UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

| | | | |

X☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20172021

or

|

| | | | |

—☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 001-35971

ALLEGION PUBLIC LIMITED COMPANY

(Exact name of registrant as specified in its charter)charter)

|

| | | | | | | |

| Ireland | | 98-1108930 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer

Identification No.)

|

Block D

Iveagh Court

Harcourt Road

Dublin 2, D02 VH94, Ireland

(Address of principal executive offices)offices, including zip code)

+(353) (1) 2546200

(Registrant’s telephone number, including area code: +(353) (1) 2546200code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | | | | |

| Title of each class | Trading symbols | Name of each exchange on which registered |

Ordinary Shares,shares, par value $0.01 per share | ALLE | New York Stock Exchange |

Par Value $0.01 per Share3.500% Senior Notes due 2029 | ALLE 3 ½ | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES Yes x NO No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES Yes ¨ NO No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES Yes x NO No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES Yes x NO No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. YES x NO ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer"filer," "smaller reporting company," and "smaller reporting"emerging growth company" in Rule 12b-2 of the Exchange Act.:

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| | | |

Large accelerated filer | x | Accelerated filer | ¨

|

| | | |

| Non-accelerated filer | ¨

☐ | Smaller reporting company | ¨

☐ |

(Do not check if a smaller reporting company) | | | |

| | Emerging growth company | ¨

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO x

Yes ☐ No ☒

The aggregate market value of ordinary shares held by non-affiliates on June 30, 20172021 was approximately $7.7$12.5 billion based on the closing price of such stock on the New York Stock Exchange.

The number of ordinary shares outstanding of Allegion plc as of February 16, 201810, 2022 was 95,185,418.88,230,442.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be filed within 120 days of the close of the registrant’s fiscal year in connection with the registrant’s Annual General Meeting of Shareholders to be held June 5, 20182, 2022 (the "Proxy Statement") are incorporated by reference into Part II and Part III of this Form 10-K.10-K as described herein.

ALLEGION PLC

Form 10-K

For the Fiscal Year Ended December 31, 20172021

TABLE OF CONTENTS

| | | | | | | | | | | |

| | | Page |

| Part I | Item 1. | | |

| | | |

| | | Page |

Part I | Item 1.1A. | | |

| | | |

| Item 1A.1B. | | |

| | | |

| Item 1B. | | |

| | | |

| Item 2. | | |

| | | |

| Item 3. | | |

| | | |

| Item 4. | | |

| | | |

| Part II | Item 5. | | |

| | | |

| Item 6. | | |

| | | |

| Item 7. | | |

| | | |

| Item 7A. | | |

| | | |

| Item 8. | | |

| | | |

| Item 9. | | |

| | | |

| Item 9A. | | |

| | | |

| Item 9B. | | |

| | | |

| Item 9C. | | |

| | | |

| Part III | Item 10. | | |

| | | |

| Item 11. | | |

| | | |

| Item 12. | | |

| | | |

| Item 13. | | |

| | | |

| Item 14. | | |

| | | |

| Part IV | Item 15. | | |

| | | |

| Item 16. | | |

| | | |

| | | |

CAUTIONARY STATEMENT FOR FORWARD LOOKING STATEMENTS

Certain statements in this report, other than purely historical information, are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally are identified by the words "believe," "project," "expect," "anticipate," "estimate," "forecast," "outlook," "intend," "strategy," "future", "opportunity", "plan," "may," "should," "will," "would," "will be," "will continue," "will likely result," or the negative thereof or variations thereon or similar terminologyexpressions generally intended to identify forward-looking statements.

Forward-looking statements may relate to such matters asas: statements regarding the continued impacts of the global COVID-19 pandemic, supply chain constraints, electronic component and labor shortages, inflation, rising freight and material costs, projections of revenue, margins, expenses, tax provisions, earnings, cash flows, benefit obligations, dividends, share purchases or other financial items; any statements of the plans, strategies and objectives of management for future operations, including those relating to any statements concerning expected development, performance or market share relating to our products and services; any statements regarding future economic conditions or our performance; any statements regarding pending investigations, claims or disputes; any statements of expectation or belief; and any statements of assumptions underlying any of the foregoing. These statements are based on currently available information and our current assumptions, expectations and projections about future events. While we believe that our assumptions, expectations and projections are reasonable in view of the currently available information, you are cautioned not to place undue reliance on our forward-looking statements. You are advised to review any further disclosures we make on related subjects in materials we file with or furnish to the SEC.United States Securities and Exchange Commission ("SEC"). Forward-looking statements speak only as of the date they are made and are not guarantees of future performance. They are subject to future events, risks and uncertainties -– many of which are beyond our control -– as well as potentially inaccurate assumptions, that could cause actual results to differ materially from our expectations and projections. We do not undertake to update any forward-looking statements.

Factors that might affect our forward-looking statements include, among other things:

•adverse impacts to our business operations due to the global COVID-19 pandemic and our ability to predict the full extent of such impacts;

•competitive factors in the industry in which we compete, including technological developments and increased competition from private label brands;

•the development, commercialization and acceptance of new products and services that meet the varied and evolving needs of our customers;

•the demand for our products and services, including changes in customer and consumer preferences, and our ability to maintain beneficial relationships with large customers;

•our products or solutions fail to meet certification and specification requirements, are defective or otherwise fall short of customers’ needs and expectations;

•the ability to complete and integrate any acquisitions and/or losses related to our investments in external companies;

•business opportunities that diverge from our core business;

•our ability to operate efficiently and productively;

•our ability to effectively manage and implement restructuring initiatives or other organizational changes;

•the effects of global climate change or other unexpected events, including global health crises, that may disrupt our operations;

•our ability to manage risks related to our information technology and operational technology systems and cybersecurity, including implementation of new processes that may cause disruptions and be more difficult, costly or time consuming than expected;

•our reliance on third-party vendors for many of the critical elements of our global information and operational technology infrastructure and their failure to provide effective support for such infrastructure;

•disruption and breaches of our information systems;

•ability to recruit and retain a highly qualified and diverse workforce;

•disruptions in our global supply chain, including supply chain constraints, electronic component and labor shortages and product manufacturing and logistical services provided by our supplier partners;

•availability of and increased inflation impacting the prices of raw materials, parts and components, freight, packaging, labor and energy;

•economic, political and business conditions in the markets in which we operate;operate, including changes to trade agreements, sanctions, import and export regulations and custom duties;

•conditions of the demand for our productsinstitutional, commercial and services;residential construction and remodeling markets, including the impact of work-from-home trends;

competitive factors in the industry in which we compete;

the ability to protect and use intellectual property;

•fluctuations in currency exchange rates;

the ability to complete and integrate any acquisitions;•potential impairment of our goodwill, indefinite-lived intangible assets and/or our long-lived assets;

our ability to operate efficiently and productively;

our ability to manage risks related to our information technology and cyber-security;

changes in tax requirements (including tax rate changes, new tax laws and revised tax law interpretations);

the outcome of any litigation, governmental investigations or proceedings;

•interest rate fluctuations and other changes in borrowing costs;costs, in addition to risks associated with our outstanding and future indebtedness;

•the impact our outstanding indebtedness may have on our business and operations and other capital market conditions, including availability of funding sources and currency exchange rate fluctuations;

availability•risks related to corporate social responsibility and reputational matters;

•the ability to protect our brand reputation and trademarks;

•the outcome of and fluctuations in the pricesany litigation, governmental investigations or proceedings;

•claims of key commodities and the impactinfringement of higher energy prices;intellectual property rights by third parties;

potential further impairment•adverse publicity or improper conduct by any of our goodwill, indefinite-lived intangible assets and/employees, agents or business partners;

•changes to, or changes in interpretations of, current laws and regulations;

•uncertainty and inherent subjectivity related to transfer pricing regulations;

•changes in tax requirements, including tax rate changes, the adoption of new tax legislation or exposure to additional tax liabilities and revised tax law interpretations; and

•risks related to our long-lived assets;

incorporation in Ireland, including the possible effects on us of future legislation or interpretations in the U.S. that may limit or eliminate potential U.S. tax benefits resulting from our incorporation in a non-U.S. jurisdiction, such as Ireland, or deny U.S. government contracts to us based upon our incorporation in such non-U.S. jurisdiction; and

the impact our outstanding indebtedness may have on our business and operations.jurisdiction.

