0001562528bsprt:CollateralizedLoanObligationsIssuedin2018FL4Memberbsprt:U.S.BankNationalAssociationMemberus-gaap:SecuredDebtMember2020-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | | | | |

| (Mark One) |

☒x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20212023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to __________

Commission file number: 000-55188001-40923

FRANKLIN BSP REALTY TRUST, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Maryland | | 46-1406086 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| 1345 Avenue of the Americas, Suite 32A, New York, NY | | 10105 |

| (Address of principal executive offices) | | (Zip Code) |

| (212) 588-6770 |

| (Registrant's telephone number, including area code) |

| | | | | | | | |

| Securities registered pursuant to section 12(b) of the Act |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | FBRT | New York Stock Exchange |

| 7.50% Series E Cumulative Redeemable Preferred Stock, par value $0.01 per share | FBRT PRE | New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act: |

Series F Convertible Preferred Stock, par value $0.01 per share |

(Title of Class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company", and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☐x | | Accelerated filer | ☐ |

| Non-accelerated filer | ☒☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicatedindicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes x No

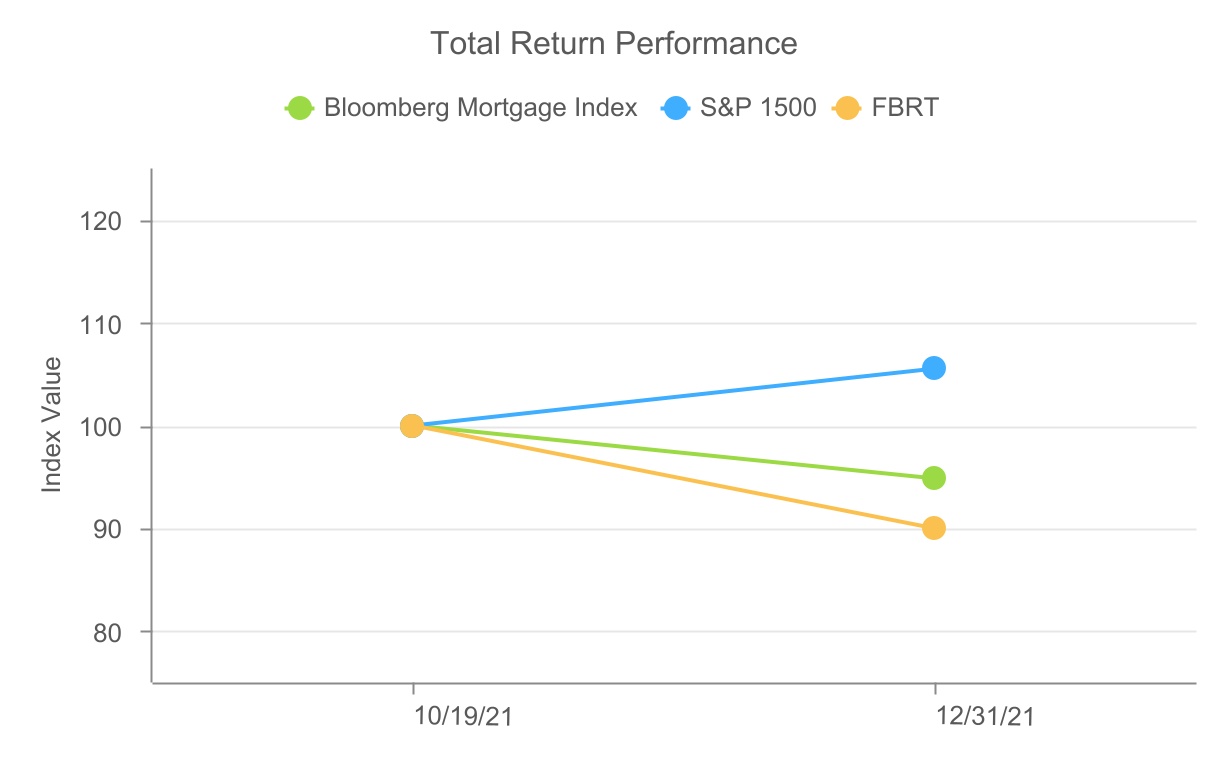

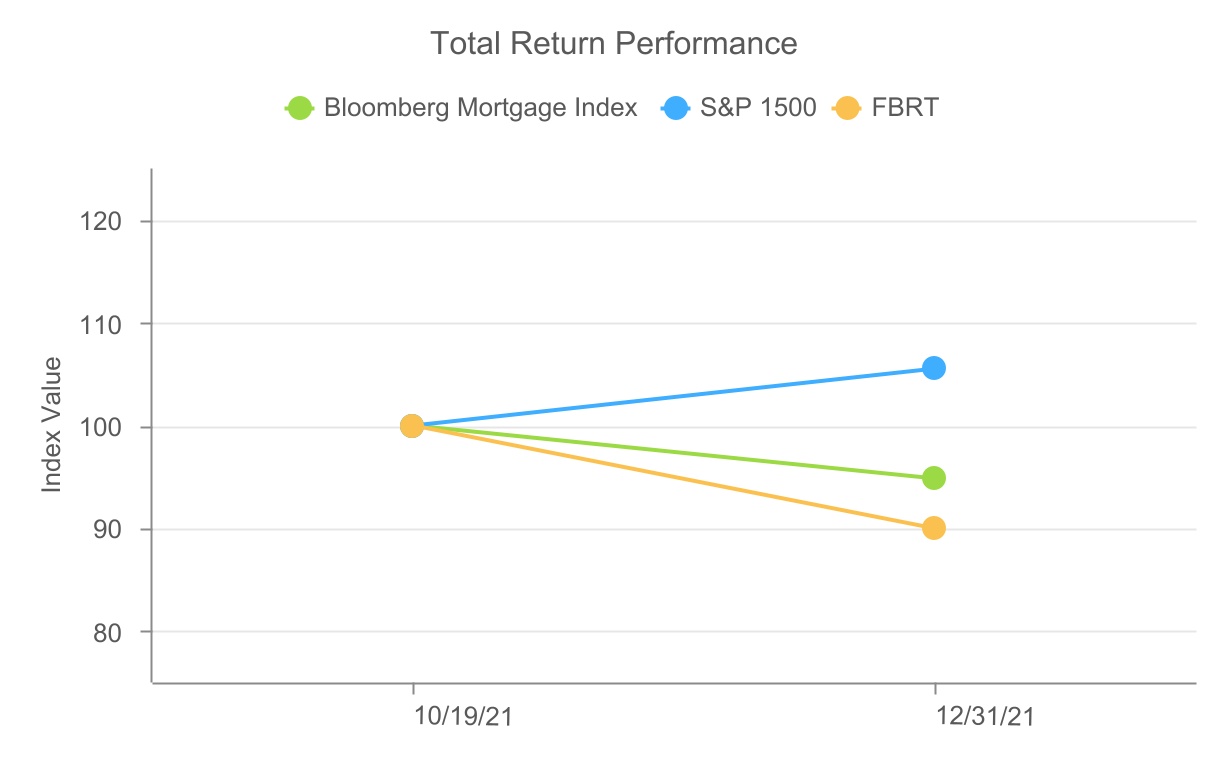

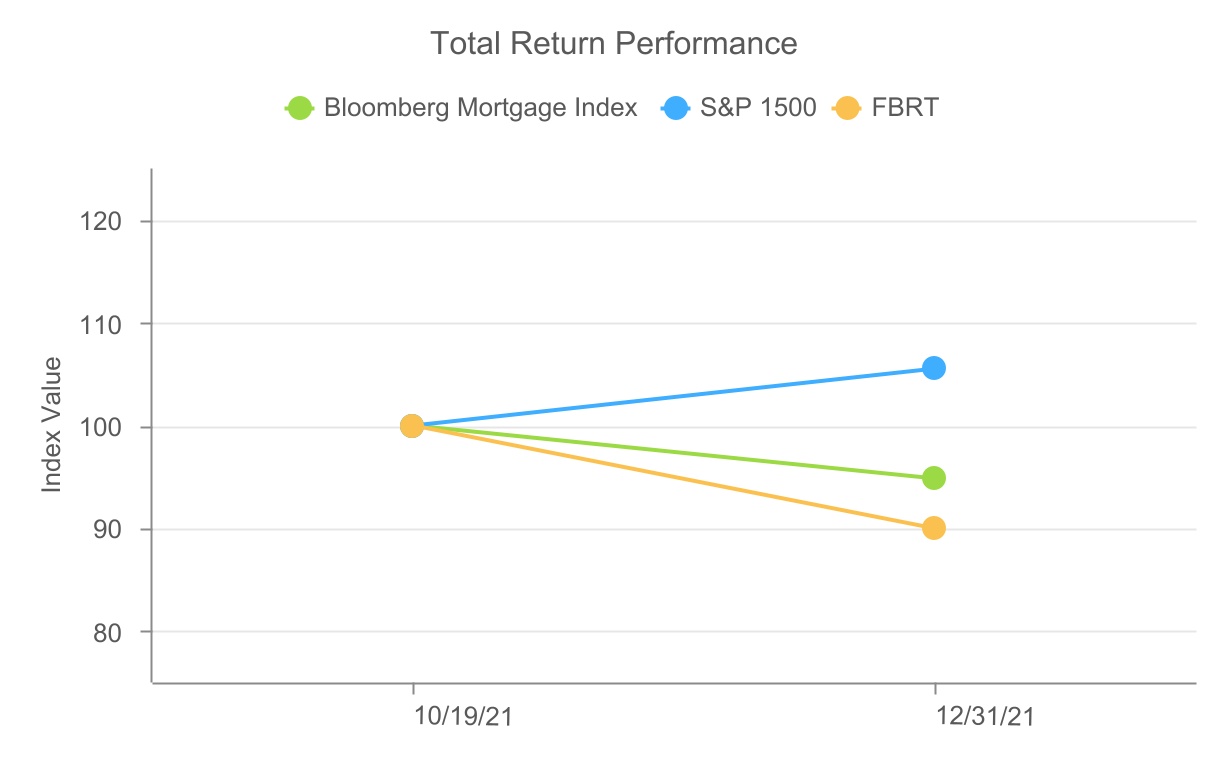

AsThe aggregate market value of the voting and non-voting common equity (not including shares of common stock underlying outstanding shares of convertible preferred stock) held by non-affiliates as of June 30, 2021 there2023 was no established public market for the registrant's shares of common stock. The registrant’s common stock commenced trading on the facilities of the New York Stock Exchange on October 19, 2021. As of December 31, 2021, the market capitalization of the registrant's common stock(not including preferred stock that will automatically convert to common stock in 2022) was $656,850,964.$1,114.5 million. See Part II, Item 5, “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.”

The number of outstanding shares of the registrant's common stock on February 17, 20227, 2024 was 43,957,36382,122,502 shares.

DOCUMENTS INCORPORATED BY REFERENCE

None.Portions of the definitive proxy statement to be filed by Franklin BSP Realty Trust, Inc. with the Securities and Exchange Commission pursuant to Regulation 14A relating to the registrant’s Annual Meeting of Stockholders to be held on May 29, 2024 will be incorporated by reference in this Form 10-K in response to Items 10, 11, 12, 13 and 14 of Part III. The definitive proxy statement will be filed with the SEC not later than 120 days after the registrant’s fiscal year ended December 31, 2023.

FRANKLIN BSP REALTY TRUST, INC.

FORM 10-K

Year Ended December 31, 20212023

Forward-Looking Statements

Certain statements included in this Annual Report on Form 10-K are forward-looking statements. Those statements include statements regarding the intent, belief or current expectations of Franklin BSP Realty Trust, Inc. ("we," "our," "us," or the "Company") and members of our management team, as well as the assumptions on which such statements are based, and generally are identified by the use of words such as "may," "will," "seeks," "anticipates," "believes," "estimates," "expects," "plans," "intends," "should" or similar expressions. Actual results may differ materially from those contemplated by such forward-looking statements. Further, forward-looking statements speak only as of the date they are made, and we undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, unless required by law.Currently, one of the most significant factors that could cause actual outcomes to differ materially from our forward-looking statements is the continuing adverse effect of the current pandemic of the novel coronavirus, or COVID-19, on the financial condition, operating results and cash flows of the Company, its borrowers, the real estate market, the global economy and the financial markets. The extent to which the COVID-19 pandemic continues to impact us and our borrowers will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the scope, severity and duration of the pandemic, including resurgences of the virus and its variants, including the Delta and Omicron variants, the speed, effectiveness and adoption of vaccine (including boosters) and treatment developments and the direct and indirect economic effects of the pandemic and containment measures, among others.

Our forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements, and thus our investors should not place undue reliance on these statements. We believe these factors include but are not limited to those described under the section entitled “Risk Factors” in this Annual Report, as such factors may be updated from time to time in our periodic filings with the Securities and Exchange Commission (the “SEC”), which are accessible on the SEC’s website at http://www.sec.gov. These factors include:

•changes in our business and investment strategy;

