UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

☒

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31 2017, 2023

OR

☐

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO

Commission File Number 001-38107

ShotSpotter,SoundThinking, Inc.

(Exact Name of Registrant as Specified in its Charter)

| |

Delaware | 47-0949915 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer

Identification No.) |

7979 Gateway Blvd.39300 Civic Center Dr., Suite 210300

Newark, Fremont, California

| 9456094538

|

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (510) (510) 794-3100

Securities registered pursuant to Section 12(b) of the Act: Common Stock, $0.005 par value per share; Common Stock traded on the Nasdaq Capital Market.

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $0.005 par value per share | SSTI | Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES Yes☐ NO No☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES Yes☐ NO No☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES Yes☒ NO No☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). YES Yes☒ NO No☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | |

Large accelerated filer | ☐ |

| Accelerated filer | ☐ |

Non-accelerated filer | ☒

| (Do not check if a smaller reporting company)

| Smaller reporting company | ☐☒

|

Emerging growth company | ☒☐

|

|

|

|

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes☐No☒

Indicate by check mark whether the Registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered independent public accounting firm that prepared or issued its audit report ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ◻

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ◻

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on a closing price of $12.79$21.86 per share of the Registrant’s common stock as reported on the Nasdaq Capital Market on June 30, 20172023 was $63,340,096.$203,469,492.

The number of shares of Registrant’s common stock outstanding as of March 21, 201826, 2024 was 10,312,702.12,786,840.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Definitive Proxy Statement relating to the Annual Meeting of Stockholders, scheduled to be held on May 29, 2018,June, 11, 2024, are incorporated by reference into Part III of this Report. Such Definitive Proxy Statement will be filed with the Securities and Exchange Commission no later than 120 days following the end of the Registrant’s fiscal year ended December 31, 2017.2023.

Table of Contents

SPECIAL NOTE REGARDING FORWARDFORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements that involve substantial risks and uncertainties. The forward-looking statements are contained principally in the sections of this Annual Report on Form 10-K entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” but are also contained elsewhere in this Annual Report on Form 10-K. In some cases,Often, you can identify forward-looking statements by the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “objective,” “ongoing,” “plan,” “predict,” “project,” “potential,” “should,” “will,” or “would,” or the negative of these terms, or other comparable terminology intended to identify statements about the future. Forward-looking statements include statements about:

•our ability to continue to increase revenues, secure customer renewals and expand coverage areas of existing public safety customers;

•our ability to continue to add new customers for our public safety and security solutions;

•our ability to grow both domestically and internationally;

•our ability to effectively manage or sustain our growth;

•our ability to maintain, increase or strengthen awareness of our solutions;

•our ability to achieve and maintain service level agreement standards in our customer contracts;

•our ability to increase revenues, which has been impacted by supply chain disruptions and delays;

•future revenues, hiring plans, expenses, capital expenditures, capital requirements and stock performance;

•our ability to service outstanding debt, if any, and satisfy covenants associated with outstanding debt facilities;

•our ability to attract and retain qualified employees and key personnel and further expand our overall headcount;

•our ability to comply with new or modified laws and regulations that currently apply or become applicable to our business both in the United States and internationally; and

•our ability to maintain, protect and enhance our intellectual property.

We caution you that the foregoing list may not contain all of the forward-looking statements made in this Annual Report on Form 10-K.

These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. Although we believe that we have a reasonable basis for each forward-looking statement contained in this Annual Report on Form 10-K, we caution you that these statements are based on a combination of facts and factors currently known by us and our expectations of the future, about which we cannot be certain. Forward-looking statements include statements about:

our ability to continue to increase revenues, secure customer renewals and expand coverage areas of existing public safety customers;

our ability to continue to add new customers for our public safety and security solutions;

the effects of increased competition as well as innovations by new and existing competitors in our market;

our ability to grow both domestically and internationally;

our ability to effectively manage or sustain our growth;

our ability to maintain, or strengthen awareness of, our solutions and our reputation;

potential acquisitions and integration of complementary business and technologies;

perceived or actual integrity, reliability, quality or compatibility problems with our solutions, including those related to unscheduled downtime or outages;

| •

| our ability to achieve and maintain service level standards (SLAs) in our customer contracts, including those SLAs we voluntarily increased in early 2018;

|

| •

| our reliance on third party providers to support our solutions;

|

statements regarding future revenues, hiring plans, expenses, capital expenditures, capital requirements and stock performance;

our ability to attract and retain qualified employees and key personnel and further expand our overall headcount;

our ability to stay abreast of new or modified laws and regulations that currently apply or become applicable to our business both in the United States and internationally;

our ability to maintain, protect and enhance our intellectual property;

costs associated with defending intellectual property infringement and other claims;

| •

| potential acquisitions and integration of complementary business and technologies; and

|

the future trading prices of our common stock and the impact of securities analysts’ reports on these prices.

We caution you that the foregoing list may not contain all of the forward-looking statements made in this Annual Report on Form 10-K.

1

You should refer to the “Risk Factors” section of this Annual Report on Form 10-K for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Annual Report on Form 10-K will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame or at all. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. The Private Securities Litigation Reform Act of 1995 and Section 27A of the Securities Act do not protect any forward-looking statements that we make in connection with this offering. In addition, statements that state “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Annual Report on Form 10-K, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

You should read this Annual Report on Form 10-K and the documents that we reference in this Annual Report on Form 10-K completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

SUMMARY OF RISK FACTORS

Investing in our common stock involves risks, including those discussed in the section. titled “Risk Factors”

These risks include, among others:

•If our business does not grow as we expect, or if we fail to manage our growth effectively, our operating results and business prospects would suffer.

•Any interruptions or delays in service from our third-party providers could impair our ability to make our solutions available to our customers, resulting in customer dissatisfaction, damage to our reputation, loss of customers, limited growth and reduction in revenue.

•If we are unable to sell our solutions into new markets, our revenues may not grow.

•Our success depends on maintaining and increasing our sales, which depends on factors we cannot control, including the availability of funding to our customers.

•Our quarterly results of operations may fluctuate significantly due to a wide range of factors, which makes our future results difficult to predict.

•Because we generally recognize our subscription revenues ratably over the term of our contract with a customer, fluctuations in sales will not be fully reflected in our operating results until future periods.

•We have not been profitable in the past and may not achieve or maintain profitability in the future.

•We may require additional capital to fund our business and support our growth, and our inability to generate and obtain such capital on acceptable terms, or at all, could harm our business, operating results, financial condition and prospects.

•Contracting with government entities can be complex, expensive, and time-consuming.

•If we are unable to further penetrate the public safety market, our revenues may not grow.

•Our sales cycle can be lengthy, time-consuming and costly, and our inability to successfully complete sales could harm our business.

•Changes in the availability of federal funding to support local law enforcement efforts could impact our business.

•The failure of our solutions to meet our customers’ expectations could harm our reputation, which may have a material adverse effect on our business, operating results and financial condition.

•Real or perceived false positive gunshot alerts or failure or perceived failure to generate alerts for actual gunfire could adversely affect our customers and their operations, damage our brand and reputation and adversely affect our growth prospects and results of operations.

•The nature of our business may result in undesirable press coverage or other negative publicity, which could adversely affect our growth prospects and results of operations.

•Economic uncertainties or downturns, or political changes, could limit the availability of funds available to our existing and potential customers, which could materially and adversely affect our business.

•The nature of our business exposes us to inherent liability risks.

•As a result of our use of outdoor acoustic sensors, we are subject to governmental regulation and other legal obligations, particularly related to data privacy, data protection and information security, and our actual or perceived failure to comply with such obligations could harm our business. Compliance with such laws could impair our efforts to maintain and expand our customer base, and thereby decrease our revenues.

•Failure to protect our intellectual property rights could adversely affect our business.

•Systems and Organizations Controls 2 (“SOC2”) and Criminal Justice Information Services (“CJIS”) requirements could potentially cause obligations that we are not able to completely perform which could adversely affect our reputation and sales, as well as the availability of our solutions in certain markets.

•Cyber-attacks, malicious internet-based activity, online and offline fraud, and other similar activities threaten the confidentiality, integrity, and availability of our sensitive information and information technology systems, and those of the third parties upon which we rely. These attacks could materially disrupt our systems and operations, supply chain, and ability to produce, sell and distribute our goods and services.

•Ongoing social unrest may have a material adverse effect on our business, the future magnitude or duration of which we cannot predict with accuracy.

PART I.

