UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20172023

OR

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-36548

ATARA BIOTHERAPEUTICS, INC.

(Exact name of Registrant as specified in its Charter)

| | |

Delaware |

| 46-0920988 |

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer

|

611 Gateway Blvd.2380 Conejo Spectrum Street, Suite 900

South San Francisco, 200

Thousand Oaks, CA

|

| 9408091320

|

(Address of principal executive offices) |

| (Zip Code) |

Registrant’s telephone number, including area code: (650) 278-8930(805) 623-4211

Securities registered pursuant to Section 12(b) of the Act: Common Stock, par value $0.0001 per share, traded on The Nasdaq Stock Market

| | | | |

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

Common Stock, par value $0.0001 per share, |

| ATRA |

| The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES Yes☐NO☒ NO ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES☐ NO No☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES Yes☒NO☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). YES Yes☒NO☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitiondefinitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

Large accelerated filer |

| ☐ |

| Accelerated filer |

| ☒☐

|

|

|

|

|

Non-accelerated filer |

| ☐ (Do not check if a small reporting company)☒

|

| Small reporting company |

| ☐☒

|

|

|

|

|

|

|

|

Emerging growth company |

| ☒☐

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES☐NO☒

The aggregate market value of common stock held by non-affiliates of the Registrant, based on the closing sales price for such stock on June 30, 20172023 as reported by The Nasdaq Stock Market, was $271,251,806.$161,602,451. This calculation excludes 10,528,420727,959 shares held by executive officers, directors and stockholders that the Registrant has concluded are affiliates of the Registrant. Exclusion of such shares should not be construed to indicate that any such person possesses the power, direct or indirect, to direct or cause the direction of the management or policies of the registrant or that such person is controlled by or under common control with the Registrant.

The number of outstanding shares of the Registrant’s Common Stock as of February 15, 2018March 20, 2024 was 38,825,835.119,359,230.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement relating to its 20182024 Annual Meeting of Stockholders are incorporated by reference into Part III of this Report where indicated. Such proxy statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

ATARA BIOTHERAPEUTICS, INC.

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements”forward-looking statements within the meaning of Section 27Athe safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act.1995. Such forward-looking statements, which represent our intent, belief or current expectations, involve risks and uncertainties and other factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. In some cases you can identify these statements by forward-looking words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “predict,” “plan,” “expect” or the negative or plural of these words or similar expressions. Forward-lookingThe forward-looking statements in this Annual Report on Form 10-K include, but are not limited to, statements about:

•our expectations regarding the timing of initiating clinical trials,studies, opening client sites, enrolling clinical trialsstudies and reporting results of clinical trialsstudies for our T-cell programs;

programs, including our ATA3219 program; •the likelihood and timing of regulatory submissions or related approvals for our product candidates;

candidates, including the initiation, completion and expectations about the timing of approvals for a biologics license application (BLA) for tab-cel® for patients with Epstein-Barr virus with post-transplant lymphoproliferative disease (EBV+ PTLD); •the potential market opportunitiesindications for commercializing our product and product candidates;

•commercialization of tab-cel (Ebvallo™ in the United Kingdom (UK) and the European Union (EU)) worldwide and our amended and restated Commercialization Agreement with Pierre Fabre Medicament, including potential milestone and royalty payments under the agreement (Ebvallo in the UK and the EU subject to the Purchase and Sale Agreement with HCR Molag Fund, L.P.);

•our Purchase and Sale Agreement and related transactions with HCR Molag Fund, L.P.;

•our Commercial Manufacturing Services Agreement with Charles River Laboratories, Inc. (CRL) and other agreements we may enter into with CRL, including our ability to enter into a new drug supply agreement with CRL on terms favorable or acceptable to us, or at all;

•our Master Services and Supply Agreement and related transactions with FUJIFILM Diosynth Biotechnologies California, Inc.;

•our expectations regarding the potential commercial market opportunities, market size and the size of the patient populations for our product candidates, if approved for commercial use;and product candidates;

•estimates of our expenses, capital requirements and need for additional financing;

•our expectation regarding the length of time that our existing capital resources will be sufficient to enable us to fund our planned operations, into the first half of 2020;

including our going concern assessment; •our ability to enter into favorable commercialization arrangements with third parties to commercialize our product candidates;

•our ability to develop, acquire and advance product candidates into, and successfully complete, clinical trials;studies;

•the initiation, timing, costs, progress and results of future preclinical studies and clinical trialsstudies and our research and development programs;

•our ability to enter into and maintain contracts with clinical research organizations, contract manufacturing organizations (CMOs) and other vendors for clinical and preclinical studies, supplies and other services;

•the scope of protection we are able to obtain and maintain for ourthe intellectual property rights covering our product and product candidates;

•our financial performance;

•our election to rely on reduced reporting and disclosure requirements available to smaller reporting companies;

•developments and projections relating to our competitors and our industry;

•our ability to manufacturehave our product and product candidates manufactured for our clinical trials,studies or for commercial sale, including our Phase 3 trials;

our ability to sell or manufacture approved products at commercially reasonable values; and

•the impact of public health emergencies, such as COVID-19, to our business and operations, as well as the businesses and operations of third parties on which we rely;

•the impact of our workforce reductions on our ability to attract, retain and motivate qualified personnel and on our business, operations and financial condition; and

•timing and costs related to buildingthe qualification of the manufacturing facilities of our manufacturing plant.CMOs for commercial production.

These statements are only current predictions and are subject to known and unknown risks, uncertainties, including, without limitation, risks and uncertainties associated with the costly and time-consuming pharmaceutical product development process and the uncertainty of clinical success; the sufficiency of our cash resources and need for additional capital; and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from those anticipated by the forward-looking statements. We discuss many of these risks in this report in greater detail under the heading “1A. Risk Factors” and elsewhere in this report. You should not rely upon forward-looking statements as predictions of future events. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risks and uncertainties.

In this Annual Report on Form 10-K, unless the context requires otherwise, “Atara,” “Atara Biotherapeutics,” “Company,” “we,” “our,” and “us” means Atara Biotherapeutics, Inc. and, where appropriate, its subsidiaries.

Summary Risk Factors

Our business is subject to numerous risks and uncertainties that may have a material adverse effect on our business, financial condition or results of operations. These risks are more fully described under the heading “1A. Risk Factors” and elsewhere in this report and include, among others:

•we have incurred substantial losses since our inception and anticipate that we will continue to incur substantial losses for the foreseeable future;

•we have earned limited commercialization revenues to date, and we may never achieve profitability;

•we have one approved product, Ebvallo, in the EU and the UK, are generally early in our development efforts and have only a small number of product candidates in clinical development, and all of our other product candidates are still in preclinical development. If we or our collaborators are unable to successfully develop, manufacture and commercialize our product or product candidates or experience significant delays in doing so, our business may be materially harmed;

•we will require substantial additional financing on terms acceptable to us to achieve our goals, and a failure to obtain this necessary capital when needed could force us to delay, limit, reduce or terminate our product development or manufacturing efforts;

•our future success depends on our ability to retain our executive officers and to attract, retain and motivate qualified personnel;

•the results of preclinical studies or earlier clinical studies are not necessarily predictive of future results, and our existing product candidates in clinical studies, and any other product candidates we advance into clinical studies may not have favorable results in later clinical studies or receive regulatory approval;

•clinical drug development involves a lengthy and expensive process with an uncertain outcome;

•our T-cell immunotherapy product and product candidates and our next-generation CAR T programs represent new therapeutic approaches that could result in heightened regulatory scrutiny, delays in clinical development or our inability to achieve regulatory approval, commercialization or payor coverage of our product candidates;

•there can be no assurance that we will achieve all of the anticipated benefits of the Fujifilm Transaction and we could face unanticipated challenges;

•the market opportunities for our product and product candidates may be limited to those patients who are ineligible for or have failed prior treatments and may be small;

•we may not be able to obtain or maintain orphan drug exclusivity for our product candidates;

•the proposed revision of the European legislation on pharmaceuticals could lead to uncertainties over the regulatory framework that will be applicable to medicinal products in the EU, including orphan medicinal products;

•we have been affected by and could be adversely affected in the future by the effects of health epidemics and pandemics, such as the COVID-19 pandemic, which could materially and adversely affect our business and operations in the future, as well as the businesses and operations of third parties on which we rely;

•if we are unable to obtain and maintain sufficient intellectual property protection for our product candidates, or if the scope of the intellectual property protection is not sufficiently broad, our ability to commercialize our product candidates successfully and to compete effectively may be adversely affected;

•our principal stockholders own a significant percentage of our stock and will be able to exert control or significant influence over matters subject to stockholder approval;

•if we fail to continue to meet the listing standards of the Nasdaq Stock Market LLC (Nasdaq), our common stock may be delisted, which could have a material adverse effect on the liquidity of our common stock;

•we recently qualified as a “smaller reporting company” and a “non-accelerated filer,” and any decision on our part to comply only with certain reduced reporting and disclosure requirements applicable to such companies could make our stock less attractive to investors;

•our workforce reductions may not result in anticipated savings, could result in total costs and expenses that are greater than expected and could disrupt our business; and

•maintaining clinical and commercial timelines is dependent on our end-to-end supply chain network to support manufacturing; if we experience problems with our third party suppliers or CMOs, development and/or commercialization of our product and product candidates may be adversely affected.

