96666666

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

Form 10-K

(Mark One)

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31 2021, 2023

or

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 000-52024

ALPHATEC HOLDINGS, INC.

(Exact Name of Registrant as Specified in its Charter)

| | |

Delaware |

| 20-2463898 |

(State or Other Jurisdiction of Incorporation or Organization) |

| (I.R.S. Employer Identification No.) |

|

|

|

1950 Camino Vida Roble, Carlsbad, California |

| 92008 |

(Address of Principal Executive Offices) |

| (Zip Code) |

(760) (760) 431-9286

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | |

Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

Common Stock, par value $0.0001 per share | ATEC | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes☒ No ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☐No☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§(§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | |

Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☒☐

|

| | Emerging growth company | ☐ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes Oxley Act (15 U.S.C. 7262 (b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☒

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by a check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant (without admitting that any person whose shares are not included in such calculation is an affiliate) computed by reference to the price at which the common stock was last sold as of the last business day of the registrant's most recently completed second fiscal quarter (June 30, 2021)2023), was approximately $1.0$1.6 billion.

The number of outstanding shares of the registrant’s common stock, par value $0.0001 per share, as of February 24, 202219, 2024 was 99,786,612.137,979,126.

DOCUMENTS INCORPORATED BY REFERENCE

The following documents (or parts thereof) are incorporated by reference into the following parts of this Form 10-K: Certain information required in Part III of this Annual Report on Form 10-K is incorporated from the Registrant’s Proxy Statement for the 20222024 Annual Meeting of Stockholders.

| | | | | |

Auditor Firm Id: | 34 | Auditor Name: | Deloitte & Touche LLPLLP | Auditor Location: | New York, New York, United States |

ALPHATEC HOLDINGS, INC.

FORM 10-K—ANNUAL REPORT

For the Fiscal Year Ended December 31, 20212023

Table of Contents

In this Annual Report on Form 10-K, the terms “we,” “us,” “our,” "ATEC," “Alphatec Holdings” and “Alphatec” mean Alphatec Holdings, Inc., our subsidiaries and their subsidiaries. “Alphatec Spine” refers to our wholly-owned operating subsidiary Alphatec Spine, Inc. “SafeOp” refers to our wholly owned operating subsidiary SafeOp Surgical, Inc. “EOS” refers to our wholly owned operating subsidiary EOS imaging S.A.S.A.S.

PART I

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and, in particular, the description of our "Business" set forth in Item 1, the "Risk Factors" set forth in this Item 1A and our "Management’s Discussion and Analysis of Financial Condition and Results of Operations" set forth in Item 7 contain or incorporate a number of forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended or the Securities Act,(the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended or the Exchange Act,(the "Exchange Act"), including statements regarding:

| • our estimates regarding anticipated operating losses, future revenue, expenses, capital requirements, uses and sources of cash and liquidity, including our anticipated revenue growth and cost savings; •our ability to achieve profitability, and the potential need to raise additional funding; •our ability to ensure that we have effective disclosure controls and procedures; •our ability to meet, and potential liability from not meeting, any outstanding commitments and contractual obligations; •our ability to maintain compliance with the quality requirements of the United States ("U.S.") Food and Drug Administration ("FDA") and similar foreign regulatory requirements; •our ability to market, improve, grow, commercialize and achieve market acceptance of any of our products or any product candidates that we are developing or may develop in the future; •our ability to continue to enhance our product offerings, and to commercialize and achieve market acceptance of any of our products or product candidates; •the effect of any existing or future federal, state or international regulations on our ability to effectively conduct our business; •our business strategy and our underlying assumptions about market data, demographic trends, reimbursement trends and pricing trends; •our ability to maintain an adequate global sales network for our products, including to attract and retain independent sales agents and direct sales representatives; •our ability to increase the use and promotion of our products by training and educating spine surgeons and our global sales network; •our ability to attract and retain a qualified management team, as well as other qualified personnel and advisors; •our ability to enter into licensing and business combination agreements with third parties and to successfully integrate the acquired technology and/or businesses; •our ability to successfully incorporate Valence into our business; •the impact of global economic and political conditions and public health crises on our business and industry; and •other factors discussed elsewhere in this Annual Report on Form 10-K or any document incorporated by reference herein or therein. •

| our estimates regarding anticipated operating losses, future revenue, expenses, capital requirements, uses and sources of cash and liquidity, including our anticipated revenue growth and cost savings;

|

| •

| our ability to ensure that we have effective disclosure controls and procedures;

|

| •

| our ability to meet, and potential liability from not meeting, the payment obligations under the Orthotec settlement agreement;

|

| •

| our ability to maintain compliance with the quality requirements of the FDA;

|

| •

| our ability to market, improve, grow, commercialize and achieve market acceptance of any of our products or any product candidates that we are developing or may develop in the future;

|

| •

| our beliefs about the features, strengths and benefits of our products;

|

| •

| our ability to continue to enhance our product offerings, outsource our manufacturing operations and expand the commercialization of our products, and the effect of our strategy;

|

| •

| our ability to successfully integrate, and realize benefits from licenses and acquisitions;

|

| •

| the effect of any existing or future federal, state or international regulations on our ability to effectively conduct our business;

|

| •

| our estimates of market sizes and anticipated uses of our products;

|

| •

| our business strategy and our underlying assumptions about market data, demographic trends, reimbursement trends and pricing trends;

|

| •

| our ability to achieve profitability, and the potential need to raise additional funding;

|

| •

| our ability to maintain an adequate sales network for our products, including to attract and retain independent distributors;

|

| •

| our ability to enhance our U.S. distribution network;

|

| •

| our ability to increase the use and promotion of our products by training and educating spine surgeons and our sales network;

|

| •

| our ability to attract and retain a qualified management team, as well as other qualified personnel and advisors;

|

| •

| our ability to enter into licensing and business combination agreements with third parties and to successfully integrate the acquired technology and/or businesses;

|

| •

| other factors discussed elsewhere in this Annual Report on Form 10-K or any document incorporated by reference herein or therein.

|

Any or all of our forward-looking statements in this Annual Report may turn out to be wrong. They can be affected by inaccurate assumptions by known or unknown risks and uncertainties. Many factors mentioned in our discussion in this Annual Report on Form 10-K will be important in determining future results. Consequently, no forward-looking statement can be guaranteed. Actual future results may vary materially from expected results.

We also provide a cautionary discussion of risks and uncertainties under “Risk Factors” in Item 1A of this Annual Report. These are factors that we think could cause our actual results to differ materially from expected results. Other factors besides those listed there could also adversely affect us.

Without limiting the foregoing, the words “believe,” “anticipate,” “plan,” “expect,” “may,” “could,” “would,” “seek,” “intend,” and similar expressions are intended to identify forward-looking statements. There are a number of factors and uncertainties that could cause actual events or results to differ materially from those indicated by such forward-looking statements, many of which are beyond our control, including the factors set forth under “Item 1A Risk Factors.” In addition, the forward-looking statements contained herein represent our estimate only as of the date of this filing and should not be relied upon as representing our estimate as of any subsequent date. While we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so to reflect actual results, changes in assumptions or changes in other factors affecting such forward-looking statements, except as required by applicable law.

Item 1.B Businessusiness

We are a medical technology company, headquartered in Carlsbad, California, focused on the design, development, and advancement of technology for better surgical treatment of spinalspine disorders. ThroughBy applying our wholly owned subsidiaries, Alphatec Spine, Inc., SafeOp Surgical, Inc.unique, 100% spine focus and EOS imaging S.A., our mission isdeep, collective industry know-how, we aim to revolutionize the approach to spine surgery through clinical distinction. We are focused on developing new The sophisticated approaches that we create from the ground up integrate seamlessly with our expanding Alpha InformatiX™ ("AIX") product platform to betterobjectively inform surgery and to achieve the goalgoals of spine surgery more safelypredictably and more reproducibly. We have a broadcomprehensive product portfolio designed to address the spine’s various pathologies. Ourpathologies, and are perpetually innovating to accomplish our ultimate vision, which is to be the standard bearer in spine.

In 2018, we embarked on a business transformation, replacing 100% of the executive team, 90% of our Board of Directors, and over 65% of the remaining team with spine-experienced professionals. Efforts that year founded our Organic Innovation Machine™, our in-house product design, development and testing capabilities aimed at the creation of clinical distinction, and furthered the strategic transition of our sales force to a more dedicated and clinically astute team. Since 2018, we believe that we have achieved the highest organic U.S. growth of any public spine company in every quarter by capitalizing on the collective spine experience that we have amassed and by investing in research and development to continually bring to market differentiated products and procedures designed to better meet the requirements of spine surgery.

