SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

x

|

| |

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31,

20132015

OR

¨

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to Commission file number 1-31234

WESTWOOD HOLDINGS GROUP, INC.

(Exact name of registrant as specified in its charter)

Delaware

| | 75-2969997

|

| | |

| Delaware | | 75-2969997 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

200 Crescent Court, Suite 1200

Dallas, Texas 75201 | | 75201 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (214) 756-6900

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

|

| | |

| Title of each class: | | Name of each exchange on which registered: |

Common Stock, par value $0.01 per share | | New York Stock Exchange |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

None

None

Indicate by check mark if registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No xý Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No xý Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes xý No ¨ Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes xý No ¨ Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | x

ý |

| | | |

Non-accelerated filer | | ¨ | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No xý The aggregate market value on June 30,

20132015 of the voting and non-voting common equity held by non-affiliates of the registrant was

$308,961,000.$380,863,476. For purposes of this calculation, the registrant has assumed that stockholders that are not officers or directors of the registrant are not affiliates of the registrant.

The number of shares of registrant’s Common Stock, par value $0.01 per share, outstanding as of February

25, 2014: 8,262,430.18, 2016: 8,628,067.

DOCUMENTS INCORPORATED BY REFERENCE

Selected portions of the registrant’s definitive Proxy Statement for the

20142016 Annual Meeting of Stockholders,

which will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates, are incorporated by reference into Part III hereof.

WESTWOOD HOLDINGS GROUP, INC.

| | PAGE

|

| | |

| | PAGE |

| | |

| | |

| | 10

|

| | 17

|

| | 17

|

| | 17

|

| | |

| | |

| | 18

|

| | 21

|

| | 21

|

| | 31

|

| | 31

|

| | 31

|

| | 32

|

| | 32

|

| | |

| | 33

|

| | 33

|

| | 33

|

| | 33

|

| | 33

|

| | |

| | 34

|

Unless the context otherwise requires, the term “we,” “us,” “our,” “Westwood,” or “Westwood Holdings Group” when used in this Form 10-K (“Report”) and in the Annual Report to the Stockholders refers to Westwood Holdings Group, Inc., a Delaware corporation, and its consolidated subsidiaries

and predecessors taken as a whole. This Report contains some forward-looking statements within the meaning of the federal securities laws. Actual results and the timing of some events could differ materially from those

projectedprojected in or contemplated by the forward-looking statements due to a number of factors, including without limitation those set forth under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Item 1A. Risk Factors”.We manage investment assets and provide services for our clients through our subsidiaries, Westwood Management Corp.

(“and Westwood

Advisors, LLC (together, “Westwood Management”),

Westwood Trust, and Westwood International Advisors Inc. (“Westwood International”)

. and Westwood Trust. Westwood Management, founded in 1983, provides investment advisory services to

corporate and public retirement plans, endowments and foundations,institutional investors, a family of mutual funds called the Westwood

Funds ™,Funds®, other mutual funds,

individualsan Ireland-domiciled fund organized pursuant to the European Union’s Undertakings for Collective Investment in Transferable Securities (“UCITS”), individual investors and clients of Westwood Trust.

WestwoodWestwood International was established in 2012 and provides investment advisory services to institutional clients, the Westwood Funds®, other mutual funds, UCITS funds and clients of Westwood Trust. Westwood Trust, founded as a state-chartered trust company in 1974, provides trust and custodial services and participation in self-sponsored common trust funds to institutions and high net worth individuals. Westwood International, based in Toronto, was established in 2012 and provides global and emerging markets investment advisory services to institutional clients, the Westwood Funds ™, other mutual funds, an Ireland-domiciled fund organized pursuant to the European Union’s Undertakings for Collective Investment in Transferable Securities (“UCITS”), and clients of Westwood Trust. Our revenues are generally derived from fees based on a percentage of assets under management. Westwood Management, Westwood TrustInternational and Westwood InternationalTrust collectively managed assets valued at approximately $18.9$20.8 billion at December 31, 2013.2015. We were incorporated under the laws of the State of Delaware on December 12, 2001. We are an independent public company and ourOur common stock is listed on the New York Stock Exchange under the ticker symbol “WHG.” We are a holding company whose principal assets consist of the capital stock of Westwood Management, Westwood Trust and Westwood International.

The success of our business is very dependent on client relationships. We believe that, in addition to investment performance, client service is paramount in the asset management business. Accordingly, a major

focus of our business

strategyfocus is to build strong relationships with clients to enhance our ability to anticipate their needs and

satisfysatisfy their investment objectives. Our team approach is designed to deliver efficient, responsive service to our clients. Our success is dependent to a significant degree on investment performance and our ability to provide attentive client service.We have focused on building theour foundation of a firm in terms of personnel and infrastructure to support a much larger business. We have also developed investment strategies that we expect to be desirable within our target institutional, private wealth and mutual fundfund markets. The costs of developingDeveloping new investment strategies and building the organization can result in incurring expenses before significant offsetting revenues are realized. We continue to evaluate new strategies and resources in terms of meeting actual and potential investor needs.

Acquisition of Woodway Financial Advisors

On January 15, 2015, we entered into an agreement (the "Merger Agreement") to acquire Woodway Financial Advisors (“Woodway”), a Houston-based private wealth and trust company that managed assets of approximately $1.6 billion at December 31, 2014. We completed the acquisition on April 1, 2015. Pursuant to the Merger Agreement, on April 1, 2015 Woodway merged with Westwood Trust, a wholly-owned subsidiary of Westwood, with Westwood Trust being the surviving entity (the “Merger”). The total Merger consideration consisted of (i) $30.6 million in cash and stock, as described below, and (ii) contingent consideration equal to the annualized revenue from the post-closing business of Woodway for the twelve-month period ending March 31, 2016 (the “Earn-Out Period”), adjusted for certain clients or accounts that have terminated, and capped at $15 million (the “Earn-Out Amount”).

The Merger consideration of $39.7 million consisted of (i) closing date consideration of $25.3 million paid in cash and the issuance of 109,712 shares of Westwood common stock, valued at $5.3 million (discounted from $6.7 million due to certain required holding periods), and (ii) contingent consideration of $9.1 million, based on estimates and assumptions as of the closing date of the acquisition, to be paid no later than 75 calendar days after the last day of the Earn-Out Period. The acquired assets were deemed to constitute a business in a transaction using the purchase method of accounting for business combinations. Accordingly, the purchase price was allocated to the tangible and intangible assets acquired and the liabilities assumed based on their estimated fair values as of the acquisition date.

We maintain a website at www.westwoodgroup.com. Information contained on, or connected to, our website is not incorporated by reference into this Report and should not be considered part of this Report or any other filing that we make with the Securities and Exchange Commission (“SEC”). All of our filings with the SEC, including our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports filed or furnished pursuant to SectionsSections 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), are available free of charge on our website. Additionally, ourOur Code of Business Conduct, our Corporate Governance Guidelines and our Audit Committee, Compensation Committee and Governance/Nominating Committee Charters are available without charge on our website. Stockholders also may obtain print copies of these documents free of charge by submitting a written request to Mark A. Wallace,Tiffany B. Kice, our Chief Financial Officer, at the address set forth in the front of this Report. The public can also obtain any document we file with the SEC at www.sec.gov.1

Advisory

Advisory

Our advisory business is comprised of Westwood Management and Westwood

International.International and encompasses three distinct investment teams – the U.S. Value Team, the Global Convertible Securities Team, and the Global and Emerging Markets Equity Team.

Westwood Management provides investment advisory services to large institutions, including corporate retirement plans, public retirement plans, endowments and foundations. Institutional separate account minimums

depend on thevary by investment strategy

offered butand generally range from

$10$5 million to $25 million. Westwood Management also provides advisory services to individuals,

and the Westwood

Funds ™Funds® and UCITS funds, as well as subadvisory services to other mutual funds and pooled investment vehicles.

Westwood Management’s investment strategies are managed by the U.S. Value Team, based in Dallas, Texas, and by the Global Convertible Securities Team, based in Boston, Massachusetts. Our

overall investment

philosophy was developed by our Founder and Chairman, Susan M. Byrne, and is implemented by a teamprofessionals average fifteen years of investment professionals under the leadership of our Chief Investment Officer, Mark Freeman. With respect to the bulk of assets under management we utilize a “value” investment style focused on achieving superior long-term, risk-adjusted returns by investing in companies with high levels of free cash flow, improving returns on equity and strengthening balance sheets that are well positioned for growth but whose value is not fully recognized in the marketplace. This investment approach is designed to preserve capital during unfavorable periods and provide superior real returns over the long term. Our investment team members average investment experience of fifteen years and one third of our team has worked together at Westwood for more than five years.experience. We believe team continuity and years of experience are among the critical elements required for successfully managing investments.Westwood International,

based in Toronto, Canada, provides investment advisory services to large institutions,

and pooled investment vehicles and UCITS funds, as well as subadvisory services to the National Bank Westwood Funds, which are mutual funds offered by National Bank of Canada. Institutional separate account minimums vary by investment strategy and generally range from $10 million to $25 million. Westwood International also providesInternational's investment advisory services to an Ireland-domiciled UCITS fund.strategies are managed by the Global and Emerging Markets Equity Team. Westwood International has entered into a Memorandum of Understanding (“MOU”) with Westwood Management pursuant to which Westwood International is considered a “participating affiliate” of Westwood Management as that term is used in relief granted by the staff of the SEC allowing U.S. registered investment advisers to use portfolio management or research resources of advisory affiliates subject to the supervision of a registered adviser. Pursuant to the MOU, Westwood International professionals provide advisory and subadvisory services to certain Westwood Funds,Funds®, pooled investment vehicles and large U.S. institutions under the supervision of Westwood Management.We offer a broad range of investment strategies, allowingwhich allows us to serve variousa variety of client types and investmentwith different investment objectives. Approximately 49% ofWe currently manage five investment strategies each with over $1 billion in assets under management, including our consolidated revenues are invested in ourIncome Opportunity, LargeCap Value, and SMidCap Value, Emerging Markets and Emerging Markets Plus strategies.

U.S. Value Team

The U.S. Value team employs a value-oriented approach. The common thread that permeates the team's strategies is a disciplined approach to controlling risk and preserving client assets whenever possible. The team seeks to invest in companies with high levels of free cash flow, improving returns on equity and strengthening balance sheets that are well positioned for growth but whose value is not fully recognized in the marketplace. Through investments in companies that exhibit these characteristics, we seek to generate consistently superior performance relative to our industry peers and relevant benchmark indices. This investment approach is intended to preserve capital during unfavorable periods and provide superior real returns over the long term. We believe that we have established a track record of delivering competitive risk-adjusted returns for our clients. The principal investment strategies currently managed by

Westwood Managementthe U.S. Value Team are as follows:

LargeCap Value: Investments in equity securities of approximately 40-60 well-seasonedseasoned companies with market capitalizations at purchase generally over $7.5 billion. This portfolio is invested in companies where we expect that futurefuture profitability, driven by operational improvements, will exceed expectations reflected in current share prices. Dividend Growth:Concentrated LargeCap Value: InvestmentsInvestment in equity securities of approximately 30-50 high quality15-30 companies with market capitalizations at purchase generally over $1$5 billion. This portfolio is invested in companies of which at least 80% are paying dividends and whose prospects for dividend growth are strong. This strategy combines quantitative and fundamental research to create a diversified portfolio of companieswhere we expect that we believe can create value for shareholders.future profitability, driven by operational improvements, will exceed expectations reflected in current share prices.SMidCap Plus+:Investments in equity securities of approximately 45-65 companies with market capitalizations at purchase of between $2 billion and $15 billion. Similar to our other value-oriented investment strategies, we seek to discover operational improvements driving earnings growth within small to mid-sized companies that can be purchased at reasonable prices. SMidCap Value: Investments in equity securities of approximately 50-6550-70 companies with market capitalizationscapitalizations at purchase of between $500 million and $8 billion. Similar to our other value-oriented investment strategies, we seek to discover operational improvements driving earnings growth within small to mid-size companies that can be purchased at reasonable prices. This strategy reached its asset capacity in 2010 and is now closed to new investors. SmallCap Value: Investments in equity securities of approximately 50-70 companies with market capitalizations at purchase of between $100 million and $2 billion. Similar to our other value-oriented investment strategies, we seek to invest in high quality companies whose earnings growth is driven by operational improvements not yet fully recognized by the market. AllCap Value: Investments in equity securitiessecurities of approximately 50-80 well-seasonedseasoned companies. The portfolio generally comprises our investment professionals’ best ideas amongfor companies with market capitalizations at purchase above $100 million. Similar to our other value-oriented investment strategies, we seek to invest in companies across a broad range of market capitalizations where we expect that future profitability, driven by operational improvements, will be higher than expectations currently reflected in share prices.2

BalancedConcentrated AllCap Value: : Investments in a combinationequity securities of equity and fixed income securities, designedapproximately 15-30 companies with market capitalization at purchase generally over $100 million. We seek to provide both growth opportunities and income, while also emphasizing asset preservationinvest in “down” markets. Westwood Management applies its expertisecompanies where we expect that future profitability, driven by operational improvements, will be higher than expectations currently reflected in dynamic asset allocation and security selection decisions in carrying out this balanced strategy approach.share prices.

Income Opportunity: Investments in dividend-paying common stocks, preferred stocks, convertible securities, master limited partnerships, royalty trusts, REITs and selected debt instruments. This portfolio’s strategy focuses on companies with strong and improving cash flows sufficientable to support sustainable or rising income streams for investors.streams. This strategy is targeted towards investors seeking current income, a competitive total return and low volatility throughvia dividend-paying or interest-bearing securities. Worldwide Income Opportunity: Investments in a diversified group of global income-producing companies that may include market capitalizations of any size, global preferred equity, global convertible preferred, global fixed income, global REITs, Royalty Trusts, MLPs and cash. This portfolio's strategy focuses on companies with strong and improving cash flow sufficient to support sustainable or rising income streams.

Master Limited Partnership Infrastructure Renewal (“MLPs”): InvestmentsInvestments include MLPs (including limited partnerships and general partnerships) and other securities. Within these types of securities, the portfolio focusesfocusing on partnerships that exhibit higher distribution yields, stable and predictable cash flows, low correlations to other asset classes, and growth potential.

Global Convertible Securities Team

The Global Convertible Securities Team manages both long-only and liquid alternative global convertible securities strategies employing a disciplined investment process and rigorous risk management. The team's investment philosophy is based on the following beliefs:

the asymmetric return profile of balanced convertible bonds can provide superior risk-adjusted returns over medium- to long-term time horizons;

convertible securities markets are inefficient and opportunities exist to benefit from pricing anomalies;

a global focus provides more robust opportunities and a clearer picture of the broad convertibles universe; and

proprietary fundamental research is the best way to identify solid companies with attractive risk-adjusted return profiles.

The team draws on the proprietary fundamental research of all three of Westwood's investment teams in order to identify securities with an attractive risk-adjusted return profile. The principal investment strategies currently managed by the Global Convertible Securities Team are as follows:

Investment Grade FixedStrategic Global Convertibles:This strategy seeks to provide equity-like returns with lower volatility by investing in a balanced portfolio of 60-90 worldwide convertible securities.

Market Neutral Income: InvestmentsThis liquid alternative strategy seeks to produce positive absolute returns over a full market cycle with low volatility by combining a yield-focused portfolio that invests in high-grade, intermediate term corporatehigh quality, short duration convertible securities with a hedged portfolio utilizing convertible arbitrage and government bonds. We seekother hedging strategies.

Global and Emerging Markets Equity Team

The Global and Emerging Markets Equity Team emphasizes Economic Value Added (EVA) in its investment process and seeks to

add value to client portfolios through yield curve positioning and investing in debt instruments with improving credit quality potential.Each investment strategy consists of a portfolio of equity and/or fixed income securities selected by Westwood’s portfolio teams and chosen to optimize long-term returns consistent with Westwood’s investment philosophy. Our portfolio teams make decisions for Westwood Management investment strategies in accordance with the investment objectives and policies of those strategies, including determining when and which securities to purchase and sell.

We employ a value-oriented approach for our domestic equity investment strategies.identify mispriced businesses that can generate sustainable earnings growth. The common thread that permeates these strategies is our disciplined approach to controlling risk and preserving client assets whenever possible. Our investment teams seek to invest in companies with high levels of free cash flow, improving returns on equity, and strengthening balance sheets that are well positioned for growth but whose value is not fully recognized in the marketplace. Through investments in companies that exhibit these characteristics, we seek to demonstrate consistently superior performance relative to our industry peers and relevant benchmark indices.

We believe that we have established a track record of delivering competitive risk-adjusted returns for our clients. Approximately 90 percent of our investment strategies have delivered above-benchmark performance and more than 90 percent have experienced below-benchmark volatility over the past ten years.

Westwood Internationalteam offers global and emerging markets equity investment strategies. Over 85% of Westwood International’s $2.5 billion of assets under management at December 31, 2013 is invested in our Emerging Markets strategies. The principal investment strategies currently managed by Westwood Internationalthe Global and Emerging Markets Equity Team are as follows:

Emerging Markets:This strategy invests in the common stocks of 70-90 companies that are located or have primary operations in emerging markets and havewith market capitalizations above $500 million. The portfolio is invested in companies that we believe arerepresents sound businesses that are mispriced and can generate sustainable earnings growth. Emerging Markets Plus:This strategy invests in the common stocks of 50-70 companies that are located or have primary operations in emerging markets and have market capitalizations above $1.5 billion. The portfolio is invested in companies that we believe arerepresent sound businesses that are mispriced and that can generate sustainable earnings growth. Emerging Markets SMid: This strategy invests in the common stocks of 70-90 small- and mid-cap companies that are located or have primary operations in emerging markets and have market capitalizations between $150 million and $9 billion. The portfolio is invested in companies that we believe are sound businesses that are mispriced and that can generate sustainable earnings growth. Global Equity:This strategy invests in the common stocks of 65-85 companies located throughout the world, with market capitalizations above $1 billion. Similar to our Emerging Markets strategy, the portfolio invests in companies that we believe are sound businesses that are mispriced and can generate sustainable earnings growth. Global Dividend:This strategy invests in the common stocksstocks of 65-90 well-established companies around the world, with an emphasis on sustainability and growth of dividends. It seeks to invest in strong franchises that we believe are mispriced, with good liquidity, the ability to generate sustainable economic profits and potentially pay dividends.3

Our ability to grow assets under management is primarily dependent on our ability to generate competitive investment performance, our success in building strong relationships with investment consulting firms and other financial intermediaries, as well as our ability to develop new

client relationships while nurturing existing relationships. We continually seek to expand assets under management by growing our existing investment strategies, as well as identifying and developing new ones. We intend to grow our investment strategies internally but may also consider acquiring new investment strategies from third parties, as discussed under “Growth Strategy” below. Our growth strategy provides clients with more investment opportunities and diversifies our assets under management, thereby reducing risk in any one area of investment and increasing our competitive ability to attract new clients. Our fourten largest clients accounted for approximately 13.7%over 20% of our fee revenues for the year ended December 31, 2013.2015. The loss of some or all of these large clients could have a material adverse effect on our business and our results of operations.Advisory and Subadvisory Agreements

Westwood Management and Westwood International manage client accounts under investment advisory and subadvisory agreements. Typical

infor the asset management industry,

suchthese agreements are usually terminable upon short notice and provide for compensation based on the market value of client assets under management. Westwood’s advisory fees are paid quarterly in advance based on assets under management on the last day of the preceding

quarter,quarter, quarterly in arrears based on assets under management on the last day of the previous quarter, or are based on a daily or monthly analysis of assets under management for the stated period. A few clients have contractual performance-based fee arrangements, which generate additional revenues if we outperform a specified index over a specific period of time. Revenue for performance-based fees is recorded at the end of the measurement period. Revenue from advance payments is deferred and recognized over the period that services are performed. Pursuant to these agreements, Westwood provides overall investment management services, including directing investments in conformity with client-established investment objectives and restrictions. Unless otherwise directed in writing by clients, Westwood has the authority to vote all proxies with respect to securities in client portfolios.Westwood Management and Westwood International are parties to subadvisory agreements with other investment advisors under which they perform similar services

as they do under advisory agreements. Our subadvisory fees are generally computed based upon the average daily assets under management and are payable on a monthly basis.

As with our advisory agreements, these agreements are terminable upon short notice.Westwood Management provides investment advisory services to the Westwood Funds ™Funds® family of mutual funds, which includes the Westwood Income Opportunity Fund, the Westwood SMidCap Fund, the Westwood LargeCap Value Fund, the Westwood SmallCap Value Fund, the Westwood Dividend Growth Fund, the Westwood SMidCap Plus+ Fund, the Westwood Short Duration High Yield Fund, the Westwood Emerging Markets Fund, the Westwood Global Equity Fund and the Westwood Global Dividend Fund. The Westwood Short Duration High Yield Fund is subadvised by SKY Harbor Capital Management, LLC, a registered investment adviser based in Greenwich, Connecticut. funds:

|

| | | |

Ÿ Westwood Income Opportunity | | Ÿ Westwood MLP & Strategic Energy |

Ÿ Westwood SMidCap | | Ÿ Westwood Worldwide Income Opportunity |

Ÿ Westwood LargeCap Value | | Ÿ Westwood Emerging Markets |

Ÿ Westwood SmallCap Value | | Ÿ Westwood Global Equity |

Ÿ Westwood Dividend Growth | | Ÿ Westwood Global Dividend |

Ÿ Westwood SMidCap Plus+ | | Ÿ Westwood Short Duration High Yield* |

Ÿ Westwood Strategic Global Convertibles | | Ÿ Westwood Opportunistic High Yield* |

Ÿ Westwood Market Neutral Income | | |

| | | |

| *Subadvised by SKY Harbor Capital Management, LLC, a registered investment adviser based in Greenwich, Connecticut |

As of December 31,

2013,2015, the Westwood

Funds ™Funds® had assets under management of

$2.8$3.6 billion.

Through the combined efforts of the Dallas, Omaha and Houston offices of Westwood Trust, we provide trustfiduciary and investment services and participation in Westwood Trust sponsored common trust funds to institutions and high net worth individuals and families, non-profit endowments and foundations, public and private retirement plans and individual retirement accounts ("IRAs"). Westwood Trust is chartered and regulated by the Texas Department of Banking. Fees charged by Westwood Trust are separately negotiated with each client and are typically based on assets under management. Clients generally havinghave at least $2$1 million in investable assets.

Fiduciary Services

Westwood Trust’s fiduciary services include but are not limited to: financial planning, wealth transfer planning, customizable trust services, trust administration and estate settlement. Westwood Trust also provides custodial services, tax reporting, accounting of trust income and principal, beneficiary and retiree distributions and safekeeping of assets.

Investment Services

Westwood Trust utilizes a consultative approach in developing a client’s portfolio asset allocation. Our approach involves examining the client’s financial situation, including their current portfolio of investments, and advising the client on ways to reduce risk, enhance investment returns and strengthen their financial position based on each client’s unique objectives and constraints. Westwood Trust seeks to define and improve risk/return profiles of client investment portfolios by offering a comprehensive investment solution or

complementing or enhancing

clients’ existing investment strategies. Westwood Trust

provides back office services to clients, including tax reporting, distributionmanages separate portfolios of equity and fixed income to beneficiaries, preparation of account statementssecurities for certain agency and attending totrust clients. Equity portfolios are generally patterned after the special needs of particular trusts, and also serves as trustee for tax and estate-planning purposes and for special needs trusts.institutional strategies offered by Westwood Trust is chartered and regulatedManagement or developed by the Texas Departmentinternal investment team in our Houston Woodway office. Fixed income portfolios consist of Banking.Westwood Trusttargeted laddered portfolios of primarily provides services for employee benefit trusts and personal trusts. Employee benefit trusts include retirement plans of businesses to benefit their employees, including defined contribution plans, pensions and profit sharing plans. Westwood Trust may also be appointed as a trustee and may provide administrative support for these plans, as well as investment advisory and custodial services. Personal trusts are developed to achieve a number of different objectives and Westwood Trust acts as trustee to such trusts and assists them in developing tax-efficient trust portfolios. Fees charged by Westwood Trust are separately negotiated with each client and are typically based on assets under management.

4

high quality municipal securities.

Services

Westwood Trust undertakes a fiduciary responsibility with regard to the management of each client’s assets and utilizes a consultative asset allocation approach. This approach involves our examining the client’s financial situation, including the client’s current portfolio of investments, and advising the client on ways to enhance investment returns and strengthen its financial position. Westwood Trust also provides custodial services, safekeeping and accounting services.

Common Trust Funds

Westwood Trust sponsors a number ofseveral common trust funds in which client assets are commingled to achieve economies of scale. Westwood Trust’s common trust funds fall within two basic categories: personal trusts and employee benefit trusts. Westwood Trust sponsors common trust funds for most of the investment strategies managed by Westwood Management.Management and Westwood International. Westwood Trust has also engages third-party subadvisors for some common trust funds, such asengaged SKY Harbor Capital Management, LLC, William Blair & Company, LLC and Brandywine Global Investment Management, LLC, all registered investment advisors, to subadvise our High Yield Bond, Domestic Growth Equity High Yield Bond and International Fixed Income common trust funds.

funds, respectively.

Westwood Trust also develops asset allocation models for certain clients utilizing mutual funds managed by Westwood Management and Westwood International, as well as from certain other mutual fund families.

Enhanced

BalancedBalanced® Portfolios

Westwood Trust is a strong proponent of asset class diversification and offers its clients the ability to diversify among many different asset classes. Westwood Trust Enhanced

Balanced™Balanced® portfolios combine these asset classes into a customizable portfolio for clients seeking to maximize return for a given level of risk. Periodic adjustments are made to asset class weightings in Enhanced

Balanced ™Balanced® portfolios based on historical returns, risk and correlation data and our current capital markets

outlook.We market our services through several distribution channels to

expandoptimize the reach of our investment advisory

and trust services. These channels enable us to leverage

the distribution infrastructures and capabilities of other financial services firms and intermediaries while focusing on our core competency of developing and managing investment strategies.

Institutional

In our institutional channel, we market our investment strategies through institutional investment consultants, financial intermediaries, managed accounts programs and directly to institutional investors. Institutional

Investment ConsultantsInvestment consulting firmsinvestment consultants serve as gatekeepers to the majority of corporate retirement plans, public retirement plans, endowments and foundations, which represent Westwood’s primary institutional target markets. Consultants provide guidance to their clients in setting asset allocation strategy,strategies, as well as creating investment policies. Consultants also make recommendations for investment firms they believe can best meet their client’s investment objectives. We have established strong relationships with many global, national and regional investment consulting firms, which collectively have contributed to our being considered and hired by their clients. Continuing to enhance existing consulting firm relationships, as well as forging new relationships, serves to increaseincreases the awareness of our services in both the consultant community and within their institutional client base.

Subadvisory Relationships

Our

Marketing our investment strategies to financial intermediaries, via subadvisory relationships,

allowallows us to extend the reach of our investment advisory services to clients of other investment companies with broad, established distribution capabilities. In subadvisory arrangements, our client is generally the investment company through which our services are offered to investors, typically via mutual fund offerings. The investment company that sponsors the mutual fund is responsible for

relevantappropriate marketing, distribution

and operational and

accountingaccounting activities.Managed Accounts

Managed accounts are similar in some respects to subadvisory relationships in that a third-party financial institution, such as a brokerage firm or turnkey asset management program provider, handles distribution to the end client. The end client in a managed account is typically a high net worth individual or small institution. In these arrangements, the third-party financial institution is responsible to the end client for client service, operations and accounting.

We also market our investment strategies directly to pension funds, endowments, foundations and other institutional investors.

Mutual Funds

In our mutual funds channel, we market our registered mutual funds, the Westwood Funds®, to institutional investment consultants, financial intermediaries, registered investment advisors, select broker-dealers and fund supermarkets. By leveraging our existing relationships with institutional investment consulting firms we are able to participate when their defined contribution and other retirement plan clients require a mutual fund vehicle. We also seek relationships with financial intermediaries that manage discretionary fund models in order to have our funds placed in such models. Our wholesaling group markets our funds directly to registered investment advisors, select broker-dealers and mutual fund supermarkets.

Private Wealth

In our private wealth channel, we generate awareness of our trust fiduciary and investment services through investment consultants, centers of influence, community involvement and targeted direct marketing to high net worth individuals, families and small to medium-sized institutions. A significant portion of our new asset growth has been generated by referrals from existing clients.

We believe that we have established a strong platform to support future growth, deriving our strength in large part from the experience and capabilities of our management team and skilled investment professionals. We believe that this focused, stable team has contributed significantly to our solid investment performance, superior client service and a growing array of investment strategies. We believe that opportunities for future growth may come from our ability to:

·

| generate growth from new and existing clients and consultant relationships

|

·

| attract and retain key employees

|

5

·

| grow assets in our existing investment strategies

|

generate growth from new and existing clients and consultant relationships;·

| foster continued growth of the Westwood Trust platform

|

attract and retain key employees;·

| foster expanded distribution via mutual funds

|

grow assets in our existing investment strategies;·

| pursue strategic corporate development opportunities

|

foster continued growth of the Westwood Trust platform;·

| pursue opportunities internationally through targeted sales and relationships with international distributors and institutional investors

|

expand distribution via mutual funds;·

| continue to strengthen our brand name

|

seek strategic corporate development opportunities;·

| develop or acquire new investment strategies

|

pursue opportunities internationally through targeted sales and relationships with international distributors and institutional investors;·

| expand our distribution focus to target U.S. plan sponsors more directly

|

continue to strengthen our brand name; anddevelop or acquire new investment strategies.

Generate growth from new and existing clients and consultant relationships. As our primary business objective, we intend to maintain and enhance existing relationships with clientsclients and investment consultants by continuing to provideproviding solid investment performance and attentive client service. We also intend to pursue growth throughvia targeted sales and marketing efforts that emphasize our investment philosophy, and performance and superior client service. New institutional client accounts are generally derived throughsourced from either investment consultants and we have developed productive long-term relationshipsor from our direct sales efforts with many national and regional investment consultants.institutional investors. We believe that the in-depth knowledge of our firm, our people and our processes embedded in our consultant relationships, as well as in existing and prospective client relationships, is a key factor when being considered for new client investment mandates. Attract and retain key employees. In order toTo achieve our investment performance andand client relationship objectives, we must be able to retainattract and attractretain talented professionals. We believe that we have created a workplace environment in which motivated, performance-driven, and client-oriented individuals can thrive. As a public company, we are able to offer our employees a compensation program that includes strong equity incentives such thatto closely align their success will be closely aligned with the successthat of our clients and stockholders. We believe that these factors are critical ingredients into maintaining a stable, client-focused environment that can support significant future growth. Grow assets in our existing investment strategies. Most of our existing, seasoned investment strategiesWe have significant capacity for additional assets.assets across our existing range of investment strategies, which we have continued to expand. We have developed a range of approximately 20 institutional investment strategies by building on the core competencies of our U.S. Value team, which has now been in place for over 30 years, as well as via the addition of new investment teams. In order to expand2012, we initiated our offerings for currentGlobal and prospective clients, we launched Westwood International in 2012, enabling us to offerEmerging Markets Equity Team, thereby adding five new equity strategies that focus on emerging and global markets: Emerging Markets, Emerging Markets Plus, Emerging Markets SMid, Global Equity and Global Dividend. TheseOur emerging markets strategies are experiencinghave experienced strong investor demand, from investors and we believe they represent significantprovide additional growth opportunities for us. Assetsopportunities. In 2014, we established the Westwood Global Convertible Securities Team, which manages two strategies - a long-only strategy, Global Convertibles Securities, and a market neutral strategy, Market Neutral Income. Our U.S. Value Team has launched four new strategies since 2014 - Concentrated LargeCap Value, Concentrated AllCap Value, MLP Opportunities and MLP & Strategic Energy - and in 2015 we launched our second Multi-Asset strategy, Worldwide Income Opportunity, strategy grew substantiallya global version of our very successful Income Opportunity strategy. These recently launched offerings, in 2012 and 2013, exceeding $2.8 billion at the endcombination with our range of 2013, as the strategy continuedseasoned investment strategies, provide significant capacity to receive strong interest from our private wealth and mutual fund channels as well as from additional institutional mandates.grow assets under management. We have the team in place to support these investment strategies in our target institutional, private wealth and, mutual fund markets. If we continue to deliverwith continuing strong investment performance, we believe that demand for these strategies can provide meaningful growth infor our assets under management. Foster continued growth of the Westwood Trust platform.Westwood Trust has experienced solid growth in serving small to medium-sized institutions as well as high net worth individuals and families. We anticipate continued interest from clients and prospects in our diversified, highly attentive service model. A significant percentage of new asset growth at Westwood Trust stems from referrals, andas well as gathering additional assets from existing clients. We believe that our Enhanced Balanced ™® strategy, which offers diversified exposure to multiple asset classes in a tax-efficient, comprehensive solution for clients, providesmanner, along with our separately managed portfolios, provide good opportunities for growth.

Foster expanded distribution via mutual funds. We have tenfifteen funds in the Westwood Funds™Funds® family: Westwood SMidCap (WHGMX), Westwood IncomeIncome Opportunity (WHGIX), Westwood LargeCap Value (WHGLX), Westwood SmallCap Value (WHGSX), Westwood Dividend Growth (WHGDX), Westwood SMidCap Plus+ (WHGPX),Westwood Short Duration High Yield (WHGHX)Strategic Global Convertibles (WSGCX), Westwood Market Neutral Income (WMNIX), Westwood Worldwide Income Opportunity (WWIOX), Westwood MLP & Strategic Energy (WMLPX), Westwood Emerging Markets (WWEMX), Westwood Global Equity (WWGEX) and, Westwood Global Dividend (WWGDX), Westwood Short Duration High Yield (WHGHX) and Westwood Opportunistic High Yield (WWHYX). We believe that providing investors access to our investment strategies via mutual funds is a key component to achieving asset growth in the defined contribution and retirement marketplaces as well as in thewith registered investment advisor distribution channel.advisors. With the exception of Westwood Short Duration High Yield and Westwood Opportunistic High Yield, both of which isare subadvised by SKY Harbor Capital Management, LLC, the Westwood Funds ™Funds® generally mirror our institutional strategies. TheAll funds offer capped expense ratios and are available in an institutional share class for all funds.class. We also offer Class A shares for Westwood LargeCap Value (WWLAX), Westwood Income Opportunity (WWIAX), Westwood Emerging Markets (WWEAX) and Westwood Short Duration High Yield (WSDAX) in order to target No Transaction Fee (“NTF”)(NTF) mutual fund supermarket platforms and the broker/dealer marketplace. Westwood Market Neutral Income (WMNUX) and Westwood Opportunistic High Yield (WHYUX) offer an Ultra share class generally only available to institutional investors who purchase the fund directly and for which no shareholder servicing fees are paid.6

Pursue strategic corporate development opportunities.We evaluate strategic corporate development opportunities carefully in order to augment organic growth. We may pursue various transactions, including acquisitionacquisitions of asset management firms, mutual funds or private wealth firms, as well as hiring investment professionals or teams. We consider opportunities to enhance our existing operations, expand our range of investment strategies and services or further develop our distribution capabilities. By acquiring investment firms or by hiring investment professionals or teams that successfully manage investment strategies beyond our current expertise, we can both attract new clients and provide existing clients with an even more diversified range of investment strategies. We may also consider forging alliances with other financial services firms to leverage our core competency of developing superior investment strategies in combination with alliance partners who couldthat can provide enhanced distribution capabilities or additional service offerings. In October 2014, we hired our Global Convertible Securities Team to manage a new, convertible securities strategy, and in April 2015, we acquired Woodway to grow our private-wealth business.

Pursue opportunities internationally through targeted sales and relationships with international distributors and institutional investors.In recent years we have increased our sales efforts outside of the U.S. As of December 31, 2015, non-U.S. clients represented 18% of our assets under management compared with 5% as of December 31, 2011. The growth in our non-U.S. client base has primarily been a function of the broadening of our range of investment strategies to include Emerging Markets equity and Global Convertible Securities. In addition, we established a UCITS platform in 2012 and now offer three sub-funds under the UCITS umbrella for non-U.S. investors. We intend to continue our sales efforts outside of the U.S. We may consider forging alliances with international financial services firms or partners that could provideto obtain enhanced distribution capabilities and greater access to global customers. We may also target institutional investors in specific non-U.S. markets including Canada, the U.K.,United Kingdom, Australia, Switzerland, Scandinavia and the Netherlands. Continue to strengthen our brand name.We believe that the strength of our brandbrand name has been a key component to our long-term success in the investment industry and will be instrumental to our future success. We have developed our strong brand name largely through excellent performance coupled with high profile coverage in investment publications and electronic media. Several of our investment professionals including Mark Freeman, David Spika, Ragen Stienke, Patricia Perez-Coutts and Thomas Pinto Basto have been visible in print and electronic media, and we will continue to look for creative ways to strengthen our brand name and reputation in our target markets. Develop or acquire new investment strategies.We continue to look for opportunities to expand the range of investment strategies that we offer to existing and prospective clients. We may consider internally-developed strategies that extend our existing investment process to new markets and may also consider externally acquired investment strategies. An expanded range of investment strategies offers us additional ways to serve our client base, generating more diversified revenue streams, as well as asset and revenue growth opportunities.Expand our distribution focus to target U.S. plan sponsors more directly.As we look to expand our footprint within the U.S. institutional market, we will be taking a more active approach in meeting directly with pension funds, endowments, foundations and other institutional investors. We believe this will complement our existing efforts with investment consultants while also increasing the universe of prospects with whom we have the ability to discuss our firm and our strategies.

We are subject to substantial and growing competition in all aspects of our business. Barriers to entry

toin the asset management business are relatively low, and we expect to face a growing number of competitors. Although no one company dominates the asset management industry, many companies are larger, better known and have greater resources than us.

Further, we compete with other asset management firms on the basis of investment strategies offered,

thetheir investment performance

of those strategies both in absolute terms and relative to peer groups, quality of service, fees charged, the level and type of compensation offered to key employees, and the manner in

which investment strategies are marketed. Many of our competitors offer more investment strategies and services and have substantially greater assets under management.We compete against numerous investment dealers, banks, insurance companies, mutual fund companies, exchange-traded funds, brokerage and investment firms, and others that sell equity funds, taxable income funds, tax-free investments and other investment products. In addition, the allocation of assets by many investors from active equity

investmentinvestment to index funds, fixed income or similar asset classes has enhanced the ability of firms offering non-equity asset classes and passive equity management to compete effectively with us effectively.us. In summary, our competitive landscape is intense and dynamic, and we may not be able to compete effectivelysuccessfully in the future as an independent company.Additionally, most prospective clients perform a thorough review of an investment manager’s background, investment policies and performance before committing assets to that manager. In many cases, prospective clients invite a number of competing firms to make presentations. The process of obtaining a new client typically takes twelve to eighteen months from the time of the initial contact. While we have achieved success in

competing successfullycompeting for new clients, it is a process to which we dedicate significant resources over an extended period, with no certainty of success.7

winning.

RegulationRegulation

Virtually all aspects of our business are subject to federal and state laws and regulations. These laws and regulations are primarily intended to protect investment advisory clients. Under such laws and regulations, agencies that regulate investment advisers have broad administrative powers, including the power to limit,

restrictrestrict or prohibit advisers from carrying on their business in the event thatif they fail to comply with such laws and regulations. Possible sanctions include suspension of individual employees, limitations on engaging in certain lines of business for specified periods of time, revocation of investment adviser and other registrations, censures and fines. We believe that we are in substantial compliance with all material laws and regulations.Our business is subject to regulation at both federal and state levels by the SEC and other regulatory bodies. Westwood Management isCorp. and Westwood Advisors, LLC are registered with the SEC under the Investment Advisers Act of 1940 (the “Investment Advisers Act”) and under the laws of various states. As a registered investment adviser,advisers, Westwood Management isManagement Corp. and Westwood Advisors, LLC are regulated and subject to examination by the SEC. The Investment Advisers Act imposes numerous obligations on registered investment advisers, including fiduciary duties, record keeping requirements, operational requirements,and marketing requirements and disclosure obligations. Westwood Management Corp. also acts as adviser to the Westwood Funds ™,Funds®, a family of mutual funds registered with the SEC under the Investment Company Act of 1940.1940 (the "Investment Company Act"). As an adviser to a registered investment company, Westwood Management Corp. must comply with the Investment Company Act and related regulations. The Investment Company Act imposes numerous obligations on registered investment companies, including requirements relating to operations, fees charged, sales, accounting, record keeping, disclosure, governance and restrictions on transactions with affiliates. Under theSEC rules and regulations of the SEC promulgated pursuant to the federal securities laws, we are subject to periodic SEC examinations. The SEC can institute proceedings and impose sanctions for violations of the Investment Advisers Act and the Investment Company Act, ranging from censure to termination of an investment adviser’s registration. The failure of Westwood Management Corp. and Westwood Advisors, LLC to comply with SEC requirements could have a material adverse effect on Westwood. We must also comply with anti-money laundering laws and regulations, including the USA PATRIOT Act of 2001, as subsequently amended and reauthorized. We believe that we are in substantial compliance with the requirements of the regulations under the Investment Advisers Act, the Investment Company Act and the USA PATRIOT Act of 2001.

As an investment adviser, we have a fiduciary duty to our clients. The SEC has interpreted that duty to impose standards, requirements and limitations on, among other things: trading of client accounts, allocations of investment opportunities among clients, use of soft dollars, execution of transactions and recommendations to clients. We manage accounts for our clients with the authority to buy and sell securities, select broker-dealers to execute trades and negotiate brokerage commission rates. We receive soft dollar credits from certain broker-dealers that reduce certain operating expenses and cash payments to these broker-dealers. Our soft dollar arrangements are intended to be within the safe harbor provided by Section 28(e) of the Exchange Act.

If our ability to use soft dollars were reduced or eliminated as a result of the implementation of statutory amendments or new regulations, our operating expenses would increase.

Westwood Trust operates in a highly regulated environment and is subject to extensive supervision and examination. As a Texas chartered trust company, Westwood Trust is subject to the Texas Finance Code (the “Finance Code”), the rules and regulations promulgated under the Finance Code and supervision by the Texas Department of Banking. These laws are intended primarily for the protection of Westwood Trust’s clients and creditors rather than for the benefit of investors. The Finance Code provides for and

regulatesregulates a variety of matters, such as:·

| minimum capital maintenance requirements

|

·

| restrictions on dividends

|

minimum capital maintenance requirements;·

| restrictions on investments of restricted capital

|

restrictions on dividends;·

| lending and borrowing limitations

|

restrictions on investments of restricted capital;·

| prohibitions against engaging in certain activities

|

lending and borrowing limitations;·

| periodic fiduciary and information technology examinations by the office of the Texas Department of Banking Commissioner

|

prohibitions against engaging in certain activities;·

| furnishing periodic financial statements to the Texas Department of Banking Commissioner

|

periodic fiduciary and information technology examinations by the Texas Department of Banking Commissioner;·

| fiduciary record keeping requirements

|

furnishing periodic financial statements to the Texas Department of Banking Commissioner;·

| prior regulatory approval for certain corporate events (such as mergers, sale/purchase of all or substantially all of the assetsfiduciary record keeping requirements; and transactions transferring control of a trust company)

|

prior regulatory approval for certain corporate events (such as mergers, the sale or purchase of all or substantially all trust company assets and transactions transferring control of a trust company).

The Finance Code also gives the Banking Commissioner broad regulatory powers (including penalties and civil and administrative actions) if the trust company violates certain provisions of the Finance Code, including

implementing conservatorship or closure if Westwood Trust is determined to be in a “hazardous condition” (as defined by

applicable law). Westwood

Trust’s failure to comply with the Finance Code could have a material adverse effect on Westwood.8

Westwood Trust is limited by the Finance Code in the payment of dividends to undivided profits, which is described as that part of equity capital equal to the balance of net profits, income, gains, and losses since formation minus subsequent distributions to stockholders and transfers to surplus or capital under share dividends or appropriate board resolutions. At the discretion of its boardBoard of directors, WestwoodDirectors, Westwood Trust has made quarterly and special dividend payments to Westwood Holdings Group, Inc. out of undivided profits.

Westwood International is registered with both the Ontario Securities Commission (“OSC”) and the Autorité des marchés financiers (“AMF”) in Québec.

The OSC is an independent Crown corporation responsible for regulating the capital markets in Ontario. Its statutory mandate is to provide protection to investors from unfair, improper or fraudulent practices and to foster fair and efficient capital markets and confidence in capital markets. The OSC has rule making and enforcement powers to help safeguard investors, deter misconduct and regulate participants involved in capital markets in Ontario. It regulates firms and individuals that sell securities and

provide advice in Ontario, and also regulates public companies, investment funds and marketplaces, such as the Toronto Stock Exchange. The OSC’s powers are granted under the Securities Act (Ontario) the Commodity Futures Act (Ontario) and certain provisions of the Business Corporations Act. It operates independently from the government and is funded by fees charged to market participants. The OSC is accountable to the Ontario Legislature through the Minister of Finance.

The AMF is the entity mandated by the government of Québec to regulate the province’s financial markets and provide assistance to consumers of financial products and services. Established on February 1, 2004 under

an Act regarding the Autorité des marchés financiers , the AMF integrates the regulation of the Québec financial sector, notably in the areas of insurance, securities, deposit institutions (other than banks) and the distribution of financial products and services. Specifically, the AMF’s mission is to:·

| provide assistance to consumers of financial products and services

|

·

| ensure that financial institutions and other regulated financial sector entities comply with applicable solvency and obligations imposed by law

|

provide assistance to consumers of financial products and services;·

| supervise activities connected with distribution of financial products and services

|

ensure that financial institutions and other regulated financial sector entities comply with applicable solvency and obligations imposed by law;·

| supervise stock market and clearing house activities and monitor the securities market

|

supervise activities connected with distribution of financial products and services;·

| supervise derivatives markets, including derivatives exchanges and clearing houses and ensure that regulated entities and other derivatives market practitioners comply with obligations imposed by law

|

supervise stock market and clearing house activities and monitor the securities market;·

| implement protectionsupervise derivatives markets, including derivatives exchanges and clearing houses and ensure that regulated entities and other derivatives market practitioners comply with obligations imposed by law; and compensation programs for consumers of financial products and services, and administer compensation funds set up by law.

|

implement protection and compensation programs for consumers of financial products and services, and administer compensation funds set up by law.

Westwood International has entered into a

Memorandum of Understanding (“MOU”)MOU with Westwood Management pursuant to which Westwood International is considered a “participating affiliate” of Westwood Management. Subject to certain conditions, the SEC staff allows U.S. registered investment

advisersadvisers to use portfolio management or research resources of advisory participating affiliates subject to the supervision of a registered adviser. Pursuant to the MOU, Westwood International professionals can provide advisory and subadvisory services to U.S clients subject to SEC rules and regulations and under the supervision of Westwood Management.Employee Retirement Income Security Act of 1974

We are subject to the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and to

theits related regulations insofar as we are a “fiduciary” under ERISA with respect to some clients. ERISA and applicable provisions of the Internal Revenue Code impose certain duties on fiduciaries under ERISA or on

thoseentities that provide services to ERISA plan clients and

prohibit certain transactions involving ERISA plan clients. Our failure to comply with these requirements could have a material adverse effect.At December 31,

2013,2015, we had

106168 full-time employees

(93(153 based in the United States and

1315 based in Canada). No employees are represented by a labor union, and we believe our employee relations to be good.

For information about our operating segments, Advisory and Trust, please see Note

1514 to the

consolidated financial statements accompanying this Report.

9

We believe these represent the material risks currently facing our business. Our business, financial condition or results of operations could be materially adversely affected by these risks. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment. You should carefully consider the risks

describeddescribed below before making an investment decision. You should also refer to the other information included or incorporated by reference in this Report, including our financial statements and related notes.Poor investment performance

Risks Related to the Investment Industry

Our results of operations depend upon the market value and composition of assets managedunder management, which can fluctuate significantly based on various factors, some of which are beyond our control.

Our revenues are primarily generated from fees derived as a percentage of assets under management (“AUM”). The value of our AUM can be negatively impacted by usseveral factors, including:

Market performance: Performance of the securities markets could

be impacted by a number of factors beyond our control, including, among others, general economic downturns, political uncertainty or acts of terrorism. Negative performance within the securities markets or short-term volatility within the securities markets could result in investors withdrawing assets, decreasing their rates of investment or shifting assets to cash or other asset classes or strategies that we do not manage, all of which could reduce our revenues. In addition, during periods of slowing growth or declining revenues, profits and profit margins are adversely

affect our results of operations.affected because certain expenses remain relatively fixed.

Investment performance: Because we compete with many asset management firms on the basis of

theour investment strategies,

we offer, the maintenance and growth of assets under management

is dependent, to a significant extent, on the investment performance of the assets that we manage. Because our revenue is primarily generated from fees derived as a percentage of assets under management, poorPoor performance tends to result in the loss or reduction of client accounts, which correspondingly decreases revenues. Underperformance relative to peer groups for our various investment strategies could adversely affect our results of operations, especially if such underperformance continues for an extended period of time. The historical returns of our strategies and the ratings and rankings we, or the mutual funds that we advise, have received in the past should not be considered indicative of the future results of these strategies or of any other strategies that we may develop in the future. The investment performance we achieve for our customers varies over time and variances can be wide. In addition, certain of our investment strategies have capacity constraints, as there is a limit to the number of securities available for the strategycertain strategies to operate effectively. In those instances, we may choose to limit access to new or existing investors.Recently, we have experienced client outflows that may have resulted in part from the underperformance of our LargeCap Value

Our business is subject to extensive regulation with attendant compliance costs and

SMidCap Value strategies. These strategies collectively represents about 49% of our consolidated revenue. While our LargeCap Value and SMidCap Value strategies have outperformed their respective benchmark indices since the strategies’ inception dates, these strategies have underperformed their respective benchmark indices and ranked below the median return of their respective peer groups over the trailing three year period ended December 31, 2013. Additionally, our Emerging Markets strategy has underperformed its benchmark index and ranked below the median return of its peer group since its inception in 2012. While we believe this recent underperformance has resulted in some client outflows, many factors are involved in client investment and allocation decisions and we cannot specifically quantify the amount of outflows resulting from this recent underperformance.Our success depends on certain key employees and our ability to attract and develop new talented investment professionals. Our inability to attract and retain key employees could compromise our future success.

We believe that our future success will depend to a significant extent upon the services of our certain key employees, particularly Brian Casey, President and Chief Executive Officer, Mark Freeman, Chief Investment Officer, and Patricia Perez-Coutts, Senior Portfolio Manager. As with other asset management businesses, our future performance depends to a significant degree upon the continued contributions of these and other key officers, investment professionals, as well as marketing, client service and management personnel. Additionally, attracting and developing new talented investment professionals is an essential component of our business strategy. There is substantial competitionserious consequences for skilled personnel and the loss of key employees or our failure to attract, develop, retain and motivate qualified personnel, could negatively impact our business, financial condition, results of operations and future prospects.

Our revenues are dependent upon the performance of the securities markets and negative performance of the securities markets could reduce our revenues.

Our results of operations are affected by many economic factors, including the performance of the securities markets. Performance of the securities markets could be impacted by a number of factors beyond our control, including, among others, general economic downturns, political uncertainty or acts of terrorism. Negative performance within the securities markets or short-term volatility within the securities markets could result in investors withdrawing assets, decreasing their rates of investment or shifting assets to cash or other asset classes or strategies that we do not manage, all of which could reduce our revenues. Because most of our revenues are based on the value of assets under management, a decline in the value of those assets would also adversely affect our revenues. In addition, in periods of slowing growth or declining revenues, profits and profit margins are adversely affected because certain expenses remain relatively fixed.

In particular, a significant portion of our assets under management is invested in equity securities of companies with large market capitalizations. As a consequence, we are particularly susceptible to the volatility associated with changes in the market for large capitalization stocks. Due to this concentration, any change or reduction in such markets, including a shift of our clients’ and potential clients’ preference from investments in equity securities of large capitalization stocks to other equity or fixed income securities could have a significant negative impact on our revenues and results of operations. This negative impact could occur due to

10

the depreciation in value of our assets under management, the election by clients to select other firms to manage their assets or the election by clients to allocate assets away from asset classes that we manage. Any of these events would result in decreased assets under management and therefore reduced revenues and a decline in results of operations.

If we are unable to realize benefits from the costs we have incurred and are continuing to incur to develop new investment strategies and otherwise broaden our capabilities, our growth opportunities may be adversely affected.

We have incurred significant costs to develop new investment strategies, to launch new mutual funds under the Westwood Funds ™ name and to upgrade our business infrastructure. We expect to continue to incur significant costs related to such improvements in the future. We may not realize the benefits of these investments and, if unable to do so, our results of operations and growth opportunities may be adversely affected.

Expansionviolations; expansion into international markets and introduction of new products and services increases our operational, regulatory and operational risks.

Virtually all aspects of our business are subject to laws and regulations, including the Investment Advisers Act, the Investment Company Act, the USA Patriot Act of 2001, the Finance Code and anti-money laundering laws. These laws and regulations generally grant regulatory agencies broad administrative powers, including the power to limit or restrict us from operating our business, as well as powers to place us under conservatorship or closure if we fail to comply with such laws and regulations. Violations of such laws or regulations could subject us or our employees to disciplinary proceedings and civil or criminal liability, including revocation of licenses, censures, fines or temporary suspensions, permanent barring from the conduct of business, conservatorship, or closure. Any such proceeding or liability could have a material adverse effect upon our business, financial condition, results of operations and business prospects.

In addition, the regulatory environment in which we operate is subject to change. We may be adversely affected as a result of new or revised legislation or regulations or by changes in the interpretation or enforcement of existing laws and regulations. In recent years, regulators have increased their oversight of the financial services industry. Some regulations are focused directly on the investment management industry, while others are more broadly focused but affect our industry as well. The Dodd-Frank Act of 2010 significantly increased and revised the federal rules and regulations governing the financial services industry and, in addition to other

risks.Weregulations, has generally resulted in increased compliance and administrative requirements. For example, the SEC’s adoption of Form PF and revisions to Form ADV impose additional reporting requirements for SEC-registered investment advisors. Additionally, ERISA Section 408(b)(2) and related regulations require additional information to be provided to ERISA-governed retirement plans. While we believe that changes in laws, rules and regulations, including those discussed above, have increased our administrative and compliance costs, we are unable to quantify the increased costs attributable to such changes. See “Item 1. Business — Regulation.”

Recently, we have expanded our product offerings,

vehicles offered and international business activities

recently with

the establishment of Westwood International and itsstrategies in global and emerging markets,

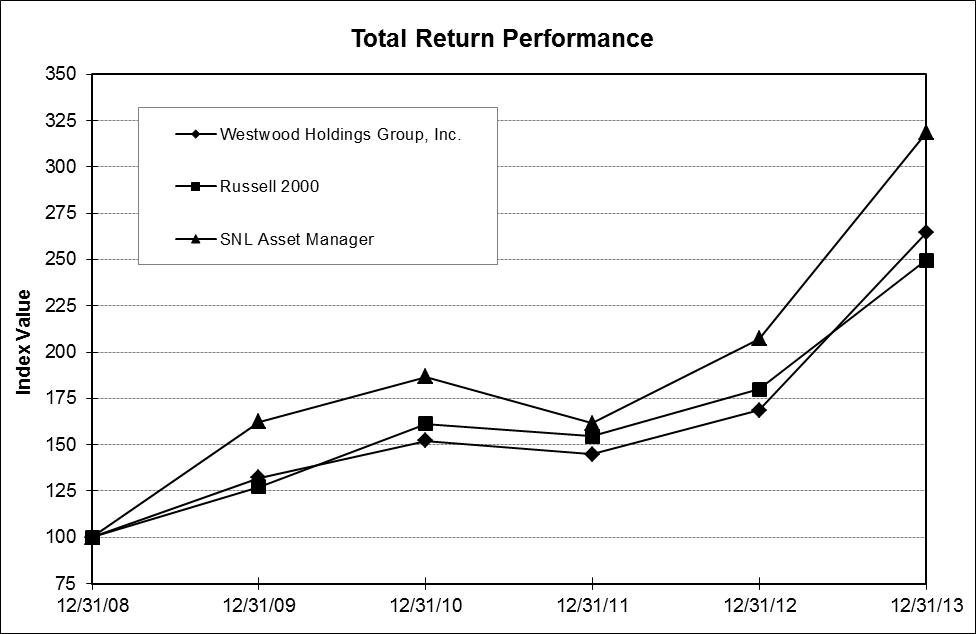

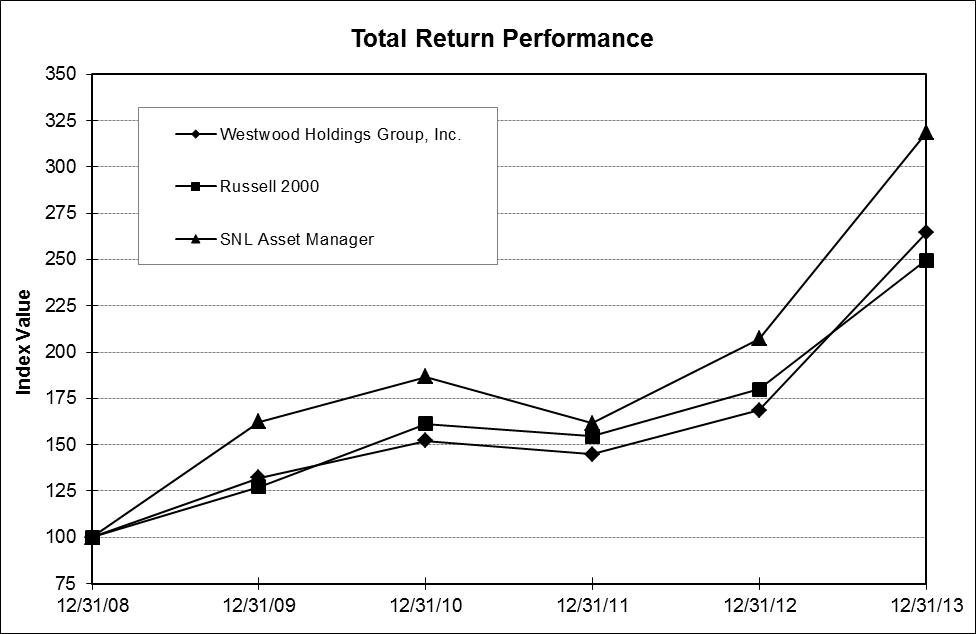

strategies.global multi-asset and global convertible securities. Additionally, our client base continues to expand internationally. As of December 31, 2015, approximately 18% of our AUM is managed for clients who are domiciled outside the United States. As a result, we face increased operational, regulatory, compliance, reputation and foreign exchange rate risks.