UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended August 31, 2023

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to

Commission file number: 000-53482

TEXAS MINERAL RESOURCES CORP.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 87-0294969 | |

| (State of other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| (Address of Principal Executive Offices) | (Zip Code) | |

| (361) 790-5831 | ||

| (Registrant’s Telephone Number, including Area Code) | ||

(361) 790-5831

(Registrant’s Telephone Number, including Area Code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:None

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:Common Stock, par value $0.01

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐No☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐No☒

Indicate by checkmark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes☒ No ☐

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☐ | Large accelerated filer | ☐ | Accelerated filer |

| ☐ | Non-accelerated filer | ☒ | Smaller reporting company |

| ☐ | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐No☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: As of December 1, 2017February 28, 2023 the aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates of the registrant was $6,492,839$59,917,619 based upon the closing sale price of the common stock as reported by the OTCQX.US. For purposes of this calculation, shares of common stock held by executive officers, directors and holders of greater than 10% of the registrant’s outstanding common stock are assumed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.OTCQB.

The number of shares of the Registrant’s common stock outstanding as of December 11, 2017November 21, 2023 was 44,941,532..

TABLE OF CONTENTS

As used in this Annual Report on Form 10-K (“Annual Report”), references to “Texas Mineral”, “the Company,” “we,” “our,” “us” or “TMRC” mean Texas Mineral Resources Corp. and its predecessors, as the context requires.

GLOSSARY OF TERMS

| 1 |

| Probable (Indicated) Reserves | Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation. | |

| Prospect | A mining property, the value of which has not been determined by exploration. | |

| Proven (Measured) Reserves | Reserves for which (i) (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill | |

| Rare earth element(s). | ||

| REO | Rare earth oxide(s). | |

| Round Top, RTMD or Round Top Mountain Development | Round Top Mountain Development, LLC, a Delaware limited liability company, which is the entity that owns the Round Top Project. | |

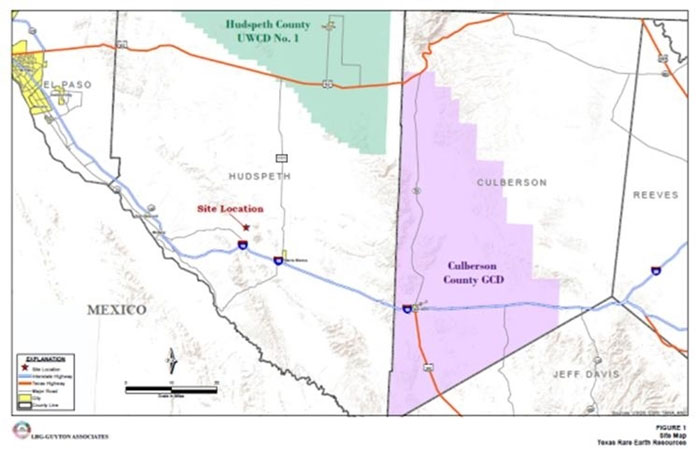

| Round Top Project | The Round Top Project is owned by Round Top and includes the following that were assigned by the Company to Round Top in May 2021: ● two leases with the GLO, executed in September 2011 and November 2011, that each expire in 2030, to explore and develop a 950 acre rare earths project located in Hudspeth County, Texas; ● the 54,990 acre surface lease, known as the West Lease, that provides unrestricted surface access for the potential development and mining of the Round Top Project; ● an option to purchase from the GLO the surface rights covering approximately 5,670 acres over the mining lease and additional acreage adequate to the site to handle potential heap leaching and processing operations as currently anticipated at the Round Top Project; and ● a ground water lease securing the right to develop the ground-water within a 13,120-acre lease area located approximately 4 miles from Round Top, containing five existing water wells. | |

| Tonne | A metric ton which is equivalent to 2,200 pounds. | |

| Trend | A general term for the direction or bearing of the outcrop of a geological feature of any dimension, such as a layer, vein, ore body, or fold. | |

| Unpatented mining claim | A parcel of property located on federal lands pursuant to the General Mining Law and the requirements of the state in which the unpatented claim is located, the paramount title of which remains with the federal government. The holder of a valid, unpatented lode-mining claim is granted certain rights including the right to explore and mine such claim. | |

| Vein | A mineralized zone having a more or less regular development in length, width, and depth, which clearly separates it from neighboring rock. |

