeting room booking process. Live Rooms features a 10” tablet that is manufactured with integrated room booking and digital signage software to deliver a powerful product to a busy marketplace. The tablet features red and green LED side lighting for instant availability recognition and is capable of at-the-source and calendar (O365 and ME) room booking with instant updates, to prevent booking overlaps. With analytics that identify users, rooms booked, frequencies and more, Live Rooms offers a smart room booking solution that, when not in use, can also serve as digital signage and provide

send instant messages for emergency alerts.

As the enterprise-level media player, the PRO V4 allows organizations to engage with their audience 24/7 or deploy dedicated messages via power scheduling for startup/shutdown and auto reboots. A slimline design, power boosting WIFI connectivity, and both HDMI and DisplayPort Outputs enables connection to multiple screens, the PRO V4 can be connected to a kiosk or UX Pro for touch interaction or a non-touch screen for feature-rich digital signage. The PRO V4 can connect to Clevertouch physical button technology for managing

emergencyemergencies and instant messaging away from the CMP. With multimedia-zoned presentation playout, the PRO V4 can livestream web pages and URL KPIs, text, images, videos, posters, RSS Feeds, social media content, audio, and more.

PICO MK 5 is a mid-range media player with 24/7 playout capability, WIFI connectivity, and is designed for multimedia-zoned presentations with text, images, videos, posters, RSS Feeds, social media content, and audio.

CleverWall is an all-in-one intelligent display solution, for enriched interaction in large spaces, lecture halls, meeting rooms, and more. This videowall solution is available in nine sizes – 120", 138”, 150”, 165”, 180”, 199”, 220”, 249”, and 299”, the latter three being ultra-wide options or larger spaces like lecture halls. The large displays with in-built audio system and 178-degree viewing angle

create an immersive user experience that is unmatched. Its plug-and-play design – one button on/off and smart remote control – make this LED solution user-friendly. Standard features include built-in Android technology, realtimereal-time wireless screen-sharing from up to four devices simultaneously, synchronized annotating from multiple devices, and syncing with CleverLive accounts for messaging (instant and scheduled) to all displays for campus or location-wide communication.

MimioPro Series 4 adds power to any learning ecosystem – a true Connected Classroom. The MimioPro 4 is a touchscreen UHD HDR display with 20 points of touch, digital passive pen and eraser, and comes in three sizes – 65”, 75” and 86”. Its natural user interface and rich features support teachers to effectively and efficiently realize learning objectives. For example, in Windows Ink compliant applications such as Office 365, the passive digital pen draws, the eraser block erases digital ink (while cleaning the glass), and touches provide gestures without having to use the software’s user interface. The MimioPro 4 has a custom inbuilt Android 11 Launcher tailored for an interactive large screen and comes with: LYNX whiteboarding app to create and capture outcomes, share content, collaborate, and distribute ad-hoc content via cloud services through a dynamic QR code;

CleverShareClevershare mirroring app used on all models of Boxlight Interactive

Flat PanelFlat-Panel Displays that allows teachers to orchestrate up to six simultaneous displays across Windows, Chrome OS, Android and iOS, and casting of the MimioPro 4 to all the devices in a classroom; NDMS (Network Device Management Systems), a cloud-based device management system to remotely manage displays, troubleshoot, message, and schedule; and CleverStore – app store which houses curated Android applications that are safe for teachers to install onto the display.

Mimio DS Series Non-Interactive Display

The Mimio DS Series displays are high-definition displays that feature enhanced color calibration, precise picture quality adjustment, flicker-free and anti-glare viewing and are available in six sizes – 43", 55”, 65”, 75”, 86”, and 98”. The Mimio DS series runs on Android 11 with seamless OTA upgrading, includes a quad-core CPU, 4 GB of RAM, and an invisible IR receiver. Connectivity is made easy with multi-functional USB Type-C ports that enable 4K audio and video transmission, network connections, charging external devices, and provide access to external microphone and camera. The displays can be orientated vertically or horizontally and tilt up to 15-degree for easy viewing from high places. Multiple displays can daisy chain via HDMI ports, up to 3 by 3, and create a larger, unified display through screen splicing. The displays come with

the CleverLive management and digital signage platform for enhanced control of content on all displays.

