UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

FORM 10-K

(Mark One)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31 2020, 2022

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 001-39345

QUANTUMSCAPE CORPORATION

(Exact name of registrant as specified in its Charter)

Delaware | 85-0796578 |

(State or

| (I.R.S. Employer Identification No.) |

1730 Technology Drive San Jose, California | 95110 |

(Address of | (Zip Code) |

Registrant’s telephone number, including area code: (408) (408) 452-2000

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Class A | QS | The New York Stock Exchange | ||

|

|

|

Securities registered pursuant to Section 12(g) of the Act: NoneNone

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes☐No☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes☒ ☐ No☐ ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes☒No☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes☒No☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

| Accelerated filer | ☐ | |||

Non-accelerated filer |

| Smaller reporting company |

| |||

|

| |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes☐No☒

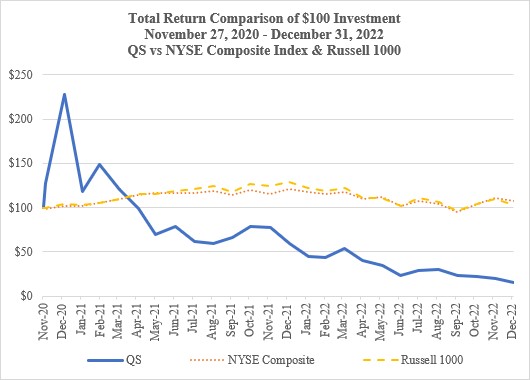

As of June 30, 2020,2022, the last day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based on the closing price of the shares of common stock on The New York Stock Exchange, was approximately $230,000,000.$2.2 billion. Shares of common stock held by each executive officer and director and by each person who owns 5% or more of the outstanding common stock have been excluded from the foregoing calculation in that such persons may be deemed affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares of the registrant’s Class A common stock,Common Stock, par value $0.0001 per share outstanding was 210,337,506,360,515,533, and the number of shares of the registrant’s Class B common stock,Common Stock, par value $0.0001 per share outstanding was 156,228,764,79,454,147, as of February 16, 2021.21, 2023.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement relating to its annual meeting of stockholders to be held in 2021 (the “2021 Annual Meeting”),2023, to be filed with the Securities and Exchange Commission (the “SEC”) within 120 days after the end of the fiscal year to which this Annual Report on Form 10-K relates, are incorporated herein by reference in Part III where indicated. Except with respect to information specifically incorporated by reference in this Annual Report on Form 10-K, such proxy statement is not deemed to be filed as part hereof.

Table of Contents

Page | ||

PART I | ||

Item 1. | 2 | |

Item 1A. |

| |

Item 1B. |

| |

Item 2. |

| |

Item 3. |

| |

Item 4. |

| |

PART II | ||

Item 5. |

| |

Item 6. |

| |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

Item 7A. |

| |

Item 8. |

| |

Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

|

Item 9A. |

| |

Item 9B. |

| |

Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | 85 |

| ||

PART III | ||

Item 10. |

| |

Item 11. |

| |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

Item 13. | Certain Relationships and Related Transactions, and Director Independence |

|

Item 14. |

| |

PART IV | ||

Item 15. |

| |

Item 16 |

|

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Unless the context otherwise requires, all references to “QuantumScape,” “we,” “us,” “our,” or the “Company” in this Annual Report on Form 10-K (this “Report”) refer to QuantumScape Corporation and its subsidiaries.

The Company makes forward-looking statements in this Annual Report on Form 10-K (this “Report”) and in documents incorporated herein by reference. All statements, other than statements of present or historical fact included in or incorporated by reference in this Report, regarding the Company’s future financial performance, as well as the Company’s strategy, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this Report, the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would”“would,” the negative of such terms, and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations, assumptions, hopes, beliefs, intentions and strategies regarding future events and are based on currently available information as to the outcome and timing of future events. The Company cautions you that these forward-looking statements are subject to all of the risks and uncertainties, including those described in Part I, Item 1A, "Risk Factors" in this Annual Report on Form 10-K, most of which are difficult to predict and many of which are beyond the control of the Company and incident to its business.

These It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements are based on information available as of the date of this Report, and current expectations, forecasts and assumptions, and involve a number of risks and uncertainties. Accordingly,we may make.

In addition, forward-looking statements in this Report and in any document incorporated herein by reference should not be relied upon as representing the Company’s views as of any subsequent date, and the Company does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

As a result of a number of known and unknown risks and uncertainties, the Company’s actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other risks and uncertainties set forthinclude those discussed in the section titled “Risk Factors” in this Report including risk factors discussedand in Part I, Item 1A underour other filings with the Heading, “Risk FactorsSecurities and Exchange Commission (“SEC”).”.

1

PART I

Item 1. Business.

Unless the context otherwise requires, all references in this section to “we,” “us,” “our,” or the “Company” refer to QuantumScape and its subsidiaries.

Corporate History and Background

The original QuantumScape Corporation, now named QuantumScape Battery, Inc. (“Legacy QuantumScape”), a wholly owned subsidiary of the Company, was founded in 2010 with the mission to revolutionize energy storage to enable a sustainable future.

On November 25, 2020 (the “Closing Date”), Kensington Capital Acquisition Corp. (“Kensington”), a special purpose acquisition company, formed in April of 2020 (“Kensington”), consummated the Business Combination Agreement (the “Business Combination Agreement”) dated September 2, 2020, by and among Kensington, Kensington Merger Sub Corp., a Delaware corporation and wholly owned subsidiary of Kensington (“Merger Sub”), and QuantumScape Battery, Inc., a Delaware corporation (f/k/a QuantumScape Corporation and f/k/a QuantumScape Subsidiary, Inc.) (“Legacy QuantumScape”) formed in May of 2010.Our Class A Common Stock and Public Warrants are listed on NYSE under the symbols “QS” and “QS.WS”, respectively. Our Class B Common Stock is neither listed nor publicly traded.QuantumScape.

Pursuant to the terms of the Business Combination Agreement, a business combination between the CompanyKensington and Legacy QuantumScape was effected through the merger of Merger Sub with and into Legacy QuantumScape, with Legacy QuantumScape surviving as the surviving company and as a wholly-owned subsidiary of Kensington (the “Merger” and, collectively with the other transactions described in the Business Combination Agreement, the “Business Combination”). On the Closing Date, the CompanyKensington changed its name from Kensington Capital Acquisition Corp. to QuantumScape Corporation.

Overview

QuantumScape is developing next generation battery technology for electric vehicles (“EVs”) and other applications.

We are at the beginning of a forecasted once-in-a-century shift in automotive powertrains, from internal combustion engines to clean EVs. While current battery technology has demonstrated the benefits of EVs, principally in the premium passenger car market, there are fundamental limitations inhibiting widespread adoption of battery technology. As a result, today, approximately 3% of global light-vehicles are electrified. We believe a new battery technology represents the most promising path to enable a mass market shift.

After 30 years of gradual improvements in conventional lithium-ion batteries, the benefits of EVs have been demonstrated, principally in the premium passenger car market. However, there are fundamental limitations inhibiting widespread adoption of battery technology, and we believe the automotive market needs a step change in battery technology to make mass market EVs competitive with the fossil fuel alternative.

We have spent the lastover a decade developing a proprietary solid-state battery technology to meet this challenge. We believe that our technology enables a new category of battery that meets the requirements for broader market adoption. TheQuantumScape’s lithium-metal solid-state battery technology that we are developing is being designed to offer greater energy density, longer life, faster charging, and greaterenhanced safety when compared to today’s conventional lithium-ion batteries. We believe no other lithium-metal battery technology has demonstrated the capability of achieving automotive rates of power (power is the rate at which a battery can be charged and discharged) with acceptable battery life, at room temperature and modest levels of pressure (approximately 3 to 4 atm).

Over the last eight yearsSince 2012, we have developed a strong partnership with Volkswagen Group of America Investments, LLC (“VGA”) and certain of its affiliates (together with VGA, “Volkswagen”). Volkswagen is one of the largest car companies in the world and intends to be a leader in EVs. Volkswagen has announced plans to launch more than 70 new EV models and build more than 25 million vehicles on electric platforms by the end of the decade. Over the last eightten years Volkswagen has invested and committed to invest, subject, in certain cases, to certain closing conditions that have not yet been satisfied, a total of more than $300 million in us and has established a 50-50 joint venture (“JV”) with us to enable an industrial level of production of our solid-state batteries. As 50-50 partners in the joint venture with Volkswagen, we expect to share equally in the revenue and profit from the joint venture. Over the course of our relationship, Volkswagen has successfully tested multiple early generations of certain of our single-layer and multi-layer laboratory cells at industry-accepted automotive rates of power (power is the rate at which a battery can be charged and discharged). We believe no other lithium-metal battery technology has demonstrated the capability of achieving automotive rates of power with acceptable battery life.power.