•our ability to make investments in a timely manner or on acceptable terms;

•the impact of the COVID-19 pandemic;

•currentchanges in credit market conditions and our ability to obtain long-term financing for our investments in a timely manner and on terms that are consistent with what we project when we invest;

•the effect of general market, real estate market, economic and political conditions;conditions, including changing interest rate environments (and sustained high interest rates) and inflation;

•our ability to make scheduled payments on our debt obligations;

•our ability to generate sufficient cash flows to make distributions to our stockholders;

•our ability to generate sufficient debt and equity capital to fund additional investments;

•our ability to refinance our existing financing arrangements;

•our ability to successfully and in a timely matter reinvest the dividend, interest,recover unpaid principal and sales proceeds from the assets acquired in the merger with Capstead Mortgage Corporation in a manner consistent with our investment strategies;

•adverse changes in the value of the assets acquired in the merger with Capstead Mortgage Corporation prior to the time such assets are monetized and reinvested in in a manner consistent with our investment strategies;on defaulted loans;

•the degree and nature of our competition;

•the availability of qualified personnel;

•we may be deemedour ability to be an investment company under recover or mitigate estimated losses on non-performing assets;

•the Investment Company Actimpact of 1940, as amended (the "Investment Company Act"), and thus subject to regulation under the Investment Company Act; andnational health crises;

•our ability to maintain our qualification as a real estate investment trust ("REIT").

All forward-looking statements should be read in light of the risks identified in Part I, Item 1A of this Annual Report on Form 10-K.

Risk Factor Summary

We are providing the following summary of the risk factors contained in this Annual Report on Form 10-K to enhance the readability and accessibility of our risk factor disclosures. We encourage our stockholders to carefully review the full risk factors contained in this Annual Report on Form 10-K in their entirety.

Risks Related to an Investment in Franklin BSP Realty Trust, Inc.

•The COVID-19 pandemic continues to adversely impact our business and the business of many of our borrowers.

•Because we have a large number of stockholders subject to lock-up restrictions which expire in April 2022, there may be significant pent-up demand to sell shares of our common stock once applicable lock-up restrictions expire.

•Our business could suffer in the event our Advisor or any other party that provides us with services essential to our operations experiences system failures or cyber-incidents or a deficiency in cybersecurity.

Risks Related to Conflicts of Interest

•The Advisor faces conflicts of interest relating to purchasing commercial real estate-related investments, and such conflicts may not be resolved in our favor.

•The Advisor and its employees face competing demands relating to their time, and this may cause our operating results to suffer.

Risks Related to Our Corporate Structure

•The limit on the number of shares a person may own may discourage a takeover.

•Certain provisions of Maryland law could inhibit a change in control of our Company.

Risks Related to Our Financing Strategy

•The Company uses leverageWe have a significant amount of indebtedness and may need to incur more in connection withthe future.

•We may not be able to earn returns on loans we make in excess of the interest we pay on our investments, which increasesborrowings.

•We rely on the riskavailability of loss associated withcollateralized debt and loan obligation securitization markets to provide long-term financing for our loans and investments.

•Lenders mayoften require us to enter into restrictive covenants relating to our operations, which could limit our ability to make distributions.

•In a periodDuring periods of rising interest rates, our interest expense could increase while theincreases may outpace any increases in interest we earn on our fixed-rate assets, would not change, which would adversely affectand the value of our profitability.assets may decrease.

•We may not be able to access financing sources on attractive terms, if at all, which could dilute our existing stockholders and adversely affect our ability to fund and grow our business.business, or result in dilution to our existing stockholders.

•We useOur short-term borrowings to finance our investments whichoften require us to provide additional collateral inwhen the event the lender determines there is a decrease in the fair market value of our collateral decreases, and these calls for collateral could significantly impact our liquidity position.

Risks Related to ourOur Investments

•Our commercial real estate debt investments are subject to the risks typically associated with ownership of commercial real estate.

•Our success depends on the availability of attractive investment opportunities and the Advisor’s ability to identify, structure, consummate, leverage, manage and realize returns on our investments.

•There can be no assurances that the U.S. or global financial systems will remain stable.

