| Director | Audit Committee | Compensation Committee | NG&S Committee | |||

| Neal P. Goldman | * | Chair | * | |||

| John H. Hollowell | * | Chair | ||||

| Ane Launy | * | * | ||||

| Patrick Carey Lowe | * | |||||

| Adam C. Peakes | Chair |

Item 1A. Risk Factors.

Our business is subject to a variety of risks and uncertainties. If any of these risks or uncertainties actually occur, our business, reputation, financial condition, results of operations, cash flows, including negative cash flows, prospects and the trading price of our securities, may be materially and adversely affected. You should carefully consider these risks when evaluating us and our securities.

The current protracted downturn in our industry may continue for several more years, and we cannot predict if or when it will end.

Over the past several years, crude oil prices have been volatile, reaching a high of $115 per barrel in 2014, declining to $55 per barrel by the end of 2014 and reaching a low of $28 per barrel during 2016. Oil prices recovered to nearly $57 per barrel by the end of 2016 and have continued to fluctuate. As of the date of this report, Brent crude oil prices were in the mid-$50-per-barrel range, having started 2020 in the mid-to-upper $60-per-barrel range. As a result of, among other things, this continued volatility in commodity price and its uncertain future, the offshore drilling industry has experienced, and is continuing to experience, a substantial decline in demand for its services, as well as a significant decline in dayrates for contract drilling services. The decline in demand for our contract drilling services and the dayrates for those services has had, and if the industry downturn continues, will continue to have, a material adverse effect on our financial condition, results of operations and cash flows, including negative cash flows. The protracted downturn in our industry will exacerbate many of the other risks included below and other risks that we face, and we cannot predict if or when the downturn will end.

The worldwide demand for drilling services has historically been dependent on the price of oil and, as a result of low oil prices, demand has continued to be depressed in 2019, and there continues a protracted downturn in our industry.

Demand for our drilling services depends in large part upon the oil and natural gas industry’s offshore exploration and production activity and expenditure levels, which are directly affected by oil and gas prices and market expectations of potential changes in oil and gas prices. Beginning in the second half of 2014, oil prices declined significantly, resulting in a sharp decline in the demand for offshore drilling services, including services that we provide, and materially adversely affecting our results of operations and cash flows compared to years before the decline. The continuation of low oil prices would make more severe the downturn in our industry and would continue to materially adversely affect many of our customers and, therefore, demand for our services and our financial condition, results of operations and cash flows, including negative cash flows.

Oil prices have been, and are expected to continue to be, volatile and are affected by numerous factors beyond our control, including:

|

|

|

|

8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Although, historically, higher sustained commodity prices have generally resulted in increases in offshore drilling projects, short-term or temporary increases in the price of oil and gas will not necessarily result in an increase in offshore drilling activity or an increase in the market demand for our rigs. The timing of commitment to offshore activity in a cycle depends on project deployment times, reserve replacement needs, availability of capital and alternative options for resource development, among other things. Timing can also be affected by availability, access to, and cost of equipment to perform work.

Our business depends on the level of activity in the offshore oil and gas industry, which has been cyclical, is currently in a protracted downturn and is significantly affected by many factors outside of our control.

Demand for our drilling services depends upon the level of offshore oil and gas exploration, development and production in markets worldwide, and those activities depend in large part on oil and gas prices, worldwide demand for oil and gas and a variety of political and economic factors. The level of offshore drilling activity is adversely affected when operators reduce or defer new investment in offshore projects, reduce or suspend their drilling budgets or reallocate their drilling budgets away from offshore drilling in favor of other priorities, such as shale or other land-based projects, which have reduced, and may in the future further reduce demand for our rigs. As a result, our business and the oil and gas industry in general are subject to cyclical fluctuations.

As a result of the cyclical fluctuations in the market, there have been periods of lower demand, excess rig supply and lower dayrates, followed by periods of higher demand, shorter rig supply and higher dayrates. We cannot predict the timing or duration of such fluctuations. Periods of lower demand or excess rig supply, such as the current protracted downturn in our industry that is continuing and may continue for several more years, intensify the competition in the industry and often result in periods of lower utilization and lower dayrates. During these periods,

9

our rigs may not be able to obtain contracts for future work and may be idle for long periods of time or may be able to obtain work only under contracts with lower dayrates or less favorable terms. Additionally, prolonged periods of low utilization and dayrates (such as we are currently experiencing) have in the past resulted in, and may in the future result in, the recognition of further impairment charges on certain of our drilling rigs if future cash flow estimates, based upon information available to management at the time, indicate that the carrying value of these rigs may not be recoverable. See “–We may incur additional asset impairments and/or rig retirements as a result of reduced demand for certain offshore drilling rigs.”

Our industry is highly competitive, with an oversupply of drilling rigs and intense price competition.

The offshore contract drilling industry is highly competitive with numerous industry participants, and such competitiveness may be exacerbated by the current protracted downturn in our industry. Some of our competitors are larger companies, have larger or more technologically advanced fleets and have greater financial or other resources than we do. The drilling industry has experienced consolidation and may experience additional consolidation, which could create additional large competitors. Drilling contracts are traditionally awarded on a competitive bid basis. Price is typically the primary factor in determining which qualified contractor is awarded a job; however, rig availability and location, a drilling contractor’s safety record and the quality and technical capability of service and equipment are also considered.

As of the date of this report, there are approximately 240 floater rigs currently available to meet customer drilling needs in the offshore contract drilling market, and many of these rigs are not currently contracted and/or are cold stacked. Although there have been over 135 floater rigs scrapped over the past six years, the market remains oversupplied as new rig construction, upgrades of existing drilling rigs, cancelation or termination of drilling contracts and established rigs coming off contract have contributed to the current oversupply, intensifying price competition. In addition, some shipyards own rigs recently constructed or under construction, which are not currently marketed, which, if acquired by us or our competitors, would further exacerbate the oversupply of rigs.

In addition, during industry downturns like the one we are currently experiencing, rig operators may take lower dayrates and shorter contract durations to keep their rigs operational. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Market Overview” in Item 7 of this report.

We can provide no assurance that our drilling contracts will not be terminated early or that our current backlog of contract drilling revenue will be ultimately realized.

Our customers may terminate our drilling contracts under certain circumstances, such as the destruction or loss of a drilling rig, our suspension of drilling operations for a specified period of time as a result of a breakdown of major equipment, excessive downtime for repairs, failure to meet minimum performance criteria (including customer acceptance testing) or, in some cases, due to other events beyond the control of either party.

In addition, some of our drilling contracts permit the customer to terminate the contract after specified notice periods, often by tendering contractually specified termination amounts, which may not fully compensate us for the loss of the contract. In some cases, our drilling contracts may permit the customer to terminate the contract without cause, upon little or no notice or without making an early termination payment to us. During depressed market conditions, such as those currently in effect, certain customers have utilized, and may in the future utilize, such contract clauses to seek to renegotiate or terminate a drilling contract or claim that we have breached provisions of our drilling contracts in order to avoid their obligations to us under circumstances where we believe we are in compliance with the contracts. Additionally, because of depressed commodity prices, restricted credit markets, economic downturns, changes in priorities or strategy or other factors beyond our control, a customer may no longer want or need a rig that is currently under contract or may be able to obtain a comparable rig at a lower dayrate. For these reasons, customers have sought and may in the future seek to renegotiate the terms of our existing drilling contracts, terminate our contracts without justification or repudiate or otherwise fail to perform their obligations under our contracts. As a result of such contract renegotiations or terminations, our contract backlog has been and may in the future be adversely impacted. We might not recover any compensation (or any recovery we obtain may not fully compensate us for the loss of the contract) and we may be required to idle one or more rigs for an extended period of time. Each of these results has had, and may in the future have a material adverse effect on our financial condition, results of operations and cash flows. See “– Our industry is highly competitive, with an oversupply of

10

drilling rigs and intense price competition” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Contract Drilling Backlog” in Item 7 of this this report.

