Merger of Celladon Corporation and Eiger BioPharmaceuticals, Inc.

On March 22, 2016, Celladon Corporation, or Celladon, and privately-held Eiger BioPharmaceuticals, Inc., or Private Eiger, completed a business combination in accordance with the terms of the Agreement and Plan of Merger and Reorganization, or the Merger Agreement, dated as of November 18, 2015, by and among Celladon, Celladon Merger Sub, Inc., a wholly-owned subsidiary of Celladon, or Merger Sub, and Private Eiger, pursuant to which Merger Sub merged with and into Private Eiger, with Private Eiger surviving as a wholly-owned subsidiary of Celladon. This transaction is referred to herein as “the Merger.” Immediately following the Merger, Celladon changed its name to “Eiger BioPharmaceuticals, Inc.” In connection with the closing of the Merger, our common stock began trading on The NASDAQ Global Market under the ticker symbol “EIGR” on March 23, 2016.

Business

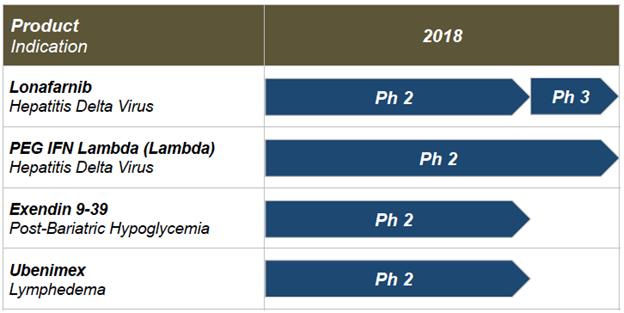

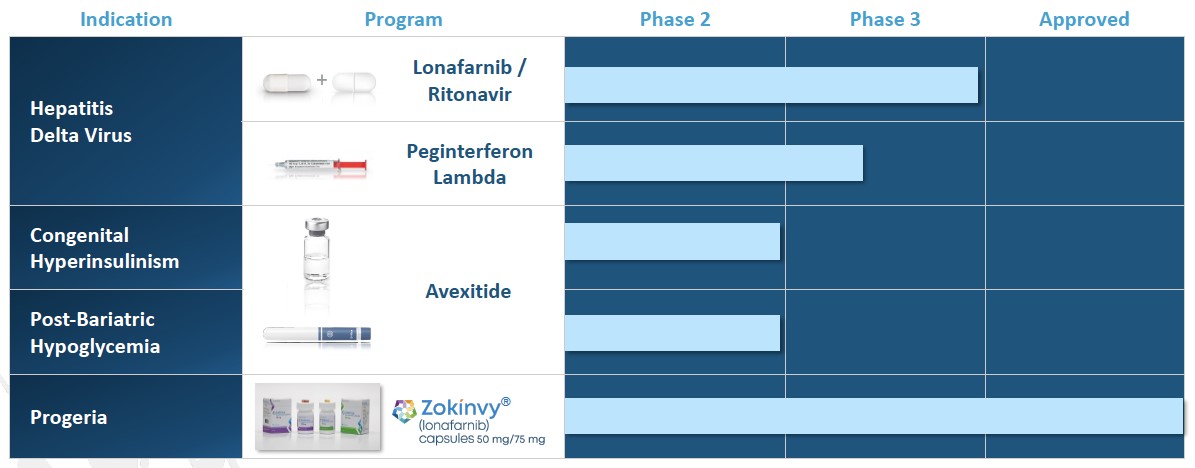

Our current project timelines, planned development and regulatory pathways are illustrated below. As discussed above, prior clinical experience by our licensors with the product candidates has supported and guided our understanding of safety in advancing these products in our clinical development programs. Specifically, we in-licensed lonafarnib from Merck Sharp & Dohme Corp, or Merck, in 2010; licensed ubenimex from Nippon Kayaku Co., Ltd., or Nippon Kayaku, in 2015; and licensed Lambda from Bristol-Myers Squibb, or BMS, in April 2016. We have relied upon Merck’s, Nippon Kayaku’s and BMS’s prior Phase 1/2/3 clinical data, manufacturing and experience with these three molecules to proceed directly into Phase 2 clinical trials following authorization by the U.S. Food and Drug Administration.

Note: All dates represent our current expectations. Actual timing may vary.

Our product candidate pipeline includes four Phase 2 programs:

|

|

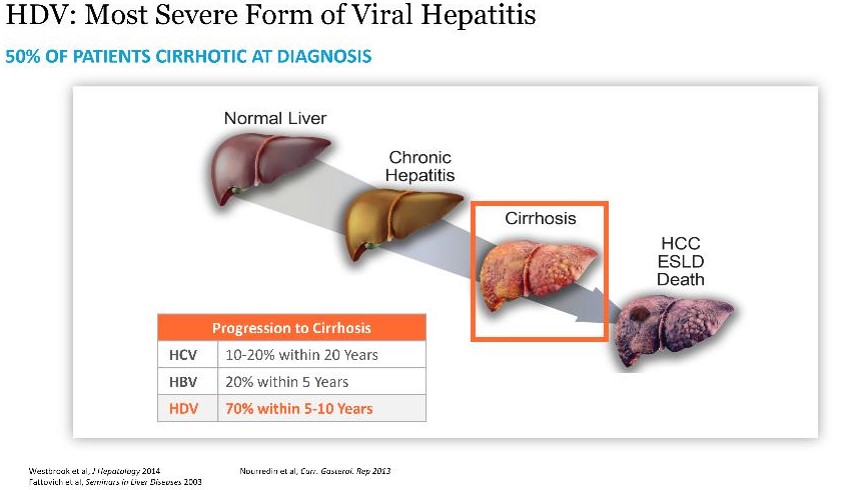

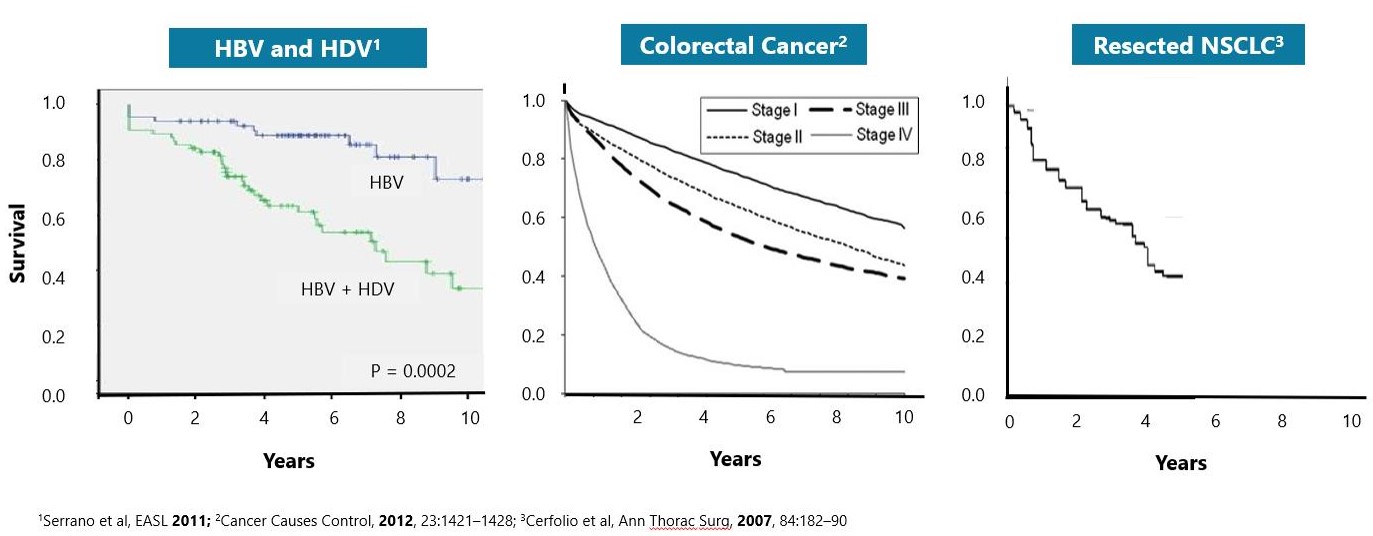

Lonafarnib, or LNF, is an orally bioavailable, small molecule in Phase 2 clinical trials for HDV infection and is our most advancedlead program. HDV is the most severe form of viral hepatitis for which there is currently no approvedFDA-approved therapy. Chronic HDV infection can lead to a rapid progression to liver cirrhosis, a greater likelihood of developing liver cancer, and has the highest fatality rate of all the chronic hepatitis infections.