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements”). Such forward-looking statements concern with respect to the Company’s anticipated results and developments in the Company’s operations, in future periods, planned exploration and development of its properties, plans related to its business, and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Any statements that express or involve discussions with respect to predictions, expectations, anticipations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements in this Annual Report include, but are not limited to:

| ● | the progress, potential and uncertainties of |

| ● |

| ● | the success of |

| ● | success, if any, of RTMD in developing the Round Top Project, including without limitation raising sufficient capital to fund any development; |

| ● | expectations regarding |

| ● | ability to complete a preliminary feasibility study; |

| ● | plans regarding anticipated expenditures at the Round Top |

| ● | plans to enter into a joint venture agreement with Santa Fe and our ability to fund such potential exploration and development project. |

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

| ● | risks of being classified as an “exploration stage” company for purposes of SEC Regulation S-K Item 1300; |

| ● | risks associated with our ability to continue as a going |

| ● | risks associated with our history of losses and need for additional financing; |

| ● | risks associated with our |

| ● | risks associated with our |

| ● | risks associated with owning a membership interest in Round Top which may be diluted (which could be significant) if we are unable to fund our cash call obligations and elect to dilute our ownership interest in Round Top in lieu of funding our cash calls per the amended RTMD Operating Agreement (as of the filing date of this Annual Report, our membership interest is 19.611%); |

| ● | risks associated with our properties; |

| ● | risks associated with the lack of history in producing metals from |

| ● | risks associated with our need for additional financing to fund our cash call obligations with respect to Round Top, as well as the requirement in general for additional capital to further develop, |

| ● | risks associated with dilution of our Round Top membership interest due to the inability to fund our cash calls; |

| ● | risks associated with owing a minority interest in Round Top; |

| ● | risks associated with exploration activities not being commercially |

| ● | risks associated with ownership of surface rights |

| ● | risks associated with increased costs affecting our financial condition; |

| ● | risks associated with a shortage of equipment and supplies adversely affecting |

| ● | risks associated with mining and mineral exploration being inherently dangerous; |

| ● | risks associated with mineralization estimates; |

| ● | risks associated with changes in mineralization estimates affecting the economic viability of |

| ● | risks associated with uninsured risks; |

| ● | risks associated with mineral operations being subject to market forces beyond our control; |

| ● | risks associated with fluctuations in commodity prices; |

| ● | risks associated with permitting, licenses and approval processes; |

| ● | risks associated with the governmental and environmental regulations; |

| ● | risks associated with future legislation regarding the mining industry and climate change; |

| ● | risks associated with potential environmental lawsuits; |

| ● | risks associated with |

| ● | risks associated with rare earth and |

| ● |

| risks related to competition in the mining and rare earth elements industries; |

| ● | risks related to |

| ● | risks associated with cybersecurity threats, breaches, and disruptions associated therewith; |

| ● | risks related to our ability to manage growth; |

| ● | risks related to the potential difficulty of attracting and retaining qualified personnel; |

| ● | risks related to our dependence on key personnel; |

| ● | risks related to conducting our business in order to be excluded from the definition of an “investment company” under the Investment Company Act of 1940; |

| ● | risks related to global hostilities, both in Ukraine and the Middle East; |

| ● | risks related to cybersecurity threats; |

4

| ● | risks related to our United States Securities and Exchange Commission (the “SEC”) filing history; and |

| ● | risks related to our securities. |

This list is not exhaustive of the factors that may affect the Company’s forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further under the section headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. The Company cautions readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Except as required by law, the Company disclaims any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.We qualify all the forward-looking statements contained in this Annual Report by the foregoing cautionary statements.

In light of these risks and uncertainties, many of which are described in greater detail elsewhere in this Annual Report, there can be no assurance that the events predicted in forward-looking statements contained in the Annual Report will in fact transpire.

