OAKTREE STRATEGIC INCOME CORPORATION

FORM 10-K FOR THE YEAR ENDED SEPTEMBER 30, 20172020

TABLE OF CONTENTS

| PART I | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| PART II | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| PART III | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| PART IV | ||||||||

| Item 15. | ||||||||

PART I

Item 1. Business

General

Oaktree Strategic Income Corporation, (formerly known as Fifth Street Senior Floating Rate Corp. through October 17, 2017), a Delaware corporation, or together with its subsidiaries, where applicable, the Company, which may also be referred to as "we", "us"“we,” “us” or "our"“our”, is a specialty finance company dedicated to providing customized capital solutions for middle-market companies in both the syndicated and private placement markets. We were formed in May 2013, as a Delaware corporation, commenced operations on June 29, 2013, and currently operate as a closed-end, externally managed, non-diversified management investment company that has elected to be regulated as a business development companyBusiness Development Company under the Investment Company Act of 1940, as amended, or the 1940Investment Company Act. In addition, we have qualified and elected to be treated as a regulated investment company, or RIC, under the Internal Revenue Code of 1986, as amended, or the Code, for tax purposes. See “Taxation as a Regulated Investment Company.” As a RIC, we generally will not have to pay corporate-level U.S. federal income taxes on any net ordinary income or net realized capital gains that we distribute to our stockholders if we meet certain source-of-income, income distribution and asset diversification requirements. Also, we are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or JOBS Act, and take advantage of the exemption for emerging growth companies allowing us to temporarily forgo the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act. We do not take advantage of other disclosure or reporting exemptions for emerging growth companies under the JOBS Act.

We have invested primarily in senior secured loans, including first lien, unitranche and second lien debt instruments, that pay interest at rates which are determined periodically on the basis of a floating base lending rate, primarily the London-Interbank Offered Rate, or LIBOR, plus a premium. The senior loans in which we invest are typically made to U.S. and, to a limited extent, non-U.S. corporations, partnerships and other business entities in the middle-market which operate in various industries and geographical regions.

Our Adviser is generally focused on middle-market companies, which we define as companies with enterprise values of between $100 million and $750 million. We expect our portfolio to include primarily first lien floating rate senior secured financings although we may also make other investments. We generally invest in securities that are rated below investment grade by rating agencies or that would be rated below investment grade if they were rated. Below investment grade securities, which are often referred to as “high yield” and “junk,” have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. Our Former Adviser targeted middle-market companies with approximately $20 million to $120 million of EBITDA (generally defined as Earnings before Interest, Taxes, Depreciation and Amortization).

We are permitted to, and expect to continue to, finance our investments through borrowings. However, as a business development company,Business Development Company, subject to certain limited exceptions, we are generallycurrently only allowed to borrow amounts such that ourin accordance

1

with the asset coverage as definedrequirements in the 1940Investment Company Act. At a special meeting of stockholders held on July 10, 2018, our stockholders approved the application of the reduced asset coverage requirements in Section 61(a)(2) of the Investment Company Act equals at least 200% after such borrowing.to us, effective as of July 11, 2018. The reduced asset coverage requirements permit us to double the maximum amount of leverage that we employ will depend on our assessment of market conditions and other factors atare permitted to incur by reducing the time of any proposed borrowing, such as the maturity, covenant package and rate structureasset coverage requirements applicable to us from 200% to 150%. As a result of the proposed borrowings, our abilityreduced asset coverage requirement, we can incur $2 of debt for each $1 of equity as compared to raise funds through the issuance$1 of sharesdebt for each $1 of our common stock and the risks of such borrowings within the context of our investment outlook. Ultimately, we only intend to use leverage if the expected returns from borrowing to make investments will exceed the cost of such borrowing.equity. As of September 30, 2017,2020, we had a debt to equity ratio of 0.90x1.00x (i.e., one dollar of equity for each $0.90$1.00 of debt outstanding). Under current market conditions, we generally expect to target a debt to equity ratio of 1.00x to 1.40x (i.e., one dollar of equity for each $1.00 to $1.40 of debt outstanding).

Our principal executive office is located at 333 South Grand Avenue, 28th Floor, Los Angeles, CA 90071 and our telephone number is (213) 830-6300.

Our Investment Adviser, was formed in April 1995 andan affiliate of OCM, is a premier credit manager and leader among alternativeleading global investment managersmanagement firm headquartered in Los Angeles, California. Oaktree has $99.5 billion in assets under management asCalifornia, focused on less efficient markets and alternative investments. A number of September 30, 2017, with approximately 70% in credit strategies. The firm has an extensive global investment platform with more than 900 employees, including over 250the senior executives and investment professionals who have significant origination, structuringof our Adviser and underwriting expertise. Oaktree’s disciplined investment philosophy and commitment to credit investing and lendingits affiliates have been demonstrated acrossinvesting together for over 34 years and have generated impressive investment performance through multiple market cycles for more than 20 years. Oaktree emphasizescycles. Our Adviser and its affiliates emphasize an opportunistic, value-oriented and risk-controlled approach to investments in distressed debt, corporate debt (including mezzanine finance, high yieldhigh-yield debt and senior loans), control investing, real estate, convertible securities and listed equities. Oaktree manages

In 2019, Brookfield acquired a majority economic interest in OCG. OCG operates as an independent business within Brookfield, with its own product offerings and investment, marketing and support teams. Brookfield is a leading global alternative asset manager with a 120-year history and approximately $550 billion of assets forunder management (inclusive of Oaktree) across a wide varietybroad portfolio of clients, including manyreal estate, infrastructure, renewable power, credit and private equity assets. Commencing in 2022, OCG's founders, senior management and current and former employee-unitholders of OCG will be able to sell their remaining OCG units to Brookfield over time pursuant to an agreed upon liquidity schedule and approach to valuing such units at the time of liquidation. Pursuant to this liquidity schedule, the earliest year in which Brookfield could own 100% of the most significant investorsOCG business is 2029.

The primary firm-wide goal of our Adviser and OCM is to achieve attractive returns while bearing less than commensurate risk. Our Adviser believes that it can achieve this goal by taking advantage of market inefficiencies in which financial markets and their participants fail to accurately value assets or fail to make available to companies the world.capital that they reasonably require.

Our Adviser and its affiliates believe that their defining characteristic is adherence to the highest professional standards, which has yielded several important benefits. First and foremost, this characteristic has allowed our Adviser and its affiliates to attract and retain an extremely talented group of investment professionals, or the Investment Professionals, as well as accounting, valuation, legal, compliance and other administrative professionals. As of September 30, 2017, this client base includes 752020, our Adviser and its affiliates had more than 1,000 professionals in 19 cities and 14 countries, including 39 portfolio managers with an average experience of the 100 largest U.S. pension plans, the main pension fund25 years and approximately 1,000 years of 38 states incombined industry experience. Specifically, the United States, over 400 corporations, over 350 university, charitable and other endowments and foundations, over 350 non-U.S. institutional investors and 16 sovereign wealth funds.

2

Our Adviser and its immediate termination. The material terms of theaffiliates provide discretionary investment management services to be provided under the New Investment Advisory Agreement, other than the fee structure, are substantially the same as the Former Investment Advisory Agreement, except that services are provided by Oaktree.

Strategic Credit

Our Adviser's affiliates officially launched the Strategic Credit strategy in early 2013 as a step-out from the Distressed Debt strategy, to capture attractive investment opportunities that appear to offer too little return for distressed debt investors, but may pose too much uncertainty for high-yield bond creditors. The strategy seeks to achieve an attractive total return by investing in public and private revenue-generating, performing debt.

Strategic Credit focuses on U.S. and non-U.S. investment opportunities that arise from pricing inefficiencies that occur in the primary and secondary markets or from the financing needs of healthy companies with limited access to traditional lenders or public markets. Typical investments will be in high yield bonds and senior secured loans for borrowers that are in need of direct loans, rescue financings, or other capital solutions or that have had challenged or unsuccessful primary offerings.

The Investment Professionals employ a fundamental, value-driven opportunistic approach to credit investing, which seeks to benefit from the resources, relationships and proprietary information of the global investment platform of our Adviser and its affiliates.

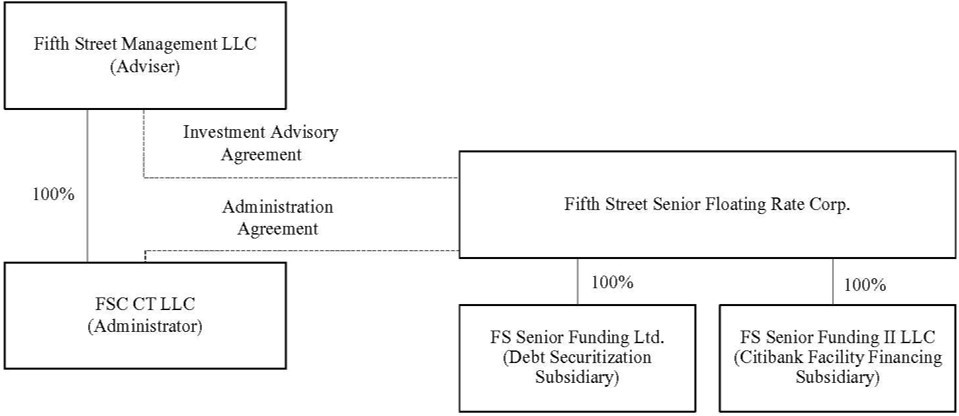

Our Administrator

We entered into an administration agreement, as amended from time to time, or the Administration Agreement, with Oaktree Administrator, a Delaware limited liability company and a wholly owned subsidiary of OCM. The principal executive offices of Oaktree Administrator are located at 333 South Grand Avenue, 28th Floor, Los Angeles, CA 90071. Pursuant to the Administration Agreement, Oaktree Administrator provides services to us, and we reimburse Oaktree Administrator for costs and expenses incurred by Oaktree as described belowAdministrator in performing its obligations under “-New Investment Advisory Agreement.” FSC CT LLC, or our Former Administrator, was a wholly-owned subsidiary of our Former Adviser. Our Former Administrator provided administrative services necessary for us to operate pursuant to an administrativethe Administration Agreement and loan services agreement, or the Former Administration Agreement. See “- Former Administration Agreement.”

Business Strategy

Emphasis on Proprietary Deals. Our Investment Adviser is primarily focused on proprietary opportunities as well as partnering with other lenders as appropriate and, to a lesser extent strategically accessing the broadly syndicated and private placement markets. Dedicated sourcing professionals of our Investment Adviser and its affiliates are in continuous contact with financial sponsors and corporate clients to originate proprietary deals and seek to leverage the networks and relationships of Oaktree’s over 250 investment professionalsInvestment Professionals with management teams and corporations to originate non-sponsored transactions. Since 2005, our Investment Adviser hasand its affiliates have invested more than $10$19 billion in over 200350 directly originated loans, and the Oaktree platform has the capacity to invest in large deals and to solely underwrite transactions.

•Focus On Quality Companies And Extensive Diligence. Our Investment Adviser seeks to maintain a conservative approach to investing with discipline around fundamental credit analysis and downside protection. Our Investment Adviser intends to focus on companies with resilient business models, we expect to be resilient in the future,strong underlying fundamentals, that will provide strength in future downturns, significant asset or enterprise value and seasoned management teams, although not all portfolio companies will meet each of these criteria. Our Investment Adviser intends to leverage its deep credit and deal structuring expertise to lend to companies that have unique needs, complex business models or specific business challenges. Our Investment Adviser conducts diligence on underlying collateral value, including cash flows, hard assets or intellectual property, and will typically model exit scenarios as part of the diligence process, including assessing potential “work-out” scenarios.

•Disciplined Portfolio Management. Our Investment Adviser monitors our portfolio on an ongoing basis to manage risk and take preemptive action to resolve potential problems where possible. Our Investment Adviser intends to seek to reduce the impact of individual investment risks by diversifying portfolios across industry sectors and, with the exception of investment vehicles with a diversified portfolio, limiting positions to no more than 5% of our portfolio.

•Manage Risk Through Loan Structures. Our Investment Adviser seeks to leverage its experience in identifying structural risks in prospective portfolio companies and developing creativecustomized solutions in an effort to enhance downside protection

3

•Concentrate on Floating Rate Senior Loans. We intend to concentrate on first lien secured loans that bear interest based on a floating rate. We believe that these loans, which are supported by a pledge of collateral, minimize the risk of principal loss. In addition,

•Completion of Rotation out of Non-Core Investments.Since an Oaktree affiliate became our investment adviser, Oaktree and its affiliates have reduced the investments identified as non-core by approximately $250 million at fair value. Oaktree intends to (1) continue to rotate out of a small number of investments where the underlying business fundamentals may expose us to significant risk of loss of principal, (2) focus on increasing the size of private first lien investments originated on Oaktree's platform (which we call "core investments" and (3) supplement the portfolio with interest rates near historically low levels, we believe that investing in floating rate loans provides us with positive exposure in a rising interest rate environment.broadly syndicated and select privately placed loans.

Our Investment Adviser’s emphasis is on fundamental credit analysis, consistency and downside protection, all of which are key tenets of its investment philosophy.philosophy and important during times of market dislocation, including during the COVID-19 pandemic. We believe this philosophy strongly aligns with the interests of our stockholders. Our Investment Adviser controls primarily for risk, rather than return. Although this may lead us to underperform in bullish markets, we expect that prudence across the economic cycle and limiting losses will allow us to achieve our investment objectives.

Identification of Investment CriteriaOpportunities

Macro Factors

Macro factors that drive market dislocations occur throughout the global economy and include sovereign debt crises, political elections, global pandemics, including the current COVID-19 pandemic, and other unexpected geopolitical events. These factors drive highly correlated “risk on” and “risk off” market swings and frequently result in the indiscriminate selling or buying of securities and obligations at prices that the Investment Professionals believe are well below or above their intrinsic values.

Market-Level Changes

We believe that many commercial banks have decreased their lending to middle-market companies in recent years, which has created an opportunity for non-traditional market participants. In addition, we believe that traditional capital providers are focusing on only higher-quality and more liquid opportunities. The lower-rated portion of the market is often less efficiently priced due to limited capital availability, which allows for more attractive risk and return opportunities.

Company Characteristics

Company-specific factors that drive market dislocations include over-leveraged balance sheets, near-term liquidity or maturity issues, secular pressures on businesses, acute shock to company operations (including from government shutdowns), asset-light businesses and new or relatively small issuers. These factors may result in mispriced securities or obligations or require a highly structured direct loan.

The Investment Professionals believe current market conditions give rise to two primary sources of investment opportunities with favorable risk-reward characteristics. The first source is private debt, which capitalizes on the Investment Professionals’ experience in negotiating and structuring complex debt investments. Private debt can include (a) loan portfolios that banks need to sell in response to regulatory capital pressure, (b) capital solutions, which involve customized, negotiated solutions for companies unable to access traditional syndicated loan and high yield markets, (c) rescue financings, which are transactions structured to provide liquidity to companies with overleveraged balance sheets, often on an urgent basis and (d) other direct loan investments to support acquisitions or capital projects that are unable to obtain financing via more traditional

4

channels. The second source is marketable securities or other forms of traded debt, which the Investment Professionals intend to purchase on the secondary market at prices they believe are below their intrinsic value.

Once the Investment Professionals have identified a potential investment opportunity, they will evaluate the opportunity against the following investment criteria and guidelines for identifying and investing in prospective portfolio companies.guidelines. However, not all of these criteria will be met by each prospective portfolio company in which we invest.

•Sustainable Cash Flow. Our investment philosophy places emphasis on fundamental analysis from an investor’s perspective and has a distinct value orientation. We intend to focus on companies with significant asset or enterprise value in which we can invest at relatively low multiples of normalized operating cash flow. Additionally, we anticipate investing in companies with a demonstrated ability or credible plan to de-lever. Typically, we will not invest in start-up companies, companies having speculative business plans or structures that could impair capital over the long-term although we may target certain earlier stage companies that have yet to reach profitability.

•Experienced Management Team. We generally will look to invest in portfolio companies with an experienced management team and proper incentive arrangements, including equity compensation, to induce management to succeed and to act in concert with our interests as investors.

•Strong Relative Position Inin Its Market. We intend to target companies with what we believe to be established and leading market positions within their respective markets and well-developed long-term business strategies.

•Exit Strategy. We generally intend to invest in companies that we believe will provide us with the opportunity to exit our investments in three to eight years, including through (1) the repayment of the remaining principal outstanding at maturity, (2) the recapitalization of the company resulting in our debt investments being repaid andor (3) the sale of the company resulting in the repayment of all of its outstanding debt.

Investment Process

Our investment process consists of the following five distinct stages.

investment opportunities and that we are well-positioned for difficult and complex transactions. In 2016, Oaktree’s Strategic Credit team evaluated more than 200 potential direct lending opportunities with total transaction value of approximately $30 billion. More than 85% of these potential direct lending opportunities were for transactions of $50 million or larger, and Oaktree’s Strategic Credit team continues to see a meaningful pipeline of sizeable transactions.

Screen Using Investment Criteria.Criteria

We expect to be highly selective in making new investments. The initial screening process will typically include a review of the proposed capital structure of the portfolio company, including level of assets or enterprise value coverage, an assessment by our Investment Adviser of the company’s management team and its equity ownership levels as well as the viability of its long-term business model, and a review of forecasted financial statements and liquidity profile. In addition, our Investment Adviser may assess the prospect of industry or macroeconomic catalysts that may create enhanced value in the investment as well as the potential ability to enforce creditor rights, particularly where collateral is located outside of the United States.

5

Research

Prior to making any new investment, our Investment Adviser intends to engage in an extensive due diligence process led by investment analysts assigned to each transaction. The analysts will assess a company’s management team, products, services, competitive position in its markets, barriers to entry and operating and financial performance, as well as the growth potential of its markets. In performing this evaluation, the analysts may use financial, descriptive and other due diligence materials provided by the target company, commissioned third party reports and internal sources, including members of the investment team, industry participants and experts with whom our Investment Adviser has relationships. As part of the research process, our Investment Adviser’s analysts typically perform a “what-if” analysis that explores a range of values for each proposed investment and a range of potential credit events.

Our Investment Adviser assesses each potential investment through a robust,rigorous, collaborative decision-making process. Our Investment Adviser applies disciplined investment criteria and evaluates potential risk and reward of each investment with significant focus on downside risk. Our Investment Adviser sizes investments at the portfolio level across a variety of characteristics, including based on the investment criteria described above.

Our Investment Adviser prioritizes managing risk. In managing our portfolio, our Investment Adviser intends to closely monitormonitors each portfolio company andto be well-positioned to make hold and exit decisions when credit events occur, our collateral becomes overvalued or opportunities with more attractive risk/reward profiles are identified. Investment analysts will beare assigned to each investment to monitor industry developments, review company financial statements, attend company presentations and regularly speak with company management. Based on their monitoring, the Investment Professionals seek to determine the optimal time and strategy for exiting and maximizing the return on the investment, typically when prices or yields reach target valuations. In circumstances where a particular investment is underperforming, our Investment Adviser intends to employ a variety of strategies to maximize its recovery based on the specific facts and circumstances of the underperforming investment, including actively working with the management to restructure all or a portion of the business, explore the possibility of a sale or merger of all or a portion of the assets, recapitalize or refinance the balance sheet, negotiate deferrals or other concessions from existing creditors and arrange new liquidity or new equity contributions. We believe that our Investment Adviser’s experience with restructurings and our access to our Investment Adviser’s deep knowledge, expertise and contacts in the distressed debt area will help us preserve the value of our investments.

Investments

Debt Investments

We intend to tailor the terms of each investment by negotiating a structure that seeks to protect our rights and manage our risk while creating incentives for the portfolio company to achieve its business plan. Our Adviser is generally focused on middle-market companies. A substantial source of return is monthly or quarterly cash interest that we collect on our debt investments. We expectinvestments, including payment-in-kind, or PIK, interest which represents contractual interest accrued and added to the principal that our Investment Adviser will focus on middle-market companies, which we define as companies with enterprise valuesgenerally becomes due at maturity. Our debt investments generally consist of between $100 and $750 million. Going forward, we expect our portfolio to include primarily first lien senior secured floating rate loans although we may also make other investments.the following:

6

•First Lien Loans. Our first lien loans generally have terms of three to seven years, provide for a variable or fixed interest rate, contain prepayment penalties and are secured by a first priority security interest in all existing and future assets of the borrower. We target first lien loans where interest is paid on a floating rate basis, often with a floor, based on the LIBOR rate. Our first lien loans may take many forms, including revolving lines of credit, term loans and acquisition lines of credit.

•Unitranche Loans. Our unitranche loans generally have terms of five to seven years and provide for a variable or fixed interest rate, contain prepayment penalties and are generally secured by a first priority security interest in all existing and future assets of the borrower. Our unitranche loans may take many forms, including revolving lines of credit, term loans and acquisition lines of credit. Unitranche loans typically provide a borrower with all of its capital except for common equity often with higher interest rates than those associated with traditional first lien loans.

•Second Lien Loans. Our second lien loans generally have terms of five to eight years, provide for a variable or fixed interest rate, contain prepayment penalties and are secured by a second priority security interest in all existing and future assets of the borrower. Our second lien loans may include payment-in-kind, or PIK, interest, which represents contractual interest accrued and added to the principal that generally becomes due at maturity.

Equity Investments

When we make a debt investment, we may also be granted equity, such as warrants to purchase common stock in the company in the same class of security as the sponsor receives upon funding. In addition, from time to timea portfolio company. To a lesser extent, we may also make preferred and/or common equity investments, which are usually in conjunction with a concurrent debt investment or the result of an investment restructuring. For non-control equity co-investments in connection with private equity sponsors. Weinvestments, we generally seek to structure our non-control equity investments such as direct equity co-investments, to provide us with minority rights provisions and event-driven put rights. We also seek to obtain limited registration rights in connection with these investments, which may include “piggyback” registration rights.

We have invested in FSFRand GF Equity Funding co-invest through the OCSI Glick JV, whichan unconsolidated Delaware limited liability company. The OCSI Glick JV was formed in October 2014 and began investing in April 2015 primarily in senior secured loans of middle market companies. We co-invest in these securities with GF Equity Funding through our investment in the OCSI Glick JV. The OCSI Glick JV is managed by a four person Board of Directors, two of whom are selected by us and two of whom are selected by GF Equity Funding. The OCSI Glick JV is capitalized as transactions are completed, and all portfolio decisions and investment decisions in respect of the OCSI Glick JV must be approved by its investment committee consisting of one representative selected by us and one representative selected by GF Equity Funding (with approval of each required). The members provide capital to the OCSI Glick JV in exchange for LLC equity interests, and we and GF Debt Funding 2014 LLC, or GF Debt Funding, an entity advised by affiliates of GF Equity Funding, provide capital to the OCSI Glick JV in exchange for subordinated notes, or the Subordinated Notes. Additionally, the OCSI Glick JV has a senior revolving credit facility with Deutsche Bank AG, New York Branch, or the JV Deutsche Bank Facility, with a reinvestment period end date and maturity date of September 30, 2021 and March 31, 2025, respectively, and, as of September 30, 2017, consisted2020, permits up to $90.0 million of borrowings. As of September 30, 2020 and September 30, 2019, the OCSI Glick JV had total capital commitments of $100.0 million, $87.5 million of which was from us and the remaining $12.5 million from GF Equity Funding and GF Debt Funding. At September 30, 2020, we had funded approximately $84.0 million of our commitment. As of September 30, 2020, our investment in the OCSI Glick JV was approximately $49.4 million at fair value. We do not consolidate the OCSI Glick JV in our Consolidated Financial Statements. As of September 30, 2020, OCSI Glick JV was invested in a portfolio of senior secured loans to 23 different borrowers40 portfolio companies in industries similar to the companies in our portfolio. FSFR Glick JV invests in middle-market and other corporate debt securities, including traditional senior debt that are secured by some or all of the company’s assets.

As a business development company, we are obligated to offer to provide significant managerial assistance to our portfolio companies and to provide it if requested. We provide managerial assistance to most of our portfolio companies as a general practice and we seek investments where such assistance is appropriate. We monitor the financial trends of each portfolio company to assess the appropriate course of action for each company and to evaluate overall portfolio quality. We have several methods of evaluating and monitoring the performance of our investments, including the following:

The following is a description of the New Investment Advisory Agreement, which has been in effect sinceAgreement. From October 17, 2017.2017 through May 3, 2020, we were externally managed by OCM pursuant to an investment advisory agreement. On May 4, 2020, OCM effected the novation of such investment advisory agreement to Oaktree. Immediately following such novation, we and Oaktree entered into a new investment advisory agreement with the same terms, including fee structure, as the investment advisory agreement with OCM. The term “Investment Advisory Agreement” refers collectively to the agreements with Oaktree and, prior to its novation, with OCM.

7

Management Services

•determines the composition of our portfolio, the nature and timing of the changes to our portfolio and the manner of implementing such changes;

•identifies, evaluates and negotiates the structure of the investments we make;

•executes, closes, monitors and services the investments we make;

•determines what securities and other assets we purchase, retain or sell; and

•performs due diligence on prospective portfolio companies.companies; and

•provides us with such other investment advisory, research and related services as we may, from time to time, reasonably required for the investment of our funds.

The New Investment Advisory Agreement provides that Oaktree’s services are not exclusive to us and Oaktree is generally free to furnish similar services to other entities so long as its services to us are not impaired.

Management Fee

Under the New Investment Advisory Agreement, we pay Oaktree a fee for its services under the investment advisory agreement consisting of two components: a base management fee and an incentive fee. The cost of both the base management fee payable to Oaktree and any incentive fees earned by Oaktree is ultimately borne by our common stockholders.

Base Management Fee

Under the New Investment Advisory Agreement, the base management fee onis calculated at an annual rate of 1.00% of total gross assets, including any investment made with borrowings, but excluding cash and cash equivalents, is 1.00%.equivalents.

Incentive Fee

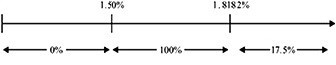

The incentive fee consists of two parts. Under the New Investment Advisory Agreement, the first part of the incentive fee, which is referred to as the incentive fee on income or the Part I incentive fee, is calculated and payable quarterly in arrears based upon our “pre-incentive fee net investment income” for the immediately preceding quarter. The payment of the incentive fee on income is subject to payment of a preferred return to investors each quarter (i.e., a “hurdle rate”), expressed as a rate of return on the value of our net assets at the end of the most recently completed quarter, of 1.50%, subject to a “catch up” feature.

For this purpose, “pre-incentive fee net investment income” means interest income, dividend income and any other income (including any other fees such as commitment, origination, structuring, diligence and consulting fees or other fees that we receive from portfolio companies, other than fees for providing managerial assistance) accrued during the fiscal quarter, minus our operating expenses for the quarter (including the base management fee, expenses payable under the New Administration Agreement and any interest expense and dividends paid on any issued and outstanding preferred stock, but excluding the incentive fee). Pre-incentive fee net investment income includes, in the case of investments with a deferred interest feature (such as original issue discount, or OID debt instruments with PIK interest and zero coupon securities), accrued income that we have not yet received in cash. Pre-incentive fee net investment income does not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation.

Under the New Investment Advisory Agreement, the calculation of the incentive fee on income for each quarter is as follows:

•No incentive fee is payable to Oaktree in any quarter in which our pre-incentive fee net investment income does not exceed the preferred return rate of 1.50% (the “preferred return”) on net assets.

•100% of our pre-incentive fee net investment income, if any, that exceeds the preferred return but is less than or equal to 1.8182% in any fiscal quarter is payable to Oaktree. We refer to this portion of the incentive fee on income as the “catch-up” provision, and it is intended to provide Oaktree with an incentive fee of 17.5% on all of our pre-incentive fee net investment income when our pre-incentive fee net investment income reaches 1.8182% on net assets in any fiscal quarter.

•For any quarter in which our pre-incentive fee net investment income exceeds 1.8182% on net assets, the subordinated incentive fee on income is equal to 17.5% of the amount of our pre-incentive fee net investment income, as the preferred return and catch-up will have been achieved.

There is no accumulation of amounts on the hurdle rate from quarter to quarter and accordingly there is no clawback of amounts previously paid if subsequent quarters are below the quarterly hurdle.

8

The following is a graphical representation of the calculation of the incentive fee on income under the New Investment Advisory Agreement:

Quarterly Incentive Fee on Income

Pre-incentive fee net investment income

(expressed as a percentage of net assets)

Percentage of pre-incentive fee net investment income

allocated to theincome-related portion of incentive fee on income

Under the New Investment Advisory Agreement, the second part of the incentive fee will beis determined and payable in arrears as of the end of each fiscal year (or upon termination of the investment advisory agreement,Investment Advisory Agreement, as of the termination date) commencing with the fiscal year endingended September 30, 2019 and will equalequals 17.5% of our realized capital gains, if any, on a cumulative basis from the beginning of the fiscal year endingended September 30, 2019 through the end of each subsequent fiscal year, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis, less the aggregate amount of any previously paid capital gain incentive fees under the New Investment Advisory Agreement. Any realized capital gains, realized capital losses, unrealized capital appreciation and unrealized capital depreciation with respect to the Company’sour portfolio as of the end of the fiscal year endingended September 30, 2018 will beare excluded from the calculations of the second part of the incentive fee.

Examples of Quarterly Incentive Fee Calculation under the New Investment Advisory Agreement (A)

Example 1: Incentive Fee on Income for Each Quarter

Alternative 1

Assumptions

Investment income (including interest, dividends, fees, etc.) = 1.75%

Preferred return under the New Investment Advisory Agreement1 = 1.50%

Management fee under the New Investment Advisory Agreement2 = 0.25%

Other expenses (legal, accounting, custodian, transfer agent, etc.) = 0.20%

Pre-incentive fee net investment income

Pre-incentive fee net investment income does not exceed the preferred return under the New Investment Advisory Agreement, therefore there is no incentive fee on income under the New Investment Advisory Agreement.

Alternative 2

Assumptions

Investment income (including interest, dividends, fees, etc.) = 2.25%

Preferred return under the New Investment Advisory Agreement1 = 1.50%

Management fee under the New Investment Advisory Agreement2 = 0.25%

Other expenses (legal, accounting, custodian, transfer agent, etc.) = 0.20%

Pre-incentive fee net investment income

Incentive fee = 17.5% × pre-incentive fee net investment income, subject to “catch-up”3

= 100% × (1.80% - 1.50%)

= 0.30%

9

Alternative 3

Assumptions

Investment income (including interest, dividends, fees, etc.) = 3.5%

Preferred return under the New Investment Advisory Agreement1 = 1.50%

Management fee under the New Investment Advisory Agreement2 = 0.25%

Other expenses (legal, accounting, custodian, transfer agent, etc.) = 0.20%

Pre-incentive fee net investment income

Incentive fee = 17.5% × pre-incentive fee net investment income, subject to “catch-up”3

Incentive fee = 100% × “catch-up” + (17.5% × (pre-incentive fee net investment income - 1.8182%))

Catch-up = 1.8182% - 1.50% = 0.3182%

Incentive fee = (100% × 0.3182%) + (17.5% × (3.05% - 1.8182%))

= 0.3182% + (17.5% × 1.2318%)

= 0.3182% + 0.2158%

= 0.534%

__________

(A) Solely for purposes of these illustrative examples, we have assumed that we have not incurred any leverage. However, we have in the past and expect to continue in the future to use leverage to partially finance our investments.

1.Represents 6.0% annualized preferred return.

2.Represents 1.0% annualized management fee.

3.The “catch-up” provision is intended to provide our Adviser with an incentive fee of 17.5% on all of our pre-incentive fee net investment income as if a preferred return did not apply when our net investment income exceeds 1.50% in any calendar quarter and is not applied once our Adviser has received 17.5% of investment income in a quarter. The “catch-up” portion of our pre-incentive fee net investment income is the portion that exceeds the 1.50% preferred return but is less than or equal to approximately 1.8182% (that is, 1.50% divided by (1 - 0.175)) in any fiscal quarter.

Example 2: Incentive Fee on Capital Gains under the New Investment Advisory Agreement

Assumptions

•Year 1: $10 million investment made in Company A (“Investment A”), $10 million investment made in Company B (“Investment B”), $10 million investment made in Company C (“Investment C”), $10 million investment made in Company D (“Investment D”) and $10 million investment made in Company E (“Investment E”).

•Year 2: Investment A sold for $20 million, fair market value (“FMV”) of Investment B determined to be $8 million, FMV of Investment C determined to be $12 million, and FMV of Investments D and E each determined to be $10 million.

•Year 3: FMV of Investment B determined to be $8 million, FMV of Investment C determined to be $14 million, FMV of Investment D determined to be $14 million and FMV of Investment E determined to be $16 million.

•Year 4: Investment D sold for $12 million, FMV of Investment B determined to be $10 million, FMV of Investment C determined to be $16 million and FMV of Investment E determined to be $14 million.

•Year 5: Investment C sold for $20 million, FMV of Investment B determined to be $14 million and FMV of Investment E determined to be $10 million.

•Year 6: Investment B sold for $16 million and FMV of Investment E determined to be $8 million.

•Year 7: Investment E sold for $8 million and FMV.

10

These assumptions are summarized in the following chart:

| Investment A | Investment B | Investment C | Investment D | Investment E | Cumulative Unrealized Capital Depreciation | Cumulative Realized Capital Losses | Cumulative Realized Capital Gains | |||||||||||||||||||

| Year 1 | $10 million (cost basis) | $10 million (cost basis) | $10 million (cost basis) | $10 million (cost basis) | $10 million (cost basis) | -- | -- | -- | ||||||||||||||||||

| Year 2 | $20 million (sale price) | $8 million FMV | $12 million FMV | $10 million FMV | $10 million FMV | $2 million | -- | $10 million | ||||||||||||||||||

| Year 3 | -- | $8 million FMV | $14 million FMV | $14 million FMV | $16 million FMV | $2 million | -- | $10 million | ||||||||||||||||||

| Year 4 | -- | $10 million FMV | $16 million FMV | $12 million (sale price) | $14 million FMV | -- | -- | $12 million | ||||||||||||||||||

| Year 5 | -- | $14 million FMV | $20 million (sale price) | -- | $10 million FMV | -- | -- | $22 million | ||||||||||||||||||

| Year 6 | -- | $16 million (sale price) | -- | -- | $8 million FMV | $2 million | -- | $28 million | ||||||||||||||||||

| Year 7 | -- | -- | -- | -- | $8 million (sale price) | -- | $2 million | $28 million | ||||||||||||||||||

The Incentive Fee on Capital Gains under the New Investment Advisory Agreement would be:

•Year 1: None

•Year 2: Capital Gains Fee = 17.5% multiplied by ($10 million realized capital gains on sale of Investment A less $2 million cumulative capital depreciation) = $1.4 million

•Year 3: Capital Gains Fee = (17.5% multiplied by ($10 million cumulative realized capital gains less $2 million cumulative capital depreciation)) less $1.4 million cumulative Capital Gains Fee previously paid = $1.4 million less $1.4 million = $0.00 million

•Year 4: Capital Gains Fee = (17.5% multiplied by ($12 million cumulative realized capital gains)) less $1.4 million cumulative Capital Gains Fee previously paid = $2.1 million less $1.4 million = $0.7 million

•Year 5: Capital Gains Fee = (17.5% multiplied by ($22 million cumulative realized capital gains)) less $2.1 million cumulative Capital Gains Fee previously paid = $3.85 million less $2.1 million = $1.75 million

•Year 6: Capital Gains Fee = (17.5% multiplied by ($28 million cumulative realized capital gains less $2 million cumulative capital depreciation)) less $3.85 million cumulative Capital Gains Fee previously paid = $4.55 million less $3.85 million = $0.70 million

•Year 7: Capital Gains Fee = (17.5% multiplied by ($28 million cumulative realized capital gains less $2 million cumulative realized capital losses)) less $4.55 million cumulative Capital Gains Fee previously paid = $4.55 million less $4.55 million = $0.00 million

Collection and Disbursement of Fees Owed to Our Former Adviser

Under the Former Investment Advisory Agreement described below, both the base management fee and incentive fee on income were calculated and paid to our Former Adviser (as defined below) at the end of each quarter. In order to ensure that our Former Adviser receivesreceived any compensation earned during the quarter endingended December 31, 2017, the initial payment of the base management fee and incentive fee on income under the New Investment Advisory Agreement will covercovered the entire quarter in which the New Investment Advisory Agreement became effective, and bewas calculated at a blended rate that will reflectreflected fee rates under the respective investment advisory agreements for the portion of the quarter in which our Former Adviser and OaktreeOCM were serving as investment adviser. This structure will allow Oaktreeallowed OCM to pay our Former Adviser in early 2018, the pro rata portion of the fees that were earned by, but not paid to, our Former Adviser for services rendered to us prior to October 17, 2017.2017 of $0.3 million.

Duration and Termination

Unless earlier terminated as described below, the New Investment Advisory Agreement will remain in effect until October 17, 2019September 30, 2021 and thereafter from year-to-year if approved annually by our Board or by the affirmative vote of the holders of a majority of our outstanding voting securities, including, in either case, approval by a majority of our directors who are not interested persons. The New Investment Advisory Agreement will automatically terminate in the event of its assignment. The New Investment Advisory Agreement may be terminated by either party without penalty upon 60 days’ written notice to the other.

11

The New Investment Advisory Agreement may also be terminated, without penalty, upon the vote of a majority of our outstanding voting securities.

Indemnification

The New Investment Advisory Agreement provides that, absent willful misfeasance, bad faith or gross negligence in the performance of their respective duties or by reason of the reckless disregard of their respective duties and obligations, Oaktree and its officers, managers, partners, members (and their members, including the owners of their members), agents, employees, controlling persons members (or their owners) and any other person or entity affiliated with it, are entitled to indemnification from us for any damages, liabilities, costs and expenses (including reasonable attorneys’ fees and amounts reasonably paid in settlement) arising from the rendering of Oaktree’s services under the New Investment Advisory Agreement or otherwise as our investment adviser.

Fee Waiver

For the two-year period commencing on October 17, 2017, Oaktree will waive, to the extent necessary, anyOCM waived management orand incentive fees payable under the New Investment Advisory Agreement that exceedexceeded what would have been paid to the Former Adviser in the aggregate under the Former Investment Advisory Agreement.

Organization of our Investment Adviser

Our Investment Adviser is a Delaware limited partnershipliability company that is registered as an investment adviser under the Advisers Act. The principal address of our Investment Adviser is 333 South Grand Avenue, 28th Floor, Los Angeles, CA 90071.

Board Approval of the New Investment Advisory Agreement

•the nature, extent and quality of services to be performed by Oaktree;OCM;

•the investment performance of us and funds managed by Oaktree;OCM with a similar investment objective to us;

•the expected costs of services to be provided and the anticipated profits to be realized by OaktreeOCM and its affiliates from their relationship with us;

•the possible economies of scale that would be realized due to our growth;

•whether fee levels reflect such economies of scale for the benefit of investors; and

•comparisons of services to be rendered to and fees to be paid by us with the services provided by and the fees paid to other investment advisers and the services provided to and the fees paid by other Oaktree clients.OCM clients; and

No single factor was determinative of the decision of theour Board of Directors, including all of the then-current independent directors, to approve the New Investment Advisory Agreement and individual directors may have weighed certain factors differently. Throughout the process, the independent directors were advised by independent counsel. Following this process, the then-current members of theour Board of Directors, including all of the then-current independent directors, unanimously voted to approve the New Investment Advisory Agreement subject to stockholder approval. Our stockholders approved the New Investment Advisory Agreement aton June 28, 2019.

Our Board of Directors met with Oaktree and OCM to consider to the Special Meeting.approval of the novation and assumption of the Investment Advisory Agreement by OCM and Oaktree, respectively, and of the new Investment Advisory Agreement between the Company and Oaktree. On April 30, 2020, our Board of Directors, including all of the independent directors, unanimously approved the novation and assumption of the Investment Advisory Agreement with OCM and entry into the Investment Advisory Agreement with Oaktree. In reaching such decision, our Board of Directors considered, among other items, that the level and quality of services and the personnel providing such services would remain unchanged, that Oaktree and OCM are under common control and that the terms and conditions of the Investment Advisory Agreement (other than the parties) would remain unchanged.

12

Payment of Our Expenses

Our primary operating expenses are the payment of (i) a base management fee and any incentive fees as described below in “-Former Investment Advisory Agreement” with respect to the period prior to October 17, 2017 and as described above in “-New Investment Advisory Agreement” with respect to the period subsequent to that date and (ii) the allocable portion of overhead and other expenses incurred by our Former Administrator or Oaktree Administrator as applicable, in performing its obligations under the Former Administration Agreement or New Administration Agreement, as applicable.Agreement. Our management fee compensates our investment adviserAdviser for its work in identifying, evaluating, negotiating, executing and servicing our investments. We generally bear all other expenses of our operations and transactions, including (without limitation) fees and expenses relating to:

•expenses of offering our debt and equity securities;

•the investigation and monitoring of our investments;

•the cost of calculating our net asset value;

•the cost of effecting sales and repurchases of shares of our common stock and other securities;

•management and incentive fees payable pursuant to the investment advisory agreement;Investment Advisory Agreement;

•fees payable to third parties relating to, or associated with, making investments and valuing investments (including third-party valuation firms);

•transfer agent, trustee and custodial fees;

•interest payments and other costs related to our borrowings;

•fees and expenses associated with marketing efforts (including attendance at investment conferences and similar events);

•federal and state registration fees;

•any exchange listing fees;

•federal, state and local taxes;

•independent directors’ fees and expenses;

•brokerage commissions;

•costs of mailing proxy statements, stockholders’ reports and notices;

•costs of preparing government filings, including periodic and current reports with the SEC;

•fidelity bond, liability insurance and other insurance premiums; and

•printing, mailing, independent accountants and outside legal costs and all other direct expenses incurred by either our administrator or us in connection with administering our business, including payments under the administration agreement.Administration Agreement.

Former Investment Advisory Agreement

Prior to October 17, 2017, we were externally managed and advised by Fifth Street Management LLC, which we refer to as our “Former Adviser”. The following is a description of the Former Investment Advisory Agreement, which was terminated on October 17, 2017. The Former Investment Advisory Agreement, dated June 27, 2013, was most recently approved by our Board of Directors on August 7, 2017, and was effective June 27, 2013 through its termination on October 17, 2017.

Management Fee

Through October 17, 2017, we paid our Former Adviser a fee for its services under the Former Investment Advisory Agreement consisting of two components: a base management fee and an incentive fee. The cost of both the base management fee paid to our Former Adviser and any incentive fees earned by our Former Adviser were ultimately borne by our common stockholders.

Base Management Fee

The base management fee was calculated at an annual rate of 1.0% of our gross assets, including any borrowings for investment purposes but excluding cash and cash equivalents. The base management fee was payable quarterly in arrears and the fee for any partial month or quarter was appropriately prorated.

Incentive Fee

The incentive fee paid to our Former Adviser had two parts. The first part was calculated and payable quarterly in arrears based on our pre-incentive fee net investment income for the immediately preceding fiscal quarter. Pre-incentive fee net investment income, expressed as a rate of return on the value of our net assets at the end of the immediately preceding quarter was comparedsubject to a “hurdle rate” of 1.5% per quarter, subject toand a “catch-up” provision measured as of the end of each quarter.provision. Our net investment income used to calculate this part of the incentive fee was also included in the amount of our gross assets used to calculate the 1.0% base management fee. The operation of the incentive fee with respect to our pre-incentive fee net investment income for each quarter was as follows:

There was no accumulation of amounts on the hurdle rate from quarter to quarter and accordingly there was no clawback of amounts previously paid if subsequent quarters were below the quarterly hurdle and there was no delay of payment if prior quarters were below the quarterly hurdle.

The second part of the incentive fee was determined and payable in arrears as of the end of each fiscal year (or upon termination of the Former Investment Advisory Agreement, as of the termination date) commencing on September 30, 2013 and equaled 20% of our realized capital gains, if any, on a cumulative basis from inception through the end of each fiscal year, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis, less the aggregate amount of any previously paid capital gain incentive fees.

13

Effective October 17, 2017.

Oaktree Administrator will also provideprovides portfolio collection functions for interest income, fees and warrants and is responsible for the financial and other records that we are required to maintain, and prepares, prints and disseminates reports to our stockholders and all other materials filed with the SEC. In addition, Oaktree Administrator will assistassists us in determining and publishing our net asset value, overseeing the preparation and filing of our tax returns, and generally overseeing the payment of our expenses and the performance of administrative and professional services rendered to us by others. Oaktree Administrator may also offer to provide, on our behalf, managerial assistance to our portfolio companies.

For providing these services, facilities and personnel, we will reimburse Oaktree Administrator the allocable portion of overhead and other expenses incurred by Oaktree Administrator in performing its obligations under the New Administration Agreement, including our allocable portion of the rent of the Company’sour principal executive offices (which are located in a building owned by a Brookfield affiliate) at market rates and the Company’sour allocable portion of the costs of compensation and related expenses of our Chief Financial Officer, Chief Compliance Officer, their staffs and other non-investment professionals at Oaktree that perform duties for us. Such reimbursement is at cost, with no profit to, or markup by, Oaktree Administrator.

The New Administration Agreement provides that, absent willful misfeasance, bad faith or gross negligence in the performance of their respective duties or by reason of the reckless disregard of their respective duties and obligations, Oaktree Administrator and its officers, managers, partners, agents, employees, controlling persons, members (or their owners) and any other person or entity affiliated with it, are entitled to indemnification from us for any damages, liabilities, costs and expenses (including reasonable attorneys’ fees and amounts reasonably paid in settlement) arising from the rendering of Oaktree Administrator’s services under the New Administration Agreement or otherwise as our administrator. Unless earlier terminated as described below, the New Administration Agreement will remain in effect until October 17, 2019September 30, 2021 and thereafter from year-to-year if approved annually by our Board of Directors or by the affirmative vote of the holders of a majority of our outstanding voting securities, including, in either case, approval by a majority of our directors who are not interested persons. The New Administration Agreement may be terminated by either party without penalty upon 60 days’ written notice to the other. The New Administration Agreement may also be terminated, without penalty, upon the vote of a majority of our outstanding voting securities.

Former Administration Agreement

Competition

We operate in a highly competitive market for investment opportunities. We compete for investments with various other investors, such as other public and private funds, other Business Development Companies, commercial and investment banks, commercial finance companies and to the extent they provide an alternative form of financing, private equity funds, some of which may be our affiliates. Other Oaktree funds may have investment objectives that overlap with ours, which may create competition for investment opportunities. Many competitors are substantially larger and have considerably greater financial, technical and marketing resources than we do. For example, some competitors may have a lower cost of funds and access to

14

funding sources that will not be available to us. In addition, some of our competitors may have higher risk tolerances or different risk assessments than we do, which could allow them to consider a wider variety of investments and establish more relationships than us. Furthermore, many of our competitors are not subject to the regulatory restrictions that the Investment Company Act and the Code impose on us. The Formercompetitive pressures could impair our business, financial condition and results of operations. As a result of this competition, we may not be able to take advantage of attractive investment opportunities. See “Item 1A. Risk Factors – Risks Relating to Our Business and Structure – We may face increasing competition for investment opportunities, which could reduce returns and result in losses."

Staffing

We do not currently have any employees and do not expect to have any employees. Services necessary for our business are provided through the Administration Agreement provided indemnification similar to that described under "- New Administrative Servicesand the Investment Advisory Agreement."

Our executive officers and directors, and certain members of our Investment Adviser, serve or may serve as officers, directors or principals of entities that operate in the same or a related line of business as we do or of investment funds managed by our affiliates. For example, Oaktree presently serves as the investment adviser to OCSL, a publicly-traded business development company withBusiness Development Company, and Oaktree Strategic Income II, Inc., or OSI II, a portfolioprivate Business Development Company. All of approximately $1.5 billion at fair valueour executive officers serve in substantially similar capacities for OCSL and OSI II, all of our independent directors serve as independent directors of September 30, 2017.OCSL, and one of our independent directors serves as an independent director of OSI II. OCSL has historically invested in senior secured loans, including first lien, unitranche and second lien debt and equityinstruments that pay interest at rates which are determined periodically on the basis of small and mid-sizeda floating base lending rate, made to private middle-market companies primarily in connection with investments by private equity sponsors, including in middle-market leveraged companieswhose debt is rated below investment grade, similar to those we target for investment. In addition, though not the primary focus of its investment portfolio, OCSL’s investmentsOSI II also include floating rate senior loans. Therefore, there may be certain investment opportunities that satisfy the investment criteria for both OCSL and us. OCSL operates as a distinct and separate public company and any investment in our common stock will not be an investment in OCSL. In addition, all of

For example, the personnel of our Investment Adviser may face conflicts of interest in the allocation of investment opportunities to us and such other funds and accounts.

Oaktree has investment allocation guidelines that govern the allocation of investment opportunities among the investment funds and accounts managed or sub-advised by Oaktree and its affiliates. To the extent an investment opportunity is appropriate for us or OCSL, OSI II or any other investment fund or account managed or sub-advised by Oaktree or its affiliates, Oaktree will adhere to its investment allocation guidelines in order to determine a fair and equitable allocation.

We may invest alongside funds and accounts managed or sub-advised by our Investment Adviser and its affiliates in certain circumstances where doing so is consistent with applicable law and SEC staff interpretations. For example, we may invest alongside such accounts consistent with guidance promulgated by the staff of the SEC permitting us and such other accounts to purchase interests in a single class of privately placed securities so long as certain conditions are met, including that our Investment Adviser, acting on our behalf and on behalf of other clients, negotiates no term other than price or terms related to price.

In addition, on October 18, 2017, affiliates of our Investment Adviser received exemptive relief from the SEC to allow certain managed funds and accounts, each of whose investment adviser is OaktreeOCM or an investment adviser controlling, controlled by or under common control with Oaktree,OCM, such as our Adviser, to participate in negotiated co-investment transactions where doing so is consistent with the applicable registered fund’s or business development company’sBusiness Development Company’s investment objective and strategies as well as regulatory requirements and other pertinent factors, and pursuant to the conditions of the exemptive relief. Each potential co-investment opportunity that falls under the terms of the exemptive relief and is appropriate for us and any affiliated fund or account, and satisfies the then-current board-established criteria, will be offered to us and such other eligible funds and accounts. If there is a sufficient amount of securities to satisfy all participants, the securities will be allocated among the participants in accordance with their proposed order size and if there is an insufficient amount of securities to satisfy all participants, the securities will be allocated pro rata based on the investment proposed by the applicable investment adviser to such participant, up to the amount proposed to be invested by each, which is reviewed and approved by an independent committee of legal, compliance and accounting professionals at our Investment Adviser. We, with our Adviser and certain other affiliates, have submitted an application to the SEC for exemptive relief that would modify the terms of our existing exemptive relief to allow proprietary accounts to participate in co-investment transactions subject to certain conditions. We may also invest alongside funds managed by our Adviser and its affiliates in certain circumstances where doing so is consistent with applicable law and SEC staff interpretations. For example, we may invest alongside such accounts consistent with guidance promulgated

15

by the staff of the SEC permitting us and such other accounts to purchase interests in a single class of privately placed securities so long as certain conditions are met, including that our Adviser, acting on our behalf and on behalf of other clients, negotiates no term other than price.

Although Oaktree will endeavor to allocate investment opportunities in a fair and equitable manner, we and our common stockholders could be adversely affected to the extent investment opportunities are allocated among us and other investment vehicles managed or sponsored by, or affiliated with, our executive officers, directors and members of our Investment Adviser. We might not participate in each individual opportunity, but will, on an overall basis, be entitled to participate equitably with other entities managed by Oaktree and its affiliates. Oaktree seeksis committed to treattreating all clients fairly and equitably over time such that none receive preferential treatment vis-à-vis the others over time, in a manner consistent with its fiduciary duty to each of them; however, in some instances, especially in instances of limited liquidity, the factors may not result in pro rata allocations or may result in situations where certain funds or accounts receive allocations where others do not.

Pursuant to the New Investment Advisory Agreement, our Investment Adviser’s liability is limited and we are required to indemnify our Investment Adviser against certain liabilities. This may lead our Investment Adviser to act in a riskier manner in performing its duties and obligations under the New Investment Advisory Agreement than it would if it were acting for its own account, and creates a potential conflict of interest.

Pursuant to the New Administration Agreement, the Oaktree Administrator furnishes us with the facilities, including our principal executive office, and administrative services necessary to conduct our day-to-day operations. We pay the Oaktree Administrator its allocable portion of overhead and other expenses incurred by the Oaktree Administrator in performing its obligations under the New Administration Agreement, including, without limitation, a portion of the rent at market rates and compensation of our Chief Financial Officer, Chief Compliance Officer, their respective staffs and other non-investment professionals at Oaktree that perform duties for us.

We maintainhave elected to be treated, and intend to qualify annually, as a website at www.oaktreestrategicincome.com. The informationRIC for U.S. federal income tax purposes under Subchapter M of the Code. As a RIC, we generally will not be required to pay corporate-level federal income taxes on our website is not incorporated by reference in this annual report on Form 10-K. We make available onany ordinary income or through our website certain reports and amendments to those reportscapital gains that we file withdistribute to our stockholders as dividends. To continue to qualify as a RIC, we must, among other things, meet certain source-of-income and asset diversification requirements (as described below). In addition, to qualify for RIC tax treatment we must distribute to our stockholders, for each taxable year, at least 90% of the Company’s “investment company taxable income” for that year, which is generally its ordinary income plus the excess of its realized net short-term capital gains over its realized net long-term capital losses, or furnishthe Annual Distribution Requirement.

If we:

•qualify as a RIC; and

•satisfy the Annual Distribution Requirement;

then we will not be subject to federal income tax on the portion of our investment company taxable income and net capital gain (i.e., realized net long-term capital gains in excess of realized net short-term capital losses) we distribute to stockholders. We are subject to U.S. federal income tax at the regular corporate rates on any income or capital gain not distributed (or deemed distributed) to our stockholders.

We will be subject to a 4% nondeductible federal excise tax on certain undistributed income unless we distribute in a timely manner an amount at least equal to the SECsum of (1) 98% of our ordinary income for each calendar year, (2) 98.2% of our capital gain net income for the one-year period ending October 31 in accordancethat calendar year and (3) any income realized, but not distributed, and on which we paid no federal income tax, in preceding years.

In order to maintain our qualification as a RIC for federal income tax purposes, we must, among other things:

•at all times during each taxable year, have in effect an election to be treated as a Business Development Company under the Investment Company Act;

•derive in each taxable year at least 90% of our gross income from (a) dividends, interest, payments with respect to certain securities (including loans), gains from the Securities Exchangesale of stock or other securities or currencies, or other income derived with respect to our business of investing in such stock, securities or currencies and (b) net income derived from an interest in a “qualified publicly traded partnership;” (the “90% Gross Income Test”) and

•diversify our holdings so that at the end of each quarter of the taxable year:

16

◦(i) at least 50% of the value of our assets consists of cash, cash equivalents, U.S. government securities, securities of other RICs, and other securities if such other securities of any one issuer do not represent more than 5% of the value of its assets or more than 10% of the outstanding voting securities of the issuer; and

◦(ii) no more than 25% of the value of our assets is invested in (a) the securities, other than U.S. government securities or securities of other RICs, of one issuer, (b) the securities of two or more issuers that are controlled, as determined under applicable tax rules, by us and that are engaged in the same or similar or related trades or businesses or (c) the securities of one or more “qualified publicly traded partnerships” ((i) and (ii) collectively, the “Diversification Tests”).

We may be required to recognize taxable income in circumstances in which we do not receive cash. For example, if we hold debt obligations that are treated under applicable tax rules as having OID (such as debt instruments with increasing interest rates or debt instruments issued with warrants), we must include in income each year a portion of the OID that accrues over the life of the obligation, regardless of whether cash representing such income is received by us in the same taxable year. Because any OID accrued will be included in our investment company taxable income for the year of accrual, we may be required to make a distribution to our stockholders in order to satisfy the Annual Distribution Requirement, even though we will not have received any corresponding cash amount.

Because we use debt financing, we are subject to certain asset coverage ratio requirements under the Investment Company Act described above and financial covenants under loan and credit agreements that could, under certain circumstances, restrict us from making distributions necessary to satisfy the Annual Distribution Requirement. If we are unable to obtain cash from other sources or are otherwise limited in our ability to make distributions, we could fail to qualify for RIC tax treatment and thus become subject to corporate-level income tax.

Certain of 1934,our investment practices may be subject to special and complex U.S. federal income tax provisions that may, among other things: (a) disallow, suspend or otherwise limit the allowance of certain losses or deductions; (b) convert lower taxed long-term capital gain into higher taxed short-term capital gain or ordinary income; (c) convert an ordinary loss or a deduction into a capital loss (the deductibility of which is more limited); (d) cause us to recognize income or gain without a corresponding receipt of cash; (e) adversely affect the time as amended,to when a purchase or sale of securities is deemed to occur; (f) adversely alter the Exchange Act. These includecharacterization of certain complex financial transactions; or (g) produce income that will not be qualifying income for purposes of the 90% gross income test described above. We will monitor our annual reports on Form 10-K,transactions and may make certain tax elections in order to mitigate the potential adverse effect of these provisions.

If, in any particular taxable year, we do not qualify as a RIC, all of our quarterly reports on Form 10-Qtaxable income (including our net capital gains) will be subject to tax at regular corporate rates without any deduction for distributions to stockholders, and distributions will be taxable to the stockholders as ordinary dividends to the extent of our current reports

Business Development Company Regulations

We have elected to be regulated as a business development companyBusiness Development Company under the 1940Investment Company Act. As with other companies regulated by the Investment Company Act, a Business Development Company must adhere to certain substantive regulatory requirements. The 1940Investment Company Act contains prohibitions and restrictions relating to transactions between business development companiesBusiness Development Companies and their affiliates (including any investment advisers), principal underwriters and affiliates of those affiliates or underwriters.

The 1940Investment Company Act further requires that a majority of our directors be persons other than “interested persons,” as that term is defined in the 1940Investment Company Act. In addition, the 1940 Act provides that we may not change the nature of our business so as to cease to be, or to withdraw our election as, a business development companyBusiness Development Company unless approvedauthorized by a majorityvote of our outstanding voting securities.

We are not generally able to issue and sell our common stock at a price below net asset value per share. We may, invest uphowever, sell our common stock, warrants, options or rights to 100%acquire our common stock, at a price below the current net asset value of our assets in securities acquired directly from issuers in privately negotiated transactions. With respect to such securities, we may, for the purpose of public resale, be deemed an “underwriter” as that term is defined in the Securities Act of 1933, as amended, or the Securities Act. Our intention is to not write (sell) or buy put or call options to manage risks associated with the publicly traded securities of our portfolio companies, except that we may enter into hedging transactions to manage the risks associated with interest rate and foreign exchange fluctuations. However, we may purchase or otherwise receive warrants to purchase the common stock if our Board of Directors determines that such sale is in our best interests and that of our portfolio companiesstockholders, and our stockholders approve such sale. In any such case, the price at which our securities are to be issued and sold may not be less than a price which, in connection with acquisition financing or other investments. Similarly, in connection with an acquisition, we may acquire rights to require the issuersdetermination of acquired securities or their affiliates to repurchaseour Board of Directors, closely approximates the market value

17

of such securities under certain circumstances.(less any distributing commission or discount). We may also make rights offerings to our stockholders at prices per share less than the net asset value per share, subject to applicable requirements of the Investment Company Act.

Investment Restrictions