STATES

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

February 3, 2024

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

Commissionfilenumber:1-13536

Macy's,Inc.

(Exactnameofregistrantasspecifiedinitscharter)

| Delaware | 13-3324058 | ||||

(State or other jurisdiction of incorporation or organization) | (I.R.S.EmployerIdentificationNo.) | ||||

151 West 34th Street, New York, New York 10001 |

| ||||

(Address of Principal Executive Offices, including Zip Code) | (Registrant's telephone number, including area code) | ||||

Securities

| Title of Each Class | Trading Symbol(s) | NameofEachExchangeonWhichRegistered | ||||||||||||||

Common Stock, $.01 par value per share | M | NewYork Stock Exchange | ||||||||||||||

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒x No ☐o

| Large Accelerated Filer | x | Accelerated Filer |

| |||||||||||||||||||||

Non-Accelerated Filer | o | Emerging Growth Company |

| Smaller Reporting Company |

| |||||||||||||||||||

$4,452,028,613.

| Class | Outstandingat | |||||||

Common Stock, $.01 par value per share |

| |||||||

| Document | Parts Into Which Incorporated | |||||||

Proxy Statement for the Annual Meeting of Stockholders to be held | Part III | |||||||

|

|

|

|

|

|

Unlessthecontextrequiresotherwise,referencesto“Macy’s”orthe“Company”arereferencestoMacy’sanditssubsidiaries andreferencesto“2021,”“2020,” and“2019” arereferencestotheCompany’sfiscalyearsended January 29, 2022, January 30, 2021 and February 1, 2020,respectively. Fiscal years 2021, 2020, and 2019 included52weeks.

Forward-LookingStatements

Thisreportandotherreports,statementsandinformationpreviouslyorsubsequentlyfiledbytheCompanywiththeSecuritiesandExchangeCommission(the“SEC”)containormaycontainforward-lookingstatements.Suchstatementsare baseduponthebeliefsandassumptionsof,andoninformationavailableto,themanagementoftheCompanyatthetimesuchstatementsare made.Thefollowingare ormayconstituteforward-lookingstatementswithinthemeaningofthePrivateSecuritiesLitigationReformActof1995:(i)statementsprecededby, followedbyorthatincludethewords“may,”“will,”“could,”“should,”“believe,”“expect,”“future,”“potential,”“anticipate,”“intend,”“plan,”“think,”“estimate”or“continue”orthenegativeorothervariationsthereof,and(ii)statementsregardingmattersthatarenothistoricalfacts.Suchforward-lookingstatementsaresubjecttovariousrisksanduncertainties,includingrisksanduncertaintiesrelatingto:

|

|

| Auditor Firm ID: |

| Auditor Name: | KPMG, LLP | Cincinnati, OH | ||||||||||||||||

| Page | |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inadditiontoanyrisksanduncertaintiesspecificallyidentifiedinthetextsurroundingsuchforward-lookingstatements,thestatementsintheimmediatelyprecedingsentenceandthestatementsundercaptionssuchas“RiskFactors”inreports,statementsandinformationfiledbytheCompanywiththeSECfromtimetotimeconstitutecautionarystatementsidentifyingimportantfactorsthatcouldcauseactualamounts,results,eventsandcircumstancestodiffermateriallyfromthoseexpressedinorimpliedbysuchforward-lookingstatements.

