| PAGE | ||||||

| PART I | ||||||

| Item 1. | Business | |||||

| Item 1A. | Risk Factors | |||||

| Item 1B. | Unresolved Staff Comments | |||||

| Item 2. | Properties | |||||

| Item 3. | Legal Proceedings | |||||

| Item 4. | Mine Safety Disclosures | |||||

| PART II | ||||||

| Item 5. | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |||||

| Item 6. | Selected Financial Data | |||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operation | |||||

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | |||||

| Item 8. | Financial Statements and Supplementary Data | |||||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |||||

| Item 9A. | Controls and Procedures | |||||

| Item 9B. | Other Information | |||||

| PART III | ||||||

| Item 10. | Directors, Executive Officers and Corporate Governance | |||||

| Item 11. | Executive Compensation | |||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | |||||

| Item 14. | Principal Accountant Fees and Services | |||||

| PART IV | ||||||

| Item 15. | Exhibits and Financial Statement Schedules | |||||

| �� | Signatures | |||||

| 2 |

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the federal securities law. Statements in this report that are not strictly historical are forward-looking and based upon current expectations that may differ materially from actual results. These forward-looking statements, identified by words such as “will”, “expect”, “believe” and “prospects”, involve risks and uncertainties that could cause actual results to differ materially from those anticipated by the statement made herein. These risks and uncertainties include, but are not limited to, general economic trends and changes in interest rates, increased competition, regulatory or legislative developments affecting the financial industry generally or Nicolet Bankshares, Inc. specifically, changes in consumer demand for financial services, the possibility of unforeseen events affecting the industry generally or Nicolet Bankshares, Inc. specifically, the uncertainties associated with newly developed or acquired operations and market disruptions. Nicolet Bankshares, Inc. undertakes no obligation to release revisions to these forward-looking statements publicly to reflect events or circumstances after the date hereof or to reflect the occurrence of unforeseen events, except as required to be reported under the rules and regulations of the Securities and Exchange Commission (“SEC”).

PART I

| ITEM 1. | BUSINESS |

General

Nicolet Bankshares, Inc. (individually referred to herein as the “Parent Company” and together with all its subsidiaries collectively referred to herein as “Nicolet,” the “Company,” “we,” “us” or “our”) is a registered bank holding company under the Bank Holding Company Act of 1956, as amended, and under the bank holding company laws of the State of Wisconsin.

Nicolet is a Wisconsin corporation, originally incorporated on April 5, 2000 as Green Bay Financial Corporation, a Wisconsin corporation, to serve as the holding company for and the sole shareholder of Nicolet National Bank. It amended and restated its articles of incorporation and changed its name to Nicolet Bankshares, Inc. on March 14, 2002. It subsequently became the holding company for Nicolet Nationalthe Bank upon the completion of the bank’sBank’s reorganization into a holding company structure on June 6, 2002.

Nicolet conducts operations through its wholly owned subsidiary, Nicolet National Bank, a commercial bank which was organized in 2000 as a national bank under the laws of the United States and opened for business, in Green Bay, Brown County, Wisconsin, on November 1, 2000 (referred to herein as “Nicolet National Bank,” or the “Bank”). Structurally, Nicolet also wholly owns a registered investment advisory firm, Brookfield Investment Partners, LLC. (“Brookfield”), that principally provides investment strategy and transactional services to select community banks, wholly owns ana registered investment subsidiary of the Bankadvisory firm, Nicolet Advisory Services, LLC (“Nicolet Advisory”), that is based in Nevada,conducts brokerage and financial advisory services primarily to individual consumers, and entered into a joint venture that provides for 50% ownership of the building in which Nicolet is headquartered. Structurally, the Bank wholly owns an investment subsidiary based in Nevada, wholly owns a subsidiary in Green Bay that provides a web-based investment management platform for financial advisor trades and related activity, and the Bank owns 99.2% of United Financial Services, Inc (“UFS Inc.”) which in turn owns 50.2% of UFS, LLC, a data processing services company located in Grafton, Wisconsin (collectively referred to herein as “UFS”). These subsidiaries are closely related to or incidental to the business of banking and none are individually or collectively significant to Nicolet’s financial position or results.

The Bank is a full-service community bank, offering traditional banking products and services, and wealth managementtrust and brokerage products and services, to businesses and individuals in the markets it serves, delivered through a branch network serving northeast and central Wisconsin communities and Menominee, Michigan, as well as through on-line and mobile banking capabilities.

Nicolet’s profitability is significantly dependent upon net interest income (interest income earned on loans and other interest-earning assets such as investments, net of interest expense on deposits and other borrowed funds), and noninterest income sources (including but not limited to service charges on deposits, trust and brokerage fees, and mortgage fee income from sales of residential mortgages into the secondary market), offset by the level of the provision for loan losses, noninterest expenses (largely employee compensation and overhead expenses tied to processing and operating the Bank’s business), and income taxes. For

| 3 |

Since its opening in late 2000, Nicolet has supplemented its organic growth with the year endedDecember 2003 purchase of a branch and deposits in Menominee, Michigan, the July 2010 purchase of 4 branches and deposits in Brown County, the April 2013 merger transaction with Mid-Wisconsin Financial Services, Inc. (“Mid-Wisconsin”), the August 2013 acquisition of selected assets and liabilities of Bank of Wausau through a transaction with the Federal Deposit Insurance Corporation (“FDIC”) (the latter two collectively referred to as the “2013 acquisitions”), and two transactions completed in the first half of 2016 (collectively the “2016 acquisitions”) consisting of a private transaction to hire a select group of financial advisors and to purchase their respective books of business and operating platform completed on April 1, 2016 and the merger transaction with Baylake Corp. (“Baylake”) consummated on April 29, 2016.

On November 4, 2016, Nicolet announced the signing of an Agreement and Plan of Merger with First Menasha Bancshares, Inc. (“First Menasha” (OTCQX: FMBJ)) pursuant to which First Menasha will merge with and into Nicolet. As of December 31, 2014, Nicolet earned net income2016, First Menasha had total assets of $9.9$465 million, loans of $365 million, deposits of $383 million and after $0.2 milliontotal stockholders’ equity of preferred stock dividends, net income available$47 million. The merger with First Menasha is expected to common shareholders was $9.7 million or $2.25 per diluted common share.

Products and Services Overview

Nicolet’s principal business is banking, consisting of lending and deposit gathering, as well as ancillary banking-related products and services, to businesses and individuals of the communities it serves, and the operational support to deliver, fund and manage such banking products and services. Additionally, through the Bank offersand Nicolet Advisory, trust, brokerage and other investment management services for individuals and retirement plan services for business customers.customers are offered. Nicolet delivers its products and services principally through 2336 bank branch locations, on-line banking, mobile banking and an interactive website. Nicolet’s call center also services customers.

Nicolet offers a variety of loans, deposits and related services to business customers (especially small and medium-sized businesses and professional concerns), including but not limited to: business checking and other business deposit products and cash management services, international banking services, business loans, lines of credit, commercial real estate financing, construction loans, agricultural real estate or production loans, and letters of credit, as well as retirement plan services. Similarly, Nicolet offers a variety of banking products and services to consumers, including but not limited to: residential mortgage loans and mortgage refinancing, home equity loans and lines of credit, residential construction loans, personal loans, checking, savings and money market accounts, various certificates of deposit and individual retirement accounts, safe deposit boxes, and personal brokerage, trust and fiduciary services. Nicolet also provides on-line services including commercial, retail and trust on-line banking, automated bill payment, mobile banking deposits and account access, remote deposit capture, and telephone banking, and other services such as wire transfers, courier services, debit cards, credit cards, pre-paid gift cards, direct deposit, official bank checks and U.S. Savingssavings bonds.