MimioWall LED all-in-one display solution

isdesignedis designed to enrich any space, including classrooms, entryways, hallways, shared spaces, and more. Available in nine different sizes (120” - 299”) including three ultra-wide screen options, the 4K UHD Android digital display and built-in speakers provide users an exceptional and immersive experience. Key features include integrated design with no external devices; 3-in-1 board that integrates power supply, a receiving card, and hub board; smart remote-control access to settings; plug-and-play system with one button on/off; and unified hardware. MimioWall enables users to screen-share wirelessly to/from up to four devices (smartphones, tablets, laptops) simultaneously. Also comes with CleverLive digital signage platform to deliver campus- and site-wide communication of information, announcements, and emergency alerts.

MimioTeach Interactive Whiteboard

MimioTeach is one of our best known and longest-lived products. Hundreds of thousands of MimioTeach portable digital interactive whiteboard systems and its predecessor models are used in classrooms around the world. MimioTeach can turn any whiteboard (retrofit) into an interactive whiteboard in as little as 30 seconds. This portable product fits into a tote bag with room for a small desktop projector, which is attractive to teachers who move from classroom to classroom. For schools where “change is our normal,” MimioTeach eliminates the high cost of moving fixed-mount implementations.

MimioFrame can turn a projection (dry erase) board into an Interactive Whiteboard in 10-15 minutes. Millions of classrooms already have a conventional whiteboard and a non-interactive projector. MimioFrame uses infrared (IR) technology embedded in the four sides of the frame to turn that non-interactive combination into a modern 10touch-interactive Digital Classroom. No drilling or cutting is required, MimioFrame easily and quickly attaches with industrial-strength double-sided tape.

Classroom Audio and School-wide Communication Category

Juno® is the towering standard of sound quality that reinforces a teacher’s voice so that every student gets a FrontRow seat. Juno sets up in minutes — and yet evenly fills the classroom with the kind of exciting, multi-layered stereo sound typical of larger installed systems. Juno is superior to other products in the classroom audio category, offering premium features such as feedback suppression, digital EQ, Bluetooth, and teacher voice priority. Juno is also uniquely expandable, with the ability to add modules for additional microphones, speakers, analog page override, and Conductor compatibility for networked campus communication.

EzRoom™ is an integrated AV solution designed for larger capital projects such as technology retrofits or new school construction. A highly customizable solution, EzRoom offers wall and ceiling mountable enclosures with pre-installed options customized for a school’s needs, simplifying the installation process for AV integrators (resellers). EzRoom is an “everything but the display” solution, providing sound reinforcement, microphones, speakers, AV control devices, AV wall plates, and networked cameras. The depth and breadth of the solution necessitates a service layer of pre-sale and post-sale support for the channel, supplied by FrontRow architectural/engineering consultant liaisons, providing design support, and the FrontRow Technical Services Group, offering system commissioning and customization. EzRoom

can use FrontRow’s SmartIR transmission technology or take advantage of FrontRow’s latest wireless voice technology – ELEVATE – that boasts the benefits of digital RF (Radio Frequency) microphone systems, combined with flexible programmability and ease-of-use features found nowhere else. The ELEVATE teacher microphone can be used as a wearable alert device, notifying administrators of urgent situations in the classroom.

The Lyrik™ amplification solution is a small yet portable system for instruction and audio media to be heard

anywhere;anywhere, from the classroom to the bus line, or even online. The tower has an integrated rechargeable battery and can be connected to a computer or other auxiliary audio source either directly using cables or wirelessly using Bluetooth®. Weighing less than 10 pounds, Lyrik is designed to be taken anywhere voice reinforcement is needed whether on campus or off.