Item 1. BUSINESS

Overview

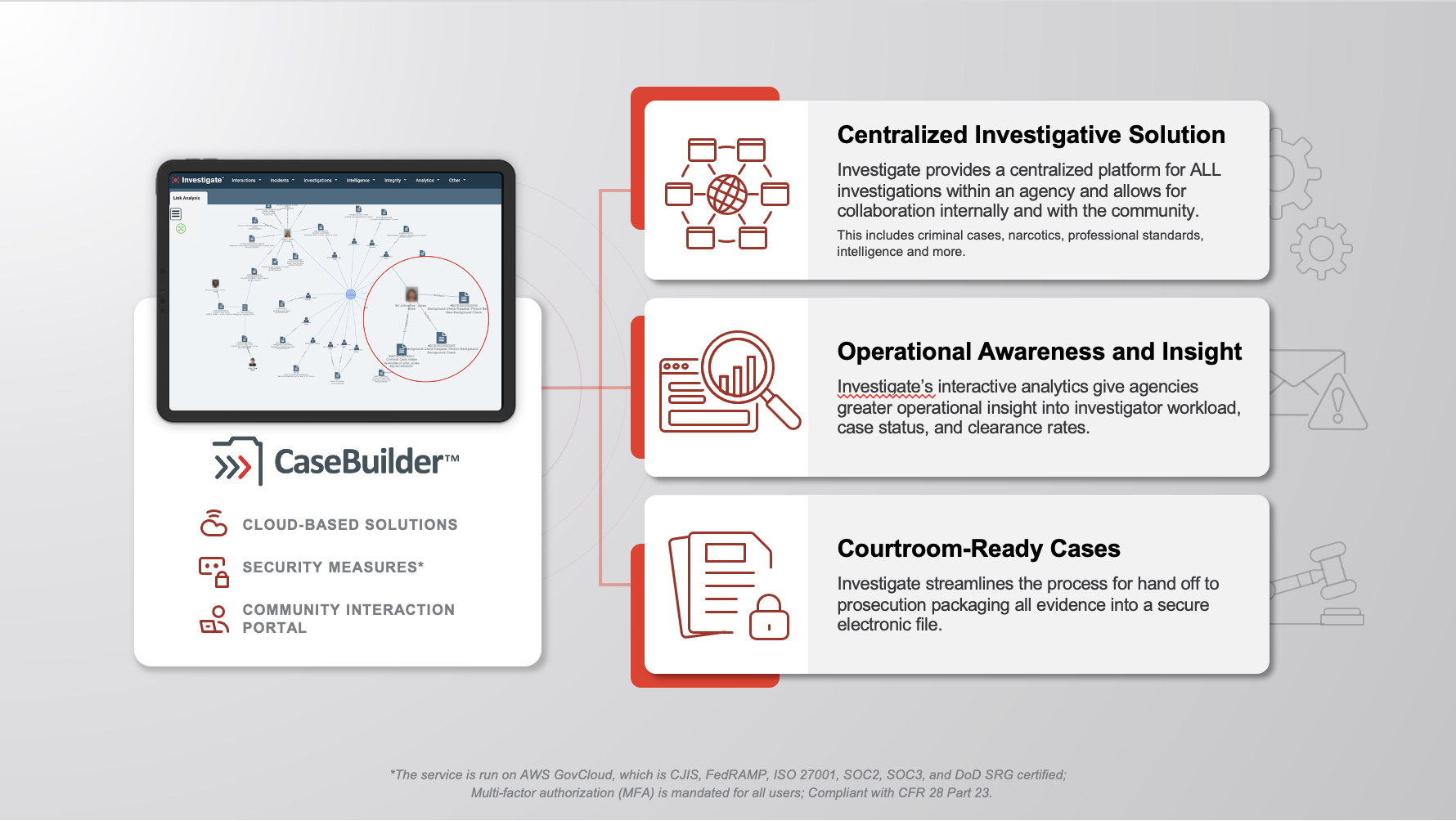

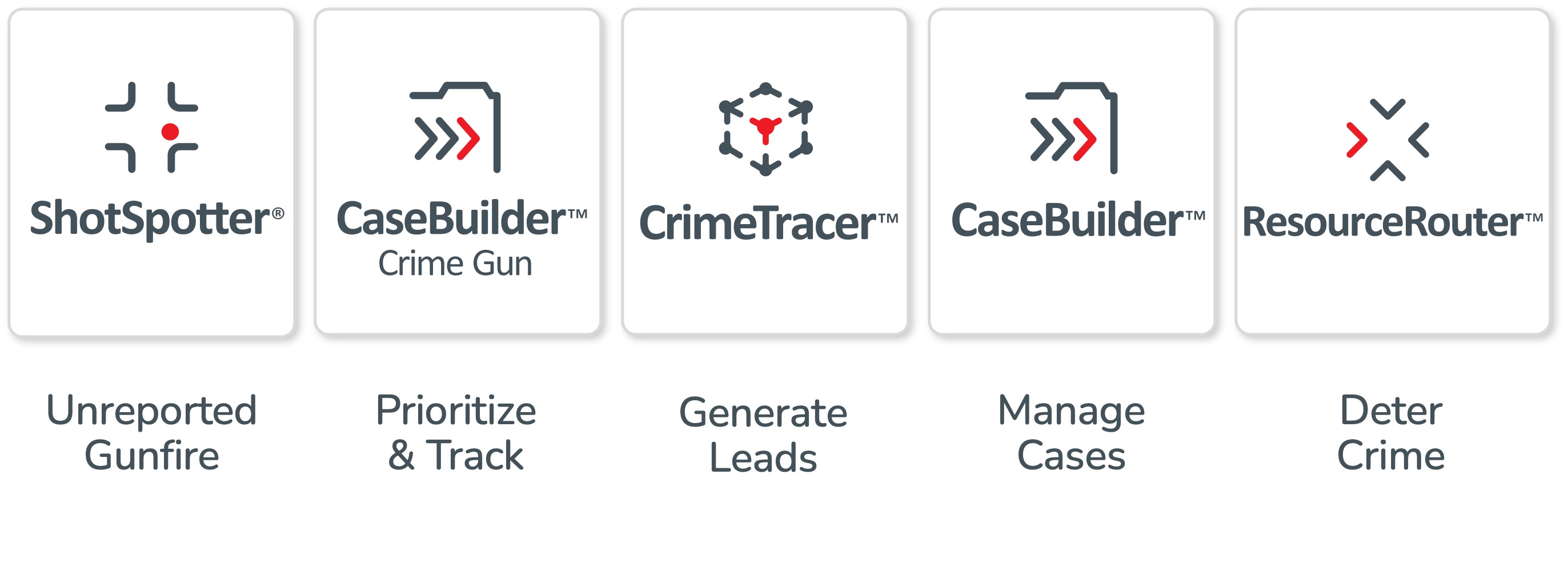

We are the leader in gunshot detection solutions that help law enforcement officials and security personnel identify, locate and respond to gun violence. We offer our software solutions on a SaaS-based subscription model to customers around the world, with current customers located in the United States and South Africa. Ourleading public safety solution, ShotSpotter Flex, is deployed in urban, high-crime areas to help deter gun violence by accurately detectingtechnology company that combines data-driven solutions and locating gunshots and sending near real-time alerts to law enforcement. Our security solutions, SST SecureCampus and ShotSpotter SiteSecure, are designed to helpstrategic advisory services for law enforcement and civic leadership. As of December 31, 2023 we had approximately 250 customers and to date have worked with approximately 2,100 agencies to help drive more efficient, effective, and equitable public safety outcomes.

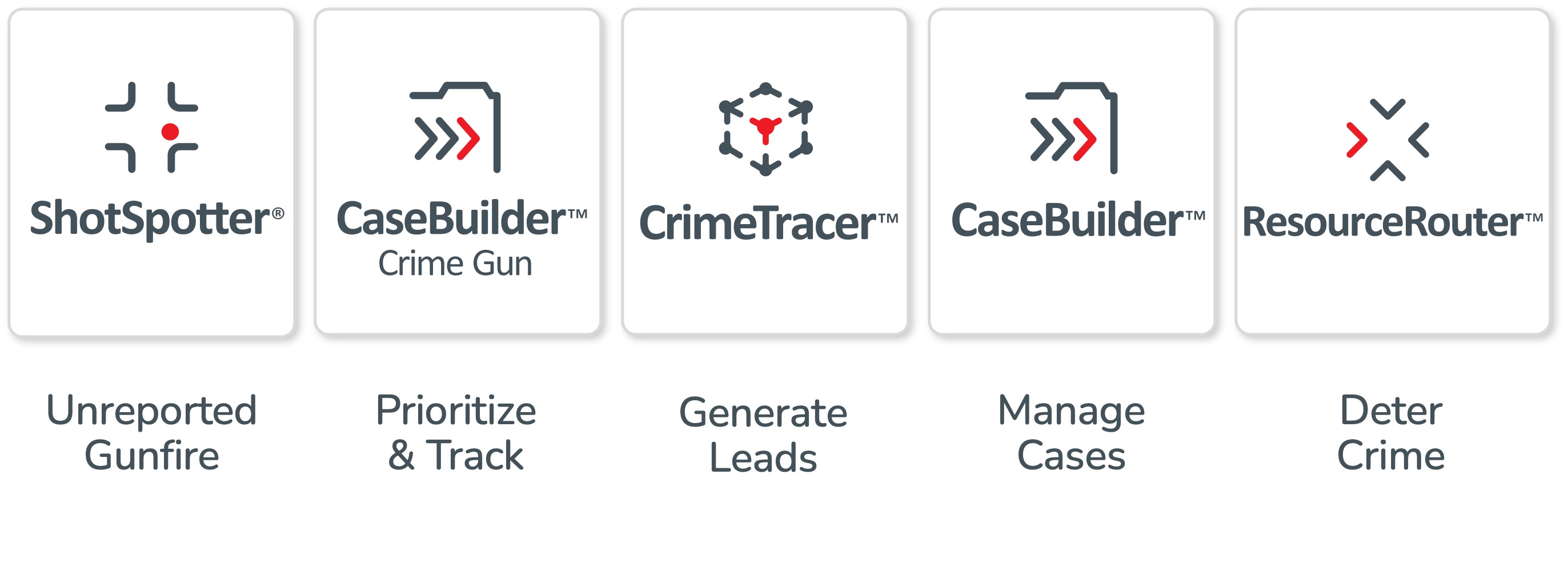

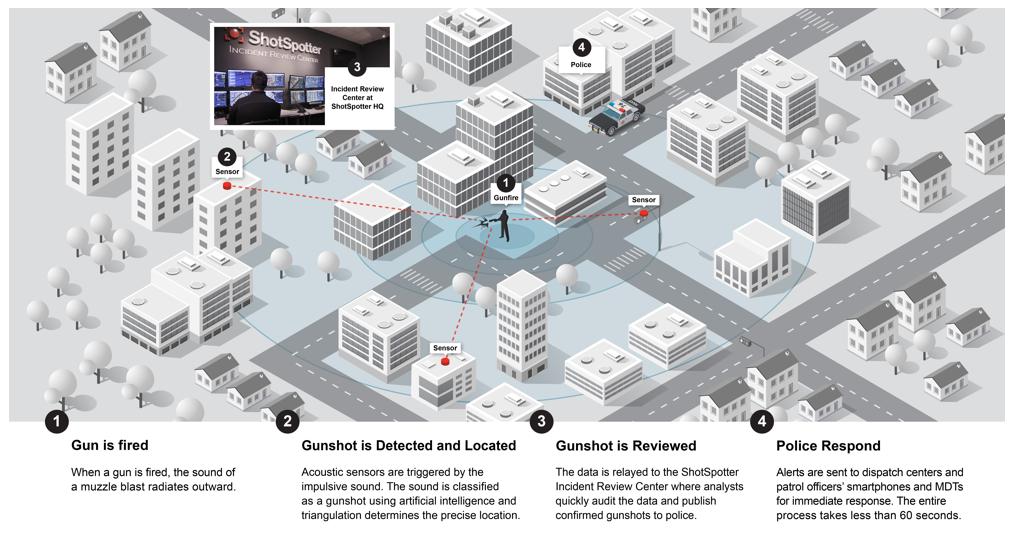

In April 2023, we changed the company name, ShotSpotter, Inc., to SoundThinking, Inc., reflecting our broader impact on public safety through a growing set of industry-leading law enforcement tools and community-focused solutions. As part of the rebranding, we introduced our SafetySmartTM platform that includes five data-driven tools consisting of: (i) our flagship product, ShotSpotter® (formerly ShotSpotter Respond), our leading outdoor gunshot detection, location and alerting system trusted by 170cities and 19 universities and corporations as of December 31, 2023, (ii) CrimeTracer™ (formerly COPLINK X), a leading law enforcement search engine that enables investigators to search through more than one billion criminal justice records from across jurisdictions to generate tactical leads and quickly make intelligent connections to solve cases, (iii) CaseBuilder™ (formerly ShotSpotter Investigate), a one-stop investigative management system for tracking, reporting, and collaborating on cases, (iv) ResourceRouter™ (formerly ShotSpotter Connect), which directs the deployment of patrol and community anti-violence resources in an objective way to help maximize the impact of limited resources and improve community safety, and (v) SafePointe™, an artificial intelligence ("AI")-based weapons detection system, that we added when we acquired SafePointe, LLC (“SafePointe”) in August 2023. We also offer other security personnel servingsolutions within our flagship product offering ShotSpotter, including ShotSpotter for Highways, ShotSpotter for Campus and ShotSpotter for Corporate, that are typically smaller-scale deployments of ShotSpotter vertically marketed to universities, corporate campuses, highways, and key infrastructure and transportation centers to mitigate risk and enhance security by notifying authorities andof outdoor gunfire incidents, saving critical minutes for first responders of an active-shooter event occurring in our deployment area almost immediately. The speed and accuracyto arrive. Weoffer the majority of our solutions enable rapid response by law enforcement and security personnel, increase the chances of apprehending the shooter, aid in evidentiary collection and can serve as an overall deterrent.

Our solutions consist of our highly-specialized, cloud-based software integrated with our proprietary, internet-enabled sensors and communication networks. When a potential gunfire incident is detected by our sensors, our software analyzes and validates the data and precisely locates where the incident occurred. An alert containing a location on a map and critical information about the incident is transmitted directlysoftware-as-a-service subscription model to subscribing law enforcement or security personnel through any internet-connected computer and to iPhone® or Android mobile devices.

For gunshots occurring outdoors, our software transmits the validated sensor data along with a recorded digital filecustomers. SoundThinking Labs supports innovative uses of the triggering soundCompany's technology to our Incident Review Center (“IRC”), where our trained acoustic experts are on duty 24 hours a day, seven days a week, 365 days a year to screenhelp protect wildlife and confirm actual gunfire incidents. Our acoustic experts can supplement alerts with additional tactical information, such as the potential presence of multiple shooters or the use of high-capacity weapons. For outdoor gunshot incidents reviewed by our IRC, alerts are typically sent within 45 seconds of the gunfire incident.environment.

We generate annual subscription revenues from the deployment of our public safety solution on a per-square-mile basis. As of December 31, 2017,2023, we had 77 public safety customers withShotSpotter, ShotSpotter for Campus, and ShotSpotter for Corporate coverage areas of approximately 510under contract for over 1,160 square miles, in 88of which over 1,120 square miles had gone live. Coverage areas under contract included 170 cities and municipalities19 universities and corporations across the United States, South Africa, Uruguay and the Bahamas, including threesome of the ten largest cities in the United States. In 2014, we began selling two security solutions, SST SecureCampus and ShotSpotter SiteSecure, which are typically sold on a subscription basis, each with a customized deployment plan. As of December 31, 2017, we had seven security customers covering eight higher-education campuses, of which all customer solutions are fully deployed. SST SecureCampus and ShotSpotter SiteSecure are designed to detect either outdoor gunfire utilizing our outdoor sensors, or both indoor and outdoor gunfire utilizing a combinationMost of our outdoor and indoor sensors. To date, while we have seen growing interest in our security solutions, interest in the indoor gunshot detection offering has been limited. We expect future customer deployments for our security solutions to consist primarily of outdoor gunshot detection deployments. We are evaluating our options with regard to our indoor gunshot detection offering, which may include ceasing to offer indoor gunshot detection or partnering with an indoor gunshot detection solution provider. For the year ended December 31, 2017, substantially all of our revenues arerevenue is attributable to customers based in the United States.

