Page | ||

2 | ||

| ||

PART I | ||

Item 1. |

| |

Item 1A. | 17 | |

Item 1B. |

| |

Item |

| |

Item |

| |

Item |

| |

Item 4. | 46 | |

| ||

PART II | ||

Item 5. |

| |

Item 6. |

| |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

Item 7A. |

| |

Item 8. |

| |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

Item 9A. |

| |

Item 9B. |

| |

Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | 93 |

| ||

PART III | ||

Item 10. |

| |

Item 11. |

| |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

Item 13. | Certain Relationships and Related Transactions, and Director Independence |

|

Item 14. |

| |

PART IV | ||

Item 15. |

| |

Item 16 |

|

i

SPECIAL NOTE REGARDING FORWARD-LOOKINGFORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (the “Annual Report”) contains “forward-looking statements” (within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended) about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this Annual Report, including statements regarding our future results of operations or financial condition, business strategy and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will” or “would” or the negative of these words or other similar terms or expressions. These forward-looking statements include, but are not limited to, statements concerning the following:

the effects of the current COVID-19 pandemic, or of other global outbreaks of pandemics or contagious diseases or fear of such outbreaks, including on our supply chain, the demand for our products, and on overall economic conditions and consumer confidence and spending levels;

our expectations regarding our revenue, expenses and other operating results;

our ability to acquire new customers and successfully retain existing customers;

our ability to attract and retain our suppliers, distributors and co-manufacturers;

our ability to maintain relationships with our existing farm networks or further expand such networks;

our expectations regarding our future growth in the foodservice channel, including commercial and non-commercial foodservice business;

real or perceived quality or food safety issues with our products or other issues that adversely affect our brand and reputation;

changes in the tastes and preferences of our consumers;

the financial condition of, and our relationships with, our farmers, suppliers, co-manufacturers, distributors, retailers and foodservice customers, as well as the health of the foodservice industry generally;

realthe effects of outbreaks of agricultural diseases, such as avian influenza, or perceived qualitythe perception that outbreaks may occur or health issues with our productsregulatory or other issues that adversely affect our brand and reputation;

the ability of our farmers, suppliers and co-manufacturers to comply with food safety, environmental or other laws or regulations;

the effects of a public health pandemic or contagious disease, or fear of such outbreaks, on our supply chain, the demand for our products, and overall economic conditions, consumer confidence and spending levels;

anticipated changes in our product offerings and our ability to innovate to offer new products;

our reliance on key personnel and our ability to identify, recruit and retain skilled personnel;

our ability to effectively manage our growth;

the potential influence of our focus on a specific public benefit purpose and producing a positive effect for society may negatively influence our financial performance;

our environmental, sustainability and governance goals, opportunities and initiatives, as well as the standards and expectations of third parties regarding these matters;

the impact of adverse economic conditions;

2

seasonality; and

the growth rates of the markets in which we compete.

You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Annual Report primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition and operating results. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors described in the section titled “Risk Factors” in Part I, Item 1A of this Annual Report and elsewhere in this Annual Report. A summary of selected risks associated with our business areis set forth below.at the beginning of Part I, Item 1A of this Annual Report. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Annual Report. The results, events and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements.

2

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this Annual Report. And while we believe that information provides a reasonable basis for these statements, that information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements.

The forward-looking statements made in this Annual Report relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Annual Report to reflect events or circumstances after the date of this Annual Report or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments.

3

Our business faces significant risks and uncertainties. If any of the following risks are realized, our business, financial condition and results of operations could be materially and adversely affected. You should carefully review and consider the full discussion of our risk factors in the section titled “Risk Factors” in Part I Item 1A of this Annual Report. Some of the more significant risks include the following:

Our recent, rapid growth may not be indicative of our future growth, and if we continue to grow rapidly, we may not be able to effectively manage our growth or evaluate our future prospects. If we fail to effectively manage our future growth or evaluate our future prospects, our business could be adversely affected.

We have incurred net losses in the past and we may not be able to maintain or increase our profitability in the future.

Failure to introduce new products may adversely affect our ability to continue to grow.

We are dependent on the market for shell eggs.

Sales of pasture-raised shell eggs contribute the vast majority of our revenue, and a reduction in these sales would have an adverse effect on our financial condition.

Fluctuations in commodity prices and in the availability of feed grains could negatively impact our results of operations and financial condition.

If we fail to effectively expand our processing, manufacturing and production capacity as we continue to grow and scale our business, our business and operating results and our brand reputation could be harmed.

All of our pasture-raised shell eggs are processed at Egg Central Station in Springfield, Missouri. Any damage or disruption at this facility may harm our business.

We are currently expanding Egg Central Station, and we may not successfully complete construction of or commence operations in this expansion, or the expanded facility may not operate in accordance with our expectations.

If we fail to effectively maintain or expand our network of small family farms, our business, operating results and brand reputation could be harmed.

Our future business, results of operations and financial condition may be adversely affected by reduced or limited availability of pasture-raised eggs and milk and other raw materials that meet our standards.

We currently have a limited number of co-manufacturers. Loss of one or more of our co-manufacturers or our failure to timely identify and establish relationships with new co-manufacturers could harm our business and impede our growth.

We could be adversely affected by a change in consumer preferences, perception and spending habits in the natural food industry and on animal-based products, in particular, and failure to develop or enrich our product offering or gain market acceptance of our new products could have a negative effect on our business.

A limited number of distributors represent the substantial majority of our sales, and the loss of one or more distributor relationships that cannot be replaced in a timely manner may adversely affect our results of operations.

We are dependent on hatcheries and pullet farms to supply our network of family farms with laying hens. Any disruption in that supply chain could materially and adversely affect our business, financial condition or results of operations.

We source substantially all of our shell egg cartons from a sole source supplier and any disruptions may impact our ability to sell our eggs.

Because we rely on a limited number of third-party vendors to manufacture and store our products, we may not be able to maintain manufacturing and storage capacity at the times and with the capacities necessary to produce and store our products or meet the demand for our products.

Our brand and reputation may be diminished due to real or perceived quality or food safety issues with our products, which could have an adverse effect on our business, reputation, operating results and financial condition.

Demand for shell eggs is subject to seasonal fluctuations and can adversely impact our results of operations in certain quarters.

The continuing COVID-19 pandemic could have a material adverse impact on our business, results of operations and financial condition.

Food safety and food-borne illness incidents or advertising or product mislabeling may materially and adversely affect our business by exposing us to lawsuits, product recalls or regulatory enforcement actions, increasing our operating costs and reducing demand for our product offerings.

Our operations are subject to FDA and USDA federal regulation, and there is no assurance that we will be in compliance with all regulations.

As a public benefit corporation, our duty to balance a variety of interests may result in actions that do not maximize stockholder value.

4

Our Company: Bringing Ethically ProducedEthical Food to the Table

Vital Farms is an ethicalethically minded food company that is disrupting the U.S. food system. We have developed a framework that challenges the norms of the incumbentfactory food model and allows us to bring high-quality products from our network of small family farms to a national audience. This framework has enabled us to become the leading U.S. brand of pasture-raised eggs and butter and the second largestsecond-largest U.S. egg brand by retail dollar sales. Our ethics are exemplified by our focus on the humane treatment of farm animalsanimal welfare and sustainable farming practices, including regenerative agricultural practices. We believe theseour standards produce happy hens with varied diets, which produce better eggs. There is a seismic shift inAs an ethical food company, we're helping meet consumer demand for ethically produced, natural, traceable, clean-label, great-tasting and nutritious foods. Supported by a steadfast adherence to the values on which we were founded, we have designed our brand and products to appeal to this consumer movement.food.