Lending is critical to Nicolet’s balance sheet and earnings potential. Nicolet seeks creditworthy borrowers principally within the geographic area of its branch locations. As a community bank with experienced commercial lenders and residential mortgage lenders, the Bank’s primary lending function is to make commercial loans [consisting(consisting of commercial, industrial, and business loans and lines of credit, owner-occupied commercial real estate (“owner-occupied CRE”), and agricultural (“AG”) production and real estate loans]; commercial real estate (“CRE”) loans [consisting of investment real estate loans (“CRE investment”), AG real estate, and construction and land development loans]loans); residential real estate loans (consisting of residential first lien mortgages, junior lien mortgages, home equity loans and lines of credit, and to a lesser degree residential construction loans); and other loans, mainly consumer in nature. As of December 31, 2014,2016, Nicolet’s loan portfolio mix was as follows:

| Loan category | % of Total Loans | ||||

| Commercial & industrial | % | ||||

| Owner-occupied CRE | % | ||||

| AG production | % | ||||

| Total commercial loans | 53 | % | |||

| AG real estate | % | ||||

| CRE investment | % | ||||

| Construction & land development | % | ||||

| Total CRE loans | % | ||||

| Residential construction | 1 | % | |||

| Residential first mortgages | % | ||||

| Residential junior mortgages | 6 | % | |||

| Total residential real estate loans | % | ||||

| Other | 1 | % | |||

| 4 |

Lending involves credit risk. Nicolet has and follows extensive loan policies and procedures to standardize processes, meet compliance requirements and prudently manage underwriting, credit and other risks. Credit risk is further controlled and monitored through active asset quality management including the use of lending standards, thorough review of current and potential borrowers through Nicolet’s underwriting process, close relationships with and regular check-ins with borrowers, and active asset quality administration. For further discussion of credit risk management, see “Management’s Discussion and Analysis of Financial Condition and Results of Operation,” under Part II, Item 7.

Employees

At December 31, 2014,2016, Nicolet had approximately 280480 full-time equivalent employees. None of our employees are represented by unions.

Market Area and Competition

The Bank is a full-service community bank, providing a full range of traditional commercial and retail banking services, as well as wealth management services throughout northeastern and central Wisconsin and the upper peninsula of Michigan. Nicolet markets its services to owner-managed companies, the individual owners of these businesses, and other residents of its market area, which at December 31, 20142016 is through 2336 branches located within 1011 Wisconsin counties (Brown, Door, Outagamie, Kewaunee, Marinette, Taylor, Clark, Marathon, Oneida, Price Vilas, and Eau Claire)Vilas) and in Menominee, Michigan. Based on deposit market share data published by the FDIC as of June 30, 2014,2016, the Bank ranks in the top three of market share for Brown, Door, Kewaunee, Taylor and Clark counties and in the top five for Menominee, Marinette and Price counties.

The financial services industry is highly competitive. Nicolet competes for loans, deposits and wealth management or financial services in all its principal markets. Nicolet competes directly with other bank and nonbank institutions located within our markets (some that may have an established customer base or name recognition), internet-based banks, out-of-market banks that advertise or otherwise serve its markets, money market and other mutual funds, brokerage houses, mortgage companies, insurance companies or other commercial entities that offer financial services products. Competition involves efforts to retain current or procure new customers, obtain new loans and deposits, increase the scope and type of products or services offered, and offer competitive interest rates paid on deposits or earned on loans, as well as to deliver other aspects of banking competitively. Many of Nicolet’s competitors may enjoy competitive advantages, including greater financial resources, broader geographic presence, more accessible branches or more advanced technologic delivery of products or services, more favorable pricing alternatives and lower origination or operating costs.

We believe our competitive pricing, personalized service and community engagement enable us to effectively compete in our markets. Nicolet employs seasoned banking and wealth management professionals with experience in its market areas and who are active in their communities. Nicolet’s emphasis on meeting customer needs in a relationship-focused manner, combined with local decision making on extensions of credit, distinguishes Nicolet from its competitors, particularly in the case of large financial institutions. Nicolet believes it further distinguishes itself by providing a range of products and services characteristic of a large financial institution while providing the personalized service, real conversation, and convenience characteristic of a local, community bank.

Supervision and Regulation

Set forth below is an explanation of the major pieces of legislation and regulation affecting the banking industry and how that legislation and regulation affects Nicolet’s actions.business. The following summary is qualified by reference to the statutory and regulatory provisions discussed. Changes in applicable laws or regulations may have a material effect on the business and prospects of Nicolet or Nicolet Nationalthe Bank, and legislative changes and the policies of various regulatory authorities may significantly affect their operations. We cannot predict the effect that fiscal or monetary policies, or new federal or state legislation may have on the future business and earnings of Nicolet or the Bank.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), enacted in 2010, contains a comprehensive set of provisions designed to govern the practices and oversight of financial institutions and other participants in the financial markets. The Dodd-Frank Act made extensive changes in the regulation of financial institutions and their holding companies.

Uncertainty remains as to the ultimate impact of the Dodd-Frank Act, which could have a material adverse impact on the financial services industry as a whole or on Nicolet’s and the Bank’s business, results of operations, and financial condition. Many aspects of the Dodd-Frank Act are in the process of being implemented while other aspects remain subject to further rulemaking. These regulations are scheduled to take effect over several years, making it difficult to anticipate the overall financial impact on Nicolet, Nationalits customers or the financial industry more generally. However, full implementation of the Dodd-Frank Act would likely increase the regulatory burden, compliance costs and interest expense for Nicolet and the Bank. Some of the rules that have been adopted to comply with the Dodd-Frank Act’s mandates are discussed below.

| 5 |

Regulation of Nicolet

Because Nicolet owns all of the capital stock of Nicolet Nationalthe Bank, it is a bank holding company under the federal Bank Holding Company Act of 1956, as amended (the “Bank Holding Company Act”). As a result, Nicolet is primarily subject to the supervision, examination, and reporting requirements of the Bank Holding Company Act and the regulations of the Board of Governors of the Federal Reserve System (the “Federal Reserve”). As a bank holding company located in Wisconsin, the Wisconsin Department of Financial Institutions (the “WDFI”) also regulates and monitors all significant aspects of its operations.

Acquisitions of Banks

. The Bank Holding Company Act requires every bank holding company to obtain the prior approval of the Federal Reserve before:| acquiring direct or indirect ownership or control of any voting shares of any bank if, after the acquisition, the bank holding company will directly or indirectly own or control more than 5% of the bank’s voting shares; |

| acquiring all or substantially all of the assets of any bank; or |

| merging or consolidating with any other bank holding company. |

Additionally, Thethe Bank Holding Company Act provides that the Federal Reserve may not approve any of these transactions if it would result in or tend to create a monopoly, substantially lessen competition, or otherwise function as a restraint of trade, unless the anti-competitive effects of the proposed transaction are clearly outweighed by the public interest in meeting the convenience and needs of the community to be served. The Federal Reserve is also required to consider the financial and managerial resources and future prospects of the bank holding companies and banks involved in the transaction and the convenience and needs of the community to be served. The Federal Reserve’s consideration of financial resources generally focuses on capital adequacy, which is discussed below.

Under Thethe Bank Holding Company Act, if adequately capitalized and adequately managed, Nicolet or any other bank holding company located in Wisconsin may purchase a bank located outside of Wisconsin. Conversely, an adequately capitalized and adequately managed bank holding company located outside of Wisconsin may purchase a bank located inside Wisconsin. In each case, however, restrictions may be placed on the acquisition of a bank that has only been in existence for a limited amount of time or will result in specified concentrations of deposits.

Change in Bank Control

.Subject to various exceptions,Permitted Activities

. The Bank Holding Company Act has generally prohibited a bank holding company from engaging in activities other than banking or managing or controlling banks or other permissible subsidiaries and from acquiring or retaining direct or indirect control of any company engaged in any activities other than those determined by the Federal Reserve to be closely related to banking or managing or controlling banks as to be a proper incident thereto. Provisions of the Gramm-Leach-Bliley Act have expanded the permissible activities of a bank holding company that qualifies as a financial holding company to engage in activities that are financial in nature or incidental or complementary to financial activities. Those activities include, among other activities, certain insurance, advisory and security activities.Nicolet meets the qualification standards applicable to financial holding companies, and elected to become a financial holding company in 2008. In2008.In order to remain a financial holding company, Nicolet must continue to be considered well managed and well capitalized by the Federal Reserve, and Nicolet Nationalthe Bank must continue to be considered well managed and well capitalized by the OCCOffice of the Comptroller of the Currency (the “OCC”) and have at least a “satisfactory” rating under the Community Reinvestment Act.