The Conductor™ School Communication System is an IP-based, campus-wide communication and control solution that allows administrators to manage their day-to-day operations with Bells, Paging, Intercom, and Alerts. Built on a client-server architecture that utilizes a school’s existing network, Conductor streams digital audio directly to FrontRow

ezRoomEzRoom and Juno Connect equipped classrooms, and interfaces with legacy analog paging systems for common areas to provide comprehensive audio coverage for announcements and alerts. The recently introduced Attention! feature integrates the CleverLive digital signage service with Conductor to synchronize audio with visual alerts to Clevertouch and Mimio interactive panels to maximize the impact of school-wide or zone-specified communications.

Through the acquisitions of Modern Robotics, Robo3D and MyStemKits, Boxlight has added to its portfolio a growing category of STEM (science, technology, engineering, and math) products.

The Mimio MyBot system bridges the gap between learning about robotics in the classroom and the application of robotics in the real world. The intuitive and accessible system helps students develop core skills in programming, engineering, and robotics. We provide a system to facilitate learning and ignite a passion in students with the freedom and flexibility to build, code, and test new and unique models. Mimio MyBot allows students to explore and learn freely while removing common obstacles such as requiring network infrastructure changes or expensive workstations.

Robo3DRobo3D

Robo E3, and the Robo E3 Pro are smart, safe, and simple 3D printers that come with access to over 300+ lessons of 3D printable STEM curriculum, replacement materials and accessories.

MyStemKits offers hundreds of standards-driven lesson plans, activities, assessments, and Design Challenges for grades K-12 math and science teachers. High-quality lessons plans are developed and studied by The Florida Center for Research in Science. Technology, Engineering, and Mathematics (FCR-STEM), which is part of one of the nation’s oldest and most productive university-based education research organizations.

MimioView document camera

Boxlight’s MimioView 350U is a 4K document camera that is integrated with MimioStudio to make the combination easy to use with a single cable connection that carries power, video, and control. MimioView 350U is fully integrated into our MimioStudio software solution and is controlled through MimioStudio’s applications menu. With two clicks, the teacher or user can turn on, auto-focus, and illuminate the included LED lights for smooth high-definition images.

Educational Software Category

The Mimio suite of software and applications is a combination of titles from acquisitions of Mimio, Qwizdom, and Sahara (Clevertouch) - leading brands in the IWB and Formative Assessment Software Categories, and since then capabilities have been built upon that IP. The premise of our software is to provide the “glue” that integrates the hardware to provide a Connected Classroom; help educators inform their decisions in the classroom, through more systematic data about their students’ performance and behaviors; make learning more engaging, interactive, accessible, and innovative; and support teachers in becoming more efficient in planning, preparation, reporting and analysis, and effective in instruction and assessment.

MimioStudio Interactive Instructional Software

MimioStudio Interactive Instructional Software enables the creation, editing, and presentation of interactive instructional lessons and activities. These lessons and activities can be presented and managed from the front of the classroom using any of Boxlight’s front-of-classroom display systems including MimioTeach, ProColor Interactive LED panels, MimioPro 4, and MimioFrame. MimioStudio can also be operated using a mobile device such as an iPad or tablet that fully replicates the front-of-classroom display generated by MimioStudio. Operation with a mobile device is enabled via the three-user license for MimioMobile, provided with the MimioStudio license that accompanies all front-of-classroom devices from Mimio.

MimioMobile Collaboration and Assessment Application

The introduction of MimioMobile, a software accessory for MimioStudio, in 2014 introduced a new era of fully interactive student activities that are directly and immediately able to be displayed on the front-of-classroom interactive displays through MimioStudio.

MimioMobile allows fully interactive activities to be pushed to student classroom devices. The students can manipulate objects within the activities, annotate “on top” of them, and even create completely new content on their own handheld devices. MimioMobile also enables assessment using mobile devices. The teacher can create multiple choice, true\false, yes\no, and text entry assessment questions. The students can respond at their own pace and their answers are stored within MimioStudio from which the teacher can display graphs showing student results. This “continuous assessment” provides formative assessment that can help guide the teacher as to whether to re-teach the material if understanding is low or move forward in the lesson. We believe that this interactive and student dependent instructional model can dramatically enhance student outcomes.