3

|

|

General

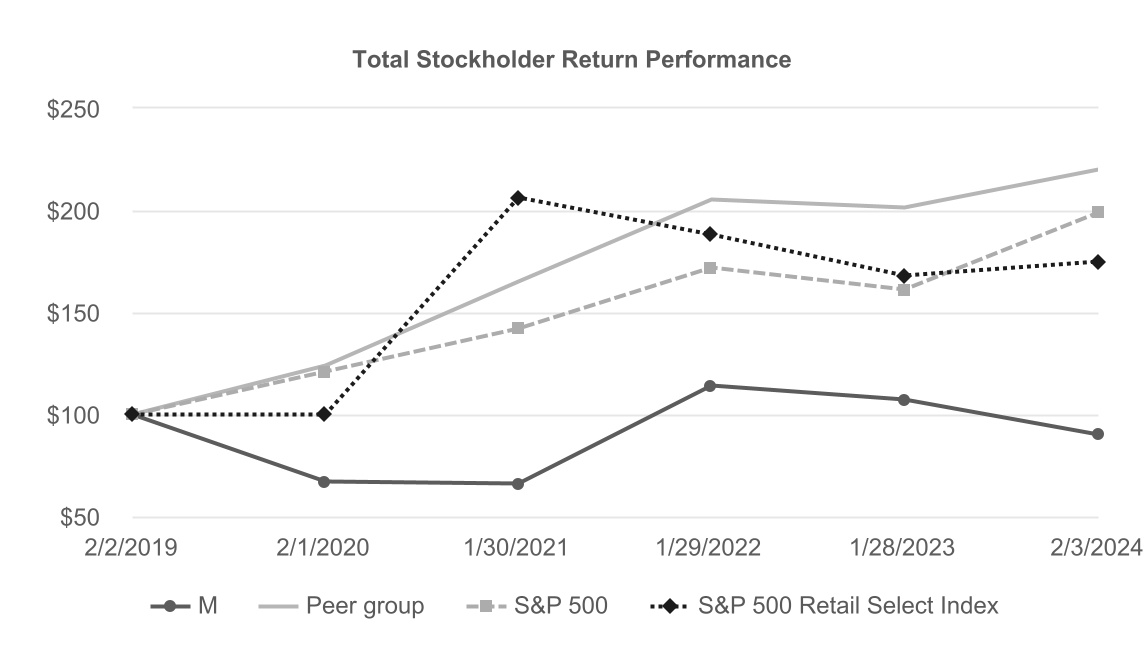

2021 2020 2019 Women’s Accessories, Intimate Apparel, Shoes, Cosmetics and Fragrances $ 10,119 $ 7,206 $ 9,454 Women’s Apparel 4,433 2,909 5,411 Men’s and Kids’ 5,252 3,486 5,628 Home/Other (a) 4,656 3,745 4,067 Total $ 24,460 $ 17,346 $ 24,560 The Company's private label brands are owned by the Company. TheCompanymakesitsannualreportonForm10-K,quarterlyreportsonForm10-Q,currentreportsonForm8-K andamendmentstothosereportsfiledorfurnishedpursuanttoSection13(a)or15(d)oftheSecuritiesExchangeActof 1934 •Charters of the Audit Committee, Compensation and Management Development Committee, Finance Committee, and Nominating and Corporate Governance Committee, •Corporate Governance Principles, •Lead Independent Director Policy, •Non-Employee Director Code of Business Conduct and Ethics, •Code of Conduct, •Standards for Director Independence, •Related Person Transactions Policy, •Method to Facilitate Receipt, Retention and Treatment of Communications, and teams and to facilitate action planning to improve the colleague experience. •Recognized by Women's Enterprise National Council (WBENC) with America's Top Corporations Award, which has been received since 2012, for our commitment to create opportunities for women-owned businesses within the Macy's supply chain. •Recognized by the National Minority Supplier Development Council (NMSDC) with the National Corporation of the Year Award (Category 2 winner). Also recognized as part of NMSDC's The Forefront 25: Top Corporations for Minority Businesses for ensuring access and equity for systemically excluded entrepreneurs of color. Learning & Development the series, the Company featured 18 workshops, panel discussions and career-planning sessions that gave colleagues a better sense of the many career opportunities that exist at Macy's, Inc. and how colleagues can enhance their skills within their current role or enable them to take the next step in their career. Total Rewards Number of Employees •managing the environmental impact of its business; •promoting positive social impact; and factories with RISE: Reimagining Industry to Support Equality. chain transparency. Position with the Company Chief Executive Officer Adrian V. Mitchell Danielle L. Kirgan Paul Griscom Senior Vice President and Controller for home furnishings. Strategic, Operational and Competitive Risks suffer. shortage. growth. occur. performance. program. suffer. business. remotely. •cause us to incur substantial costs, including costs associated with remediation of information technology systems, customer protection costs and incentive payments for the maintenance of business relationships, litigation costs, lost revenues resulting from negative changes in consumer shopping patterns, unauthorized use of proprietary information or the failure to retain or attract customers following an attack. While we maintain insurance coverage that may, subject to policy terms and conditions, cover certain aspects of cyber risks, such insurance coverage may be unavailable or insufficient to cover all losses or all types of claims that may arise in the continually evolving area of cyber risk. Supply Chain and Third-Party Risks to a lesser extent, from factories in Vietnam, India, Indonesia, Jordan and other countries. Since 2017, the U.S. and China have been engaged in a trade dispute that has involved a number of actions against China including the imposition of tariffs on Chinese imports; sanctions on Chinese military-industrial complex companies; stricter reviews of direct investments in the U.S. by Chinese companies; and detention by U.S. Customs of products made in Xinjiang involving alleged human rights violations, which have or may prompt countersanctions or other retaliatory actions from the Chinese government. In addition, differing policies on China–Taiwan and the Russia–Ukraine war have further strained relations between the countries. These geopolitical, trade and investment tensions have created additional uncertainty and increased risk in doing business in China, including potential supply disruptions and higher costs of our products sourced or imported from China. business. confidence, spending and tourism could negatively affect our business and results of operations. Unstable political conditions, civil unrest, terrorist activities, armed conflicts or events of extreme violence, including any escalation of the conflict between Russia and Ukraine and the Israel-Hamas war, may disrupt commerce and could negatively affect our business and results of operations. cash flows. The Inflation Reduction Act was enacted on August 16, 2022 and includes a number of provisions that may impact the Company, including a corporate alternative minimum tax on certain large corporations, incentives to address climate change mitigation and other non-income tax provisions, including an excise tax on the repurchase of our stock. We are assessing these impacts on our consolidated financial statements. results of operations. The burdens imposed by these and other laws and regulations that may be enacted, or new interpretations of existing laws and regulations, may also require us to incur substantial costs to reach compliance or change the manner in which we use data. •Regulatory Risks. Unfavorable global, domestic or regional economic or political conditions and other developments and risks could negatively affect our business and results of operations. For example, energy or carbon policies (both existing and emerging) that apply to our energy suppliers have the ability to impact indirect costs to our operations through shifts in energy prices. Recent and future developments in regional cap-and-trade programs such as the Regional Greenhouse Gas Initiative (RGGI), which sets a declining limit on emissions from regulated power plants within the RGGI states, could increase our energy costs and affect the profitability of operations. The RGGI program spans 11 states and includes Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Rhode Island, Vermont, and Virginia. In 2020, Macy's, Inc. reported energy data for 217 locations across these states and could experience increases in the cost of energy in these regions as a result of the RGGI program. From 2021 to 2022, Macy's, Inc. experienced a 22% electricity cost increase across its sites located in RGGI states. Current environmental and climate-related regulation, both at the state and federal levels, are monitored as part of our enterprise risk management process. •make it more difficult for us to satisfy our debt obligations; •increase our vulnerability to general adverse economic and external conditions; •impair our ability to obtain additional debt or equity financing in the future for working capital, capital expenditures, acquisitions or general corporate or other purposes; •require us to dedicate a material portion of our cash flows from operations to the payment of principal and interest on our indebtedness, thereby reducing the availability of our cash flows to fund working capital needs, capital expenditures, acquisitions and other general corporate purposes; •expose us to the risk of increased interest rates to the extent we make borrowings under our asset-based credit facility, which bears interest at a variable rate; •limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; 2021 Boxes Locations Macy's 570 510 Bloomingdale's 57 55 bluemercury 160 160 787 725 2021 Boxes Locations Store count at beginning of fiscal year 789 727 Stores opened 9 9 Stores closed, consolidated into or relocated from existing centers (11 ) (11 ) Store count at end of fiscal year 787 725 By Brand Total Owned Leased Subject to a Ground Lease Partly Owned and Partly Leased Macy's 570 309 160 97 4 Bloomingdale's 57 14 36 7 — bluemercury 160 — 160 — — 787 323 356 104 4 Item Total Number of Shares Purchased Average Price Paid per Share ($) Number of Shares Purchased as Part of Publicly Announced Plans or Programs (1) Maximum Number (or Approximate Dollar Value) of Shares that May Yet be Purchased Under the Plans or Programs ($)(1) (thousands) (thousands) (millions) October 31, 2021 - November 27, 2021 — — — 200 November 28, 2021 - January 1, 2022 7,463 26.82 7,463 — January 2, 2022 - January 29, 2022 — — — — 7,463 26.82 7,463 The following graph compares the cumulative total stockholder return on the Company's common stock withthe Standard&Poor's500CompositeIndexandtheCompany'speergroupsfortheperiodfrom The peer group comprised of companies within the S&P Retail Select Index is used by the CompensationandManagementDevelopmentCommitteeoftheBoardofDirectors for evaluating compensation related to the " A Bold New Chapter, detailed further below. In evaluating •Comparable sales, on a 52-week basis, decreased 6.9% on an owned basis and 6.0% on an owned-plus-licensed basis. •Other revenue, consisting of net credit card revenue and Macy's Media Network revenue, decreased $233 million to $774 million. •The gross margin rate was 38.8%, an increase of 140 basis points from 37.4%. •Selling, general & administrative (SG&A) expenses decreased $86 million to $8,375 million, or 35.1% of net sales, an increase of 190 basis points. •Net income was $105 million, a decrease from net income of $1,177 million. Net income adjusted for impairment, restructuring and other costs, settlement charges, and losses on early retirement of debt (Adjusted net income) declined from $1,259 million to adjusted net income of $973 million. •Earnings before interest, taxes, depreciation and amortization excluding restructuring, impairment, store closings and other costs and settlement charges (Adjusted EBITDA) were $2,317 million, a decline from $2,648 million. •Diluted earnings per share were $0.38, compared to diluted earnings per share of $4.19. On an adjusted basis, diluted earnings per share were $3.50, compared to adjusted diluted earnings per share of $4.48. •Merchandise inventories were up 2% and inventory turnover decreased 2%. with 120 brands and over 2,300 brands, respectively, at each nameplate. •Luxury: In 2023, Bloomingdale's celebrated 50 years of its iconic Big Brown Bag, added several exciting brands and launched key collaborations with engaging in-store and digital activations, including Barbie- and Wonka-themed takeovers of The Carousel @ Bloomingdale's. The fourth quarter of 2023 marked Bluemercury's 12th consecutive quarter of comparable sales growth. It also unveiled two remodeled luxury stores in 2023 with elevated spa offerings and high-touch customer service, which serve as the foundation for future locations. •Personalized offers and communication: The digital and technology teams tested and learned throughout 2023, including the recent launch of several multi-touch communications. The Company anticipates moving from testing in 2023 to scaling in 2024. •.Strengthen the Macy's nameplate 2021 2020 2019 Amount % to Sales Amount % to Sales Amount % to Sales (dollars in millions, except per share figures) Net sales $ 24,460 $ 17,346 $ 24,560 Increase (decrease) in comparable sales 43.0 % (27.9 )% (0.8 )% Credit card revenues, net 832 3.4 % 751 4.3 % 771 3.1 % Cost of sales (14,956 ) (61.1 )% (12,286 ) (70.8 )% (15,171 ) (61.8 )% Selling, general and administrative expenses (8,047 ) (32.9 )% (6,767 ) (39.0 )% (8,998 ) (36.6 )% Gains on sale of real estate 91 0.4 % 60 0.3 % 162 0.6 % Impairment, restructuring and other costs (30 ) (0.1 )% (3,579 ) (20.6 )% (354 ) (1.4 )% Operating income (loss) 2,350 9.6 % (4,475 ) (25.8 )% 970 3.9 % Diluted earnings (loss) per share $ 4.55 $ (12.68 ) $ 1.81 Supplemental