•We may have difficulty in redeploying the proceeds from repayments of our existing loans and other investments.opportunities.

•Delays in liquidating defaulted commercial real estate debt investments could reduce our investment returns.

•Operating and disposing of properties acquired through foreclosure subject us to additional risks that could harm our results of operations.

•Subordinate commercial real estate debt that we originate or acquire exposescould expose us to greater losses.

•We may be subject to risks associated with construction lending, such as declining real estate values, cost overruns and delays in completion.

•Investments in non-conformingJurisdictions with one action or non-investment grade rated loanssecurity first rules or securities involve greater risk of loss.anti-deficiency legislation may limit the ability to foreclose on the property or to realize the obligation secured by the property by obtaining a deficiency judgment.

•Insurance may not cover all potential losses on the properties underlying our investments.investments, which may harm the value of our assets.

•We invest in CMBS and CRE CLO Bonds, which may include subordinate securities, which entails certain risks.

•TheWe may not control the special servicing of the mortgage loans underlying the CMBS and CRE CLO Bonds in which we invest and, in such cases, the special servicer may invest are subject to the risks of the mortgage securities market as a whole and risks of the securitization process.take actions that could adversely affect our interests.

•We invest in collateralized debt obligations ("CDOs") and such investments involve significant risks.

•Adjustable-rate commercial real estate loans may entail greater risks of default to us than fixed-rate commercial real estate loans.

•Changes in interest rates could negatively affect the value of our investments, which could result in reduced income or losses and negatively affect the cash available for distribution.

•Hedging against interest rate exposure may adversely affect our income, limit our gains or result in losses, which could adversely affect cash available for distribution to our stockholders.

•Most of our investments are illiquid and we may not be able to vary our portfolio in response to changes in economic and other conditions, which may result in losses to us.

•WhileSome of our investments will be carried at estimated fair value as determined by us and, as a result, there may be uncertainty as to the value of these investments.

•Competition with third parties for originating and acquiring investments may reduce our profitability.

•Our due diligence may not reveal all material issues relating to our origination or acquisition of a particular investment.

•We may be unable to restructure loans in a manner that we attemptbelieve maximizes value, particularly if we are one of multiple creditors in large capital structures.

•We may be subject to risks associated with future advance obligations, such as declining real estate values and operating performance.

•We may not be successful in our attempts to align the maturities of our liabilities with the maturities on our assets, we may not be successful in that regard which could harm our operating results and financial condition.

•Provision for credit losses is difficult to estimate.

•Any credit ratings assigned to our investments will be subject to ongoing evaluations and revisions and we cannot assure you that those ratings will not be downgraded.

•Changes to, or the elimination of, LIBOR may adversely affect our interest income, interest expense, or both.

Risks Related to the Conduit Segment of the Business

•We use warehouse facilities that may limit our ability to acquire assets, and we may incur losses if the collateral is liquidated.

•We directly or indirectly utilize non‑recourse securitizations, and such structures expose us to risks that could result in losses to us.

•The securitization market is subject to a regulatory environment that may affect certain aspects of these activities.

Risks Related to our merger with Capstead Mortgage Corporation

•We may not be ableenter into hedging transactions that could expose us to realizecontingent liabilities in the anticipated benefits of the merger on the anticipated timeframe or at all.future.

•Changes inHedging against interest rates, whether increases or decreases,rate exposure may adversely affect yields on the securities acquiredour income, limit our gains or result in the merger.losses, which could adversely affect cash available for distributions to our stockholders.

Risks Related to Conflicts of Interest

•The Advisor faces conflicts of interest relating to purchasing commercial real estate-related investments, and such conflicts may not be resolved in our favor, which could adversely affect our investment opportunities.

•An increaseThe Advisor and its employees face competing demands relating to their time, and this may cause our operating results to suffer.

•The fee structure set forth in prepaymentsthe Advisory Agreement may adversely affectnot create proper incentives for the fair value of the Capstead portfolio.Advisor.

•PeriodsOur Advisor manages our portfolio pursuant to broad investment guidelines and is not required to seek the approval of illiquidityour board of directors for each investment, financing, asset allocation or hedging decision made by it, which may result in the mortgage markets may reduce amounts availableour making riskier loans and other investments and which could materially and adversely affect us.

•Our Advisor maintains a contractual as opposed to a fiduciary relationship with us. Our Advisor’s liability is limited under secured borrowing arrangements dueour Advisor Agreement, and we have agreed to declines in the perceived valueindemnify our Advisor against certain liabilities.

•Termination of related collateralour Advisory Agreement would be difficult and may reducecostly.

Risks Related to Our Corporate Structure

•The limit on the number of counterparties willingshares a person may own may discourage a takeover that could otherwise result in a premium price to lend to us and/or the amounts individual counterparties are willing to lend.our stockholders.

•We incurred direct and indirect costs asCertain provisions of Maryland law could inhibit a resultchange in control of the merger with Capstead.

•We have a significant amount of indebtedness and may need to incur more in the future.our Company.

Risks Related to Taxation

•Our failure to qualify as a REIT could have significant adverse consequences to us and the value of our common stock.

•The failure of a mezzanine loan to qualify as a real estate asset could adversely affect our ability to qualify as a REIT.

•Even if we qualify as a REIT, we may be subject to tax liabilities that reduce our cash flow for distribution to our stockholders.

•The failure of assets subject to repurchase agreements to qualify as real estate assets could adversely affect our ability to qualify as a REIT.

•The “taxable mortgage pool” rules may increase the taxes that we or our stockholders incur, and may limit the manner in which we effect future securitizations.

•The prohibited transactions tax may limit our ability to engage in transactions, including certain methods of securitizing mortgage loans that would be treated as sales for U.S. federal income tax purposes.

•Complying with REIT requirements may limit our ability to hedge effectively and may cause us to incur tax liabilities.

•Liquidation of assets may jeopardize our REIT qualification.

•Modification of the terms of our debt investments and mortgage loans underlying our CMBS in conjunction with reductions in the value of the real property securing such loans could cause us to fail to qualify as a REIT.

Risks Related to an Investment in Franklin BSP Realty Trust, Inc.

•Public health crises have, and may in the future, adversely impact our business and the business of many of our borrowers.

•We may be unable to maintain or increase cash distributions over time, or may decide to reduce the amount of distributions for business reasons.

•Our business could suffer in the event our Advisor or any other party that provides us with services essential to our operations experiences system failures or cyber-incidents or a deficiency in cybersecurity.

•We are subject to risks from natural disasters such as earthquakes and severe weather, including as the result of global climate changes, which may result in damage to the properties securing our loans.

PART I

Item 1. Business

Franklin BSP Realty Trust, Inc. (the “Company”), formerly known as Benefit Street Partners Realty Trust, Inc., is a real estate finance company that primarily originates, acquires and manages a diversified portfolio of commercial real estate debt investments secured by properties located within and outside the United States. The Company isWe are a Maryland corporation and hashave made tax elections to be treated as a real estate investment trust (a "REIT") for U.S. federal income tax purposes since 2013. We believe that we have qualified as a REIT and we intend to continue to meet the requirements for qualification and taxation as a REIT. Substantially all of our business is conducted through Benefit Street Partners Realty Operating Partnership, L.P. (the “OP”), a Delaware limited partnership. We are the sole general partner and directly or indirectly hold all of the units of limited partner interests in the OP. In addition, the Company, through oneOne or more of our wholly-owned subsidiaries which are each treated as a taxable REIT subsidiary (asubsidiaries (each a “TRS”), is indirectlyand are subject to U.S. federal, state and local income taxes.

The Company has no employees. Benefit Street Partners L.L.C. serves as our advisor ("Advisor") pursuant to an advisory agreement, as amended on August 18, 2021 (the "Advisory Agreement"). The Advisor, an investment adviser registered with the SEC, is a credit-focused alternative asset management firm.

Establishedfirm that was established in 2008, our2008. Our Advisor's credit platform manages funds for institutions and high-net-worth investors across various credit funds and complementary strategies including high yield, levered loans, private/opportunistic debt, liquid credit, structured credit and commercial real estate debt. These strategies complement each other as they all leverage the sourcing, analytical, compliance, and operational capabilities that encompass the platform. The Advisor manages the Company's affairs on a day-to-day basis. The Advisor receives compensation fees and reimbursements for services related to the investment and management of the Company's assets and the operations of the Company. The advisor is a wholly-owned subsidiary of Franklin Resources, Inc., which together with its various subsidiaries operates as "Franklin Templeton”.