PART I

Item 1. Business

Overview

Atara Biotherapeutics is a leadingleader in T-cell immunotherapy, company developingleveraging its novel treatmentsallogeneic Epstein-Barr virus (EBV) T-cell platform to develop transformative therapies for patients with cancer and autoimmune disease. Tab-cel (tabelecleucel), our lead program in Phase 3 clinical development in the U.S., has received marketing authorization approval (MAA) under the proprietary name Ebvallo™ for commercial sale in the European Union (EU) by the European Commission (EC) and viral diseases. The Company'sfor commercial sale and use in the United Kingdom (UK) by the Medicines and Healthcare products Regulatory Agency (MHRA). We are the most advanced allogeneic T-cell immunotherapy company and intend to rapidly deliver off-the-shelf or allogeneic, T-cells are bioengineered from donors with healthy immune function and allow for rapid delivery from inventorytreatments to patients withoutwith high unmet medical need. Our platform leverages the unique biology of EBV T cells and has the capability to treat a requirement for pretreatment. Atara'swide range of EBV-driven diseases or other serious diseases through incorporation of engineered chimeric antigen receptors (CARs) or T-cell immunotherapiesreceptors (TCRs). We are designedapplying this one platform, that does not require TCR or human leukocyte antigen (HLA) gene editing, to precisely recognize and eliminate cancerous or diseased cells without affecting normal, healthy cells. Atara'screate a robust pipeline. Our strategic priorities are:

•Tab-cel®: Our most advanced T-cell immunotherapy program, tab-cel, has received MAA for commercial sale in the EU and the UK under the proprietary name Ebvallo and is partnered with Pierre Fabre Medicament (Pierre Fabre) for commercialization in Europe and potential commercialization, if approved, worldwide, including in the U.S. Tab-cel is currently in Phase 3 development tabelecleucel (formerly known as ATA129), is being developedin the U.S. for the treatment of patients with Epstein-Barr virus, or EBV,EBV- associated post-transplant lymphoproliferative disorder, or EBV+ PTLD, disease (EBV+ PTLD) who have failed rituximab or rituximab plus chemotherapy, as well as other EBV-driven diseases; and •ATA3219: Allogeneic CAR T targeting CD19, currently in Phase 1 development is being developed as a potential best-in-class product intended to target B-cell malignancies and autoimmune diseases, based on a next generation 1XX co-stimulatory domain and the innate advantages of EBV associated hematologicT cells as the foundation for an allogeneic CAR T platform.

In addition to the aforementioned strategic priorities, we also have a number of preclinical programs, including ATA3431, an allogeneic dual CAR T immunotherapy targeting both CD19 and solid tumors, including nasopharyngeal carcinoma, or NPC. Off-the-shelfCD20 for B-cell malignancies; and a potential next generation EBV vaccine which is differentiated from earlier EBV vaccine efforts that solely focused on B cell responses to EBV. We have paused development on ATA188, and autologous, or patient derived, ATA190, the Company'san allogeneic T-cell immunotherapies using a complementary targeted antigen recognition technology, target specificimmunotherapy targeting EBV antigens believed to be important for the potential treatment of multiple sclerosis or MS. Atara's clinical pipeline also includes ATA520 targeting Wilms Tumor 1, or WT1,(MS), while we explore strategic options for this asset.

Our T-cell immunotherapy platform is potentially applicable to a broad array of targets and ATA230 directed against cytomegalovirus, or CMV.

diseases. Our technologyoff-the-shelf, allogeneic T-cell platform allows for rapid delivery of a T-cell immunotherapy product that has been manufactured in advance of patient need and stored in inventory, with each manufactured lot of cells providing therapy for numerous potential patients. This differs from autologous or patient-derived, treatments, in which each patient’s own cells must be extracted, genetically modified outside the body and then delivered back to the patient.patient, requiring a complex logistics network. We utilize a proprietary cell selection algorithm to select the appropriate set of cells for use based on a patient’s unique immune profile,profile. We estimate that only four and unlike manysix unique ATA3219 lots will be needed to cover approximately 90% of U.S. NHL and lupus patients, respectively. One of our contract manufacturing organizations (CMOs) has completed commercial production qualification activities for tab-cel and another of our CMOs is currently in the process of completing commercial production qualification activities for tab-cel while we manufacture inventory according to Pierre Fabre’s commercial product supply strategy.

In October 2021, we entered into the Commercialization Agreement with Pierre Fabre (Pierre Fabre Commercialization Agreement), pursuant to which we granted to Pierre Fabre an exclusive, field-limited license to commercialize and distribute Ebvallo in Europe and select emerging markets in the Middle East, Africa, Eastern Europe and Central Asia (the Initial Territory) following regulatory approval. As contemplated by the Pierre Fabre Commercialization Agreement, we entered into (i) a Manufacturing and Supply Agreement (ii) a Pharmacovigilance Agreement (iii) and a Quality Agreement, in each case, with Pierre Fabre to further advance our partnership with Pierre Fabre. In September 2022, we amended the Pierre Fabre Commercialization Agreement and received an additional $30 million milestone payment from Pierre Fabre following EC approval of Ebvallo for EBV+ PTLD and subsequent filing of the MAA transfer to Pierre Fabre, in exchange for, among other T-cell programs, there is neitherthings, a requirementreduction in: (i) royalties we are eligible to receive as a percentage of net sales of Ebvallo in the Initial Territory, and (ii) the supply price mark up on Ebvallo purchased by Pierre Fabre. Additionally, we agreed to extend the time period for pre-treatment beforeprovision of certain services to Pierre Fabre under the Pierre Fabre Commercialization Agreement. In December 2022, we entered into a Purchase and Sale Agreement (HCRx Agreement) with HCR Molag Fund L.P. (HCRx,) a Delaware limited partnership. Pursuant to the terms of the HCRx Agreement, we received a total investment amount of $31.0 million in exchange for granting HCRx the right to receive a portion of the tiered, sales-based royalties for Ebvallo, in amounts ranging from the mid-single digits to significant double digits, and certain milestone payments, both related to the Initial Territory and otherwise payable to us by Pierre Fabre. The total royalties and milestones payable to HCRx related to the Initial Territory under the HCRx Agreement are capped between 185% and 250% of the total investment amount by HCRx, dependent upon the timing of such royalty and milestone payments to HCRx.

On October 31, 2023, we entered into an amended and restated Pierre Fabre Commercialization Agreement (A&R Commercialization Agreement), pursuant to which we expanded Pierre Fabre’s exclusive rights to research, develop, manufacture, commercialize and distribute tab-cel (Ebvallo) to include all other countries in the world (Additional Territory) in addition to the Initial Territory (together, the Territory), subject to our cellsperformance of certain obligations as described below. In December 2023, upon the effective date of the A&R Commercialization Agreement, we met the contractual right to receive an additional upfront cash payment of $20.0 million for the expanded exclusive license grant, for which such cash was received in January 2024. We will also be entitled to receive an aggregate of up to $620.0 million in additional milestone payments upon achieving certain regulatory and commercial milestones relating to tab-cel in the Additional Territory including up to $100.0 million in potential regulatory milestones through approval by the United States Food and Drug Administration (FDA) of a biologics license application (BLA) for tab-cel. Of the $100.0 million in potential regulatory milestones, we expect to receive $20.0 million in April 2024 based on the positive pre-BLA meeting, an additional $20.0 million in connection with BLA acceptance, and up to $60.0 million in potential regulatory milestones in connection with BLA approval. We are administered nor is there extended monitoring following administration. For example,eligible to receive significant double-digit tiered royalties as a percentage of net sales of tab-cel (Ebvallo) in ourthe Territory until the later of 12 years after the first commercial sale in each such country, the expiration of specified patent rights in each such country, or the expiration of all regulatory exclusivity for tab-cel in each such country. Royalty payments may be reduced in certain specified customary circumstances. Royalties and milestones from the commercialization of Ebvallo in the Initial Territory remain subject to the HCRx Agreement.

