Auditor Firm Id: | 185 | Auditor Name: | KPMG, LLP | Auditor Location: | Dallas, Texas, United States |

NEXPOINT RESIDENTIAL TRUST, INC.

Form 10-K

Year Ended December 31, 20212023

INDEX

Page | ||||

ii | ||||

Item 1. | 5 | |||

Item 1A. |

| |||

Item 1B. |

| |||

Item | 42 | |||

Item 2. |

| |||

Item 3. |

| |||

Item 4. |

| |||

Item 5. |

| |||

Item 6. |

| |||

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| ||

Item 7A. |

| |||

Item 8. |

| |||

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

| ||

Item 9A. |

| |||

Item 9B. |

| |||

Item 10. |

| |||

Item 11. |

| |||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

| ||

Item 13. | Certain Relationships and Related Transactions, and Director Independence |

| ||

Item 14. |

| |||

Item 15. |

| |||

F-1 | ||||

i

i

Cautionary Statement Regarding Forward-Looking Statements

This annual report (the "Annual Report") contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties. In particular, statements relating to our liquidity and capital resources, the performance of our properties and results of operations contain forward-looking statements. Furthermore, all of the statements regarding future financial performance (including market conditions and demographics) are forward-looking statements. We caution investors that any forward-looking statements presented in this annual reportAnnual Report are based on management’s current beliefs and assumptions made by, and information currently available to, management. When used, the words “anticipate,” “believe,” “expect,” “intend,” “may,” “might,” “plan,” “estimate,” “project,” “should,” “will,” “would,” “result” and similar expressions that do not relate solely to historical matters are intended to identify forward-looking statements. You can also identify forward-looking statements by discussions of strategy, plans or intentions.

Forward-looking statements are subject to risks, uncertainties and assumptions and may be affected by known and unknown risks, trends, uncertainties and factors that are beyond our control. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. We caution you therefore against relying on any of these forward-looking statements.

Some of the risks and uncertainties that may cause our actual results, performance, liquidity or achievements to differ materially from those expressed or implied by forward-looking statements include, among others, the following:

| • unfavorable changes in market and economic conditions in the United States and globally and in the specific markets where our properties are located; • macroeconomic trends including inflation and high interest rates may adversely affect our financial conditions and results of operations; • risks associated with ownership of real estate; • limited ability to dispose of assets because of the relative illiquidity of real estate investments; • our multifamily properties are concentrated in certain geographic markets in the Southeastern and Southwestern United States, which makes us more susceptible to adverse developments in those markets; • increased risks associated with our strategy of acquiring value enhancement multifamily properties rather than more conservative investment strategies; • failure to succeed in new markets may have adverse consequences on our performance; • potential reforms to the Federal Home Loan Mortgage Corporation (“Freddie Mac”) and the Federal National Mortgage Association (“Fannie Mae”); • competition could limit our ability to acquire attractive investment opportunities, which could adversely affect our profitability and impede our growth; • competition and any increased affordability of residential homes could limit our ability to lease our apartments or increase or maintain rents; • the relatively low residential mortgage rates may result in potential renters purchasing residences rather than leasing them, and as a result, cause a decline in our occupancy rates; • the risk that we may fail to consummate future property acquisitions; • failure of acquisitions to yield anticipated results; • risks associated with increases in interest rates and our ability to issue additional debt or equity securities in the future; • risks associated with selling apartment communities, which could limit our operational and financial flexibility; • contingent or unknown liabilities related to properties or businesses that we have acquired or may acquire; • lack of or insufficient amounts of insurance; • the risk that our environmental assessments may not identify all potential environmental liabilities and our remediation actions may be insufficient; • high costs associated with the investigation or remediation of environmental contamination, including asbestos, lead-based paint, chemical vapor, subsurface contamination and mold growth; • high costs associated with the compliance with various accessibility, environmental, building and health and safety laws and regulations, such as the Americans with Disabilities Act of 1990 and the Fair Housing Act; ii • risks associated with limited warranties we may obtain when purchasing properties; • exposure to decreases in market rents due to our short-term leases; • risks associated with operating through joint ventures and funds; • our dependence on information systems; • risks associated with breaches of our data security; • costs associated with being a public company, including compliance with securities laws; • the risk that our business could be adversely impacted if there are deficiencies in our disclosure controls and procedures or internal control over financial reporting; • risks associated with our substantial current indebtedness and indebtedness we may incur in the future; • risks associated with derivatives or hedging activity; • risks associated with representations and warranties made by us in connection with sales of our properties may subject us to liability that could result in losses and could harm our operating results and, therefore, distributions we make to our stockholders; • loss of key personnel of NexPoint Advisors, L.P. (our “Sponsor”), NexPoint Real Estate Advisors, L.P. (“our Adviser”) and our property manager; • the risk that we may not replicate the historical results achieved by other entities managed or sponsored by affiliates of our Adviser, members of our Adviser’s management team or by our Sponsor or its affiliates; • risks associated with our Adviser’s ability to terminate the Advisory Agreement (as defined below); • our ability to change our major policies, operations and targeted investments without stockholder consent; • the substantial fees and expenses we pay to our Adviser and its affiliates; • risks associated with any potential internalization of our management functions; • conflicts of interest and competing demands for time faced by our Adviser, our Sponsor and their officers and employees; • the risk that we may compete with other entities affiliated with our Sponsor or property manager for properties and residents; • failure to maintain our status as a REIT; • failure of our operating partnership to be taxable as a partnership for U.S. federal income tax purposes, possibly causing us to fail to qualify for or to maintain REIT status; • compliance with REIT requirements, which may limit our ability to hedge our liabilities effectively and cause us to forgo otherwise attractive opportunities, liquidate certain of our investments or incur tax liabilities; • risks associated with our ownership of interests in TRSs; • the recognition of taxable gains from the sale of properties as a result of the inability to complete certain like-kind exchanges in accordance with Section 1031 of the Internal Revenue Code of 1986, as amended (the “Code”); • the risk that the Internal Revenue Service (the “IRS”) may consider certain sales of properties to be prohibited transactions, resulting in a 100% penalty tax on any taxable gain; • the risk that we may be subject to other tax liabilities that may reduce our cash flows and distributions on our shares; • the ineligibility of dividends payable by REITs for the reduced tax rates available for some dividends; • risks associated with the stock ownership restrictions of the Code for REITs and the stock ownership limit imposed by our charter; • the ability of our board of directors to revoke our REIT qualification without stockholder approval; • recent and potential legislative or regulatory tax changes or other actions affecting REITs; • foreign investors may be subject to U.S. federal income tax or withholding tax on distributions received from us or on proceeds and the disposition of our current common stock; • risks associated with the market for our common stock and the general volatility of the capital and credit markets; • failure to generate sufficient cash flows to service our outstanding indebtedness or pay distributions at expected levels; iii • risks associated with limitations of liability for and our indemnification of our directors and officers; • the risk that legal proceedings we become involved in from time to time could adversely affect our business; • the risk that acts of violence could decrease the value of our assets and have an adverse effect on our business and results of operations; • risks associated with the Highland Capital Management, L.P. bankruptcy, including related litigation and potential conflicts of interest; and • any other risks included under the heading “Risk Factors” in this Annual Report.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ii

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

iii

|

|

|

|

|

|

While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. They are based on estimates and assumptions only as of the date of this annual report.Annual Report. We undertake no obligation to update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes, except as required by law.