Revenue from products and servicesTotal revenue was $242.3$482.3 million for the year ended December 31, 2021,2023, representing an increase of $101.2$131.4 million, or 72%37% compared to $141.1$350.9 million for the year ended December 31, 2020.2022. We believe our future success will continue to be fueled by the introduction and tractionincreasing adoption of the distinct productsnew and proceduresexisting integrated technologies that we have developed anddistinguish our approach-specific procedures. We feel that we areATEC is well-positioned to continue to capitalize on current spine market dynamics.

Recent DevelopmentsBackground

0.75% Senior Convertible Notes due 2026The year 2018 marked the beginning of a business transformation that replaced 100% of our executive team, 92% of our Board of Directors, and 96% of the remaining team with experienced professionals, infusing industry-leading spine know-how throughout our organization. Efforts that year founded the ATEC Organic Innovation Machine™, in-house product design, development and testing capabilities that harnessed the team’s collective spine expertise to create clinical distinction.

In AugustFrom 2019 through 2021, we issued $316.3 million principal amountfocused on building a foundation capable of unsecured senior convertible notes withsupporting the organization as we scale. We invested in new headquarters to substantially increase surgeon and sales training capacity and opened a stated interest rate of 0.75% (the “2026 Notes”). Interest on the 2026 Notes is payable semi-annuallydistribution facility in arrears on February 1Memphis, Tennessee, to ensure predictable and August 1 of each year, beginning on February 1, 2022. The 2026 Notes are convertible into sharesexpedient surgical support as our footprint expands. We developed and released several key elements of our common stock based upon an initial conversion rateapproach-based portfolio, including a comprehensive posterior fixation system and approach-specific IdentiTi™ porous titanium implants. We also acquired and integrated SafeOp™, technology that integrates uniquely with our approaches to provide information about both the location and the health of 54.5316 shares of our common stock per $1,000 principal amount of 2026 Notes (equivalent to an initial conversion price of approximately $18.34 per share). The initial conversion pricenerves intra-operatively. SafeOp became the informational foundation of the 2026 Notes represents a premiumProne TransPsoas (“PTP”) approach, which we developed and launched in 2020 to advance first-generation lateral spine surgery. We also acquired EOS®, technology that enables full-body, calibrated, 3D images that integrate throughout the span of approximately 100% overpatient spine care to influence procedure planning and improve and quantify the closing priceunderstanding of global alignment. As we execute our common stock on August 5, 2021, the date the 2026 Notes offering was priced. The net proceeds from the sale of the 2026 Notes were approximately $306.2 million after deducting the offering expenses. The 2026 Notesvision for EOS, we believe it will mature on August 1, 2026, unless earlier converted, redeemed, or repurchased.set new standards for spine care.

From 2022 to 2023, the momentum of PTP™ was robust, as both lateral-experienced and surgeons new to lateral surgery adopted the approach. We applied learnings from PTP to develop and introduce the Lateral TransPsoas ("LTP") and Midline ALIF approaches. Like PTP, the approaches were built from the ground up and integrated with SafeOp, and are designed to enable single-position surgery for the most commonly treated levels in spine. We believe that our lateral franchise boasts unparalleled optionality, the capacity to address the clinical requirements for every pathology and surgeon preference regardless of patient position. The lateral sophistication that we have created is earning surgeons’ confidence and loyalty, and that is fueling portfolio-wide utilization of even our most conventional procedures.

The application of our team’s deep spine know-how, coupled with a willingness to invest holistically in each of the technologies integrated into all of ATEC’s procedural approaches continues to increasingly compel surgeons and sales talent to partner with us. That adoption-driven validation has been the source of industry-leading market share expansion, which has delivered an approximately 40% revenue compound annual growth rate since our transformation commenced in 2018.

Recent Developments

Public Offering

On October 27, 2023, we completed an underwritten public offering (the “Public Offering”) of 14,300,000 shares of our common stock at a price of $10.50 per share. In connection with the Public Offering, we granted the underwriters a 30-day option (the "Green-Shoe") to purchase additional shares of common stock in the offering at the public offering price, less underwriting discounts and commissions. The net proceeds from the Public Offering and Green-Shoe, were approximately $145.8 million, including the underwriting discounts and commissions and offering expenses paid by us. We used $39.9 million ofexpect to use the net proceeds from the 2026 Notes offeringPublic Offering to enterfund general corporate purposes, including working capital, capital expenditures, acquisitions, or research and development.

Asset Purchase Agreement

On April 19, 2023, we entered into separate capped call instrumentsan Asset Purchase Agreement with Integrity Implants Inc. and Fusion Robotics, LLC (collectively, the “Sellers”), whereby we acquired certain financial institutions (the “Capped Call Transactions”). The Capped Call Transactions are generally expected to reduce potential dilution to our common stock beyond the conversion price upassets, liabilities, employees, and contracts related to the capped price on any conversionSellers’ navigation-enabled robotics platform ("Valence"). We paid the Sellers cash consideration of $55.0 million for the 2026 Notes and/or offset any paymentspurchase of Valence.

Underwritten Offering

On April 19, 2023, we make in excesscompleted a registered securities offering (the “Offering”) of the principal amount upon conversion.

In addition, we repurchased 1,806,3584,285,715 shares of our common stock forat a price of $14.00 per share. The net proceeds from the Offering were approximately $25.0$57.5 million, concurrently withincluding the issuance of the 2026 Notes.underwriting discounts and commissions and offering expenses paid by us. We also used approximately $53.4 milliona portion of the net proceeds of the offering to repay all obligations under our secured term loan with Squadron Medical Finance Solutions, LLC (the “Term Loan”) and our inventory finance agreement with an inventory supplier (the “Inventory Financing Agreement”).fund the purchase of Valence. We intendexpect to use the remainder ofremaining proceeds to fund the net proceeds fromcosts related to the 2026 Notes forpost-closing integration and research and development activities related to Valence, as well as to fund general corporate purposes.purposes, including working capital, capital expenditures, acquisitions, or research and development.

Term Loan

AcquisitionOn January 6, 2023, we entered into a $150.0 million term loan credit facility with Braidwell Transaction Holdings, LLC (the “Braidwell Term Loan”). The Braidwell Term Loan provided for an initial term loan of EOS

$100.0 million which was funded on the closing date. On May 13, 2021,September 28, 2023, we acquireddrew the additional $50.0 million (the “delayed draw term loan(s)” or the “DDTL”). The Braidwell Term Loan matures on January 6, 2028. Borrowings under the Braidwell Term Loan bear interest at a controlling interest in EOS imaging S.A. (“EOS”), pursuantrate per annum equal to the Tender Offer Agreement (the “Tender Offer Agreement”Term Secured Overnight Financing Rate for such SOFR business day ("SOFR") we entered on December 16, 2020, and in June 2021, we purchased the remaining issued and outstanding ordinary shares forsubject to a 100% interest in EOS. 3% floor, plus 5.75%.EOS, which now operates as our wholly owned subsidiary,

is a global medical device company that designs, develops and markets innovative, low-dose 2D/3D full-body scans for biplanar weight-bearing imaging, rapid 3D modeling

Strategy

Since the beginning of the COVID-19 pandemic, we have seen volatility in sales trends as the elective surgeries that employ our products and services have been impacted to varying degrees.

We continue to monitor the impact of the COVID-19 pandemic on our business and recognize it may continue to negatively impact our business and results of operations during 2022 and beyond. Given the present uncertainty surrounding the pandemic, we expect continued volatility through at least the remaining duration of the pandemic as the impact on individual markets and responses to conditions by international, state and local governments varies.

Strategy

Our vision is to be the standard bearer in spine. By leveraging our team’s extensive spine experience to createcreating clinically distinct solutions that improve surgical outcomes, we believe that we are positioned to take a greatercontinue to earn share of the U.S. spine market, becoming the partner of choice for spine surgeons, hospitals, healthcare systems, and payors.

