UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

Form 10-K

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20152017

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-35073

Gevo, Inc.

(Exact name of registrant as specified in its charter)

Delaware |

| 87-0747704 |

(State or Other Jurisdiction of Incorporation or Organization) |

| (I.R.S. Employer Identification No.) |

345 Inverness Drive South, Building C, Suite 310, Englewood, CO |

| 80112 |

(Address of Principal Executive Offices) |

| (Zip Code) |

(303) 858-8358

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

|

| Name of Each Exchange on Which Registered |

|

Common Stock, par value $0.01 per share |

| NASDAQ Capital Market | ||||

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨☐ No x☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨☐ No x☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x☒ No ¨☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x☒ No ¨☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”filer,” “smaller reporting company,” and “smaller reporting“emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer |

|

|

| Accelerated filer |

|

|

|

|

|

| |||

Non-accelerated filer |

|

|

| Smaller reporting company |

|

|

Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨☐ No x☒

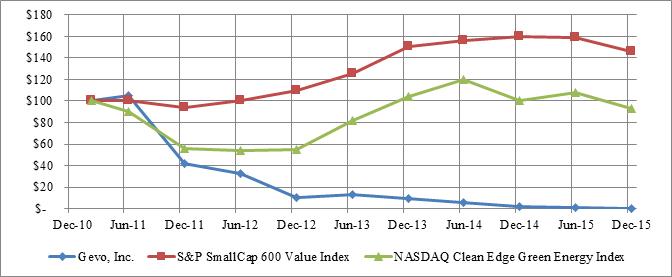

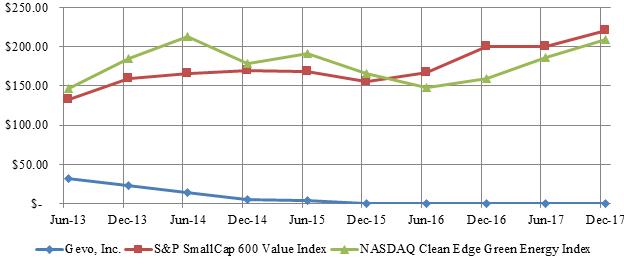

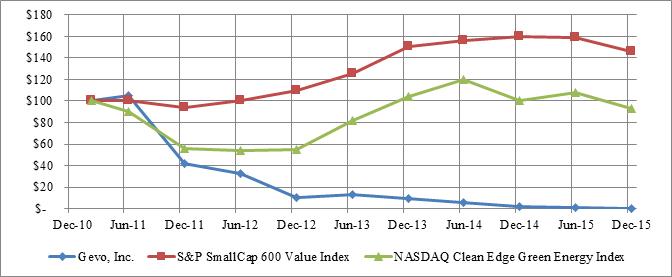

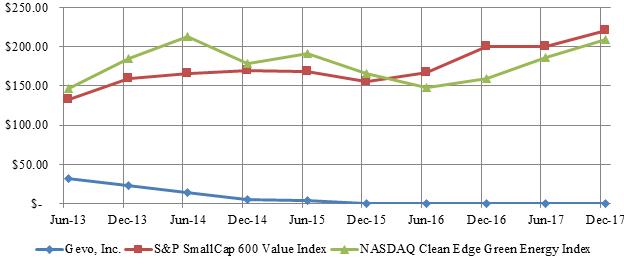

The aggregate market value of 16,499,378 shares of voting stockcommon equity held by non-affiliates of the registrant based on the closing sale pricewas approximately $11.2 million as of the common stock as reported on the NASDAQ on June 30, 2015,2017, the last business day of the registrant’s most recently completed second fiscal quarter, based on the closing price of $3.27 per share was $53,952,966.the common stock as reported on the NASDAQ Capital Market on June 30, 2017. Shares of common stock held by each officer, director and holder of 5%10% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of February 29, 2016,28, 2018, the number of outstanding shares of the registrant’s common stock, par value $0.01 per share, was 23,510,855.22,600,849

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Annual Report on Form 10-K incorporates certain information by reference from the registrant’s proxy statement for the 20162018 annual meeting of stockholders to be filed no later than 120 days after the end of the registrant’s fiscal year ended December 31, 2015.2017.

FORM 10-K—ANNUAL REPORT

For the Fiscal Year Ended December 31, 20152017

Table of Contents

|

| Page |

|

| |

Item 1. | 4 | |

Item 1A. |

| |

Item 1B. |

| |

Item 2. |

| |

Item 3. |

| |

Item 4. |

| |

|

|

|

Item 5. |

| |

Item 6. |

| |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

Item 7A. |

| |

Item 8. |

| |

| Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

Item 9A. |

| |

Item 9B. |

| |

|

|

|

Item 10. |

| |

Item 11. |

| |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

Item 13. | Certain Relationships and Related Transactions, and Director Independence |

|

Item 14. |

| |

|

|

|

Item 15. |

| |

Item 16. | 112 | |

| ||

This report contains forward-looking statements within the meaning of Section 21 E of the Securities Exchange Act of 1934 (the “Exchange Act”). When used anywhere in this Annual Report on Form 10-K (this “Report”), the words “expect,” “believe,” “anticipate,” “estimate,” “intend,” “plan” and similar expressions are intended to identify forward-looking statements. These statements relate to future events or our future financial or operational performance and involve known and unknown risks, uncertainties and other factors that could cause our actual results, levels of activity, performance or achievement to differ materially from those expressed or implied by these forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. These forward-looking statements include, among other things, statements about: the continued listing of our common stock on the NASDAQ, our ability to raise additional funds to continue operations,operate our business, our ability to produce isobutanol on a commercial level and at a profit, achievement of advances in our technology platform, the success of our retrofit production model, our ability to expand our Luverne, Minnesota facility for our first commercial hydrocarbons facility, our ability to gain market acceptance for our products, additional competition and changes in economic conditions.conditions and the continued listing of our common stock on NASDAQ. Important factors could cause actual results to differ materially from those indicated or implied by forward-looking statements such as those contained in documents we have filed with the U.S. Securities and Exchange Commission (the “SEC”), including this Report in “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Risk Factors” and subsequent reports on Form 10-Q. All forward-looking statements in this Report are qualified entirely by the cautionary statements included in this Report and such other filings. These risks and uncertainties or other important factors could cause actual results to differ materially from results expressed or implied by forward-looking statements contained in this Report. These forward-looking statements speak only as of the date of this Report. We undertake no intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, and readers should not rely on the forward-looking statements as representing the Company’s views as of any date subsequent to the date of the filing of this Report. Unless the context requires otherwise, in this Report the terms “we,” “us,” “our” and “Company” refer to Gevo, Inc. and its wholly-owned and indirect subsidiaries.

This Report contains estimates and other information concerning our target markets that are based on industry publications, surveys and forecasts, including those generated by SRI Consulting, a division of Access Intelligence, LLC, Chemical Market Associates, Inc., the U.S. Energy Information Association (the “EIA”), the International Energy Agency (the “IEA”), the Renewable Fuels Association, and Nexant, Inc. (“Nexant”). Certain target market sizes presented in this Report have been calculated by us (as further described below) based on such information. This information involves a number of assumptions and limitations and you are cautioned not to give undue weight to this information. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause actual results to differ materially from those expressed in these publications, surveys and forecasts.

Conventions that Apply to this Report

With respect to calculation of product market volumes:

|

|

product market volumes are provided solely to show the magnitude of the potential markets for isobutanol and the products derived from it. They are not intended to be projections of our actual isobutanol production or sales;

|

|

product market volume calculations for fuels markets are based on data available for the year 2013;

|

|

product market volume calculations for chemicals markets are based on data available for the year 2012; and

|

|

volume data with respect to target market sizes is derived from data included in various industry publications, surveys and forecasts generated by the EIA, the IEA and Nexant.