During the applicable period specified in the A&R Commercialization Agreement, we will be responsible, at Pierre Fabre’s cost, to continue conducting the ongoing trials with our most advanced product candidate, tabelecleucel, patients are monitoredPhase 3 ALLELE clinical study and the Phase 2 multi-cohort clinical study. We will also be responsible, at Pierre Fabre’s cost, for onecertain other activities directed to two hours following receiptobtaining regulatory approval in the United States for tab-cel for EBV-associated post-transplant lymphoproliferative disease pursuant to the terms of tabelecleucel. Our T-cell immunotherapy platform is applicablethe A&R Commercialization Agreement. Pierre Fabre will be responsible, at its cost, for obtaining and maintaining all other required regulatory approvals and for commercialization and distribution of tab-cel in the Territory, including conducting any other clinical study required.

Prior to the transfer of manufacturing responsibility to Pierre Fabre, we will be responsible for manufacturing and supplying tab-cel to Pierre Fabre for commercialization in the Territory at cost plus a margin for orders placed after December 31, 2023, subject to a broad arraymaximum annual increase. Pierre Fabre will assume the responsibility and cost for the manufacture and supply of targetstab-cel in the Territory upon the Manufacturing Transition Date, which is defined as the earlier of i) the date on which all activities relating to the transfer of tab-cel manufacturing, pursuant to the A&R Commercialization Agreement, from Atara to Pierre Fabre have been completed to the reasonable satisfaction of both parties, or ii) December 31, 2025, throughout the remainder of the term of the A&R Commercialization Agreement. Pierre and diseases. With more than 200 patients treated acrosswe are to use commercially reasonable efforts to achieve such transition prior to the platform, we have observed clinical proofearlier transfer date from Atara to Pierre Fabre of concept across both viral and non-viral targetsthe first marketing authorization in conditions ranging from liquid and solid tumors to infectious and autoimmune diseases. the Additional Territory or the first BLA.

We have also observed a safety profile characterized by few treatment-related serious adverse events, or SAEs, and no evidence of cytokine release syndrome to date.

Our T-cell immunotherapy product candidates are engineered from cells donated by healthy individualsentered into research collaborations with normal immune function. Once cells are collected from a donor, they are bioengineered to expand those T-cells that recognize the antigens of interest. The resulting expanded T-cells are then characterized and heldleading academic institutions such as inventory. From inventory, these cells can be selected, distributed and prepared for infusion in a partially human leukocyte antigen, or HLA, matched patient in approximately 3-5 days. Following administration, our T-cells home to their target, undergo target-controlled proliferation, eliminate diseased cells and eventually recede. Target-controlled proliferation means that our T-cells expand in number when they encounter diseased cells in a patient’s body that express the antigen the cells are designed to recognize.

We have two technology platforms. One of our technology platforms was developed from more than a decade of experience at Memorial Sloan Kettering Cancer Center or MSK. The other was developed at QIMR Berghofer(MSK) and the Council of the Queensland Institute of Medical Research Institute, or QIMR Berghofer, in Australia. We licensed(QIMR Berghofer) pursuant to which we acquired rights to novel and proprietary technologies and programs.

Our research facilities in Thousand Oaks, California (ARC) and Aurora, Colorado contain our translational and preclinical sciences, analytical development and process science functions. These facilities support our product pipeline, process development and leverage our allogeneic cell therapy platform to drive innovation.

In January 2022, we entered into an asset purchase agreement with FUJIFILM Diosynth Biotechnologies California, Inc. (FDB) and, for certain know-howlimited purposes, FUJIFILM Holdings America Corporation, to sell all of the Company’s right, title and T-cellinterest in and to certain assets related to the Atara T-Cell Operations and Manufacturing facility (ATOM Facility) located in Thousand Oaks, California for $100 million in cash, subject to potential post-closing adjustments pursuant to the asset purchase agreement (the Fujifilm Transaction). The closing of the Fujifilm Transaction occurred on April 4, 2022. We also entered into a Master Services and Supply Agreement with FDB (Fujifilm MSA) that became effective upon the closing and could extend for up to ten years. Pursuant to the Fujifilm MSA, FDB will supply us with specified quantities of our cell therapy products (if approved) and product candidates, manufactured in accordance with cGMP standards. The Fujifilm MSA does not obligate us to purchase products and product candidates exclusively from MSKFDB.

We also work with Charles River Laboratories (CRL) pursuant to a Commercial Manufacturing Services Agreement (CRL MSA) that we entered into in June 2015. Our most advancedDecember 2019. Pursuant to the CRL MSA, CRL provides manufacturing services for our product candidate, tabelecleucel, targets EBV. Tabelecleucel received Breakthrough Therapy Designation,and certain intermediates. We further amended the CRL MSA to extend the term until the earlier of March 31, 2024 or BTD, fromupon receipt of certain batches of our product and product candidates. We are currently in negotiations with CRL for a new commercial drug product supply agreement to be effective upon the U.S. Foodexpiration of the CRL MSA. However, there can be no assurance that we will be able to enter into a new commercial drug product supply agreement with CRL on terms favorable or acceptable to us, or at all. If we are

unable to enter into a new commercial drug product supply agreement or extend the CRL MSA, we may need to identify alternative sources of drug product supply.

We have non-cancellable minimum commitments for products and Drug Administration, or FDA,services, subject to agreements with a term of greater than one year, with clinical research organizations and Priority Medicines, or PRIME, designation from the European Medicines Agency, or EMA,CMOs.

In November 2023, we announced a reduction in force of approximately 30% of our workforce at that time. This workforce reduction resulted in total restructuring charges of $6.7 million, comprised primarily of severance payments and is currently being evaluated as monotherapy in two Phase 3 trialswages for the treatment60-day notice period in accordance with the California Worker Adjustment and Retraining Notification (WARN) Act. In most cases, the severance payments were paid as a lump sum in January 2024. All of patientsthe severance costs represent cash expenditures.

In January 2024, we announced another reduction in force of approximately 25% of total workforce. We expect to recognize approximately $4.5 million in total severance and related benefits as a result of this reduction in force, consisting primarily of severance payments and wages for the 60-day notice period in accordance with EBV+ PTLD. We believe that tabelecleucel has the potential toCalifornia WARN Act. In most cases, the severance will be the first commercially available off-the-shelf T-cell immunotherapy and the first FDA and EMA approved therapy for EBV+ PTLD. With a European conditional marketing authorization application planned forpaid in the first half of 20192024. Certain of the notified employees had employment agreements which provided for separation benefits in the form of salary continuation; these benefits will be paid from February 2024 through January 2025. The majority of the associated costs represent cash expenditures.

Pipeline

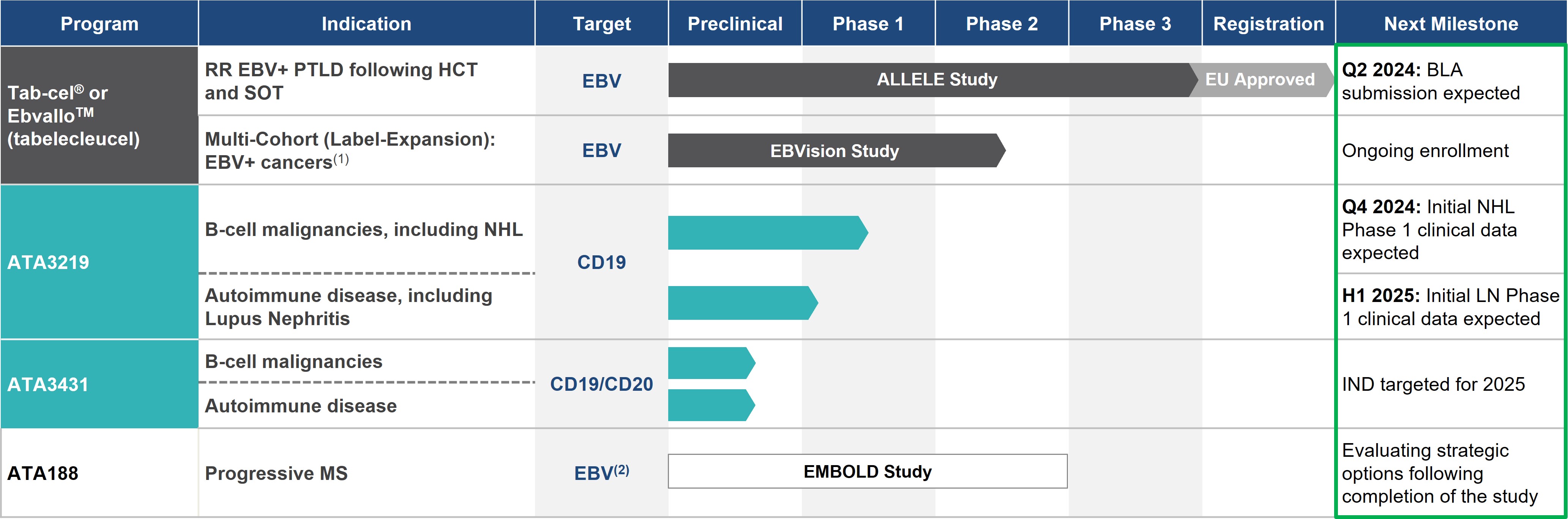

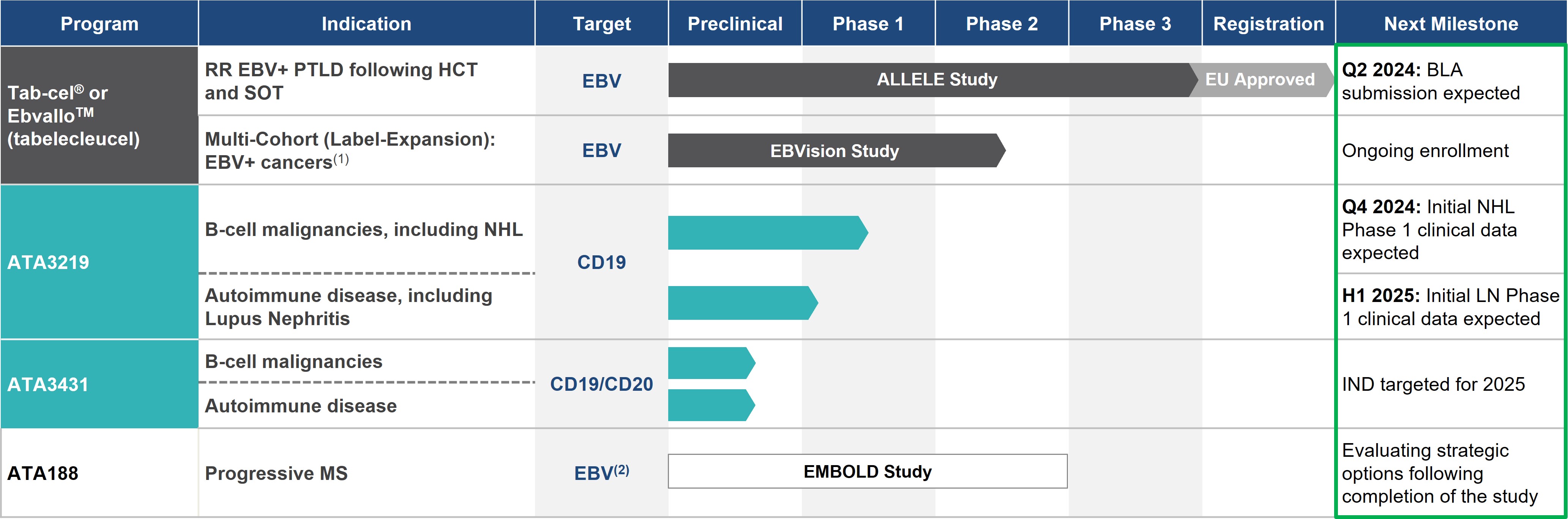

Our pipeline is summarized below:

Excluding Ebvallo™ in EU, these investigational agents are not approved by any regulatory agencies and U.S. biologics licensing applications planned following the completion of one of our ongoing Phase 3 trials, we are currently developing the infrastructureefficacy and safety have not been established

EBV+ PTLD: EBV-Associated Post-Transplant Lymphoproliferative Disease; RR: rituximab relapsed/refractory; HCT: allogeneic hematopoietic cell transplant; SOT: solid organ transplant; NHL: non-Hodgkin’s lymphoma

Atara has entered into an agreement with Pierre Fabre to commercialize tabelecleucel globallytab-cel® for EBV+ cancers worldwide

Other programs: EBV vaccine and other hematological malignancies and solid tumor AlloCAR T programs

(1)Phase 2 multi-cohort initiated in Q3 2020, with possible indications including EBV+ PTLD with CNS involvement, front-line treatment in EBV+

PTLD. We are also evaluating thePTLD including front line with CNS involvement, EBV+ PID/AID LPD, and other potential

utility of tabelecleucel in patients with other EBV associated cancers, such as NPC, to continue its development in solid tumors. Additional product candidates derived from the collaboration with MSK are being developed to treat various cancers and severe viral infections.In October 2015 and September 2016, we licensed rights to certain know-how and technology from QIMR Berghofer that are complementary to those we which was licensed from MSK. This know-how and technology uses targetedEBV-associated diseases

(2)Targeted antigen recognition

to create off-the-shelf T-cell immunotherapy product candidates applicable to a variety of diseases, including autoimmune conditions such as multiple sclerosis, or MS. We are also working with QIMR Berghofer on the development of EBV and other virally targeted T-cells. Through this technology, we are expanding the role of immunotherapy beyond oncology and viral infections to autoimmune disease. Our most advanced off-the-shelf T-cell product candidate utilizing this technology, ATA188, targets select antigens of EBV and is currently being evaluated in atechnology; Phase

1 trial in an initial cohort for the treatment of patients with progressive MS. In connection with the initial license from QIMR Berghofer, we received an option to exclusively license an autologous version of ATA188, also known as ATA190, which recently demonstrated clinical activity in a Phase 1 trial in progressive MS. We expect to broadly explore the utility of our targeted antigen recognition technology in EBV and other virally driven diseases, and additional product candidates derived from our collaboration with QIMR Berghofer are being developed.

2 Randomized Controlled Trial

Overall, we believe that Atara is a leading allogeneic T-cell immunotherapy company with a robust and late stage oncology pipeline and potentially transformative T-cell immunotherapies for MS and other viral diseases. With tabelecleucel poised to potentially become the first approved off-the-shelf T-cell therapy and a robust pipeline of high potential candidates, our ambition is to be recognized as the leader in off-the-shelf T-cell immunotherapy.Ebvallo™ (Tab-cel®)

Tabelecleucel for EBV+ PTLD following HCT or SOT

Since its discovery as the first human oncovirus, EBV has been implicated in the development of a wide range of diseases, including lymphomas and other cancers. EBV is widespread in human populations and persists as a lifelong, asymptomatic infection. In healthy individuals, a small percentage of T-cellsT cells are devoted to keeping EBV in check. In contrast, immunocompromised patients, such as those undergoing hematopoietic cell transplants or HCT,(HCT) or solid organ transplants or SOT,(SOT) have a reduced ability to control EBV. Left without appropriate immune surveillance, EBV transformedEBV-transformed cells can, in some patients, proliferate and cause an aggressive, life-threatening cancer called EBV+ PTLD.PTLD. Nearly all cases of PTLD that occur following HCT are EBV positive while approximately 70%60% of PTLD cases that occur following SOT are EBV positive. Approximately 10-15% of

Historical studies suggest a high unmet medical need for improved therapies in patients with EBV+ PTLD patients are children. Patients with EBV+ PTLD are currently treated withwho have failed rituximab or rituximab plus chemotherapy, when systemic treatment is indicated, with approximately 50-60%40% to 60% of patients either not responding to or progressing following this first line of therapy. Historical studies suggest a high unmet medical need for improved therapies in patients with EBV+ PTLD who have failed rituximab. MedianExpected median overall survival in patients with EBV+ PTLD following HCT who have failed rituximab-based first line therapy is 16-56 days, with a one-year survival rate of approximately 23% based on our evaluation of available historical outcomes data. One-1.7 months, and two-year survival following incomplete response to rituximab infor patients with high-risk EBV+ PTLD after following SOT who have failed rituximab-based first line therapy, the median overall survival is 36% and 0%, respectively.approximately 3.3 months. The use of chemotherapy in patients with EBV+ PTLD who have failed rituximab is frequently associated with significant rates of treatment-related mortality due to the frailty of the patients and severe toxicities associated with chemotherapy.

We believe that the global commercial opportunity for PTLD is attractive. We expect the number of EBV+ PTLD patients to grow over time as a result of increases in the number of transplant procedures and an increasing rate of PTLD following these procedures. Based on our market research, we estimate that in 2019, approximately 164,000 HCT and SOT transplant procedures are expected to be performedthere were several hundred EBV+ PTLD patients who failed rituximab or rituximab plus chemotherapy in the United States,U.S. in 2019.

Tab-cel® (Ebvallo™) for EBV+ PTLD

In June 2015, we licensed certain patent rights, know-how and a library of T cells and cell lines specific to EBV from MSK under an exclusive license agreement. In accordance with the European Union, or EU, Australia, Canada, China, Japan, South Korealicense agreement, we agreed to use commercially reasonable efforts to commercialize the licensed products and Turkey,to make milestone payments with this number expected to increase to approximately 207,000 by 2024, predominantly due to increases in bone marrow, peripheral blood and umbilical cord blood donation and more haploidentical transplants. Similarly, the number of cases of EBV+ PTLD is expected to increase from approximately 4,700 in 2019 to 6,000 in 2024 duerespect to the uselicensed programs and to make royalty payments to MSK to the extent product candidates arising from the collaboration are commercialized. Our first commercial product, Ebvallo, is part of more potent immuno-suppression in haploidentical transplants.this MSK collaboration and targets EBV.

Our most advanced T-cell immunotherapy product candidate, tabelecleucel,Tab-cel® (Ebvallo™) is an allogeneic EBV-specific T-cell immunotherapy that is approved in the EU and UK and currently being investigatedin Phase 3 development in the U.S. for the treatment of patients with EBV+ PTLD who have failed rituximab. In February 2015, the FDA granted tabelecleucel BTD or rituximab plus chemotherapy. Tab-cel is also under development for other EBV+ diseases with significant unmet medical need through a Phase 2 multi-cohort study that was initiated in the treatmentthird quarter of patients with EBV+ PTLD after HCT who have failed rituximab. BTD is an FDA process designed to accelerate the development and review of drugs intended to treat a serious condition when early trials show that the drug may be substantially better than current treatment. In October 2016, tabelecleucel was accepted into the EMA PRIME regulatory pathway for the same indication, providing enhanced regulatory support. In addition, tabelecleucel2020.

Tab-cel has received orphan status inBreakthrough Therapy Designation (BTD) from the United StatesU.S. Food and European UnionDrug Administration (FDA) for the treatment of patients with EBV+ PTLD after HCT who have failed rituximab and orphan designation in the U.S. and European Union (EU) for the treatment of patients with EBV+ PTLD following HCT or SOT. In December 2016, we announced that we had reached agreement with the FDA on the designs of two Phase 3 trials for tabelecleucel intended to support approval in two separate indications, the treatment of EBV+ PTLD following HCT and SOT in patients who have failed rituximab. In December 2017, following discussion with the FDA of manufacturing and comparability data generated on material manufactured by our contract manufacturing organization, we initiated these trials in the United States. We expect to expand these trials geographically to include Europe, Canada, and Australia.

The Phase 3 MATCH trial (EBV+ PTLD following HCT) is a multicenter, open label, single arm trial designed to enroll approximately 35 patients with EBV+ PTLD following HCT who have failed rituximab. The Phase 3 ALLELE trial (EBV+ PTLD following SOT) is a multicenter, open label trial with two non-comparative cohorts. Each cohort is designed to enroll approximately 35 patients. The first cohort will include patients who previously received rituximab monotherapy, and the second cohort will include patients who previously received rituximab plus chemotherapy. Both cohorts are planned to enroll concurrently. The primary endpoint of both the MATCH and ALLELE trials is confirmed best objective response rate, or ORR, defined as the percent of patients achieving either a complete or partial response to treatment with tabelecleucel confirmed after the initial tumor assessment showing a response. The protocols are designed to rule out a 20% ORR as the null hypothesis. This means that if the lower bound of the 95% confidence interval on ORR among patients receiving at least one dose of tabelecleucel exceeds 20% at the end of the study, then the trial would be expected to meet the primary endpoint for the treatment of PTLD. For example, assuming anticipated enrollment of 35 patients in MATCH, an observed ORR above approximately 37% would be expected to meet the primary endpoint. In ALLELE, each of the two cohorts with an anticipated enrollment of 35 patients will be analyzed separately with respect to the primary endpoint and, similarly, as an example, with 35 patients enrolled in either cohort, an observed ORR above approximately 37% would be expected to meet the primary endpoint. Secondary endpoints for both trials include duration of response, overall survival, safety, quality of life metrics, and other measures to evaluate its health economic impact. A safety committee will meet periodically to monitor for safety. Results from the first tabelecleucel Phase 3 study, or cohort in the case of ALLELE, to reach the primary endpoint are expected to be available in the first half of 2019.

In clinical trialsstudies conducted at MSK that have enrolled patients with EBV+ PTLD following HCT and SOT, efficacy following treatment with tabelecleuceltab-cel monotherapy compared favorably with historical data in these patient populations. Patients with EBV+ PTLD after HCT who have failed rituximab and were treated with tabelecleuceltab-cel had one-yeartwo-year overall survival of approximately 70%83% in two separate clinical trials.studies. In the setting of EBV+ PTLD after SOT in patients who have failed rituximab,, similar results were observed, with one-yeartwo-year overall survival of approximately 60%86% in tabelecleucel-treatedtab-cel-treated patients. A response rate of greater than or equal to 50% was observed in HCT and SOT patients in these studies.

In June 2016,December 2017, we openedinitiated two Phase 3 studies for tab-cel intended to support approval in two separate indications, the treatment of EBV+ PTLD following HCT (which was referred to as the MATCH study) and SOT in patients who have failed rituximab (which was referred to as the ALLELE study). In 2019, after discussion and alignment with regulators, we combined MATCH and ALLELE into a single study (which we now refer to as the ALLELE study) that now consists of an HCT cohort for EBV+ PTLD patients who have failed rituximab, and a single SOT cohort for EBV+ PTLD patients who have failed prior treatment with rituximab with or without chemotherapy. Additionally, we expanded the ALLELE study geographically to include clinical sites in Europe and Canada.

In the third quarter of 2020, we completed an interim analysis for the ALLELE study. Data from the interim analysis showed a 50 percent objective response rate (ORR) to tab-cel with independent oncologic and radiographic assessment (IORA) in patients with relapsed-refractory EBV+ PTLD following HCT or SOT, that had reached at least six months follow-up after the ORR assessment. This ORR is consistent with previously published investigator assessed data. The tab-cel safety profile is also consistent with previously published data, with no new safety signals. In December 2022, we presented updated interim analysis and safety results from the ALLELE study and updated efficacy and safety data from two single-center, open-label studies, and multicenter expanded access protocol, or EAP, trial. The trial is currently open at more than ten clinical sitesprogram in the United States. The primary objective of this trial is to provide tabelecleucel monotherapy to patients with EBV-associated diseases or certain EBV positive malignancies for whom there are no other therapeutic options. Key secondary objectives include evaluation of efficacy and safety through a robust collection of data. We recently announced the presentation of positive interim results from this multicenter EAP trialEBV+ Leiomysosarcomas at the 59th2022 American Society of Hematology or ASH, Annual Meeting. Efficacy resultsIn December 2023, we presented new data for patients with relapsed or refractory (r/r) or treatment-naïve EBV+ PTLD involving the central nervous system following SOT or HCT. An ORR of 77.8% was observed in 1118 central nervous system (CNS) EBV+ PTLD patients including first line PTLD, and the estimated one-year overall survival rate (OS) was 70.6%. The one-year OS for responders was 85.7% versus 0% for non-responders. In January 2024, data from the planned Phase 3 populationsALLELE study that was published in The Lancet Oncology showed a 51.2% objective response rate and 23-month median duration of response in r/r EBV+ PTLD patients and that tab-cel was well tolerated with EBV+ PTLD following HCTno events of graft-versus-host disease as related to tab-cel.

In October 2021, we entered into the Pierre Fabre Commercialization Agreement, pursuant to which we granted to Pierre Fabre an exclusive, field-limited license to commercialize and SOT who had failed rituximab were consistent with the single-institution safety profile and response rates previously reported by our collaborating investigators at MSK. The response rates in both the five evaluable HCT patients treateddistribute Ebvallo in the EAPInitial Territory. In September 2022, we amended the Pierre Fabre Commercialization Agreement to receive an additional $30 million milestone payment from Pierre Fabre in exchange for a reduction in royalties and the six evaluable SOT patients was greater than 70%. Ansupply price mark up on Ebvallo purchased by Pierre Fabre. See section ‘Terms of Certain License and Collaboration Agreements’ below for additional patient with EBV+ PTLD following HCT remains alive but was not evaluable duedetails. In December 2022, we sold a portion of our right to lackreceive royalties and certain milestones in Ebvallo under the Pierre Fabre Commercialization Agreement to HCRx for a total investment amount of post-baseline assessment. We believe these results are consistent with$31.0 million, subject to a repayment cap between 185% and 250% of the tabelecleucel profile observedtotal investment amount by HCRx.

On October 31, 2023, we entered into the A&R Commercialization Agreement, which became effective in December 2023. Pursuant to the A&R Commercialization Agreement, Pierre Fabre’s exclusive rights to research, develop, manufacture, commercialize and distribute tab-cel (Ebvallo) will be expanded to include all other countries in the Phase 2 trials conducted at MSK. The Phase 3 trialsworld (Additional Territory) in addition to the Initial Territory (together, the Territory), subject to our performance of certain obligations as described below. In December 2023, upon the effective date of the A&R Commercialization Agreement, we met the contractual right to receive an additional upfront cash payment of $20.0 million for tabelecleucelthe expanded exclusive license grant, for which such cash was received in January 2024. We will also be entitled to receive an aggregate of up to $620.0 million in additional milestone payments upon achieving certain regulatory and commercial milestones relating to tab-cel in the Additional Territory, including up to $100.0 million in potential regulatory milestones through BLA approval. Of the $100.0 million in potential regulatory milestones, we expect to receive $20.0 million in April 2024 based on the positive pre-BLA meeting, an additional $20.0 million in connection with BLA acceptance, and up to $60.0 million in potential regulatory milestones in connection with BLA approval.

We are expectedeligible to enrollreceive significant double-digit tiered royalties as a percentage of net sales of tab-cel (Ebvallo) in the same EBV+ PTLD patient populations. Tabelecleucel was generally well toleratedTerritory until the later of 12 years after the first commercial sale in this study population. each such country, the expiration of specified patent rights in each such country, or the expiration of all regulatory exclusivity for tab-cel in each such country. Royalty payments may be reduced in certain specified customary circumstances. Royalties and milestones from the commercialization of Ebvallo in the Initial Territory remain subject to the HCRx Agreement.

In this study, five patients experienced treatment-related SAEs. One patient died due to PTLD disease progression. Two possibly related cases of graft versus host disease, or GvHD,November 2021, we submitted an EU marketing authorization application (MAA) for tab-cel in patients with EBV+ PTLD. In December 2022, the EC granted marketing authorization for Ebvallo under the “exceptional circumstances” regulatory pathway as a monotherapy for the treatment of adult and pediatric patients two years of age and older with r/r EBV+ PTLD following HCT were reported. A tumor flare who have received at least one prior therapy. For SOT patients, prior therapy includes chemotherapy unless chemotherapy is inappropriate. Our request to transfer the marketing authorization for Ebvallo to Pierre Fabre was observedadopted by the EC in one patient with EBV+HIV-associated plasmablastic lymphoma that resolved without clinical sequelae.

With respect to the total safety population following treatment with tabelecleucel, few treatment-related SAEs have been observed. Among 173 patients treated with tabelecleucel in clinical trials, there have been 12 patients with possibly related SAEs, with no infusion related toxicities, no cytokine release syndrome and three possibly related cases of GvHD.

We are also pursuing marketing approval of tabelecleucelFebruary 2023. Pierre Fabre commenced Ebvallo launch activities in the first European Union. countries in the first quarter of 2023 and is progressively launching Ebvallo on a country-by-country basis. Under the “exceptional circumstances” marketing authorization, Pierre Fabre is subject to annual reassessments of certain ongoing post-marketing obligations to continue confirmation of the benefits of Ebvallo. The annual reassessments will determine whether the Ebvallo marketing authorization should be maintained, changed, or suspended, based on Pierre Fabre’s fulfillment of post-marketing obligations and the risk/benefit profile of Ebvallo.

In March 2016,October 2022, we filed the EMA issued a positive opinionMAA for orphan drug designation for tabelecleucelEbvallo with the Medicines and Healthcare Products Regulatory Authority (MHRA) in the United Kingdom (UK). In May 2023, the MHRA granted Ebvallo marketing authorization in the UK for the treatment of patients with EBV+ PTLD. In October 2016, and the marketing authorization was subsequently transferred to Pierre Fabre.

We have performed extensive studies demonstrating analytical comparability between the tab-cel manufacturing process versions used for the pivotal ALLELE study and that intended for commercialization. Comprehensive comparability analyses covered 21 key attributes for potency, purity and alloreactivity. We believe analytic comparability between tab-cel process versions has been demonstrated based on well-established statistical methodology and application of International Council for Harmonization (ICH) guidelines and is further supported by significant and consistent clinical experience. These comparability data analyses were submitted to the EMA Committeethrough our MAA filing. EMA stated in its assessment report issued following approval of the MAA for Medicinal Productstab-cel by the EC that it considered comparability of the intended commercial product with the clinically used product to be shown.

We have been engaged in discussions with the FDA regarding a potential biologics license application (BLA) submission for Human Usetab-cel in the United States, including on (i) the content of chemistry, manufacturing and controls (CMC) module 3 and the Committeeassessment of comparability between the product used in the pivotal ALLELE study and that intended for Advanced Therapies granted tabelecleucel accesscommercialization and (ii) the clinical data package requirements.

In February 2022, we held a Type B CMC meeting with the FDA to discuss comparability between the intended commercial and pivotal clinical trial process versions. This meeting did not result in alignment on comparability and the FDA initially recommended we conduct a clinical study with commercial product as the FDA did not agree that comparability has been demonstrated between product used in the pivotal ALLELE study and the intended commercial product. Following further discussions, the FDA recommended a potential path to a BLA submission without the need for a new clinical study.

We subsequently held another meeting with the FDA to discuss topics relating to CMC, which culminated in clear guidance and agreement on specific CMC module 3 requirements for a potential BLA submission. Following this meeting, we filed an amendment to the EMA’sInvestigational New Drug (IND) application for tab-cel to provide additional CMC information requested by the FDA.

In 2023, we held a number of meetings with the FDA on clinical aspects and CMC for a potential BLA submission for tab-cel. Following such discussions, we aligned with the FDA on analytical comparability between manufacturing process versions of tab-cel. This alignment supports our ability to pool the pivotal clinical trial data from different process versions in a tab-cel BLA submission.

We recently established PRIMEheld a pre-BLA meeting with the FDA to discuss various aspects of our proposed BLA submission, which supports our plan to submit the tab-cel BLA in the second quarter of 2024. Of the $100.0 million in potential regulatory initiativemilestones that we may be entitled to receive through approval from Pierre Fabre pursuant to the terms of the A&R Commercialization Agreement, we expect to receive $20.0 million in April 2024 based on the positive pre-BLA meeting, an additional $20.0 million in connection with BLA acceptance, and up to $60.0 million in potential regulatory milestones in connection with BLA approval.

Tab-cel Multi-Cohort Study

We continue to pursue development of tab-cel in additional patient populations, with a primary focus on immunodeficiency-associated lymphoproliferative diseases (IA-LPDs), given the commonality of their EBV-driven mechanism of disease in immunocompromised patients, high unmet medical needs and positive clinical data to date with tab-cel. In patients where previous treatments have failed, the objective response rates, including complete response, were 33.3% (three out of nine patients) in AID-LPD and 37.5% (three out of eight patients) in PID-LPD groups. Tab-cel was generally well-tolerated with a favorable safety profile consistent with previously published clinical studies. These clinical data demonstrated that tab-cel was well-tolerated and showed encouraging clinical activity in this patient population, with objective response rates ranging from 50% (two out of four patients) to 80% (four out of five patients). The overall survival (OS) rate at one year in patients with EBV viremia treated in the EAP-201 study was 100 percent for a median follow-up of 14.6 months (min 12.2, max 17.8).

In the third quarter of 2020, we initiated a Phase 2 multi-cohort study which comprises a total of five patient populations, including IA-LPDs and other EBV-driven diseases, in both the U.S. and EU. We continue to enroll patients in this study. We are investigating additional label expansion opportunities with our Phase 2 multi-cohort study. In December 2023, we presented combined analysis that included the first reported data from our Phase 2 multi-cohort study at the European Society for Medical Oncology Immuno-Oncology annual congress that demonstrated a 77.8% ORR in 18 CNS EBV+ PTLD patients including first line PTLD.

ATA3219

We are developing ATA3219, an allogeneic CD19 CAR T immunotherapy targeting B-cell malignancies and autoimmune diseases, leveraging our next-generation 1XX CAR co-stimulatory domain and EBV T-cell platform and does not require TCR or HLA gene editing. ATA3219 combines the natural biology of unedited T cells with the benefits of an allogeneic therapy. It consists of allogeneic EBV-sensitized T cells that express a CD19 CAR construct for the treatment of CD19+ r/rB-cell malignancies, including B-cell non-Hodgkin’s lymphoma (NHL) and B-cell mediated autoimmune diseases including systemic lupus erythematosus (SLE) with kidney involvement (lupus nephritis (LN)). ATA3219 has been optimized to offer a potential best-in-class profile, featuring off-the-shelf availability. It incorporates multiple clinically validated technologies including a modified CD3ζ signaling domain (1XX) that optimizes expansion and mitigates exhaustion, provides enrichment during manufacturing for a less differentiated phenotype for robust expansion and persistence and retains the endogenous T-cell receptor without gene editing as a key survival signal for T cells which contribute to persistence.

Data from preclinical studies for ATA3219 suggest enhanced functional persistence, polyfunctional phenotype and efficient targeting of CD19-expressing tumor cells both in vitro and in vivo with a manufacturing process that focuses on T-cell stemness. Additional in vitro data demonstrate the CD19 antigen-specific functional activity of ATA3219 and CAR-mediated activity against B cells from SLE patients, leading to robust CD19-specific B-cell depletion compared to controls. This preclinical data was submitted as part of a late-breaking abstract which was accepted for poster presentation at the upcoming International Society for Cell & Gene Therapy meeting to be held May 29-June 1, 2024.

Based on academic data from a clinical study, an EBV T-cell platform has the potential to generate off-the-shelf, allogeneic CAR T immunotherapies with EBV+ PTLD following HCT who have failed rituximab. PRIME provides early enhanced regulatory supporthigh response rates, durable responses and low risk of toxicity that can be rapidly delivered to facilitate regulatory applicationspatients.

Our EBV CD19 CAR T program incorporates multiple clinically validated technologies designed for a memory phenotype, robust expansion, and accelerateretains the reviewendogenous T-cell receptor without gene editing as a key survival signal for T cells contributing to functional persistence. We continue to make progress on the ATA3219 manufacturing process for scale-up.

Data from an academic study (Curran et al ASH 2023) that used allogeneic EBV CAR T cells (CD28/CD3ζ co-stimulatory domain), demonstrated proof of medicinesprinciple for Atara’s allogeneic CAR T approach with overall survival up to 3 years in post-transplant B-cell malignancy patients. Atara’s ATA3219 builds upon this study with an improved process and construct that addressleverages multiple clinically validated technologies featuring a high unmet need. less differentiated phenotype and a novel 1XX costimulatory domain. We continue to make progress on the ATA3219 manufacturing process for scale-up.

In January 2017,July 2023, we received parallel scientific advicea Safe to Proceed letter from the EMA’s Scientific Advice Working Group and several national Health Technology Assessment agenciesFDA in response to our IND submission for ATA3219 in r/r B-cell NHL. We initiated enrollment of a multi-center, Phase 1 open-label, dose escalation clinical trial for ATA3219 in NHL, including large B-cell lymphomas, follicular lymphoma, or mantle cell lymphoma, with initial clinical data anticipated in the EU, including thosefourth quarter of 2024.

In February 2024, we received a Safe to Proceed letter from the FDA in the United Kingdom, Germany and France. Based on these discussions, we planresponse to submit an applicationour IND submission for Conditional Marketing Authorization, or CMA,use of tabelecleucel inATA3219 as a monotherapy for the treatment of patientsSLE with EBV+ PTLD following HCT who have failed rituximabLN and expect to initiate a Phase 1 study to evaluate the safety and preliminary efficacy of ATA3219 in the second half of 2024. Initial data is anticipated in the first half of 2019. The CMA will be based on clinical2025.

Additional Programs and Platform Expansion Activities

In addition to the prioritized programs described above, we have a number of preclinical programs.

Our CAR T immunotherapy pipeline includes ATA3431, an allogeneic, bispecific CAR directed against CD19 and CD20 for B-cell malignancies and autoimmune disease, leveraging our 1XX CAR co-stimulatory domain and EBV T-cell platform and does not require gene TCR or HLA gene editing. ATA3431 is enriched for central memory CAR T cells and in December 2023, we presented preclinical data from Phase 1that demonstrated early evidence of antitumor activity, long-term persistence, and 2 trials conducted at MSK and supported by available data from our Phase 3 MATCH and ALLELE trials in patients with EBV+ PTLD after HCT and SOT who have failed rituximab, which will be ongoingsuperior tumor growth inhibition compared to an autologous CD19/CD20 CAR T benchmark at the time65th American Society of filing.

In 2017, we began pre-commercial preparation to support the planned tabelecleucel EU CMA submission. For example, we are developing a proprietary, web-based, off-the-shelf delivery solution for commercial use that we call Atara MatchMe™. The Atara MatchMe system will be a portal for health care professionalsHematology Annual Meeting and institutions that allows for order input including the provision of required patient HLA and other information, the execution of our cell selection algorithm, product shipment and tracking, as well as the capture of data on outcomes following treatment. In the first quarter of 2017, we also signed a lease for an approximately 90,580 square foot facility in Thousand Oaks, California.Exposition 2023. We are building out a multi-product cellular therapy manufacturing facility with operations expected to commence in 2018. Overall, we believe that tabelecleucel monotherapy has a compelling value proposition in the treatment of patients with EBV+ PTLD who have failed rituximab. Weprogressing toward an IND submission and expect to pursue approvals globallyfile an IND submission for tabelecleucelATA3431 in patients2025.

We are also collaborating with EBV+ PTLD following HCT and SOT who have failed rituximab and may seek partnersQIMR Berghofer to aid in our commercializationdevelop a potential next generation EBV vaccine which is differentiated from earlier EBV vaccine efforts in select markets. In addition, we expectthat solely focused on B cell responses to pursue development of tabelecleucel in earlier lines of therapy, including first line EBV+ PTLD in combination with rituximab.

Tabelecleucel for nasopharyngeal carcinoma, or NPC

NPC, is a type of head and neck cancer that is primarily EBV associated. Standard treatment for NPC includes radiation therapy with or without platinum-based chemotherapy. InEBV. We also retain the setting of metastatic disease after the failure of chemotherapy, median survival is approximately fiverights to 11 months based on historical data, and there are no approved therapeutic agents available to treat this disease today. Based on our market research, we estimate that in 2015 there were approximately 9,400 patients with metastatic or recurrent Type III NPC in the United States, the United Kingdom, France, Germany, Italy and Spain and approximately 93,000 in Asia. Treatment with tabelecleucel as a monotherapy has been evaluated in 14 patients with metastatic NPC after failure of one to three lines of chemotherapy in the studies conducted by MSKCC. An ORR of 21% was observed in these patients with one complete response and two partial responses. In addition, 11 of the 14 patients were alive at a median follow up of 18 months with a Kaplan-

Meier survival estimate of 84% at two years. Tabelecleucel was administered to this immune competent patient population without prior lymphodepleting chemotherapy. Additionally, evidence of T-cell expansion following administration was observed. In April 2017, we entered intoATA188, an agreement with Merck (known as MSD outside of the United States and Canada) to provide drug supply for a trial sponsored and conducted by us to evaluate tabelecleucel in combination with Merck’s anti-PD-1 (programmed death receptor-1) therapy, KEYTRUDA ® (pembrolizumab), in patients with platinum-resistant or recurrent EBV-associated NPC. The Phase 1/2 trial will evaluate the safety, pharmacokinetics, pharmacodynamics, and preliminary efficacy of the combination and is planned for initiation in the second half of 2018.

Other T-Cell Programs

ATA188 and ATA190 for multiple sclerosis

MS is a chronic disorder of the central nervous system, or CNS, that disrupts the myelination and normal functioning of the brain, optic nerves and spinal cord through inflammation and tissue loss. The evolution of MS results in an increasing loss of both physical and cognitive (e.g., memory) function. This has a substantial negative impact on the approximately 2.3 million people worldwide affected by MS.

There are two categories of MS: progressive MS, or PMS; and relapsing-remitting MS, or RRMS. PMS is a severe form of MS with few therapeutic options. Within PMS there are two types of MS: secondary progressive MS, or SPMS; and primary progressive MS, or PPMS. According to the National Multiple Sclerosis Society, there are approximately one million people affected by PMS. Both types of PMS are characterized by persistent progression and worsening of MS symptoms and physical disability over time. PPMS occurs when the patient has a disease course characterized by steady and progressive worsening after disease onset. SPMS initially begins as RRMS, but once patients have continuous progression of their disease, they have developed SPMS. This is distinct from RRMS, where patients have flares of the disease that are followed by periods of recovery and quiescence during which the disease does not progress. There is substantial unmet medical need for new and effective therapies for patients with PMS. Most of the treatment options that work well in reducing the flares in RRMS have not been shown to be effective in slowing or reversing the progression of disability in PMS. The two approved therapeutic options for PMS patients have a modest impact on symptoms and disease progression and, therefore, we believe that unmet need remains. In the United States, mitoxantrone is approved for SPMS and ocrelizumab was approved in March 2017 for PPMS. Siponimod is currently being studied in Phase 3 trials for SPMS.

There is a strong biologic connection between EBV and MS. EBV is present in nearly all patients with MS. For example, in an international study of patients with clinically isolated syndrome, a CNS demyelinating event isolated in time that is compatible with the possible future development of MS, only one patient out of 1,407 was seronegative for, or not infected with, EBV. In addition, in separate studies, clusters of EBV infected B-cells and plasma cells were evident in the brains of MS patients but not found in brains of patients without MS. In these studies, the EBV infected B-cells and plasma cells were in close proximity to areas of active demyelination. Studies suggest that EBV positive B-cells and plasma cells in the CNS have the potential to catalyze an autoimmune response and the MS pathophysiology. In patients with MS, their T-cells may be unable to control EBV positive B-cells and plasma cells so that B-cells and plasma cells could then accumulate in the brain and generate antibodies that attack and destroy myelin, the protective layer that insulates nerves in the brain and spinal cord. This loss of myelin ultimately leads to MS symptoms. MS disease course has also been shown to correlate with measures of EBV activity. The role of B-cells in MS is supported by the recent approval by the FDA of ocrelizumab for PPMS which broadly targets B-cells through their expression of a cell surface marker known as CD20. Low vitamin D also suppresses T-cells and is associated with MS.

Our secondallogeneic T-cell immunotherapy product candidate, ATA188, is an off-the-shelf EBV-specific T-cell that utilizes a targeted antigen recognition technology that enables the T-cells we administer to selectively identify cells expressing thetargeting EBV antigens that we believe arebelieved to be important for the potential treatment of MS.multiple sclerosis (MS). We arehave paused development on ATA188 while we explore strategic options for this asset. We have also developing an autologous version of this product candidatediscontinued some programs and will return the programs to our collaborators. For example, in February 2024, we notified MSK that we call ATA190. ATA190 utilizeswill return the same approachATA2271 and ATA3271 programs targeting mesothelin to targeted antigen recognition as ATA188. These product candidates are designed to selectively target only those cells which are EBV positive while sparing those that are not. We believe that eliminating only EBV positive B-cells, including plasma cells, has the potential to benefit some patients with MS through enhanced efficacy and a better side-effect profile. In October 2015, we obtained an exclusive, worldwide license to develop and commercialize allogeneic T-cell immunotherapy product candidates targeting EBV, including ATA188, utilizing technology and know-how developed by QIMR Berghofer. In connection with this license, we also received an option to exclusively license the autologous version of EBV product candidates, including ATA190.MSK.

In the fourth quarter of 2017, we initiated an open label, single arm, multi-center, multi-national Phase 1 trial with allogeneic ATA188 for patients with MS and in January 2018 received clearance of our investigational new drug, or IND, application from the FDA to proceed with patient enrollment at U.S. sites. The primary objective of this Phase 1 trial is to assess the safety of ATA188 in patients followed for at least one year after the first dose. Key secondary endpoints in the trial include measures of clinical improvement such as Expanded Disability Status Scale, or EDSS, and annualized relapse rate, or ARR, as well as MRI imaging. The trial is expected to enroll a total of 60 patients across the United States, Australia and Europe: 30 patients with PMS, either PPMS or SPMS, and 30 patients with RRMS. We expect to announce results from our ATA188 Phase 1 trial in patients with PMS in the first half of 2019.

In addition, based on the Phase 1 clinical results observed to date with ATA190, we believe the continued development of ATA190 will enhance our understanding of the potential therapeutic utility of targeting EBV in the treatment of MS and further inform and complement our development of ATA188, and we are planning a multicenter Phase 1/2 trial with ATA190 in PMS.

Our collaborating investigators at QIMR Berghofer are currently conducting a Phase 1 trial utilizing autologous ATA190 for the treatment of patients with PMS. We believe this is the first clinical trial to prospectively explore both the feasibility and potential utility of targeting EBV in MS. The trial is designed to:

enroll 10 patients: five with PPMS and five with SPMS;

assess the safety and tolerability of ATA190 in patients with PMS;

document preliminary evidence of efficacy through the evaluation of both clinically measured and patient reported changes in MS symptoms during and following treatment; and

determine if autologous ATA190 can be generated to clinical scale from the blood of patients with PMS.

Each patient receives four escalating doses of ATA190 over six weeks, with each individual dose given once every two weeks. Patients are followed for 20 weeks after the last dose. An abstract from our collaborating investigators describing interim results from this Phase 1 trial was selected for inclusion in the Emerging Science Program during the 69th American Academy of Neurology Annual Meeting in April 2017 and updated interim results for all ten patients were recently presented at the MSParis 2017 Congress, the 7th Joint Meeting of the European Committee for Treatment and Research in Multiple Sclerosis and the Americas Committee for Treatment and Research in Multiple Sclerosis.

Results presented include data on five SPMS patients and five PPMS patients. Clinical improvements were reported in six of the ten patients treated and these improvements were observed within two to fourteen weeks after the first dose. Three patients improved their EDSS score. EDSS is a method for quantifying disability and monitoring changes over time. Reduction in fatigue was a consistent observation in responding patients. Five of the six patients who showed clinical improvements received ATA190 with greater than or equal to 7% EBV reactivity, or T-cell reactivity against target EBV antigens following manufacturing. This suggests that EBV reactivity may be an important product characterization metric for future development. ATA190 was well-tolerated, and no significant treatment-related adverse events were observed. A summary of study results is highlighted in the table below.

| | | | | | | | | | |

Subject Age/Gender

(MS Type)

| | EDSS1

BL2/

Post

Tx3

| | | CD8+

T cell

Reactivity

to EBV

| | | Observed Improvement

|

60 yo F (SPMS)

| | | 6.5/6.0

| | | | 47%

| | | Yes

|

60 yo M (PPMS)

| | | 5.0/3.5

| | | | 31%

| | | Yes

|

49 yo F (PPMS)

| | | 8.0/8.0

| | | | 15%

| | | Yes

|

61 yo M (SPMS)

| | | 6.5/6.5

| | | | 10%

| | | Equivocal

|

55 yo F (PPMS)

| | | 5.0/4.5

| | | | 8%

| | | Yes—still in follow up

|

46 yo M (SPMS)4

| | | 8.0/8.0

| | | | 7%

| | | Yes

|

42 yo F (PPMS)

| | | 6.5/7.0

| | | | 3%

| | | None

|

53 yo M (PPMS)

| | | 6.0/6.0

| | | | <1%

| | | None

|

54 yo F (SPMS)

| | | 6.5/6.5

| | | | <1%

| | | None

|

49 yo F (SPMS)

| | | 6.5/6.5

| | | | <1%

| | | Mild

|

|

| | |

1

| | EDSS = Expanded Disability Scale Score.

|

2

| | BL = Baseline EDSS score prior to treatment with ATA190.

|

3

| | Post Tx = EDSS score following treatment with ATA190.

|

4

| | This patient received ATA190 under a compassionate use protocol approximately 4 years prior to entry into the Phase 1 trial.

|

Overall, we believe these results are encouraging and support the continued development of ATA188 and ATA190 in MS.

ATA520 for hematologic malignancies