SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ☒

| | | | |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31,

20222023

OR

| ☐

| | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from

to______________ to______________

(Commission File Number)

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 51-0278097 |

(State or Other Jurisdiction of Incorporation

or Organization) | (I.R.S. Employer Identification No.) |

or Organization)

| |

(Address of principal executive offices)

Registrant’s telephone number: (212) 632-6000

Securities Registered Pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

None | None | None |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒x No ☐o Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐o No ☒x Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒x No ☐o Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒x No ☐o Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐

o | Accelerated filer | ☐

o |

Non-accelerated filer | ☒

x | Smaller reporting company | ☐

o |

| | Emerging growth company | ☐

o |

If the Registrant is an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐o Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒x If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐o No ☒x As of June 30,

20222023 none of the Registrant’s common membership interests were held by non-affiliates.

As of January 31,

2023,2024, in addition to profit participation interests, there were two managing member interests outstanding.

The Registrant meets the conditions set forth in General Instructions (I)(1)(a) and (b) of Form 10-K and is therefore filing this Form with the reduced disclosure format by omitting the information called for by the following items of Form 10-K: Item 10, Directors, Executive Officers and Corporate Governance; Item 11, Executive Compensation; Item 12, Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters; and Item 13, Certain Relationships and Related Transactions, and Director Independence.

DOCUMENTS INCORPORATED BY REFERENCE

| | | | | | | | |

| Auditor Firm Id: 34 | Auditor Name: Deloitte & Touche LLP | Auditor Location: New York, New York USA |

Auditor Name: Deloitte & Touche LLP

Auditor Location: New York, New York USA

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31,

20222023

When we use the terms “Lazard Group”, “Lazard”, “we”, “us”, “our” and “the Company”, we mean Lazard Group LLC, a Delaware limited liability company, that is the current holding company for the subsidiaries that conduct our businesses. Lazard Ltd

iscompleted its conversion on January 1, 2024 (the “Conversion”) from an exempted company incorporated under the laws of Bermuda named Lazard Ltd to a

Bermuda exemptU.S. C-Corporation named Lazard, Inc., a company

whose sharesincorporated under the laws of

Class Athe state of Delaware, whose common stock (“common stock”)

, the only class of common stock of Lazard outstanding, are is publicly traded on the New York Stock Exchange under the symbol “LAZ”. Lazard,

Ltd’sInc.’s subsidiaries include Lazard Group and their respective subsidiaries. Lazard,

Ltd’sInc.’s primary operating asset is its indirect ownership as of December 31,

20222023 of all of the common membership interests in Lazard Group. Lazard,

LtdInc. controls Lazard Group through two of its indirect wholly-owned subsidiaries that are co-managing members of Lazard Group.

Lazard Group has granted profit participation interests in Lazard Group to certain of its managing directors. The profit participation interests are discretionary profits interests that are intended to enable Lazard Group to compensate its managing directors in a manner consistent with historical practices. Lazard Group has also granted profits interest participation rights to certain of its managing directors. See Note 1516 of Notes to Consolidated Financial Statements.

Item 1. Business

Lazard, one of the world’s preeminent financial advisory and asset management firms, operates

from 43 cities across 26 countries in North and South America, Europe,

the Middle East, Asia and Australia. With origins dating to 1848, we have long specialized in crafting solutions to the complex financial and strategic challenges of a diverse set of clients around the world, including corporations, governments, institutions, partnerships and individuals.

We focus primarily on two business segments: Financial Advisory and Asset Management. We believe that the mix of our activities across business segments, geographic regions, industries and investment strategies helps to diversify and stabilize our revenue stream.

Our Financial Advisory business offers corporate, partnership, institutional, government, sovereign and individual clients across the globe a wide array of financial advisory services regarding strategic and mergers and acquisitions (“M&A”) advisory, capital markets advisory, shareholder advisory, restructuring and

capital solutions,liability management, sovereign advisory, geopolitical advisory

capital raising and placement, and other strategic advisory

matters.matters and capital raising and placement. We focus on solving our clients’ most complex issues, providing advice to key decision-makers, senior management, boards of directors and business owners, as well as governments and governmental agencies, in transactions that typically are of significant strategic and financial importance to them.

We continue to build our Financial Advisory business by fostering long-term, senior-level relationships with existing and new clients as their independent advisor on strategic transactions and other matters. We seek to build and sustain long-term relationships with our clients rather than focusing simply on individual transactions, a practice that we believe enhances our access to senior management of major corporations and institutions around the world. We emphasize providing clients with senior-level focus during all phases of transaction analysis and execution.

While we strive to earn repeat business from our clients, we operate in a highly competitive environment in which there are no long-term contracted sources of revenue. Each revenue-generating engagement is separately negotiated and awarded. To develop new client relationships, and to develop new engagements from historical client relationships, we maintain an active dialogue with a large number of clients and potential clients, as well as with their financial and legal advisors, on an ongoing basis. We have gained a significant number of new clients each year through our business development initiatives, through recruiting additional senior investment banking professionals who bring with them client relationships and through referrals from directors, attorneys and other third parties with whom we have relationships. At the same time, we lose clients each year as a result of the sale,

merger or

mergerrestructuring of a client, a change in a client’s senior management, competition from other investment banks and other causes.

We earned $1 million or more from

304299 clients for the year ended December 31,

2022.2023. For the year ended December 31,

2022,2023, the ten largest fee paying clients constituted approximately 19% of our Financial Advisory segment net revenue, with no client individually contributing more than 10% of segment net revenue.

We believe that we have been pioneers in offering

financial advisoryinternational Financial Advisory services,

on an international basis, with the establishment of our New York, Paris and London offices dating back to the nineteenth century. We maintain a major local presence in the United States (the “U.S.”), the United Kingdom (the “U.K.”) and France,

including a network of regional branchwith offices

inacross the

U.S., as wellworld as a

presence in Argentina, Belgium, Brazil, Chile, China, Colombia, Germany, Hong Kong, Italy, Japan, Mexico, the Netherlands, Panama, Singapore, Spain, Sweden and the Middle East region.part of our global network. For a full list of our current locations, visit www.lazard.com.

In addition to seeking business centered in the regions described above, we historically have focused in particular on advising clients with respect to cross-border transactions. We believe that we are particularly well known for our legacy of offering broad teams of professionals who are indigenous to their respective regions, who have long-term client relationships, capabilities and know-how in their respective regions and who will coordinate with our professionals who have global sector expertise. We also believe that this positioning affords us insight around the globe into key industry, economic, governmental and regulatory issues and developments, which we can bring to bear on behalf of our clients.

We advise clients on a wide range of strategic and financial issues. When we advise clients on the potential acquisition of another company, business or certain assets, our services include evaluating potential acquisition targets, providing valuation analyses, evaluating and proposing financial and structural alternatives and rendering, if appropriate, fairness opinions. We also may advise as to the timing, financing and pricing of a proposed acquisition and assist in negotiating and closing the acquisition.

In addition, we may assist in executing an acquisition by acting as a dealer-manager in transactions structured as a tender or exchange offer.When we advise clients that are contemplating the sale of

certain businesses, assets or an entire company, our services include advising on the sale process, providing valuation analyses, assisting in preparing an information memorandum or other appropriate sale materials and rendering, if appropriate, fairness opinions. We also identify and contact selected qualified potential acquirors and assist in negotiating and closing the proposed sale. As appropriate, we also advise our clients regarding potential financial and strategic alternatives to a sale, including recapitalizations, spin-offs, carve-outs and split-offs. We frequently provide advice with respect to the structure, timing and pricing of these alternatives.

With respect to companies in financial distress, we provide services to the company, creditors or other interested parties, which

services may include reviewing and analyzing the business, operations, properties, financial condition and prospects of the company, evaluating debt capacity, assisting in the determination of an appropriate capital structure, assisting in structuring and effecting the financial aspects of

amendments to debt documents or exchange offers

or refinancings, evaluating financial and strategic alternatives and assisting and participating in negotiations with affected entities or groups. If appropriate, we may provide financial advice and assistance in developing and seeking approval of a restructuring or reorganization plan, which may include a plan of reorganization under Chapter 11 of the U.S. Bankruptcy Code or other similar court administered processes in non-U.S. jurisdictions. In such cases, we may assist in certain aspects of the implementation of such a plan, including advising and assisting in structuring and effecting the financial aspects of a sale or recapitalization, structuring new securities, other consideration or other inducements to be offered or issued, as well as assisting and participating in negotiations with affected entities or groups.

When we assist clients in connection with shareholder advisory and corporate preparedness matters, our services may include reviewing and analyzing the business,

andoperations, properties, financial condition

and prospects of the company, providing insights on the company’s shareholders

assisting in the evaluation of environmental, social and governance (“ESG”) matters, and advising on defense measures and strategic alternatives potentially available to the company. Our advice may relate to a broad range of matters including M&A and capital markets transactions and activist situations.

2

When we assist clients in connection with their capital structure, we typically review and analyze structural alternatives, assist in long-term capital planning and advise and assist with respect to rating agency discussions and relationships, among other things.

When we assist clients in raising private or public market financing or capital, our services

may include assisting clients in connection with securing, refinancing or restructuring bank loans or other debt, securing venture capital

and other financial investor funding, originating and executing, or participating in, public underwritings and private placements of securities, and originating and executing private placements of partnership and similar interests in alternative investment funds such as leveraged buyout, mezzanine or real estate focused

funds and single or multi-asset continuation funds.

We are at the forefront of providing independent advice to governments and governmental agencies in connection with economic developments. Lazard’s Sovereign Advisory Group has advised a number of countries and institutions with respect to sovereign debt and other financial matters.

We staff each of our assignments with a team of quality professionals who have appropriate product, industry and geographic expertise. We pride ourselves on, and we believe we differentiate ourselves from our competitors by, being able to offer a high level of attention from senior personnel to our clients and organizing ourselves in such a way that managing directors who are responsible for securing and maintaining client relationships also actively participate in providing related advice and services. Our managing directors have significant experience, and many of them are able to use this experience to advise on M&A, financings, restructurings, capital structure, shareholder advisory and other transactions or financial matters, depending on our clients’ needs. Many of our managing directors and senior employees come from diverse backgrounds, such as senior leadership positions in corporations, government, law and strategic consulting, which we believe enhances our ability to offer sophisticated advice and customized solutions to our clients. As of December 31,

2022,2023, our Financial Advisory segment had

211210 managing directors and

1,4521,392 other professionals and support staff.

Industries Served

and Practice Areas

We seek to offer our services across most major industry groups, including, in many cases, sub-industry specialties. Managing directors and professionals in our M&A practice are organized to provide advice in the following major industry practice areas:

| •consumer;• | financial institutions;

|

| •financial institutions;• | health care and life sciences;

|

| •health care and life sciences;• | industrials;

|

| •industrials;• | power and energy/infrastructure;

|

| •power and energy/infrastructure;• | real estate;

|

| •real estate;• | technology; and

|

| •technology; and• | telecommunications, media and entertainment.

|

•telecommunications, media and entertainment.

These groups are managed locally in each relevant geographic region and are coordinated globally, which allows us to bring local industry-specific knowledge to bear on behalf of our clients on a global basis. We believe that this enhances the scope and the quality of the advice that we can offer, which improves our ability to market our capabilities to clients.

In addition to our M&A and Restructuring and

Capital SolutionsLiability Management practices, we also maintain specialties in the following distinct practice areas within our Financial Advisory business:

| •

| government and sovereign advisory;

|

| •

| capital structure debt and equity•government and sovereign advisory;

|

•capital structure debt and equity advisory;

| • | shareholder and corporate preparedness advisory; |

| • | fundraising and arranging liquidity for third-party alternative investment funds; |

| • | corporate finance and other services, including private placements, underwritten offerings related to our Financial Advisory business and transactions involving the exchange or issuance of securities; and |

We endeavor to coordinate the activities of the professionals in these areas with our M&A industry specialists in order to offer clients customized teams of cross-functional expertise spanning both industry and practice area expertise.

Our focus in our Financial Advisory business is on:

| •

| investing in our intellectual capital through senior professionals who we believe have strong client relationships and industry expertise;

|

| •investing in our intellectual capital through senior professionals who we believe have strong client relationships and industry expertise;• | increasing our contacts with existing clients to further enhance our long-term relationships and our efforts in developing new client relationships;

|

| • | increasing our contacts with existing clients to further enhance our long-term relationships and our efforts in developing new client relationships; |

| •developing new client relationships;• | expanding the breadth and depth of our industry expertise and selectively adding or reinforcing practice areas, such as our Capital Markets Advisory, Shareholder Advisory, Sovereign Advisory and Geopolitical Advisory groups;

|

| •expanding the breadth and depth of our industry expertise and selectively adding or reinforcing practice areas, such as our Capital Markets Advisory, Shareholder Advisory, Sovereign Advisory and Geopolitical Advisory groups;• | coordinating our industry specialty activities on a global basis and increasing the integration of our industry experts in M&A with our other professionals;

|

| •coordinating our industry specialty activities on a global basis and increasing the integration of our industry experts in M&A with our other professionals;• | selectively bolstering our existing presence in certain local markets;

|

| •selectively bolstering our existing presence in certain local markets;• | broadening our geographic presence by adding new offices where opportunities arise;

|

| •broadening our geographic presence by adding new offices where opportunities arise;• | investing in our technology infrastructure and data science capabilities to enhance our business; and

|

| •investing in our technology infrastructure and data science capabilities to enhance our business; and• | deploying our intellectual capital, strong client relationships and other assets to generate new revenue streams.

|

•deploying our intellectual capital, strong client relationships and other assets to generate new revenue streams.

In addition to the investments made as part of this strategy, we believe that our Financial Advisory business may benefit from external market factors, including:

| •

| demand for independent, sophisticated financial advice;

|

| •demand for independent, sophisticated financial advice;• | recapitalization and related activities in developed and emerging markets;

|

| •recapitalization and related activities in developed and emerging markets;• | high corporate cash balances;

|

| •high corporate cash balances;• | attractive equity valuations, favorable credit conditions and generally positive market sentiment;

|

| •attractive equity valuations, stable credit conditions and generally positive market sentiment;• | favorable levels of cross-border M&A and large capitalization M&A, two of our areas of historical specialization;

|

| •favorable levels of cross-border M&A and large capitalization M&A, two of our areas of historical specialization;• | strategic market and industry catalysts, including energy transition, technology disruption, and infrastructure investment; and

|

| •strategic market and industry catalysts, including energy transition, technology disruption, life sciences evolution and infrastructure investment; and• | possible M&A activity that may result from tax, regulatory and similar reform.

|

•favorable tax, regulatory and similar reform.

Going forward, our strategic emphasis in our Financial Advisory business is to leverage the investments we have made to grow our business and drive our productivity. We continue to seek to opportunistically attract

4

outstanding individuals to our business.business, and expect the number of Financial Advisory managing directors to increase in the future as part of our initiative to grow revenues. Net hiring may also increase compensation expenses. We routinely reassess our strategic position and may in the future seek opportunities to further enhance our competitive position.

Our Asset Management business offers a broad range of global investment solutions and investment and wealth management services in equity and fixed income strategies, asset allocation strategies, alternative investments and private equity funds to corporations, public funds, sovereign entities, endowments and foundations, labor funds, financial intermediaries and private clients. Our goal in our Asset Management business is to produce superior risk-adjusted investment returns and provide customized investment solutions for our clients through the active management of their

portfolios.assets. Our investment teams construct and manage portfolios using various techniques and investment philosophies, including traditional fundamental research and analysis and quantitative tools.

Our top ten clients accounted for 27%29% of our total assets under management (“AUM”) for the year endedas of December 31, 2022,2023, with no client individually contributing more than 10% of our Asset Management segment net revenue. Approximately 85% of our AUM as of December 31, 20222023 was managed on behalf of institutional and intermediary clients, including corporations, labor unions, public pension funds, insurance companies and banks, and through sub-advisory relationships,

mutual fund sponsors, broker-dealers and registered advisors, and approximately 15% of our AUM was managed on behalf of individual client relationships, which are principally with family offices and high-net worth individuals.

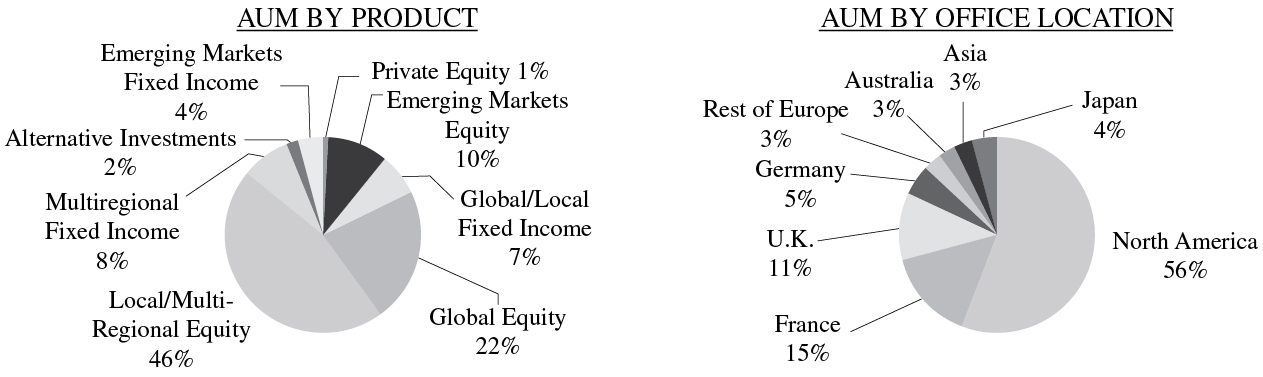

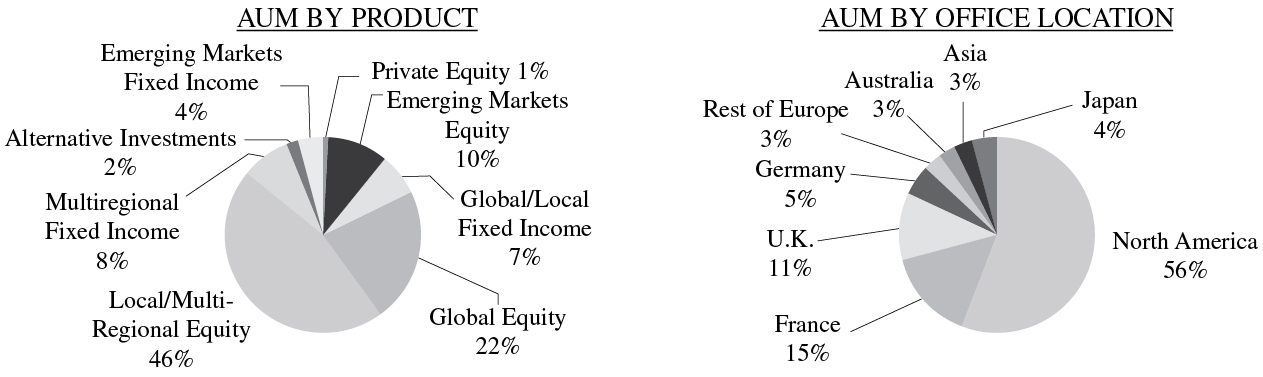

The charts below illustrate the mix of our AUM as of December 31,

2022,2023, measured by broad product strategy and by office location.

Our Asset Management business maintains offices in New York, Amsterdam, Bordeaux, Boston, Brussels, Chicago, Dubai, Dublin, Frankfurt, Geneva, Hamburg, Hong Kong, London, Luxembourg, Lyon, Madrid, Melbourne, Milan, Montreal, Nantes, Paris,

Riyadh, San Francisco, Seoul, Singapore, Sydney, Tokyo, Toronto,

Vienna and Zurich. These operations, with

120114 managing directors and

1,1051,107 other professionals and support staff as of December 31,

2022,2023, provide our Asset Management business with both a global presence and a local identity.

Primary distinguishing features of these operations include:

| •

| a global footprint with global research, global mandates and global clients;

|

| •a global footprint with global research, global mandates and global clients;• | a broad-based team of investment professionals, including focused, in-house investment analysts across all products and platforms, many of whom have substantial industry or sector specific expertise; and

|

| •a broad-based team of investment professionals, including focused, in-house investment analysts across all products and platforms, many of whom have substantial industry or sector specific expertise; and •world-wide brand recognition and multi-channel distribution capabilities. •

| world-wide brand recognition and multi-channel distribution capabilities.

|

Our Investment Philosophy, Process and Research

Our investment philosophy is generally based upon a fundamental security selection approach to investing. Across many of our products, we apply three key principles to investment portfolios:

| •

| select securities, not markets;

|

•select securities, not markets;

| • | evaluate a company’s financial position, outlook, opportunities and risks, together with its valuation; and |

In searching for investment opportunities, many of our investment professionals follow an investment process that incorporates several interconnected components that may include:

| •

| quantitative•fundamental analysis;

|

| •

| accounting•quantitative analysis;

|

| •accounting analysis;• | security selection and portfolio construction;

|

| •security selection and portfolio construction;• | risk management; and

|

| •risk management; and• | ESG factors.

|

•environmental, social and governance (“ESG”) factors.

In our Asset Management business, we conduct investment research on a global basis to develop market, industry and company-specific insights and evaluate investment opportunities. Many of our global equity analysts, located in our worldwide offices, are organized around global industry sectors.

Our Asset Management business provides equity, fixed income, cash management and alternative investment strategies to our clients, paying close attention to our clients’ varying and expanding investment needs. We offer the following product platform of investment strategies:

| | | | | | | | | | | | | | | | | | | | | | | |

| Global | | Global

Multi-Regional | | Local | | Multi-Regional

| Local

| | Emerging Markets |

Equity | Sustainable Agriculture Global Ex Global Ex-U.K.

Global Ex-Japan

Global Ex-Emerging Markets Circular Economy | | Multi-Capitalization Value Thematic Eurozone Euro-Trend (Thematic)

Europe, Australasia and Far East Sustainable | | Large Capitalization Small/Mid

Quantitative Small Capitalization U.K. (Large Capitalization) U.K. Quantitative

France France (Large Capitalization)

France (Small Capitalization)

Large Capitalization Small Capitalization | | Small Capitalization Frontier Equities

Managed Volatility Sustainable

Middle East North Africa |

| | | | | | | |

Fixed Income and Cash Management | Total Return Short Duration Convertibles | | Pan-European Core High Yield Short Duration

Convertibles

| | Pan-European

Core

High Yield

Total Return Eurozone Fixed Income

Cash Management

Corporate Bonds

Scandinavian

Short Duration

| | U.S.

Cash Management Corporate Bonds Nordic Scandinavian Short Duration | | U.S. Core/Core Plus High Yield | | Emerging DebtEmerging Debt-

Core/Local/Blend/Corporate |

| | | | | | | |

Alternative | Sustainable Private Infrastructure | | | | Quantitative Long/Short Equity Long/Short Credit

Japan Long/Short Equity | | Emerging Debt Total Return Emerging Income Emerging Debt

|

In addition to the primary investment strategies listed above, we also provide other asset management services to our clients, including asset allocation and other investment advisory services, as well as locally customized investment solutions. In many cases, we also offer both diversified and more concentrated versions of our products. These products are generally offered on a separate account basis, as well as through pooled vehicles.

Distribution. We distribute our products through a broad array of marketing channels on a global basis. Marketing, sales and client service efforts are organized through a global market delivery and service network, with distribution professionals located in cities including New York, Amsterdam, Bordeaux, Boston, Brussels, Chicago, Dubai, Frankfurt, Geneva, Hamburg, Hong Kong, London, Luxembourg, Lyon, Madrid, Melbourne, Milan, Montreal, Nantes, Paris, Riyadh, San Francisco, Seoul, Singapore, Sydney, Tokyo, Toronto, Vienna and Zurich. We have developed a well-established presence in the institutional asset management arena, managing assets for corporations, labor unions, sovereign wealth funds and public pension funds around the world. In addition, we manage assets for insurance companies, savings and trust banks, endowments, foundations and charities. We

also have becomeare a leading firm in managing mutual funds, sub-advisory funds and separately managed accounts for many of the world’s largest broker-dealers, insurance companies, registered advisors and other financial intermediaries.

Our strategic plan in our Asset Management business is to focus on delivering superior investment performance and client service and broadening our product offerings and distribution in selected areas in order to continue to drive improved business results. Over the past several years, in an effort to improve our Asset Management business’ operations and expand our Asset Management business, we have:

| •

| focused on enhancing our investment performance;

|

| •focused on enhancing our investment performance;• | improved our investment management platform by adding a number of senior investment professionals, including portfolio managers and analysts;

|

| •improved our investment management platform by adding a number of senior investment professionals, including portfolio managers and analysts;• | continued to strengthen our marketing and consultant relations capabilities, including by optimizing our distribution capabilities across client channels in North America;

|

| •continued to strengthen our marketing and consultant relations capabilities, including by optimizing our distribution globally;• | expanded our product platform, including through the addition of long/short equity strategies, sustainable strategies, quantitative equity strategies, long/short credit capabilities and thematically oriented strategies;

|

| •expanded our product platform, including through the addition of long/short equity strategies, sustainable strategies, quantitative equity strategies and thematically oriented strategies;• | invested in our technology infrastructure and data science capabilities to enhance our business; and

|

| •invested in our technology infrastructure and data science capabilities to enhance our business; and• | continued to expand the geographic reach of our Asset Management business.

|

•continued to expand our geographic reach where opportunities arise.

We believe that our Asset Management business has long maintained an outstanding team of portfolio managers and global research analysts. We intend to maintain and supplement our intellectual capital to achieve our goals. We routinely reassess our strategic position and

may in the future seekaim to add capabilities potentially through acquisitions or other transactions, including the opportunistic hiring of new employees, in order to further enhance our competitive position.

We also believe that our specific investment strategies, global reach, unique brand identity and access to multiple distribution channels may allow us to expand into new investment products, strategies and geographic locations. In addition, we may expand our participation in alternative investment activities through investments in new and successor funds, and through organic growth, acquisitions or otherwise. We may also continue to expand our geographic reach where opportunities arise.We engage in selected alternative investments and private equity activities. In 2009, we established a private equity business with The Edgewater Funds (“Edgewater”), a Chicago-based private equity firm, through the acquisition of Edgewater’s management vehicles. As of December 31,

2022,2023, Edgewater had approximately

$1.0$1.6 billion of AUM and unfunded fee-earning commitments.

Historically, Lazard also has made selected investments with its We have historically, and may in the future, invest our own capital often alongside capitalthat of qualified institutional and individualother investors, in connection with Lazard’s selectedcertain of our activities in managing alternative investmentsasset and private equity activities. These investments typically have been organized in funds that make substantial or

8

controlling investments in private or public companies, generally through privately negotiated transactions. While potentially risky and frequently illiquid, such investments, when successful, can yield investors substantial returns on capital and generate attractive management and performance-based incentive fees for the sponsor of such funds.

investment vehicles.

We believe that our people are our most important asset. Their talent, integrity and engagement have shaped our success in the past, and they are instrumental to our ability to achieve sustainable growth and deliver value for our shareholders in the future. We strive to create a culture that fosters excellence, collaboration, innovation, empowerment, inclusion and engagement.

Our human capital efforts are overseen by Lazard Ltd’sour Board of Directors, with a focus on enhancing our workplace environment which in turn, attracts a diversity of perspectives and exceptional talent. In February 2018, Lazard Ltd’sour Board of Directors formally established its Workplace and Culture Committee to assist and advise management on cultivating and

reinforcing a workplace culture that helps attract, motivate and retain talented people; fosters productivity, professional and personal development; values diversity, equity and inclusion; and encourages its people to engage with each other and their communities. The Company has several areas of focus to support these objectives:

Attracting and Retaining Talent. We offer competitive compensation packages to recruit and retain exceptional talent. We offer a variety of employee benefits, including comprehensive health insurance coverage, flexible retirement and health carehealthcare savings account plans as well as family planning and support services. We also invest in wellness programs that are broadly inclusive and support varied lifestyles. We further believe that the equity-based portion of our compensation program fosters a greater sense of ownership among our senior employees and aligns their interests with those of our shareholders. Talent Development. We seek to hire talented and motivated individuals and prioritize their continued education and training. The Company works to support the success and growth of its employees through a collaborative and dynamic 360-degree performance management and review cycle. Furthermore, through investments in technology, we have enhanced knowledge management and collaboration tools across our businesses. Inclusion, Diversity, Equity and Allyship.Allyship (“IDEA”). We strive to cultivate a workforce comprised of people with different backgrounds and experiences, which we believe creates an environment of cognitive diversity that promotes new ideas and innovation. Our IDEA strategy fosters diversity through hiring, development, promotion and retention while contributing to an equitable and inclusive culture by calling on everyone at the firm to take personal responsibility in ensuring the strategy’s success. Additionally, we support the creation of a variety of employee resource groups, which build community across the firm, contribute to our inclusive culture, and provide opportunities for individuals to give back to their communities through volunteering and educational outreach. Personal Well-Being. The Company invests in the well-being of our employees by offering benefits intended to meet the varied and evolving needs of our diverse workforce across businesses and geographies. The Company addresses this through its Work to Wellness program, a global initiative that educates, motivates and empowers employees to maintain a healthy lifestyle in and out of the workplace. We offer a wide range of resources to support employees and their families’ emotional and financial well-being. We have also made investments in technology that enable remote and hybrid working options. Community. The Company promotes community engagement through our Work for Good initiative, which supports employee initiatives to volunteer with a variety of local charities. Volunteering through our Work for Good program allows employees to make a positive impact in their communities and share experiences with their colleagues outside of the workplace. In addition to Work for Good, the Company encourages participation in, among others, the Lazard Foundation in the U.S. and Give as You Earn in the U.K., which host additional volunteer opportunities and charitable fundraising events. Employees. As of December 31, 2022,2023, we employed approximately 3,3893,289 full-time people based in 43 cities across 26 countries.people. We operate through two business segments: our Financial Advisory business included 211210 managing directors and 1,4521,392 professionals and support staff, and our Asset Management business included 1209

114 managing directors and 1,1051,107 professionals and support staff. Our Corporate segment included 2526 managing directors and 476440 professionals and support staff. Generally, our employees are not subject to collective bargaining agreements, except that our employees in some offices, including France and Italy, are covered by national, industry-wide collective bargaining agreements. We believe that we have good relations with our employees.

The financial services industry, and all of the businesses in which we compete, are intensely competitive, and we expect them to remain so. Our competitors are other investment banking and financial advisory firms, broker-dealers, commercial and “universal” banks, insurance companies,

investmenttraditional asset management firms, hedge fund management firms, alternative investment firms, private banks and other financial institutions. We compete with some of them globally and with others on a regional, product or niche basis. We compete on the basis of a number of factors, including industry and product expertise, innovative insights of our people, transaction execution skills, investment track record, quality of client service, individual and institutional client relationships, absence of conflicts, range and price of products and services, innovation, brand recognition and business reputation.

While we believe our independent advisory perspective and global footprint offersoffer a uniquely competitive position, many of our competitors are large, consolidated financial institutions that have the ability to offer a wider range of

products, including loans, insurance, foreign exchange, hedging, research, brokerage and underwriting services, which may enhance their competitive position. They also may have the ability to support clients with other financial services in an effort to gain market share, which could result in pricing pressure in our business or loss of opportunities for us. At the same time, demand for independent financial advice has created opportunities for

new entrants, including a number of boutique financial advisory firms. These boutique firms frequently compete, among other factors, on the basis of their independent financial advice, and their activities also could result in pricing and other competitive pressure in our businesses. In some circumstances, our competitors may offer financial products or services that we do not offer, such as low-cost passive or private investment vehicles. We compete based on the quality and breadth of our products and innovative solutions we offer, which

isare derived from our objectivity, differentiated insights and fundamental research orientation.

Competition is also intense in each of our businesses for the attraction and retention of qualified employees, and we compete, among other factors, on the level and nature of compensation and long-term incentives, workplace culture and opportunities for professional and personal development for our employees. Our ability to continue to compete effectively in our businesses will depend upon our ability to attract new employees and retain and motivate our existing employees, in each case, at appropriate compensation levels.

See Item 1A, “Risk Factors—The financial services industry, and all of the businesses in which we compete, are intensely competitive” below.

Our businesses are subject to extensive regulation throughout the world. As a matter of public policy, regulatory bodies are generally charged with safeguarding the integrity of the securities and other financial markets and with protecting the interests of customers participating in those markets, not with protecting the interests of our stockholders or creditors. Many of our affiliates that participate in securities markets are subject to comprehensive regulations that include some form of minimum capital retention requirements and customer protection rules. In the U.S., certain of our subsidiaries are subject to such regulations promulgated by the United States Securities and Exchange Commission (the “SEC”) and/or the Financial Industry Regulatory Authority (“FINRA”). Standards, requirements and rules implemented throughout the European Union are broadly comparable in scope and purpose to the regulatory capital and customer protection requirements imposed under the SEC and FINRA rules. European Union directives also permit local regulation in each jurisdiction, including those in which we operate, to be more restrictive than the requirements of such European Union-wide directives. These local requirements can result in certain competitive disadvantages to us.

In the U.S., the SEC is the federal agency responsible for the administration of the federal securities laws. FINRA is a voluntary, self-regulatory body composed of members, such as our broker-dealer subsidiaries, that have agreed to abide by FINRA’s rules and regulations.

The SEC, FINRA and other U.S. and non-U.S. regulatory

10

organizations may examine the activities of, and may expel, fine and otherwise discipline us and our employees. The laws, rules and regulations comprising this framework of regulation and the interpretation and enforcement of existing laws, rules and regulations are continually changing. The effect of any such changes cannot be predicted and may impact the manner of operation and profitability of our businesses.

Our principal U.S. broker-dealer subsidiary, Lazard Frères & Co. LLC (“LFNY”), through which we conduct most of our U.S. Financial Advisory business, is currently registered as a broker-dealer with the SEC and FINRA, and as a broker-dealer in all 50 U.S. states, the District of Columbia and Puerto Rico. As such, LFNY is subject to regulations governing most aspects of the securities business, including regulations regarding minimum capital retention requirements, record-keeping and reporting procedures, relationships with customers, experience and training requirements for certain employees and business procedures with firms that are not members of certain regulatory bodies. Lazard Asset Management Securities LLC (“LAM Securities”), a subsidiary of Lazard Asset Management LLC (“LAM LLC”), is registered as a broker-dealer with the SEC and FINRA and in all 50 U.S. states, the District of Columbia and Puerto Rico.

Lazard Middle Market LLC is registered as a broker-dealer with the SEC and FINRA and as a broker-dealer in various U.S. states and territories.Our U.S. broker-dealer subsidiaries, including LFNY, are subject to the SEC’s uniform net capital rule, Rule 15c3-1 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the net capital rules of FINRA, which may limit our ability to make withdrawals of capital from our broker-dealer subsidiaries. The uniform net capital rule sets the minimum level of net capital a broker-dealer must maintain and also requires that a portion of its assets be relatively liquid. FINRA may prohibit a member firm from expanding its business or paying cash dividends if it would result in net capital falling below FINRA’s requirements. In addition, our broker-dealer subsidiaries are subject to certain notification requirements related to withdrawals of excess net capital. Our broker-dealer subsidiaries are also subject to regulations, including the USA PATRIOT Act of 2001, which impose obligations regarding the prevention and detection of money-laundering activities, including the establishment of customer due diligence and other compliance policies and procedures. Failure to comply with these requirements may result in monetary, regulatory and, in certain cases, criminal penalties.

Certain U.K. subsidiaries of Lazard Group, including Lazard & Co., Limited (“LCL”), Lazard Fund Managers Limited and Lazard Asset Management Limited, which we refer to in this Annual Report on Form 10-K (this “Form 10-K”) as the “U.K. subsidiaries,” are authorized and regulated by the Financial Conduct Authority (the “FCA”), and are subject to various rules and regulations made by the FCA under the authorities conferred upon it by the Financial Services and Markets Act 2000, as amended by the Financial Services Act 2012.

Certain of our Asset Management subsidiaries are registered as investment advisors with the SEC. As a registered investment advisor, each is subject to the requirements of the Investment Advisers Act of 1940, as amended (the “Investment Advisers Act”), and the SEC’s regulations thereunder. Such requirements relate to, among other things, the relationship between an advisor and its advisory clients, as well as general anti-fraud prohibitions. LAM LLC serves as an investment advisor to several U.S. mutual funds which are registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”). The Investment Company Act regulates, among other things, the relationship between a mutual fund and its investment advisor (and other service providers) and prohibits or severely restricts principal transactions between an advisor and its advisory clients, imposes record-keeping and reporting requirements, disclosure requirements, limitations on trades where a single broker acts as the agent for both the buyer and seller, and limitations on affiliated transactions and joint transactions. LAM Securities serves as an underwriter or distributor for mutual funds and private funds managed by LAM LLC and its subsidiaries (collectively, “LAM”), and as an introducing broker to Pershing LLC for unmanaged accounts of certain of LAM LLC’s private clients.

As a result of certain changes effected by the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) related to the regulation of over-the-counter swaps and other derivative instruments, LAM and certain of its subsidiaries have registered with the U.S. Commodity Futures Trading Commission (the “CFTC”) and the National Futures Association (the “NFA”), and are subject to certain aspects of the U.S. Commodity Exchange Act and the regulations thereunder and to the rules of the NFA. The CFTC and the NFA have authority over the laws, rules and regulations related to commodities (including the over-the-counter swaps and derivatives markets), and regulate our relationship with clients who trade in these instruments. The U.S. Commodity Exchange Act and the regulations thereunder also impose additional record-keeping and reporting requirements and disclosure requirements on LAM and its subsidiaries.

Compagnie Financière Lazard Frères SAS (“CFLF”), our French subsidiary under which asset management and commercial banking activities are carried out in France, is subject to regulation by the Autorité de Contrôle Prudentiel et de Résolution (“ACPR”) for its banking activities conducted through our Paris-based banking subsidiary, Lazard Frères Banque SA (“LFB”). The investment services activities of the Paris group, exercised through LFB and other subsidiaries of CFLF, primarily Lazard Frères Gestion SAS (“LFG”), also are subject to regulation and supervision by the Autorité des Marchés Financiers. In addition, pursuant to the consolidated supervision rules in the European Union, LFB, in particular, as a French credit institution, is required to be supervised by a regulatory body, either in the U.S. or in the European Union. In 2013, the Company and the ACPR

11

agreed on terms for the consolidated supervision of LFB and certain other non-Financial Advisory European subsidiaries of the Company (referred to herein, on a combined basis, as the “combined European regulated group”) under such rules. Under this supervision, the combined European regulated group is required to comply with minimum requirements for regulatory net capital to be reported on a quarterly basis and satisfy periodic financial and other reporting obligations.capital. Additionally, the combined European regulated group, together with certain of our European Financial Advisory entities, is required to perform an annual risk assessment and provide certain other information on a periodic basis, including financial reports and information relating to financial performance, balance sheet data and capital structure.

As a result of certain changes effected by the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) related to the regulation of over-the-counter swaps and other derivative instruments, LAM and certain of its subsidiaries have registered with the U.S. Commodity Futures Trading Commission (the “CFTC”) and the National Futures Association (the “NFA”), and are subject to certain aspects of the U.S. Commodity Exchange Act and the regulations thereunder, and to the rules of the NFA. The CFTC and the NFA have authority over the laws, rules and regulations related to commodities (including the over-the-counter swaps and derivatives markets), and regulate our relationship with clients who trade in these instruments. The U.S. Commodity Exchange Act and the regulations thereunder also impose additional record-keeping and reporting requirements and disclosure requirements on LAM and its subsidiaries.

basis.

In addition, the Central Bank of Ireland, the Japanese Ministry of Finance and Financial Services Agency, the Korean Financial Supervisory Commission, the Securities and Futures Commission of Hong Kong, the Monetary Authority of Singapore, the Australian Securities & Investments Commission, the Dubai Financial Services Authority, the Italian Companies and Stock Exchange Commission and the German Federal Financial Supervisory Authority, among others, regulate relevant operating subsidiaries of the Company and also have capital standards and other requirements broadly comparable to the rules of the SEC. Our business is also subject to regulation by other non-U.S. governmental and regulatory bodies and self-regulatory authorities in other countries in which we operate.

Regulators are empowered to conduct periodic examinations and initiate administrative proceedings that can result, among other things, in censure, fine, the issuance of cease-and-desist orders or the suspension or expulsion or other disciplining of a regulated entity or its directors, officers or employees.

We are also subject to various anti-bribery, anti-money laundering and counter-terrorist financing laws, rules and regulations in the jurisdictions in which we operate. The U.S. Foreign Corrupt Practices Act, for example, generally prohibits offering, promising or giving, or authorizing others to give, anything of value, either directly or indirectly, to a

non-U.S. government official in order to influence official action or otherwise gain an unfair business advantage, such as to obtain or retain business. Similar rules and regulations exist in other jurisdictions in which we operate. In addition, we are required to comply with economic sanctions and embargo programs administered by the U.S. Treasury’s Office of Foreign Assets Control and by similar governmental agencies and other authorities worldwide. Violations of any of these laws, rules, regulations and programs can give rise to administrative, civil or criminal penalties.

The U.S. and other governments and institutions have taken actions, and may continue to take further actions, that affect the global financial markets. Such further actions could include expanding current or enacting new standards, requirements and rules that may be applicable to us and our subsidiaries. The effect of any such expanded or new standards, requirements and rules is uncertain and could have adverse consequences to our business and results of operations. See Item 1A, “Risk Factors—Other Business Risks—Extensive regulation of our businesses limits our activities and results in ongoing exposure to the potential for significant penalties, including fines or limitations on our ability to conduct our

businesses.”businesses”.

Executive Officers of the Registrant

Set forth below are the name, age, present title, principal occupation and certain biographical information for each of our executive officers as of February

14, 2023,13, 2024, all of whom have been appointed by, and serve at the discretion of, our board of directors.

Mr. Jacobs

has servedbecame Executive Chairman at Lazard, Inc. and Lazard Group in October 2023 after previously serving as Chairman of the Board of Directors and Chief Executive Officer of Lazard,

LtdInc. and Lazard Group

sincefrom November

2009.2009 through September 2023. Mr. Jacobs has served as a Managing Director of Lazard,

Inc. since 1991 and had been a Deputy Chairman of Lazard from January 2002 until November 2009. Mr. Jacobs also served as Chief Executive Officer of Lazard North America from January 2002 until November 2009. Mr. Jacobs initially joined Lazard in 1988. Mr. Jacobs is a member of the

BoardBoards of Trustees of the University of Chicago and the Brookings Institution.

Mary Ann Betsch, 44

Ms. Betsch became Chief Financial Officer of Lazard Ltd and Lazard Group in October 2022. Prior to joining Lazard, Ms. Betsch worked at Citadel, where she helped lead the finance and accounting function since 2018. Ms. Betsch was previously He is also a partner at PwC, where she spent 17 years in a variety of audit and advisory roles serving global investment banks and other financial institutions. She also completed a two-year fellowship program supported by the Federal Reserve Board’s Chief Accountant.

Scott D. Hoffman, 60

Mr. Hoffman has served as Chief Administrative Officer of Lazard Ltd and Lazard Group since July 2017 and as General Counsel of Lazard Ltd since May 2005. Mr. Hoffman has served as a Managing Director of Lazard since January 1999 and General Counsel of Lazard Group since January 2001. Mr. Hoffman previously served as Vice President and Assistant General Counsel from February 1994 to December 1997 and as a Director from January 1998 to December 1998. Prior to joining Lazard, Mr. Hoffman was an attorney at Cravath, Swaine & Moore LLP. Mr. Hoffman is a member of the Board of Trustees of thePartnership for New York University School of LawCity, and a member of the Board of Directors of Film at Lincoln Center.

Council on Foreign Relations.

Mr. Orszag became Chief Executive Officer of

Lazard, Inc. and Lazard Group in October 2023. He previously served as Chief Executive Officer of Financial Advisory

infrom June

2019.2019 until September 2023. Prior to that he was Lazard’s Head of North American Mergers & Acquisitions since July 2018 and Global Co-Head of Healthcare since November 2016. Mr. Orszag joined Lazard in May 2016 as a Vice Chairman of Investment Banking from Citigroup, where he was Vice Chairman of Corporate and Investment Banking and Chairman of the Financial Strategy and Solutions Group from January 2011 to February 2016. Mr. Orszag served as the Director of the Office of Management and Budget in the Obama Administration from January 2009 to July 2010, and was the Director of the Congressional Budget Office from January 2007 to December 2008. Mr. Orszag is a member of the Board of Directors of the Peterson Institute for International Economics, the Mt. Sinai Medical Center and New Visions for Public Schools in New York, and is a member of the National Academy of Medicine.

Mary Ann Betsch, 45

Ms. Betsch became Chief Financial Officer of Lazard, Inc. and Lazard Group in October 2022. Prior to joining Lazard, Ms. Betsch worked at Citadel, where she helped lead the finance and accounting function since 2018. Ms. Betsch was previously a partner at PwC, where she spent 17 years in a variety of audit and advisory roles serving global investment banks and other financial institutions. She also completed a two-year fellowship program supported by the Federal Reserve Board’s Chief Accountant. She holds a CPA license in the State of New York and is a CFA charterholder.

Mr. Russo became Chief Executive Officer of Lazard’s Asset Management business in June 2022. He previously served as Chief Financial Officer of Lazard,

LtdInc. and Lazard Group from October 2017 until October 2022. Mr. Russo has served as Managing Director of Lazard since 2009, and prior to becoming Chief Financial Officer was Co-Head of Lazard’s Capital Markets and Capital Structure Advisory practice. Mr. Russo joined Lazard as a Director in 2007. Prior to joining Lazard, Mr. Russo worked for Goldman, Sachs & Co. in the Investment Banking Division, and prior to that, for Barclays Capital. Mr. Russo began his career as an attorney at Milbank, Tweed, Hadley & McCloy.

13

Ms. Soto became Chief Operating Officer of Lazard, Inc. and Lazard Group in October 2023. She previously served as Group Executive, Human Capital and Workplace Innovation, of Lazard, LtdInc. and Lazard Group in June 2019. She became the Global Chief Operating Officer of Financial Advisory in July 2018 and has served as a Managing Director of Lazard since January 2001. Ms. Soto was previously Chief Operating Officer of Lazard Europe Financial Advisory from January 2006 to July 2018, and Chief Operating Officer of Lazard Paris Financial Advisory from October 2009 to August 2013. Prior to joining Lazard in June 1993, Ms. Soto worked for Morgan Stanley. She is a member of the Supervisory Board of Metro AG.

Christian A. Weideman, 48

Mr. Weideman became General Counsel of Lazard, Inc. and Lazard Group in October 2023. Prior to joining Lazard, Mr. Weideman was global General Counsel and a partner at Apollo Global Management, where he led and managed Apollo's legal, tax, and compliance team. Mr. Weideman also served in senior roles at the United States Department of the Treasury including as Deputy General Counsel and then Chief of Staff. Prior to the Department of Treasury, Mr. Weidemanserved as Associate Counsel to the President at the White House and as a litigator at Williams & Connolly.

Where You Can Find Additional Information

Lazard Group files current, annual and quarterly reports and other information required by the Exchange Act with the SEC. The Company’s SEC filings are available to the public from the SEC’s internet site at http://www.sec.gov. Our public website is http://www.lazard.com and the investor relations section thereof hosts our SEC filings. We will make available free of charge, on or through the investor relations section of our website, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports filed or furnished pursuant to the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Also posted on our website, and available in print upon request of any Lazard, LtdInc. shareholder to the Investor Relations Department, are charters for Lazard, Ltd’sInc.’s Audit Committee, Compensation Committee, Nominating & Governance Committee and Workplace and Culture Committee. Copies of these charters and Lazard, Ltd’sInc.’s Corporate Governance Guidelines and Code of Business Conduct and Ethics governing our directors, officers and employees are also posted on the investor relations section of our website in the corporate governance subsection. ITEM 1A. RISK FACTORS

You should carefully consider the following risks and all of the other information set forth in this Form 10-K, including our consolidated financial statements and related notes. The following risks comprise the material risks of which we are aware. If any of the events or developments described below actually occurred, our business, financial condition or results of operations would likely suffer.

The following is a summary of certain material risks of which we are aware. You should carefully consider this summary, together with the more detailed description of each risk factor contained below.

•• | Difficult market conditions can adversely affect our business in many ways, including by reducing the volume of transactions involving our Financial Advisory business and reducing the value or performance of the assets we manage in our Asset Management business.

|

•

| Fluctuations in foreign currency exchange rates could reduce our members’ equity and net income or negatively impact the portfolios of our Asset Management clients and may affect the levels of our AUM.

|

•

| Our results of operations may be affected by fluctuations in the fair value of positions held in our investment portfolios.

|

•

| Our business, financial condition and results of operations could be materially adversely affected by pandemics, including the ongoing COVID-19 pandemic.

|

•

| Due to the nature of our business, financial results could differ significantly from period to period, which may make it difficult for us to achieve steady earnings growth on a quarterly basis.

|

•

| Our ability to retain our managing directors and other key professional employees, including maintaining compensation levels at an appropriate level, is critical to the success of our business and failure to do so may materially adversely affect our results of operations and financial position.

|

•

| The financial services industry, and all of the businesses in which we compete, are intensely competitive.

|

•

| A substantial portion of our revenue is derived from Financial Advisory fees, which are not long-term contracted sources of revenue and are subject to intense competition.

|

•

| If the number of debt defaults, bankruptcies or other factors affecting demand for our Restructuring services declines, our Restructuring revenue could suffer.

|

•

| Certain of our services are dependent on the availability of private capital for deployment in illiquid asset classes.

|

15

•

| Potential underwriting activities or advisory roles on capital raises may expose us to risk.

|

•

| Our investment style in our Asset Management business, including the mix of asset classes and investment strategies comprising our AUM, may underperform or generate less demand than other investment approaches, which may result in significant client or asset departures or a reduction in AUM.

|

•

| We could lose clients and suffer a decline in our Asset Management revenue and earnings if the investments we choose in our Asset Management business perform poorly, regardless of overall trends in the prices of securities.

|

•

| Because many of our Asset Management clients can remove the assets we manage on short notice, we may experience unexpected declines in revenue and profitability.

|

•

| Access to clients through intermediaries and consultants is important to our Asset Management business, and reductions in referrals from such intermediaries or consultants or poor reviews of our products or our organization by such intermediaries or consultants could materially reduce our revenue and impair our ability to attract new clients.

|

•

| Our Asset Management business relies on non-affiliated third-party service providers.

|

•

| Certain of our investments are in relatively high-risk, illiquid assets, and we may lose some or all of the principal amount of these investments or fail to realize any profits from these investments for a considerable period of time.

|

•

| We may pursue new business lines, acquisitions, joint ventures, cooperation agreements or other growth or geographic expansion strategies that may result in additional risks and uncertainties in our business and could present unforeseen integration obstacles or costs.

|

•

| An inability to access the debt and equity capital markets as a result of our debt obligations, credit ratings or other factors could impair our liquidity, increase our borrowing costs or otherwise adversely affect our financial position or results of operations.

|

•

| The soundness of third parties, including our clients, as well as financial, governmental and other institutions, could adversely affect us.

|

•

| Other operational risks may disrupt our businesses, result in regulatory action against us or limit our growth.

|

•

| Extensive regulation of our businesses limits our activities and results in ongoing exposure to the potential for significant penalties, including fines or limitations on our ability to conduct our businesses.

|

•

| The financial services industry faces substantial litigation and regulatory risks, and we may face damage to our professional reputation and legal liability if our services are not regarded as satisfactory or if conflicts of interest should arise.

|

•

| Expectations relating to ESG considerations expose us to potential liabilities, increased costs, reputational harm, and other adverse effects on our business.

|

•

| Employee misconduct, which is difficult to detect and deter, could harm us by impairing our ability to attract and retain clients and subjecting us to significant legal liability and reputational harm.

|

•

| A failure in or breach of our information systems or infrastructure, or those of third parties with which we do business, including as a result of cyber attacks, could disrupt our businesses, lead to reputational harm and legal liability or otherwise impact our ability to operate our business.

|

•

| Failure to maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act could materially adversely affect our business.

|

•

| Uncertainty regarding the outcome of future arrangements between the European Union and the United Kingdom may adversely affect our business.

|

16

•

| In the event of a change or adverse interpretation of relevant income tax law, regulation or treaty, or a failure to qualify for treaty benefits, our overall tax rate may be substantially higher than the rate used for purposes of our consolidated financial statements.

|

•

| Tax authorities may challenge our tax computations and classifications, our transfer pricing methods and our application of related policies and methods.

|

•

| Lazard Group is a holding company and, accordingly, depends on its subsidiaries to make distributions to Lazard Group to enable it to service its obligations under its indebtedness.

|

Risks Related to Economic and Current Conditions Impacting Us and our Business

Difficult market conditions can adversely affect our business in many ways, including by reducing the volume of transactions involving our Financial Advisory business and reducing the value or performance of the assets we manage in our Asset Management business.

•Consequences of geopolitical conditions, military conflicts, wars and acts of terrorism could adversely affect our business, financial condition and results of operations.

•Fluctuations in foreign currency exchange rates could reduce our members’ equity and net income or negatively impact the portfolios of our Asset Management clients and may affect the levels of our AUM.

•Our results of operations may be affected by fluctuations in the fair value of positions held in our investment portfolios.

•Our business, financial condition and results of operations could be materially adversely affected by pandemics.

•Due to the nature of our business, financial results could differ significantly from period to period, which may make it difficult for us to achieve steady earnings growth on a quarterly basis.

•Our ability to retain and attract managing directors and other key professional employees, including maintaining compensation levels at an appropriate level, is critical to the success of our business and failure to do so may materially adversely affect our results of operations and financial position.

•The financial services industry, and all of the businesses in which we compete, are intensely competitive.

•A substantial portion of our revenue is derived from Financial Advisory fees, which are not long-term contracted sources of revenue and are subject to intense competition.

•If the number of debt defaults, bankruptcies or other factors affecting demand for our Restructuring services declines, our Restructuring revenue could suffer.

•Certain of our services are dependent on the availability of private capital for deployment in illiquid asset classes.

•Potential underwriting or deal manager activities or advisory roles on capital raises or exchange transactions may expose us to risk.

•Our investment style in our Asset Management business, including the mix of asset classes and investment strategies comprising our AUM, may underperform or generate less demand than other investment approaches, which may result in significant client or asset departures or a reduction in AUM.

•We could lose clients and suffer a decline in our Asset Management revenue and earnings if the investments we choose in our Asset Management business perform poorly, regardless of overall trends in the prices of securities.

•Because many of our Asset Management clients can remove the assets we manage on short notice, we may experience unexpected declines in revenue and profitability.

•Access to clients through intermediaries and consultants is important to our Asset Management business, and reductions in referrals from such intermediaries or consultants or poor reviews of our products or our organization by such intermediaries or consultants could materially reduce our revenue and impair our ability to attract new clients.

•Our Asset Management business relies on non-affiliated third-party service providers.

•Certain of our investments are in relatively high-risk, illiquid assets, and we may lose some or all of the principal amount of these investments or fail to realize any profits from these investments for a considerable period of time.

•We may pursue new business lines, acquisitions, joint ventures, cooperation agreements or other growth or geographic expansion strategies that may result in additional risks and uncertainties in our business and could present unforeseen integration obstacles or costs.

•An inability to access the debt and equity capital markets as a result of our debt obligations, credit ratings or other factors could impair our liquidity, increase our borrowing costs or otherwise adversely affect our financial position or results of operations.

•The soundness of third parties, including our clients, as well as financial, governmental and other institutions, could adversely affect us.

•Other operational risks may disrupt our businesses, result in regulatory action against us or limit our growth.

•Extensive regulation of our businesses limits our activities and results in ongoing exposure to the potential for significant penalties, including fines or limitations on our ability to conduct our businesses.

•The financial services industry faces substantial litigation and regulatory risks, and we may face damage to our professional reputation and legal liability if our services are not regarded as satisfactory or if conflicts of interest should arise.

•Expectations relating to ESG considerations expose us to potential liabilities, increased costs, reputational harm, and other adverse effects on our business.

•Employee misconduct, which is difficult to detect and deter, could harm us by impairing our ability to attract and retain clients and subjecting us to significant legal liability and reputational harm.

•A failure in or breach of our information systems or infrastructure, or those of third parties with which we do business, including as a result of cybersecurity incidents or threats, could disrupt our businesses, lead to reputational harm and legal liability or otherwise impact our ability to operate our business.

•Failure to maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act could materially adversely affect our business.

•Uncertainty regarding the outcome of future arrangements between the European Union and the United Kingdom may adversely affect our business.

•Changes in relevant tax laws, regulations or treaties or an adverse interpretation of these items by tax authorities could negatively impact our effective tax rate.

•Tax authorities may challenge our tax computations and transfer pricing methods and our application of related policies and methods.

•Lazard Group is a holding company and, accordingly, depends on its subsidiaries to make distributions to Lazard Group to enable it to service its obligations under its indebtedness.

Risks Related to Economic and Current Conditions Impacting Us and our Business

Difficult market conditions can adversely affect our business in many ways, including by reducing the volume of transactions involving our Financial Advisory business and reducing the value or performance of the

assets we manage in our Asset Management business, which, in each case, could materially reduce our revenue or income and adversely affect our financial position.

As a financial services firm, our businesses are materially affected by conditions in the global financial markets and economic conditions throughout the world. Unfavorable economic and market conditions can adversely affect our financial performance in both the Financial Advisory and Asset Management businesses. The future market and economic climate may deteriorate because of many factors, such as a general slowing of economic growth globally or regionally, periods of disruption or volatility in securities markets, volatility and tightening of liquidity in credit markets, volatility or significant realignments in currency markets, increases in interest rates, inflation, corporate or sovereign defaults, natural disasters, pandemics, terrorism or political uncertainty or instability.