UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of |

For the fiscal year ended February 3 |

or

☐ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Transition period from ____________ to ___________ |

Commission file number 1-11084

KOHL’S CORPORATIONCORPORATION

(Exact name of registrant as specified in its charter)

Wisconsin | 39-1630919 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

N56 W17000 Ridgewood Drive, Menomonee Falls, Wisconsin | 53051 | |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (262) (262) 703-7000

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $.01 | KSS | New York Stock Exchange |

|

|

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes X ☒ No .☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐No X .☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X ☒ No .☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes X ☒ No .☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. X .

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer X Accelerated filer Non-accelerated filer (Do not check if a smaller reporting company)

Large Accelerated Filer | ☒ | Accelerated Filer | ☐ | |||

Non-Accelerated Filer | ☐ | Smaller Reporting Company | ☐ | |||

Emerging Growth Company | ☐ |

Smaller reporting company Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐No X .☒

At July 28, 2017,2023, the aggregate market value of the voting stock of the Registrant held by stockholdersshareholders who were not affiliates of the Registrant was approximately $7.0$3.1 billion (based upon the closing price of Registrant’s Common Stock on the New York Stock Exchange on such date).

At March 14, 2018,20, 2024, the Registrant had outstanding an aggregate of 168,236,899110,906,777 shares of its Common Stock.

Documents Incorporated by Reference:

Portions of the Definitive Proxy Statement for the Registrant’s 2024 Annual Meeting of Shareholders to be held on May 16, 2018 are incorporated into Part III.

KOHL’S CORPORATION

INDEX

INDEX

Item 1. | 3 | |||||

Item 1A. |

| |||||

Item 1B. |

| |||||

Item |

| |||||

Item |

| |||||

Item |

| |||||

Item |

| |||||

Item 4A. | 17 | |||||

Item 5. |

| |||||

Item 6. |

| |||||

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| ||||

Item 7A. | Quantitative and Qualitative Disclosures |

| ||||

Item 8. |

| |||||

Item 9. | Changes |

| ||||

Item 9A. |

| |||||

Item 9B. |

| |||||

Item 9C. | Disclosure Regarding Foreign Jurisdictions That Prevent Inspections | 60 | ||||

Item 10. |

| |||||

Item 11. |

| |||||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

| ||||

Item 13. | Certain Relationships and Related Transactions, and Director Independence |

| ||||

Item 14. |

| |||||

Item 15. |

| |||||

Item 16. |

| |||||

| ||||||

| ||||||

2

PART I

Kohl’s Corporation (the “Company," “Kohl’s,” "we," "our""our," or "us") was organized in 1988 and is a Wisconsin corporation. As of February 3, 2018,2024, we operated 1,1581,174 Kohl's department stores and a website (www.Kohls.com), 12 FILA outlets, and four Off-Aisle clearance centers.. Our Kohl's stores and website sell moderately-priced proprietaryprivate and national brand apparel, footwear, accessories, beauty, and home products. Our Kohl's stores generally carry a consistent merchandise assortment with some differences attributable to local preferences.preferences, store size, and Sephora at Kohl's shop-in-shops ("Sephora shops"). Our website includes merchandise thatwhich is available in our stores, as well as merchandise that is available only online.

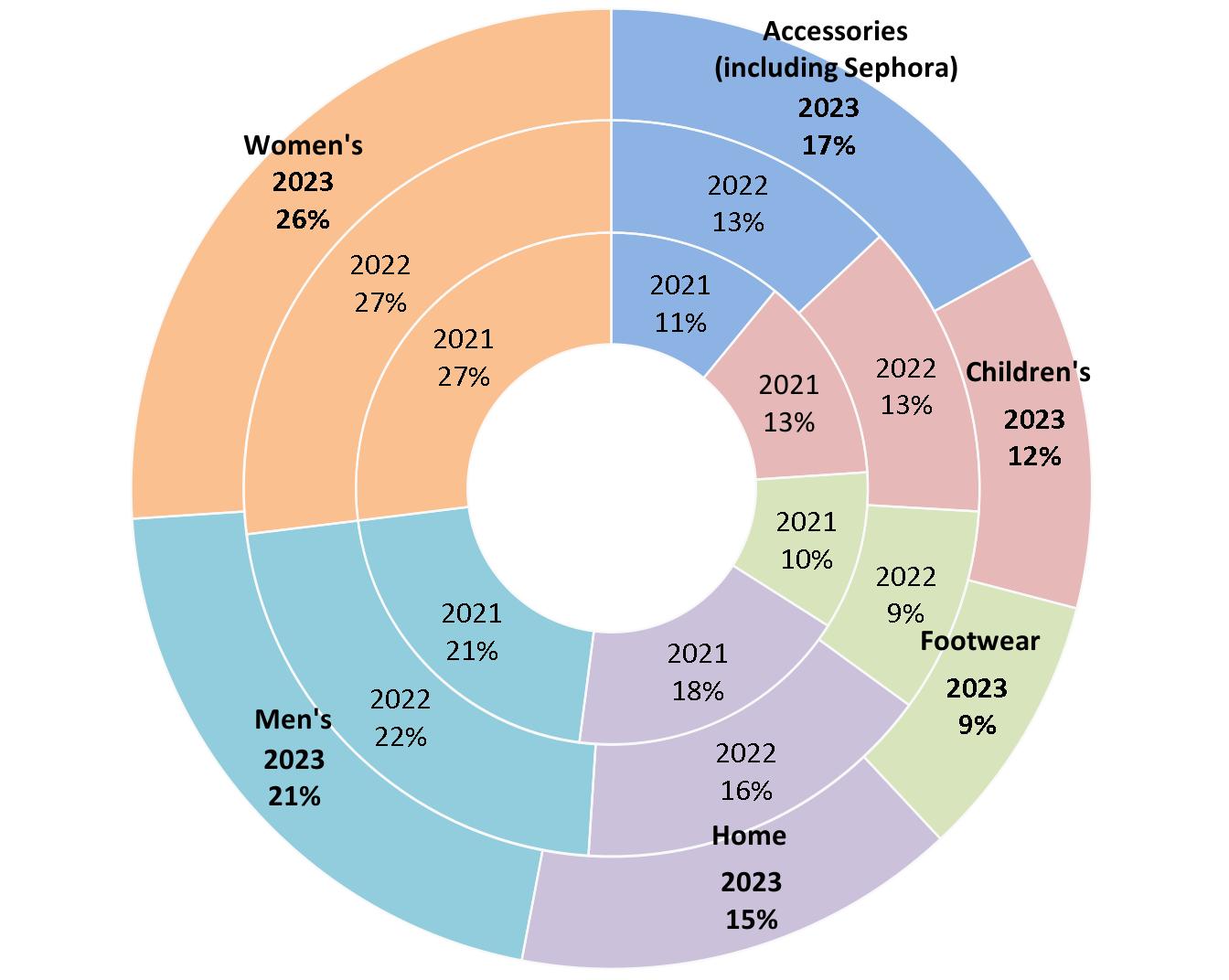

Our merchandise mix includes both national brands and proprietaryprivate brands that are available only at Kohl's. Our proprietaryprivate portfolio includes well-known established private brands such as Apt. 9, Croft & Barrow, Jumping Beans, SO, and Sonoma Goods for Life, and Tek Gear, and exclusive brands that are developed and marketed through agreements with nationally-recognized brands such as Food Network, Jennifer Lopez, Marc Anthony, Rock & RepublicLC Lauren Conrad, Nine West, and Simply Vera Vera Wang. NationalCompared to national brands, private brands generally have higherlower selling prices, but lowerhigher gross margins, than proprietary brands.margins.

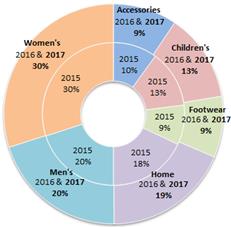

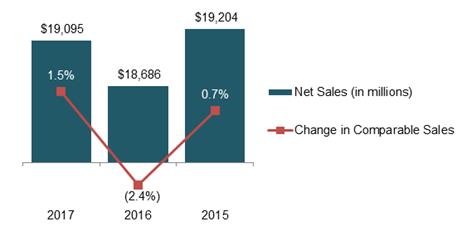

The following tables summarize our net sales penetration by line of business and brand type over the last three years:

Our fiscal year ends on the Saturday closest to January 31st each year. Unless otherwise stated, references to years in this report relate to fiscal years rather than to calendar years. The following fiscal periods are presented in this report.report:

| Fiscal Year | Ended | Number of Weeks |

| |

| 2017 | February 3, 2018 |

| 53 |

|

| 2016 | January 28, 2017 |

| 52 |

|

| 2015 | January 30, 2016 |

| 52 |

|

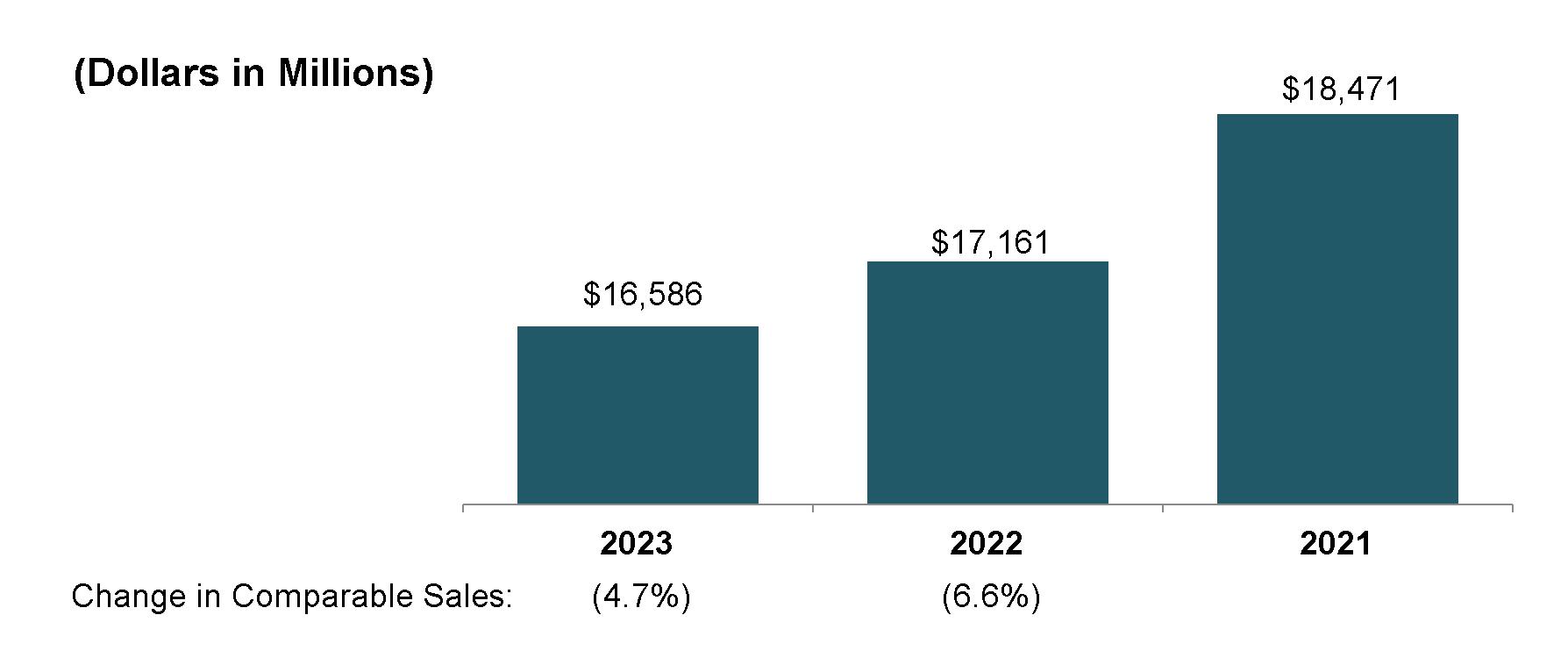

Fiscal Year | Ended | Number of Weeks |

2023 | February 3, 2024 | 53 |

2022 | January 28, 2023 | 52 |

2021 | January 29, 2022 | 52 |

For discussion of our financial results, see Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations."

3

Distribution

We receive substantially all of our store merchandise at our nine retail distribution centers and six e-fulfillment centers. A small amount of our merchandise is delivered directly to the stores by vendors or their distributors. The retail distribution centers, which are strategically located throughout the United States, ship merchandise to each store by contract carrier several times a week.carrier. Digital sales may be picked up in our stores or are shipped to the customer from a Kohl’s fulfillmente-fulfillment center, retail distribution center or store; by a third-party fulfillment center;store, or directly by a third-party vendor.

See Item 2, “Properties,” for additional information about our distribution and e-fulfillment centers.

3Human Capital

TableAt Kohl’s, we strive to create a welcoming and inclusive culture of Contentscare. We believe our associates are our most valuable asset and a differentiator for our business. Our teams of associates take care of each other, our customers and the communities we serve. We support our associates by fostering a safe and healthy work environment, offering competitive total compensation and benefits, including many health and wellness offerings, providing ongoing training and development opportunities, and cultivating an inclusive culture where all associates feel a sense of belonging and appreciation.

During 2017,2023, we employed an average of approximately 137,00096,000 associates, includingwhich included approximately 33,00036,000 full-time and 104,00060,000 part-time associates. The number of associates varies during the year, peaking during the back-to-school and holiday seasons. None of our associates are represented by a collective bargaining unit. We believe our relationswe maintain positive relationships with our associates.

Health, Safety, and Wellness

We lead initiatives that ensure the way we communicate, work, and develop our product enables our customers and associates to shop, work, and engage in a safe environment. We have a team dedicated to defining plans and preparing for business crisis events, including natural disasters and other unplanned disruptions like those brought on by the COVID-19 pandemic. To keep a healthy workforce, we maintain an advocacy program that provides associates with 24/7 access to medical professionals following a work accident. We continue to pursue innovative ways to educate our teams on safety. Associates at our stores, distribution, and e-fulfillment centers receive specialized training to enhance our safety culture and reduce associate accidents.

Diversity, Equity, and Inclusion

At Kohl’s, we are committed to our Diversity, Equity, and Inclusion ("DEI") strategy focused on Our People, Our Customers, and Our Community. This strategy accelerates how we are embedding DEI throughout our business by being intentional about our programs and practices and holding ourselves accountable to the work.

We are committed to creating an environment where diversity is valued at all levels, everyone feels a sense of equity, and where inclusion is evident across our business. Our DEI strategy is embedded into our acquisition and retention practices for all associates. We strive to celebrate our differences and help more customers see themselves reflected in our brands.

We are focused on growing leaders by engaging talent in internal and external professional development offerings and we are working to develop inclusive leaders through programs aimed at building awareness and encouraging advocacy. In the space of continuous development and engagement, we have eight Business Resource Groups with members focused on championing and enhancing diversity and inclusion efforts across our business.

4

At Kohl's, we believe our leaders are responsible for strengthening, modeling, and supporting our DEI efforts by ensuring that they are building a culture and environment where our associates feel seen, and their unique needs, experiences, abilities, and perspectives are valued and heard. Each leader is responsible for creating a caring culture and experience for our team, one that embraces and strives to understand our differences, and provides an inclusive environment for all. We work to provide learning opportunities for our leaders and associates to build a more diverse and inclusive workforce and engage associates on how that creates a competitive advantage.

Compensation and Benefits

We are committed to providing competitive and fair compensation and benefits programs to our associates and offer a range of benefits that are meaningful to our associates' everyday lives, with a commitment to supporting all aspects of associates' well-being. All eligible associates receive a 100% match (up to 5% of pay) in Kohl’s 401(k) Savings Plan after one year of employment. Full-time associates are very good.offered medical, dental, vision, prescription drug, disability and life insurance coverage, paid time off, and a merchandise discount. Part-time associates are offered a primary care health and pharmacy plan, dental, vision, supplementary life insurance, and a merchandise discount. Kohl's also offers adoption and surrogacy reimbursement options. Kohl's has Wellness Centers available to associates at corporate and credit locations, distribution centers, and e-commerce fulfillment centers, as well as for near-site store and remote associates within the vicinity.

CompetitionKohl's fosters associates' total well-being, which includes a number of benefits that focus on mental well-being and health, including the Employee Assistance Program, counseling coverage, mental well-being activities, webinars, business resource groups, support groups, and leader resources. We empower our associates’ work-life balance by giving them access to a full range of professional resources. An education benefit was introduced in 2022, which provides fully-funded tuition, books, and fees for associates pursuing high school completion, select certificates, and undergraduate degrees.

Training and Development

Behind our success are great teams of talented individuals who embody our values. We are committed to attracting, growing, and engaging talent, while giving associates equitable opportunities for career growth. Our talent management team brings together performance management, talent assessment, succession planning, and career planning. This team provides tools, resources, and best practices to ensure we have the right talent in the right roles at the right time. We invest in executive coaching, assessments, internal programs, external courses, peer networks, and more.

From initial onboarding to high potential leadership development, we believe in training and career growth for our associates. We encourage our associates to keep their skills fresh through different mediums ranging from live workshops to on-demand skills training available through our online library of courses. We also provide training to teams that provide skills and mindsets to help them perform at their highest level. Additionally, our development teams throughout the company provide job-specific training to ensure associates have the tools they need to excel in their jobs and serve our customers.

We are committed to the highest integrity standards and maintain a Code of Ethics to guide ethical decision-making for associates. As a company of integrity, we expect our associates to be honest and accountable. Our ethics training, which we require all associates to take annually, is refreshed yearly to ensure topics covered are relevant and impactful. The training helps connect ethics to an associate's day-to-day job responsibilities and promotes honesty, integrity, and fairness.

5

Competition

The retail industry is highly competitive. Management considers style, qualityproduct and pricevalue to be the most significant competitive factors in the industry. Merchandise mix, brands, service, loyalty programs, credit availability, and customer experience and convenience are also key competitive factors. Our primary competitors are online retailers, off-price retailers, warehouse clubs, mass merchandisers, specialty stores, traditional department stores, upscale mass merchandisers, off-price retailers, specialty stores, internet and catalog businesses and other forms of retail commerce. Our specific competitors vary from market to market.

Merchandise Vendors

We purchase merchandise from numerous domestic and foreign suppliers. All business partnerssuppliers must meet certain requirements in order to do business with us. Our Terms of Engagement are part of our purchase order terms and conditions and include provisions regarding laws and regulations, employment practices, ethical standards, environmental and legal requirements, communication, monitoring/monitoring and compliance, record keeping, subcontracting, and corrective action. Our expectation isWe expect that all business partnerssuppliers will comply with these Terms of Engagementour purchase terms and quickly remediate any deficiencies, if noted, in order to maintain our business relationship.

Approximately 25%A third-party purchasing agent sources approximately 15% of the merchandise we sell is sourced through a third-party purchasing agent.sell. No vendorsvendor individually accounted for more than 10% of our net purchases in 2017.2023. We have no significant long-term purchase commitments or arrangements with any of our suppliers and believe that we are not dependent on any one supplier.supplier or one geographical location. We believe we have good working relationships with our suppliers.

Seasonality

Our business, like that of mostother retailers, is subject to seasonal influences. The majority of our salesSales and income are typically realizedhigher during the second half of each fiscal year. The back-to-school season extends from August through September and represents approximately 15% of our annual sales. Approximately 30% of our annual sales occur during the holiday season in the months of November and December.seasons. Because of the seasonality of our business, results for any quarter are not necessarily indicative of the results that may be achieved for thea full fiscal year.