Some of the significant risks and uncertainties that could cause actual results to differ materially from our expectations and projections are described more fully in Item 1A1A. "Risk Factors." You should read that information in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Item 7 of this report and our Consolidated Financial Statements and related notes in Item 8 of this report. We note such information for investors as permitted by the Private Securities Litigation Reform Act of 1995.

PART I

Item 1.BUSINESS

Overview

Allegion plc ("Allegion," "we," "us" or "the Company") is a leading global provider of security products and solutions that keep people and assets safe and secure and productive. We make the world safer as a company of experts, securingin the places where people thrive,they reside, work and wethrive. We create peace of mind by pioneering safety and security.security with a vision of seamless access and a safer world. Seamless access allows authorized, automated and safe passage and movement through spaces and places in the most efficient and frictionless manner possible. Central to our vision is partnering and developing ecosystems to create a flawless experience and enable an uninterrupted and secure flow of people and assets. We offer an extensive and versatile portfolio of mechanicalsecurity and electronic securityaccess control products and solutions across a range of market-leading brands. Our experts across the globe deliver high-quality security products, services and systems, and we use our deep expertise to serve as trusted partners to end-users who seek customized solutions to their security needs.

|

| | | | |

| Allegion Principal Products |

| Door closers and controls | Doors and door systems |

| Electronic security products | Electronic and biometricSoftware-enabled access control systems |

| Exit devices | Locks, locksets, portable locks, and key systems and services |

| Time, attendance and workforce productivity systems | Other accessories |

Access control security products and solutions are critical elements in every building and home. Many door openings are configured to maximize a room’s particular form and function while also meeting local and national building and safety code requirements and end-user security needs. Most buildings have multiple door openings, each serving its own purpose and requiring different specific access-controlaccess control solutions. Each door must fit exactly within its frame, be prepared precisely for its hinges, synchronize with its specific lockset and corresponding latch and align with a specific key to secure the door. Moreover, with the increasing adoption of the Internet of Things ("IoT"), security products – including keys – are increasingly linked electronically, integrated into software and popular consumer technology platforms and controlled with mobile applications, creating additional functionality and complexity. Seamless access capitalizes on the ability for multiple products and brands to work in tandem, allowing people and assets to move efficiently and safely by adapting access rights for various settings or use cases. These solutions can also provide insights on usage and traffic patterns to improve hygiene of high-traffic areas, boost efficiency and improve visitor, staff and tenant experiences.

We believe our ability to deliver a wide range of solutions that can be custom-configuredcustom configured to meet end-users’ security needs is a key driver of our success. We accomplish this with:

•Our extensive and versatile product portfolio, combined with our deep expertise, which enables us to deliver the right products and solutions to meet diverse security and functional specifications;specifications and to successfully and securely integrate into leading technology and systems;

•Our consultative approach and expertise, which enables us to develop the most efficient and appropriate building security and access-controlaccess control specifications to fulfill the unique needs of our end-users and their partners, including architects, contractors, home-buildershomebuilders and engineers;

•Our access to and management of key channels in the market, which is critical to delivering our products in an efficient and consistent manner; and

•Our enterprise excellence capabilities, including our global manufacturing operations and agile supply chain, which facilitate our ability to deliver specific product and system configurations to end-users and consumers worldwide, quickly and efficiently.

We believe that the security products industry is growing and will continue to benefit from several global macroeconomic and long-term demographic trends, including:

stabilization of construction markets in key North American markets;

the convergence of mechanical and electronic security products;

heightened awareness of security requirements;

increased global urbanization; and

the shift to a digital, interconnected environment.

We believe the security products industry will also benefit from continuedseveral global macroeconomic trends, including:

•Expected growth in institutional, commercial, and residential end-markets. We also expect growth in the global electronic product categories we serve to outperform the security products industry as end-users adopt newer technologies in their facilities.facilities and homes;

•Heightened awareness of security and privacy requirements;

•Increased focus on touchless solutions that help promote a healthy environment; and

•The shift to a digital, interconnected environment.

We operate in three geographic regions: Americas;and report financial results for two segments: Allegion Americas and Allegion International, the latter of which provides security products, services and solutions primarily throughout Europe, Middle East, IndiaAsia and Africa ("EMEIA"); and Asia Pacific.Oceania. We sell our products and solutions under the following brands:

|

| | | |

Allegion Brands |

(listed for each region) |

|

We sell a wide range of security products and access control solutions for end-users in commercial, institutional and residential facilities worldwide, including into the education, healthcare, government, hospitality, commercial office and single and multi-family residential markets. Our corporateleading brands areinclude CISA®, Interflex®, LCN®, Schlage®, SimonsVoss®, and Von Duprin®. We believe LCN, Schlage and Von Duprin hold the No. 1 or No. 2 position in their primary product categories in North America andwhile CISA, Interflex and SimonVossSimonsVoss hold the No.1No. 1 or No. 2 position in their primary product categories in certain European markets.