Financial Measure Gross margin $ 9,504 38.9 % $ 5,060 29.2 % $ 9,389 38.2 % Digital sales as a percent of net sales 35.0 % 44.3 % 25.3 % Supplemental Non-GAAP Financial Measures Increase (decrease) in comparable sales on an owned plus licensed basis 42.9 % (27.9 )% (0.7 )% Adjusted diluted earnings (loss) per share $ 5.31 $ (2.21 ) $ 2.91 EBITDA $ 3,194 $ (3,546 ) $ 1,924 Adjusted EBITDA $ 3,320 $ 117 $ 2,336 ROIC 27.2 % 3.0 % 17.1 % 2021 2020 Net sales $ 24,460 $ 17,346 Increase (decrease) in comparable sales 43.0 % (27.9 )% Increase (decrease) in comparable sales on an owned plus licensed basis 42.9 % (27.9 )% Digital sales as a percent of net sales 35.0 % 44.3 % 2021 2020 Credit card revenues, net $ 832 $ 751 Proprietary credit card sales penetration 41.6 % 43.0 % cost saving initiatives. The increase in 2021 2020 Cost of sales $ (14,956 ) $ (12,286 ) As a percent to net sales 61.1 % 70.8 % Gross margin $ 9,504 $ 5,060 As a percent to net sales 38.9 % 29.2 % 2021 2020 SG&A expenses $ (8,047 ) $ (6,767 ) As a percent to net sales 32.9 % 39.0 % SG&A 2021 2020 Gains on sale of real estate $ 91 $ 60 2021 2020 Impairment, restructuring and other costs $ (30 ) $ (3,579 ) 2021 2020 Benefit plan income, net $ 66 $ 54 2021 2020 Settlement charges $ (96 ) $ (84 ) 2021 2020 Net interest expense $ (255 ) $ (280 ) The 17% decrease in net interest expense, excluding losses on early retirement of debt, was 2021 2020 Losses on early retirement of debt $ (199 ) $ — 2021 2020 Effective tax rate 23.4 % 17.7 % Federal income statutory rate 21 % 21 % The Company's principal sources of liquidity are cash from operations, cash on hand and the asset-based credit facility described below. Material contractual obligations arising in the normal course of business primarily consist of long-term debt and related interest payments, lease obligations, merchandise purchase obligations, retirement plan benefits, and self-insurance reserves. See Notes 4, 6 and 9 to the consolidated financial statements included in Item 8 of this Report for amounts outstanding on Merchandise purchase obligations represent future merchandise payables for inventory purchased from various suppliers through contractual arrangements and are expected to be funded through cash from operations. 2021 2020 2019 Net cash provided by operating activities $ 2,712 $ 649 $ 1,608 Net cash used by investing activities (370 ) (325 ) (1,002 ) Net cash provided (used) by financing activities (2,381 ) 699 (1,123 ) fiscal 2022. Standard & Stable January 29, 2022 (in millions) ASSETS Current Assets $ 1,517 Noncurrent Assets 6,784 LIABILITIES Current Liabilities $ 2,243 Noncurrent Liabilities (a) 10,407 $ 2021 (in millions) Net Sales $ 867 Consignment commission income (a) 3,793 Cost of sales (460 ) Operating loss (746 ) Loss before income taxes (b) (203 ) Net income 277 962 Macy's, Inc. Comparable Sales vs. 52 Weeks Ended January 30, 2021 Comparable Sales vs. 52 Weeks Ended February 1, 2020 Increase in comparable sales on an owned basis (Note 1) 43.0 % 3.1 % Impact of growth in comparable sales of departments licensed to third parties (Note 2) (0.1 )% (0.1 )% Increase in comparable sales on an owned plus licensed basis 42.9 % 3.0 % 2021 2020 2019 Net Income Diluted Earnings Per Share Net Income (Loss) Diluted Earnings (Loss) Per Share Net Income Diluted Earnings Per Share As reported $ 1,430 $ 4.55 $ (3,944 ) $ (12.68 ) $ 564 $ 1.81 Impairment, restructuring and other costs 30 0.10 3,579 11.50 354 1.13 Settlement charges 96 0.31 84 0.27 58 0.19 Losses on early retirement of debt 199 0.63 — — 30 0.10 Financing costs — — 5 0.02 — — Income tax impact of certain items identified above (87 ) (0.28 ) (412 ) (1.32 ) (100 ) (0.32 ) As adjusted $ 1,668 $ 5.31 $ (688 ) $ (2.21 ) $ 906 $ 2.91 2021 2020 2019 (millions) Net income (loss) $ 1,430 $ (3,944 ) $ 564 Interest expense - net 255 280 185 Losses on early retirement of debt 199 — 30 Financing costs — 5 — Federal, state and local income tax expense (benefit) 436 (846 ) 164 Depreciation and amortization 874 959 981 EBITDA $ 3,194 $ (3,546 ) $ 1,924 Impairment, restructuring and other costs 30 3,579 354 Settlement charges 96 84 58 Adjusted EBITDA $ 3,320 $ 117 $ 2,336 2021 2020 2019 (millions, except percentages) Net income (loss) $ 1,430 $ (3,944 ) $ 564 Property and equipment - net $ 5,665 $ 5,940 $ 6,633 Net income (loss) as a percent to property and equipment - net 25.2 % (66.4 )% 8.5 % Net income (loss) $ 1,430 $ (3,944 ) $ 564 Add back interest expense, net 255 280 185 Add back financing cost — 5 — Add back losses on early retirement of debt 199 — 30 Add back (deduct) federal, state and local tax expense (benefit) 436 (846 ) 164 Add back impairment, restructuring and other costs 30 3,579 354 Add back settlement charges 96 84 58 Add back depreciation and amortization 874 959 981 Deduct benefit plan income, net (66 ) (54 ) (31 ) Add back rent expense Real estate 326 334 335 Personal property 7 7 8 Adjusted EBITDA, excluding benefit plan income, net and lease expense $ 3,587 $ 404 $ 2,648 Property and equipment - net $ 5,802 $ 6,092 $ 6,628 Add back accumulated depreciation and amortization 4,474 4,590 4,438 Add back capitalized value of variable rent 83 16 114 Add back lease right of use assets 2,462 2,378 2,241 Add (deduct) other selected assets and liabilities: Receivables 234 204 265 Merchandise inventories 4,763 4,356 5,743 Prepaid expenses and other current assets 376 442 551 Other assets 534 589 675 Merchandise accounts payable (2,760 ) (2,213 ) (2,183 ) Accounts payable and accrued liabilities (2,431 ) (2,508 ) (2,609 ) Other long-term liabilities (313 ) (348 ) (371 ) Total average invested capital $ 13,224 $ 13,598 $ 15,492 ROIC 27.1 % 3.0 % 17.1 % charge. Taxes 2024. Name Age Director Since Principal Occupation Francis S. Blake 71 2015 Former Chairman and Chief Executive Officer of The Home Depot, Inc., a multinational home improvement retailer. Torrence N. Boone 51 2019 Vice President, Global Client Partnerships, Alphabet Inc. since 2010. John A. Bryant 55 2015 Former Chairman, President and Chief Executive Officer of Kellogg Company, a multinational cereal and snack food producer. Ashley Buchanan 48 2021 Chief Executive Officer of The Michaels Companies, Inc., an arts and crafts specialty retailer, since 2020. Deirdre P. Connelly 60 2008 Former President, North American Pharmaceuticals of GlaxoSmithKline, a global pharmaceutical company. Leslie D. Hale 48 2015 President and Chief Executive Officer of RLJ Lodging Trust, a publicly-traded lodging real estate investment trust, since 2018. William H. Lenehan 44 2016 President and Chief Executive Officer of Four Corners Property Trust, Inc., a real estate investment trust, since 2015. Sara Levinson 70 1997 Co-Founder and Director of Katapult, a digital entertainment company making products for today's creative generation, since 2013. Paul C. Varga 57 2012 Former Chairman and Chief Executive Officer of Brown- Forman Corporation, a spirits and wine company. Marna C. Whittington 73 1993 Former Chief Executive Officer of Allianz Global Investors Capital, a diversified global investment firm. Tracey Zhen 45 2021 President of Zipcar, a car sharing service and a subsidiary of Avis Budget Group, Inc., since 2017. Changes in Shareholders Matters certain long-lived assets associated with corporate and other assets. key assumptions required specialized skills and knowledge. cumulative results of the audit procedures. 2021 2020 2019 Net sales $ 24,460 $ 17,346 $ 24,560 Credit card revenues, net 832 751 771 Cost of sales (14,956 ) (12,286 ) (15,171 ) Selling, general and administrative expenses (8,047 ) (6,767 ) (8,998 ) Gains on sale of real estate 91 60 162 Restructuring, impairment, store closing and other costs (30 ) (3,579 ) (354 ) Operating income (loss) 2,350 (4,475 ) 970 Benefit plan income, net 66 54 31 Settlement charges (96 ) (84 ) (58 ) Interest expense (256 ) (284 ) (205 ) Financing costs 0 (5 ) 0 Losses on early retirement of debt (199 ) 0 (30 ) Interest income 1 4 20 Income (loss) before income taxes 1,866 (4,790 ) 728 Federal, state and local income tax benefit (expense) (436 ) 846 (164 ) Net income (loss) $ 1,430 $ (3,944 ) $ 564 Basic earnings (loss) per share $ 4.66 $ (12.68 ) $ 1.82 Diluted earnings (loss) per share $ 4.55 $ (12.68 ) $ 1.81 2021 2020 2019 Net income (loss) $ 1,430 $ (3,944 ) $ 564 Other comprehensive income (loss), net of taxes: Net actuarial gain (loss) and prior service credit on post employment and postretirement benefit plans, net of tax effect of $23 million, $37 million and $36 million 69 107 (107 ) Reclassifications to net income (loss): Net actuarial loss and prior service cost on post employment and postretirement benefit plans, net of tax effect of $9 million, $12 million and $8 million 25 35 23 Settlement charges, net of tax effect of $24 million, $22 million and $14 million 72 62 44 Total other comprehensive income (loss) 166 204 (40 ) Comprehensive income (loss) $ 1,596 $ (3,740 ) $ 524 January 29, 2022 January 30, 2021 ASSETS Current Assets: Cash and cash equivalents $ 1,712 $ 1,679 Receivables 297 276 Merchandise inventories 4,383 3,774 Prepaid expenses and other current assets 366 455 Total Current Assets 6,758 6,184 Property and Equipment – net 5,665 5,940 Right of Use Assets 2,808 2,878 Goodwill 828 828 Other Intangible Assets – net 435 437 Other Assets 1,096 1,439 Total Assets $ 17,590 $ 17,706 LIABILITIES AND SHAREHOLDERS’ EQUITY Current Liabilities: Short-term debt $ 0 $ 452 Merchandise accounts payable 2,222 1,978 Accounts payable and accrued liabilities 3,086 2,927 Income taxes 108 0 Total Current Liabilities 5,416 5,357 Long-Term Debt 3,295 4,407 Long-Term Lease Liabilities 3,098 3,185 Deferred Income Taxes 983 908 Other Liabilities 1,177 1,296 Shareholders’ Equity: Common stock (292.4 and 310.5 shares outstanding) 3 3 Additional paid-in capital 517 571 Accumulated equity 5,268 3,928 Treasury stock (1,545 ) (1,161 ) Accumulated other comprehensive loss (622 ) (788 ) Total Shareholders' Equity 3,621 2,553 Total Liabilities and Shareholders’ Equity $ 17,590 $ 17,706 Accumulated Additional Other Total Common Paid-In Accumulated Treasury Comprehensive Shareholders’ Stock Capital Equity Stock Income (Loss) Equity Balance at February 2, 2019 $ 3 $ 652 $ 8,050 $ (1,318 ) $ (951 ) $ 6,436 Cumulative-effect adjustment (a) (158 ) (158 ) Net income 564 564 Other comprehensive loss (40 ) (40 ) Common stock dividends ($1.51 per share) (470 ) (470 ) Stock repurchases (1 ) (1 ) Stock-based compensation expense 38 38 Stock issued under stock plans (69 ) 78 9 Other 3 (4 ) (1 ) Balance at February 1, 2020 3 621 7,989 (1,241 ) (995 ) 6,377 Net loss (3,944 ) (3,944 ) Other comprehensive income 204 204 Common stock dividends ($0.3775 per share) (117 ) (117 ) Stock-based compensation expense 31 31 Stock issued under stock plans (81 ) 80 (1 ) Other 3 3 Balance at January 30, 2021 3 571 3,928 (1,161 ) (788 ) 2,553 Net income 1,430 1,430 Other comprehensive income 166 166 Common stock dividends ($0.30 per share) (90 ) (90 ) Stock repurchases (500 ) (500 ) Stock-based compensation expense 55 55 Stock issued under stock plans (109 ) 116 7 Balance at January 29, 2022 $ 3 $ 517 $ 5,268 $ (1,545 ) $ (622 ) $ 3,621 2021 2020 2019 Cash flows from operating activities: Net income (loss) $ 1,430 $ (3,944 ) $ 564 Adjustments to reconcile net income (loss) to net cash provided by operating activities: Impairment, restructuring and other costs 30 3,579 354 Settlement charges 96 84 58 Depreciation and amortization 874 959 981 Benefit plans 34 47 31 Stock-based compensation expense 55 31 38 Gains on sale