Trademarks and Service Marks

KOHL'S®is a registered trademark owned by one of our wholly-owned subsidiaries. We consider this mark and the accompanying goodwill to be valuable to our business. This subsidiary has over 200 additional registered trademarks, most of which are used in connection with our private brand products.

We consider the KOHL'S® mark, all other trademarks, and the accompanying goodwill to be valuable to our business.

Available Information

Our corporate website is https://corporate.kohls.com. Through the “Investors” portion of this website, we make available, free of charge, our proxy statements, Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, SECSecurities and Exchange Commission (“SEC”) Forms 3, 4, and 5, and any amendments to those reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after such material has been filed with, or furnished to, the Securities and Exchange Commission (“SEC”).SEC.

4

The following have also been posted on our website, under the caption “Investors” and sub-captionsub-captions "Corporate Governance" or “ESG”:

Committee charters of our Board of Directors’ Audit Committee, Compensation Committee, Finance Committee, and Governance & Nominating and ESG Committee

Corporate Governance Guidelines

Code of Ethics

Corporate Social Responsibility Report6

InformationThe information contained on our website is not part of this Annual Report on Form 10-K. Paper copies of any of the materials listed above will be provided without charge to any shareholder submitting a written request to our Investor Relations Department at N56 W17000 Ridgewood Drive, Menomonee Falls, Wisconsin 53051 or via e-mail to Investor.Relations@Kohls.com.

This Form 10-K contains “forward-looking statements” made within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as "believes," "anticipates," "plans," "may," "intends," "will," "should," "expects""expects," and similar expressions are intended to identify forward-looking statements. Forward-looking statements alsoinclude the statements under management's discussion and analysis, financial and capital outlook and may include comments about our future sales or financial performance and our plans, performance and other objectives, expectations or intentions, such as statements regarding our liquidity, debt service requirements, planned capital expenditures, future businessstore initiatives, and adequacy of capital resources and reserves. ThereForward-looking statements are based on management’s then current views and assumptions and, as a number of important factorsresult, are subject to certain risks and uncertainties that could cause ouractual results to differ materially from those indicated by theprojected. As such, forward-looking statements including, among others,are qualified by those risk factors described below. Forward-looking statements relate to the date made, and we undertake no obligation to update them.

Our sales, revenues, gross margin, expenses, and operating results could be negatively impacted by a number of factors including, but not limited to those described below. Many of these risk factors are outside of our control. If we are not successful in managing these risks, they could have a negative impact on our sales, revenues, gross margin, expenses, and/or operating results.

Macroeconomic and Industry Risks

General economic conditions, consumer spending levels, and/or other conditions could decline.

Consumer spending habits, including spending for the merchandise that we sell, are affected by many factors including prevailing economic conditions, inflation and measures to control inflation, consumer responses to recessionary concerns, levels of employment, salaries and wage rates, prevailing interest rates, housing costs, energy and fuel costs, income tax rates and policies, consumer confidence, consumer perception of economic conditions, and the consumer’s disposable income, credit availability, and debt levels. The moderate incomemoderate-income consumer, which is our core customer, is especially sensitive to these factors. A slowdown in the U.S. economy or an uncertain economic outlook could adversely affect consumer spending habits. As all of our stores are located in the United States, we are especially susceptible to deteriorations in the U.S. economy.

Consumer confidence is also affected by the domestic and international political situation. The outbreak or escalation of war, or the occurrence of terrorist acts or other hostilities in or affecting the United States, could lead to a decrease in spending by consumers.

Future pandemics could have a material adverse impact on our business, financial condition, and results of operations. The impact of, and actions taken in response to COVID-19, had a significant impact on the retail industry generally and our business. Future pandemics could have a material adverse effect on our business, financial condition, and results of operations.

Our competitors could make changes to their pricing and other practices.

The retail industry is highly competitive. We compete for customers, associates, locations, merchandise, services, and other important aspects of our business with many other local, regional, and national retailers. Those competitors include online retailers, off-price retailers, warehouse clubs, mass merchandisers, specialty stores, traditional department stores, upscale mass merchandisers, off-price retailers, specialty stores, internet and catalog businesses, and other forms of retail commerce.

57

We consider style, qualityproduct and pricevalue to be the most significant competitive factors in our industry. The continuing migration and evolution of retailing to digital channels has increased our challenges in differentiating ourselves from other retailers especially as it relates to national brands. In particular, consumers are able tocan quickly and conveniently comparison shop with digital tools, which can lead to decisions based solely on price. Unanticipated changes in the pricing and other practices of our competitors may adversely affect our performance.performance and lead to loss of market share in one or more categories.

Tax, trade and tradeclimate, and other ESG-related policies and regulations could change or be implemented and adversely change.affect our business and results of operations.

Uncertainty with respect to tax and trade policies, tariffs, and government regulations affecting trade between the United States and other countries has recently increased. We source theThe majority of our merchandise from manufacturers locatedgoods sourced are manufactured outside of the United States, primarily in Asia. Major developments in tax policy or trade relations, such as the imposition of tariffs on imported products, could have a material adverse effect on our business, results of operations, and liquidity. Furthermore, increased governmental focus on climate change and other ESG matters may result in complex regulatory requirements that may directly or indirectly have a significant impact on the costs of our operations, including energy, resources used to produce our products and compliance costs, which may have a material adverse effect on our business and results of operations. We also expect there will likely be increasing levels of regulation, disclosure-related and otherwise, with respect to ESG matters. Increased regulation and increased stakeholder expectations will likely lead to increased costs as well as scrutiny that could heighten all of the ESG-related risks we are subject to. Additionally, many of our suppliers may be subject to similar regulations and expectations, which may exacerbate existing risks or create new ones, including risks that may not be known to us. Any of these developments may have a material adverse effect on our business and results of operations.

Operational Risks

We may be unable to offer merchandise that resonates with existing customers and attracts new customers as well as successfully manage our inventory levels.

Our business is dependent on our ability to anticipate fluctuations in consumer demand for a wide variety of merchandise. Failure to accurately predict constantly changing consumer tastes, preferences, spending patterns, and other lifestyle decisions could create inventory imbalances and adversely affect our performance and long-term relationships with our customers. Additionally, failure to accurately predict changing consumer tastes may result in excess inventory, which could result in additional markdowns and adversely affect our operating results. Negative publicity surrounding us, our activities, or the products we offer, including consumer perception of our response to political and social issues, and campaigns by political activists promoting certain causes, could adversely impact our brand image and may decrease demand for our products, thereby adversely affecting our business, results of operations, cash flows or financial condition. As with most retailers, we also experience inventory shrinkage due to theft or damage. Higher rates of inventory shrinkage or increased security or other costs to combat inventory shrinkage could adversely affect our results of operations and financial condition, and our efforts to contain or reduce inventory shrinkage may not be successful.

We may be unable to source merchandise in a timely and cost-effective manner.

Approximately 25%A third-party purchasing agent sources approximately 15% of the merchandise we sell is sourced through a third-party purchasing agent.sell. The remaining merchandise is sourced from a wide variety of domestic and international vendors. Our ability to find qualified vendors and access to brands or products in a timely and efficient manner is a significant challenge which is typically even more difficult for goods sourced outside the United States, substantially all of which are shipped by ocean to ports in the United States. Political or financial instability, trade restrictions, tariffs, currency exchange rates, transport capacity and costs, pandemic outbreaks, work stoppages, port strikes, port congestion and delays, information technology challenges, and other factors relating to foreign trade are beyond our control and have impacted or could continue to adversely

8

impact our performance and cause us to pay more to obtain inventory or result in having the wrong inventory at the wrong time. In addition, certain laws and regulations impose import restrictions for goods, which may induce greater supply chain compliance costs and may result in delays to us or adversely impact our performance.inventory. Where we are the importer of record, we may be subject to additional regulatory and other requirements.

Increases in the price of merchandise, raw materials, fuel, and labor, or their reduced availability, could increase our cost of merchandise sold. The price and availability of raw materials may fluctuate substantially, depending on a variety of factors, including demand, weather, supply conditions, transportation costs, energy prices, work stoppages, government regulation and policy, economic climates, market speculation, and other unpredictable factors. An inability to mitigate these cost increases, unless sufficiently offset with our pricing actions, might cause a decrease in our profitability.operating results. Any related pricing actions might cause a decline in our sales volume. Additionally, a decreasereduction in the availability of raw materials could impair ourthe ability to meet our production or purchasing requirements in a timely manner. Both the increased cost and lower availability of merchandise, raw materials, fuel, and labor may also have an adverse impact on our cash and working capital needs as well as those of our suppliers.

If any of our significant vendors were to become subject to bankruptcy, receivership, or similar proceedings, we may be unable to arrange for alternate or replacement contracts, transactions, or business relationships on terms as favorable as current terms, which could adversely affect our sales and operating results.

6

Our vendors may not adhere to our Terms of Engagement or to applicable laws.

A substantial portion of our merchandise is received from vendors and factories outside of the United States. We require all of our suppliers to comply with all applicable local and national laws and regulations and our Terms of Engagement for Kohl's Business Partners. These Terms of Engagement include provisions regarding laws and regulations, employment practices, ethical standards, environmental and legal requirements, communication, monitoring/compliance, record keeping, subcontracting, and corrective action. From time to time, suppliers may not be in compliance with these standards or applicable laws. Significant or continuing noncompliance with such standards and laws by one or more suppliers could have a negative impact on our reputation and our results of operations.

Our marketing may be ineffective.

We believe that differentiating Kohl's in the marketplace is critical to our success. We design our marketing and loyalty programs to increase awareness of our brands and to build personalized connections with new and existing customers. We believe these programs will strengthen customer loyalty, increase the number and frequency of customers that shop our stores and website, and increase our sales. If our marketing and loyalty programs are not successful or efficient, our sales and operating results could be adversely affected.