The Company primarily invests in commercial real estate debt investments, which may include first mortgage loans, subordinated mortgage loans, mezzanine loans and participations in such loans. The Company also originates conduit loans which the Company intends to sell through its TRS into commercial mortgage-backed securities ("CMBS") securitization transactions.

The Company also invests in Historically this business has focused primarily on CMBS, commercial real estate securities. Real estate securities may include CMBS, senior unsecured debt of publicly traded REITs, debt or equity securities of other publicly traded real estate companies andcollateralized loan obligation bonds ("CRE CLO bonds"), collateralized debt obligations ("CDOs"). The Company also owns real estate acquired by and other securities. As a result of the Company through foreclosure and deed in lieuOctober 2021 acquisition of foreclosure, and purchased for investment, typically subject to triple net leases.

On October 19, 2021, the Company completed a merger with Capstead Mortgage Corporation (“Capstead”("Capstead") pursuant to which Capstead merged into a wholly-owned subsidiary of, the Company and the Company’s common stock commenced trading on the New York Stock Exchange ("NYSE"acquired a portfolio of residential mortgage backed securities (“RMBS”) under the ticker “FBRT”. The Capstead assets acquired in the merger consist primarilyform of cash and residential adjustable-rate mortgage pass-through securities ("ARM Agency Securities" or "ARMs") issued and guaranteed by government-sponsored enterprises or by an agency of the federal government. TheAs of December 31, 2023, the Company intendshas fully disposed of all of its ARM Agency Securities and is continuing to reinvest the cash and proceeds from dividends, interest, repayments and salesthe sale of these securities in its other businesses. The Company also owns real estate that was either acquired by the assets acquiredCompany through foreclosure or deed in the merger into its ownlieu of foreclosure, or that was purchased for investment, strategies.typically subject to triple net leases.

Investment Objectives

We plan to implement policies and strategiesOur objective is to provide our common shareholders attractive, risk-adjusted returns through a stable divideddividend and capital growth.

Investment Strategies and Policies

We have four investment strategies. OneOur first and primary strategy is to originate, acquire and manage a diversified portfolio of commercial real estate debt, including first mortgage loans, subordinate loans, mezzanine loans and participations in such loans. We expect that our portfolio of debt investments will be secured by real estate located within and outside the United States and diversified by property type and geographic location. TheOur second strategy is to invest in commercial real estate securities, such as CMBS, CRE CLO Bonds, senior unsecured debt of publicly-traded REITs and CDO notes. TheOur third strategy is to originate conduit loans and sell them through our TRS business into CMBS securitization transactions. TheOur fourth strategy representsis to maximize cash flows from real estate acquired by the Company through foreclosure and deed in lieu of foreclosure, and purchases of real estate that generally are, or will be, subject to a triple net lease.

As noted above, we also acquired a significant portfolio of residential adjustable-rate mortgage pass-through securities issued and guaranteed by government-sponsored enterprises or by an agency of the federal government in our merger with Capstead.We intend to reinvest the cash and proceeds from dividends, interest, repayments and sales of these assets into our four investment strategies.

Commercial Real Estate Debt

We originate, fund, acquire and structure commercial real estate debt, including first mortgage loans, mezzanine loans, bridge loans, and other loans related to commercial real estate. We may also acquire some equity participations in the underlying collateral of commercial real estate debt. We structure, underwrite, and originate most of our investments. We use conservative underwriting criteria to focus on risk adjusted returns based on several factors, which may include the leverage point, debt service coverage and sensitivity, lease sustainability studies, market and economic conditions, quality of the underlying collateral and location, reputation and track record of the borrower, and a clear exit or refinancing plan for the borrower. Our underwriting process involves comprehensive financial, structural, operational, and legal due diligence to assess any risks in connection with making such investments so that we can optimize pricing and structuring. By originating loans directly, we are able to structure and underwrite loans that satisfy our standards, establish a direct relationship with the borrower, and utilize our own documentation. Described below are some of the types of loans we may originate or acquire. In addition, although we generally prefer the benefits of new origination, market conditions can create situations where holders of commercial real estate debt may be in distress and are therefore willing to sell at prices that compensate the buyer for the lack of control typically associated with directly structured investments.

First Mortgage Loans

We primarily focus on first mortgage loans. First mortgage loans generally finance the acquisition, refinancing or rehabilitation of commercial real estate. First mortgage loans may be either short (one-to-five years) or long (up to ten years) term, may be fixed or floating rate, and are predominantly current-pay loans. We may originate or acquire current-pay first mortgage loans backed by properties that fit our investment strategy. We may selectively syndicate portions of these loans, including senior or junior participations that will effectively provide permanent financing or optimize returns which may include retained origination fees.

First mortgage loans typically provide for a higher recovery rate and lower defaults than other debt positions due to the lender's favorable control position, which at times can include control of the entire capital structure. Because of these attributes, this type of investment typically receives favorable treatment from third-party rating agencies and financing sources, which should increase the liquidity of these investments. However, these loans typically generate lower returns than subordinate debt, such as subordinate loans and mezzanine loans, commonly referred to as B-notes.

B-notes

B-notes consist of subordinate mortgage loans, including structurally subordinated first mortgage loans and junior participations in first mortgage loans or participations in these types of assets. Like first mortgage loans, these loans generally finance the acquisition, refinancing, rehabilitation or construction of commercial real estate. Subordinated mortgage loans or B-notes may be either short (one-to-five years) or long (up to ten years) term, may be fixed or floating rate, and are predominantly current-pay loans. We may originate or acquire current-pay subordinated mortgage loans or B-notes backed by high quality properties that fit our investment strategy. We may create subordinated mortgage loans by tranching our directly originated first mortgage loans generally through syndications of senior first mortgages or buy such assets directly from third party originators. Due to the limited opportunities in this part of the capital structure, we believe there are certain situations that allow us to directly originate or to buy subordinated mortgage investments from third parties on favorable terms.

Bridge Loans

We may offer bridge financing products to borrowers who are typically seeking short-term capital to be used in an acquisition, development or refinancing of a given property. From the borrower’s perspective, shorter term bridge financing is advantageous because it allows time to improve the property value through repositioning without encumbering it with restrictive long-term debt. The terms of these loans generally do not exceed three years.

Mezzanine Loans

Mezzanine loans are secured by one or more direct or indirect ownership interests in an entity that directly or indirectly owns commercial real estate and generally finance the acquisition, refinancing, rehabilitation or construction of commercial real estate. Mezzanine loans may be either short (one-to-five years) or long (up to ten years) term and may be fixed or floating rate. We may originate or acquire mezzanine loans backed by properties that fit our investment strategy. We may own such mezzanine loans directly or we may hold a participation in a mezzanine loan or a sub-participation in a mezzanine loan. These loans are predominantly current-pay loans (although there may be a portion of the interest that accrues) and may provide for participation in the value or cash flow appreciation of the underlying property as described below. With the credit market disruption and resulting dearth of capital available in this part of the capital structure, we believe that the opportunities to both directly originate and to buy mezzanine loans from third parties on favorable terms will continue to be attractive.

Equity Participations or “Kickers”

We may pursue equity participation opportunities in connection with our commercial real estate debt originations if we believe that the risk-reward characteristics of the loan merit additional upside participation related to the potential appreciation in value of the underlying assets securing the loan. Equity participations can be paid in the form of additional interest, exit fees, percentage of sharing in refinance or resale proceeds or warrants in the borrower. Equity participation can also take the form of a conversion feature, sometimes referred to as a "kicker," which permits the lender to convert a loan or preferred equity investment into common equity in the borrower at a negotiated premium to the current net asset value of the borrower. We expect to generate additional revenues from these equity participations as a result of excess cash flows being distributed or as appreciated properties are sold or refinanced.

Commercial Real Estate Securities

In addition to our focus on origination of and investments in commercial real estate debt, we may also acquire commercial real estate securities, such as CMBS, RMBS, unsecured REIT debt,CRE CLO Bonds, CDO notes, and equity investments in entities that own commercial real estate.

CMBS & CRE CLO Bonds

CMBS and CRE CLO Bonds are securities that are collateralized by, or evidence ownership interests in, a single commercial mortgage loan or a partial or entire pool of mortgage loans secured by commercial properties. CMBS and CRE CLO Bonds are generally pass-through certificates that represent beneficial ownership interests in common law trusts whose assets consist of defined portfolios of one or more commercial mortgage loans. They are typically issued in multiple tranches whereby the more senior classes are entitled to priority distributions of specified principal and interest payments from the trust’s underlying assets. The senior classes are often securities which, if rated, would have ratings ranging from low investment grade “BBB-” to higher investment grades “A,” “AA” or “AAA.” The junior, subordinated classes typically would include one or more non-investment grade classes which, if rated, would have ratings below investment grade “BBB.” Losses and other shortfalls from expected amounts to be received on the mortgage pool are borne first by the most subordinate classes, which receive payments only after the more senior classes have received all principal and/or interest to which they are entitled. We may invest in senior or subordinated, investment grade or non-investment grade CMBS and CRE CLO Bonds, as well as unrated CMBS.CMBS and CRE CLO Bonds.