Support of Subsidiary Institutions

. Under Federal Reserve policy and the Dodd-FrankIn addition, any capital loans made by Nicolet to Nicolet Nationalthe Bank will be repaid only after Nicolet Nationalthe Bank’s deposits and various other obligations are repaid in full.

Capital Adequacy

. Nicolet is subject to capital requirements applied on a consolidated basis, which are substantially similar to those required of| 6 |

Dividend Restrictions

. Under Federal Reserve policies, bank holding companies may pay cash dividends on common stock only out of income available over the past year if prospective earnings retention is consistent with theRegulation of the Treasury (the “Treasury”) underBank

Because the Small Business Lending Fund (the “SBLF”) on September 1, 2011, it became subject to certain contractual limitations on the payment of dividends. These limitations require, among other things, that (1) all dividends for the SBLF Preferred Stock be paid before other dividends can be paid and (2) no dividends on or repurchases of Nicolet common stock will be permitted if the payment or dividends would result in a reduction of Nicolet’s Tier 1 capital from the level on the SBLF closing date by more than 10%.

Branching.

National banks are required by the National Bank Act to adhere to branching laws applicable to state banks in the states in which they are located. Under Wisconsin law and the Dodd-Frank Act, and with the prior approval of the OCC,Capital Adequacy.

Banks and bank holding companies, as regulated institutions, are required to maintain minimum levels of capital. The Federal ReserveIn addition to thesethe minimum risk-based capital and leverage ratios, the Basel III final rule requires that all banking organizations must maintain a “capital conservation buffer” consisting of CET1 in an amount equal to 2.5% of risk-weighted assets in order to avoid restrictions on their ability to make capital distributions and to pay certain discretionary bonus payments to executive officers. In order to avoid those restrictions, the capital conservation buffer effectively increases the minimum CET1 capital, Tier 1 capital, and total capital ratios for U.S. banking organizations to 7.0%, 8.5%, and 10.5%, respectively. Banking organizations with capital levels that fall within the buffer will be required to limit dividends, share repurchases or redemptions (unless replaced within the same calendar quarter by capital instruments of equal or higher quality), and discretionary bonus payments. The capital conservation buffer is phased in over a 5-year period beginning January 1, 2016.

| Adequately Capitalized Requirement, effective January 1, 2015 | Well-Capitalized Requirement, effective January 1,2015 | Well-Capitalized with Buffer, fully phased in 2019 | |

| Leverage | 4.0% | 5.0% | 5.0% |

| CET1 | 4.5% | 6.5% | 7.0% |

| Tier 1 | 6.0% | 8.0% | 8.5% |

| Total Capital | 8.0% | 10.0% | 10.5% |

The following table presents the Basel III final rule requires thatrisk-based and leverage capital requirements applicable to the Bank:

| Adequately Capitalized Requirement | Well-Capitalized Requirement | Well-Capitalized with Buffer, fully phased in 2019 | |

| Leverage | 4.0% | 5.0% | 5.0% |

| CET1 | 4.5% | 6.5% | 7.0% |

| Tier 1 | 6.0% | 8.0% | 8.5% |

| Total Capital | 8.0% | 10.0% | 10.5% |

Although capital instruments such as trust preferred securities and cumulative preferred shares were required by the Dodd-Frank Act to be phased-out of Tier 1 capital by January 1, 2016, for certain larger banking organizations, that had $15 billion or more in total consolidated assets as of December 31, 2009 andNicolet’s trust preferred securities are permanently grandfathersgrandfathered as Tier 1 capital such instruments issued by these smaller entities prior to May 19, 2010 (provided they do not exceed 25 percent25% of Tier 1 capital). Nicolet’s trust preferred securities are grandfathered under this provision.

The Basel III final rule provides banking organizations under $250 billion in total consolidated assets or under $10 billion in foreign exposures with a one-time “opt-out” right to continue excluding Accumulated Other Comprehensive Income from CET1 capital. The election to opt-out must be made on the banking organization’s first Call Report filed after January 1, 2015. Nicolet intends to elect to opt-out to continue excluding Accumulated Other Comprehensive Income from its regulatory capital.

| 7 |

The OCC also considers interest rate risk (arising when the interest rate sensitivity of the Bank’s assets does not match the sensitivity of its liabilities or its off-balance-sheet position) in the evaluation of the bank’s capital adequacy. Banks with excessive interest rate risk exposure are required to hold additional amounts of capital against their exposure to losses resulting from that risk. Through the risk-weighting of assets, the regulators also require banks to incorporate market risk components into their risk-based capital. Under these market risk requirements, capital is allocated to support the amount of market risk related to a bank’s lending and trading activities.

The Bank’s capital categories are determined solely for the purpose of applying the “prompt corrective action” rules described below and they are not necessarily an accurate representation of its overall financial condition or prospects for other purposes. Failure to meet capital guidelines could subject a bank or bank holding company to a variety of enforcement remedies, including issuance of a capital directive, the termination of deposit insurance by the FDIC, a prohibition on accepting brokered deposits, and certain other restrictions on its business. See “Prompt Corrective Action” below.

Prompt Corrective Action.The Federal Deposit Insurance Corporation Improvement Act of 1991 (“FDICIA”) establishes a system of prompt corrective action to resolve the problems of undercapitalized financial institutions. Under this system, the federal banking regulators have established five capital categories: well capitalized, adequately capitalized, undercapitalized, significantly undercapitalized, and critically undercapitalized, in which all institutions are placed. The federal banking agencies have also specified by regulation the relevant capital levels for each category.

A “well-capitalized” bank is one that is not required to meet and maintain a specific capital level for any capital measure, pursuant to any written agreement, order, capital directive, or prompt corrective action directive, and has a total risk-based capital ratio of at least 10%, a Tier 1 risk-based capital ratio of at least 8%, a common equity Tier 1 capital ratio of at least 6.5%, and a Tier 1 leverage ratio of at least 5%. Generally, a classification as well capitalized will meetplace a bank outside of the regulatory zone for purposes of prompt corrective action. However, a well-capitalized bank may be reclassified as “adequately capitalized” based on criteria other than capital, if the federal regulator determines that a bank is in an unsafe or exceedunsound condition, or is engaged in unsafe or unsound practices, which requires certain remedial action.

As of December 31, 2016, the newBank satisfied the requirements of “well-capitalized” under the regulatory framework for prompt corrective action. See Note 19, “Regulatory Capital Requirements and Restrictions of Dividends,” in the Notes to continueConsolidated Financial Statements, under Part II, Item 8, for Nicolet and the Bank regulatory capital ratios.

As a bank’s capital position deteriorates, federal banking regulators are required to be classified as well-capitalized under Basel III astake various mandatory supervisory actions and are authorized to take other discretionary actions with respect to institutions in the three undercapitalized categories: undercapitalized, significantly undercapitalized, and critically undercapitalized. The severity of January 1, 2015.

FDIC Insurance Assessments.

Commercial Real Estate Lending.

| · | total reported loans for construction, land development and other land represent 100% or more of the institution’s total capital, or |

| · | total commercial real estate loans represent 300% or more of the institution’s total capital, and the outstanding balance of the institution’s commercial real estate loan portfolio has increased by 50% or more. |

At December 31, 2014 Nicolet National2016 the Bank’s commercial real estate lending levels are below the guidance levels noted above.

Enforcement Powers

.The Financial Institution Reform Recovery and Enforcement Act (“FIRREA”) expanded and increased civil and criminal penalties available for use by the federal regulatory agencies against depository institutions and certain “institution-affiliated parties.” Institution-affiliated parties primarily include management, employees, and agents of a financial institution, as well as independent contractors and consultants such as attorneys and accountants and others who participate in the conduct of the financial institution’s affairs. These practices can include the failure of an institution to timely file required reports or the filing of false or misleading information or the submission of inaccurate reports. Civil penalties may be as high as| 8 |

Community Reinvestment Act.