The reputation and brand image of Kohl’s and the Kohl's brand or our proprietary brands and products we sell could be damaged.

We believe the Kohl's brand name and many of our proprietaryprivate brand names are powerful sales and marketing tools. We devote significant resources to promotingdevelop, promote, and protecting them. We develop and promote proprietaryprotect private brands that have generatedgenerate national recognition. In some cases, the private brands or the marketing of such brands are tied to or affiliated with well-known individuals. We also associate the Kohl’s brand with third-party national brands that we sell in our store and through our partnerships with companies in pursuit of strategic initiatives. Further, we focus on ESG as a component of our strategy, and we have and may at times continue to engage in voluntary initiatives (such as voluntary disclosures, certifications, or goals, among others) to improve the ESG profile of our company and/or products. For example, we publish an annual report to share information with our partners, shareholders, customers, and associates regarding our ESG progress. These disclosures reflect our goals and other expectations and assumptions, which are necessarily uncertain and may not be realized. Such initiatives may be costly, even if realized, may not have the desired effect, and actions or statements that we may take based on expectations, assumptions, or third-party

9

information that we currently believe to be reasonable may subsequently be determined to be erroneous or be subject to misinterpretation. At the same time, investor and other stakeholder expectations, and voluntary and regulatory ESG disclosure standards and policies, continue to evolve. We may be subject to investor or regulator engagement and/or litigation on our ESG initiatives and disclosures, even if such initiatives are currently voluntary. We also note that divergent views regarding ESG principles are emerging in the U.S., and in particular, in U.S. state-level regulation and enforcement efforts and among certain activist stakeholders. To the extent ESG matters negatively impact our brand and reputation, they may also impede our ability to compete as effectively to attract and retain employees or customers, which may adversely impact our operations, business, financial condition, results of operations, cash flow and prospects.

Damage to the reputations (whether or not justified) of the Kohl’s brand, our proprietaryprivate brand names, or any affiliated individuals or companies with which we have partnered, could arise from product failures; concerns about human rights, working conditions, and other labor rights and conditions associated with our own operations or where merchandise is produced; perceptions of our diversity, equity, and inclusion efforts; perceptions of our pricing and return policies; litigation; vendor violations of our Terms of Engagement; perceptions of the national vendors and/or other third parties with which we partner; failure, or perceived failure, to realize our ESG goals on a timely basis or at all; perceptions of our management of ESG risks and opportunities; our performance on various ESG ratings; failure to meet evolving investor and other stakeholder expectations with respect to ESG matters; or various other forms of adverse publicity, especially in social media outlets. Damage to our reputationThis type of reputational damage may result in deterioration in our relationships with stakeholders and/or a reduction in sales, earnings,operating results, and shareholder value.

There may be concerns about the safety of products that we sell.

If our merchandise offerings do not meet applicable safety standards or our customers' expectations regarding safety, we could experience lost sales, experience increased costs, and/or be exposed to legal and reputational risk. Events that give rise to actual, potential, or perceived product safety concerns could expose us to government enforcement action and/or private litigation. Reputational damage caused by real or perceived product safety concerns could have a negative impact on our sales and operating results.

We may be unable to adequately maintain and/or update our information systems.

The efficient operation of our business is dependent on our information systems. In particular, we rely on our information systems to effectively manage sales, distribution, and merchandise planning and allocation functions. We also generate sales thoughthrough the operations of our Kohls.com website. We frequently make investments that will help maintain and update our existing information systems. We also depend on third parties as it relates to our information systems. The potential problems and interruptions associated with implementing technology initiatives, or the failure of our information systems to perform as designed, or the failure to successfully partner with our third party service providers, such as our cloud platform providers, could disrupt our business and harm our sales and profitability.

7

Our information technology projects may not yield their intended results.

We regularly have internal information technology projects in process. Although the technology is intended to increase productivity and operating efficiencies, these projects may not yield their intended results or may deliver an adverse user or customer experience. We may incur significant costs in connection with the implementation, ongoing use, or discontinuation of technology projects, or fail to successfully implement these technology initiatives, or achieve the anticipated efficiencies from such projects, any of which could adversely affect our operations, liquidity, and financial condition. In addition, we may not be able to adapt or adapt quickly enough to technological change, including that brought about by the use of artificial intelligence. If our competitors are more successful in adapting to such changes or otherwise incorporating such changes into their business or operations, this could have a material adverse impact on our business and results of operations.

10

Weather conditions and natural disasters could adversely affect consumer shopping patterns.patterns and disrupt our operations.

A significant portion of ourOur business is apparel, footwear, accessories, beauty, and ishome products. Both our business and our supply chain are subject to weather conditions. As a result, our operating results may be adversely affected by severe or unexpected weather conditions.conditions (including those that may be caused by climate change). Frequent or unusually heavy snow, ice, or rain storms; natural disasters such as earthquakes, tornadoes, floods, fires, and hurricanes; or extended periods of unseasonable temperatures or droughts could adversely affect our supply chain or our performance by affecting consumer shopping patterns and diminishing demand for seasonal merchandise and/or causingmerchandise. In addition, these events could cause physical damage to our properties.properties or impact our supply chain, making it difficult or impossible to timely deliver seasonally appropriate merchandise. Climate change may impact the frequency and/or intensity of such events, as well as contribute to various chronic changes in the physical environment. Although we maintain crisis management and disaster response plans and may take various actions to mitigate our business risks associated with such events and climate change, our mitigation strategies may be inadequate to address such a major disruption event.

Further, unseasonable weather conditions, including unusually warm weather in the fall or winter months or abnormally wet or cold weather in the spring or summer months, whether due to climate change or otherwise, could have a material adverse effect on our business, financial condition, and operating results, as consumer spending may be inconsistent with our typical inventory purchasing cycle.

We may be unable to successfully execute an omnichannel strategy.

Customer expectations about the methods by which they purchase and receive products or services are evolving. Customers are increasingly using technology and mobile devices to rapidly compare products and prices, and to purchase products. Once products are purchased, customers are seeking alternate options for delivery of those products. We must continually anticipate and adapt to these changes in the purchasing process. Our ability to compete with other retailers and to meet our customercustomers' expectations may suffer if we are unable to provide relevant customer-facing technology and omnichannel experiences. OurWe have taken steps to simplify our value strategy by eliminating online-only promotions in favor of omnichannel pricing across the enterprise. This pressured our digital performance in 2023. While we believe this approach aligns with our long-term strategy, our efforts may not produce the intended results. Similarly, as we refine our value strategy to be less promotional, our efforts may negatively impact the loyalty of certain customers and our efforts to mitigate this impact may not be successful.

In addition, our ability to compete may also suffer if Kohl’s, our suppliers, or our third-party shipping and delivery vendors are unable to effectively and efficiently fulfill and deliver orders, especially during the holiday season when sales volumes are especially high. Consequently, our results of operations could be adversely affected.

Our business is seasonal in nature, which could negatively affect our sales, revenues, operating results, and cash requirements.

Our business is subject to seasonal influences, with a major portion of sales and income historically realized during the second half of the fiscal year, which includes the back-to-school and holiday seasons.

If we do not properlyadequately stock or restock popular products, particularly during the back-to-school and holiday seasons, we may fail to meet customer demand, which could affect our revenue and our future growth. If we overstock products, we may be required to take significant inventory markdowns or write-offs, which could reduce profitability. Underestimating customer demand, or failing to timely receive merchandise to meet demand, can lead to inventory shortages and missed sales opportunities, as well as negative customer experiences.

11

We have and may continue to experience an increase in costs associated with shipping digital orders due to complimentary upgrades,promotional shipping offers, split shipments, freight surcharges due to peak capacity constraints, and additional long-zone shipments necessary to ensure timely delivery for the holiday season. If too many customers access our website within a short period of time, particularly during peak selling periods, we may experience system interruptions that make our website unavailable or prevent us from efficiently fulfilling orders, which may reduce the volume of goods we sell and the attractiveness of our products and services. Also, third-party delivery and direct ship vendors may be unable to deliver merchandise on a timely basis.

This seasonality causes our operating results and cash needs to vary considerably from quarter to quarter. Additionally, any decrease in sales or profitability during the second half of the fiscal year could have a disproportionately adverse effect on our results of operations.

8

Changes in credit card operations and payment-related risks could adversely affect our sales, revenues, and/or profitability.

Our credit card operations facilitate merchandise sales and generate additional revenue from fees related to extending credit. The proprietaryprivate label and co-branded Kohl's credit card accounts are owned by an unrelated third-party, but we share in the net risk-adjusted revenue of the portfolio, which is defined as the sum of finance charges, late fees, and other revenue less write-offs of uncollectible accounts. Changes in funding costs related to interest rate fluctuations are shared similar to the revenue when interest rates exceed defined amounts. Though management currently believes that increases in funding costs will be largely offset by increases in finance charge revenue, increases in funding costs could adversely impact the profitability of this program. On March 5, 2024, the Consumer Financial Protection Bureau ("CFPB") finalized a rule lowering the safe harbor dollar amount credit card companies can charge for late fees for a missed payment. The rule reduces the typical amount of late fees that can be charged, which could have a negative impact on Kohl’s credit card revenues, particularly if Kohl’s steps to mitigate the impact of such rule are not successful.

Changes in credit card use and applications, payment patterns, credit fraud, and default rates may also result from a variety of economic, legal, social, and other factors that we cannot control or predict with certainty. Changes that adversely impact our ability to extend credit and collect payments could negatively affect our results.

We also accept payment from customers in a variety of ways, such as cash, checks, debit cards, gift cards, mobile payments, as well as other forms, which subject us to rules, regulations, contractual obligations, and other compliance requirements such as those related to payment network rules and operating guidelines, as well as potential fraud, which may have an adverse impact on our operating results.

We may be unable to attract, develop, and retain quality associates while controlling costs, which could adversely affect our operating results.