OKTOPUS Instructional and Whiteboarding Software

Designed specifically for touch-enabled devices, OKTOPUS Interactive Instructional Software enables the creation, editing, and presentation of interactive instructional lessons and activities. More than 70 interactive widgets, tools, and classroom game modes make it simple and fun to run ad-hoc or pre-planned sessions. Similar to MimioStudio, these lessons and activities can be presented and managed from the front of the classroom using any of Boxlight’s front-of-classroom display systems.

Notes+ Collaboration and Assessment Application

Notes+ is a software accessory for use with OKTOPUS Software or a PPT plugin that allows students to view and interact with the teacher presentation during a live class session. Students can answer questions, annotate, request help, and share content with the main display from nearly any mobile device or laptop. Question types supported include multiple choice, multiple mark, yes/no, true/false, sequencing, numeric and text response.

GameZones Multi-student Interactive Gaming Software

GameZones allows up to four students to work simultaneously on a touch screen or tablet to complete interactive ‘game style’ activities. The solution is extremely simple and easy to use and includes over 150 educational activities.

MimioConnect Student Engagement Platform

MimioConnect is an online student engagement platform that combines innovative lesson building and instructional tools to create an active learning environment. Teachers can create interactive content and assessments from scratch, import existing lessons and content, or draw from 10,000+ premade digital lessons in the lesson library. Built-in tools for collaboration, instant polling, assessment, student monitoring and management, make classroom teaching and discussion more impactful. Other modes extend usage outside of the classroom, allowing students to complete homework or review daily lessons at their own pace. MimioConnect also integrates deeply with all the major LMS (Learning Management System). Users can sign in and access assignments through their LMS, use existing rosters, and pass data back to the LMS. MimioConnect helps teachers and students connect, collaborate, and learn more effectively from anywhere, making it a perfect solution for inside and outside the classroom. A MimioConnect Classroom license (lifetime) and MimioConnect Pro license (1 year) accompanies all front-of-classroom Boxlight displays.

Designed for interactive displays, LYNX Whiteboard is a free-to-use lesson building app, enabling student collaboration and allowing teachers to bring vibrancy to their lessons with a built-in media search. In addition, LYNX Whiteboard provides searchable images,

gifsGIFs and videos, allowing users to drag content into whiteboard presentations, all in a safe search enabled environment. With teacher favorites, such as Rainbow Pen and Spotlight included, as well as interactive learning tools, LYNX Whiteboard is packed with features to make lessons flow seamlessly.

Peripherals and Accessories

We offer a line of peripherals and accessories, mobile carts, installation accessories, and adjustable wall-mount accessories that complement our entire line of interactive LED

flat panelsflat-panels and audio solutions.

LessonCam Instructional Camera

The FrontRow LessonCam is a high-definition Pan, Tilt, Zoom (PTZ) instructional camera with 12x optical zoom, enabling dynamic and engaging remote-only, hybrid, or asynchronous learning. LessonCam integrates with the FrontRow ezRoomEzRoom and Juno classroom audio systems with popular video conferencing solutions such as Microsoft Teams, Microsoft Skype, Zoom, Google Meet, and Cisco Webex. LessonCam is a stand-out educational tool for teachers who want to engage with students wherever they are learning.

Our

ever growingEver-growing suite of Clevertouch products includes a variety of Clever Peripherals such as OPS PC modules, which is a windows i5 and i7 modular PC, and our sensor module which plugs into the Clevertouch screens and measures temperature, humidity CO2 and air quality as well as an NFC.RFID sensor for logging into screens. In addition, we also offer our Clever Connect device that allows users to mirror directly to the screen. These and other Clever Peripherals continue to enhance the user experience of our Clevertouch displays.