The Community Reinvestment Act requires that, in connection with examinations of financial institutions within their respective jurisdictions, the federal banking agencies evaluate the record of each financial institution in meeting the credit needs of its local community, including low- and moderate-income neighborhoods. These facts are also considered in evaluating mergers, acquisitions, and applications to open a branch or facility. Failure to adequately meet these criteria could impose additional requirements and limitations onPayment

of Dividends. Statutory and regulatory limitations apply toThe Bank is required by federal law to obtain prior approval of the OCC for payments of dividends if the total of all dividends declared by Nicolet Nationalthe Bank in any year will exceed (1) the total of Nicolet Nationalthe Bank’s net profits for that year, plus (2) Nicolet Nationalthe Bank’s retained net profits of the preceding two years, less any required transfers to surplus. The payment of dividends may also be affected by other factors, such as the requirement to maintain adequate capital above regulatory guidelines or any conditions or restrictions that may be imposed by regulatory authorities.

Transactions with Affiliates and Insiders

.USA PatriotPATRIOT Act

Customer Protection

.Consumer Financial Protection Bureau.

The Dodd-Frank Act centralized responsibility for consumer financial protection including implementing, examining and enforcing compliance with federal consumer financial laws with the Consumer Financial Protection Bureau (the “CFPB”). Depository institutions with less than $10 billion in assets, such asUDAP and UDAAP.

| 9 |

Mortgage Reform.

The CFPB has adopted final rules implementing minimum standards for the origination of residential mortgages, including standards regarding aAvailable Information

Nicolet became a public reporting company under Section 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) on March 26, 2013, when Nicolet’s registration statement related to its acquisition of Mid-Wisconsin Financial Services, Inc. (Registration Statement on Form S-4, “Regis.Regis. No. 333-186401”)333-186401) became effective. Nicolet registered its common stock under Section 12(b) of the Exchange Act on February 24, 2016 in connection with listing on the Nasdaq Capital Market. Nicolet files annual, quarterly, and current reports, and other information with the SEC. These filings are available to the public on the Internet at the SEC’s website atwww.sec.gov. Shareholders may also read and copy any document that we file at the SEC’s public reference rooms located at 100 F Street, NE, Washington, DC 20549. Shareholders may call the SEC at 1-800-SEC-0330 for further information on the public reference room.

Nicolet’s internet address iswww.nicoletbank.com. We make available free of charge on or through our website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

| ITEM 1A. | RISK FACTORS |

An investment in our common stock involves risks. If any of the following risks, or other risks which have not been identified or which we may believe are immaterial or unlikely, actually occur,occurs, our business, financial condition and results of operations could be harmed. In such a case, the trading price of our common stock could decline, and you could lose all or part of your investment. The risks discussed below also include forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements.

Risks Relating to Nicolet’s Business

Nicolet may not be able to sustain its historical rate of growth, or may encounter issues associated with its growth, either of which could adversely affect our financial condition, results of operations, and share price.

We have grown over the past several years and intend to continue to pursue a significant growth strategy for our business. Our prospects must be considered in light of the risks, expenses and difficulties frequently encountered by companies in significant growth stages of development. We may not be able to further expand our market presence in existing markets or to enter new markets successfully, nor can we guarantee that any such expansion would not adversely affect our results of operations. Failure to manage growth effectively could have a material adverse effect on the business, future prospects, financial condition or results of our operations, and could adversely affect our ability to successfully implement business strategies. Also, if such growth occurs more slowly than anticipated or declines, our operating results could be materially adversely affected.

Our ability to grow successfully will depend on a variety of factors including the continued availability of desirable business opportunities, the competitive responses from other financial institutions in our market areas and the ability to manage our growth. While we believe we have the management resources and internal systems in place to manage future growth successfully, there can be no assurance that growth opportunities will be available or that any growth will be managed successfully. In addition, our recent growth may distort some of our historical financial ratios and statistics.

As part of our growth strategy, we regularly evaluate merger and acquisition opportunities and conduct due diligence activities related to possible transactions with other financial institutions and financial services companies. As a result, negotiations may take place and future mergers or acquisitions involving cash, debt, or equity securities may occur at any time. We seek merger or acquisition partners that are culturally similar, have experienced management, and possess either significant market presence or have potential for improved profitability through financial management, economies of scale, or expanded services.

As noted above in Item 1, Business, Nicolet completed its acquisition of Baylake on April 29, 2016, and completed the hiring of a select group of financial advisors and purchase of their respective books of business and operating platform on April 1, 2016. In addition, on November 4, 2016, we announced the signing of a definitive merger agreement pursuant to which Nicolet will acquire First Menasha. As evidenced by our pending acquisition of First Menasha, we intend to continue pursuing a growth strategy for our business through attractive acquisition opportunities.

| 10 |

Acquiring other banks, businesses, or branches involves potential adverse impact to our financial results and various other risks commonly associated with acquisitions, including, among other things, difficulty in estimating the value of the target company, payment of a premium over book and market values that may dilute our tangible book value and earnings per share in the short and long term, potential exposure to unknown or contingent liabilities of the target company, exposure to potential asset quality issues of the target company, potential volatility in reported income as goodwill impairment losses could occur irregularly and in varying amounts, difficulty and expense of integrating the operations and personnel of the target company, inability to realize the expected revenue increases, cost savings, increases in geographic or product presence, and / or other projected benefits, potential disruption to our business, potential diversion of our management’s time and attention, and the possible loss of key employees and customers of the target company.

As a community bank, Nicolet’s success depends upon local and regional economic conditions and has different lending risks than larger banks.

We provide services to our local communities. Our ability to diversify economic risks is limited by our own local markets and economies. We lend primarily to individuals and small- to medium-sized businesses, which may expose us to greater lending risks than those of banks lending to larger, better-capitalized businesses with longer operating histories.

We manage our credit exposure through careful monitoring of loan applicants and loan concentrations in particular industries, and through loan approval and review procedures. We have established an evaluation process designed to determine the adequacy of our allowance for loan losses. While this evaluation process uses historical and other objective information, the classification of loans and the establishment of loan losses is an estimate based on experience, judgment and expectations regarding borrowers and economic conditions, as well as regulator judgments. We can make no assurance that our loan loss reserves will be sufficient to absorb future loan losses or prevent a material adverse effect on its business, profitability or financial condition.

The core industries in our market area are manufacturing, wholesaling, paper, packaging, food production and processing, agriculture, forest products, retail, service, and businesses supporting the general building industry. The area has a broad range of diversified equipment manufacturing services related to these core industries and others. The residential and commercial real estate markets throughout these areas depend primarily on the strength of these core industries. A material decline in any of these sectors will affect the communities we serve and could negatively impact our financial results and have a negative impact on profitability.

If the communities in which we operate do not grow or if the prevailing economic conditions locally or nationally are less favorable than we have assumed, our ability to maintain our low volume of non-performing loans and other real estate owned and implement our business strategies may be adversely affected and our actual financial performance may be materially different from our projections.

Nicolet may experience increased delinquencies and credit losses, which could have a material adverse effect on our capital, financial condition, results of operations, and share price.

Our success depends to a significant extent upon the quality of our assets, particularly loans. In originating loans, there is a substantial likelihood that we will experience credit losses. The risk of loss will vary with, among other things, general economic conditions, the type of loan, the creditworthiness of the borrower over the term of the loan, and, in the case of a collateralized loan, the quality of the collateral for the loan.