We may not be able to renew or replace expiring contracts for our rigs.

As of the date of this report, all of our current customer contracts will expire between 2020 and 2023. Two of our contracts expire in 2020, six contracts expire in 2021, and two contracts expire in each of 2022 and 2023. Some of our drilling rigs are not currently contracted for continuous utilization between contracts and are being actively marketed for these uncontracted periods. Our ability to renew or replace expiring contracts or obtain new contracts, and the terms of any such contracts, will depend on various factors, including market conditions and the specific needs of our customers, at such times. Given the historically cyclical and highly competitive nature of our industry and the likelihood that the current protracted downturn in our industry continues, we may not be able to renew or replace the contracts or we may be required to renew or replace expiring contracts or obtain new contracts at dayrates that are below existing dayrates, or that have terms that are less favorable to us, including shorter durations, than our existing contracts. Moreover, we may be unable to secure contracts for these rigs. Failure to secure contracts for a rig may result in a decision to cold stack the rig, which puts the rig at risk for impairment and may competitively disadvantage the rig as many customers, during the current protracted market downturn, have expressed a preference for ready or “warm” stacked rigs over cold-stacked rigs. If a decision is made to cold stack a rig, our operating costs for the rig are typically reduced; however, we will incur additional costs associated with cold stacking the rig (particularly if we cold stack a newer rig, such as a drillship or other DP semisubmersible rig, for which cold-stacking costs are typically substantially higher than for an older non-DP rig). In addition, the costs to reactivate a cold-stacked rig may be substantial. See “– We must make substantial capital and operating expenditures to reactivate, build, maintain and upgrade our drilling fleet.”

We may incur additional asset impairments and/or rig retirements as a result of reduced demand for certain offshore drilling rigs.

The current oversupply of drilling rigs in the offshore drilling market has resulted in numerous rigs being idled and, in some cases, retired and/or scrapped. We evaluate our property and equipment for impairment whenever changes in circumstances indicate that the carrying amount of an asset may not be recoverable, and we have incurred impairment charges in the past, and may incur additional impairment charges in the future related to the carrying value of our drilling rigs. Impairment write-offs could result if, for example, any of our rigs become obsolete or commercially less desirable due to changes in technology, market demand or market expectations or their carrying values become excessive due to the condition of the rig, cold stacking the rig, the expectation of cold stacking the rig in the near future, contracted backlog of less than one year for a rig, a decision to retire or scrap the rig, or spending in excess of budget on a newbuild, construction project or major rig upgrade. We utilize an undiscounted probability-weighted cash flow analysis in testing an asset for potential impairment, reflecting management’s assumptions and estimates regarding the appropriate risk-adjusted dayrate by rig, future industry conditions and operations and other factors. Asset impairment evaluations are, by their nature, highly subjective. The use of different estimates and assumptions could result in materially different carrying values of our assets, which could impact the need to record an impairment charge and the amount of any charge taken. Since 2012, we have retired and sold 30 drilling rigs (inclusive of the sale of the Ocean Confidence, which is expected to be completed in the first quarter of 2020) and recorded impairment losses aggregating $1.7 billion. Historically, the longer a drilling rig remains cold stacked, the higher the cost of reactivation and, depending on the age, technological obsolescence and condition of the rig, the lower the likelihood that the rig will be reactivated at a future date. The current oversupply of rigs in our industry, together with the current protracted downturn, heightens the risk of the need for future rig impairments. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Estimates– Property, Plant and Equipment” in Item 7 of this report and Note 3 “Asset Impairments” to our Consolidated Financial Statements in Item 8 of this report.

We can provide no assurance that our assumptions and estimates used in our asset impairment evaluations will ultimately be realized or that the current carrying value of our property and equipment will ultimately be realized.

The incurrence of additional asset impairment charges would lower the aggregate carrying value of our rigs and could cause us to breach certain debt covenants under our credit facilities, such as the requirement to maintain a

11

specified ratio of (A) the aggregate value of certain of our rigs to (B) the aggregate value of substantially all rigs owned by us and the requirement to maintain a specified ratio of (A) the aggregate value of certain of our marketed rigs to (B) the sum of the commitments under our $950 million revolving credit facility, plus certain outstanding loans, letter of credit exposures and other indebtedness. See “– Our significant debt levels may limit our liquidity and flexibility in obtaining additional financing and in pursuing other business opportunities.”

Our significant debt levels may limit our liquidity and flexibility in obtaining additional financing and in pursuing other business opportunities.

Our business is highly capital intensive and dependent on having sufficient cash flow and/or available sources of financing in order to fund our capital expenditure requirements. During 2019, our cash and cash equivalents and marketable securities decreased an aggregate $300.8 million and during 2018 increased an aggregate $74.0 million. Based on our cash flow forecast, as of the date of this report, we expect to generate aggregate negative cash flows for 2020. If market conditions do not improve, we could continue to generate aggregate negative cash flows in future periods.

As of December 31, 2019, we had outstanding approximately $2.0 billion of senior notes, maturing at various times from 2023 through 2043. As of February 7, 2020, we had no borrowings outstanding under our $225 million revolving credit facility maturing in October 2020, which we may have difficulty replacing upon maturity, or our $950 million revolving credit facility maturing in October 2023 and had utilized $6.0 million for the issuance of a letter of credit under the latter in support of an existing bond. We expect to begin to utilize borrowing under our two credit facilities in the first half of 2020 to meet our liquidity requirements and anticipate ending 2020 with a drawn balance on our $950 million revolving credit facility. At February 7, 2020, we had approximately $1.2 billion available under such credit facilities in the aggregate, subject to their respective terms, to meet our short-term liquidity requirements. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources – Sources and Uses of Cash – Credit Agreements” in Item 7 of this report and Note 9 “Credit Agreements and Senior Notes” to our Consolidated Financial Statements in Item 8 of this report.

Our ability to meet our debt service obligations is dependent upon our future performance, which is unpredictable and dependent on our ability to manage through the current protracted industry downturn. Our levels of indebtedness could have negative consequences to us, including:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12

In addition, our failure to comply with the restrictive covenants in our debt instruments could result in an event of default that, if not cured or waived, could have a material adverse effect on our business. Among other things, these covenants:

|

|

|

|

|

|

|

|

|

|

In September 2019, S&P Global Ratings, or S&P, downgraded our corporate and senior unsecured notes credit ratings to CCC+ from B. The rating outlook from S&P changed to stable from negative. Our current corporate credit rating from Moody’s Investor Services, or Moody’s, is B2 and our current senior unsecured notes credit rating from Moody’s is B3. The rating outlook from Moody’s is negative. These credit ratings are below investment grade and could raise our cost of financing. Consequently, we may not be able to issue additional debt in amounts and/or with terms that we consider to be reasonable. These ratings could limit our ability to pursue other business opportunities or to refinance our indebtedness as it matures.