Our missionSince our founding over 27 years ago, SoundThinking has been and continues to be a purpose-led company. We are a mission-driven organization that is focused on improving public safety outcomes. We accomplish this by earning the trust of law enforcement and providing them solutions to help preventthem better engage and reducestrengthen the societal costs of gun violencepolice-community relationships in orderfulfilling their sworn obligation to create saferserve and more vibrant communities.protect all. Our inspiration comes from our principal founder, Dr. Bob Showen, who believes that the highest and best use of technology is to promote social good. We are committed to developing comprehensive, respectful and engaged partnerships with law enforcement agencies, elected officials and communities focused on making a positive difference in our society.the world.

Industry Background: The Problem of Gun ViolencePublic Safety Gap

AccordingLocal police departments are challenged to serve and protect in an increasingly transparent fashion without unintentionally over-policing and under serving their communities. This mandate must be met while facing municipal budget pressures and community activist calls to defund the Federal Bureau of Investigation (the “FBI”), an estimated 1.2 millionpolice while violent crimes occurred in the United States in 2015. Of those violent crimes, itcrime is estimated that guns were used in approximately 330,000 incidents, including 71.5% of murders, 40.8% of robberieson a measurable uptick and 24.2% of aggravated assaults. A March 2016 report published by The American Journal of Medicine stated that the gun homicide rate in the United States is more than 25 times the average of other high-income countries.

3

case closure rates are at all-time lows. There is a staggering economic costare three distinct problems associated with gun violence. A 2015 study commissioned by Mother Jones, an independent news organization, found that gun violence costs the American economy at least $229 billion every year, inclusive of $8.6 billion in direct expenses such as for emergency and medical care.public safety gap, which are discussed below.

The Challenge of Urban Gun-RelatedViolent Crime Problem

The majority of urban gunfire goes unreported. A 2016 report published by The Brookings Institute analyzing data collected from our public safety solutionShotSpotter and our customers suggests that approximately 90%80% of the gunshots detected by our public safety solution are not reported to 911 by residents. Even in the instances when 911 calls are made, the information reported by the caller is often incomplete or inaccurate as to the time and location of the gunshot. Furthermore, in many cases it is often difficult for the caller to authenticate the incident as gunfire. In addition, we believe that in communities plagued by gun violence, there is often a lack of trust between the community’s residents and its police force, which can exacerbate the underreporting of gunfire and create a vicious cycle of underreporting, lack of response and increased mistrust due to continued unaddressed gun violence in the community. When gunfire is not reported or is reported inaccurately, law enforcement and medical personnel cannot address injuries nor effectively investigate and solve related crimes or prevent future incidents.

The communities in which gun violence occurs suffer significant economic loss. A 20162017 report by the Urban Institute, which studied the effect of gun violence in Minneapolis, Minnesota, Oakland, California and Washington, D.C., noted that the perceived risk of gun violence imposed heavy social, psychological and monetary damages in communities, including in the forms of fewer jobs and lower economic vitality. The study concluded:

•In Minneapolis, one fewereach additional gun homicide in a given year was statistically associatedcorrelated with the creation of 80 jobs and an additional $9.4 million in sales across all business establishments in the next year.

fewer jobs. •In Oakland, every additional gun homicide in a given year was statistically associated with five fewer job opportunities in contracting businesses in the next year.

•In Washington, D.C., every additional gun homicide in a given year was statistically associated with two fewer retail and service establishments the next year.

In addition, several studies have suggested that property values are inversely correlated with violent crime.For example, the Center for American Progress conducted a study of changes in homicide incidents and housing prices in Boston, Massachusetts; Seattle, Washington; Chicago, Illinois; Philadelphia, Pennsylvania and Milwaukee, Wisconsin and found that a reduction in a given year of one homicide in a ZIP code causescaused a 1.5% increase in housing values in that same ZIP code the following year.

The Rise of Active-Shooter EventsGut-based Patrolling Problem

In additionAgencies face a resource deficit and need more efficient ways to patrol and prevent crime. Most departments use old patrolling methods that are non data-driven, have limited visibility to officer activity and no controls to reduce over-policing. We believe the problem of localized, persistent gun violence, overcategory is ripe for AI-based automation for more efficient and effective patrolling done in a way that better engages the past several years there has been an increasing number of high-profile mass shootingscommunity and terror events. reduces crime.

Low Case Closure/Victim Resolution Problem

According to a 2016 report published by the FBI, the number of active-shooter eventsThe Marshall Project in 2022, homicide clearance rates in the United States reached a 40-year low of less than 50% in 20142021. Too many suspects do not face the consequences and 2015 was among the highestare free to commit additional crimes while victims and their families suffer without closure. Police use a mix of manual, homegrown and limited function record management system ("RMS") modules for any two-year average period in the preceding 16 years and nearly six times as many as the period between 2000 and 2001, the first two years that the FBI began tracking active-shooter events.

Unlike gunfire incidents occurring in high-crime areas, active-shooter events often result in a high volumecase management. To solve cases, detectives must access multiple, siloed sources of telephone reports to 911. However, each caller may provide untimely, inaccuratedata with limited automation tools for analytical support or incomplete information, causing confusion or delays in first responders’ ability to react quickly and accurately. Response time is critical as nearly 70% of active-shooter events last five minutes or less with over one third ending in two minutes or less according to a 2013 study conducted by the FBI of active-shooter events.

4

Our Market

collaboration. We believe thereinvestigative case management can significantly benefit from greater automation to improve clearance rates and solves cases faster.

Our Vision

We see a world where data is significant demand for advanced gunfire detection and location notification solutions that accurately and quickly report instances of gunfire, based on two primary use cases:

public safety—for domestic and internationalconverted into actionable intelligence thereby enabling police departments to implement modern 21st century policing practices. These practices can help police be more efficient directing law enforcement serving communities plagued by persistent, localized gun violence,interventions toward the few that commit crimes and more effective in order to identify, locatebuilding community trust and deter gun violence; and

security—for law enforcement and security personnel serving universities, corporate campuses, key infrastructure, transportation centers and other areas in which authorities desire to prepare for and mitigate risks related to an active-shooter event.

Based on data from the 2015 FBI Uniform Crime Report, we estimate that the domestic market for ourengagement while co-producing public safety solution consists of the approximately 1,400 cities that had four or more homicides per 100,000 residents in 2015. The Uniform Crime Report includes information reported directly to the FBI on a voluntary basis by 18,000 city, university and college, county, state, tribal and federal law enforcement agencies.outcomes. We believe that four or more homicides per 100,000 residents representsthe SoundThinking SafetySmart platform can be a significant gun violence problem. We estimate that a customervaluable set of tools in this market could invest an average of approximately $400,000 per year forimplementing 21st century policing practices. Our precision policing solutions included our public safety solution.flagship product ShotSpotter, CrimeTracer, CaseBuilder and ResourceRouter. In August 2023, we acquired SafePointe, LLC ("SafePointe") and added their AI-based weapons detection system to our SafetySmart platform.

Outside of the United States, we estimate that the market for

ShotSpotter

ShotSpotter (formerly ShotSpotter Respond), our public safety solution includes approximately 200 cities in the European Union, Central America, the Caribbean, South America and southern Africa that have at least 500,000 residents. We estimate that a customer in this market could invest an average of approximately $750,000 per year for our public safety solution.

We estimate the average investment amounts for prospective customers based on our experience with existing customers, our anticipated demand for our solutions and the corresponding coverage areas that we expect prospective customers would elect to cover with our solutions.

Based on data made available by the National Center for Education Statistics and the Federal Aviation Administration, we believe that the domestic market for our security solutions includes approximately 5,000 college campuses and airports. We estimate that, on average, a customer in this market could invest approximately $100,000 per year for one of our security solutions. In addition, we believe that there exists a broader market for our security solutions that include, primarily the outdoor areas of college campuses and airports outside of the United States as well as large corporate campuses, train stations and other highly-trafficked areas worldwide.

The ShotSpotter Solutions

Our solutions consist of our highly-specialized, cloud-based software integrated with our proprietary, internet-enabled sensors and connected through third-party communication networks. We brand our solutions based on particular use cases and target customers as follows:

ShotSpotter Flex. ShotSpotter Flex, our public safety solution,acoustic gunshot detection technology serves cities and municipalities seeking to identify, locate and deter persistent, localized gun violence by incorporating a real-time gunshot detection system into their policing systems. ShotSpotter is used by local police departments and a version of ShotSpotter, branded as ShotSpotter for Highways, ShotSpotter for Campus and ShotSpotter for Corporate, are used by security personnel in the protection of critical assets such as colleges, universities, commercial campuses and highways.

SST SecureCampus. SST SecureCampus helps theOur gunshot detection solutions consist of highly-specialized, cloud-based software integrated with proprietary, internet-enabled sensors designed to detect outdoor gunfire. The speed and accuracy of our gunfire alerts enable law enforcement and security personnel serving universities, collegesto consistently and other educational institutions mitigate riskquickly respond to shooting events including those unreported through 911, which can increase the chances of apprehending the shooter, providing timely aid to victims, and enhance security by notifying authoritiesidentifying witnesses before they scatter, as well as aid in evidentiary collection and first responders ofserve as an active-shooter event almost immediately.

ShotSpotter SiteSecure. ShotSpotter SiteSecure is designed to serve customers such as corporations trying to safeguard their facilities and public agencies focused on protecting critical infrastructure, including train stations, airports and freeways.

5

ShotSpotter Flex is designed to detect outdoor gunfire only using our proprietary outdoor sensors. SST SecureCampus and ShotSpotter SiteSecure are designed to detect either outdoor gunfire utilizing outdoor sensors, or both indoor and outdoor gunfire utilizing a combination of our outdoor and indoor sensors. To date, while we have seen growing interest in all of our solutions, interest in the indoor gunshot detection offering has been limited. We expect future customer deployments for our security solutions to consist primarily of outdoor gunshot detection deployments. We are evaluating our options with regard to our indoor gunshot detection offering, which may include ceasing to offer indoor gunshot detection or partnering withoverall deterrent. When an indoor gunshot detection solution provider.

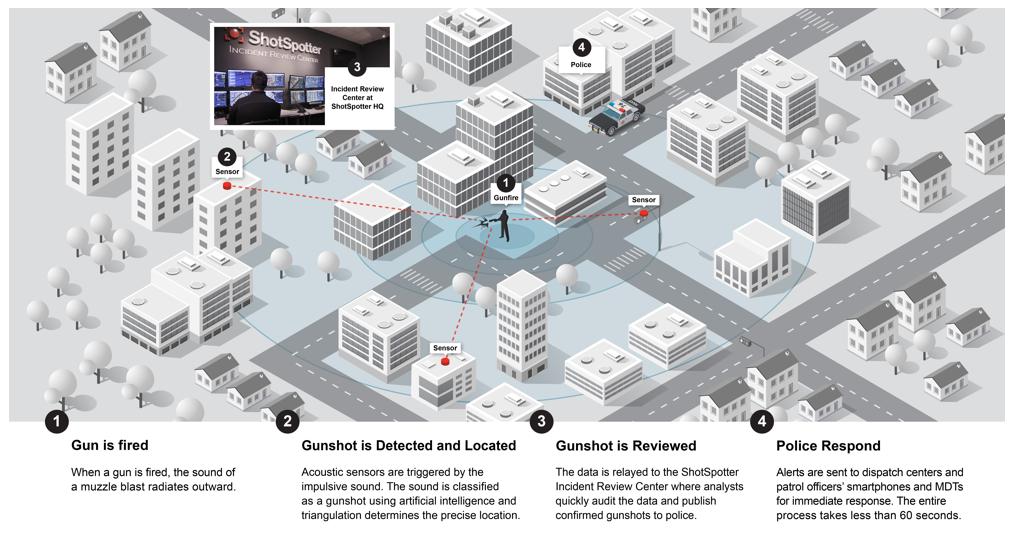

When a potential gunfire incidentimpulsive sound is detected by our sensors, our software uses quantitative computational analysissystem precisely locates where the incident occurred, and artificial intelligence methodsif it determines there is a possibility the sound was caused by gunfire, sends its data for human review to precisely locateanalyze and classifyvalidate the sound. A digitalincident. An alert containing a location on a map and locationcritical information about the incident is transmittedsent directly to subscribing law enforcement or security personnel through anyan internet-connected computer and toor iPhone® or Android mobile devices.