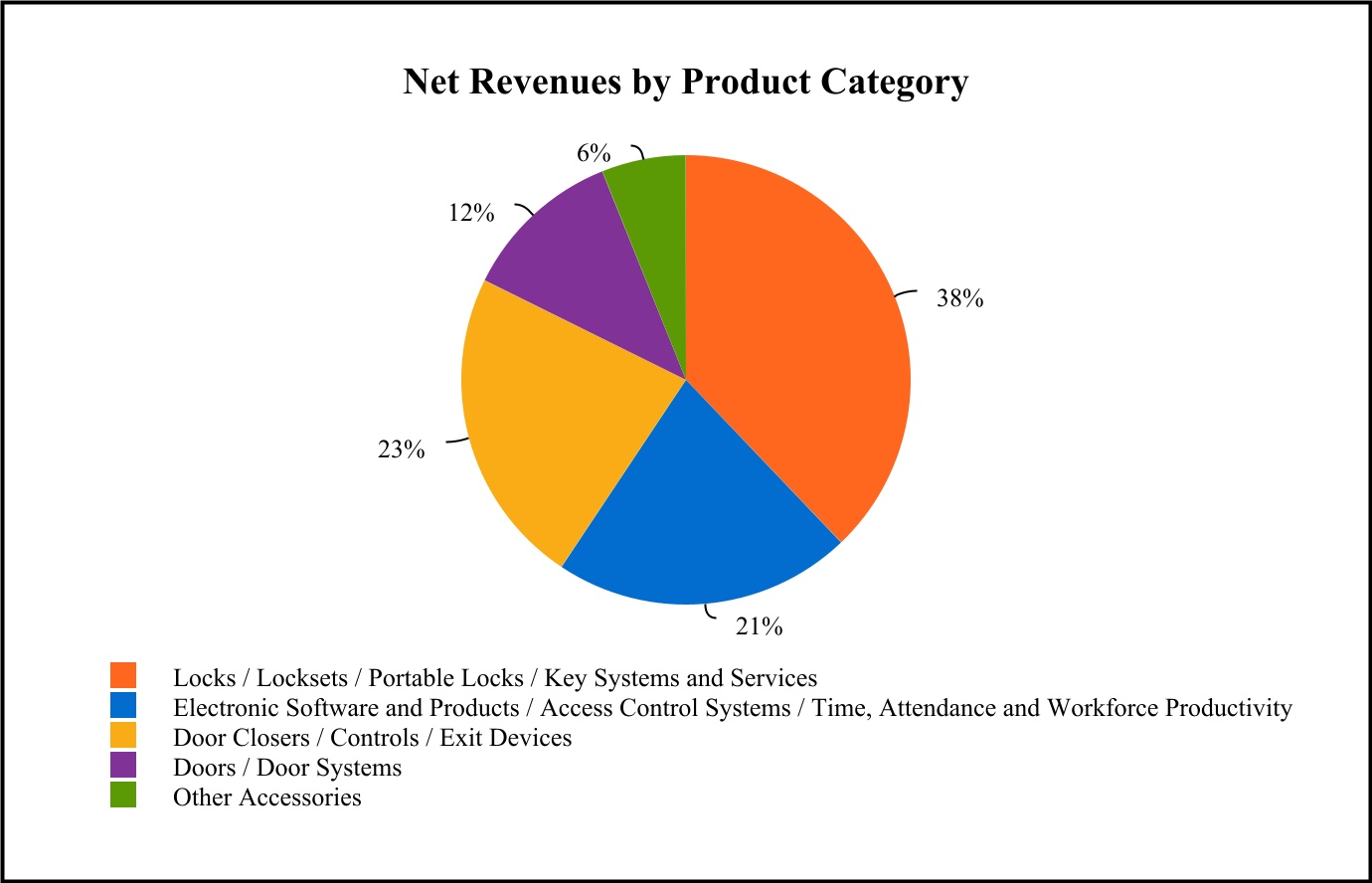

ForDuring the year ended December 31, 2017,2021, we generated Net revenues of $2,408.2$2,867.4 million and operatingOperating income of $488.2$530.2 million.

History and Developments

We were incorporated in Ireland on May 9, 2013, to hold the commercial and residential security businesses of what was then Ingersoll Rand plc ("Ingersoll Rand"). On December 1, 2013, we became a stand-alone public company after Ingersoll Rand completed the separation of these businesses from the rest of Ingersoll Rand via the transfer of these businesses from Ingersoll Rand to us and the issuance by us of ordinary shares directly to Ingersoll Rand’s shareholders (the "Spin-off"). Our security businesses have long and distinguished operating histories. Several of our brands were established more than 75100 years ago, and many of our brands originally created their categories:

•Von Duprin, established in 1908, was awarded the first exit device patent;

•Schlage, established in 1920, was awarded the first patents granted for the cylindrical lock and the push button lock;

•LCN, established in 1926, created the first door closer;

•CISA, established in 1926, devised the first electronically controlled lock; and

•SimonsVoss, established in 1995, created the first keyless digital transponder.

We have built upon these founding legacies since our entry into the security products market through the acquisition of Schlage, Von Duprin and LCN in 1974. Today, we continue to develop and introduce innovative and market-leading products. For example, in 2018, we announced the formation of Allegion Ventures, a corporate venture fund with an initial allocation of $50 million to invest in and help accelerate the growth of companies that have innovative, digital-first technologies and products such as touchless access and workspace monitoring solutions that complement our core business solutions. Building on this success, in December 2021, Allegion Ventures announced a second fund with an additional allocation of $100 million to focus on investing in technologies like artificial intelligence, machine learning and cybersecurity.

Recent examples of successful product launches by Allegion are illustrated in the table below:

|

| | | | | | | | | | | | | | | | | | | |

| Product | | Brands | | Year | | Innovation |

| Residential Locks, Cylinders and Levers | | Schlage Touch, Connect, Sense, Control, SEL, Custom | | 2015/2016/ 2017 | | New singleSchlage, Gainsborough,

CISA | | 2019/2020/ 2021 | | Schlage Primus® RP patented, restricted key systems, allowing the widely used, historic Schlage Obverse keyway family a path to Primus levels of security with patent coverage to 2029.

Next generation smart lock (Schlage Encode) is joined by one in Australia (Gainsborough Freestyle Trilock), which has passage, privacy or dead lock modes that can be operated using the built-in keypad, a key override or through the mobile app and multi-family residential electronic locking platforms that provide for keyless entry (Touch), connected locking (Connect), integrationoffers integrations with the Internet of Things (IoT) and Apple HomeKit, Amazon Alexa and Google AssistantAssistant. The optional WiFi bridge can be used to program and Android platforms (Sense), multi-family interconnected locking (Control), 4-in-1 locks, fingerprint sensors,operate the lock from anywhere in the world.

New flat key European cylinders for multiple entrance buildings (CISA Asix P8) and smart card or code access (SEL)high security connected solutions (CISA Domo Connexa).

A new range with universal functionality (Custom) allows homeowners to change from a doorknob to a lever and convert a non-locking door to lockable in minutes.

|

| Commercial Locks, Cylinders, Levers and Electronic Access Platforms | | Schlage, SimonsVoss, CISA SimonsVoss | | 2015/2016/ 20172019/2020/2021 | | Access control platforms and proximityRelease of mobile-enabled versions of locks, readers and smartcontrollers (Schlage NDE, LE, MTB and CTE), mobile credentials, upgradedBluetooth Low Energy ("BLE") and RFID technology and integrations between electronic locks and exit devices (Schlage, CISA). RC reader controller combines powerful ISONAS PureIP technology together with intelligent hardware (Schlage Mobile Access Solutions). New Digital Cylinder AX (SimonsVoss) supports active transponders, Mifare badges and BLE, a further step towards digitizing the door through the keyhole.

Mortice self-locking system with a mono-point motorized lock variant (CISA) and new platformed, modular replacement of cylindrical locks (Schlage ALX). New multipoint exit mortice self-locking system for improved strengthpanic exit doors with narrow profile (CISA).

Enhanced access control solutions for low-to-medium complexity applications offers a complete portfolio of IP and durability (Schlage)mobile-enabled devices across a variety of popular applications and openings (Schlage, ISONAS, Locknetics, Von Duprin, and Falcon). Comprehensive offerings featuring |

| Exit Devices and Closers | | LCN | | 2020/2021 | | New low-energy automatic operator (LCN 6400 Compact series), retrofit solution with actuators reduces the cost and complexity of touchless access and ADA accessibility, converting the popular LCN 4040XP mechanical wired electrifiedcloser and powered by a simple wall plug or an external power supply. Follows the introduction of a range of touchless solutions, including automatic operators, actuators and wireless electronic solutions for common aesthetic and consistent user experience throughout a building. Wireless locks able to be managed with ENGAGE™ web and mobile apps or with our Software Alliance Member (SAM) systems (Schlage LE and NDE).

Multipoint locking line (CISA) designed for high security European applications, correcting for heat distortion. MobileKey (SimonsVoss) provides facility managers highly secure and sophisticated access control with mobile phone technology.

transmitters. |

ClosersDoors and Door Systems | | LCN, Briton, CISA, ITO KilitTGP | | 2015/2016/ 20172021 | | Cast Aluminum Series closers (LCN) were specially designedNorth America's first fire-rated Full-Lite Door System, certified to deliver consistent, dependable and long-term performance.