Our revolving credit facilities bear interest at variable rates, based on our corporate credit rating and market interest rates. If market interest rates increase, our cost to borrow under our revolving credit facilities may also increase. Although we may employ hedging strategies such that a portion of the aggregate principal amount outstanding under our credit facilities would effectively carry a fixed rate of interest, any hedging arrangement put in place may not offer complete protection from this risk.

Changes in tax laws and policies, effective income tax rates or adverse outcomes resulting from examination of our tax returns could adversely affect our financial results.

Tax laws and regulations are highly complex and subject to interpretation and disputes. We conduct our worldwide operations through various subsidiaries in a number of countries throughout the world. As a result, we are subject to highly complex tax laws, regulations and income tax treaties within and between the countries in which we operate as well as countries in which we may be resident, which may change and are subject to interpretation. In addition, in several of the international locations in which we operate, certain of our wholly-owned subsidiaries enter into agreements with each other to provide specialized services and equipment in support of our foreign operations. In such cases, we apply an intercompany transfer pricing methodology to determine the arm’s length amount to be charged for providing the services and equipment. In most cases, there are alternative transfer pricing methodologies that could be applied to these transactions and, if applied, could result in different chargeable amounts.

As a result, we determine our income tax expense based on our interpretation of the applicable tax laws and regulations in effect in each jurisdiction for the period during which we operate and earn income. Our overall effective tax rate could be adversely affected by lower than anticipated earnings in countries where we have lower statutory rates and higher than anticipated earnings in countries where we have higher statutory rates, by changes in the valuation of our deferred tax assets and liabilities or by changes in tax laws, tax treaties, regulations, accounting principles or interpretations thereof in one or more countries in which we operate. In addition, changes in laws, treaties and regulations and the interpretation of such laws, treaties and regulations may put us at risk for future tax assessments and liabilities which could be substantial.

13

Our income tax returns are subject to review and examination. We recognize the benefit of income tax positions we believe are more likely than not to be sustained on their merit should they be challenged by a tax authority. If any tax authority successfully challenges any tax position taken or any of our intercompany transfer pricing policies, or if the terms of certain income tax treaties are interpreted in a manner that is adverse to us or our operations, or if we lose a material tax dispute in any country, our effective tax rate on our worldwide earnings could increase substantially.

Our consolidated effective income tax rate may vary substantially from one reporting period to another.

Our consolidated effective income tax rate is impacted by the mix between our domestic and international pre-tax earnings or losses, as well as the mix of the international tax jurisdictions in which we operate. We cannot provide any assurance as to what our consolidated effective income tax rate will be in the future due to, among other factors, uncertainty regarding the nature and extent of our business activities in any particular jurisdiction in the future and the tax laws of such jurisdictions, as well as potential changes in U.S. and foreign tax laws, regulations or treaties or the interpretation or enforcement thereof, changes in the administrative practices and precedents of tax authorities or any reclassification or other matter (such as changes in applicable accounting rules) that increases the amounts we have provided for income taxes or deferred tax assets and liabilities in our consolidated financial statements. This variability may cause our consolidated effective income tax rate to vary substantially from one reporting period to another.

Our customer base is concentrated.

We provide offshore drilling services to a customer base that includes major and independent oil and gas companies and government-owned oil companies. During 2019, two of our customers in the GOM and our three largest customers in the aggregate accounted for 50% and 69%, respectively, of our annual total consolidated revenues. In addition, the number of customers we have performed services for has declined from 35 in 2014 to 12 in 2019. As of January 1, 2020, our contracted backlog was an aggregate $1.6 billion of which 43%, 44% and 24% for the years 2020, 2021 and 2022, respectively, was attributable to our operations in the GOM from three customers. The loss of a significant customer could have a material adverse impact on our financial condition, results of operations and cash flows, especially in a declining market (like the current protracted industry downturn) where the number of our working drilling rigs is declining along with the number of our active customers. In addition, if a significant customer experiences liquidity constraints or other financial difficulties, or elects to terminate one of our drilling contracts, it could have a material adverse effect on our utilization rates in the affected market and also displace demand for our other drilling rigs as the resulting excess supply enters the market. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Contract Drilling Backlog” in Item 7 of this report.

We may be subject to litigation and disputes that could have a material adverse effect on us.

We are, from time to time, involved in litigation and disputes. These matters may include, among other things, contract disputes, personal injury claims, environmental claims or proceedings, asbestos and other toxic tort claims, employment and tax matters, claims of infringement of patent and other intellectual property rights, and other litigation that arises in the ordinary course of our business. We cannot predict with certainty the outcome or effect of any dispute, claim or other litigation matter, and there can be no assurance as to the ultimate outcome of any litigation. We may not have insurance for litigation or claims that may arise, or if we do have insurance coverage it may not be sufficient, insurers may not remain solvent, other claims may exhaust some or all of the insurance available to us or insurers may interpret our insurance policies such that they do not cover losses for which we make claims or may otherwise dispute claims made. Litigation may have a material adverse effect on us because of potential adverse outcomes, defense costs, the diversion of our management’s resources and other risk factors inherent in litigation or relating to the claims that may arise.

Our contract drilling expense includes fixed costs that will not decline in proportion to decreases in rig utilization and dayrates.

Our contract drilling expense includes all direct and indirect costs associated with the operation, maintenance and support of our drilling equipment, which is often not affected by changes in dayrates and utilization. During

14

periods of reduced revenue and/or activity (like the current protracted industry downturn), certain of our fixed costs will not decline and often we may incur additional operating costs, such as fuel and catering costs, for which the customer generally reimburses us when a rig is under contract. During times of reduced dayrates and utilization, like the current protracted industry downturn, reductions in costs may not be immediate as we may incur additional costs associated with cold stacking a rig (particularly if we cold stack a newer rig, such as a drillship or other DP semisubmersible rig, for which cold-stacking costs are typically substantially higher than for an older non-DP rig), or we may not be able to fully reduce the cost of our support operations in a particular geographic region due to the need to support the remaining drilling rigs in that region. Accordingly, a decline in revenue due to lower dayrates and/or utilization may not be offset by a corresponding decrease in contract drilling expense.

Contracts for our drilling rigs are generally fixed dayrate contracts, and increases in our operating costs could adversely affect our profitability on those contracts.

Our contracts for our drilling rigs generally provide for the payment of an agreed dayrate per rig operating day, although some contracts do provide for a limited escalation in dayrate due to increased operating costs we incur on the project. Over the term of a drilling contract, our operating costs may fluctuate due to events beyond our control. In addition, equipment repair and maintenance expenses vary depending on the type of activity the rig is performing, the age and condition of the equipment and general market factors impacting relevant parts, components and services. The gross margin that we realize on these fixed dayrate contracts will fluctuate based on variations in our operating costs over the terms of the contracts. In addition, for contracts with dayrate escalation clauses, we may not be able to fully recover increased or unforeseen costs from our customers.

We are subject to extensive domestic and international laws and regulations that could significantly limit our business activities and revenues and increase our costs.