Our purpose is rooted in a commitment to Conscious Capitalism, which prioritizes theand our belief in co-creating positive, long-term benefits of eachoutcomes with all of our stakeholders (farmers– farmers and suppliers, customers and consumers, communities and the environment, employees, who we refer to as crew members, and stockholders). Our business decisions consider the impact on all of our stakeholders, in contrast with the factory farming model, which principally emphasizes cost reduction at the expense of animals, farmers, consumers, crew members, communities and the environment. These principles guide our day-to-day operations and, we believe, help us deliver a more sustainable and successful business.stockholders. Our approach has been validated by our financial performance and our designation asimpact on the food industry. We are also a Certified B Corporation, a certificationdesignation reserved for businesses that balance profit and purpose to meet the highest verified standards of social and environmental performance, public transparency and legal accountability.

Our Ethical Decision-Making Model

Stakeholders | Guiding Principles |

|

|

Farmers and Suppliers |

Forming strong relationships with our network of more than |

Customers and Consumers |

Delivering the transparency and quality around food products that |

Crew Members | |

|

|

Community and Environment |

Investing in |

Stockholders | |

|

|

4

We have scaled our brand through our strong relationships with small family farms and deliberate efforts to design and build the infrastructure to bring our products to a national audience. Today, with a network of more than 200300 family farms, we believe our pasture-raised productswe have set the national standard for ethically produced food.pasture-raised eggs. We believe the success of our relationships with small family farms and the efficiency of our supply chain provide us with a competitive advantage in the approximately $45 billion U.S. natural food and beverageconsumer packaged goods industry, in which achieving reliable supply at a national scale can be challenging. In 2017, we opened Egg Central Station, a shell egg processing facility in Springfield, Missouri, which is centrally located within our network of family farms. In April 2022, we completed an expansion of Egg Central Station that nearly doubled its square footage and capacity. Egg Central Station is capable of packing threesix million eggs per day and has achieved Safe Quality Food, or SQF, Excellent rating, the highest level of such certification recognized by the Global Food Safety Initiative, or GFSI. In addition, Egg Central Station is the only egg facility, and we are one of only six companies globally to havehas received the Safe Quality Food Institute, or SQFI, Select Site certification, indicating that the site has voluntarily elected to undergo annual unannounced recertification audits by SQFI, the organization responsible for administering a global food safety and quality program known as the SQF Program. The design of Egg Central Station includes investments inthat support of each of our stakeholders, from our crew members (daylighting, climate control and slip resistant floors in the egg grading room), to the community and environment (consulting with the community before we built the facility, restoring native vegetation on the property, best-in-class storm water management)retention and stormwater management measures and the use of solar panels), to our customers and consumers (food safety and maintenance investments far beyond regulatory requirements). In November 2019, we began construction onOur efforts to build a sustainable, stakeholder-focused facility expansion that will nearly double our current square footage. This expansion will enable us to double our capacity to meet growing demand. We expectwere recognized by the expansion to be operational in early 2022.industry publication Food Processing, which named Egg Central Station as its 2022 “Green Plant of the Year.” We believe owning and operating this important element of our supply chain is a key differentiator and provides us with a competitive advantage, which we intend to continue to leverage to grow both our net revenue and gross margin. We are currently in the process of exploring potential sites for an additional egg packing facility.

5

Our loyal and growing consumer base has fueled the expansion of our brand from the natural channel to the mainstream channel and has facilitated our entry intogrowth within the foodservice channel. As of December 2020,2023, we offeroffered 23 retail stock keeping units, or SKUs, through a multi-channel retail distribution network across more than 16,000approximately 24,000 stores. Our products generate stronger velocities and, we believe, greater profitability per unit for our retail customers in key traffic-generating categories as compared to products offered by our competitors. We believe we have significant room for growth within the retail and in the medium- to long-term, foodservice channels, and we believe that we can capture this opportunity by growing brand awareness and through new product innovation. We also believe there are incremental growth opportunities in additional distribution channels, including the convenience, drugstore, club, military and international markets, which we may access along with retail and foodservice growth opportunities to enable us to continue our net revenue growth.

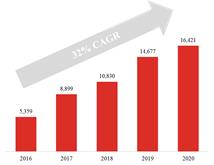

We have built a sustainable company founded on ethically produced products that increasingly resonate with consumers. Our trusted brand and Conscious Capitalism-focused business model have resulted in significant growth. We have increased net revenue from $1.9$140.8 million in fiscal 20102019 to $214.5$471.9 million in fiscal 2020,2023, which represents a 60%35.3% compounded annual growth rate, or CAGR. From fiscal 2018 to fiscal 2020, we grew net revenue by 101% and the number of stores carrying our products increased by 52%. Going forward, we believe thethat consumer movement away from factory farming practices will continue to fuel demand for ethically produced food. We believe these demands extend toour products, and in September 2023, we announced updated long-term financial targets reflecting our continued confidence in the food industry and that consumers are recognizing the benefitspotential of pasture-raised egg and dairy products. Managementour business. Our management team is committed to ensuring our values remain aligned with those of our consumers while delivering stockholder value.

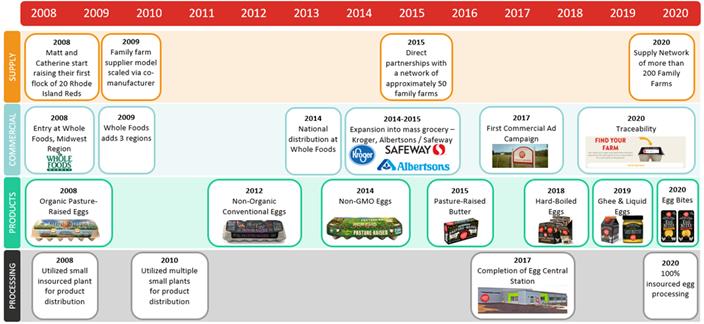

Evidence of our historical success in continuing to scale our business is shown in the graphics below. All dates refer to the year ended December 31, except for 2018, 2019 and 2020, whichDates refer to the fiscal yearyears ended December 30, 2019, December 2927, 2020, December 26, 2021, December 25, 2022, and December 27,31, 2023, respectively.

Number of Stores |

| Net Revenue | Gross Profit | |

(thousands) |

| $MM | $MM | |

|

|

|

|

Our History

Vital Farms was founded in 2007 on a 27-acre plot of land in Austin, Texas. Armed with a small flock of hens, the company maintained a strong belief that a varied diet and better animal welfare practices would lead to superior eggs. Our first sales came from farmers markets and restaurants around Austin and, less than a year later, our eggs were discovered by Whole Foods Market, Inc., or Whole Foods. The opportunity was identifiedFrom the beginning, we sought to do something more thannot simply sell eggs to a few stores. The opportunity wasstores, but to build a sustainable company that aligned with the family farming community and was able to profitably deliver quality products to a devoted consumer base. As our business has continued to grow, our model remains rooted in trust and mutual accountability with our farmers, who are and will remain core to our business.