To achieve our vision and buildunlock long-term value, we have, and will continue to prioritize the following vitalthree key strategic initiatives:

1. Create Clinical Distinction

Clinical distinction is paramount to our value creation strategy. We are committed to continuing to invest in the development, launch, and promotion of approaches and technologies intended to improverevolutionize spine surgery. We have developed, and continue to seek to develop, next-generation surgical approaches that advance spine care with seamlessly integrated access systems, implants, positioners, biologics and enabling technologies, that integrate seamlessly andeach specifically designed to beget objective decision-making and to more successfully address the core spine pathologies, regardless of surgical approach.

pathologies.1 | Yeh, Kuang-Ting MD, PhD; Lee, Ru-Ping RN, PhD; Chen, Ing-Ho MD; Yu, Tzai-Chiu MD; Liu, Kuan-Lin MD, PhD; Peng, Cheng-Huan MD, Wang, Jen-Hung MD; Wu, Wen-Tien MD, PhD. October 2018. Correlation of Functional Outcomes and Sagittal Alignment After Long Instrumented Fusion for Degenerative Thoracolumbar Spinal Disease. Spine: Volume 43, Issue 19.

|

3

Table of Contents

We continue to make investments to advance the clinical distinction of our product portfolio and accelerate revenue growth. During the year ended December 31, 2021,2023, we continued to champion adoption of our lateral franchise, including both PTP and LTP, and launched Calibrate LTX™, a totallateral expandable interbody implant system. We also continued to foster development of 10 new productsAlpha InformatiX, a workflow-integrated informatic ecosystem being designed to automatically and proceduresobjectively inform spine patient care before, during and beganafter surgery. A foundation of that ecosystem, the EOS imaging system, drove revenue growth of over 20%, while significant progress was made on initiatives intended to materially advance the system’s capabilities. We also acquired a robotic-enabled navigation system, branded "Valence", which is currently being developed to integrate EOS imaging technology into our Alpha InformatiX product platform. Our comprehensive portfolio now offers over 80 products across various product categories, of which roughly 40 were launched between July 2018 and December 2021.lateral procedural workflow.

With the expansion and increasing capabilities of our product portfolio, we continue to drive year-over-year increasesgrowth in revenue contributions from new products, increases inthe number of product categories used per surgery, surgical volume, and average revenue per surgery, and revenue per surgeon. For the year ended December 31, 2021, the percentage of revenue contribution from new products was 82%, compared to 67% in the prior year.surgery. Aggregate product categories used per surgery expanded to 2.02.4 for the full-year 2021,2023, compared to 1.82.2 in the prior year. For the full year 2023, surgical volume grew 31% and average revenue per surgery expanded 7% compared to 2022.

Looking to 20222024 and beyond, we intend to continue to be a pioneer of industry innovation.spine innovation that improves surgical outcomes. As such, we expect continued growth will continue to be driven by new technologies that improve the reproducibility and predictability of surgery, expanding surgeon adoption of our procedures and increasingin the number of our products sold into each surgery, surgical volume and revenue per surgery.

2. Compel Surgeon Adoption

An integral part of our strategy is to compel surgeon adoption ofwith the innovative productsclinical distinction that we have, and will continue to introduce. A key component ofCentral to inspiring surgeon interest in our drive to inspire surgeon interestapproaches is the “ATEC Experience”. The ATEC Experience, is” an outcome-basedoutcomes-based educational program for visiting surgeons facilitated at our headquarters in Carlsbad, CA.California. The program provides an interactive learning environment tailored to surgeon needs through both a peer-to-peer and subject matter expert approach. We leverage our state-of-the-art, 7-station cadaveric lab to enable visiting surgeons to gain deep practical experience with our procedural solutions and educate participants on our role in shaping innovation.

The surgeon relationships we are creating through ourthat educational program continue to drivefuel strong growth, evidenced by the increase in surgeon participation in the program, as well as the continued growth of surgeon adoption.growth. Over 400500 new and existing surgeons participated in the ATEC Experience in 2021,2023, driving 27% growth in our surgeon user basebase. Over time, we cultivate the relationships created, partnering with each surgeon in 2021,an increasing number of surgeries and increasing average revenue per surgeonfostering training to inspire partnership in increasingly complex surgeries. We seek to gradually expand utilization and average revenue per surgery in 2021. Revenue attributable to new surgeon customers has continued to contribute meaningfully to revenue growth overall.position us well for sustained long-term growth.

Revitalize the Sales Channel3. Elevate Distribution

We market and sell our products through a strategic network of independent distributorssales agents and direct sales representatives.

Distributors. To deliver increasingly consistent, predictable growth, we have added, and intend to continue to add, clinically astute and exclusive independent sales agents and direct distributors to form a strategic U.S. sales network. Consolidation in the industry continues to facilitate the process as large, seasoned agents are seeking opportunities to partner with a spine-focused company at the forefront of innovation. The expansion and professionalization of our sales team is allowing usrepresentatives to reach untapped surgeons, hospitals, and national accounts across the U.S., as well asand better penetrate existing accounts and territories.

During 2021, We believe the percentage of U.S. revenue driven by strategic independent distributors increasedopportunity to 97% of our U.S. revenue, up from 92% in 2020. Revenue fromexpand our strategic sales channel grew by 59% in 2021, compared to 2020.

National Accounts. We employ a national accounts team thatnetwork is responsible for securing access at hospitals and group purchasing organizations (“GPOs”) acrossvast, with approximately one third of U.S. territories, including many of the U.S. We have been very successful securing access to hospitals and GPOs and a majority of our business is achieved through these accounts. We will continue to focus on developing and maintaining relationships with key GPOs and hospital networks to secure favorable contracts and develop strategies to convert' most significant spine markets, still under- or grow business within these existing accounts.completely unrepresented.

Sales Training and Education. We continually enhance our sales training and education programs for independent distributors and direct sales representatives to optimize sales productivity.

EOS Sales Team Integration.With our acquisition of EOS, in May 2021, we aligned EOS’ U.S.-based capital sales team with our regional sales teams and leadership. The EOS sales team will continue to focusfocuses on hospital administrators, now with the benefitbenefits of leads generated by our broadening sales team. team and enhanced service support.

In 2023, we continued to enhance the expertise within our Memphis distribution facility. With expedient, flexible access to nearby distribution centers, we believe the facility will foster centralized, predictable surgical support as we grow.

We are also in the nascent stages of building an international footprint. Beginning in 2022, we partnered with surgeons to treat our first patients in Australia and New Zealand. Looking forward, we intend to focus our international investments in economically attractive markets with strong surgeon influence and reasonable regulatory pathways where we believe we can build a direct sales team that mirrors the sophistication of our U.S. network.

Spine Anatomy

The spine is the core of the human skeleton, and providesproviding important structural support and alignment while remaining flexible to allow movement. The spine is aA column of 33 bones thatvertebrae, it protects the spinal cord and provides the main support for the body. Each bony segment of the spine is referred to as a vertebra (two or more are called vertebrae). The spine has five regions containing groups of similar bones, listed from top to bottom: seven cervical vertebrae in the neck, twelve thoracic vertebrae in the mid-back (each attached to a rib), five lumbar vertebrae in the lower back, five sacral vertebrae fused together to form one bone called the sacrum, which sits in the pelvis, and four coccygeal bones fused together that form the tailbone. At the front of each vertebra is a block of bone called the vertebral body. Vertebrae are stacked on top of each other and separated from each other through a cushioning intervertebral disc in the front, and bony joints in the back, which create the stability and mobility needed for sitting, standing, and walking. Strong muscles and bones, flexible tendons and ligaments, and sensitive nerves contribute to a healthy spine.