of real estate (91 ) (60 ) (162 ) Deferred income taxes 19 (327 ) (6 ) Amortization of financing costs and premium on acquired debt 70 18 4 Changes in assets and liabilities: (Increase) decrease in receivables (21 ) 132 (9 ) (Increase) decrease in merchandise inventories (610 ) 1,406 75 (Increase) decrease in prepaid expenses and other current assets (39 ) 51 89 Increase in merchandise accounts payable 218 237 40 Increase (decrease) in accounts payable and accrued liabilities 245 (759 ) (257 ) Increase (decrease) in current income taxes 588 (617 ) (60 ) Change in other assets and liabilities (186 ) (188 ) (132 ) Net cash provided by operating activities 2,712 649 1,608 Cash flows from investing activities: Purchase of property and equipment (354 ) (338 ) (902 ) Capitalized software (243 ) (128 ) (255 ) Disposition of property and equipment 164 113 185 Other, net 63 28 (30 ) Net cash used by investing activities (370 ) (325 ) (1,002 ) Cash flows from financing activities: Debt issued 1,085 2,780 0 Debt issuance costs (9 ) (95 ) (3 ) Debt repaid (2,699 ) (2,042 ) (569 ) Debt repurchase premium and expenses (152 ) (7 ) (28 ) Dividends paid (90 ) (117 ) (466 ) Increase (decrease) in outstanding checks (23 ) 181 (62 ) Acquisition of treasury stock (500 ) (1 ) (1 ) Issuance of common stock 7 0 6 Net cash provided (used) by financing activities (2,381 ) 699 (1,123 ) Net increase (decrease) in cash, cash equivalents and restricted cash (39 ) 1,023 (517 ) Cash, cash equivalents and restricted cash beginning of period 1,754 731 1,248 Cash, cash equivalents and restricted cash end of period $ 1,715 $ 1,754 $ 731 Supplemental cash flow information: Interest paid $ 442 $ 257 $ 242 Interest received 1 5 20 Income taxes paid (received), net (171 ) 98 229 Restricted cash, end of period 3 75 46 Year 2021 2020 2019 (millions) Gross advertising and promotional costs $ 1,267 $ 907 $ 1,330 Cooperative advertising allowances 90 89 188 Advertising and promotional costs, net of cooperative advertising allowances $ 1,177 $ 818 $ 1,142 Net sales $ 24,460 $ 17,346 $ 24,560 Advertising and promotional costs, net of cooperative advertising allowances, as a percent to net sales 4.8 % 4.7 % 4.6 % Depreciationofownedpropertiesisprovidedprimarilyonastraight-linebasisovertheestimatedassetlives,which range from fifteen Income. the fiscal year ending February 1, 2025. The Company 2021 2020 2019 Women’s Accessories, Intimate Apparel, Shoes, Cosmetics and Fragrances $ 10,119 $ 7,206 $ 9,454 Women’s Apparel 4,433 2,909 5,411 Men’s and Kids’ 5,252 3,486 5,628 Home/Other (a) 4,656 3,745 4,067 Total $ 24,460 $ 17,346 $ 24,560 2021 2020 2019 (millions) Balance, beginning of year $ 616 $ 839 $ 856 Liabilities issued but not redeemed (a) 394 262 554 Revenue recognized from beginning liability (529 ) (485 ) (571 ) Balance, end of year $ 481 $ 616 $ 839 (a) accounts, credit card funding costs and bad debt reserves and are a component of other revenue on the consolidated statements of income. 2021 2020 2019 (millions) Asset Impairments $ 6 $ 3,280 $ 197 Restructuring 3 224 123 Other 21 75 34 $ 30 $ 3,579 $ 354 Professional fees and Severance and other related other benefits charges Total (millions) Balance at February 2, 2019 $ 0 $ 0 $ 0 Additions charged to expense 121 36 157 Cash payments (6 ) (27 ) (33 ) Balance at February 1, 2020 115 9 124 Additions charged to expense 55 17 72 Cash payments (156 ) (24 ) (180 ) Balance at January 30, 2021 14 2 16 Additions charged to expense 5 0 5 Cash payments (18 ) (2 ) (20 ) Balance at January 29, 2022 $ 1 $ 0 $ 1 January 29, January 30, 2022 2021 (millions) Land $ 1,353 $ 1,390 Buildings on owned land 3,635 3,650 Buildings on leased land and leasehold improvements 1,303 1,268 Fixtures and equipment 3,922 4,032 10,213 10,340 Less accumulated depreciation and amortization 4,548 4,400 $ 5,665 $ 5,940 January 29, January 30, 2022 2021 Classification (millions) Assets Finance lease assets (a) Right of Use Assets $ 10 $ 12 Operating lease assets (b) Right of Use Assets 2,798 2,866 Total lease assets $ 2,808 $ 2,878 Liabilities Current Finance (a) Accounts payable and accrued liabilities $ 2 $ 2 Operating (b) Accounts payable and accrued liabilities 328 198 Noncurrent Finance (a) Long-Term Lease Liabilities 17 19 Operating (b) Long-Term Lease Liabilities 3,081 3,166 Total lease liabilities $ 3,428 $ 3,385 (a) Financeleaseassetsarerecordednetofaccumulatedamortizationof 2021 2020 2019 (millions) Real estate Operating leases (c) – Minimum rents $ 359 $ 376 $ 364 Variable rents 48 45 54 407 421 418 Less income from subleases – Operating leases (1 ) (1 ) (2 ) Operating leases Operating leases $ 406 $ 420 $ 416 Personal property – Operating leases $ 7 $ 7 $ 8 Certain supply chain operating lease expense amounts are included in cost of sales. Operating Finance Leases Leases (d and e) Total (millions) Fiscal year 2022 $ 3 $ 358 $ 361 2023 3 352 355 2024 3 346 349 2025 3 342 345 2026 2 326 328 After 2026 13 5,181 5,194 Total undiscounted lease payments 27 6,905 6,932 Less amount representing interest 8 3,496 3,504 Total lease liabilities $ 19 $ 3,409 $ 3,428 (d) Operatingleasepaymentsinclude January 29, January 30, Lease Term and Discount Rate 2022 2021 Weighted-average remaining lease term (years) Finance leases 11.9 12.1 Operating leases 21.7 22.4 Weighted-average discount rate Finance leases 6.73 % 6.70 % Operating leases 6.54 % 6.32 % 52 Weeks Ended 52 Weeks Ended Other Information January 29, 2022 January 30, 2021 (millions) Cash paid for amounts included in the measurement of lease liabilities: Operating cash flows used from operating leases $ 322 $ 521 Financing cash flows used from financing leases 3 4 Leased assets obtained in exchange for new operating lease liabilities 15 430 January 29, January 30, 2022 2021 (millions) Non-amortizing intangible assets Goodwill $ 9,290 $ 9,290 Accumulated impairment losses (8,462 ) (8,462 ) 828 828 Tradenames 403 403 $ 1,231 $ 1,231 Amortizing intangible assets Favorable leases and other contractual assets $ 5 $ 5 Tradenames 43 43 48 48 Accumulated amortization Favorable leases and other contractual assets (1 ) (1 ) Tradenames (15 ) (13 ) (16 ) (14 ) $ 32 $ 34 Capitalized software Gross balance $ 1,010 $ 1,136 Accumulated amortization (499 ) (645 ) $ 511 $ 491 For the Company's annual impairment assessment as of the end of fiscal May Amortizing Capitalized intangible assets Software (millions) Fiscal year 2022 $ 2 $ 180 2023 2 111 2024 2 65 2025 2 25 2026 2 0 January 29, January 30, 2022 2021 (millions) Short-term debt: 3.875% Senior notes due 2022 $ 0 $ 450 Current portion of other long-term obligations 0 2 $ 0 $ 452 Long-term debt: 8.375% Senior secured notes due 2025 $ 0 $ 1,300 2.875% Senior notes due 2023 504 640 5.875% Senior notes due 2029 500 0 4.5% Senior notes due 2034 367 367 3.625% Senior notes due 2024 350 500 5.125% Senior notes due 2042 250 250 4.3% Senior notes due 2043 250 250 6.375% Senior notes due 2037 192 192 6.7% Senior secured debentures due 2034 183 183 4.375% Senior notes due 2023 161 210 7.0% Senior debentures due 2028 105 105 6.65% Senior secured debentures due 2024 81 81 6.9% Senior debentures due 2029 79 79 6.7% Senior secured debentures due 2028 74 74 6.79% Senior debentures due 2027 71 71 6.65% Senior debentures due 2024 36 41 6.7% Senior debentures due 2028 29 29 8.75% Senior secured debentures due 2029 13 13 6.7% Senior debentures due 2034 18 18 6.9% Senior debentures due 2032 12 12 7.6% Senior debentures due 2025 6 24 7.875% Senior secured debentures due 2030 5 5 6.9% Senior secured debentures due 2032 5 5 7.875% Senior debentures due 2030 5 5 Unamortized debt issue costs and discount (22 ) (77 ) Premium on acquired debt, using an effective interest yield of 5.760% to 6.021% 21 30 $ 3,295 $ 4,407 NOTESTO CONSOLIDATEDFINANCIALSTATEMENTS— (Continued) 2021 2020 2019 (millions) Interest on debt $ 246 $ 273 $ 211 Amortization of debt premium (3 ) (4 ) (5 ) Amortization of financing costs and debt discount 26 23 6 Interest on finance leases 1 1 2 270 293 214 Less interest capitalized on construction 14 9 9 Interest expense $ 256 $ 284 $ 205 Losses on early retirement of debt $ 199 $ 0 $ 30 (millions) Fiscal year 2023 $ 665 2024 467 2025 6 2026 0 2027 71 After 2027 2,086 2021 2020 2019 (millions) 8.375% Senior secured notes due 2025 $ 1,300 $ 0 $ 0 Revolving credit facility 585 1,500 0 3.875% Senior notes due 2022 450 0 100 3.625% Senior notes due 2024 150 0 0 2.875% Senior notes due 2023 136 0 110 4.375% Senior notes due 2023 49 0 190 7.6% Senior debentures due 2025 18 0 0 6.65% Senior debentures due 2024 5 0 0 3.45% Senior notes due 2021 0 500 0 10.25% Senior debentures due 2021 0 33 0 6.9% Senior debentures due 2029 0 0 113 7.0% Senior debentures due 2028 0 0 12 8.5% Senior debentures due 2019 0 0 36 9.5% amortizing debentures due 2021 2 4 4 9.75% amortizing debentures due 2021 1 2 2 $ 2,696 $ 2,039 $ 567 On March 3, 2022, the subject to up to two one-year extensions that could be requested by the Company and agreed to by the lenders. The agreement provides for revolving credit borrowings and letters of credit in an aggregate amount not to exceed $1 million. The unsecured revolving credit facility contains covenants that provide for, among other things, limitations on fundamental changes, use of proceeds, and maintenance of property, as well as customary representations and warranties and events of default. As of February 3, 2024 and January 28, 2023, there were no revolving credit loans outstanding under the credit agreement. released. January 29, January 30, 2022 2021 (millions) Accounts payable $ 1,058 $ 878 Gift cards and customer rewards 481 616 Lease related liabilities 433 285 Accrued wages and vacation 290 201 Allowance for future sales returns 198 159 Current portion of post employment and postretirement benefits 148 142 Taxes other than income taxes 141 265 Current portion of workers’ compensation and general liability reserves 92 97 Accrued interest 44 54 Restructuring accruals, including severance 5 27 Other 196 203 $ 3,086 $ 2,927 2021 2020 2019 (millions) Balance, beginning of year $ 416 $ 462 $ 487 Charged to costs and expenses 108 88 120 Payments, net of recoveries (137 ) (134 ) (145 ) Balance, end of year $ 387 $ 416 $ 462 2021 2020 2019 Current Deferred Total Current Deferred Total Current Deferred Total (millions) Federal $ 369 $ (21 ) $ 348 $ (520 ) $ (179 ) $ (699 ) $ 137 $ 4 $ 141 State and local 48 40 88 1 (148 ) (147 ) 33 (10 ) 23 $ 417 $ 19 $ 436 $ (519 ) $ (327 ) $ (846 ) $ 170 $ (6 ) $ 164 benefits in income tax expense. The 2021 2020 2019 (millions) Expected tax $ 392 $ (1,006 ) $ 153 State and local income taxes, net of federal income taxes 84 (140 ) 13 CARES Act carryback benefit (29 ) (205 ) 0 Goodwill impact 0 492 0 Tax impact of equity awards 0 8 1 Federal tax credits (3 ) (5 ) (3 ) Change in valuation allowance (15 ) 24 5 Other 7 (14 ) (5 ) $ 436 $ (846 ) $ 164 January 29, January 30, 2022 2021 (millions) Deferred tax assets Post employment and postretirement benefits $ 48 $ 126 Accrued liabilities accounted for on a cash basis for tax purposes 100 103 Lease liabilities 917 937 Unrecognized state tax benefits and accrued interest 38 39 State operating loss and credit carryforwards 152 194 Other 95 95 Valuation allowance (89 ) (104 ) Total deferred tax assets 1,261 1,390 Deferred tax liabilities Excess of book basis over tax basis of property and equipment (914 ) (937 ) Right of use assets (751 ) (766 ) Merchandise inventories (300 ) (300 ) Intangible assets (116 ) (115 ) Other (163 ) (180 ) Total deferred tax liabilities (2,244 ) (2,298 ) Net deferred tax