Boxlight-EOS Professional Development

Mimio strives to provide the best tools to help teachers improve student outcomes. Through our subsidiary, EOS Education, we can extend our commitment to schools and districts by providing a rich portfolio of classroom training, professional development, and educator certification. EOS Education provides engaging and differentiated professional development for teachers to ensure that every student benefits from the technology tools available in their classrooms and schools. Programs can be customized, building comfort, confidence, and competence using the specific hardware and software platforms available to each teacher.

EOS Education unique professional learning experiences are:

| ● | Teacher-centric - We help teachers use the technology they have access to for their specific instructional purposes—we go beyond just point and click. |

| ● | Hands-on - Teachers have an opportunity to practice new technical skills during sessions. |

| ● | Differentiated - Adjusted to current skills, knowledge, and teachers’ in-classroom practices. |

| ● | Job-embedded - Grounded in day-to-day teaching to be relevant, engaging, and practical to implement. |

| ● | Student context - Introducing technology tools to students and how to engage them with purpose. |

•Teacher-centric - We help teachers use the technology they have access to for their specific instructional purposes—we go beyond just point and click.

•Hands-on - Teachers have an opportunity to practice new technical skills during sessions.

•Differentiated - Adjusted to current skills, knowledge, and teachers’ in-classroom practices.

•Job-embedded - Grounded in day-to-day teaching to be relevant, engaging, and practical to implement.

•Student context - Introducing technology tools to students and how to engage them with purpose.

We

plan to centralizehave centralized our business management for all acquisitions through an enterprise resource planning (ERP) system which offers streamlined subsidiary integration utilizing a multi-currency platform. We have strengthened and refined the process to drive front-line sales forecasting to factory production. Through the ERP system, we have synchronized five separate accounting and customer relationship management systems through a cloud-based interface to improve inter-company information sharing and allow management of the Company to have immediate access to snapshots of the performance of each of our subsidiaries in a common currency. As we grow, organically or through acquisition, we plan to quickly integrate each subsidiary or division into the Company to allow for clearer and earlier visibility of performance to enable

for timely and effective business decisions.

Logistics is currently provided in the US by our Lawrenceville, Georgia facility and internationally by the Sahara team in London. Together these teams manage multiple third-party logistics partners throughout the world (3PL’s). These 3PL partners allow Boxlight to provide affordable freight routes and shorter delivery times to our customers by providing on-hand inventory in localized markets. Contract manufacturing for Boxlight products is through original design manufacturer (ODM) and original equipment manufacturer (OEM) partners according to Boxlight’s specific engineering specifications and utilizing IP developed and owned by Boxlight. Boxlight’s factories for ODM and OEM are located in the USA, Taiwan,

Mainland China,

Germany, and

Germany.Turkey.

Technical Support and Service

The Company currently has its core technical support and service centers located near Atlanta, GA, London, England, and Belfast, Northern Ireland. Additionally, the Company’s technical support division is responsible for the repair and management of customer service cases, resulting in more than 60% of the Company’s customer service calls ending in immediate closure of the

applicable service case. We accomplish this as a result of the familiarity between our products and having specialized customer service technicians hired internally and with key partners in certain international markets.

Our sales force consists of

5356 account managers in EMEA including an EMEA sales director,

4341 regional account managers in the

USU.S. including

ourtwo Vice

PresidentPresidents of Sales

US,U.S., four sales heads based in Canada,

three sales heads in Northern Ireland, two in Australia, and one in Latin

America and one in Australia.America. Our marketing team consists of our Vice President of Marketing Communications, a

senior manager of marketing,

coordinator,four marketing specialist, an education specialist, and a graphic designer. Our sales force and marketing teams primarily drive sales of all Boxlight products (including our Mimio, Clevertouch, FrontRow and EOS brands) throughout North, Central and South America, Europe, the Middle East and Asia. In addition, we go to market through an indirect channel distribution model and utilize traditional value-added resellers and support them with training to become knowledgeable about the products we sell. We currently have approximately 800 resellers.

We believe we offer the most comprehensive product portfolio in today’s education technology industry, along with best-in-class service and technical support. Our award-winning, interactive classroom technology and easy to use line of classroom hardware and software solutions provide schools and districts with the most complete line of progressive, integrated classroom technologies available worldwide.