Our performance is dependent on attracting and retaining a large number of quality associates, including our senior management team and other key associates. While we have succession plans for our senior management team, they may not be adequate to replace members of our senior management, including our Chief Executive Officer, or may not be successfully executed.

Many associates are in entry levelentry-level or part-time positions with historically high rates of turnover. Many of our strategic initiatives require that we hire and/or develop associates with appropriate experience. Our staffing needs are especially high during the holiday season. Competition for these associates is intense. We cannot be sure that we will be able to attract and retain a sufficient number of qualified personnel in future periods.

Our ability to meet our labor needs while controlling costs is subject to external factors such as government benefits, unemployment levels and labor participation rates, prevailing wage rates, minimum wage legislation, actions by our competitors in compensation levels, perceptions of our employee experience, potential labor organizing efforts, and

12

changing demographics. Competitive and regulatory pressures have already significantly increased our labor costs. Further changes that adversely impact our ability to attract and retain quality associates could adversely affect our performance and/or profitability. In addition, changes in federal and state laws relating to employee benefits, including, but not limited to, sick time, paid time off, leave of absence, minimum wage, wage-and-hour, overtime, meal-and-break time, and joint/co-employment could cause us to incur additional costs, which could negatively impact our profitability.

Capital Risks

We may be unable to raise additional capital or maintain bank credit on favorable terms, which could adversely affect our business and financial condition.

We have historically relied on the public debt markets to raise capital to partially fund our operations and growth. We have also historically maintained lines of credit with financial institutions. In January 2023, we upsized and replaced our unsecured credit facility with a $1.5 billion senior secured, asset based revolving credit facility. Changes in the credit and capital markets, including market disruptions, limited liquidity, and interest rate fluctuations may increase the cost of financing or restrict our access to these potential sources of future liquidity. Our continued access to these liquidity sources on favorable terms depends on multiple factors, including our operating performance and maintaining strong debt ratings. IfDuring 2022, our credit ratings fallwere reduced below desirable levels,investment grade, which resulted in an increase in the interest rate on a portion of our long-term debt. During the first quarter of 2023, S&P downgraded our senior unsecured credit rating from BB+ to BB and Moody's downgraded our rating from Ba2 to Ba3. These downgrades have caused our cost of borrowing to increase, and further downgrades would cause our cost of borrowing to further increase. Declines in our credit ratings may also adversely affect our ability to access the debt markets and the terms and our cost of funds for new debt issuances couldissuances. If our credit ratings were to be adverselyfurther downgraded, or general market conditions were to ascribe higher risk to our credit rating levels, our industry, or our Company, our access to capital and the cost of debt financing may be negatively impacted. Additionally, if unfavorable capital market conditions exist if and when we were to seek additional financing, we may not be able to raise sufficient capital on favorable terms and on a timely basis (if at all). The terms of current and future debt agreements could restrict our business operations or cause future financing to be unavailable due to our covenant restrictions then in effect. Also, if we are unable to comply with the covenants under our revolving credit facility, the lenders under that agreement will have the right to terminate their commitments thereunder and declare the outstanding loans thereunder to be immediately due and payable. A default under our revolving credit facility could trigger a cross-default, acceleration, or other consequences under other indebtedness or financial instruments to which we are a party. If our access to capital was to become significantly constrained or our cost of capital was to increase significantly our financial condition, results of operations, and cash flows could be adversely affected.

9

Our capital allocation could be inefficient or ineffective.

Our goal is to invest capital to maximize our overall long-term returns. This includes spending on inventory, capital projects and expenses, managing debt levels, and periodically returning value to our shareholders through share repurchases and dividends. To a large degree, capital efficiency reflects how well we manage our other key risks. The actions taken to address other specific risks may affect how well we manage the more general risk of capital efficiency. If we do not properly allocate our capital to maximize returns, we may fail to produce optimal financial results, and we may experience a reduction in shareholder value.

13

Legal and Regulatory Risks

Regulatory and legal matters could adversely affect our business operations and change financial performance.

Various aspects of our operations are subject to federal, state, or local laws, rules, and regulations, including consumer regulations, any of which may change from time to time. The costs and other effects of new or changed legal requirements cannot be determined with certainty. For example, new legislation or regulations may result in increased costs directly for our compliance or indirectly to the extent such requirements increase prices of goods and services, reduce the availability of raw materials, or further restrict our ability to extend credit to our customers.

We continually monitor the state and federal legal/legal and regulatory environmentenvironments for developments that may impact us. Failure to detect changes and comply with such laws and regulations may result in an erosion of our reputation, disruption of business, and/or loss of associate morale. Additionally, we are regularly involved in various litigation matters that arise out of the conduct of our business. Litigation or regulatory developments could adversely affect our business operations and financial performance.

SensitiveOur efforts to protect the privacy and security of sensitive or confidential customer, associate, or company information could be improperly disclosed or lost,unsuccessful, which could severely damage our reputation, expose us to risks of litigation and liability, disrupt our operations, and harm our business.

As part of our normal course of business, we collect, retain, process, and retaintransmit sensitive and confidential customer, associate, and company information. The protectionWe also engage third-party vendors that provide technology, systems, and services to facilitate our collection, retention, processing, and transmission of this datainformation. It is extremely important to us, our associates and our customers. Despite the considerable security measures we have in place,possible that our facilities and systems and those of our third-party service providers, may bevendors are vulnerable to cybersecurity threats, security breaches, system failures, acts of vandalism, fraud, misappropriation, computer viruses,malware, ransomware, and other malicious or harmful code, misplaced or lost data, programming and/or human errors, or employee negligence,insider threats, or other similar events. The ever-evolving and increasingly sophisticated methods of cyber-attack may be difficult or impossible to anticipate and/or detect. Any data security breachincident involving the breach, misappropriation, loss, or other unauthorized disclosure of sensitive and/or confidential information, whether by us or our vendors, could disrupt our operations, damage our reputation and customers' willingness to shop in our stores or on our website, violate applicable laws, regulations, orders and agreements, and subject us to additional costs and liabilities which could be material. In addition, the regulatory environment related to data privacy and cybersecurity is constantly changing, with new and increasingly demanding requirements applicable to our business. Maintaining our compliance with those requirements, including recently enacted state consumer privacy laws, may increase our compliance costs, require changes to our business practices, limit our ability to use and collect data, impact our customers’ shopping experience, reduce our business efficiency, and subject us to additional regulatory scrutiny or data breach litigation.

Item 1B. Unresolved Staff Comments

Not applicable.

Item 1C. Cybersecurity

Cybersecurity Risk Management and Strategy

We have developed and implemented a cybersecurity risk management program intended to protect the confidentiality, integrity, and availability of our critical systems and information. We designed and assess our program based on the National Institute of Standards and Technology Cybersecurity Framework (NIST CSF), International Organization for Standardization (ISO) 27001, and Payment Card Industry Data Security Standard (PCI DSS). This does not imply that we meet any particular technical standards, specifications, or requirements, only that we use these frameworks as a guide to help us identify, assess, and manage cybersecurity risks relevant to our business.

14

Our cybersecurity risk management program is integrated into our overall enterprise risk management program and shares common methodologies, reporting channels, and governance processes that apply across the enterprise risk management program to other legal, compliance, strategic, operational, and financial risk areas. Our cybersecurity risk management program includes:

We have not identified risks from known cybersecurity threats, including as a result of any prior cybersecurity incidents, that have materially affected us, including our operations, business strategy, results of operations, or financial condition. We face risks from cybersecurity threats that, if realized, are reasonably likely to materially affect us, including our operations, business strategy, results of operations, or financial condition. See "Risk Factors- Legal and Regulatory Risks".

Cybersecurity Governance

Our Board considers cybersecurity risk as part of its risk oversight function and has delegated to its Audit Committee oversight of cybersecurity and other information technology risks. Our Audit Committee oversees management’s implementation of our cybersecurity risk management program.

Our Audit Committee receives regular reports from management on our cybersecurity risks, and our full Board receives a periodic update. In addition, management updates the Audit Committee, as necessary, regarding any material cybersecurity incidents, as well as significant incidents.

Our Audit Committee reports to the full Board regarding its activities, including those related to cybersecurity. Board members receive presentations on cybersecurity topics from our Chief Technology Officer (CTO), Chief Risk and Compliance Officer (CRCO), and Chief Information Security Officer (CISO) or external experts as part of the Board’s continuing education on topics that impact public companies.

Our management team, including our CTO, CRCO, and CISO, has overall responsibility for assessing and managing our material risks from cybersecurity threats. The team has primary responsibility for our overall cybersecurity risk management program and supervises both our internal cybersecurity personnel and our retained external cybersecurity consultants. Our management team’s experience includes over 25 years of technology and finance leadership experience across multiple industries for our CTO, over 30 years of experience in the Legal, Risk and Compliance disciplines for our CRCO, and over 20 years of cybersecurity leadership experience for our CISO.

Our management team is informed about and monitors the prevention, detection, mitigation, and remediation of key cybersecurity risks and incidents through various means, which may include briefings from internal security personnel, threat intelligence and other information obtained from governmental, public or private sources, including external consultants engaged by us, and alerts and reports produced by security tools deployed in the information technology environment.

15

Stores

As of February 3, 2018,2024, we operated 1,1581,174 Kohl's department stores with 82.882 million selling square feet in 49 states. We also operate four Off-Aisle clearance centers and 12 FILA outlets.

Our typical store lease has an initial term of 20-25 years and four to eight five-year renewal options for consecutive five-year extension terms.options. Substantially all of our leases provide for a minimum annual rent that is fixed or adjusts to set levels during the lease term, including renewals. Approximately one-fourthSome of theour store leases provide for additional rent based on a percentage of sales over designated levels.