Unsecured Publicly-Traded REIT Debt Securities

We may also choose to acquire senior unsecured debt of publicly-traded equity REITs that acquire and hold real estate. Publicly-traded REITs may own large, diversified pools of commercial real estate properties or they may focus on a specific type of property, such as shopping centers, office buildings, multifamily properties and industrial warehouses. Publicly-traded REITs typically employ moderate leverage. Corporate bonds issued by these types of REITs are usually rated investment grade and benefit from strong covenant protection.

CDO Notes

CDOs are multiple class debt notes, secured by pools of assets, such as CMBS and mezzanine loans, and unsecured REIT debt.loans. Like typical securitization structures, in a CDO, the assets are pledged to a trustee for the benefit of the holders of the bonds. CDOs often have reinvestment periods that typically last for five years, during which time, proceeds from the sale of a collateral asset may be invested in substitute collateral. Upon termination of the reinvestment period, the static pool functions very similarly to a CMBS securitization where repayment of principal allows for redemption of bonds sequentially.

Commercial Real Estate Equity Investments

We may acquire: (i) equity interests (including preferred equity) in an entity (including, without limitation, a partnership or a limited liability company) that is an owner of commercial real property (or in an entity operating or controlling commercial real property, directly or through affiliates), which may be structured to receive a priority return or is senior to the owner's equity (in the case of preferred equity); (ii) certain strategic joint venture opportunities where the risk-return and potential upside through sharing in asset or platform appreciation is compelling; and (iii) private issuances of equity securities (including preferred equity securities) of public companies. Our commercial real estate equity investments may or may not have a scheduled maturity and are expected to be of longer duration (five-to-ten year terms) than our typical portfolio investment. Such investments are expected to be fixed rate (if they have a stated investment rate) and may have accrual structures and provide other distributions or equity participations in overall returns above negotiated levels.

Conduit Loans

The Company originates conduit loans which the Company intends to sell through its TRS into CMBS securitization transactions at a profit. The Conduit loans are typically fixed-rate commercial real estate loans and are long (up to ten years) term, and are predominantly current-pay loans.

Ownership of Properties and Other Possible Investments

Although we expect that most of our investments will be of the types described above, we may make other investments. For example, we own and expect in the future to own real estate acquired by the Company through foreclosure and deed in lieu of foreclosure, or from purchases of real estate that generally are, or will be, subject to a triple net lease.We may also invest in whatever other types of interests in real estate-related assets that we believe are in our best interest which may include the commercial real property underlying our debt investments as a result of a loan workout, foreclosure or similar circumstances.

Investment Process

Our Advisor has the authority to make all the decisions regarding our investments consistent with the investment guidelines and borrowing policies approved by our board of directors and subject to the direction and oversight of our board of directors. With respect to investments in commercial real estate debt, our board of directors has adopted investment guidelines that our Advisor must follow when acquiring such assets on our behalf without the approval of our board of directors.. We will not however, purchase assets in which our Advisor, any of our directors or any of their affiliates has an interest without a determination by a majority of our directors (including a majority of the independent directors) not otherwise interested in the transaction that such transaction is fair and reasonable to us and at a price to us no greater than the cost of the asset to the affiliated seller, unless there is substantial justification for the excess amount and such excess is reasonable. Our investment guidelines and borrowing policies may be altered by a majority of our directors without approval of our stockholders. Our Advisor may not alter our investment guidelines or borrowing policies without the approval of a majority of our directors, including a majority of our independent directors.

Borrowing Strategies and Policies

Our financing strategy primarily includes the use of secured repurchase agreement facilities for loans, securities and securitizations. We have also raised capital through private placements of our equity securities. In addition to our current mix of financing sources, we may also access additional forms of financings, including credit facilities, and public or private secured and unsecured debt issuances by us or our subsidiaries.

We expect to use additional debt financing as a source of capital. We intend to employ reasonable levels of borrowing in order to provide more cash available for investment and to generate improved returns. We believe that careful use of leverage will help us to achieve our diversification goals and potentially enhance the returns on our investments. Our board of directors reviewsoversees our aggregate borrowings at least quarterly.borrowing levels.

Income Taxes

We elected to be taxed as a REIT under Sections 856 through 860 of the Internal Revenue Code of 1986, as amended (the "Internal Revenue Code") commencing with the taxable year ended December 31, 2013. In general, as a REIT, if we meet certain organizational and operational requirements and distribute at least 90% of our "REIT taxable income" (determined before the deduction of dividends paid and excluding net capital gains) to our stockholders in a year, we will not be subject to U.S. federal income tax to the extent of the income that we distribute. We believe that we currently qualify and we intend to continue to qualify as a REIT under the Internal Revenue Code. If we fail to qualify as a REIT in any taxable year and statutory relief provisions were not to apply, we will be subject to U.S. federal income tax on our income at regular corporate tax rates for the year in which we do not qualify and the succeeding four years. Even if we qualify for taxation as a REIT, we may be subject to certain U.S. federal, state and local taxes on our income and property and U.S. federal income and excise taxes on our undistributed income.

We pay income taxes on our Conduit segment, which is conducted by our wholly-owned TRS entities. The income taxes on the Conduit segment are paid at the U.S. federal and applicable state levels.

Competition

Our net income depends, in large part, on our ability to originate investments that provide returns in excess of our borrowing cost. In originating these investments, we compete with other mortgage REITs, specialty finance companies, savings and loan associations, banks, mortgage bankers, insurance companies, mutual funds, institutional investors, investment banking firms, private funds, other lenders, governmental bodies, and other entities, many of which have greater financial resources and lower costs of capital available to them than we have. In addition, there are numerous mortgage REITs with asset acquisition objectives similar to ours, and others may be organized in the future, which may increase competition for the investments suitable for us. Competitive variables include market presence and visibility, size of loans offered and underwriting standards. To the extent that a competitor is willing to risk larger amounts of capital in a particular transaction or to employ more liberal underwriting standards when evaluating potential loans than we are, our investment volume and profit margins for our investment portfolio could be impacted. Our competitors may also be willing to accept lower returns on their investments and may succeed in buying or underwriting the assets that we have targeted. Although we believe that we are well positioned to compete effectively in each facet of our business, there is enormous competition in our market sector and there can be no assurance that we will compete effectively or that we will not encounter increased competition in the future that could limit our ability to conduct our business effectively.

Human Capital Resources

As of December 31, 2021,2023, we had no employees. Our executive officers serve as officers of our Advisor and are employed by an affiliate of our Advisor. The employees of the Advisor and other affiliates of the Advisor perform a full range of real estate services for us, including origination, acquisitions, accounting, legal, asset management, wholesale brokerage, and investor relations services. We are dependent on these affiliates for services that are essential to us, including asset acquisition decisions, and other general administrative responsibilities. In the event that any of these companies were unable to provide these services to us, we would be required to provide such services ourselves or obtain such services from other sources.

Government Regulation

Our operations are subject, in certain instances, to supervision and regulation by U.S. and other governmental authorities, and may be subject to various laws and judicial and administrative decisions imposing various requirements and restrictions, which, among other things: (i) regulate credit-granting activities; (ii) establish maximum interest rates, finance charges and other charges; (iii) require disclosures to customers; (iv) govern secured transactions; and (v) set collection, foreclosure, repossession and claims-handling procedures and other trade practices. We intend to conduct our business so that neither we nor any of our subsidiaries are required to register as an investment company under the Investment Company Act.

In our judgment, existing statutes and regulations have not had a material adverse effect on our business. In recent years, legislators in the United States and in other countries have said that greater regulation of financial services firms is needed, particularly in areas such as risk management, leverage, and disclosure. While we expect that additional new regulations in these areas will be adopted and existing ones may change in the future, it is not possible at this time to forecast the exact nature of any future legislation, regulations, judicial decisions, orders or interpretations, nor their impact upon our future business, financial condition, or results of operations or prospects.