We have converted these market sizes into volumes of isobutanol as follows:

|

|

we calculated the size of the market for isobutanol as a gasoline blendstock and oxygenate by multiplying the world gasoline market volume by an estimated 12.5% by volume isobutanol blend ratio;

|

|

we calculated the size of the specialty chemicals markets by substituting volumes of isobutanol equivalent to the volume of products currently used to serve these markets;

|

|

we calculated the size of the petrochemicals and hydrocarbon fuels markets by calculating the amount of isobutanol that, if converted into the target products at theoretical yield, would be needed to fully serve these markets (in substitution for the volume of products currently used to serve these markets); and

|

|

for consistency in measurement, where necessary we converted all market sizes into gallons.

Conversion into gallons for the fuels markets is based upon fuel densities identified by Air BP Ltd. and the American Petroleum Institute.

Company Overview

We are a renewable chemicals and next generation biofuels company. company, targeting what we believe to be very large potential markets: that of low carbon fuels and chemicals that can compete directly against petro-chemical products depending on the price of oil and value of carbon. Renewable fuels are one of the few markets where the value for renewable carbon has already been established, particularly in the U.S. We believe that the demand for low carbon fuels, chemicals, and plastics will continue and grow stronger over time. We believe that renewable carbon will eventually be valued in chemicals and plastics in addition to fuels.

The challenges to displace petrochemical products with renewable products are enormous: (i) the products need to meet or exceed the stringent performance requirements established by the incumbent products, (ii) the products need to be compatible with existing distribution infrastructure, (iii) the products must be economical in the market place, and (iv) in most cases, the products must have a lower carbon footprint and improve the “sustainability” of the business system. We believe we have viable technologies that produce products that address these challenges.

We have developed proprietary technology that uses a combination of synthetic biology, metabolic engineering, chemistry and chemical engineering to focus primarily on the production ofmake isobutanol as well as relatedand hydrocarbon products from isobutanol that can displace petrochemical incumbent products. We have been able to genetically engineer yeast, whereby the yeast produces isobutanol from carbohydrates at costs that we believe to be commercially competitive once large production facilities are deployed that will enable economies of scale to be reached. We have shown that the isobutanol production process works in full scale fermenter systems at our production facility in Luverne, Minnesota (the “Luverne Facility”). We also have shown that our renewable feedstocks.isobutanol can be readily converted to hydrocarbon products that address large markets. Specifically, our renewable alcohol-to-jet fuel (“ATJ”) has been approved for use in commercial aviation and used multiple times for commercial flights. In addition, our renewable isobutanol is being used as a gasoline blendstock in the Houston area for on-road vehicles as an ethanol-free fuel option for consumers. Our renewable isooctane meets the performance and specification requirements for use in chemicals and fuels and is currently being used in the European Union. We believe that there is large potential to grow our business, through a combination of (i) directly producing and selling our renewable isobutanol and related hydrocarbon products, and (ii) licensing our technology.

We believe that renewable isobutanol is a potentially valuable commercial product because of its versatility to address large markets either as a product directly or as a key intermediate for producing renewable carbon alternatives to mainstream fuels such as jet fuel, gasoline, plastics such as Polyethylenen Terephthalate (“PET”), and various other chemical products and materials. Isobutanol is a four-carbon alcohol that can be sold directly for use as a specialty chemical in the production of solvents, paints and coatings, or more importantly from a market size and performance value-added point of view, as a value-added gasoline blendstock. IsobutanolBecause isobutanol can also be readily converted into butenes using dehydration chemistry deployed in the refining and petrochemicals industries today. The convertibility of isobutanol into butenes is important because butenes are primaryto hydrocarbon building blocks used in the production ofproducts such hydrocarbon fuels, including isooctane, isooctene and ATJ, lubricants, polyester, rubber, plastics, fibers and other polymers. Wepolymers, we believe that the products derived from isobutanol have potential applications in substantially all of the global hydrocarbon fuelsaddressable markets and in approximatelyare very large; potentially being able to ultimately reach 40% of the global petrochemicals markets.markets depending on the price of oil and the value for renewable carbon.

Our renewable isobutanol production technology has been proven to work in a 1.5 million gallon per year (“MGPY”) capacity production line, (~265,000 gallon fermenter scale) at our Luverne Facility. We have concluded that the technology works as we expected at this scale. Our technology to convert our renewable isobutanol to ATJ, isooctane, isooctene, and para-xylene (building block for polyester) has been proven at our hydrocarbons demonstration plant located at South Hampton Resources located in Silsbee, TX. In order to producereduce production costs further, we need to achieve economies of scale. We plan to do this by expanding our isobutanol and sell isobutanol made from renewable sources,hydrocarbon capabilities once we have developedoff-take agreements in place.

In addition to our isobutanol production line, our Luverne Facility has production capacity of about 20 MGPY of ethanol, 45-50 kilotons (“KT”) of animal feed, and 3 million pounds of corn oil. We plan on optimizing the Gevo Integrated Fermentation Technology® (“GIFT®”), an integrated technology platform forLuverne Facility to increase margin at the efficient productionsite by reducing carbohydrate feedstock costs, improving the value of animal feed and separationprotein products, and the yield of renewable isobutanol. GIFT® consists of two components, proprietary biocatalystscorn oil. These improvements are expected to benefit both ethanol and isobutanol production. We believe that convert sugars derived from multiple renewable feedstocks into isobutanol through fermentation, and a proprietary separation unit that is designedthese upgrades to continuously separate isobutanol during the fermentation process. We developed our technology platformLuverne Facility could prove to be compatible with the existing approximately 25 billion gallons per year (“BGPY”)a key step to reach profitability, independent of global operating ethanol production capacity, as estimated by the Renewable Fuels Association.isobutanol production.

GIFT® Our technology is designed to permit (i) the retrofit of existing ethanol capacity to produce renewable isobutanol, ethanol or both products simultaneously or (ii) the addition of renewable isobutanol or ethanol production capabilities to a facility’s existing ethanol production by adding additional fermentation capacity side-by-side with the facility’s existing ethanol fermentation capacity (collectively referred to as “Retrofit”). Having the flexibility to switch between the production of isobutanol and ethanol, or produce both products simultaneously, should allow us to optimize asset utilization and cash flows at a facility by taking advantage of fluctuations in market conditions. GIFT® Our technology is also designed to allow relatively low capital expenditure Retrofits of existing

ethanol facilities, enabling a relatively rapid route to isobutanol production from the fermentation of renewable feedstocks. Alternatively, our technology can be deployed at a greenfield or brownfield site to produce isobutanol and hydrocarbons without producing ethanol.

NASDAQ Market Price Compliance

On June 21, 2017, we received a deficiency letter from the Listing Qualifications Department of the Nasdaq Stock Market, notifying us that, for the prior 30 consecutive business days, the closing bid price of our common stock was not maintained at the minimum required closing bid price of at least $1.00 per share as required for continued listing on the Nasdaq Capital Market. In accordance with Nasdaq Listing Rules, we had an initial compliance period of 180 calendar days, to regain compliance with this requirement. On December 20, 2017, the Nasdaq Stock Market granted us an additional 180 calendar days, or until June 18, 2018, to regain compliance. To regain compliance, the closing bid price of our common stock must be $1.00 per share or more for a minimum of 10 consecutive business days at any time before June 18, 2018. The Nasdaq determination to grant the second compliance period was based on our meeting of the continued listing requirement for market value of publicly held shares and all other applicable requirements for initial listing on the Nasdaq Capital Market, with the exception of the bid price requirement, and our written notice of our intention to cure the deficiency during the second compliance period by effecting a reverse stock split, if necessary.