Our loan customers may not repay their loans according to the terms of these loans, and the collateral securing the payment of these loans may be insufficient to assure repayment. As a result, we may experience significant loan losses, which could have a material adverse effect on our operating results. Management makes various assumptions and judgments about the collectability of our loan portfolio, including the creditworthiness of our borrowers and the value of the real estate and other assets serving as collateral for the repayment of many of our loans. We maintain an allowance for loan losses in an attempt to cover any loan losses that may occur. In determining the size of the allowance, we rely on an analysis of our loan portfolio based on historical loss experience, volume and types of loans, trends in classification, volume and trends in delinquencies and non-accruals, national and local economic conditions, and other pertinent information.

If management’s assumptions are wrong, our current allowance may not be sufficient to cover future loan losses, and we may need to make adjustments to allow for different economic conditions or adverse developments in our loan portfolio. Material additions to our allowance would materially decrease net income. We expect our allowance to continue to fluctuate; however, given current and future market conditions, we can make no assurance that our allowance will be adequate to cover future loan losses.

In addition, the market value of the real estate securing our loans as collateral continues tocould be adversely affected by the slow economy and unfavorable changes in economic conditions in our market areas and could be further adversely affected in the future.areas. As of December 31, 2014,2016, approximately 40% of our loans were secured by commercial-based real estate, 3% of loans were secured by agriculture-based real estate, and 25%26% of our loans receivable were secured by residential real estate. Any sustained period of increased payment delinquencies, foreclosures, or losses caused by adverse market and economic conditions, including another downturn in the real estate market, in our markets could adversely affect the value of our assets, revenues, results of operations, and financial condition.

| 11 |

Nicolet is subject to extensive regulation that could limit or restrict our activities, which could have a material adverse effect on our results of operations or share price.

We operate in a highly regulated industry and are subject to examination, supervision, and comprehensive regulation by various regulatory agencies. Our compliance with these regulations, including compliance with regulatory commitments, is costly and restricts certain of our activities, including the declaration and payment of cash dividends to stockholders, mergers and acquisitions, investments, loans and interest rates charged, interest rates paid on deposits, and locations of offices. We are also subject to capitalization guidelines established by our regulators, which require us to maintain adequate capital to support our growth and operations.

The laws and regulations applicable to the banking industry have recently changed and may continue to change, and we cannot predict the effects of these changes on our business and profitability. Some or all of the changes, including the new rulemaking authority granted to the newly-created CFPB, may result in greater reporting requirements, assessment fees, operational restrictions, capital requirements, and other regulatory burdens for us, and many of our competitors that are not banks or bank holding companies may remain free from such limitations. This could affect our ability to attract and maintainretain depositors, to offer competitive products and services, and to expand our business. Because government regulation greatly affects the business and financial results of all commercial banks and bank holding companies, the cost of compliance could adversely affect our ability to operate profitably.

Congress may consider additional proposals to substantially change the financial institution regulatory system and to expand or contract the powers of banking institutions, bank holding companies and bankfinancial holding companies. Such legislation may change existing banking statutes and regulations, as well as the current operating environment significantly. If enacted, such legislation could increase or decrease the cost of doing business, limit or expand our permissible activities, or affect the competitive balance among banks, savings associations, credit unions, and other financial institutions. We cannot predict whether new legislation will be enacted and, if enacted, the effect that it, or any regulations, would have on our business, financial condition, or results of operations.

Nicolet’s profitability is sensitive to changes in the interest rate environment.

As a financial institution, our earnings significantly depend on net interest income, which is the difference between the interest income that we earn on interest-earning assets, such as investment securities and loans, and the interest expense that we pay on interest-bearing liabilities, such as deposits and borrowings. Therefore, any change in general market interest rates, including changes in federal fiscal and monetary policies, affects us more than non-financial institutions and can have a significant effect on our net interest income and total income. Our assets and liabilities may react differently to changes in overall market rates or conditions because there may be mismatches between the repricing or maturity characteristics of the assets and liabilities. As a result, an increase or decrease in market interest rates could have material adverse effects on our net interest margin and results of operations.

In addition, we cannot predict whether interest rates will continue to remain at present levels, or the timing of any anticipated changes. Changes in interest rates may cause significant changes, up or down, in our net interest income. Depending on our portfolio of loans and investments, our results of operations may be adversely affected by changes in interest rates. If there is a substantial increase in interest rates, our investment portfolio is at risk of experiencing price declines that may negatively impact our total capital position through changes in other comprehensive income. In addition, any significant increase in prevailing interest rates could adversely affect our mortgage banking business because higher interest rates could cause customers to request fewer refinancingsrefinancing and purchase money mortgage originations.

We rely on other companies to provide key components of our business infrastructure.

Third party vendors provide key components of our business infrastructure such as internet connections, network access and core application processing. While we have selected these third party vendors carefully, we do not control their actions. Any problems caused by these third parties, including as a result of their not providing us their services for any reason or their performing their services poorly, could adversely affect our ability to deliver products and services to our customers and otherwise to conduct our business. Replacing these third party vendors could also entail significant delay and expense.

Negative publicity could damage our reputation.

Reputation risk, or the risk to our earnings and capital from negative public opinion, is inherent in our business. Negative public opinion could adversely affect our ability to keep and attract customers and expose us to adverse legal and regulatory consequences. Negative public opinion could result from our actual or alleged conduct in any number of activities, including lending or foreclosure practices, corporate governance, regulatory compliance, mergers and acquisitions, and disclosure, sharing or inadequate protection of customer information, and from actions taken by government regulators and community organizations in response to that conduct.

| 12 |

Competition in the banking industry is intense and Nicolet faces strong competition from larger, more established competitors.

The banking business is highly competitive, and we experience strong competition from many other financial institutions. We compete with commercial banks, credit unions, savings and loan associations, mortgage banking firms, consumer finance companies, securities brokerage firms, insurance companies, money market funds, and other financial institutions that operate in our primary market areas and elsewhere.

We compete with these institutions both in attracting deposits and in making loans. In addition, we have to attract our customer base from other existing financial institutions and from new residents. Many of our competitors are well-established, much larger financial institutions. While we believe we can and do successfully compete with these other financial institutions in its markets, we may face a competitive disadvantage as compared to large national or regional banks as a result of our smaller size and relative lack of geographic diversification.

Although we compete by concentrating our marketing efforts in our primary market area with local advertisements, personal contacts, and greater flexibility in working with local customers, we can give no assurance that this strategy will be successful.

Nicolet continually encounters technological change and we may have fewer resources than our competition to continue to invest in technological improvements; as well,improvements, and Nicolet’s information systems may experience an interruption or breach in security.

The banking and financial services industry is undergoing rapid technological changes, with frequent introductions of new technology-driven products and services. In addition to better serving customers, the effective use of technology increases efficiency and enables financial institutions to reduce costs. Our future success will depend, in part, upon our ability to address the needs of our customers by using technology to provide products and services that enhance customer convenience, as well as create additional efficiencies in operations. Many of our competitors have greater resources to invest in technological improvements, and we may not be able to effectively implement new technology-driving products and services, which could reduce our ability to effectively compete.

In addition, we rely heavily on communications and information systems to conduct our business. Any failure, interruption or breach in security of these systems could result in failures or disruptions in customer relationship management, general ledger, deposit, loan functionality and the effective operation of other systems. While we have policies and procedures designed to prevent or limit the effect of a failure, interruption or security breach of our information systems, there can be no assurance that any such failures, interruptions or security breaches will not occur or, if they do occur, that they will be adequately addressed. The occurrence of any failures, interruptions or security breaches of our information systems could damage our reputation, result in a loss of customer business, subject us to additional regulatory scrutiny, or expose us to civil litigation and possible financial liability, any of which could have a material adverse effect on our financial condition and results of operations.

Risks Related to Ownership of Nicolet’s Common Stock

Our stock price can be volatile.

Stock price volatility may make it more difficult for you to sell your common stock when you want and at prices you find attractive. Our stock price can fluctuate widely in response to a variety of factors including, among other things:

General market fluctuations, industry factors, and general economic and political conditions and events, such as economic slowdowns or recessions, interest rate changes, or credit loss trends, could also cause our stock price to decrease regardless of our operating results.

Nicolet has not historically paid dividends to our common shareholders, and we cannot guarantee that weit will pay dividends to such shareholders in the future.

