UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20222023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 000-55610

GREENBACKER RENEWABLE ENERGY COMPANY LLC

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Delaware | | 80-0872648 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

230 Park Avenue, Suite 1560

New York, NY 10169

Tel (646) 720-9463

(Address, including zip code and telephone number, including area code, of registrants principal executive office)

Charles Wheeler

230 Park Avenue, Suite 1560

New York, NY 10169

Tel (646) 720-9463

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Limited liability company interestsNone | | N/A | | N/A |

Securities registered pursuant to section 12(g) of the Act: None

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Shares of Limited Liability Company Interests | | N/A | | N/A |

| Class C Shares of Limited Liability Company Interests | | N/A | | N/A |

| Class I Shares of Limited Liability Company Interests | | N/A | | N/A |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of March 1, 2023,2024, the registrant had 198,482,500199,056,630 shares of common interests, $0.001 par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The Registrant intends to file a definitive proxy statement pursuant to Regulation 14A within 120 days after the end of the year ended December 31, 20222023 (the “2023“2024 Proxy Statement”). Portions of the Registrant’s 20232024 Proxy Statement to be filed pursuant to Regulation 14A are incorporated herein by reference into Part III of this Form 10-K.

EXPLANATORY NOTE

As previously announced by Greenbacker Renewable Energy Company LLC (the “Company”) in its Current Report on Form 8-K filed with the Securities and Exchange Commission on May 23, 2022, the Company completed the acquisition of Greenbacker Capital Management LLC (“GCM”), Greenbacker Administration LLC (“Greenbacker Administration”) and other affiliated companies on May 19, 2022 (the “Acquisition”). As a result of the Acquisition and other steps taken by the Company to transition the focus of the Company's business from being an investor in clean energy projects to a diversified independent power producer coupled with an investment management business, the Company was required to transition the basis of its accounting. Since inception, the Company's historical financial statements have been prepared using the investment company basis of accounting in accordance with Accounting Standards Codification (“ASC”) Topic 946, Financial Services – Investment Companies (“ASC 946”). ASC 946 (or “Investment Basis”) requires that if there is a subsequent change in the purpose and design of an entity, the entity should reevaluate its status as an investment company. Based on the above noted changes, management determined the Company no longer exhibited the fundamental characteristics of, and no longer qualified as, an investment company as defined in ASC 946. As a result, the Company was required to discontinue the application of ASC 946 and, in connection therewith, began applying other non-investment company U.S. generally accepted accounting principles (“U.S. GAAP”) prospectively beginning May 19, 2022 (the closing of the Acquisition).

As the change in status occurred during the Company’s second fiscal quarter of 2022, the results of operations as included in this annual report on Form 10-K (this “Annual Report”) will be presented as they would be for an investment company under ASC 946 for all historical periods and the period(s) through May 18, 2022, and presented as they would be under other non-investment company U.S. GAAP accounting (“Non-Investment Basis”) for the time period betweenas of and subsequent to May 19, 2022, the effective date of the change in status, through December 31, 2022.status. Given that the financial statements prior to and subsequent to the change in status are not comparable, the Company will present separate Consolidated Financial Statements, including footnotes as applicable, for the time periods prior to and subsequent to May 19, 2022.

TABLE OF CONTENTS

GLOSSARY OF KEY TERMS

InWhen the following terms and abbreviations appear in the text of this annual report, on Form 10-K (this “Annual Report”), except as otherwise indicated, they have the following terms mean:meanings indicated below:

| | | | | |

| Acquisition | The management internalization transaction completed by the Company on May 19, 2022 |

| Adjusted EBITDA | A non-GAAP financial measure that the Company uses as a performance measure as well as for internal planning purposes |

| Administration Agreement | First Amended and Restated Administration Agreement between Greenbacker Renewable Energy Company LLC, Greenbacker Renewable Energy Corporation and Greenbacker Administration LLC |

| Advisers Act | The Investment Advisers Act of 1940 |

| Advisory Agreement | Fourth Amended and Restated Advisory Agreement between Greenbacker Renewable Energy Company LLC and Greenbacker Capital Management LLC |

| AEC Companies | LED Funding LLC and Renew AEC One LLC |

| ARO | Asset Retirement Obligation |

| ASC | Accounting Standards Codification |

| ASC 946 or Investment Basis | ASC Topic 946, Financial Services – Investment Companies. The accounting method used by the Company prior to the Acquisition on May 19, 2022 |

| Aurora Solar | Aurora Solar Holdings, LLC |

| CES | Clean Energy Standards |

| COD | Commercial Operations Date |

| CODM | Chief Operating Decision Maker |

| Contribution Agreement | Contribution agreement between Greenbacker Renewable Energy Company LLC and Greenbacker Capital Management LLC’s former parent, Greenbacker Group LLC under which the Acquisition was implemented |

| DRP | Distribution Reinvestment Plan |

Earnout ShareShares | Class EO common shares issued as part of the Acquisition |

| EBITDA | A non-GAAP financial measure that adjusts income before income taxes to exclude interest, depreciation expense and amortization expense, as well as other income and expense items |

| EIA | U.S. Energy Information Administration |

| EPC | Engineering, procurement, and construction companies |

| Exchange Act | Securities Exchange Act of 1934 |

| FASB | Financial Accounting Standards Board |

| FERC | U.S. Federal Energy Regulatory Commission |

| FFO | A non-GAAP financial measure that the Company uses as a performance measure to analyze net earnings from operations without the effects of certain non-recurring items that are not indicative of the ongoing operating performance of the business |

| Fifth Operating Agreement | Fifth Amended and Restated Limited Liability Company Operating Agreement of Greenbacker Renewable Energy Company LLC |

| Fourth Operating Agreement | Fourth Amended and Restated Limited Liability Company Operating Agreement of Greenbacker Renewable Energy Company LLC |

| FPA | Federal Power Act |

| GCM | Greenbacker Capital Management LLC |

| GDEV | Greenbacker Development Opportunities Fund I, LP |

| GDEV B | Greenbacker Development Opportunities Fund I (B), LP |

| GDEV GP | Greenbacker Development Opportunities Fund GP I, LLC |

| GDEV GP II | Greenbacker Development Opportunities GP II, LLC |

| GDEV I | Refers collectively to GDEV and parallel fund, GDEV B |

| GDEV II | Greenbacker Development Opportunities Fund II, LP |

| GREC | Greenbacker Renewable Energy Corporation, a Maryland corporation |

| GREC HoldCo or GREC Entity Holdco | GREC Entity HoldCo LLC, a wholly owned subsidiary of GREC |

| GREC II | Greenbacker Renewable Energy Company II, LLC |

| | | | | |

| Greenbacker Administration or Administrator | Greenbacker Administration LLC |

| | | | | |

| Group LLC | Greenbacker Group LLC |

| GROZ | Greenbacker Renewable Opportunity Zone Fund LLC |

| GROZ, GDEV I, GDEV II and GREC II | The managed funds |

| GW | Gigawatts |

| HLBV | Hypothetical Liquidation at Book Value |

| IM | The Investment Management segment represents GCM’s investment management platform – a renewable energy, energy efficiency and sustainability-related project acquisition, consulting and development company that is registered as an investment adviser under the Advisers Act |

| Investment Basis | Investment Basis ASC Topic 946, Financial Services – Investment Companies |

| IPP | The Independent Power Producer segment represents the active management and operations of the Company's fleet of renewable energy projects, including those in late-stage development and under construction |

| IRA | Inflation Reduction Act of 2022 |

| IRS | Internal Revenue Service

| ITC | Investment Tax Credit |

| JOBS Act | Jumpstart Our Business Startups Act |

| kW | Kilowatts |

| kWh | Kilowatt hours |

| LIBOR | London Interbank Offered Rate |

| LP | Limited partner |

| |

| LPU Holder | GB Liquidation Performance Holder LLC |

| MIPA | Membership Interest Purchase Agreement |

| MSV | Monthly share value |

| MW | Megawatts: (DC) for all solar assets and (AC) for wind assets |

| MWh | Megawatt Hours |

| N/A | Not applicable |

| NAV | Net asset value |

| NCI | Noncontrolling interests |

| NM | Not meaningful |

NOL | Net Operating Losses |

| Non-Investment Basis | Non-investment company U.S. GAAP accounting the Company applied subsequent to the Acquisition |

| NTP | Notice to Proceed |

| O&O costs | Organization and Offering Costs |

OYA Solar | OYA-Rosewood Holdings LLC, previously OYA Solar B1 Intermediate Holdco LLC |

PCAOB | Public Company Accounting Oversight Board |

| PPA | Power Purchase Agreement |

| PTC | Production Tax Credit |

| PTO | Permission to operate |

| REC | Renewable Energy Credit |

| RNCI | Redeemable noncontrolling interests |

| ROU | Right-of-use asset |

| RPS | Renewable Portfolio Standard |

| SEC | Securities and Exchange Commission |

| SOFR | Secured Overnight Financing Rate |

Special unitUnit | Prior to the Acquisition, referred to the special unit of the limited liability company interest in the Greenbacker Renewable Energy Company LLC entitling the Special Unitholder to a performance participation fee |

| Special Unitholder | GREC Advisors, LLC, a Delaware limited liability company, which is a subsidiary of GCM |

| | | | | |

| SRP | Share Repurchase Program |

| Tax Equity Investors | Third-party investors under tax equity financing facilities |

| U.S. GAAP | U.S. generally accepted accounting principles |

| VIE | Variable interest entities |

| We, us, our and the Company | Greenbacker Renewable Energy Company LLC and its subsidiaries as of and subsequent to May 19, 2022 |

| | | | | |

| We, us, our and the LLC | Greenbacker Renewable Energy Company LLC, Greenbacker Renewable Energy Corporation, GREC Entity HoldCo LLC, GREC Administration LLC and Danforth Shared Services LLC as of and prior tothrough May 18, 2022 |

Forward Looking Statements

Various statements in this Annual Report on Form 10-K (this “Annual Report”), including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. The forward-looking statements may include projections and estimates concerning the timing and success of specific projects, revenues, income and capital spending. We generally identify forward-looking statements with the words “believe,” “intend,” “expect,” “seek,” “may,” “will,” “should,” “would,” “anticipate,” “could,” “estimate,” “plan,” “predict,” “project” or their negatives, and other similar expressions. All statements we make relating to our estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results, or to our expectations regarding future industry trends, are forward-looking statements. These forward-looking statements are subject to risks and uncertainties that may change at any time, and, therefore, our actual results may differ materially from those that we expected. The forward-looking statements contained in this Annual Report are largely based on our expectations, which reflect many estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe such estimates and assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect our actual results. In addition, assumptions about future events may prove to be inaccurate. We caution all readers that the forward-looking statements contained in this Annual Report are not guarantees of future performance, and we cannot assure any reader that such statements will prove correct or that the forward-looking events and circumstances will occur. Actual results may differ materially from those anticipated or implied in the forward-looking statements due to the numerous risks and uncertainties as described under Part I — Item 1A. Risk Factors and elsewhere in this Annual Report. All forward-looking statements are based upon information available to us on the date of this Annual Report. We undertake no obligation to update or revise any forward-looking statements as a result of new information, future events or otherwise, except as otherwise required by law. You are advised to consult any additional disclosures that we may make directly to you or through reports that we in the future may file with the SEC, including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. These cautionary statements qualify all forward-looking statements attributable to us, or persons acting on our behalf. The risks, contingencies and uncertainties associated with our forward-looking statements relate to, among other matters, the following:

•volatility of the global financial markets and uncertain economic conditions, including rising interest rates, inflationary pressures, recessionary concerns or global supply chain issues;

•other changes in the economy;

•the ability to complete the under construction renewable energy projects that we acquire;

•our inability to obtain or re-negotiate long-term contracts for the sale of our power produced by our projects on favorable terms and our inability to meet certain milestones and other performance criteria under existing PPAs;

•our relationships with project developers, lawyers, investment and commercial banks, individual and institutional investors, consultants, diligence specialists, EPCs, contractors, renewable energy technology manufacturers (such as panel manufacturers), solar insurance specialists, component manufacturers, software providers and other industry participants in the renewable energy, capital markets and project finance sectors;

•fluctuations in supply, demand, prices and other conditions for electricity, other commodities and RECs;

•public response to and changes in the local, state and federal regulatory framework affecting renewable energy projects, including the potential expiration or extension of the PTC, ITC and the related United States (“U.S.”) Treasury grants, potential reductions in RPS requirements and the impacts of the recent passage of the IRA;

•competition from other energy developers and asset managers;

•the worldwide demand for electricity and the market for renewable energy;

•the ability or inability of conventional fossil fuel-based generation technologies to meet the worldwide demand for electricity;

•our competitive position and our expectation regarding key competitive factors;

•risks associated with our hedging strategies;

•potential environmental liabilities and the cost of compliance with applicable environmental laws and regulations, which may be material;

•our electrical production projections (including assumptions of curtailment and facility availability) for our renewable energy projects;

•our ability to operate our business efficiently, manage costs (including salary and compensation related expenses and other general and administrative expenses) effectively and generate cash flow;

•availability of suitable renewable energy resources and other weather conditions that affect our electricity production;

•the effects of litigation, including administrative and other proceedings or investigations relating to our renewable energy projects;

•non-payment by customers and enforcement of certain contractual provisions;

•the lack of a public trading market for our shares;

•the ability to make and the amount and timing of anticipated future distributions;

•risks associated with possible disruption in our operations or the economy generally due to terrorism, natural or man-made disasters, pandemics or threatened or actual armed conflicts;

•future changes in laws or regulations and conditions in our operating areas;

•the loss of our exemption from the definition of an “investment company” under the Investment Company Act of 1940, as amended;

•fiscal policies or inaction at the U.S. federal government level, which may lead to federal government shutdowns or negative impacts on the U.S economy;

•failure to attract and retain qualified personnel, increased labor costs, and the unavailability of skilled workers; and

•our ability to achieve the cost savings and economies of scale expected to be realized as a result of the Company's management internalization.

PART I

ITEM 1. BUSINESS

The use of “we”, “us”, “our” and the “Company” refer, collectively to the Greenbacker Renewable Energy Company LLC and its subsidiaries, unless otherwise expressly stated or context otherwise requires. This report does not constitute an offer of any of the Company'sCompany’s managed funds described herein.

Organizational Overview

Greenbacker Renewable Energy Company LLC (the “Company”) is a Delaware limited liability company formed in December 2012. The Company is an energy transition, renewable energy and investment management company that acquires, constructs and operates renewable energy and energy efficiency projects, as well as finances the construction and/or operation of these and other sustainable development projects and businesses and provides through GCM investment management services to funds within the sustainable infrastructure and renewable energy industry. As of December 31, 2022,2023, the Company’s fleet comprised 456435 renewable energy projects with an aggregate power production capacity of approximately 3.13.3 GW, when fully operational.which includes operating capacity of approximately 1.5 GW and pre-operational capacity of approximately 1.8 GW. As of December 31, 2022,2023, GCM serves as the registered investment adviser of four funds in the sustainable and renewable energy industry.

The Company conducts substantially all its operations through its wholly owned subsidiary, GREC. Until May 19, 2022, the Company was externally managed by GCM. As of and after May 19, 2022, the Company operates as a fully integrated and internally managed company after acquiring GCM and several other related entities, which are now wholly owned subsidiaries of GREC. The Company’s fiscal year-end is December 31.

The Company previously conducted continuous public offerings of Class A, C, and I shares of limited liability company interests, along with Class A, C, and I shares pursuant to the Company’s DRP. The public offerings were initially commenced in August 2013 and terminated March 29, 2019, raising a total of $253.4 million. The Company also privately offered Class P-A, P-I, P-D, P-T and P-S shares. These private offerings were conducted between April 2016 and March 16, 2022, raising a total of $1.4 billion. The Company currently offers the DRP pursuant to which shareholders may elect to have the full amount of cash distributions reinvested in additional shares. The Company also offersoffered the SRP pursuant to which quarterly share repurchases arewere conducted to allow shareholders to sell shares back to the Company. On September 23, 2023, the Company suspended the SRP (except with respect to repurchase requests made in connection with the death, qualifying disability or determination of incompetence of a shareholder).

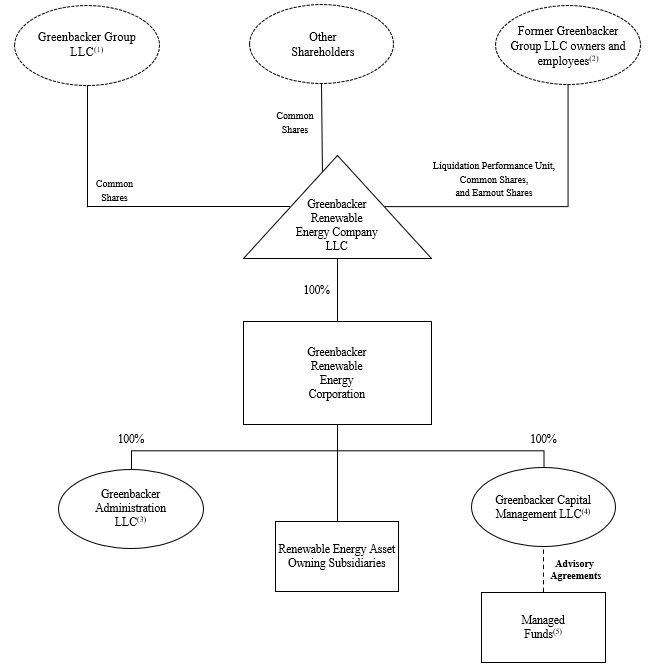

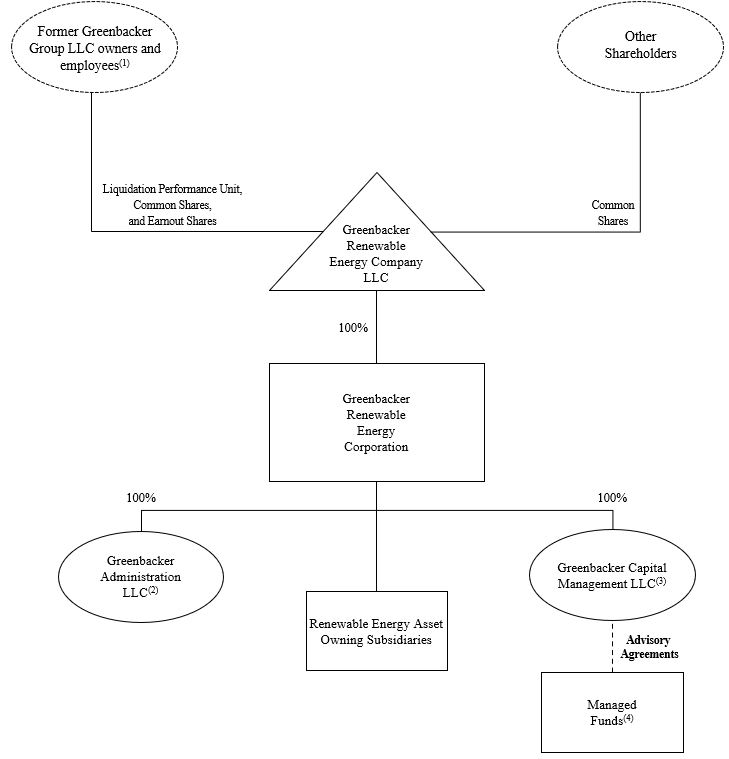

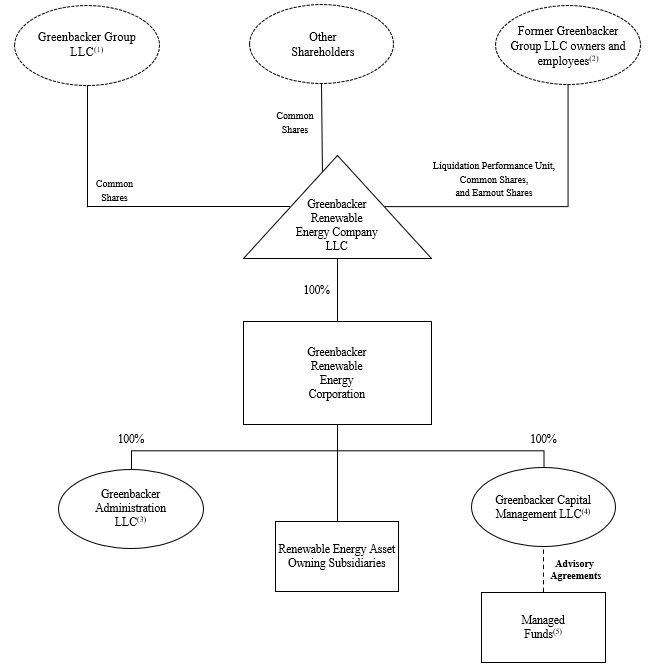

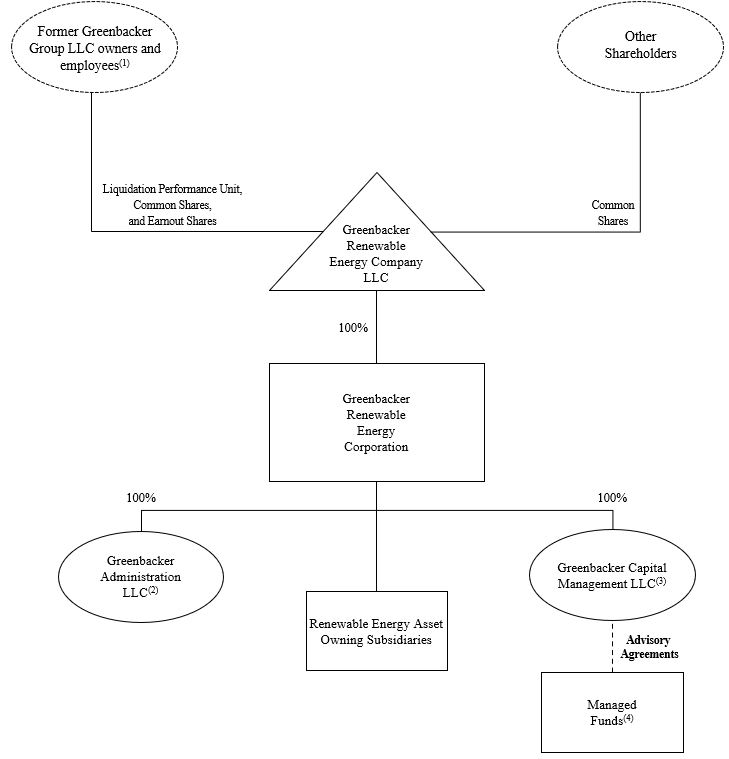

The organizational structure chart below depicts a simplified version of our structure as of the date of the filing of this Annual Report. This structure chart does not include all legal entities.