New closers (Briton, CISA, ITO Kilit) significantly expanded the European standard portfolio in 2017, offering affordable quality and specialty applications.

meet forced entry standards (TGP ASTM E2395). |

Exit Devices | | Von Duprin, CISA | | 2016/2017 | | Concealed vertical cables (Von Duprin) give doors aesthetics, strength and security in an exit device system that is easy to install and maintain.

e-Fast motorized push bars (CISA) now include lighting features.

|

| Bike Lighting and Portable Locking Solutions | | AXA, Kryptonite, Trelock | | 20172019/2020/2021 | | Innovation in bike safety and security from each of our Global Portable Security brands (AXA, Kryptonite, Trelock); and Trelock), ranging from compact dynamo lightsnew ergonomic cable and e-bike lightschain locks (AXA). |

| Software, Mobile and Web Applications | | Schlage, CISA, Gainsborough | | 2019/2020/2021 | | Mobile apps for iOS and Android phones (Schlage, CISA, Gainsborough) lock, unlock, issue mobile keys and give status checks. Schlage Mobile Student ID allows university students, faculty and staff to USBadd student ID cards to Apple Wallet or Google Pay for door access, payments, attendance tracking and battery powered lights, as well as new lines of folding locks, integrated chains and electronic ring locksticketing). App and mobile applicationssolution (CISA Smart Access) allows guests to use their smartphone like a room key and also start a WhatsApp chat with the front desk with a single click, creating guest experiences beyond security and safety.

Cloud access management software (CISA AERO) expands with a new open software interface for bikes and motorcycles.property management systems. |

| | | | | | |

Industry and Competition

The global markets we serve encompass institutional, commercial institutional and residential construction and remodeling markets throughout North America, Europe, the Middle EastAsia and Asia-Pacific. In recent years, growth in electronic security products and solutions continues to outperform the industry as a whole as end-users adopt newer technologies in their facilities.Oceania. We expect the security products industry will continue to benefit from favorable long-term demographic trends such as continued urbanization of the global population, increased concerns about safety and security, new attention on touchless solutions that help promote a healthy environment and technology-driven innovation.innovation that enables seamless access and a better user experience as people and assets traverse multiple locations and facilities. Further, we also expect continued growth in connected security products and solutions as end-users continue to adopt newer technologies, including IoT, in their facilities and single and multi-family homes.

The security products markets are highly competitive and fragmented throughout the world, with a number of large multi-national companies and thousands of smaller regional and local companies. This high fragmentation primarily reflects local regulatory requirements and highly variable end-user needs. We believe our principal global competitors are Assa Abloy AB and dorma+kabadormakaba Group. We also face competition in various markets and product categories throughout the world, including from Spectrum Brands Holdings, Inc. in the North American residential market. As we move into more technologically-advancedtechnologically advanced product categories, we may also compete against new, more specialized competitors.

Our success depends on a variety of factors, including brand and reputation, product breadth, innovation, integration with popular technology platforms, quality and delivery capabilities, price and service capabilities. As many of our businesses sell through wholesale distribution, our success also depends on building and partnering with a strong channel network. Although price often serves as an important customer decision criterion,point, we also compete based on the breadth, innovation and quality of our products and solutions, our ability to custom-configure solutions to meet individual end-user requirements and our global supply chain.

Our Reporting Segments

We manufacture and sell mechanical and electronic security products and solutions in approximately 130 countries. Approximately 96% of our 2017 revenues were to customers in the North America, Western Europe and the Asia-Pacific regions.

The following table presents the relative percentages of total segment revenue attributable to each reporting segment for each of the last three fiscal years. See Note 20, "Business Segment Information," to our annual consolidated financial statements for information regarding net revenues, operating income, and total assets by reportable segment:

|

| | | | | |

| | For the Years Ended December 31 |

| | 2017 | | 2016 | | 2015 |

| Americas | 73% | | 74% | | 75% |

| EMEIA | 22% | | 21% | | 19% |

| Asia Pacific | 5% | | 5% | | 6% |

Our Americas segment provides security products and solutions in approximately 30 countries throughout North America, Central America, the Caribbean and South America. The segment offers a broad range of products and solutions including locks, locksets, portable locks, key systems, door closers, exit devices, doors and door systems, electronic products, and access control and time and attendance systems to end-users in the commercial, institutional and residential markets, including into the education, healthcare, government, commercial office and single and multi-family residential markets. This segment’s primary brands are LCN, Schlage, and Von Duprin.

Our EMEIA segment provides security products and solutions in approximately 85 countries throughout Europe, the Middle East, India and Africa. The segment offers the same portfolio of products as the Americas segment, as well as workforce productivity solutions. This segment’s primary brands are AXA, Bricard, CISA, Interflex and SimonsVoss. This segment also resells North American LCN, Schlage, and Von Duprin products, primarily in the Middle East.

Our Asia Pacific segment provides security products and solutions in approximately 15 countries throughout Asia Pacific. The segment offers the same portfolio of products as the Americas segment. This segment’s primary brands are Brio, FSH, Legge, Milre, and Schlage.

Products and Services

We offer an extensive and versatile portfolio of mechanicalsecurity and electronic securityaccess control products and solutions across a range of market-leading brands:

•Locks, locksets, portable locks and key systems and services: A broad array of cylindrical and mortise door locksets, security levers and master key systems that are used to protect and control access. We also offeraccess and a range of portable security products, including bicycle, small vehicle and travel locks.

We also offer locksmith services in select locations;•Door closers, controls and exit devices: An extensive portfolio of life-safety products and solutions generally installed on fire doors and facility entrances and exits. Door controls include both mechanical door closers are devices that automatically close doors after they are opened.and automatic door operators. Exit devices, are generally horizontal attachmentsalso known as panic hardware, provide rapid egress to doors and enable rapid egress.

allow building occupants to exit safely in an emergency;•Electronic security products and access control systems, including software solutions: A broad range of electrified locks, access control systems, biometric hand reader systems, key card and reader systems and accessories, including Internet of Things (IoT)IoT, BLE, Power over Ethernet and cloud-based solutions.

solutions;•Time, attendance and workforce productivity systems: Products and services designed to help business customers manage and monitor workforce access control parameters, attendance and employee scheduling. We also offer ongoing aftermarket services in addition to design and installation offerings.

offerings;•Doors and door systems: A portfolio of hollow metal, glass wood, and specialty doors and door systems.

systems; and•Other accessories: A variety of additional security and product components, including hinges, door levers,pulls, door stops, bike lights, louvers, weather stripping, thresholds and other accessories, as well as certain bathroom fittings.

fittings and accessibility aids.

Customers

We sell most of our products and solutions through distribution and retail channels, ranging fromincluding specialty distribution, toe-commerce and wholesalers. We have built a network of channel partners that help our customers choose the right solution to meet their security needs and help commercial and institutional end-users fulfill and install orders. We also sell through a variety of retail channels, ranging fromincluding large do-it-yourself home improvement centers, tomultiple online and e-commerce platforms, as well as small, specialty showroom outlets. We work with our retail partners on developing marketing and merchandising strategies to maximize their sales per square foot of shelf space. Through a few of our businesses, such as Interflex business and our Global Portable Security brands, we also provide products and solutionsservices directly to end-users.

Our 10 largest customers represented approximately 25% of our total Net revenues in 2017.2021. No single customer represented 10% or more of our total Net revenues in 2017.2021.

Sales and Marketing

In markets where we sell through commercial and institutional distribution channels, we employ sales professionals around the world who work with a combination of end-users, security professionals, architects, contractors, engineers and distribution partners to develop specific, custom-configured solutions for our end-users’ needs. Our field sales professionals are assisted by specification writers who work with architects, engineers and consultants to help design door openings and security systems to meet end-users’ functional, aesthetic and regulatory requirements. Both groups are supported by dedicated customer care and technical sales-support specialists worldwide. We also support our sales efforts with a variety of marketing efforts, including trade-specific advertising, cooperative distributor merchandising, digital marketing and marketing at a variety of industry trade shows.