5

In 2014, our current presidentPresident and chief executive officer,Chief Executive Officer Russell Diez-Canseco joined Vital Farms and led the development of our large and scalable network of family farms. In 2015, recognizing the opportunity to elevate our production process and bolster long-term growth and profitability, we began the design process for Egg Central Station, which opened in 2017 in Springfield, Missouri. We meticulously designed Egg Central Station in service of all of our stakeholders by improving on the best practices we observed across numerous world-class facilities. Today, Egg Central Station is capable of packing threesix million eggs per day and has achieved an SQF Excellent rating, the highest level of such certification recognized byfrom the GFSI. In addition, Egg Central Station is the only egg facility, and we are one of only six companies globally to have received the SQFI Select Site certification.

Demand for our high-quality products has enabled us to expand our brand beyond the natural channel and into the mainstream channel through relationships with Albertsons Companies, Inc., or Albertsons, The Kroger Co., or Kroger, Publix Super Markets, Inc., or Publix, Target Corporation, or Target, Walmart Inc., or Walmart, and numerous other national and regional food retailers. As of December 2020,2023, our ethically produced pasture-raised products arewere sold in more than 16,000approximately 24,000 stores nationwide. Over the course of our journey, our founder, Matthew O’Hayer, has continued to inform our strategic vision and remains intimately involved with theour business as the Executive Chairperson of our executive chairman.Board of Directors.

6

Our purpose is to improve the lives of people, animals and the planet through food. Our mission is to bring ethically producedethical food to the table. We do thiscarry out our purpose and mission by partnering with family farms that operate within our strictly defined set of ethical food productionfarming practices. We are motivated by the influence we have on rural communities through creating impactful, long-term business opportunities for small family farmers. Moreover, we are driven to stand up for sustainable production practices that have been largely cast aside under the factory farming system. In our view, thisthe factory farming system has been consistently misguided, focused on producing products at lowest cost rather than driving long-term and sustainable benefits for all stakeholders.

Since inception, our values have been rooted in the principles of Conscious Capitalism. We believe managing our business in the best interest of all of our stakeholders will result in a more successful and sustainable enterprise. A key premise of our business model is our consumer-centric approach, which focuses on identifying consumer needs and developing products that address these needs. While remaining committed to ethical decision-making, we have achieved strong financial performance and earned the Certified B Corporation designation, reflecting our role as a contributor to the global cultural shift toward redefining success in business in order to build a more inclusive and sustainable economy. We believe our consumers connect with Vital Farms because they love our products, relate to our values and trust our practices.

Industry Overview

We operate in the large and growing U.S. natural food and beverage industry. Consumer awareness of the negative health, environmental and agricultural impacts of processed food and factory farming standards has resulted in increased consumer demand for ethically produced food. We believe this trend has had a meaningful impact on the growth of the natural food industry, which is increasingly penetrating the broader U.S. food market as mainstream retailers respond to consumer demand. We believe increased demand for natural food and a willingness to pay a premium for brands focused on transparency, sustainability and ethical values will continue to be a catalyst for our growth.

According to SPINS, LLC, or SPINS, data, the U.S. shell egg market accounted for approximately $6.5$9.0 billion in retail sales for the 52 weeks ended December 27, 2020in 2023 and grew at a CAGR of 3%10.3% between 2018December 2020 and December 2020.2023. Our relatively low household penetration of 3.9%7.5%, compared to the shell egg category penetration of approximately 98%96.5%, provides a significant long-term growth opportunity for our business. According to SPINS data, the U.S. pasture-raised retail egg market accounted for approximately $256.0$531.0 million in retail sales for the 52 weeks ended December 27, 2020in 2023 and grew at a CAGR of 35%26.6% between 2018December 2020 and December 2020,2023, while the specialty egg (including pasture-raised, free-range and cage-free) market accounted for approximately $1.3$1.8 billion in retail sales for the 52 weeks ended December 27, 2020in 2023 and grew at a CAGR of 14%11.2% between 2018December 2020 and December 2020. Additionally, we estimate that the U.S. processed egg market as of December 2020 accounted for approximately $3.3 billion in retail sales.2023. According to SPINS data, the U.S. butter market accounted for approximately $4.0$4.8 billion in retail sales for the 52 weeks ended December 27, 2020in 2023 and grew at a CAGR of 10%5.3% between 2018December 2020 and December 2020.2023. We believe the strength of our platform, coupled with significant investments in our crew members and infrastructure, position us to continue to deliver industry-leading growth across new and existing categories.

Our Strengths

Trusted Brand Aligned with Consumer Demands

We believe consumers have grown to trust our brand because of our adherence to our values and a high level of transparency. We have positioned our brand to capitalize on growing consumer interest in natural, clean-label, traceable, ethical, great-tasting and nutritious foods. Growing public awareness of major issues connected to animal farming, including human health, climate change and resource conservation, is closely aligned with our ethical mission. We believe consumers are increasingly focused on the source of their food and are willing to pay a premium for brands that deliver transparency, sustainability and integrity. As a company focused on driving the success of our stakeholders, our brand resonates with consumers who seek to align themselves with companies that share their values. Through our Vital Times newsletter, andutilization of social media presence,outlets and our high-touch consumer engagement marketing campaigns, we cultivate and support our relationship with consumers by communicating our values, building trust and promoting brand loyalty.

6

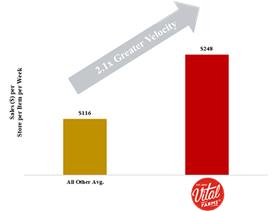

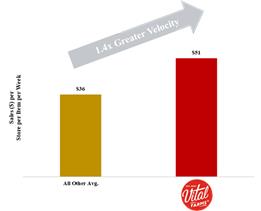

Strategic and Valuable Brand for Retailers

Our historical performance has demonstrated that we are a strategic and valuable partner to retailers. We have innovated and grown into adjacent food categories while reachingreached a broad set of consumers through a variety of retail partners, including Albertsons, Kroger, Publix, Target and Walmart. As of December 2020,2023, we arewere the number one or two egg brand by retail dollar sales for branded eggs with key customers such as Albertsons, Kroger, Sprouts Farmers Market, or Sprouts, Target and Whole Foods. We believe the success of our brand demonstrates that consumers are demanding premium products that meet a higher ethical standard. We have expanded into the mainstream channel while still continuing to command premium prices for our ethically produced products, which sell for as much as three times the price of commodity eggs.products. We believe that our products are more attractive to retail customers because they help generate growth, deliver strong gross profits and drive strong velocities, as represented by the natural channel velocities depicted below.velocities.