liability $ (983 ) $ (908 ) January 29, January 30, February 1, 2022 2021 2020 (millions) Balance, beginning of year $ 113 $ 133 $ 149 Additions based on tax positions related to the current year 12 9 18 Additions for tax positions of prior years 0 0 11 Reductions for tax positions of prior years (11 ) (13 ) (20 ) Settlements (2 ) (4 ) (16 ) Statute expirations (10 ) (12 ) (9 ) Balance, end of year $ 102 $ 113 $ 133 Amounts recognized in the Consolidated Balance Sheets Current income taxes $ 14 $ 6 $ 12 Deferred income taxes 3 3 4 Other liabilities (a) 85 104 117 $ 102 $ 113 $ 133 January 29, January 30, 2022 2021 (millions) Amount of unrecognized tax benefits, net of deferred tax assets, that if recognized would affect the effective tax rate $ 81 $ 90 Accrued federal, state and local interest and penalties 65 60 Amounts recognized in the Consolidated Balance Sheets Current income taxes 32 3 Other liabilities 33 57 2021 2020 2019 (millions) 401(k) Qualified Defined Contribution Plan $ 76 $ 68 $ 96 Non-Qualified Defined Contribution Plan 1 1 2 Pension Plan (85 ) (73 ) (54 ) Supplementary Retirement Plan 24 26 30 $ 16 $ 22 $ 74 Pension Plan SERP 2021 2020 2021 2020 (millions) Change in projected benefit obligation Projected benefit obligation, beginning of year $ 3,030 $ 3,321 $ 673 $ 681 Service cost 1 4 0 0 Interest cost 49 66 11 14 Actuarial (gain) loss (172 ) 12 (32 ) 42 Benefits paid (502 ) (373 ) (46 ) (64 ) Projected benefit obligation, end of year 2,406 3,030 606 673 Changes in plan assets Fair value of plan assets, beginning of year 3,359 3,359 0 0 Actual return on plan assets 43 373 0 0 Company contributions 0 0 46 64 Benefits paid (502 ) (373 ) (46 ) (64 ) Fair value of plan assets, end of year 2,900 3,359 0 0 Funded status at end of year $ 494 $ 329 $ (606 ) $ (673 ) Amounts recognized in the Consolidated Balance Sheets at January 29, 2022 and January 30, 2021 Other assets $ 494 $ 329 $ 0 $ 0 Accounts payable and accrued liabilities 0 0 (47 ) (49 ) Other liabilities 0 0 (559 ) (624 ) $ 494 $ 329 $ (606 ) $ (673 ) Amounts recognized in accumulated other comprehensive loss at January 29, 2022 and January 30, 2021 Net actuarial loss $ 617 $ 794 $ 257 $ 301 Prior service cost 0 0 5 6 $ 617 $ 794 $ 262 $ 307 NOTESTO CONSOLIDATEDFINANCIALSTATEMENTS— (Continued) Pension Plan SERP 2021 2020 2019 2021 2020 2019 (millions) Net Periodic Pension Cost Service cost $ 1 $ 4 $ 5 $ 0 $ 0 $ 0 Interest cost 49 66 103 11 14 21 Expected return on assets (161 ) (183 ) (191 ) 0 0 0 Amortization of net actuarial loss 26 40 29 13 12 9 (85 ) (73 ) (54 ) 24 26 30 Settlement charges 96 74 45 0 10 13 Other Changes in Plan Assets and Projected Benefit Obligation Recognized in Other Comprehensive Loss Net actuarial (gain) loss (55 ) (178 ) 51 (32 ) 40 87 Amortization of net actuarial loss (26 ) (40 ) (29 ) (13 ) (12 ) (9 ) Settlement charges (96 ) (74 ) (45 ) 0 (10 ) (13 ) (177 ) (292 ) (23 ) (45 ) 18 65 Total recognized $ (166 ) $ (291 ) $ (32 ) $ (21 ) $ 54 $ 108 Pension Plan SERP 2021 2020 2021 2020 Discount rate 3.06 % 2.43 % 3.10 % 2.51 % Rate of compensation increases 3.50 % 3.45 % 0 0 Cash balance plan interest crediting rate 5.00 % 5.00 % 0 0 Pension Plan SERP 2021 2020 2019 2021 2020 2019 Discount rate used to measure service cost 2.69% - 3.07% 2.35% - 2.96% 4.09 % 0 0 0 Discount rate used to measure interest cost 1.76% - 2.07% 1.65% - 2.46% 3.67 % 1.74 % 1.65% - 2.44% 2.65% - 3.69% Expected long-term return on plan assets 5.75 % 6.25 % 6.50 % 0 0 0 Rate of compensation increases 3.45 % 3.25 % 4.00 % 0 0 0 Cash balance plan interest crediting rate 5.00 % 5.00 % 5.00 % 0 0 0 The Fair Value Category 2021 2020 (millions) Short term investments Level 2 $ 10 $ 3 Money market funds Level 1 206 136 Equity securities: U.S. pooled funds Level 1 77 356 International pooled funds Level 1 31 37 Fixed income securities: U.S. Treasury bonds Level 2 121 270 Other Government bonds Level 2 74 63 Corporate bonds Level 2 1,877 1,609 Mortgage-backed securities Level 2 10 11 Asset-backed securities Level 2 1 1 Pooled funds Level 1 72 271 Other types of investments: Derivatives in a positive position Level 2 12 8 Derivatives in a negative position Level 1 0 (4 ) Derivatives in a negative position Level 2 (1 ) 0 Pooled funds (a) 164 296 Real estate (a) 32 31 Private equity (a) 186 160 Total $ 2,872 $ 3,248 Pension Plan SERP (millions) Fiscal year 2022 $ 224 $ 47 2023 206 47 2024 193 45 2025 188 44 2026 180 48 2027-2031 768 190 2021 2020 2019 (millions) Stock options $ 4 $ 8 $ 15 Restricted stock units 51 23 23 $ 55 $ 31 $ 38 Income. There were 2019 Weighted average grant date fair value of stock options granted during the period $ 5.11 Dividend yield 6.3 % Expected volatility 40.6 % Risk-free interest rate 2.4 % Expected life 5.5 years Shares Weighted Average Exercise Price Weighted Average Remaining Contractual Life Aggregate Intrinsic Value (thousands) (years) (millions) Outstanding, beginning of period 16,345 $ 40.69 Granted 0 0 Canceled or forfeited (1,914 ) 27.40 Exercised (267 ) 26.51 Outstanding, end of period 14,164 $ 42.75 Exercisable, end of period 13,281 $ 43.92 3.1 $ 2 Options expected to vest 588 $ 25.26 6.9 $ 1 2021 2020 2019 (millions) Intrinsic value of options exercised $ 9 $ 0 $ 10 Cash received from stock options exercised 7 0 6 2021 2020 2019 Restricted stock units (performance-based) $ 15.80 $ 6.24 $ 24.28 Restricted stock units (time-based) 17.88 6.96 17.81 NOTESTO CONSOLIDATEDFINANCIALSTATEMENTS— (Continued) units, which is expected to be recognized over a weighted average period of approximately 2.5 years. Weighted Average Grant Date Shares Fair Value (thousands) Nonvested, beginning of period 9,752 $ 9.95 Granted – performance-based 841 15.80 Performance adjustment (34 ) 24.09 Granted – time-based 2,096 17.88 Forfeited (782 ) 10.65 Vested (2,773 ) 14.33 Nonvested, end of period 9,100 $ 10.87 Treasury Stock Common Stock Issued Deferred Compensation Plans Other Total Common Stock Outstanding (thousands) Balance at February 2, 2019 333,606 (941 ) (25,145 ) (26,086 ) 307,520 Stock issued under stock plans (130 ) 1,510 1,380 1,380 Stock repurchases (38 ) (38 ) (38 ) Deferred compensation plan distributions 169 169 169 Balance at February 1, 2020 333,606 (902 ) (23,673 ) (24,575 ) 309,031 Stock issued under stock plans (127 ) 1,577 1,450 1,450 Stock repurchases (79 ) (79 ) (79 ) Deferred compensation plan distributions 98 98 98 Balance at January 30, 2021 333,606 (931 ) (22,175 ) (23,106 ) 310,500 Stock issued under stock plans (277 ) 2,454 2,177 2,177 Stock repurchases (20,511 ) (20,511 ) (20,511 ) Deferred compensation plan distributions 193 193 193 Balance at January 29, 2022 333,606 (1,015 ) (40,232 ) (41,247 ) 292,359 January 29, 2022 January 30, 2021 Fair Value Measurements Fair Value Measurements Quoted Prices Quoted Prices Total in Active Markets for Identical Assets (Level 1) Significant Observable Inputs (Level 2) Significant Unobservable Inputs (Level 3) Total in Active Markets for Identical Assets (Level 1) Significant Observable Inputs (Level 2) Significant Unobservable Inputs (Level 3) (millions) Marketable equity and debt securities $ 39 $ 39 $ 0 $ 0 $ 100 $ 37 $ 63 $ 0 January 29, 2022 January 30, 2021 Notional Amount Carrying Amount Fair Value Notional Amount Carrying Amount Fair Value (millions) Long-term debt $ 3,295 $ 3,295 $ 3,254 $ 4,454 $ 4,407 $ 4,320 2021 2020 2019 Net Income Shares Net Loss Shares Net Income Shares (millions, except per share data) Net income (loss) and average number of shares outstanding $ 1,430 305.8 $ (3,944 ) 310.2 $ 564 308.8 Shares to be issued under deferred compensation and other plans 1.0 1.0 0.9 $ 1,430 306.8 $ (3,944 ) 311.1 $ 564 309.7 Basic earnings (loss) per share $ 4.66 $ (12.68 ) $ 1.82 Effect of dilutive securities: Stock options and restricted stock units 7.2 — 1.7 $ 1,430 314.0 $ (3,944 ) 311.1 $ 564 311.4 Diluted earnings (loss) per share $ 4.55 $ (12.68 ) $ 1.81 NOTESTO CONSOLIDATEDFINANCIALSTATEMENTS— (Continued) TheCompanyisacorporationorganizedunderthelawsoftheStateofDelawarein1985.TheCompanyanditspredecessorshavebeenoperatingdepartmentstoressince1830. As of January 29, 2022, respectively. Fiscal year 2023 included 53 weeks and fiscal years 2022 and 2021 each included 52 weeks.Forward-Looking StatementsThis Annual Report on Form 10-K and other reports, statements and information previously or subsequently filed by the Company with the Securities and Exchange Commission (the SEC) contain or may contain forward-looking statements. Such forward-looking statements are based upon the beliefs and assumptions of, and on information available to, the management of the Company at the time such statements are made. The following are or may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995: (i) statements preceded by, followed by or that include the words “may,” “will,” “could,” “should,” “believe,” “expect,” “future,” “potential,” “anticipate,” “intend,” “plan,” “think,” “estimate” or “continue” or the negative or other variations thereof and (ii) statements regarding matters that are not historical facts. Such forward-looking statements are subject to various risks and uncertainties, including risks and uncertainties relating to:•the possible invalidity of the underlying beliefs and assumptions;•the Company's ability to successfully implement A Bold New Chapter strategy, including the ability to realize the anticipated benefits within the expected time frame or at all;•the success of the Company's operational decisions, including product sourcing, merchandise mix and pricing, and marketing and strategic initiatives, such as growing its digital channels, expanding the Company's off-mall store presence and modernizing its technology and supply chain infrastructures;•general consumer shopping behaviors and spending levels, including the shift of consumer spending to digital channels, the impact of changes in general economic conditions, consumer disposable income levels, consumer confidence levels, the availability, cost and level of consumer debt, and the costs of basic necessities and other goods;•competitive pressures from department stores, specialty stores, general merchandise stores, manufacturers' outlets and websites, off-price and discount stores, and all other retail channels, including digitally-native retailers, social media and catalogs;•the Company's ability to remain competitive and relevant as consumers' shopping behaviors continue to migrate to digital shopping channels and other shopping channels;•the Company's ability to maintain its brand image and reputation;•possible systems failures and/or security breaches or other types of cybercrimes or cybersecurity attacks, including any security breach that results in the theft, transfer or unauthorized disclosure of customer, employee or company information, or the failure to comply with various laws applicable to the Company in the event of such a breach;•the cost of colleagues, inclusive of inflation and cost of benefits as well as attracting and retaining quality colleagues;•transactions and strategy involving the Company's real estate portfolio;•the seasonal nature of the Company's business;•declines in the Company's credit card revenues;•the effects of weather and natural disasters, including the impact of climate change and health pandemics, on the Company's business, including the ability to open stores, customer demand and its supply chain, as well as our consolidated results of operations, financial position and cash flows;•conditions to, or changes in the timing of, proposed transactions and changes in expected synergies, cost savings