Certain countries are subject to restrictions, sanctions and embargoes imposed by the U.S. government or other governmental or international authorities. These restrictions, sanctions and embargoes may prohibit or limit us from participating in certain business activities in those countries. Our operations are also subject to numerous local, state and federal laws and regulations in the U.S. and in foreign jurisdictions concerning the containment and disposal of hazardous materials, the remediation of contaminated properties and the protection of the environment. Laws and regulations protecting the environment have become increasingly stringent, and may in some cases impose “strict liability,” rendering a person liable for environmental damage without regard to negligence or fault on the part of that person. Failure to comply with such laws and regulations could subject us to civil or criminal enforcement action, for which we may not receive contractual indemnification or have insurance coverage, and could result in the issuance of injunctions restricting some or all of our activities in the affected areas. We may be required to make significant expenditures for additional capital equipment or inspections and recertifications thereof to comply with existing or new governmental laws and regulations. It is also possible that these laws and regulations may in the future add significantly to our operating costs or result in a substantial reduction in revenues associated with downtime required to install such equipment or may otherwise significantly limit drilling activity.

In addition, these laws and regulations require us to perform certain regulatory inspections, which we refer to as a special survey. For most of our rigs, these special surveys are due every five years, although the inspection interval for our North Sea rigs is two-and-one-half years. Our operating income is negatively impacted during these special surveys. These special surveys are generally performed in a shipyard and require scheduled downtime, which can negatively impact operating revenue. Operating expenses increase as a result of these special surveys due to the cost to mobilize the rigs to a shipyard, and inspection, repair and maintenance costs. Repair and maintenance activities may result from the special survey or may have been previously planned to take place during this mandatory downtime. The number of rigs undergoing a special survey will vary from year to year, as well as from quarter to quarter. Operating income may also be negatively impacted by intermediate surveys, which are performed at interim periods between special surveys. Although an intermediate survey normally does not require shipyard time, the survey may require some downtime for the rig. We can provide no assurance as to the exact timing and/or duration of downtime and/or the costs or lost revenues associated with regulatory inspections, planned rig mobilizations and other shipyard projects.

In addition, the offshore drilling industry is dependent on demand for services from the oil and gas exploration industry and, accordingly, can be affected by changes in tax and other laws relating to the energy business generally.

15

Governments in some countries are increasingly active in regulating and controlling the ownership of concessions, the exploration for oil and gas and other aspects of the oil and gas industry. The modification of existing laws or regulations or the adoption of new laws or regulations curtailing exploratory or developmental drilling for oil and gas for economic, environmental or other reasons could limit drilling opportunities.

U.S. federal, state, foreign and international laws and regulations address oil spill prevention and control and impose a variety of obligations on us related to the prevention of oil spills and liability for damages resulting from such spills. Some of these laws and regulations have significantly expanded liability exposure across all segments of the oil and gas industry. For example, the United States Oil Pollution Act of 1990 imposes strict and, with limited exceptions, joint and several liability upon each responsible party for oil removal costs and a variety of public and private damages. Failure to comply with such laws and regulations could subject us to civil or criminal enforcement action, for which we may not receive contractual indemnification or have insurance coverage, and could result in the issuance of injunctions restricting some or all of our activities in the affected areas. In addition, legislative and regulatory developments may occur that could substantially increase our exposure to liabilities that might arise in connection with our operations.

Regulation of greenhouse gases and climate change could have a negative impact on our business.

Governments around the world are increasingly considering and adopting laws and regulations to address climate change issues. Lawmakers and regulators in the U.S. and other jurisdictions where we operate have focused increasingly on restricting the emission of carbon dioxide, methane and other “greenhouse” gases. This may result in new environmental regulations that may unfavorably impact us, our suppliers and our customers. Moreover, there is increased focus, including by governmental and non-governmental organizations, investors and other stakeholders on these and other sustainability matters. In addition, efforts have been made and continue to be made in the international community toward the adoption of international treaties or protocols that would address global climate change issues and impose reductions of hydrocarbon-based fuels. We may be exposed to risks related to new laws, regulations, treaties or international agreements pertaining to climate change, greenhouse gases, carbon emissions or energy use that could decrease the use of oil or natural gas, thus reducing demand for hydrocarbon-based fuel and our drilling services. Governments may also pass laws or regulations incentivizing or mandating the use of alternative energy sources, such as wind power and solar energy, which may reduce demand for oil and natural gas and our drilling services. Such laws, regulations, treaties or international agreements could result in increased compliance costs or additional operating restrictions, or adversely affect the demand for hydrocarbons, which may have a negative impact on our business, and could materially adversely affect our operations by limiting drilling opportunities.

If we, or our customers, are unable to acquire or renew permits and approvals required for drilling operations, we may be forced to delay, suspend or cease our operations.

Oil and natural gas exploration and production operations require numerous permits and approvals for us and our customers from governmental agencies in the areas in which we operate or expect to operate. Depending on the area of operation, the burden of obtaining such permits and approvals to commence such operations may reside with us, our customers or both. Obtaining all necessary permits and approvals may necessitate substantial expenditures to comply with the requirements of these permits and approvals, future changes to these permits or approvals, or any adverse change in the interpretation of existing permits and approvals. In addition, such regulatory requirements and restrictions could also delay or curtail our operations.

Our business involves numerous operating hazards that could expose us to significant losses and significant damage claims. We are not fully insured against all of these risks and our contractual indemnity provisions may not fully protect us.

Our operations are subject to the significant hazards inherent in drilling for oil and gas offshore, such as blowouts, reservoir damage, loss of production, loss of well control, unstable or faulty sea floor conditions, fires and natural disasters such as hurricanes. The occurrence of any of these types of events could result in the suspension of drilling operations, damage to or destruction of the equipment involved and injury or death to rig personnel and damage to producing or potentially productive oil and gas formations, oil spillage, oil leaks, well blowouts and extensive uncontrolled fires, any of which could cause significant environmental damage. In addition, offshore drilling operations

16

are subject to marine hazards, including capsizing, grounding, collision and loss or damage from severe weather. Operations also may be suspended because of machinery breakdowns, abnormal drilling conditions, failure of suppliers or subcontractors to perform or supply goods or services or personnel shortages. Any of the foregoing events could result in significant damage or loss to our properties and assets or the properties and assets of others, injury or death to rig personnel or others, significant loss of revenues and significant damage claims against us.

Our drilling contracts with our customers provide for varying levels of indemnity and allocation of liabilities between our customers and us with respect to the hazards and risks inherent in, and damages or losses arising out of, our operations, and we may not be fully protected. Our contracts are individually negotiated, and the levels of indemnity and allocation of liabilities in them can vary from contract to contract depending on market conditions, particular customer requirements and other factors existing at the time a contract is negotiated. We may incur liability for significant losses or damages under such provisions.

Additionally, the enforceability of indemnification provisions in our contracts may be limited or prohibited by applicable law or such provisions may not be enforced by courts having jurisdiction, and we could be held liable for substantial losses or damages and for fines and penalties imposed by regulatory authorities. The indemnification provisions in our contracts may be subject to differing interpretations, and the laws or courts of certain jurisdictions may enforce such provisions while other laws or courts may find them to be unenforceable. The law with respect to the enforceability of indemnities varies from jurisdiction to jurisdiction and is unsettled under certain laws that are applicable to our contracts. There can be no assurance that our contracts with our customers, suppliers and subcontractors will fully protect us against all hazards and risks inherent in our operations. There can also be no assurance that those parties with contractual obligations to indemnify us will be financially able to do so or will otherwise honor their contractual obligations.