7

Vital Farms Natural Channel Velocity versus All Other Competitors (1)

|

|

|

|

Source: Refrigerated Eggs & Refrigerated Butter - SPINS, LLC, Natural Channel, 52 Weeks Ending December 27, 2020

|

|

|

|

|

|

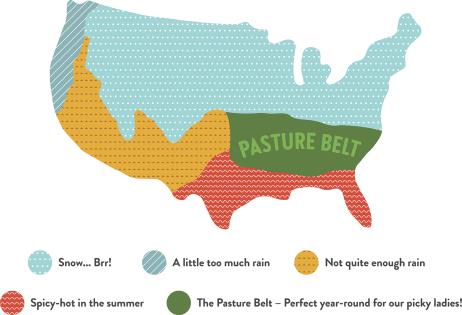

Supply Chain Rooted in Commitment to Our Stakeholders

Our ongoing commitment to the social and economic interests of our stakeholders guides our supply chain decisions. We carefully select and partnercollaborate with family farms in the Pasture Belt, the U.S. region where pasture-raised eggs can be produced year-round.the weather is conducive to hens being outside as much as possible. We establish supply contracts that we believe are attractive for all parties, demonstrate our commitment to our network of small family farms through educational programs that transfer critical best practice knowledge and pay farmers competitive prices for high-quality pasture-raised eggs. During fiscal year 2020, we experienced no voluntary attrition for supply contract renewals. We believe our commitment to farmers facilitates more sustainable farm operations and significantly reduces turnover. Our network of small family farms gives us a strategic advantage through a scaled and sustainable supply chain and allows us to go to market with the highest quality pasture-raised premium products.

Map of the Pasture Belt

8

Experienced and Passionate Team

We have an experienced and passionate executive management team that we refer to as the “C-crew,” which has approximately 60over 100 years of combined industry experience and includes our presidentPresident and chief executive officer,Chief Executive Officer Russell Diez-Canseco, a seasoned food industry expert with over 1619 years of relevant experience, including at H-E-B, a privately held supermarket chain. Our C-crewleadership team works in partnership with Matthew O’Hayer, our founder and executive chairman,the Executive Chairperson of our Board of Directors, who continues to inform our strategic vision with the entrepreneurial perspective gained through over 40 years of building businesses. We also have a deep bench of talent with strong business and operational experience, and crew members at all levels of our organization who are passionate about addressing the needs of our stakeholders. We have leveraged the experience and passion of our C-crew,leadership team, our founder and executive chairman,Executive Chairperson, and our other crew members to grow net revenue over 234%at a CAGR of 35.3% since the beginning of 2016,2019, enter our second major food category, butter, and build and expand our first shell egg processing facility, Egg Central Station.

7

Our Growth Strategies

We believe our investments in our brand, our stakeholders and our infrastructure position us to continue delivering industry-leading growth that outpaces both the natural food industry and the overall food industry.

Compete to Win in Our Current Categories

We continue to compete at the top of our current categories, which helps fuel our continued, profitable growth and we believe there is significant opportunity to further grow volume with existing retail customers by building consumer awareness and demand for our brand. Our products generate stronger velocities and, we believe, greater profitability per unit for our retail customers in the categories in which we compete. By capturing greater shelf space, driving higher product velocities and increasing our average SKU count per retail partner, we believe there is meaningful runway for further growth with existing retail customers. Beyond our existing retail footprint, we believe there are significant opportunities to gain incremental stores from existing retail customers and to add new retail customers. Additionally, we believe there is significant demand for our products in the foodservice channel since we offer versatile ingredients with high menu penetrations across commercial and non-commercial operator segments. We also believe there are significant further long-term opportunities in additional distribution channels, including the convenience, drugstore and club channels. We see considerable opportunity for medium- to long-term growth in this channel by increasing our category market share through sales to values-aligned foodservice operators and their distributors.

Expand Household Penetration through Greater Consumer AwarenessOur Portfolio

We plan to continue seeking out opportunities to expand our product offerings. We believe making strategic bets on larger-scale opportunities will help reinforce our position as an ethical food company. The successes of our core products have confirmed our belief that there is significant demand for ethically produced food products, and our proprietary consumer surveys confirm our belief that there is significant demand for our brand across a wide spectrum of food categories. We are committed to continuing to introduce consumers to our expanding range of product offerings.

Strengthen the Brand

We will compete in the marketplace by continuing to build long-term trusted relationships with our target consumer. Critical to the success of ourthis mission is our ability to share the Vital Farmsour story with a broader audience. ByWe intend to increase our household penetration by educating consumers about our brand, our values and the premium quality of our products, we intend to increase our household penetration.products. Our relatively low household penetration of 3.9%7.5% for our pasture-raised shell eggs, compared to the shell egg category penetration of approximately 98%96.5%, showsdemonstrates that expanding the national presence of our brand offers a significant runway for future growth.

We believe we are well positioned to further increase household penetration of our products given their alignment with consumer trends and approachability with consumers. We intend to increase the number of consumers who buy our products by using digitally integrated media campaigns, social media tools, earned awareness drivers like press outreach and other owned media channels. We believe these efforts will educate consumers on our ethical values and the attractive attributes of our pasture-raised products, generate further demand for our products and ultimately expand our consumer base.

Grow WithinScale a World-Class Organization

We have always believed that our most important competitive advantage is great people, operating as one high-performing team in a strong culture, with the Retail Channel

By leveraging greater consumer awarenessright tools to help us reach our potential, both individually and demand forcollectively. Our strategic and people functions are led by a single leader in order to unify our brand,organization in attracting talent that supports our growth initiatives and our culture. This effort is critical not only to our current success but the direction of our company in the future. As we continue our focus on scaling a world-class organization, we believe this tighter link between where we are going, the processes we will put in place to get there, is significant opportunity to grow volume with existing retail customers. Ourand, most importantly, how we engage, inspire, and develop our crew members will fuel our continued growth.

8

Product Overview

We produce products generate stronger velocities and, we believe, greater profitability per unit for our retail customers in the categories in which we compete. By capturing greater shelf space, driving higher product velocities and increasing our SKU count, we believe there is meaningful runway for further growth with existing retail customers. Beyond our existing retail footprint, we believe there is significant opportunity to gain incremental storessourced from existing retail customers as well as to add new retail customers. We also believe there are significant further long-term opportunities in additional distribution channels,animals raised on family farms, including the convenience, drugstore, club, military and international markets.

Expand Footprint across Foodservice

We believe there is significant demand for our products in the foodservice channel. We see significant opportunity for medium- to long-term growth in this channel through sales to foodservice operators supported by joint marketing and advertising. Our brand has a differentiated value proposition with consumers, and we believe consumers are increasingly demanding ethically produced ingredients when they eat outside of the home. We are also working with Acosta Foodservice, a foodservice sales and marketing agency in the consumer-packaged goods industry, to increase our broadline distribution and presence in national and regional restaurant chains. We believe that more consumers will look for our products on menus, particularly with foodservice partners whose values are aligned with our own, and that on-menu branding of our products as ingredients in popular meals and menu items will drive traffic and purchases in the foodservice channel. An example of our recent foodservice growth initiative is our relationship with Tacodeli, which sells breakfast tacos made exclusively with our pasture-raised shell eggs, across 11 restaurant locations and approximately 90 points of distribution, such as coffee shops and farmers’ market stands, across Texas. We have launched similar regional concepts with Moe’s Broadway Bagel, an East Coast-style family-run bagel chain in the Denver/Boulder, Colorado area; Cafe Patachou, a breakfast and lunch restaurant based in the Indianapolis, Indiana area with 5 locations; Roam Artisan Burgers, a fast-casual burger restaurant dedicated to high-quality sourcing in the San Francisco, California area with 6 locations; Homegrown, a sustainability-focused brand in the Seattle, Washington area with 11 locations; and Pura Vida, a fresh all-day concept in the Miami, Florida area with 7 locations . We believe branded foodservice offerings will further drive consumer awareness of our brand and purchase rates of our products in the retail channel.