and non-recurring charges;•the potential for the incurrence of charges in connection with the impairment of tangible and intangible assets, including goodwill;•possible changes or developments in social, economic, business, industry, market, legal and regulatory circumstances and conditions, including supply chain disruptions, inventory shortage, labor shortages, wage pressures and rising inflation, and their related impact on costs;•possible actions taken or omitted to be taken by third parties, including customers, suppliers, business partners, competitors, banks and other financial institutions, and legislative, regulatory, judicial and other governmental authorities and officials;•changes in relationships with vendors and other product and service providers;1•our level of indebtedness;•currency, interest and exchange rates and other capital market, economic and geo-political conditions;•unstable political conditions, civil unrest, terrorist activities and armed conflicts, including the ongoing conflict between Russia and Ukraine and the Israel-Hamas war;•the possible inability of the Company's manufacturers or transporters to deliver products in a timely manner or meet the Company's quality standards;•the Company's reliance on foreign sources of production, including risks related to the disruption of imports by labor disputes, regional and global health pandemics, and regional political and economic conditions;•duties, taxes, other charges and quotas on imports;•labor shortages;•the Company's ability to declare and pay future dividends and continue its share repurchases; and•the Company's ability to execute on its strategies or achieve expectations related to environmental, social, and governance matters.In addition to any risks and uncertainties specifically identified in the text surrounding such forward-looking statements, the statements in the immediately preceding sentence and the statements under captions such as “Risk Factors” in reports, statements and information filed by the Company with the SEC from time to time constitute cautionary statements identifying important factors that could cause actual amounts, results, events and circumstances to differ materially from those expressed in or implied by such forward-looking statements.2PART IItem 1. Business.GeneralThe Company is a corporation organized under the laws of the State of Delaware in 1985. The Company and its predecessors have been operating department stores since 1830. As of February 3, 2024, the Company operated725 718 storelocationsin43states,the DistrictofColumbia,PuertoRicoandGuam. TheCompany'soperationsare conductedthrough Macy's, Macy’s Macy's Backstage, MarketMacy's small format, Bloomingdale's, Bloomingdale's The Outlet, Bloomie's, and Bluemercury. In addition, Bloomingdale's in Dubai, United Arab Emirates, and Al Zahra, Kuwait are operated under license agreements with Al Tayer Insignia, a company of Al Tayer Group, LLC.The Company sells a wide range of merchandise, including apparel and accessories (men's, women's and kids'), cosmetics, home furnishings and other consumer goods. The specific assortments vary by Macy’s, Bloomingdale's,Bloomingdale’sTheOutlet, Bloomies, andbluemercury.Inaddition,Bloomingdale'sinDubai,UnitedArabEmirates,andAlZahra,KuwaitareoperatedunderlicenseagreementswithAlTayerInsignia,acompanysize ofAlTayer Group,LLC.TheCompanysellsawiderangeofmerchandise,includingapparelandaccessories(men’s,women’sandkids'),cosmetics,homefurnishingsandotherconsumergoods.Thespecificassortmentsvarybysizeofstore,merchandising assortmentsandcharacterofcustomersinthetradeareas.Moststoresarelocatedaturbanorsuburbansites,principallyin densely populated areas across the United States.Disaggregation of the Company's net sales by family of business for 2023, 2022 and 2021 was as follows:2023 2022 2021 Women's Accessories, Shoes, Cosmetics and Fragrances $ 9,520 $ 9,597 $ 9,385 Women's Apparel 4,861 5,349 5,174 Men's and Kids' 4,918 5,297 5,247 Home/Other (a) 3,793 4,199 4,654 Total $ 23,092 $ 24,442 $ 24,460 populatedareasacrosstheUnitedStates.DisaggregationoftheCompany'snetsalesbyfamilyofbusinessfor 2021, 2020(a)Other primarily includes restaurant sales, allowance for merchandise returns adjustments and breakage income from unredeemed gift cards.andIn 2023, the Company's subsidiaries provided various support functions to the Company's retail operations on an integrated, company-wide basis. 2019 wereasfollows:(a)Other primarily includes restaurant sales, allowance for merchandise returns adjustments, breakage income from unredeemed gift cards and certain loyalty program income.In 2021,the•Company’sThe Company's wholly-owned bank subsidiary, FDS Bank, provides certain collections, customer service and credit marketing services in respect of all credit card accounts that are owned either by Citibank, N.A. or FDS Bank and that constitute a part of the credit programs of the Company's retail operations.•Macy's Systems and Technology, Inc., a wholly-owned indirect subsidiary of the Company, provides operational electronic data processing and management information services to all of the Company's operations other than Bluemercury.subsidiariesprovidedvarioussupportfunctionstothe•Company’sMacy's Merchandising Group, Inc. (MMG), a wholly-owned direct subsidiary of the Company, and its subsidiaries Macy's Merchandising Group International, LLC and Macy's Merchandising Group Procurement, LLC, are responsible for the design and development of Macy's private label brands and certain licensed brands. Bloomingdale's uses MMG for a small portion of its private label merchandise. The Company believes that its private label merchandise differentiates its merchandise assortments from those of its competitors. MMG also offers its services, either directly or indirectly, to unrelated third parties.•Macy's Logistics and Operations, a division of a wholly-owned indirect subsidiary of the Company, provides warehousing and merchandise distribution services for the Company's operations and digital customer fulfillment.retailoperationsonanintegrated,company-widebasis.•TheCompany’swholly-ownedbanksubsidiary,FDSBank,providescertaincollections,customerserviceandcreditmarketingservicesinrespectofallcreditcardaccountsthatareownedeitherbyDepartment StoresNationalBank,asubsidiaryofCitibank,N.A.,orFDSBankandthatconstituteapartof thecreditprogramsoftheCompany’sretailoperations.•Macy’sSystemsandTechnology,Inc.,awholly-ownedindirectsubsidiaryoftheCompany,providesoperationalelectronicdataprocessingandmanagementinformationservicestoallofthe Company’soperationsotherthanbluemercury.•Macy’sMerchandisingGroup,Inc.(“MMG”),awholly-owneddirectsubsidiaryoftheCompany,anditssubsidiaryMacy'sMerchandisingGroupInternational,LLC,areresponsibleforthedesign anddevelopmentofMacy’sprivatelabelbrandsandcertainlicensedbrands.Bloomingdale’susesMMGfora smallportionofitsprivatelabelmerchandise.TheCompanybelievesthatitsprivatelabelmerchandise differentiatesitsmerchandiseassortmentsfromthoseofitscompetitors. MMGalsooffersitsservices,eitherdirectlyorindirectly,tounrelatedthirdparties.•Macy’sLogisticsandOperations,adivisionofawholly-ownedindirectsubsidiaryoftheCompany,provideswarehousingandmerchandisedistributionservicesfortheCompany’soperationsanddigitalcustomerfulfillment.Company’s Company's principalexecutiveofficeislocatedat151West34th 34th Street,NewYork,NewYork10001,telephonenumber:(212) 494-1621.SeasonalityTheretailbusinessisseasonalinnaturewithahighproportionofsalesandoperatingincomegeneratedinthemonths ofNovemberandDecember.Workingcapitalrequirementsfluctuateduringtheyear,increasinginmid-summerinanticipationofthefallmerchandisingseasonandincreasingsubstantiallypriortothemonths of November and DecemberwhentheCompany carriessignificantlyhigherinventorylevels.4PurchasingTheCompanypurchasesmerchandisefrommanysuppliers,noneofwhichaccountedformorethan5%ofthe Company’sCompany's purchasesduring 2021. 2023. TheCompanyhasnomateriallong-termpurchasecommitmentswithanyofits suppliers and believes that it is not dependent on any one supplier. The Company considers its relations with its suppliers to be good.3Private Label Brands and Related TrademarksThe principal private label brands offered by the Companyconsidersitsrelationswithitssupplierstobegood.PrivateLabelBrandsandRelatedTrademarksTheprincipalprivatelabelbrandscurrentlyofferedbytheCompany as of February 3, 2024 includeAlfani, And Now This, Aqua,BarIII,Belgique, Cerulean 6, CharterClub,ClubRoom,EpicThreads, Family PJ’s, PJ's, firstimpressions,GianiBernini,HolidayLane,HomeDesign,HotelCollection,HudsonPark,Ideology,I-N-C,jenni,JMCollection,KarenScott,lune+aster,M-61,MaisonJules,MarthaStewartCollection, Morgan Taylor, Oake, On 34th, Sky,Style&Co.,Sun+Stone,SuttonStudio,TassoElba,TheCellar,ToolsoftheTradeandWildPair.ThetrademarksassociatedwiththeCompany'sprivatelabelbrands,otherthanMarthaStewartCollection,areownedbytheCompany.TheMarthaStewartCollection isownedby a thirdparty,whichlicenses thetrademarkassociatedwiththebrandtoCompany pursuantbegan to an agreement. exit its Women's Alfani and Karen Scott brands during fiscal 2023.Theagreement for trademarks associated with the MarthaStewart Collection extendsthrough 2022.CompetitionTheretailindustryishighlycompetitive.TheCompany’s Company's operationscompetewithmanyretailformatsonthenationalandlocallevel,includingdepartmentstores,specialtystores,generalmerchandisestores,manufacturers'outlets and websites, off-priceanddiscountstores,onlineretailers andcatalogs,amongothers.TheCompanyseekstoattractcustomersbyofferingcompelling,high-qualityproducts,greatpricesandtrustedserviceacrossallchannels, including its digital platforms.Otherretailers maycompeteforcustomersonsomeorallofthesebases,oronotherbases,andmaybeperceivedbysomepotential customers as being better aligned with their particular preferences.Government RegulationWe are subject to extensive and varied laws and regulations in the jurisdictions in which we operate in connection with both our core business operations and our credit card and other ancillary operations, including those relating to anti-bribery, customs, child labor, truth-in-advertising, consumer protection, zoning, occupancy, anti‑corruption and trade, anti-money laundering, import and export compliance, antitrust, data privacy and data protection, employment, workplace safety, public health and safety, environmental compliance, intellectual property, transportation, and fire codes. Our policies mandate compliance with all applicable laws and regulations, and we operate our business in accordance with standards and procedures designed to comply with these laws and regulations. We believe that we are in compliance with such laws and regulations in all material respects and do not expect that continued compliance with such regulations will have a material effect upon capital expenditures, earnings, or our competitive position.Available Informationasbeingbetteralignedwiththeirparticularpreferences.AvailableInformation(the" (the ExchangeAct") Act) availablefreeofchargethroughitsinternetwebsiteat https://www.macysinc.comassoonasreasonablypracticableafteritelectronicallyfilessuchmaterialwith,orfurnishesitto,theSEC.TheSECalsomaintainsan internetsitethatcontainsreports,proxyandinformationstatements,andotherinformationregardingissuersthatfile electronicallywith In addition, theSEC.Inaddition, Company has made theCompanyhasmadethefollowingavailablefreeofchargethroughitswebsiteat https://www.macysinc.com:•ChartersoftheAuditCommittee,CompensationandManagementDevelopmentCommittee,Finance Committee,andNominatingandCorporateGovernanceCommittee,CorporateGovernancePrinciples,LeadIndependentDirectorPolicy,Non-EmployeeDirectorCodeofBusinessConductandEthics,CodeofConduct,StandardsforDirectorIndependence,RelatedPersonTransactionsPolicy,MethodtoFacilitateReceipt,RetentionandTreatmentofCommunications,andProxyAccess By-Laws.