We maintain liability insurance, which generally includes coverage for environmental damage; however, because of contractual provisions and policy limits, our insurance coverage may not adequately cover our losses and claim costs. In addition, certain risks and contingencies related to pollution, reservoir damage and environmental risks are generally not fully insurable. Also, we do not typically purchase loss-of-hire insurance to cover lost revenues when a rig is unable to work. There can be no assurance that we will continue to carry the insurance we currently maintain, that our insurance will cover all types of losses or that we will be able to maintain adequate insurance in the future at rates we consider to be reasonable or that we will be able to obtain insurance against some risks.

We are self-insured for physical damage to rigs and equipment caused by named windstorms in the GOM. This results in a higher risk of material losses that are not covered by third party insurance contracts. In addition, certain of our shore-based facilities are located in geographic regions that are susceptible to damage or disruption from hurricanes and other weather events. Future hurricanes or similar natural disasters that impact our facilities, our personnel located at those facilities or our ongoing operations may negatively affect our financial position and operating results.

If an accident or other event occurs that exceeds our insurance coverage limits or is not an insurable event under our insurance policies, or is not fully covered by contractual indemnity, it could result in a significant loss to us.

We must make substantial capital and operating expenditures to reactivate, build, maintain and upgrade our drilling fleet.

Our business is highly capital intensive and dependent on having sufficient cash flow and/or available sources of financing in order to fund our capital expenditure requirements. Our expenditures could increase as a result of changes in offshore drilling technology; the cost of labor and materials; customer requirements; the cost of replacement parts for existing drilling rigs; the geographic location of the rigs; and industry standards. Changes in offshore drilling technology, customer requirements for new or upgraded equipment and competition within our industry may require us to make significant capital expenditures in order to maintain our competitiveness. In addition, changes in governmental regulations, safety or other equipment standards, as well as compliance with standards imposed by maritime self-regulatory organizations, may require us to make additional unforeseen capital expenditures. As a result, we may be required to take our rigs out of service for extended periods of time, with corresponding losses of revenues, in order to make such alterations or to add such equipment. Depending on the length of time that a rig has been cold-stacked, we may incur significant costs to restore the rig to drilling capability,

17

which may also include capital expenditures due to the possible technological obsolescence of the rig. Market conditions, such as the current protracted industry downturn, may not justify these expenditures or enable us to operate our older rigs profitably during the remainder of their economic lives. We can provide no assurance that we will have access to adequate or economical sources of capital to fund our capital and operating expenditures.

Significant portions of our operations are conducted outside the U.S. and involve additional risks not associated with U.S. domestic operations.

Our operations outside the U.S. accounted for approximately 47%, 41% and 58% of our total consolidated revenues for 2019, 2018 and 2017, respectively, and include, or have included, operations in South America, Australia and Southeast Asia, Europe and Mexico. Because we operate in various regions throughout the world, we are exposed to a variety of risks inherent in international operations, including risks of war or conflicts; political and economic instability and disruption; civil disturbance; acts of piracy, terrorism or other assaults on property or personnel; corruption; possible economic and legal sanctions (such as possible restrictions against countries that the U.S. government may consider to be state sponsors of terrorism); changes in global monetary and trade policies, laws and regulations; fluctuations in currency exchange rates; restrictions on currency exchange; controls over the repatriation of income or capital; and other risks. We may not have insurance coverage for these risks, or we may not be able to obtain adequate insurance coverage for such events at reasonable rates. Our operations may become restricted, disrupted or prohibited in any country in which any of these risks occur.

On January 29, 2020, the European Parliament approved the U.K.’s withdrawal from the European Union, commonly referred to as Brexit. The U.K. officially left the European Union on January 31, 2020. Following its departure, the U.K. entered into a transition period that is scheduled to last until December 31, 2020 during which period of time the U.K.’s trading relationship with the European Union is expected to remain largely the same while the two parties negotiate a trade agreement as well as other aspects of the U.K.’s relationship with the European Union. The impact of Brexit and the future relationship between the U.K. and the European Union are uncertain for companies that do business in the U.K. and the overall global economy. Approximately 17% of our total revenues for the year ended December 31, 2019 were generated in the U.K. Brexit, or similar events in other jurisdictions, could depress economic activity or impact global markets, including foreign exchange and securities markets, which may have an adverse impact on our business and operations as a result of changes in currency exchange rates, tariffs, treaties and other regulatory matters.

We are also subject to the following risks in connection with our international operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18

|

|

|

|

We are also subject to the regulations of the U.S. Treasury Department’s Office of Foreign Assets Control and other U.S. laws and regulations governing our international operations in addition to domestic and international anti-bribery laws and sanctions, trade laws and regulations, customs laws and regulations, and other restrictions imposed by other governmental or international authorities. Failure to comply with these laws and regulations could result in criminal and civil penalties, economic sanctions, seizure of shipments and/or the contractual withholding of monies owed to us, among other things. We have operated and may in the future operate in parts of the world where strict compliance with anti-corruption and anti-bribery laws may conflict with local customs and practices. Any failure to comply with the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act 2010 or other anti-corruption laws due to our own acts or omissions or the acts or omissions of others, including our partners, agents or vendors, could subject us to substantial fines, sanctions, civil and/or criminal penalties and curtailment of operations in certain jurisdictions. In addition, international contract drilling operations are subject to various laws and regulations in countries in which we operate, including laws and regulations relating to the equipping and operation of drilling rigs; import-export quotas or other trade barriers; repatriation of foreign earnings or capital; oil and gas exploration and development; local content requirements; taxation of offshore earnings and earnings of expatriate personnel; and use and compensation of local employees and suppliers by foreign contractors.

Any significant cyber attack or other interruption in network security or the operation of critical information technology systems could materially disrupt our operations and adversely affect our business.

Our business has become increasingly dependent upon information technologies, computer systems and networks, including those maintained by us and those maintained and provided to us by third parties (for example, “software-as-a-service” and cloud solutions), to conduct day-to-day operations, and we are placing greater reliance on information technology to help support our operations and increase efficiency in our business functions. We are dependent upon our information technology and infrastructure, including operational and financial computer systems, to process the data necessary to conduct almost all aspects of our business. Computer, telecommunications and other business facilities and systems could become unavailable or impaired from a variety of causes including, among others, storms and other natural disasters, terrorist attacks, utility outages, theft, design defects, human error or complications encountered as existing systems are maintained, repaired, replaced or upgraded. It has been reported that known or unknown entities or groups have mounted so-called “cyber attacks” on businesses and other organizations solely to disable or disrupt computer systems, disrupt operations and, in some cases, steal data. In addition, the U.S. government has issued public warnings that indicate that energy assets might be specific targets of cybersecurity threats. Cybersecurity risks and threats continue to grow and may be difficult to anticipate, prevent, discover or mitigate. A breach, failure or circumvention of our computer systems or networks, or those of our customers, vendors or others with whom we do business, including by ransomware or other attacks, could materially disrupt our business operations and our customers’ operations and could result in the alteration, loss, theft or corruption of data, and unauthorized release of, unauthorized access to, or our loss of access to confidential, proprietary, sensitive or other critical data or systems concerning our company, business activities, employees, customers or vendors. Any such breach, failure or circumvention could result in loss of customers, financial losses, regulatory fines, substantial damage to property, bodily injury or loss of life, or misuse or corruption of critical data and proprietary information and could have a material adverse effect on our operations, business or reputation.