9

Extend Our Product Offering through Innovation

The successes of our core products have confirmed our belief that there is significant demand for pasture-raised and ethically produced food products. We expect to continue to extend our product offerings through innovation in both new and existing categories, including with our launch of pasture-raised egg bites in August 2020. In 2018, we launched the only pasture-raisedbutter, hard-boiled eggs in the U.S. market, and in 2019, we launched both ghee and liquid whole eggs, the latter of which are the only pasture-raised liquid whole eggs in the U.S. market. The success of our product portfolio and our proprietary consumer surveys confirm our belief that there is significant demand for our brand across a wide spectrum of food categories. Within this broader market, we believe the U.S. refrigerated value-added dairy category represents a total addressable market of $34.5 billion and is the closest adjacency and best near-term opportunity for our brand. We have several products in our innovation pipeline that we believe will be successful in these adjacent markets.eggs.

10

Motivated by our mission, our success and our customers’ feedback, we continue to innovate and expand our product offerings to address growing consumer demand.

9

Innovation

Innovation

The successes of our core products have confirmed our belief that there is significant demand for pasture-raised and ethically produced food products. We expect to continue to extendexpand our product offerings through innovation in both existing and new categories, including with our launch of pasture-raised egg bites in August 2020.categories. We have a dedicated product development team that leverageswill continue to leverage comprehensive consumer insights and trend data to provide innovative solutions and ideas that meet new consumer needs and usage occasions. We also have a proven innovation model that utilizes a trusted network of partners to bring products to market without requiring significant upfront investment. We are committed to building on the success of our recent product launches and continuing to introduce consumers to our expanding range of ethically produced food products.product offerings.

|

Marketing

Note: Store count figures as of December 27, 2020.

11

Our multi-faceted,multifaceted, consumer-centric marketing strategy has been instrumental in building our brand and driving net revenue. Our marketing strategy is aimed at solidifying our brand’s positioningposition as a leading provider of ethically produced food. We execute on this strategy by advertising through digitally integrated media campaigns, social media toolstools. earned awareness drivers like press outreach and other owned media channels. Our brand’s standout packaging has been a signature communication vehicle since our inception. We maintain a presence across all major social media platforms.

Our brand has grown rapidly into the #1 U.S. pasture-raised, #1 U.S. natural channel and #2 U.S. overall egg brand by retail dollar sales, with an 82%over 85% share of the U.S. pasture-raised retail egg marketsegment for the 52-week53-week period ended December 27, 2020.31, 2023. Our brand awareness is represented by a strong social media following, with approximately 91,000140,000 Instagram followers. Building on prior success, we will continue to invest in the brand through digitally integrated national media campaigns and build customer loyalty through other media formats, including our quirky Vital Times newsletter, now in its tenthtwelfth year of print, which is placed in each egg carton. During the past two years, weWe have circulated over 78more than 150 million copies of our Vital Times newsletter. newsletter since 2021.

Building upon a landscape of shifting consumer preferences, we are focused on reaching new consumers to educate them about our ethically focused value proposition. We work continuously to understand our consumers and leverage those insights to develop impactful communication plans and messaging. We remain focused on deploying our sophisticated marketing capabilities and world-class sales team to ensure that both customers and consumers understand the Vital Farms story.

Our Customers

We market our products throughout the United States, with the majority of our net revenue coming from our pasture-raisedshell egg products. As of December 2020,2023, we currently distribute through third parties and direct to retailers to reach more than 16,000approximately 24,000 stores. With significant expansion in recent years, our retail sales are evenly distributed between the natural channel and mainstream channel. Because of our brand equity, loyal consumer base and expanding line of high-quality products, we believe there are attractive growth opportunities across these channels, in addition to a sizable opportunity in the foodservice channel in the medium- to long-term.channel. We believe there are also incremental growth opportunities in additional distribution channels, including the convenience, drugstore, club, military and international markets, which we may access along with retail growth opportunities to enable us to continue our net revenue growth.

Natural Channel

Natural channel retailers, including Whole Foods and Sprouts, represented approximately 52%42%, 51%39% and 47%39% of our retail dollar sales in fiscal years 2018, 20192021, 2022 and 2020,2023, respectively.

Mainstream Channel

Widespread consumer demand for high-quality and traceable foods has driven our expansion into the mainstream channel with national retailers, including Albertsons, Kroger, Publix, Target and Walmart. We began selling eggs in select Kroger divisions in 2014. Since that time, Kroger has grown to become our second largest customer, offering our products in over 2,100 stores. We also continue to expand our relationships with Albertsons, Publix, Target and Walmart. The mainstream channel represented approximately 48%58%, 49%61% and 53%61% of our retail dollar sales in fiscal years 2018, 20192021, 2022 and 2020,2023, respectively.

Foodservice Channel

In addition to our primary natural and mainstream channels, we have a presence insell shell and value-added eggs into the foodservice through the sale of shell eggs to select accounts.channel, which includes commercial and non-commercial foodservice operators. We expect our foodservice business to continue to grow in the medium- to long-term through expansive newour two-pronged sales approach. We anticipate growing our foodservice distribution penetration through our relationships, for example, with Dot Foods, the largest redistribution company in the country, and broad-line distributors, as well as direct accounts. including Sysco, US Foods, Performance Food Group, Gordon Food Service and Ben E. Keith. By deepening our distribution penetration, we are becoming more accessible to foodservice operators across the country. We anticipate more growth with values-aligned regional and national restaurants that want to innovate their menus with our quality, ethically produced eggs.

10

In fiscal years 2018, 20192021, 2022 and 2020,2023, the foodservice channel accounted for approximately 2%1%, 2%3% and 1%6%, respectively, of our net revenue.

Our established foodservice relationships help to extend our marketing efforts through unique co-branding opportunities.opportunities, which amplify our consumer awareness and allow us to reach new households. We plan towill continue to capitalize on these opportunitiesco-marketing tactics as we work to introducebring new products through the foodservice channel.operators into our customer base.

OneA multi-unit example offrom our successful foodservice programsprogram is Tacodeli. InTrue Food Kitchen, an award-winning restaurant brand and a pioneer of wellness-driven dining with over 40 locations across the springcountry that shares our values for improving the lives of 2019, Tacodelipeople, animals and the planet. Our collaboration is a recipe for success to serve nourishing food that people know they can trust. At the start of 2023, True Food Kitchen committed to exclusively using Vital Farmsour pasture-raised eggs for its menu and calling out our brand in its marketing channels.