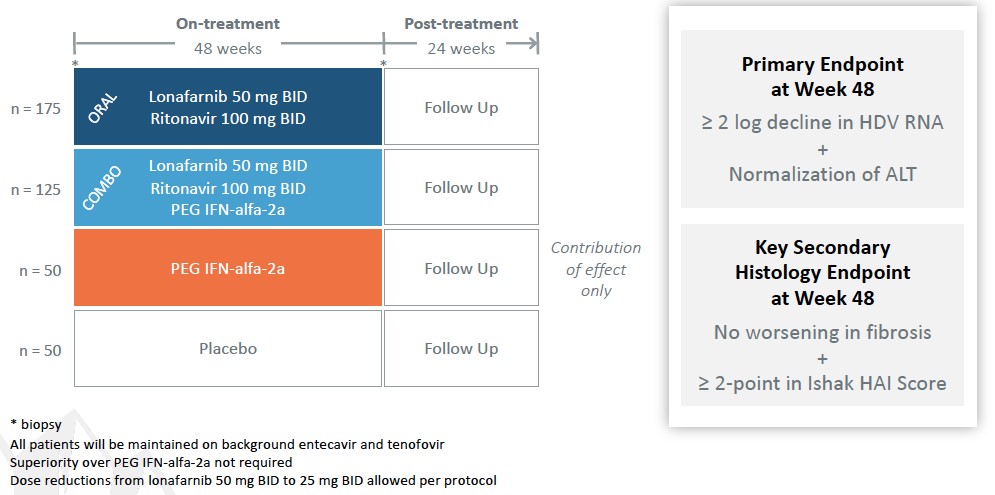

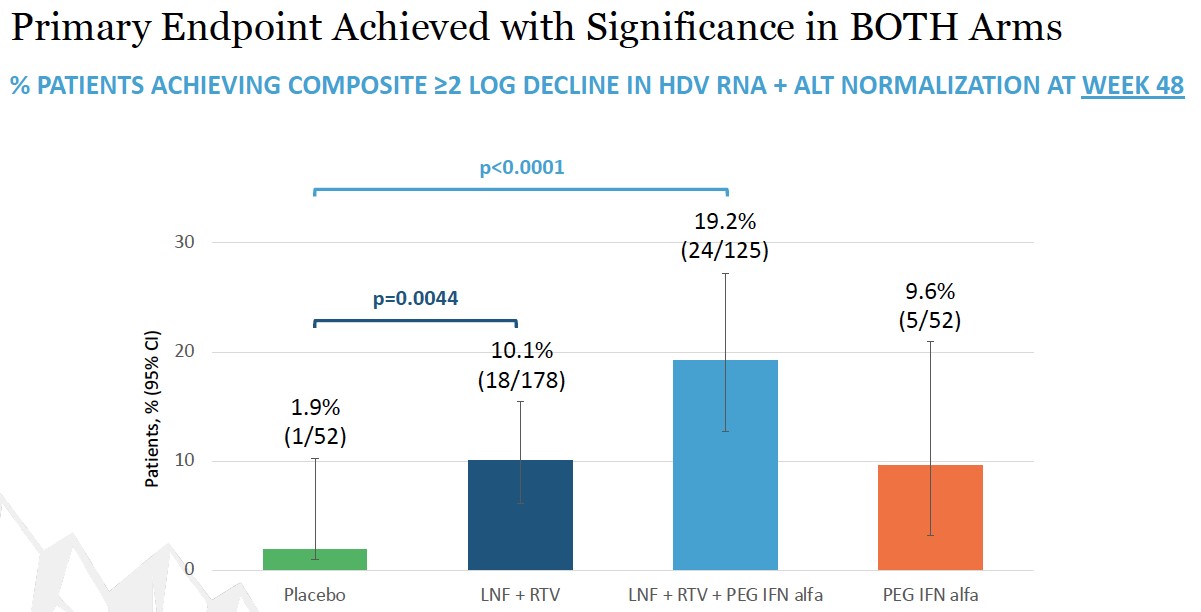

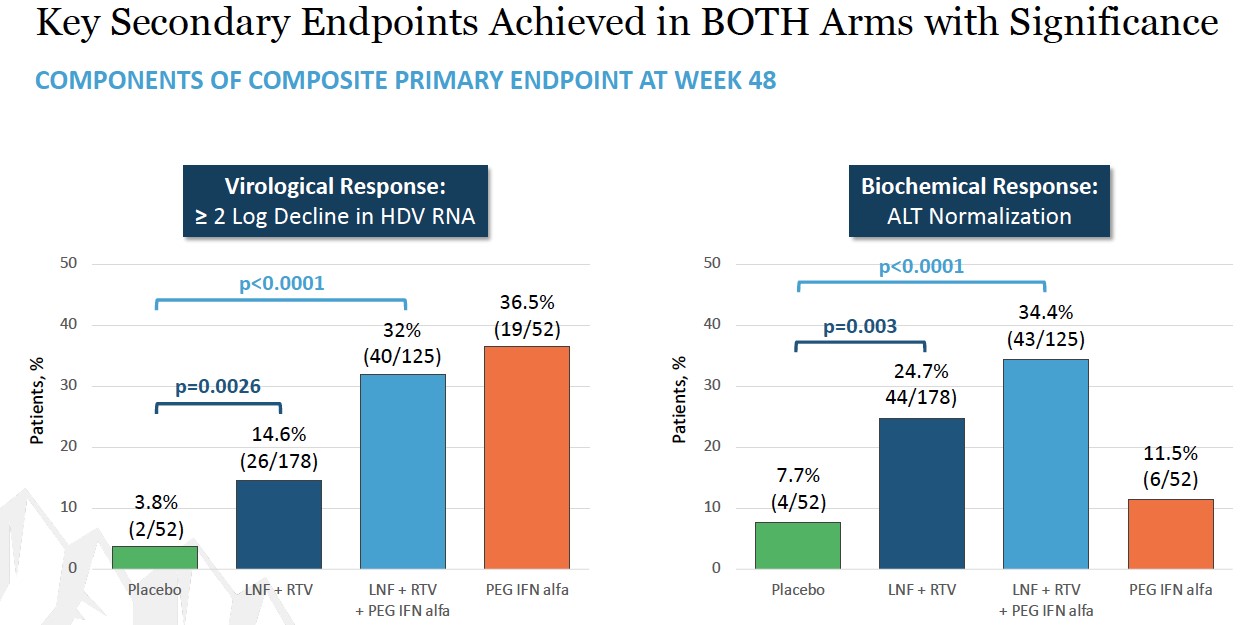

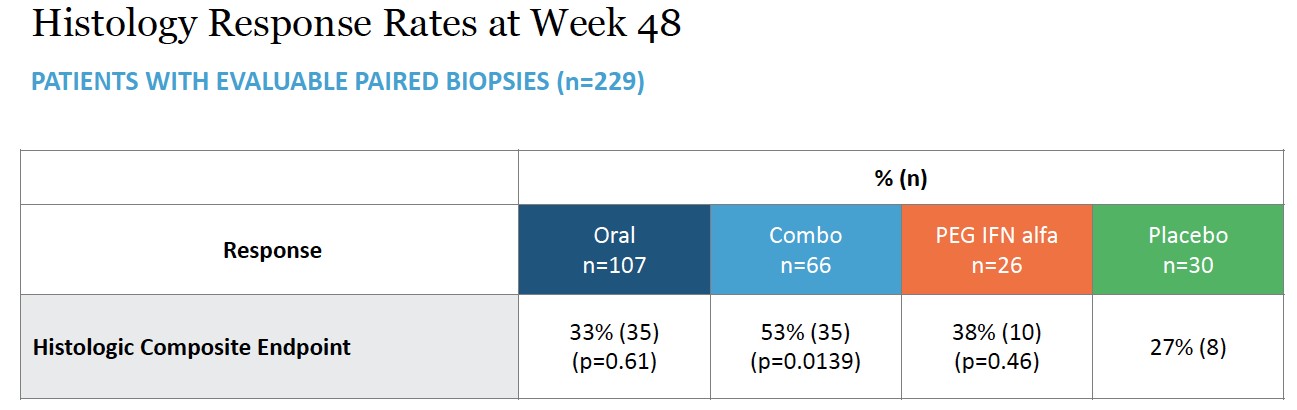

placebo. Topline Week 48 data announced in December 2022 demonstrated that both lonafarnib-based regimens showed statistical significance versus placebo on the primary endpoint. Week 72 data is expected in mid-2023

| Lambda |

Pegylated interferon lambda (Lambda) is our second program treating HDV.in clinical development for HDV and is currently in Phase 3. Lambda is a well-characterized, late-stage, first in class,first-in-class, type III, well-tolerated interferon or IFN,(IFN), that stimulates immune responses that are critical for the development of host protection during viral infections. Lambda targets type III IFN receptors which are distinct from the type I IFN, receptors targeted by IFN-alfa. These type III receptors are highly expressed on hepatocytes with limited

expression on hematopoietic and central nervous system cells, which has been demonstrated to reduce the off-target effects associated with other IFNs and improve the tolerability of Lambda. Although Lambda does not use the IFN-alfa receptor, signaling through either the IFN-lambda or IFN-alfa receptor complexes results in the activation of the same Jak-STAT signal transduction cascade.

We licensed worldwide rights to Lambdalambda from BMSBristol Myers Squibb in April 2016. Lambda has been administered in clinical trials involving over 3,0004,000 patients infected with the Hepatitis B Virus or HBV, or(HBV), Hepatitis C Virus or HCV.(HCV), Hepatitis D Virus (HDV), and SARS-CoV-2. Lambda has not been approved for any indication.

|

|

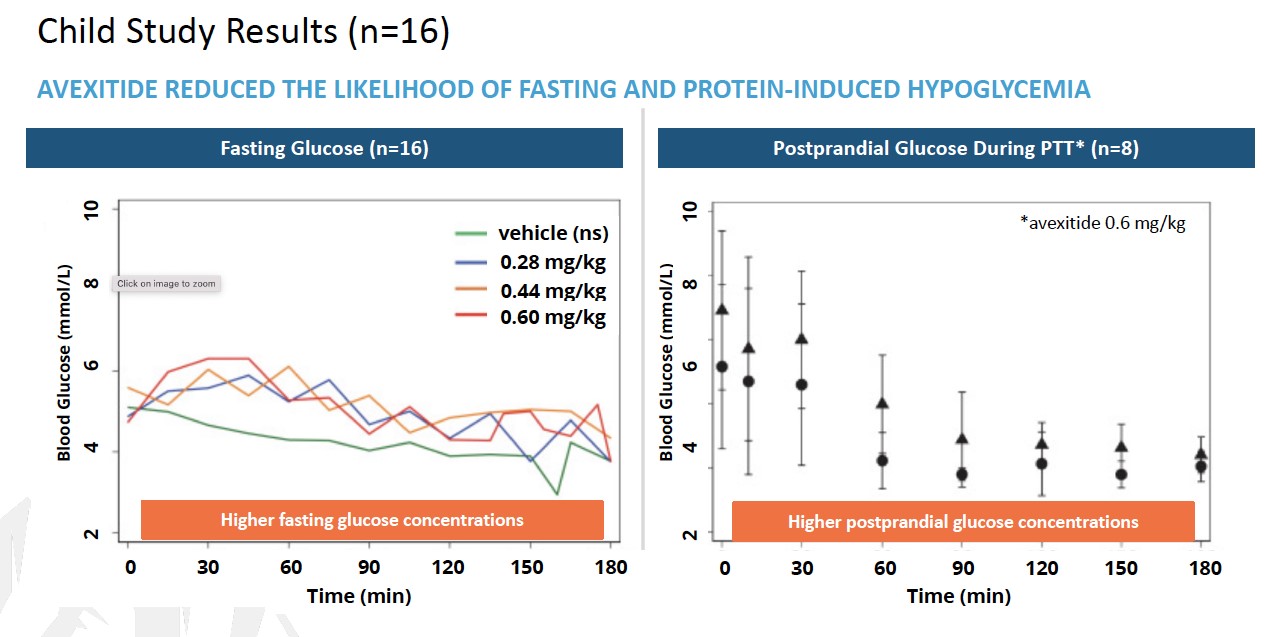

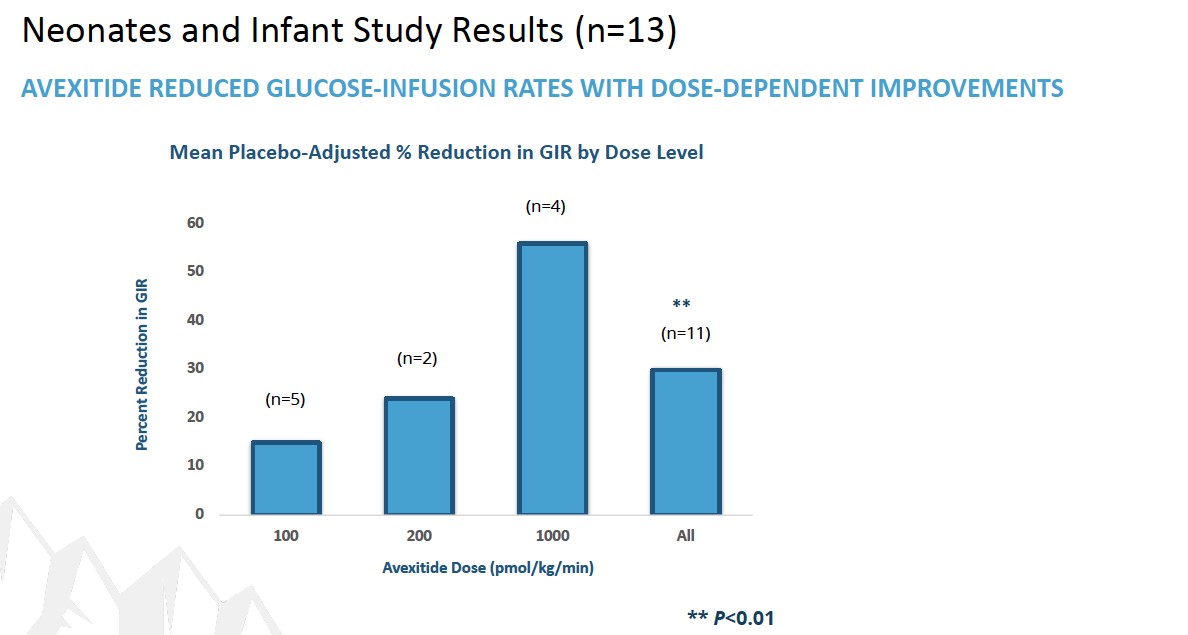

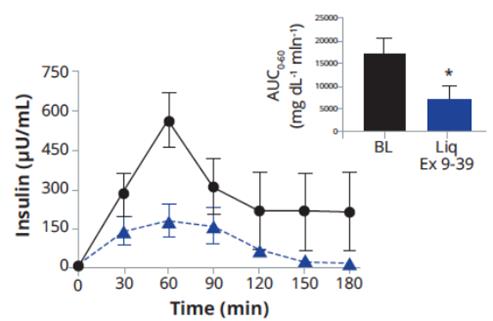

Exendin 9-39 is the third Phase 2 program andwell-characterized peptide that we are developing this candidate as a treatment for PBH. PBHcongenital hyperinsulinism (HI), an ultra-rare, pediatric metabolic disorder. HI is the most frequent cause of persistent hypoglycemia in neonates and children and is characterized by fasting and protein-induced hypoglycemia and results in permanent brain damage with neurodevelopmental deficits in up to 50% of patients. Near-total pancreatectomy is often indicated and leads to life-long insulin-dependent diabetes (IDDM). Safe and effective therapies are urgently needed to prevent brain damage, IDDM and death.

We

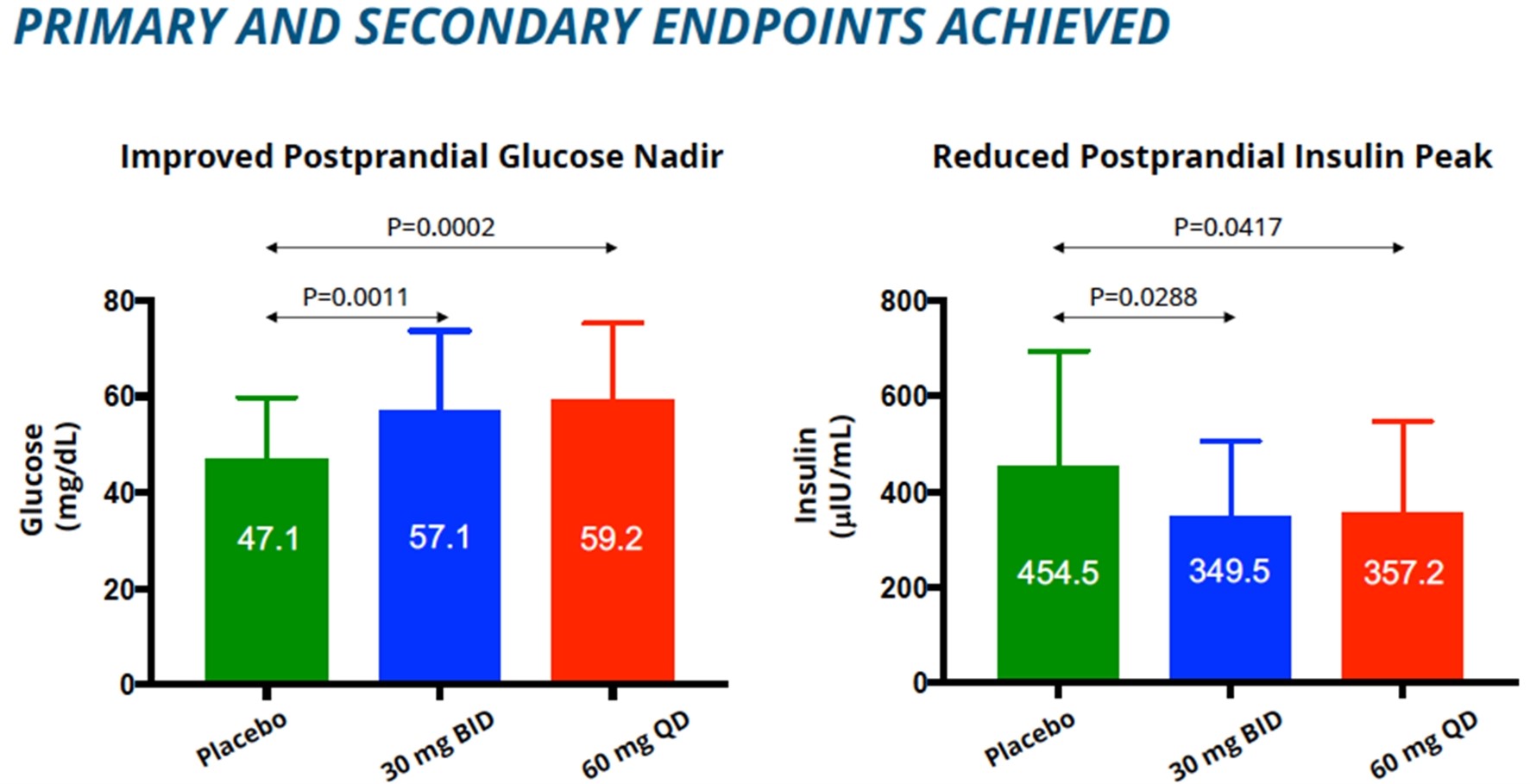

In December 2016, Eiger filed an Investigational New Drug application for exendin 9-39 in the United States. Exendin 9-39reduced postprandial insulin peak during MMTT was also statistically significant.

|

|

Our fourth NIPHS describes a spectrum of acquired metabolic disorders characterized by inappropriately high insulin levels (hyperinsulinemia) and low blood glucose levels (hypoglycemia), which includes PBH. Avexitide for the treatment of PBH has also been granted Breakthrough Therapy designation by the FDA. Following End of Phase 2 program involves clinical developmentand Scientific Advice meetings with regulatory agencies, we have agreement on a single pivotal Phase 3 study.