While we expect Volkswagen will be the first to commercialize vehicles using our battery technology, we are, and over the next few years, as we build our initial pre-pilot manufacturing facility and our 1GWh pilot facility (the “Pilot Facility”), we intend to workcontinue, working closely with other automotive original equipment manufacturers (“OEMs”) to make our solid-state battery cells widely available over time. As part of our joint venture agreement we have agreed that the Pilot Facility will be the first commercial-scale facility to manufacture our battery technology for automotive applications, but, subjectSubject to the other terms of the joint ventureJV arrangements with Volkswagen, we are not limitedprohibited from working in parallel with other automotive OEMs or other non-automotive companies to commercialize our technology. As of December 31, 2022, we have customer sampling agreements with five other OEMs to collaborate with us in the testing and validation of our solid-state battery cells, with the goal of providing such cells to the OEMs for inclusion into pre-production prototype vehicles. These OEMs range from top ten manufacturers by global revenue to premium performance and luxury carmakers; additionally, they include both traditional and pure play EV companies. We recentlyare currently focused on automotive EV applications, which have among the most stringent sets of requirements for batteries. However, we recognize that our solid-state battery technology has applicability in other large and growing markets including stationary storage and consumer electronics, such as smartphones and wearables and intend to explore opportunities in those areas as appropriate.

In 2021, we announced our plans to expandbuild up our manufacturing capability with the addition of a pre-pilot production line facility in San Jose, CA (“QS-0”). in California. QS-0 is intended to have a continuous flow, high automation line capablewith sufficient capacity and process maturity to engage in automotive qualification and if successful, provide first commercialization via the production of building over 100,000 engineering cell samples per year.C-sample battery cells made available for sale to a third party. We expect to securesecured a long-term lease in April 2021 for QS-0. QS-0 in the second half of this year and for QS-0is intended to be producing cellsfollowed by 2023.a 1GWh pilot-production line (“QS-1”), and subsequently expansion to the full 21GWh target (“QS-1 Expansion”).

2

Our development uses earth-abundant materials and processes suitable for high volume production. Our processes use toolsequipment which areis already used at scale in the battery or ceramics industries. Outside of the separator, our battery is being designed to use many of thegenerally available materials and processes that are standard across today’s battery manufacturers. As a result, we expect to benefit from the projected industry-wide cost declines for these materials that result from process improvements and economies of scale. We believe that the manufacturing of our solid-state battery cells provides us with a structural cost advantage because our battery cells are manufactured without an anode.

There are government regulations pertaining to battery safety, transportation of batteries, use of batteries in cars, factory safety, and disposal of hazardous materials. We will ultimately have to comply with these regulations to sell our batteries into the market. The license and sale of our batteries abroad is likely to be subject to export controls in the future.

Our investor relations website is located at https://ir.quantumscape.com and our Company Twitter account is located at https://twitter.com/QuantumScapeCo. We use our investor relations website and our Company Twitter account to post important information for investors, including news releases, analyst presentations, and supplemental financial information, and as a means of disclosing material non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor our investor relations website and our Company Twitter account, in addition to following press releases, filings with the Securities and Exchange Commission (the “SEC”) and public conference calls and webcasts. We also make available, free of charge, on our investor relations website under “Financials—SEC Filings,” our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to these reports as soon as reasonably practicable after electronically filing or furnishing those reports to the SEC.

Industry Background

Shift to EVs

We believe that evolving consumer preferences coupled with growing government incentives and regulations are driving a once-in-a-century shift to EVs.

Countries around the world are promoting EVs. The dependence on gasoline-powered internal combustion engine (“ICE”) vehicles has heightened environmental concerns, created reliance among industrialized and developing nations on large oil imports, and exposed consumers to unstable fuel prices and health concerns related to heightened emissions. Many national and regional regulatory bodies have adopted legislation to incentivize or require a shift to lower-emission and zero-emission vehicles. For example, over a dozen countries such asincluding the United Kingdom, the Netherlands, Sweden, Germany, France and FranceNorway have announced intentions to either increase applicable environmental targets or outright ban the sale of new ICE vehicles in the next two decades. More recently,In 2022, the California passed regulations requiring halfAir Resources Board (CARB) approved the regulation that establishes a year-by-year roadmap so that by 2035 100% of new cars and light trucks sold in the stateCalifornia are required to be zero-emissions by 2035zero-emission vehicles. Also in 2022, the European Union approved an effective ban on the sale of new petrol and 100% by 2045.diesel cars from 2035. This global push to transition from ICE vehicles, aided by favorable government incentives and regulations, is accelerating the growth in lower- and zero-emission vehicle markets.

Furthermore, consumers are increasingly considering EVs for a variety of reasons including better performance, growing EV charging infrastructure, significantly lighter environmental impact, and lower maintenance and operating costs. Automakers such as Tesla, Inc. have demonstrated that premium EVs can deliver a compelling alternative to fossil fuels. As EVs become more competitive and more affordable, we believe that they will continue to take market share from ICE vehicles. We believe that this shift will occur across vehicle types and market segments. However, some of the inherent limitations of lithium-ion battery technology remain an impedimentcontinue to meaningfulimpede improvements in EV competitiveness on range and cost.chagrining times compared with ICE vehicles.

Current Battery Technology Will Not Meet the Requirements for Broad Adoption of EVs

Despite the significant progress in the shift to EVs, the market remains dominated by ICE vehicles. According to the International Energy Association,The Wall Street Journal, approximately 3%10% of light vehicles are EVs.global car sales in 2022 were electrified. For EVs to be adopted at scale across market segments batteries need to improve. In particular, we believe there are five key requirements to drive broad adoption of EVs:

• Battery capacity (energy density). EVs need to be able to drive over 300 miles on a single charge to be competitive with ICE vehicles and achieve broad market adoption. The space required for conventional lithium-ion battery technology limits the range of many EVs. Higher energy density will enable automotive OEMs to increase battery pack energy without increasing the size and weight of the vehicle’s battery pack. • Fast charging capability. EV batteries need to be fast-charging to replicate the speed and ease with which a gasoline car can be refueled. We believe this objective is achieved with the ability to charge from 10% to 80% capacity in approximately 15 minutes or less, faster than today’s conventional batteries can deliver without materially degrading life. • Safety (nonflammable). EV batteries need to replace as many of the flammable components in the battery as possible with non-flammable equivalents to reduce the extent of damage caused by a fire. With current batteries, many abuse conditions can result in fires, for example malfunctions that can result in overcharges and battery damage from accidents. • Battery cycle life. Batteries need to be usable for the life of the vehicle, typically 12 years or 150,000 miles. If the battery fades prematurely, EVs will not be an economically practical alternative. • Cost. Mass market adoption of EVs requires a battery that is capable of delivering long range while remaining cost competitive with a vehicle price point of around $30,000. |

|

|

|

|

|

|

3

|

|

|

|

Since these requirements have complex interlinkages, most manufacturers of conventional lithium-ion batteries used in today’s cars are forced to make trade-offs. For example, conventional batteries can be fast-charged, but at the cost of significantly limitingadversely impacting their battery life.

We believe that a battery technology that can meet these requirements will enable an EV solution that is much more broadly competitive with internal combustion engines. WithICE. According to the Organisation Internationale des Constructeurs d’Automobiles, more than 9080 million ICE vehicles were produced in 20192021 across the auto industry, there isrepresenting a significant untapped demand for a battery that meets these goals – a potential market opportunity in excess of $450 billion annually.requirements.

3

Limitations of Conventional Lithium-ion Battery Technologies

The last significant development in battery technology was the commercialization of lithium-ion batteries in the early 1990s which created a new class of batteries with higher energy density. Lithium-ion batteries have enabled a new generation of mobile electronics, efficient renewable energy storage, and the start of the transition to electrified mobility.

Since the 1990s, conventional lithium-ion batteries have seen a gradual improvementgradually improved in energy density. Most increases in cell energy density have come from improved cell design and incremental improvements in cathode and anode technology. However, there is no Moore’s law in batteries – batteries—it has taken conventional lithium-ion batteries at least 10 years to double in energy density and it has been approximately 30 years since the introduction of a major new chemistry. As the industry approaches the theoretical limit of achievable energy density for lithium-ion batteries, involving carbon, we believe a new architecture is required to deliver meaningful gains in energy density.