(1) Includes common shares, representing less than 1% of the Company’s outstanding shares, issued to Group LLC and held back in the event Group LLC breaches its representations and warranties under the Contribution Agreement, and until such time as the survival period specified therein expires.

(2) Held directly or through entities owned by them. Refer to Note 3. Acquisitions under the Non-Investment Basis for a summary of these interests that were issued in connection with the Acquisition.

(3)(2) Greenbacker Administration performs certain operational management, construction management, compliance and oversight services, as well as asset accounting and administrative services, for certain of our managed funds. In connection with the Acquisition, Greenbacker Administration also provides certain transitional services, which include financial and corporate recordkeeping services, to Group LLC and certain other parties. Refer to Note 14.16. Related Parties underin the Non-Investment BasisNotes to the Consolidated Financial Statements (Non-Investment Basis) for further details on these agreements.

(4)(3) GCM is ana SEC-registered investment adviser and provides investment management services to our managed funds,funds: GROZ, GDEV I, GDEV II, and GREC II.

(5)(4) We hold a 75.00% interest in the general partner of one of our managed funds, GDEV GP. The amended and restated limited partnership agreements of GDEV I provides for a 20.00% carried interest over an 8.00% hurdle, subject to side letter agreements. In addition, we hold 90.00% interest in the general partner of one of our managed funds, GDEV GP II. The amended and restated limited partnership agreement of GDEV II provide for a 20.00% carried interest over an 8.00% hurdle, subject to a side letter agreement. Refer to Note 14.16. Related Parties underin the Non-Investment BasisNotes to the Consolidated Financial Statements (Non-Investment Basis) for further details on these interests.

Management Internalization

On May 19, 2022, the Company completed the Acquisition pursuant to which it acquired substantially all of the business and assets, including intellectual property and personnel of its external advisor, GCM, an investment management and energy transition, renewable energy, energy efficiency and sustainability-related project acquisition, consulting and development company that is registered as an investment adviser under the Advisers Act, Greenbacker Administration and certain other affiliated companies. All of the acquired businesses and assets were immediately thereafter contributed by the Company to GREC. As a result of the Acquisition, the Company operates as a fully integrated and internally managed company with its own dedicated executive management team and other employees to manage its business and operations. The Company now operates with the capabilities of both an actively managed owner-operator of sustainable infrastructure and renewable energy businesses and as an active third-party investment manager of other funds within the sustainable infrastructure and renewable energy industry.

Business Overview

The Company’s business objective is to generate attractive risk-adjusted returns for its shareholders, consisting of both current income and long-term capital appreciation, by acquiring and financing the construction and/or operation of income-generating renewable energy, energy efficiency and sustainable development projects, primarily within North America, as well as by providing investment management services to funds within the sustainable infrastructure and renewable energy industry where the Company expectexpects to receive investment management and incentive fees.

The Company operates with the capabilities of both an actively managed owner-operator of renewable energy businesses and as an active third-party investment manager of other funds within the sustainable infrastructure and renewable energy industry. The Company currently operates in two reportable segments described below.

•IPP – The IPP business represents the active management and operations of the Company's fleet of renewable energy projects, including those in late-stage development and under construction. The Company's renewable energy projects generally earn revenue through the sale of generated electricity as well as frequently through the sale of other commodities such as RECs. In certain cases, the Company also serves as a minority member in renewable energy projects where it does not actively manage and operate the project but receives periodic dividends. The Company also provides loans to developers for the construction of renewable energy and energy efficiency projects as an incremental revenue stream for IPP.

The IPP business includes the direct costs to operate the Company's fleet, including costs such as operations and maintenance, repairs, and other costs incurred at the project / site level. Additionally, the Company employs a dedicated team of technical asset managers as well as a construction team to oversee the development and operations of our fleet. Such costs are recorded as Direct operating costs for IPP.

The IPP business also includes the allocable portion of the Company’s General and administrative expenses, which represents overhead functions such as: finance and accounting, legal, information technology, human resources and other general functions that support the operations of IPP.

•IM – The IM business represents GCM’s investment management platform – a renewable energy, energy efficiency and sustainability-related project acquisition, consulting and development company that is registered as an investment adviser under the Advisers Act. The IM business will also includeincludes administrative services provided by Greenbacker Administration for managed funds in the renewable energy industry as an additional revenue stream.

The Company's IM business includes the direct costs incurred for the investment management services for managed funds and other marketing and investor relation services. This includes the costs to raise and deploy capital for such funds. Such costs are recorded as Direct operating costs for IM.

The IM business also includes the allocable portion of the Company’s General and administrative expenses, which represents overhead functions such as: finance and accounting, legal, information technology, human resources and other general functions that support the operations of IM.

The segment discussion following, and included in Part II — Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations within this Annual Report, reflects information on our business as of December 31, 20222023 and includes the impact of the Acquisition.

Independent Power Producer Segment

Our IPP segment represents the active management and operations of our fleet of renewable energy projects, including those in late-stage development and construction. Our growth strategy for the IPP segment is to continue to build a diversified portfolio of renewable energy, energy efficiency and other sustainability-related projects and businesses.

We target IPP acquisitions that generally range between approximately $1 million and $250 million. We will seek to maximize our risk-adjusted returns by: (1) capitalizing on market opportunities; (2) focusing on hard assets that produce dependable cash flows; (3) efficiently utilizing government incentives where available; (4) employing creative deal structuring to optimize capital and ownership structures; (5) partnering with experienced financial, legal, engineering and other professional firms; (6) employing sound due diligence and risk mitigation processes; and (7) monitoring and managing our portfolio of assets on an ongoing basis. We may change our acquisition strategies without prior notice or shareholder approval.

Our preferred acquisition strategy is to acquire controlling equity stakes in our target assets or to be named the managing member of a limited liability company in order to oversee and supervise its operations. We define controlling equity stakes as companies in which we own 25% or more of the voting securities of such company, have greater than 50% representation on such company’s board of directors, or as the managing member of a limited liability company. However, we will also provide financing to projects owned by others, including through the provision of secured loans which may or may not include some form of equity participation.

We from time to time also provide projects with senior unsecured debt, subordinated secured debt, subordinated unsecured debt, mezzanine debt, convertible debt, convertible preferred equity and preferred equity, and make minority equity investments. We from time to time also participate in projects by acquiring contractual payment rights or rights to receive a proportional interest in the operating cash flow or net income of a project. We may also make equity investments in or loans to parties financing the supply of renewable energy and energy efficiency to residential and commercial customers or adopting strategies that encourage energy conservation to reduce the consumption of energy by those customers. Our strategy is flexible, and we balance long-term cash flow certainty, which we can achieve through long-term agreements for our projects, with shorter-term arrangements that allow us to potentially generate higher risk-adjusted returns.

We expect to supplement our equity capital and increase potential returns to our shareholders through the use of prudent levels of borrowings, both at the corporate level and the project level. In addition to any corporate credit facility or other secured and unsecured borrowings, we use a variety of other financing methods at the project level as necessary, including but not limited to joint venture structures, back leverage loans, construction loans, tax equity bridge loans, property mortgages, letters of credit, sale and leaseback transactions, other lease transactions and other arrangements, any of which may be unsecured or may be secured by mortgages or other interests in our assets. In addition, we may issue publicly or privately placed debt instruments. When appropriate, we will seek to replace short-term sources of capital with long-term financing.

We have historically focused on solar, wind and energy efficiency projects. We believe solar energy projects generally offer more predictable power generation characteristics due to the relative predictability of sunlight over the course of time compared to other renewable energy technologies, and therefore we expect them to provide more stable income streams. However, technological advances in wind turbines and other energy-generation technologies, as well as government incentives, also make wind energy and other types of projects attractive. In 2023, the Company invested in three wind repower projects. These assets were retrofit with new and/or refurbished technology, including erecting taller, more efficient wind turbines to increase productivity. Solar energy projects provide maximum energy production during daylight hours in the summer months when days are longer and nights shorter. Conversely, wind energy projects tend to provide more energy production during nighttime hours and during the winter months thus providing a diversified production profile. Solar energy projects vary in size from hundreds of kW to hundreds of MW and tend to have minimal environmental impact, enabling such projects to be developed close to areas of dense population where electricity demand is highest.

Over time, we have broadened our strategy, and expect to continue to broaden our strategy to include other types of renewable energy projects and energy efficiency projects and businesses, which may include battery storage, hydropower assets, geothermal plants, biomass and biofuel assets, combined heat and power technology assets, fuel cell assets and other energy efficiency assets, among others, and to the extent we deem the opportunity attractive, other energy and sustainability-related assets and businesses.