10

The following tables summarize key information about our Kohl's stores as of February 3, 2018:2024:

Number of Stores by State | |||||

Mid-Atlantic Region: | Northeast Region: | South Central Region: | |||

Delaware | 5 | Connecticut | 20 | Arkansas | 8 |

Maryland | 23 | Maine | 5 | Kansas | 12 |

Pennsylvania | 51 | Massachusetts | 26 | Louisiana | 7 |

Virginia | 31 | New Hampshire | 11 | Missouri | 27 |

West Virginia | 8 | New Jersey | 38 | Oklahoma | 11 |

|

| New York | 50 | Texas | 89 |

|

| Rhode Island | 4 |

|

|

|

| Vermont | 2 |

|

|

Total Mid-Atlantic | 118 | Total Northeast | 156 | Total South Central | 154 |

|

|

|

|

|

|

Midwest Region: | Southeast Region: | West Region: | |||

Illinois | 66 | Alabama | 14 | Alaska | 1 |

Indiana | 42 | Florida | 50 | Arizona | 26 |

Iowa | 18 | Georgia | 33 | California | 117 |

Michigan | 46 | Kentucky | 18 | Colorado | 24 |

Minnesota | 28 | Mississippi | 5 | Idaho | 6 |

Nebraska | 8 | North Carolina | 31 | Montana | 4 |

North Dakota | 4 | South Carolina | 17 | Nevada | 13 |

Ohio | 59 | Tennessee | 20 | New Mexico | 4 |

South Dakota | 4 |

|

| Oregon | 11 |

Wisconsin | 42 |

|

| Utah | 12 |

|

|

|

| Washington | 21 |

|

|

|

| Wyoming | 2 |

Total Midwest | 317 | Total Southeast | 188 | Total West | 241 |

Location |

| Ownership | ||

Strip centers | 951 |

| Owned | 406 |

Freestanding | 161 |

| Leased | 521 |

Community & regional malls | 62 |

| Ground leased | 247 |

Number of Stores by State | |||||||

Mid-Atlantic Region: |

| Northeast Region: |

| South Central Region: | |||

Delaware | 5 |

| Connecticut | 22 |

| Arkansas | 8 |

Maryland | 23 |

| Maine | 5 |

| Kansas | 12 |

Pennsylvania | 50 |

| Massachusetts | 25 |

| Louisiana | 8 |

Virginia | 31 |

| New Hampshire | 11 |

| Missouri | 27 |

West Virginia | 7 |

| New Jersey | 38 |

| Oklahoma | 11 |

|

|

| New York | 51 |

| Texas | 84 |

|

|

| Rhode Island | 4 |

|

|

|

|

|

| Vermont | 2 |

|

|

|

Total Mid-Atlantic | 116 |

| Total Northeast | 158 |

| Total South Central | 150 |

|

|

|

|

|

|

|

|

Midwest Region: |

| Southeast Region: |

| West Region: | |||

Illinois | 66 |

| Alabama | 14 |

| Alaska | 1 |

Indiana | 40 |

| Florida | 51 |

| Arizona | 26 |

Iowa | 18 |

| Georgia | 32 |

| California | 117 |

Michigan | 46 |

| Kentucky | 17 |

| Colorado | 24 |

Minnesota | 27 |

| Mississippi | 5 |

| Idaho | 5 |

Nebraska | 7 |

| North Carolina | 30 |

| Montana | 3 |

North Dakota | 4 |

| South Carolina | 16 |

| Nevada | 12 |

Ohio | 59 |

| Tennessee | 20 |

| New Mexico | 5 |

South Dakota | 4 |

|

|

|

| Oregon | 11 |

Wisconsin | 41 |

|

|

|

| Utah | 12 |

|

|

|

|

|

| Washington | 19 |

|

|

|

|

|

| Wyoming | 2 |

Total Midwest | 312 |

| Total Southeast | 185 |

| Total West | 237 |

16

Location |

| Ownership | ||

Strip centers | 779 |

| Owned | 412 |

Community & regional malls | 83 |

| Leased | 509 |

Freestanding | 296 |

| Ground leased | 237 |

Distribution Centers

The following table summarizes key information about each of our distribution centers.and e-fulfillment centers:

|

|

| Year Opened |

| Square Footage |

| |

| Store distribution centers: |

|

|

|

|

|

|

| Findlay, Ohio |

| 1994 |

|

| 780,000 |

|

| Winchester, Virginia |

| 1997 |

|

| 420,000 |

|

| Blue Springs, Missouri |

| 1999 |

|

| 540,000 |

|

| Corsicana, Texas |

| 2001 |

|

| 540,000 |

|

| Mamakating, New York |

| 2002 |

|

| 605,000 |

|

| San Bernardino, California |

| 2002 |

|

| 575,000 |

|

| Macon, Georgia |

| 2005 |

|

| 560,000 |

|

| Patterson, California |

| 2006 |

|

| 360,000 |

|

| Ottawa, Illinois |

| 2008 |

|

| 328,000 |

|

| Online fulfillment centers: |

|

|

|

|

|

|

| Monroe, Ohio |

| 2001 |

|

| 1,200,000 |

|

| San Bernardino, California |

| 2010 |

|

| 970,000 |

|

| Edgewood, Maryland |

| 2011 |

|

| 1,450,000 |

|

| DeSoto, Texas |

| 2012 |

|

| 1,200,000 |

|

| Plainfield, Indiana |

| 2017 |

|

| 936,000 |

|

| Year | Square |

Store distribution centers: |

|

|

Findlay, Ohio | 1994 | 780,000 |

Winchester, Virginia | 1997 | 450,000 |

Blue Springs, Missouri | 1999 | 540,000 |

Corsicana, Texas | 2001 | 540,000 |

Mamakating, New York | 2002 | 605,000 |

San Bernardino, California | 2002 | 575,000 |

Macon, Georgia | 2005 | 560,000 |

Patterson, California | 2006 | 365,000 |

Ottawa, Illinois | 2008 | 330,000 |

E-commerce fulfillment centers: |

|

|

Monroe, Ohio | 2001 | 1,225,000 |

San Bernardino, California | 2010 | 970,000 |

Edgewood, Maryland | 2011 | 1,450,000 |

DeSoto, Texas | 2012 | 1,515,000 |

Plainfield, Indiana | 2017 | 975,000 |

Etna, Ohio | 2021 | 1,300,000 |

We own all of the distribution and e-fulfillment centers except the San Bernardino, California locations and Corsicana, Texas, which isare leased.

11

We own our corporate headquarters in Menomonee Falls, Wisconsin. We also own or lease additional buildings and office space, which are used by various corporate departments, including our credit operations.

We are not currentlyFor a party to any materialdescription of our legal proceedings, but are subject to certain legal proceedings and claims from time to time that arise outsee Note 7, Contingencies, of the conduct ofnotes to our business.consolidated financial statements included elsewhere in this Annual Report on Form 10-K, which is incorporated by reference in response to this item.

Item 4. Mine Safety Disclosures

Not applicable.

Item 4A. Information about Our Executive Officers

Our executive officers as of February 3, 20182024 were as follows:

Name | Age | Position |

|

|

|

|

| Chief Financial Officer |

Fred Hand | 60 | Senior Executive Vice President, Director of Stores |

Nick Jones | 51 | Chief Merchandising and |

|

| Senior Executive Vice President, Chief |

|

| Senior Executive Vice President, Chief |

|

| Senior Executive Vice President, Chief |

17

Thomas A. Kingsbury

Mr. Mansell is responsible for Kohl’s strategic direction, long-term growth and profitability. HeKingsbury has served as Chairman since September 2009,our Chief Executive Officer since August 2008February 2023 and President and Director since February 1999. We previously announced Mr. Mansell’s retirementserved as the Chairman of the Board, Chief Executive Officer and Presidentour Interim CEO from December 2022 through January 2023 and as a director since May 2021. Mr. Kingsbury has more than 40 years of Kohl’s effective as ofexperience in the close ofretail industry. Prior to joining the 2018 Annual Meeting of Shareholders or any adjournment thereof. Mr. Mansell began his retail careerCompany in 1975.

Ms. Gass joined Kohl's in June 2013 as Chief Customer Officer and was named Chief Merchandising and Customer Officer in June 2015 and CEO-elect in September 2017. She is responsible for all of Kohl's merchandising, planning and allocation, and product development functions as well as the company's overall customer engagement strategy, including marketing, public relations, social media and philanthropic efforts. Previously, she served inDecember 2022, he held a variety of management positions with Starbucks Coffee Company since 1996, most recentlycompany and board leadership roles at Kohl’s, Burlington Stores, Inc., and The May Department Stores Company. He led Burlington Stores, Inc. as President Starbucks Coffee EMEA (Europe, Middle East, Russia and Africa) from 2011 to May 2013. Ms. Gass began her retail career in 1991.

Ms. Chawla joined Kohl's in November 2015 as Chief Operating Officer and was named President-elect in September 2017. She is responsible for Kohl's full omnichannel operations. She oversees all store operations, logistics and supply chain network, information and digital technology, and omnichannel strategy, planning and operations. Previously, she had served with Walgreens as President of Digital and Chief MarketingExecutive Officer from February2008 to 2019 and served on the Burlington Stores Board of Directors from 2008 to 2020, including as Chairman from 2014 to November 20152019 and President, E-Commerceas Executive Chairman from January 20112019 to February 2014. 2020.

Jill Timm

Ms. Chawla began her retail and digital career in 2000.

Mr. Besanko joined Kohl’s in July 2017Timm has served as Chief Financial Officer since November 2019. Ms. Timm joined the Company in 1999 and is responsible for financial planning and analysis, investor relations, financial reporting, accounting operations, tax, treasury, non-merchandise purchasing, credit and capital investment strategies. Previously, he served with Supervalu, Inc. as Executive Vice President, Chief Operating Officer and Chief Financial Officer from October 2015 to July 2017 and Executive Vice President and Chief Financial Officer from August 2013 to October 2015. Mr. Besanko alsohas held a number of progressive leadership roles across several areas of finance, most recently having served as Executive Vice President Chief Financial Officer and Chief Administrative Officerof Finance. Prior to joining the Company, she served as senior auditor at OfficeMax, Inc. from 2008 to August 2013 and Executive Vice President, Chief Financial Officer at Circuit City from 2007 to 2008. On November 10, 2008, Circuit City and severalArthur Andersen LLP. Ms. Timm has more than 20 years of its subsidiaries filed voluntary petitions for relief under Chapter 11 of the United States Bankruptcy Codeexperience in the United States Bankruptcy Court for the Eastern District of Virginia. Circuit City’s Chapter 11retail industry.