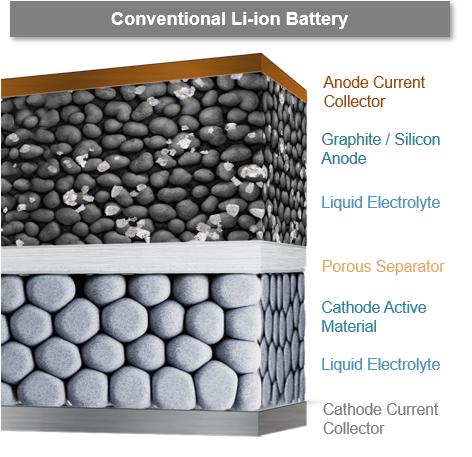

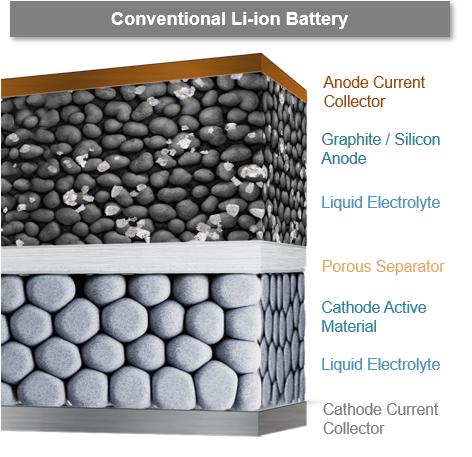

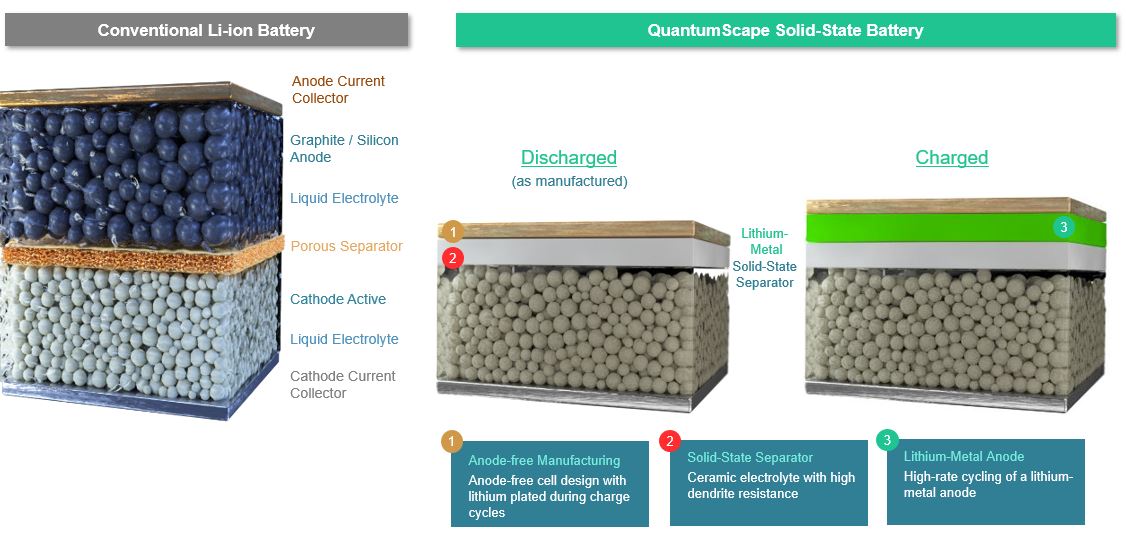

Batteries have a cathode (the positive electrode), an anode (the negative electrode), a separator which prevents contact between the anode and cathode, and an electrolyte which transports ions but not electrons. A conventional lithium-ion battery (as shown in the figure below) uses a liquid electrolyte, a polymer separator, and an anode made principally of carbon (graphite) or a carbon/silicon composite. Lithium ions move from the cathode to the anode when the battery is charged and vice versa during discharge.

Conventional Lithium-Ion Battery Design

TheOne limit to the energy density of conventional lithium-ion batteries is fundamentally limitedimposed by the anode, which provides a host material made of carbon (graphite) and/or silicon to hold the lithium ions, preventing them from binding together into pure metallic lithium. Metallic lithium, when used with conventional liquid electrolytes and porous separators, can form needle-like crystalsgrowths of lithium known as dendrites, which can penetrate through the separator and short-circuit the cell.

4

While using a host material in the anode is an effective way to prevent dendrites, this host material adds volume and mass to the cell, it adds cost to the battery, and it limits the battery life due to side reactions at the interface with the liquid electrolyte. The rate at which lithium diffuses through the anode also limits the maximum cell power.

4

The addition of silicon to a carbon anode provides a modest boost to energy density relative to a pure carbon anode. However, silicon is also a host material that not only suffers from the limitations of carbon as discussed above, but also introduces cycle life challenges as a result of the repeated expansion and contraction of the silicon particles, since silicon undergoes significantly more expansion than carbon when hosting lithium ions. Furthermore, the voltage of the lithium-silicon reaction subtracts from the overall cell voltage, reducing cell energy.

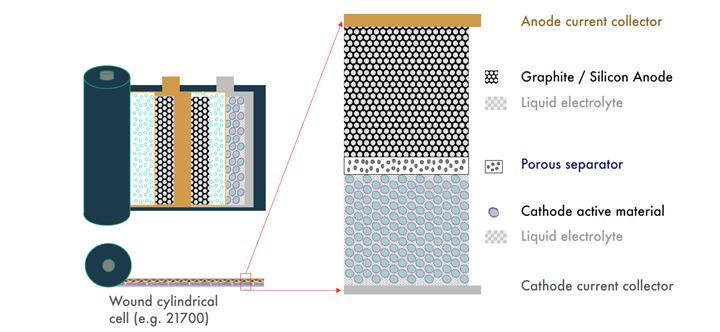

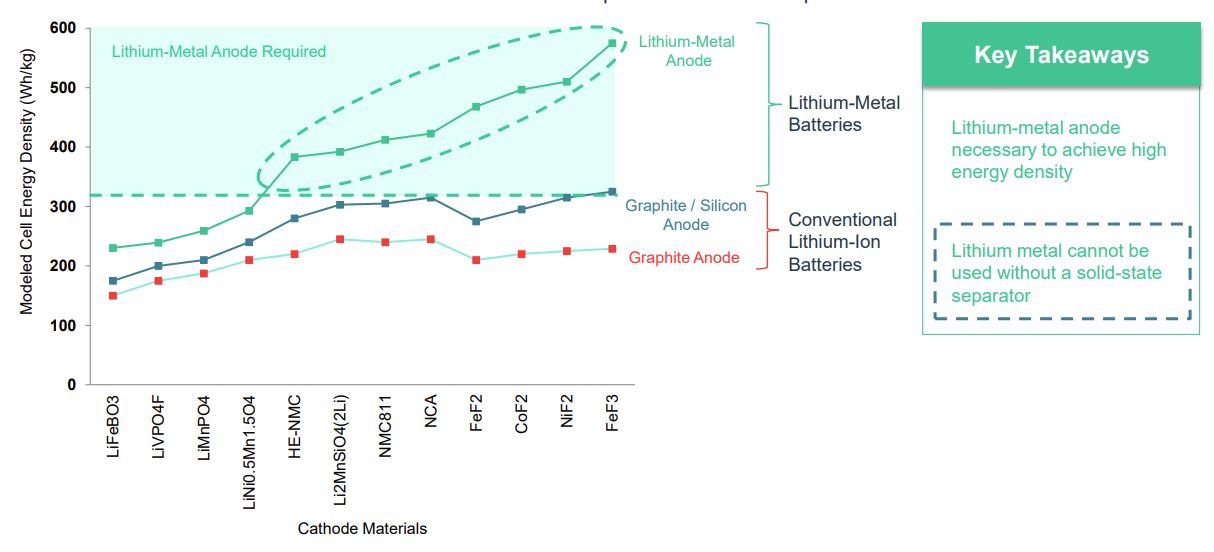

Lithium-Metal Anode Required to Unlock Highest Energy Density

We believe that a lithium-metal anode is the most promising approach that can break out of the current constraints inherent in conventional lithium-ion batteries and enable significant improvements in energy density.

In a lithium-metal battery, the anode is made of metallic lithium; there is no host material. Eliminating the host material reduces the size and weight of the battery cell and eliminates the associated materials and manufacturing costs. This results in the highest theoretical gravimetric energy density for a lithium-based battery system.system if the system can be manufactured without excess lithium on the anode. Lithium-ion batteries currently used in the auto industry have energy densities of less than 300 Wh/kg. We believe lithium-metal batteries have the potential to achieve significantly increase thishigher energy density.

Lithium-metal anodes are generally compatible with conventional cathode materials, and lithium-metal batteries will derive some benefit from continued improvement in conventional cathodes.cathode materials. Moreover, lithium-metal anodes may enable future generations of higher energy cathodes, such as the metal fluorides, that cannotmay not achieve significant energy density gains when used with lithium-ion anodes, as shown in the figure below.

SimulatedModeled Cell Specific Energy

SimulatedNote: Modeled cell specific energy is based on traditional cell designs and architectures. Source: Andre et al, J Mater Chem A, (2015) 6709.

Although the industry has understood for over 40 years the potential benefits of lithium-metal anodes, the industry has not been able to develop a separator that makes a lithium-metal anode practical for automotive use.rechargeable applications.

5

Solid-State Separator Required to Enable Lithium-Metal Anode

We believe that a lithium-metal battery requires that the porous separators used in currentconventional lithium-ion batteries be replaced with a solid-state separator capable of conducting lithium ions between the cathode and anode at rates comparable to conventional liquid electrolyte while also suppressing the formation of lithium dendrites.dendrites, which are growths of lithium metal which can grow across the separator and short-circuit the cell. While various solid-state separators have been shown to operate at low power densities, such low power densities are not useful for most practical applications. To our best knowledge, we are the only company that has been able to demonstrate a solid-state separator for lithium-metal batteries that reliably preventscapable of resisting dendrite formation at higher power densities, such as those required for automotive applications and fast-charging.fast-charging, for at least 800 cycles at around 25°C.

We believe that our ability to develop this proprietary solid-state separator will enable the shift from lithium-ion to lithium-metal batteries.