iv

iv

PART I

ITEM 1. BUSINESS

General

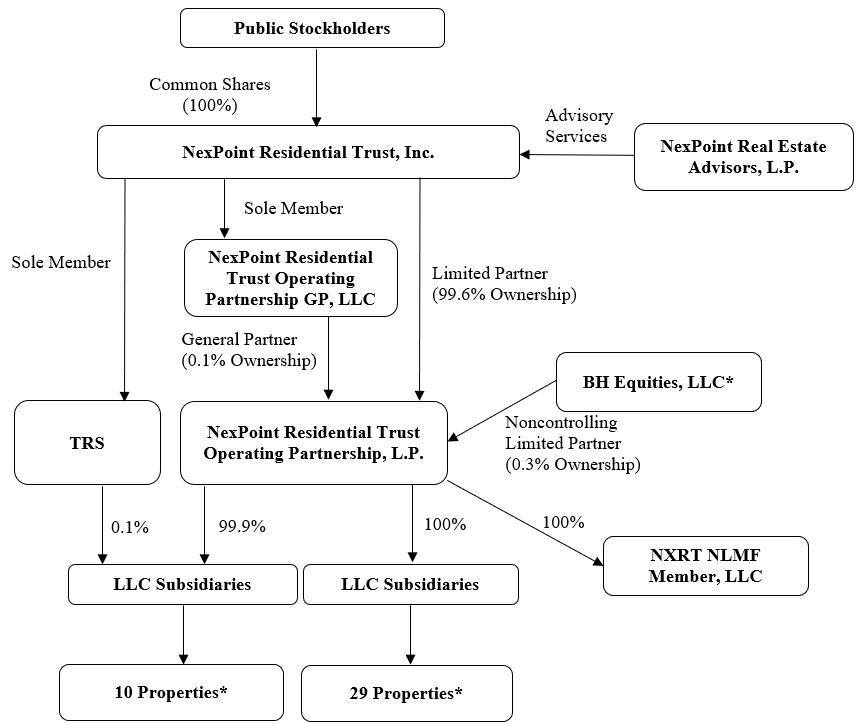

NexPoint Residential Trust, Inc. (the “Company”, “we”,“Company,” “we,” “our”) was incorporated in Maryland on September 19, 2014, and has elected to be taxed as a REIT. The Company is focused on “value-add” multifamily investments primarily located in the Southeastern and Southwestern United States. Substantially all of the Company’s business is conducted through NexPoint Residential Trust Operating Partnership, L.P. (the “OP”), the Company’s operating partnership. The Company owns its properties (the “Portfolio”“portfolio”) through the OP and its wholly owned taxable REIT subsidiary (“TRS”).TRS. The OP owns approximately 99.9% of the Portfolio;portfolio; the TRS owns approximately 0.1% of the Portfolio.portfolio. The Company’s wholly owned subsidiary, NexPoint Residential Trust Operating Partnership GP, LLC (the “OP GP”), is the sole general partner of the OP. As of December 31, 2021,2023, there were 23,819,40226,053,988 common units in the OP (“OP Units”) outstanding, of which 23,746,169,25,951,154, or 99.7%99.6%, were owned by the Company and 73,233,102,834, or 0.3%0.4%, were owned by a noncontrolling limited partnerpartners (see Note 109 to our consolidated financial statements).

The Company is externally managed by the Adviser, through an agreement dated March 16, 2015, as amended, and renewed on February 14, 202226, 2024 for a one-year term (the “Advisory Agreement”), by and among the Company, the OP and the Adviser. The Adviser conducts substantially all of the Company’s operations and provides asset management services for its real estate investments. The Company expects it will only have accounting employees while the Advisory Agreement is in effect. All of the Company’s investment decisions are made by the Adviser, subject to general oversight by the Adviser’s investment committee and the Board.Company’s board of directors (the “Board”). The Adviser is wholly owned by ourthe Sponsor.

The Company’s investment objectives are to maximize the cash flow and value of properties owned, acquire properties with cash flow growth potential, provide quarterly cash distributions and achieve long-term capital appreciation for its stockholders through targeted management and a value-add program. Consistent with the Company’s policy to acquire assets for both income and capital gain, the Company intends to hold at least majority interests in its properties for long-term appreciation and to engage in the business of directly or indirectly acquiring, owning, and operating well-located multifamily properties with a value-add component in large cities and suburban submarkets of large cities primarily in the Southeastern and Southwestern United States consistent with its investment objectives. We generate revenue primarily by leasing our multifamily properties. Economic and market conditions may influence the Company to hold properties for different periods of time. From time to time, the Company may sell a property if, among other deciding factors, the sale would be in the best interest of its stockholders.

The entities through which we own the properties in the Portfolio have entered into management agreements with BH Management Services, LLC (“BH”). Pursuant to these agreements, BH operates and leases the underlying properties in the Portfolio and provides construction management services. BH has significant experience operating and leasing multifamily properties, having begun business in 1993 and currently operating and leasing approximately 103,000 multifamily units across the country. The Company pays BH a management fee of approximately 3% of the monthly gross income from each property managed, as well as construction supervision fees and certain other fees. BH is an affiliate of the noncontrolling limited partner of the OP. See Note 10 to our consolidated financial statements for additional information.

The Company may also participate with third parties in property ownership through limited liability companies (“LLCs”), funds or other types of co-ownership or acquire real estate or interests in real estate in exchange for the issuance of common stock, OP Units, preferred stock or options to purchase stock. These types of investments may permit the Company to own interests in larger assets without unduly restricting diversification, which provides flexibility in structuring the Company’s portfolio.

The Company may allocate up to 30% of the portfolio to investments in real estate-related debt and securities with the potential for high current income or total returns. These allocations may include first and second mortgages and subordinated, bridge, mezzanine, construction and other loans, as well as debt securities related to or secured by multifamily real estate and common and preferred equity securities, which may include securities of other REITs or real estate companies.

As of December 31, 2021,2023, the Company, through the OP and the wholly owned TRS, owned 3938 properties representing 14,82514,133 units in seven states, as further described under Item 2, “Properties” and Notes 3 4 and 54 to our consolidated financial statements.

20212023 Highlights

Key highlights and transactions completed in 20212023 include the following:

| • Dispositions: We sold two properties totaling 994 units in 2023. Details of the dispositions are in the table below (in thousands):

(1) Represents the outstanding principal balance when the loan was repaid. (2) Represents sales price, net of closing costs. 5 • Renovations: For the properties in our portfolio as of December 31, 2023, we completed full and partial renovations on 2,073 units at an average cost of $12,303 per renovated unit. Since inception, for the properties in our portfolio as of December 31, 2023, we have completed full and partial renovations on 8,534 units at an average cost of $9,715 per renovated unit that has been leased as of December 31, 2023. We have achieved average rent growth of 14.5%, or a $169 average monthly rental increase per unit, on all units renovated and leased as of December 31, 2023, resulting in a return on investment on capital expended for interior renovations of 20.9%. • Dividends: We declared dividends totaling $45.2 million, or $1.722 per share for the year ended December 31, 2023. During the fourth quarter of 2023, we increased our quarterly dividend for the sixth time since the Spin-Off (as defined below) to $0.46242 per share, which was an increase of $0.04242 per share, or a 10.1% increase, over our previous quarterly dividends declared in 2023. The increase in our quarterly dividend to $0.46242 per share is an increase of $0.26 per share, or a 124.5% increase, over our quarterly dividends declared from the Spin-Off. Our fourth quarter dividend equates to a 5.4% annualized yield based on our closing share price of $34.43 on December 31, 2023. • Results of Operations and Non-GAAP Measures: We reported the following net income (loss), net operating income (“NOI”), funds from operations (“FFO”), core funds from operations (“Core FFO”) and adjusted funds from operations (“AFFO”) for the year ended December 31, 2023 as compared to the year ended December 31, 2022 (dollars in thousands):