In markets in which we sell through retail and home-builder distribution channels, we have teams of sales, merchandising and marketing professionals who help drive brand and product awareness through our channel partners and to consumers. We utilize a variety of advertising and marketing strategies, including traditional consumer media, retail merchandising, digital marketing, retail promotions and builder and consumer trade shows, to support these teams.

We also work actively with several industry bodies around the world to help promote effective and consistent safety and security standards. For example, we are members of Builders Hardware Manufacturers Association (BHMA), Connectivity Standards Alliance, Construction Specification Institute, Door and Hardware Institute (DHI), FiRa Consortium, Partner Alliance for Safer Schools (PASS), Physical Security Interoperability Alliance (PSIA), Security Industry Association, Smart CardSecurity Technology Alliance, American SocietyZ-Wave Alliance, The European Federation of Healthcare Engineering, American InstituteAssociations of Architects, Construction Specification Institute,Locks and Builders Hardware Manufacturers (ARGE), ASSOFERMA (Italy), BHE (Germany) and UNIQ (France). We also have established the Safety and Security Institute in China, which helps to educate government officials, architects and builders and advocates for consistent building codes and standards that address end-users’ safety and security.

Production and Distribution

We manufacture our products in our geographic markets around the world. We operate 3129 principal production and assembly facilities including– 14 in theour Allegion Americas region, 12segment and 15 in EMEIA and 5 in Asia Pacific.our Allegion International segment. We own 15 of these facilities and lease the others. Our

strategy is to produce in the region of use, wherever appropriate, to allow us to be closer to the end-user and increase efficiency and timely product delivery. Much of our United States (U.S.)U.S. based residential portfolio is manufactured in the Baja Regionregion of Mexico under a NAFTA Maquiladora.

the Maquiladora, Manufacturing and Export Services Industry ("IMMEX") program. In managing our network of production and assembly facilities, we focus on eliminating excess capacity, reducing cycle time through productivity, and harmonizing production practicescontinuous improvement in customer experience, employee health and safety, procedures.productivity, resource utilization and operational excellence.

We distribute our products through a broad network of channel partners. In addition, third-party manufacturing and logistics providers perform certain manufacturing, storage and distribution services for us to support certain parts of our manufacturing and distribution network.

Raw Materials

We support our region-of-use production strategy with corresponding region-of-use supplier partners, where available. Our global and regional commodity teams work with production leadership, product management and materials management teams to ensure adequateprocure materials are available for production. Where appropriate, we may enter into fixed-cost contracts to lower overall costs.

We purchase a wide range of raw materials, including steel, zinc, brass and other non-ferrous metals, as well as other parts and components, such as electronic components, to support our production facilities. Where appropriate,During 2021, especially in the second half of the year, we may enter into fixed-cost contractsexperienced an acceleration of several macroeconomic challenges, including supply chain disruptions and delays; shortages in materials, including reductions in allocations of electronic components and other parts from key suppliers; and increased material and other inflation. These trends had a negative impact on our results of operations in 2021, and while we currently anticipate these challenges to lower overall costs.continue in 2022, we are rapidly adapting to navigate these challenges. See "Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations" for a more detailed discussion of these trends and challenges.

Intellectual Property

Intellectual property, inclusive of certain patents, trademarks, copyrights, know-how, trade secrets and other proprietary rights, is important to our business. We create, protect and enforce our intellectual property investments in a variety of ways. We work actively in the U.S. and internationally to try to ensure the protection and enforcement of our intellectual property rights. We use trademarks on nearly all of our products and believe that such distinctive marks are an important factor in creating a market for our goods, in identifying us and in distinguishing our products from others. We consider our CISA, Interflex, LCN, Schlage,

SimonsVoss, Von Duprin LCN, CISA, SimonsVoss, Interflex and other associated trademarks to be among our most valuable assets, and we have registered these trademarks in a number of countries. Although certain proprietary intellectual property rights are important to our success, we do not believe we are materially dependent on any particular patent or license, or any particular group of patents or licenses.

Facilities

We operate through a broad network of sales offices, engineering centers, 3129 principal production and assembly facilities and several distribution centers throughout the world. Our active properties represent approximately 7.06.3million square feet, of which approximately 47%40%is leased.

The following table shows the location of our principal worldwide production and assembly facilities:

|

| | | | | | | |

| Production and Assembly Facilities |

| Allegion Americas | | EMEIA | | Asia PacificAllegion International |

| Blue Ash, Ohio | | Clamecy, France | | Auckland, New Zealand |

Bogota, ColombiaChino, California | | Dubai, United Arab EmiratesBrooklyn, Australia |

| Ensenada, Mexico | | Blackburn, Australia |

| Everett, Washington | | Bucheon, South Korea |

Chino, CaliforniaIndianapolis, Indiana | | Durchhausen, Germany | | Jinshan, ChinaClamecy, France |

Ensenada, MexicoIrving, Texas | | Duzce, Turkey | | Melbourne, AustraliaDurchhausen, Germany |

Indianapolis, IndianaMcKenzie, Tennessee | | Faenza, Italy | | Sydney, Australia |

Irving, TexasMississauga, Ontario | | Feuquieres, France | | |

McKenzie, TennesseePerrysburg, Ohio | | Monsampolo, Italy | | Jinshan, China |

Perrysburg, OhioPrinceton, Illinois | | Muenster, Germany | | Monsampolo, Italy |

Princeton, IllinoisSecurity, Colorado | | Osterfeld, Germany | | |

Security, ColoradoSnoqualmie, Washington | | Renchen, Germany | | |

Snoqualmie, WashingtonTecate, Mexico | | Siewierz, Poland | | Sydney, Australia |

Tecate,Tijuana, Mexico | | Veenendaal, Netherlands | | |

Tijuana, Mexico | | | | |

Toronto, Ontario | | | | Zawiercie, Poland |

Research and Development

We are committed to investing in highly productiveour research and development capabilities particularly in electro-mechanical systems. Our research and development ("R&D") expenditures were approximately $48.3 million, $47.3 million and $45.2 million for the years ended December 31, 2017, 2016 and 2015, respectively.

We concentratewith a focus on developing technology innovations that will deliver growth through the introduction of new products and solutions, and also on driving continuoussolutions. In addition, we invest in initiatives that continuously drive improvements in product cost, quality, safety and sustainability.

We manage our R&DOur research and development team is managed as a global, group with an emphasis on a global collaborative approachgroup to identify and develop new technologies and worldwide product platforms. We are organized on a regional basis toOur regionally located resources leverage expertise in local standards and configurations. In additionconfigurations and apply those to regional engineering centers in each geographic region,adapt products for the benefit of our customers. Further, we also operate a global engineeringtechnology center of excellence in Bangalore, India.India, which augments and supports the regional engineering teams.

Seasonality

Our business experiences seasonality that varies by product line. Because more construction and do-it-yourself projects occur during the second and third calendar quarters of each year in the Northern Hemisphere, our security product sales related to those projects are typically are higher in those quarters than in the first and fourth calendar quarters. However, our Interflex businesscertain other businesses typically experiencesexperience higher sales in the fourth calendar quarter due to project timing. RevenueIn 2020, we experienced lower sales volumes during the second quarter, principally due to the economic challenges stemming from the COVID-19 pandemic; however, this is not anticipated to be a long-term trend in the seasonality of our businesses. Net revenues by quarter for the years ended December 31, 2017, 20162021, 2020 and 2015 are2019, were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | First Quarter | | Second Quarter | | Third Quarter | | Fourth Quarter |

| 2021 | | 24% | | 26% | | 25% | | 25% |

| 2020 | | 25% | | 21% | | 27% | | 27% |

| 2019 | | 23% | | 26% | | 26% | | 25% |

|

| | | | |

| First Quarter | Second Quarter | Third Quarter | Fourth Quarter |

| 2017 | 23% | 26% | 25% | 26% |

| 2016 | 22% | 26% | 26% | 26% |

| 2015 | 22% | 25% | 26% | 27% |

EmployeesThe Company’s human capital strategy is based on our values and is foundational to achieving our business strategy. To ensure we attract and retain top talent, we strive for a diverse and inclusive culture that rewards performance, provides growth and development opportunities and supports employees and their families through competitive compensation, benefits and numerous volunteer and charitable giving opportunities.

