UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-K

|

| | |

| | þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | For the fiscal year ended September 30, 20162017 |

OR

|

| | |

| | ¨

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

COMMISSION FILE NUMBER: 1-35999

Fifth Street Senior Floating Rate Corp.OaktreeStrategic Income Corporation

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

|

| | |

DELAWARE (State or jurisdiction of

incorporation or organization) | | 61-1713295 (I.R.S. Employer

Identification No.) |

| | | |

777 West Putnam333 South Grand Avenue, 3rd28th Floor

Greenwich, CTLos Angeles, CA

(Address of principal executive office) | | 0683090071

(Zip Code) |

REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE:

(203) 681-3600(213) 830-6300

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

|

| | |

| Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share | | The NASDAQ Global Select Market |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter periods as the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

Large accelerated filer ¨o | | Accelerated filer þ | | Non-accelerated filer ¨o | | Smaller reporting company ¨o |

| | | | | (Do not check if a smaller reporting company) | | |

| | | | | | |

Emerging growth company þ

| | If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes ¨ No þ

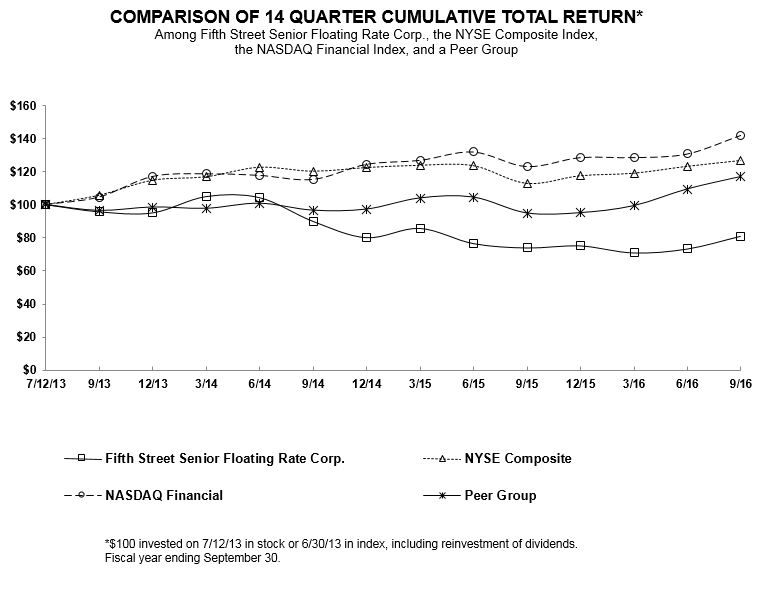

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of March 31, 20162017 is $211,431,851.190,396,952. For the purposes of calculating the aggregate market value of common stock held by non-affiliates, the registrant has excluded (1) shares held by its current directors and officers and (2) those reported to be held by Fifth Street Holdings L.P. and Leonard M. Tannenbaum and his other affiliates. The registrant had 29,466,768 shares of common stock outstanding as of December 13, 2016.7, 2017.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement relating to the registrant’s 20172018 Annual Meeting of Stockholders, to be filed with the Securities and Exchange Commission within 120 days following the end of the Company’s fiscal year, are incorporated by reference in Part III of this Annual Report on Form 10-K as indicated herein.

OAKTREE STRATEGIC INCOME CORPORATION

FORM 10-K FOR THE YEAR ENDED SEPTEMBER 30, 2017

TABLE OF CONTENTS

|

| | |

| | |

| | Page |

| | | |

| | PART I | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | PART II | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| | PART III | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | PART IV | |

| Item 15. | | |

| |

| |

PART I

Item 1. Business

General

Oaktree Strategic Income Corporation (formerly known as Fifth Street Senior Floating Rate Corp. through October 17, 2017), a Delaware corporation, or together with its subsidiaries, where applicable, the Company, which may also be referred to as "we", "us" or "our", is a specialty finance company that isdedicated to providing customized capital solutions for middle-market companies in both the syndicated and private placement markets. We were formed in May 2013 as a Delaware corporation, commenced operations on June 29, 2013, and currently operate as a closed-end, externally managed, non-diversified management investment company. We havecompany that has elected to be regulated as a business development company or BDC, under the Investment Company Act of 1940, as amended, or the 1940 Act. In addition, we have qualified and elected to be treated as a regulated investment company, or RIC, under the Internal Revenue Code of 1986, as amended, or the Code, for tax purposes. See “ - Taxation“Taxation as a Regulated Investment Company.” As a RIC, we generally will not have to pay corporate-level U.S. federal income taxes on any net ordinary income or net realized capital gains that we distribute to our stockholders if we meet certain source-of-income, income distribution and asset diversification requirements. We are managed by Fifth Street Management LLC, which we also refer to as "Fifth Street Management" or our "investment adviser." Also, we are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or JOBS Act, and take advantage of the exemption for emerging growth companies allowing us to temporarily forgo the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002.2002, or the Sarbanes-Oxley Act. We do not take advantage of other disclosure or reporting exemptions for emerging growth companies under the JOBS Act.

OurAs of October 17, 2017, we are externally managed by Oaktree Capital Management, L.P., which we also refer to as “Oaktree” or our “Investment Adviser,” pursuant to an Investment Advisory Agreement, dated October 17, 2017, or the New Investment Advisory Agreement, between the Company and Oaktree. Oaktree is a subsidiary of Oaktree Capital Group, LLC, or OCG, a global investment objective ismanager specializing in alternative investments. Oaktree Fund Administration, LLC, which we refer to maximizeas “Oaktree Administrator” or “OFA”, a subsidiary of our portfolio’s total returnInvestment Adviser, also provides certain administrative and other services necessary for us to operate. Prior to October 17, 2017, we were externally managed and advised by generatingFifth Street Management LLC, which we refer to as our “Former Adviser” or “Fifth Street Management.” For more information about the New Investment Advisory Agreement and Oaktree see “-The Investment Adviser” below.

We seek to generate a stable source of current income from our debt investments while seekingminimizing the risk of principal loss and, to preserve our capital. We investa lesser extent, capital appreciation by providing middle-market companies with primarily in senior secured loans, including first lien unitranche and second liensecured debt instruments,financings that pay us interest at rates which are determined periodically on the basis of a floating base lending rate, maderate. We invest in companies across a variety of industries that typically possess business models we expect to private middle market companies whose debt is rated below investment grade,be resilient in the future with underlying fundamentals that will provide strength in future downturns. We intend to deploy capital across credit and economic cycles with a focus on long-term results, which we referbelieve will enable us to collectively as “senior loans.”build lasting partnerships with financial sponsors and management teams. Under normal market conditions, through January 18, 2018, at least 80% of the value of our net assets plus borrowings for investment purposes will be invested in floating rate senior loans.loans, which include both first and second lien secured debt financings. We may also invest in unsecured loans, including subordinated loans, issued by private middle marketmiddle-market companies and, to a lesser extent, senior and subordinated loans issued by public companies and equity investments. This policy may be changed by our Board of Directors with at least 60 days’ prior written notice to stockholders to the extent such a change would not affect our ability to maintain our election as a BDC.