(1) The change in our net income (loss) between the periods primarily relates to an increase in gain on sales of real estate of $53.2 million and increases in property operating expenses of $0.4 million and depreciation and amortization expense of $2.4 million, partially offset by an increase in total revenues of $13.5 million. (2) See Item 7, “Management's Discussion and Analysis of Financial Condition and Results of Operations” for a discussion regarding the non-GAAP measures of NOI, FFO, Core FFO and AFFO provided above, including reconciliations to net income in accordance with U.S. generally accepted accounting principles (“GAAP”). (3) Prior year NOI was updated to include current year NOI add backs. • Same Store Growth: There are 33 properties encompassing 12,378 units of apartment space in our same store pool for the years ended December 31, 2023 and 2022 (our “2022-2023 Same Store” properties). Our 2022-2023 Same Store properties exclude the following 5 properties in our portfolio as of December 31, 2023: Old Farm, Stone Creek at Old Farm, The Adair, Estates on Maryland and Radbourne Lake as well as the 45 units that are currently down (see Note 4 to our consolidated financial statements). For our 2022-2023 Same Store properties, we recorded the following operating metrics for the year ended December 31, 2023 as compared to the year ended December 31, 2022:

(1) Occupancy is calculated as the number of units occupied as of December 31 for the respective year, divided by the total number of units, expressed as a percentage. (2) Average effective monthly rent per unit is equal to the average of the contractual rent for commenced leases as of December 31 for the respective year minus any tenant concessions over the term of the lease, divided by the number of units under commenced leases as of December 31 for the respective year. 6 • Corporate Credit Facility: On February 2, 2023, the Company made a $17.5 million principal payment on the Corporate Credit Facility. On September 25, 2023, the Company made a $16.0 million principal payment on the Corporate Credit Facility. On December 15, 2023, the Company made a $17.0 million principal payment on the Corporate Credit Facility, reducing the outstanding principal balance to $24.0 million as of December 31, 2023. • Cash Position: At December 31, 2023, we had $45.3 million of cash on our balance sheet, of which $2.9 million was reserved for future renovations, and $30.0 million was reserved for lender-required escrows and security deposits. We believe we have adequate cash on hand, in addition to our expected cash flows from operations, to meet our near-term obligations, service our debt, pay distributions and make opportunistic acquisitions.

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Gross proceeds |

| $ | 57,979,098 |

|

Common shares issued |

|

| 1,068,819 |

|

Gross average sale price per share |

| $ | 54.25 |

|

|

|

|

|

|

Sales commissions |

| $ | 869,687 |

|

Offering costs |

|

| 1,056,003 |

|

Net proceeds |

|

| 56,053,408 |

|

Average price per share, net |

| $ | 52.44 |

|

|

|

Property Name |

| Location |

| Date of Acquisition |

| Purchase Price |

|

| Mortgage Debt (1) |

|

| # Units |

|

| Effective Ownership |

| ||||

The Verandas at Lake Norman |

| Charlotte, North Carolina |

| June 30, 2021 |

| $ | 63,500 |

|

| $ | 34,925 |

|

|

| 264 |

|

|

| 100 | % |

Creekside at Matthews |

| Charlotte, North Carolina |

| June 30, 2021 |

|

| 58,000 |

|

|

| 31,900 |

|

|

| 240 |

|

|

| 100 | % |

Six Forks Station |

| Raleigh, North Carolina |

| September 10, 2021 |

|

| 74,760 |

|

|

| 41,180 |

|

|

| 323 |

|

|

| 100 | % |

Hudson High House |

| Cary, North Carolina |

| December 7, 2021 |

|

| 93,250 |

|

|

| 46,625 |

|

|

| 302 |

|

|

| 100 | % |

|

|

|

|

|

| $ | 289,510 |

|

| $ | 154,630 |

|

|

| 1,129 |

|

|

|

|

|

|

|

|

|

Property Name |

| Location |

| Date of Sale |

| Sales Price |

|

| Outstanding Principal (1) |

|

| Net Cash Proceeds (2) |

|

| Gain on Sale of Real Estate |

| ||||

Beechwood Terrace |

| Antioch, Tennessee |

| November 1, 2021 |

| $ | 53,600 |

|

| $ | 23,365 |

|

| $ | 53,004 |

|

| $ | 33,961 |

|

Cedar Pointe |

| Antioch, Tennessee |

| November 1, 2021 |

|

| 37,650 |

|

|

| 17,300 |

|

|

| 37,232 |

|

|

| 12,253 |

|

|

|

|

|

|

| $ | 91,250 |

|

| $ | 40,665 |

|

| $ | 90,236 |

|

| $ | 46,214 |

|

|

|

|

|

|

|

|

|

|

|

|

| For the Year Ended December 31, |

|

|

|

|

|

|

|

|

| |||||

|

| 2021 |

|

| 2020 |

|

| $ Change |

|

| % Change |

| ||||

Net income |

| $ | 23,106 |

|

| $ | 44,150 |

|

| $ | (21,044 | ) | (1) |

| -47.7 | % |

NOI | (2) |

| 128,389 |

|

|

| 118,396 |

|

|

| 9,993 |

|

|

| 8.4 | % |

FFO attributable to common stockholders | (2) |

| 63,579 |

|

|

| 57,238 |

|

|

| 6,341 |

|

|

| 11.1 | % |

Core FFO attributable to common stockholders | (2) |

| 62,487 |

|

|

| 55,512 |

|

|

| 6,975 |

|

|

| 12.6 | % |

AFFO attributable to common stockholders | (2) |

| 70,919 |

|

|

| 62,448 |

|

|

| 8,471 |

|

|

| 13.6 | % |

|

|

|

|

|

|

Operating Metric |

| 2021 |

|

| 2020 |

|

| % Change |

| |||

Occupancy (1) |

|

| 94.2 | % |

|

| 93.9 | % |

|

| 0.3 | % |

Average Effective Monthly Rent Per Unit (2) |

| $ | 1,255 |

|

| $ | 1,130 |

|

|

| 11.1 | % |

Rental income (in thousands) |

| $ | 194,609 |

|

| $ | 185,283 |

|

|

| 5.0 | % |

Other income (in thousands) |

| $ | 5,474 |

|

| $ | 5,416 |

|

|

| 1.1 | % |

NOI (in thousands) |

| $ | 115,332 |

|

| $ | 109,286 |

|

|

| 5.5 | % |

|

|

|

|

|

|

|

|

|

|

Our Real Estate Portfolio

As of December 31, 2021,2023, we owned 3938 properties representing 14,82514,133 units that we lease in seven states that were approximately 94.3%94.7% occupied with a weighted average monthly effective rent per occupied apartment unit of $1,261.$1,502. For additional information regarding our Portfolio,portfolio, see Item 2, “Properties” and Notes 3 4 and 54 to our consolidated financial statements.

We evaluate our operating performance on an individual property level and view our real estate assets as one industry segment and, accordingly, our properties are aggregated into one reportable segment.