We are also developing our Corporate, Higher Education and Government solutions and have separate sales teams in both the USU.S. and EMEAin other countries focused on these areas. Our expectation is that over time, opportunity in these areas will expand to be as large or potentially larger than our K-12 Education business.

The interactive education industry is highly competitive and characterized by frequent product introductions and rapid technological advances that have substantially increased the capabilities and use of interactive

flat panelsflat-panels and interactive whiteboards. Interactive displays, since the time they were first introduced, have evolved from a high-cost technology that involves multiple components requiring professional installers, to a one-piece technology that is available at increasingly reduced-price points and affords simple installations. With lowered technology entry barriers, we face heated competition from other interactive display developers, manufacturers and distributors. We compete with other developers, manufacturers and distributors of interactive displays and personal computer technologies, tablets, television screens and smart phones, such as Smart Technologies, Promethean, ViewSonic, Dell Computers, Samsung, Panasonic and ClearTouch.

Even with these competitors, the market presents new opportunities in responding to demands to replace outdated and failing interactive displays with more affordable and simpler solution interactive displays. Our ability to integrate our technologies and remain innovative and develop new technologies desired by our current and potential new contract manufacturing customers will determine our ability to grow our contract manufacturing divisions. In addition, we have begun to see expansion in the market

tofor sales of complementary products that work in conjunction with the interactive technology, including software, audio solutions, data capture and tablets.

As of December 31, 2022,2023, we had the following distribution of employees:

|

Operations | | |

Operations

| | 44

|

Sales & Marketing | | 98117

|

Administration | | 4521

|

Total | | 187228

|

All of our employees are full-time employees. None of our employees are represented by labor organizations. We consider our relationship with our employees to be excellent. A majority of our employees have entered into non-disclosure and non-competition agreements with us or our operating subsidiaries.

On December 31, 2021, the Company and substantially all of its direct and indirect subsidiaries, including Boxlight, FrontRow, and Sahara as guarantors

(together the "Loan Parties"), entered into a maximum four-year $68.5 million term loan credit facility, dated December 31, 2021 (the “Credit Agreement”), with WhiteHawk Finance LLC, as lender (the “Lender”), and WhiteHawk Capital Partners, LP, as collateral agent (“the Collateral Agent”). Under the terms of the Credit Agreement, the Company received an initial term loan of $58.5 million on December 31, 2021 (the “Initial Loan”) and obtained a delayed draw facility of up to $10 million (the “Delayed Draw”). The Initial Loan and the Delayed Draw are collectively referred to as the Term Loans. The “Term Loans” bear interest at the LIBOR rate plus 10.75%; provided that after June 30, 2022, if the Company’s Senior Leverage Ratio (as defined in the Credit Agreement) is less than 2.25, the interest rate would be reduced to LIBOR plus 10.25%. Such terms are subject to the Company maintaining a borrowing base in

terms compliantcompliance with the Credit Agreement.

The proceeds of the Initial Loan were used to finance the Company’s acquisition of FrontRow and pay off all indebtedness owed to our then lenders.

The terms of the Credit Agreement and related loans are described in more detail in the section entitled “Management’s Discussion and Analysis of Financial Conditions and Results of Operations.” Of the Initial Loan, $8.5 million, was subject to repayment on February 28, 2022, with quarterly principal payments of $625,000 and interest payments commencing March 31, 2022, and the $40.0 million remaining balance plus any Delayed Draw loans becoming due and payable in full on December 31, 2025.