12

Table of ContentsFred Hand

plan of liquidation was confirmed by the Bankruptcy Court on September 14, 2010. In addition to his business experience, he served 26 years in the U.S. Air Force where he rose to the rank of Lieutenant Colonel. Mr. Besanko began his retail career in 1996.

Mr. Schepp was promoted to the principal officer position of Chief Administrative Officer in June 2015 and is responsible for Kohl's human resources, legal, risk management and compliance, real estate, business development and store construction and design functions. He previouslyHand has served as Senior Executive Vice President, Human Resources, General CounselDirector of Stores since September 2023. Prior to joining the Company, Mr. Hand served as Chief Executive Officer of Tuesday Morning from August 2020 to May 2021. Prior to that, he was Chief Operating Officer at Burlington, where he led the Stores organization for more than 13 years. Mr. Hand has also held a variety of senior leadership roles in stores and Secretaryvisual merchandising at May Department Stores (then Macy's) and Filene's. Mr. Hand has more than 30 years of retail experience.

Nick Jones

Mr. Jones has served as Chief Merchandising and Digital Officer since March 2023. Prior to joining the Company, Mr. Jones served as Chief Executive Officer at Joules Group — a premium British lifestyle clothing brand from April 2013September 2019 to June 2015,August 2022. Mr. Jones has also held a variety of business and merchandise leadership positions with ASDA/Walmart UK and Marks & Spencer. Mr. Jones has more than 25 years of retail experience.

Jennifer Kent

Ms. Kent has served as Senior Executive Vice President, General CounselChief Legal Officer and Corporate Secretary since February 2023. Prior to joining the Company, Ms. Kent served in various legal leadership roles at Quad/Graphics, Inc., a publicly traded Milwaukee-based company, from May 20112010 to April 2013 andFebruary 2023, most recently having served as its Executive Vice President and Chief People and Legal Officer and Corporate Secretary. Ms. Kent also held a variety of other legal roles throughout her career, including as an Associate General Counsel at Harley-Davidson Motor Company, an Assistant United States Attorney at the U.S. Attorney’s Office, and Secretaryas an associate at Foley & Lardner LLP. Ms. Kent has over 25 years of legal experience.

Siobhán Mc Feeney

Ms. Mc Feeney has served as Senior Executive Vice President, Chief Technology Officer since July 2022. She joined the Company in January 2020 as Senior Vice President, Technology. Prior to joining the Company, Ms. Mc Feeney served in a number of technology leadership roles, including leading innovation and strategy at Pivotal Software, Inc. from 2014 to January 2020. Ms. Mc Feeney has also held various leadership roles at AAA Northern California, including Chief Financial Officer, Chief Information Officer, and Interim Chief Executive Officer. Ms. Mc Feeney has more than 25 years of technology and finance experience.

Christie Raymond

Ms. Raymond has served as Senior Executive Vice President, Chief Marketing Officer since August 20012022. She joined the Company in October 2017 as Senior Vice President, Media and Personalization and was promoted to May 2011. Mr. Schepp began hisExecutive Vice President, Customer Engagement, Analytics & Insights in June 2020. Prior to joining the Company, she served in marketing, new business, and strategic planning leadership roles at The Walt Disney Company and Aspen Club Technologies. Ms. Raymond has 15 years of marketing and retail career in 1992.industry experience.

18

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities

Market information

Our Common Stock has been traded on the New York Stock Exchange ("NYSE") since May 19, 1992, under the symbol “KSS.” The prices in the table set forth below indicate the high and low sales prices of our Common Stock per the New York Stock Exchange Composite Price History and our quarterly cash dividends per common share for each quarter in 2017 and 2016.

|

|

| 2017 |

|

|

| 2016 |

| ||||||||||||||||||

|

|

| High |

|

| Low |

|

| Dividend |

|

|

| High |

|

| Low |

|

| Dividend |

| ||||||

| Fourth quarter |

| $ | 69.14 |

|

| $ | 37.97 |

|

| $ | 0.55 |

|

|

| $ | 59.43 |

|

| $ | 39.00 |

|

| $ | 0.50 |

|

| Third quarter |

|

| 47.44 |

|

|

| 36.50 |

|

|

| 0.55 |

|

|

|

| 46.15 |

|

|

| 37.70 |

|

|

| 0.50 |

|

| Second quarter |

|

| 42.13 |

|

|

| 35.16 |

|

|

| 0.55 |

|

|

|

| 45.07 |

|

|

| 34.49 |

|

|

| 0.50 |

|

| First quarter |

|

| 44.50 |

|

|

| 36.66 |

|

|

| 0.55 |

|

|

|

| 51.13 |

|

|

| 39.69 |

|

|

| 0.50 |

|

Holders

On February 28, 2018, our Board of Directors approved an 11% increase in our dividend to $0.61 per common share. The dividend will be paid on March 28, 2018 to shareholders of record asAs of March 14, 2018. In 2017, we paid aggregate cash dividends of $368 million.

Holders

As of March 14, 2018,20, 2024, there were approximately 4,0003,200 record holders of our Common Stock.

13

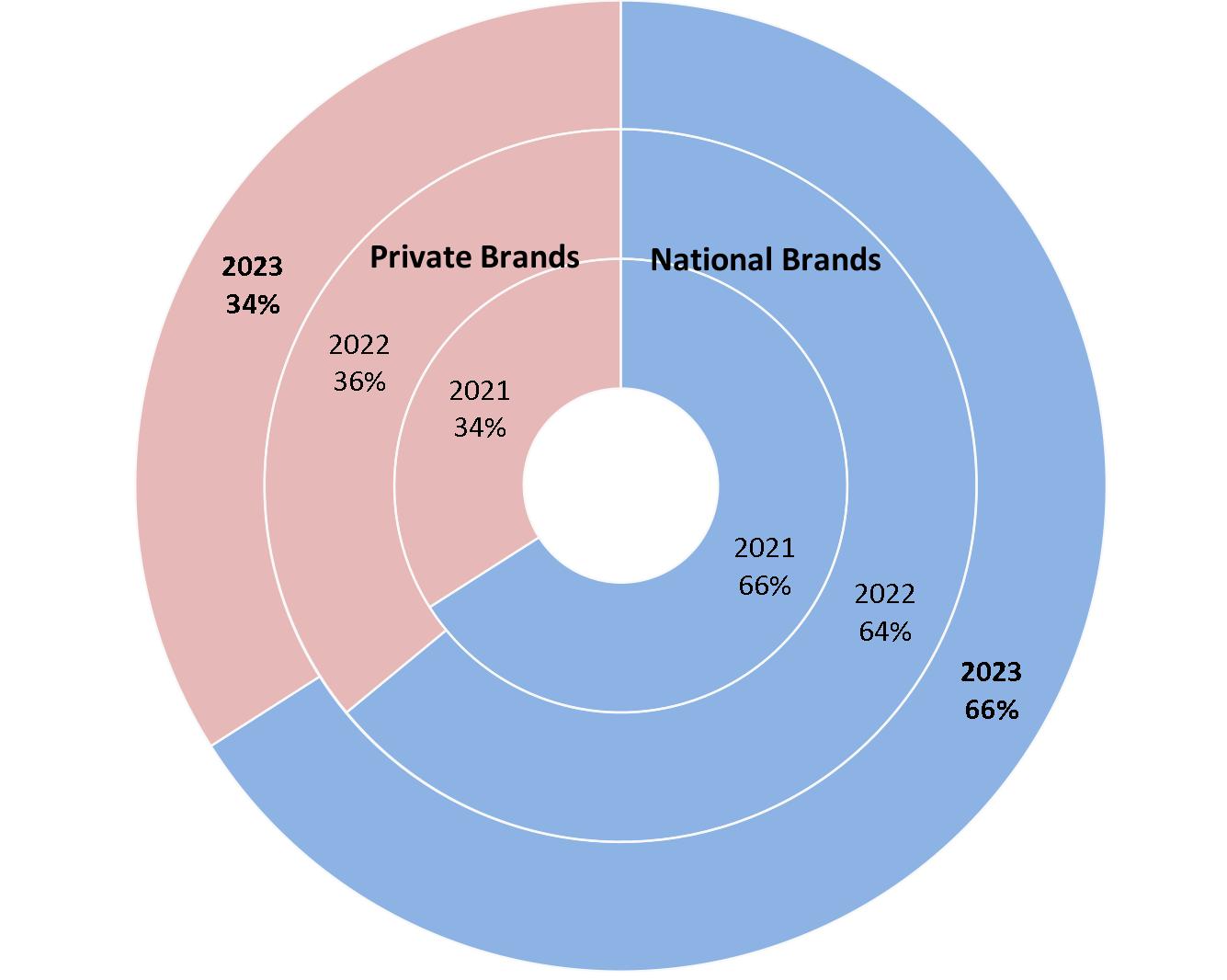

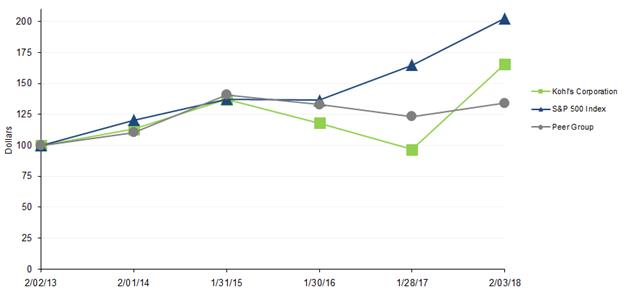

The graph below compares our cumulative five-year shareholder return to that of the Standard & Poor’s (“S&P”) 500 Index and a Peer Groupthe S&P 500 Consumer Discretionary Distribution & Retail Index, that is consistent withformerly known as the retail peer group used in the Compensation DiscussionS&P 500 Retailing Index. The S&P 500 Consumer Discretionary Distribution & Analysis section of our Proxy Statement for our May 16, 2018 Annual Meeting of Shareholders. The Peer GroupRetail Index was calculated by S&P Global, a Standard & Poor’s business and includes Bed, Baththe same companies within the S&P Consumer Discretionary Distribution & Beyond Inc.;Retail Index. The Gap, Inc.; J.C. Penney Company, Inc.; L Brands, Inc.; Macy’s, Inc.; Nordstrom, Inc.; Ross Stores, Inc.; Sears Holding Corporation; Target Corporation; and The TJX Companies, Inc. The Peer GroupS&P 500 Consumer Discretionary Distribution & Retail Index is weighted by the market capitalization of each component company at the beginning of each period. The graph assumes an investment of $100 on February 2, 20132019 and reinvestment of dividends. The calculations exclude trading commissions and taxes.