Our Business Objectives and Strategies

Our primary business objectives are to:

|

|

|

|

|

|

|

|

|

|

| • recycle capital from dispositions when economic and market conditions present opportunities that we believe are in the best interest of our stockholders. |

We intend to accomplish these objectives by:

| • Focusing on Acquiring Class B Properties in Our Core Markets. We will continue to seek opportunities to acquire primarily Class B multifamily properties at prices that we believe represent discounts to replacement cost, provide the potential for significant long-term value appreciation and that we expect will generate attractive yields for our stockholders. We will focus on these types of opportunities in our core markets, which we consider to be primarily major metropolitan areas in the Southeastern and Southwestern United States. • Focusing on Multifamily Properties with a Value-Add Component. We will continue to seek opportunities to acquire multifamily properties that have a value-add component. Due to a lack of reinvestment by many prior owners, we believe these types of properties provide us the opportunity to make relatively modest capital expenditures that result in a significant increase in rents, thereby generating NOI growth, and thus higher yields and capital appreciation for our stockholders. • Prudently Using Leverage to Increase Stockholder Value. We will typically finance new property acquisitions at a target leverage level of approximately 50-60% loan-to-value (outstanding principal balance to enterprise value). Given that we intend for the majority of our acquisitions to have a value-add component in the first three years of ownership, we will generally seek leverage with the optionality to refinance (such as floating rate debt). In the management team’s experience, this leverage strategy allows for the opportunity to maximize returns for our stockholders while providing maximum flexibility. We are currently targeting to reduce our leverage to 40-45% loan-to-value (outstanding principal balance to enterprise value) over time by increasing the value of our properties, refinancing properties we intend to hold longer term and strategically paying down debt with excess cash flows from operations or future equity offerings.

|

|

|

|

|

|

Our Adviser’s investment approach combines its management team’s experience with a structure that emphasizes thorough market research, local market knowledge, underwriting discipline and risk management in evaluating potential investments with a goal of maximizing long-term stockholder value and a philosophy of thoughtful capital allocation and balance sheet management.

7

Acquisition and Operating Strategy

We seek primarily Class B multifamily properties that are priced at a discount to replacement cost. We believe that through the implementation of our value-add program we will be able to grow the NOI of these types of properties significantly in the first three years of ownership and thus these types of acquisitions will be accretive over the long-term to our FFO, Core FFO and AFFO. As we progress through the real estate life cycle, these opportunities will become more difficult to find. However, we will continue to take a disciplined approach to acquisitions by primarily pursuing these types of opportunities.

At times, we may acquire properties from affiliates, including from Delaware statutory trusts managed by affiliates of our AdvisorAdviser (“Advised DSTs”). On or about March 1, 2022, through our operating partnership, we will sendsent an offer to acquire two properties from Advised DSTs. One property iswas a Class B apartment community consisting of 232 units located in the Atlanta, Georgia MSA (“Adair”). The other property iswas a Class A apartment community consisting of 330 units located in the Phoenix, Arizona MSA (“Estates”). The Operating Partnership will acquireacquired Adair and Estates through exchange rights granted to the Operating Partnership in the respective trust agreements for Adair and Estates. The total consideration for Adair is $65was $65.5 million. The total consideration for Estates iswas $77.9 million. Affiliates of our AdvisorAdviser own less than 2% of the Adair trust units and less than 1% of the Estates trust units and will participateparticipated in the sales on the same terms as other holders. Under the exchange rights, the current owners of the Advised DSTs arewere permitted to elect to receive either units of the Operating Partnership or cash for their proportionate share of the consideration. We expect to close these acquisitionsThe transaction closed in the late first, or early second quarter of 2022.

Our Adviser’s investment approach includes active management of each property acquired. Our Adviser believes that active management is critical to creating value. Prior to the purchase of a property, BH Management Services, LLC (“BH”) and our Adviser generally tour each property and develop a business strategy for the property. This includes a forecast of the action items to be taken and the capital needed to achieve the anticipated returns. Our Adviser reviews such property-level business strategies on an ongoing basis to anticipate changes or opportunities in the market. In an effort to keep properties in compliance with our underwriting standards and management strategies, our Adviser remains involved throughout the investment life cycle of each acquired property and actively consults with BH throughout the holding period.

Value-Add Strategy

We will continue to implement our value-add strategy at our properties where we believe we can achieve a significant increase in rents above what would otherwise be the case with purely organic market increases. Our value-add program has three components: 1) improvement of exteriors and common areas, 2) improvement of interiors and 3) management and cost improvements.

We invest in exterior and common areas improvements at our properties in an effort to enhance asset quality, to improve “curb appeal”/market positioning, and expand or enhance our amenity offerings, all of which we believe will improve tenant retention and modestly drive rent and NOI growth. Renovations to the exteriors and common areas include structural improvements that enhance

the physical condition, value and/or useful life of our properties, as well as aesthetic improvements to, among others, landscape and signage. We also seek to improve our competitive positioning by adding to, redecorating or otherwise enhancing our common areas and amenity offerings. As of December 31, 2021, with the exception of the properties we acquired in 2021,2023, we have renovated the exteriors and common areas at a majority of the properties in our Portfolio.portfolio.

We expect interior renovations, along with organic growth in rents, to be the primary drivers of rent and NOI growth at our properties. Our interior renovations include: 1) aesthetic design enhancements such as kitchen and/or bath remodeling, 2) replacement of outdated appliances, equipment and fixtures, 3) addition of washer/dryer appliances, 4) private yards, 5) fiber internet and 6) smart technologies such as Bluetooth locks, networked climate control systems and USB electrical outlets. We also seek to achieve cost improvements through investment in longer-lived materials, energy conservation projects, and other strategic initiatives. Since inception, for the properties in our Portfolioportfolio as of December 31, 2021,2023, we have completed full and partial renovations on 6,0158,534 units out of our 14,82514,133 total units with an average monthly rental increase per unit of $136$169 and an average cost of $7,547$9,715 per renovated unit that has been leased as of December 31, 2021.2023. In cases where we believe rents will grow significantly in a market organically, we will implement the value-add program more strategically in order to capture significant rent and NOI growth without expending additional capital. Additionally, to the extent we believe rents at a property are maximized regardless of the level of additional renovations, we may opt not to further renovate units at that property. As of December 31, 2021,2023, we had reserved approximately $11.9$2.9 million for our planned capital expenditures and other expenses to implement our value-add program, which will complete approximately 1,22613,209 planned interior rehabs, eliminating the need for us to raise additional capital in order to carry out our currently planned value-add program.

8

Disposition Strategy

In general, we intend to hold our multifamily properties for production of rental income for a period of at least three years from the date of acquisition. Economic and market conditions may influence us to hold our investments for different periods of time. From time to time, we may sell an asset before the end of the expected holding period, particularly if we receive a bona fide unsolicited offer with attractive terms, have an upcoming liquidity need, such as a debt maturing, are strategically exiting a certain market or sub-market or the sale of the asset would otherwise be in the best interest of our stockholders. When reviewing whether a sale is in the best interest of our stockholders, we take into consideration whether market conditions and asset positioning have maximized the value of the property to us and any potential adverse tax consequences of a sale.

Financing Strategy

We intend to use leverage in making our investments with an objective of maintaining a strong balance sheet and providing liquidity to grow our Portfolio.portfolio. We are currently targeting to reduce our leverage to 40-45% loan-to-value (outstanding principal balance to enterprise value) over time by increasing the value of our properties and refinancing properties we intend to hold longer-term. However, we are not subject to any limitations on the amount of leverage we may use, and, accordingly, the amount of leverage we use may be significantly less or greater than what we currently anticipate. We are currently meeting our short-term liquidity needs through our cash and cash equivalents and cash flows from operations.