The holders of our common stock receive dividends if and when declared by the Nicolet board of directors out of legally available funds. Nicolet’s board of directors has not declared a dividend on the common stock since our inception in 2000 and does not expect to do so in the foreseeable future. Any future determination relating to dividend policy will be made at the discretion of Nicolet’s board of directors and will depend on a number of factors, including the company’s future earnings, capital requirements, financial condition, future prospects, regulatory restrictions and other factors that the board of directors may deem relevant.

Our principal business operations are conducted through Nicolet Nationalthe Bank. Cash available to pay dividends to our shareholders is derived primarily, if not entirely, from dividends paid by Nicolet Nationalthe Bank. The ability of Nicolet Nationalthe Bank to pay dividends to us, as well as our ability to pay dividends to our shareholders, is subject to and limited by certain legal and regulatory restrictions.restrictions, as well as contractual restrictions related to our junior subordinated debentures. Further, any lenders making loans to us may impose financial covenants that may be more restrictive than regulatory requirements with respect to the payment of dividends by us. There can be no assurance of whether or when we may pay dividends in the future.

Nicolet may need to raise additional capital in the future including through proposed increased minimum capital thresholds established by our regulators as part of their implementation of Basel III, but that capital may not be available when it is needed or may be dilutive to our shareholders.

We are required by federal and state regulatory authorities to maintain adequate capital levels to support our operations. New regulations implementing the Basel III capital standards require financial institutions to maintain higher capital ratios and place a greater emphasis on common equity as a component of Tier 1 capital. In order to support our operations and comply with regulatory standards, we may need to raise capital in the future. Our ability to raise additional capital will depend on conditions in the capital markets at that time, which are outside our control, and on our financial performance. Accordingly, we cannot assure you of our ability to raise additional capital, if needed, on favorable terms. The capital and credit markets have experienced significant volatility in recent years. In some cases, the markets have produced downward pressure on stock prices and credit availability for certain issuers without regard to those issuers’ underlying financial strength. If current levels of volatility worsen, our ability to raise additional capital may be disrupted. If we cannot raise additional capital when needed, our results of operations and financial condition may be adversely affected, and our banking regulators may subject us to regulatory enforcement action, including receivership. In addition, the issuance of additional shares of our equity securities will dilute the economic ownership interest of our common and preferred shareholders.

Nicolet’s directors and executive officers own a significant portion of our common stock and can influence stockholdershareholder decisions.

Our directors and executive officers, as a group, beneficially owned approximately 24%14% of our fully diluted issued and outstanding common stock as of December 31, 2014.2016. As a result of their ownership, our directors and executive officers have the ability, if they voted their shares in concert, to influence the outcome of all matters submitted to our shareholders for approval, including the election of directors.

Holders of Nicolet’s subordinated debentures have rights that are senior to those of its common stockholders.

We have supported our continued growth by issuing trust preferred securities and accompanying junior subordinated debentures.debentures and by assuming the trust preferred securities and accompanying junior subordinated debentures issued by companies we have acquired. As of December 31, 2014,2016, we had outstanding trust preferred securities and associated junior subordinated debentures with an aggregate par principal amount of approximately $16.5$32.6 million.

We have unconditionally guaranteed the payment of principal and interest on our trust preferred securities. Also, the junior debentures issued to the special purpose trusts that relate to those trust preferred securities are senior to our common stock. As a result, we must make payments on the junior subordinated debentures before we can pay any

| 14 |

Because Nicolet is a regulated bank holding company, your ability to obtain “control” or to act in concert with others to obtain control over Nicolet without the prior consent of the Federal Reserve or other applicable bank regulatory authorities is limited and may subject you to regulatory oversight.

Nicolet is a bank holding company and, as such, is subject to significant regulation of its business and operations. In addition, under the provisions of the Bank Holding Company Act and the Change in Bank Control Act, certain regulatory provisions may become applicable to individuals or groups who are deemed by the regulatory authorities to “control” Nicolet or our subsidiary bank. The Federal Reserve and other bank regulatory authorities have very broad interpretive discretion in this regard and it is possible that the Federal Reserve or some other bank regulatory authority may, whether through a merger or through subsequent acquisition of Nicolet’s shares, deem one or more of Nicolet’s shareholders to control or to be acting in concert for purposes of gaining or exerting control over Nicolet. Such a determination may require a shareholder or group of shareholders, among other things, to make voluminous regulatory filings under the Change in Bank Control Act, including disclosure to the regulatory authorities of significant amounts of confidential personal or corporate financial information. In addition, certain groups or entities may also be required to either register as a bank holding company under the Bank Holding Company Act, becoming themselves subject to regulation by the Federal Reserve under that Act and the rules and regulations promulgated thereunder, which may include requirements to materially limit other operations or divest other business concerns, or to divest immediately their investments in Nicolet.

In addition, these limitations on the acquisition of our stock may generally serve to reduce the potential acquirers of our stock or to reduce the volume of our stock that any potential acquirer may be able to acquire. These restrictions may serve to generally limit the liquidity of our stock and, consequently, may adversely affect its value.

We are an emerging growth company and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and we have taken advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including, but not limited to, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. In addition, even if we comply with the greater obligations of public companies that are not emerging growth companies, we may avail ourselves of the reduced requirements applicable to emerging growth companies from time to time in the future, so long as we are an emerging growth company. We will remain an emerging growth company for up to five years following the first sale of our common stock pursuant to an effective registration statement filed under the Securities Act, though we may cease to be an emerging growth company earlier under certain circumstances, including if, before the end of such five years, we are deemed to be a large accelerated filer under the rules of the SEC (which depends on, among other things, having a market value of common stock held by non-affiliates in excess of $700 million) or if our total annual gross revenues equal or exceed $1 billion in a fiscal year. We cannot predict if investors will find our common stock less attractive because we will rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

Nicolet’s securities are not FDIC insured.

Our securities are not savings or deposit accounts or other obligations of Nicolet Nationalthe Bank, and are not insured by the Deposit Insurance Fund, or any other agency or private entity and are subject to investment risk, including the possible loss of some or all of the value of your investment.

| 15 |

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

| ITEM 2. | PROPERTIES |

The corporate headquarters of both Nicolet and Nicolet Nationalthe Bank is located at 111 North Washington Street, Green Bay, Wisconsin. IncludingAt year-end 2016, including the main office, Nicolet Nationalthe Bank operates 23 owned or leasedoperated 36 bank branch locations, noted below, most28 of which are owned and eight that are leased. In addition, we have one leased location solely related to Nicolet Advisory. Most of the offices are free-standing, newer buildings that provide adequate access, customer parking, and drive-through and/or ATM services. The properties are in good condition and considered adequate for present and near term requirements. In addition, Nicolet owns or leases other real property that, when considered in aggregate, is not significant to its financial position. No property listed below asNone of the owned isproperties are subject to a mortgage or similar encumbrance.

Four of the leased locations involve related parties.directors, executive officers, or direct relatives of a director or executive officer, each with lease terms that management considers arms-length. For additional disclosure, see Note 15,17, “Related Party Transactions,” of the Notes to Consolidated Financial Statements under Part II, Item 8.

During the fourth quarter of 2016, six bank branch locations were closed and are not included in the numbers above. An additional two branch locations are expected to be closed in March 2017.

| ITEM 3. | LEGAL PROCEEDINGS |

We and our subsidiaries may be involved from time to time in various routine legal proceedings incidental to our respective businesses. Neither we nor any of our subsidiaries are currently engaged in any legal proceedings that are expected to have a material adverse effect on our results of operations or financial position.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

| 16 |

| ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Nicolet registered its common stock under Section 12(b) of the Exchange Act on February 24, 2016, in connection with listing on the Nasdaq Capital Market, and trades under the symbol “NCBS”. Prior to February 24, 2016, Nicolet’s common stock iswas traded on the Over-The-Counter Markets (“OTCQB”OTCBB”), also under the symbol “NCBS”. The common stock was authorized to commence trading on the OTCQB on April 26, 2013, with the first trade completed on May 12, 2013. Prior to such trading, there was no established market forvolume of Nicolet’s common stock. Although the common stock is currently traded on the OTCQB, the trading volume is less than that of banks with larger market capitalizations.capitalizations, even though Nicolet has improved accessibility to its common stock first through the OTCBB and more recently through its listing on Nasdaq. As of February 28, 2015,2017, Nicolet had approximately 6602,400 shareholders of record.