Our Technology

* Catholyte includes an organic gel made of an organic polymer and organic liquid.

Our proprietary solid-state lithium-metal cell represents the next-generation of battery technology.

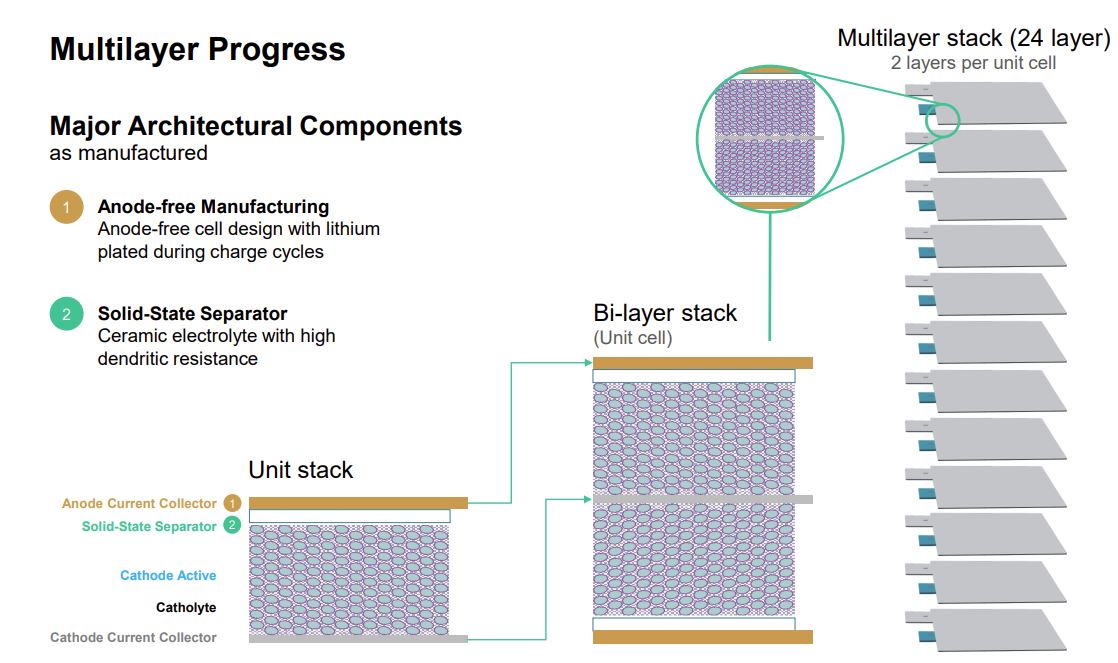

Our battery cells have none of the host materials used in conventional anodes. In fact, when our cells are manufactured there is no anode; lithium is present only in the cathode.anode. When the cell is first charged, lithium moves out of the cathode, diffuses through our solid-state separator and plates in a thin metallic layer directly on the anode current collector, forming an anode. When the battery cell is discharged, the lithium diffuses back into the cathode.

Eliminating the anode host material found in conventional lithium-ion cells substantially increases the volumetric energy density. A pure lithium-metal anode also enables the theoretically highest gravimetric energy density for a lithium battery system.system, if the system can be manufactured without excess lithium on the anode.

Our proprietary solid-state separator is the core technology breakthrough that enables reliable cycling of the lithium-metal anode battery. Without a working solid-state separator, the lithium would form dendrites which would grow through a traditional porous separator and short circuit the cell.

6

An effective solid-state separator requires a solid material that is as conductive ashas conductivity in a range similar to liquid electrolyte,electrolytes, chemically stable next to lithium–lithium— one of the most reactive elements–elements — and able to preventresist the formation of dendrites. Our team worked over ten years to develop a composition that meets these requirements and to develop the techniques necessary to manufacture the separator material at scale using a continuous process. We have a number of patents covering both the composition of this material and key steps of the manufacturing process.

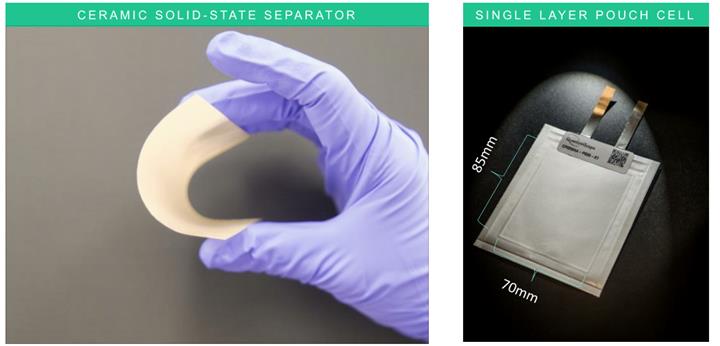

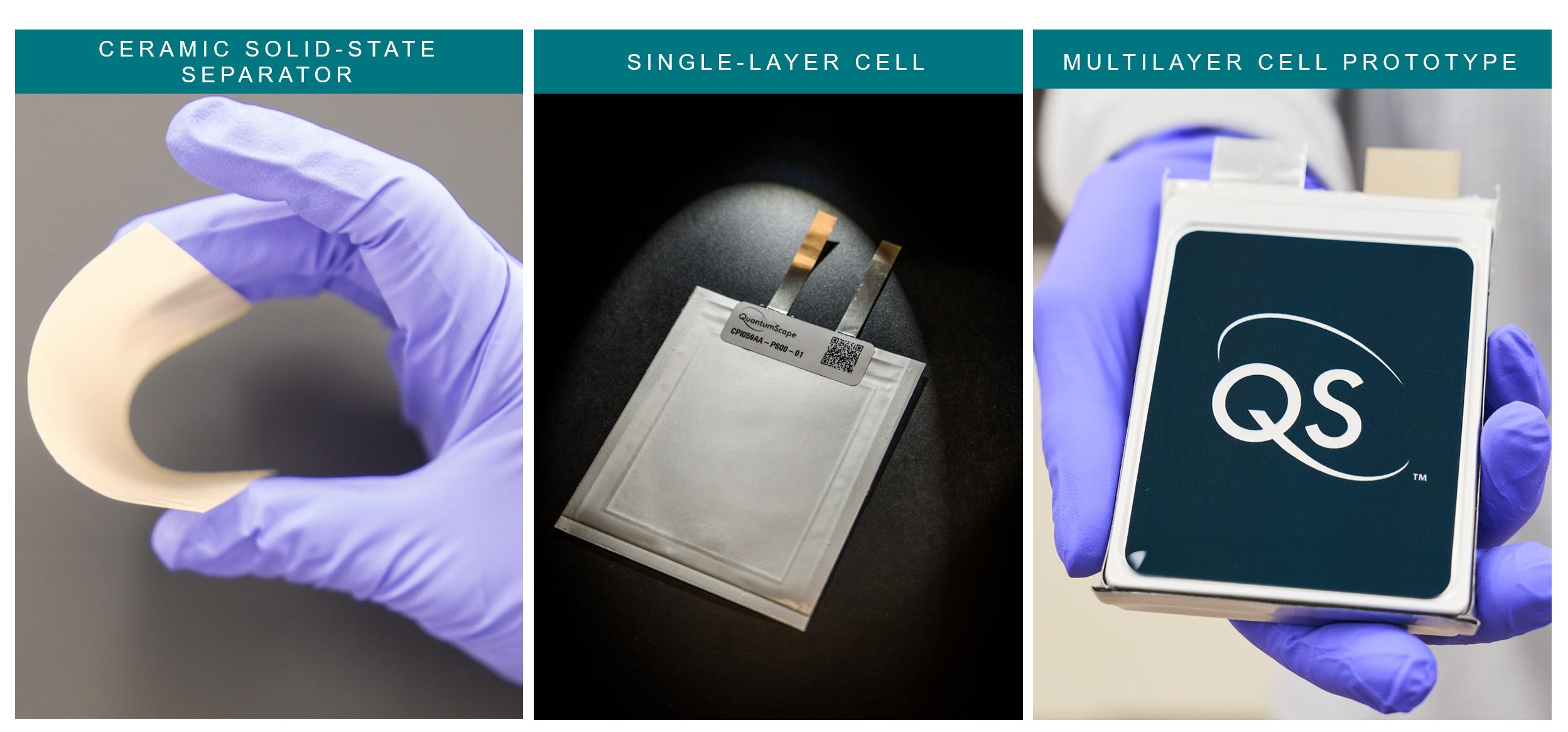

Our Material and Cell

Our solid-state separator is a dense, entirely inorganic ceramic. ItAs shown in the figure above, it is made into a film that is thinner than a human hair and then cut into pieces aboutroughly the length and widthsize of a playing card. Our solid-state separator is flexible because it has a low defect density and is thin. In contrast, typical household ceramics are brittleless flexible and can break due to millions of microscopic defects which reduce structural integrity.

The separator is placed between a cathode and anode current collector to form a single battery cell layer. Theselayer, as shown by the single layers will be stacked together into a multi-layerlayer pouch cell aboutin the size of a deck of cards, that will be the commercial form factor for EV batteries.

graphic above. Our cathodes use a combination of conventional cathode active materials (NMC) with an organic gel made of an organic polymer and organic liquid catholyte. In the future, we may use other compositions of cathode active materials, including cobalt-free compositions. We have an ongoing research and development investigation into inorganic catholyte that could replace the organic gel made of an organic polymer and organic liquid catholyte currently used.

7

As communicated in our solid-state battery showcase event on December 8, 2020, our single-layer solid-state cells have been extensively tested for power density, cycle life and temperature performance. This is the only solid-state celltechnology we are aware of that is capable of simultaneously satisfying what we believe are the key requirements for automotive commercial usage (at least 800 cycles while maintaining at least 80% energy retention, 100% depth of discharge, 1C/1C rates, <30°C temperature, <4 atm pressure) and that has been validated by independent testing.

Data from our testing of single-layer battery cells shows that unlike previous solid-state efforts, our solid-state separators can work at high rates of power, with the ability to runcharge from 10% to 80% capacity in approximately 15 minutes or less, faster than today’s conventional batteries can deliver without materially degrading life. We also presented data showing our single-layer battery cell can work at a wide range of temperatures, including results that show cycling at –10°C.

7

The basic building block of our designed battery package is the bilayer cell, consisting of a double-sided cathode with a separator on either side. We stack these bilayer cells together to form multi-layer cells. Our form factor for EV batteries is targeted to be roughly the size of a deck of cards.

Multi-Layer Progress

Depending upon our potential customers' requirements, our battery cell will require several dozen layers within each battery package. We have not yet built a complete multi-layer solid-state battery cell in the dimensions required for automotive applications but have announced the results of our single-layer, and multi-layer cells in commercially relevant areas, and in 2022, shipped 24-layer A0 prototype battery cells to multiple automotive OEMs for testing.

We need more production capacity to make the large number of multi-layer cells needed for testing and for process optimization, including yield improvement and reliability. We have ordered and continue to order new automation and high-volume equipment that we expect will increase both output and repeatability; the nature of the task, and the development approach that we use, involves high velocity experimentation and a large number of samples. We now plan to focus on improving the reliability of our prototype cells by reducing manufacturing defects, and increasing the energy density of these prototype cells to get closer to our commercial targets by incorporating higher capacity-loading cathodes and more efficient packaging.

Our cathodes use a combination of conventional cathode active materials such as NMC or a cobalt-free, nickel-free composition like LFP with a catholyte made of an organic polymer and organic liquid. In the future, we may use other compositions of cathode active materials. Over the years, we have developed catholytes made of differing mixtures of organic polymer and organic liquid electrolyte to optimize performance across multiple metrics such as voltage, temperature, power, densities byand safety, among others. We continue to test solid, gel and liquid catholytes in our cells. The solid catholyte is part of our ongoing research and development investigation into inorganic catholytes. Our solid-state separator platform is being designed to enable faster charge rates for thicker cathode electrodes, which, when combined with a leading automotive OEM. In addition, welithium-metal anode, may further increase cell energy densities.

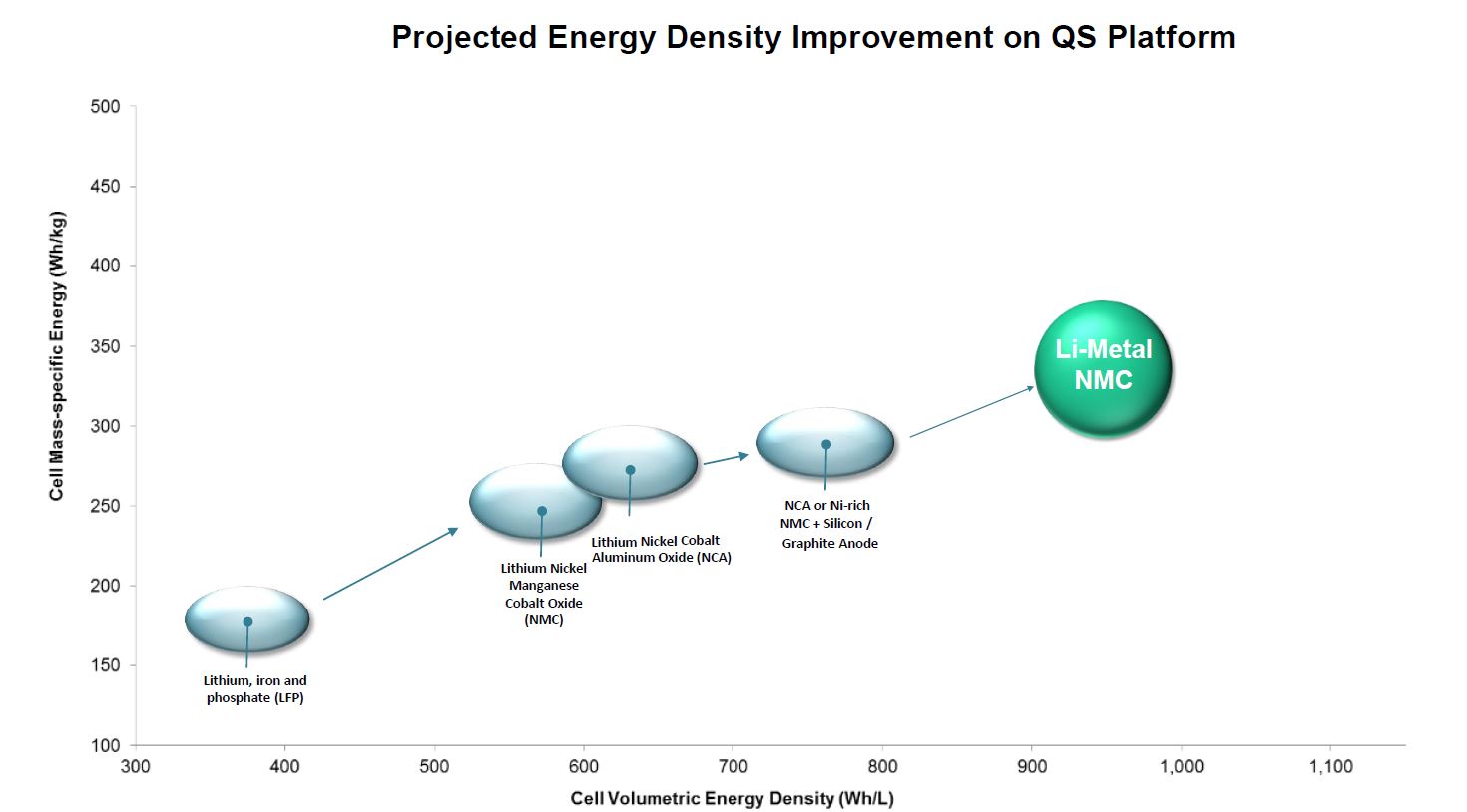

We believe our battery technology may provide significant improvements in energy density compared to today’s conventional lithium-ion batteries, as shown in the figure below.

8

Sources: Cell densities for commercialized chemistries based on Ding, Y. et al (2019) and Yang, X. et al. (2021); QuantumScape cell densities based on management estimates.

Benefits of Our Technology

We believe our battery technology will enable significant benefits across battery capacity, life,charging rate, safety, and fast charginglife while minimizing cost. We believe these benefits will provide significant value to automotive OEMs by enabling greater customer adoption of their EVs. By solving key pain-points such as 15-minute fast charging, we believe our battery technology will enable the delivery of an EV experience that is significantly more competitive with fossil fuel vehicles than what today’s EVs can achieve with conventional batteries.

Our battery technology is intended to meet the five key requirements we believe will enable mass market adoption of EVs:

|

|

89

| • Battery cycle life. We are designing our technology to enable increased battery cycle life relative to conventional lithium-ion batteries. In a conventional cell, a reason that battery capacity fades over time is the gradual irreversible loss of lithium due to side reactions between the liquid electrolyte and the anode. By eliminating the anode host material, we expect to eliminate those anode side reactions to enable longer battery cycle life. Our single-layer, four-layer, and 10-layer prototype cells have been tested to over 800 cycles (under stringent test conditions, including 100% depth-of-discharge cycles at one-hour charge and discharge rates at 25 to 30 degrees Celsius and approximately 3.4 atm of pressure with approximately 3mAh/cm2 cathode loading) while still retaining over 80% of the cells’ energy. This performance exceeds the cycle life and capacity retention in battery warranties for some of the best-selling EVs in the U.S. market today, which require that cells retain 70% of the rated capacity at 150,000 miles. • Cost. Our battery technology eliminates the anode host material and the associated manufacturing costs, providing a structural cost advantage compared to traditional lithium-ion batteries. When comparing manufacturing facilities of similar scale, we estimate that eliminating these costs has the potential to provide a cost savings compared to the costs of building traditional lithium-ion batteries.

|

|

|

|

|

|

|

|

Our Competitive Strengths

Only proven lithium-metal battery technology showing capability to meet automotive requirements for automotive applicationspower, cycle life, and temperature range to our knowledge.We have built and tested over one hundred thousand single-layersingle- and multi-layer solid-state cells, and have demonstrated that our technology meetsshows the capability to meet automotive requirements for power, cycle life, and temperature range. In 2018, Volkswagen announced it had successfully tested certain of our single-layer, laboratory battery cells at automotive rates of power. Subsequently, Volkswagen has tested certain subsequent generations of laboratory cells, including multi-layer laboratory cells. As of December 31, 2022, we have customer sampling agreements with five other OEMs to collaborate with us in the testing and validation of our solid-state battery cells with the goal of providing such cells to the OEM for inclusion into pre-production prototype vehicles. These OEMs range from top ten manufacturers by global revenue to premium performance and luxury carmakers; additionally, they include both traditional and pure play EV companies.

Partnership with one of the world’s largest automotive OEMs. We are partnered with Volkswagen, one of the largest automakers in the world. Volkswagen has been a collaboration partner and major investor since 2012 and has invested or committed to invest, subject, in certain cases, to certain closing conditions that have not yet been satisfied, a total of more than $300 million.million in us. In addition, Volkswagen has committed additional capital to fund our joint venture. Volkswagen plans to launch more than 70 new electric models and build more than 25 million vehicles on electric platforms by the end of the decade. Together with Volkswagen, we have established a50-50 joint venture to enable an industrial level ofindustrial-level production of our solid-state batteries for use in Volkswagen vehicles. As 50-50 partners in the joint venture with Volkswagen, we expect to share equally in the revenue and profit from the joint venture.

High barriers to entry withand extensive patent and intellectual property portfolio. Over the course of 10 years,Since inception, we have generated more than 200300 U.S. and foreign patents and patent applications – including broad fundamental patents around our core technology. Our proprietary solid-state separator uses the only material we know of that can cycle lithium at automotive current densities and room temperature without forming dendrites. Our battery technology is protected byWe have a range of patents, including patents that cover:

| • Composition of matter, including the optimal composition as well as wide-ranging coverage of a number of variations; • Enabling battery technology covering compositions and methods required to incorporate a solid-state separator into a battery; • Manufacturing technology, protecting the way to make the separator at scale without semiconductor-style vacuum production or batch processes used in traditional ceramics; and • Material dimensions, including our proprietary solid-state separator, covering any separator with commercially practical thicknesses for a solid-state battery. 10

|

|

|

|

|

|

|

|

Significant development focused on next-gen technology for automotive applications. We have spent overten years a decade and over $300$700 million developing our battery technology. We have run over 2.6 million tests on over 700,000 cells and cell components. OurMany of our technical team comprises more than 250 employees, many of whommembers have worked at large battery manufacturers and automotive OEMs. Through its experience, our team has significant technical know-how and is supported by extensive facilities and equipment, development infrastructure, and data analytics.

9

Designed for volume production. Our technology isbattery cells are designed to use earth-abundant materials and processes suitable for high volume production. Our processes use toolsmanufacturing process for our proprietary separator uses equipment which are already used at scale in the battery or ceramics industries. While preparing for scale production, we have purchased or tested production-intent toolsequipment from the world’s leading vendors. In particular, we expect to produce our proprietary separator using scalable continuous processing. Although our separator material is proprietary, the inputs are readily available and can be sourced from multiple suppliers across geographies.

Structural cost advantage leveraging industry cost trends. Aside from the separator, our battery is being designed to use many of the materials and processes that are standard across today’s lithium-ion battery manufacturers. As a result, we expect to benefit from the projected industry-wide cost declines for these materials that result from process improvements and economies of scale. We believe that the manufacturing of our solid-state battery cells provides us with a structural cost advantage because our battery cells are manufactured without an anode.

Our Growth Strategy

Continue to develop our commercial battery technology and manufacturing capabilities. We will continue developing our battery technology with the goal of enabling commercial production in 2024.subsequent to the automotive qualification process, which involves several major delivery milestones — A, B and C samples. We have validateddemonstrated capabilities of our solid-state separator and battery technology in single-layer and multi-layer, solid-state cellsat the in commercially required size (70x85mm)relevant areas (ranging from 60x75mm to 70x85mm), and four-layer solid-statein 2022, shipped 24-layer A0 prototype battery cells at a smaller size (30x30mm). We must now develop multi-layer cellswithto multiple automotive OEMs for testing. As we move from prototypes to commercial dimensionsproducts, we may need to increase cell layer count and many more layers,will need to continue improving yieldthe quality and performanceconsistency of materials and to optimize all components of the cellprocesses for high volume manufacturing.manufacturing, including increased precision through automation and process control, quality of material inputs, and particle reduction across our process flow. We will continue to work to further develop and validate the volume manufacturing processes to enable high volume manufacturing and minimize manufacturing costs. We will continue to work on increasing the yield of our separators to reduce scrappage and to increase utilization of manufacturing tools. Our current funds will enable us to expand and accelerate research and development activities and undertake additional initiatives. Finally, we will continue to useequipment. Commercialization via the production of initial C samples is first expected from QS-0, our engineeringpre-pilot production line in San Jose, California, to prepare for high volume manufacturing and plan our first commercialwith subsequent production Pilot Facility throughexpected from QS-1, a 1GWh pilot-production line, as part of our joint venture partnership with Volkswagen. In addition, we expect that our recently announced QS-0 facility will help provide the additional capacity we need for our development work and will enable us to accelerate work on the next-generation of manufacturing tools. QS-0 is also intended to provide capacity to make enough batteries for hundreds of long-range battery electric test vehicles per year. This will allow us to provide early cells to Volkswagen, as well as other automotive partners, explore non-automotive applications, and help de-risk subsequent commercial scale-up. We expect to secure a long-term lease for QS-0 in the second half of this year and for QS-0 to be producing cells by 2023.

Meet Volkswagen battery demand. The Pilot FacilityQS-1 is to be built and run by QSV Operations LLC (“QSV”)our 50-50 joint venture with Volkswagen and, together with the subsequent 20GWh expansion ofQS-1 Expansion, the Pilot Facility (the “20GWhExpansion Facility”)full 21GWh target, would represent a small fraction of Volkswagen’s demand for batteries and impliesconsidering vehicle volumes under 2%2.6% of Volkswagen’s total production in 2019,2022, assuming a 100KWh pack size. Our goal is to significantly expand the production capacity of the joint venture, in partnership with Volkswagen, to meet more of their projected demand.

Expand partnershipsrelationships with other automotive OEMs. While we expect Volkswagen will be the first to commercialize vehicles using our battery technology, we are, and over the next few years as we build our Pilot Facility, weQS-1, intend to workcontinue, working closely with other automotive OEMs to make our solid-state battery cells widely available over time. As part of our joint venture agreement we have agreed that the Pilot Facility will be the first commercial-scale facility to manufacture our battery technology for automotive applications, but, subjectSubject to the other terms of the joint ventureJV arrangements with Volkswagen, we are not limitedprohibited from working in parallel with other automotive OEMs or other non-automotive companies to commercialize our technology. We expect that QS-0 will allow usAs of December 31, 2022, we have customer sampling agreements with five other OEMs, to provide earlycollaborate in the testing and validation of our solid-state battery cells, with the goal of providing such cells to Volkswagen, as well as other automotive partners, explore non-automotive applications,the OEMs for inclusion into pre-production prototype vehicles. These OEMs range from top ten manufacturers by global revenue to premium performance and help de-risk subsequent commercial scale-up.luxury carmakers; additionally, they include both traditional and pure play EV companies.

Expand target markets. We are currently focused on automotive EV applications, which have the most stringent set of requirements for batteries. However, we recognize that our solid-state battery technology has applicability in other large and growing markets including stationary storage and consumer electronics such as smartphones and wearables. As of December 31, 2022, we have an agreement with Fluence Energy Inc. to evaluate our batteries for inclusion in their stationary energy storage applications, and have shipped single-layer pouch cells with zero externally applied pressure for customer testing within the consumer electronics sector.

Expand commercialization models. Our technology is being designed to enable a variety of business models. In addition to joint ventures, such as the one with Volkswagen, we may operate solely-owned manufacturing facilities or license technology to other manufacturers, such as our recently announced QS-0 facility that is planned for the San Jose area.manufacturers. Where appropriate, we may build and sell separators or cell layers rather than complete battery cells.

Continued investment in next-gen battery innovation. We intend to continue to invest in research and development to improve battery cell performance, improve manufacturing processes, and reduce cost.

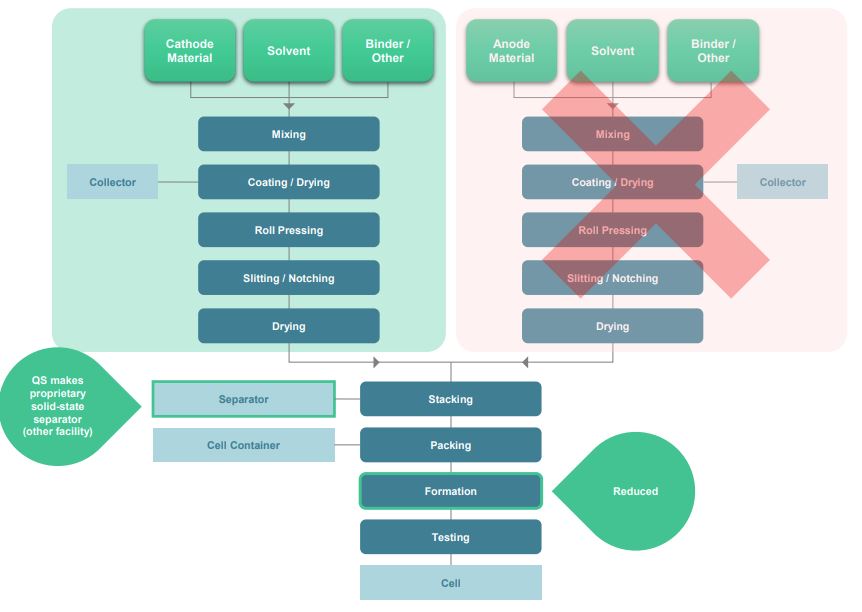

Manufacturing and Supply

Our battery manufacturing process is being designed to be very similar to that of conventional lithium-ion battery manufacturing, with a few exceptions:

|

|

|

|

1011

• Our cell design allows us to shorten the weeks-long aging process required for conventional lithium-ion cells, thus decreasing manufacturing cycle time and reducing working capital needs. |

|

|

|

Our architecture depends on our proprietary separator, which we will manufacture ourselves. Though our separator design is unique, its manufacturing relies on well-established, high-volume production processes currently deployed globally in other industries.

We plan to source our input materials from industry leading suppliers to the lithium-ion battery industry, and we already have strategic relationships in place with the industry’s leading vendors of cathode material, the most critical purchased input to our cell, along with leading vendors of other less critical inputs. Our separator is made from abundant materials produced at industrial scale in multiple geographies. We do not anticipate any unique supply constraints that would impede the commercialization of our product for the foreseeable future.

Relative to conventional lithium-ion cells, our technology eliminates the anode material cost (e.g., carbon/silicon host material, electrolyte in the anode) and reduces manufacturing costs (e.g., no anode related manufacturing costs, reduced formation costs). This enables savings in materials, capital equipment and manufacturing time, as illustrated in the graphic below.

Partnerships

12

Partnerships

Volkswagen Collaboration

QuantumScape has had a strong collaborative relationship with Volkswagen since 2012. Our collaboration initially focused on the testing and evaluation of QuantumScape’s battery technology. Volkswagen engineers worked closely with our engineering team and oversaw the progress on our technology development efforts and battery testing. Volkswagen has made several rounds of equity investments in QuantumScape, and senior executives of Volkswagen joined our board of directors (the “Board”), including two successive heads of group research for the Volkswagen Group.. During the early part of this collaboration we worked closely with members of Volkswagen’s global research and development team, and now the QuantumScape team works closely with the Volkswagen BatteryVolkswagen's Center of Excellence for Battery Center, which is tasked with commercializing battery technologies within Volkswagen. TheFrank Blome, the CEO of PowerCo. SE, Volkswagen’s battery company, and former Head of Volkswagen’s Battery Center of Excellence Frank Blome,for Battery Center, and Jens Wiese, the Head of Volkswagen Group M&A, Investment Advisory, and Partnerships, Jens Wiese,are members of the Board.

11

Joint Venture Relationship

In June 2018, we formed QSV Operations LLC (“QSV”), a 50-50 joint venture entitywith Volkswagen named QSV,focused on cell manufacturing, to facilitate the commercialization of our solid-state battery technology and enable Volkswagen to be the first automotive OEM to utilize this technology. In 2018, the parties collectively made an initial equity investment in the joint venture of approximately $3 million. Upon the occurrence of certain development milestones and subject to the entry by QuantumScape, Volkswagen and QSV into certain related agreements, QuantumScape and Volkswagen have agreed to commit additional capital on a 50-50 basis to QSV to fund the buildout of the Pilot FacilityQS-1 and the 20GWh Expansion Facility.QS-1 Expansion. As 50-50 partners in the cell manufacturing joint venture with Volkswagen, we expect to share equally in the revenue and profit from the joint venture, including from QS-1 and QS-1 Expansion. Under the Pilot Facility and the 20GWh Expansion Facility.joint venture agreements, QSV will purchase solid state separators from QuantumScape.

The joint venture agreements were amended in 2020 in connection with a further $200 million investment commitment by Volkswagen in QuantumScape (subject to certain closing conditions). $100 million of this equity investment by Volkswagen was paid on December 1, 2020 and the second $100 million equity investment is subject to completion of a certain technical milestone by the end of the first quarter of 2021. As part of the first tranche ofQuantumScape. In connection with this equity investment, Volkswagen has the right to increase its representation on the Board from one member to two members. As of January 13, 2021, Volkswagen haddesignate two members on the Board.to our Board, who are currently Mr. Blome and Mr. Wiese.

The joint venture agreements provide for the commercialization of our solid-state battery cells to occur in two phases. The first phase is the construction of the Pilot FacilityQS-1 with an annual capacity of 1GWh. QSV will begin construction of the Pilot FacilityQS-1 when certain delivery and validation milestones are met for our solid-state battery cells. The second phase is the 20GWh Expansion Facility.QS-1 Expansion.

We believe the joint venture structure will enable Volkswagen to benefit from early access to our solid-state battery cells, but also protect our intellectual property. For example, intellectual property for certain key battery technology will continue to be owned by us and will be provided to the joint venture through a limited license for purposes of the Pilot Facility.QS-1. The parties will agree on the license terms for a high-volume manufacturing facility for this battery technology license.technology. The joint venture terminates upon the earliest to occur of (i) Volkswagen exercising specified put rights in the event of, amongst others, (a) a change of control of QuantumScape, or (b) the failure by us to meet specified development milestones within certain timeframes, (ii) QuantumScape or Volkswagen exercising specified call or put rights in the event of, amongst others, if the parties cannot agree to commercial terms for the Pilot FacilityQS-1 or 20GWhQS-1 Expansion Facility within certain timeframes, (iii) a certain date after commencement of production of a Volkswagen series production vehicle using our battery cells (or an alternative end date if no such production was commenced after certain technical milestones with respect to our battery cell technology were reached) and (iv) December 31, 2028.

The commercialization timeline originally contemplated in 2018 by the joint venture agreements, and by subsequent amendments, has changed, and as of the time of our filing of this annual report on Form 10-K, certain milestones contemplated by the joint venture agreements were not met. As a result, Volkswagen now has the right to exercise its put rights. If Volkswagen exercises such rights, the joint venture with Volkswagen and Volkswagen’s commitments to purchase output capacity from the joint venture would terminate, and we would be obligated to purchase Volkswagen’s interest in the joint venture for its book value. As of December 31, 2022, the book value of this interest was approximately $1.7 million and is recorded as a redeemable non-controlling interest in our Consolidated Balance Sheets. To the extent that we and Volkswagen allocate additional money to the joint venture in the future, the cost to us of a decision by Volkswagen to exercise its put rights would increase. To date, Volkswagen has not informed us of any intention to exercise their put rights. There can be no assurance that Volkswagen will not decide to exercise these or any other put rights that it may have in the future with respect to its interest in the joint venture.

Volkswagen committed to purchase a certain portion of the output capacity of the Pilot FacilityQS-1 at a price for the solid-state battery cells that is comparable to those of lithium-ion batteries, but with a premium for the outperformance of these battery cells based on certain key technical parameters. We will sell separators to the joint venture at a price to be agreed by the parties based on the provisions of the joint venture agreements. The joint venture agreements provide the framework for the commercial relationship. At the appropriate time, the parties will negotiate agreements covering the details of these purchase commitments.

The 20GWhQS-1 Expansion Facility is subject to meeting additional technical milestones and agreement on commercial terms, including pricing for the battery cells, agreement on the terms of purchase or license for the separators, and agreement on terms of the license to our battery technology for the 20GWh Expansion Facility. As 50-50 partners in the joint venture with Volkswagen, we expect to share equally in the capital contributions required for the 20GWh Expansion Facility and in the revenue and profit from the 20GWh Expansion Facility.QS-1 Expansion. We have agreed that the pricing for the battery cells sold by the 20GWhQS-1 Expansion Facility and the separators purchased by the 20GWhQS-1 Expansion Facility may be different from the pricing set for the Pilot Facility,QS-1, and we will need to agree on pricing at the appropriate time. In addition, we will need to agree to the terms of the license to our battery technology.technology for QS-1 Expansion.

13

Volkswagen is expected to have a significant role in the manufacturing ramp-up of QSV, and we have agreed that certain technology that is developed by QSV will be owned by the joint venture and licensed to each of QuantumScape and Volkswagen on a royalty-free basis. None of this intellectual property has been developed to date. Although the parties have not commenced operations on the Pilot Facility,QS-1, Volkswagen has offered to assist us with supply chain, manufacturing ramp-up planning, and automation. In addition, the partieswe have collaborated with Volkswagen on enabling us to develop stronger relationships with battery component supply companies, such as cathode manufacturers and equipment supply companies.

Research and Development

We conduct research and development at our headquarters facility in San Jose, California. Research and development activities concentrate on making further improvements to our battery technology, including improvementstechnology. Following the shipment of 24-layer A0 prototype battery cells, we plan to battery performancefocus our research and cost.development on subsequent generations of prototype samples incorporating advances in cell functionality, process and reliability. We are working to improve the maturity of our production processes and to bring online and scale up our pre-production QS-0 line.

Our research and development currently includes programs for the following areas:

|

|

1214

| • Continued improvement in quality, consistency and reliability. We are working to improve the quality and uniformity of our cells, including our solid-state separators, to further improve, among other things, the cycling behavior, power, operating conditions, and reliability of our cells. For certain of our processes, we use methods of continuous processing found at scale in both the battery and ceramic industries and are working on continuous improvement of this process, including better quality, consistency, and higher throughput through automation and process control, quality of material inputs, and particle reduction across our process. We are also exploring new methods not typically used in ceramics that offer significant potential cost savings. Regarding consistency, tightening the variability of separator quality we believe results in better yield. We plan to implement process improvements and controls necessary to manufacture higher quality, more consistent materials; we believe these activities will ultimately lead to higher reliability. • Continued improvement in throughput. Increasing the volume of separator production results in the increased quantities required for prototypes with higher layer counts and delivery of more test cells to prospective customers. We continue to invest and deploy resources to automate our manufacturing process, including purchasing larger-scale manufacturing equipment, that we expect will substantially improve our manufacturing processes and, as a result, increase throughput required for product qualification and to achieve the cost, performance and volume levels required for commercial shipments. • Multi-layering. We have demonstrated capabilities of our solid-state separator and battery technology in single-layer and multi-layer solid-state cells in commercially relevant areas (ranging from approximately 60x75mm to 70x85mm), and in 2022, shipped 24-layer A0 prototype battery cells to multiple automotive OEMs for testing. In order to advance the maturity of our prototype cells and produce commercially-viable solid-state battery cells, we must produce battery cells with dozens of layers and may have to increase cell layer count; the exact number of layers will vary and depend upon specific customer preference, cell design considerations, and other factors. We will need to overcome production challenges to increase the layer count and implement the appropriate cell design for our solid-state battery cell. • Continued improvement of the cathode. Our cathodes use a conventional cathode active material such as NMC mixed with a catholyte. We plan to benefit from industry cathode chemistry improvements and/or cost reduction, which in the future may include use of other cathode active materials, including cobalt-free compositions, including LFP, as well as cathode processing advances such as dry electrode processing. Over the years, we have developed catholytes made of differing mixtures of organic polymer and organic liquid electrolyte to optimize performance across multiple metrics such as voltage, temperature, power, and safety, among others. We continue to test solid, gel and liquid catholytes in our cells. The solid catholyte is part of our ongoing research and development investigation into inorganic catholytes. Our solid-state catholyte platform is being designed to enable high rates of charge and discharge for even thicker cathode electrodes, which when combined with a lithium-metal anode, may further increase cell energy densities.

|

|

|

|

|

|

|

|

Intellectual Property

The success of our business and technology leadership is supported by our proprietary battery technology. We rely upon a combination of patent, trademarkpatents, trademarks and trade secret lawssecrets in the United States and other jurisdictions, as well as license agreements and other contractual protections, to establish, maintain and enforce rights in our proprietary technologies. In addition, we seek to protect our intellectual property rights through nondisclosure and invention assignment agreements with our employees and consultants and through non-disclosure agreements with business partners and other third parties. We regularly file applications for patents and have a significant number of patents in the United States and other countries where we expect todo business. Our patent portfolio is deepest in the area of solid-state separators with additional areas of strength in anodes, next-generation cathode materials, and cell, module, and pack design specific to lithium-metal batteries. Our trade secrets primarily cover manufacturing methods.

As of December 31, 2020,2022, we owned or licensed, on an exclusive basis, 80101 issued U.S. patents and 4061 pending or allowed U.S. patent applications, and 103165 granted foreign patents and patent applications. We have 12 registered U.S. trademarktrademarks and 65 pending U.S. trademark applications. OurPatents issued patentsto us start expiring in 2033.

Competition

The EV market, and the battery segment in particular, is rapidly evolving and highly competitive. With the introduction of new technologies and the potential entry of new competitors into the market, we expect competition to increase in the future, which could harm our business, results of operations, or financial condition.

Our prospective competitors include major manufacturers currently supplying the industry, automotive OEMs and potential new entrants to the industry. Major companies now supplying batteries for the EV industry include Panasonic Corporation, Samsung SDI, Contemporary Amperex Technology Co. Limited, LG Energy Solutions and LG-Chem Ltd.BYD Co. Limited. They supply conventional lithium-ion batteries and in many cases are seeking to develop solid-state batteries, including potentially lithium-metal batteries. In addition, because of the importance of electrification, mostmany automotive OEMs are researching and investing in solid-state battery efforts and, in some cases, in battery development and production. For example, Tesla, Inc. is building multiple battery gigafactories and potentially could supply batteries to other automotive OEMs, and Toyota Motors and a Japanese consortium have a multi-year initiative pursuing solid-state batteries.

15

A number of development-stage companies such as SES, Solid Power and Enovix are also seeking to improve conventional lithium-ion batteries or to develop new technologies for solid-state batteries, includingand/or lithium-metal batteries. Potential new entrants are seeking to develop new technologies for cathodes, anodes, electrolytes and additives. Some of these companies have established relationships with automotive OEMs and are in varying stages of development.

We believe our ability to compete successfully with lithium-ion battery manufacturers and with other companies seeking to develop solid-state batteries will depend on a number of factors including battery price, safety, energy density, charge rate and cycle life, and on non-technical factors such as brand, established customer relationships and financial and manufacturing resources.

Many of the incumbents have, and future entrants may have, greater resources than we have and may also be able to devote greater resources to the development of their current and future technologies. They may also have greater access to larger potential customer bases and have and may continue to establish cooperative or strategic relationships amongst themselves or with third parties (including automotive OEMs) that may further enhance their resources and offerings.

Government Regulation and Compliance

There are government regulations pertaining to battery safety, transportation of batteries, use of batteries in cars, factory safety, and disposal of hazardous materials. We will ultimately have to comply with these regulations to sell our batteries into the market. The license and sale of our batteries abroad is likely to be subject to export controls in the future.

13

Employees and Human Capital

We pride ourselves on the quality of our world-class team and seek to hire only employees dedicated to our strategic mission. Many of our employees have significant experience working with large battery manufacturers and automotive OEMS. As of December 31, 2020,2022, we employed 276 full-time employees and 10 temporaryapproximately 850 employees, based primarily in our headquarters in San Jose, California. Over 250Many of our employees are engaged in our research and development and related functions and more than half of these employees hold engineering and scientific degrees, including many from the world’s top universities.

Diversity, Equity and Inclusion

We seek team members who want to help solve a significant problem that will positively impact the world. We value diversity and recognize the importance of fostering a positive, inclusive culture. As such, we have actively taken steps towards eliminating unconscious bias in our hiring and promotion processes while enabling us to add and promote team members who demonstrate behaviors aligned with our values.values, including but not limited to delivering unconscious bias training to senior leaders, redesigning and enhancing hiring processes and establishing new college relationships to increase the diversity of our candidate pool.

Attraction and Retention

We are committed to maintaining equitable compensation programs including equity participation. We offer market-competitive salaries and strong equity compensation aimed at attracting and retaining team members capable of making exceptional contributions to our success. Our full-time regular employees hold equity in our company and are generally eligible for the employee stock purchase plan. Our compensation decisions are guided by the external market, role criticality, and the contributions of each team member. Our new job leveling framework and associated pay ranges allow us to maintain pay equity while offering the attractive and effective compensation needed as we grow and compete for talent.

Health and Safety

The health and safety of our employees is mission critical. We place heavy emphasis on a proactive safety culture and maintain a supportive organization that encourages personal health for our employees. Our Environmental, Health and Safety (EHS) department leads the programs that address workplace health and safety concerns through engineering controls, policies, procedures, training, monitoring and audits.

To date, we have not experienced any work stoppages and considers itswe consider our relationship with itsour employees to be good. None of our employees are either represented by a labor union or are subject to a collective bargaining agreement.

14Available Information

16

Our investor relations website is located at https://ir.quantumscape.com, our Twitter account is @QuantumScapeCo, our investor relations Twitter account is @QuantumScapeIR, our Chief Executive Officer’s Twitter account is @startupjag, our Chief Technology Officer’s Twitter account @ironmantimholme, our Chief Marketing Officer’s Twitter account is @HussainAsim, and our corporate LinkedIn account is located at https://www.linkedin.com/company/quantumscape/posts/. We use our investor relations website, aforementioned Twitter accounts and LinkedIn account to post important information for investors, including news releases, analyst presentations, and supplemental financial information, and as a means of disclosing material non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor our investor relations website, aforementioned Twitter accounts, and LinkedIn account in addition to following press releases, filings with the Securities and Exchange Commission (the “SEC”) and public conference calls and webcasts. We also make available, free of charge, on our investor relations website under “SEC Filings,” our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to these reports as soon as reasonably practicable after electronically filing or furnishing those reports to the SEC.

17

Item 1A. Risk Factors.

The following summary risk factors and other information included in this Report should be carefully considered. The summary risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not currently known to us or that we currently deem less significant may also affect our business operations or financial results. If any of the following risks actually occur,materializes, our stock price, business, operating results and financial condition could be materially adversely affected. For more information, see below for more detailed descriptions of each risk factor.