When interest rates are high or financing is otherwise unavailable on a timely basis, we may purchase certain properties and other assets for cash with the intention of obtaining a loan for a portion of the purchase price at a later time. We will refinance properties during the term of a loan only under certain circumstances, such as when a decline in interest rates makes it beneficial to prepay an existing mortgage, an existing mortgage matures, the value of the property has increased significantly and we can obtain more attractive terms through refinancing the property, or an attractive investment becomes available and the proceeds from the refinancing can be used to purchase such investment.

We typically use floating rate debt with interest rate swaps and interest rate caps as opposed to using fixed rate debt. We believe this is a more sensible and flexible way to utilize leverage, while limiting our interest rate risk in our strategy as we attempt to increase the value of each property over the course of three years after acquisition through our value-add program. Fixed rate financing is typically more expensive and less flexible since there are typically high prepayment penalties, yield maintenance payments and/or defeasance penalties when refinancing the debt prior to maturity. To the extent we intend to hold a property long-term, we will reassess the use of refinancing with fixed rate debt.

Property Management Strategy

We seek to achieve long-term earnings growth through superior property management. To achieve this, we have partnered with BH to manage all of our properties as an external manager. In order to align our property manager’s interests with those of our stockholders, BH (through an affiliate) is a noncontrolling limited partner of the OP. We believe BH provides the following benefits:

| • manages approximately 104,000 multifamily units in 27 states and has managed multifamily communities for 31 years; • brings a scale of operations we could not otherwise achieve for approximately 3% of gross income, which is the contracted amount we pay for its property management services; • has operations in all of our current and desired markets, allowing us greater scale when entering new markets or make investments in non-core markets without making substantial investments in management infrastructure in those markets; • has a construction management operation and substantial experience in renovating Class B multifamily units; • its scale allows it to obtain highly competitive pricing as it pertains to the costs of our value-add program, increasing our return on investment for renovations; • helps us source and underwrite opportunities as well as assist in due diligence of properties prior to closing; • assists in locating potential buyers for our properties; • its size, scale and experience allows it to keep costs low and maximize rents and occupancy; and • has proved successful in driving other revenue growth at properties it manages. 9

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our Structure

The following chart shows our ownership structure.

| An affiliate of BH Equities, LLC is the property manager for all of our properties.

|

|

Our Adviser

We are externally managed by our Adviser pursuant to the Advisory Agreement, by and among the OP, our Adviser, and us. Our Adviser was organized on September 5, 2014 and is an affiliate of our Sponsor. Our Adviser has contractual and fiduciary responsibilities to us and our stockholders as further described under “—“—Our Advisory Agreement” below. The members of our Adviser’s management team are Jim Dondero, Brian Mitts, Matt McGraner and D.C. Sauter, and Matthew Goetz, all of whom are employed by our Adviser or its affiliates.

Our Advisory Agreement

Below is a summary of the terms of our Advisory Agreement:

Duties of Our Adviser. Our Advisory Agreement provides that our Adviser manage our business and affairs in accordance with the policies and guidelines established by our Board and that our Adviser be under the supervision of our Board. The agreement requires our Adviser to provide us with all services necessary or appropriate to conduct our business, including the following:

| • locating, presenting and recommending to us real estate investment opportunities consistent with our investment policies, acquisition and disposition strategies and objectives, including our conflicts of interest policies; 10 • structuring the terms and conditions of transactions pursuant to which acquisitions and dispositions of properties will be made; • acquiring and disposing properties on our behalf in compliance with our investment objectives, strategies and applicable tax regulations; • arranging for the financing and refinancing of properties; • administering our bookkeeping and accounting functions; • serving as our consultant in connection with policy decisions to be made by our Board, managing our properties or causing our properties to be managed by another party; • monitoring our compliance with regulatory requirements, including the Securities Act of 1933, as amended, (the “Securities Act”) and the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations promulgated thereunder, the New York Stock Exchange (“NYSE”) rules and regulations of the Code to maintain our status as a REIT; • performing administrative services; and • rendering other services as our Board deems appropriate.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our Adviser is required to obtain the prior approval of our Board in connection with:

| • any investment for which the portion of the consideration paid out of our equity equals or exceeds $50,000,000; • any investment that is inconsistent with the publicly disclosed investment guidelines as in effect from time to time, or, if none are then publicly disclosed, as otherwise adopted by our Board from time to time; or • any engagement of affiliated service providers on behalf of us or the OP, which engagement terms will be negotiated on an arm’s length basis.

|

|

|

|

|

|

For these purposes, “equity” means the purchase price of the investment, exclusive of the proceeds of any debt financing incurred or to be incurred in connection with the relevant investment and anticipated closing and other acquisition costs.

Our Adviser will be prohibited from taking any action, in its sole judgment, or in the sole judgment of our Board, that:

| • would adversely affect our qualification as a REIT under the Code, unless our Board had determined that REIT qualification is not in the best interest of us and our stockholders; • would subject us to regulation under the Investment Company Act of 1940 (the “1940 Act”), except to the extent that we and our Adviser have undertaken in the Advisory Agreement and our charter to comply with Section 15 of the 1940 Act in connection with the entry into, continuation of, or amendment of the Advisory Agreement or any advisory agreement; • is contrary to or inconsistent with our investment guidelines; or • would violate any law, rule, regulation or statement of policy of any governmental body or agency having jurisdiction over us or our shares of common stock, or otherwise not be permitted by our charter or bylaws.

|

|

|

|

|

|

|

|

Advisory Fee. Our Advisory Agreement requires that we pay our Adviser an annual advisory fee of 1.00% of our Average Real Estate Assets.

“Average Real Estate Assets” means the average of the aggregate book value of Real Estate Assets (see below) before reserves for depreciation or other non-cash reserves, computed by taking the average of the book value of real estate assets at the end of each month (1) for which any fee under the Advisory Agreement is calculated or (2) during the year for which any expense reimbursement under the Advisory Agreement is calculated. “Real Estate Assets” is defined broadly in the Advisory Agreement to include, among other things, investments in real estate-related securities and mortgages and reserves for capital expenditures (the value-add program).

11

In calculating the advisory fee, we categorize our Average Real Estate Assets into either “Contributed Assets” or “New Assets.” The advisory fee on Contributed Assets may not exceed $4.5 million in any calendar year. This cap is intended to limit the fees paid to our Adviser on the Contributed Assets following theour Spin-Off (the "Spin-Off") to the fees that would have been paid by NHF to its adviser had the Spin-Off not occurred. The advisory fee on New Assets is not subject to this limitation but is subject to the expense cap mentioned below.

“Contributed Assets” means all of the real estate assets we owned upon the completion of the Spin-Off and is not reduced for dispositions of such assets subsequent to the Spin-Off.

“New Assets” means all of the Average Real Estate Assets other than Contributed Assets. New Assets includes proceeds from the sale of a Contributed Asset that are used to purchase a new investment.

The advisory fee is payable monthly in arrears in cash, unless our Adviser elects, in its sole discretion, to receive all or a portion of such fee in shares of our common stock, subject to the limitations set forth below under “—Limitations on Receiving Shares.” The number of shares issued to our Adviser as payment for the advisory fee will be equal to the dollar amount of the portion of such fee that is payable in shares divided by the volume-weighted average closing price of shares of our common stock for the ten trading days prior to the end of the month for which such fee will be paid, which we refer to as the fee VWAP. Our Adviser computes each installment of the advisory fee as promptly as possible after the end of the month with respect to which such installment is payable.