An investment in our Common Stock involves significant risks, including the risk of a loss of your entire investment. You should carefully consider the risks and uncertainties described herein before purchasing our Common Stock. The risks set forth herein are not the only ones facing our Company. Additional risks and uncertainties may exist and others could arise that could also adversely affect our business, financial condition, operations and prospects. If any of the risks set forth herein actually materialize, our business, financial condition, prospects and operations would suffer. In such event, the value of our Common Stock would decline, and you could lose all or a substantial portion of your investment.

5

PART I

Corporate Organization and HistoryITEM 1. BUSINESS

We were incorporated in the State of Nevada in 1970 as Standard Silver Corporation. In July 2004, our Articles of Incorporation were amended and restated to increase the number of shares of common stock to 25,000,000, and in March 2007, we affected a 1 for 2 reverse stock split. In September 2008, we amended and restated our Articles of Incorporation to: (i) increase of the number of shares of common stock from 25,000,000 to 100,000,000; and to (ii) authorize an additional 10,000,000 shares of preferred stock, to be issued at management’s discretion. In September 2010, we amended our Amended and Restated Articles of Incorporation to change our name from Standard Silver Corporation to Texas Rare Earth Resources Corp.

On August 24, 2012, we changed our state of incorporation from the State of Nevada to the State of Delaware (the “Reincorporation”) pursuant to a plan of conversion dated August 24, 2012. The Reincorporation was previously submitted to a vote of, and approved by, our stockholders at a special meeting of the stockholders held on April 25, 2012.

On March 14, 2016, the Company filed a Certificate of Amendment with the Secretary of State of the State of Delaware to amend its Certificate of Incorporation to change the name of the Company from “Texas Rare Earth Resources Corp” to “Texas Mineral Resources Corp”. The amendment became effective on March 21, 2016. The Certificate of Amendment did not make any other amendments to the Company’s Certificate of Incorporation.

Our common stock is traded on the OTCQX U.S. operated by OTC Markets Group Inc. under the symbol “TMRC.” The market for our common stock on the OTCQX U.S. is extremely limited, sporadic and highly volatile.

Our fiscal year-end is August 31.

Narrative Description of Business

We are a mining company engaged in the business of the acquisition, exploration and development of mineral properties. We currently holdown a 19.611% membership interest in Round Top, which entity holds two nineteen yearmineral property leases executed in September 2011 and November 2011 respectively,with the GLO to explore and develop a 950 acre950-acre rare earths project located in Hudspeth County, Texas, known as the Round Top Project. WeThe leases expire in 2030 with provisions for automatic renewal if Round Top is producing in paying quantities (the receipt from the sale of materials exceeds all costs and expenses associated therewith for the prior 12 months). Round Top also haveholds prospecting permits covering 9,345 acres adjacent to the Round Top Project. Our principal focusProject and other related assets. The strategy with Round Top is on developingto develop a metallurgical process to concentrate or otherwise extract the metals from the Round Top Project’s rhyolite, although we will continue to examine other opportunities in the region as they develop. We currently have limited operationsconduct additional engineering, design, geotechnical work, and have not established that any of our projects or properties contain any Proven or Probable Reserves under SEC Industry Guide 7 (“Guide 7”).

On November 8, 2011, we announced that our supplementary operating plan to expand exploration activities at our Round Top Project had been approved by the Texas General Land Office (GLO); the expanded development and exploration drill plan calledpermitting necessary for an additional 40 drill holes and 4 diamond core holes for an estimated planned drilled footage of 20,000 feet. The program included 4,000 feet of Core drilling to establish a high level of confidence in the mineralization, provide physical engineering data and additional metallurgical sample. During 2011-2012 the permits were amended and there were 41,765 feet of reverse circulation drilling and 1,294.5 feet of core drilling done on Round Top.