We have launched similar relationships with national foodservice operators, including Hopdoddy Burger Bar and Chicken N Pickles. Additionally, we have regional chain collaborations across the country. Several examples include:

12

Vital Farms and Tacodeli Co-Branding

Our products can also currently be found in micro-marketsover 70 retail partners in the Austin, Texas officesNew York City area;

11

Supply Chain

We have strategically designed our supply chain to ensure high-productionhigh production standards and optimal year-round operation. We are motivated by the positive impact we have on rural communities and enjoy a strong relationship and reputation with our network of more than 200 small300 family farms. In order to capitalize on this strong supply network, we built a state-of-the-art shell egg processing facility, Egg Central Station in Springfield, Missouri. Following its expansion in April 2022, Egg Central Station is approximately 82,000153,000 square feet and utilizes highly automated equipment to grade and package our shell egg products. The design of our facility includes investments in support of each of our stakeholders, from our crew members, (daylighting, climate control, slip resistant floors in the egg grading room), to the community and environment (consulting with the community before we built the facility, restoring native vegetation on the property, best-in-class storm water management),environment, to our customers and consumers (food safety and maintenance investments far beyond regulatory requirements). Today, Egg Central Station is capable of packing three million eggs per day and has achieved an SQF Excellent rating, the highest level of such certification recognized by GFSI. In addition, Egg Central Station is the only egg facility, and we are one of only six companies globally to have received the SQFI Select Site certification, indicating that the site has voluntarily elected to undergo annual unannounced recertification audits by SQFI, the organization responsible for administering a global food safety and quality program known as the SQF Program. To facilitate further growth, we have established a plan to double the capacity of Egg Central Station through a mirror-image expansion adjacent to the existing location. This expansion will enable us to double our capacity to meet growing demand. We began construction in November 2019 and expect the expansion to be operational in early 2022.consumers.

Our eggs are kept in on-farm coolers using equipment that meets our precise equipment specified by us.standards. The eggs are then collected on a regular basis by a third-party freight carrier and placed in cold storage until packing for shipment to customers. Each of our butter, ghee, hard-boiled eggs,egg and liquid whole egg products is produced by a co-manufacturer (with eggs from our network of family farms used for our hard-boiled egg and liquid whole egg bites products have a dedicated co-manufacturing partner.products). To support the growth of our business, we are focused on expanding existing co-manufacturing relationships where appropriate and establishing new co-manufacturing relationships.

Our egg packaging consists primarily of corrugated boxes and egg cartons, and we use a limited amount of recycled plastic packaging.cartons. Our corrugated boxes are sourced from a supplier in Springfield, Missouri, and our egg cartons are substantially sourced from a single-source supplier from Missouri, Canada and Europe from a sole-source supplier and our recycled plastic packaging is sourced from Mexico from a single-source supplier.Europe. Our other products are packaged in jars, bottles, film and cartons that are primarily managed by our co-manufacturing partners.co-manufacturers. In every case, we strive to find the most sustainable and environmentally considered packaging, shipping materials and inks.

Competition

We operate in a highly competitive environment across each of our product categories. We have numerous competitors of varying sizes, including producers of private-label products as well as producers of other branded egg and butter products that compete for trade merchandising support and consumer dollars. We compete with large egg companies such as Cal-Maine, Inc. and large international food companies such as Ornua Co-operative Limited (Kerrygold). We also compete directly with local and regional egg and dairy companies as well as private-label specialty egg products processed by other egg and dairy companies. In our market, competition is based on, among other things, product quality and taste, brand recognition and loyalty, product variety, product packaging and package design, shelf space, reputation, price, advertising, promotion and nutritional claims.

13

ShellAcross the industry, eggs may be sourced from hens that are caged, cage free, free rangecage-free, free-range or pasture raised.pasture-raised. Large egg companies offer commodity eggs sourced from caged hens, and in an attempt to address growing consumer demand for ethically produced and higher quality eggs, they have also grown their cage-free, free-range and free-rangepasture-raised offerings.

Although we operate in competitive industries, we believe that we have a strong and sustainable competitive advantage based on an ongoing process of values-driven decisions, our fundamental commitment to producing food ethically and humanely,minded food, the trust we have developed in our brand and our ability to provide reliable supply to our distribution partners and customers. We built and operate what we believe is one of the largest sourcing and distribution networks of family farms with strong growth potential. By focusing on the interests of each of our stakeholders, we believe we have created a model that attracts the best family farm partners, produces the highest quality productproducts and creates benefits for all parties. We believe our experience in building this network will provide significant scale and execution advantages as we continue to expand.

Government Regulation

We are subject to laws and regulations administered by various federal, state and local government agencies in the United States, such as the U.S. Department of Agriculture, or USDA; the Food and Drug Administration, or FDA; the Federal Trade Commission, or FTC; the Environmental Protection Agency, or EPA; and the Occupational Safety and Health Administration, or OSHA. These laws and regulations apply to the processing, packaging, distribution, sale, marketing, labeling, quality, safety, importation and transportation of our products, as well as our occupational safety and health practices.

Under various federal statutes and implementing regulations, these agencies, among other things, prescribe the requirements and establish the standards for quality and safety and regulate our products and the manufacturing, labeling, marketing, promotion and advertising thereof. With respect to eggs in particular, the FDA and the USDA split jurisdiction depending on the type of product involved. While the FDA has primary responsibility for the regulation of shell eggs, the USDA has primary responsibility for the regulation of dried, frozen or liquid eggs and other “egg products,” subject to certain exceptions. In addition, with respect to meat products, the USDA has primary jurisdiction for the regulation of products made wholly or in part from cattle, sheep, swine, or goats, such as certain of our egg bite products which contain bacon or ham, subject to certain exceptions.

12

Among other things, the facilities in which our products are manufactured or processed must register with the FDA and/or the USDA, comply with current good manufacturing practices, or cGMPs, and comply with a range of food safety and labeling requirements established by the Federal Food, Drug, and Cosmetic Act, as amended by the Food Safety Modernization Act of 2011, or FSMA, the Egg Products Inspection Act, the Federal Meat Inspection Act, the Organic Foods Production Act and the Agricultural Marketing Act of 1946, among other laws implemented by the FDA, the USDA and other regulators. The FDA and the USDA have the authority to inspect these facilities depending on the type of product involved;involved. For example, Egg Central Station, our facility in Springfield, Missouri, has been subject to periodic inspections by the USDA to evaluate compliance with certain applicable requirements, and the FDA may likewise inspect the facility. Additionally, we are subject to requirements under FSMA’s foreign supplier verification program and import tariffs, bond and other requirements by U.S. Customs and Border Protection for supply for our butter products, which we began importing from Ireland in late 2023. The FDA and the USDA also require that certain nutrition and product information appear on our product labels and, more generally, that our labels and labeling be truthful and non-misleading. Similarly, the FTC requires that our marketing and advertising be truthful, non-misleading and not deceptive to consumers. We are also restricted from making certain types of claims about our products, including nutrient content claims, health claims, organic claims and claims regarding the effects of our products on any structure or function of the body, whether express or implied, unless we satisfy certain regulatory requirements. We also participate in the USDA’s voluntary egg grading program, which requires compliance with additional labeling and facility requirements.

In addition, our suppliers are subject to numerous regulatory requirements. For example, the farmers who produce our shell eggs may be subject to requirements implemented by the FDA pertaining to pest control, salmonella enteritidis prevention and other requirements.

We are also subject to state and local food safety regulation, including registration and licensing requirements for our facilities, enforcement of standards for our products and facilities by state and local health agencies, and regulation of our trade practices in connection with selling our products.

We are also subject to labor and employment laws, laws governing advertising, privacy laws, safety regulations and other laws, including consumer protection regulations that regulate retailers or govern the promotion and sale of merchandise. Our operations, and those of our co-manufacturers, distributors and suppliers, are subject to various laws and regulations relating to environmental protection and worker health and safety matters.