SeniorWe have invested primarily in senior secured loans, typicallyincluding first lien, unitranche and second lien debt instruments, that pay interest at rates which are determined periodically on the basis of a floating base lending rate, primarily the London-Interbank Offered Rate, or LIBOR, plus a premium. The senior loans in which we invest are typically made to U.S. and, to a limited extent, non-U.S. corporations, partnerships and other business entities in the middle-market which operate in various industries and geographical regions. We generally invest in securities that are rated below investment grade by rating agencies or that would be rated below investment grade if they were rated. Below investment grade securities, which are often referred to as “high yield” and “junk,” have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. We target senior loans that generally bear annual interest at a rate of LIBOR plus a 5.0% premium (with a LIBOR floor), and for our investments that are not considered senior loans, we target an annual interest rate of LIBOR plus a 9.0% premium (with a LIBOR floor). If the LIBOR floor is higher than the current applicable LIBOR rate, the LIBOR floor will be deemed to be the applicable LIBOR rate. We may make investments with interest rates that differ from our target rates and will periodically reassess our target rates in light of prevailing market conditions.

We seek to invest in senior loans made primarily to private, leveraged, middle marketOur Former Adviser targeted middle-market companies with approximately $20 million to $120 million of EBITDA (Earnings(generally defined as Earnings before Interest, Taxes, Depreciation and Amortization).

Our business model is focused primarily onInvestment Adviser intends to reposition our portfolio in the direct originationnear-term in order to (1) rotate out of a small number of investments through portfolio companies or their financial sponsors. Our investments generally range in size between $3 million and $30 million each, although we expect that this investment size will vary proportionately withit views as challenged, (2) focus on increasing the size of our capital base. In addition,core private investments and (3) supplement the portfolio with broadly syndicated and select privately placed loans. We expect that our Investment Adviser will focus on middle-market companies, which we may invest a portiondefine as companies with enterprise values of between $100 and $750 million. Going forward, we expect our portfolio in other types of investments, which we refer to as opportunistic investments, which are not our primary focus, but are intended to enhance our overall returns. These opportunistic investments may include direct investments in public companies that are not thinly traded and securities of leveraged companies located in select countries outside of the United States. We may invest up to 30% of our total assets in such opportunistic investments, includingprimarily first lien floating rate senior loans issued by non-U.S. issuers, subject to compliance with our regulatory obligations as a BDC under the 1940 Act. See “ - Business Development Company Regulations.”secured financings.

We were formed in May 2013 as a Delaware corporation and commenced operations on June 29, 2013.

From the time we commenced operationsinception through September 30, 2016,2017, we have originated over $1.7$2.0 billion of funded debt investments. As of September 30, 2016, ourOur portfolio totaled $573.6$560.4 million at fair value as of September 30, 2017 and was comprised of 63 investments,67 portfolio companies, including our investment in subordinated notes and limited liability company, or LLC, equity interests in FSFR Glick JV LLC, or FSFR Glick JV. At fair value as of September 30, 2016, 87.6%2017, 89.5% of our portfolio consisted of senior secured floating rate debt investments, and 11.0%10.3% of the portfolio consisted of investments in the subordinated notes and LLC equity interests of FSFR Glick JV.JV and 0.2% consisted of equity investments in other portfolio companies. The weighted average annual yield of our debt investments as of September 30, 2016,2017, including the return on our subordinated note investment in FSFR Glick JV, was approximately 8.58%7.5%, of which 8.29% representedincluding 7.3% representing cash payments. The weighted average annual yield of

our debt investments is determined before the payment of, and therefore does not take into account, the payment of all of our and(and our consolidated subsidiaries’) expenses and the payment by an investor of any stockholder transaction expenses, and does not represent the return on investment for our stockholders.

As a BDC, we are required to comply with certain regulatory requirements, including limitations on our use of debt. We are permitted to, and expect to continue to, finance our investments through borrowings. However, as a BDC,business development company, we are generally only generally allowed to borrow amounts such that our asset coverage, as defined in the 1940 Act, equals at least 200% after such borrowing. The amount of leverage that we employ will depend on our assessment of market conditions and other factors at the time of any proposed borrowing, such as the maturity, covenant package and rate structure of the proposed borrowings, our ability to raise funds through the issuance of shares of our common stock and the risks of such borrowings within the context of our investment outlook. Ultimately, we only intend to use leverage if the expected returns from borrowing to make investments will exceed the cost of such borrowing. As of September 30, 2016,2017, we had a debt to equity ratio of 0.90x (i.e., one dollar of equity for each $0.90 of debt outstanding).

Our principal executive office is located at 777 West Putnam Avenue, 3rd Floor, Greenwich, Connecticut 06830 and our telephone number is (203) 681-3600.

Joint Venture

We and GF Equity Funding 2014 LLC, or GF Equity Funding, also co-invest through an unconsolidated, Delaware limited liability company, FSFR Glick JV. FSFR Glick JV was formed in October 2014 and began investing in April 2015 primarily in senior secured loans of middle market companies. We co-invest in these securities with GF Equity Funding through our investment in FSFR Glick JV. FSFR Glick JV is managed by a four person board of directors, two of whom are selected by us and two of whom are selected by GF Equity Funding. FSFR Glick JV is capitalized as transactions are completed, and all portfolio decisions and investment decisions in respect of the FSFR Glick JV must be approved by anits investment committee of the FSFR Glick JV consisting of one representative of the Companyselected by us and one representative ofselected by GF Equity Funding (with approval of each required). The members provide capital to FSFR Glick JV in exchange for limited liability company, or LLC equity interests, and the Company and GF Debt Funding 2014 LLC, or GF Debt Funding, an entity advised by affiliates of GF Equity Funding, provide capital to the FSFR Glick JV in exchange for subordinated notes, or the Subordinated Notes. Additionally, FSFR Glick JV has a senior revolving credit facility with Credit SuisseDeutsche Bank AG, Cayman IslandNew York Branch, or the Credit SuisseDeutsche Bank facility, with a stated maturity date of April 17, 2023, which, as of September 30, 2016,2017, permits up to $200.0 million of borrowings. As of September 30, 20162017 and September 30, 2015,2016, FSFR Glick JV had total capital commitments of $100.0 million, $87.5 million of which was from the Company and the remaining $12.5 million from GF Equity Funding and GF Debt Funding. At September 30, 2016,2017, we had funded approximately $71.1$71.4 million of our commitment. As of September 30, 2016,2017, our investment in SLFFSFR Glick JV I was approximately $63.3$57.6 million at fair value. We do not consolidate SLFFSFR Glick JV I in our Consolidated Financial Statements.

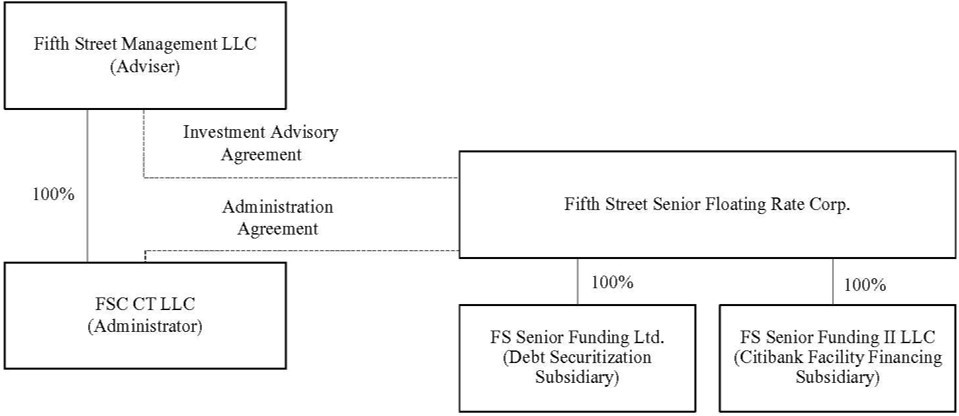

Organizational Structure

The following diagram shows a simplified organizational structure reflecting our relationship with Oaktree and OFA, our Investment Adviser and administrator, respectively, as of October 17, 2017 and our direct and indirect ownership interest in certain of our subsidiaries as of such date:

Our principal executive office is located at 333 South Grand Avenue, 28th Floor, Los Angeles, CA 90071 and our telephone number is (213) 830-6300.