For gunshots occurring outdoors, ourOur software transmits thesends validated sensorgunfire data along with a recorded digital filethe audio of the triggering sound to our IRC,Incident Review Center (“IRC”) that has locations in Fremont, CA and Washington, D.C. where our trained acoustic expertsincident review specialists are on duty 24 hours a day, seven days a week, 365 days a year to screen and confirm actual gunfire incidents. Our acoustic expertstrained incident review specialists can supplement alerts with additional tactical information, such as the potential presence of multiple shooters or the use of high-capacity weapons. For outdoor gunshotGunshot incidents reviewed by our IRC result in alerts are typically sent within approximately 45 seconds of the report of the gunfire incident. For

Specialized Gunshot Detection Software

The heart of our gunshot detection solutions is our sophisticated and specialized software. Our software analyzes audio signals for potential gunshots occurring indoors,detected by our solutionsintelligent sensors. Our sensor filters out ambient background noise, such as traffic or wind, and looks for impulsive sounds characteristic of gunfire. If the sensor detects such an impulse, it extracts pulse features of the soundwave, such as sharpness, strength, duration, rise time and decay time. Then, the sensor sends these features to our cloud servers as part of a data packet that includes the location coordinates of the reporting sensor and the precise time of arrival and angle of arrival of the sound.

When the data reaches our cloud servers, our software assesses whether three or more of our outdoor sensors detected the same sound impulse and, if so, finds the location coordinates of the sound source based on the time of arrival and the angle of arrival of the sound using the technique of multilateration. The accuracy of the coordinates derived from our proprietary software is significantly improved when, as is typically the case, more than three sensors

participate. We deploy our sensor arrays such that, on average, six to eight sensors participate in the detection of a gunshot.

After the software determines the location of the sound source, our machine classifier algorithms analyze the pulse features to filter out sounds that are unlikely to be gunfire. Our algorithms consider pulse features, the distance from the sound source, pattern matching and other heuristic methods to evaluate and classify the sound. The machine classifier algorithm is periodically trained and validated against our large database of known gunfire and other community sounds that are impulsive in nature. We continue to add new data to our machine learning database from the incidents reviewed by our incident review specialists in our IRC process. Incidents that are determined by the machine classifier algorithms to be obviously non-gunfire are filtered out and not presented for human classification.

All incidents not filtered out by our machine classifier algorithms are sent to the incident review specialists in our IRC for analysis and human classification. Incident notifications are sent when the incident is confirmed as gunfire by one of our incident review specialists and may include additional information that may be helpful to first responders, such as the possibility of multiple shooters or use of a high-capacity or fully automatic weapon. Alerts are delivered using push notifications to our mobile, desktop or browser applications and through email or SMS text messages. The time from a report of an outdoor trigger-pull to a notification being sent to our customers is typically 45 seconds or less.

Intelligent and Ruggedized Sensors

Our rugged gunshot detection sensor is an intelligent, internet-enabled device that is specially built to ignore ambient noise and respond to impulsive sounds, accurately time-stamping their arrival times. Advanced digital signal processing algorithms filter out background sounds such as traffic, and extract pulse features from the audio signal that, along with the time and angle of arrival of the sound, are sent to our servers where algorithms compute the location of the sound source.

The sensors do not have the ability to live stream audio. Sounds captured by the secure sensors are permanently deleted after 30 hours. When a sensor is triggered by an impulsive sound, the “incident” that is created includes a recording including no more than one second before the incident and one second after the incident. This audio snippet is preserved indefinitely for potential evidentiary use.

Our sensors are designed and tested against international standards for installation in unprotected outdoor environments. Special consideration is given to automatically alert security personnel within ten seconds.minimize the sound of wind, rain and hail, which could otherwise

limit the range of detection and produce false results. Environmental condition tests performed on the sensors include temperature cycling, temperature soak, shock, vibration, and salt, fog and moisture ingress protection.

The key featuresWe typically design and deploy arrays of our solutions are:

Comprehensive Coverage. We believe that we sell the only public safety solution that provides comprehensive outdoor coverage for gunshot detection over large and complex acoustic environments. Our outdoor acoustic sensors are strategically placed in an array of 2015 to 25 sensors per square mile taking into consideration the unique acoustic environment in which we are deploying. The cumulative experience of deploying in various cities with different acoustic properties has provided a distinct advantage in tailoring our sensor arrays to perform at high levels. We have full telemetry to each sensor that provides detailed data to our system to monitor each sensor’s health and availability. Sensor firmware is maintained with over-the-air updates. Because we design our networks with a certain amount of redundancy to ensure durability, in our sensor arrays, multiple sensors can easily be expanded to coveroffline at any size area. In addition to providing acoustic surveillance over wide areas, our solutions operate on a continuous basis—given time without affecting the overall performance of the system.

Incident Review Centers - Classification

Our IRC operates 24 hours a day, seven days a week, 365 days a year—year. When a loud impulsive sound triggers enough of our outdoor sensors that an incident is detected and located, audio from the incident is sent to provide immediate notificationour IRC via secure, high-speed network connections for real-time confirmation. Within seconds of an incident, one of our incident review specialists analyzes audio data and recordings of the potential gunfire. When gunfire is confirmed, our IRC team sends an alert directly to emergency dispatch centers and field personnel through a computer or mobile device with access to the Internet. This process typically takes less than 45 seconds from the report of the gunfire incident. Alerts include:

•the precise location of gunfire, at anyincluding both latitude/longitude and approximate street address;

•the number and exact time of day.shots fired;

•if detectable, the involvement of multiple shooters; and

•if detectable, the use of fully automatic or high-capacity weapons.

Our IRC operates primarily out of our principal facilities in Fremont, CA and Washington, D.C. and receives audio from incidents detected by our outdoor sensors regardless of where such incidents occur. Although our IRC normally operates from our offices, our trained personnel can perform IRC functions from any location that has a high-speed internet connection. During the COVID-19 pandemic, IRC personnel performed their job function from our IRC facilities and/or remote locations.

Gunshot Detection Alerts

Our alerts are delivered in the following forms:

Real-Time Precise Alerts. Alerts

Our solutions typically notify users within 45 secondsIRC sends real-time notifications of outdoor gunfire incidents to the ShotSpotter application, which is specifically designed for emergency communications centers, dispatch centers, and other public safety answering points.

The ShotSpotter alert received by the ShotSpotter application includes a gunshot, providing data on theunique identification number (ShotSpotter ID number), a precise time and locationdate of the shooting andgunfire (trigger time), approximate street address of the gunfire, number of shots fired. An alert is sent depicting a dot on a map that correspondsand police district and beat identification. One of our incident review specialists may add other contextual information related to a specific address or latitudinal and longitudinal coordinates (in the case of outdoor gunshots) or a floor plan (in the case of indoor gunshots). In addition, when shots are fired outside, our alerts provide valuable additional information about the scene of the incident such as the potential presencepossibility of multiple shooters, high-capacity or fully automatic weapons and vehicles.

The 911 dispatcher may add their own notes relating to the incident in which case the notes are time- and date-stamped and indicate the operator’s identification. A comprehensive audit trail of all changes to the incident is maintained that includes the time the alert was received and acknowledged by the dispatcher. These data may be used to measure key performance indicators by dispatch personnel.

ShotSpotter Application

We offer a robust ShotSpotter application for use by patrol officers and security personnel that is available on iPhone or Android mobile devices and computers installed in patrol vehicles and dispatch centers. This application allows field personnel to directly receive alerts of outdoor gunshots and related critical information. The alert includes a unique identification number (ShotSpotter ID number), a precise time and date of the gunfire (trigger time), nearest street address to the location of the gunfire, number of shots and police district and beat identification. One of our incident review specialists may add other contextual information related to the incident such as the possibility of multiple shooters, or the use ofhigh-capacity or fully automatic weapons. In addition, the dispatcher may add their own notes. The alert also includes an audio snippet of the incident.

Mobile Device Support-Apple iOS and high-capacity weapons. This enhanced tactical awarenessAndroid-phones/tablets and watches

Related Applications and Services

ShotSpotter Insight

All historical incident data in our database can help protect first responders in dangerousbe viewed, searched, sorted, and unpredictable situations.

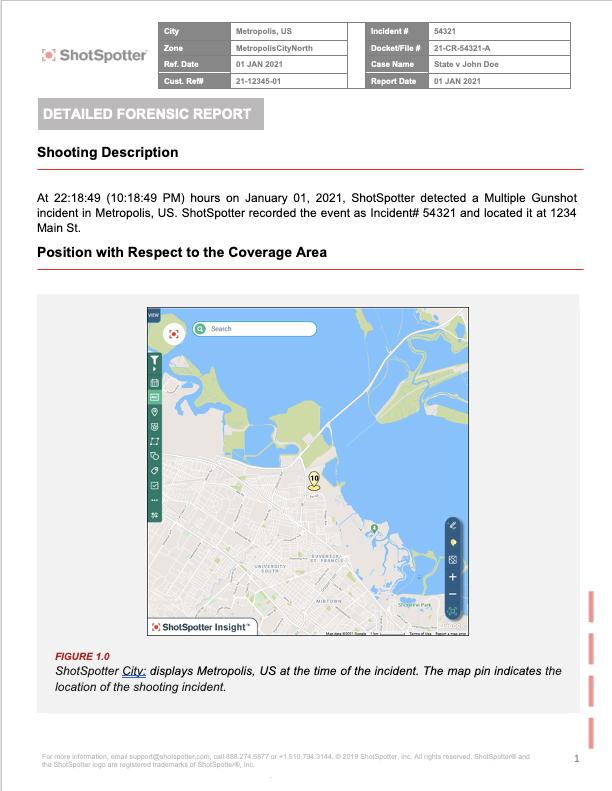

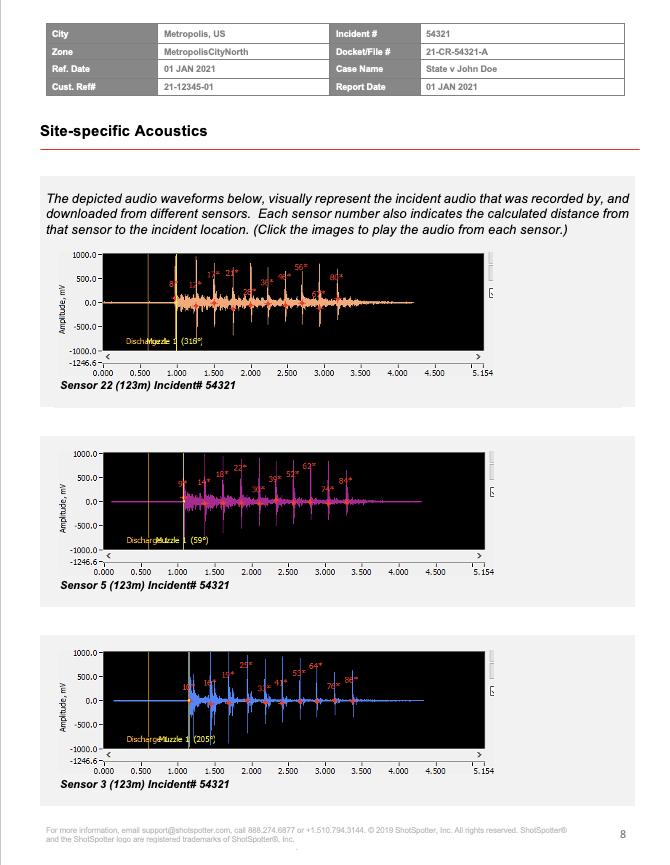

Forensically-Sound Data. Becausefiltered using our outdoor solutions provideShotSpotter Insight application. The Insight application can create an exact time, location and audio recordinginvestigative lead summary report that describes the specifics of a gunshot, we are ablesingle incident as reported by the IRC staff or a multiple incident report that lists groups of such incidents. Complex filters may be defined using multiple search criteria and the filters named and saved for recurring use. Incident data may be exported for use in third-party applications such as Excel, currently the tool of choice for police department crime analysts.