The following table sets forth the high and low sales prices (beginning February 24, 2016) or the high and low bid prices (prior to February 24, 2016) and quarter end closing prices of Nicolet’s common stock as reported by Nasdaq and the OTCQBOTCBB for the periods indicated on or after April 26, 2013. High and low prices noted for the periods prior to April 26, 2013 represent sales prices for the common stock, to the extent known by management.

For The Quarter Ended | ||||||||||||

| High Bid Prices | Low Bid Prices | Closing Sales Prices | ||||||||||

| December 31, 2014 | $ | 25.00 | $ | 23.10 | $ | 25.00 | ||||||

| September 30, 2014 | 24.74 | 22.35 | 23.20 | |||||||||

| June 30, 2014 | 27.25 | 19.05 | 24.55 | |||||||||

| March 31, 2014 | 19.44 | 16.51 | 19.44 | |||||||||

| December 31, 2013 | $ | 17.00 | $ | 15.71 | $ | 16.54 | ||||||

| September 30, 2013 | 17.00 | 15.77 | 16.51 | |||||||||

| June 30, 2013 | 17.50 | 15.80 | 16.50 | |||||||||

| March 31, 2013 | 16.50 | 16.50 | 16.50 | |||||||||

For The Quarter Ended

| High Sales/Bid Prices | Low Sales/ Bid Prices | Closing Sales Prices | ||||||||||

| December 31, 2016 | $ | 48.00 | $ | 37.21 | $ | 47.69 | ||||||

| September 30, 2016 | 39.91 | 35.63 | 38.35 | |||||||||

| June 30, 2016 | 47.00 | 33.72 | 38.08 | |||||||||

| March 31, 2016 | 38.91 | 30.51 | 38.85 | |||||||||

| December 31, 2015 | $ | 32.49 | $ | 30.60 | $ | 31.79 | ||||||

| September 30, 2015 | 34.75 | 30.80 | 32.00 | |||||||||

| June 30, 2015 | 31.50 | 27.00 | 30.80 | |||||||||

| March 31, 2015 | 27.50 | 25.00 | 27.50 | |||||||||

Nicolet has not paid dividends on its common stock since its inception in 2000, nor does it currently have any plans to pay dividends on Nicolet common stock in the foreseeable future. Any cash dividends paid by Nicolet on its common stock must comply with applicable Federal Reserve policies and with certain contractual limitations on the payment of dividends related to the SBLF, both described further in “Business—Regulation of Nicolet—Dividend Restrictions.” Nicolet NationalThe Bank is also subject to regulatory restrictions on the amount of dividends it is permitted to pay to Nicolet as further described in “Business—Regulation of Nicolet Nationalthe Bank – Payment of Dividends” and in Note 17,19, “Regulatory Capital Requirements and Restrictions onof Dividends,” in the Notes to Consolidated Financial Statements under Part II, Item 8.

Following are Nicolet’s monthly common stock purchases during the fourth quarter of 2016.

| Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs | |||||||||||||

| (#) | ($) | (#) | (#) | |||||||||||||

| Period | ||||||||||||||||

| October 1 – October 31, 2016 | 52,485 | $ | 38.82 | 48,687 | 281,000 | |||||||||||

| November 1– November 30, 2016 | 3,070 | $ | 42.73 | — | 281,000 | |||||||||||

| December 1 – December 31, 2016 | — | — | — | 281,000 | ||||||||||||

| Total | 55,555 | $ | 39.03 | 48,687 | 281,000 | |||||||||||

(a) During the fourth quarter of 2016, the Company repurchased 4,198 and 2,340 shares for minimum tax withholding settlements on restricted stock and net settlements of stock options, respectively. These purchases do not count against the maximum number of shares that may yet be purchased under the board of directors approveddirectors’ authorization.

(b) During early 2014, a resolution authorizing acommon stock repurchase program whereby Nicolet may utilizewas approved which authorized, with subsequent modifications through January 2017, the use of up to $12$30 million to purchaserepurchase up to 625,0001,050,000 shares of its outstanding common stock. The common stock from time to time in the open market or block transactions as market conditions warrant or in private transactions. Through December 31, 2014, $5.6repurchase program has no expiration date. During 2016 and 2015, Nicolet spent $4.4 million was usedand $4.2 million to repurchase and cancel 257,291114,914 and 146,404 shares, respectively, at a weighted average price per share of $37.98 and $28.35, respectively, including commissions. Since the commencement of the common stock repurchase program through December 31, 2016, Nicolet has used $14.2 million to repurchase and cancel 518,609 shares at a weighted average price of $21.95 per share of $27.31 including commissions. Given the pending merger with First Menasha, Nicolet has suspended its repurchase program.

| 17 |

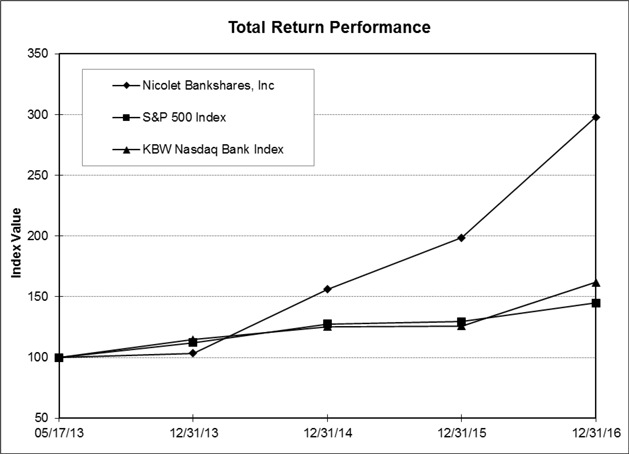

Performance Graph

The following graph shows the cumulative stockholder return on our common stock for the period of May 17, 2013 to December 31, 2016, compared with the KBW NASDAQ Bank Index and the S&P 500 Index. The graph assumes a $100 investment on May 17, 2013, the date Nicolet began trading on the OTCBB.

| Period Ending | |||||

| Index | 05/17/13 | 12/31/13 | 12/31/14 | 12/31/15 | 12/31/16 |

| Nicolet Bankshares, Inc. | 100.00 | 103.38 | 156.25 | 198.69 | 298.06 |

| S&P 500 Index | 100.00 | 112.30 | 127.67 | 129.43 | 144.91 |

| KBW Nasdaq Bank Index | 100.00 | 114.66 | 125.40 | 126.02 | 161.95 |

| ITEM 6. | SELECTED FINANCIAL DATA |

The selected consolidated financial data presented as of December 31, 20142016 and 20132015 and for each of the years in the two-yearthree-year period ended December 31, 20142016 is derived from the audited consolidated financial statements and related notes included in this report and should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The selected consolidated financial data as of December 31, 2012, 2011 and 2010for all other periods shown is derived from audited consolidated financial statements that are not required to be included in this report.

