UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________

FORM 10‑K10-K

_______________________________

☒xANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended DECemberDecember 31, 20172021

OR

☐oTRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________to____________

Commission File No.NUMBER 001-36491

__________________________

Century Communities, Inc.

(Exact Name of Registrant as Specified in Its Charter)

____________________________________________

|

|

|

|

|

|

Delaware |

| 68-0521411 |

(State or Other Jurisdiction of

Incorporation or Organization) |

| (I.R.S. Employer

Identification No.) |

8390 East Crescent Parkway, Suite 650

Greenwood Village, Colorado |

| 80111 |

(Address of Principal Executive Offices) |

| (Zip Code) |

(Registrant’s Telephone Number, Including Area Code):Code:(303) 770-8300

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each Classclass | Trading Symbol(s) | Name of each Exchangeexchange on which registered |

Common Stock, par value $0.01 per share | CCS | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

__________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐x No ☒o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐o No ☒x

Indicate by check mark whether the registrant:registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒x No ☐o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒x No ☐o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

|

Large accelerated filer | ☐x

|

| Accelerated filer | ☒o

|

Non-accelerated filer | ☐o

| (Do not check if smaller reporting company)

| Smaller reporting company | ☐o

|

|

|

| Emerging growth company | ☐o

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑12b-2 of the Exchange Act.) Yes ☐o No ☒x

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant on June 30, 20172021 was approximately $457.7 million$2.0 billion based on the closing price of $24.80$66.54 per share as reported on the New York Stock Exchange on June 30, 2017. 2021.

As of February 27, 2018,January 25, 2022, the registrant had 29,616,59733,764,801 shares of common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Part III of this Annual Report on Form 10-K incorporates by reference certain portions of the registrant’s definitive proxy statement for its 20182022 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission not later than 120 days after the end of the fiscal year covered by this report.

CENTURY COMMUNITIES, INC.

ANNUAL REPORT ON FORM 10-K

For the Fiscal Year Ended December 31, 20172021

Table of Contents

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS

Some of the statements included in or incorporated by reference into this Annual Report on Form 10-K (which we refer to as this “Form 10-K”) constitute forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, forecasts, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. These statements are only predictions. We caution that forward-looking statements are not guarantees. Actual events and results of operations could differ materially from those expressed or implied in the forward-looking statements. Forward-looking statements are typically identified by the use of terms such as “may,” “will,” “should,” “expect,” “could,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “predict,” “potential” or the negative of such terms and other comparable terminology.terminology, and the use of future dates. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Actual results and the timing of events may differ materially from those contained in these forward-looking statements due to a number of factors.

The forward-looking statements included in this Form 10-K reflect our current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause our actual results to differ significantly from those expressed in any forward-looking statement. Statements regarding the following subjects, among others, may be forward-looking:forward-looking and subject to risks and uncertainties, including, among others:

| ·

| | economic changes either nationally or in the markets in which we operate, including declines in employment, volatility of mortgage interest rates and inflation;

|

| ·

| | economic changes either nationally or in the markets in which we operate, including declines in employment, volatility of mortgage interest rates and inflation;

|

| ·

| | a downturn in the homebuilding industry, including a decline in real estate values or market conditions resulting in impairment of our assets;

|

| ·

| | changes in assumptions used to make industry forecasts;

|

| ·

| | continued volatility and uncertainty in the credit markets and broader financial markets;

|

| ·

| | our future operating results and financial condition;

|

| ·

| | our business operations;

|

| ·

| | changes in our business and investment strategy;

|

| ·

| | availability of land to acquire, and our ability to acquire such land on favorable terms or at all;

|

| ·

| | availability, terms and deployment of capital;

|

| ·

| | availability of mortgage financing or an increase in the number of foreclosures in the market;

|

| ·

| | shortages of or increased prices for labor, land or raw materials used in housing construction;

|

| ·

| | delays in land development or home construction resulting from adverse weather conditions or other events outside our control;

|

| ·

| | impact of construction defect, product liability, and/or home warranty claims, including the adequacy of accruals and the applicability and sufficiency of our insurance coverage;

|

| ·

| | changes in, or the failure or inability to comply with, governmental laws and regulations;

|

| ·

| | the timing of receipt of regulatory approvals and the opening of projects;

|

| ·

| | the degree and nature of our competition;

|

| ·

| | our leverage and debt service obligations;

|

| ·

| | availability of qualified personnel and our ability to retain our key personnel; and

|

| ·

| | changes in United States generally accepted accounting principles (which we refer to as “GAAP”).

|

The forward-lookingthe impact of the COVID-19 pandemic and measures taken in response to the COVID-19 pandemic on our business operations, operating results and financial condition, as well as the general economy and housing market in particular;

economic changes either nationally or in the markets in which we operate, including declines in employment, volatility of mortgage interest rates and inflation;

shortages of or increased prices for labor, land or raw materials, including lumber, used in housing construction and resource shortages;

a downturn in the homebuilding industry, including a reduction in demand or a decline in real estate values or market conditions resulting in an adverse impact on our business, operating results and financial conditions, including an impairment of our assets;

changes in assumptions used to make industry forecasts, population growth rates or trends affecting housing demand or prices;

continued volatility and uncertainty in the credit markets and broader financial markets;

our future operating results and financial condition;

our business operations;

changes in our business and investment strategy;

availability and price of land to acquire, and our ability to acquire such land on favorable terms or at all;

availability, terms and deployment of capital;

availability or cost of mortgage financing or an increase in the number of foreclosures in the market;

delays in land development or home construction resulting from adverse weather conditions or other events outside our control;

impact of construction defect, product liability, and/or home warranty claims, including the adequacy of accruals and the applicability and sufficiency of our insurance coverage;

changes in, or the failure or inability to comply with, governmental laws and regulations;

the timing of receipt of regulatory approvals and the opening of projects;

the impact and cost of compliance with evolving environmental, health and safety and other laws and regulations and third-party challenges to required permits and other approvals and potential legal liability in connection therewith;

the degree and nature of our competition;

our leverage, debt service obligations and exposure to changes in interest rates and our ability to refinance our debt when needed or on favorable terms;

our ability to continue to fund and succeed in our mortgage lending business and the additional risks involved in that business;

availability of qualified personnel and contractors and our ability to retain key personnel and contractor relationships;

our ability to pay dividends in the future;

taxation and tax policy changes, tax rate changes, new tax laws, new or revised tax law interpretations or guidance; and

changes in United States generally accepted accounting principles (which we refer to as “GAAP”).

Forward-looking statements are based on our beliefs, assumptions and expectations of future events, taking into account all information currently available to us. Forward-looking statements are not guarantees of future events or of our performance. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us. Some of these events and factors are described in “Item“Part I, Item 1A. Risk Factors” and “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in “Part I, Item 1A. Risk Factors” in this Form 10-K, and other risks and uncertainties detailed in this report and our

other reports and filings with the SEC. If a change occurs, our business, financial condition, liquidity, cash flows and results of operations may vary materially from those expressed in or implied by our forward-looking statements. New risks and uncertainties arise over time, and it is not possible for us to predict the occurrence of those matters or the manner in which they may affect us. Except as required by law, we are not obligated to, and do not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Therefore, you should not rely on these forward-looking statements as of any date subsequent to the date of this Form 10-K.

As used in this Form 10-K, references to “Company,” “we,” “us” or “our” refer to Century Communities, Inc., a Delaware corporation, and, unless the context otherwise requires, its subsidiaries and affiliates.

PART I

ITEM 1.BUSINESS.

GeneralOverview

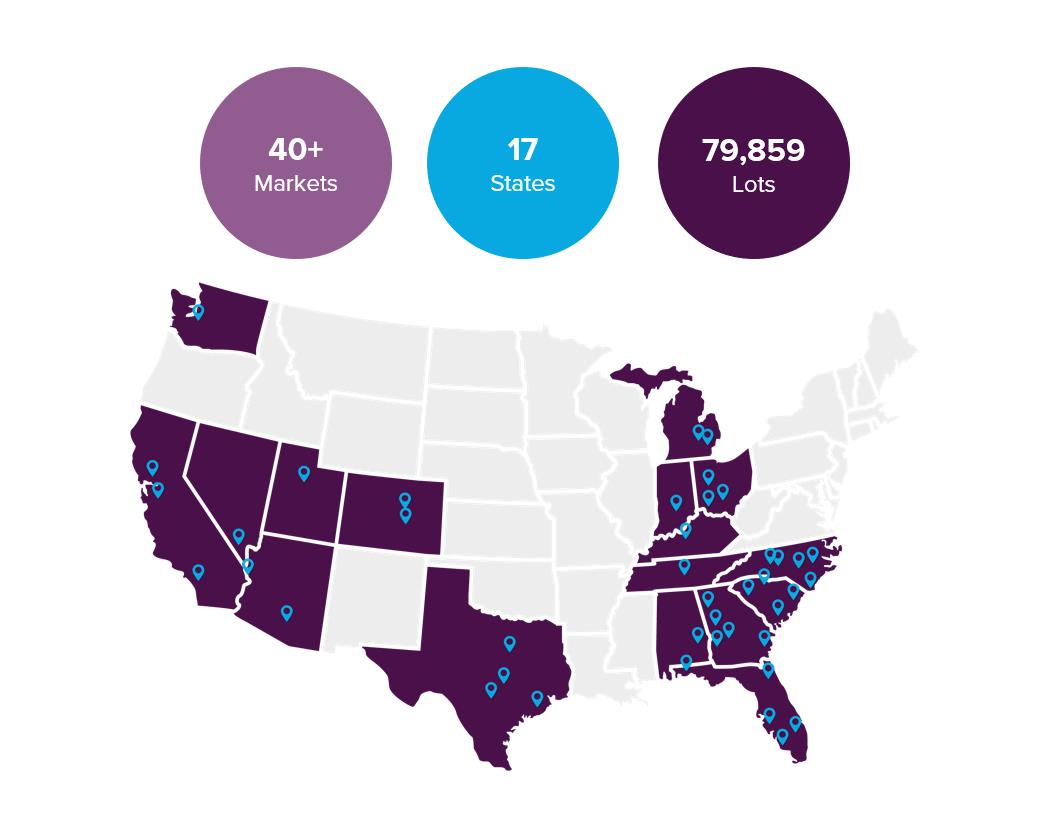

Century Communities, Inc., a Delaware corporation (which we refer to as “we,” “us,” “our,” “CCS,” or the “Company”), is engaged in the development, design, construction, marketing and sale of single-family attached and detached homes in metropolitan areas in the States of California, Colorado, Georgia, Nevada, North Carolina, South Carolina, Tennessee, Texas, Utah, and Washington.17 states. In many of our projects, in addition to building homes, we are responsible for the entitlement and development of the underlying land. We build and sell homes under our Century Communities and Century Complete brands.

Our Century Communities brand offers a wide range of buyer profiles including: entry-level, first and second time move-up, and lifestyle homebuyers, and provides our homebuyers with the ability to personalize their homes through certain option and upgrade opportunities. Our Century Complete brand targets entry-level homebuyers, primarily sells homes through retail studios and the internet, and generally provides no option or upgrade opportunities. We now have six states where both Century brands have a presence and we believe there are more opportunities for increased penetration within our over 40 high-growth markets to enable both brands to benefit from increased scale and enhanced operational efficiencies.

Our homebuilding operations are organized into the following fourfive reportable segments based on the geographic regions in which we operate:segments: West, Mountain, Texas, Southeast, and Southeast.Century Complete. Additionally, our indirect wholly-owned subsidiaries, Inspire Home Loans Inc., Parkway Title, LLC, and Parkway Title,IHL Home Insurance Agency, LLC, which provide mortgage, servicestitle, and titleinsurance services, respectively, primarily to our home buyers have been identified as our Financial Services segment.

Since the private placementWhile we offer homes that appeal to a broad range of 12.1 million sharesentry-level, move-up, and lifestyle homebuyers, our offerings are heavily weighted towards providing affordable housing options in each of our common stock, par value $0.01 per share,homebuyer segments. Additionally, we prefer building move-in-ready homes over built-to-order homes, which we believe allows for a faster construction process, advantageous pricing with subcontractors, and shortened time period from home sale to home delivery, thus allowing us to more appropriately price the homes and deploy our capital.Of the 10,805 homes delivered during 2021, approximately 75% of our deliveries were made to entry-level homebuyers and approximately 87% of homes delivered were built as move-in ready homes.

Since our initial public offering in May of 2013,2014, we have grown rapidlyexpanded geographically through the acquisitions of other homebuilders and organic entrance into new markets. We are one of the largest homebuilders in the United States and our common shares trade on the New York Stock Exchange under the symbol “CCS.” As of December 31, 2021, we operated in the 17 states and over 40 markets depicted below:

We operate our homebuilding operations within the following five reportable segments:

West (California and Washington)

Mountain (Arizona, Colorado, Nevada and Utah)

Texas

Southeast (Florida, Georgia, North Carolina, South Carolina and Tennessee)

Century Complete (Alabama, Arizona, Florida, Georgia, Indiana, Kentucky, Michigan, North Carolina, Ohio, South Carolina and Texas)

We have also identified our Financial Services operations, which provide mortgage, title, and insurance services to our and other homebuyers, as a sixth reportable segment. Our Corporate operations are a non-operating segment, as it serves to support our homebuilding, and to a lesser extent our Financial Services operations, through functions, such as our executive, finance, treasury, human resources, accounting and legal departments. See Note 2 – Reporting Segments in the Notes to the Consolidated Financial Statements for further detail on our reportable segments.

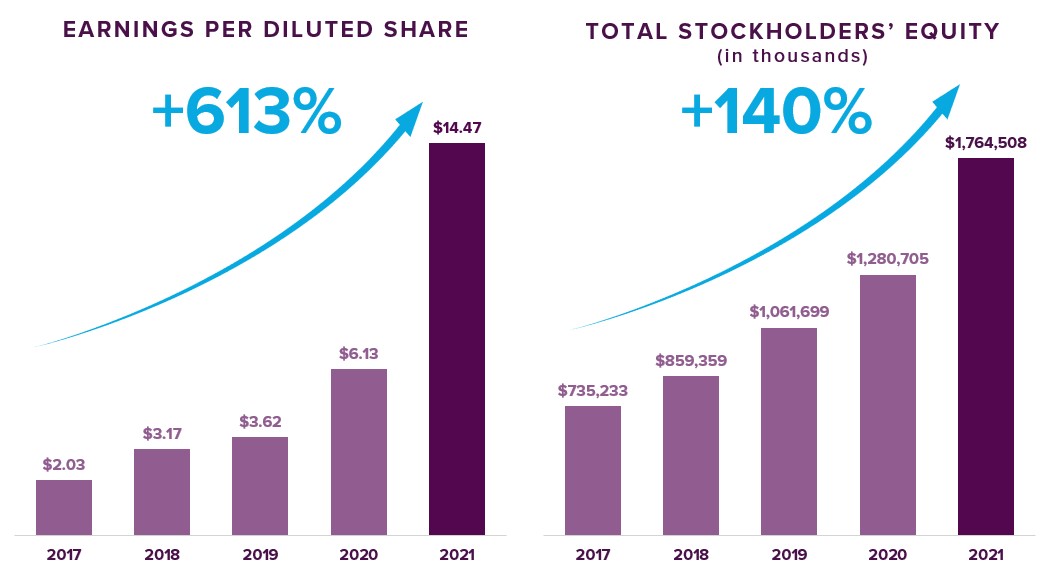

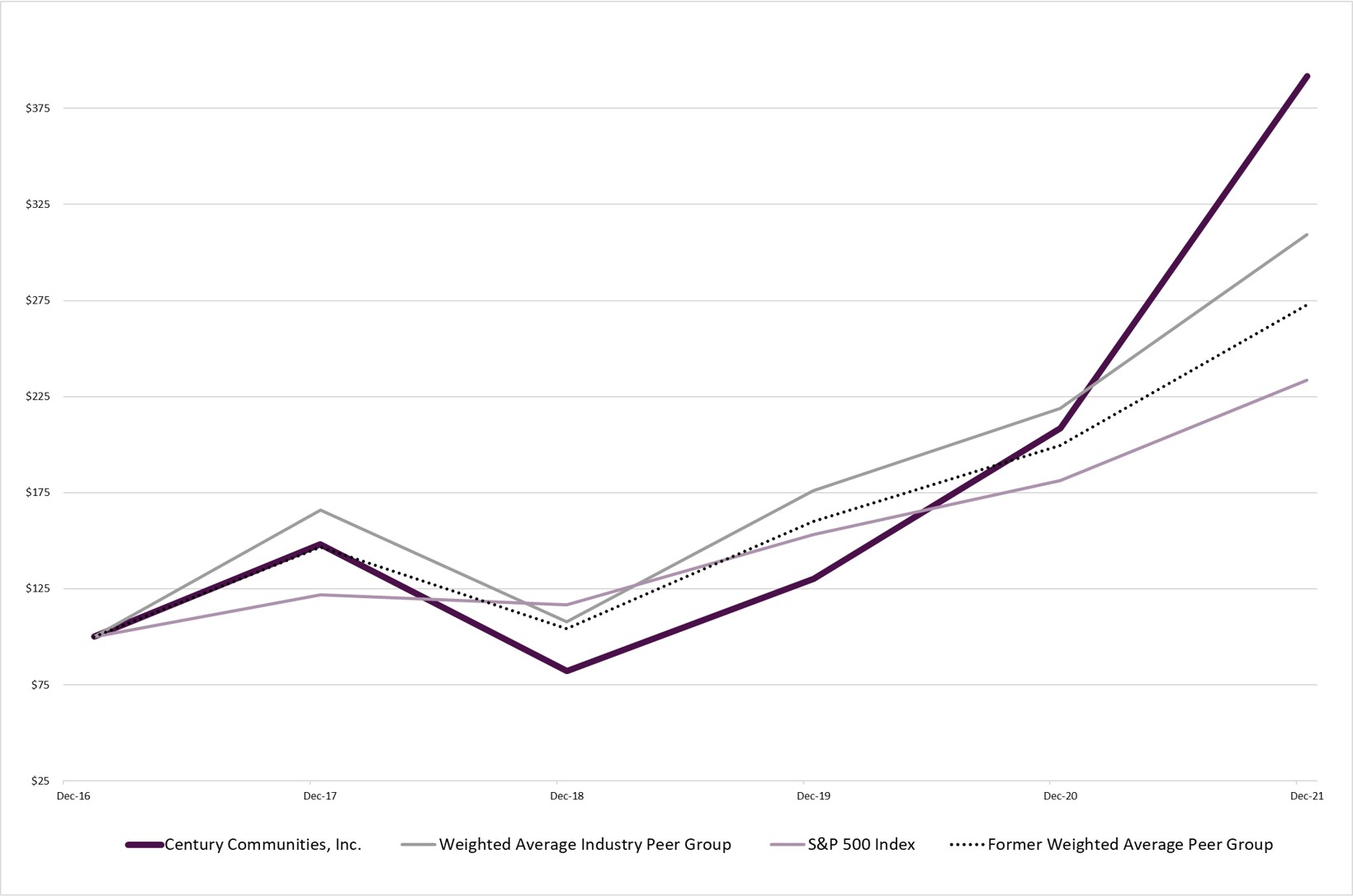

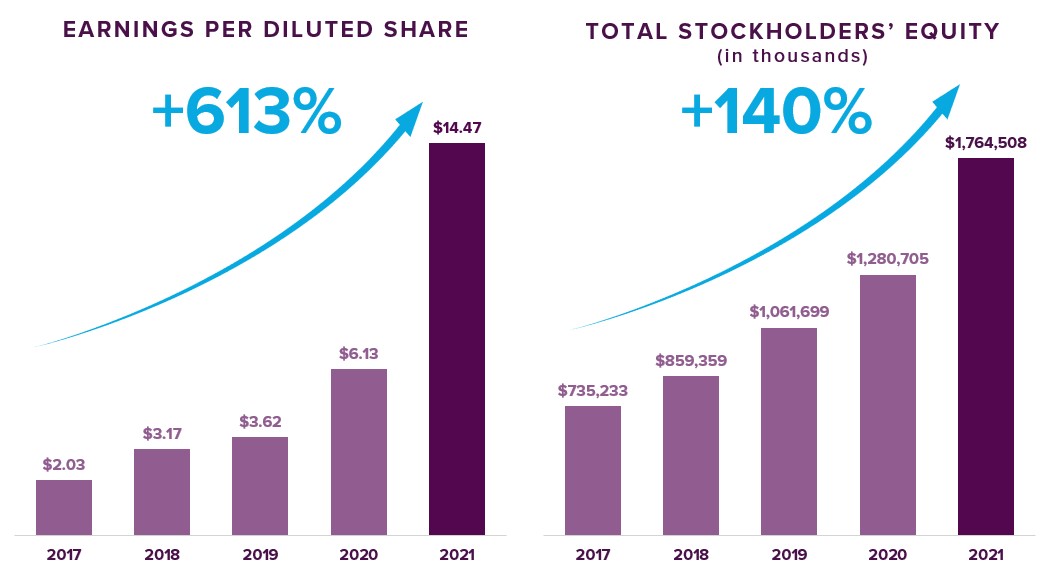

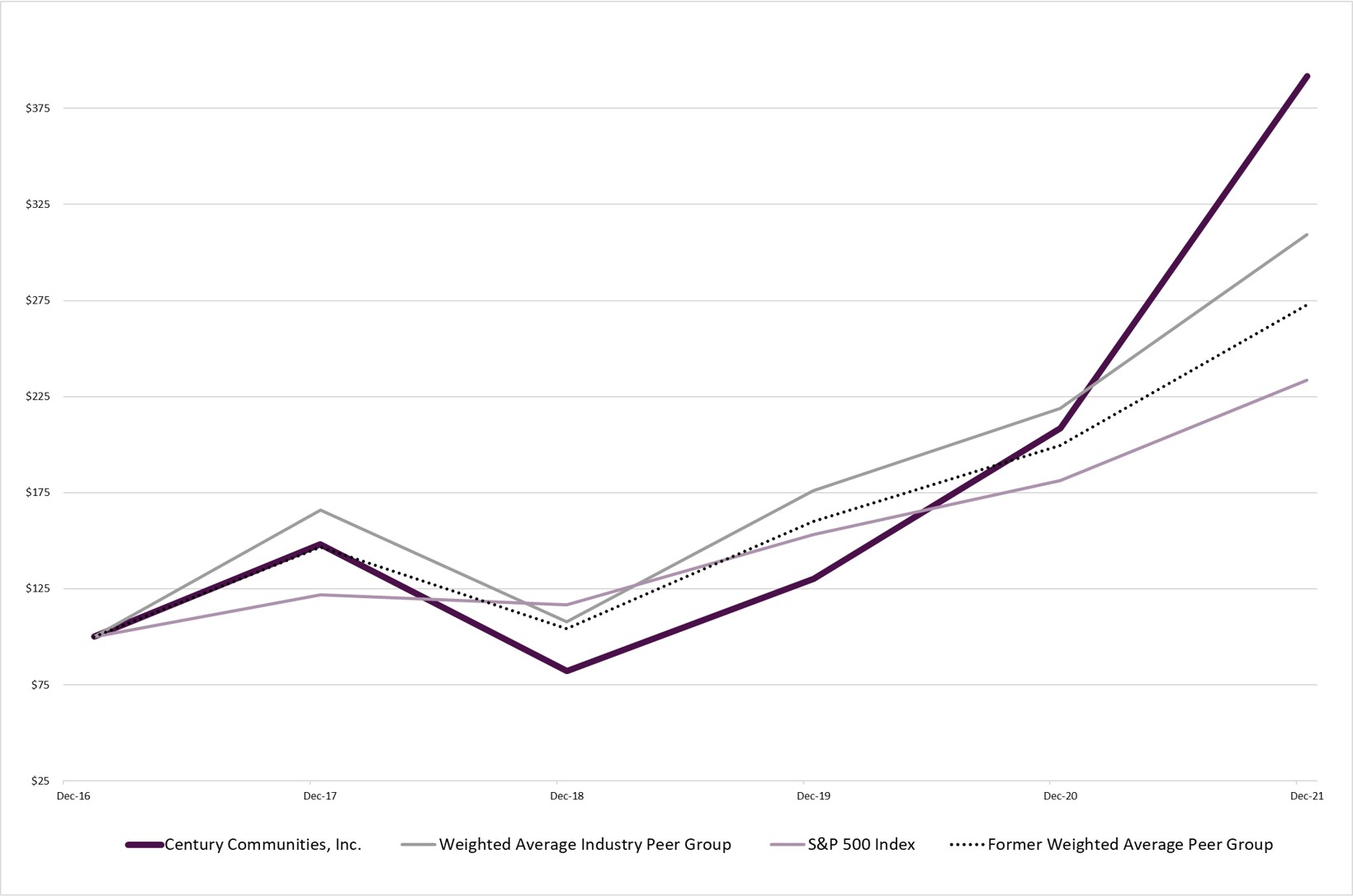

Positive macro-economic conditions, along with our operating efficiencies, business strategy and geographic expansion through the acquisition of other homebuilders and organic entrance into new markets has resulted in significant increases in total revenues, net income, earnings per diluted share, and stockholders’ equity over the last five years of 196%, 891%, 613%, and 140% respectively, as outlined below:

The outbreak of COVID-19, which was declared a pandemic by the World Health Organization on March 11, 2020, created significant volatility, disruption, and uncertainty across the nation and abroad. After an initial slowing of home sales trends in early spring of 2020, due in part to consumer uncertainty, home sales sharply rebounded, aided by historically low interest rates, lack of supply, and renewed desire from customers to move out of urban areas and/or apartments and into new homes in suburban areas, which desire was likely accelerated by the COVID-19 pandemic. These positive trends and market dynamics continued through the year ended December 31, 2021.

Although the trajectory and strength of our markets have continued to remain strong and consumer demand allowed us to pass on increased costs through increases in our selling prices and increase our margins during 2021, we continued to experience shortages of labor, land and raw materials, delays and material and labor supply cost pressures, and elongated construction cycle times to build homes in many of our markets, caused in part by increased demand, global supply chain disruptions and inflation, during 2021 that could negatively impact our margins in future periods. While the impact of the COVID-19 pandemic will continue to evolve and at any given time recovery could be slowed or reversed by a number of factors, including the emergence of new variants of COVID-19, such as Delta and Omicron, we believe we are well positioned from a cash and liquidity standpoint not only to operate in an uncertain environment,

| | | | |

•Raised $224 million through 144A equity offering.

•Acquired Jimmy Jacobs Homes in Austin and San Antonio Texas for $16 million

| •Acquired LVLH in Las Vegas for $165 million.

•Raised $200 million through offering of senior unsecured notes.

•Successfully completed IPO

•Acquired Grand View Builders in Houston for $13 million.

•Acquired Peachtree Communities in Atlanta for $57 million.

| •Raised $60 million through offering of senior unsecured notes.

•Expanded unsecured line of credit to $300 million with $100 million accordion feature.

| •Entered the Salt Lake City market.

•Acquired 50% of Wade Jurney Homes for $15 million.

•Formed financial services companies to provide title and mortgage services.

•Entered the Charlotte, NC market.

| •Expanded unsecured line of credit to $400 million.

•Raised $525 million through offering of senior unsecured notes.

•Entered West Coast and strengthened Southeast presence through the acquisition of UCP, Inc. for $362 million, including acquired debt

•Expanded Seattle through the acquisition of Sundquist Homes for $50 million.

|

but also to continue to grow with the market and pursue other ways to properly deploy capital to enhance returns, which may include taking advantage of debt refinancing and/or strategic opportunities as they arise.

Our Annual Reportsfinancial results for the year ended December 31, 2021 were driven by continued favorable market dynamics across our markets. These conditions included an increase in demand for new housing, particularly entry-level housing, impacted by the COVID-19 pandemic, which accelerated the trend of migration out of high-density urban areas and into suburban areas, historically low interest rates on Form 10-K, Quarterly Reportsmortgage products, including rates on Form 10-Q,30-year fixed mortgages, a low supply of available inventories and Current Reportspositive demographic trends. These conditions, coupled with our strategy to focus on Form 8-K are availableentry-level housing (approximately 75% of our deliveries in 2021 qualified for Federal Housing Administration-insured (“FHA”) mortgages) resulted in a positive sales environment, which we leveraged in 2021 to increase net new home contracts to 12,017, an 11.0% increase over the prior year period.

Homebuilding Operations

Strategy

Our strategy is focused on increasing the returns on our stockholders’ equity and inventory, and continuing to generate growth and strong profitability. In general, we are focused on the following initiatives:

Maintaining a strong balance sheet and prudent use of leverage;

While we offer homes that appeal to a broad range of entry-level, move-up, and lifestyle homebuyers, offerings are heavily weighted towards providing affordable housing options in each of our homebuyer segments;

Preferring building move-in-ready homes over built-to-order homes, which we believe allows for a faster construction process, advantageous pricing with subcontractors, and a shortened time period from home sale to home delivery, thus allowing us to more appropriately price the home;

Maintaining a strong pipeline of future land holdings, including favoring lot option contracts to manage our risk to land holdings;

Increasing our market share within our existing markets through organic growth and/or acquisitions of other homebuilders already operating in the market;

Expanding into new markets that meet our underwriting criteria either through organic start-up operations or through acquisitions of existing homebuilders;

Evaluation of opportunistic strategies for construction of single-family and multi-family rental units; and

Controlling costs, including costs of home sales revenue and selling, general and administrative expenses, and generating further efficiencies, including through the increased reliance on digital marketing and direct outreach to potential customers through our website at www.centurycommunities.com as soon as reasonably practicable afterand digital tools, such materials are electronically filed with, or furnished to, the U.S. Securities and Exchange Commission (which we refer to as the “SEC”).introduction of the ability to buy a home via our website, to achieve increased profitability.

DescriptionOur operating strategy has resulted in significant growth in revenue and income before income taxes over the last five years, and we believe it will continue to produce positive results. We expect our operating strategy will continue to adapt to market changes, and we cannot provide any assurance that our strategies will continue to be successful.

The core of Businessour business plan is to acquire land strategically, based on our understanding of population growth patterns, local markets, entitlement restrictions and infrastructure development. We focus on locations within our markets that are generally characterized by diverse economic and employment bases and demographics and increasing populations. We believe these conditions create strong demand for new housing, and these locations represent what we believe to be attractive opportunities for long-term growth. We also seek assets that have desirable characteristics, such as good access to major job centers, schools, shopping, recreation and transportation facilities. Location, product, price point and customer service are key components of the connection we seek to establish with each individual homebuyer. Our construction expertise across an extensive product offering allows us flexibility to pursue a wide array of land acquisition opportunities and appeal to a broad range of potential homebuyers, from entry-level to first- and second-time move-up buyers and lifestyle homebuyers. Additionally, we believe our diversified product strategy enables us to adapt quickly to changing market conditions and to optimize returns while strategically reducing portfolio risk.

Land acquisition process

We acquire land for our homebuilding operations with the primary intent to develop and construct single familysingle-family detached or attached homes for sale on the acquired land. From time to time we may sell land to other developers and homebuilders where we have excess land positions. We generally acquire land for cash, either through bulk acquisitions of land or through option contracts. Option contracts are generally structured where we have the right, but not the obligation, to buy land at predetermined prices on a defined schedule. Potential land acquisitions are identified by our local management within the markets in which we operate. We typically purchase lots for our Century Communities brand which range in status at acquisition from fully entitled for residential construction but requiring installation of streets, common areas, and wet and dry utilities to lots which are fully entitled and developed and immediately available for permitting and construction of the residence. For lots requiring development work, we negotiate, contract for, and oversee the work performed by subcontractors internally, and in some limited cases, we may hire a third-party general contractor for these services. For our Century Complete brand, we typically purchase lots which are immediately available for permitting and construction of the residence. Our land acquisition process typically includes soil tests, independent environmental studies, other engineering work and financial analysis which include an evaluation of expected returns, projected gross margins, estimated sales paces and pricing. All potentialPotential land acquisitions are approved by our Corporate office above established limits to ensure appropriate capital allocations taking into consideration current and projected inventory levels and risk adjusted returns.

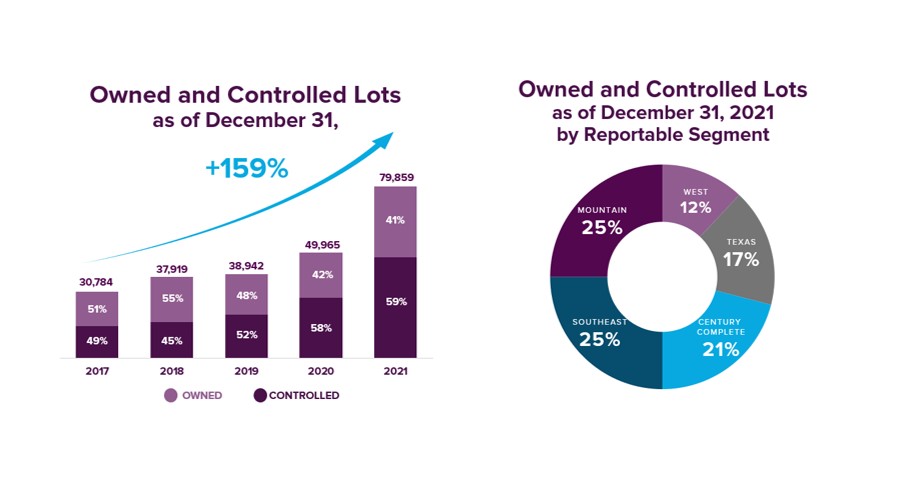

We strive to increase the number of lots we own and control across our markets in order to support future increases in the number of our home deliveries, while also maintaining a balance between the number of owned lots as compared to lots we control through option and other contracts. This balance allows us flexibility to adjust to local market conditions as they develop. This strategy has resulted in an owned and under control lot position of 79,859 as of December 31, 2021, of which 41% were owned and 59% were controlled through option contracts. Our owned and controlled lot position since 2017 and our owned and controlled lot position by segment as of December 31, 2021 are outlined below.

Design and construction

We engage architects, engineers and other professionals in connection with the home design process who are familiar with local market preferences, constraints, conditions and requirements, and we generally own the architectural design rights to our home plans. We serve as the general contractor, with all construction work typically performed by subcontractors. While we maintain long-standing relationships with many of our subcontractors and design professionals, we typically do not enter into long-term contractual

commitments with them and as a result may be subject to shortages of qualified and skilled labor. Our personnel, along with subcontracted marketing and design consultants, carefully design the exterior and interior of each home to coincide with the needs of targeted homebuyers.

When constructing homes, we use various construction materials and components including lumber, steel and concrete. It has typically taken us four to eight months or more in some instances to construct a home, though due to supply chain shortages during 2021, the average time to construct a home increased sequentially each quarter as compared to the previous quarter. While we attempt to contract for all input costs of the home at the start of construction, it is not always possible to do so. In those instances, labor and materials are subject to price fluctuations during the construction period. Such price fluctuations are caused by several factors, including recent global supply chain disruptions as well as seasonal variation in availability and demand for labor and materials. We may experience shortages in the availability of materials and/or labor in each of our markets and these shortages and delays may result in delays in the delivery of homes under construction, and/or reduced gross margins from home sales.

We are dependent upon building material suppliers for a continuous flow of certain materials. Whenever possible, we utilize standard products available from multiple national and international sources and utilize our buying power and relationships throughout the supply chain to ensure availability of products. We may also contract on a national level, directly with suppliers in many instances, to ensure availability and competitive prices of key materials.

We design and engineer our homes for energy efficiency to reduce the impact on the environment and lower energy costs to our homeowners. We have historically qualified approximately 70% of our homes for Energy Efficient Home Credits under Internal Revenue Code Section 45L.

Homebuilding marketing and sales process – Century Communities brand

We build and sellOur Century Communities brand has a focus on affordable housing options in each market but builds an extensive range of home types across a variety of price points. Our emphasis is on acquiring well-located land positions and offering quality homes. The core of our business plan is to acquire and develop land strategically, based on our understanding of population growth patterns, entitlement restrictions and infrastructure development. We focus on locations within our

markets with convenient access to metropolitan areas that are generally characterized by diverse economic and employment bases and demographics and increasing populations. We believe these conditions create strong demand for new housing, and these locations represent what we believe to be attractive opportunities for long-term growth. We also seek assets that have desirable characteristics, such as good access to major job centers, schools, shopping, recreation and transportation facilities, and we strive to offer a broad spectrum of product types in these locations. Location, product and customer service are key components of the connection we seek to establish with each individual homebuyer. Our construction expertise across an extensive product offering allows us flexibility to pursue a wide array of land acquisition opportunities and appeal to a broad range of potential homebuyers, from entry-level to first- and second-time move-up buyers and lifestyle homebuyers. Additionally, we believe our diversified product strategy enables us to adapt quickly to changing market conditions and to optimize returns while strategically reducing portfolio risk.

Our philosophy isCentury Communities brand strives to provide our customers with a positive experience to our homeowners by actively engaging them in the building process and by enhancing communication, knowledge and satisfaction. “Home for Every Dream.”

In many of our communities, we provide our customers with customization options to suit their lifestyle needs and have developed a number of home designs with features such as outdoor living spaces, one-story living and first floor master bedroom suites to appeal to universalbroad design needs. We also engineer our homes for energy efficiency, which is aimed at reducing the impact on the environment and lowering energy costs to our homebuyers. As part of these efforts, we offerneeds, while often offering homebuyers environmentally friendly alternatives, such as solar power to supplement a home’s energy needs.

We engage architects, engineers and other professionals in connection with the home design process who are familiar with local market preferences, constraints, conditions and requirements. We serve as the general contractor, with all construction work typically performed by subcontractors. While we maintain long-standing relationships with many of our subcontractors and design professionals, we typically do not enter into long-term contractual commitments with them.

We sell our homes through our own sales representatives and throughoften with the assistance of independent real estate brokers. Our in-house sales force typically works from sales offices located in model homes close to or in each community. In addition, in response to the COVID-19 pandemic and government restrictions, during 2020, we shifted our sales process to offer additional virtual online tours and appointments and where permitted, appointment only in-person meetings that complied with social distancing and other health and safety requirements and protocols. During 2021, we provided the ability for our customers to purchase homes directly on our website. Sales representatives assist potential buyers by providing them with basic floor plans, price information, development and construction timetables, tours of model homes where available and the selection of available options. Sales personnel are trained by us and generally have had prior experience selling new or resale homes in the local market. Our personnel, along with subcontracted marketing and design consultants, carefully design the exterior and interior of each home to coincide with the lifestyles of targeted homebuyers.

We advertise directly to potential homebuyers through the internet and in newspapers and trade publications, as well as throughdigital marketing, marketing brochures and newsletters.to a lesser extent newspapers. We may also use billboards, radio and television advertising, andalong with our website, to market the location, price range and availability of our homes. We also attempt to operate in conspicuously located communitiesareas that permit us to take advantage of local traffic patterns. Model homes play a significant role in our marketing efforts by not only by creating an attractive atmosphere, but also by displaying options and upgrades.

Homebuilding marketing and sales process – Century Complete brand

Our Century Complete brand primarily sells affordable homes to entry-level buyers through our own sales representatives located in retail locations which we refer to as studios, as opposed to model homes; however, model and vignetted homes are used in certain instances. We lease our studios within strip malls or other high traffic retail centers, located centrally to our homes under construction. Our studios are generally leased for a period of three years and average approximately 1,550 square feet. We also sell homes directly through our Century Complete website and utilize the services of independent real estate brokers in many cases. Our Century Complete brand aims to provide our customers with “More Home, Less Money.”

Our Century Complete brand often competes with resales as well as other new home builders within the submarkets in which we operate. We are often able to offer a new home offering to our customers at prices that are lower than other new home offerings. Our philosophy is to be the price leader through providing a limited number of floor plans, with no options or upgrades offered. Our advertising and marketing efforts are focused on cost effective means of reaching potential customers including centralized digital marketing, and direct

outreach to independent real estate brokers. Our goal is to leverage our studios and advertising and marketing efforts to generate homebuyer leads, which are then actively pursued by our sales associates.

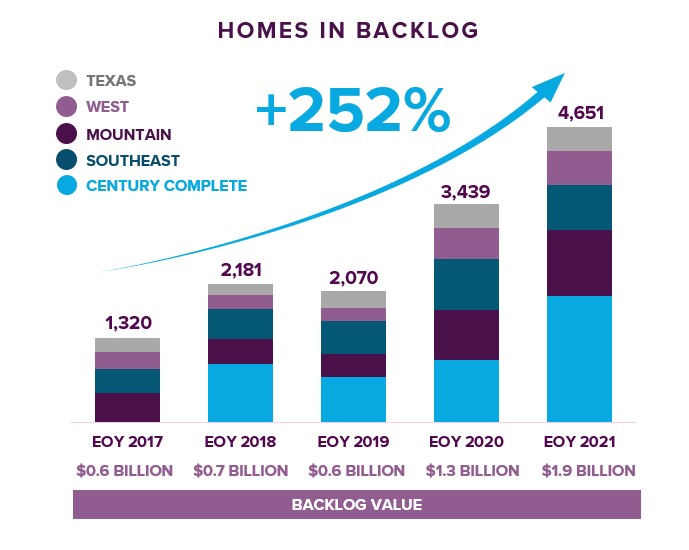

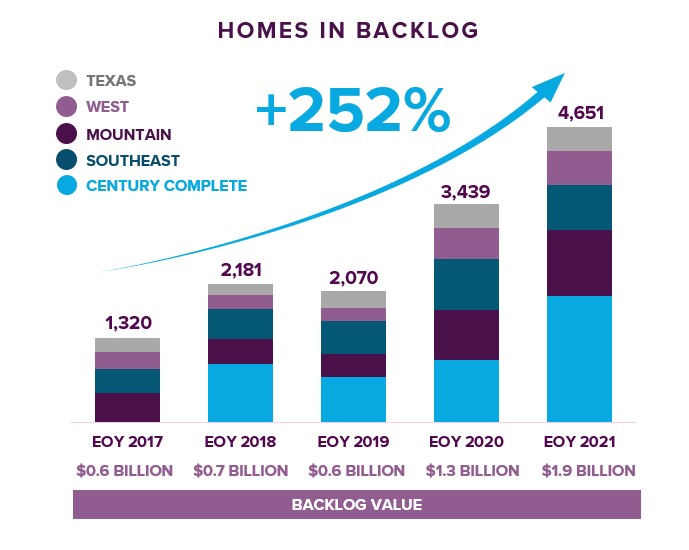

Our marketing and sales process for both of our brands combined with our overall growth has resulted in a 252% increase in units in backlog as of December 31, 2021 over the last five years as outlined below:

Customer relations, quality controlexperience

Our goal is to provide a positive experience to our homeowners by engaging them in the homebuying and warranty programs

homeowning processes. We pay particular attention to the product design process and carefully consider quality and choice of materials in order to attempt to eliminate building deficiencies. The quality and workmanship of the subcontractors we employ are monitored and we make regular inspections and evaluations of our subcontractors.

We maintain quality control and customer service staff whose role includes providing a positive experience for each customer throughout the pre-sale, sale, building, closinghomebuying process and post-closing periods. These employees arebeyond. This group is also responsible for providing after sales customer service. Our quality andcustomer service initiatives include taking customers on a comprehensive tour of their home prior to closing and using customer survey results to improve our standards of quality and customer satisfaction.

Generally, we provide each homeowner with product warranties covering workmanship and materials for one year from the time of closing, and warranties covering structural systems for eight to 10 years from the time of closing through the statute of repose with the states we operate in, connection with our general liability insurance policy.or ten years, whichever is shorter. The subcontractors who perform most of the actual construction also provide to us customary warranties on workmanship.

Customer FinancingSeasonality

DuringHistorically, the fourth quarterhomebuilding industry experiences seasonal fluctuations in quarterly operating results and capital requirements. We typically experience the highest new home order activity during the spring, although this activity is also highly dependent on the number of 2016,active selling communities, timing of new community openings and other market factors. Since it has historically taken four to eight months to construct a new home, we deliver more homes in the second half of the year as spring and summer home orders convert to home deliveries. Because of this seasonality, home starts, construction costs and related cash outflows have historically been highest in the second and third quarters, and the majority of cash receipts from home deliveries occurs during the second half of the year. We expect this seasonal pattern to continue over the long term, although it may be affected by volatility in the homebuilding industry and the COVID-19 pandemic and supply chain challenges which have extended our construction cycle times in many cases.

Financial Services Operations

We offer home financing for our customers and other homebuyers through our wholly owned subsidiary, Parkway Financial Group, LLC, formed Inspire Home Loans Inc. (which we refer to as “Inspire”). Inspire offers mortgageis authorized to originate Federal National Mortgage Association (“Fannie Mae”), Federal Home Loan Mortgage Corporation (“Freddie Mac”), FHA, and Department of Veterans Affairs-guaranteed (“VA”) mortgages (which

we refer to collectively as the “government sponsored entities”). We also offer title and home owners insurance services tothrough our homebuyers. In addition to Inspire,wholly owned subsidiaries, Parkway Title, LLC (which we refer to as “Parkway Title”“Parkway”) provides title servicesand IHL Home Insurance Agency, LLC (which we refer to select markets in which we operate.as “IHL”), respectively. These operations along with Inspire and Parkway Titlecollectively comprise our

Financial Services operating segment. We seekbelieve that our customers’ use of Inspire, Parkway, and IHL provides us with a competitive advantage by enabling more control over the quality of the overall home buying process for our customers, while also helping us align the timing of the house construction process with our customers’ financing, title and insurance needs.

The results of operations of our Financial Services operating segment are primarily driven by the results of Inspire. Because Inspire originates mortgage loans primarily for our homebuilding customers, Inspire is dependent on our homebuilding operations and its results of operations are highly correlated with our homebuilding operations, and to assista lesser degree the overall market demand for mortgages.

Our Financial Services segment generated income before income tax of $51.2 million for the year ended December 31, 2021, a 5.5% increase over the prior year. This increase was primarily the result of a $20.4 million increase in financial services revenue during the year ended December 31, 2021 compared to the prior year period. This increase was due to (1) a 21.1% increase to 8,375 in the number of mortgages originated during the year ended December 31, 2021, due to our homebuyersincreased capture rate of 76% as compared to 64% for the prior year period and the increase in obtaining financingthe number of homes delivered by arrangingour Century Communities and Century Complete brands year over year, and (2) a 25.2% increase in the number of loans sold to third parties during the year ended December 31, 2021 as compared to the prior year period. These increases were partially offset by (1) lower fair value of our mortgage loans held for sale and our mortgage loans in process for which interest rates were locked by borrowers, (2) reduced gain on sale margin from loans sold and (3) increased headcount to support continued growth, in each case as compared to the prior year period.

Inspire sells substantially all of the loans it originates, either as whole loans, or with servicing retained, in the secondary mortgage market within a short period of time after origination, generally within 30 days. This strategy results in owning the loans for only a short period of time. After the loans are sold, Inspire may be responsible for potential losses associated with mortgage lenders to offer qualified buyers a variety of financing options.

Materials

When constructing homes, we use various materialsloans originated and components. It has typically taken us five to eight months or more to construct a home, during which time materials are subject to price fluctuations. Such price fluctuations are caused by several factors, among them seasonal variation in availability and increased demand for materials as a result of the improved housing market.

Seasonality

We experience seasonal variations in our quarterly operating results and capital requirements. Historically, new order activity is highest during the spring and summer months. As a result, we typically have more homes under construction, close more homes, and have greater revenues and operating incomesold in the second halfevent of our fiscal year. Historical results are not necessarily indicativeerrors or omissions relating to customary industry-standard representations and warranties made by Inspire that the loans met certain requirements. Representations include underwriting standards, the existence of current or future homebuilding activities.primary mortgage insurance, and the validity of certain borrower representations in connection with the loans.

Governmental regulationRegulation and environmental mattersEnvironmental Matters

We are subject to numerous local, state, federal and other statutes, ordinances, rules and regulations concerning zoning, development, building design, construction and similar matters which impose restrictive zoning and density requirements in order to limit the number of homes that can eventually be built within the boundaries of a particular area. In the normal course of business, we incur the costs associated with these laws and regulations, which are included in our homebuilding cost of revenues. Projects that are not entitled may be subjected to periodic delays, changes in use, less intensive development or elimination of development in certain specific areas due to government regulations. We may also be subject to periodic delays or may be precluded entirely from developing in certain communities due to building moratoriums or “slow-growth” or “no-growth” initiatives that could be implemented in the future. Local and state governments also have broad discretion regarding the imposition of development fees for projects in their jurisdiction. Projects for which we have received land use and development entitlements or approvals may still require a variety of other governmental approvals and permits during the development process and can also be impacted adversely by unforeseen municipal, regulatory, health, safety and welfare issues, which can further delay these projects or prevent their development.

We are also subject to a variety of local, state, federal and other statutes, ordinances, rules and regulations concerning the environment. The particular environmental laws which apply to any given homebuilding site vary according to the site’s location, its environmental conditions, and the present and former uses of the site, as well as adjoining properties. Environmental laws and conditions may result in delays, may cause us to incur substantial compliance and other costs, which are difficult or impossible to estimate, and can prohibit or severely restrict homebuilding activity in environmentally sensitive regions or areas. From time to time, the Environmental Protection Agency and similar federal or state agencies review homebuilders’ compliance with environmental laws and may levy fines and penalties for failure to strictly comply with applicable environmental laws or impose additional requirements for future compliance as a result of past failures. Any such actions taken with respect to us may increase our costs. Further, we expect that increasingly stringent requirements will be imposed on homebuilders in the future. Environmental regulations can also have an adverse impact on the availability and price of certain raw materials such as lumber. Any delays and costs associated with our compliance with environmental laws and conditions have not materially impacted our results of operations.

Under various environmental laws, current or former owners of real estate, as well as certain other categories of parties, may be required to investigate and clean up hazardous or toxic substances or petroleum product releases, and may be held liable to a governmental entity or to third parties for property damage and for investigation and cleanup costs incurred by such parties in connection with the

contamination. In addition, in those cases where an endangered species is involved, environmental rules and regulations can result in the elimination of development in identified environmentally sensitive areas. To date, we have never had a significant environmental issue.

SegmentOur mortgage, title, and geographic area disclosures

We have broken our homebuilding operations intoinsurance subsidiaries must comply with applicable real estate, lending and insurance laws and regulations. The subsidiaries are licensed in the following reportable segments based on the geographic marketsstates in which they do business and must comply with laws and regulations in those states. These laws and regulations include provisions regarding capitalization, operating procedures, investments, lending and privacy disclosures, forms of policies and premiums. The Dodd-Frank Wall Street Reform and Consumer Protection Act contains a number of requirements relating to mortgage lending and securitizations. These include, among others, minimum standards for lender practices, limitations on certain fees and a requirement that the originator of loans that are securitized retain a portion of the risk, either directly or by holding interests in the securitizations. The impact of those statutes, rules, and regulations can be to increase our home buyers’ cost of financing, increase our cost of doing business, and restrict our home buyers’ access to some types of loans.

Several federal, state and local laws, rules, regulations and ordinances, including, but not limited to, the Federal Fair Debt Collection Practices Act (“FDCPA”) and the Federal Trade Commission Act and comparable state statutes, regulate consumer debt collection activity. Although, for a variety of reasons, we operate:

| ·

| | West (Southern California, Central Valley, Bay Area and Washington)

|

| ·

| | Mountain (Colorado, Nevada and Utah)

|

| ·

| | Texas (Houston, San Antonio and Austin)

|

| ·

| | Southeast (Georgia, North Carolina, South Carolina and Tennessee)

|

We have also identifiedmay not be specifically subject to the FDCPA or to some state statutes that govern debt collectors, it is our Financial Services operations, which provide mortgage and title servicespolicy to comply with applicable laws in our collection activities. To the extent that some or all of these laws apply to our homebuyers, ascollection activities, our failure to comply with such laws could have a fifth reportable segment. Our Corporate operationsmaterial adverse effect on us. We are a nonoperating segment, as it servesalso subject to support our homebuilding operations throughregulations promulgated by the Federal Consumer Financial Protection Bureau regarding residential mortgage loans.

functions, such as our executive, finance, treasury, human resources, and accounting departments. We have adjusted prior period segment information to conform to the current period presentation.

Footnote 2 (Reporting Segments) of our Consolidated Financial Statements contains information regarding the operations of our reportable segments.

The below table presents the approximate number of employees for each reportable segment as of December 31, 2017 and 2016.

| | | | | | |

| | Year Ended December 31, |

| | 2017 | | 2016 |

West | | | 160 | | | - |

Mountain | | | 262 | | | 265 |

Texas | | | 106 | | | 95 |

Southeast | | | 308 | | | 165 |

Financial Services | | | 70 | | | - |

Corporate | | | 105 | | | 40 |

Total | | | 1,011 | | | 565 |

Competition

We face competition in the homebuilding industry, which is characterized by relatively low barriers to entry. Homebuilders compete for, among other things, home buying customers, desirable land parcels, employees, financing, raw materials and skilled labor. Increased competition may prevent us from acquiring attractive land parcels on which to build homes or make such acquisitions more expensive, hinder our market share expansion or lead to pricing pressures on our homes that may adversely impact our margins and revenues. Our competitors may independently develop land and construct housing units that are superior or substantially similar to our products, or may be significantly larger, have a longer operating history and have greater resources or lower cost of capital than us; accordingly, they may be able to compete more effectively in one or more of the markets in which we operate or plan to operate. We also compete with other homebuilders that have long-standing relationships with subcontractors and suppliers in the markets in which we operate or plan to operate and we compete for sales with individual resales of existing homes and with available rental housing.

Our Financial Services operations compete with other mortgage lenders, including national, regional and local mortgage bankers and brokers, banks, savings and loan associations and other financial institutions, in the origination and sale of residential mortgage loans. Principal competitive factors include interest rates and other features of mortgage loan products available to the consumer. We compete with other title insurance agencies and underwriters for closing services and title insurance. We also compete with other insurance agencies. Principal competitive factors include service and price.

Human Capital Resources

We believe our employees have and will continue to be a primary reason for our growth and success. We place a focus on attracting and retaining talented and experienced individuals to manage and support our operations. Recognizing the importance of our human capital, our Board of Directors, through the Compensation Committee, retains direct oversight of our human capital and oversees and reviews our culture and policies and strategies related to human capital management, including with respect to diversity and inclusion initiatives, pay equity, talent, recruitment and development, performance management and employee engagement.

Employees

The total number of full-time employees as of December 31, 2021 was 1,600, which includes 246 employees related to our Financial Services segment and 1,354 employees related to our corporate and homebuilding operations. Within our homebuilding operations, the majority of our employees are related to our construction and sales functions, which totaled 405 and 342 employees, respectively, as of December 31, 2021. We do not have collective bargaining agreements relating to any of our employees. However, we subcontract many phases of our homebuilding operations and some of the subcontractors we use may have employees who are represented by labor unions.

Employee compensation and benefits

We offer our employees pay and benefits packages, which we believe are competitive with others throughout our industry, as well as within the local markets in which we operate. Compensation packages for our employees generally include competitive base pay and the opportunity to receive periodic bonus payments which are tied to individual employee performance and often times the achievement of operational performance targets. These operational performance targets vary by year and may vary based on local market

conditions. Additionally, for certain employees critical to the management of our operations, we provide long-term incentive compensation, in the form of restricted stock units, which typically vest over a three year period. We believe this compensation structure provides our employees with competitive pay and aligns individual performance with Company success.

Employee training

In accordance with our Commitment to Training and Professional Development, Century trains its employees in a variety of areas, including company policies, anti-harassment, anti-discrimination, sales, information technology including cyber security risks, retirement and financial wellness planning, and safety. On an individual level, we are committed to providing employees with the feedback necessary to improve their performance, reviewing expectations of their position, and fostering growth in their current role.

Diversity, inclusion, and ethics

As set forth in our Commitment to Diversity and Inclusion, we are committed to hiring and supporting a diverse and inclusive workforce. We define diversity as the range of human differences, including but not limited to race, ethnicity, gender, gender identity, sexual orientation, age, social class, physical ability or attributes, religious or ethical values system, national origin, and political beliefs. We aim to create an inclusive organization where all employees are treated with dignity and respect and are empowered to reach their full potential. Among other programs, all new employees are required to take trainings related to anti-harassment and anti-discrimination. Further, all employees are trained on anti-harassment and anti-discrimination every two years or more often if required by state law. We are committed to equal opportunity from the time a position becomes open, and are committed to pay equity, a core element of our pay-for-performance strategy.

Additionally, all our employees are expected to display and encourage honest, ethical, and respectful conduct in the workplace. Our employees must adhere to our Code of Business Conduct and Ethics that sets standards for appropriate behavior and includes periodic training on preventing, identifying, reporting, and stopping discrimination of any kind.

Health and safety

We are committed to workplace health and safety, as outlined in our Labor Rights Policy. Safety is promoted through designated lead Safety Officers, who promote and maintain Occupational Safety and Health Administration compliance. Additionally, Century conducts monthly safety audits, as well as third-party safety inspections, to ensure our construction operations are safe. Century also provides safety training through webinars, classroom settings, field onsite forums, trade toolbox talks, and one-on-one mentoring with third-party safety auditors.

The health of our employees and others is also critical to our workplace. During 2020 and 2021, in response to the COVID-19 pandemic, we implemented safety protocols and procedures to protect our employees, customers, homeowners and trade partners. These procedures include complying with social distancing and other health and safety standards as required by federal, state, and local government agencies. Additionally, we modified the way in which we conduct many aspects of our business to reduce the amount of in-person contact and interactions. We significantly expanded the use of virtual interactions in all aspects of our business, including customer facing activities. Our teams across all facets of the Company were able and continue to adapt to these changes in our work environment and have successfully managed our business during the pandemic.

Available Information

We are a U.S. public reporting company under the Securities Exchange Act of 1934, as amended (which we refer to as the “Exchange Act”), and file reports, proxy statements, and other information with the U.S. Securities and Exchange Commission (which we refer to as the “SEC”). Copies of these reports, proxy statements, and other information can be accessed from the SEC's home page on the Internet at http://www.sec.gov. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K are available free of charge on our website at www.centurycommunities.com as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC. The information contained on our website or connected to our website is not incorporated by reference into this Form 10-K and should not be considered part of this report.

ITEM 1A.RISK FACTORS.

Our business routinely encounters and attempts to address risks, some of which will cause our future results to differ, sometimes materially, from those originally anticipated. Below, we have described our present view of the most significantmaterial risks facing the Company. The risk factors set forth below are not the only risks that we may face or that could adversely affect us. If any of the circumstances described in the risk factors discussed in this Form 10-K actually occur, our business, prospects, liquidity, financial condition and results of

operations could be materially and adversely affected. If this were to occur, the trading price of our securities could decline significantly and stockholders may lose all or part of their investment.

The following discussion of risk factors contains “forward-looking“forward-looking statements,” which may be important to understanding any statement in this Form 10-K or in our other filings and public disclosures. In particular, the following information should be read in conjunction with the sections in this Form 10-K entitled, “Cautionary“Cautionary Note about Forward-Looking Statements,” “Item“Item 7. Management’sManagement’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Item“Item 8. Financial Statements and Supplementary Data.”

Risk Factors Summary

This summary is not complete and should be read in conjunction with the risk factors that follow.

Risks Related to the Housing Market and General Economic Conditions

We are subject to demand fluctuations in the housing industry.

Adverse changes in general economic conditions, including inflation, unemployment rates, interest rates, and availability of financing, and changing home buying patterns and trends could reduce demand for our homes.

Our long-term growth depends upon our ability to successfully identify and acquire desirable land parcels at reasonable prices and to successfully manage our land and lot inventory.

Our geographic concentration and changes to the population growth rates in our markets could adversely affect our business.

Risks Related to the Homebuilding and Real Estate Industries

Our operating results are dependent on our ability to develop our communities successfully and within expected timeframes and to maintain good relations with the residents of our communities.

We face risks regarding utility, resource, raw material, building supply and labor shortages and prices, which have been exacerbated by recent inflation and supply chain disruptions.

We are subject to potential liability for health and safety incidents and product liability and warranty claims, which may exceed our insured limits.

The homebuilding industry is cyclical, seasonal and competitive.

Real estate investments are risky and dependent upon our ability to successfully manage our land acquisitions and development and construction processes.

Risk Related to Our Financial Services Business

Our mortgage lending business requires substantial capital, which may not continue to be available to us in the amounts we require and at acceptable pricing.

Our Financial Services segment can be adversely affected by reduced demand for our homes, a slowdown in mortgage refinancings, our inability to sell mortgages into the secondary market or potential liability in connection with such sales.

The financial services market is competitive.

Governmental regulation may adversely affect our Financial Services operations.

A cyber attack or other security breach of our Financial Services business could subject us to significant liability and harm our reputation.

Risks Related to Human Capital Management

The success of our business is dependent upon highly skilled, competent and key personnel, as well as suitable contractors.

We depend on key personnel, the loss of which could have a material adverse effect on our business

Risks Related to the COVID-19 Pandemic

There is significant uncertainty regarding the extent to which and how long the COVID-19 pandemic and its related effects will impact the U.S. economy.

Risks Related to Governmental, Regulatory, Legal and Compliance Matters

Government regulations and legal challenges may delay the start or completion of our communities, increase our costs and expenses or limit our homebuilding or other activities.

We may face substantial damages or be enjoined from pursuing important activities as a result of existing or future litigation, arbitration or other claims.

We are subject to liability under various data protection laws, the non-compliance of which could subject us to significant monetary damages, regulatory enforcement actions, fines and/or criminal prosecution.

Risks Related to Environmental Matters

We are subject to environmental laws and regulations, which may increase our costs, limit the areas in which we can build homes, delay completion of our projects or result in potential liability.

Risks Related to Weather and Climate Change

Adverse weather and geological conditions may increase our costs, cause project delays and reduce consumer demand for housing.

Changes in global or regional climate conditions and governmental actions in response to such changes may adversely affect us by increasing the costs of, or restricting, our planned or future growth activities.

Risk Related to Acquisitions and Joint Venture Investments

Acquisitions, investments and/or disposals involve risks and may result in unexpected costs and unrealized benefits.

A significant portion of our historical growth has been due to our prior acquisitions and we may not be able to continue to grow through acquisitions.

Risks Related to Our BusinessIndebtedness and Liquidity

Difficulty in obtaining sufficient additional capital at reasonable prices when needed could result in an inability to acquire land for our developments or increased costs and delays in the completion of our development projects.

We have substantial indebtedness and expect to continue to use leverage in executing our business strategy.

Interest expense on our debt limits our cash available to fund our growth strategies and we may be unable to generate sufficient cash flows to meet our debt service obligations or comply with our covenants.

Risks Related to Tax Policies and Regulation

Tax policies and regulation, including in particular any limitation on, or reduction or elimination of, tax benefits associated with owning a home or increases in property and sales taxes, may affect our business.

Risk Related to Possible Conflicts of Interest

Conflicts of interest may arise as a result of relationships between our Co-Chief Executive Officers and the Company.

Risks Related to Ownership of our Common Stock

The ownership of our common stock is risky as it is subordinated to our existing and future indebtedness.

Our actual operating results may differ significantly from our guidance, which could cause the market price of our common stock to decline.

General Risk Factors

We are subject to several other risks of which other public companies are subject, including without limitation, the effect of negative publicity; increased scrutiny related to our environmental, social and governance practices; information technology failures or data security breaches; our ability to change our operational policies, investment guidelines and business and growth strategies without stockholder consent; and our ability to maintain an effective system of internal controls.

Risks Related to the Housing Market and General Economic Conditions

We are subject to demand fluctuations in the housing industry. Any reduction in demand for our homes would adversely affect our business, results of operations, and financial condition.

Demand for our homes is subject to fluctuations, often due to factors outside of our control. In a housing market downturn when demand for our homes decreases, our revenues and results of operations are typically adversely affected; we may have significant inventory impairments and other write-offs; our gross margins may decline significantly from historical levels; and we may incur substantial losses from operations. At any particular time, we cannot accurately predict whether housing market conditions existing at that time will continue. For example, in the beginning of the COVID-19 pandemic, we experienced a decrease in demand for our homes which began to reverse course in May and June of 2020 and remained strong throughout the rest of 2020 and all of 2021. Despite overall strong demand and sales during 2021, continued demand for our homes during 2022 and beyond is uncertain in light of rising inflation, decreased consumer confidence, decreased availability of credit, and other factors, including those described elsewhere in this report.

Adverse changes in general economic conditions could reduce the demand for our homes and, as a result, could have a material adverse effect on us.our business, results of operations and financial condition.

The residential homebuilding industry is cyclical and is highly sensitive to changes in local and general economic conditions that are outside our control, including:

| ·

| | consumer confidence, levels of employment, personal income growth and household debt-to-income levels of potential homebuyers;

|

| ·

| | the availability of financing for homebuyers, including private and federal mortgage financing programs and federal, state, and provincial regulation of lending practices;

|

| ·

| | real estate taxes and federal and state income tax provisions, including provisions for the deduction of mortgage interest payments;

|

| ·

| | U.S. and global financial system and credit markets, including short- and long-term interest rates and inflation;

|

| ·

| | housing demand from population growth and demographic changes (including immigration levels and trends in urban and suburban migration);

|

| ·

| | competition from other real estate investors with significant capital, including other real estate operating companies and developers and institutional investment funds; and

|

| ·

| | the supply of new or existing homes and other housing alternatives, such as apartments and other residential rental property.

|

The U.S. housing market can also be negatively impacted by declining consumer confidence, employment levels, job growth, spending levels, wage and personal income growth, personal indebtedness levels, and household debt-to-income levels of potential homebuyers;

the availability and cost of financing for homebuyers or restrictive mortgage standards, including private and relatively large suppliesfederal mortgage financing programs and federal, state, and provincial regulation of lending practices;

real estate taxes and federal and state income tax provisions, including provisions for the deduction of mortgage interest payments;

U.S. and global financial system and credit markets, including short- and long-term interest rates and inflation;

housing demand from population growth, household formations, new home buying catalysts (such as marriage and children), second home buying catalysts (such as retirement), home sale catalysts (such as an aging population), demographic changes (including immigration levels and trends in urban and suburban migration), generational shifts, or otherwise, or perceptions regarding the strength of the housing market, and home price appreciation and depreciation resulting therefrom;

competition from other real estate investors with significant capital, including other real estate operating companies and developers, institutional investment funds and companies solely focused on single-family rentals; and

the supply of new or existing homes, including foreclosures, resales and new homes, among other factors. housing alternatives, such as apartments and other residential rental property, and the aging of existing housing inventory.

In the event these economic and business factors occur, we could experience declinesa decline in the demand and pricing for our homes, an increase in customer cancellations, an increase in selling concessions and downward pressure on the market value of our inventory, and demand for our homes, which could have a material adverse effect on our business, prospects, liquidity, financial condition and results of operations.

The health ofoperations and increase the residential homebuilding industry may also be significantly affected by “shadow inventory” levels. “Shadow inventory” refers to the number of homes with a mortgage that are in some form of distress but that have not yet been listedrisk for sale. Shadow inventory can occur when lenders put properties that have been foreclosed or forfeited to lenders on the market gradually, rather than all at once, or delay the foreclosure process. They may choose to do so because of regulations and foreclosure moratoriums, because of the additional costs and resources required to process and sell foreclosed properties, or because they want to avoid depressing housing prices further by putting many distressed properties up for sale at the same time.asset impairments. A significant shadow inventoryor sustained downturn in our markets could, were it to be released into our markets, adversely impact home prices and demand for our homes, which couldthe homebuilding market would likely have a materialan adverse effect on our business prospects, liquidity, financial condition and results of operations.operations for multiple years.

In addition, an important segmentthe portion of our customer base that consists of first- and second-time move-up buyers, who often purchase homes subject to contingencies related to the sale and/or closing of their existing homes. The difficulties thatIf these potential buyers face difficulties in selling or closing their homes, duringwhether due to periods of weak economic conditions, oversupply, high interest rates, restrictive mortgage standards or otherwise, our sales may be adversely affect our sales.affected. Moreover, during such periods, we may need to reduce our sales prices and offer greater incentives to buyers to compete for sales that may result in reduced margins.

Furthermore, deployments of U.S. military personnel to foreign regions, terrorist attacks, other acts of violence or threats to national security and any corresponding response by the United States or others, related domestic or international instability or civil unrest may cause an economic slowdown in the markets where we operate, which could adversely affect our business.

Our future success depends upon our ability to successfully adapt our business strategy to changing home buying patterns and trends.

Future changing home buying patterns and trends could reduce the demand for our homes and, as a result, could have a material adverse effect on our business and results of operations. Our business strategy has historically been to offer homes that appeal to a broad range of entry-level, move-up and, lifestyle homebuyers based on each local market in which we operate. However, given the significant increases in average home sales prices across our markets and the increased demand for more affordable homes due to generational shifts, affordability concerns, changing demographics and other factors, we have increased our focus on offering more affordable housing options in our markets. We believe that due to anticipated generational shifts, changing demographics and other factors, the demand for more entry-level and affordable homes will increase. This is particularly true in light of future home buyers being motivated to move out of their apartments or confined living areas, often in urban areas, and into more spacious homes, often in nearby suburbs, as they spend more time at home as a result of part- and full-time remote-working arrangements, which has become significantly more prevalent due primarily to the COVID-19 pandemic and which is expected to continue beyond the pandemic. Indeed, part of our strategy with our Century Complete brand is to target first time home buyers with an asset light business model. Our Century Complete brand targets entry-level homebuyers, primarily sells homes through retail studios and the internet, and generally provides no option or upgrade opportunities. We have also pivoted our Century Communities brand to target more affordable price points as well. No assurance can be provided that our current business strategy to focus on more affordable homes will be effective or that we will successfully anticipate and react to future changing home buying patterns and trends, which may include higher levels of single-family rental demand. In addition, if the level of new home demand continues to increase in future periods as a result of changing home buying patterns or trends

or otherwise, the risk of shortages and cost increases in residential lots, labor and materials available to the homebuilding industry will likely increase.

Our long-term growth depends upon our ability to successfully identify and acquire desirable land parcels at reasonable prices for residential build-out.