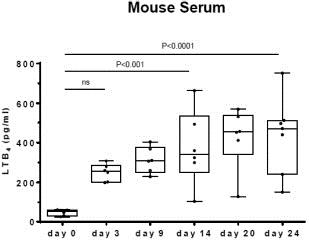

Ubenimex is a well-characterized, oral, small-molecule inhibitor of leukotriene A4 hydrolase, or LTA4H, the enzyme responsible for converting the inflammatory mediator leukotriene A4, or LTA4, to leukotriene B4, or LTB4.

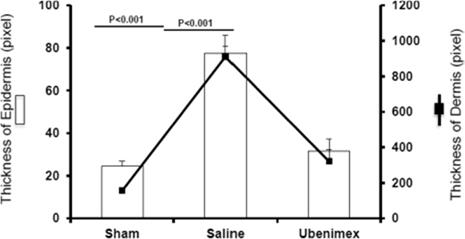

Researchers at Stanford have demonstrated for the first time that LTB4 is elevated in both animal models of lymphedema as well as human lymphedema and that elevated LTB4 is associated with tissue inflammation and impaired lymphatic function. In that research, applying inhibitors of LTB4 promoted physiologic lymphatic repair and reversed lymphedema in treated animals. Eiger is developing ubenimexapproved therapy for lymphedema based on its distinct mechanism of action impacting lymphangiogenesis as published in Science Translation Medicine (Tian et al, May 2017). Wethese indications. There are currently conducting a Phase 2 clinical trial, or the ULTRA Study, treating subjects with both primary lymphedema and secondary lymphedema with ubenimex. We completed enrollment of 54approximately 20 identified patients in the ULTRA StudyU.S. who are eligible for treatment with Zokinvy.

Ubenimex was exclusively licensed from Nippon Kayaku,mortality by 60% (p=0.0064) and increased average survival time by at least 2.5 years. The most commonly reported adverse reactions were gastrointestinal (vomiting, diarrhea, nausea), and most were mild or moderate (Grade 1 or 2) in severity. Many patients with HGPS have received continuous Zokinvy therapy for usemore than 10 years.

In January 2018, Phase 2 LIBERTY study results in PAH demonstrated no improvement overall or in key subgroups for bothlicense agreement with Merck to include not only all uses of LNF related to the primary efficacy endpointtreatment of pulmonary vascular resistance (PVR) and the secondary endpoint of 6-minute walk distance (6MWD). No safety signals attributed to ubenimex were identified in the preliminary analysis. Further analysis of data, including biomarkers is ongoing, although we will discontinue development of ubenimex in PAH based on these results. We plan to continue to study ubenimex in lymphedema.

HGPS, but also progeroid laminopathies.

We

Amgen.

•Advance our existing product candidates through late-stage clinical trials, generating meaningful clinical results;

•Work with U.S. and international regulatory authorities for expeditious, efficient development pathways toward registration;

•Prepare for commercialization of each program;

•Use our industry relationships and experience to source, evaluate and in-license well-characterized product candidates to continue pipeline development; and

|

|

•Identify potential commercial or distribution partners for our products in relevant territories.

Our Product Candidates

Lonafarnib in HDV

Lonafarnib, or LNF, is a small molecule that we in-licensed from Merck in 2010 and that we are advancing for the treatment of HDV infection. LNF is a well-characterized, orally active inhibitor of farnesyl transferase, an enzyme involved in modification of proteins through a process called prenylation. HDV uses this prenylation process inside host liver cells to complete a key step in its life cycle. LNF inhibits the prenylation step of HDV replication inside liver cells and blocks the virus life cycle at the stage of assembly. Since prenylation is carried out by a host enzyme, there is a higher barrier to develop viral resistance mutations to LNF therapy. We have generated clinical results in over 129 HDV-infected patients in Phase 2 trials, across international study sites, demonstrating rapid decreases in HDV viral loads and no measurable levels of resistance. We have completed five Phase 2 clinical trials including Proof of Concept (NIH), LOWR HDV – 1 (Ankara, Turkey), LOWR HDV – 2 study (Ankara, Turkey), LOWR HDV – 3 (NIH) and LOWR HDV – 4 (Hannover, Germany) in over 129 HDV-infected patients, across international study sites, demonstrating rapid decreases in HDV viral loads and no resistance. In February 2018, we met with the FDA and, subject to agreement on a proposed Phase 3 clinical trial design, have an opportunity for a potentially pivotal single Phase 3 trial as the basis for an NDA filing.

Lambda in HDV

Lambda is a well-characterized, late-stage, first in class, type III interferon, or IFN, that we in-licensed from BMS in April 2016 for the treatment of HDV. Lambda stimulates immune responses that are critical for the development of host protection during viral infections. Lambda targets type III IFN receptors which are distinct from the type I IFN receptors targeted by IFN-alfa. These type III receptors are highly expressed on hepatocytes with limited expression on hematopoietic and central nervous system cells, which in BMS’s clinical trials has demonstrated to reduce the off-target effects associated with other IFNs and improve the tolerability of Lambda. Although Lambda does not use the IFN-alfa receptor, signaling through either the lambda or IFN-alfa receptor complexes results in the activation of the same Jak-STAT signal transduction cascade. Lambda has not been approved for any indication. We are developing Lambda as both a monotherapy and a combination therapy with lonafarnib. Currently, we are conducting a Phase 2 monotherapy study using Lambda to treat HDV and have completed recruitment of 33 patients and are currently dosing at four international sites.

As part of the FDA meeting in February 2018, Eiger discussed the potential regulatory pathways for a Lonafarnib / Ritonavir / Lambda combination regimen including possible study designs and clinical endpoints. The current status of discussion with the FDA is as follows:

|

|

Agency has agreed that the next Eiger study can be a single, registration trial in HDV.

Eiger expects written minutes from the agency (by the end of March 2018) and plans to announce additional details on its clinical development efforts in HDV during the second quarter of this year.

Hepatitis Delta Virus Overview

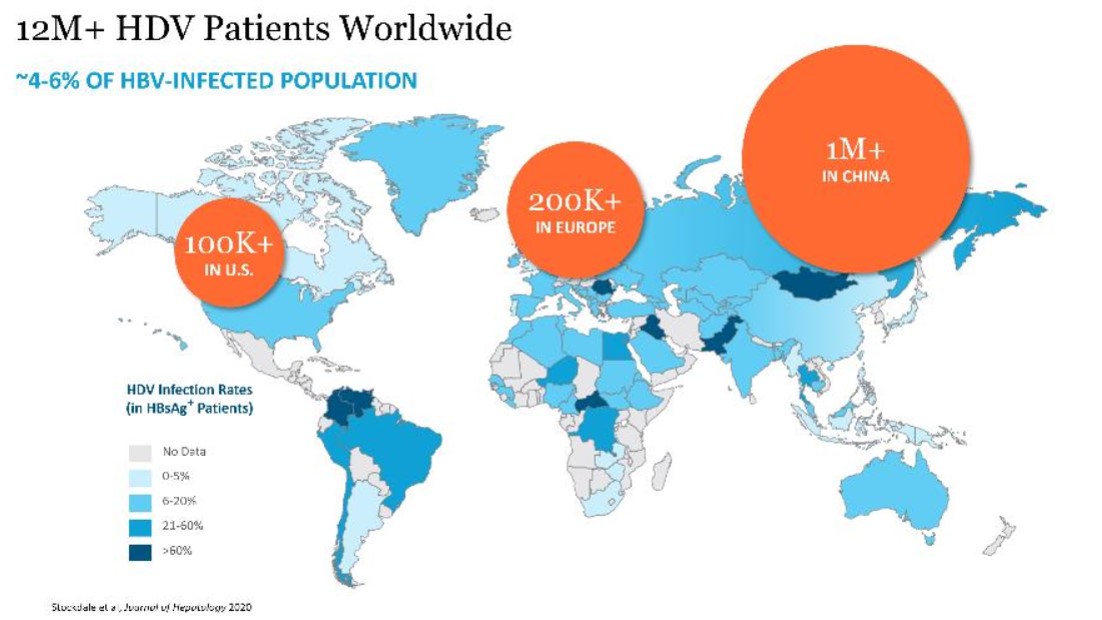

Hepatitis delta infection

HDV is the most severe form of viral hepatitis. HDV can be acquired either by co-infection (a simultaneous co-infection with HDV and HBV) or by super-infection (HDV infection of someone already harboring a chronic HBV infection). Both co-infection and super-infection with HDV result in more severe complications compared to infection with HBV alone. These complications include a greater likelihood of experiencing liver failure in acute infections and a rapid progression to liver cirrhosis, with an increased chance of developing liver cancer in chronic infections. HDV has the highest fatality rate of all the hepatitis infections at up to 20%. Although HDV/HBV simultaneous co-infection in adults usually resolves completely, in some cases it can become fulminant hepatitis, which carries a very high mortality rate. In the case of super-infections, the predominant form of HDV, HDV super-infection leads to a more severe form of disease than chronic HBV mono-infection. In a study published in 1987 in the Journal of Infectious Diseases (Fattovich, G. et al. “Influence of Hepatitis Delta Virus Infection on Progression to Cirrhosis in Chronic Hepatitis Type B,” J Infect Dis, 1987; 155:931), histological liver deterioration was observed in 77% of HBV patients co-infected with HDV over a 15-year follow-up period, versus 30% of patients infected with HBV alone (p<0.01). In a 2013 study of chronic HBV patients published in the Journal of Gastroenterology and Hepatology, (Gish, R. et al. “Coinfection with hepatitis B and D: epidemiology, prevalence and disease in patients in Northern California,” J Gastroenterol Hepatol, 2013; 28(9):1521), cirrhosis was present in 73% of HBV patients co-infected with HDV, compared to only 22% of those infected with HBV alone. Patients co-infected with HDV are more than twice-as-likely to develop liver-related complications, cirrhosis, or require liver transplants than matched patients infected with HBV alone.

There are diagnostic tests in use today in clinical laboratories to detect anti-HDV antibodies in serum. These tests are currently able to detect acute HDV infections after four weeks, but they are poor tests for active HDV infections.

LNF and lambda.

HDV Replication and Farsenylation

Farnesylation

LNFLonafarnib (LNF) for HDV

LNF Clinical Data

LNF has been tested in

•POC Study (Placebo-controlled LNF monotherapy) (N=14)

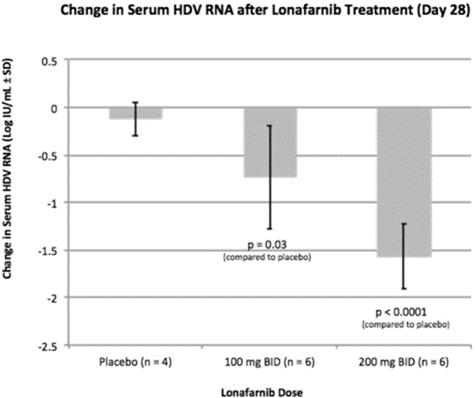

The National Institutes of Health, or the2 NIH conducted a 14 patient, double blind, placebo-controlled, proof of conceptproof-of-concept study which was the first ever to evaluate LNF in patients infected with HDV. Patients either received LNF 100 mg (group 1) or LNF 200 mg (group 2) twice daily, or BID, for 28 days with six months of follow-up. Both groups enrolled six treatment participants and two placebo participants. The two placebo patients from group 1 later received open-label LNF as group 2 participants. Doses of 100 mg and 200 mg of LNF administered BID demonstrated a dose dependent decrease in viral loads of 0.73 and 1.54 log decline, respectively, in 28 days. The results were published in The Lancet Infectious Diseases Journal in 2015.

As shown in the table above, statistically significant decreases in HDV RNA viral load were demonstrated by both the 100 mg ofwith two LNF BID (p=0.03) and 200 mg of LNF BID (p<0.0001) active groups versus the placebo.placebo for 28-days. A statistically significant correlation between increasing LNF serum levels and decreasing HDV RNA viral loads was also demonstrated. observed, demonstrating that higher serum levels resulted in greater decline in HDV RNA.

A p-value is a statistical measure of the probability that the difference in two values could have occurred by chance. The smaller the p-value, the greater the statistical significance and confidence in the result. Typically, results are considered statistically significant if they have a p-value less than 0.05, meaning that there is less than a one-in-20 likelihood that the observed results occurred by chance. The FDA requires that sponsors demonstrate the effectiveness and safety of their product candidates through the conduct of adequate and well-controlled studies in order to obtain marketing approval. Typically, the FDA requires a p-value of less than 0.05 to establish the statistical significance of a clinical trial, although there are no laws or regulations requiring that clinical data be statistically significant, or that require a specific p-value, in order for the FDA to grant approval.