Certified B Corporation

While not required by Delaware law or the terms of our certificate of incorporation, we have elected to have our social and environmental performance, accountability and transparency assessed against the proprietary criteria established by B Lab, an independent non-profit organization. As a result of this assessment, we were designated as a Certified B Corporation in December 2015.

In order to be designated as a Certified B Corporation, companies are required to take a comprehensive and objective assessment of their positive impact on society and the environment. The assessment evaluates how a company’s operations and business model impact its workers, customers, suppliers, community and the environment using a 200-point scale. While the assessment varies depending on a company’s size (number of employees), sector and location, representative indicators in the assessment include payment above a living wage, employee benefits, stakeholder engagement, supporting underserved suppliers and environmental benefits from a company’s products or services. After completing the assessment, B Lab will verify the company’s score to determine if it meets the 80-point minimum bar for certification. The review process includes a phone review, a random selection of indicators for verifying documentation and a random selection of company locations for onsite reviews, including employee interviews and facility tours. Once certified, every Certified B Corporation must make its assessment score transparent on B Lab’s website.

Designation and continued certification as a Certified B Corporation is at the sole discretion of B Lab. To maintain our certification, we are required to update our assessment and verify our updated score with B Lab every three years. We were most recently recertified in January 2022. Our Certified B Corporation designation remains in good standing.

Public Benefit Corporation Status

In connection with our Certified B Corporation status and as a demonstration of our long-term commitment to our mission to bring ethical food to the table, we elected in October 2017 to be treated as a public benefit corporation under Delaware law.

Under Delaware law, a public benefit corporation is required to identify in its certificate of incorporation the public benefit or benefits it will promote, and its directors have a duty to manage the affairs of the corporation in a manner that balances the pecuniary interests of the corporation’s stockholders, the best interests of those materially affected by the corporation’s conduct, and the specific public benefit or benefits identified in the certificate of incorporation. Public benefit corporations organized in Delaware are also required to assess their benefit performance internally and to disclose to stockholders at least biennially a report detailing their success in meeting their benefit objectives.

13

As provided in our amended and restated certificate of incorporation, the public benefits that we promote, and pursuant to which we manage our company, are: (i) bringing ethically produced food to the table; (ii) bringing joy to our customers through products and services; (iii) allowing crew members to thrive in an empowering, fun environment; (iv) fostering lasting partnerships with our farms and suppliers; (v) forging an enduring profitable business; and (vi) being stewards of our animals, land, air and water, and being supportive of our community.

Our Commitment to Impact

At Vital Farms, we are dedicated to creating long-term benefits through sustainable practices for our stockholders, crew members, farmers and suppliers, customers and consumers, communities and the environment. We promote sustainable practices and place an emphasis on being conscious environmental stewards. Our commitment to bringing ethical food to the table has helped us to integrate sustainable practices throughout our business. Our dedication to our stakeholders inspires us to continuously raise our standards and practices.

In 2023, we continued to make progress toward the short- and medium-term sustainability goals we first identified in December 2022. Such goals include reducing the ecological impact of our business, driving inclusion within our crew, fostering governance accountability and mitigating climate-related risks.

The Nominating and Corporate Governance Committee of our Board of Directors has been tasked with oversight of our strategy, initiatives, policies, practices and reporting relating to environmental sustainability, climate-related risks and opportunities, human capital management, social and ethical issues and our obligations as a Delaware public benefit corporation. This committee receives quarterly updates from our Head of Impact and reports out to the Board of Directors regarding its oversight responsibilities.

We are committed to building a people-first culture that embodies our values and understands the unique needs of our crew members. We will continue to hold ourselves accountable to the important role we play in helping transition the world around us to a more diverse, equitable and inclusive place through initiatives to foster crew learning, inclusion, and belonging that are grounded in our purposes to improve the lives of people, animals, and the planet through food. See the section titled “—Culture and Human Capital” below for further information about our commitment to a diverse crew and an inclusive work environment.

We acknowledge the potential threat that climate change may have on our business and are committed to taking action to mitigate our emissions and overall environmental risk. In 2021, we began to track and analyze our greenhouse gas emissions to understand and mitigate our carbon footprint, as well as water risks relative to our business and operations. We conduct an annual inventory of our greenhouse gas emissions and assessment of our climate-related risks, publishing disclosures under the Task Force on Climate-Related Financial Disclosure framework.

We believe in providing transparent disclosure regarding our commitment to impact and communicating our progress with stakeholders. We released our most recent Impact Report in March 2023 and plan to continue to provide regular updates as to our progress toward our sustainability goals. To learn more about these efforts and our relevant policies, please visit our investor relations website: investors.vitalfarms.com. Information contained on, or that can be accessed through, our website (including information in our Impact Report) is not incorporated by reference into this Annual Report or any of our other filings with the SEC. We welcome our stakeholders’ feedback and can be contacted at investors@vitalfarms.com.

Seasonality

Demand for shell eggs and butter fluctuates in response to seasonal factors. Demand tends to increase with the start of the school year, is highest prior to holiday periods, particularly Thanksgiving, Christmas and Easter, and is lowest during the summer months. As a result of these seasonal and quarterly fluctuations, comparisons of our sales and operating results between different quarters within a single fiscal year are not necessarily meaningful comparisons.

Trademarks and Other Intellectual Property

We own trademarks and other proprietary rights that are important to our business, including our principal trademark, Vital Farms. All our key trademarks are registered with the U.S. Patent and Trademark Office. Our trademarks are valuable assets that reinforce the distinctiveness of our brand to our consumers. We believe the protection of our trademarks, copyrights and domain names are important to our success. We aggressively protect our intellectual property rights by relying on trademark and copyright.

14

Culture and Human Capital

Our Conscious Commitment

We are committed to prioritizing long-term benefits to each of our stakeholders, including our talented and passionate crew members, our employees, who are invaluable to our business. Prioritizing Conscious Capitalism, our business decisions consider the impact on all our stakeholders, including our crew members, and we believe this helps us to create a more sustainable and successful business.

Vital Farms is committed to fostering an environment that values collaboration, trust, and respect. Furthermore, we endeavor to provide our crew members with the resources they need to be successful through culture-enhancing programs and professional development opportunities.

We believe in cultivating meaningful opportunities, from supporting the economic well-being of the family farmers in our network to fostering a collaborative and inspiring environment for our crew members across the country.

Crew Recruitment, Development and Retention

Through a thoughtful and thorough selection process, we bring crew members into the business who we believe are aligned with our values and culture. We have structured our crew member orientation and onboarding processes to help foster continued alignment, including through in-person visits to our Austin headquarters and Egg Central Station processing facility, as well as fireside chats with functional leadership and substantive introductions to each business unit. The Vital Farms crew member journey, including recruiting, onboarding and each step of the career experience, is guided by the philosophy of supporting a people-first culture. We believe in enabling our crew members to grow both professionally and personally. We cultivate leaders across every level of the business and are committed to building a culture that embodies our values and understands the unique needs of our crew members. This commitment is evidenced by our investment in two new programs in 2023. The first is our new learning management system, which houses custom internal material, hands-on learning and world-class content from top universities and companies focusing on both functional and interpersonal skills, which all crew members can access. The second is a six-month blended learning program we designed and launched for all people managers across the company. Incorporating in-person, virtual and individual learning activities, this training program focuses on building strong leadership foundations and fostered strong cross-functional connection and development across our Egg Central Station and remote people leadership teams.