•Proxy Access By-Laws.Anyoftheseitemsarealsoavailableinprinttoanyshareholderwhorequeststhem.Requestsshouldbesenttothe CorporateSecretaryof Macy’s, Macy's, Inc.at151West34th 34th Street,NewYork,NewYork10001.5Human Capital ResourcesCulture & EngagementAt Macy’s, culture is howMacy's Inc., we strive to be the Company servespreferred employer across our brands through an unwavering passion and supports itscommitment to our customers, communities and employees (called colleagues). The Company’sCompany's workplace is rooted in equity and guided by its valuessocial purpose, called Mission Every One, to create a brighter future with bold representation for all.4The Company gathers colleague feedback at key times throughout the colleague lifecycle from onboarding to offboarding and provides regular venues for colleagues to ask questions and share their opinions, such as Ask Me Anything sessions, town halls and colleague resource groups. The Company formally solicits feedback from all colleagues twice a year through an enterprise-widecompany-wide Culture Pulse Survey. The results are shared across the organization to provide visibility to both managers (called people leaders) and colleagues, andto help create an opportunityopportunities for open and constructive discussions among teams. Diversity, Equity & Inclusion (DE&I)Macy’sThe Company's commitment to diversity, equity and inclusion is guided by its values and starts from within by working to build a workforce that represents the communities it serves atenhance diversity and inclusion across all levels of our organization to enable us to more closely and making structural changes to implement practices and processes designed to be equitableeffectively engage with all of our customers and cultivate a culture of belonging. The Company seeks to empower colleagues to harness and unleash the power of their individuality to help drive better business decisions for customers and shareholders.The Company actively promotes an inclusive and welcoming environment for all customers and is also focused on supporting and developing underrepresented suppliers; investing in economic and workforce development; contributing to organizations fighting for social justice; and awarding scholarships to cultivate future leaders.One of the Company’s measures to advance the diversity of its leadership is the MOSAIC program, a one-year professional development program with continued support available as participants progress through their careers, launched in 2019 for its top talent at the manager and director levels who self-identify as ethnically diverse. From 2020 to 2021, approximately 74% of program participants were promoted or moved into a new role, with approximately 18% promoted to senior director level. The Company achieved 27.5% ethnic diversity representation at the director level and above, with a goal to reach 28.3% in 2022 and 30% by 2025.Macy’s believes people leaders play an important role in driving performance and an inclusive culture. In 2020, the Company incorporated People Leader Commitments (which were launched in 2019) and DE&I into the performance review process. In 2021, the Company included standardized DE&I goals into annual reviews at the director level and above. Starting in 2022, the Company has included the ethnic representation goal at the director level and above as part of annual incentive goals for the Company.Company-sponsored, employee-ledcolleague-led resource groups (ERGs)(CRGs) provide an opportunity for colleagues to experience connection, achieve belonging and develop leadership skills. In 2023, the Company completed its first phase of the CRG refresh, which included further expansion of chapters resulting in 100% of Macy's and Bloomingdale's colleagues now having access to a CRG.Since 2015, the Company has achieved a score of 100 every year on the Human Rights Campaign Foundation's Corporate Equality Index, earning the designation as “Best Place to Work for LGBTQ+ Equality.” This index is the national benchmarking tool measuring corporate policies, practices and benefits pertinent to LGBTQ+ workplace equality. In 2023, the Company received the Equality 100 Award marking the ninth consecutive year that the Company has received a score of 100. Additionally, the Company broadened the Week of Understanding programming in 2023 to encompass two additional topics, Disability Inclusion and Religion, as part of the Company's efforts to foster a more inclusive culture. Other enterprise-wide events included our CEO-led "Can We Talk?" discussion series featuring external keynote speakers designed to further build community. In 2021, ERGs expanded beyond our corporate offices to all supply chain locations and 124 stores and continue to be a resource for attracting and retaining talent. We also launched the Interfaith ERG across Macy’s and Bloomingdales, based on colleague feedback that there is a need to incorporate dialogue and education about religion and non-religious beliefs in the workplace.Macy’scritical DE&I skills.The Company's DE&I focus areas extend beyond its colleagues and include community, customers, marketing and suppliers. We have achievedBelow are a scorefew additional highlights from the past year:•Hosted second Vendor Pitch Competition and awarded $250,000 in business grants to graduates of 100 every year since 2015 onThe Workshop at Macy's 2023 program.•Deployed $6.2 million in capital to historically underfunded businesses and businesses serving underserved communities through S.P.U.R. Pathways: Shared Purpose, Unlimited Reach to accelerate growth and create new jobs in these communities.•Expanded our portfolio of diverse suppliers, onboarding over 130 new diverse-owned businesses online and in-store.•Donated $1 million to advance social justice and racial equity causes; added three new partners, supporting the Human Rights Campaign Foundation’s Corporate Equity Index, earningHispanic/Latino, People with Disabilities and Environmental Justice communities for greater balance across diversity dimensions.•Continued to leverage best in class partners, such as Seven Elements Group and Publicis Once & For All Coalition, to advance the designation as “Best Place to Work for LGBTQ+ Equity.” This index is the nation’s foremost benchmarking surveycultural fluency of our marketing and report measuring corporate policies and practices related to LGBTQ+ workplace equality. In November 2021, Macy’s was recognized by the NBIC, a coalition of the nation’s leading business organizations representing diverse communities,media.•Recognized as one of the Top 50 Best-of-the-Best Corporations for Inclusion. For example, here areInclusion for the third consecutive year by the National Business Inclusion Consortium (NBIC), a few highlights fromcoalition of the past year:•nation's leading business organizations representing diverse communities.Two Macy’s colleagues continued their second year as fellows, solely dedicated to the work of CEO Action for Racial Equity Taskforce—the mission of the taskforce is to identify, develop and promote scalable and sustainable public policies and corporate engagement strategies that will address systemic racism, social justice and improve societal well-being.6•Added pronouns to colleague name badges and email signatures to foster a more inclusive environment for customers and colleagues.Advanced diverse representation in advertising to reflect customers and expanded media to reach more ethnically diverse audiences. Launched a new partnership with a strategic marketing and creative agency, JOY Collective, to integrate deeper cultural fluency across marketing activities including heritage and history month campaigns.•Celebrated a decade of The Workshop at Macy’s with expanded class size and month-long e-commerce activation.Macy’sMacy's, Inc. believes that learning goes hand in hand with career growth, personal satisfaction and outstanding results. The Company aspires to create a learning culture where colleagues actively learn,can build their skills, apply what they have learnedtheir learning to address business challenges and share their knowledge, including their mistakes,experiences, to help others grow. Learning is accessible through Ignite (powered by Degreed), the Company’sCompany's self-directed learning experience platform as well as through technology, social learning and meaningful experiences and exposures with colleagues. We have also partnered with Guild a leading education and upskilling platform,Education to provide “Fully Funded Education for Everyone,”eligible colleagues with a fully-funded education benefit, including over 50more than 100 programs that lead range from foundational learning–such as high school completion and English language–to college degrees.5The Company makes investments in its people leaders and future leaders. Macy’s and Bloomingdale’sMacy's Executive Development ProgramsProgram and Bloomingdale's Leadership Development Program offer immersive, hands-on learning experiences for recent college graduates from top universities across the U.S. to jump startjump-start a career in retail, with specialization in technology, digital, stores, merchandising, and supply chain. Macy’sMacy's and Bloomingdale’sBloomingdale's offer internships for college students and Bloomingdale’sBloomingdale's offers an early immersion program focused on providing experiential learning and career exposure to those who identify with underrepresented groups. Bluemercury’sfoster inclusivity. Bluemercury's Shooting Stars is a six-month mentorship program that empowers mentees to own their journey by creating a development plan, becoming an inclusive leader and leveraging resources to support their career aspirations. In 2019, Macy’s partnered with Parsons School2022, the Company launched a multi-year career development initiative. This initiative included the launch of Design to launch Macy’s Fashion Academy – a custom executive education program designedCareer Hub on the Company intranet to offer best-in-class development across all disciplinesuser-friendly tools to assist colleagues at any part of its merchant talent. Astheir career journey; a resultvirtual Career Expo that featured workshops, panel discussions, external speakers and functional showcases; and people leader support with learning plans focused on career coaching and development. In 2023, the Company expanded the Career Expo from two weeks to a three-month-long series of this partnership, we have been ablesmall-group interactive sessions, which enabled colleagues to offer our Merchants custom experiences alignedinteract directly with key pillarsexperts and leaders to learn about career resources and build skills. Over the course of our Polaris Strategy.People leaders participate annually in required leadership development training and have access to robust on-demand development resources. Professional colleagues participate in a 90-day onboarding experience with performance milestones, support resources and role-specific trainingData AnalyticsDuring 2021, Macy’s continued to make progress in embedding data and analytics in Human Capital strategies and program measurements. Taking advantage of cloud-based HR technology has enabled real-time access to information and driven more colleague and people leader self-service.