The Investment Adviser

WeAs of October 17, 2017, we are externally managed and advised by Fifth Street Management,Oaktree, a registered investment adviser under the Investment Advisers Act of 1940, as amended, or the Advisers Act, thatAct. Oaktree, subject to the overall supervision of our Board of Directors, manages our day-to-day operations, and provides investment advisory services to us pursuant to the New Investment Advisory Agreement.

Our Investment Adviser was formed in April 1995 and is partiallya premier credit manager and indirectly ownedleader among alternative investment managers headquartered in Los Angeles, California. Oaktree has $99.5 billion in assets under management as of September 30, 2017, with approximately 70% in credit strategies. The firm has an extensive global investment platform with more than 900 employees, including over 250 investment professionals who have significant origination, structuring and underwriting expertise. Oaktree’s disciplined investment philosophy and commitment to credit investing and lending have been demonstrated across market cycles for more than 20 years. Oaktree emphasizes an opportunistic, value-oriented and risk-controlled approach to investments in distressed debt, corporate debt (including mezzanine finance, high yield debt and senior loans), control investing, real estate, convertible securities and listed equities. Oaktree manages assets for a wide variety of clients, including many of the most significant investors in the world. As of September 30, 2017, this client base includes 75 of the 100 largest U.S. pension plans, the main pension fund of 38 states in the United States, over 400 corporations, over 350 university, charitable and other endowments and foundations, over 350 non-U.S. institutional investors and 16 sovereign wealth funds.

Members of our Investment Adviser’s Strategic Credit team have, in the aggregate, over 50 years of investment experience and include professionals who have experience structuring new investments and restructuring existing capital structures in order to maximize recoveries. Our Investment Adviser’s Strategic Credit team is comprised of individuals with a diversity of backgrounds, including, as of the date hereof, former investment bankers, corporate/restructuring lawyers, a doctor, private equity investors, and management consultants. We believe this diversity of experience helps enhance the investment process by bringing different perspectives to credit discussions.

The Transaction and the New Investment Advisory Agreement with Oaktree

On July 13, 2017, Oaktree, entered into an Asset Purchase Agreement, or the Purchase Agreement, with our Former Adviser, and for certain limited purposes, Fifth Street Asset Management Inc., or FSAM, the indirect, partial owner of our Former Adviser, and Fifth Street Holdings L.P., the direct, partial owner of our Former Adviser.

In order to ensure that the transactions contemplated by the Purchase Agreement, or the Transaction, complied with Section 15(f) of the 1940 Act, our Investment Adviser and our Former Adviser agreed to certain conditions. First, for a publicly-traded, nationally-recognized asset manager with over $5 billionperiod of assetsthree years after the closing of the Transaction, at least 75% of the members of our Board of Directors must not be interested persons of Oaktree or our Former Adviser. Second, an “unfair burden” must not be imposed on us as a result of the closing of the Transaction or any express or implied terms, conditions or understandings applicable thereto during the two-year period after the closing of the Transaction. In addition, for the two-year period commencing on October 17, 2017, Oaktree will waive,

to the extent necessary, any management or incentive fees payable under management asthe New Investment Advisory Agreement that exceed what would have been paid to the Former Adviser in the aggregate under the Former Investment Advisory Agreement.

On September 7, 2017, we held a special meeting of September 30, 2016.stockholders, or the Special Meeting. At the Special Meeting, our stockholders approved the New Investment Advisory Agreement to take effect upon the closing of the Transaction. Our investment adviser serves pursuantstockholders also approved, contingent upon the closing of the Transaction, the election of John B. Frank, Marc H. Gamsin, Craig Jacobson, Richard G. Ruben and Bruce Zimmerman to an investment advisory agreement adoptedserve on our Board of Directors, each of whom commenced serving on our Board of Directors on October 17, 2017. In addition, in accordanceconnection with the Advisers Act, under which it receives from us a percentageTransaction, Edgar Lee became our Chief Executive Officer and Chief Investment Officer, Mathew Pendo became our Chief Operating Officer, Mel Carlisle became our Chief Financial Officer and Treasurer and Kimberly Larin became our Chief Compliance Officer.

Upon the closing of our gross assets as a management fee and a percentage of our ordinary income and capital gains as an incentive fee. See “- Investment Advisory Agreement.”

The key principals and members of senior management of our investment adviser are Leonard M. Tannenbaum, our investment adviser’s chief executive officer, Bernard D. Berman, our chairman and our investment adviser’s president, Todd G. Owens, our president, Ivelin M. Dimitrov, our chief executive officer and the chief investment officer of our investment adviser, and Alexander C. Frank, the chief operating officer of our investment adviser. Mr. Tannenbaum has led the investment of over $10 billion in small and mid-sized companies and the origination of over 300 investment transactions since 1998. Our investment adviser also currently serves asTransaction on October 17, 2017, Oaktree became the investment adviser to another business development company,each of Oaktree Specialty Lending Corporation (formerly known as Fifth Street Finance Corp.), or FSC,OCSL, and us, and Oaktree paid gross cash consideration of $320 million to our Former Adviser. The closing of the Transaction resulted in addition to various other private fund vehicles. Since we focusing on senior loans that bear interest onan assignment for purposes of the basis1940 Act of the investment advisory agreement between our Former Adviser and us, or the Former Investment Advisory Agreement, and, as a floating base lending rate, our primary investment focus differs from that of FSC, which focuses more generally on debt and equity investments in small and mid-sized companies. However, there may be overlap inresult, its immediate termination. The material terms of the services to be provided under the New Investment Advisory Agreement, other than the fee structure, are substantially the same as the Former Investment Advisory Agreement, except that services are provided by Oaktree.

On October 17, 2017, each of Bernard D. Berman, James Castro-Blanco, Richard P. Dutkiewicz, Alexander C. Frank and Jeffrey R. Kay resigned as a member of our targeted investments.Board of Directors. In addition, on October 17, 2017, each of Mr. Berman, our former Chief Executive Officer, Mr. Steven Noreika, our former Chief Financial Officer, and Ms. Kerry Acocella, our former Secretary and Chief Compliance Officer, resigned from his or her role as an officer of the Company.

Our administrator,Former Adviser and Administrator

Prior to October 17, 2017, we were externally managed and advised by our Former Adviser, which was a registered investment adviser under the Advisers Act. Subject to the overall supervision of our Board of Directors, our Former Adviser managed our day-to-day operations and provided us with investment advisory services similar to those now provided by Oaktree as described below under “-New Investment Advisory Agreement.” FSC CT LLC, or FSC CT,our Former Administrator, was a wholly-owned subsidiary of Fifth Street Management, provides theour Former Adviser. Our Former Administrator provided administrative services necessary for us to operate.operate pursuant to an administrative and loan services agreement, or the Former Administration Agreement. See “- Former Administration Agreement.”

The following diagram shows a simplified organizational structure reflecting our relationship with our Former Adviser and Former Administrator and our direct and indirect ownership interest in certain of our subsidiaries as of September 30, 2017:

Market Opportunity

We believe that the middle market represents a significant opportunity for direct lending for many reasons, including:

Large Market. According to the National Center for the Middle Market, as of the second quarter of 2017, there were nearly 200,000 businesses with annual revenues of $50 million to $1 billion or EBITDA of $10 million to $50 million, which businesses represented one-third of private sector U.S. gross domestic product and accounted for nearly 48 million jobs in the United States.

Demand From Middle-Market Companies. According to Thomson Reuters Q3’17 Middle Market Lender Outlook, over the past five years, middle-market lending has averaged $170 billion annually, much of which we believe has been used to finance leveraged buyouts, recapitalizations, capital expenditures and acquisitions. While the market for middle-market lending has attracted increased capital flows and competition, we believe that the market remains robust and growing and that new market participants may not have the same experience in direct lending and investing across credit cycles as our Investment Adviser. We believe that the market for middle-market lending is relatively less efficient and less well-trafficked, which may provide us with opportunities for incremental returns on our investments relative to the risk of such investments.

Reduced Focus From Banks on Middle-Market Lending. We believe that many commercial banks have decreased their lending to middle-market companies in recent years, which has created an opportunity for non-traditional market participants. According to the Standard & Poor’s Leveraged Commentary & Data Leveraged Lending Review - Q2’17, banks account for just 10% of middle-market loans as of September 30, 2017.

Business Strategy

Our investment objective isWe seek to maximize our portfolio’s total return by generatinggenerate a stable source of current income from our debt investments while seekingminimizing the risk of principal loss and, to preserve our capital.a lesser extent, capital appreciation. We have adoptedinvest in companies across a variety of industries that typically possess business models we expect to be resilient in the future with underlying fundamentals that will provide strength in future downturns. We intend to deploy capital across credit and economic cycles with a focus on long-term results, which we believe will enable us to build lasting partnerships with financial sponsors and management teams. Our Investment Adviser intends to implement the following business strategy to achieve our investment objective:

Portfolio Repositioning.Our Investment Adviser intends to reposition our portfolio in the near-term in order to (1) rotate out of a small number of investments that it views as challenged, (2) focus on increasing the size of our core private investments and (3) supplement the portfolio with broadly syndicated and select privately placed loans. In the longer-term, our Investment Adviser intends to generate consistent income to support sustainable dividends through (1) providing larger, more liquid first lien loans in the established middle market, (2) minimizing risk of principal loss, with reduced focus on opportunities for capital appreciation, (3) mitigating interest rate risk by targeting floating-rate loans and (4) strategically accessing the broadly syndicated and private placement markets.

Emphasis on Proprietary Deals.Our Investment Adviser is primarily focused on proprietary opportunities as well as partnering with other lenders as appropriate and, to a lesser extent strategically accessing the broadly syndicated and private placement markets. Dedicated sourcing professionals of our Investment Adviser are in continuous contact with financial sponsors and corporate clients to originate proprietary deals and seek to leverage the networks and relationships of Oaktree’s over 250 investment professionals with management teams and corporations to originate non-sponsored transactions. Since 2005, our Investment Adviser has invested more than $10 billion in over 200 directly originated loans, and the Oaktree platform has the capacity to invest in large deals and to solely underwrite transactions.

Focus On Quality Companies And Extensive Diligence. Our Investment Adviser seeks to maintain a conservative approach to investing with discipline around fundamental credit analysis and downside protection. Our Investment Adviser intends to focus on companies with business models we expect to be resilient in the future, underlying fundamentals that will provide strength in future downturns, significant asset or enterprise value and seasoned management teams, although not all portfolio companies will meet each of these criteria. Our Investment Adviser intends to leverage its deep credit and deal structuring expertise to lend to companies that have unique needs, complex business models or specific business challenges. Our Investment Adviser conducts diligence on underlying collateral value, including cash flows, hard assets or intellectual property, and will typically model exit scenarios as part of the diligence process, including assessing potential “work-out” scenarios.

Disciplined Portfolio Management. Our Investment Adviser monitors our portfolio on an ongoing basis to manage risk and take preemptive action to resolve potential problems where possible. Our Investment Adviser intends to seek to reduce the impact of individual investment risks by limiting positions to no more than 5% of our portfolio.

Manage Risk Through Loan Structures. Our Investment Adviser seeks to leverage its experience in identifying structural risks in prospective portfolio companies and developing creative solutions in an effort to enhance downside

protection where possible. Our Investment Adviser has the expertise to structure comprehensive, flexible and creative solutions for companies of all sizes across numerous industry sectors. Our Investment Adviser employs a rigorous due diligence process and seeks to include covenant protections designed to ensure that we, as the lender, can negotiate with a portfolio company before a deal reaches impairment. The Oaktree platform has the ability to address a wide range of borrower needs, with capability to invest across the capital structure and to fund large loans, and our Investment Adviser pays close attention to market trends. Our Investment Adviser provides certainty to borrowers by seeking to provide fully underwritten financing commitments and has expertise in both performing credit as well as restructuring and turnaround situations, which we expect will allow us to invest and lend during times of market stress when our competitors may halt investment activity.

Concentrate on floating rate senior loans.Floating Rate Senior Loans. We intend to concentrate on seniorfirst lien secured loans that bear interest based on a floating rate. We believe that seniorthese loans, which are often supported by a pledge of collateral, provide us with adequate protection and attractive risk-adjusted returns. However, we can provide no assurance that any collateral will be sufficient to pay interest due or repayminimize the risk of principal in the event of a default by a portfolio company.loss. In addition, with interest rates atnear historically low levels, we believe that investing in floating rate loans provides us with positive exposure to any near future period ofin a rising interest rates.rate environment.

CapitalizeOur Investment Adviser’s emphasis is on ourfundamental credit analysis, consistency and downside protection, all of which are key tenets of its investment adviser's strong relationships with private equity sponsors.Our investment adviser has developed an extensive network of relationships with private equity sponsors that invest in middle market companies, which should serve as a significant source of investment opportunities for us.philosophy. We believe thatthis philosophy strongly aligns with the strengthinterests of these relationships is due to a common investment philosophy, a consistent market focus, a rigorous approach to diligence and a reputationour stockholders. Our Investment Adviser controls primarily for delivering on commitments.risk, rather than return. Although our intereststhis may not always be aligned with our private equity sponsors given their position as the equity holder and our position as the debt holder in our portfolio companies, we believe that private equity sponsors provide significant benefits including incremental due diligence, additional monitoring capabilities and a potential source of capital and operational expertise for our portfolio companies.

Focus on established middle market companies. We believe that there are fewer finance companies focused on transactions involving middle market companies than larger companies and that this is one factor that allowslead us to negotiate favorable investment terms. Such favorable terms include higher debt yields and lower leverage levels, as well as more significant covenant protection than typical of transactions involving larger companies. We generally investunderperform in companies with established market positions, seasoned management teams, proven products and services and strong regional or national operations. We believe that these companies possess better risk-adjusted return profiles than newer companies that are in the early stages of building management teams and/or a revenue base.

Make direct originations.Over the last several years, the principals of our investment adviser have developed an origination strategy that allows us to directly originate a significant portion of our investments. We believe that the benefits of direct originations include, among other things, our ability to control the structuring of investment protections and to generate origination and prepayment fees.

Benefit from the large pool of uninvested private equity capital likely to seek complementary debt financing. Webullish markets, we expect that private equity firmsprudence across the economic cycle and limiting losses will continue to be active investors in middle market companies. These private equity funds generally seek to leverage their investments by combining their capital with senior secured loans and/or mezzanine debt provided by other sources, and we believe that our capital is well-positioned to partner with such equity investors who we believe have raised substantial amounts of private equity capital in recent years.

Selectively participate in a broad pipeline of capital market transactions. In addition to making direct originations, we also acquire senior loans through assignments or participations of interests in such loans. To do so, we utilize our investment adviser’s extensive network of sponsor and bank relationships to review a wide variety of transactions. This robust pipeline should allow us to efficiently deployachieve our investment objectives.

Investment Criteria

Our Investment Adviser has identified the following investment criteria and guidelines for identifying and investing in prospective portfolio companies. However, not all of these criteria will be met by each prospective portfolio company in which we invest.

Equity Cushion. We generally expect to invest in loans that have covenants that may help to minimize our risk of capital loss and makemeaningful equity investments in selected companies that align with our investment objective.

Employ disciplined underwriting policies and rigorous portfolio management.Our investment adviser has developed an extensive underwriting process which includes a review of the prospects, competitive position, financial performance and industry dynamics of each potential portfolio company. In addition, we perform substantial diligence on potentialWe intend to target investments and seek to invest alongside private equity sponsors whothat have proven capabilities in building value. As part of the monitoring process, our investment adviser will analyze monthly and quarterly financial statements versus the previous periods and year, review financial projections, compliance certificates and covenants, meet with management and attend board meetings.

Structure our investments to minimize risk of loss and achieve attractive risk-adjusted returns. We structure our investments on a conservative basis with high cash yields, cash advisory fees, low leverage levels and strong investmentcredit protections, including prepayment fees. As of September 30, 2016, our debt investments had a weighted average debt to EBITDA multiple of 4.5x calculated at the time of origination of the investment. The weighted average annual yield of our debt investments as of September 30, 2016, including the return on our subordinated note investment in FSFR Glick JV, was approximately 8.58%, of which 8.29% represented cash payments. Our investments typically have strong investment protections, which may include one or more of: default penalties, prepayment fees, information rights, board observation rights and affirmative, negative and financial covenants, such as limitations on debt incurrence, lien protection and prohibitions against change of control. We believe these protections, coupled with the other features of ouron dividends.

investments described above, should allow us to reduce our risk of capital lossSustainable Cash Flow. Our investment philosophy places emphasis on fundamental analysis from an investor’s perspective and achieve attractive risk-adjusted returns; however, there can be no assurance that we will be ablehas a distinct value orientation. We intend to successfully structure our investments to minimize risk of loss and achieve attractive risk-adjusted returns.

Leverage the skills and experience of our investment adviser.The principals of our investment adviser have broad investment backgrounds, with prior experience at private investment funds, investment banks and other financial services companies and they also have experience managing distressed companies. We believe that our investment adviser’s expertise in valuing, structuring, negotiating and closing transactions provides us with a competitive advantage by allowing us to provide financing solutions that meet the needs of our portfolio companies while adhering to our underwriting standards.

Investment Criteria

The principals of our investment adviser have identified the following investment criteria and guidelines for use in evaluating prospective portfolio companies and they use these criteria and guidelines in evaluating investment opportunities for us. However, not all of these criteria and guidelines were, or will be, met in connection with each of our investments.

Established companies with a history of positive operating cash flow. We generally seek to invest in established companies with sound historical financial performance. We typically focus on companies with a historysignificant asset or enterprise value in which we can invest at relatively low multiples of profitability on annormalized operating cash flow basis however,flow. Additionally, we anticipate investing in certain casescompanies with a demonstrated ability or credible plan to de-lever. Typically, we will not invest in start-up companies, companies having speculative business plans or structures that could impair capital over the long-term although we may target investments incertain earlier stage companies some of whichthat have yet to reach positive levels of profitability.

Strong market presence. Experienced Management Team.We seekgenerally will look to invest in portfolio companies thatwith an experienced management team and proper incentive arrangements, including equity compensation, to induce management to succeed and to act in concert with our interests as investors.

Strong Relative Position In Its Market. We intend to target companies with what we believe have developed strongto be established and leading market positions within their respective markets and exhibit the potential to maintain sufficient cash flows and profitability to service their obligations in a range of economic environments. We also seek portfolio companies that we believe possess advantages in scale, scope, customer loyalty, product pricing or product quality as compared to their competitors.

Private equity sponsorship.We generally seek to invest in companies in connection with private equity sponsors who have proven capabilities in building value. We believe that a private equity sponsor can serve as a committed partner and advisor that will actively work with the company and its management team to meet company goals and create value. We assess a private equity sponsor’s commitment to a portfolio company by, among other things, the capital contribution it has made or will make in the portfolio company.

Seasoned management team.We generally will require that our portfolio companies have a seasoned management team, with strong corporate governance. We also seek to invest in companies that have proper incentives in place, including having significant equity interests, to motivate management to act in accordance with our interests.

Defensible and sustainable business. We seek to invest in companies with proven products and/or services and strong regional or national operations.well-developed long-term business strategies.

Exit strategy.Strategy.We generally seekintend to invest in companies that we believe possess attributes that will provide us with the ability to exit our investments. We expectopportunity to exit our investments typicallyin three to eight years, including through one(1) the repayment of three scenarios: (i)the remaining principal outstanding at maturity, (2) the recapitalization of the company resulting in our debt investments being repaid and (3) the sale of the company resulting in the repayment of all of its outstanding debt, (ii)debt.

Geography. As a business development company, we will invest at least 70% of our investments in U.S. companies. To the recapitalizationextent we invest in non-U.S. companies, we intend to do so in accordance with 1940 Act limitations and only in jurisdictions with established legal frameworks and a history of respecting creditor rights.

Investment Process

Our investment process consists of the following five distinct stages.

Source.

Oaktree’s Strategic Credit team has dedicated sourcing professionals and also leverages its strong market presences and relationships across Oaktree’s global platform, which includes more than 250 highly-experienced investment professionals, to gain access to opportunities from advisers, sponsors, banks, management teams, capital raising advisers and other sources. Our Investment Adviser is a trusted partner to financial sponsors and management teams based on its long-term commitment and focus on lending across economic cycles. We believe this will give us access to proprietary deal flow and first looks at

investment opportunities and that we are well-positioned for difficult and complex transactions. In 2016, Oaktree’s Strategic Credit team evaluated more than 200 potential direct lending opportunities with total transaction value of approximately $30 billion. More than 85% of these potential direct lending opportunities were for transactions of $50 million or larger, and Oaktree’s Strategic Credit team continues to see a meaningful pipeline of sizeable transactions.

Screen Using Investment Criteria.

We expect to be highly selective in making new investments. The initial screening process will typically include a review of the proposed capital structure of the portfolio company, through whichincluding level of assets or enterprise value coverage, an assessment by our loanInvestment Adviser of the company’s management team and its equity ownership levels as well as the viability of its long-term business model, and a review of forecasted financial statements and liquidity profile. In addition, our Investment Adviser may assess the prospect of industry or macroeconomic catalysts that may create enhanced value in the investment as well as the potential ability to enforce creditor rights, particularly where collateral is replaced with debt or equity fromlocated outside of the United States.

Research.

Prior to making any new investment, our Investment Adviser intends to engage in an extensive due diligence process led by investment analysts assigned to each transaction. The analysts will assess a company’s products, services, competitive position in its markets, barriers to entry and operating and financial performance, as well as the growth potential of its markets. In performing this evaluation, the analysts may use financial, descriptive and other due diligence materials provided by the target company, commissioned third party or parties or (iii) the repaymentreports and internal sources, including members of the initial or remaining principal amount ofinvestment team, industry participants and experts with whom our loan then outstanding at maturity. In some investments, there may be scheduled amortization of some portion of our loan which would result in a partial exit of our investment prior to the maturityInvestment Adviser has relationships. As part of the loan.research process, our Investment Adviser’s analysts typically perform a “what-if” analysis that explores a range of values for each proposed investment and a range of potential credit events.

Evaluate.

Our Investment Adviser assesses each potential investment through a robust, collaborative decision-making process. Our Investment Adviser applies disciplined investment criteria and evaluates potential risk and reward of each investment with significant focus on downside risk. Our Investment Adviser sizes investments at the portfolio level across a variety of characteristics, including based on the investment criteria described above.

Monitor.

Our Investment Adviser prioritizes managing risk. In addition, although less common, we may sellmanaging our portfolio, our Investment Adviser intends to closely monitor each portfolio company and be well-positioned to make hold and exit decisions when credit events occur, our collateral becomes overvalued or opportunities with more attractive risk/reward profiles are identified. Investment analysts will be assigned to each investment to monitor industry developments, review company financial statements, attend company presentations and regularly speak with company management. In circumstances where a particular investment is underperforming, our Investment Adviser intends to employ a variety of strategies to maximize its recovery based on the specific facts and circumstances of the underperforming investment, including actively working with the management to restructure all or a portion of the business, explore the possibility of a sale or merger of all or a portion of the assets, recapitalize or refinance the balance sheet, negotiate deferrals or other concessions from existing creditors and arrange new liquidity or new equity contributions. We believe that our investmentsInvestment Adviser’s experience with restructurings and our access to our Investment Adviser’s deep knowledge, expertise and contacts in the distressed debt area will help us preserve the value of our investments.

Due Diligence Process

As part of the underwriting process, our Investment Adviser completes a rigorous due diligence process that focuses on four key areas:

Company Analysis. Our Investment Adviser actively engages and assesses company management teams. The focus of this analysis also includes identifying and understanding key business and demand drivers. Our Investment Adviser strives to evaluate core risks within businesses and industries and to complete the analysis by thinking like company ownership when evaluating cash flows.

Financial Analysis. Our Investment Adviser analyzes the consistency, stability and reliability of cash flows in addition to evaluating the quality of earnings and conversion of EBITDA to cash. Our Investment Adviser also reviews historical performance through economic cycles, analyzes the potential impact of a downturn in the prospective portfolio company’s end markets and compares the prospective portfolio company’s key metrics to those of its competitors.

Down-side Focus. Our Investment Adviser considers the impact on the secondary market.prospective portfolio company’s business and cash flows under a number of downside case scenarios and develops an exit strategy in the event of the downside case. There is also a focus on potential risks to business models. Following this analysis, our Investment Adviser considers appropriate risk mitigants, including the structure of the investment and affirmative, negative and financial covenants.

Value. Our Investment Adviser analyzes the risk/reward potential of each new investment relative to other opportunities in the industry and market as well as overall industry valuation trends as compared to the industry risk profile. As part of this analysis, our Investment Adviser considers the cost of capital to competitors as well as alternative investment options. Our Investment Adviser also considers the value of liquidity to our business and operations as well as appropriate illiquidity premiums where we are unlikely to acquire liquid securities.

Investments

We invest in portfolioseek to generate a stable source of current income while minimizing the risk of principal loss and, to a lesser extent, capital appreciation by providing middle-market companies primarily with first lien senior secured debt financings that pay us interest at a floating rate. We seek to structure our debt investments to provide downside protection through strong credit protections, including default penalties, information rights and affirmative, negative and financial covenants, such as limitations on debt incurrence, lien protection and prohibitions on dividends, although not all of our investments will meet each of these criteria. Our Investment Adviser has expertise in creative, efficient structuring and institutional knowledge of bankruptcy and restructurings enabling our Investment Adviser to focus on risk control. Going forward, we expect most of our debt investments to be collateralized by a first lien on the formassets of the portfolio company. As of September 30, 2017, 89.5% of our portfolio at fair value consisted of debt investments that were secured by first or second priority liens on the assets of the portfolio company.

Debt Investments

We intend to tailor the terms of each investment by negotiating a structure that seeks to protect our rights and manage our risk while creating incentives for the portfolio company to achieve its business plan. A substantial source of return is monthly or quarterly cash interest that we collect on our debt investments. We expect that our Investment Adviser will focus on middle-market companies, which we define as companies with enterprise values of between $100 and $750 million. Going forward, we expect our portfolio to include primarily first lien senior loans. These seniorsecured floating rate loans typicallyalthough we may also make other investments.

First Lien Loans. Our first lien loans generally have current cash payterms of three to seven years, provide for a variable or fixed interest with some amortizationrate, contain prepayment penalties and are secured by a first priority security interest in all existing and future assets of principal. Interestthe borrower. We target first lien loans where interest is generally paid on a floating rate basis, often with a floor, based on the LIBOR rate. WeOur first lien loans may take many forms, including revolving lines of credit, term loans and acquisition lines of credit.

Unitranche Loans. Our unitranche loans generally obtainhave terms of five to seven years and provide for a variable or fixed interest rate, contain prepayment penalties and are generally secured by a first priority security interestsinterest in theall existing and future assets of our portfolio companies that serve as collateralthe borrower. Our unitranche loans may take many forms, including revolving lines of credit, term loans and acquisition lines of credit.

Second Lien Loans. Our second lien loans generally have terms of five to eight years, provide for a variable or fixed interest rate, contain prepayment penalties and are secured by a second priority security interest in supportall existing and future assets of the repaymentborrower. Our second lien loans may include payment-in-kind, or PIK, interest, which represents contractual interest accrued and added to the principal that generally becomes due at maturity.

Unsecured Loans. Our unsecured investments generally have terms of these loans. This collateral may take the form of first or second priority liens on the assets offive to ten years and provide for a portfolio company.fixed interest rate. We also may make unsecured investments on a stand-alone basis, or in connection with a senior secured loan, a junior secured loan or a “one-stop” financing. Our unsecured investments may include PIK interest and an equity component, such as warrants to purchase common stock in the portfolio company.

Equity Investments

When we make a debt orinvestment, we may be granted equity investmentsin the company in the same class of security as the sponsor receives upon funding. In addition, from time to time including investments in structured products such as loan securitizations.

The senior loans that we target typically have final maturities of four to seven years. However, we expect that our portfolio companies often may repay these loans early, generally within three to four years from the date of initial investment. Early repayments of loans by portfolio companies may have an adverse effect on our earnings to the extent that we are not able to re-invest the proceeds from such repayments in loans that bear interest at rates similar to the rates of the repaid loans or at all.

We generally tailor the terms of an investment to the facts and circumstances of the transaction and the prospective portfolio company, negotiating a structure that protects our rights and manages our risk while creating incentives for the portfolio company to achieve its business plan and improve its profitability. We seek to limit the downside potential of our

investments by negotiating covenantsmake non-control, equity co-investments in connection with private equity sponsors. We generally seek to structure our equity investments, that afford our portfolio companies flexibilitysuch as direct equity co-investments, to provide us with minority rights provisions and event-driven put rights. We also seek to obtain limited registration rights in managing their businesses, consistentconnection with preservation of our capital. Such restrictionsthese investments, which may include affirmative and negative covenants, default penalties, lien protection, change of control provisions and board rights, including either observation or participation“piggyback” registration rights.

FSFR Glick JV

We have invested in FSFR Glick JV, which as of September 30, 2016,2017, consisted of a portfolio of loans to 3623 different borrowers in industries similar to the companies in our portfolio. FSFR Glick JV invests in middle-market and other corporate debt securities, including traditional senior debt that are secured by some or all of the issuer’scompany’s assets.

Deal Origination

Our deal originating efforts are focused on building relationships with private equity sponsors that are focused on investing in the small and mid-sized companies that we target. We divide the country geographically into Eastern, Central and Western regions and emphasize active, consistent sponsor coverage. The investment professionals of our investment adviser have developed an extensive network of relationships with these private equity sponsors. We estimate that our investment adviser has active relationships with approximately 200 private equity sponsors. An active relationship is one through which our investment adviser has received at least one investment opportunity from the private equity sponsor within the last year.

Our investment adviser reviewed over 700 potential investment transactions with private equity sponsors during the year ended September 30, 2016. A significant portion of the investment transactions that we have completed to date were originated through our investment adviser’s relationships with private equity sponsors. We believe that our investment adviser has a reputation as a reliable, responsive and efficient source of funding to support private equity investments. We believe that this reputation and the relationships of our investment adviser with private equity sponsors will provide us with significant investment opportunities.

Our origination process is designed to efficiently evaluate a large number of opportunities and to identify the most attractive of such opportunities. A significant number of opportunities that clearly do not fit our investment criteria are screened by the originators of our investment adviser when they are initially identified. If an originator believes that an opportunity fits our investment criteria and merits consideration, the investment is presented to our investment adviser’s Investment Committee. This is the first stage of our origination process, the “Review” stage. During this stage, the originator gives a preliminary description of the opportunity. This is followed by preliminary due diligence, from which an investment summary is created. The opportunity may be discussed several times by the full Investment Committee of our investment adviser, or subsets of that committee. At any point in this stage, we may reject the opportunity, and, indeed, we have historically decided not to proceed with more than 80% of the investment opportunities reviewed by our investment adviser's Investment Committee.

For the subset of opportunities that we decide to pursue, we issue preliminary term sheets and classify them in the “Term Sheet Issued” stage. This term sheet serves as a basis for negotiating the critical terms of a transaction. At this stage we begin our underwriting and investment approval process, as more fully described below. After the term sheet for a potential transaction has been fully negotiated, the transaction is presented to our investment adviser’s Investment Committee for approval. If the deal is approved, the term sheet is signed. Approximately half of the term sheets we issue result in an executed term sheet. Our underwriting and investment approval process is ongoing during this stage, during which we begin documentation of the loan. The final stage, “Closings,” culminates with the funding of an investment only after all due diligence is satisfactorily completed and all closing conditions, including the sponsor’s funding of its investment in the portfolio company, have been satisfied.

Investment Underwriting

Investment Underwriting Process and Investment Approval

We make our investment decisions only after consideration of a number of factors regarding the potential investment including: (i) historical and projected financial performance; (ii) company and industry specific characteristics, such as strengths, weaknesses, opportunities and threats; (iii) composition and experience of the management team; and (iv) track record of the private equity sponsor leading the transaction.

If an investment is deemed appropriate to pursue, a more detailed and rigorous evaluation is made along a variety of investment parameters, not all of which may be relevant or considered in evaluating a potential investment opportunity. The following outlines the general parameters and areas of evaluation and due diligence for investment decisions, although not all will necessarily be considered or given equal weighting in the evaluation process.

Management Assessment

Our investment adviser makes an in-depth assessment of the management team, including evaluation along several key metrics:

The number of years in their current positions;

Track record;

Industry experience;

Management incentive, including the level of direct investment in the enterprise;

Background investigations; and

Completeness of the management team (lack of positions that need to be filled).

Industry Dynamics

An evaluation of the industry is undertaken by our investment adviser that considers several factors. If considered appropriate, industry experts will be consulted or retained. The following factors are analyzed by our investment adviser:

Sensitivity to economic cycles;

Competitive environment, including number of competitors, threat of new entrants or substitutes;

Fragmentation and relative market share of industry leaders;

Growth potential; and

Regulatory and legal environment.

Business Model and Financial Assessment

Prior to making an investment decision, our investment adviser will undertake a review and analysis of the financial and strategic plans for the potential investment. There is significant evaluation of and reliance upon the due diligence performed by the private equity sponsor and third party experts including accountants and consultants. Areas of evaluation include:

Historical and projected financial performance;

Quality of earnings, including source and predictability of cash flows;

Customer and vendor interviews and assessments;

Potential exit scenarios, including probability of a liquidity event;

Internal controls and accounting systems; and

Assets, liabilities and contingent liabilities.

Private Equity Sponsor

Among the most critical due diligence investigations is the evaluation of the private equity sponsor making the investment. A private equity sponsor is typically the controlling shareholder upon completion of an investment and as such is considered critical to the success of the investment. The private equity sponsor is evaluated along several key criteria, including:

Investment track record;

Industry experience;

Capacity and willingness to provide additional financial support to the company through additional capital contributions, if necessary; and

Reference checks.

Portfolio Management

Active Involvement in our Portfolio Companies

As a business development company, we are obligated to offer to provide significant managerial assistance to our portfolio companies and to provide it if requested. In fact, weWe provide managerial assistance to most of our portfolio companies as a general practice and we seek investments where such assistance is appropriate. We monitor the financial trends of each portfolio company to assess the appropriate course of action for each company and to evaluate overall portfolio quality. We have several methods of evaluating and monitoring the performance of our investments, including but not limited to, the following:

Review of monthly and quarterly financial statements and financial projections for portfolio companies;

Periodic and regular contact with portfolio company management to discuss financial position requirements and accomplishments;

Attendance at board meetings;

Periodic formal update interviews with portfolio company management and, if appropriate, the private equity sponsor; and

Assessment of business development success, including product development, profitability and the portfolio company’s overall adherence to its business plan.

Ranking Criteria

In addition to various risk management and monitoring tools, we use an investment ranking system to characterize and monitor the credit profile and our expected level of returns on each investment in our portfolio. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Portfolio Asset Quality” for a description of our four-level numeric ranking scale and the distributions of our investments on the 1 to 4 investment ranking scale at fair value as of September 30, 2016 and 2015.

Valuation of Portfolio Investments

As a business development company, we generally invest in illiquid senior loans issued by private middle marketmiddle-market companies. All of our Level 3 investments are recorded at fair value as determined in good faith by our Board of Directors. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Critical Accounting Policies- Investment Valuation” for a description of our investment valuation processes and procedures.

Net Asset Value Determinations

Our Board of Directors determines the net asset value per share of our common stock on a quarterly basis. The net asset value per share of our common stock is equal to the value of our total assets minus liabilities divided by the total number of shares of common stock outstanding. Our liabilities will include amounts that we have accrued under our investment advisory agreement, including the management fee, income incentive fee and capital gains incentive fee, the latter of which will be accrued for GAAP purposes based upon the cumulative realized and unrealized capital appreciation in our portfolio.

Competition

We compete for investments with a number ofother business development companies, public and investmentprivate funds (including hedge funds, mezzanine funds and collateralized loan obligations) and private equity funds)funds (to the extent they provide an alternative form of financing), as well as traditional financial services companies such as commercial and investment banks, commercial financing companies and other sources of financing. Many of these entities have greater financial and managerial resources than we do. We believe we are able to be competitive with these entities primarily on the basis of the experience and contacts of our management team, our responsive and efficient investment analysis and decision-making processes, the investment terms we offer, and our willingness to make smaller investments.

We believe that some of our competitors make loans with interesttotal rates andof returns that are comparable to or lower than the rates and returns that we target. Therefore, we do not seek to compete solely on the interest rates that we offer to potential portfolio companies. For additional information concerning the competitive risks we face, seeSee “Risk Factors —- Risks Relating to Our Business and Structure —- We may face increasing competition for investment opportunities, which could reduce returns and result in losses.”

Employees

We do not have any employees. Our day-to-day investment operations are managed by Fifth StreetOaktree Capital Management, L.P. as our investment adviser.Investment Adviser. See “—“-New Investment Advisory Agreement.” Fifth Street Management utilizes over 25Our Investment Adviser and its affiliates employ more than 250 investment professionals, including its principals.professionals. In addition, we reimburse our administrator, FSC CT,Oaktree Administrator, for the allocable portion of overhead and other expenses incurred by it in performing its obligations under an administration agreement, or the New Administration Agreement, including our allocable portion of the costs of compensation of our chief financial officerChief Financial Officer, Chief Compliance Officer, their staffs and chief compliance officer and their staffs. For a more detailed discussion of the administration agreement, see “— Administrationother non-investment professionals at Oaktree that perform duties for us. See “- New Administrative Services Agreement.”

Properties

We do not own any real estate or other physical properties material to our operations. Our administrative and principal executive offices are located at 333 South Grand Avenue, 28th Floor, Los Angeles, CA 90071. We utilizebelieve that our office space that is leased by our administrator from an affiliate controlled by the chief executive officer of our investment adviserfacilities are suitable and administrator, Mr. Tannenbaum. See “Material Conflicts of Interest.” Pursuant to an administration agreement with our administrator, we pay FSC CT an allocable portion of the rent at market ratesadequate for our principal executive office at 777 West Putnam Avenue, 3rd Floor, Greenwich, CT 06830. Such reimbursement is at cost with no profit to, or markup by, FSC CT. We also utilize additional office space that is leased by affiliates of our administrator at 311 South Wacker Drive, Suite 3380, Chicago, IL 60606 and 309 23rd Street, Suite 200A, Miami Beach, FL 33139.

Material Conflicts of Interest

Our executive officers and directors, and certain members of our investment adviser, serve or may serve as officers, directors or principals of entities that operate in the same or a related line of business as we do or of investment funds managed by our affiliates. For example, Fifth Street Managementit is presently serves as investment adviser to FSC, a publicly-traded BDC with total assets at fair value of approximately $2.4 billion as of September 30, 2016. FSC invests in the debt and equity of small and mid-sized companies, primarily in connection with investments by private equity sponsors, including in middle market leveraged companies similar to those we target for investment. Specifically, FSC generally targets small and mid-sized companies with annual EBITDA between $10 million and $120 million and generally targets investment sizes ranging from $10 million to $100 million. In addition, though not the primary focus of its investment portfolio, FSC's investments also include floating rate senior loans. In contrast, we target investments ranging from between $3 million and $30 million, and generally target private leveraged middle market companies with approximately $20 million to $120 million of EBITDA. Therefore, there may be certain investment opportunities that satisfy the investment criteria for both FSC and us. In addition, certain of our executive officers and three of our independent directors serve in substantially similar capacities for FSC. Fifth Street Management and its affiliates also manage private investment funds, and may manage other funds in the future, that have investment mandates that are similar, in whole or in part, with ours. Accordingly, they may have obligations to investors in those entities, the fulfillment of which might not be in the best interests of us or our stockholders. For example, the principals of our investment adviser may face conflicts of interest in the allocation of investment opportunities to us and such other funds. The fact that our investment advisory fees are lower than those of certain other funds, such as FSC, could amplify this conflict of interest.conducted.

Fifth Street Management has adopted, and our Board of Directors has approved, an investment allocation policy that governs the allocation of investment opportunities among the investment funds managed by Fifth Street Management and its affiliates. To the extent an investment opportunity is appropriate for us or FSC or any other investment fund managed by our affiliates, Fifth Street Management will adhere to its investment allocation policy in order to determine to which entity to allocate the opportunity. As a business development company, we were substantially limited in our ability to co-invest in privately negotiated transactions with affiliated funds until we obtained an exemptive order from the SEC in September 2014. The exemptive relief permits us to participate in negotiated co-investment transactions with certain affiliates, each of whose investment adviser is Fifth Street Management, or an investment adviser controlling, controlled by or under common control with Fifth Street Management, in a manner consistent with our investment objective, positions, policies, strategies and restrictions as well as regulatory requirements and other pertinent factors, and pursuant to the conditions to the exemptive relief.

If we are unable to rely on our exemptive relief for a particular opportunity, such opportunity will be allocated first to the entity whose investment strategy is the most consistent with the opportunity being allocated, and second, if the terms of the opportunity are consistent with more than one entity's investment strategy, on an alternating basis. Although our investment professionals will endeavor to allocate investment opportunities in a fair and equitable manner, we and our common stockholders could be adversely affected to the extent investment opportunities are allocated among us and other investment vehicles managed or sponsored by, or affiliated with, our executive officers, directors and members of our investment adviser.

Fifth Street Management’s investment allocation policy is also designed to manage and mitigate the conflicts of interest associated with the allocation of investment opportunities if we are able to co-invest, either pursuant to Securities and Exchange Commission, or the SEC, interpretive positions or our exemptive order, with other accounts managed by our investment adviser and its affiliates. Generally, under the investment allocation, co-investments will be allocated pursuant to the conditions of the exemptive order. Under the investment allocation policy, a portion of each opportunity that is appropriate for us and any affiliated fund will be offered to us and such other eligible accounts as determined by Fifth Street Management and generally based on asset class, fund size and liquidity, among other factors. If there is a sufficient amount of securities to satisfy all participants, the securities will be allocated among the participants in accordance with their order size and if there is an insufficient amount of securities to satisfy all participants, the securities will be allocated pro rata based on each participating party’s capital available for investment in the asset class being allocated, up to the amount proposed to be invested

by each. In accordance with Fifth Street Management’s investment allocation policy, we might not participate in each individual opportunity, but will, on an overall basis, be entitled to participate equitably with other entities managed by Fifth Street Management and its affiliates. Fifth Street Management seeks to treat all clients fairly and equitably such that none receive preferential treatment vis-à-vis the others over time, in a manner consistent with its fiduciary duty to each of them; however, in some instances, especially in instances of limited liquidity, the factors may not result in pro rata allocations or may result in situations where certain funds receive allocations where others do not. See “Certain Relationships and Related Transactions, and Director Independence.”

Pursuant to the administration agreement with FSC CT, FSC CT furnishes us with the facilities, including our principal executive office, and administrative services necessary to conduct our day-to-day operations. We pay FSC CT its allocable portion of overhead and other expenses incurred by FSC CT in performing its obligations under the administration agreement, including a portion of the rent at market rates and compensation of our chief financial officer and chief compliance officer and their respective staffs.

New Investment Advisory Agreement

The following is a description of the New Investment Advisory Agreement, which has been in effect since October 17, 2017.

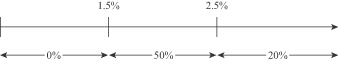

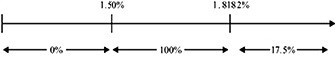

Management Services