19

| Company / Index |

| Feb 2, 2013 |

|

| Feb 1, 2014 |

|

| Jan 31, 2015 |

|

| Jan 30, 2016 |

|

| Jan 28, 2017 |

|

| Feb 3, 2018 |

| ||||||

| Kohl’s Corporation |

| $ | 100.00 |

|

| $ | 113.07 |

|

| $ | 137.13 |

|

| $ | 117.90 |

|

| $ | 96.59 |

|

| $ | 165.78 |

|

| S&P 500 Index |

|

| 100.00 |

|

|

| 120.30 |

|

|

| 137.42 |

|

|

| 136.50 |

|

|

| 164.99 |

|

|

| 202.66 |

|

| Peer Group Index |

|

| 100.00 |

|

|

| 110.41 |

|

|

| 140.97 |

|

|

| 132.93 |

|

|

| 123.18 |

|

|

| 134.02 |

|

Company / Index | Feb 2, | Feb 1, | Jan 30, | Jan 29, | Jan 28, | Feb 3, |

Kohl’s Corporation | $100.00 | $67.42 | $72.06 | $100.18 | $55.41 | $50.62 |

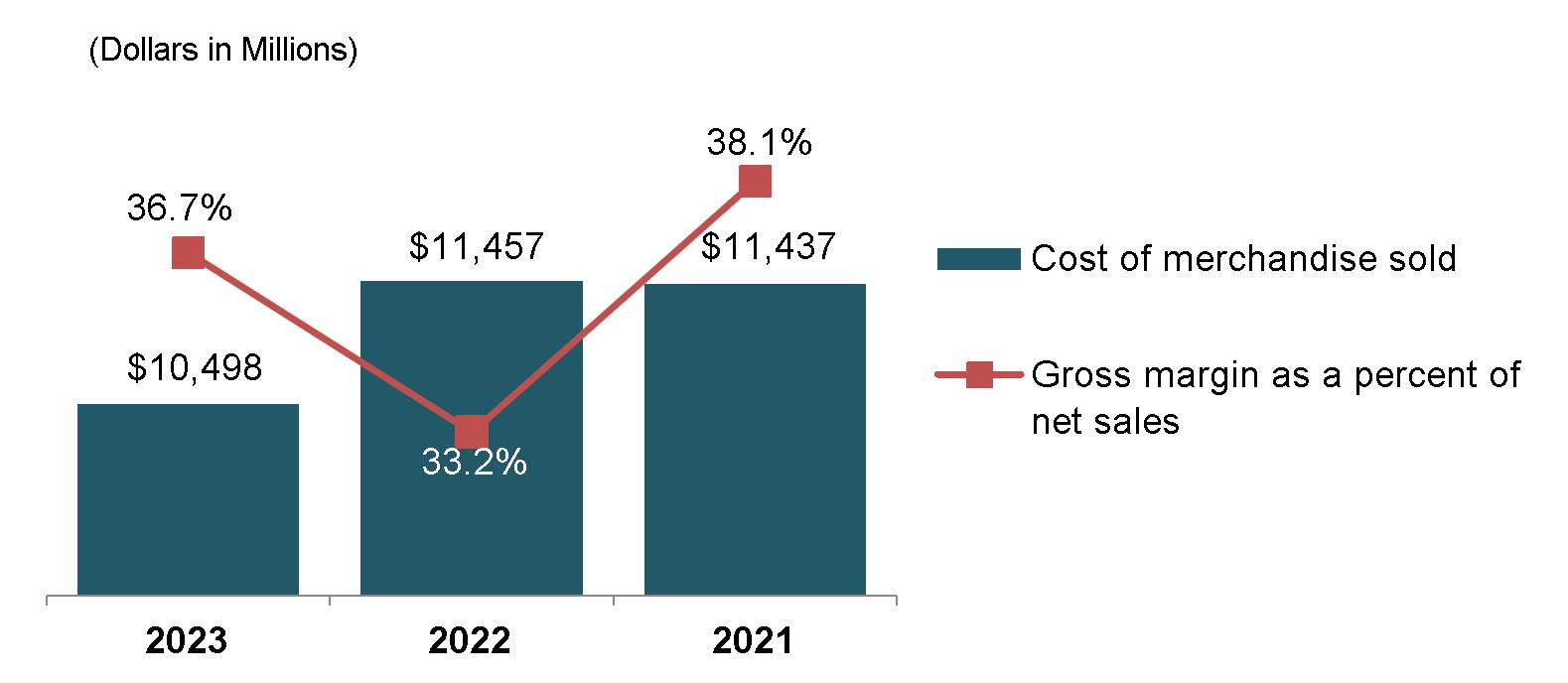

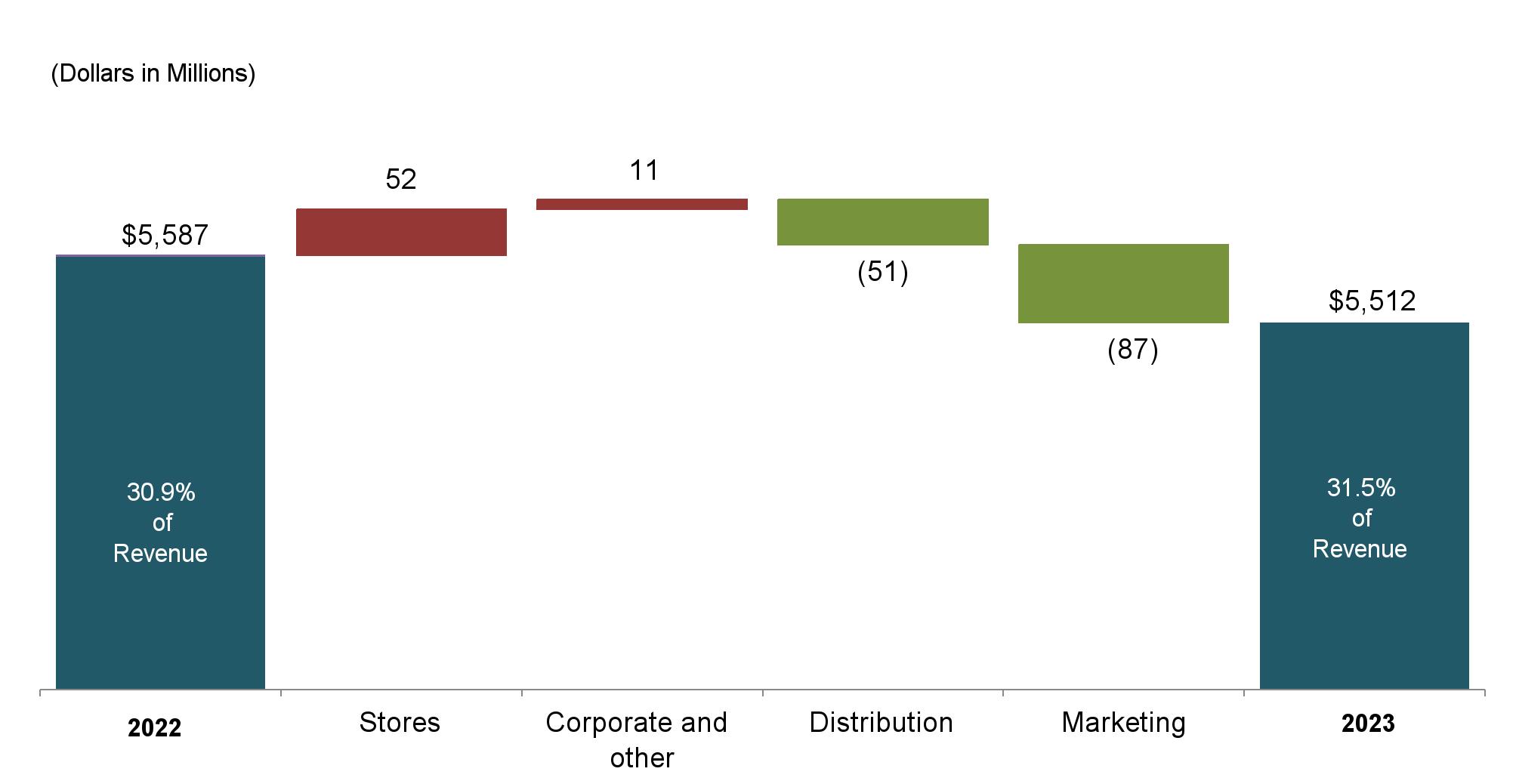

S&P 500 Index | 100.00 | 121.56 | 142.53 | 172.46 | 161.03 | 199.42 |