On March 20, 2012, we submitted for approval an updated plan of operations. The updated plan of operations consisted of the reclassification of the drilling program through to abankable feasibility study into three phases. Phase 1 consists of 25 drill locations, phase 2 consists of 41 drill locations and phase 3 consists of 27 drill locations all located onthen to extract mineral resources from the Round Top Project. The planRound Top Project has not established as of operations also included two locationsthe date hereof that any of the properties contain any probable mineral reserves or proven mineral reserves under Item 1300 of Regulation S-K.

Rare earth elements are a group of chemically similar elements that usually are found together in nature – they are referred to as the “lanthanide series.” These individual elements have a variety of characteristics that are critical in a wide range of technologies, products, and applications and are critical inputs in existing and emerging applications. Without these elements, multiple high-tech technologies would not be possible. These technologies include:

| ● | cell phones, |

| ● | computer and television screens, |

| ● | battery operated vehicles, |

| ● | clean energy technologies, such as hybrid and electric vehicles and wind power turbines, |

| ● | fiber optics, lasers and hard disk drives, |

| ● | numerous defense applications, such as guidance and control systems and global positioning systems, and |

| ● | advanced water treatment technology for use in industrial and military. |

Because of these applications, global demand for 100 ton bulk sample collection for additional metallurgical tests. We have suspended this phase of physical explorationREE is projected to steadily increase due to continuing growth in existing applications and increased innovation and development atof new end uses. Interest in developing resources domestically has become a strategic necessity as there is limited production of these elements outside of China. Our ability to raise additional funds to continue to fund our participation interest in the Round Top Project pending developmentmay be impacted by, among other factors, future prices for REEs.

As a part of a metallurgical processour ongoing operations, we will occasionally investigate new mining opportunities. We may also incur expenses associated with our investigations. These costs are expensed as incurred until such time when we have agreements in place to extractpurchase such mining rights. See “Properties – Alhambra Project.”

Operations Update

USARE, the potentially marketable metals.

On June 22, 2012, we published our Preliminary Economic Assessment for ouroperating manager of the Round Top project, has advised TMRC that it continues to progress the Round Top Project entitled “NI 43-101 Preliminary Economic Assessmenttoward operations. Over the last twelve months, Round Top achieved several major milestones including: (i) favorable breaker trials with the goal to increase mine throughput; (ii) favorable CIX separation trials for rare earth elements indicating that the CIX technology employed can extract commercial quality rare earths from the Round Top Project Sierra Blanca, Texas,” dated June 22, 2012, effective asore; and (iii) favorable membrane concentration trials. The USARE Round Top team continues its work to determine an efficient means of May 15, 2012 (the “PEA”).

On October 3, 2012, our management released updated economic projections relatedmanaging alumina content, adding gallium to various revisionsits output and is working with a major lithium company to maximize the proposed mine plan presentedvalue of the lithium content. USARE has advised the Company that it (i) currently expects that (A) a PFS reflecting this work should be completed during calendar 2024 and (B) a small manufacturing unit should be established to begin processing Round Top Project ore in calendar 2025, and (ii) believes that Round Top remains an attractive venture and is in the PEA.process of updating the Round Top Project economic model.

History of the Round Top Project

In 2011, the Company entered into two leases with the GLO to explore and develop the Round Top Project, which leases were transferred to Round Top in 2021.

6

On

In March 6, 2013, we purchased the 54,990 acre surface lease atcovering the Round Top Project, known as the West Lease, from the Southwest Wildlife and Range Foundation (the “Foundation”(“Foundation”) for $500,000 cash and the issuance of 1,063,830 shares of our common stock. We alsoCommon Stock and agreed to support the Foundation through an annual payment of $45,000 for ten years to support conservation efforts within the Rio Grande Basin and in particular engaging in stewardship of Lake Amistad, a large and well-known fishing lake near Del Rio, Texas.Basin. The West Lease comprises approximately 54,990 acres. Most importantly, purchase ofprovides exclusive surface access to the surface lease gave us unrestricted surface accessarea for the potential development and mining of our Round Top Project. As of the date of this filing the $45,000 payments due in June 2016 and 2017 have not been paid; consequently, we have expensed the value of the West Lease during fiscal 2017. We fully intend to continue with the evaluation of the mineral potential of the property, to ultimately mine the property, and to bring the lease current when funds are available. Expensing the value of the West Lease does not restrict our access to the mineral leases.