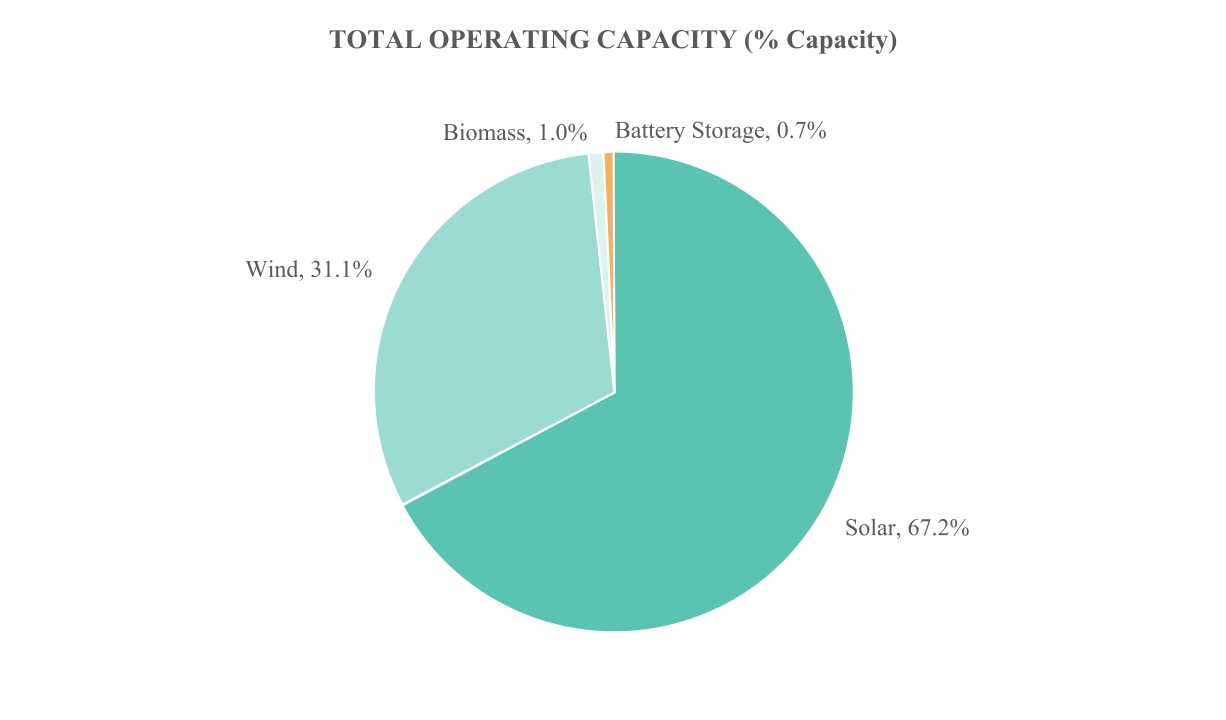

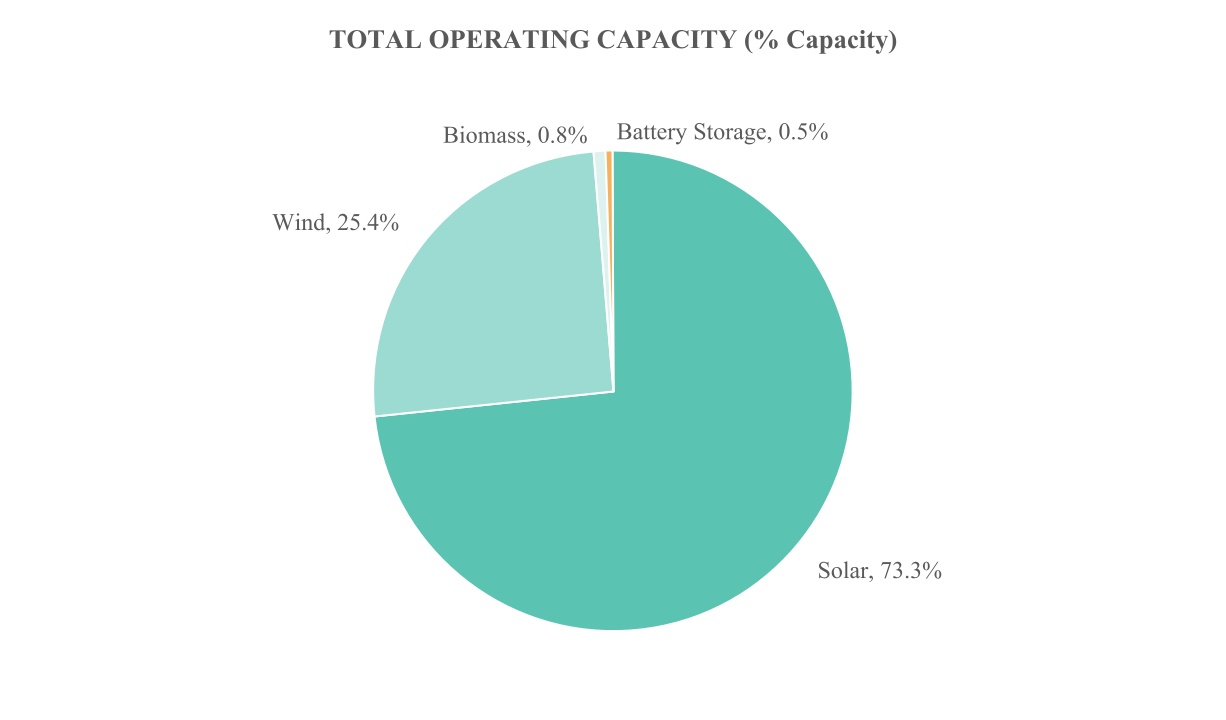

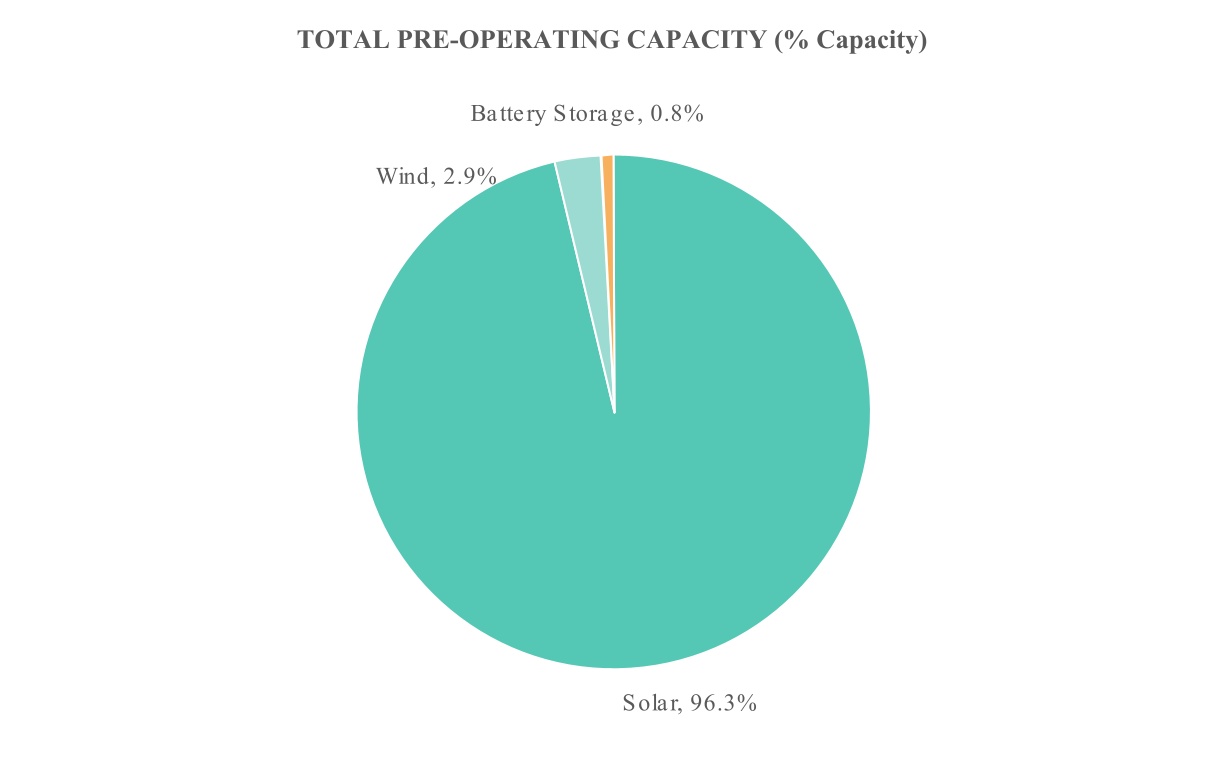

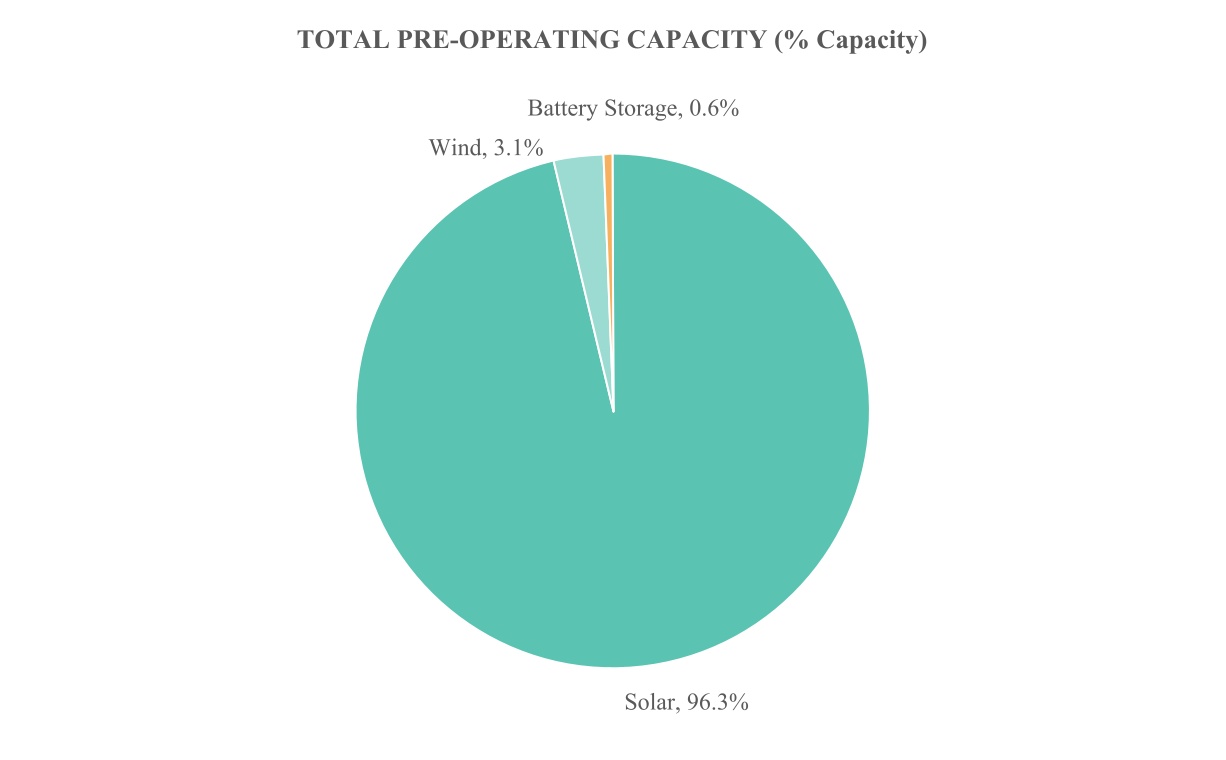

As of December 31, 2022,2023, our fleet comprised 456435 renewable energy projects with an aggregate power production capacity of approximately 3.13.3 GW when fully operational, as summarized below.