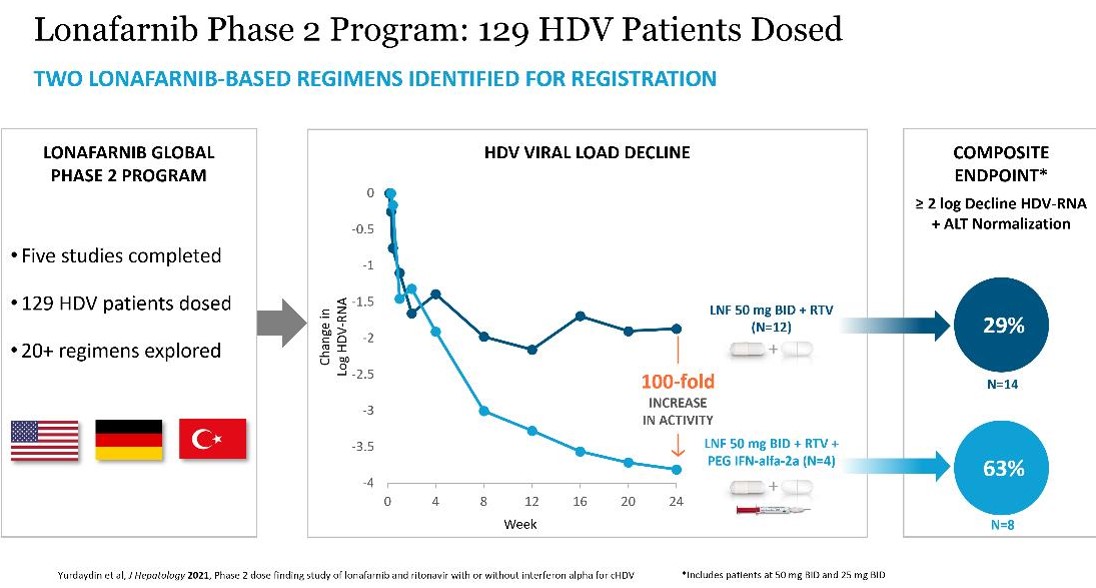

In 2014, we initiated the LOWR HDV (Lonafarnib With Ritonavir in HDV) Phase 2 Program. The objective of this program is to identify dose(s) and regimen(s) for registration. To date, 129 HDV subjects have been dosed with LNF in multiple studies including:

LOWR HDV – 1 Study (Combination: LNF with RTV or PEG IFN-α)

LOWR HDV – 2 Study (Dose Finding: LNF + RTV ± PEG IFN-α)

LOWR HDV – 3 Study (QD Dosing: LNF + RTV)

LOWR HDV – 4 Study (Dose-Escalation: LNF + RTV)

LOWR HDV—1 (LOnafarnib With and without Ritonavir in HDV - 1) Phase 2 Study

The LOWR HDV—1 trial studied LNF in 21 subjects who were enrolled into one of seven groups for durations of 4-12 weeks (three patients in each group): LNF 200 mg BID (12 weeks), LNF 300 mg BID (12 weeks), LNF 100 mg TID (5 weeks), LNF 100 mg BID + RTV 100 mg QD (8 weeks), LNF 100 mg BID + PEG-IFN-alfa 180 mcg QW (8 weeks), LNF 200 mg BID + PEG-IFN-alfa 180 mcg QW (8 weeks) and LNF 300 mg BID + PEG-IFN-alfa 180 mcg QW (8 weeks).

In LNF monotherapy treatment groups, increasing the dosageRTV-boosting of LNF from 100 mg three times a dayfor up to 200 mg twice a day to 300 mg twice a day led to greater reductions in viral loads at Week 4 (1.2 logs versus 1.6 logs versus 2.0 logs). However, increasing the dosage24 weeks of LNF also led to increasing gastrointestinal, or GI, intolerability and was not considered for longer term dosing.

In the LNF-RTV combination arm of LOWR HDV—1, 100 mg of LNF BID was combined with 100 mg of RTV once daily. RTV is a pharmacokinetic or PK,(PK) enhancer known to inhibit the metabolism of LNF, allowing lower doses of LNF to be administered, while resulting in higher systemic concentrations of LNF.

The additionPhase 2 LOWR HDV studies identified two LNF-based regimens that can achieve clinically meaningful composite endpoints of 100 mg of RTV once daily to 100 mg LNF BID led to a four- to five-fold increase in the serum concentration of LNF in treated patients compared to LNF 100 mg BID alone. This dose combination led to a mean viral load decrease of 2.4 logs after 28 days of treatment, which is a greater than three-fold reduction in viral load compared to the NIH data of a mean viral load decrease of 0.74 logs after 28 days of monotherapy treatment of 100 mg LNF BID. Extending dosing to Week 8 resulted in a 3.2 viral load decline. Importantly, when therapy was discontinued the viral loads rebounded, which we believe indicates that LNF treatment was eliciting an antiviral effect. The addition of 180 mcg of PEG-IFN-alfa once weekly to 100 mg LNF BID was also more active in reducing HDV RNA versus studies with either agent alone. This dose combination led to a greater reduction in viral load, compared to the NIH results on monotherapy treatment with 100 mg LNF BID, with a mean decrease of 0.74 logs versus 1.8 logs after four weeks. Extending dosing to eight weeks resulted in a 3.0 logs viral load decline. Importantly, when therapy was discontinued the viral loads rebounded. The mean change in HDV RNA for the patients receiving eight weeks of treatment of 100 mg LNF BID in combination with RTV and 100 mg LNF BID in combination with PEG-IFN-alfa is shown below. Viral loads for LNF 200 mg and 300 mg BID in combination with PEG-IFN-alfa was not shown since these dosages were intolerable (all patients discontinued) for future development. LOWR HDV-1 did not include a placebo arm and, as such, statistical significance could not be determined.

Liver enzymes are often elevated during infections with viral hepatitis, a sign of damage being done to liver cells. In both LNF combination cohorts, all HDV patients enrolled had elevated alanine aminotransferase, or ALT, a liver enzyme that is a surrogate marker of inflammation, prior to receiving any treatment. By the end of eight weeks of combination therapy with LNF and RTV or LNF and PEG-IFN-alfa, all patients’ ALT liver enzymes normalized or trended toward normal while on therapy.

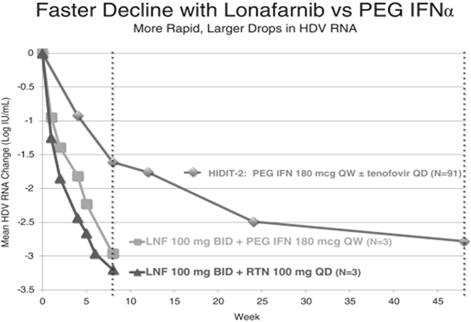

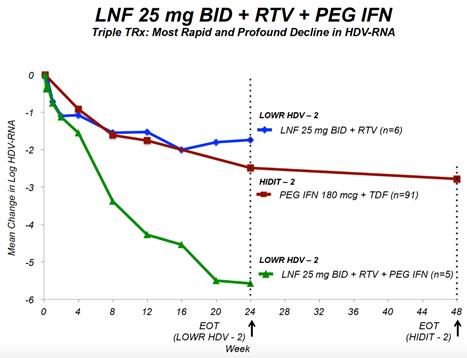

In the three patients receiving LNF in combination with RTV and the three patients receiving LNF in combination with PEG-IFN-alfa, we observed decreases in HDV RNA viral load of approximately 3.2 logs and 3.0 logs after eight weeks of treatment, respectively. For comparison, and as shown in the figure below, published data from the HIDIT-2 trial of PEG-IFN-alfa in 91 HDV infected patients demonstrated a mean decline in HDV RNA of approximately 1.6 logs and 2.7 logs after 8 weeks and 48 weeks, respectively. The HIDIT-2 (Hep-Net International Delta Hepatitis International Trial-II) was a multicenter randomized trial studying effects of PEG-IFN-alfa plus tenofovir in chronic HDV patients, and is the largest clinical study to date in HDV. The HIDIT-2 trial was conducted on 91 patients, whereas the LOWR HDV—1 study was conducted on an aggregate of 21 patients, with three patients per treatment arm. If the LOWR HDV—1 trial was conducted on a larger group of patients, the mean HDV RNA decline may differ≥ 2 logs from the 3.2 logbaseline and 3.0 log declines after eight weeksnormalized ALT at Week 24: all-oral regimen of treatment observed in the three patient arms receiving LNF combination treatment in the LOWR HDV—1 trial. However, based on clinical results to date, we expect all patients who are treated with LNF to show a viral load response.

LOWR HDV—2 (LOnafarnib With Ritonavir in HDV - 2) Phase 2 Study

LOWR HDV – 2 is a dose-finding Phase 2 study of multiple doses of LNF boosted by RTV with and without PEG-IFN-alfa in 58 subjects for 24-48 weeks of treatment with 24 weeks of follow-up, with the aim to identify regimen(s) with improved tolerability for the longer-term registration studies. LOWR HDV – 2 (conducted as an extension of LOWR HDV – 1, collectively EIG-300) was conducted at Ankara University in Turkey and we have identified and certain good clinical practice violations at this site that may impact certain data and information that we plan to submit to the FDA.

Fifty-eight subjects were enrolled into one of ten groups of different LNF with RTV and/or PEG-IFN-alfa combinations for 12 or 24 or 48 weeks as follows: Group 1: LNF 100 mg BID + RTV 50 mg BID; Group 2: LNF 100 mg BID + RTV 100 mg QD; Group 3: LNF 150 mg QD + RTV 100 mg QD; Group 4: LNF 100 mg QD + RTV 100 mg QD; Group 5: LNF 75 mg BID + RTV 100 mg BID with PEG-IFN-alfa 180 mcg QW added at week 12; Group 6: LNF 50 mg BID +boosted with RTV 100 mg BID; Group 7:twice daily and combination regimen of LNF 50 mg BID + RTV 100 mg BID with PEG-IFN-alfa 180 mcg QW added at week 12; Group 8: LNF 50 mg BID + RTV 100 mg BID + PEG-IFN-alfa 180 mcg QW; Group 9: LNFor 25 mg BID +boosted with RTV 100 mg BID; and Group 10: LNF 25 mg BID + RTV 100 mg BID + PEG-IFN-alfa 180 mcg QW.

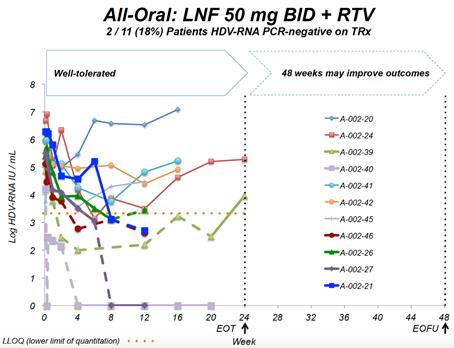

End of study results were presented at EASL 2017 in Amsterdam, Netherlands. Key findings were that in the all-oral LNF 50 mg BID + RTV 100 mg BID regimen, 7 of 14 (50%) patients demonstrated ≥ 2 log decline or PCR-negative at Week 24. Combination regimens of LNF 25 mg BID + RTV 100 mg BID + PEG IFN-α 180 mcg QW resulted in the highest response rates of 5 of 7 (71%) patients achieving ≥ 2 log decline or PCR-negative at Week 24 and the majority of patients normalized ALT at Week 24. In addition, GI AEs predominantly were predominantly mild and moderate. Reported data used a research use only assay at Ankara University.

LOWR HDV—3 (LOnafarnib With Ritonavir in HDV - 3) Phase 2 Study

LOWR HDV – 3 was a double-blind, randomized, placebo-controlled study designed to evaluate the efficacy and tolerability of once-daily doses of LNF – 50 mg, 75 mg and 100 mg – each combined with RTV 100 mg once daily for 12 (N=9) or 24 (N=12) weeks. Twenty-one patients with chronic hepatitis delta were randomized into one of six treatment groups. LOWR HDV – 3 was conducted at the National Institutes of Health (NIH) Bethesda, MD. This study has completed.

End of study results were presented at EASL 2017 in Amsterdam, Netherlands. After 12 weeks of therapy, the median log HDV RNA decline from baseline was 1.60 log IU/mL (LNF 50 mg), 1.33 (LNF 75 mg) and 0.83 (LNF 100 mg) (p=0.001)PEG IFN-alfa-2a (see figures below). In subjects treated for 24 weeks, HDV RNA levels significantly differed from placebo (p=0.04). During the study, 6 patients achieved ≥ 2 log decline in HDV RNA; HDV RNA levels became undetectable in one subject and < LLOQ in three subjects. ALT normalization was achieved in 47% of patients. Adverse events were mild to moderate and included nausea, vomiting, dyspepsia, anorexia, diarrhea, and weight loss. There were no treatment discontinuations for adverse events.

The LOWR HDV-3 study demonstrated that the all-oral combination of once-daily ritonavir boosted lonafarnib was safe and tolerable in patients for up to 6 months of therapy and demonstrated antiviral activity. Reported data used Robogene® HDV RNA Quantification Kit 2.0.

LOWR HDV—4 (LOnafarnib With Ritonavir in HDV - 4) Phase 2 Study

LOWR HDV – 4 was an open-label study to evaluate the efficacy and tolerability of dose-escalation of LNF combined with RTV administered twice daily for dosing durations of 24 weeks. Fifteen patients were initiated at LNF 50 mg and RTV 100 mg twice daily, and dose-escalated up to LNF 100 mg twice daily at the discretion of the investigator and patient tolerability. LOWR HDV – 4 was conducted at Hannover Medical School in Hannover, Germany.

End of study results were presented at EASL 2017 in Amsterdam, Netherlands. At end of treatment, 5 of 15 (33%) patients reached and maintained LNF 100 mg BID + RTV through EOT; 1 of 5 (20%) patients achieved undetectable HDV-RNA, and 1 of 5 (20%) patients achieved HDV-RNA < LLOQ. ALT normalization was demonstrated in 53% patients.

In follow-up visits, 1 of 15 (7%) patients remained HDV-RNA < LLOQ and 3 of 15 (20%) patients dropped > 2 logs from baseline. Gastrointestinal AEs were mostly grade 1-2; 8 of 15 (53%) patients required dose reduction and 2 of 15 (13%) patients were discontinued. Reported data used Robogene® HDV RNA Quantification Kit 2.0.

Key findings from the LOWR HDV Program demonstrate that LNF (all-oral) can achieve HDV-RNA negativity on-treatment, and that the most robust HDV-RNA on-treatment on-anti-viral activity is observed in LNF triple therapy with PEG-IFN-alfa. Findings demonstrate that LNF-based regimens can normalize ALTs in 60% of patients. WithThese dosing regimens of LNF 25 and 50 mg BID identifiedwere associated with predominantly grade 1 GI AEs amongst per-protocol treated patient.

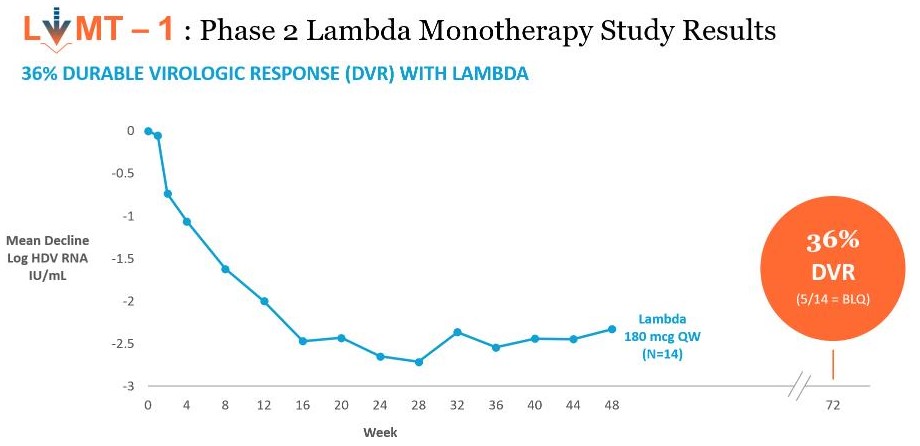

Our Second HDV Therapeutic Approach:Program: Peginterferon Lambda (lambda) for HDV

demonstrated to reduce the off-target effects associated with other IFNs and improve the tolerability of Lambdalambda (Chan 2016). Although Lambdalambda does not use the IFN-alfa receptor, signaling through either the IFN-lambda or IFN-alfa receptor complexes results in the activation of the same Jak-STAT signal transduction cascade.

a combination with LNF + RTV.