The accrued fees are payable monthly as promptly as possible after the end of each month during which the Advisory Agreement is in effect. A copy of the computations made by our Adviser to calculate such installment is delivered to our Board for informational purposes only.

Administrative Fee. Our Advisory Agreement requires that we pay our Adviser an annual administrative fee of 0.20% of the Average Real Estate Assets.

In calculating the administrative fee, we categorize our Average Real Estate Assets into either Contributed Assets or New Assets. The administrative fee on Contributed Assets may not exceed $890,000 in any calendar year. This cap is intended to limit the fees paid to our Adviser on the Contributed Assets following the Spin-Off to the fees that would have been paid by NHF to its adviser had the Spin-Off not occurred. The administrative fee on New Assets is not subject to this limitation but is subject to the expense cap described below.

The administrative fee is payable monthly in arrears in cash, unless our Adviser elects, in its sole discretion, to receive all or a portion of such fee in shares of our common stock, subject to the limitations set forth below under “—Limitations on Receiving Shares.” The number of shares issued to our Adviser as payment for the administrative fee will be equal to the dollar amount of the portion of such fee that is payable in shares divided by the fee VWAP. Our Adviser computes each installment of the administrative fee as promptly as possible after the end of each month with respect to which such installment is payable. The accrued fees are payable monthly as promptly as possible after the end of each month during which the Advisory Agreement is in effect. A copy of the computations made by our Adviser to calculate such installment is delivered to our Board for informational purposes only.

Reimbursement of Expenses. Our Advisory Agreement requires that we reimburse our Adviser for all of its out-of-pocket expenses in performing its services, including legal, accounting, financial, due diligence and other services performed by our Adviser that outside professionals or outside consultants would otherwise perform and also pay our pro rata share of rent, telephone, utilities, office furniture, equipment, machinery and other office, internal and overhead expenses of our Adviser required for our operations (“Adviser Operating Expenses”). Adviser Operating Expenses do not include expenses for the advisory and administrative services provided under the Advisory Agreement. We will also reimburse our Adviser for any and all expenses (other than underwriters’ discounts) in connection with an offering, including, without limitation, legal, accounting, printing, mailing and filing fees and other documented offering expenses.

When applicable, our Adviser prepares a statement documenting all expenses incurred during each month, and delivers such statement to us within 15 business days after the end of each month. When submitted for reimbursement, such expenses are reimbursed by us no later than the 15th business day immediately following the date of delivery of such statement of expenses to us. All expenses payable by us or reimbursable to our Adviser pursuant to the agreement will not be in amounts greater than those which would be payable to outside professionals or consultants engaged to perform such services pursuant to agreements negotiated on an arm’s length basis. Our Adviser may, at its discretion and at any time, waive its right to reimbursement for eligible out-of-pocket expenses paid on our behalf. Once waived, these expenses are considered permanently waived and become non-recoupable in the future.

12

Expense Cap. Reimbursement of Adviser Operating Expenses under the Advisory Agreement, advisory and administrative fees paid to our Adviser and corporate general and administrative expenses such as audit, legal, listing and Board fees and equity-based compensation expense recognized under a long-term incentive plan will not exceed 1.5% of Average Real Estate Assets per calendar year (or part thereof that the Advisory Agreement is in effect) (the “Expense Cap”). The Expense Cap does not limit the reimbursement by us of expenses related to securities offerings paid by our Adviser. The Expense Cap also does not apply to legal, accounting, financial, due diligence and other service fees incurred in connection with mergers and acquisitions, extraordinary litigation or other events outside our ordinary course of business or any out-of-pocket acquisition or due diligence expenses incurred in connection with the acquisition or disposition of real estate assets.

Term of the Advisory Agreement. The Advisory Agreement has a one-year term. The Advisory Agreement shall continue in full force and effect so long as the Advisory Agreement is approved at least annually by our Board. On February 14, 2022,26, 2024, our Board, including the independent directors, unanimously approved the renewal of the Advisory Agreement with the Adviser for a one-year term.

The Advisory Agreement may be terminated at any time, without payment of any penalty to our Adviser, by vote of our Board or stockholders, or by our Adviser, in each case on not more than 60 days’ nor less than 30 days’ prior written notice to the other party. The Advisory Agreement shall automatically and immediately terminate in the event of its “assignment” (as defined in the 1940 Act).

Amendment. The Advisory Agreement may only be amended, waived, discharged or terminated in writing signed by the party against which enforcement of the amendment, waiver, discharge or termination is sought.

Limitations on Receiving Shares. The ability of our Adviser to receive shares of our common stock as payment for all or a portion of the advisory and administrative fees due under the terms of our Advisory Agreement will be subject to the following limitations: (1) the ownership of shares of common stock by our Adviser may not violate the ownership limitations set forth in our charter, after giving effect to any exception from such ownership limitations that our Board may grant to our Adviser or its affiliates and (2) compliance with all applicable restrictions under the U.S. federal securities laws and the NYSE rules. To the extent that payment of any fee in shares of our common stock would result in a violation of the ownership limits set forth in our charter (taking into account any applicable waiver or any restrictions imposed under the U.S. federal securities laws or NYSE rules), all or a portion of such fee payable to our Adviser will be payable in cash to the extent necessary to avoid such violation.

Registration Rights. We entered into a registration rights agreement with our Adviser with respect to any shares of our common stock that our Adviser receives as payment for any fees owed under our Advisory Agreement. These registration rights will require us to file a registration statement with respect to such shares. We agreed to pay all of the expenses relating to registering these securities. The costs associated with registering these securities will not be deducted from the compensation owed to our Adviser.

Liability and Indemnification of our Adviser. Under the Advisory Agreement, we are also required to indemnify our Adviser and to pay or reimburse reasonable expenses in advance of final disposition of a proceeding with respect to certain of our Adviser’s acts or omissions.

Other Activities of our Adviser and its Affiliates. Our Adviser and its affiliates expect to engage in other business ventures, and as a result, their resources will not be dedicated exclusively to our business. However, pursuant to the Advisory Agreement, our Adviser will be required to devote sufficient resources to our administration to discharge its obligations.

Potential Acquisition of our Adviser. Many REITs that are listed on a national stock exchange are considered “self-managed” or “internally managed,” since the employees of such REITs perform all significant management functions. In contrast, REITs that are not self-managed, like us, are referred to as “externally managed” and typically engage a third party, such as our Adviser, to perform management functions on its behalf. Our independent directors may determine that we should become self-managed through the acquisition of our Adviser, which we refer to as an internalization transaction. See “Risk Factors—If we internalize our management functions, the percentage of our outstanding common stock owned by our other stockholders could be reduced, and we could incur other significant costs associated with being self-managed.”

Our Property Manager

The entities through which we own the properties in our Portfolioportfolio have entered into management agreements with BH.BH (the "Management Agreements"). Pursuant to these agreements, BH operates and leases the underlying properties in our Portfolio.portfolio. In addition to property management and leasing services, BH also provides us with market research, acquisition advice, a pipeline of investment opportunities and construction management services. We utilize BH for property and construction management services and leasing, paying BH a management fee of approximately 3% of the monthly gross income from each property managed, as well as construction supervision fees and certain other fees described under “—“—Property Management Agreements” below.

13

Property Management Agreements

Under these agreements, BH operates, coordinates and supervises the ordinary and usual business and affairs pertaining to the operation, maintenance, leasing, licensing, and management of each property. The following summarizes the terms of the management agreements.Management Agreements.

Term. The terms of the management agreementsManagement Agreements will continue until the last day of the calendar month following the second anniversary of the agreement.Management Agreement. Upon the expiration of the original term, the agreementsManagement Agreements will automatically renew on a month-to-month basis until terminated. The agreementsManagement Agreements may be terminated at any time with 60 days written notice.

Proposed Management Plans. Each management agreementManagement Agreement requires that BH prepare and submit a proposed management plan and operating budget for the marketing, operation, repair and maintenance, and renovation of the property for the year the agreementManagement Agreement is entered into. BH must submit subsequent proposed management plans 45 days prior to the beginning of the next year.

Amounts Payable under the Management Agreements. The entities that own the properties pay BH monthly for its services. Pursuant to the management agreements,Management Agreements, BH may pay itself out of each property’s operating account. Any sums not paid within 10 days after becoming due bear interest at the rate of 18% per annum. Compensation under the management agreementsManagement Agreements consists of the following components:

| • Management Fee. The management fee is approximately 3% of the monthly gross income from each property. For the purposes of calculating the management fee, “monthly gross income” is defined as all receipts of every kind and nature actually collected from the operation of the property, determined on a cash basis, including, without limitation, rental or lease payments, late charges, service charges, forfeited security deposits, proceeds of vending machine collections, resident utility payment collections, and all other forms of miscellaneous income (but excluding the collection of any insurance or condemnation awards). • Set-Up/Inspection Fees. BH receives a one-time set-up/inspection fee per unit upon commencement of management of each property. • Construction Supervision Fee. BH receives a construction supervision fee of 5-6% of total project costs if BH performs these services. • Renter’s Insurance Program Fee; Other Fees. In the event that the entities that own the properties direct BH to implement a renter’s insurance program at a property, the entities pay BH a fee in connection with running such program. In consideration for any additional services other than the services required under the Management Agreements, the entities pay BH an hourly rate.

|

|

|

|

|

|

|

|

Additionally, BH also acts as a paymaster for the properties and is reimbursed at cost for various operating expenses it pays on behalf of the properties.

Termination. A management agreementManagement Agreement will terminate automatically in the event that the entity that owns the property is sold or if all or substantially all of the property to which the agreement applies is otherwise disposed of. Additionally, a management agreementManagement Agreement may be terminated if certain other events occur, including:

| • a default by BH or the entity that owns the property that is not cured prior to the expiration of any applicable cure periods; • upon written notice by either party if a petition for bankruptcy, reorganization or arrangement is filed by the other party, or if any such petition shall be filed against the other party and is not dismissed within 60 days of the date of such filing, or in the event the other party shall make an assignment for the benefit of creditors, or take advantage of any insolvency statute or similar law; • upon 15 days written notice in the event that all or substantially all of the property is destroyed by a casualty, or taken by means of eminent domain or condemnation; or • upon 60 days written notice by either party.

|

|

|

|

|

|

|

|

If a management agreementManagement Agreement is terminated by the entity that owns the property for any reason, or if it is terminated by BH due to our default or due to the destruction, condemnation or taking by eminent domain of a property, the entity that owns the property will be required to pay damages to BH. Such damages will be equal to the management fee earned by BH for the calendar month immediately

14

preceding the month in which the notice of termination is given, multiplied by the number of months and/or portions thereof remaining from the termination date until the end of the initial term or term year in which the termination occurred.

Additionally, for the month or the partial month after the date of the termination of BH’s on-site property management responsibilities, BH will be paid a close-out management fee equivalent to 50% of the last month’s full management fee.

Insurance. The entities that own the properties are required to maintain property and liability insurance for each property, and its liability insurance policy must include BH as an “Additional Insured.” BH is required to maintain, at the entities’ expense, workers’ compensation insurance covering all employees of BH employed in, on, or about each property so as to provide statutory benefits required by state and federal laws.

Assignment. BH may not assign the management agreementsManagement Agreements without the prior written consent of the entities that own the properties.

Indemnification. The entities that own the properties are required to indemnify, defend and hold harmless BH and its agents and employees from and against all claims, liabilities, losses, damages, and/or expenses arising out of (1) BH’s performance under the management agreements,Management Agreements, or (2) facts, occurrences, or matters first arising before the date of the management agreements.Management Agreements. The entities that own the properties are not required to indemnify BH against damages or expenses suffered as a result of the gross negligence, willful misconduct, or fraud on the part of BH, its agents, or employees.

BH is required to indemnify, defend, and hold harmless the entities that own the properties and their agents and employees from and against all claims, liabilities, losses, damages, and/or expenses arising out of the gross negligence, willful misconduct, or fraud on the part of BH, its agents, or employees, and shall at its own cost and expense defend any action or proceeding against us arising therefrom.

Regulation

Multifamily properties are subject to various laws, ordinances and regulations, including regulations relating to common areas, such as swimming pools, activity centers, and recreational facilities. We believe that each of our properties has the necessary permits and approvals to operate its business.

Americans with Disabilities Act

The properties in our Portfolioportfolio must comply with Title III of the Americans with Disability Act of 1990 (the “ADA”), to the extent that such properties are “public accommodations” as defined by the ADA. The ADA may require removal of structural barriers to access by persons with disabilities in certain public areas of our properties where such removal is readily achievable. We believe that our properties are in substantial compliance with the ADA and that we will not be required to make substantial capital expenditures to address the requirements of the ADA. However, noncompliance with the ADA could result in imposition of fines or an award of damages to private litigants. The obligation to make readily accessible accommodations is an ongoing one, and we will continue to assess our properties and make alterations as appropriate in this respect.

Fair Housing Act

The Fair Housing Act (the “FHA”), its state law counterparts and the regulations promulgated by the U.S. Department of Housing and Urban Development and various state agencies, prohibit discrimination in housing on the basis of race or color, national origin, religion, sex, familial status (including children under the age of 18 living with parents or legal custodians, pregnant women and people securing custody of children under 18) or handicap (disability) and, in some states, financial capability or other bases. A failure to comply with these laws in our operations could result in litigation, fines, penalties or other adverse claims, or could result in limitations or restrictions on our ability to operate, any of which could materially and adversely affect us. We believe that we operate our properties in substantial compliance with the FHA.

Environmental Matters

Under various federal, state and local laws and regulations relating to the environment, as a current or former owner or operator of real property, we may be liable for costs and damages resulting from the presence or discharge of hazardous or toxic substances, waste or petroleum products at, on, in, under, or migrating from such property, including costs to investigate and clean up such contamination and liability for natural resources. Such laws often impose liability without regard to whether the owner or operator knew of, or was responsible for, the presence of such contamination, and the liability may be joint and several. These liabilities could be substantial and the cost of any required remediation, removal, fines, or other costs could exceed the value of the property and/or our aggregate assets. In addition, the presence of contamination or the failure to remediate contamination at our properties may expose us to third-party liability for costs of remediation and/or personal or property damage or materially adversely affect our ability to sell, lease

15

or develop our properties or to borrow using the properties as collateral. In addition, environmental laws may create liens on contaminated sites in favor of the government for damages and costs it incurs to address such contamination. Moreover, if contamination is discovered on our properties, environmental laws may impose restrictions on the manner in which property may be used or businesses may be operated, and these restrictions may require substantial expenditures.

Independent environmental consultants have conducted Phase I Environmental Site Assessments at all of the properties in our Portfolioportfolio using the American Society for Testing and Materials Standard E 1527-05. A Phase I Environmental Site Assessment is a report that identifies potential or existing environmental contamination liabilities. Site assessments are intended to discover and evaluate information regarding the environmental condition of the assessed property and surrounding properties. These assessments do not generally include soil samplings, subsurface investigations or an asbestos survey. None of the site assessments identified any known past or present contamination that we believe would have a material adverse effect on our business, assets or operations. However, the assessments are limited in scope and may have failed to identify all environmental conditions or concerns. A prior owner or operator of a property or historic operations at our properties, or operations and conditions at nearby properties, may have created a material environmental condition that is not known to us or the independent consultants preparing the site assessments. Material environmental conditions may have arisen after the review was completed or may arise in the future, and future laws, ordinances or regulations may impose material additional environmental liability. Moreover, conditions identified in environmental assessments that did not appear material at that time, may in the future result in material liability.

Environmental laws also govern the presence, maintenance and removal of hazardous materials in building materials (e.g., asbestos and lead), and may impose fines and penalties for failure to comply with these requirements or expose us to third-party liability (e.g., liability for personal injury associated with exposure to asbestos). Such laws require that owners or operators of buildings containing hazardous materials properly manage and maintain certain hazardous materials, adequately notify or train those who may come into contact with certain hazardous materials, and undertake special precautions, including removal or other abatement, if certain hazardous materials would be disturbed during renovation or demolition of a building. In addition, the properties in our Portfolioportfolio are subject to various federal, state, and local environmental and health and safety requirements, such as state and local fire requirements.

When excessive moisture accumulates in buildings or on building materials, mold growth may occur, particularly if the moisture problem remains undiscovered or is not addressed over a period of time. Some molds may produce airborne toxins or irritants. Indoor air quality issues can also stem from inadequate ventilation, chemical contamination from indoor or outdoor sources, and other biological contaminants such as pollen, viruses and bacteria. Indoor exposure to airborne toxins or irritants above certain levels can be alleged to cause a variety of adverse health effects and symptoms, including allergic or other reactions. As a result, the presence of significant mold or other airborne contaminants at any of our properties could require us to undertake a costly remediation program to contain or remove the mold or other airborne contaminants from the affected property or increase indoor ventilation. In addition, the presence of significant mold or other airborne contaminants could expose us to liability from our tenants or others if property damage or personal injury occurs. We are not presently aware of any material adverse indoor air quality issues at our properties.

We believe that there are no compliance issues with laws and regulations that have been enacted or adopted regulating the discharge of materials into the environment, or otherwise relating to the protection of the environment, that have adversely affected, or are reasonably expected to adversely affect, our business, financial condition and results of operations, and we do not currently anticipate material capital expenditures arising from environmental regulation. We believe that climate change could present risks to our business. Some of the potential impacts of climate change to our business include increased operating costs due to additional regulatory requirements and the risk of disruptions to our business. We do not believe these risks are material to our business at this time. Our currently anticipated capital expenditures for environmental control facility matters are not material.

The cost of future environmental compliance may materially and adversely affect us. See “Risk Factors—We may face high costs associated with the investigation or remediation of environmental contamination, including asbestos, lead-based paint, chemical vapor, subsurface contamination and mold growth.”

Insurance

We carry comprehensive general liability coverage on the properties in our Portfolio,portfolio, with limits of liability customary within the industry to insure against liability claims and related defense costs. Similarly, we are insured against the risk of direct physical damage in amounts necessary to reimburse us on a replacement-cost basis for costs incurred to repair or rebuild each property, including loss of rental income during the reconstruction period. The majority of our property policies for all U.S. operating and development communities include coverage for the perils of flood, tornado and earthquake shock with limits and deductibles customary in the industry and specific to the project. We will also obtain title insurance policies when acquiring new properties, which insure fee title to the properties in our Portfolio.portfolio. We have obtained coverage for losses incurred in connection with both domestic and foreign terrorist-related activities. These policies include limits and terms we consider commercially reasonable. There are certain losses (including, but not

16

limited to, losses arising from environmental conditions, acts of war or certain kinds of terrorist attacks) that are not insured, in full or in part, because they are either uninsurable or the cost of insurance makes it, in our belief, economically impractical to maintain such coverage. Should an uninsured loss arise against us, we would be required to use our own funds to resolve the issue, including litigation costs. In addition, for the properties in our Portfolio,portfolio, we could self-insure certain portions of our insurance program and therefore, use our own funds to satisfy those limits. We believe the policy specifications and insured limits are adequate given the relative risk of loss, the cost of the coverage and industry practice. In the opinion of our management team, the properties in our Portfolioportfolio are adequately insured.

Competition

In attracting and retaining residents to occupy the properties in our Portfolio,portfolio, we compete with numerous other housing alternatives. The properties in our Portfolioportfolio compete directly with other rental apartments as well as condominiums and single-family homes that are available for rent or purchase in the sub-markets in which our properties are located. Principal factors of competition include rent or price charged, attractiveness of the location and property and quality and breadth of services and amenities. If our competitors offer leases at rental rates below current market rates, or below the rental rates that the tenants of the properties in our Portfolioportfolio pay, we may lose potential tenants and we may be pressured to reduce rental rates below those currently charged or to offer more substantial rent abatements, tenant improvements, early termination rights or below-market renewal options in order to retain tenants when the tenants’ leases expire.

The number of competitive properties relative to demand in a particular area has a material effect on our ability to lease apartment units at our properties and on the rents we charge. In addition, we compete with numerous other investors for suitable properties. This competition affects our ability to acquire properties and the price that we pay in such acquisitions.

Human Capital Disclosure

As of December 31, 2021,2023, we had three employees. We endeavor to maintain workplaces that are free from discrimination or harassment on the basis of color, race, sex, national origin, ethnicity, religion, age, disability, sexual orientation, gender identification or expression or any other status protected by applicable law. The basis for recruitment, hiring, development, training, compensation and advancement is a person’s qualifications, performance, skills and experience. Our employees are fairly compensated, without regard to gender, race and ethnicity, and routinely recognized for outstanding performance.

Our Adviser conducts substantially all of our operations and provides asset management for our real estate investments. We expect we will only have accounting employees while the Advisory Agreement is in effect.

Corporate Information

Our Adviser’s offices are located at 300 Crescent Court, Suite 700, Dallas, Texas 75201. Our Adviser’s telephone number is (214) 276-6300. We maintain a website at nxrt.nexpoint.com. We make our annual reportAnnual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act available on our website as soon as reasonably practicable after we file such material with, or furnish it to, the SEC. Information contained on, or accessible through our website, is not incorporated by reference into and does not constitute a part of this annual reportAnnual Report or any other report or documents we file with or furnish to the SEC.Securities and Exchange Commission ("SEC"). These documents may also be found on the SEC’s website at www.sec.gov.

Item 1A. Risk Factors

You should carefully consider the following risks and other information in this annual reportAnnual Report in evaluating us and our capital stock. Any of the following risks, as well as additional risks and uncertainties not currently known to us or that we currently deem immaterial, could materially and adversely affect our business, financial condition or results of operations, and could, in turn, impact the trading price of our capital stock.

Summary Risk Factors

The following is a summary of some of the risks and uncertainties that could materially adversely affect our business, financial condition and results of operations. You should read this summary together with the more detailed description of each risk factor contained below.