As of December 31, 2021, we had approximately 11,000 employees around the world, the vast majority working full time. Our employee base is supplemented by contingent labor where demand fluctuates or we experience short-term needs for specialized skills.

Compensation and Benefits

Compensation and benefit programs are tailored to be competitive in the geographies where we work, including the total package (which varies by country/region) that includes hourly and salaried compensation, performance incentive and equity plans, retirement, insurance and government social welfare programs, disability and family leave, education benefits to pursue degrees and certifications and additional offerings to support financial stability and personal planning. Health and wellness programs are provided globally and contribute to a productive, sustainable workforce by empowering our employees to take personal responsibility for their health, safety and well-being. In addition, we maintain tobacco-free facilities and pursue strategies to incentivize healthy behaviors and outcome-driven rewards. Pay for performance strategies consider not only accomplishments, but how individuals achieve results. The Allegion Leadership Behaviors – be a pioneer, break boundaries, coach, champion change, be courageous and inspire – are used to identify key talent and to train and develop aspiring leaders. They also work in concert with our performance management system to reinforce our values and code of conduct in assessing how people lead and deliver top performance.

Talent Attraction

Our employer brand strength creates a differentiated employee experience that attracts and retains the right talent for Allegion, both now and in the future. Talent attraction efforts are focused on our unique employee value proposition and highlight a culture that reflects our core values and business objectives. These efforts begin well before people walk in our doors and begin to work for us. Around the world, our sites partner with schools and support teachers, providing mentoring, grants, scholarships, internships, co-op programs, classroom technology and on-site activities and full-time rotational programs after graduation. Our sites sponsor science, technology, engineering and math ("STEM") programs and robotics and engineering competitions. In the U.S., we also host an annual Manufacturing Day event at several of our production and assembly facilities. These programs expose students to careers in manufacturing and technology and provide educators with programming to encourage academic excellence and social development while building a pipeline of talent for Allegion.

Talent attraction efforts go beyond emerging talent strategies to span core capabilities that enable the business to run, grow and transform. Key capabilities have been identified for our long-term corporate business strategy: talent, customer focus, innovation, partnering, pace and agility and collaboration. We use a variety of recruitment tactics to ensure a strong base of labor for manufacturing operations and to build the base of talent with these capabilities. Throughout the process, there is a focus on driving a technology-enabled seamless experience for internal and external candidates and hiring managers throughout the recruitment cycle. These talent attraction efforts are complemented with a total reward framework, internal learning and development paths and career growth opportunities to secure Allegion as an employer of choice, where people want to come work, stay and thrive.

Talent Development and Succession Planning

Talent development and succession planning at all levels of the organization are instrumental in ensuring we have the key capabilities to deliver the value proposition expected by our customers and employees. Inclusive succession planning is supported through the Allegion Leadership Behaviors, individual career mapping, assessment of performance and talent pipeline planning up to and including the Chief Executive Officer ("CEO"). On a quarterly basis, the executive team reviews talent development, focusing on developing a diverse succession bench, as part of their quarterly business review and a key component of the Allegion Operating System, our system of annual operation to support governance, reporting processes and management of the business. These cross-functional reviews highlight individuals who are ready for new opportunities, individuals who are on a special assignment or project and individuals early in their career that demonstrate emerging leadership skills.

Learning and Development

Opportunities for on-going learning and development are delivered to employees through structured coursework, on-site and expert-led training and experiential, applied development. The Allegion Academy is offered globally, supporting multiple languages and providing more than 17,000 self-guided online courses, as well as community channels on targeted skills and inclusion and diversity. We offer programs to provide successive levels of development, including reskilling and upskilling existing employees, as well as strengths-based leadership curriculum. Enterprise excellence initiatives and sprint teams expand skills in lean manufacturing and quality principles and lead to redesigning workflow to boost productivity and reduce waste. Employee-led resource and affinity groups provide enrichment opportunities for women’s leadership, early-career professionals, creativity and innovation, health and fitness, community volunteering and philanthropy.

Engagement, Inclusion and Diversity

A commitment to engagement, inclusion and diversity is core to the Allegion Operating System. Engagement surveys provide team leaders with insights on potential areas of focus and help them prioritize and take action on their teams’ foundational, inclusion, growth and development needs. Strengths-based leadership is an element of our commitment to inclusion: the more employees understand their own strengths, the better equipped they are to add value and appreciate the contributions of diverse members of their teams.

Inclusion and diversity are topics for learning communities, employee roundtables and ongoing, regular analysis and dialogue among our people leaders, executive leadership and our Board of Directors. We believe in fundamental standards that support our employees, including a commitment to building and maintaining diverse and inclusive workplaces, safe and healthy practices and competitive wages and benefits. We embrace all differences and similarities among colleagues and within the relationships we foster with customers, suppliers and the communities where we live and work. Whatever background, experience, race, color, national origin, religion, age, gender, gender identity, disability status, sexual orientation, protected veteran status or any other characteristic protected by law, we make sure that potential and current employees have every opportunity for application and the opportunity to give their best at work because it’s the right thing to do.

The combined efforts of Allegion’s Inclusion and Diversity Steering Committee, our Executive Leadership Team ("ELT") and, as of June 2021, a new employee-led Inclusion Council, are driving expectations and accountability while creating role models and change champions. Our engagement, inclusion and diversity strategy has three core pillars:

•Learn & listen deeply: Learn to recognize biases and mitigate them. Seek to first understand the other person's perspective rather than respond or act;

•Unite widely: Create a workplace where all employees feel welcomed, respected and valued, enabling customers to more easily connect with our brands through our people; and

•Take action: Identify the unique things that impact our organization, our communities and our industry.

During 2021, we focused on four action priorities: establish the Inclusion Council; charter and expand employee resource groups; review business policies, processes and practices; and launch the Supplier Diversity Program. In 2021, Allegion was named the winner of the Jackson Lewis Diversity, Equity and Inclusion Champion, on the merits of our company’s proactive and intentional global efforts throughout 2021.

We currentlyare dedicated to fulfilling equal opportunity commitments in all decisions regarding all employment actions and at all levels of employment. In partnership with our Human Resources organization, our Equal Employment Opportunity Officer ensures that the applicable policy and procedures are appropriately established, implemented and disseminated, including those prohibiting discrimination, harassment, bullying and/or retaliation.

Civic Involvement

Civic involvement is part of the value proposition we offer employees and supports inclusion, diversity, growth and development. The Company and its employees provide multi-faceted support for our communities, guided by three philanthropic pillars: safety and security; wellness; and addressing the unique needs of the communities where we work, live and thrive. Corporate sponsorships and voluntary employee payroll deductions support a wide range of non-profits, including those that address housing and school security and safety; children and youth programs; education and scholarships for people of color and those who are economically disadvantaged and support for Historically Black Colleges and Universities; community safety nets for basic needs (e.g., food, shelter, transportation) for underserved people and to break the cycle of poverty; wellness, mental health, health research, emergency relief and blood supply initiatives; and programs to advance

equality, justice and address systemic bias. In addition to corporate sponsorships, site leaders and employees are encouraged to organize local volunteer and fundraising activities, provide grants to local organizations and serve on boards and committees.

Respect for Human Rights

Our respect for human rightsisexpressed instandards for our employees, our business partners, our customers and our communities. We have approximately 10,000 employees.adopted and continue to uphold our Global Human Rights Policy, with standards that align with basic working conditions and human rights concepts advanced by international organizations such as the International Labor Organization and the United Nations. This policy also represents our own minimum standards for working conditions and human rights in our business and supply chains. In addition, we conduct risk assessments and continue to have conversations with the suppliers and companies we work with about the importance of human rights.

Employee Health and Safety

Employee health and safety are top priorities, and we consistently rank as the safest among leading competitors on core measures such as the total recordable incident rate. ‘Be safe, be healthy’ is a core organizational value in our proactive safety culture and has guided our response to the COVID-19 pandemic throughout 2020 and 2021. We have adopted numerous health and safety measures in accordance with best-practice safe hygiene guidelines issued by recognized health experts like the U.S. Centers for Disease Control and Prevention (“CDC”), the European Centre for Disease Prevention and Control (“ECDC”) and the World Health Organization (“WHO”), as well as any applicable government mandates. We continue to adapt to changing health conditions at a local level and support a wide range of health and safety measures, including reduced density, remote and hybrid work options for appropriate roles, cleaning and hygiene protocols, visitor management and mask-wearing. We also encourage preventative measures, including COVID-19 and influenza vaccines and booster shots.

The CEO and senior executives have responsibility for risk management, employee accountability and safety hazard recognition and take a personal responsibility toward executing on safety initiatives. We monitor leading and lagging indicators related to health and safety as part of our ongoing management of the Allegion Operating System and regularly update the Corporate Governance and Nominating Committee of the Board of Directors on key accomplishments and employee health and safety topics. In recognition of our efforts over the past several years to integrate sound environmental, health and safety ("EHS") management with our business operations, in 2021, we received the renowned Robert W. Campbell Award from the National Safety Council.

Regulatory Matters

We are subject to a variety of federal, state and local laws and regulations, both within and outside the U.S., relating to environmental, health and safety concerns. We are committed to conducting our business in a safe, environmentally responsible and sustainable manner, in compliance with all applicable EHS laws and regulations, and in a manner that helps promote and protect the health and safety of our environment, associates, customers, contractors and members of our local communities worldwide.Environmental, Regulationsocial and governance ("ESG") matters are embedded into the Allegion Operating System and, in tandem with our values and Allegion leadership behaviors, create a workplace culture committed to doing the right thing in the right way. Our Board of Directors oversees the Company's ESG initiatives, strategies, goals and performance, and Company leaders and our employees all have a responsibility to uphold excellence, as we believe ESG helps advance engagement and business vitality. We operate with principles that support our proactive commitments, including:

•Integrating sound, EHS and sustainability strategies in all elements of our business functions, including objectives and measurements;

•Conducting periodic, formal evaluation of our compliance status and annual review of objectives and targets;

•Creating a workplace culture where all employees are responsible for safety;

•Making continuous improvements in EHS and sustainability management systems and performance, including the reduction in the usage of natural resources, waste minimization, prevention of pollution and prevention of workplace accidents, injuries and risks;

•Designing, operating and maintaining our facilities in a manner that minimizes negative EHS and sustainability impacts;

•Using materials responsibly, including, where feasible, the recycling and reuse of materials; and

•Acting in a way that shows sensitivity to community concerns about EHS and sustainability issues.

We recognize that these principles are critical to our future success. We have a dedicated environmental program that is designed to reduce the utilization and generation of hazardous materials during the manufacturing process as well asand to remediate any identified environmental concerns. As to the latter, we are currently engaged in site investigations and remediation activities to address environmental cleanup from past operations at current and former production facilities. The CompanyWe also regularly evaluates its remediation programs and considers alternative evaluate our

remediation methods that are in addition to, or in replacement of, those we currently utilized by the Companyutilize based upon enhanced technology and regulatory changes.

We are sometimes a party to environmental lawsuits and claims and have, from time to time, received notices of potential violations of environmental laws and regulations from the U.S. Environmental Protection Agency (the "EPA"("EPA") and similar state authorities. We have also been identified as a potentially responsible party ("PRP") for cleanup costs associated with off-site waste disposal at federal Superfund and state remediation sites. For all such sites, there are other PRPs and, in most instances, our involvement is minimal.

In estimating our liability, we have assumed that we will not bear the entire cost of remediation of any site to the exclusion of other PRPs who may be jointly and severally liable. The ability of other PRPs to participate has been taken into account, based on our understanding of the parties’ financial condition and probable contributions on a per site basis. Additional lawsuits and claims involving environmental matters are likely to arise from time to time in the future. For a further discussion of our potential environmental liabilities, see Notes 2 and 21 to the Consolidated Financial Statements.

We incurred $3.2 million, $23.3 million,Further, during 2021, we provided additional transparency on our sustainability priorities and $4.4 millionprogress by creating a new ESG section of expenses during the years ended December 31, 2017, 2016,corporate website (found under the ESG tab at www.allegion.com). The website highlights our ongoing progress and 2015, respectively, for environmental remediation at sites presentlyadvancements in ESG, including the development of the cross-functional ESG Council which was formed in 2020 and establishing Allegion’s materiality matrix of ESG priorities.

Throughout this Form 10-K, we may refer to additional information that is available on our websites. The information contained on, or formerly owned or leasedthat may be accessed through, the Company's websites is not incorporated by us. Asreference into, and is not part of, December 31, 2017 and 2016, we have recorded reserves for environmental matters of $28.9 million and $30.6 million. Of these amounts $8.9 million and $9.6 million, respectively, relate to remediation of sites previously disposed by us. Given the evolving nature of environmental laws, regulations and technology, the ultimate cost of future compliance is uncertain.this Form 10-K.

Available Information

We are required to file annual, quarterly and current reports, proxy statements and other documents with the U.S.SEC under the Securities and Exchange Commission ("SEC").Act of 1934. The public may read and copy any materials filed with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Also, the SEC maintains an Internet website that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. The public can obtain any documents that are filed by us at http://www.sec.gov.

In addition, thisthe Company's Annual Report on Form 10-K, as well as future quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to all of the foregoing reports, are made available free of charge on our Internet website (http://www.allegion.com)www.allegion.com) as soon as reasonably practicable after such reports are electronically filed with or furnished to the SEC. The contents of our website are not incorporated by reference in this report.

Item 1A. RISK FACTORS

We discuss our expectations regarding future performance, events and outcomes in this Form 10-K, quarterly and annual reports, press releases and other written and oral communications. All statements except for historical and present factual information are “forward-looking statements” and are based on financial data and business plans available only as of the time the statements are made, which may become outdated or incomplete. Forward-looking statements are inherently uncertain, and investors must recognize that events could significantly differ from our expectations. You should carefully consider the risksrisk factors discussed below, together with all the other information included in this Form 10-K, in evaluating us, our ordinary shares and our senior notes. If any of the risks below actually occurs, our business, financial conditions,condition, results of operations and cash flows could be materially and adversely affected. Any such adverse effect may cause the trading price of our ordinary shares to decline, and as a result, you could lose all or part of your investment in us. Our business may also be adversely affected by risks and uncertainties not known to us or risks that we currently believe to be immaterial. We assume no obligation to update any forward-looking statements as a result of new information, future events or other factors.

Strategic and Operational Risks Related to Our Business

Our business operations have been, and are expected to continue to be, adversely impacted by the global operations subject us to economic risks.

COVID-19 pandemic. We are incorporatedunable to predict the full extent to which the pandemic and related impacts, including macroeconomic impacts and the pace of global economic recovery, will continue to adversely impact our business, results of operations and financial condition.

The COVID-19 pandemic and preventative measures taken to contain the spread of COVID-19 or mitigate this pandemic have caused, and are continuing to cause, business slowdowns or shutdowns in Irelandvarious countries around the world. This pandemic has also caused, and operatemay continue to cause, disruption to our global supply chain and business operations, in countries worldwide. Our global operations dependaddition to the various effects noted elsewhere within the risk factors contained in this Annual Report on products manufactured, purchasedForm 10-K. Numerous actions taken to help limit the spread of COVID-19, such as stay-at-home orders, quarantines, increased border controls and sold in the U.S. and internationally, including in Australia, China, Europe, Korea, Mexico, New Zealand and Turkey. The political, economic and regulatory environments in which we operate are becoming increasingly volatile and uncertain. Accordingly, we are subject to risks that are inherent in operating globally, including:

changes in laws and regulations or imposition of currency restrictionsclosures, business shutdowns, and other restraints in various jurisdictions;

limitation of ownership rights, including expropriation of assets by a localpublic health and government mandates that restrict business activities and limitation on the abilitytravel have impacted, and will likely continue to repatriate earnings;

sovereign debt crises and currency instability in developed and developing countries;

changes in applicable tax regulations and interpretations;

imposition of burdensome tariffs and quotas;

difficulty in staffing and managing global operations;

difficulty in enforcing agreements, collecting receivables and protecting assets through non-U.S. legal systems;

political unrest, national and international conflict, including war, civil disturbances and terrorist acts; and

economic downturns and social and political instability.

These risks could increase our cost of doing business in the U.S. and internationally, increase our counterparty risk, disrupt our operations, disrupt the ability of suppliers and customers to fulfill their obligations, increase our effective tax rate, increase the cost of our products, limit our ability to sell products in certain markets, reduce our operating margin and negatively impact our ability to compete.carry out business as usual, including the temporary suspension of some of our operations, shortages in materials, parts and components, fluctuations in customer demand, costs associated with operational changes and an extended period of remote work arrangements for some of our employees which could increase cybersecurity risks and other operational risks. Conversely, as some governments ease their restrictions and social interactions increase prior to the widespread global distribution and adoption of effective vaccines or treatments for COVID-19, and as the COVID-19 virus mutates into more contagious or severe variants, preventative and precautionary measures may not be sufficient to mitigate the risk of increased infection and could result in increased illness among our employees, business partners and others, and lead to further business interruption.

OurIn addition, our operations, as well as a significant number of our customers, suppliers, vendors and other business relies onpartners have been, and continue to be, adversely affected by the commercialCOVID-19 pandemic. In particular, shortages in commodities and residential constructionmaterials, including shortages and remodeling markets.

reductions in allocations of electronic and other components from key suppliers, labor shortages and elevated levels of employee absenteeism, freight delays and other supply chain constraints and disruptions have significantly delayed or disrupted, and may continue to adversely impact, both our suppliers’ and our ability to manufacture and deliver products to our customers. We primarily rely on the commercialhave also experienced a significant increase in commodity, parts and residential constructionmaterial component inflation in 2021, as well as inflation in other costs, such as packaging, freight, labor and remodeling markets, which are marked by cyclicality based on overall economic conditions. Weakness or instability in these markets may cause currentenergy prices. Continued supply chain disruptions and potential customersdelays, as well as continued heightened inflation, could lead to delay or choose not to make purchases, whichcontinued periodic production interruptions and other inefficiencies that could negatively impact our productivity, margin performance and our results of operations.

Further, we have experienced increased labor shortages at some of our production and distribution facilities. While we have historically experienced some level of ordinary course turnover of employees, the COVID-19 pandemic and resulting impacts have exacerbated labor shortages and increased employee turnover. A number of factors have had and may continue to have adverse effects on the labor force available to us, including reduced employment pools, increased competition for manufacturing employees, any unemployment subsidies, including unemployment benefits offered in response to the COVID-19 pandemic, and other government regulations, which include laws and regulations related to workers’ health and safety, wage and hour practices and immigration. It is also uncertain to what extent any COVID-19 vaccine mandates, if imposed or implemented, may result in further workforce attrition. Labor shortages and increased turnover rates within our Company have led to and could in the future lead to increased costs, such as increased overtime to meet demand forand increased wage rates to attract and retain employees and could negatively affect our productsability to efficiently operate our production facilities or otherwise operate at full capacity. An overall or prolonged labor shortage, lack of skilled labor, increased turnover or labor cost inflation could have a material adverse impact on our operations, results of operations, liquidity or cash flows.

Despite our best efforts to manage and services.mitigate the negative effects of the COVID-19 pandemic to the Company, their ultimate impact also depends on factors beyond our knowledge or control, including the duration and severity of this pandemic, the

emergence and spread of more contagious or severe variants of the COVID-19 virus, the continuing prevalence of severe, unconstrained or escalating rates of infection in certain countries and regions, the availability, adoption and efficacy of treatments and vaccines, future actions taken by public health and governmental authorities, including any unintended consequences of such actions, and the pace of global economic recovery. Further, to the extent our management is focused on mitigating the impacts of the COVID-19 pandemic which has required, and will continue to require, a large investment of time and resources, our attention and resources may be diverted from other business matters.

The impact of the COVID-19 pandemic continues to evolve, and its ultimate impact on our business is highly uncertain and difficult to predict. The continued spread of COVID-19 may have further adverse impacts on our business, operations, customer demand, supply chain, cash flow generation, financial position and liquidity and may also exacerbate other risks and uncertainties described in this Annual Report on Form 10-K.

Increased competition, including from technicaltechnological developments, could adversely affect our business.

The markets in which we operate include a large number of participants, including multi-national, companies, regional companies and small, local companies. We primarily compete on the basis of quality, innovation, expertise, effective channels to market, breadth of product offering and price. We may be unable to effectively compete on all these bases. Further, in a number of our product offerings, we compete with our retail customers and technology partners who use their own private labels. If we are unable to anticipate evolving trends in the market or the timing and scale of our competitors’ activities and initiatives, including increased competition from private label brands, the demand for our products and services could be negatively impacted.

In addition, we compete in a marketan industry that is experiencing the convergence of the mechanical, electronic and digital products. Technology and innovation play significant roles in the competitive landscape. Our success depends, in part, upon the research, development and implementation of new technologies and products.products including obtaining, maintaining and enforcing necessary intellectual property protections. Securing and maintaining key partnerships and alliances, as well asrecruiting and retaining highly skilled and qualified employee talent includingand having access to technologies, services, intellectual property and solutions developed by others will play a significant role in our ability to effectively compete. The continual development of new technologies by existing and new competitors, including non-traditional competitors with significant resources, could adversely affect our ability to sustain operating margins and desirable levels of sales volumes. To remain competitive, we must develop new products and respond to new technologies in a timely manner.

Our growth is dependent, in part, on the development, commercialization and acceptance of new products and services.

We must develop and commercialize new products and services that meet the varied and evolving needs of our customers and end-users in order to remain competitive in our current and future markets and in order to continue to grow our business. The speed of development by our competitors and new market entrants is increasing. We cannot provide any assurance that any new product or service will be successfully commercialized in a timely manner, if ever, or, if commercialized, will result in returns greater than our investment. Investment in a product or service could divert our attention and resources from other projects that become more commercially viable in the market. We also cannot provide any assurance that any new product or service will be accepted by the market.