A head-to-head study comparing the safety and efficacy of lambda versus PEG-IFN-alfa was reported in 2016 by Chan et al. In this study, HBeAg(+) patients were treated with either Lambda (n=80) or PEG-IFN-alfa (n=83) for 48 weeks. A subset of on-treatment safety data is summarized in the table below. Lambda is generally better-tolerated when compared to PEG-IFN-alfa. Lower rates of flu-like symptoms and musculoskeletal symptoms were observed with lambda versus PEG-IFN-alfa.

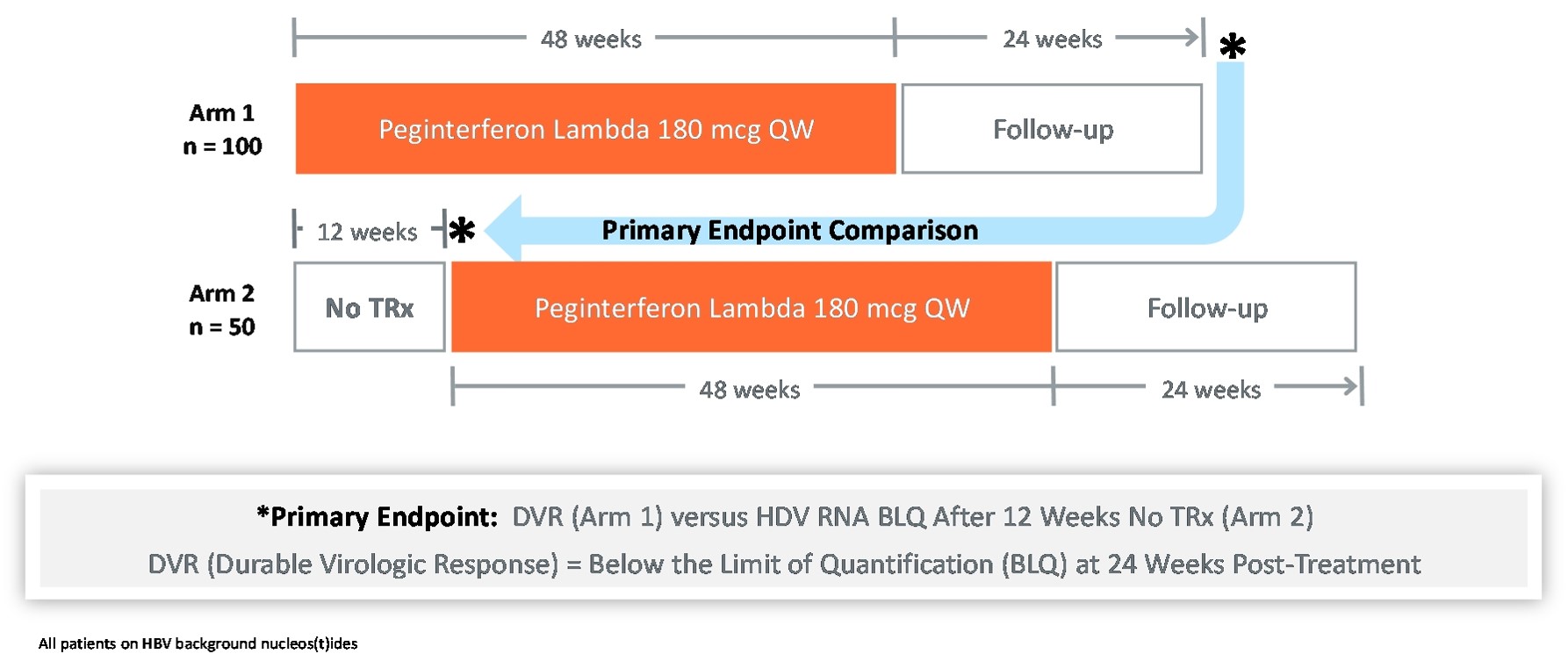

LIMT HDV

The LIMT HDV Phase 2 Clinical Trial is

Interim

Interim data shows that Lambda demonstrates comparable anti-HDV activity to historical PEG-alfa and that Lambda is well toleratedpatients were HDV-RNA negative at end of treatment. At Week 48, patients in the majority120 μg lambda treated group experienced a 1.5 log

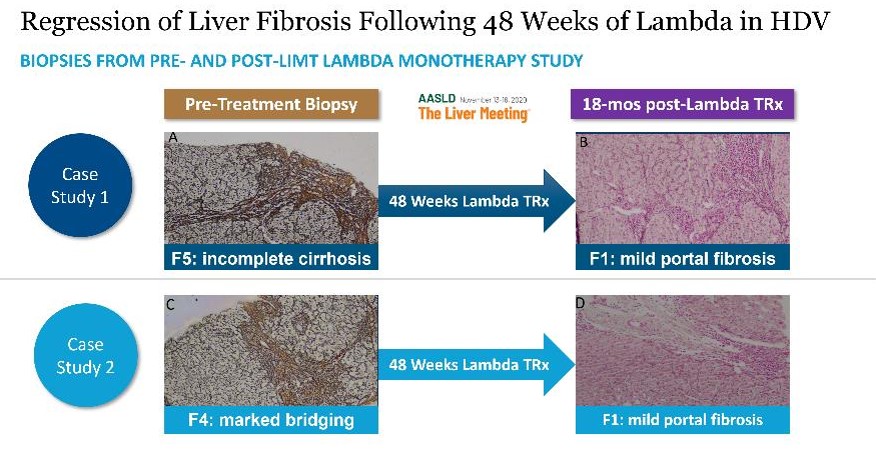

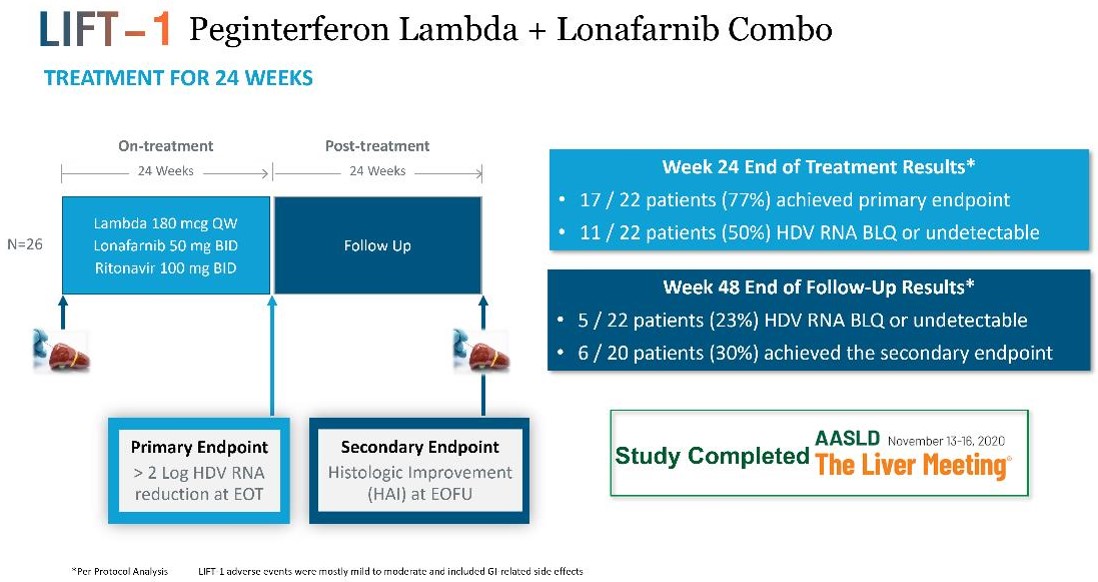

condition. Severe cases have historically been surgically managed with near-total to total pancreatectomy, which results in insulin dependent diabetes and is associated with a greater than 6% surgical mortality risk. called PREVENT in October 2018. The PBH. To date, our third-party manufacturers have met the manufacturing requirements for the product candidates. We expect third-party manufacturers to be capable of providing sufficient quantities of our product candidates to meet anticipated All of our third-party manufacturers are subject to periodic audits to confirm compliance with applicable regulations and must pass inspection before we can manufacture our products for commercial sales. GMP products from all CMOs. third-party CMOs. We also rely on trade secrets, know-how, and continuing innovation to develop and maintain our competitive position. We cannot be certain that patents will be granted with respect to any of our pending patent applications or with respect to any patent applications filed by us in the future, nor can we be sure that any of our existing patents or any patents granted to us in the future will be commercially useful in protecting our technology. intellectual property owned by others; (iv) preserve the confidentiality of our trade secrets, and (v) operate without infringing the valid and enforceable patents and other proprietary rights of others. In addition to maintaining our existing proprietary assets, we seek to strengthen our proprietary positions when economically reasonable to do so. Our ability to augment our proprietary position relies on its: (i) know-how; (ii) ability to access technological innovations, and (iii) ability to in-license technology when appropriate. (PCT). Other Proprietary Rights and Processes There are other therapies that are used or may be used for our targeted indications, and these other products in clinical development or marketed for other indications may be used in competition with our product candidates if we are able to identify potential market opportunities of interest. For example, HDV has not been generally identified as a target for development compared to hepatitis B or hepatitis C, and products on the market or in development for those indications may potentially be tested in HDV as the understanding of the potential medical need for therapies in this indication become more widely understood. the study is expected to complete by the end of 2023. The term of the EGI APA extends until expiration of all payment obligations, and we may terminate the agreement upon notice to EGI. EGI may terminate the EGI APA if we fail to use commercially reasonable efforts to develop and commercialize licensed products. In addition, each party may terminate the EGI APA for the other party’s uncured material breach or bankruptcy. In the event of any termination, other than termination by us for EGI’s breach, we will assign the purchased assets back to EGI. Asset Purchase Agreement with Tracey McLaughlin and Colleen Craig avexitide. License Agreement with Bristol-Myers Squibb Company Under the BMS License Agreement, BMS granted us an exclusive, worldwide, license to research, develop, manufacture, and sell products within the specified periods, subject to our extension rights. Preclinical tests include laboratory evaluation of the product’s chemistry, formulation, and toxicity, as well as animal studies to characterize and assess the potential safety, •Phase 1. The •Phase 2. The trials are conducted using a limited patient population for the purposes of preliminarily determining the effectiveness of the •Phase 3. If a compound demonstrates evidence of efficacy and has an acceptable safety profile in the Phase 2 clinical trials, then Phase 3 clinical trials are undertaken to obtain additional information from an expanded and diverse patient population, at multiple, geographically dispersed clinical trial sites, in randomized controlled studies often with a double-blind design to maximize the reproducibility of the study results. Typically, a minimum of two positive Phase 3 clinical trials are submitted to support the product’s marketing application. These Phase 3 clinical trials are intended to provide sufficient data demonstrating evidence of the safety, efficacy, purity and Sponsors of clinical trials for investigational After the FDA evaluates the application and conducts its inspections, it issues either an approval letter or a complete response letter. A complete response letter generally outlines the deficiencies contained in the submission and may require substantial additional testing or information in order for the FDA to reconsider the application, including potentially significant, expensive and time-consuming requirements related to clinical trials, nonclinical studies or manufacturing. Even if such data are submitted, the FDA may ultimately decide that the NDA or BLA does not satisfy the criteria for approval. Data from clinical trials are not always conclusive, and the FDA may interpret data differently than we do. If and when those deficiencies have been addressed to the FDA’s satisfaction in a resubmission of the application, the FDA will typically issue an approval letter. The FDA has committed to reviewing such resubmissions in two or six months depending on the type of additional information requested. FDA approval is never guaranteed. The FDA may refuse to approve an application if applicable regulatory criteria are not satisfied. industry-sponsored scientific and educational activities and promotional activities involving the Internet. Failure to comply with these requirements can result in adverse publicity as well as significant penalties, including the issuance of warning letters directing a company to correct any deviations from the FDA’s standards. The FDA may also impose a requirement that future advertising and promotional materials be pre-cleared by the FDA, and the product. intended to induce prescribing, purchases or recommendations may be subject to scrutiny if they do not qualify for an exception or safe harbor. Failure to meet all of the requirements of a particular applicable statutory exception or regulatory safe harbor does not make the conduct per se illegal under the Anti-Kickback Statute. Instead, the legality of the arrangement will be evaluated on a case-by-case basis based on a cumulative review of all of its facts and circumstances. Several courts have interpreted the statute’s intent requirement to mean that if any one purpose of an arrangement involving remuneration is to induce referrals of federal healthcare covered business, the Anti-Kickback Statute has been violated. Violations of the federal Anti-Kickback Statute are punishable by imprisonment for up to ten years and statutory fines of up to $100,000. Additional criminal fines can be imposed under federal U.S. criminal procedure laws. If our operations are found to be in violation of any of the Additionally, coverage policies and third‑party reimbursement rates may change at any time. Therefore, even if favorable coverage and reimbursement status is attained for one or more of our products, less favorable coverage policies and reimbursement rates may be implemented in the future. and Human Capital We have also agreed with The Progeria Research Foundation to make Zokinvy available to progeria (HGPS and processing-deficient progeroid laminopathies) patients under an expanded access program that may not result in payment to us. Future clinical trials of new therapies for progeria conducted by third parties may also result in patients converting from commercially reimbursed Zokinvy to product provided through clinical trials and result in lower revenues received by us. •continue the clinical development of our product candidates; •in-license or acquire additional product candidates; •undertake the manufacturing or have manufactured our product candidates; •advance our programs into larger, more expensive clinical studies; •identify •seek regulatory and marketing approvals and reimbursement for our product candidates; •establish a sales, marketing, and distribution infrastructure to commercialize any products for which we may obtain marketing approval and market ourselves; •seek to identify, assess, acquire, and/or develop other product candidates; •make milestone, royalty or other payments under third-party license agreements; •seek to maintain, protect, and expand our intellectual property portfolio; •seek to attract and retain skilled personnel; •create additional infrastructure to support our operations as a public company and our product development and planned future commercialization efforts; and experience any delays or encounter issues with the development and potential for regulatory approval of our clinical candidates such as safety issues, clinical trial accrual delays, longer follow-up for planned studies, additional major studies, or supportive studies necessary to support marketing approval. •completing research and development of our product candidates; •obtaining additional and maintaining current regulatory and marketing approvals for our product candidates; •manufacturing product candidates and establishing and maintaining supply and manufacturing relationships with third parties that meet regulatory requirements and our supply needs in sufficient quantities to meet market demand for our product candidates, if approved; •marketing, launching and commercializing product candidates for which we obtain regulatory and marketing approval, either directly or with a collaborator or distributor; •gaining market acceptance of our product candidates as treatment options; •addressing any competing products; •protecting and enforcing our intellectual property rights, including patents, trade secrets, and know-how; •negotiating favorable terms in and maintaining any collaboration, licensing, or other arrangements into which we may enter; •obtaining reimbursement or pricing for our product candidates that supports profitability; and •attracting, hiring, and retaining qualified personnel. Even if regulatory approval or authorization for use in these jurisdictions. product candidates significantly less competitive and potentially not viable investments for further development. Although we •the FDA or comparable foreign regulatory authorities may disagree with the design, size or implementation of our clinical studies; •the population studied in the clinical program may not be sufficiently broad or representative to assure safety in the full population for which we seek approval; •the FDA or comparable foreign regulatory authorities may disagree with our interpretation of data from our development efforts; •the data collected from clinical studies of our product candidates may not be sufficient or complete or meet the regulatory requirements to support the submission of •the FDA or comparable foreign regulatory authorities may find failures in our manufacturing processes, validation procedures and specifications, or facilities of our third-party manufacturers with which we contract for clinical and commercial supplies that may delay or limit our ability to obtain regulatory approval for our product candidates; and •the approval policies or regulations of the FDA or comparable foreign regulatory authorities may significantly change in a manner rendering our NDA, BLA or other submission insufficient for approval. conduct larger, well-controlled studies in our proposed indications to verify the results obtained to date and to support any regulatory submissions for further clinical development. A number of companies in the biopharmaceutical industry have suffered significant setbacks in advanced clinical studies due to lack of efficacy or adverse safety profiles despite promising results in earlier, smaller clinical studies. Moreover, clinical data are often susceptible to varying interpretations and analyses. We do not know whether any Phase 2, Phase 3, or other clinical studies we have conducted or may conduct will demonstrate consistent or adequate safety, efficacy, For example, in 2018 we announced negative results from two of our Phase 2 clinical trials of ubenimex in two different indications, and as a result we have terminated further development of ubenimex. •delays in reaching agreement on acceptable terms with •delays in obtaining required Institutional Review Board •failure to permit the conduct of a study by regulatory authorities, after review of an investigational new drug •delays in recruiting qualified patients, or patients dropping out of, in our clinical •failure to perform the clinical studies in accordance with the FDA’s •occurrence of adverse events associated with our product candidates; •changes in regulatory requirements and guidance that require amending or submitting new clinical protocols; •the cost of clinical studies of our product candidates; •negative or inconclusive results from our clinical trials which may result in our deciding, or regulators requiring us, to conduct additional clinical studies or abandon development programs in other ongoing or planned indications for a product candidate; and •delays in reaching agreement on acceptable terms with third-party manufacturers and the time for manufacture of sufficient quantities of our product candidates for use in clinical studies. For example, the ECG abnormalities seen with lonafarnib in HGPS and PL patients has the potential to impact the labeling for lonafarnib-based regimens for HDV. Our avexitide product candidate has been studied in 39 HI patients and over 70 PBH patients, and the most common adverse events are injection site bruising/reaction, nausea, and headache. There is no guarantee that additional or more severe side effects will not be identified through ongoing clinical studies for other uses of avexitide in clinical trials. •regulatory authorities may withdraw approvals of such products; •regulatory authorities may require additional warnings on the label; •we could be sued and held liable for harm caused to patients; and •our reputation may suffer. •issue warning letters; •impose civil or criminal penalties; •suspend or withdraw regulatory approval; •suspend any of our ongoing clinical studies; •refuse to approve pending applications or supplements to approved applications submitted by us; •impose restrictions on our operations, including closing our contract manufacturers’ facilities; or •require a product recall. candidate products. •We may be unable to identify manufacturers on acceptable terms or at all; •Our third-party manufacturers might be unable to timely formulate and manufacture our product or produce the quantity and quality required to meet our clinical and commercial needs, if any; •Contract manufacturers may not be able to execute our manufacturing procedures appropriately; •Our future contract manufacturers may not perform as agreed or may not remain in the contract manufacturing business for the time required to supply our clinical trials or to successfully produce, store and distribute our products; •Manufacturers are subject to ongoing periodic unannounced inspection by the FDA and corresponding state agencies to ensure strict compliance with cGMP and other government regulations and corresponding foreign standards. We do not have control over third-party manufacturers’ compliance with these regulations and standards; •We may not own, or may have to share, the intellectual property rights to any improvements made by our third-party manufacturers in the manufacturing process for our product candidates; and •Our third-party manufacturers could breach or terminate their agreement with us. Each of these risks could delay our clinical trials, the approval Moreover, we expect that the sales of Zokinvy to patients with progeria will have limited profits given the ultra-rare nature of these diseases. substantially greater financial, technical, and other resources, such as larger research and development staff and experienced marketing and manufacturing organizations. Additional mergers and acquisitions in the biotechnology and pharmaceutical industries may result in even more resources being concentrated in our competitors. As a result, these companies may obtain regulatory approval more rapidly than we are able to and may be more effective in selling and marketing their products as well. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large, established companies. Competition may increase further as a result of advances in the commercial applicability of technologies and greater availability of capital for investment in these industries. Our competitors may succeed in developing, acquiring, or licensing on an exclusive basis, products that are more effective or less costly than any product candidate that we may develop, or achieve earlier patent protection, regulatory approval, product commercialization, and market penetration than we do. Additionally, technologies developed In addition, we have established an expanded access program in order to make Zokinvy available for patients with progeria, which requires additional resources and costs to support. •the timing of our receipt of any marketing and commercialization licensures; •the prevalence and severity of the disease and any side effects; •the clinical indications for which approval is granted, including any limitations or warnings contained in a product’s approved labeling; •the convenience and ease of administration; •the cost of treatment; •the willingness of the patients and physicians to accept these •the marketing, sales and distribution support for the product; •the pricing and availability of third-party insurance coverage and reimbursement. For example, Zokinvy for patients with HGPS and processing-deficient progeroid laminopathies provided under an expanded access program may not result in reimbursement. In the United States, parties may challenge their validity, enforceability, or scope, which may result in such patents being narrowed, found unenforceable or invalidated. Furthermore, even if they are unchallenged, our patents and patent applications may not adequately protect our intellectual property, provide exclusivity for our product candidates, or prevent others from designing around our claims. Any of these outcomes could impair our ability to prevent competition from third parties, which may have an adverse impact on our business. Although we have licensed a number of patents covering methods of use and certain compositions of matter, we do not have complete patent protection for our product candidates. For example, in connection with the are typically not published until 18 months after filing, or in some cases not at all. We therefore cannot be certain that it or our licensors were the first to make the invention claimed in our owned and licensed patents or pending applications, or that we or our licensor were the first to file for patent protection of such inventions. Assuming the other requirements for patentability are met, in the United States prior to March 15, 2013, the first to make the claimed invention is entitled to the patent, while outside the United States, the first to file a patent application is entitled to the patent. After March 15, 2013, under the Leahy-Smith America Invents Act through development. Accordingly, there may be third-party patents that would impair our ability to commercialize product candidates and we cannot assure you that we could obtain a license, or even if available, whether such license might be obtained on commercially reasonable terms. Even in those situations where we conduct a freedom to operate analysis, there can be no assurance that we would identify all relevant or necessary patents and patent applications that may apply to the manufacture and commercialization of our product candidates. Because patent applications can take many years to issue, there may be currently pending patent applications that may later result in issued patents that our product candidates may If we are unable to successfully obtain and maintain rights to required third-party intellectual property, we may have to abandon development of that product candidate or pay additional amounts to the third party, and our business and financial condition could suffer. If we fail to comply with obligations in the agreements under which we license intellectual property and other rights from third parties or otherwise experience disruptions to our business relationships with our licensors, we could lose license rights that are important to our business. We may not be able to protect our intellectual property rights throughout the world. on January 3, 2023, Sriram Ryali notified the Company of his resignation as the Company’s Chief Financial Officer, effective January 20, 2023, and on February 17, 2023, Erik Atkisson resigned as our General Counsel, Corporate Secretary and Chief Compliance Officer. business and result in increased costs or loss of revenue, other financial and reputational harm to us, theft of •our research or business development methodology or search criteria and process may be unsuccessful in identifying potential product candidates; •we may not be able or willing to assemble sufficient resources to acquire or discover additional product candidates; •our product candidates may not succeed in preclinical or clinical testing; •our potential product candidates may be shown to have harmful side effects or may have other characteristics that may make the products unmarketable or unlikely to receive marketing approval; •competitors may develop alternatives that render our product candidates obsolete or less attractive; •product candidates we develop may be covered by third parties’ patents or other exclusive rights; •the market for a product candidate may change during our program so that such a product may become unreasonable to continue to develop; •a product candidate may not be capable of being produced in commercial quantities at an acceptable cost, or at all; and •a product candidate may not be accepted as safe and effective by patients, the medical community, or third-party payors. Further, it is possible that additional governmental action is taken in response to the COVID-19 pandemic. •the federal Anti-Kickback Statute, which prohibits, among other things, persons from knowingly and willfully soliciting, receiving, offering or paying anything of value as remuneration, directly or indirectly, to induce, or in return for, the purchase or recommendation of an item or service reimbursable under a federal healthcare program, such as the Medicare and Medicaid programs; •federal civil and criminal false claims laws and civil monetary penalty laws, which prohibit, among other things, individuals or entities from knowingly presenting, or causing to be presented, claims for payment from Medicare, Medicaid, or other third-party payors that are false or fraudulent; •The Physician Payments Sunshine Act, which requires manufacturers of drugs, devices, biologics, and medical supplies to report annually to •state law equivalents of each of the above federal laws, such as anti-kickback and false claims laws that may apply to items or services reimbursed by any third-party payors, including commercial insurers, state laws that require pharmaceutical companies to comply with the pharmaceutical industry’s voluntary compliance guidelines and the relevant compliance guidance promulgated by the federal government, or otherwise restrict payments that may be made to healthcare providers and other potential referral sources; state laws that require drug manufacturers to report information related to payments and other transfers of value to physicians and other healthcare providers or marketing We face potential product liability, and, if successful claims are brought against us, we may incur substantial liability and costs. If the use or misuse of our product candidates harm patients or is perceived to harm patients even when such harm is unrelated to our product candidates, our regulatory approvals could be revoked or otherwise negatively impacted, and we could be subject to costly and damaging product liability claims. •impairment of our business reputation; •initiation of investigations by regulators; •withdrawal of clinical trial participants; •costs due to related litigation; •distraction of management’s attention from our primary business; •substantial monetary awards to patients or other claimants; •the inability to commercialize our product candidates; •product recalls, withdrawals or labeling, marketing or promotional restrictions; and •decreased demand for our product candidates, if approved for commercial sale. commercialization efforts, research and development efforts and business operations, environmental damage resulting in costly clean-up and liabilities under applicable laws and regulations governing the use, storage, handling, and disposal of these materials and specified waste products. Although we believe that the safety procedures utilized by our licensors and our third-party manufacturers for handling and disposing of these materials generally comply with the standards prescribed by these laws and regulations, we cannot guarantee that this is the case or eliminate the risk of accidental contamination or injury from these materials. In such an event, we may be held liable for any resulting damages and such liability could exceed our resources and state or federal or other applicable authorities may curtail our use of certain materials and/or interrupt our business operations. Furthermore, environmental laws and regulations are complex, change frequently, and have tended to become more stringent. We cannot predict the impact of such changes and cannot be certain of our future compliance. We do not currently carry biological or hazardous waste insurance coverage. operations and prospects. region may disrupt our supply chain or limit our ability to obtain sufficient materials for our drug products. treat COVID-19. In addition, to the extent the ongoing COVID-19 pandemic adversely affects our business and results of this ‘‘Risk Factors’’ section. •results or delays in preclinical studies or clinical trials; •our decision to initiate a clinical trial, not to initiate a clinical trial or to terminate an existing clinical trial; •unanticipated serious safety concerns related to the use of any of our product candidates; •reports of adverse events in other gene therapy products or clinical trials of such products; •inability to obtain additional funding; •any delay in filing an IND, NDA, BLA, or •our ability to obtain regulatory approvals for our product candidates, and delays or failures to obtain such approvals; •failure of any of our product candidates, if approved, to achieve commercial success; •failure to obtain •failure to maintain our existing third-party license and supply agreements; •failure by our licensors to prosecute, maintain, or enforce our intellectual property rights; •changes in laws or regulations applicable to our product candidates; •adverse regulatory authority decisions; •introduction of new products, services, or technologies by our competitors; •failure to meet or exceed financial and development projections we may provide to the public; •failure to meet or exceed the financial and development projections of the investment community; •the perception of the pharmaceutical industry by the public, legislatures, regulators, and the investment community; •announcements of significant acquisitions, strategic partnerships, joint ventures, or capital commitments by us or our competitors; •disputes or other developments relating to proprietary rights, including patents, litigation matters, and our ability to obtain patent protection for our technologies; •additions or departures of key personnel; •significant lawsuits, including patent or stockholder litigation; •if securities or industry analysts do not publish research or reports about our business, or if they issue adverse or misleading opinions regarding our business and stock; •changes in the market valuations of similar companies; •general market or macroeconomic conditions; •sales of our common stock by us or our stockholders in the future; •trading volume of our common stock; •announcements by commercial partners or competitors of new commercial products, clinical progress or the lack thereof, significant contracts, commercial relationships or capital commitments; •adverse publicity relating to the hepatitis market generally, including with respect to other products and potential products in such markets; •the introduction of technological innovations or new therapies that compete with potential products of ours; •changes in the structure of health care payment systems; and •period-to-period fluctuations in our financial results. who have not previously managed and operated a public company. These executive officers and other personnel will need to devote substantial time to gaining expertise regarding operations as a public company and compliance with applicable laws and regulations. In addition, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers, which may adversely affect investor confidence and could cause our business or stock price to suffer. Price Range High Low Year Ended December 31, 2017 First Quarter $ 12.65 $ 10.15 Second Quarter $ 11.60 $ 6.10 Third Quarter $ 12.05 $ 7.13 Fourth Quarter $ 14.50 $ 10.26 Year Ended December 31, 2016 First Quarter $ 25.80 $ 12.90 Second Quarter $ 23.10 $ 17.06 Third Quarter $ 20.63 $ 13.15 Fourth Quarter $ 14.75 $ 10.71 Holders of Record 2022. a focus on enhancing long-term shareholder value while fulfilling the promise of advancing our high-potential product candidates for patients with serious diseases. other period costs. •expenses incurred under agreements with consultants, contract research organizations and clinical trial sites that conduct research and development activities on our behalf; •laboratory and vendor expenses related to the execution of clinical trials; •contract manufacturing expenses, primarily for the production of clinical trial supplies; •license fees associated with our license agreements; and •internal costs that are associated with activities performed by our research and development organization and generally benefit multiple programs. These costs are not separately allocated by product candidate. Unallocated internal research and development costs consist primarily of: ◦personnel costs, which include salaries, benefits and stock-based compensation expense; ◦allocated facilities and other expenses, which include expenses for rent and maintenance of facilities and depreciation expense; and ◦regulatory expenses and technology license fees related to development activities. The largest component of our operating expenses has historically been the investment in clinical trials, including contract manufacturing Year Ended December 31, 2017 2016 2015 Product candidates: Lonafarnib HDV $ 4,284 $ 5,237 $ 2,052 Lambda HDV 3,892 7,244 — Exendin 9-39 PBH 3,173 2,984 115 Ubenimex PAH (terminated in January 2018) 9,789 10,393 648 Ubenimex Lymphedema 2,132 2,271 198 Internal research and development costs 6,249 4,885 5,104 Total research and development expense $ 29,519 $ 33,014 $ 8,117 The COVID-19 pandemic presents additional risks and uncertainties associated with developing drugs, We expect our selling, general and administrative expenses to increase in the future due to sales and marketing activities from the commercialization of our product candidates. (expense) income, net 2022. Costs liabilities. We record forfeitures when they occur. following assumptions: prior to exercise. 2021 Years Ended December 31, Increase / (Decrease) % Change 2017 2016 Operating expenses: Research and development $ 29,519 33,014 $ (3,495 ) (11 )% General and administrative 12,001 13,106 $ (1,105 ) (8 )% Total operating expenses 41,520 46,120 (4,600 ) Loss from operations (41,520 ) (46,120 ) 4,600 Interest expense (1,524 ) (690 ) (834 ) 121 % Interest income 410 97 313 323 % Other income (expense), net 186 (374 ) 560 (150 )% Net loss $ (42,448 ) $ (47,087 ) $ 4,639 Years Ended December 31, Increase / (Decrease) % Change 2016 2015 Operating expenses: Research and development $ 33,014 $ 8,117 $ 24,897 307 % General and administrative 13,106 4,855 $ 8,251 170 % Total operating expenses 46,120 12,972 33,148 Loss from operations (46,120 ) (12,972 ) (33,148 ) Interest expense (690 ) (350 ) $ (340 ) 97 % Interest income 97 — $ 97 100 % Other expense, net (374 ) — $ (374 ) 100 % Net loss $ (47,087 ) $ (13,322 ) $ (33,765 ) Innovatus loan. income in offerings that are seemed “at the market” offerings as defined in Rule 415 under the Securities Act (2020 ATM Facility). In COVID-19 pandemic, among other events. Our primary uses of capital are, and we expect will continue to be, funding Years Ended December 31, 2017 2016 2015 Net cash provided by (used in): Operating activities $ (38,372 ) $ (37,970 ) $ (9,134 ) Investing activities 22,657 (4,194 ) (45 ) Financing activities 19,994 65,142 13,180 Net increase in cash and cash equivalents $ 4,279 $ 22,978 $ 4,001 Contractual Obligations and Other Commitments Payments due by period Total Less than 1 year 1 – 3 Years 3 – 5 Years More than 5 years Operating lease obligations (1) $ 3,222 $ 634 $ 1,203 $ 1,276 $ 109 Term loan debt (2) $ 15,000 $ 2,083 $ 10,000 $ 2,917 $ — Interest on term loan debt (3) $ 3,641 $ 1,156 $ 1,284 $ 1,201 $ — Total $ 21,863 $ 3,873 $ 12,487 $ 5,394 $ 109 We are obligated to make future payments to third parties under asset purchase and license agreements, including royalties and payments that become due and payable on the achievement of certain development and commercialization milestones. December 31, 2022. the other. : December 31, 2017 2016 Assets Current assets: Cash and cash equivalents $ 32,035 $ 27,756 Short-term marketable securities 9,744 32,180 Prepaid expenses and other current assets 712 581 Total current assets 42,491 60,517 Property and equipment, net 79 76 Other assets 312 143 Total assets $ 42,882 $ 60,736 Liabilities and Stockholders’ Equity Current liabilities: Accounts payable $ 3,183 $ 2,639 Accrued liabilities 2,084 2,649 Current portion of long term debt 2,002 — Total current liabilities 7,269 5,288 Long term debt, net 13,091 14,727 Total liabilities $ 20,360 $ 20,015 Commitments and contingencies (Note 15) Stockholders’ equity: Common stock, $0.001 par value, 200,000,000 shares authorized as of December 31, 2017 and 2016; 10,526,599 and 8,356,659 shares issued and outstanding as of December 31, 2017 and 2016, respectively 11 8 Additional paid-in capital 141,320 117,086 Accumulated other comprehensive loss (3 ) (15 ) Accumulated deficit (118,806 ) (76,358 ) Total stockholders’ equity 22,522 40,721 Total liabilities and stockholders’ equity $ 42,882 $ 60,736 Year Ended December 31, 2017 2016 2015 Operating expenses: Research and development $ 29,519 $ 33,014 $ 8,117 General and administrative 12,001 13,106 4,855 Total operating expenses 41,520 46,120 12,972 Loss from operations (41,520 ) (46,120 ) (12,972 ) Interest expense (1,524 ) (690 ) (350 ) Interest income 410 97 — Other income (expense), net 186 (374 ) — Net loss $ (42,448 ) $ (47,087 ) $ (13,322 ) Net loss per share, basic and diluted $ (4.86 ) $ (7.84 ) $ (62.19 ) Weighted-average common shares outstanding, basic and diluted 8,727,935 6,007,027 214,228 Consolidated Statements of Comprehensive Loss Year Ended December 31, 2017 2016 2015 Net loss $ (42,448 ) $ (47,087 ) $ (13,322 ) Other comprehensive loss: Unrealized gain (loss) on marketable securities, net 12 (15 ) — Comprehensive loss $ (42,436 ) $ (47,102 ) $ (13,322 ) Convertible Preferred Stock Common Stock Additional Paid-In Accumulated Other Comprehensive Accumulated Total Stockholders’ Shares Amount Shares Amount Capital Loss Deficit Equity (Deficit) Balance at December 31, 2014 1,519,274 $ 15,366 193,850 $ - $ 1,114 $ - $ (15,949 ) $ 531 Issuance of Series A-1 convertible preferred stock, net of $22 of issuance costs 1,089,828 7,201 — — — — — 7,201 Issuance of common stock in connection with a license and asset purchase agreement — — 15,378 — 211 — — 211 Issuance of common stock upon stock option exercises — — 64,765 — — — — — Stock-based compensation expense — — — — 227 — — 227 Net loss — — — — — — (13,322 ) (13,322 ) Balance at December 31, 2015 2,609,102 22,567 273,993 — 1,552 — (29,271 ) (5,152 ) Issuance of common stock upon private placement, net of $1,300 of issuance cost — — 1,954,390 2 32,106 — — 32,108 Issuance of common stock upon conversion of convertible promissory note — — 350,040 — 6,129 — — 6,129 Issuance of common stock upon exercise of warrants — — 61,254 — 1,057 — — 1,057 Issuance of common stock to Eiccose upon private placement — — 96,300 — 1,661 — — 1,661 Conversion of preferred stock into common stock (2,609,102 ) (22,567 ) 2,609,102 3 22,564 — — — Issuance of common stock upon reverse merger — — 1,596,959 2 27,388 — — 27,390 Issuance of common stock upon execution of license agreement — — 157,587 — 3,172 — — 3,172 Issuance of common stock upon public offering, net of $1,800 of issuance costs — — 1,250,000 1 18,228 — — 18,229 Issuance of common stock upon exercise of stock option — — 7,034 — 39 — — 39 Stock-based compensation expense — — — — 3,190 — — 3,190 Unrealized loss on marketable securities, net — — — — — (15 ) — (15 ) Net loss — — — — — — (47,087 ) (47,087 ) Balance at December 31, 2016 — — 8,356,659 8 117,086 (15 ) (76,358 ) 40,721 Issuance of common stock upon public offering, net of $376 issuance costs — — 2,143,525 3 19,797 — — 19,800 Issuance of common stock upon ESPP purchase — — 16,186 — 142 — — 142 Issuance of common stock upon stock option exercise — — 10,229 — 52 — — 52 Stock-based compensation expense — — — — 4,243 — — 4,243 Unrealized gain on marketable securities, net — — — — — 12 — 12 Net loss — — — — — — (42,448 ) (42,448 ) Balance at December 31, 2017 — $ — 10,526,599 $ 11 $ 141,320 $ (3 ) $ (118,806 ) $ 22,522 Year Ended December 31, 2017 2016 2015 Operating Activities Net loss $ (42,448 ) $ (47,087 ) $ (13,322 ) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation 41 23 11 Amortization of premiums on marketable securities (53 ) (41 ) — Stock-based compensation 4,243 3,190 227 Non-cash interest expense 366 685 350 Gain on intellectual property sale (200 ) — — Issuance of common stock in connection with a license and asset purchase agreement — 3,172 211 Change in fair value of obligation to issue shares to Eiccose — 204 1,457 Change in fair value of warrants liability — 165 — Changes in operating assets and liabilities: Prepaid expenses and other current assets (131 ) 326 (685 ) Other non-current assets (169 ) (89 ) (46 ) Accounts payable 544 699 1,881 Accrued liabilities (565 ) 783 782 Net cash used in operating activities (38,372 ) (37,970 ) (9,134 ) Investing Activities Purchase of marketable securities (24,524 ) (34,154 ) — Proceeds from maturities of marketable securities 47,025 2,000 — Proceeds from intellectual property sale 200 — — Cash received from merger transaction — 28,018 — Purchase of property and equipment (44 ) (58 ) (45 ) Net cash provided by (used in) investing activities 22,657 (4,194 ) (45 ) Financing Activities Proceeds from issuance of common stock upon public offering, net of issuance cost 19,800 18,229 — Proceeds from borrowings in connection with term loan, net of issuance cost — 14,759 — Proceeds from issuance of common stock upon private placement, net of issuance cost — 32,108 — Proceeds from issuance of common stock upon ESPP purchase 142 — — Proceeds from issuance of common stock upon options exercises 52 39 — Proceeds from issuance of common stock upon warrants exercises — 7 — Proceeds from issuance of convertible promissory note, net of issuance costs — — 5,979 Proceeds from issuance of preferred stock, net of issuance costs — — 7,201 Net cash provided by financing activities 19,994 65,142 13,180 Net increase in cash and cash equivalents 4,279 22,978 4,001 Cash and cash equivalents at beginning of period 27,756 4,778 777 Cash and cash equivalents at end of period $ 32,035 $ 27,756 $ 4,778 Supplemental disclosure of cash flow information Non-cash investing and financing activities: Conversion of warrant liability to common stock upon private placement $ — $ 1,050 $ — Issuance of common stock in connection with a license agreement — 3,172 211 Issuance of common stock to Eiccose upon private placement — 1,661 — Non-cash net liabilities assumed in reverse merger — 671 — Conversion of convertible promissory note to common stock upon private placement — 6,129 — Conversion of preferred stock to common stock upon reverse merger — 22,567 — Issuance of warrants in connection with convertible promissory note — — 885 Management believes that the currently available resources will be sufficient to fund its planned operations Lab equipment 3 years Costs expenses. Manufacturing costs related to products undergoing regulatory approval are expensed as research and development costs until receipt of such approval. Advance payments for research and development activities are deferred as prepaid expenses. The prepaid amounts are expensed as the related services are performed. model inputs. The Company accounts for forfeitures of stock-based awards when they occur. December 31, 2017 2016 2015 Options to purchase common stock 1,467,051 1,212,044 254,058 Warrants to purchase common stock 10,180 10,180 — Convertible preferred stock — — 2,609,102 Total 1,477,231 1,222,224 2,863,160 In June 2016, the In There were no assets or liabilities classified as Level 3 as of December 31, 2022 and 2021. December 31, 2017 Level 1 Level 2 Level 3 Total Financial Assets: Money market funds $ 19,612 $ — $ — $ 19,612 Corporate debt securities — 6,501 — 6,501 Commercial paper — 3,243 — 3,243 Total $ 19,612 $ 9,744 $ — $ 29,356 December 31, 2016 Level 1 Level 2 Level 3 Total Financial Assets: Money market funds $ 9,657 $ — $ — $ 9,657 Corporate debt securities — 11,469 — 11,469 Commercial paper — 22,891 — 22,891 Total $ 9,657 $ 34,360 $ — $ 44,017 Year Ended December 31, 2016 Balance at December 31, 2015 $ 2,342 Change in fair value of common stock warrants and obligation to issue common stock to Eiccose (1) 369 Settlement of warrant liability upon exercise of common stock warrants (1,050 ) Settlement of Eiccose obligation upon issuance of common stock (1,661 ) Balance at December 31, 2016 $ — December 31, 2017 Amortized cost Unrealized gain Unrealized loss Estimated Fair Value Cash equivalents: Money market funds $ 19,612 $ — $ — $ 19,612 Total cash equivalents $ 19,612 $ — $ — $ 19,612 Marketable securities: Corporate debt securities $ 6,503 $ — $ (2 ) $ 6,501 Commercial paper 3,244 — (1 ) 3,243 Total marketable securities $ 9,747 $ — $ (3 ) $ 9,744 December 31, 2016 Amortized cost Unrealized gain Unrealized loss Estimated Fair Value Cash equivalents: Money market funds $ 9,657 $ — $ — $ 9,657 Corporate debt securities 2,180 — — 2,180 Total cash equivalents $ 11,837 $ — $ — $ 11,837 Marketable securities: Corporate debt securities $ 9,294 $ — $ (5 ) $ 9,289 Commercial paper 22,901 3 (13 ) 22,891 Total marketable securities $ 32,195 $ 3 $ (18 ) $ 32,180 December 31, 2017 2016 Lab equipment $ 36 $ 35 Computer equipment and software 150 107 Total property and equipment 186 142 Less: accumulated depreciation (107 ) (66 ) Property and equipment, net $ 79 $ 76 December 31, 2017 2016 Compensation and related benefits $ 1,262 $ 1,299 Contract research costs 634 834 Consulting costs 87 106 Franchise tax 56 97 Contract manufacturing costs 4 122 Other 41 191 Total accrued liabilities $ 2,084 $ 2,649 Cash and cash equivalents $ 28,018 Prepaid and other assets 198 Current liabilities (857 ) Non-current liabilities (12 ) Net acquired tangible assets 27,347 Estimated total purchase consideration $ 27,347 Bristol-Meyers Squibb License Agreement EGI Asset Purchase Agreement Of the 46,134 options to purchase common stock, 15,378 shares vest monthly over four years as services are provided by the Sellers and 30,756 vest upon the earlier of the first commercial sale of the product or the approval of new drug application by the U.S. 2020. December 31, 2017 2016 Face value of long term debt $ 15,000 $ 15,000 Exit fee 1,125 1,125 Unamortized debt discount associated with exit fee, debt issuance costs and loan origination fees (1,032 ) (1,398 ) Total long term debt 15,093 14,727 Less: current portion of long term debt (2,002 ) — Long term debt, net $ 13,091 $ 14,727 Year ending December 31, 2018 $ 3,239 2019 5,839 2020 5,445 2021 4,118 Total future payments 18,641 Less: unamortized interest (2,516 ) Less: exit fee (1,125 ) Face value of term loan $ 15,000 In May 2017, the Company and Theragene Pharmaceuticals, Inc. To-date, no consideration has been earned or is expected to be earned. December 31, 2017 2016 Options issued and outstanding 1,467,051 1,212,044 Options available for future grants 799,375 646,778 Warrants to purchase common stock issued and outstanding 10,180 10,180 Total 2,276,606 1,869,002 Shares Available for Grant Number of Options Weighted- Average Exercise Price Per Option Weighted- Average Remaining Contractual Life (in Years) Aggregate Intrinsic Value Outstanding as of December 31, 2016 646,778 1,212,044 $ 14.06 9.00 $ 2,414 Additional options authorized 417,833 — — Granted (652,200 ) 652,200 $ 10.91 Exercised — (10,229 ) $ 5.04 Forfeited or cancelled 386,964 (386,964 ) $ 14.13 Outstanding as of December 31, 2017 799,375 1,467,051 $ 12.70 8.41 $ 4,511 Vested and exercisable as of December 31, 2017 630,727 $ 13.82 8.01 $ 2,117 2022. Year Ended December 31, 2017 2016 2015 Expected term (in years) 5.27 - 6.08 5.27 - 6.08 5.00 - 6.08 Volatility 79.00% - 80.00% 73.91% - 78.00% 77.58% - 97.62% Risk free interest rate 1.63% - 2.23% 1.21% - 2.27% 1.44% - 1.75% Dividend yield — — — Expected Term: The prior to exercise. price volatility. qualify as an employee stock purchase plan under Section 423 of the U.S. Internal Revenue Code and is administered by the Company’s board of directors. Year Ended December 31, 2017 2016 2015 Remaining contractual term (in years) 6.00 – 10.00 6.75 – 10.00 7.75 – 10.00 Volatility 83.62% – 106.13% 84.42% – 98.13% 85.83% – 90.50% Risk-free interest rate 1.90% – 2.43% 1.37% – 2.50% 1.73% – 2.24% Dividend yield — — — Year Ended December 31, 2017 2016 2015 Research and development $ 1,214 $ 737 $ 64 General and administrative 3,029 2,453 163 Total stock-based compensation expense $ 4,243 $ 3,190 $ 227 administrative expenses. As of December 31, 11. Income Taxes state taxes. Year Ended December 31, 2017 2016 2015 Federal statutory income tax rate 34.00 % 34.00 % 34.00 % State income taxes, net of federal benefit 0.36 (0.21 ) 6.11 Federal and state tax credits 5.10 4.68 2.54 Change in valuation allowance (8.04 ) (36.67 ) (42.14 ) Stock-based compensation (1.06 ) (1.26 ) (0.49 ) Other, net — (0.54 ) (0.02 ) Change in tax law (30.36 ) — — Provision (benefit) for income taxes — % — % — % December 31, 2017 2016 Deferred tax assets: Net operating loss carryforwards $ 20,230 $ 19,882 Tax credits 9,514 5,344 Depreciation and amortization 1,700 3,025 Accruals and reserves 1,158 936 Gross deferred tax assets 32,602 29,187 Valuation allowance (32,602 ) (29,187 ) Net deferred tax assets $ — $ — The Company had $10.8 million of federal Orphan Drug credit carryforwards available to reduce future taxable income that will begin to expire in 12/31/2041. Additional ownership changes in the future could result in additional limitations on the Company’s NOL and tax credit carryforwards. Year Ended December 31, 2017 2016 2015 Balance at beginning of year $ 1,831 $ 404 $ 99 Additions based on tax positions related to prior year — 19 46 Additions based on tax positions related to current year 1,387 1,408 259 Balance at end of year $ 3,218 $ 1,831 $ 404 Contingencies Year ending December 31, Amounts $ 634 2019 593 2020 610 2021 629 2022 647 Thereafter 109 Total minimum payments $ 3,222 2022. Exhibit Description of Document 2.1 3.1 3.2 3.3 3.4 4.1 4.2 10.2+ 10.7+ 10.8 24.1 Inline XBRL Instance Inline XBRL Taxonomy Extension Schema Document Inline XBRL Taxonomy Extension Calculation Linkbase Document Inline XBRL Taxonomy Extension Definition Linkbase Document Inline XBRL Taxonomy Extension Label Linkbase Document Inline XBRL Taxonomy Extension Presentation Linkbase Document Date: /s/ David David Director, Interim President and Chief Executive Officer (Principal Executive Officer) Eiger BioPharmaceuticals, Inc. Date: /s/ (Acting Principal Financial and Accounting Officer) Chairman of the Board of Directors Member of the Board of Directors Member of the Board of Directors Member of the Board of Directors Member of the Board of Directors LNFLNF/RTV and Lambdain developing LNF and Lambda is to reduce viral load in such a manner as to achieve durable suppressionapproval of the virus to below the level of quantification (<LLOQ), the pointthese treatments for HDV, where upon withdrawal of the therapy, the infection does not return to quantifiable levels. Evidence that academic investigatorsthere is an urgent, unmet medical need. Key opinion leaders have gathered suggestssuggested that combinations of LNFLNF/RTV and Lambdalambda with other antiviral agents may hold promisedemonstrate an even greater antiviral effect.longer duration24 weeks and underwent off-treatment follow-up for 24 weeks. The primary endpoint was >2 log decline in HDV RNA at end of 24-weeks of treatment. The secondary endpoint was an improvement in histology (>2-point improvement in histological activity index and no progression in fibrosis) at end of follow-up. LIFT-1 was conducted within the National Institutes of Health (NIH) at the NIDDK. The final end-of-treatment and end-of-study data were reported in November 2020 at the AASLD conference and are summarized in the figure below.sustained, long-term reduction6 of viral load.We20 patients (30%) achieved the secondary endpoint of > 2 point improvement in HAI.