In conjunction with its receipt of the Initial Loan, the Company issued to the Lender (i) 528,16966,022 shares of Class A common stock (the “Shares”), which Shares were registered pursuant to our existing shelf registration statement and were delivered to the Lender in January 2022, (ii) a warrant to purchase 2,043,291255,412 shares of Class A common stock (subject to increase to the extent of 3% of any Series B and Series C convertible preferred stock converted into Class A common stock), exercisable at $2.00$16.00 per share (the “Warrant”), which Warrant may be subject to repricing on March 31, 2022 based on the arithmetic volume weighted average prices for the 30 trading days prior to March 31, 2022, in the event our stock is then trading below $2.00$16.00 per share, (iii) a 3% fee of $1,800,000 and (iv) a $500,000 original issue discount. In

addition, the Company agreed to register for resale the shares issuable upon exercise of the Warrant. The Company also incurred agency fees, legal fees and other costs in connection with the execution of the Credit Agreement. Based on the arithmetic volume weighted average prices of the Company’s Class A common stock for the 30 trading days prior to March 31, 2022, the exercise price of the Warrant was reduced to

$1.19$9.52 per share and the shares increased to

3,434,103.429,263. On July 22, 2022, the Company entered into a Securities Purchase Agreement with an accredited institutional investor. According to the terms of the

WhiteHawk agreement,Credit Agreement, this purchase agreement triggered a reduction of the exercise price of the

warrants.Warrants. The

warrantsWarrants were repriced to

$1.10$8.80, and shares increased to

3,715,075.On March 29, 2022, the Company received a notice from the collateral agent, alleging, among other things, defaults as a result of (i) failure to repay $8.5 million of the facility by February 28, 2022, (ii) non-compliance with the borrowing base resulting in the Company being in an over advance position under the Credit Agreement, and (iii) failure to timely provide certain reports and documents. As a result, all accrued and unpaid interest owed under the Term Loan, became subject to a post-default interest rate equal to the highest interest rate allowed for under the Credit Agreement plus 2.50% until such time as the events of default were either waived or cured.

464,385.

In February 2022,

WhiteHawkthe Lender and the Company agreed in principle to an extension of the February 2022 Payment. Pursuant to amendment to the Credit Agreement, dated April 4, 2022, the Collateral Agent and Lender agreed to extend the terms of repayment of the $8.5 million originally due on February 28, 2022 until February 28, 2023 and waive and/or otherwise extend compliance with certain other terms of the Credit Agreement in order to allow the Loan Parties adequate time to comply with such

terms.terms (the “First Amendment”). In July 2022, the Company and

WhiteHawkthe Lender agreed that the notice had inadvertently included the default with respect to the failure to repay $8.5 million of the facility. As a result, notwithstanding the notice, both

WhiteHawkthe Lender and the Company have agreed that the Company was not in default in making the February 2022 Payment to

WhiteHawk.the Lender.

The principal elements of the April amendmentFirst Amendment included (a) an extension of time to repay $8.5 million of the principal amount of the term loan from February 28, 2022 to February 28, 2023, and (b) forbearance on $3,500,000 in over advances until May 16, 2022 to allow the Company to come into compliance with the borrowing base requirements set forth in the Credit Agreement. In such connection, the Loan Parties have obtained credit insurance on certain key customers whose principal offices are located in the European Union and Australia as, without the credit insurance, their accounts owed to the Loan Parties had been deemed ineligible for inclusion in the borrowing base calculation primarily due to the perceived inability of the Collateral Agent to enforce security interests on such

accounts. In addition, the Lender and Collateral Agent agreed to (i) reduce, through September 30, 2022, the minimum cash reserve requirement for the Loan Parties, (ii) reduce the interest rate by 50 basis points (to LIBOR plus 9.75%) after delivery of the Loan Parties’ September 30, 2023 financial statements, subject to the Loan Parties maintaining 1.75 EBITDA coverage ratio, and (iii) waive all prior Events of Default (as defined therein) under the Credit Agreement. In conjunction with the amendmentthis First Amendment to the Credit Agreement, the parties entered into an amended and restated fee letter (the “Fee Letter”) pursuant to which the parties agreed to prepayment premiums of (i) 5% for payments made on or before December 31, 2022, (ii) 4% for payments made between January 1, 2023 and December 31, 2023, and (iii) 2% for payments made between January 1, 2024 and December 31, 2025. Furthermore, the parties agreed that no prepayment premiums would be payable with respect to the first $5.0 million paid under the Term Loan, any payments made in relation to the $8.5 million due on or before February 28, 2023, any required amortization payments under the Credit Agreement and any mandatory prepayments by way of ECF or casualty events.