Markets

Isobutanol Direct Use Markets

Without modification, isobutanol has applications in the specialty chemical and gasoline blendstock markets. Since our potential customers in these markets would not be required to develop any additional infrastructure to use our isobutanol, we believe that selling into these markets will result in a relatively low risk profile and produce attractive margins.

Gasoline Blendstocks

Isobutanol has direct applications as a gasoline blendstock. Fuel-grade isobutanol may be used as a high energy content, low Reid Vapor Pressure (“RVP”), gasoline blendstock and oxygenate. Based on isobutanol’s low water solubility, in contrast with ethanol, we believe that isobutanol will be compatible with existing refinery infrastructure, allowing for blending at the refinery rather than blending at the terminal.

Further, based on isobutanol’s high energy content and low water solubility, as well as testing completed by the National Marine Manufacturers Association, the Outdoor Power Equipment Institute and Briggs & Stratton, we believe that isobutanol has direct applications as a blendstock in high value specialty fuels markets serving marine, off-road vehicles, small engine and sports vehicle markets.

We estimate the total addressable worldwide market for isobutanol as a gasoline blendstock to be approximately 43 billion gallons per year (“BGPY”).

The market size for ethanol free (E0) gasoline, a large niche, is estimated by the EIA to be about 5 BGPY, outside of RFG regions. RFG areas are required to sell gasoline containing an oxygenate. Up to this point, ethanol was the only gasoline oxygenate available. We believe our isobutanol enables ethanol free gasoline in RFG areas, a market estimated to be about 2BGPY. When RFG regions are included in the total US market size estimation, the total ethanol free market is expected to be about 7 BGPY.

Specialty Chemicals

Isobutanol has direct applications as a specialty chemical. High-purity and chemical-grade isobutanol can be used as a solvent and chemical intermediate. We plan to produce high-purity and chemical-grade isobutanol that can be used in the existing butanol markets as a cost-effective, environmentally sensitive alternative to petroleum-based products.

We believe that our production route will be cost-efficient and will enable relatively rapid deploymentallow for significant expansion of our technology platform and allow ourthe historical isobutanol andmarkets within existing butanol markets through displacing n-butanol, a related renewable productscompound to isobutanol that is currently sold into butanol markets.

We estimate the total addressable worldwide market for isobutanol as a specialty chemical to be economically competitive with many of the petroleum-based products used in the chemicalsapproximately 1.2 BGPY.

Butene and fuels markets today.Hydrocarbon Markets Derived from Isobutanol

Our Strategy

Our strategy is to commercialize our isobutanol forBeyond direct use directly as a specialty chemical and gasoline blendstock, isobutanol can be dehydrated to produce butenes which can then be converted into other products such as para-xylene, jet fuel blendstock and many other hydrocarbon fuels and specialty blendstocks, and specialty chemicals offering substantial potential for additional demand. The conversion of isobutanol into butenes is a fundamentally important process that enables isobutanol to be used as a building block chemical in multiple markets.

Jet Fuel

According to IATA, the year-on-year growth for jet fuel is about 3 BGPY and is expected to continue at approximately the same growth rate for the next decade. From 2020 onward the airlines industry has pledged to hold its annual emission of fossil carbon constant after 2020. By the year 2027 IATA expects that the airlines industry will have adopted penalties tied to GHG emissions. This means that the emissions from jets need to be mitigated. As part of the mitigation of fossil based GHG’s, IATA expects that renewable resource based low carbon fuels will be needed. We have developed a jet fuel made from our isobutanol. This fuel is commonly referred to as alcohol-to-jet fuel or ATJ.

In April 2016, ASTM International completed its process of approving a revision of ASTM D7566 (Standard Specification for Aviation Turbine Fuel Containing Synthesized Hydrocarbons) to include alcohol to jet synthetic paraffinic kerosene derived from renewable isobutanol. This allows our renewable jet fuel to be used as a blending component in standard Jet A-1 for commercial airline use in the United States and around the globe.

We have delivered ATJ which was used by nine airlines for Fly Green Day, sponsored by the O’Hare Fuel Committee, at Chicago O’Hare International Airport. This event is the first time renewable jet fuel has been supplied at Chicago O’Hare using the existing airport fueling infrastructure, such as pipelines, terminals and tankage.

We have previously delivered ATJ to Alaska Airlines, which successfully flew multiple commercial flights using our fuel in 2016, including what we believed was the first commercial flight using a cellulosic jet fuel derived from wood waste.

We have successfully delivered to the U.S. Air Force, the U.S. Army and the U.S. Navy a combined total of approximately 90,000 gallons of our ATJ. Military and commercial airlines are currently looking to form strategic alliances with biofuels companies to meet their renewable fuel needs.

We estimate the global market for jet fuel to be approximately 89 BGPY.

Other Hydrocarbon Fuels

Isooctane, isooctene, diesel fuel and bunker fuel may also be produced from our isobutanol. We have been producing jet fuel and isooctane for renewable gasoline at our demonstration plant located at South Hampton Resources in Silsbee, TX since 2011. The products produced at our hydrocarbon plant are sold on a commercial basis to develop the markets. We continue to optimize the technologies and production systems, but we believe this technology is ready to scale up on a full commercial basis.

Para-xylene (“PX”) and Polyethylene Terephthalate (“PET”)

Isobutanol can be used to produce PX, polyester and their derivatives, which are used in the beverage, food packaging, textile and fibers markets. PX is a key raw material in PET production.

We estimate the global market for PET to be approximately 50 million metric tons per year of which approximately 30% is used for plastic bottles and containers. We have demonstrated the conversion of our isobutanol into renewable PX at the demonstration plant in Silsbee, TX. This demonstration plant produced renewable PX from October 2013 through March 2014, and, in May 2014, we shipped renewable PX to Toray Industries, Inc. (“Toray Industries”) under the terms of a supply agreement.

Butenes

Traditionally butenes have been produced as co-products from the process of cracking naphtha in the production of ethylene. Historically, lower natural gas prices and reported reductions in the use of naphtha as the feedstock for the production of ethylene have resulted in a projected reduction in the volume of available butenes. This structural shift in feedstocks increases the potential market opportunity for our isobutanol in the production of butenes.

Isobutanol can be sold to isobutylene and n-butene (butenes) chemicals users for conversion into plastics, fibers, polyester,lubricants, methyl methacrylate and rubber other polymersapplications.

We are working to secure off-take agreements that justify the build-out of additional isobutanol and hydrocarbon fuels. Key elements ofproduct capacities at our strategy include:

|

|

|

|

|

|

|

|

|

|

|

|

Our Retrofit Strategy

Luverne Facility or another suitable location. We plan to commercializeuse those agreements to aid in the financing of these build-out projects. The size of the build-out projects will be determined by customer demand. We currently believe that the Luverne Facility offers the best site for the build-out projects given the technology already deployed at the Luverne Facility. However, if an opportunity arose whereby overall production cost of products (net of carbon value) or if a different location aided financing significantly, certain equipment could be moved from the Luverne Facility to a new site, and our isobutanol throughproducts could be produced at a strategy of Retrofittingsite other than the Luverne Facility instead. Beyond the Luverne Facility, we believe that we will license our technology or partner to build additional plants, leveraging existing ethanol production facilities to produce isobutanolindustry infrastructure and related renewable products and have developed our technology platform to be compatible with the existing approximately 25 BGPY of global operating ethanol production capacity. We believe thatmay not be successful in our design will enable a switch betweenefforts to build out the production of isobutanol and ethanol,Luverne Facility or the ability to produce both products simultaneously, which will allow optimization of asset utilization and cash flows at a facility by taking advantage of fluctuations in market conditions.

The Retrofit approach allows us to project potentially lower capital outlays and a faster commercial deployment schedule than the construction of new plants. We believe the ability of GIFT® to convert sugars from multiple renewable feedstocks into isobutanol will enable us to leverage the abundant domestic sources of historically low cost grain feedstocks (e.g., corn) currently used for ethanol production and will potentially enable the expansion oflicense our production capacity into international markets that use sugar cane or other feedstocks that are prevalent outside of the U.S.

We plan to secure access to existing ethanol production facilities through joint ventures, licensing arrangements, tolling partnerships and direct acquisitions. We then plan to work with design, engineering, and construction partners to deploy GIFT® through Retrofit of these production facilities.technology.

Our Retrofit at the Agri-EnergyLuverne Facility

In September 2010, we acquired the Luverne Facility, a 22 million gallon per year (“MGPY”)MGPY ethanol production facility in Luverne, Minnesota (the “Agri-Energy Facility”).Minnesota. Since 2010, we made improvements and modifications to the Luverne Facility to add isobutanol production capabilities. The Agri-EnergyLuverne Facility is a traditional dry-mill facility, which means that it uses dry-milled corn as a feedstock. In partnership with ICM, Inc. (“ICM”), we developed a detailed Retrofit design for this facility and began the Retrofit in 2011. In May 2012, we commenced initial startup operations for the production of isobutanol at the Agri-Energy Facility. In September 2012, as a result of a lower than planned production rate of isobutanol, we made the strategic decisioncurrently configured to pause isobutanol production at the Agri-Energy Facility at the conclusion of startup operations to focus on optimizing specific parts of the process to further enhance isobutanol production rates.

In 2013, we made modifications to our Agri-Energy Facility designed to increase the isobutanol production rate. In June 2013, we resumed the limited production of isobutanol, operating one fermenter and one GIFT® separation system in order to (i) verify that the modifications had significantly reduced the previously identified infections, (ii) demonstrate that our biocatalyst performs in the one million liter fermenters at the Agri-Energy Facility, and (iii) confirm GIFT® efficacy at commercial scale at the Agri-Energy Facility. In August 2013, we expanded production capacity at the Agri-Energy Facility by adding a second fermenter and second GIFT® system to further verify our results with a second configuration of equipment. For these initial production runs, we demonstrated fermentation operations at commercial scale combined with the use of our GIFT® separation system using a dextrose (sugar) feedstock. Based on the results of these initial production runs, in October 2013 we began commissioning the Agri-Energy Facility on corn mash to test isobutanol production run rates and to optimize biocatalyst production, fermentation separation and water management systems.

In March 2014, we decided to leverage the flexibility of our GIFT® technology and further modify the Agri-Energy Facility in order to enable the simultaneous production of isobutanol and ethanol. In July 2014, we began more consistent co-production of isobutanol and ethanol at the Agri-Energy Facility, with one fermenter utilized for isobutanol production and three fermenters utilized for ethanol production.

In September 2015, we began deploying additional capital at our Agri-Energy Facility, primarily designed to decrease the cost of production for isobutanol by bringing parts of the process to the facility that have previously been done off-site by third parties. Key equipment being installed at the plant include a distillation system to purify isobutanol on site, an addition to our seed train to improve our ability to grow our yeast on site and a stainless steel fermenter to replace one of the existing carbon steel fermenters that had reached the end of its useful life. The installation of this equipment is expected to decrease our cost of production of isobutanol, with a goal of producing isobutanol at our Agri-Energy Facility at a positive contribution margin in 2016. These capital projects are anticipated to be completed in the first or second quarter of 2016.

Through December 31, 2015, we have incurred capital costs of approximately $65.5 million on the Retrofit of the Agri-Energy Facility. The Retrofit of the Agri-Energy Facility includes a number of additional capital costs that are unique to the design of the facility, including additional equipment that we believe will allow us to switch betweenproduce ethanol and isobutanol, production, modifications to increase the potential production capacity of GIFT® at this facility and the establishment of an enhanced yeast seed train to accelerate the adoption of improved yeast strains at this facility and at future plants. Capital expenditures at the Agri-Energy Facility also include upfront design and engineering costs, plant modifications identified as necessary during initial startup operations for the production of isobutanol and capitalized interest.

Until May 2012, when we commenced initial Retrofit startup operations for the production of isobutanol at the Agri-Energy Facility, we derived revenue from the sale of ethanol, distiller’s grains and other related products produced as part of the ethanol production process at the Agri-Energy Facility. Continued ethanol production during the Retrofit process allowed us to retain local staff for the future operation of the plant, maintain the equipment and generate cash flow. Our Retrofit strategy includes the ability to switch between the production of isobutanol and ethanol, or produce both products simultaneously, with an emphasis on maximizing cash flows at a site. In the past we have been able to switch between the production of isobutanol and ethanol at the Agri-Energy Facility. In the future, we believe that we will be able to transition between the production and sale of ethanol and related products at the Agri-Energy Facility, in whole or in part, if we were to project positive cash flows from ethanol operations versus maintaining the

facility at idle or producing isobutanol, including any costs related to the transition, but there is no guarantee that this will be the case. As a result, the historical operating results of our subsidiary, Agri-Energy, LLC (“Agri-Energy”), and the operating results reported during the Retrofit to isobutanol production may not be indicative of future operating results for Agri-Energy or Gevo’s consolidated results. The future return on our invested capital depends on our ability to maximize cash flows from the Retrofit of the Agri-Energy Facility.side-by-side.

Third Party Retrofit and Construction Activities

We have commenced a licensing strategy whereby a licensee would invest the capital for the Retrofit of its own ethanol plant or for a new greenfield build out of an isobutanol-producing plant. In return, we, as the licensor, would expect to receive an up-front license fee and ongoing royalty payments from the project,projects, as well as other potential revenue streams such as yeast sales. This licensing strategy is expected to take some time to develop. The ability to license a technology is generally related to the commercial track record of the underlying technology itself. In addition, revenues from licensing our isobutanol and/or hydrocarbon technologies are expected to be directly linked to the build out of specific projects, which may take multiple years to construct.

Our Production Technology Platform

We have used tools from synthetic biology, biotechnology, chemical catalysis, and process engineering to develop a proprietary set of technologies that enable the potential of cost effective production of isobutanol and hydrocarbon fuels and chemicals. We believe the technologies to be proven to work, having made and sold products using these technologies.

We have a proprietary fermentation yeast biocatalyst that effectively produces isobutanol. The advantage of this biocatalyst is that it (i) works in large scale fermentation systems, and (ii) can operate in complex biological mixtures such as corn mash or molasses and produce a suitable clean isobutanol product. The technology is designed to use similar carbohydrate feedstocks, similar to ethanol technology. For example, carbohydrates from non-food corn, sugar cane, molasses or cellulosic sugars each could be used depending upon cost and availability. We believe that our technology has the potential to add value to existing ethanol production sites by increasing the site profitability if our technologies are deployed.

We have demonstrated that our isobutanol to hydrocarbon technologies for the production of jet fuel, isooctane, isooctene, and paraxylene appear to be viable from a technical and process point of view. These catalytic technologies appear to be effective and scalable.

Animal feed, protein, and oil are important products produced at our Luverne Facility. Animal feed is made from the spent grain mash from isobutanol and fermentations. We market our distiller’s grains to the, beef, swine and poultry industries as a high-protein, high-energy animal feed. The spent yeast from fermentation adds protein to the mix, resulting in a higher protein content than corn itself. By selling the feed, protein, and oil products, we generate additional revenues and effectively reduce the net cost of fermentation feedstock. Going forward we see opportunity to further add value to animal feed, protein, and oil products, thereby benefiting the site margin at the Luverne Facility, whether we produce isobutanol, ethanol, or both.

Biocatalyst Overview

Our biocatalysts are microorganisms that have been designed to consume carbohydrates and produce isobutanol as a product. Our technology team developed these proprietary biocatalysts to efficiently convert fermentable sugars of all types into isobutanol by engineering isobutanol pathways into the biocatalysts. We designed our biocatalysts to equal or exceed the performance of the yeast currently used in commercial ethanol production in yield (percentage of the theoretical maximum percentage of isobutanol that can be made from a given amount of feedstock) and rate (how fast the sugar fed to the fermentation is converted to isobutanol). To achieve this, we believe that more than 100 genetic changes have been made to our yeast biocatalyst. We achieved our target fermentation performance goals at our Luverne Facility, given the scale we at which we operate. We continue to seek to improve the performance

parameters of our biocatalyst with a goal of reducing projected capital and operating costs, increasing operating reliability and increasing the volume of isobutanol production.

In January 2016, in a project sponsored by the USDA, we used our one MGPY demonstration facility located at ICM, Inc.’s St. Joseph, Missouri facility to convert hydrolyzed wood feedstocks into isobutanol. The isobutanol produced was converted to jet fuel and used for flights on Alaska Airlines.

While we believe that the majority of the development work on a commercially viable isobutanol producing yeast is complete, we expect to continue to make incremental improvements targeted to its commercial performance.

Feedstocks

In the U.S., non-food corn is a commercially attractive feedstock for both ethanol and isobutanol, because it is abundant and readily available, but more importantly because this corn generates low cost carbohydrates, protein and feed for the food chain, and corn oil. In other parts of the world sugar or molasses from cane, beets, or other sugar producing crops could be used. In the future, certain types of cellulosic sugars could be used once the cost to acquire those sugars becomes cost effective. We have designed our biocatalyst platform to be capable of producing isobutanol from any fuel ethanol feedstock currently in commercial use, which we believe, in conjunction with our proprietary isobutanol separation unit, will permit us to modify any existing fuel ethanol facility to produce our products.

Our Luverne Facility is currently set up to use non-food corn as a feedstock. The starch is fermented to isobutanol and or ethanol, the fiber and protein are isolated from the process and sold as animal feed, and the corn oil is sold for industrial use.

We expect that our feedstock flexibility will allow our technology to be deployed worldwide and will enable us to offer our customers protection from the raw material cost volatility historically associated with petroleum-based products. For example, in some parts of the world, it may be that molasses is a lower cost feedstock, in others, sugar from beets or cane might be the lower cost feedstock. As cellulosic sugars become economical, we expect that these could be viable as a feedstock too.

In the future we expect feedstocks to be chosen on the collective basis of (i) cost, (ii) carbon and or sustainability footprint with associated value, (iii) positive contribution to food chain where possible, and (iv) availability of the feedstock at a practical scale.

In June 2015, Agri-Energy, LLC, our wholly-owned subsidiary, entered into a license agreementPrice Risk Management, Origination and joint development agreementMerchandising Agreement, as amended as of December 21, 2017 (the “Origination Agreement”) with Porta Hnos. S.A.FCStone Merchant Services, LLC (“Porta”FCStone”) and a Grain Bin Lease Agreement with FCStone, as amended as of December 21, 2107 (the “Lease Agreement”). Pursuant to construct multiplethe Origination Agreement, FCStone will originate and sell to Agri-Energy, the owner of the Luverne Facility, and Agri-Energy will purchase from FCStone, the entire volume of corn grain used by the Luverne Facility in Luverne, Minnesota. For more information, see Item 7A.Quantitative and Qualitative Disclosures about Market Risk below.

Conversion of Isobutanol into Hydrocarbons

We have demonstrated conversion of our isobutanol plantsinto a wide variety of hydrocarbon products which are currently used to produce plastics, fibers, polyester, rubber and other polymers and hydrocarbon fuels. Hydrocarbon products consist entirely of hydrogen and carbon and are currently derived almost exclusively from petroleum, natural gas and coal. Importantly, isobutanol can be dehydrated to produce butenes, which are an intermediate product in Argentina using cornthe production of hydrocarbon products with many industrial uses. The straightforward conversion of our isobutanol into butenes is a fundamentally important process that enables isobutanol to be used as a feedstock,building block chemical. Much of the firsttechnology necessary to convert isobutanol into butenes and subsequently into these hydrocarbon products is commonly known and practiced in the chemicals industry today. For example, the dehydration of ethanol to ethylene, which is expecteduses a similar process and technology to be wholly owned by Porta and is anticipated to begin producing isobutanol in 2017. The plant is expected to have a production capacity of up to five million gallonsthe dehydration of isobutanol, per year. Onceis practiced commercially today to serve the plantethylene market. The dehydration of isobutanol into butenes is operational, we expect to generate revenues from this licensing arrangement, through royalties, sales and marketing fees, and other revenue streams such as yeast sales. The agreements also contemplate Porta constructing at least three additional isobutanol plants for certain of their existing ethanol plant customers. For these projects, we would be the direct licensor of our technology and the marketer for anynot commercially practiced today because isobutanol produced and would expect to receive all royalties and sales and marketing fees generated from these projects. Porta would provide the engineering, procurement and construction (“EPC”) servicespetroleum is not cost-competitive with other petrochemical processes for the projects. The production capacitygeneration of these additional plants is still to be determined. Porta is a leading supplier of EPC services to the ethanol industry in South America. As a result, webutenes. We believe that our alliance with Porta will allow us to more quickly achieve commercial-scale production of isobutanol in Argentina and potentially elsewhere in South America.

In November 2015, we entered into a joint development agreement with Praj Industries Limited (“Praj”), which establishes a strategic relationship to: (i) jointly develop our technology for use in certain ethanol plants that utilize certain non-corn based feedstocks (the “Feedstock”); (ii) jointly develop an engineering package for greenfield isobutanol plants and Retrofitting ethanol plants to produce renewable isobutanol from the Feedstock; and (iii) license our technology to build greenfield isobutanol plants and Retrofit certain ethanol plants to produce isobutanol. We and Praj will jointly develop and optimize the parameters to produce isobutanol from the Feedstock. After the development work is completed, we will negotiate commercial license agreements with Praj and third party licensees. Praj has the exclusive right to supply equipment and process engineering services for (i) certain greenfield isobutanol plants covered by the joint development agreement and (ii) the addition of isobutanol capacity for certain ethanol plants that utilize the Feedstock and Praj technology. Praj agreed to meet certain milestones to maintain its exclusive rights. We will negotiate and license ourefficient fermentation technology for producing isobutanol directlywill promote commercial isobutanol dehydration and provide us with the opportunity to access hydrocarbon markets. To assist in accessing these markets, we have developed a hydrocarbon processing demonstration plant (“Hydrocarbons Demo Plant”) near Houston, Texas, in partnership with South Hampton Resources, Inc. (“South Hampton”). The Hydrocarbon Demo Plant can process approximately 6,000 to 7,000 gallons of our isobutanol per month into a variety of renewable hydrocarbons for use as fuels and chemicals. We have been selling products from this plant since 2011.

We have also developed new technologies using ethanol as a feedstock for the production of hydrocarbons, renewable hydrogen, and other chemical intermediates, which we describe as our ethanol-to-olefins (“ETO”) technologies. The process produces tailored mixes of isobutylene, propylene, hydrogen and acetone, which are valuable as standalone molecules, or as feedstocks to produce other chemical products and longer chain alcohols. This technology has the potential to address additional markets in the chemicals and plastics fields, such as renewable polypropylene for automobiles and packaging and renewable hydrogen for use in chemical and fuel cell markets. At this time, this technology has only been operated at a laboratory scale, but if successfully scaled up to commercial level, this technology may provide the estimated 25BGPY global ethanol industry a broader set of end-product market and margin opportunities.

Underpinning the ETO technology is our development of proprietary mixed metal oxide catalysts that produce either polymer grade propylene, isobutylene or acetone in high yields in a single processing step. One of the benefits of the technology is that we can use conventional fuel grade specification ethanol that can be sourced from a variety of feedstocks with no apparent adverse impact on end product yields. Water, which is co-fed with the ethanol, plants covered byis able to be recycled resulting in a process which generates minimal waste. The ethanol and water mixture is vaporized and fed across a fixed catalyst bed resulting in a gaseous product mix consisting of the joint development agreementpropylene, isobutylene or acetone, in addition to hydrogen and will alsocarbon dioxide, along with lesser amounts of methane and ethylene. Separation of gaseous products can be achieved via conventional process technologies and unit operations within the petroleum industry.

We have the right to supply biocatalysts, nutrient packages, and support services to such plants. Praj will be the EPC services supplier for the ethanol plants covered by the joint development agreement and we will be the exclusive seller of all isobutanol produced by such plants. We believefound that our alliance with Praj will allow us to more quickly achieve commercial-scale production of isobutanol derived from the Feedstock outside of the United States.

In addition, in October 2013, we signed a letter of intent with IGPC Ethanol Inc. to Retrofit its approximately 40 MGPY ethanol plant,ETO technology is effective at converting fusel oils into flavors, fragrances, and in November 2014, we signed a letter of intent with Highlands EnviroFuels, LLC which contemplates Highlands EnviroFuels, LLC obtaining a license from us to produce renewable isobutanol at a plant that would be bolted on to the back-end of a sugar cane and sweet sorghum syrup mill and have a nameplate capacity of approximately 20 to 25 MGPY of isobutanol.

In June 2011, we entered into an isobutanol joint venture agreement with Redfield Energy, LLC, a South Dakota limited liability company (“Redfield”), under which we have agreed to work with Redfield to Retrofit Redfield’s approximately 50 MGPY ethanol production facility located near Redfield, South Dakota (the “Redfield Facility”) for the commercial production of isobutanol. Under the terms of the joint venture agreement, we are responsible for all costs associated with the Retrofit of the Redfield Facility.certain specialty solvents. We are entitled to a percentage of Redfield’s profits, lossesevaluating the business opportunities and distributions after commercial production of isobutanol has begun. As of December 31, 2015, we have incurred $0.4 million in planning-related costs, such as project engineering and permitting costs, for the future Retrofit of the Redfield Facility. Based on our preliminary engineering estimates, we will need to raise additional debt or equity capital to Retrofit the Redfield Facility, but are not obligated to do so under the Joint Venture Agreement. There are no assurances that we will move forward with the Retrofit of the Redfield Facility. We do not expect to advance this project during 2016.potential.

Butamax Advanced Biofuels LLC

Between 2011 and 2015, we were involved in an intellectual property dispute with Butamax Advanced Biofuels LLC (“Butamax”). We believe the dispute was satisfactorily resolved, enabling each of our companies to pursue their respective businesses.

Cross License Agreement

On August 22, 2015, we entered into a Settlement Agreement and Mutual Release (the “Settlement Agreement”) with Butamax, Advanced Biofuels LLC (“Butamax”), E.I. du Pont de Nemours & Company (“DuPont”) and BP Biofuels North America LLC (“BP”

and, together with Butamax and DuPont, the “Butamax Parties”), that resolves the various disputes, lawsuits and other proceedings between one or more of the Butamax Parties and us, as previously disclosed and as specifically identified in the Settlement Agreement (the “Subject Litigation”), and creates a new business relationship pursuant to which Butamax and we have granted rights to each other under certain patents and patent applications in accordance with the terms of a Patent Cross-License Agreement (the “License Agreement”) which was entered into by us and Butamax concurrently with the Settlement Agreement as described in detail below. For moreadditional information concerning the Settlement Agreement,settlement agreement, please see our Annual Report on Form 10-K for the year-ended December 31, 2015 — Item 3.3 Legal Proceedings.Proceedings.

Pursuant to the terms of the License Agreement, each party receives a non-exclusive license under certain patents and patent applications owned or licensed (and sublicensable) by the other party for the production and use of biocatalysts in the manufacture of isobutanol using certain production process technology for the separation of isobutanol, and to manufacture and sell such isobutanol in any fields relating to the production or use of isobutanol and isobutanol derivatives, subject to the customer-facing field restrictions described below. Each party also receives a non-exclusive license to perform research and development on biocatalysts for the production, recovery and use of isobutanol.

Each party may produce and sell up to 30 million gallons of isobutanol per year in any field on a royalty-free basis. Butamax will be the primary customer-facing seller of isobutanol in the field of fuel blending (subject to certain exceptions, the “Direct Fuel Blending” field) and we will be the primary customer-facing seller of isobutanol in the field of jet fuel for use in aviation gas turbines (the “Jet” field, also subject to certain exceptions). As such, subject to each party’s right to sell up to 30 million gallons of isobutanol per year in any field on a royalty-free basis, other than with Butamax’s written consent, we will only sell isobutanol through Butamax in the Direct Fuel Blending field subject to a royalty based on the net sales price for each gallon of isobutanol sold or transferred by us, our affiliates or sublicensees within the Direct Fuel Blending field (whether through Butamax or not) and on commercially reasonable terms to be negotiated between the parties and Butamax will only sell isobutanol through us in the Jet field subject to a royalty based on the net sales price for each gallon of isobutanol sold or transferred by Butamax, its affiliates or sublicensees within the Jet field (whether through us or not) and on commercially reasonable terms to be negotiated between the parties; provided, that each party may sell up to fifteen million gallons of isobutanol in a given year directly to customers in the other party’s customer-facing field on a royalty-free basis so long as the isobutanol volumes are within the permitted 30 million gallons of isobutanol sold or otherwise transferred per year in any field described above and, in certain instances, each party may then sell up to the total permitted 30 million gallons per year in the other party’s customer-facing field on a royalty-free basis. In addition, in order to maintain its status

as the primary customer-facing seller in these specific fields, each party must meet certain milestones within the first five years of the License Agreement. If such milestones are not met as determined by an arbitration panel, then a party will have the right to sell directly to customers in the other party’s customer-facing field subject to the payment of certain royalties to the other party on such sales.

In addition to the royalties discussed above for sales of isobutanol in the Direct Fuel Blending field, and subject to our right to sell up to 30 million gallons of isobutanol per year in any field on a royalty-free basis, we will pay to Butamax a royalty per gallon of isobutanol sold or transferred by us, our affiliates or sublicensees within the field of isobutylene (a derivative of isobutanol) applications (other than isobutylene for paraxylene, isooctane, Jet, diesel and oligomerized isobutylene applications). Likewise, in addition to the royalties discussed above for sales of isobutanol in the Jet field, and subject to Butamax’s right to sell up to 30 million gallons of isobutanol per year in any field on a royalty-free basis, Butamax will pay to us a royalty per gallon of isobutanol sold or transferred by Butamax, its affiliates or sublicensees within the fields of marine gasoline, retail packaged fuels and paraxylene (except for gasoline blending that results in use in marine or other fuel applications). The royalties described above will be due only once for any volume of isobutanol sold or transferred under the License Agreement, and such royalties accrue when such volume of isobutanol is distributed for end use in the particular royalty-bearing field. All sales of isobutanol in other fields will be royalty-free, subject to the potential technology fee described below.

In the event that we, our affiliates or sublicensees choose to employ a certain solids separation technology for the production of isobutanol at one of their respective plants (“Solids Separation Technology”), we are granted an option to license such technology from Butamax on a non-exclusive basis subject to the payment of a one-time technology license fee based on the rated isobutanol capacity for each such plant (subject to additional fees upon expansion of such capacity). We also receive the option to obtain an engineering package from Butamax to implement the Solids Separation Technology on commercially reasonable terms to be negotiated between the parties and subject to the technology fee described above and an additional technology licensing fee for use of the Solids Separation Technology applicable to ethanol capacity as provided in such engineering package from Butamax (which capacity is not duplicative of the rated isobutanol capacity referenced above) in instances where Butamax provides an engineering package for use at a particular plant that will run isobutanol and ethanol production side-by-side using the licensed Solids Separation Technology at such plant.

The License Agreement encompasses both parties’ patents for producing isobutanol, including biocatalysts and separation technologies, as well as for producing hydrocarbon products derived from isobutanol, including certain improvements and new patent applications filed within seven years of the date of the License Agreement. While the parties have cross-licensed their patents for making and using isobutanol, the parties will not share their own proprietary biocatalysts with each other. The parties may use third

parties to manufacture biocatalysts on their behalf and may license their respective technology packages for the production of isobutanol to third parties, subject to certain restrictions. A third party licensee would be granted a sub-license, and would be subject to terms and conditions that are consistent with those under the License Agreement.

Under the License Agreement, the parties have also agreed to certain limitations on the making or participating in a challenge of the other party’s patents that are at issue in the Subject Litigation. The parties have also made certain representations, warranties and covenants to each other including, without limitation, with respect to obtaining certain consents, indebtedness, rights in the licensed patents, and relationships with certain other ethanol plant process technology providers.

The License Agreement will continue in effect until the expiration of the licensed patents, unless earlier terminated by a party as provided in the License Agreement. The parties also have certain termination rights with respect to the term of the license granted to the other party under the License Agreement upon the occurrence of, among other things, a material uncured breach by the other party. In the event that a party’s license is terminated under the License Agreement, such party’s sublicense agreements may be assigned to the other party, subject to certain restrictions.

The parties may not assign the License Agreement or any right or obligation thereunder without the prior written consent of the other party. However, the parties may assign the License Agreement to an affiliate or a person that acquires all of the business or assets of such party, subject to certain restrictions.

Isobutanol Direct Use Markets

Without modification, isobutanol has applications in the specialty chemical and gasoline blendstock markets. Since our potential customers in these markets would not be required to develop any additional infrastructure to use our isobutanol, we believe that selling into these markets will result in a relatively low risk profile and produce attractive margins.

Specialty Chemicals

|

|

|

|

|

|

Gasoline Blendstocks

|

|

|

|

|

|

Butene and Hydrocarbon Markets Derived from Isobutanol

Beyond direct use as a specialty chemical and gasoline blendstock, isobutanol can be dehydrated to produce butenes which can then be converted into other products such as para-xylene, jet fuel and many other hydrocarbon fuels and specialty blendstocks, offering substantial potential for additional demand. The conversion of isobutanol into butenes is a fundamentally important process that enables isobutanol to be used as a building block chemical in multiple markets.

Jet Fuel

|

|

|

|

|

|

Para-xylene (“PX”) and Polyethylene Terephthalate (“PET”)

|

|

|

|

Butenes

|

|

|

|

|

|

Other Hydrocarbon Fuels

|

|

Our Production Technology Platform

We have used tools from synthetic biology, biotechnology and process engineering to develop a proprietary fermentation and separation process to cost effectively produce isobutanol from renewable feedstocks. GIFT® is designed to allow for relatively low capital expenditure Retrofits of existing ethanol facilities, enabling a rapid route to isobutanol production from the fermentation of renewable feedstocks, while maintaining the flexibility to revert to the production of ethanol or the simultaneous production of isobutanol and ethanol. GIFT® isobutanol production is very similar to existing ethanol production, except that we replace the ethanol producing biocatalyst with our isobutanol producing biocatalyst and we incorporate well-known equipment into the production process to separate and collect the isobutanol during the fermentation process. We believe that reusing large parts of the ethanol plant without modification is beneficial because the unchanged parts will stay in place and continue to operate after the Retrofit as they did when ethanol was produced. This means that the existing operating staff can continue to manage the production of isobutanol because they will already have experience with the base equipment. We believe this continuity will reduce the risks associated with the

production startup following the Retrofit as most of the process is unchanged and the existing operating staff is available to monitor and manage the production process. In addition, we believe that our GIFT® design will enable us to switch between the production of isobutanol and ethanol, or produce both products simultaneously, which will allow us to optimize asset utilization and cash flows at a facility by taking advantage of fluctuations in market conditions.

We intend to process the spent grain mash from our fermenters to produce isobutanol distiller’s grains (“iDGs™”), relying on established processes in the current ethanol industry. We plan to market our iDGs™ to the dairy, beef, swine and poultry industries as a high-protein, high-energy animal feed. To support these efforts, in December 2011 we entered into an exclusive off-take and marketing agreement with Land O’Lakes Purina Feed for the sale of iDGs™ produced at the Agri-Energy Facility. We believe that our sales of our iDGs™ will allow us and our partners to offset a significant portion of our grain feedstock costs, in the same manner as is practiced by the corn-based ethanol industry today through the sale of dry distiller’s grains.

Biocatalyst Overview

Our biocatalysts are microorganisms that have been designed to metabolize sugars to produce isobutanol. Our technology team developed these proprietary biocatalysts to efficiently convert fermentable sugars of all types into isobutanol by engineering isobutanol pathways into the biocatalysts. We designed our biocatalysts to equal or exceed the performance of the yeast currently used in commercial ethanol production in yield (percentage of the theoretical maximum percentage of isobutanol that can be made from a given amount of feedstock) and rate (how fast the sugar fed to the fermentation is converted to isobutanol). We initially achieved our target fermentation performance goals with our research biocatalyst at our GIFT® mini-plant and then replicated this performance in a retrofitted one MGPY ethanol demonstration facility located at ICM’s St. Joseph, Missouri site. We select biocatalysts for their projected performance in the GIFT® process, targeting lower cost isobutanol production. We continue to seek to improve the performance parameters of our biocatalyst with a goal of reducing projected capital and operating costs, increasing operating reliability and increasing the volume of isobutanol production.

Continuous improvement of biocatalyst performance is achieved using a variety of synthetic biology and conventional biotechnology tools to minimize the production of unwanted by-products to improve isobutanol yield and rate, thereby reducing capital and operating costs. With our biocatalysts, we have demonstrated that we can produce isobutanol at commercial scale with rates and yields which we believe validate our biotechnology pathways and efficiencies. Our commercial biocatalyst is designed to produce isobutanol from common commercial fermentation ethanol feedstocks, including grains (e.g., corn, wheat, sorghum and barley), sugar cane, and molasses. This feedstock flexibility supports our initial deployment in the U.S. and is designed to enable our future expansion into international markets for production of isobutanol.

Although development work continues, we have shown at laboratory scale and at our one MGPY demonstration facility located at ICM’s St. Joseph, Missouri facility that we can convert hydrolyzed wood feedstocks into isobutanol. We are further improving biocatalysts to efficiently produce isobutanol from cellulosic feedstocks, including crops that are specifically cultivated to be converted into fuels (e.g., switchgrass), forest residues (e.g., waste wood, pulp and sustainable wood), agricultural residues (e.g., corn stalks, leaves, straw and grasses) and municipal green waste (e.g., grass clippings and yard waste). We carefully select our biocatalyst platforms based on their tolerance to isobutanol and other conditions present during an industrial fermentation process, as well as their known utility in large-scale commercial production processes.

Feedstocks

We have designed our biocatalyst platform to be capable of producing isobutanol from any fuel ethanol feedstock currently in commercial use, which we believe, in conjunction with our proprietary isobutanol separation unit, will permit us to Retrofit any existing fuel ethanol facility. We have demonstrated that our biocatalysts are capable of converting the types of sugars in grains and sugar cane to isobutanol at our commercial targets for fermentation time and yield and we believe that they will have the ability to convert these sugars into isobutanol at a commercial scale. The vast majority of fuel ethanol currently produced in the U.S. is produced from corn feedstock, which is abundant according to data from the U.S. Department of Agriculture and the Renewable Fuels Association. Although development work continues to be done, we have shown at laboratory scale and at our one MGPY demonstration facility located at ICM’s St. Joseph, Missouri site that we can convert certain cellulosic sugars into isobutanol.

We expect that our feedstock flexibility will allow our technology to be deployed worldwide and will enable us to offer our customers protection from the raw material cost volatility historically associated with petroleum-based products.

In June 2015, Agri-Energy, our wholly-owned subsidiary, entered into a Price Risk Management, Origination and Merchandising Agreement (the “Origination Agreement”) with FCStone Merchant Services, LLC (“FCStone”) and a Grain Bin Lease Agreement with FCStone (the “Lease Agreement”). Pursuant to the Origination Agreement, FCStone will originate and sell to Agri-Energy, and Agri-Energy will purchase from FCStone, the entire volume of corn grain used by our plant in Luverne, Minnesota. The initial term of the Origination Agreement will continue for a period of eighteen months and will automatically renew for additional

terms of one year unless Agri-Energy gives notice of non-renewal to FCStone. FCStone will receive an origination fee for purchasing and supplying Agri-Energy with all of the corn used by Agri-Energy’s plant in Luverne, Minnesota. As security for the payment and performance of all indebtedness, liabilities and obligations of Agri-Energy to FCStone, Agri-Energy granted to FCStone a security interest in the corn grain stored in grain storage bins owned and operated by Agri-Energy (“Storage Bins”) and leased to FCStone pursuant to the Lease Agreement. Pursuant to the Lease Agreement, FCStone will lease Storage Bins from Agri-Energy to store the corn grain prior to title of the corn grain transferring to Agri-Energy upon Agri-Energy’s purchase of the corn grain. FCStone agrees to lease Storage Bins sufficient to store 700,000 bushels of corn grain and agrees to pay to Agri-Energy $175,000 per year. The term of the Lease Agreement will run concurrently with the Origination Agreement, and will be extended, terminated, or expire in accordance with the Origination Agreement. The Company also entered into an unsecured guaranty (the “Guaranty”) in favor of FCStone whereby the Company guaranteed the obligations of Agri-Energy to FCStone under the Origination Agreement. The Guaranty shall terminate on the earlier to occur of (i) April 15, 2020 or (ii) termination of the Origination Agreement.

GIFT® Improves Fermentation Performance

Our experiments show that the GIFT® fermentation and recovery system provides enhanced fermentation performance as well as efficient recovery of isobutanol and other alcohols. The GIFT® system enables continuous separation of isobutanol from the fermentation tanks while fermentation is in process. Isobutanol is removed from the fermentation broth using a low temperature distillation to continuously remove the isobutanol as it is formed without the biocatalyst being affected. Since biocatalysts have a low tolerance for high isobutanol concentrations in fermentation, the ability of our process to continuously remove isobutanol as it is produced allows our biocatalyst to continue processing sugar into isobutanol at a high rate without being suppressed by rising levels of isobutanol in the fermenter, reducing the time to complete the fermentation. Using our biocatalysts, we have demonstrated that GIFT® enables isobutanol fermentation times equal to, or less than, those achieved in the current conventional production of ethanol, which allows us to fit our technology into existing ethanol fermenters reducing capital expenditures. We have designed a proprietary engineering package to carry out our isobutanol fermentation and recovery process.

GIFT® requires limited change to existing ethanol production infrastructure. As with ethanol production, feedstock is ground, cooked, treated with enzymes and fermented. Just like ethanol production, after fermentation, a primary product (isobutanol) and a co-product (iDGs™) are recovered for sale. The main modifications of the GIFT® system are replacing the ethanol producing yeast with Gevo’s proprietary isobutanol producing biocatalyst, and adding low temperature distillation equipment for continuous removal and separation of isobutanol.

Conversion of Isobutanol into Hydrocarbons

We have demonstrated conversion of our isobutanol into a wide variety of hydrocarbon products which are currently used to produce plastics, fibers, polyester, rubber and other polymers and hydrocarbon fuels. Hydrocarbon products consist entirely of hydrogen and carbon and are currently derived almost exclusively from petroleum, natural gas and coal. Importantly, isobutanol can be dehydrated to produce butenes, which are an intermediate product in the production of hydrocarbon products with many industrial uses. The straightforward conversion of our isobutanol into butenes is a fundamentally important process that enables isobutanol to be used as a building block chemical. Much of the technology necessary to convert isobutanol into butenes and subsequently into these hydrocarbon products is commonly known and practiced in the chemicals industry today. For example, the dehydration of ethanol to ethylene, which uses a similar process and technology to the dehydration of isobutanol, is practiced commercially today to serve the ethylene market. The dehydration of isobutanol into butenes is not commercially practiced today because isobutanol produced from petroleum is not cost-competitive with other petrochemical processes for generation of butenes. We believe that our efficient fermentation technology for producing isobutanol will promote commercial isobutanol dehydration and provide us with the opportunity to access hydrocarbon markets. To assist in accessing these markets, we have developed a hydrocarbon processing demonstration plant (“Hydrocarbons Demo Plant”) near Houston, Texas, in partnership with South Hampton Resources, Inc. (“South Hampton”). The Hydrocarbon Demo Plant can process 6,000 to 7,000 gallons of our isobutanol per month into a variety of renewable hydrocarbons for use as fuels and chemicals.

Our ETO Technology

We have also developed new technologies using ethanol as a feedstock for the production of hydrocarbons, renewable hydrogen, and other chemical intermediates, which we describe as our ethanol-to-olefins (“ETO”) technologies. The process produces tailored mixes of isobutylene, propylene, hydrogen and acetone, which are valuable as standalone molecules, or as feedstocks to produce other chemical products and longer chain alcohols. This technology has the potential to address additional markets in the chemicals and plastics fields, such as renewable polypropylene for automobiles and packaging and renewable hydrogen for use in chemical and fuel cell markets. At this time, this technology has only been operated at a laboratory scale, but if successfully scaled up to commercial level, this technology may provide the estimated 25BGPY global ethanol industry a broader set of end-product market and margin opportunities.

Underpinning the ETO technology is our development of proprietary mixed metal oxide catalysts that produce either polymer grade propylene, high purity isobutylene or acetone in high yields in a single processing step. One of the benefits of the technology is that we can use conventional fuel grade specification ethanol that can be sourced from a variety of feedstocks with no apparent adverse impact on end product yields. Water, which is co-fed with the ethanol, is able to be recycled resulting in a process which generates minimal waste. The ethanol and water mixture is vaporized and fed across a fixed catalyst bed resulting in a gaseous product mix consisting of the propylene, isobutylene or acetone, in addition to hydrogen and carbon dioxide, along with lesser amounts of methane and ethylene. Separation of gaseous products can be achieved via conventional process technologies and unit operations within the petroleum industry.

Competition

Our isobutanol is targeted for use in the following markets: direct use as a solvent and gasoline blendstock, use in the chemicals industry for producing rubber, plastics, fibers, polyester and other polymers and use in the production of hydrocarbon fuels. We face competitors in each market, some of which are limited to individual markets, and some of which will compete with us across all of our target markets. Many of our competitors have greater financial resources than we do. If we fail to raise sufficient capital for our business and strategy, we may not be able to successfully compete.

Renewable isobutanol. We are a leader in the development of renewable isobutanol via fermentation of renewable plant biomass. While the competitive landscape in renewable isobutanol production is limited at this time, we are aware of other companies that are seeking to develop isobutanol production capabilities, including Butamax with whom we have entered into the License Agreement described above.Agreement. See Item 1. Business—above—Butamax Advanced Biofuels LLC—Cross License Agreement.