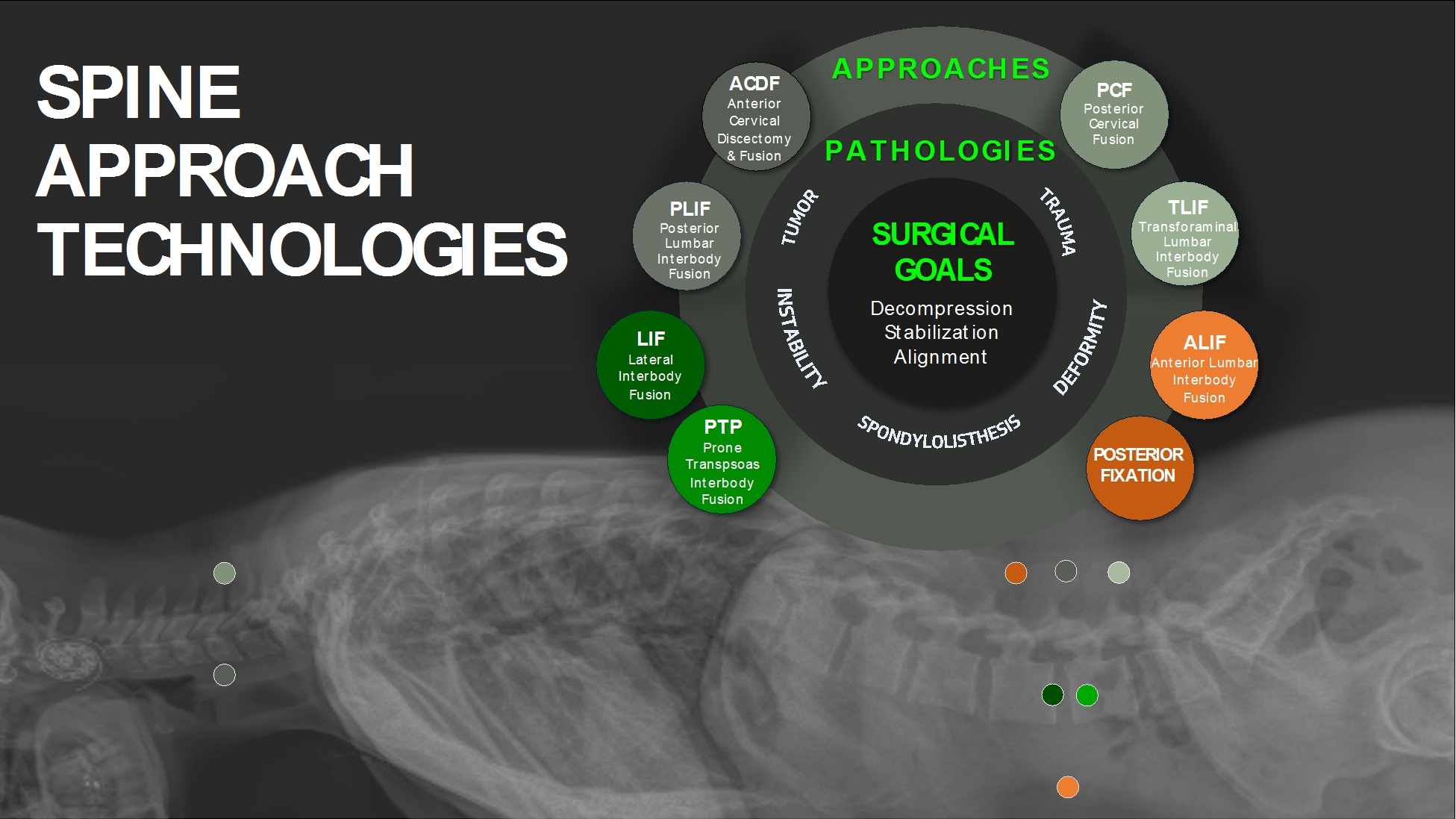

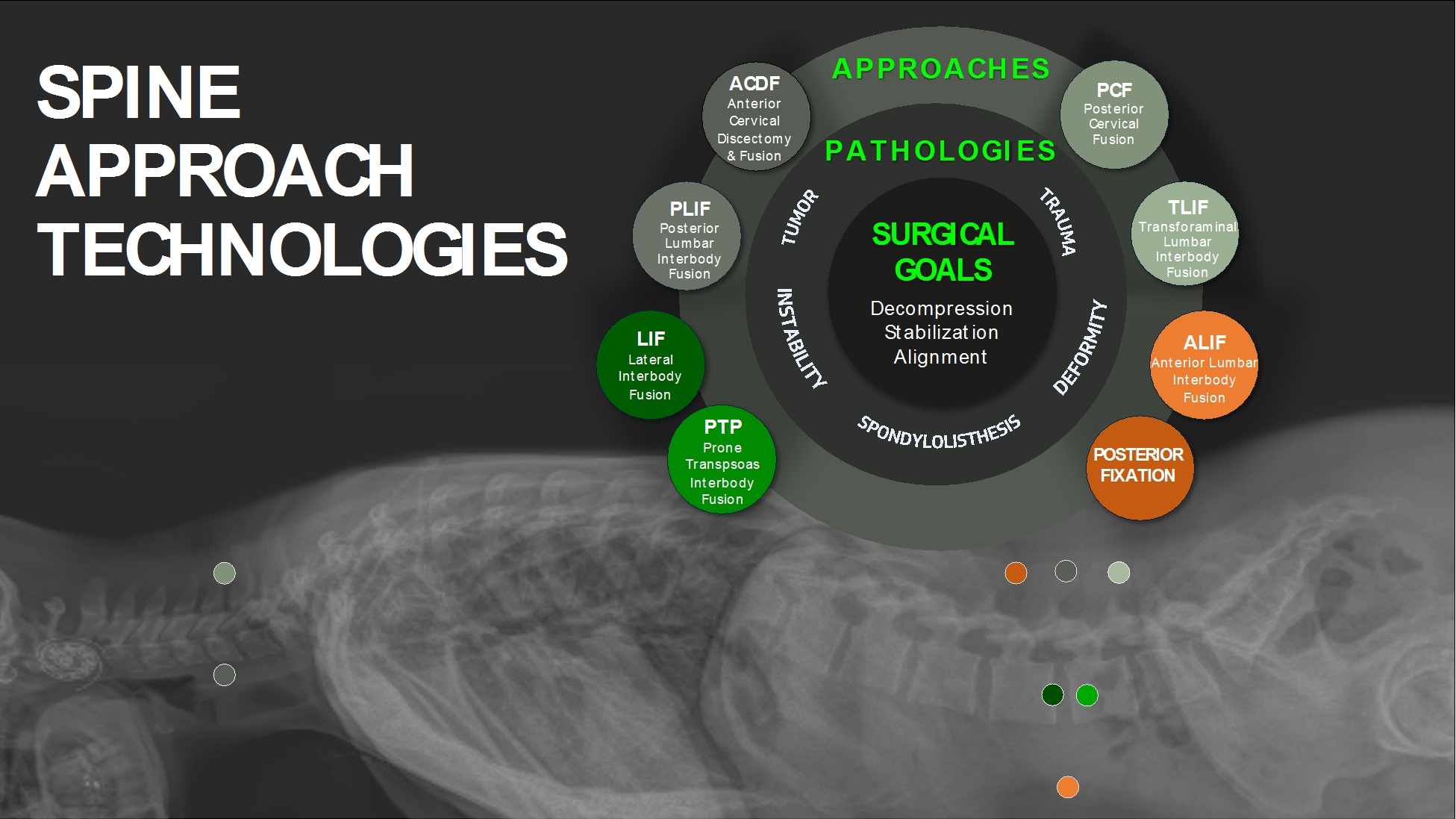

Pain can be caused when any of thesethe spine’s structures is affected by strain, injury, or disease.disease, and spine surgery seeks to alleviate that pain. While the spine has been surgically intervened upon for decades, research demonstrates that surgical outcomes in spine are generally inferior to surgical outcomes delivered by most other orthopedic specialties, particularly in terms of durability, predictability and reproducibility. ATEC’s procedural offerings are designed to treat the various spine pathologies by better achieving the three goals of surgery including: (1) decompression, (2) stabilization, and (3) alignment. We believe there is vast opportunity to create value by innovating to improve surgical outcomes in spine.

The Alphatec Solution

Our mission to improve outcomes by revolutionizing spine surgery affords a differentiated procedural investment thesis. Unlike most of our peers, we take a holistic approach to the approaches that we bring to market, investing not just in the highest dollar components of the approach, but in each of the technologies that integrate to enhance the clinical predictability and reproducibility of an approach. Our procedures seamlessly incorporate technology engendered by that thesis, including an expanding informatic ecosystem designed to automatically and objectively inform spine patient care before, during and after surgery, as well as approach-specific, ergonomic patient positioning and surgical access technology.

Our principal procedural offerings include a wide varietycomprehensive approaches designed and developed to specifically meet the requirements of Approach Technologies designed to achieve clinical success inthe various spine approaches that treat conditions ranging from degenerative disc disease to complex deformity and trauma. Our Approach TechnologiesDepending on the approach, our solutions may comprise intraoperativepre-, intra-, and post-operative information, and neuromonitoring technologies,positioners, access systems, interbody implants, fixation systems, and various biologics offerings; all designed to more reproducibly and predictably improve patient outcomes by achieving the three tenets of spine surgery: (1) decompression, (2) stabilization,outcomes.

Our flagship approach, PTP, was designed and (3) alignment.