On March 29, 2022, the Company received a notice from the Collateral Agent, alleging, among other things, defaults as a result of (i) failure to repay $8.5 million of the facility by February 28, 2022, (ii) non-compliance with the borrowing base resulting in the Company being in an over advance position under the Credit Agreement, and (iii) failure to timely provide certain reports and documents. As a result, all accrued and unpaid interest owed under the Term Loan, became subject to a post-default interest rate equal to the highest interest rate allowed for under the Credit Agreement plus 2.50% until such time as the events of default were either waived or cured.

On April 4, 2022, the Collateral Agent and Lender agreed to extend the terms of repayment of the $8.5 million originally due on February 28, 2022 until February 28, 2023. The principal elements of the April amendment included (a) an extension of time to repay $8.5 million of the principal amount of the term loan from February 28, 2022 to February 28, 2023, and (b) forbearance on $3.5 million in over advances until May 16, 2022 to allow the Company to come into compliance with the borrowing base requirements set forth in the Credit Agreement. In such connection, the Loan Parties obtained credit insurance on certain key customers whose principal offices are located in the European Union and Australia as, without the credit insurance, the accounts of these key customers had been deemed ineligible for inclusion in the borrowing base calculation primarily due to the perceived inability of the Collateral Agent to enforce security interests on such accounts. In addition, the Lender and Collateral Agent agreed to (i) reduce, through September 30, 2022, the minimum cash reserve requirement for the Loan Parties, (ii) reduce the interest rate by 50 basis points (to Libor plus+ 9.75%) after delivery of the Loan Parties’ September 30, 2023 financial statements, subject to the Loan Parties maintaining 1.75 EBITDA coverage ratio, and (iii) waive all prior Events of Default under the Credit Agreement. Furthermore, the parties agreed that no prepayment premiums would be payable with respect to the first $5.0 million paid under the Term

Loan, any payments made in relation to the $8.5 million due on or before February 28, 2023, any required amortization payments under the Credit Agreement and any mandatory prepayments by way of excess cash flow or casualty events.

On June 21, 2022, the Company and substantially all of its direct and indirect subsidiaries,

(together with the Company, the “Loan Parties”), entered into a second amendment (the “Second Amendment”) to the

four-year term loan credit facility, originally entered intoCredit Agreement December 31, 2021 and as amended on April 4, 2022, with the Collateral Agent and Lender. The Second Amendment to the Credit Agreement was entered into for purposes of the Lender funding a $2.5 million delayed draw term loan and adjusting certain terms to the Credit Agreement, including adjusting the Applicable Margin (as defined in the Second Amendment) to 13.25% for LIBOR Rate Loans and 12.25% for Reference Rate Loans, increasing the definition of change of control from 33% voting power to 40% voting power, requiring the Company to engage a financial advisor, and allowing additional time, until July 15, 2022, for the Company to come into compliance with certain borrowing base requirements set forth in the Second Amendment to the Credit Agreement, among other adjustments.

On April 24, 2023, the Loan Parties entered into a third amendment (the “Third Amendment”) to the Credit Agreement, with the Collateral Agent and the Lender. The Third Amendment was entered into for purposes of the Lender funding an additional $3.0 million delayed draw term loan (the “Additional Draw”). The Additional Draw was funded on April 24, 2023, must be repaid on or prior to September 29, 2023, and is not subject to any prepayment penalties, and adjusts certain terms to the Credit Agreement, including adjusting the test period end dates and corresponding Senior Leverage Ratios (as defined in the Credit Amendment) and revising the minimum liquidity requirements that the Company must maintain compliance with pertaining to certain Borrowing Base Requirements, among other adjustments. The completion of the Additional Draw eliminates further delayed draws under the Credit Agreement. On July 20, 2023, the Company paid the $3.0 million due under the terms of the Third Amendment. There were no prepayment penalties or premiums included with this payment.