Integration Services

We believe that integrating our solutions with other tools and technologies enhances the value of our solutions to provide authoritiesour customers. For example, our solutions can be used in connection with critical evidence for investigationscomputer-aided dispatch systems, video surveillance cameras, National Integrated Ballistic Information Network (“NIBIN”), and prosecutions. Our detailed forensic reports, or DFRs, provideautomated license plate readers used by law enforcement to improve the effectiveness of police response and prosecutorsinvestigation efforts. We continue to evaluate new technologies that may integrate with detailed,our solutions to generate additional value for our customers.

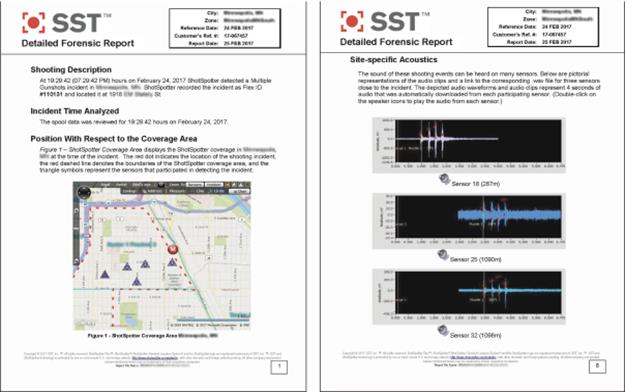

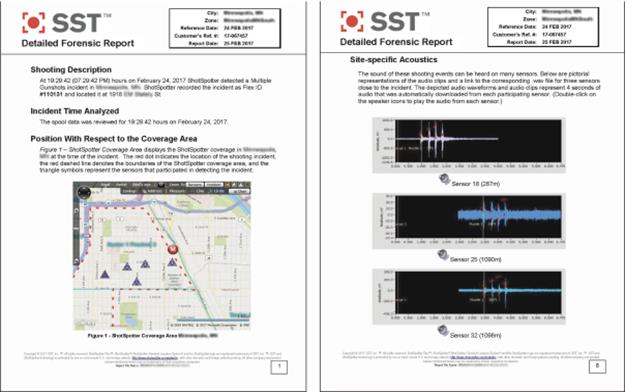

Detailed Forensic Reports and Certified Expert Witness Services

As part of our solution, we offer Detailed Forensic Reports (“DFRs”). These provide investigators and attorneys with comprehensive, court-admissible audio andanalysis of a shooting incident, analyses.including the gunfire audio. We also offer expert witness testimony to review detailsintroduce the forensic analysis of the DFRs at trial and to provide technical expertise regarding our technology. DuringOur forensic employees have testified in over 300 cases throughout the year ended December 31, 2017, we completed 578 DFRs for outdoor gunshot incidents,United States. Our forensic analyses have survived dozens of challenges in numerous states, under both the Frye and during 2017, our evidence was requested for use in approximately 96 federalDaubert standards of admissibility. The following is an example of a DFR.

Detailed Forensic Report:

ShotSpotter Results and state cases, including 26 trials in which we provided expert witness testimony.

Annual Subscription to a Cloud-Based Solution. We provide our solutions as an annual subscription-based service in which we design, deploy, own, manage and maintain the acoustic sensors, host the software and gunshot data and operate our IRC with trained acoustic experts. Occasionally we receive customer requests for direct purchase of our sensors in conjunction with the purchase of our subscription service. We evaluate each of these requests on a case by case basis.

6

The key benefits provided by these features include:Benefits

•Expedited Response to Gunfire.In 2017,2023, we issued more than 99,000over 328,000 gunshot alerts to our customers. In areas where gun violence is persistent, we believe most gunshots are not otherwise reported. Even when calls are made, many callers are unable to provide a location of the gunshot or other relevant details. Human response time to unfolding violence often delays calls for several minutes in circumstances where response time can be critical. By contrast, our solutions typically alert emergency dispatch centers and field personnel within 45 seconds of confirmedthe report of the gunfire incident and provide an exact location, enabling them to respond faster and to a specific location. The ability to respond more quickly increases the chances of apprehending the shooter and assisting victims of violence, in addition to aiding in evidentiaryevidence collection.

•Prevention and Deterrence of Gun Violence. We believe increasing the speed and accuracy of law enforcement responses to gunfire can act as a long-term deterrent that can decrease the overall prevalence of gunfire. We also believe that knowledge of the existence of our solutions may have a deterrent effect on localized gun violence. When elected officials and law enforcement have an enhanced awareness of gun violence activity and patterns, they have tools to facilitate a rapid and accurate response to gunfire incidents and improve relations between law enforcement and these communities, potentially increasing crime reporting and community cooperation with investigations, which can result in improved public safety.

•Improved Community Relations and Collaboration. We believe that persistent gun violence limits the ability of police and other community leaders to serve their constituents and improve their communities. Many cities struggle to establish and foster a cooperative and trusting relationship between their police department and the communities they serve. Our public safety solution provides cities with the ability to react quickly to gun violence, thus providing the ability to improve their responses and residents’ perception

of their responses. This provides our customers with the opportunity to foster improved community relations and collaboration with their residents.

•Improved Police Officer Safety.Safety. We believe that our solutions provide additional and valuable information regarding gunshot incidents as the alerts we provide give additional insight and situational awareness, including in the case shots fired outdoors, round count, potential multiple shooters and potential use of an automatic weapon, that allow the responders to be better prepared to respond appropriately.

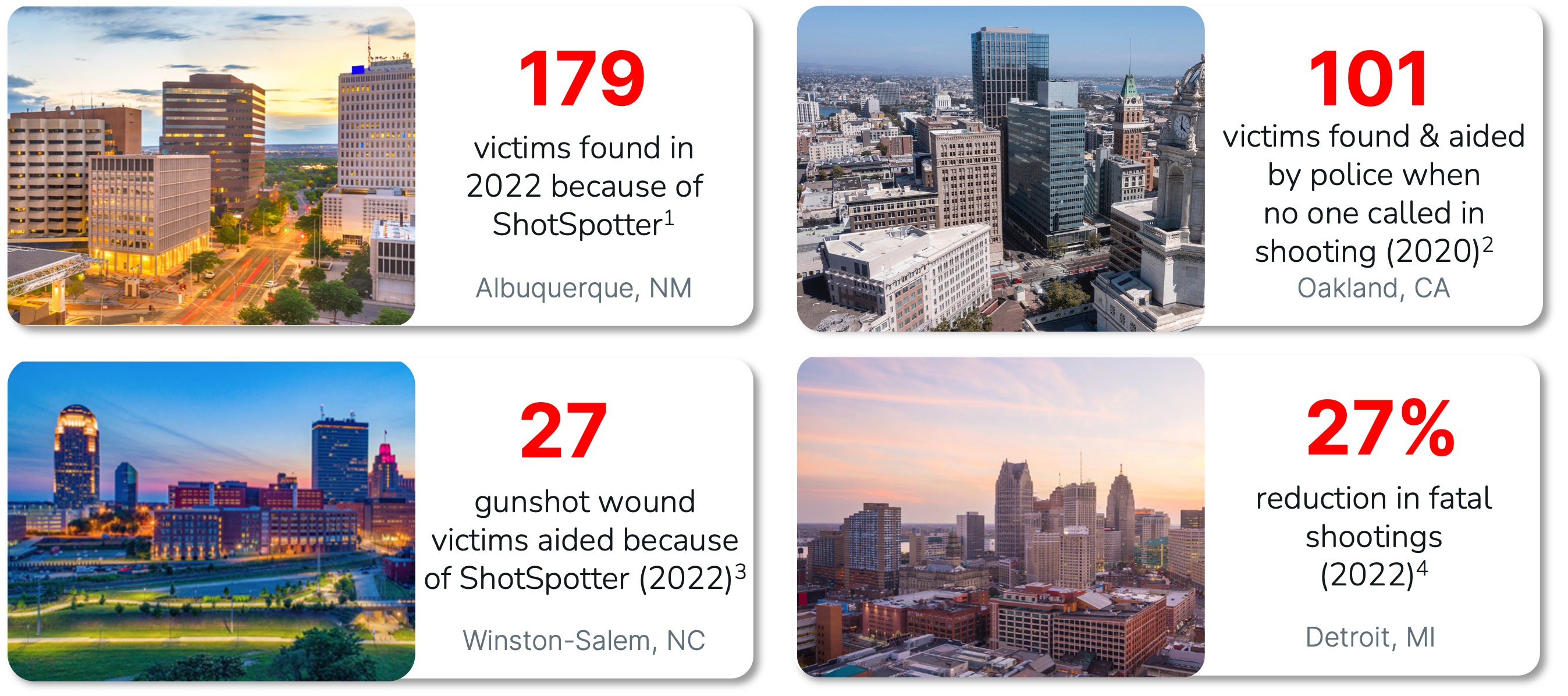

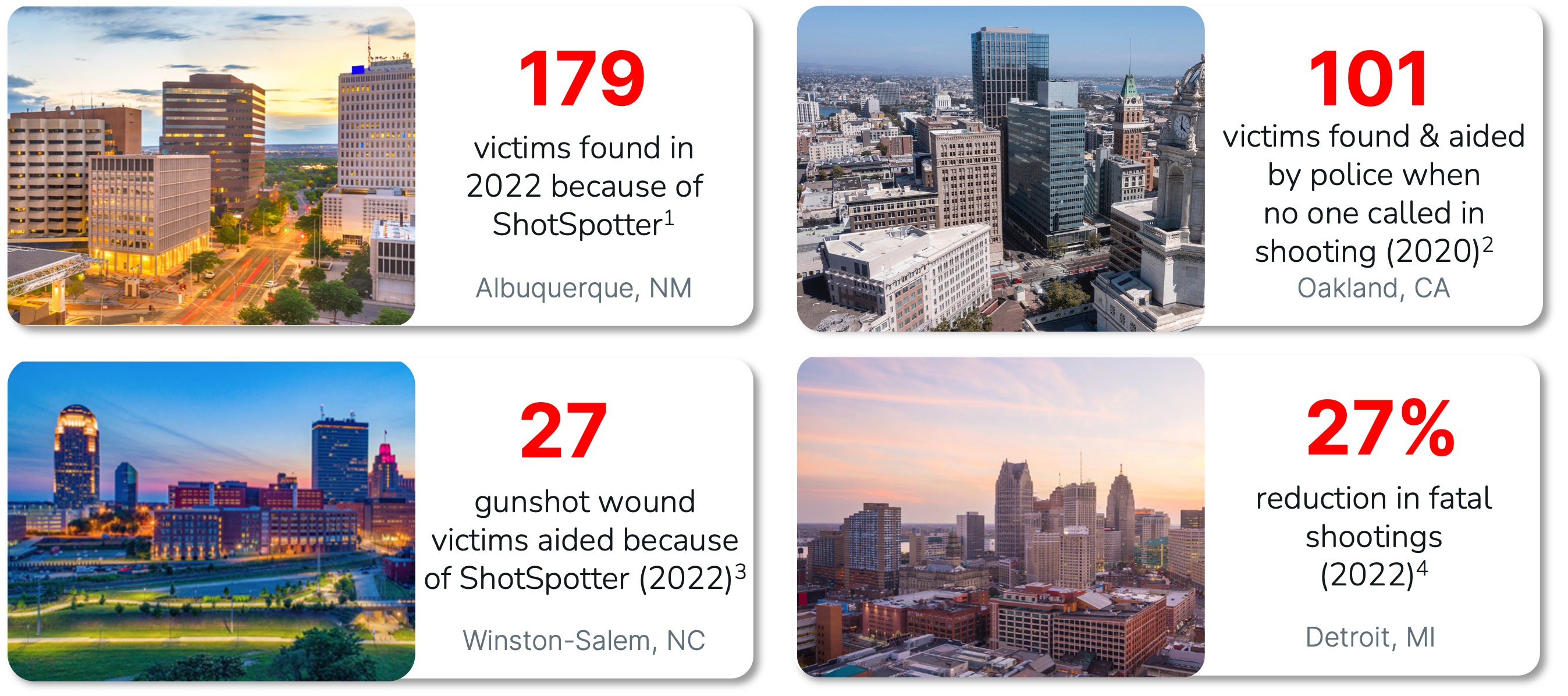

ShotSpotter Potentially Helps Save Lives

The below graphic demonstrates positive impact results observed at a few of our customers.

1 Albuquerque PD statistics 2022

2 Oakland PD Statistics 2020

3 Winston Salem, NC, Public Safety News Conference, October 12, 2022

4 Detroit PD statistics 2022

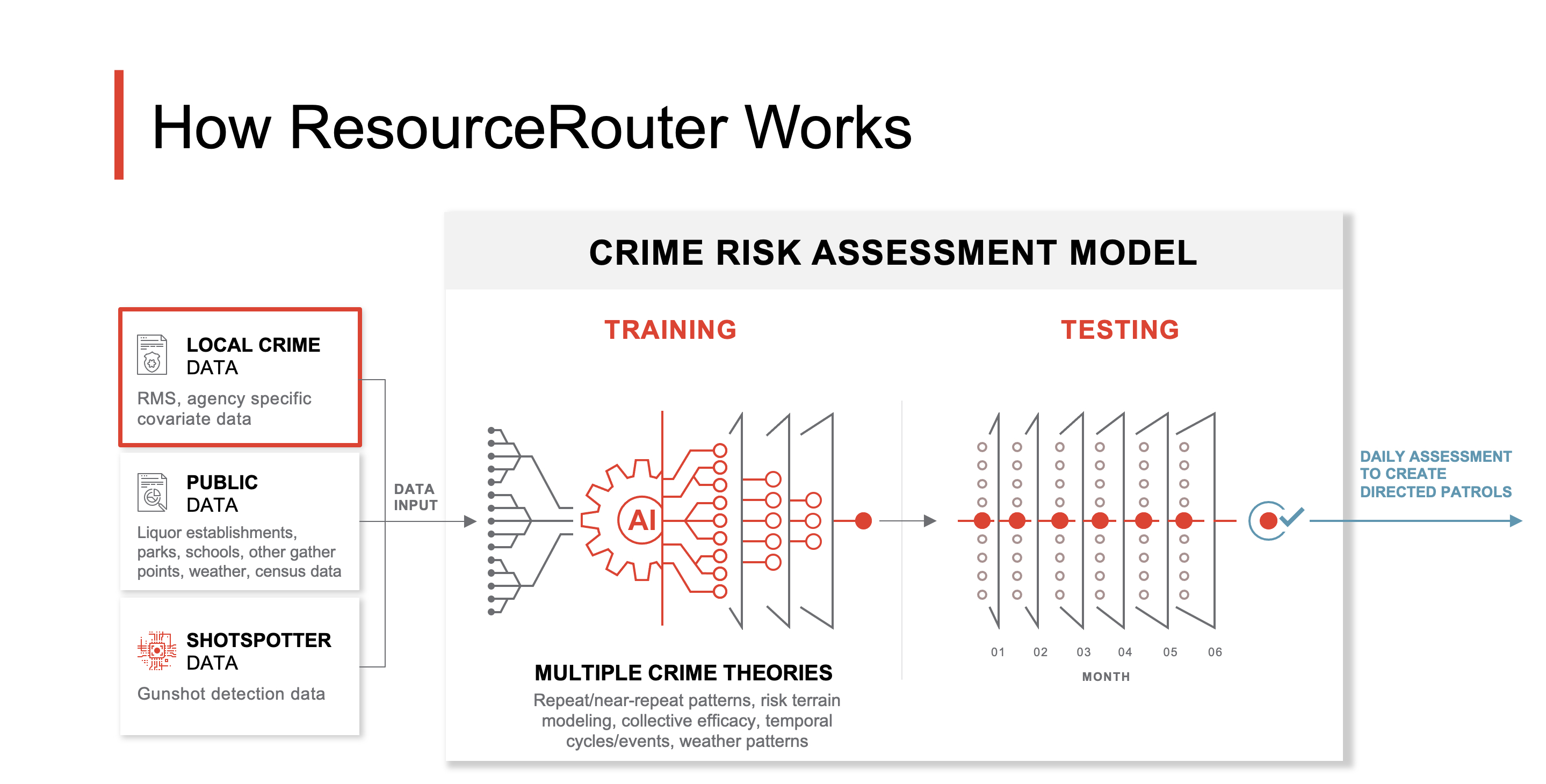

ResourceRouter (formerly ShotSpotter Connect)

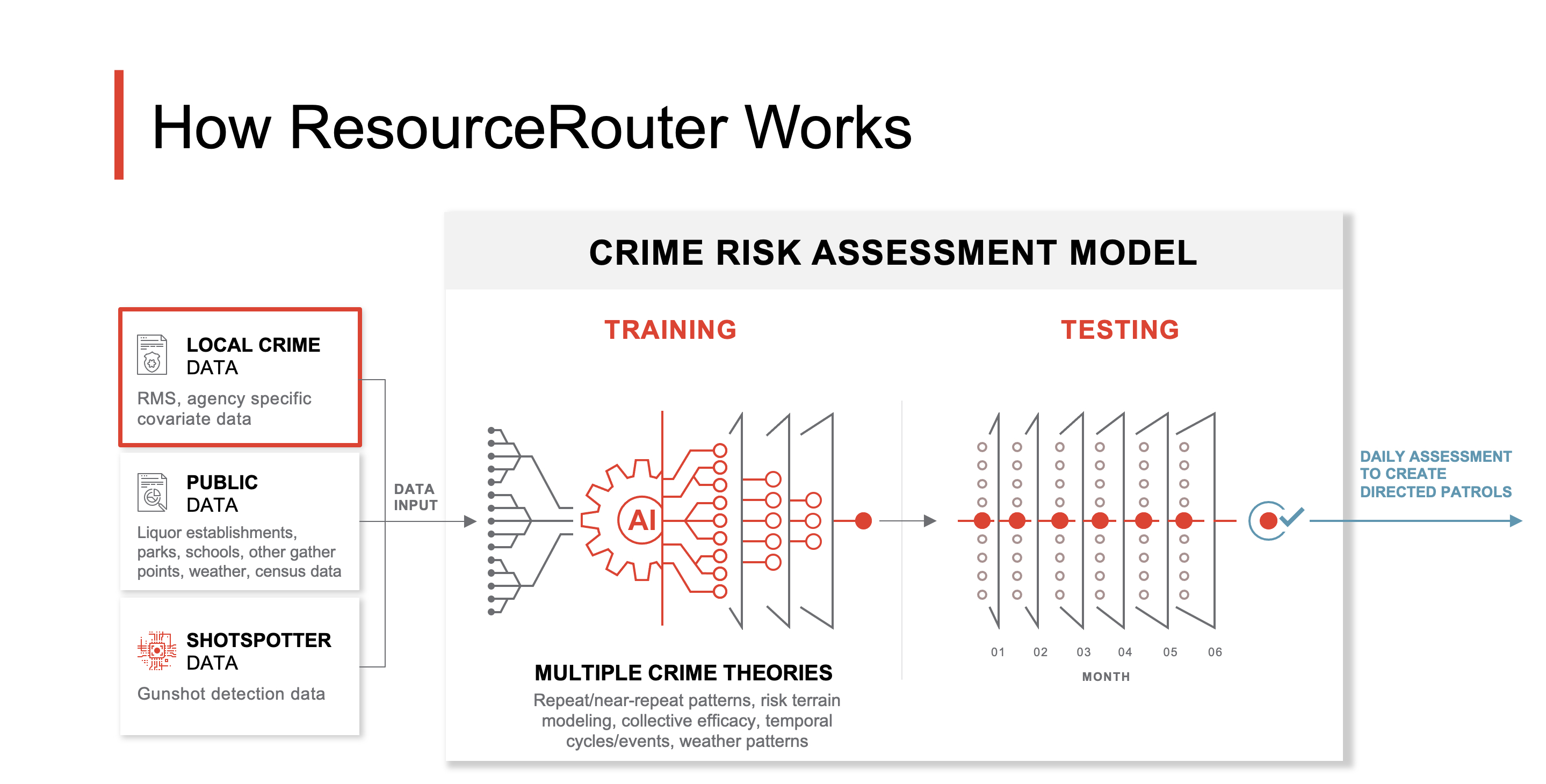

Law enforcement agencies are increasingly facing challenges in maintaining a functional level of staffing due to early retirements and a more limited ability to recruit new officers. ResourceRouter helps address this new reality by helping agencies make their largest cost center – patrol – more efficient and effective in reducing crime and better engaging with the community.

ResourceRouter automates the planning of directed patrols for all serious crime data across an entire jurisdiction on a daily basis. With ResourceRouter, analysts and supervisors review pre-generated directed patrol assignments that ensure officers are at the right place at the right time to maximize crime prevention while also guarding against over- and under-policing. Pre-patrol briefings provide situational awareness to officers and recommend patrol tactics, facilitating optimal outcomes even with limited staffing and resources.

ResourceRouter uses AI-driven analysis to direct officers to patrol a location within their beat that is likely to have the highest risk for crime during their shift. A timer guides officers to patrol this area for a short period of time, often 15 minutes, to create a deterrent effect that can last for hours. ResourceRouter collects time, place, and tactical data from all directed patrol sessions which can be analyzed to determine the impact on crime as well as provide a level of oversight that can be used to optimize future assignments, policies, and strategies.

The system combines carefully selected historical crime data that is less susceptible to enforcement bias ingested through the agency RMS feeds along with objective temporal, location and event-based inputs including ShotSpotter data for cities that use our ShotSpotter solution, to create crime risk assessments. The system ingests multiple years’ worth of agency data and is “trained” using machine learning to determine correlations across variables. The models are then tested against recent crime data to calibrate forecast accuracy. We believe these light touch, non-enforcement tactics help agencies interact with the community in a more standardized, positive and respectful manner.

Results and Benefits:

•Directed patrol planning to maximize crime deterrence.

•Non-enforcement tactics guidance by crime type.

•Reports on officer activity for impact and accountability.

•Better community engagement.

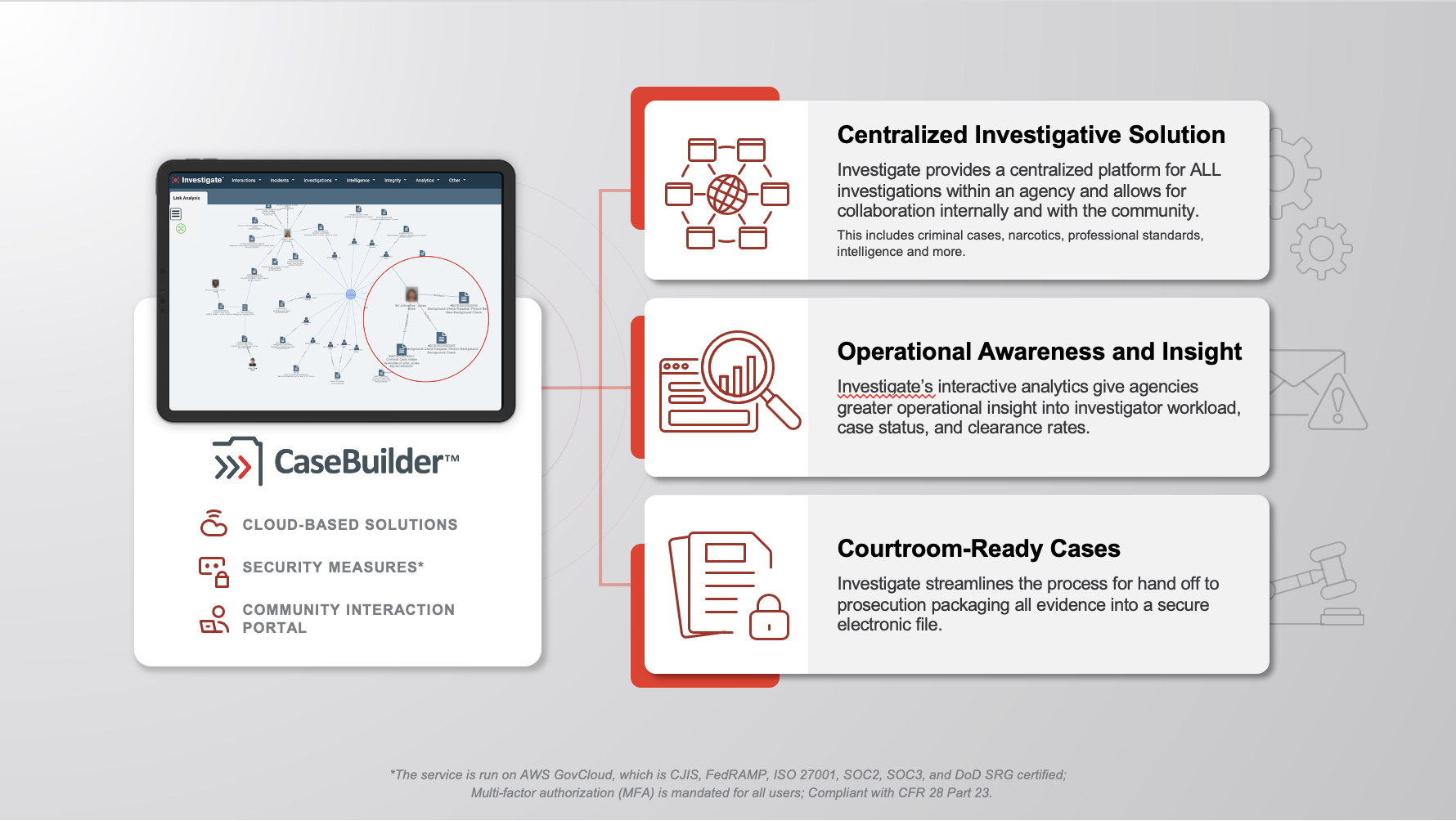

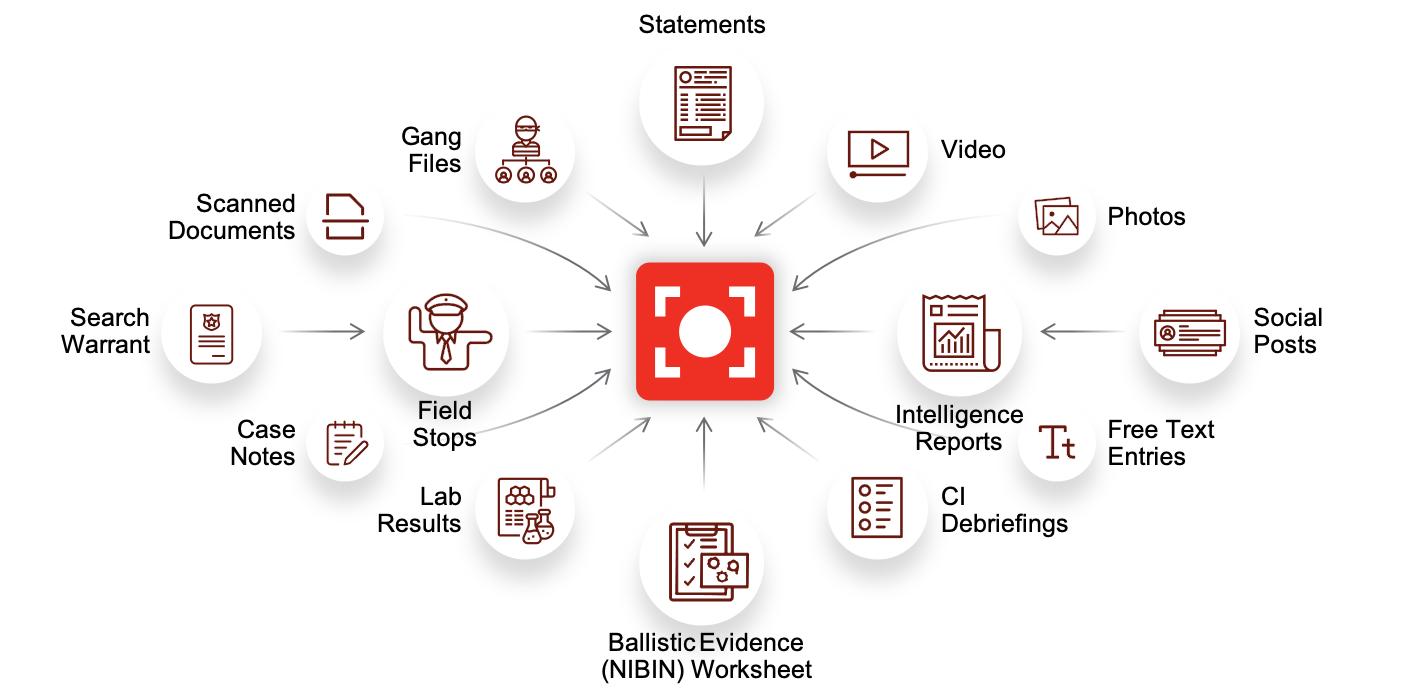

CaseBuilder (formerly ShotSpotter Investigate) Tools Portfolio

CaseBuilder's tools portfolio includes CrimeTracer (formerly COPLINK X) and CaseBuilder (formerly ShotSpotter Investigate and ShotSpotter GCM (Gun Crime Management).

CrimeTracer (formerly COPLINK X)

CrimeTracer is a powerful law enforcement search engine and information platform that enables law enforcement to procuresearch data from agencies across the United States using natural language speech terms and use. By deliveringconcepts. With CrimeTracer, officers have instant access to information they need, enabling them to strike the right balance between crime reduction, community engagement, and personal safety. CrimeTracer provides law enforcement with the abilities to:

•Search through structured and unstructured data to obtain immediate tactical leads.

•Access law enforcement data records from a centralized, user-friendly interface.

•Leverage advanced link analysis to quickly detect relationships between people, places and events.

•Link leads to reports, suspects and other entities.

•Identify crime trends to make operational and resource decisions.

CrimeTracer was added to our investigative tools portfolio in January 2022 through the acquisition of Forensic Logic, LLC ("Forensic Logic").

CaseBuilder (formerly ShotSpotter Investigate)

We acquired the CaseBuilderinvestigative case management solution in November 2020. We reconfigured and integrated the product to create the ability to use gunfire incident data from ShotSpotter to populate cases automatically and launched the solution in July 2021.

The average homicide clearance rate in the United States was less than 50% in 2021, according to a report published by The Marshall Project in 2022. This means that in more than half the cases the suspect is not held accountable and is free to commit another crime while victims’ families don’t get closure A low clearance rate is a self-perpetuating problem for a law enforcement agency. The problem starts when detectives can’t quickly close cases and clear up their case load, while they continue to catch new ones. Soon they are overloaded with cases and as they attempt to juggle a high caseload they get spread too thin and then leads start to slip through the cracks and the opportunity to solve the case diminishes. In the longer term, this can create a moral problem within the investigative arm of the agency and they are exposed to losing experienced detectives. This exacerbates the low clearance rates meaning victims are denied justice and the mistrust of law enforcement increases.

The most common tools that departments use to manage, track and solve cases range from purely manual to homegrown to limited function RMS modules or a mix of these. These approaches lack robust collaboration features, have poor data security features and the inability for supervisors to track case progress. We believe there is an opportunity to bring a complete digital case management solution to the market to help improve clearance rates of all crime types and accelerate solvability under the SoundThinking brand and sell to both our installed base and new potential customers, such as prisons.

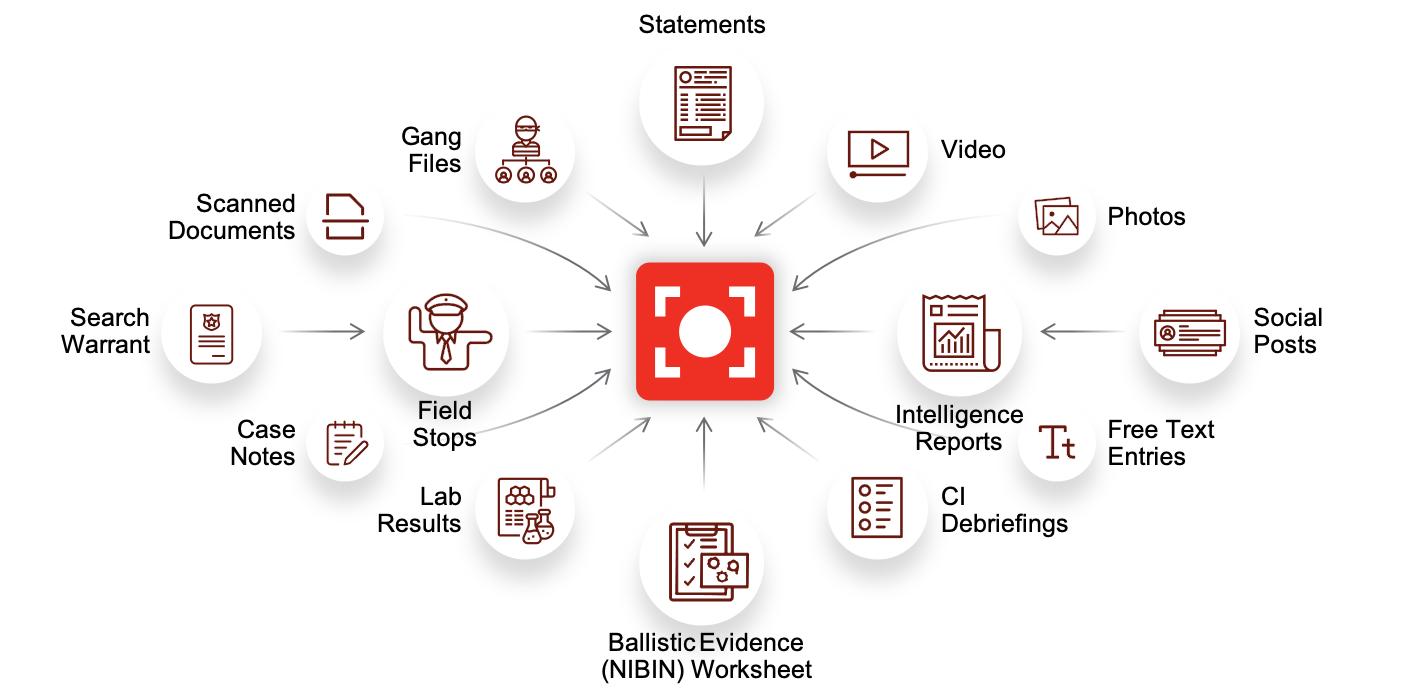

CaseBuilder provides a complete case management solution for detectives and supervisors in local, state and federal law enforcement agencies. It has been used by the New York Police Department for years at scale by thousands of officers as an on-premise solution. The solution provides:

•Complete Digital Case Management. CaseBuilder addresses the challenges investigators and supervisors face in conducting and documenting investigations. It enables police to have all case-related data in one place in a digital and structured format so that it is quickly searchable and able to be used to drive analysis and reporting.We believe law enforcement agencies can use this tool to be more efficient and effective at solving crimes and close more cases to provide resolution for victims and keep offenders from committing additional crimes.

•Analytical and Collaboration Tools. The ability to have the system automatically show linkages between people, property, and places can identify connections more quickly and help solve cases faster. Collaboration tools make investigators aware when new relevant evidence is submitted for the same or unrelated cases, and able to more easily communicate on a case across a police department or other city agency such as the district attorney’s office.

•Supervisor Reporting. Supervisor dashboards and reports ensure they have visibility into the status of every case and are aware of roadblocks so they know when to get involved and can more easily provide updates to command staff.

How CaseBuilder works

CaseBuilder Crime Gun

CaseBuilder includes a first-of-its-kind digital case management solution that focuses specifically on gun crime and was launched in June 2022. This offering subset of CaseBuilder focuses on gun violence. The solution automates the process by which key information is inputted, captured and used to identify associated gun crime cases leading to the identification of persons of interest. The solution also supports streamlined collaboration and generation of operational insights that we believe enables detectives and investigative supervisors to solve gun crime more efficiently and effectively.