We believe in a culture of transparency and ownership. We communicate regularly with our crew members across departments and position levels, including through monthly all-company meetings (which are in-person for our Egg Central Station crew members) with updates and messaging from our senior leadership team, and virtual sessions for our remote teams that include executive question-and-answer sessions. In addition, we have enhanced our internal communications programs to drive engagement by adding two inclusive platforms: an expanded company intranet and crew member newsletter. These frequent touchpoints are focused on helping crew members feel connected to our mission and empowered to make informed decisions that drive our business forward.

In 2021, we transitioned to a remote workforce for our crew members outside Egg Central Station to provide our crew members greater flexibility. We continue to believe this transition has enabled us to attract top talent across the country and has had a positive impact on crew member retention and engagement.

We plan to continue to add programs and thoughtful engagement opportunities for all crew members in service of fostering an environment where crew members can do their best work and help achieve our collective goals. We are doing this by creating a performance and development ecosystem that inspires a growth mindset and unlocks crew member potential. Through creating clarity on how to be successful at Vital Farms and providing opportunities to build relevant job skills, we believe we are empowering our crew members to own their respective career journeys.

Workplace Health and Safety

We continue to prioritize the safety and well-being of our crew and have a number of features to ensure our crew members feel safe, engaged and valued. At Egg Central Station, these features include continued identification of opportunities to automate more physically challenging processes, offering subsidies to purchase slip-resistant and safety toe shoes and partnering with a local occupational health organization for regular assessment and training of Egg Central Station crew members on ergonomics. Additionally, we continue to follow protocols and take preventative measures to protect the health and safety of our crew members, customers, and communities.

15

What We Value

We have defined our company values as (1) Be Humble, (2) Act Like an Owner, (3) Lead with a Growth Mindset, (4) Practice Empathy and (5) Compete to Win. We strive to create a culture that reflects these important pillars of our business.

Our Crew Members

As of December 31, 2023, we had approximately 447 full-time crew members, including 251 in operations, 59 in sales and marketing, 26 in finance and 111 in general and administrative functions, all of whom are located in the United States. Of our full-time crew members, one is a contract worker. As of December 31, 2023, approximately 41% of our full-time crew members were women and approximately 23% were members of underrepresented minority groups. None of our crew members is represented by a labor union. We have never experienced a labor-related work stoppage, and we consider our relations with our crew members to be good.

Our Corporate Information

We were founded in 2007, originally incorporated in Texas in July 2009 and reincorporated in Delaware in June 2013, and we became a public benefit corporation in Delaware in October 2017. Our principal executive offices are located at 3601 South Congress Avenue, Suite C100, Austin, Texas 78704, and our telephone number is (877) 455-3063. Our website address is www.vitalfarms.com.www.vitalfarms.com. Information contained on, or that can be accessed through, our website is not incorporated by reference into this Annual Report or any of our other filings with the Securities and Exchange Commission, or SEC. We make available on our website, free of charge, our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The SEC maintains a website that contains reports, proxy and information statements and other information regarding our filings at www.sec.gov.

Certified B Corporation

While not required by Delaware law or the terms of our certificate of incorporation, we have elected to have our social and environmental performance, accountability and transparency assessed against the proprietary criteria established by B Lab, an independent non-profit organization. As a result of this assessment, in December 2015, we were designated as a Certified B Corporation.

In order to be designated as a Certified B Corporation, companies are required to take a comprehensive and objective assessment of their positive impact on society and the environment. The assessment evaluates how a company’s operations and business model impacts its workers, customers, suppliers, community and the environment using a 200-point scale. While the assessment varies depending on a company’s size (number of employees), sector and location, representative indicators in the assessment include payment above a living wage, employee benefits, stakeholder engagement, supporting underserved suppliers and environmental benefits from a company’s products or services. After completing the assessment, B Lab will verify the company’s score to determine if it meets the 80-point minimum bar for certification. The review process includes a phone review, a random selection of indicators for verifying documentation and a random selection of company locations for onsite reviews, including employee interviews and facility tours. Once certified, every Certified B Corporation must make its assessment score transparent on B Lab’s website.

Designation as a Certified B Corporation and continued certification is at the sole discretion of B Lab. To maintain our certification, we are required to update our assessment and verify our updated score with B Lab every three years. We were most recently recertified in February 2018 and are in the process of recertification with B Lab. We were randomly selected for an onsite review, which is expected to occur in the second quarter of fiscal year 2021. Our Certified B Corporation designation remains in good standing while we conduct the recertification process.

Public Benefit Corporation Status

In connection with our Certified B Corporation status and as a demonstration of our long-term commitment to our mission to bring ethically produced food to the table by coordinating a network of family farms to operate with a well-defined set of organic agricultural practices that includes the humane treatment of farm animals as a central tenet, we elected in October 2017 to be treated as a public benefit corporation under Delaware law.

Under Delaware law, a public benefit corporation is required to identify in its certificate of incorporation the public benefit or benefits it will promote and its directors have a duty to manage the affairs of the corporation in a manner that balances the pecuniary interests of the corporation’s stockholders, the best interests of those materially affected by the corporation’s conduct, and the specific public benefit or public benefits identified in the public benefit corporation’s certificate of incorporation. Public benefit corporations organized in Delaware are also required to assess their benefit performance internally and to disclose to stockholders at least biennially a report detailing their success in meeting their benefit objectives.

As provided in our certificate of incorporation, the public benefits that we promote, and pursuant to which we manage our company, are: (i) bringing ethically produced food to the table; (ii) bringing joy to our customers through products and services; (iii) allowing crew members to thrive in an empowering, fun environment; (iv) fostering lasting partnerships with our farms and suppliers; (v) forging an enduring profitable business; and (vi) being stewards of our animals, land, air and water, and being supportive of our community.

15

Demand for shell eggs fluctuates in response to seasonal factors. Shell egg demand tends to increase with the start of the school year, is highest prior to holiday periods, particularly Thanksgiving, Christmas and Easter, and is lowest during the summer months. As a result of these seasonal and quarterly fluctuations, comparisons of our sales and operating results between different quarters within a single fiscal year are not necessarily meaningful comparisons.

Trademarks and Other Intellectual Property

We own trademarks and other proprietary rights that are important to our business, including our principal trademark, Vital Farms. All of our trademarks are registered with the U.S. Patent and Trademark Office. Our trademarks are valuable assets that reinforce the distinctiveness of our brand to our consumers. We believe the protection of our trademarks, copyrights and domain names are important to our success. We aggressively protect our intellectual property rights by relying on trademark and copyright.

Culture and Human Capital

Our Conscious Commitment

Our commitment to prioritizing the long-term benefits of each of our stakeholders includes our talented and passionate crew members, employees who are invaluable to our business. Following the Conscious Capitalism model, our business decisions consider the impact on all of our stakeholders, which we believe helps us to deliver a more sustainable and successful business.

Vital Farms is committed to creating and maintaining an environment that fosters collaboration, trust, and respect. Furthermore, we endeavor to provide our crew members with the resources they need to be successful, along with culture-enhancing programs and professional development opportunities.

Life at Vital Farms