Acts of terrorism, piracy and political and social unrest could affect the markets for drilling services, which may have a material adverse effect on our results of operations.

Acts of terrorism and social unrest, brought about by world political events or otherwise, have caused instability in the world’s financial and insurance markets in the past and may occur in the future. Such acts could be directed against companies such as ours. In addition, acts of terrorism, piracy and social unrest could lead to increased volatility in prices for crude oil and natural gas and could adversely affect the market for offshore drilling services. Insurance premiums could increase and coverage may be unavailable in the future. Government regulations may effectively preclude us from engaging in business activities in certain countries. These regulations could be amended to cover countries where we currently operate or where we may wish to operate in the future.

19

We rely on third-party suppliers, manufacturers and service providers to secure and service equipment, components and parts used in rig operations, conversions, upgrades and construction.

Our reliance on third-party suppliers, manufacturers and service providers to provide equipment and services exposes us to volatility in the quality, price and availability of such items. Certain components, parts and equipment that we use in our operations may be available only from a small number of suppliers, manufacturers or service providers. The failure of one or more third-party suppliers, manufacturers or service providers to provide equipment, components, parts or services, whether due to capacity constraints, production or delivery disruptions, price increases, quality control issues, recalls or other decreased availability of parts and equipment, is beyond our control and could materially disrupt our operations or result in the delay, renegotiation or cancellation of drilling contracts, thereby causing a loss of contract drilling backlog and/or revenue to us, as well as an increase in operating costs and an increased risk of additional asset impairments.

Additionally, our suppliers, manufacturers and service providers could be negatively impacted by the current protracted industry downturn or global economic conditions. If certain of our suppliers, manufacturers or service providers were to experience significant cash flow issues, become insolvent or otherwise curtail or discontinue their business as a result of such conditions, it could result in a reduction or interruption in supplies, equipment or services available to us and/or a significant increase in the price of such supplies, equipment and services,.

Changes in accounting principles and financial reporting requirements could adversely affect our results of operations or financial condition.

We are required to prepare our financial statements in accordance with accounting principles generally accepted in the U.S., or GAAP, as promulgated by the Financial Accounting Standards Board. It is possible that future accounting standards that we are required to adopt could change the current accounting treatment that we apply to our consolidated financial statements and that such changes could have a material adverse effect on our results of operations and financial condition. For a description of recent accounting standards that we have not yet adopted and, if known, our estimates of their expected impact, see Note 1 “General Information – Recent Accounting Pronouncements Not Yet Adopted” to the Consolidated Financial Statements included under Item 8 of this report.

Failure to obtain and retain highly skilled personnel could hurt our operations.

We require highly skilled personnel to operate and provide technical services and support for our business. A well-trained, motivated and adequately-staffed work force has a positive impact on our ability to attract and retain business. As a result, our future success depends on our continuing ability to identify, hire, develop, motivate and retain skilled personnel for all areas of our organization. To the extent that demand for drilling services and/or the size of the active worldwide industry fleet increases, shortages of qualified personnel could arise, creating upward pressure on wages and difficulty in staffing and servicing our rigs. Our continued ability to compete effectively depends on our ability to attract new employees and to retain and motivate our existing employees. Heightened competition for skilled personnel could materially and adversely limit our operations and further increase our costs.

We are controlled by a single stockholder, which could result in potential conflicts of interest.

Loews Corporation, which we refer to as Loews, beneficially owned approximately 53% of our outstanding shares of common stock as of February 7, 2020, and is in a position to control actions that require the consent of stockholders, including the election of directors, amendment of our Restated Certificate of Incorporation and any merger or sale of substantially all of our assets. In addition, three officers of Loews serve onassist our Board of Directors or Board. We have also entered into a services agreement and a registration rights agreement with Loews, and we may inits responsibility of overseeing the future enter into other agreements with Loews.

In addition, under each of our credit facilities, a change of control event would occur if (a) any person other than Loews, its subsidiaries or affiliates and/or certain issuers of investment grade debt owns or has the power to vote more than 50% of our outstanding common stock or (b) any combination of Loews, its subsidiaries or affiliates and/or certain issuers of investment grade debt ceases to own or have the power to vote more than 25% of our outstanding common stock. If a change of control event occurs, we would be required to cash collateralize part or all of the lenders’ credit exposures under the credit facility if we fail to obtain at least one investment grade credit rating

20

as set forth in the credit facility. Under our credit ratings as of the date of this report, we would be required to cash collateralize all of the lenders’ credit exposures under each credit facility if a change in control event occurred. See “–Our significant debt levels may limit our liquidity and flexibility in obtaining additional financing and in pursuing other business opportunities.

Loews is a holding company, with principal subsidiaries (in addition to us) consisting of CNA Financial Corporation, an 89%-owned subsidiary engaged in commercial property and casualty insurance; Boardwalk Pipeline Partners, LP, a wholly-owned subsidiary engaged in the transportation and storage of natural gas and natural gas liquids; Loews Hotels Holding Corporation, a wholly-owned subsidiary engaged in the operation of a chain of hotels; and Altium Packaging LLC, a 99%-owned subsidiary engaged in the manufacture of rigid plastic packaging solutions. It is possible that potential conflicts of interest could arise in the future for our directors who are also officers of Loews with respect to a number of areas relating to the past and ongoing relationships of Loews and us, including tax and insurance matters, financial commitments and sales of common stock pursuant to registration rights or otherwise. Although the affected directors may abstain from voting on matters in which our interests and those of Loews are in conflict so as to avoid potential violations of their fiduciary duties to stockholders, the presence of potential or actual conflicts could affect the process or outcome of Board deliberations.

Item 1B. Unresolved Staff Comments.

Not applicable.

Item 2. Properties.

We own an office building in Houston, Texas, where our corporate headquarters are located. We also own offices and other facilities in New Iberia, Louisiana, Aberdeen, Scotland, Macae, Brazil and Ciudad del Carmen, Mexico. Additionally, we currently lease various office, warehouse and storage facilities in Australia, Brazil, Louisiana, Malaysia, Singapore and the U.K. to support our offshore drilling operations.

Item 3. Legal Proceedings.

See information with respect to legal proceedings in Note 10 “Commitments and Contingencies” to our Consolidated Financial Statements in Item 8 of this report.

Item 4. Mine Safety Disclosures.

Not applicable.

21

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information and Holders of Record

Our common stock is listed on the New York Stock Exchange, or NYSE, under the symbol “DO.”

As of February 7, 2020, there were approximately 118 holders of record of our common stock. This number represents registered stockholders and does not include stockholders who hold their shares through an institution.

Dividend Policy

We pay dividends at the discretion of our Board. Any determination to declare a dividend, as well as the amount of any dividend that may be declared, will be based on the Board’s consideration of our financial position, earnings, earnings outlook, capital spending plans, outlook on current and future market conditions and business needs, contractual obligations and other factors that our Board considers relevant at that time. The Board’s dividend policy may change from time to time, but there can be no assurance that we will declare any cash dividends at all or in any particular amounts. We have not paid a dividend to stockholders since 2015.

Cumulative Total Stockholder Return

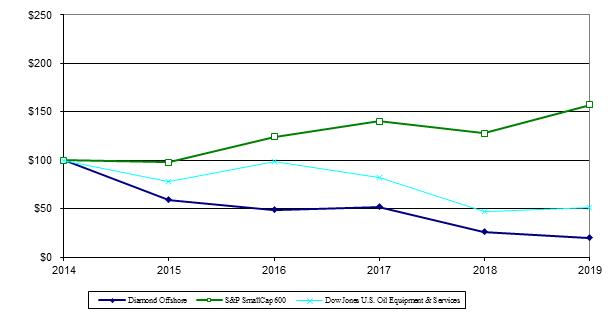

The following graph shows the cumulative total stockholder return for our common stock, the Standard & Poor's SmallCap 600 Index and the Dow Jones U.S. Oil Equipment & Services index over the five-year period ended December 31, 2019.

Comparison of Five-Year Cumulative Total Return (1)

|

| Dec. 31, 2014 |

|

| Dec. 31, 2015 |

|

| Dec. 31, 2016 |

|

| Dec. 31, 2017 |

|

| Dec. 31, 2018 |

|

| Dec. 31, 2019 |

| ||||||

Diamond Offshore |

| $ | 100 |

|

|

| 59 |

|

|

| 49 |

|

|

| 52 |

|

|

| 26 |

|

|

| 20 |

|

S&P SmallCap 600 Index |

| $ | 100 |

|

|

| 98 |

|

|

| 124 |

|

|

| 140 |

|

|

| 128 |

|

|

| 157 |

|

Dow Jones U.S. Oil Equipment & Services |

| $ | 100 |

|

|

| 78 |

|

|

| 99 |

|

|

| 82 |

|

|

| 47 |

|

|

| 51 |

|

|

|

22

Item 6. Selected Financial Data.

The following table sets forth certain historical consolidated financial data relating to Diamond Offshore. We prepared the selected consolidated financial data from our consolidated financial statements as of and for the periods presented. The selected consolidated financial data below should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Item 7 and our Consolidated Financial Statements (including the Notes thereto) in Item 8 of this report.

|

| As of and for the Year Ended December 31, |

|

| |||||||||||||||||||||

|

| 2019 |

|

|

| 2018 |

|

|

| 2017 |

|

|

| 2016 |

|

|

| 2015 |

|

| |||||

|

| (In thousands, except per share data) |

|

| |||||||||||||||||||||

Income Statement Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues |

| $ | 980,644 |

|

|

| $ | 1,083,215 |

| (1) |

| $ | 1,485,746 |

|

|

| $ | 1,600,342 |

|

|

| $ | 2,419,393 |

|

|

Operating (loss) income |

|

| (282,330 | ) |

|

|

| (112,183 | ) | (2) |

|

| 123,879 |

| (2) |

|

| (356,884 | ) | (2) |

|

| (294,074 | ) | (2) |

Net (loss) income |

|

| (357,214 | ) |

|

|

| (180,272 | ) |

|

|

| 18,346 |

|

|

|

| (372,503 | ) |

|

|

| (274,285 | ) |

|

Net (loss) income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

| (2.60 | ) |

|

|

| (1.31 | ) |

|

|

| 0.13 |

|

|

|

| (2.72 | ) |

|

|

| (2.00 | ) |

|

Diluted |

|

| (2.60 | ) |

|

|

| (1.31 | ) |

|

|

| 0.13 |

|

|

|

| (2.72 | ) |

|

|

| (2.00 | ) |

|

Balance Sheet Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Drilling and other property and equipment, net |

| $ | 5,152,828 |

|

|

| $ | 5,184,222 |

| (2) |

| $ | 5,261,641 |

| (2) |

| $ | 5,726,935 |

| (2) |

| $ | 6,378,814 |

| (2) |

Total assets |

|

| 5,834,044 |

|

|

|

| 6,035,694 |

|

|

|

| 6,250,570 |

|

|

|

| 6,371,877 |

|

|

|

| 7,149,894 |

| (3) |

Long-term debt (excluding current maturities)(4) |

|

| 1,975,741 |

|

|

|

| 1,973,922 |

|

|

|

| 1,972,225 |

|

|

|

| 1,980,884 |

|

|

|

| 1,979,778 |

| (3) |

Other Financial Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures, excluding accruals |

| $ | 326,090 |

|

|

| $ | 222,406 |

|

|

| $ | 139,581 |

|

|

| $ | 652,673 |

|

|

| $ | 830,655 |

|

|

Cash dividends declared per share |

|

| — |

|

|

|

| — |

|

|

|

| — |

|

|

|

| — |

|

|

|

| 0.50 |

|

|

|

|

|

|

|

|

|

|

23

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion should be read in conjunction with Item 1A, “Risk Factors” and our Consolidated Financial Statements (including the Notes thereto) in Item 8 of this report.

This section of this Form 10-K generally discusses 2019 and 2018 items and year-to-year comparisons between 2019 and 2018. For a discussion of our financial condition and results of operations for 2018 compared to 2017, please refer to Item 7 of Part II, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2018 filed with the SEC on February 13, 2019.

We provide contract drilling services to the energy industry around the globe with a fleet of 15 offshore drilling rigs, consisting of four drillships and 11 semisubmersible rigs, including two semisubmersible rigs that are cold stacked as of the date of this report.

Market Overview

Over the past several years, crude oil prices have been volatile, reaching a high of $115 per barrel in 2014 but dropping to $55 per barrel by the end of 2014. In 2015, oil prices continued to decline, closing at $37 per barrel at the end of the year, and continuing to fall to a low of $28 per barrel during 2016 before recovering to nearly $57 per barrel by the end of 2016. The price of crude oil continued to fluctuate in 2017 and 2018, with oil prices in the $60- per-barrel range at the beginning of 2019. As of the date of this report, Brent crude oil prices were in the mid-$50-per-barrel range, having started 2020 in the mid-to-upper $60-per-barrel range. As a result of, among other things, this continued volatility in commodity price and its uncertain future, the offshore drilling industry has experienced a substantial decline in demand for its services, as well as a significant decline in dayrates for contract drilling services.

Industry-wide floater utilization was approximately 66% at the end of 2019 based on industry analyst reports, which was unchanged from the third quarter of 2019, but an increase from nearly 60% utilization at the end of 2018. Tendering activity has also increased in some markets, but drilling programs remain primarily short term in nature, with options for future wells. Industry analysts have reported that capital investments are expected to increase slightly in 2020 compared to recent years, but forecasted spending in 2020 remains lower than previous spending levels. Dayrates remain low and pricing power currently remains with the customer, as some industry analysts have indicated that, based on historical data, utilization rates must increase to the 80%-range before pricing power shifts to the drilling contractor.