SafePointe

On August 18, 2023, we acquired SafePointe, an innovator in intelligent weapons detection technology. SafePointe’s AI-based solution is designed for high-traffic environments that require highly secure, frictionless access in a low-profile form factor. SafePointe extends our SafetySmart™ platform with a proven weapons (firearms, tactical knives, explosives) detection solution that identifies potential threats. SafePointe’s systems have been installed in workplaces, museums, schools, casinos, financial institutions and hospitals that rely on SafePointe to field, monitor and screen on-premises security concerns.

Our weapons detection technology consists of proprietary sensors deployed in a variety of configurations, and cloud-based software designed to detect and alert the customer of possible weapons entering their facility. The speed and accuracy of our weapons detection alerts enable local security teams and/or law enforcement to consistently and quickly respond to potential weapons-related incidents before they occur. Many SafePointe customers have implemented our solution as their first, and often only, weapons detection option.

When our sensors detect the possible presence of a cloud-weapon, a picture and subscription-based service, our customers do not need to design, install or maintain their own complex infrastructure or hire or train acoustic experts to continuously manage such a solution. We offer consultative ongoing on-boarding, best practicesvideo clip is captured and tactical training supportthe alert is immediately sent to our customersAlert Review Center (“ARC”). Similar to insure they deriveShotSpotter’s IRC, the full valueARC is where our trained alert review analysts are on duty 24 hours a day, seven days a week, 365 days a year to screen and classify threat levels on our customer’s property. The reviewed alert is then pushed to the customer through the cloud-based software in a variety of implementingdelivery options; email, text, mobile app, or browser notification.

Our Markets

We believe there is significant demand for advanced gunfire detection and location notification solutions that accurately and quickly report instances of gunfire, based on three primary use cases:

•Law enforcement— for domestic and international law enforcement serving communities plagued by persistent, localized gun violence, in order to identify, locate and deter gun violence; and

•Security— for security personnel (which may include law enforcement personnel) serving universities, corporate campuses, key infrastructure, transportation centers and other areas in which authorities desire to prepare for and mitigate risks related to an active-shooter event, and desire to provide a zone of detection coverage surrounding the respective campus or secured area.

•Corporate/Other— for security personnel (which may include law enforcement personnel) serving large enterprise businesses, hospitals, casinos, hotels, and other areas in which authorities desire to know if and when weapons are being brought onto their property.

Based on data from the Federal Bureau of Investigation's (the “FBI”) 2018 Uniform Crime Report, we estimate that the domestic market for our solution.

Integration Capability. We can customizepublic safety solution consists of the integration of our solutions with existing customer systems, including video management systems, computer-aided dispatch, records management systems, video analytics, automated license plate number readers, camera management systems, crime analysisapproximately 1,400 cities that had four or more homicides per 100,000 residents in 2016. The Uniform Crime Report includes information reported directly to the FBI by 18,000 city, university and statistics packages (including the COMPSTAT software tools commonly used by police departments)college, county, state, tribal and common operating picture software. Interfacing with our alerts can enhance the effectiveness of these customer tools by providing information such as precise latitude and longitude (geolocation), timestamps, incident audio and situational context. For example, police in Minneapolis, Minnesota used our alerts to trigger video recordings of certain key intersections in high crime areas and capture the image of a suspect fleeing the scene of a shooting. Similarly, in Boston, Massachusetts, police correlate our data with surveillance cameras and parolee ankle bracelet tracking data to monitor parolees who may be violating parole terms by committing crimes or consorting with criminals.

Gun Violence Data Collection. federal law enforcement agencies.] We believe that four or more homicides per 100,000 residents represents a significant gun violence problem. We estimate that a customer in this market could invest an average of approximately $400,000 per year for ShotSpotter. In 2021, we also started focusing on smaller cities that may not be included in the 1,400 cities list and expect this could add another several hundred potential customers. We believe these smaller cities could invest an average of approximately $50,000 to $100,000 per year for ShotSpotter.

Based on data made available by the National Center for Education Statistics and the Federal Aviation Administration, we believe that the domestic market for our security solutions includes approximately 5,000 college campuses and airports. We estimate that, on average, a customer in this market could invest approximately $50,000-$75,000 per year for one of our security solutions. In addition, we believe that there exists a broader market for our security solutions that include, primarily the outdoor areas of college campuses and airports outside of the United States as well as large corporate campuses, train stations and other highly-trafficked areas worldwide. In 2021, we started to focus on commercial opportunities, initially targeting certain major companies and their associated locations, such as their corporate offices and potentially even parking areas for major “big-box” retailers. Investments by customers in this market for our security solutions continue to be evaluated but could be similar or even greater than those made by our larger city customers.

Outside of the United States, we estimate that the market for ShotSpotter includes approximately 200 cities in Central America, the Caribbean, South America and southern Africa that have amassed the world’s largest and most accurate collectionat least 500,000 residents. We estimate that a customer in this market could invest an average of urban gunshot data. We provideapproximately $1.0 million per year for our public safety solution. We estimate the average investment amounts for prospective customers based on our experience with detailed gun crime pattern analysisexisting customers, our anticipated demand for theirour solutions and the corresponding coverage areas that we expect prospective customers would elect to cover with our solutions.

We believe there is demand for ResourceRouter both within our existing ShotSpotter customer base and within a broader set of police departments that are not ShotSpotter customers today. We estimate that the market for our ResourceRouter solution includes up to 1,500 cities, based on cities that have a population above 25,000 people. We expect that, on average, a customer could invest approximately $50,000-$100,000 per year for our ResourceRouter solution. We expect that ResourceRouter may also be needed by potential international customers as well, as accesswho could invest over $100,000 per year for the solution.

We believe there is demand for a robust tool that would empower law enforcement agencies to additional datasolve more crime and close more cases. Every law enforcement agency has the duty and mandate to document and investigate alleged crimes in order to hold perpetrators accountable and provide resolution for victims. Unfortunately, the options to do this in a digitized and automated way are generally lacking. We believe CaseBuilder offers the most complete investigative case management solution on the market that can assist themhas been proven to be effective with further analytics. This information provides an awarenessone of gunshot activity that may otherwise go unreported. For example, by collecting information regarding the time and location of otherwise unreported gunfire, our customers can become aware of patterns of violenceleading law

enforcement agencies in the community. This increased awareness can helpcountry. We estimate the market for our solution consists of over nearly 3,000 local, state and federal agencies in the United States and potentially thousands internationally. We expect that, on average, United States customers create policy, allocate appropriate resourcescould invest approximately $100,000 per year for our CaseBuilder solution and help to address pervasive problems in high gun-activity areas.international customers could invest approximately $500,000 per year.

7

Our Growth Strategy

We intend to drive growth in our business by continuing to build on our position and brand as athe leading provider of outdoor gunshot detection, location and alerting solutions. We also plan to leverage our large and growing installed base of customers with high net promoter attributes that consider SoundThinking a trusted partner, to grow adoption of our newer products ResourceRouter, CaseBuilder, and CrimeTracer not only within the installed base, but outside of it. Key elements of our strategy include:

| •

| Accelerate Our Acquisition of Public Safety Customers. We believe that we are in the early stages of penetrating the markets for our public safety solution. We count law enforcement agencies in three of the ten largest U.S. cities among our public safety solution customers, all of which were•Accelerate Our Acquisition of Public Safety Customers. We believe that we continue to be in the early stages of penetrating the markets for our public safety solutions. We serve law enforcement agencies in three of the ten largest U.S. cities as ShotSpotter customers. Over the last few years we expanded our direct sales force and customer success teams and added marketing lead-generation capabilities to accelerate growth in this market. Moreover, as we add new public safety customers, publicity and the number of potential references for our solutions increase, which results in our brand and our solutions becoming more well known. We intend to capitalize on this momentum to grow sales. •Expand ShotSpotter Revenue within the last four years. We expanded our direct sales force and customer success team in 2017 and intend to expend additional resources on our marketing efforts to accelerate growth in this market. Moreover, as we add new public safety customers, publicity and the number of potential references for our solutions increase, which results in our brand and our solutions becoming more well known. We intend to capitalize on this momentum to drive an increase in sales.

|

Further Penetrate Our Existing Customer Base. As customers realize the benefits of our solutions, we believe that we have a significant opportunity to increase the lifetime value of our customer relationships by expanding coverage within their communities.communities through a “land and expand” strategy. For example, of our 77 ShotSpotter Flex customers, as of December 31, 2017, more than 40%approximately 39% have expanded their coverage areas from their original deployment areas by an average of almost eight square miles and ouras of December 31, 2023. Our overall revenue retention rate has been over 100%was 107% for each2023, 124% for 2022 and was 125% for 2021.

•Expand Our International Footprint. With only three currently deployed ShotSpotter customers outside of 2017, 2016the United States in South Africa, the Bahamas and 2015.

Partner with “Smart Cities” Initiatives Providers. Uruguay, we believe that we have a significant opportunity to expand internationally. We estimate that the market outside the United States for our public safety solutions includes approximately 200 cities in Central America, the Caribbean, South America and southern Africa that have at least 500,000 residents. In addition, we believe that there is a significantmarket for our security solutions, ResourceRouter and CaseBuilder outside the United States. We intend to increase our investment in our international product, sales and marketing efforts to penetrate new geographies over the coming years.

•Drive Additional Revenue per Customer with the Development or Acquisition of New Products and Services. We are transforming the company from a domestic acoustic gunshot detection company to a global precision policing technology solutions company. We evaluate opportunities to develop or acquire complementary products and services. For example, our acquisition of HunchLab in 2018, renamed ResourceRouter, provides an opportunity to partnerincrease our revenue per customer with providersa related and value-added technology that helps deter crime through strategically planned patrols. Our 2020 acquisition of “Smart Cities” initiatives. For example, we have partneredLEEDS, LLC ("LEEDS") provided entry into a comprehensive investigative case management solution, with GE Currentour CaseBuilder solution. Our 2022 acquisition of Forensic Logic added investigative lead generation and Verizonsearch and analysis technology with our CrimeTracer solution. Our 2023 acquisition of SafePointe added their AI-based weapons detection system to incorporateour SafetySmart platform. We offer our solutions into intelligent street lights in areas not otherwise covered byon a software-as-a-service subscription model to our solutions. By incorporating our solutions into these initiatives, we believe we cancustomers. Our current approach is to leverage trusted relationships with current customers to drive initial adoption and increase our customer base, expand our footprint with those customersrevenue and deploy our solutions at a reduced cost to us. These partnerships provide new and incremental go-to market strategies we believe we can use to accelerate market penetration for our services over time.lifetime value per customer.

•Maintain Passionate Focus on Customer Success. Given the specialized nature of our market, a key component of our strategy is to maintain our passionate focus on customer success.success and satisfaction. We pride ourselves on our execution inof customer on-boarding as well as ongoing consulting and customer support, all of which are critical to ensure not only high customer retention rates, but new customer acquisitions. We implement our customer success initiative early in the sales process in order to ensure that we are aligned with the customer’s objectives and can positively impact their defined outcomes. We apply consultative best practices and policy development at the command staff level as well as tactical training

for field patrol officers. We also consistently measure our performance with customers through an annual Net Promoter Survey. We have extremely high agency participation rates and our scores the last two years have ranked between “excellent” and “world class” according to our Survey partner benchmarks. All of our efforts are focused on driving positive measurable outcomes on gun violence reduction and prevention, which we believe will in turnknow leads to positive word of mouth referrals that can attract new customers and drive an increase in sales.

•ExpandGrow Our International Footprint. With only one currentSecurity Business. We have developed our ShotSpotter Flex customer outside of the United States in South Africa, we believe that we have a significant opportunity to expand internationally. We estimate that the market outside the United States for our public safetyCampus, (formerly ShotSpotter SecureCampus) solution includes approximately 200 cities in the European Union, Central America, the Caribbean, South America and southern Africa that have at least 500,000 residents. In addition, we believe that there is a market for our security solutions outside the United States that includes primarily the outdoor areas of college campuses and airports, as well as large corporate campuses, train stationsuniversities and other highly-trafficked areas.educational institutions. We intend to invest in our international sales and marketing efforts to reach these customers.