| 18 |

EARNINGS SUMMARY AND SELECTED FINANCIAL DATA

| (In thousands, except per share data) | At and for the year ended December 31, | |||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

| Results of operations: | ||||||||||||||||||||

| Interest income | $ | 75,467 | $ | 48,597 | $ | 48,949 | $ | 43,196 | $ | 28,795 | ||||||||||

| Interest expense | 7,334 | 7,213 | 7,067 | 6,292 | 6,530 | |||||||||||||||

| Net interest income | 68,133 | 41,384 | 41,882 | 36,904 | 22,265 | |||||||||||||||

| Provision for loan losses | 1,800 | 1,800 | 2,700 | 6,200 | 4,325 | |||||||||||||||

| Net interest income after provision for loan losses | 66,333 | 39,584 | 39,182 | 30,704 | 17,940 | |||||||||||||||

| Other income | 26,674 | 17,708 | 14,185 | 25,736 | 10,744 | |||||||||||||||

| Other expense | 64,942 | 39,648 | 38,709 | 36,431 | 24,062 | |||||||||||||||

| Income before income taxes | 28,065 | 17,644 | 14,658 | 20,009 | 4,622 | |||||||||||||||

| Income tax expense | 9,371 | 6,089 | 4,607 | 3,837 | 1,529 | |||||||||||||||

| Net income | 18,694 | 11,555 | 10,051 | 16,172 | 3,093 | |||||||||||||||

| Net income attributable to noncontrolling interest | 232 | 127 | 102 | 31 | 57 | |||||||||||||||

| Net income attributable to Nicolet Bankshares, Inc. | 18,462 | 11,428 | 9,949 | 16,141 | 3,036 | |||||||||||||||

| Preferred stock dividends and discount accretion | 633 | 212 | 244 | 976 | 1,220 | |||||||||||||||

| Net income available to common shareholders | $ | 17,829 | $ | 11,216 | $ | 9,705 | $ | 15,165 | $ | 1,816 | ||||||||||

| Earnings per common share: | ||||||||||||||||||||

| Basic | $ | 2.49 | $ | 2.80 | $ | 2.33 | $ | 3.81 | $ | 0.53 | ||||||||||

| Diluted | 2.37 | 2.57 | 2.25 | 3.80 | 0.53 | |||||||||||||||

| Weighted average common shares outstanding: | ||||||||||||||||||||

| Basic | 7,158 | 4,004 | 4,165 | 3,977 | 3,440 | |||||||||||||||

| Diluted | 7,514 | 4,362 | 4,311 | 3,988 | 3,442 | |||||||||||||||

| Year-End Balances: | ||||||||||||||||||||

| Loans | $ | 1,568,907 | $ | 877,061 | $ | 883,341 | $ | 847,358 | $ | 552,601 | ||||||||||

| Allowance for loan losses | 11,820 | 10,307 | 9,288 | 9,232 | 7,120 | |||||||||||||||

| Investment securities available for sale, at fair value | 365,287 | 172,596 | 168,475 | 127,515 | 55,901 | |||||||||||||||

| Total assets | 2,300,879 | 1,214,439 | 1,215,285 | 1,198,803 | 745,255 | |||||||||||||||

| Deposits | 1,969,986 | 1,056,417 | 1,059,903 | 1,034,834 | 616,093 | |||||||||||||||

| Other debt | 1,000 | 15,412 | 21,175 | 39,538 | 39,190 | |||||||||||||||

| Junior subordinated debentures | 24,732 | 12,527 | 12,328 | 12,128 | 6,186 | |||||||||||||||

| Subordinated notes | 11,885 | 11,849 | - | - | - | |||||||||||||||

| Common equity | 275,947 | 97,301 | 86,608 | 80,462 | 52,933 | |||||||||||||||

| Stockholders’ equity | 275,947 | 109,501 | 111,008 | 104,862 | 77,333 | |||||||||||||||

| Book value per common share | 32.26 | 23.42 | 21.34 | 18.97 | 15.45 | |||||||||||||||

| Average Balances: | ||||||||||||||||||||

| Loans | $ | 1,346,304 | $ | 883,904 | $ | 859,256 | $ | 753,284 | $ | 521,209 | ||||||||||

| Interest-earning assets | 1,723,600 | 1,083,967 | 1,084,408 | 913,104 | 614,252 | |||||||||||||||

| Total assets | 1,934,770 | 1,185,921 | 1,191,348 | 997,372 | 674,222 | |||||||||||||||

| Deposits | 1,641,894 | 1,021,155 | 1,028,336 | 830,884 | 545,896 | |||||||||||||||

| Interest-bearing liabilities | 1,307,471 | 851,957 | 892,872 | 756,606 | 511,572 | |||||||||||||||

| Common equity | 217,432 | 90,787 | 84,033 | 70,737 | 52,135 | |||||||||||||||

| Stockholders’ equity | 226,265 | 112,012 | 108,433 | 95,137 | 76,535 | |||||||||||||||

| Financial Ratios: | ||||||||||||||||||||

| Return on average assets | 0.95 | % | 0.96 | % | 0.84 | % | 1.62 | % | 0.45 | % | ||||||||||

| Return on average equity | 8.16 | % | 10.20 | % | 9.18 | % | 16.97 | % | 3.97 | % | ||||||||||

| Return on average common equity | 8.20 | % | 12.35 | % | 11.55 | % | 21.44 | % | 3.48 | % | ||||||||||

| Average equity to average assets | 11.69 | % | 9.45 | % | 9.10 | % | 9.54 | % | 11.35 | % | ||||||||||

| Net interest margin | 4.01 | % | 3.88 | % | 3.89 | % | 4.06 | % | 3.67 | % | ||||||||||

| Stockholders’ equity to assets | 11.99 | % | 9.02 | % | 9.13 | % | 8.75 | % | 10.38 | % | ||||||||||

| Net loan charge-offs to average loans | 0.02 | % | 0.09 | % | 0.31 | % | 0.54 | % | 0.60 | % | ||||||||||

| Nonperforming loans to total loans | 1.29 | % | 0.40 | % | 0.61 | % | 1.21 | % | 1.27 | % | ||||||||||

| Nonperforming assets to total assets | 0.97 | % | 0.32 | % | 0.61 | % | 1.02 | % | 0.97 | % | ||||||||||

| 19 |

| EARNINGS SUMMARY AND SELECTED FINANCIAL DATA | ||||||||||||||||||||

| (In thousands, except per share data) | At and for the year ended December 31, | |||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| Results of operations: | ||||||||||||||||||||

| Interest income | $ | 48,949 | $ | 43,196 | $ | 28,795 | $ | 29,830 | $ | 31,420 | ||||||||||

| Interest expense | 7,067 | 6,292 | 6,530 | 8,383 | 11,291 | |||||||||||||||

| Net interest income | 41,882 | 36,904 | 22,265 | 21,447 | 20,129 | |||||||||||||||

| Provision for loan losses | 2,700 | 6,200 | 4,325 | 6,600 | 8,500 | |||||||||||||||

| Net interest income after provision for loan losses | 39,182 | 30,704 | 17,940 | 14,847 | 11,629 | |||||||||||||||

| Other income | 14,185 | 25,736 | 10,744 | 8,444 | 8,968 | |||||||||||||||

| Other expense | 38,709 | 36,431 | 24,062 | 21,443 | 19,316 | |||||||||||||||

| Income before income taxes | 14,658 | 20,009 | 4,622 | 1,848 | 1,281 | |||||||||||||||

| Income tax expense | 4,607 | 3,837 | 1,529 | 318 | 136 | |||||||||||||||

| Net income | 10,051 | 16,172 | 3,093 | 1,530 | 1,145 | |||||||||||||||

| Net income attributable to noncontrolling interest | 102 | 31 | 57 | 40 | 35 | |||||||||||||||

| Net income attributable to Nicolet Bankshares, Inc. | 9,949 | 16,141 | 3,036 | 1,490 | 1,110 | |||||||||||||||

| Preferred stock dividends and discount accretion | 244 | 976 | 1,220 | 1,461 | 985 | |||||||||||||||

| Net income available to common equity | $ | 9,705 | $ | 15,165 | $ | 1,816 | $ | 29 | $ | 125 | ||||||||||

| Earnings per common share: | ||||||||||||||||||||

| Basic | $ | 2.33 | $ | 3.81 | $ | 0.53 | $ | 0.01 | $ | 0.04 | ||||||||||

| Diluted | 2.25 | 3.80 | 0.53 | 0.01 | 0.04 | |||||||||||||||

| Weighted average common shares outstanding: | ||||||||||||||||||||

| Basic | 4,165 | 3,977 | 3,440 | 3,469 | 3,452 | |||||||||||||||