Available Information

We electronically file annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports, and proxy statements, with the SEC. We also filed with the SEC a registration statement in connection with our dividend reinvestment plan ("DRIP") securities offerings. The SEC maintains an internet address at www.sec.gov that contains reports, proxy statements and information statements, and other information, which may be obtained free of charge. In addition, copies of our filings with the SEC may be obtained from the website maintained for us at www.fbrtreit.com. Access to these filings is free of charge. We are not incorporating our website or any information from the website into this Form 10-K.

Item 1A. Risk Factors

Risks Related to an Investment in Franklin BSP Realty Trust, Inc.

The COVID-19 pandemic continues to adversely impact our business and the business of many of our borrowers.

The COVID-19 pandemic has had, and another pandemic or public health crisis in the future could have, repercussions across domestic and global economies and financial markets. The COVID-19 pandemic resulted in many governmental authorities, including state and local governments in regions in which our borrowers own properties, reacting by instituting government restrictions, border closings, quarantines, “shelter-in-place” orders and “social distancing” guidelines which forced many of our borrowers to suspend or significantly restrict their business activities. The recent resurgences driven by variants, such as Delta and Omicron, have resulted in some of these restrictions, which had been lifted, being reimposed. The economic consequences of the pandemic and government and individual responses to it resulted challenging operating conditions for many businesses, particularly in the retail (including restaurants) and hospitality sectors.

The COVID-19 pandemic has adversely affected our business in a number of respects, including:

•at the onset of the pandemic in March and April of 2020, the financial markets for the assets we then held in our real estate securities portfolio were significantly disrupted, resulting in significant decreases in market values for these assets and significant market volatility. This resulted in margin calls from our lenders, which we satisfied, but similar disruptions in the future could result in additional margin calls, including with respect to the assets we acquired in the Capstead merger, which, if not satisfied, could result in the liquidation of some of our assets at significant losses.

•declines in the value of commercial real estate generally, and significant declines in certain assets classes, including office, hospitality and retail, which negatively impacted the value of our commercial mortgage loan portfolio, and could continue to negatively impact the value in the future, potentially materially.

•adverse impacts on the financial stability of many of our borrowers, which has and will continue to increase the prospects of borrower delinquencies,defaults, or requests for loan modifications.

•periodic increases in the cost and decreases in the availability of debt capital, including as a result of dislocations in the commercial mortgage-backed securities market, and as a result of lenders permitting significantly lower advance rates on our repurchase agreements.

•increases in the risk that we may not meet certain interest coverage tests, over-collateralization coverage tests or other tests related to our securitized debt that could result in a change in the priority of distributions, which could result in the reduction or elimination of distributions to the subordinate debt and equity tranches we own until the tests have been met or certain senior classes of securities have been paid in full. Accordingly, we may experience a reduction in our cash flow from those interests which may adversely affect our liquidity and therefore our ability to fund our operations or address maturing liabilities on a timely basis.

•periodic declines in business activity which if continued will result in a decline in demand for mortgage financing, which could adversely affect our ability to make new investments or to redeploy the proceeds from repayments of our existing investments.

The extent to which the COVID-19 pandemic impacts our or our borrowers’ operations will depend on future developments which are highly uncertain and cannot be predicted with confidence, including the scope, severity and duration of the pandemic, including any resurgences due to variants, such as the Delta and Omicron variants, the effectiveness of vaccines against variants such as the Delta and Omicron variants, the speed of vaccine (including booster) distribution, treatment developments and the direct and indirect economic effects of the pandemic and containment measures. The inability of our borrowers to meet their loan obligations and/or borrowers filing for bankruptcy protection would reduce our cash flows, which would impact our ability to pay dividends to our stockholders. The rapid development and fluidity of this situation precludes any prediction as to the full adverse impact of the COVID-19 pandemic. Moreover, many risk factors set forth in this Annual Report on Form 10-K should be interpreted as heightened risks as a result of the impact of the COVID-19 pandemic.

We may be unable to maintain or increase cash distributions over time, or may decide to reduce the amount of distributions for business reasons.

There are many factors that can affect the amount and timing of cash distributions to stockholders. The amount of cash available for distributions is affected by many factors, such as the cash provided by the Company's investments and obligations to repay indebtedness as well as many other variables. There is no assurance that the Company will be able to pay or maintain the current level of distributions or that distributions will increase over time. In certain prior periods, distributions have been in excess of cash flows from operations. Distributions in excess of earnings will decrease the book value per share of common stock. The Company cannot give any assurance that returns from the investments will be sufficient to maintain or increase cash available for distributions to stockholders. Actual results may differ significantly from the assumptions used by the board of directors in establishing the distribution rate to stockholders. The Company may not have sufficient cash from operations to make a distribution required to qualify for or maintain our REIT status, which may materially adversely affect the value of our securities.

Because we have a large number of stockholders subject to lock-up restrictions which expire six months after the effective time of the merger, there may be significant pent-up demand to sell shares of our common stock once applicable lock-up restrictions expire. Significant sales of shares of our common stock, or the perception that significant sales of such shares could occur, may adversely impact the price of shares of our common stock.

Pursuant to certain lock-up agreements and the restructuring of our equity prior to the effective time of the merger with Capstead, approximately 94% of the shares of our common stock (including shares of common stock underlying preferred shares that will automatically convert to common stock) which were outstanding prior to the effective time of the merger are prohibited from being publicly traded for six months following the merger (i.e., until April 19, 2022). Prior to its listing in connection with the closing of the merger on October 19, 2021, our common stock had never been listed on any national securities exchange and the ability of stockholders to liquidate their investments was limited. As a result, there may be significant pent-up demand to sell shares of our common stock once the lock-up restrictions referenced above expire. A large volume of sales of shares of our common stock could decrease the prevailing market price of shares of our common stock and could impair our ability to raise additional capital through the sale of equity securities in the future. Even if actual sales volumes are not elevated, the mere perception of the possibility of these sales could depress the market price of shares of our common stock and have a negative effect on our ability to raise capital in the future.

Our business could suffer in the event our Advisor or any other party that provides us with services essential to our operations experiences system failures or cyber-incidents or a deficiency in cybersecurity.

Despite system redundancy, the implementation of security measures and the existence of a disaster recovery plan for the internal information technology systems of our Advisor and other parties that provide us with services essential to our operations, these systems are vulnerable to damage from any number of sources, including computer viruses, unauthorized access, energy blackouts, natural disasters, terrorism, war and telecommunication failures. Any system failure or accident that causes interruptions in our operations could result in a material disruption to our business.

A cyber-incident is considered to be any adverse event that threatens the confidentiality, integrity or availability of information resources. More specifically, a cyber-incident is an intentional attack or an unintentional event that can result in third parties gaining unauthorized access to systems to disrupt operations, corrupt data or steal confidential information. As reliance on technology in our industry has increased, so have the risks posed to the systems of our Advisor and other parties that provide us with services essential to our operations, both internal and outsourced. In addition, the risk of a cyber-incident, including by computer hackers, foreign governments and cyber terrorists, has generally increased as the number, intensity and sophistication of attempted attacks and intrusions from around the world have increased. Even the most well protected information, networks, systems and facilities remain potentially vulnerable because the techniques used in such attempted attacks and intrusions evolve and generally are not recognized until launched against a target, and in some cases are designed not to be detected and, in fact, may not be detected.

The remediation costs and lost revenues experienced by a victim of a cyber-incident may be significant and significant resources may be required to repair system damage, protect against the threat of future security breaches or to alleviate problems, including reputational harm, loss of revenues and litigation, caused by any breaches.

Although the Advisor and other parties that provide us with services essential to our operations intend to continue to implement industry-standard security measures, there can be no assurance that those measures will be sufficient, and any material adverse effect experienced by the Advisor and other parties that provide us with services essential to our operations could, in turn, have an adverse impact on us.

If we are unable to implement and maintain effective internal controls over financial reporting in the future, investors may lose confidence in the accuracy and completeness of our financial reports and the market price of our common stock may be negatively affected.

As a newly-listed public company, beginning with the 2022 fiscal year, our independent registered public accounting firm will be required to formally attest to the effectiveness of our internal controls over financial reporting on an annual basis. The process of designing, implementing and testing the internal controls over financial reporting required to comply with this obligation is time consuming, costly and complicated. If we identify material weaknesses in our internal controls over financial reporting, if we are unable to comply with the requirements of Section 404 of the Sarbanes-Oxley Act in a timely manner or to assert that our internal controls over financial reporting are effective or if the independent registered public accounting firm is unable to express an opinion as to the effectiveness of our internal controls over financial reporting, investors may lose confidence in the accuracy and completeness of our financial reports and the market price of our common stock could be negatively affected. We could also become subject to investigations by the SEC or other regulatory authorities, which could require additional financial and management resources.