We continue to execute on our communicated product strategy, leveraging investments made to provide the sales channel with a differentiated portfolio and to build a strong pipeline capable of launching 8-10 solutions each year going forward (10 released in 2021 and 11 in 2020). Integrated new surgical approaches such as PTP™, enabling technologies such as EOS imaging equipment and our SafeOp Neural InformatiX System™, and the continued advancement of innovations like IdentiTi™, a differentiated portfolio of titanium interbody cages, and InVictus®, a next-generation pedicle screw system capable of addressing the spine from occiput to ilium, continue to gain traction and are delivering on our goal of driving above-market revenue growth. While new products launched since new management took over in late 2017 accounted for less than 10% of total revenue in 2018, that percentage increased to 82% in 2021.

5

Table of Contents

Figure 1: Our portfolio of access systems, implants, technologies and biologics are designed to seamlessly integrate and enhance clinical outcomes across multiple pathologies, regardless of a surgeon’s preferred surgical approach.

The prone transpsoas (“PTP”) approach, was designed2020 by the team that created the first-generation lateral approach for spinal fusion to treat a wide rangedirectly address the known challenges that limited earlier adoption of patient pathologies. The technique has been designedthe technique. Engineered to leverage the benefits achieved by lateral spinal fusion procedures, such as reduced blood loss, shorter hospital stays, and quicker recovery times, while addressing the known challenges that have limited adoptionPTP safely treats a wide range of the technique2. patient pathologies.

Compared to a standard lateral procedure, the PTP approach positions the patient in a prone (face down) position, allowing simultaneous access to the spine laterally (from the side) and posteriorly (from the back), all while in a position that is more familiar surgical positionto surgeons and offering a more streamlined, more orthogonal approach. The PTP techniqueSingle-position lateral surgery in the prone position minimizes unnecessary patient repositioning, enhances time efficiencies, provides surgeons with increased optionality, and achieves spinal alignment objectives more reproducibly. To date, surgeons have performed over 2,500

The PTP procedures.approach is enabled through a combination of purposefully developed technologies that address the unique challenges of approaching the spine laterally while prone. One such challenge, and probably the greatest limit to earlier adoption of lateral approaches overall, is the need to safely and predictably navigate across the lumbar plexus, an essential collection of nerves, to access the lumbar spine during surgery. Key to our PTP approach is the integration of SafeOp Advanced Neuromonitoring, a proprietary technology that couples automated electromyographic (“EMG”) and somatosensory evoked potential (“SSEP”) monitoring. SafeOp technology, as a result, is designed to uniquely beget real-time, surgeon-directed intra-operative information about both the location and the health of the patient’s nerves, enhancing the predictability and reproducibility of lateral approach outcomes.

TheOur Technology

Alpha InformatiX

Designed to provide actionable information that controls clinical variables in spine care, our AIX™ product platform comprises our EOS imaging system and VEA™ alignment mobile application, our SafeOp Neural InformatiX System and Valence. While some AIX applications are commercially available, significant development is underway to integrate and interconnect these technologies and bring unprecedented functionalities to market in 2024 and beyond.

Our EOS imaging system is designed to provide unbiased, high-quality, and calibrated full-body imaging that enables a 3D model of patients’ skeletal systems and to provide valuable diagnostic and surgical planning capabilities. The integration of our approach-specific solutions into EOS’ 3D surgical planning platform is expected to better inform surgery and enhance the predictability of outcomes. Development is expected to allow surgeons to more effectively and efficiently assess patients’ full-body alignment, assess level-specific bone quality, establish surgical objectives, bend patient-specific rods pre-operatively, reconcile to surgical objectives intra-operatively, and determine whether surgical objectives were met post-operatively. Ultimately, we believe the standardized images uniquely made possible by EOS pre-, intra-, and post-operatively can be the foundation for predictive care in spine.

Our SafeOp Neural InformatiX System was the first advanced technology to launch from our AlphaInformatiXthe AIX product platform, uniquely deliversplatform. SafeOp is a patented technology that automates both EMG and SSEP monitoring. As a result, the system can provide surgeons with objective, real-time, objective, and actionable information about both nerve location and nerve health to surgeons.intra-operatively on a small, easy-to-use tablet platform. Integration of the information with our advanced access, implant, and implantfixation technologies equips surgeons with procedural solutions designed to enhance safety, efficiency, and reproducibility. The VEA mobile alignment application is designed to leverage EOS technology to more quickly quantify alignment parameters on a mobile device. Further development is aimed at enabling broad EOS image access for the integration of intraoperative solutions.

Valence was acquired in 2023. An intra-operative system developed by spine experts with deep navigation and robotics know-how, Valence integrates navigation and robotics into spine procedures utilizing either a 3D imaging scan or 2D fluoroscopic images of the patient. Utilizing a small, table-mounted navigation system, a robotic arm guides instrumentation and implants to a pre-determined destination during surgery. While we achieved regulatory clearance to place Invictus® screws through the system late in 2023, we are seeking to further develop and commercialize our vision for Valence, which we expect to integrate the navigation and robotics into our lateral procedures to improve surgical predictability, reduce radiation exposure, and enhance intra-operative precision.

Positioners

We have developed approach-specific patient positioning systems that integrate with our other access systems, providing for a more rigid construct and enhanced reproducibility. The PTP Patient Positioning System™, for example,was developed specifically for the PTP procedure as an adjunct to the Sigma™-PTP Access System. Designed to maximize the positional effects of having the patient in a prone position while streamlining operating room setup, PTP enables a single-position surgery. Key features include bi-lateral structural support to minimize patient movement, adjustable side paddle position to accommodate varying patient habitus, an integrated bed-rail system and compatibility with the Jackson frame. In addition, the system’s ultra-radiolucent carbon fiber frame is designed to help enhance fluoroscopic visibility and its coronal bending mechanism is designed to create reproducible access to L4-5 and upper lumbar regions.

Access Systems

We have differentiated surgical access instruments that are designed to maximize patient outcomes through enhanced visibility and rigidity, intuitive orthogonality, and approach-specific exposure. We offer several split-blade retractors which allow for direct, illuminated visualization and freedom of maneuverability within the operative corridor. Our retractors also provide for stable positioning by attaching directly to the surgical table. We also offer procedure-specific access systems, including our Sigma-ALIF Access System which allows for custom anterior abdominal exposure through freehand placement of dissecting blades and connection to a ringed frame. The Sigma-ALIF Access System provides an unobstructed working corridor with custom features to enable an ALIF approach in either supine or lateral decubitus.

Implants and Fixation Systems

Our portfolio of specialized spinal implants and fixation systems are designed to specifically meet the requirements of each approach. Available in varying shapes, sizes, and lordosis options, our spinal implants include implants made from allograft, PEEK, and porous titanium. We offer NanoTec™ surface modifications to our interbody systems to increase the surface area for cell adhesion and proliferation. Customization can be enhanced with our lordotic expandable intervertebral body fusion system, Calibrate™ PSX, which was released in 2022. We also offer several standalone implants designed to provide for height restoration and stabilization in one integrated solution.

Invictus is our next-generation comprehensive spinal fixation solution, designed to treat the range of pathologies, with intraoperative adaptability and surgical predictability through an open, minimally invasive, or hybrid approach. The sophistication of the InVictusInvictus Posterior Fixation System continues to be expanded, providing adaptable, predictable surgical treatment of a range of pathologies through open, MIS, or hybrid approaches.expand. The commercial release of InVictusInvictus OCT in early 2021 extended the system’s proficiencies to include the thoracicocciput and cervical spine, creating a single system capable of addressing the entire spine from occiput to ilium with familiar and consistent instrument design, simplified screw insertion, and intraoperative adaptability. The launch of InVictusInvictus OsseoScrew® later in 2021 advanced the system with the first and only expandable screw commercially available in the United States.U.S. OsseoScrew has been designed to optimize fixation and address fixation failure in compromised bone.

2

| Data on file: LIT-85034.

|

6

Table of Contents

Biologics

Current Product Portfolio

Figure 2: We are creating clinical distinction with our portfolio of procedurally integrated approach-based products and technologies.

Alpha InformatiX

The SafeOp Neural InformatiX Systemlaunched in November 2019 and is the first installment from our Alpha InformatiX product platform. Our Alpha InformatiX product platform is an advanced neuromonitoring solution, which is designed to reduce the risk of intraoperative nerve injury. The SafeOp Neural InformatiX System is our patented next-generation technology which automates somatosensory evoked potential (“SSEP”) monitoring and is designed to provide surgeons with objective, real-time feedback on an easy-to-use mobile platform, while providing increased intraoperative information that monitors nerve health during a surgical procedure.

Key features of the SafeOp Neural InformatiX System include:

| •

| Proprietary peripheral devices designed to integrate critical neural information into our approaches

|

| •

| Real-time triggered electromyography (“tEMG”) nerve detection designed to provide reliable information regarding the location, direction, and proximity of relevant neural anatomy, in posterior fixation and lateral approach spine procedures

|

| •

| Validated Response Thresholding (“VRT”) algorithm designed to deliver industry-leading tEMG nerve detection while reducing the incidence of false positive responses due to electrical noise

|

| •

| Novel SSEP technology leveraging advanced signal processing and unique waveform averaging to provide an unparalleled ability to monitor femoral nerve health throughout lateral approach procedures

|

| •

| Seamless integration of critical neural information into our InVictus posterior fixation instruments, like SingleStep™

|

7

Table of Contents

The EOS imaging portfolio provides unbiased, calibrated full-body imaging that enable a 3D model of patients’ skeletal systems and provide unprecedented diagnostic and surgical planning capabilities. The integration of ATEC’s approach-specific solutions into EOS’ 3D surgical planning platform is expected to better inform surgery and enhance the predictability of outcomes by allowing surgeons to more effectively assess patients’ full-body alignment, establish surgical objectives, and simulate surgery with optimized implants.

Key features of the EOS portfolio include:

| •

| Standing full-body assessment. Head-to-toe biplanar exams in the weight-bearing position for accurate assessment of factors causing pain and disability to better guide treatment and surgical decisions. Surgical planning from a standing position enables alignment parameters that more closely match functional posture

|

| •

| High image quality. EOSedge® is the first X-ray system with a high-resolution photon-counting detector that delivers outstanding-quality images, reinforcing diagnostic capabilities while addressing a broad range of imaging and orthopedic surgery challenges

|

| •

| Reduced radiation exposure. Driven by the ALADA (as low as diagnostically acceptable) principle, the EOS or EOSedge exam delivers a minimal dose of radiation to reduce the long-term impact of repeated imaging. With the introduction of the proprietary EOSedge Flex Dose™ feature, the dose automatically adjusts along the patient’s body habitus to further optimize the radiation as well as delivering homogeneous image quality by avoiding over/under exposure in the thinner/larger parts of the body

|

| •

| Precise 3D measurements. Patient-specific measurements, dimensions, and angles to make informed clinical decisions at all stages of care

|

| •

| EOSapps and EOSlink for surgical planning and operating room integration. Pre-operative planning software to anticipate surgical results and select components for spine surgery; pairs with surgical technologies for precise execution with EOSlink

|

Access Systems

The Sigma-TLIF Pedicle-based AccessSystem™ provides direct visualization of key anatomical landmarks to help create a reproducible transforaminal lumbar interbody fusion (“TLIF”) approach. Key features include:

| •

| Vertebral body distraction which facilitates access to a collapsed disc space

|

| •

| Integrated fiber-optic light source designed to improve illumination

|

| •

| Modular shank and blade help provide direct visualization of facet, pars, and lamina

|

| •

| Independent cranial and caudal retraction which enable customized exposure

|

| •

| Surgeon-guided medial blade to help support differing patient pathologies

|

| •

| Quick-connect engagement which provides for a more streamlined assembly

|

The Sigma PTP Access System™was developed specifically for the PTP procedure and is designed to maximize efficiency and help achieve alignment through increased rigidity, customizable exposure, and intuitive orthogonality. Key features include:

| •

| Singular titanium construct designed to maximize rigidity and reduce weight

|

| •

| Independent anterior and posterior retraction mechanisms designed to enable customized exposure

|

| •

| Intuitive fluoroscopic indicators that provide reinforced orthogonality

|

| •

| Low-profile rounded blade design to enhance fluoroscopic visibility to the disc space

|

| •

| Contoured blade tips help establish optimal psoas retraction

|

| •

| Integrated fiber-optic light source designed to provide improved illumination of the exposure site

|

8

Table of Contents

| •

| A quick-connect articulating arm post for more streamlined engagement

|

The PTP Patient Positioning System™was developed specifically for the PTP procedure as an adjunct to the Sigma-PTP Access System. Designed to maximize the positional effects of having the patient in a prone position while streamlining operating room setup and provide a fully integrated rigid construct, the system’s key features include:

| •

| Ultra-radiolucent carbon fiber frame to help enhance fluoroscopic visibility

|

| •

| Bi-lateral structural support to minimize patient movement

|

| •

| Adjustable side paddle position to accommodate varying patient habitus

|

| •

| Coronal bending mechanism to create reproducible access to L4-5 and upper lumbar regions

|

| •

| Integrated nylon straps to eliminate need for taping patient to the table

|

| •

| Integrated bed-rail system which enables fixation of the Sigma-PTP Access System to facilitate a singular rigid construct

|

| •

| Compatibility with Jackson frame to help simplify pre-operational setup

|

The Squadron® Lateral Retractoris designed to maximize patient outcomes during lateral-approach surgery with the patient in the lateral decubitus position. The retractor offers multiple features to accommodatehave a variety of surgical techniques, as well as more quickly establish access, leading to minimized retraction times. Key features include:

| •

| Robust construction that provides a stable corridor with the ability to replace blades in-situ

|

| •

| Independent cranial and caudal blade movement which enables more precise surgical aperture

|

| •

| Telescoping blades and a fourth blade articulation that allows surgeons to traverse challenging anatomy

|

| •

| LevelToe™ mechanics that provide a parallel toe up to 15° to reduce tissue creep

|

Fixation Systems

The InVictus Spinal Fixation Systems (Open and MIS), which were introduced in 2019, are comprehensive thoracolumbar fixation systems that arebiologics designed to treat a rangefacilitate the process of pathologies. Fully integrated with our SafeOp electromyography (“EMG technology”), InVictus assists surgeons with intraoperative adaptability and surgical efficiency through a variety of surgical approaches including open, minimally invasive (“MIS”) or hybrid approaches. Key system features include:

| •

| Helical Flange®: construct confidence provided by the InVictus thread form designed to reduce the potential to cross-thread and eliminate tulip splay

|

| •

| Adaptability to surgical needs with a variety of implants designed to accept multiple rod diameters and materials

|

| •

| Instrumentation designed to provide more predictable surgical outcomes in the most challenging or complex procedural scenarios

|

The InVictus MIS SingleStepSystem is an extension of the InVictus platform, which offers a simplified approach to traditional minimally invasive pedicle screw placement through utilization of an all-in-one driver which is designed to improve surgical efficiency without compromising accuracy. SingleStep eliminates guidewire management and targeting needles, while reducing instrument passes, procedural steps, screw insertion time, and reliance on fluoroscopy.3Key features include:

| •

| Integrated, steerable stylet which enables robust pedicle targeting

|

3

| Data on file – LIT-17021

|

9

Table of Contents

| •

| Surgeon-controlled stylet advancement with visual indication of stylet depth

|

| •

| Robust, low-profile, extended tab design to accommodate complex manipulations

|

| •

| Quick-connect ratcheting handle which inserts the screw over the stylet

|

| •

| Leverages screws with InVictus thread-form designed to reduce cross-threading and tulip splay

|

| •

| Serrated, self-starting screw tip which is intended to eliminate the need for tapping

|

| •

| When combined with SafeOp automated EMG technology, the SingleStep approach offers a real-time trajectory and placement confirmation during stylet and screw insertion, helping to reinforce confidence of safe screw placement

|

The InVictus Modular Fixation Systems (Open and MIS) are extensions of the InVictus platform and are designed to enhance adaptability with the power of screw modularity. Key features include:

| •

| Screws with InVictus thread-form designed to help form reduced cross-threading and tulip splay

|

| •

| Modular tulip interconnection strength which is 4.5x greater than the average pull-out strength of pedicle screws4,5

|

| •

| Robust instruments and customizable modular implants designed to accept multiple rod diameters and materials to adapt intraoperatively to surgical techniques

|

| •

| Guidewire-less SingleStep technique designed to advance the standard of modular fixation to deliver modular shank and Sigma blade with one instrument pass

|

| •

| Integrates with SafeOp Neural InformatiX System and is intended to provide surgeons with more predictable real-time and actionable information which helps detect and monitor the health of at-risk nerves during posterior fixation procedures

|

| •

| Audible, tactile, and visual confirmations of tulip-to-shank attachment designed to instill confidence

|

The InVictus OsseoScrew System is an expandable screw system used in conjunction with the InVictus platform, and as an alternative to the use of cemented fenestrated screws. OsseoScrew is designed to restore the integrity of the spinal column in the absence of fusion (for a limited period) in patients with advanced stage tumors involving the thoracic and lumbar spine, and whose life expectancy is of insufficient duration to permit achievement of fusion. Key features include:

| •

| 29% greater pull-out strength over conventional pedicle screws6

|

| •

| Expansion zone location which is designed to optimize pedicle fixation

|

| •

| Stabilization in patients with compromised bone structures

|

The Arsenal® Spinal Fixation System is a comprehensive thoracolumbar fixation platform with components to support procedures aimed to fix a range of degenerative to deformity pathologies and both primary and revision surgical procedures. The Arsenal Spinal Fixation System also contains thread forms to accommodate both traditional and medialized (cortical) trajectories. Key features include:

| •

| Ergonomically designed instrumentation

|

| •

| Multiple instrument options designed to accommodate anatomical and pathological diversity

|

| •

| Multiple screw options which include polyaxial, uniplanar, monoaxial, reduction, and sacral screws

|

4

| Liljenqvist U, Hackenberg L, Link T, Halm H. Pullout strength of pedicle screws versus pedicle and laminar hooks in the thoracic spine. Acta Orthop Belg. 2001;67(2):157-63.