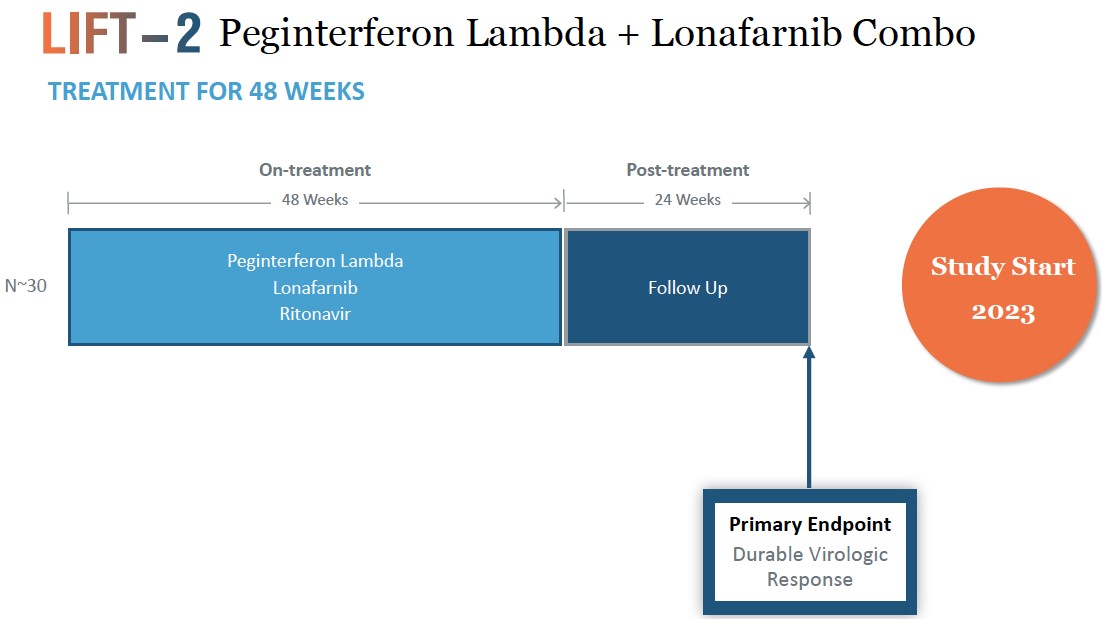

believebe conducted within the (NIH) at the NIDDK. If positive, data from LIFT-2 will provide additional support for this combination therapy.

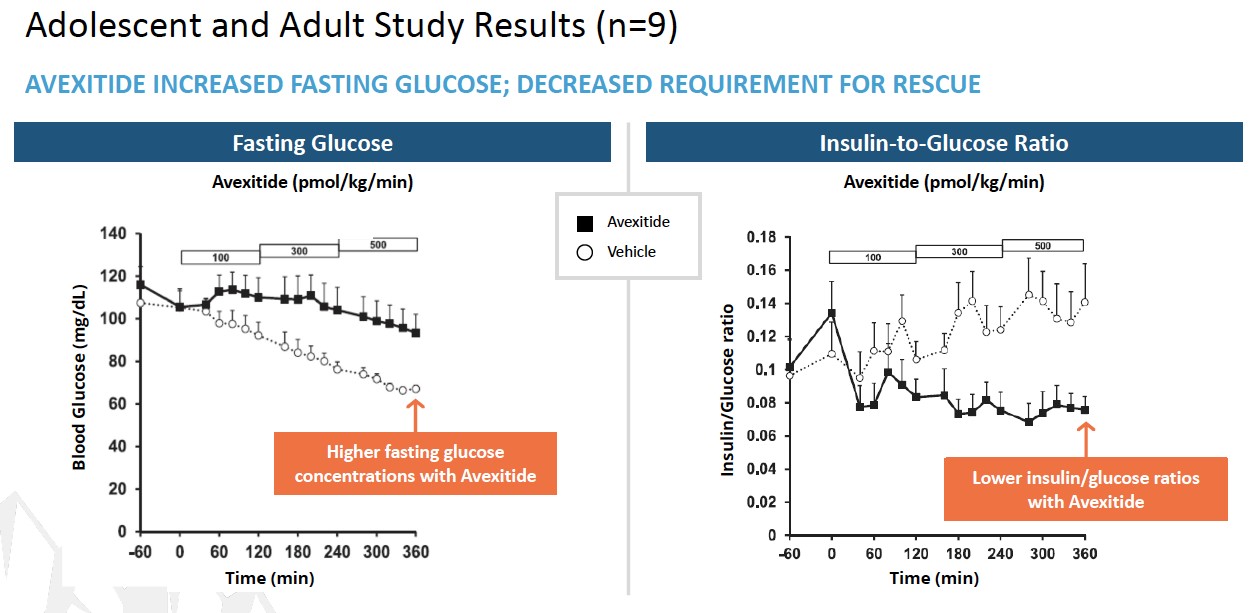

LNFavexitide may effectively reduce fasting and Lambdapostprandial hypoglycemia in combinationpatients with other antiviral agents may contribute to long-term benefit for patients, which may represent an alternative path to regulatory approval. In a study published in Plos One in 2014 (Romeo, R. et al. “High Serum LevelsHI. Avexitide treatment was well tolerated, with no serious drug-related adverse events (AEs) reported. Data from each of HDV RNA Are Predictors of Cirrhosis and Liver Cancer in Patients with Chronic Hepatitis Delta,” Plos One, 2014; 9:1), high serum levels of HDV were found to be a predictor of cirrhosis and liver cancer development. In a study published in Gastroenterology in 2004 (Farci, P. et al. “Long-Term Benefit of Interferon Therapy of Chronic Hepatitis D: Regression of Advanced Hepatic Fibrosis,” Gastroenterol, 2004; 126:1740), researchers demonstrated that lower frequencies of clinical events, leading to improvements in overall liver health and reductionsthe three studies are presented in the ratesfigures below. Avexitide for treatment of developing hepatic complications, could be achievedHI has been granted Rare Pediatric Disease designation by the FDA.