training.•Career & leadership development: Online learning platform enables the development of targeted learning driven by Company-desired skill sets and/or colleague-driven skill development •Culture: Through the analysis of culture surveys, the Company can gauge progress over time and identify areas where enhancements need to be introduced•Human resources: Leveraging technology to automate responses for common colleague questions related to pay and benefits•Talent recruitment and retention: Leveraging recruiting data from previous years enables the forecasting of talent needs and leads to more improved onboarding, leadership spans of control and marketing investments•Workplace structure: Through customer analysis, the Company has identified opportunities for sales growth, which in turn have led to the launch and build-out of specialized teams targeted on delivering these opportunities 7Macy’sMacy's, Inc. offers comprehensive benefits and an awards strategy that is designed to recognize performance and talent development. Eligible colleagues have varied medical plan options to meet individual needs. The Company provides paid time-off, parental leave and holiday pay, as well as a company 401(k) plan and match, dependent care flexible spending account and a colleague merchandise discount for eligible colleagues.The Company believes that pay equity is fundamental to its culture and DE&I strategy. Compensation is based on job, position, responsibilities, experience and performance with incentive opportunities that allow colleagues to share in the Company’sCompany's success.In 2021, the Company achieved greater than 99% pay equity across gender and race. In termsAs part of both base pay and total compensation, the Company expectsour commitment to pay femaletransparency, all colleagues at greater than 99% of what it pays malehave access to view their role's pay zone and salary range to ensure colleagues understand their earnings potential. In addition, pay ranges are viewable on all job postings nationwide. People leaders and it expects that minorities will be paid at greater than 99% of what it pays non-minorities in the U.S.In 2021, we continuedsalaried colleagues have access to on-demand Compensation Education webinars to learn how pay is determined and to deep dive into our path to clear and competitive compensation programs by making the following investments: