UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

| | | | | | | | | | |

x☒ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the Fiscal Year ended | December 31, 2017.2020 |

| ☐ | | |

o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition period from to . |

Commission File Number: 001-36002

NRG Yield,Clearway Energy, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | | 46-1777204 |

(State or other jurisdiction

of incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | |

Delaware

(State or other jurisdiction of incorporation or organization)

| | 46-1777204

(I.R.S. Employer Identification No.)

|

| 300 Carnegie Center, Suite 300 | Princeton | New Jersey | 08540 |

804 Carnegie Center, Princeton, New Jersey

(Address of principal executive offices) | | 08540

(Zip Code) |

(609) 524-4500608-1525

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | | | | |

Title of Each Classeach class | Trading Symbol(s) | Name of Exchangeeach exchange on Which Registeredwhich registered |

Class A Common Stock, Class A, par value $0.01 | CWEN.A | New York Stock Exchange |

Class C Common Stock, Class C, par value $0.01 | CWEN | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x☒ No o☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o☐ No x☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx☒Noo ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yesx☒Noo

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large“large accelerated filer," "accelerated” “accelerated filer," "smaller” “smaller reporting company,"” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | | | |

Large accelerated filerx | ☒ | Accelerated filero | ☐ |

Non-accelerated filer o | ☐ | Smaller reporting companyo | Emerging Growth Company o

☐ |

| | Emerging growth company | | (Do not check if a smaller reporting company) | | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o☐ No x

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Yes ☒ No ☐

As of the last business day of the most recently completed second fiscal quarter, the aggregate market value of the common stock of the registrant held by non-affiliates was approximately $1,705,887,079$1,786,941,297 based on the closing sale prices of such shares as reported on the New York Stock Exchange.

Indicate the number of shares outstanding of each of the registrant's classes of common stock as of the latest practicable date.

|

| | | | | | | |

| Class | | Outstanding at January 31, 20182021 |

| Common Stock, Class A, par value $0.01 per share | | 34,586,25034,599,645 |

| Common Stock, Class B, par value $0.01 per share | | 42,738,750 |

| Common Stock, Class C, par value $0.01 per share | | 64,730,51981,635,540 |

| Common Stock, Class D, par value $0.01 per share | | 42,738,750 |

Documents Incorporated by Reference:

Portions of the Registrant's Definitive Proxy Statement relating to its 20182021 Annual Meeting of Stockholders

are incorporated by reference into Part III of this Annual Report on Form 10-K

TABLE OF CONTENTS

Index

|

| | | | |

| GLOSSARY OF TERMS | |

| PART I | |

| Item 1 — Business | |

| Item 1A — Risk Factors | |

| Item 1B — Unresolved Staff Comments | |

| Item 2 — Properties | |

| Item 3 — Legal Proceedings | |

| Item 4 — Mine Safety Disclosures | |

| PART II | |

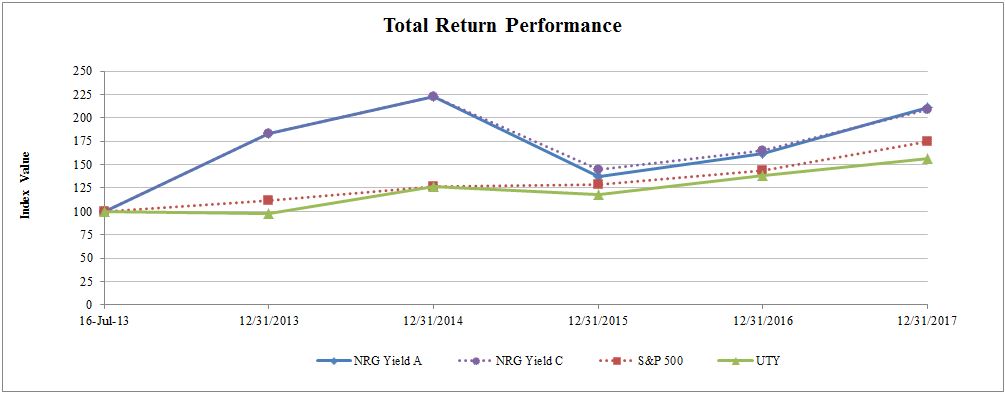

| Item 5 — Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

| Item 6 — Selected Financial Data | |

| Item 7 — Management's Discussion and Analysis of Financial Condition and Results of Operations | |

| Item 7A — Quantitative and Qualitative Disclosures About Market Risk | |

| Item 8 — Financial Statements and Supplementary Data | |

| Item 9 — Changes in Disagreements With Accountants on Accounting and Financial Disclosure | |

| Item 9A — Controls and Procedures | |

| Item 9B — Other Information | |

| PART III | |

| Item 10 — Directors, Executive Officers and Corporate Governance | |

| Item 11 — Executive Compensation | |

| Item 12 — Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

| Item 13 — Certain Relationships and Related Transactions, and Director Independence | |

| Item 14 — Principal Accounting Fees and Services | |

| PART IV | |

| Item 15 — Exhibits, Financial Statement Schedules | |

| EXHIBIT INDEX | |

| Item 16 — Form 10-K Summary | |

GLOSSARY OF TERMS

When the following terms and abbreviations appear in the text of this report, they have the meanings indicated below:

|

| | | | | | | |

2019 Convertible Notes | | $345 million aggregate principal amount of 3.50% Convertible Notes due 2019 |

| 2020 Convertible Notes | | $287.545 million aggregate principal amount of 3.25% Convertible Notesconvertible notes due 2020, issued by Clearway Energy, Inc., which were repaid on June 1, 2020 |

| 2024 Senior Notes | | $500 million aggregate principal amount of 5.375% unsecured senior notes due 2024, issued by NRG YieldClearway Energy Operating LLC, which were repaid on January 3,2020 |

| 2025 Senior Notes | | $600 million aggregate principal amount of 5.750% unsecured senior notes due 2025, issued by Clearway Energy Operating LLC |

| 2026 Senior Notes | | $350 million aggregate principal amount of 5.00% unsecured senior notes due 2026, issued by NRG YieldClearway Energy Operating LLC |

| 2028 Senior Notes | | $850 million aggregate principal amount of 4.75% unsecured senior notes due 2028, issued by Clearway Energy Operating LLC |

Alta TE HoldcoAdjusted EBITDA | | Alta Wind X-XI TE Holdco LLCA non-GAAP measure, represents earnings before interest, tax, depreciation and amortization adjusted for mark-to-market gains or losses, asset write offs and impairments; and factors which the Company does not consider indicative of future operating performance |

Alta Wind PortfolioARO | | Seven wind facilities that total 947 MW located in Tehachapi, California and a portfolio of associated land leases |

AOCL | | Accumulated Other Comprehensive Loss |

ARO | | Asset Retirement Obligation |

ARRAASC | | American Recovery and Reinvestment Act of 2009 |

ASC | | The FASB Accounting Standards Codification, which the FASB established as the source of

authoritative GAAP

|

| ASU | | Accounting Standards Updates – updates to the ASC |

ATM ProgramPrograms | | At-The-Market Equity Offering ProgramPrograms |

August 2017Bankruptcy Code | | Title 11 of the U.S. Code |

| Bankruptcy Court | | U.S. Bankruptcy Court for the Northern District of California |

Buckthorn Solar Drop Down AssetsAsset | | The remaining 25% interest in NRG Wind TE Holdco, an 814 net MW portfolioBuckthorn Renewables, LLC, which owns 100% of twelve wind projects,Buckthorn Solar Portfolio, LLC, which was acquired by Clearway Energy Operating LLC from NRG on August 1, 2017March 30, 2018 |

Buckthorn SolarCAFD | | The 154 MW Buckthorn Solar project |

Buffalo Bear | | Buffalo Bear, LLC, the operating subsidiary of Tapestry Wind LLC, which owns the Buffalo Bear project |

CAA | | Clean Air Act |

CAFD | | A non-GAAP measure, Cash Available Forfor Distribution which the Company definesis defined as net income before interest expense, income taxes, depreciation and amortization,of December 31, 2020 as Adjusted EBITDA plus cash distributionsdistributions/return of investment from unconsolidated affiliates, adjustments to reflect CAFD generated by unconsolidated investments that were not able to distribute project dividends prior to PG&E's emergence from bankruptcy on July 1, 2020 and subsequent release post-bankruptcy, cash receipts from notes receivable, cash distributions from noncontrolling interests, adjustments to reflect sales-type lease cash payments, less cash distributions to noncontrolling interests, maintenance capital expenditures, pro-rata Adjusted EBITDA from unconsolidated affiliates, cash interest paid, income taxes paid, principal amortization of indebtedness, andWalnut Creek investment payments, changes in prepaid and accrued capacity payments, and adjusted for development expenses. |

| Carlsbad Drop Down | | The acquisition by the Company of the Carlsbad Energy Center, a 527 MW natural gas fired project located in Carlsbad, CA |

CfDCEG | | Contract for DifferencesClearway Energy Group LLC (formerly Zephyr Renewables LLC) |

CFTCCEG Master Services Agreement | | U.S. Commodity Future Trading CommissionMaster Services Agreements entered into as of August 31, 2018 between the Company, Clearway Energy LLC and Clearway Energy Operating LLC, and CEG |

CODCEG ROFO Agreement | | Right of First Offer Agreement, entered into as of August 31, 2018, by and between Clearway Energy Group LLC and Clearway Energy, Inc., and solely for purposes of Section 2.4, GIP III Zephyr Acquisition Partners, L.P., as amended by the First Amendment dated February 14, 2019, the Second Amendment dated August 1, 2019, the Third Amendment dated December 6, 2019 and the Fourth Amendment dated November 2, 2020 |

| Clearway Energy LLC | | The holding company through which the projects are owned by Clearway Energy Group LLC, the holder of Class B and Class D units, and Clearway Energy, Inc., the holder of the Class A and Class C units |

| Clearway Energy Group LLC | | The holder of the Company's Class B and Class D common shares and Clearway Energy LLC's Class B and Class D units |

| Clearway Energy Operating LLC | | The holder of the project assets that are owned by Clearway Energy LLC |

| COD | | Commercial Operation Date |

| Code | | Internal Revenue Code of 1986, as amended |

| Company | | NRG Yield,Clearway Energy, Inc. together with its consolidated subsidiaries |

| | | | | | | | |

| CVSR | | California Valley Solar Ranch |

CVSR Drop Down | | The Company's acquisition from NRG of the remaining 51.05% interest of CVSR Holdco |

CVSR Holdco | | CVSR Holdco LLC, the indirect owner of CVSR |

DGCL | | Delaware General Corporation Law |

DGPV Holdco 1Entities | | NRGCollectively, DGPV Holdco 1, LLC |

| DGPV Holdco 2 and DGPV Holdco 3 |

| DGPV Holdco 1 | | NRG DGPV Holdco 1 LLC |

| DGPV Holdco 2 | | DGPV Holdco 2 LLC |

| DGPV Holdco 3 | | NRG DGPV Holdco 3 LLC |

| Distributed Solar | | Solar power projects, typically less than 20 MW in size, that primarily sell power produced to customers for usage on site, or are interconnected to sell power into the local distribution grid |

| Drop Down Assets | | Collectively, assets under common control acquired by the JuneCompany from NRG from January 1, 2014 Drop Down Assets, January 2015 Drop Down Assets, November 2015 Drop Down Assets, CVSR Drop Down, March 2017 Drop Down Assets,through the period ended August 2017 Drop Down Assets31, 2018 and November 2017 Drop Down Assetsfrom CEG from August 31, 2018 through the period ending December 31, 2020 |

| Economic Gross Margin | | EnergyA non-GAAP measure, energy and capacity revenue, less cost of fuelsfuels. See Item 7 — Management's Discussion and Analysis of Financial Condition and Results of Operations — Management's discussion of the results of operations for the years ended December 31, 2020 and 2019 for a discussion of this measure. |

EDAECP | | Equity Distribution Agreement |

| Energy Center Pittsburgh LLC, a subsidiary of the Company |

| EPA | | United States Environmental Protection Agency |

EGUEPC | | Electric Utility Generating Unit |

El Segundo | | NRG West Holdings LLC, the subsidiary of Natural Gas Repowering LLC, which owns the El Segundo Energy Center project |

EPC | | Engineering, Procurement and Construction |

| ERCOT | | Electric Reliability Council of Texas, the ISO and the regional reliability coordinator of the various electricity systems within Texas |

| EWG | | Exempt Wholesale Generator |

| Exchange Act | | The Securities Exchange Act of 1934, as amended |

| FASB | | Financial Accounting Standards Board |

| FERC | | Federal Energy Regulatory Commission |

| FPA | | Federal Power Act |

| GAAP | | Accounting principles generally accepted in the U.S. |

| GenConn | | GenConn Energy LLC |

| GHG | | Greenhouse gas |

GIPGIM | | Global Infrastructure Management, LLC |

| GIP | | Collectively, Global Infrastructure Partners III-C Intermediate AIV 3, L.P., Global Infrastructure Partners III-A/B AIV 3, L.P., Global Infrastructure Partners III-C Intermediate AIV 2, L.P., Global Infrastructure Partners III-C2 Intermediate AIV, L.P. and GIP III Zephyr Friends & Family, LLC. |

GW | | Gigawatt |

HLBV | | Hypothetical Liquidation at Book Value |

IASB | | International Accounting Standards Board |

IRS | | Internal Revenue Service |

ISO | | Independent System Operator, also referred to as Regional Transmission Organization, or RTO |

ITC | | Investment Tax Credit |

January 2015 Drop Down Assets | | The Laredo Ridge, Tapestry and Walnut Creek projects, which were acquired by Yield Operating LLC from NRG on January 2, 2015 |

June 2014 Drop Down Assets | | The TA High Desert, Kansas South and El Segundo projects, which were acquired by Yield Operating LLC from NRG on June 30, 2014 |

Kansas South | | NRG Solar Kansas South LLC, the operating subsidiary of NRG Solar Kansas South Holdings LLC, which owns the Kansas South project |

KPPH | | 1,000 Pounds Per Hour |

Laredo Ridge | | Laredo Ridge Wind, LLC, the operating subsidiary of Mission Wind Laredo, LLC, which owns the Laredo Ridge project |

LIBOR | | London Inter-Bank Offered Rate |

Management Services Agreement | | Agreement between NRG and the Company for various operational, management and administrative services |

March 2017 Drop Down Assets | | (i) Agua Caliente Borrower 2 LLC, which owns a 16% interest (approximately 31% of NRG's 51% interest) in the Agua Caliente solar farm and (ii) NRG's 100% ownership in the Class A equity interests in the Utah Solar Portfolio (defined below), both acquired by the Company on March 27, 2017 |

Marsh Landing | | NRG Marsh Landing LLC, formerly GenOn Marsh Landing LLC |

May 9, 2017 Form 8-K | | NRG Yield, Inc.'s Current Report on Form 8-K filed with the SEC on May 9, 2017 in connection with NRG Yield Operating LLC's acquisition of the March 2017 Drop Down Assets |

MMBtu | | Million British Thermal Units |

MW | | Megawatt |

MWh | | Saleable megawatt hours, net of internal/parasitic load megawatt-hours |

MWt | | Megawatts Thermal Equivalent |

NECP | | NRG Energy Center Pittsburgh LLC |

NERC | | North American Electric Reliability Corporation |

Net Exposure | | Counterparty credit exposure to NRG Yield, Inc. net of collateral |

NOLs | | Net Operating Losses |

November 2015 Drop Down Assets | | 75% of the Class B interests of NRG Wind TE Holdco, which owns a portfolio of 12 wind facilities totaling 814 net MW, which was acquired by Yield Operating LLC from NRG on November 3, 2015 |

|

| GIP Transaction | | |

November 2017 Drop Down Assets | | 38 MW portfolio of distributed and small utility-scale solar assets, primarily comprised of assets from NRG's Solar Power Partners (SPP) funds, in addition to other projects developed since the acquisition of SPP byOn August 31, 2018, NRG which was acquired by NRG Yield Operating LLC from NRG on November 1, 2017 |

NOx

| | Nitrogen Oxides |

NPNS | | Normal Purchases and Normal Sales |

NRG | | NRG Energy, Inc. |

NRG Power Marketing | | NRG Power Marketing LLC |

NRG ROFO Agreement | | Second Amended and Restated Right of First Offer Agreement between the Company and NRG |

NRG Transaction | | On February 6, 2018, GIP entered into a purchase and sale agreement with NRG for the acquisition of NRG'stransferred its full ownership interest in the Company to Clearway Energy Group LLC and subsequently sold 100% of its interests in Clearway Energy Group LLC, which includes NRG's renewable energy development and operations platform.platform, to an affiliate of GIP. GIP, NRG and the Company also entered into a consent and indemnity agreement in connection with the purchase and sale agreement.agreement, which was signed on February 6, 2018 |

| HLBV | | Hypothetical Liquidation at Book Value |

| IRS | | Internal Revenue Service |

| ISO | | Independent System Operator, also referred to as an RTO |

| ITC | | Investment Tax Credit |

| kWh | | Kilowatt Hour |

| | |

| LIBOR | | London Inter-bank Offered Rate |

| MBTA | | Migratory Bird Treaty Act |

| MMBtu | | Million British Thermal Units |

| MW | | Megawatt |

| MWh | | Saleable megawatt hours, net of internal/parasitic load megawatt-hours |

| MWt | | Megawatts Thermal Equivalent |

| NERC | | North American Electric Reliability Corporation |

| | | | | | | | |

| Net Exposure | | Counterparty credit exposure to Clearway Energy, Inc. net of collateral |

| NOLs | | Net Operating Losses |

NOx | | Nitrogen Oxides |

| NPNS | | Normal Purchases and Normal Sales |

| NRG | | NRG Transformation PlanEnergy, Inc. |

| NRG Power Marketing | | A three-year, three-part improvement plan announcedNRG Power Marketing LLC |

| NRG TSA | | Transition Services Agreement, entered into as of August 31, 2018, by and between NRG on July 12, 2017, which includes exploring strategic alternatives for NRG's renewables platform and its interest in the Company |

NRG Wind TE HoldcoOCI/OCL | | NRG Wind TE Holdco LLC |

NRG Yield, Inc. | | NRG Yield, Inc., together with its consolidated subsidiaries, or the Company |

NRG Yield LLC | | The holding company through which the projects are owned by NRG, the holder of Class B and Class D units, and NRG Yield, Inc., the holder of the Class A and Class C units |

NRG Yield Operating LLC | | The holder of the project assets that belong to NRG Yield LLC |

OCI/OCL | | Other comprehensive income/loss |

| O&M | | Operations and Maintenance |

OSHAPG&E | | Occupational SafetyPacific Gas and Health AdministrationElectric Company |

| PG&E Bankruptcy | | On January 29, 2019, PG&E Corporation and Pacific Gas &and Electric Company filed voluntary petitions for relief under the Bankruptcy Code in the U.S. Bankruptcy Court for the Northern District of California |

PinnaclePJM | | Pinnacle Wind, LLC, the operating subsidiary of Tapestry Wind LLC, which owns the Pinnacle project |

PJM | | PJM Interconnection, LLC |

| PPA | | Power Purchase Agreement |

| PTC | | Production Tax Credit |

| PUCT | | Public Utility Commission of Texas |

| PUHCA | | Public Utility Holding Company Act of 2005 |

| PURPA | | Public Utility Regulatory Policies Act of 1978 |

| QF | | Qualifying Facility under PURPA |

RECRENOM | | Clearway Renewable Energy CertificateOperation & Maintenance LLC |

RecapitalizationROFO | | The adoptionRight of the Company's Second Amended and Restated Certificate of Incorporation which authorized two new classes of common stock, Class C common stock and Class D common stock, and distributed shares of such new classes of common stock to holders of the Company’s outstanding Class A common stock and Class B common stock, respectively, through a stock split on May 14, 2015 First Offer |

ROFO AssetsRPS | | Specified assets subject to sale, as described in the NRG ROFO Agreement |

RPM | | Reliability Pricing Model |

RPS | | Renewable Portfolio Standards |

RPV HoldcoRTO | | NRG RPV Holdco 1 LLC |

RTO | | Regional Transmission Organization |

| SCE | | Southern California Edison |

| SEC | | U.S. Securities and Exchange Commission |

| Senior Notes | | Collectively, the 2024 Senior Notes, andthe 2025 Senior Notes, the 2026 Senior Notes and the 2028 Senior Notes |

SO2 | | Sulfur Dioxide |

SPPSREC | | Solar Power Partners |

| Renewable Energy Credit |

| Tax Act | | |

TA High Desert | | TA-High Desert LLC, the operating subsidiary of NRG Solar Mayfair LLC, which owns the TA High Desert project |

Taloga | | Taloga Wind, LLC, the operating subsidiary of Tapestry Wind LLC, which owns the Taloga project |

Tapestry | | Collection of the Pinnacle, Buffalo Bear and Taloga projects |

Tax Act | | Tax Cuts and Jobs Act of 2017 |

| Thermal Business | | The Company's thermal business, which consists of thermal infrastructure assets that provide steam, hot water and/or chilled water, and in some instances electricity, to commercial businesses, universities, hospitals and governmental units |

| UPMC Thermal Project | | The University of Pittsburgh Medical Center Thermal Project, a 73 MWt district energy system that allows ECP to provide steam, chilled water and 7.5 MW of emergency backup power service to UPMC |

| U.S. | | United States of America |

| U.S. DOE | | U.S. Department of Energy |

| Utah Solar Portfolio | | Collection consists of Four Brothers Solar, LLC, Granite Mountain Holdings, LLC, and Iron Springs Holdings, LLC, which are equity investments owned by Four Brothers Holdings,Capital, LLC, Granite Mountain Renewables,Capital, LLC, and Iron Springs Renewables,Capital, LLC, respectively and are part of the March 2017 Drop Down Assets acquisition that closed on March 27, 2017 |

| Utility Scale Solar | | Solar power projects, typically 20 MW or greater in size (on an alternating current, or AC, basis), that are interconnected into the transmission or distribution grid to sell power at a wholesale level |

| VaR | | Value at Risk |

| VIE | | Variable Interest Entity |

Walnut CreekWind TE Holdco | | NRG Walnut Creek,Wind TE Holdco LLC, the operating subsidiaryan 814 net MW portfolio of WCEP Holdings, LLC, which owns the Walnut Creek projecttwelve wind projects |

PART I

Item 1 — Business

General

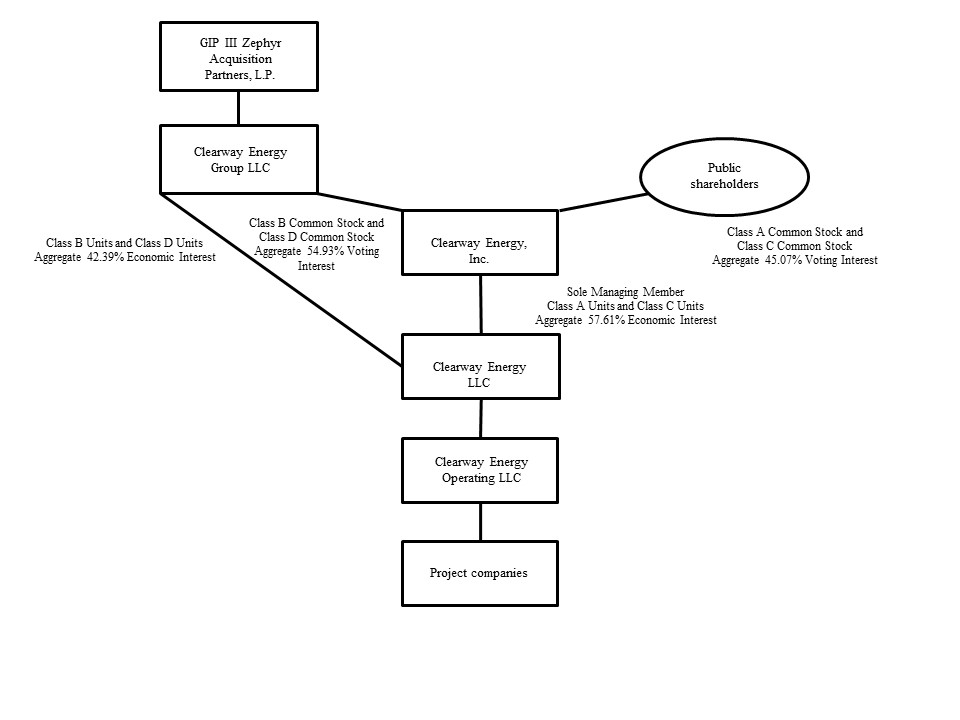

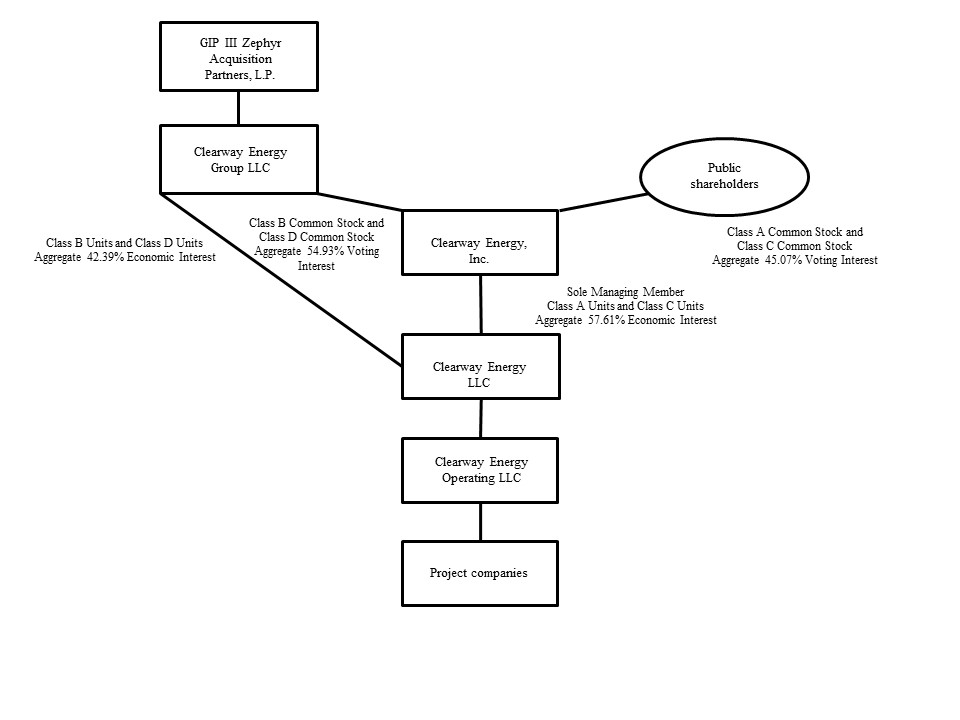

NRG Yield,Clearway Energy, Inc., together with its consolidated subsidiaries, or the Company, is a dividend growth-oriented company that has historically served as the primary vehicle through which NRG owns, operatespublicly-traded energy infrastructure investor in and acquiresowner of modern, sustainable and long-term contracted renewable and conventional generation and thermal infrastructure assets. On February 6, 2018,assets across North America. The Company is indirectly owned by Global Infrastructure Partners orIII. Global Infrastructure Management, LLC is an independent fund manager that invests in infrastructure assets in the energy and transport sectors, and Global Infrastructure Partners III is its third equity fund. The Company is sponsored by GIP entered into a purchase and sale agreement with NRG, orthrough GIP's portfolio company, CEG.

The Company is one of the NRG Transaction, for the acquisition of NRG’s full ownership interest in NRG Yield, Inc. and NRG’slargest renewable energy developmentowners in the U.S. with over 4,200 net MW of installed wind and operations platform.

solar generation projects. The Company believes it isalso owns approximately 2,500 net MW of environmentally-sound, highly efficient natural gas generation facilities as well positionedas a portfolio of district energy systems. Through this environmentally-sound, diversified and primarily contracted portfolio, the Company endeavors to be a premier company forprovide its investors seekingwith stable and growing dividend income from a diversified portfolio of lower-risk, high-quality assets. The Company owns a diversified portfolio of contracted renewable and conventional generation and thermal infrastructure assets in the U.S. The Company’s contracted generation portfolio collectively represents 5,118 net MW as of December 31, 2017. Nearly all of these assets sell substantiallyincome.Substantially all of itsthe Company's generation assets are under long-term contractual arrangements for the output pursuant to long-term offtake agreements with creditworthy counterparties.or capacity from these assets. The weighted average remaining contract duration of these offtake agreements was approximately 1513 years as of December 31, 20172020 based on CAFD.

The Company alsoconsolidates the results of Clearway Energy LLC through its controlling interest, with CEG's interest shown as noncontrolling interest in the financial statements. The holders of the Company's outstanding shares of Class A and Class C common stock are entitled to dividends as declared. CEG receives its distributions from Clearway Energy LLC through its ownership of Clearway Energy LLC Class B and Class D units.

As of December 31, 2020, the Company owns thermal infrastructure assets57.61% of the economic interests of Clearway Energy LLC, with an aggregate steam and chilled water capacityCEG retaining 42.39% of 1,319 net MWt and electric generation capacitythe economic interests of 123 net MW. These thermal infrastructure assets provide steam, hot and/or chilled water, and, in some instances, electricity to commercial businesses, universities, hospitals and governmental units in multiple locations, principally through long-term contracts or pursuant to rates regulated by state utility commissions.Clearway Energy LLC.

A complete listing of the Company's interests in facilities, operations and/or projects owned or leased as of December 31, 20172020 can be found in Item 2 — Properties.

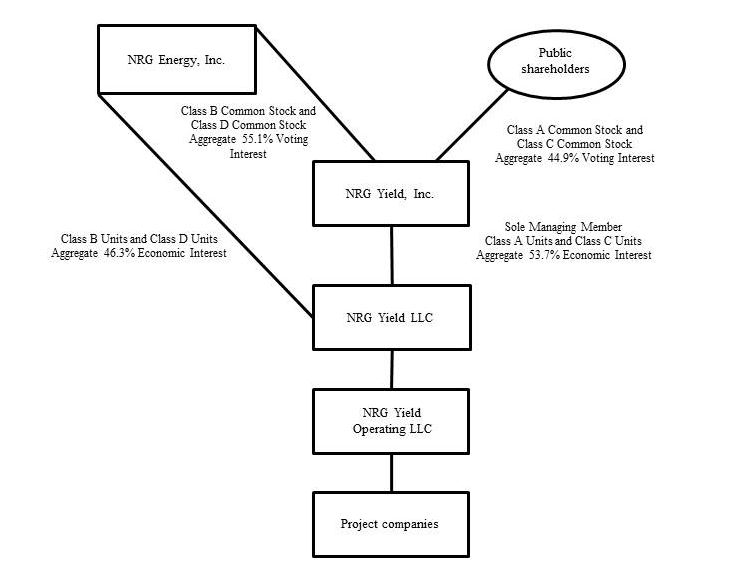

History

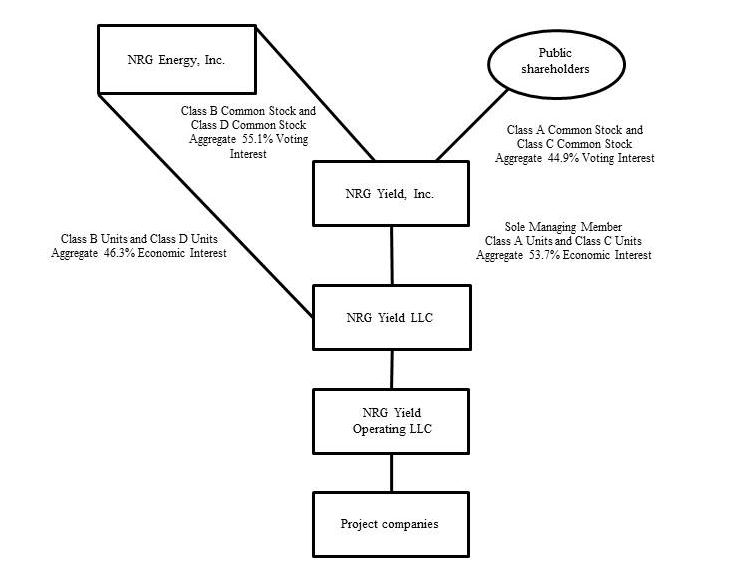

The Company was formed by NRG Energy, Inc., or NRG, as a Delaware corporation on December 20, 2013.2012 by NRG. On August 31, 2018, NRG throughtransferred its holdings of Class B common stock and Class D common stock, has a 55.1% votingfull ownership interest in the Company to CEG, the holder of NRG's renewable energy development and receives distributions from NRG Yield LLC throughoperations platform, and subsequently sold 100% of its ownership of Class B units and Class D units. The holders ofinterest in CEG to GIP, referred to hereinafter as the Company's issued and outstanding shares of Class A common stock and Class C common stock are entitled to dividends as declared and have 44.9% of the voting power in the Company.GIP Transaction.

The Company is the sole managing member of NRG YieldClearway Energy LLC and operates and controls all of its business and affairs and consolidates the financial results of NRG YieldClearway Energy LLC and its subsidiaries. NRG YieldClearway Energy LLC is a holding company for the companies that directly and indirectly own and operate the Company's assets. As of December 31, 2017,2020, the Company and NRG have 53.7% and 46.3%owns 57.61% of the economic interests in NRG Yieldof Clearway Energy LLC, respectively.with CEG retaining 42.39% of the economic interests of Clearway Energy LLC. As a result of the current ownership of the Class B common stock and Class D common stock, NRG continues at the present time to controlCEG controls the Company, and the Company in turn, as the sole managing member of NRG YieldClearway Energy LLC, controls NRG YieldClearway Energy LLC and its subsidiaries.

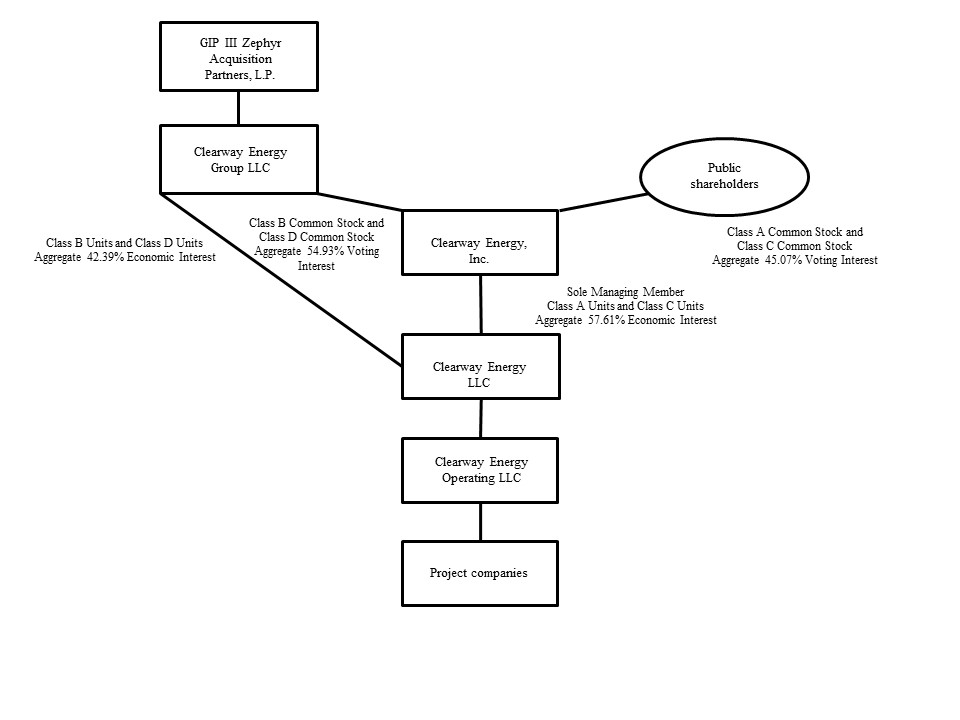

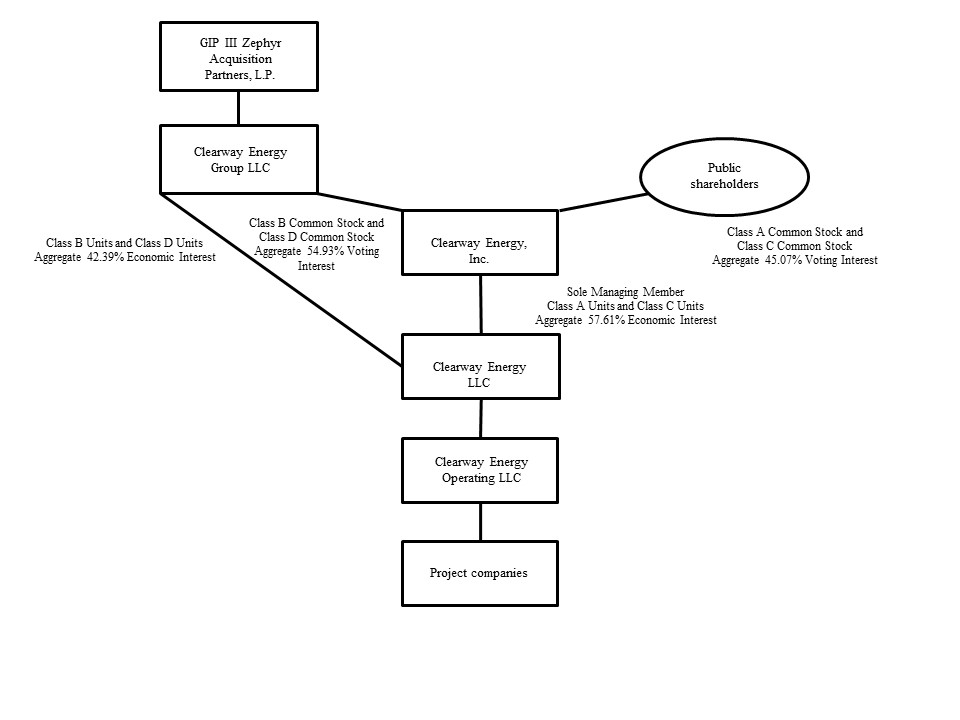

The diagram below depicts the Company’s organizational structure as of December 31, 2017:2020:

Strategic Sponsorship with Global Infrastructure Partners

On February 6, 2018, Global Infrastructure Partners, or GIP, entered into a purchase and sale agreement with NRG, or the NRG Transaction, for the acquisition of NRG’s full ownership interest in NRG Yield, Inc. and NRG’s renewable energy development and operations platform. The NRG Transaction is subject to certain closing conditions, including customary legal and regulatory approvals. The Company expects the NRG Transaction to close in the second half of 2018.

In connection with the NRG Transaction, the Company entered into a Consent and Indemnity Agreement with NRG and GIP setting forth key terms and conditions of the Company's consent to the NRG Transaction. Key provisions of the Consent and Indemnity Agreement include:

Minimized impact to CAFD from potential change in control costs — No more than $10 million in reduced annual CAFD on a recurring basis that would result from changes in the Company's cost structure or any impact from various consents.

Enhanced ROFO pipeline — Upon closing, the Company will enter into a new ROFO agreement with GIP that adds 550 MW to the current pipeline through the operational 150 MW Langford Wind project and the 400 MW Mesquite Star Wind project which is under development. The NRG ROFO Agreement will be amended to remove the Ivanpah solar facility.

Financial cooperation and support — GIP has arranged a $1.5 billion backstop credit facility to manage any change of control costs associated with the Company's corporate debt. GIP has also committed to provide up to $400 million in financial support, if necessary, for the purchase of the Carlsbad Energy Center.

Voting and Governance Agreement — As part of the NRG Transaction, the parties have agreed to enter into a voting and governance agreement, which would provide that:

the Chief Executive Officer of the Company will at all times be a full-time Company employee appointed by the Board of Directors, or the Board, of the Company;

the parties thereto will use their commercially reasonable efforts to submit to the Company’s stockholders at the Company’s 2019 Annual Meeting of Stockholders a charter amendment to classify the Board into two classes (with the independent directors and directors designated by an affiliate of GIP allocated across the two classes); and

the Board will be expanded to nine members at the closing of the NRG Transaction, comprised at that date of five directors designated by GIP, three independent directors and the Company’s Chief Executive Officer.

Business Strategy

The Company's primary business strategy is to focus on the acquisition and ownership of assets with predictable, long-term cash flows in order that it may be able to increase the cash dividends paid to holders of the Company's Class A and Class C common stock over time without compromising the ongoing stability of the business.

The Company's plan for executing thisits business strategy includes the following key components:

Focus on contracted renewable energy and conventional generation and thermal infrastructure assets. The Company owns and operates utility scale and distributed renewable energy and natural gas-fired generation, thermal and other infrastructure assets with proven technologies, low operating risks and stable cash flows. The Company believes by focusing on this core asset class and leveraging its industry knowledge, it will maximize its strategic opportunities, be a leader in operational efficiency and maximize its overall financial performance.

Growing the business through acquisitions of contracted operating assets. The Company believes that its base of operations and relationship with NRG provideprovides a platform in the conventional and renewable power generation and thermal sectors for strategic growth through cash accretive and tax advantaged acquisitions complementary to its existing portfolio. In addition to acquiring renewable generation, conventional generation and thermal infrastructure assets from third parties where the Company believes its knowledge of the market and operating expertise provides it with a competitive advantage, the Company entered into a Right of First Offer Agreement with NRG, or the NRGCEG ROFO Agreement. Under the NRGCEG ROFO Agreement, NRGCEG has granted the Company and its affiliates a right of first offer on any proposed sale, transfer or other disposition of certain assets of NRGCEG, or the CEG ROFO Assets, until February 24, 2022. NRGAugust 31, 2023. CEG is not obligated to sell the remaining NRGCEG ROFO Assets to the Company and, if offered by NRG,CEG, the Company cannot be sure whether these assets will be offered on acceptable terms, or that the Company will choose to consummate such acquisitions. The Company and CEG work collaboratively in considering new assets to be added under the CEG ROFO

Agreement or to be acquired by the Company outside of the CEG ROFO Agreement. The assets listed in the table below represent the NRGCompany's currently committed investments in projects with CEG and the CEG ROFO Assets:

Committed Investments and CEG ROFO Assets |

| | | | | | |

| Asset | | Fuel Type | | Rated Capacity

(MW)(a) | | COD |

| Agua Caliente | | Solar | | 102 | | 2014 |

| Ivanpah | | Solar | | 196 | | 2013 |

Hawaii(b) | | Solar | | 80 | | 2019 |

Distributed Solar (up to $190 million of equity in distributed solar generation portfolio(s)(b) | | Solar | | various | | various |

Buckthorn Solar(c) | | Solar | | 154 | | 2018 |

Carlsbad (d) | | Conventional | | 527 | | 2018 |

Puente/Mandalay(e) | | Conventional | | Project not expected to move forward |

| Community | | Wind | | Sold to third party |

| Jeffers | | Wind | | Sold to third party |

| Minnesota Portfolio | | Wind | | Sold to third party |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Asset | | Technology | | Gross Capacity (MW) | | State | | COD | | Status |

| Pinnacle Repowering | | Wind | | 55 | | WV | | 2021 | | Committed |

Mesquite Sky (a) | | Wind | | 345 | | TX | | 2021 | | Committed |

Black Rock (a) | | Wind | | 110 | | WV | | 2021 | | Committed |

Mililani I (a) | | Solar | | 39 | | HI | | 2022 | | Committed |

Waiawa (a) | | Solar | | 36 | | HI | | 2022 | | Committed |

Daggett (a) | | Solar | | 482 | | CA | | 2022 | | Committed |

| Wildflower | | Solar | | 100 | | MS | | 2023 | | ROFO |

(a)Projects included in a co-investment partnership with Hannon Armstrong Sustainable Infrastructure Capital, Inc (a) Represents the maximum, or rated, electricity generating capacity of the facility in MW multiplied by NRG's percentage ownership interest in the facility as of December 31, 2017.

(b) Hawaii and Distributed Solar are part of the NRG ROFO Agreement. These are not expected to be offered by NRG prior to consummation of the NRG Transaction and, at that time, would become part of a new ROFO Agreement with GIP.

(c) The transaction is expected to close in the first quarter of 2018.

(d) The transaction is expected to close in the fourth quarter of 2018 and is contingent upon the consummation of the NRG Transaction. Reflects capacity per the Power Purchase & Tolling Agreement with San Diego Gas & Electric; actual tested capacity is expected to be 530 MW.

(e) On November 3, 2017, the California Energy Commission suspended the permitting process for the Puente Power Project after two commissioners issued a statement stating their intention to deny the permit. If the CEC formally denies a permit for the Puente Power Project, then the project will not move forward.

Upon closing of the NRG Transaction, the Company will enter into a new ROFO agreement with GIP that adds 550 MW to the current pipeline through the operational 150 MW Langford Wind project and the 400 MW Mesquite Star Wind project which is under development. The NRG ROFO Agreement will be amended to remove the Ivanpah solar facility.

Primary focus on North America.The Company intends to primarily focus its investments in North America (including the unincorporated territories of the U.S.). The Company believes that industry fundamentals in North America present it with significant opportunity to acquire renewable, natural gas-fired generation and thermal infrastructure assets,grow its portfolio without creating significant exposure to currency and sovereign risk. By primarily focusing its efforts on North America, the Company believes it will best leverage its regional knowledge of power markets, industry relationships and skill sets to maximize the performance of the Company.

Maintain sound financial practices to grow the dividend. The Company intends to maintain a commitment to disciplined financial analysis and a balanced capital structure to enable it to increase its quarterly dividend over time and serve the long-term

interests of its stockholders. The Company's financial practices include a risk and credit policy focused on transacting with credit-worthycreditworthy counterparties; a financing policy, which focuses on seeking an optimal capital structure through various capital formation alternatives to minimize interest rate and refinancing risks, ensure stable long-term dividends and maximize value; and a dividend policy that is based on distributing a significant portion of CAFD each quarter that the Company receives from NRG YieldClearway Energy LLC, subject to available capital, market conditions and compliance with associated laws, regulations and other contractual obligations. The Company intends to evaluate various alternatives for financing future acquisitions and refinancing of existing project-level debt, in each case, to reduce the cost of debt, extend maturities and maximize CAFD. The Companybelieves it has additional flexibility to seek alternative financing arrangements, including, but not limited to, debt financings and equity-like instruments.

Competition

Power generation is a capital-intensive business with numerous and diverse industry participants. The Company competes on the basis of the location of its plants and on the basis of contract price and terms of individual projects. Within the power industry, there is a wide variation in terms of the capabilities, resources, nature and identity of the companies with whom the Company competes with depending on the market. Competitors for energy supply are utilities, independent power producers and other providers of distributed generation. The Company also competes to acquire new projects with renewable developers who retain renewable power plant ownership, independent power producers, financial investors and other dividend, growth-oriented companies. Competitive conditions may be substantially affected by capital market conditions and by various forms of energy legislation and regulation considered by federal, state and local legislatures and administrative agencies, including tax policy. Such laws and regulations may substantially increase the costs of acquiring, constructing and operating projects, and it could be difficult for the Company to adapt to and operate under such laws and regulations.

The Company's thermal businessThermal Business has certain cost efficiencies that may form barriers to entry. Generally, there is only one district energy system in a given territory, for which the only competition comes from on-site systems. While the district energy system can usually make an effective case for the efficiency of its services, some building owners nonetheless may opt for on-site systems, either due to corporate policies regarding allocation of capital, unique situations where an on-site system might in fact prove more efficient or because of previously committed capital in systems that are already on-site. Growth in existing district energy systems generally comes from new building construction or existing building conversions within the service territory of the district energy provider.

Competitive Strengths

Stable, high quality cash flows. The Company's facilities have a stable, predictable cash flow profile consisting of predominantly long-life electric generation assets that sell electricity under long-term fixed priced contracts or pursuant to regulated rates with investment grade and certain other credit-worthycreditworthy counterparties. Additionally, theThe Company's facilities have minimal fuel risk. For the Company's conventional assets, fuel is provided by the toll counterparty or the cost thereof is a pass-through cost under the CfD.Contract for Differences. Renewable facilities have no fuel costs, and most of the Company's thermal infrastructure assets have contractual or regulatory tariff mechanisms for fuel cost recovery. The offtake agreements for the Company's conventional and renewable generation facilities have a weighted-average remaining duration, based on CAFD, of approximately 1513 years as of December 31, 2017, based on CAFD,2020, providing long-term cash flow stability. The Company's generation offtake agreements with counterparties for whom credit ratings are available have a weighted-average Moody’s rating of A3Ba1 based on rated capacity under contract. All of the Company's assets are in the U.S. and accordingly have no currency or repatriation risks.

High quality, long-lived assets with low operating and capital requirements. The Company benefits from a portfolio of relatively younger assets, other than thermal infrastructure assets. The Company's assets are comprised of proven and reliable technologies, provided by leading original solar and wind equipment manufacturers such as General Electric, Siemens AG, SunPower Corporation, or SunPower, First Solar Inc., or First Solar, Vestas, Suzlon and Mitsubishi. Given the modern nature of the portfolio, which includes a substantial number of relatively low operating and maintenance cost solar and wind generation assets, the Company expects to achieve high fleet availability and expend modest maintenance-related capital expenditures. Additionally, with the support of services provided by NRG, the Company expects to continue to implement the same rigorous preventative operating and management practices that NRG uses across its fleet of assets.

Significant scale and diversity. The Company owns and operates a large and diverse portfolio of contracted electric generation and thermal infrastructure assets. As of December 31, 2017, the Company's 5,118 net MW contracted generation portfolio benefits from significant diversification in terms of technology, fuel type, counterparty and geography. The Company's thermal business consists of twelve operations, seven of which are district energy centers that provide steam and chilled water to approximately 695 customers, and five of which provide generation. The Company believes its scale and access to best practices across the fleet improves its business development opportunities through enhanced industry relationships, reputation and understanding of regional power market dynamics. Furthermore, the Company's diversification reduces its operating risk profile and reliance on any single market.

Relationship with NRG. The Company believes its relationship with NRG, a leading competitive power generator in the U.S., provides significant benefits to the Company, including access to the significant resources of NRG to support its operational, financial, legal, regulatory and environmental functions.

Relationship with GIP. The Company believes its potential relationship with GIP, should the NRG Transaction be consummated, may provide significant benefits to the Company. GIP is an independent infrastructure fund with over $45 billion in assets under management that invests in infrastructure assets and businesses in both OECD and select emerging market countries. GIP has a strong track record of investment and value creation in the renewable energy sector. Additionally, GIP has extensive experience with publicly traded yield vehicles and development platforms, ranging from Europe's first application of a yield company/development company model to the largest renewable platform in Asia-Pacific.

Environmentally well-positioned portfolio of assets. The Company's portfolio of electric generation assets consists of 3,1734,208 net MW of renewable generation capacity that are non-emitting sources of power generation. The Company's conventional assets consist of the dual fuel-fired GenConn assets as well as the Carlsbad, Marsh Landing and Walnut Creek simple cycle natural gas-fired peaking generation facilities and the El Segundo combined cycle natural gas-fired peaking facility. The Company does not anticipate having to expend any significant capital expenditures in the foreseeable future to comply with current environmental regulations applicable to its generation assets. Taken as a whole, the Company believes its strategy will be a net beneficiary of current and potential environmental legislation and regulatory requirements that may serve as a catalyst for capacity retirements and improve market opportunities for environmentally well-positioned assets like the Company's assets once its current offtake agreements expire.

High quality, long-lived assets with low operating and capital requirements. The Company benefits from a portfolio of relatively younger assets, other than thermal infrastructure assets. The Company's assets are comprised of proven and reliable technologies, provided by leading original solar and wind equipment manufacturers such as General Electric, Siemens AG, SunPower Corporation, or SunPower, First Solar Inc., or First Solar, Vestas, Mitsubishi, Trina Solar, JA Solar and Siemens Gamesa. Given the modern nature of the portfolio, which includes a substantial number of relatively low operating and maintenance cost solar and wind generation assets, the Company expects to achieve high fleet availability and expend modest maintenance-related capital expenditures.

Significant scale and diversity. The Company owns and operates a large and diverse portfolio of electric generation and thermal infrastructure assets. As of December 31, 2020, the Company owns and operates a portfolio of 6,690 net MW of primarily contracted renewable and conventional generation assets which benefit from significant diversification in terms of technology, fuel type, counterparty and geography. The Company's Thermal Business consists of thirteen operations, seven of which are district energy centers that provide steam and chilled water to approximately 695 customers, and six of which provide generation. The Company believes its scale and access to best practices across the fleet improves its business development opportunities through enhanced industry relationships, reputation and understanding of regional power market dynamics. Furthermore, the Company's diversification reduces its operating risk profile and reliance on any single market.

Relationship with GIP and CEG. The Company believes that its relationship with GIP and CEG provides significant benefits. GIM, the manager of GIP, is an independent infrastructure fund manager that invests in infrastructure assets and businesses in both the Organization for Economic Co-operation and Development and select emerging market countries. GIM has a strong track record of investment and value creation in the renewable energy sector. GIM also has extensive experience with publicly traded yield vehicles and development platforms, ranging from Europe's first application of a yield company/development company model to the largest renewable platform in Asia-Pacific. Additionally, the Company believes that CEG provides the Company access to a highly capable renewable development and operations platform that is aligned to support the Company's growth.

Thermal infrastructure business has high entry costs. Significant capital has been invested to construct the Company's thermal infrastructure assets, serving as a barrier to entry in the markets in which such assets operate. As of December 31, 2017, the Company's thermal gross property, plant, and equipment was approximately $473 million. The Company's thermal district energy centers are located in urban city areas, with the chilled water and steam delivery systems located underground. Constructing underground delivery systems in urban areas requires long lead times for permitting, rights of way and inspections and is costly. By contrast, the incremental cost to add new customers in existing markets is relatively low. Once thermal infrastructure is established, the Company believes it has the ability to retain customers over long periods of time and to compete effectively for additional business against stand-alone on-site heating and cooling generation facilities. Installation of stand-alone equipment can require significant modification to a building as well as significant space for equipment and funding for capital expenditures. The Company's system technologies often provide economies of scale in terms of fuel procurement, ability to switch between multiple types of fuel to generate thermal energy, and fuel conversion efficiency.

Segment Review

The following tables summarize the Company's operating revenues, net income (loss) and assets by segment for the years ended December 31, 2017, 20162020, 2019 and 2015,2018, as discussed in Item 15 — Note 13, Segment Reporting, to the Consolidated Financial Statements. All amounts

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year ended December 31, 2020 |

| (In millions) | Conventional Generation | | Renewables | | Thermal | | Corporate | | Total |

| Operating revenues | $ | 437 | | | $ | 569 | | | $ | 193 | | | $ | — | | | $ | 1,199 | |

| | | | | | | | | |

| Net income (loss) | 140 | | | (109) | | | 3 | | | (96) | | | (62) | |

| Total assets | 2,575 | | | 7,157 | | | 627 | | | 233 | | | 10,592 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year ended December 31, 2019 |

| (In millions) | Conventional Generation | | Renewables | | Thermal | | Corporate | | Total |

| Operating revenues | $ | 346 | | | $ | 485 | | | $ | 201 | | | $ | — | | | $ | 1,032 | |

| | | | | | | | | |

| Net income (loss) | 135 | | | (104) | | | (5) | | | (122) | | | (96) | |

| Total assets | 2,753 | | | 6,186 | | | 633 | | | 128 | | | 9,700 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year ended December 31, 2018 |

| (In millions) | Conventional Generation | | Renewables | | Thermal | | Corporate | | Total |

| Operating revenues | $ | 337 | | | $ | 523 | | | $ | 193 | | | $ | — | | | $ | 1,053 | |

| | | | | | | | | |

| Net income (loss) | 135 | | | 86 | | | 29 | | | (196) | | | 54 | |

Policy Incentives

Policy incentives in the U.S. have been recast to include the effect of making the acquisitionsdevelopment of renewable energy projects more competitive by providing credits and other tax benefits for a portion of the Drop Down Assets,development costs. A loss of or reduction in such incentives could decrease the attractiveness of renewable energy projects to developers, including CEG, which were accountedcould reduce the Company's future acquisition opportunities. Such a loss or reduction could also reduce the Company's willingness to pursue or develop certain renewable energy projects due to higher operating costs or decreased revenues under its PPAs.

U.S. federal, state and local governments have established various incentives to support the development of renewable energy projects. These incentives include accelerated tax depreciation, PTCs, ITCs, cash grants, tax abatements and RPS programs. Pursuant to the U.S. federal Modified Accelerated Cost Recovery System, or MACRS, wind and solar projects are generally fully depreciated for as transferstax purposes over a five-year period (before taking into account certain conventions) even though the useful life of entities under common control.such projects is generally much longer than five years. The accounting guidance requires retrospective combinationTax Act also provides the ability for wind and solar projects to claim immediate expensing for property acquired and placed in service after September 27, 2017, and before January 1, 2023.

Owners of utility-scale wind facilities are eligible to claim an income tax credit (the PTC, or an ITC in lieu of the entitiesPTC) upon initially achieving commercial operation. The PTC is determined based on the amount of electricity produced by the wind facility during the first ten years of commercial operation. This incentive was created under the Energy Policy Act of 1992 and has been extended several times. Alternatively, an ITC equal to a percentage of the cost of a wind facility may be claimed in lieu of the PTC. In order to qualify for all periods presented asthe PTC (or ITC in lieu of the PTC), construction of a wind facility must begin before a specified date and the taxpayer must maintain a continuous program of construction or continuous efforts to advance the project to completion. The Internal Revenue Service, or IRS, issued guidance stating that the safe harbor for continuous efforts and continuous construction requirements will generally be satisfied if the combination has beenfacility is placed in effect sinceservice no more than four years after the inceptionyear in which construction of common control. Accordingly, the Company prepared its consolidated financial statementsfacility began. In response to reflect the transfers as if they had taken place fromCOVID-19 pandemic, the IRS extended this safe harbor by one year for facilities that began construction in 2016 or 2017. The IRS also confirmed that retrofitted wind facilities may re-qualify for PTCs or ITCs pursuant to the beginning construction requirement, as long as the cost basis of the financial statements period or from the date the entities were under common control (if later than the beginningnew investment is at least 80% of the financial statements period).facility’s total fair value.

Owners of solar projects are eligible to claim an ITC for new solar projects. Tax credits for qualifying wind and solar projects are subject to the following phase-down schedule.

|

| | | | | | | | | | | | | | | | | | | |

| Year ended December 31, 2017 |

| (In millions) | Conventional Generation |

| Renewables |

| Thermal |

| Corporate |

| Total |

| Operating revenues | $ | 336 |

| | $ | 501 |

| | $ | 172 |

| | $ | — |

| | $ | 1,009 |

|

| Net income (loss) | 120 |

| | 9 |

| | 25 |

| | (177 | ) | | (23 | ) |

| Total assets | 1,897 |

| | 5,811 |

| | 422 |

| | 153 |

| | 8,283 |

|

|

| | | | | | | | | | | | | | | | | | | |

| | Year ended December 31, 2016 |

| (In millions) | Conventional Generation | | Renewables | | Thermal | | Corporate | | Total |

| Operating revenues | $ | 333 |

| | $ | 532 |

| | $ | 170 |

| | $ | — |

| | $ | 1,035 |

|

| Net income (loss) | 153 |

| | (86 | ) | | 29 |

| | (94 | ) | | 2 |

|

| Total assets | 1,993 |

| | 6,114 |

| | 426 |

| | 429 |

| | 8,962 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year construction of project begins |

| | 2015 | | 2016 | | 2017 | | 2018 | | 2019 | | 2020 | | 2021 | | 2022 | | 2023 | | 2024 |

PTC (a) | 100 | % | | 100 | % | | 80 | % | | 60 | % | | 40 | % | | 60 | % | | 60 | % | | — | % | | — | % | | — | % |

On Shore Wind ITC (b) | 30 | % | | 30 | % | | 24 | % | | 18 | % | | 12 | % | | 18 | % | | 18 | % | | — | % | | — | % | | — | % |

Solar ITC (c) | 30 | % | | 30 | % | | 30 | % | | 30 | % | | 30 | % | | 26 | % | | 26 | % | | 26 | % | | 22 | % | | 10 | % |

|

| | | | | | | | | | | | | | | | | | | |

| | Year ended December 31, 2015 |

| (In millions) | Conventional Generation | | Renewables | | Thermal | | Corporate | | Total |

| Operating revenues | $ | 336 |

| | $ | 458 |

| | $ | 174 |

| | $ | — |

| | $ | 968 |

|

| Net income (loss) | 156 |

| | (18 | ) | | 22 |

| | (88 | ) | | 72 |

|

Government Incentives

Government incentives, including PTCs and ITCs, can enhance the economics(a) Percentage of the Company's generating assetsfull PTC available for wind projects that begin construction during the applicable year.

(b) The Taxpayer Certainty and investments by providing,Disaster Tax Relief Act of 2020 provides for example, loan guarantees, cash grants, favorable tax treatment, favorable depreciation rulesa new 30% ITC for offshore wind projects that begin construction before January 1, 2026.

(c) ITC is limited to 10% for projects not placed in service before January 1, 2026.

RPS, currently in place in certain states and territories, require electricity providers in the state or territory to meet a certain percentage of their retail sales with energy from renewable sources. Additionally, other incentives.states in the U.S. have set renewable energy goals to reduce GHG emissions from historic levels. The Company cannot predictbelieves that these standards and goals will create incremental demand for renewable energy in the effects that the current U.S. presidential administration will have on government incentives.future.

Regulatory Matters

As owners of power plants and participants in wholesale and thermal energy markets, certain of the Company's subsidiaries are subject to regulation by various federal and state government agencies. These agencies include FERC and the PUCT, as well as other public utility commissions in certain states where the Company's assets are located. Each of the Company's U.S. generating facilities qualifies as an EWG or QF. In addition, the Company is subject to the market rules, procedures and protocols of the various ISO and RTO markets in which it participates. Likewise, certain of the CompanyCompany's subsidiaries must also comply with the mandatory reliability requirements imposed by NERC and the regional reliability entities in the regions where the Company operates.has generating facilities subject to NERC's reliability authority.The Company's operations within the ERCOT footprint are not subject to rate regulation by FERC, as they are deemed to operate solely within the ERCOT market and not in interstate commerce. These operations are subject to regulation by PUCT.

FERC

FERC, among other things, regulates the transmission and the wholesale sale of electricity in interstate commerce under the authority of the FPA. The transmission and sale of electric energy occurring wholly within ERCOT is not subject to FERC’s jurisdiction under Sections 203 or 205 of the FPA.jurisdiction. Under existing regulations, FERC determineshas the authority to determine whether an entity owning a generation facility is an EWG, as defined in the PUHCA. FERC also determineshas the authority to determine whether a generation facility meets the ownership and technicalapplicable criteria of a QF under the PURPA. Each of the Company’s non-ERCOTU.S. generating facilities qualifies as either an EWG.EWG or QF.

The FPA gives FERC exclusive rate-making jurisdiction over the wholesale sale of electricity and transmission of electricity in interstate commerce of public utilities (as defined by the FPA). Under the FPA, FERC, with certain exceptions, regulates the owners and operators of facilities used for the wholesale sale of electricity or transmission in interstate commerce as public utilities, and establishesis charged with ensuring that market rules that are just and reasonable.

Public utilities are required to obtain FERC’s acceptance, pursuant to Section 205 of the FPA, of their rate schedules for the wholesale sale of electricity. AllSeveral of the Company's QF generating facilities and all of the Company’s non-QF generating entitiesfacilities located in the U.S. outside of ERCOT make sales of electricity pursuant to market-based rates, as opposed to traditional cost-of-service regulated rates. Every three years FERC will conductconducts a review of the Company’s market basedmarket-based rates of Company public utilities and potential market power onevery three years according to a regional basis.schedule established by FERC.

In accordance with the Energy Policy Act of 2005, FERC has approved the NERC as the national Energy Reliability Organization, or ERO. As the ERO, NERC is responsible for the development and enforcement of mandatory reliability standards for the wholesale electric power system. In addition to complying with NERC requirements, each entity must comply with the requirements of the regional reliability entity for the region in which it is located.

The PURPA was passed in 1978 in large part to promote increased energy efficiency and development of independent power producers. The PURPA created QFs to further both goals, and FERC is primarily charged with administering the PURPA as it applies to QFs. Certain QFs are exempt from regulation, either in whole or in part,certain regulations under the FPA as public utilities.FPA.

The PUHCA provides FERC with certain authority over and access to books and records of public utility holding companies not otherwise exempt by virtue of their ownership of EWGs, QFs, and Foreign Utility Companies. The Company is exempt from many of the accounting, record retention, and reporting requirements of the PUHCA.

Environmental Matters

The Company is subject to a wide range of environmental laws induring the development, construction, ownership and operation of projects.facilities. These existing and future laws generally require that governmental permits and approvals be obtained before construction and maintained during operation of facilities. The Company is also subjectobligated to comply with all environmental laws regardingand regulations applicable within each jurisdiction and required to implement environmental programs and procedures to monitor and control risks associated with the protectionconstruction, operation and decommissioning of wildlife, including migratory birds, eagles, threatened and endangered species.regulated or permitted energy assets. Federal and state environmental laws have historically become more stringent over time, although this trend could change with respect toin the future.

A number of regulations that may affect the Company are either recently effective for 2021 or under review for potential revision or rescission in 2021, including the Affordable Clean Energy (ACE) rule, state solar photovoltaic module (solar panel) disposal and recycling regulations, and federal laws underMigratory Bird Treaty Act, or MBTA, incidental take regulations. Government leaders have also considered proposed MBTA legislation. The Company will evaluate the current U.S. presidential administration.impact of the legislation and regulations as they are revised but cannot fully predict the impact of each until anticipated revisions and legal challenges are resolved. To the extent that proposed legislation and new or revised regulations restrict or otherwise impact the Company's operations, the proposed legislation and regulations could have a negative impact on the Company's financial performance.

Affordable Clean EnergyRule— The attention in recent years on GHG emissions has resulted in federal regulations and state legislative and regulatory action. In October 2015, the EPA finalized the Clean Power Plan, or the CPP, addressingwhich addressed GHG emissions from existing EGUs. On February 9,electric utility steam generating units. The CPP was challenged in court and in 2016 the U.S. Supreme Court stayed the CPP. In 2019, the EPA published the Affordable Clean Energy, or ACE, rule to replace the CPP. The D.C.ACE rule establishes emission guidelines for states to develop plans to address greenhouse gas emissions from existing power plants. The ACE rule also reinforces the states’ broad discretion in establishing and applying emissions standards to new emission sources. However, on January 19, 2021, the U.S. Court of Appeals for the District of Columbia Circuit heard oral argumentissued a judgment vacating and remanding the ACE rule. The CPP is currently expected to become effective in 2021, barring additional action by the Biden Administration or the U.S. Supreme Court. The reimplementation of the CPP, or a potential replacement of the CPP by the Biden Administration with another program regulating GHG emissions could result in increased operating costs or capital expenses for our conventional power generating facilities.

Proposed and Final State Solar Photovoltaic Module Disposal and Recycling Regulations —On October 1, 2015, California enacted SB 489, which authorized California’s Department of Toxic Substances Control ("DTSC") to adopt regulations to designate discarded photovoltaic modules, which are classified as hazardous waste, as universal waste subject to universal waste management. On April 19, 2019, the department proposed regulations that would allow discarded photovoltaic modules to be managed as universal waste. The final regulations were approved by the CA Office of Administrative Law in September 2020 and became effective January 1, 2021. DTSC issued the final regulatory text in April 2020 and the regulations became effective January 1, 2021.

In January 2021, the State of Hawaii issued a public notice of proposed rule changes which amongst other items, include proposed new solar panel universal waste rule. This proposed rule would create a new universal waste category for solar panels and allow solar panel waste management to be conducted under the existing regulatory framework.

Proposed Federal MBTA Incidental Take Legislation and Regulations — On January 15, 2020, the House Natural Resources Committee voted to advance a bill that would reinstate the interpretation that incidental take is prohibited under the MBTA, overriding the Trump-administration Solicitor’s Opinion M-37050 that held the MBTA only applies to intentional takings.The bill also develops a general permitting program that covers incidental take of migratory birds. To the extent that electric generation takes migratory birds, it typically is incidental to its operations.

On January 7, 2021, the U.S. Fish and Wildlife Service (“FWS”) published a final rule codifying the Solicitor’s Opinion M-37050 defining the scope of certain prohibitions under the MBTA.The final rule clarifies that criminal liability for pursuing, hunting, taking, capturing, or killing or attempting to take, capture or kill migratory birds is limited to actions directed at migratory birds, their nests, or their eggs.Under the final rule, these prohibitions do not extend to actions that only incidentally take or kill migratory birds as a result of otherwise lawful activities.However, the final rule and the underlying Solicitor’s Opinion have both been subject to legal challenges.On August 11, 2020, the Southern District Court in New York vacated the Solicitor's Opinion, finding there was not an adequate legal basis for the policy changes articulated in the guidance

document.In addition, on January 19, 2021, environmental groups filed a lawsuit in the U.S. District Court for the Southern District of New York arguing that the FWS’s January 2021 final rule improperly relied on the legal challengesvacated Solicitor’s Opinion, violates the MBTA, and should be vacated. Finally, on January 20, 2021, President Biden issued an executive order to review and consider suspending, revising, or rescinding agency actions taken between January 20, 2017 and January 20, 2021 determined to be inconsistent with certain public health and environmental goals.This includes a review of both the Solicitor’s Opinion and the FWS’s January 2021 final rule.In response to this directive, on February 9, 2021, the FWS delayed the effective date of the January 2021 final rule until March 8, 2021 and requested public comment to inform its review and a potential extended delay. A return to the CPPposition that incidental take is prohibited under the MBTA, or the development of legislation or regulations contrary to the FWS’s January 2021 rule, could increase potential liability and impose additional permitting requirements on our operations.

State Migratory Bird Incidental Take Legislation and Regulations —In 2019, Assembly Member Kalra introduced AB 454 to protect migratory bird species in September 2016. AtCalifornia. This new bill was intended to backstop the EPA's request,MBTA. The bill, which sunsets on January 20, 2025, makes it unlawful to take or possess any migratory bird in California except as provided by pre-2017 federal guidance. The bill was approved by the D.C. Circuit agreed on April 28, 2017 to hold the caseState Legislature and signed into law by Governor Newsom in abeyance. On October 16, 2017, the EPA proposed a rule to repeal the CPP. Accordingly, the Company believes the CPP is not likely to survive.2019.

Customers

The Company sells its electricity and environmental attributes, including RECs, primarily to local utilities under long-term, fixed-price PPAs. During the year ended December 31, 2017,2020, the Company derived approximately 41%34% of its consolidated revenue from Southern California Edison, or SCE, and approximately 23%18% of its consolidated revenue from Pacific Gas and Electric, or PG&E.

EmployeesHuman Capital

The Company employs Christopher Sotos as its President and Chief Executive Officer and Chad Plotkin as its Senior Vice President and Chief Financial Officer. As of December 31, 2017, other than Messrs. Sotos and Plotkin,2020, the Company did not employ anyhad 301 employees, 56 of which are in Corporate and 245 of which are in the Thermal business. The Company also depends upon personnel of CEG for the provision of management, administration, O&M and certain other services at certain of the Company's renewable generation facilities.

The Company focuses on attracting, developing and retaining a team of highly talented and motivated employees. The majorityCompany regularly conducts assessments of its compensation and benefit practices and pay levels to help ensure that staff members are compensated fairly and competitively. The Company devotes extensive resources to staff development and training, including tuition assistance for career-enhancing academic and professional programs. Employee performance is measured in part based on goals that are aligned with the Company's annual objectives. The Company recognizes that its success is based on the talents and dedication of those it employs, and the Company is highly invested in their success. See "Environmental, Social and Governance (ESG)" below for a discussion of the Company's commitment to the health and safety of the Company's employees.

The Company is committed to maintaining a workplace that acknowledges, encourages, and values diversity and inclusion. The Company believes that individual differences, experiences, and strengths enrich the culture and fabric of its organization. Having employees with backgrounds and orientations that reflect a variety of viewpoints and experiences also helps the Company to better understand the needs of its customers and the communities in which it operates.

By leveraging the multitude of backgrounds and perspectives of its team and developing ongoing relationships with diverse vendors, the Company achieves a collective strength that enhances the work place and makes the Company a better business partner for its customers and others with a stake in the Company’s success.

In 2020, the Company launched its Equity, Partnership & Inclusion Council, or EPIC. As part of its commitment, the Company provides education on topics related to diversity, inclusion, and anti-racism. The Company also identified three areas of focus – Our People, Our Product & Customers and Our Purchasing. With the involvement of its employees, EPIC is advancing efforts in each of these areas to identify and implement opportunities for the Company to address equity, partnership and inclusion issues in our business activities.

Our People focuses on education and training; diversity, equity and inclusion policies and recruitment strategies; community and industry partnerships; and maintaining high employee engagement and retention.

Our Product & Customers focuses on identifying and eliminating any sales practices that could have a discriminatory impact and creating program development for low-income customers.

Our Purchasing focuses on establishing a non-discriminatory practices standard for the Company’s suppliers, diverse vendor sourcing and benchmarking.

In addition to the personnel who manageof CEG, the Company relies on other third-party service providers in the daily operations of certain of the Company's renewable and conventional facilities.

Environmental, Social and Governance (ESG)

The Company is committed to engaging with its stakeholders on environmental, social and governance, or ESG, matters in a proactive, holistic and integrated manner. The Company strives to provide recent, credible and comparable data to ESG agencies while engaging institutional investors and investor advocacy organizations around ESG issues. The Company's Corporate Governance, Conflicts and Nominating Committee reviews developing trends and emerging ESG matters, as well as the Company’s strategies, activities policies and communications regarding ESG matters, and makes recommendations to the Company's Board of Directors regarding potential actions by the Company.

The Company has issued $1.1 billion of corporate green bonds under a green bond framework that applies the net proceeds to finance or refinance, in part or in full, new and existing projects and assets meeting certain criteria focused on the supply of energy from renewable resources, including solar energy and wind energy. The Company's projects and alignment of its Green Bond Principles (2018) are reviewed by Sustainalytics, an outside consultant with recognized expertise in ESG research and analysis.

The Company includes safety performance goals in the annual incentive plan for its management and the Company arehad zero fatalities in 2020. In response to the ongoing coronavirus (COVID-19) pandemic, the Company has implemented preventative measures and developed corporate and regional response plans to protect the health and safety of its employees, customers and other business counterparties, while supporting the Company’s suppliers and customers’ operations to the best of NRG or third parties managedits ability in the circumstances. The Company also has modified certain business practices (including discontinuing all non-essential business travel, implementing a temporary work-from-home policy for employees who can execute their work remotely and encouraging employees to adhere to local and regional social distancing, more stringent hygiene and cleaning protocols across the Company’s facilities and operations and self-quarantining recommendations) to support efforts to reduce the spread of COVID-19 and to conform to government restrictions and best practices encouraged by NRG,governmental and their services are providedregulatory authorities. The Company continues to evaluate these measures, response plans and business practices in light of the evolving effects of COVID-19.

As discussed in greater detail above, the Company has focused its diversity, equity and inclusion efforts in three areas – Our People, Our Product & Customers and Our Purchasing – through its launch of EPIC. With the involvement of the Company’s employees, EPIC is advancing efforts in each of these areas to identify and implement opportunities for the Company's benefit under the Management Services AgreementCompany to address equity, partnership and project operations and maintenance agreements with NRG as describedinclusion issues in Item 15 — Note 15, Related Party Transactions, to the Consolidated Financial Statements.its business activities.

Available Information

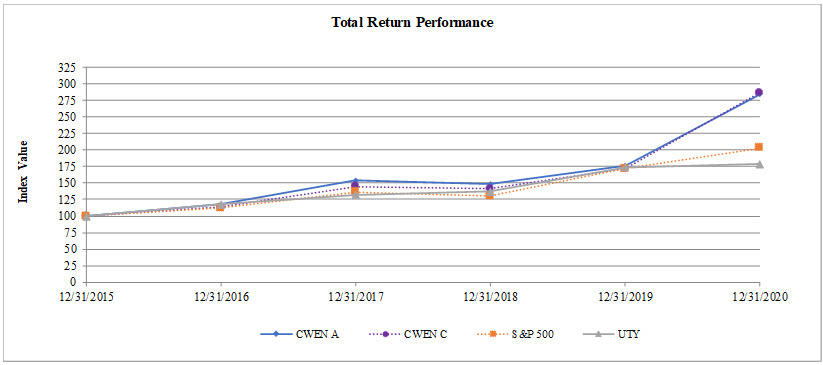

The Company's annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to section 13(a) or 15(d) of the Exchange Act are available free of charge through the "Investor Relations" section of the Company's website, www.nrgyield.comwww.clearwayenergy.com, as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. The Company also routinely posts press releases, presentations, webcasts, and other information regarding the Company on its website. The information posted on the Company's website is not a part of this report.