|

6

| Vishnubhotla S, McGarry WB, Mahar AT, et al. A titanium expandable pedicle screw improves initial pullout strength as compared with standard pedicle screws. Spine J 2011;11:777-81.

|

10

Table of Contents

| •

| Multiple pelvic fixation options

|

| •

| Low-profile, dual-lead screws

|

The Aspida Anterior Lumbar Plating System™ is a fixation system for anterior lumbar interbody fusion (“ALIF”) and consists of specifically designed lumbar and lumbo-sacral anterior plates and dual-lead self-drilling and self-tapping screws. Its intuitive instrument design, which is complemented by the AnchorMax™ locking mechanism is designed to provide efficient and effective anterior plating. Key features include:

| •

| Consistent 3.5 mm thickness which provide a low-profile design for reduced risk of vascular interference

|

| •

| An integrated passive locking mechanism

|

| •

| Dual-lead self-drilling and self-tapping screws for improved surgical efficiency

|

| •

| Intuitive instrumentation

|

The AMP Anti-Migration Plate™ is a plating system designed to be used with our lateral interbody spacer system and is designed to provide integrated fixation for lateral interbody fusion (“LIF”) constructs. Key features include:

| •

| One and two-screw plate options

|

| •

| Zero-step screw locking with audible, tactile, and visible indicators

|

| •

| Divergent screw angulation of 25°

|

| •

| Convergent screw angulation of 5°

|

| •

| Compatibility with IdentiTi and Transcend® lateral implants

|

| •

| Ability to implant as assembled with or after placement of the interbody implant

|

The InVictus OCT Spinal Fixation Systemis an extension of the InVictus platform with implant solutions to span the occipital-cervical-thoracic regions and is compatible with our Arsenal® and InVictus Spinal Fixation Systems using various rod-to-rod connectors and/or transitional rods.

The Trestle Luxe® Anterior Cervical Plate Systemis a fixation system used in anterior cervical discectomy and fusion procedures (“ACDF”). Key features include:

| •

| Low-profile design intended to reduce the irritation of the tissue adjacent to the plate following surgery

|

| •

| Large window design intended to enable enhanced graft site and end plate visualization, which ease plate placement

|

| •

| Self-retaining screw-locking mechanism which provides quick and easy plate locking

|

| •

| Flush profile upon screw insertion

|

The Insignia Anterior Cervical Plate System™ is our next-generation ACDF fixation system. Key features include:

| •

| Industry-leading screw angle and trajectory capabilities with a full range of screw and plate options to meet varied clinical requirements

|

| •

| Low-profile, attached active locking mechanism which allows for visual and tactile confirmation of secure blocker locking as well as compatible bone screw drivers which minimize the number of passes into a surgical site

|

11

Table of Contents

| •

| Locking screwdriver that allows for improved axial retention of the screw when compared to traditional tapered drivers and simplified usability when compared to traditional threaded driver and screw interfaces

|

| •

| A single-level plate technique, which allows for single-pass placement of plate and cage into surgical site as well as selection of optimized plate length, reproducible screw placement and optimized plate alignment

|

Interbody Systems

IdentiTi Porous Ti Interbody Implants™ are designed to provide the biological, biomechanical, and imaging characteristics that surgeons seek in a fusion construct. The subtractive process used to manufacture each IdentiTi Implant results in more predictable mechanical performance and enhanced imaging characteristics. IdentiTi implants take advantage of bone’s affinity for titanium and because of their porosity, have a surface roughness that enhances stability.7 Key features include:

| •

| Commercially pure titanium

|

| •

| Multiple lordosis and footprint options to accommodate varying surgical requirements across all interbody fusion procedures including ACDF, ALIF, LIF, PLIF, and TLIF

|

| •

| Fully interconnected porosity to promote bony on-growth and in-growth (as seen in animal model)89

|

| •

| 60% porosity which provides for reduced density and designed to enhance intraoperative and postoperative imaging

|

| •

| Porous titanium has a bone-like stiffness10

|

Transcend® Lateral Interbody Implants are polyetheretherketone (“PEEK”) interbody spacers for use in LIF procedures. Transcend and IdentiTi Lateral Implants are designed to function with the same instrumentation, providing surgeons with a more seamless experience regardless of implant material. The Transcend implant offering provides continuity in lordotic options with a refined design to meet a surgeon’s lateral needs. Key features include:

| •

| Quick-connect inserter feature which is designed to eliminate point loading

|

| •

| Bulleted distal tip which helps provide smooth disc-space insertion

|

| •

| Directional anti-migration teeth to help resist expulsion

|

| •

| Tantalum markers designed to enhance imaging via fluoroscopy

|

Battalion® Posterior Interbody Implants combine a PEEK body with our patented TiTec™ (titanium) coating technology to take advantage of the characteristics of both materials. The PEEK material allows surgeons to assess fusion through the implant while the titanium-coating provides initial stability due to the roughened surface. Key features include:

| •

| Straight (“PS”) and curved (“PC”) options to accommodate PLIF and TLIF surgical approaches

|

| •

| Multiple length options to accommodate varying surgical requirements

|

| •

| Patented TiTec coating helps improve expulsion strength when compared to PEEK11

|

| •

| TiTec coating combines visualization and stiffness benefits of PEEK with the initial stability characteristics of titanium

|

7

| Data on file – LIT-84895

|

8

| Data on file – LIT-84894

|

9

| Data on file – LIT-84890

|

10

| Data on file – LIT-84898

|

11

| Data on file – LIT-84701

|

12

Table of Contents

| •

| Uncoated nose structured to help combat delamination and wear debris issues

|

Novel®is a PEEK intervertebral body fusion system consisting of varying lengths, widths, and heights to accommodate individual patient anatomies and procedural approaches. Key features include:

| •

| Various size and shape options to accommodate different surgical approaches including PLIF, TLIF, ALIF, ACDF

|

| •

| Bulleted nose designed to facilitate easy insertion and matches anatomy

|

| •

| Multiple footprint options to accommodate different anatomy and surgical procedures

|

| •

| Tooth pattern helps to prevent migration and adds stability

|

| •

| Large contact area intended to increase subsidence resistance

|

| •

| PEEK radiographic markers which ease visual assessment of implant placement and fusion process

|

| •

| Color-coded titanium color-coding by size to help simplify identification

|

Biologics

Cervical Structural Allograft Spacers™Our biologics offerings consist of our portfolioseveral allograft (donated human tissue) options, including 3D ProFuse™ Osteoconductive Bioscaffold, and a family of allograft spacers which are available in a range of shapes and sizes, each with corresponding instrumentation, and are intended for use in the cervical spine.AlphaGRAFT

® products. 3D ProFuse Demineralized Bone Scaffold™consistsOsteoconductive Bioscaffold is highly compressible when hydrated, allowing for ease of a sponge-like demineralized bone matrix that has been pre-cut into sizes to fit within a spinal spacer. The 3D ProFuse Demineralized Bone Scaffold provides a natural scaffold derived entirely from bone that can be placed into a void within a spinal spacer or around a spinal spacer. The sponge-like qualities of the scaffold allow a surgeon to compress the scaffoldhandling and place it into a small space. Following placement, the scaffold expands for maximum contact between the spinal spacer and the endplate of the vertebral body and is designed to promote fusion.

Neocore® Osteoconductive Matrix is designed to provide an effective core environment for bone growth through a synthetic scaffold. When hydrated with patient bone marrow aspirate (“BMA”), Neocore becomes a complete bone graft, which possesses all the necessary components of bone growth. Engineered to perform like natural bone, Neocore’s composition and porosity provide the benefits of rapid revascularization throughout graft and supports replacement of three-dimensional matrix with healthy new bone growth. Offering excellent handling characteristics, these pre-formed strips are flexible to conform to adjacent structures, compressible, and moldable.

better endplate-to-endplate contact. Our AlphaGRAFT® Demineralized Bone Matrix (DBM)(“DBM”) consists of demineralized human tissue that is mixed with a bioabsorbable carrier and intended for use in surgery for bone grafting and is available in gel, putty, and fiber forms. AlphaGRAFT DBM Fibers combine the regenerative capacity of interconnected fibers with the maximum availability of growth factors endogenous to bone. Composed of 100% demineralized fibers, AlphaGRAFT DBM Fibers offer moldable, cohesive handling characteristics and provide an osteoconductive scaffold for the delivery of autologous stem cells.

characteristics. AlphaGRAFT Cellular Bone Matrix is our most recent addition to this family of products and(“CBM”) is a growth factor-enriched cellular bone matrix (“CBM”) with two differentiating technologies. Cellular activity via retention of endogenous mesenchymal stem cells and osteoprogenitor cells; and intracellular growth factors from the bone and bone marrow stroma contribute to amplify growth factors bound to the extracellular matrix of the bone, resulting in a product that exhibits the angiogenic, osteoinductive, and mitogenic growth factors necessary for bone growth. AlphaGRAFT CBM may be delivered in granular, fiber, or structural form. We also offer BioCORE

™ Moldable Bioactive Graft which is a synthetic mineral-collagen composite matrix that can be molded to fit the bone defect. OurAmnioshield® Amniotic Tissue Barrier is an allograft for spinal surgical barrier applications. The composite amniotic membrane reduces inflammationis intended to act as a biological barrier and enhances healing at the surgical site, reduces scar tissue formation, and providesprovide an excellent dissection plane.

13

Table of Contents

Products and Technologies Under Development

Internally Developed Products and Technologies

We are expanding our portfolio of products and technologies to enhance clinical outcomes across multiple pathologies, regardless of a surgeon’s preferred surgical approach. We expect to launch 8-10 new products during 2022.2024.

Research and Development

Our research and development team seeks to better meet the requirements of each surgical approach and design and release new products that increase our penetration of the U.S. spine market. We are focused on developing technology platforms and products that span the largest market segments addressing degenerative and deformity spine pathologies. We have transformed our development process by focusing our programs and leveraging integrated teams to reduce the time frame from product concept to market commercialization. We also collaborate with surgeon partners to design products that are intended to enhance the clinical experience, simplify surgical techniques, and reduce overall costs, while improving patient outcomes. Most of our product development efforts are fully integrated in a singular location, our Carlsbad headquarters, which allows us to bring products from concept to market rapidly responding to surgeon and patient needs. Our resources include a technology advancement cell for rapid prototyping, a cadaveric lab, and mechanical testing laboratory.

Sales and Marketing

We market and sell our products through a sales force consisting of dedicated and non-dedicated independent distributorssales agents and dedicated employee direct sales representatives. We employ a team of area vice presidents, (“AVPs”),sales directors, and regional business managers, (“RBMs”), who are responsible for overseeing the sales channel process in their territories. Although surgeons in the U.S. typically make the ultimate decision to use our products, we generally invoice the hospital for the products that are used and pay commissions to the sales representative, or the sales agent based on payment received from the hospital. We compensate our direct sales employees AVPs, and RBMs through salaries and incentive bonuses based on performance measures.

We evaluate and select our distributionindependent sales agent partners and sales employees based upon their expertise in selling spinal devices, reputation within the surgeon community, geographical coverage, and established sales network.

We market our products at various industry conferences, organized surgical training courses, and in industry trade journals and periodicals.

Surgeon Training and Education

We focus our surgeon training efforts on delivering critical technical skills needed to perform the entire spinal fusion procedure through a peer-to-peer approach for qualified surgeon customers. Well-timed surgeon education programs drive customer conversion and loyalty by focusing on delivering value through improved clinical outcomes. We devote significant resources to training and education and are committed to a culture of scientific excellence and ethics.

We believe that one of the most effective ways to introduce and build market demand for our products is by training and educating spine surgeons, independent distributors,sales agents, and direct sales representatives on the benefits and use of our products. Sales training programs are a platform for learning and organizational development, ensuring the sales force is clinically competitive and considered an essential resource to all stakeholders. We focus on cross-functional collaboration and alignment to deliver timely and relevant programs to meet surgeon and representative needs and positively impact the business.

Our training and education programs are designed to support new product introductions to the market as well as ongoing portfolio advancement. Our resources are nimble and responsive and include field-based engagements to supplement our core curriculum. We believe this is an effective way to increase overall surgeon adoption of our new products.

14

Table of Contents

We believe that surgeons, independent distributors,sales agents, and direct sales representatives will become exposed to the merits and distinguishing features of our products through our training and education programs, and that such exposure will increase the use and promotion of our products. With a focus on the entire procedure, we expect to build awareness of the breadth of our product offering. We are conscientious in the pursuit of delivering value to all stakeholders. Our goal is to provide surgeon education programs, coupled with a growing and comprehensive sales training platform that create a sustainable competitive advantage for our organization.

Manufacture and Supply

We rely on third-party suppliers for the manufacture of all our implants and instruments. Outsourcing implant manufacturing reduces our need for capital investment and reduces operational expense. Additionally, outsourcing provides expertise and capacity necessary to scale up or down based on demand for our products. We select our suppliers to ensure that all of our products are safe, effective, adhere to all applicable regulations, are of the highest quality, and meet our supply needs. We employ a rigorous supplier assessment, qualification, and selection process targeted to suppliers that meet the requirements of the U.S. Food and Drug Administration (“FDA”),FDA, and International Organization for Standardization (“ISO”), and quality standards supported by internal policies and procedures. Our quality assurance process monitors and maintains supplier performance through qualification and periodic supplier reviews and audits.

The raw materials used in the manufacture of our non-biologic products are principally titanium, titanium alloys, stainless steel, cobalt chrome, ceramic, allograft, and PEEK. With the exception of PEEK, none of our raw material requirements is limited to any significant extent by critical supply. We are subject to the risk that Invibio, one of a limited number of PEEK suppliers, will be unable to supply PEEK in adequate amounts and in a timely manner. We believe our supplier relationships, alternative product offerings, vendor-managed inventory, and quality processes will support our potential capacity needs for the foreseeable future.

With respect to biologics products, we are FDA-registered and licensed in the states of California, New York, and Florida, the only states that currently require licenses. Our facility and the facilities of the third-party suppliers we use are subject to periodic unannounced inspections by regulatory authorities and may undergo compliance inspections conducted by the FDA and corresponding state and foreign agencies. Because our biologics products are processed from human tissue, maintaining a steady supply can sometimes be challenging. We have not experienced significant difficulty in locating and obtaining the materials necessary to fulfill our production requirements and we have not experienced a meaningful disruption to sales orders.

Table of Contents

In connection with the sale of the previous international distribution business, the Company entered into a product manufacture and supply agreement (the “Supply Agreement”) with Globus Medical Ireland, Ltd., a subsidiary of Globus Medical, Inc., and its affiliated entities (collectively “Globus Medical”), pursuant to which the Company supplied to Globus

MedicalCompetition certain of its implants and instruments, previously offered for sale by the Company in international markets at agreed-upon prices. The Supply Agreement expired and terminated on August 31, 2021.

Competition

Although we believe that our current broad product portfolio and development pipeline is differentiated and has numerous competitive advantages, the spinal implant industry is highly competitive, subject to rapid technological change, and significantly affected by new product introductions. We believe that the principal competitive factors in our market include:

• improved outcomes for spine pathology procedures; •ease of use, quality, and reliability of product portfolio; •effective and efficient sales, marketing, and distribution; •quality service and an educated and knowledgeable sales network; •technical leadership and superiority; •surgeon services, such as training and education; •responsiveness to the needs of surgeons; •acceptance by spine surgeons; •product price and qualification for reimbursement; and

| •

| improved outcomes for spine pathology procedures

|

| •

| ease of use, quality, and reliability of product portfolio

|

| •

| effective and efficient sales, marketing, and distribution

|

| •