4 | | | | | | | | | | | | | | |

| Technology | Number of Assets | Capacity in MW |

| Operating | Pre-Operating | Operating | Pre-Operating |

| Solar | 324 | 65 | 1,123.6 | 1,685.8 |

| Wind | 16 | 1 | 389.0 | 54.4 |

| Biomass | 1 | N/A | 12.0 | N/A |

| Battery Storage | 19 | 5 | 8.3 | 10.8 |

| Energy Efficiency | 4 | N/A | N/A | N/A |

| Total | 364 | 71 | 1,532.9 | 1,751.0 |

| | | | | | | | | | | | | | |

| Technology | Number of Assets | Capacity in MW |

| Operating | Pre-Operating | Operating | Pre-Operating |

| Solar | 285 | 119 | 834.4 | 1,812.6 |

| Wind | 16 | 1 | 386.1 | 54.4 |

| Biomass | 1 | N/A | 12.0 | N/A |

| Battery Storage | 19 | 11 | 8.3 | 14.1 |

| Energy Efficiency | 4 | N/A | N/A | N/A |

| Total | 325 | 131 | 1,240.8 | 1,881.1 |

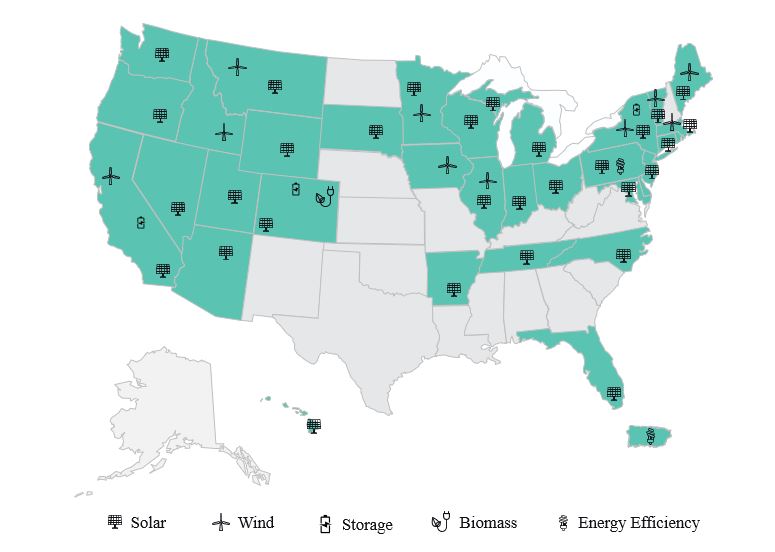

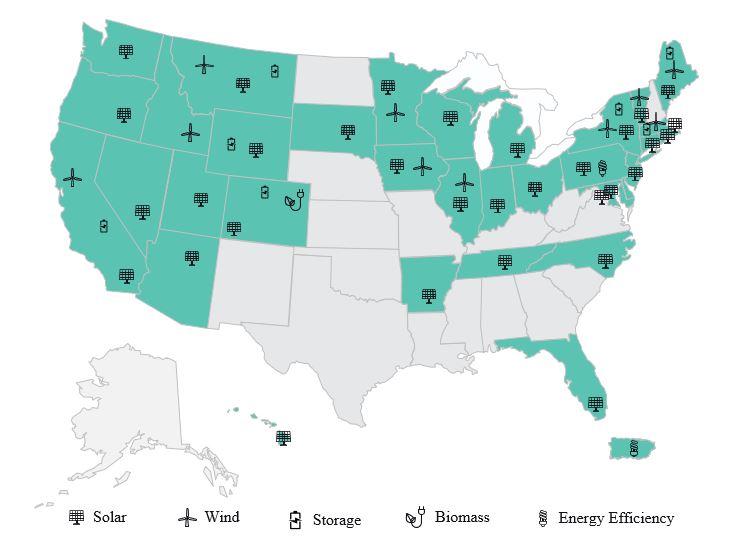

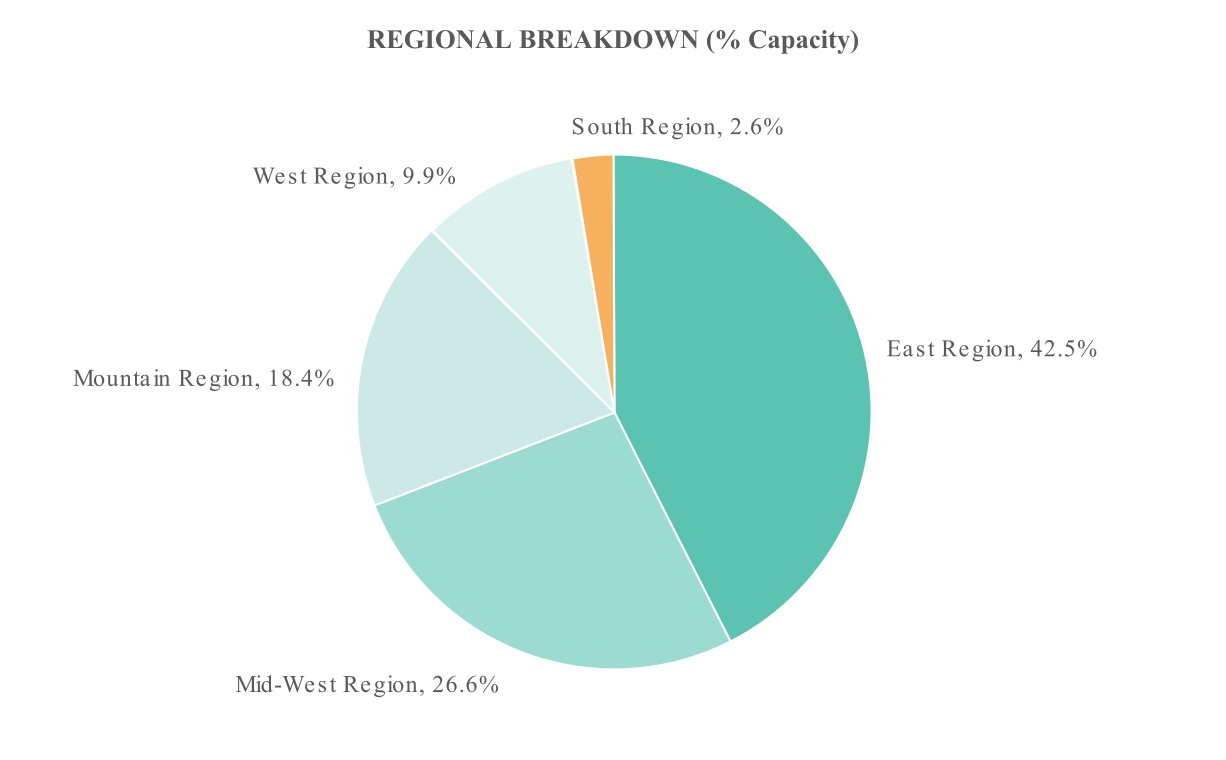

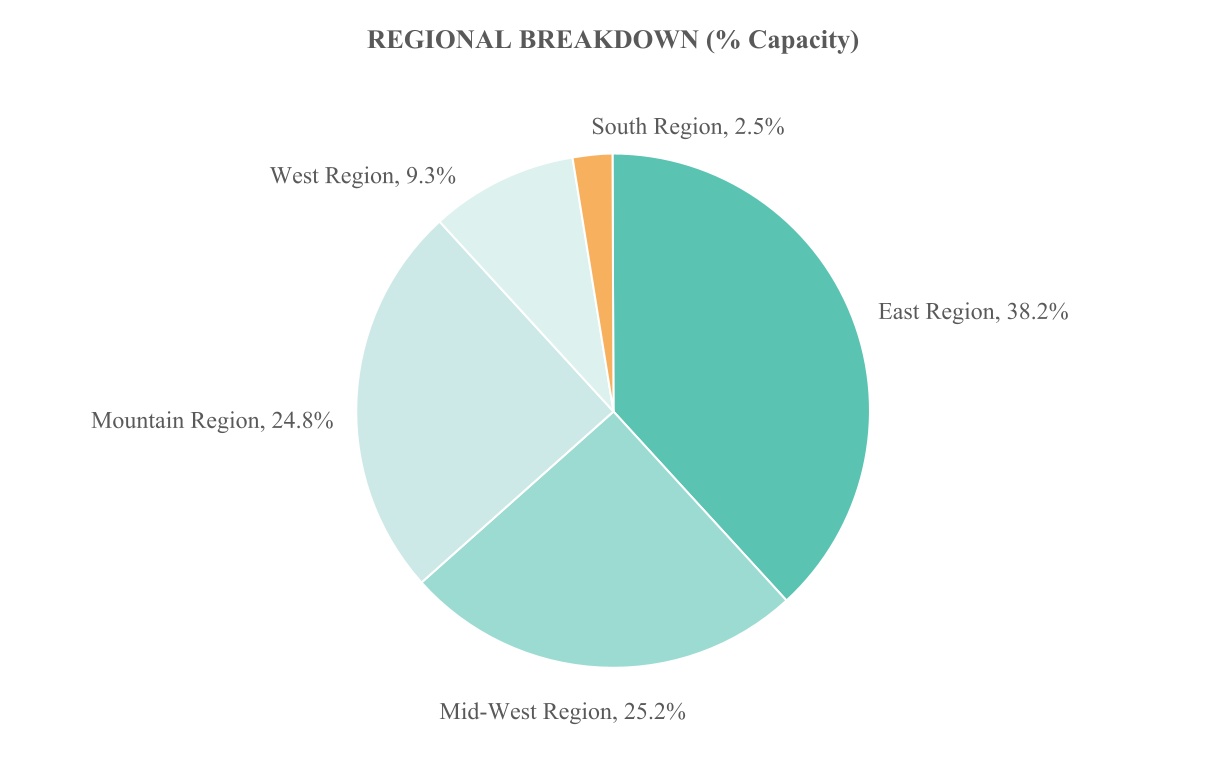

We have diversified our fleet of renewable energy projects both by industry type, as illustrated above, and geographically.As of December 31, 2022,2023, our fleet was spread across 32 states, Canada, Puerto Rico and Washington, D.C., as illustrated below.

PORTFOLIO ASSET MAP

* Solar asset in Canada is not shown on the map

| | CAPACITY BREAKDOWN | CAPACITY BREAKDOWN | CAPACITY BREAKDOWN |

| Technology | Technology | Percent capacity (%) | Size (MW) | Technology | Percent capacity (%) | Size (MW) |

| Solar | Solar | 84.8 | 2,647.0 | Solar | 85.5 | 2,809.4 |

| Wind | Wind | 14.1 | 440.5 | Wind | 13.5 | 443.4 |

| Biomass | | Biomass | 0.4 | 12.0 |

| Battery Storage | Battery Storage | 0.7 | 22.4 | Battery Storage | 0.6 | 19.1 |

| Biomass | 0.4 | 12.0 |

Our renewable energy projects generate revenue primarily by selling (1) generated electric energy and/or capacity to local utilities and high-quality utility, municipal, corporate and in the case of community solar, residential counterparties; and (2) in some cases, RECs and other commodities associated with renewable generation or related incentives. We seek to acquire or finance projects that contain transmission infrastructures and access to power grids or networks that will enable the generated power to be sold. We generally expect our projects will have PPAs with one or more counterparties, including local utilities or other high-credit-quality counterparties, who agree to purchase the electricity generated from the project. We refer to these PPAs as “must-take contracts,” and we refer to these other counterparties as “offtakers.” These must-take contracts in general are output-based and guarantee that all electricity generated by each project will be purchased.

As of December 31, 2022,2023, the PPA contracts in our existing operating fleet have approximately 18 weighted average years remaining prior to exposure to market prices.

Although we intend to work primarily with high-credit-quality counterparties, if an offtaker cannot fulfill its contractual obligation to purchase the power, we generally can sell the power to the local utility or other suitable counterparty, which would potentially ensure that revenue is generated for all solar electricity generation. We may also generate revenue from the receipt of interest, fees, capital gains and distributions from investments in our target assets.

We employ a rigorous credit underwriting process for each of our contractual counterparties, including: (1) identification of high-credit-quality counterparties with appropriate bonding and insurance capacity; (2) where available, the review of counterparty financial statements and/or publicly available credit rating reports; (3) worst-case analysis testing of assets; and (4) ongoing monitoring of acquired assets and counterparty creditworthiness, including monitoring the public credit ratings reports issued by Moody’s and Standard and Poor’s.

Our PPAs, when structured with utilities and other large commercial users of electricity, are generally long-term in nature, tied to 100% of the output of the specific generating asset. Although we focus on projects with long-term contracts that ensure

price certainty, we may also look for projects with shorter-term arrangements that will allow us to participate in market rate changes, which may lead to higher current income.

A number of the PPAs for our projects are structured as “behind-the-meter” agreements with residential, commercial or government entities. Under the agreements, all electricity generated by a project will be purchased by the offtaker at an agreed-upon rate that may be set at a slight discount to the retail electric tariff rate for the offtaker. These agreements also typically provide for annual rate increases over the term of the agreement, although that is not a necessary requirement. The behind-the-meter agreement is generally long termlong-term in nature, and further typically provides that, should the offtaker fail to fulfill its contractual obligation, in some cases electricity that is not purchased by the offtaker may be sold to the local utility, usually at an equivalent wholesale spot electric rate, more typically the projects would have remedies available in terms of make whole and termination provisions that seek to satisfy the required economics of the deal.

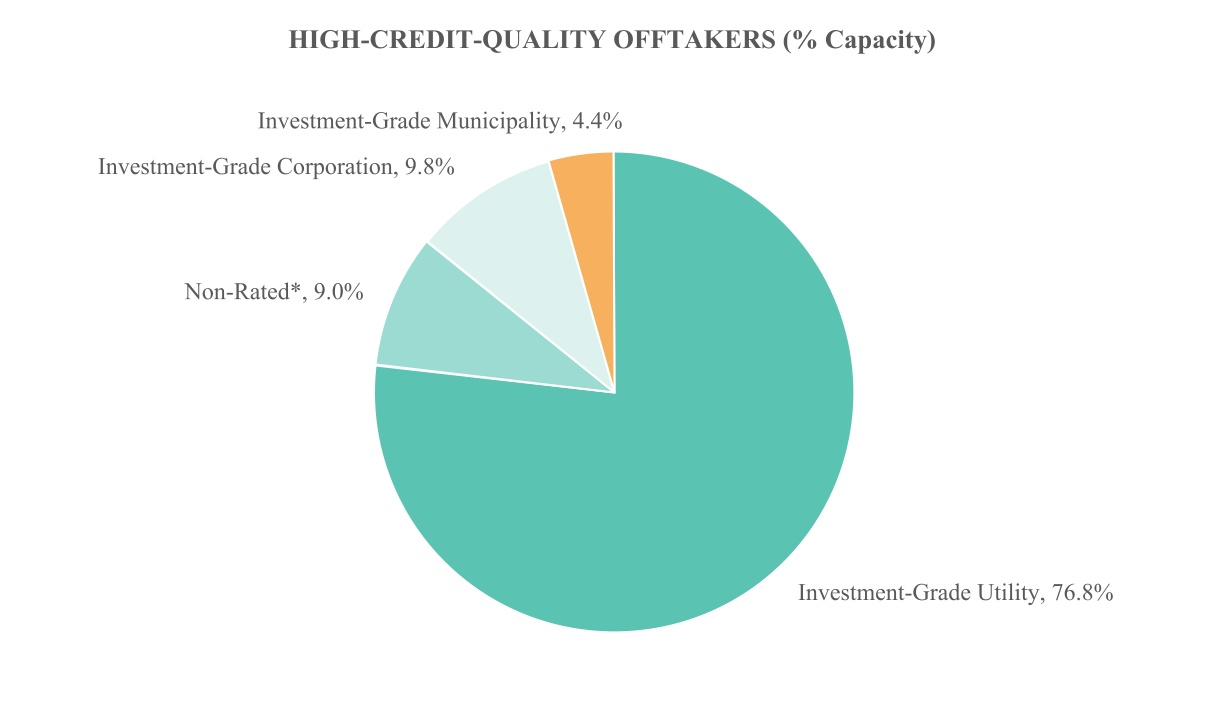

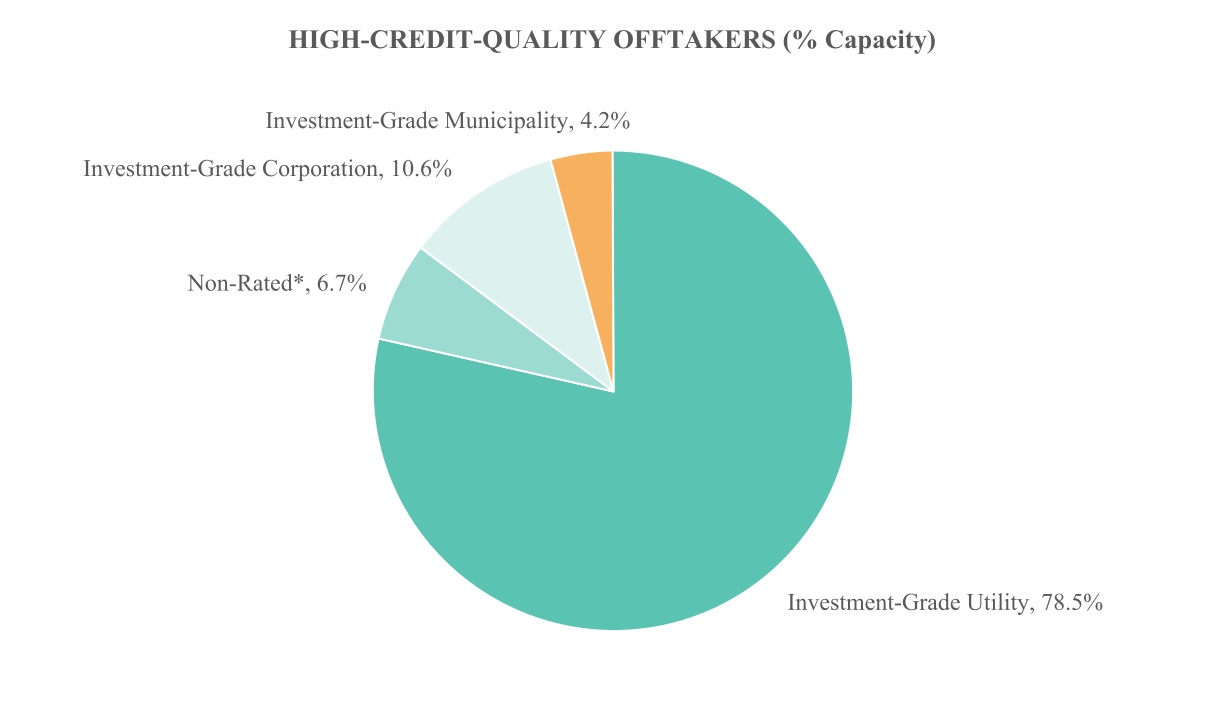

The following chart illustrates the allocation by percentage of the Company’s contracted offtakers by counterparty type and creditworthiness as of December 31, 2022:2023:

* Non-rated offtakers are unrated by credit rating agencies.

Acquisition of Pre-Operating Assets

We believe that the hallmark of a successful acquisition strategy is the ability to take advantage of new opportunities and adjust to changing market conditions. Over the years, the Company observed an increase in the opportunities to participate in projects that were largely similar to our operating assets in terms of the long-term risks, but which promised additional returns if we could manage additional risks in the early stages of the investment lifecycle. As a result, we expanded our investment capabilities to include four basic investment categories:

1.Operating Assets – We will continue to acquire and invest in solar, wind and other alternative energy assets that are already in commercial operation and generating investment returns through the sale of contracted electricity and environmental attributes.

2.Assets before their COD – We will also purchase assets that have been constructed by developers but have not been placed in service. Functionally these assets are generally ready to generate electricity but have not reached a milestone known as PTO with the local utility or COD. While we have determined that a modest investment premium could be obtained by investing before PTO and COD, most importantly the term of the contracted cash flows is maximized through this strategy.

3.Assets at NTP – We further determined that we could invest in assets that had not yet been constructed but that had received substantially all of the contracts necessary to operate and permits necessary to begin construction, a milestone

known as NTP. While potentially riskier than operating or pre-COD projects due to the level of construction risk, we believe that the additional return associated with these projects more than compensates for the additional risk. Furthermore, when we invest in NTP assets we generally have the added benefit of having more control of equipment selection and implementation of construction best practices, which positively affects the long-term performance of our plants. With the continued growth of the renewable energy market, driven by increases in the level of Renewable Portfolio Standards in several states and the recent passage of the IRA, we identified a significant number of NTP transactions coming to market and an opportunity to develop strong pipeline-type relationships with the developers of these projects. Besides increasing returns to investors, this has enabled management to substantially increase our access to a proprietary pipeline of sound projects.

4.Special Situations – We also determined there are market opportunities for selected projects driven by either technical or financial issues, either at the project or owner level, that can be resolved by accessing the broad range of expertise we have in-house to deal with our day-to-day operations. Therefore, we determined that on a limited basis we would make investments that have these characteristics, since by resolving the issues, we have the potential to generate attractive returns. We believe that the number of these “distressed” assets may increase materially over the coming years.

In order to execute this broader investment strategy, we have built a dedicated team of technical asset management professionals. We now have a team of experienced engineers, operations and maintenance experts, and construction professionals, which enabled us to expand our investment focus into these additional categories of investment. In addition to the expansion of our current investment strategy as laid out above, havehaving a team of experienced engineers and construction managers increases our ability to extract revenue from aging renewable energy assets through repowers and plant optimization. Having access to this level and breadth of expertise is a major competitive advantage for us in the marketplace.

Strategic Considerations of Acquiring NTP Projects

We believe that acquiring renewable energy projects across the four categories discussed above provides the best opportunity for us to generate attractive returns over the medium term, diversify our portfolio, and create a proprietary pipeline of sound investment opportunities for future growth. The downside of this approach is that investing in pre-operational solar and wind projects has a negative impact on near-term cash flows as material amounts of our capital is invested in non-yielding assets. To minimize the downside effects of the strategy, management continues to explore more sophisticated financing tools to enable us to direct more of our investable capital into current income-generating investments going forward. As the size of our portfolio grows, our ability to access the more sophisticated financial products increases.

Our Financing Strategy

We supplement our equity capital and increase potential returns to our shareholders through the use of prudent levels of borrowings both at the corporate level and the project level. The Company's Fifth Operating Agreement does not impose limitations on the amount of borrowings we may employ, either at the corporate level or the project level. Our current policy is to generally target a leverage ratio of up to $2 of debt for every $1 of equity on our overall acquisition strategy for IPP, with individual allocations of leverage based on the mix of asset types and obligors; however, we will in no event exceed a leverage ratio of $3 of debt for every $1 of equity, unless any excess is approved by a majority of our independent directors. In addition to any corporate-level credit facility or other secured and unsecured borrowings, we expect to use other financing methods at the project level as necessary, including joint venture structures, back leverage loans, construction loans, tax equity bridge loans, property mortgages, letters of credit, sale and leaseback transactions, other lease transactions, and other arrangements, any of which may be unsecured or may be secured by mortgages or other interests in our assets. In addition, we may issue publicly or privately placed debt instruments. Our indebtedness may be recourse or non-recourse and may be cross-collateralized. In addition, we may invest in assets subject to existing liens, or may refinance the indebtedness on assets acquired on a leveraged basis. We may use the proceeds from any borrowings to acquire assets, refinance existing indebtedness, finance investments, fund distributions or for general corporate purposes. In addition to these financing methods, we may utilize tax equity structures to monetize U.S. federal income tax attributes.

General Market Overview for Alternative Energy Projects

The U.S. electric consumer expects a virtually error-free, consistent supply of sufficient electricity at all times for all purposes. The U.S. power industry, which includes energy generation and transmission, is structured to ensure sufficient, constant supply of energy to all end-users to meet varying demand requirements on a minute-by-minute basis. Historically, the mix of electricity supply was dependent largely on fossil fuels such as coal and natural gas as well as nuclear and hydroelectric power. However, this is changing rapidly due to the rise of renewable energy and the ongoing electrification of the transportation fleet. According to the EIA, as late as 2014, fossil fuels such as coal, petroleum and gas supplied about 67%more than half of

the U.S.’s energy requirements.power generation mix in past years. Since then, however, there has been a shift in the mix of energy sources highlighted by a substantial rise in renewables, which grew to 22% of the U.S. power generation mix in 2022.2023. The EIA expects this trend to continue, estimating that in 20232024 renewables will rise to 24% of the U.S.’s power generation mix, (and continuebefore increasing to increase26% in 2024).2025. The advanceadvancement of renewable energy has also created new opportunities in adjacent energy transition investments including energy storage and grid enhancements. Furthermore, advances in electric vehicle adoption have created a substantial need for investment in charging stations and other related infrastructure.

According to BloombergNEF (“BNEF”), renewable energy, which includes wind, solar, biofuels, and other renewables, remained the largest sector in investment terms, achieving a new record of $495 billion committed in 2022, up 17% from the year prior.1

We believe that renewable energy and the energy transition are poised to gain even more market share, driven by several supportive trends:

The decline of coal. The U.S. coal industry is rapidly declining — the EIA expects coal-burning plants will account for the majority of retiring utility scale power generation in 2023 — in the face of lower-cost natural gas and renewable energy, as well as regulations designed to reduce greenhouse gas emissions and protect public health. Coal burning power plants accounted for the majority of retiring utility scale power generation in 2023, and the EIA expects coal production to drop by 19% in 2024, as both consumption and inventories decrease.

Falling price of renewables and storage. The cost of renewable energy and energy storage has fallen substantially over the past decade, making renewable energy the lowest-cost provider of new generation in many markets.

State mandates. States' clean energy goals and mandates to use more renewable energy sources have contributed to the historic growth of renewables and are likely to drive further growth.

Federal support. Availability of government policy and other financial incentives for building new renewable capacity has supported the case for renewables when they were priced. This includes the passage of the IRA.

Environmental concerns. Reliance on fossil fuels has resulted in excessive production of harmful greenhouse gas emissions, which has been identified as one of the major causes of global climate change and numerous other environmental issues. This has led to growing support among the voting public for an energy transition based upon renewable energy.

The result of these and other factors is that renewable energy has gone from being a niche player in energy markets to being widely perceived as the present and future of energy generation in the United States.U.S. We anticipate that these trends will continue accelerating the growth of renewable energy, particularly solar and wind for power generation and batteries for storage.

The U.S. Renewable Energy Industry Has Been a High-Growth Market

The market for renewable energy has grown rapidly over the past decade. According to the EIA, renewables will now accountaccounts for 24%22% of U.S. electric generation in 2023. In 2022,2023, renewable energy sources generated over 1,087868 billion kWh of electricity and are expected to generate more than 1,109981 billion kWh of power in 2023.2024, before increasing further to 1,062 billion kWh in 2025.

The U.S. Renewable Energy Industry Is Expected to Be a High-Growth Market for Decades

We believe that demand for renewable energy will continue to grow as countries seek to reduce their dependence on outside sources of energy, and as the political and social climate continues to demand social responsibility on environmental matters. The EIA anticipates that consumption of renewable energy and the need for additional battery storage will grow significantly by 2050, supported by decreasing technology costs, as well as wind and solar incentives.

Energy Transition Investments Have Grown Substantially and Are Expected to Continue

According to BNEF, annual global investment in the energy transition has more than quadrupled in the past decade, reaching new heights each year of that period. In 2022,2023, energy transition investments topped $1reached a record-high $1.8 trillion, for the first time, significantly surpassing the previous record of $849 billion$1.1 trillion in 2021.2022.

Tax Equity Capital Sources in the Renewable Energy Market

Our ability to raise capital from tax equity investorsTax Equity Investors and lenders on competitive terms to help finance the development, construction, and operations of our projects will be a significant driver of our further growth. We have historically used a

1 Global Low-Carbon Energy Technology Investment Surges Past $1 Trillion for the First Time - BloombergNEF

variety of structures including tax equity financing, construction loan financing, tax equity bridge loan financing, back leverage loan financing, and subordinated non-recourse financing to help fund our operations. Our ability to raise capital from tax equity investorsTax Equity Investors and lenders is also affected by general economic conditions, the state of the capital markets, inflation levels, and concerns about our industry or business. See “LiquidityRefer to Part II — Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources” belowResources within this Annual Report for further details on capital raising and the effective management of our capital structure.

Tax equity is an important source of financing for renewable energy projects. The federal government first introduced renewable energy tax credits with the Energy Tax Act of 1978, with the aim of supporting sustainable energy infrastructure and reducing dependence on foreign and non-renewable energy sources. The Act allowed businesses and individuals to reduce their tax bills by a percentage of the amount they spent on qualified investments in property and equipment for solar and wind energy (up to certain limits). These tax benefits have expanded in the decades since, and today the federal government offers renewable energy investors larger tax credits, along with other incentives. The wide appeal of these tax benefits has given rise to a robust tax equity market with sophisticated capital market participation. A tax equity investor — which could be a financial institution, insurance company or corporation — contributes capital based on construction milestones in exchange for a share of the tax credits (and other tax benefits such as accelerated depreciation) and cash flows generated by a qualifying physical investment.

There are two main tax federal credits provided for renewable energy projects:

1. ITC: This tax credit is equal to 30% of a renewable energy or energy storage project’s eligible cost.

2. PTC: This tax credit, currently stands at 2.62.75 cents per kWh of electricity generated during the first 10 years of operation.

In general, our tax equity investments are structured using the "partnership flip"“partnership flip” structure. Under partnership flip structures, we and our tax equity investorsTax Equity Investors contribute cash into a partnership to fund the acquisition of renewable energy or energy storage systems. Upon the satisfaction of certain conditions precedent, tax equity fund commitments become available. The conditions precedent to funding vary across our tax equity funds but generally require that we have entered into a PPA with a credit worthy off taker,offtaker, the renewable energy system is expected to be eligible for the Section 48(a) ITC or Section 45(a) PTC, there is a recent appraisal from an independent appraiser establishing the fair market value of the renewable energy system, certain construction milestones are met and verified by an independent engineer and the property is in an approved state or territory. Initially, the tax equity investor receives substantially all of the non-cash value attributable to the renewable energy systems and energy storage systems, which includes accelerated depreciation and Section 48(a) ITCs or Section 45(a) PTC;PTCs; however, we typically receive a majority of the cash distributions, which are generally paid quarterly. These allocations then flip once certain time or yield basedyield-based milestones are met. Time basedTime-based flips occur on a set date after a five-year recapture period while yield basedyield-based flips occur after the tax equity investor achieves a specified return typically on an after-tax basis. After the flip occurs, we receive substantially all of the cash and tax allocations.

Current Competition in the Alternative Energy — Solar Marketplace

The solar financing market started as a cottage industry where developers would bring together high-net-worth investors to fund single solar and wind transactions. Though successful in jump starting the industry, true capital formation is a relatively new phenomenon and is not as well developed as in other asset classes. Currently in the renewable energy — marketplace, there are several sources of capital:

•Developer/Owner Operators. The major competition we face in the market for the assets we target comes from privately backed developer/owner operators. The capital from these organizations has generally been sourced from a combination of family offices/private equity funds and hedge funds. These organizations are generally set up as developers, with investment return expectations in the 20%-30% range.

However, to facilitate the most favorable exit for the sponsors, the developer/owner operators seek to accumulate a significant portfolio of operating assets to provide a base level of stable and predictable earnings for the enterprise. Through a combination of developer profits and leverage they can generate satisfactory ongoing returns, with the bulk of the upside being generated for the sponsors through the exit. Particularly in circumstances where equity markets experience a downturn, we are of the opinion this group of buyers will ultimately be capital constrained.

•Single-Purpose Limited Partnerships. These entities are typically funded by high-net-worth individuals or family offices and are generally focused on a small number of deals, as they have a limited amount of capital to invest.

•Institutional Investors and Utilities. Comprised of large life insurance companies, pension funds, infrastructure funds, and large public utilities. This sector dominates investment in the larger projects (e.g., $100.0 million or

greater). We tend not to encounter this group in our middle market Commercial and Industrial (“C&I”) sector but do see these players when targeting the larger projects in our portfolio.

In management’s view, the Company has been competitive in bidding for solar assets against all these sources of capital and maintains a significant pipeline of deals which can be consummated as offering proceeds are raised.

Opportunities in Solar Power Today

Solar is again expectedcontinues to be the leadingfastest-growing renewable energy source, with the EIA expecting a 38% increase in installed capacity during 2024, increasing total capacity from 95 GW to 131 GW by the end of new utility scale capacity in 2023, accounting for 54% of new electric-generating capacity.the year.

We believe that the greatest opportunity exists within the smallmiddle market utility scale, as well as the large commercial solar and community solar sectors of the market. In the smallmiddle market utility scale market, the Company can buy assets with similar commercial attributes to the large utility scale projects —(e.g., investment-grade offtaker, same equipment and warranties, same operations and maintenance service provider —provider) but where returns are higher.

We have also noted a growing trend among U.S. corporations to work with developers and financiers to provide renewable power for their operations. Driven by a desire to save money, create certainty around long-term electricity prices and support green marketing initiatives, the C&I sector is rapidly becoming one of the most exciting parts of the renewable energy project market. These deals tend to be smaller than utility scale solar, which fits well with our strategy of focusing on the middle market sector of the industry.

A number of U.S. states have adopted programs that encourage the development of community solar projects, where groups of companies, municipalities and individuals can buy renewable power from solar and wind plants that are located within the customers' utility zone. While there are certain complexities associated with such projects, we are closely monitoring the rapid growth of this sector.

In our view, there is a significant opportunity to aggregate portfolios of high-quality small utility scale, commercial solar and community solar projects that have experienced developers looking for a reliable and sustainable source of capital to increase the certainty of their closing transactions. As a result, we have been focusing on building relationships with respected developers with a view toward acquiring pipelines of projects rather than one-off deals.

By working closely with developers to efficiently close their transactions, we are seeking to create a sustainable competitive advantage which will lead to recurring and consistent deal flow. Importantly, our strategy is differentiated from the developer/owner operators mentioned above, because we do not seek to compete with the developers. Rather, we work with developers so that they can focus their activities on development while we focus on the financing and long-term ownership of their developed assets. This symbiotic alignment of interests has proven to be mutually beneficial.

Current Competition in the Alternative Energy — Wind Marketplace

We believe that market conditions remain favorable for wind development and, according to the EIA, the U.S. wind industry already has 6.0is expected to add 7 GW of new wind capacity scheduled for 2023.in 2024. Particularly for smaller middle market transactions involving assets similar to those in our current portfolio, we believe that we will continue to be competitive in bidding for wind assets. We also believe that we may see opportunities to purchase operating wind assets which have run through their tax credits.

Opportunities in Wind Power Today

We believe that the middle market segment presents the best opportunities for investment. This sector faces less competition for assets than the large utility scale sector, which tends to be highly competitive. Furthermore, we believe that targeted investments in select wind opportunities provide us with increased diversification of cash flows stemming from the fact that wind assets tend to perform better in the winter months, while solar tends to perform better in the summer months.

We believe that this countercyclical diversification is highly beneficial in managing our cash flows throughout the year. We also believe that we are well positioned to find target assets in this sector. In the past two years alone, we have acquired over 200275 MW of wind assets. These purchases have enabled us to build relationships with respected developers, with whom we may be able to work with in the near future.

General Market Overview for Battery Storage

According to Mercom Capital, in 2022, annual corporate funding in the battery storage sector reached a record high $26.7$26.4 billion across more than 120 deals, marking an increase of 55% from the $17 billion seen in 2021. This was2021 driven by falling costs, particularly in certain battery chemistries such as lithium-ion. AccordingIn the first nine months of 2023, corporate funding for battery storage exceeded $15 billion, putting it on track to make the second highest total annual investment behind 2022. Moreover, venture capital funding in the energy storage space reached a recent analysis by Lazardrecord high $9.2 billion across 86 deals in its “Levelized Costthe year ended 2023, an increase of Storage Analysis (LCOS 6.0)59%,” storage costs have declined across most use cases and technologies, particularly for shorter-duration applications. In addition, long-duration compared to 2022. Long-duration storage has been gaining particular traction as a commercially viable solution to challenges created by intermittent energy resources such as solar or wind. Additionally, under the IRA—and for the first time ever—standalone projects are now eligible for the 30% ITC.

Due to its potential for rapid growth, as well as new state mandates and rapidly falling costs for both short-term and long-term storage, we believe battery storage represents a large and growing investment opportunity for the foreseeable future.

Investment Management Segment

Our IM segment represents GCM’s investment management platform –— a sustainable infrastructure, renewable energy, energy efficiency and sustainability-related asset management company that focuses on project acquisition, financing, consulting and development and that is registered as an investment adviser under the Advisers Act. The Company believes that the IM business will enable it to further diversify its revenue streams through investment management and certain administrative services for investment funds on behalf of external stakeholders whichthat invest in adjacent areas of the sustainable infrastructure space. GCM’s platform will allow the Company to raise and deploy capital for the managed funds, – consistent with our overall mission and expanding our ability to positively impact social and environmental challenges.

Since inception, GCM’s management team has developed significant commercial relationships and capital raising processprocesses across multiple industries that we can continue to develop and grow. Both the IPP business and IM business have complementary growth strategies that will continue to provide the Company with diversification in its revenue streams, as well as givinggive us several alternate ways of raising capital, decreasing our reliance upon public capital markets for growth. Additionally, we expect that the combination will enable the Company to benefitcontinue benefiting from cost savings through the sharing of overhead and through the elimination of management fees that were formerly being charged to the Company by its external investment manager. We believe that this has the potential to result in an increase in the value of the Company, as the fully integrated and internally managed company will representrepresents a platform that can take advantage of many market opportunities while at the same time reducing the Company's overhead and increasing its profitability through the inclusion of IM revenue streams.

The services performed by our IM business include capital raise and deployment, marketing, and other investor relations functions, as well as technical asset management, finance and accounting, and other administrative serviceservices for managed funds in the sustainable infrastructure renewable energy industries.

The primary source of IM revenues are management fees earned. Management fee revenue earned by our IM business areis generally based upon the underlying net asset value of the managed funds for which GCM provides investment management services. For certain of our IM customers, the Company is also eligible to receive certain performance-based incentive fees.

An additional revenue source for IM will include, for certain managed funds, administrative services performed by Greenbacker Administration. These services include technical asset management, finance and accounting, legal and other costs incurred by the Company in performing its administrative services. GCM managed funds will be charged their allocable portion of such costs with no margin.

Prior to the Acquisition, GCM served as the external manager of four investment entities –— the Company, GROZ, GDEV I, and GREC II. The Advisory Agreement between GCM and the Company was terminated in connection with the Acquisition. However, the Company continues to provide, through GCM, investment management services to GROZ, GDEV I and GREC II as a result of the acquisition of GCM. In addition, the Company now provides, through GCM, investment management services to GDEV II. A summary of the managed funds is included below.

In addition, the Company launched its fourth sustainability driven investment strategy during the year ended December 31, 2023. The new strategy focuses on acquiring energy transition real estate where the Company can leverage access to power to host distributed generation, storage and charging infrastructure.

Greenbacker Renewable Opportunity Zone Fund

GROZ is an investment vehicle dedicated to investing in renewable energy investment opportunities that are located within “Qualified Opportunity Zones” as designated by the Internal Revenue Service, in order to capture the potential growth from, and the advantages offered under, the JOBS Act. Qualified Opportunity Zones target lower income communities in the United States that,U.S., with capital investment, have significant potential for economic development and job creation. GROZ is now closed to new investment.

Base management fees under GCM's advisory fee agreement with GROZ are calculated at a monthly rate of 0.125% (1.50% annually) of the average gross invested capital for GROZ. The Company is also eligible to receive certain performance-

basedperformance-based incentive fee distributions from GROZ, including upon liquidation of GROZ, subject to certain distribution thresholds as defined in the amended and restated limited liability company operating agreement of GROZ.

Greenbacker Development Opportunities Fund I & II

In October 2020, GDEV was launched to make private equity and development capital investments in the sustainable infrastructure industry. GREC’s investment in GDEV is synergistic with the Company’s core business, and it is expected to help retain and strengthen existing project developer relationships, increase the number of developer relationships that do business with the Company going forward, generate incremental investment opportunities for the Company and give the Company insights into new markets and trends within the industry. GDEV B was launched in March 2022 as a parallel fund to GDEV.

As the initial investor, GREC was awarded a 10.00% carried interest participation in GDEV GP, GDEV I’s general partner. The amended and restated limited partnership agreements of GDEV I provide for a 20.00% carried interest over an 8.00% hurdle, subject to side letter agreements. On May 19, 2022, the Company acquired a 75.00% equity interest stake in GDEV GP.

In conjunction with the Acquisition and specifically the acquisition of a 75.00% equity interest in GDEV GP, the Company also assumed GDEV GP's additional commitment to GDEV and gained control over GDEV GP. Additionally, the Company through the GDEV GP’s role as general partner of GDEV, assumed operational control over GDEV. As a result of the Company consolidating GDEV during the period from May 19, 2022 through November 17, 2022, the management fee revenue earned under the advisory agreement with GDEV was considered intercompany revenue and is therefore eliminated in consolidation. On November 18, 2022, GREC sold its investment in GDEV to an unrelated third party. As of December 31, 2022,2023, GDEV GP held 3.70%2.80% of the interests in GDEV. The Company has determined that it no longer has the obligation to absorb losses of GDEV, nor the right to receive benefits from GDEV that could be potentially significant to GDEV, and therefore, no longer consolidates GDEV. As a result of the deconsolidation of GDEV on November 18, 2022, management fee revenue is no longer eliminated and is recorded on the Consolidated StatementStatements of Operations.

In March 2022, GCM closed GDEV I to new investors and in November 2022, launched a successor fund called GDEV II, which also aims to makemakes private equity and development capital investments in the sustainable infrastructure industry. The Company receives management fees from GDEV I based on the aggregate cost basis of all portfolio securities, management fees from GDEV II based on committed capital, as well as certain performance-based incentive fees from GDEV II.

Greenbacker Renewable Energy Company II, LLC

GREC II was launched in May 2022 and is an investment vehicle that intends to acquire, ownacquires, owns and operateoperates renewable energy projects with an emphasis on up-and-coming areas of the energy investment sector, including battery storage, mobility and other related investments. GREC II is structured as a total return vehicle which is expected to prioritize long termlong-term internal rates of return over near-term cash yields. GREC II intends to deploydeploys into pre-construction and operating renewable energy projects, as well as energy efficiency, battery storage, mobility and other related investments. The Company is eligible to receivereceives management fees, as well as certain performance-based incentive fees and administrative fees from GREC II under the advisory agreement. Due to GREC II’s early stage of development, the Company did not record any management fees under the advisory agreement during the period from May 19, 2022 through December 31, 2022.

Refer to Note 14.16. Related Parties underin the Non-Investment BasisNotes to the Consolidated Financial Statements (Non-Investment Basis) for further details.

General Market Overview for Investment Management

While there continues to be turmoil in the public equity and debt markets, and therefore headwinds in the investment management industry in general, alternative investment managers experiencedcontinue to experience strong capital inflows as investors lookedlook to diversify away from public stocks and bonds and towards investments in alternative strategies that they judge to be less correlated to public market movements, despite the downward trends in the fourth quarter of 2022. According to Robert A. Stanger and Company,movements. Indeed, through December 2023, fundraising for non-traded alternative investments totaled a record $104 billion; a 23% increase over 2021.nearly $73.1 billion, according to Robert A. Stanger and Company.21 Despite the challenging market conditions, we believe there is an opportunity for higher investment returns due to less competition in the marketplace and, more recently, some of the macro factors have moved in our favor; such as interest rates, which have fallen from their highs in 2023.

Seasonality

Certain types of renewable power generation may exhibit seasonal behavior. For example, wind power generation is generally stronger in winter than in summer as wind speed tends to be higher when the weather is colder. In contrast, solar power generation is typically stronger in the summer than in the winter. This is primarily due to the brighter sunshine, longer days and shorter nights of the summer months, which generally result in the highest power output of the year for solar power. Because these seasonal variations are relatively predictable for these types of assets, we factor in the effects of seasonality when

2Non-Traded Alternative Investments Raised Record $104 Billion in 2022, The DI Wire, January 20, 2023

analyzing a potential acquisition in these target assets. Therefore, the impact that seasonality may have on our business, including the income from our renewable energy projects, will depend on the diversity of our acquisitions in renewable energy, energy efficiency and other sustainability-related projects in our overall portfolio. However, to the extent our acquisitions are concentrated in either solar or wind power, we expect our business to be seasonal based on the mix of renewable power generation technology.

Overview of Significant Government Incentives

The renewable energy and energy efficiency sector attracts significant U.S. federal, state and local government support and incentives to address technical barriers to the deployment of renewable energy and energy efficiency technologies and to promote the use of renewable energy and energy-saving strategies. These U.S. federal, state and local government incentives have historically functioned to increase (1) the revenue generated by, and (2) the equity returns available from, renewable energy projects. Energy efficiency projects are also eligible to receive government incentives at the U.S. federal, state and local levels that can be applied to offset project development costs. Governments in other jurisdictions also provide several types of incentives.

Corporate entities are eligible to receive benefits through tax credits, such as PTCs, ITCs, tax deductions, accelerated depreciation and U.S. federal grants and loan guarantees (from the U.S. Department of Energy, for instance), as described below.