From a supply perspective, the offshore floater market remains oversupplied with approximately 240 rigs available based on industry reports. Over the last six years, 135 floaters reportedly have been scrapped; however, the pace of rig attrition has now slowed. Industry reports indicate that there remain approximately 25 newbuild floaters on order with scheduled deliveries in 2020 through 2022. Of these newbuild rigs, 16 are scheduled for delivery in 2020, but only one is under contract as of the date of this report. In addition, over the next twelve months, more than 60 currently contracted floaters are estimated to roll off their contracts, further adding to the oversupply of floaters. This combination of factors points to a continued, challenging offshore drilling market and a continuation of the protracted industry downturn.

As a result of the continuing protracted industry downturn and these challenges, we are continuing to actively seek ways to drive efficiency, reduce non-productive time and provide technical innovation to our customers. We expect these innovations and efficiencies to result in faster and safer drilling and completion of wells, leading to lower overall well costs to the benefit of our customers.

See “– Contract Drilling Backlog”for future commitments of our rigs during 2020 through 2023.

ContractDrillingBacklog

Contract drilling backlog, as presented below, includes only firm commitments (typically represented by signed contracts) and is calculated by multiplying the contracted operating dayrate by the firm contract period. Our

24

calculation also assumes full utilization of our drilling equipment for the contract period (excluding scheduled shipyard and survey days); however, the amount of actual revenue to be earned and the actual periods during which revenues will be earned will be different than the amounts and periods shown in the tables below due to various factors. Utilization rates, which generally approach 92-98% during contracted periods, can be adversely impacted by downtime due to various operating factors including weather conditions and unscheduled repairs and maintenance. Contract drilling backlog excludes revenues for mobilization, demobilization, contract preparation and customer reimbursables. No revenue is generally earned during periods of downtime for regulatory surveys. Changes in our contract drilling backlog between periods are generally a function of the performance of work on term contracts, as well as the extension or modification of existing term contracts and the execution of additional contracts. In addition, under certain circumstances, our customers may seek to terminate or renegotiate our contracts, which could adversely affect our reported backlog.

See “Risk Factors — We can provide no assurance that our drilling contracts will not be terminated early or that our current backlog of contract drilling revenue will be ultimately realized” in Item 1A of this report, which is incorporated herein by reference.

The backlog information presented below does not, nor is it intended to, align with the disclosures related to revenue expected to be recognized in the future related to unsatisfied performance obligations, which are presented in Note 2 “Revenue from Contracts with Customers” to our Consolidated Financial Statements in Item 8 of this report. Contract drilling backlog includes only future dayrate revenue as described above, while the disclosure in Note 2 excludes dayrate revenue and only reflects expected future revenue for mobilization, demobilization and capital modifications to our rigs, which are related to non-distinct promises within our signed contracts.

The following table reflects our contract drilling backlog as of January 1, 2020 (based on information available at that time), October 1, 2019 (the date reported in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2019), and January 1, 2019 (the date reported in our Annual Report on Form 10-K for the year ended December 31, 2018) (in millions).

|

| January 1, 2020(1) |

|

| October 1, 2019(1) |

|

| January 1, 2019(1) |

| |||

Contract Drilling Backlog |

| $ | 1,611 |

|

| $ | 1,835 |

|

| $ | 1,973 |

|

|

|

The following table reflects the amount of our contract drilling backlog by year as of January 1, 2020 (in millions).

|

| For the Years Ending December 31, |

| |||||||||||||||||

|

| Total |

|

| 2020 |

|

| 2021 |

|

| 2022 |

|

| 2023 |

| |||||

Contract Drilling Backlog (1) |

| $ | 1,611 |

|

| $ | 802 |

|

| $ | 486 |

|

| $ | 209 |

|

| $ | 114 |

|

|

|

25

The following table reflects the percentage of rig days committed by year as of January 1, 2020. The percentage of rig days committed is calculated as the ratio of total days committed under contracts, as well as scheduled shipyard, survey and mobilization days for all rigs in our fleet, to total available days (number of rigs, including cold-stacked rigs, multiplied by the number of days in a particular year).

|

| For the Years Ending December 31, |

| |||||||||

|

| 2020 |

|

| 2021 |

|

| 2022 |

|

| 2023 |

|

Rig Days Committed (1) |

| 75% |

|

| 42% |

|

| 15% |

|

| 8% |

|

|

|

Important Factors That May Impact Our Operating Results, Financial Condition or Cash Flows

Operating Income. Our operating income is primarily a function of contract drilling revenue earned less contract drilling expenses incurred or recognized. The two most significant variables affecting our contract drilling revenue are the dayrates earned and utilization rates achieved by our rigs, each of which is a function of rig supply and demand in the marketplace. These factors are not entirely within our control and are difficult to predict. We generally recognize revenue from dayrate drilling contracts as services are performed. Consequently, when a rig is idle, no dayrate is earned and revenue will decrease as a result.

Revenue is affected by the acquisition or disposal of rigs, rig mobilizations, required surveys and shipyard projects. In connection with certain drilling contracts, we may receive fees for the mobilization and demobilization of equipment. In addition, some of our drilling contracts require downtime before the start of the contract to prepare the rig to meet customer requirements for which we may or may not be compensated. We recognize these fees ratably as services are performed over the initial term of the related drilling contracts. We defer mobilization and contract preparation fees received (on either a lump-sum or dayrate basis), as well as direct and incremental costs associated with the mobilization of equipment and contract preparation activities, and amortize each, on a straight-line basis, over the term of the related drilling contracts. As noted above, demobilization revenue expected to be received upon contract completion is estimated and is also recognized ratably over the initial term of the contract.

Operating income also fluctuates due to varying levels of contract drilling expenses. Our operating expenses represent all direct and indirect costs associated with the operation and maintenance of our drilling equipment, which generally are not affected by changes in dayrates and short-term reductions in utilization. For instance, if a rig is to be idle for a short period of time, few decreases in operating expenses may actually occur since the rig is typically maintained in a prepared or “warm-stacked” state with a full crew. In addition, when a rig is idle, we are responsible for certain operating expenses such as rig fuel and supply boat costs, which are typically costs of our customer when a rig is under contract. However, if a rig is expected to be idle for an extended period of time, we may reduce the size of a rig’s crew and take steps to “cold stack” the rig, which lowers expenses and partially offsets the impact on operating income. The cost of cold stacking a rig can vary depending on the type of rig. The cost of cold stacking a drillship, for example, is typically substantially higher than the cost of cold stacking an older floater rig.

The principal components of our operating expenses include direct and indirect costs of labor and benefits, repairs and maintenance, freight, regulatory inspections, boat and helicopter rentals and insurance. Labor and repair and maintenance costs represent the most significant components of our operating expenses. In general, our labor costs increase primarily due to higher salary levels, rig staffing requirements and costs associated with labor regulations in the geographic regions in which our rigs operate. In addition, the costs associated with training employees can be significant. Costs to repair and maintain our equipment fluctuate depending upon the type of activity the drilling unit is performing, as well as the age and condition of the equipment and the regions in which our rigs are working. See “– Contractual Cash Obligations – Pressure Control by the Hour®.”

Regulatory Surveys and Planned Downtime. Our operating income is negatively impacted when we perform certain regulatory inspections, which we refer to as a special survey, that are due every five years for most of our rigs. The inspection interval for our North Sea rigs is two-and-one-half years. Operating revenue decreases because

26