Risks Related to Conflicts of Interest

The Advisor faces conflicts of interest relating to purchasing commercial real estate-related investments, and such conflicts may not be resolved in our favor, which could adversely affect our investment opportunities.

We rely on the Advisor and the executive officers and other key real estate professionals at our Advisor to identify suitable investment opportunities for us. Although there are restrictions in the Advisory Agreement we have entered into with the Advisor with respect to the Advisor’s ability to manage another REIT that competes with us, or to provide any services related to fixed-rate conduit lending to another person, the Advisor and its employees are not otherwise restricted from engaging in investment and investment management activities unrelated to us and do engage in these activities. Some investment opportunities that are suitable for us may also be suitable for other investment vehicles managed by the Advisor or its affiliates. Thus, the executive officers and real estate professionals of the Advisor could direct attractive investment opportunities to other entities or investors. In addition, we have any may in the future engage in transactions with our Advisor or affiliates of our Advisor and these transactions may not be on terms as favorable as transactions with third parties. Such events could result in us investing in assets that provide less attractive returns, which may reduce our ability to make distributions.

The Advisor and its employees face competing demands relating to their time, and this may cause our operating results to suffer.

The Advisor and its employees are engaged in investment and investment management activities unrelated to us. Because these persons have competing demands on their time and resources, they may have conflicts of interest in allocating their time between our business and these other activities. If this occurs, the returns on our investments may suffer.

Risks Related to Our Corporate Structure

The limit on the number of shares a person may own may discourage a takeover that could otherwise result in a premium price to our stockholders.

The Company's charter, with certain exceptions, authorizes the board of directors to take such actions as are necessary and desirable to preserve our qualification as a REIT. Unless exempted by the board of directors, no person or entity may own more than 7.9% in value of the aggregate of our outstanding shares of stock or more than 7.9% (in value or in number of shares, whichever is more restrictive) of any class or series of shares of our stock determined after applying certain rules of attribution. This restriction may have the effect of delaying, deferring or preventing a change in control of us, including an extraordinary transaction (such as a merger, tender offer or sale of all or substantially all our assets) that might provide a premium price for holders of our common stock.

Certain provisions of Maryland law could inhibit a change in control of our Company.

Certain provisions of the Maryland General Corporation Law (“MGCL”) may have the effect of inhibiting a third party from making a proposal to acquire us or of impeding a change in control under circumstances that otherwise could provide the holders of shares of our common stock with the opportunity to realize a premium over the then-prevailing market price of such shares, including:

•“business combination” provisions that, subject to limitations, prohibit certain business combinations between us and an “interested stockholder” (defined generally as any person who beneficially owns 10% or more of our then outstanding voting power of our shares or an affiliate or associate of ours who, at any time within the two-year period prior to the date in question, was the beneficial owner of 10% or more of our then outstanding voting shares) or an affiliate thereof for five years after the most recent date on which the stockholder becomes an interested stockholder, and thereafter imposes special appraisal rights and special stockholder voting requirements on these combinations; and

•“control share” provisions that provide that “control shares” of our company (defined as shares which, when aggregated with other shares controlled by the stockholder, entitle the stockholder to exercise one of three increasing ranges of voting power in electing directors) acquired in a “control share acquisition” (defined as the direct or indirect acquisition of ownership or control of “control shares”) have no voting rights except to the extent approved by our stockholders by the affirmative vote of at least two-thirds of all the votes entitled to be cast on the matter, excluding all interested shares.

Pursuant to the MGCL, our board of directors has exempted any business combination involving our Advisor or any affiliate of our Advisor. Consequently, the five-year prohibition and the super-majority vote requirements will not apply to business combinations between us and our Advisor or any affiliate of our Advisor.

In addition, the Company's bylaws contain a provision exempting from the control share provisions any and all acquisitions of our stock by any person. There can be no assurance that this provision will not be amended or eliminated at any time in the future.

In addition, the “unsolicited takeover” provisions of Title 3, Subtitle 8 of the MGCL permit the Board, without shareholder approval and regardless of what is currently provided in the charter or bylaws, to implement certain takeover defenses, including adopting a classified board or increasing the vote required to remove a director. Such takeover defenses may have the effect of inhibiting a third-party from making an acquisition proposal for us or of delaying, deferring or preventing a change in control of us under the circumstances that otherwise could provide our common stockholders with the opportunity to realize a premium over the then-current market price.

The value of our common stock may be reduced if we are required to register as an investment company under the Investment Company Act.

We are not registered, and do not intend to register ourselves, our operating partnership or any of our subsidiaries, as an investment company under the Investment Company Act. If we become obligated to register ourselves, our operating partnership or any of our subsidiaries as an investment company, the registered entity would have to comply with a variety of substantive requirements under the Investment Company Act imposing, among other things, limitations on capital structure and restrictions on specified investments.

Although we monitor the portfolio of the Company, the operating partnership and its subsidiaries periodically and prior to each acquisition and disposition, any of these entities may not be able to maintain an exclusion from the definition of investment company. If the Company, the operating partnership or any subsidiary is required to register as an investment company but fails to do so, the unregistered entity would be prohibited from engaging in our business, and criminal and civil actions could be brought against such entity. In addition, the contracts of such entity would be unenforceable unless a court required enforcement, and a court could appoint a receiver to take control of the entity and liquidate its business.

RisksRisk Related to Our Financing Strategy

The Company uses leverageWe have a significant amount of indebtedness and may need to incur more in the future.

We have substantial indebtedness. In connection with executing our business strategies, we expect to evaluate the possibility of originating, funding, and acquiring additional commercial real estate debt and making other strategic investments, and we may elect to finance these endeavors by incurring additional indebtedness. The amount of such indebtedness could have material adverse consequences, including:

•hindering our ability to adjust to changing market, industry or economic conditions;

•limiting our ability to access the capital markets to raise additional equity or refinance maturing debt on favorable terms or to fund acquisitions;

•limiting the amount of cash flow available for future operations, acquisitions, dividends, stock repurchases or other uses;

•making us more vulnerable to economic or industry downturns, including interest rate increases or sustained high interest rate environments; and

•placing us at a competitive disadvantage compared to less leveraged competitors.

Moreover, we may be required to raise substantial additional capital to execute our business strategy. Our ability to arrange additional financing will depend on, among other factors, our financial position and performance, as well as prevailing market conditions and other factors beyond our control. If we are unable to obtain additional financing, our credit ratings could be further adversely affected, which increases the risk of loss associated withcould further raise our investments.borrowing costs and further limit our future access to capital and our ability to satisfy our obligations under our indebtedness.

We financemay not be able to earn returns on loans we make in excess of the originationinterest we pay on our borrowings.

We try to generate financial returns by making and acquisition of a portioninvesting in loans and debt securities that generate returns in excess of our investments with repurchase agreements, collateralized loan obligations ("CLO") and other borrowings. Although the usecost of leverage may enhance returns and increase the number of investments that we can make, it may also substantially increase the risk of loss.capital. Our ability to execute this strategy depends on various conditions in the financing markets that are beyond our control, including liquidity, fluctuations in prevailing interest rates and credit spreads. Interest rate and credit spread fluctuations resulting in our interest and related expense exceeding interest and related income would result in operating losses

for us. Changes in the level of interest rates and credit spreads also may affect our ability to make new loans or investments and may decrease the value of our existing loans and investments. Increases in interest rates and credit spreads may also negatively affect demand for loans and could result in higher borrower default rates. We may be unable to obtain additional financing on favorable terms or, with respect to our debt and other investments, on terms that parallelmatch the maturities of the debt originated or other investments acquired, if we are able to obtain additional financing at all.

We rely on the availability of collateralized debt and loan obligation securitization markets to provide long-term financing for our loans and investments.

We rely on short-term borrowings, such as repurchase agreements and our secured revolving credit facilities, to initially fund our investments. The term of these short-term borrowing facilities is generally shorter than the term of our investments and therefore we typically intend to refinance these short-term borrowings with long-term match-funded financing through issuances of CDO’s and CLO’s. There have been times in the past when the CDO and CLO securitization markets have effectively been closed or are only available at a cost of capital that is not practicable. If our current financing strategy is notbecame no longer viable, we willwould have to find alternative forms of long-term financing for our assets, as secured revolving credit facilities and repurchase facilities may not accommodate long-term financing.assets. This could subject us to more restrictive recourse borrowings and subject us to capital costs that significantly reduce or eliminate the risk that debt servicespread between our cost of capital and the returns on less efficient forms of financing would require a larger portion of our cash flows, thereby reducing cash available for distribution, for our operations and for future business opportunities.investments. If alternative financing is not available, we may have to liquidate assets at unfavorable prices to pay off such financingour short-term borrowings or pay significant fees to extend ourthese financing arrangements. The return on our investments and cash available for distribution may be reduced to the extent that changes in market conditions cause the cost of our financing to increase relative to the income that we can derive from the assets we originate or acquire.

Lenders mayoften require us to enter into restrictive covenants relating to our operations, which could limit our ability to make distributions.

When providing financing, a lender may impose restrictions on us that affect our distribution and operating policies, and our ability to incur additional borrowings. Financing agreements that we may enter into mayoften contain covenants that limit our ability to further incur borrowings, restrict distributions or that prohibitrestrict our operations, such as prohibiting us from discontinuing insurance coverage or replacing our Advisor. CertainThese limitations would decrease our operating flexibility and may impact our ability to achieve our operating objectives, including making distributions.

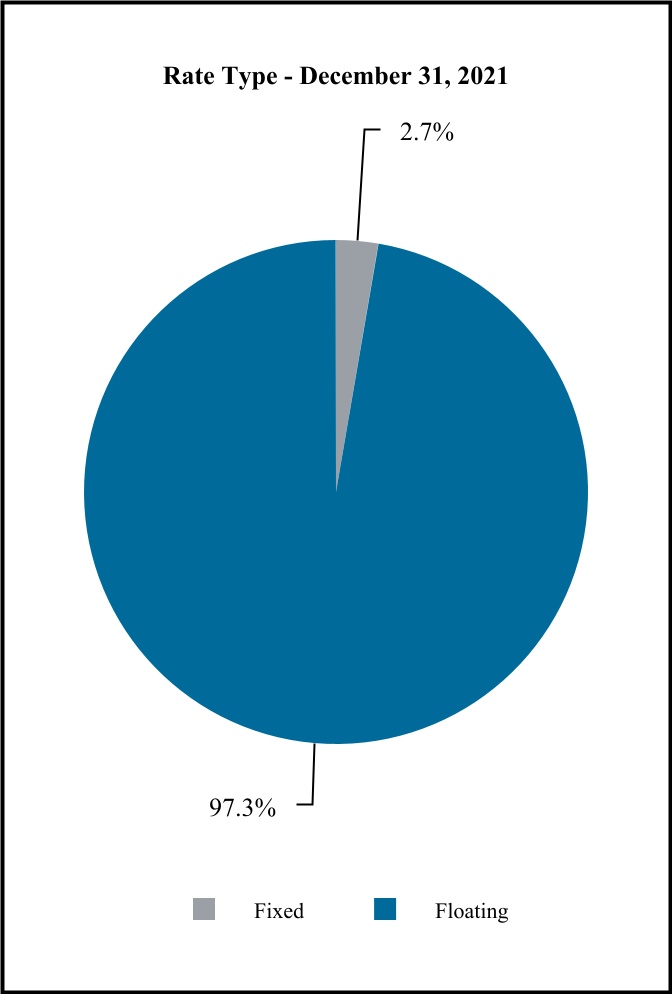

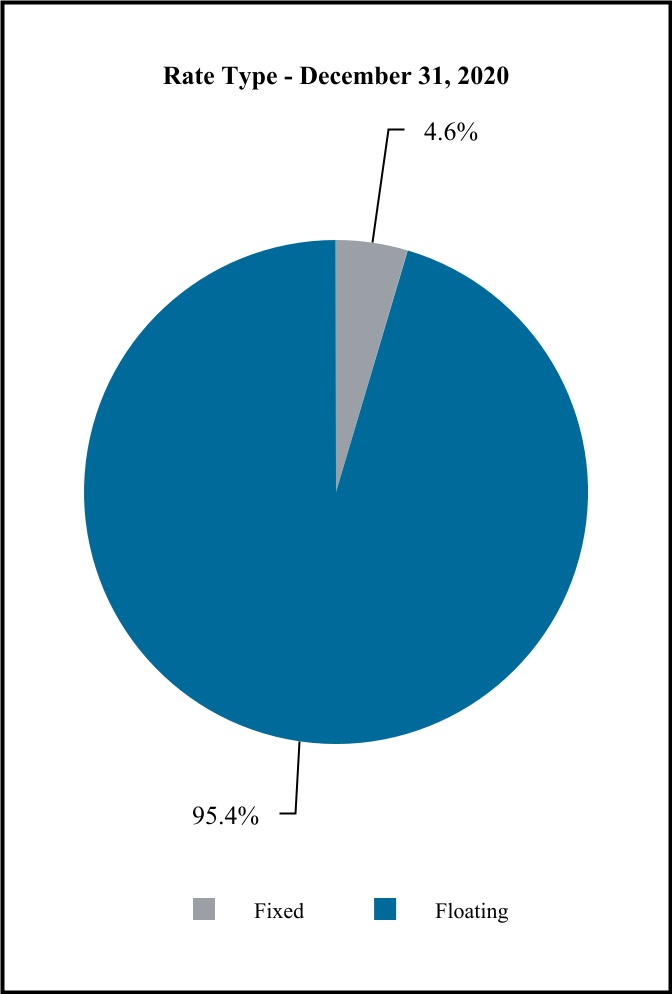

In a periodDuring periods of rising interest rates, our interest expense could increase while theincreases may outpace any increases in interest we earn on our fixed-rate assets, would not change, which would adversely affectand the value of our profitability.assets may decrease.

Our operating results depend in large part on differences between the income from our assets, reduced by any credit losses and financing costs. Income from our assets may respond more slowly to interest rate fluctuations than the cost of our borrowings. In a period of rising interest rates, our interest expense on floating-rate debt would increase, while any additional interest income we earn on our floating-rate investments may not compensate for such increase in interest expense. Consequently, changes in interest rates, particularly short-term interest rates, may significantly influence our net income. Increases in these rates will tend to decrease our net income and the market value of our assets. Similarly, in a period of declining interest rates, our interest income on floating-rate investments would generally decrease, and interest rate floors on our floating-rate investments may not align with the interest rate floors on our floating-rate debt to compensate for such a decrease in interest income. Interest rate fluctuations resulting in our interest expense exceeding the income from our assets would result in operating losses for us and may limit our ability to make distributions to our stockholders. In addition, if we need to repay existing borrowings during periods of rising interest rates, we could be required to liquidate one or more of our investments at times that may not permit realization of the maximum return on those investments, which would adversely affect our profitability.

We may not be able to access financing sources on attractive terms, if at all, which could dilute our existing stockholders and adversely affect our ability to fund and grow our business.business, or result in dilution to our existing stockholders.

Our ability to fund our loans and investments may be impacted by our ability to secure bank credit facilities (including term loans and revolving facilities), warehouse facilities and structured financing arrangements, public and private debt issuances (including through securitizations) and derivative instruments, in addition to transaction or asset specific funding arrangements and additional repurchase agreements on acceptable terms. We may also rely on short-term financing that would be especially exposed to changes in availability. Our access to sources of financing will depend upon a number of factors, over which we have little or no control, including:

•general economic or market conditions;

•the market’s view of the quality of our assets;

•the market’s perception of our growth potential;

•our current and potential

•future earnings and cash distributions; and

•the market price of the shares of our common stock and preferred stock.

We may need to periodically access the capital markets to, among other things, raise cash to fund new loans and investments. Unfavorable economic conditions such as those caused by the COVID-19 pandemic, or capital market conditions may increase our funding costs, limit our access to the capital markets or could result in a decision by our potential lenders not to extend credit. An inability to successfully access the capital markets could limit our ability to grow our business and fully execute our business strategy and could decrease our earnings and liquidity. Additional equity issuances in the capital markets on unfavorable terms could also be dilutive to our

existing stockholders. In addition, any dislocation or weakness in the capital and credit markets could adversely affect our lenders and could cause one or more of our lenders to be unwilling or unable to provide us with financing or to increase the costs of that financing. In addition, as regulatory capital requirements imposed on our lenders are increased, they may be required to limit, or increase the cost of, financing they provide to us. In general, this could potentially increase our financing costs and reduce our liquidity or require us to sell assets at an inopportune time or price. We cannot make assurances that we will be able to obtain any additional financing on favorable terms or at all.

We useOur short-term borrowings such as credit facilities and repurchase agreements to finance our investments, whichoften require us to provide additional collateral inwhen the event the lender determines there is a decrease in the fair market value of our collateral decreases, and these calls for collateral could significantly impact our liquidity position.