On May 8, 2013, we released testing results by an independent laboratory of the leaching characteristic of the rhyolite at our Round Top Project, which demonstrates characteristics that may be favorable to heap leach mining at the Round Top Project. These leaching characteristics are described in greater detail below underWe transferred the section heading “Item 2. Properties –West lease to Round Top Project – Metallurgy”.in 2021.

On September 30, 2013 we released the results on column leach testing by an independent laboratory and announced our intention to issue a revised PEA based on a heap leach operation designed to produce approximately 2,500 tons per year of heavy rare earth elements plus yttrium. The column leach testing results are described in greater detail below under the section heading “Item 2. Properties – Round Top Project – Metallurgy”.

On December 23, 2013, we published a revised version of the June 2012 Preliminary Economic Assessment (the “Revised PEA”) based on a 20,000 tonne per day heap leach operation using a conventional element separation plant. The mineralized material estimate was recalculated to include uranium, niobium, tantalum and tin. The Revised PEA assesses the potential economic viability of the simplified and “scaled down” operation which we believe is a much better fit with the present rare earth market.

On September 8,In October 2014, we announced that we had completed an internal analysis suggesting that there is a reasonable possibility to adapt a lower volume staged growth approach to development of our Round Top project. The analysis indicated that an operation designed to produce a selected group of separated REE products in the range of 350-450 tonnes per year range, could potentially yield favorable mine economics. The goal of the proposed staged approach would be to increase mining rates if and when our products gained acceptability. The analysis suggested that capital needs in the Revised PEA could be proportionally reduced in relation to the lower volume initial stage. We are currently conducting a more detailed analysis of the relative capital expenses and operating expenses requirements of a scaled down processing plant with both solvent extraction and ion exchange processes under evaluation. We believe the lower capital requirements of a staged startup could offset any marginal increase in unit operating costs.

On October 29, 2014, we announced that we had executed agreements with the Texas General Land OfficeGLO securing the option to purchase the surface rights covering the potential Round Top projectProject mine and plant areas and, separately, a lease to develop the water necessary for the potential Round Top project mine operations.groundwater lease. The option to purchase the surface rights covers approximately 5,670 acres over the mining lease and we believe that the additional acreage should be adequate to site all potential heap leaching and processing operations as currently anticipated by the Company. WeRound Top. The option may exercise the optionbe exercised for all or part of the option acreage at any time during the sixteen year primary term of the mineral lease.lease as defined above. The “primary term” of the GLO mineral leases and the option is through August 2030. The option can be kept current by an annual payment of $10,000. The annual payment for the fiscal year ending August 31, 2017 has not been made as of the date of this filing. The purchase price will be the appraised value of the surface at the time of exercising the option.

The ground water lease secures ourthe right to develop the ground water within a 13,120 acre13,120-acre lease area located approximately 4 miles from the Round Top deposit. The lease area contains five existing water wells. It is anticipated that all potential water needs for the Round Top project mine operations would be satisfied by the existing wells covered by this water lease.Project. This lease has an annual minimum production payment of $5,000 prior to production of water for the operation. The minimum production payment for the fiscal year ending August 31, 2017 has not been made as of the date of this filing. After initiation of production we will paypayments of $0.95 per thousand gallons or $20,000 annually, whichever is greater.greater, is required. This lease remains effective as long as the mineral lease is in effect.

On February 24, 2015, we signed a letter of intent We transferred the option to form a joint venture with K-Technologies, Inc. (K-Tech), a chemical process developmentproduce the surface lease and applications company serving the minerals and chemicals industrieswater lease to develop, refine and market K-Tech’s Continuous Ion Exchange (CIX) and Continuous Ion Chromatography (CIC) technology as it applies primarily to the extraction of rare earth elements (REE) from native ores. The joint venture will license the technology to us, as well as other rare earth production companies. Subject to agreement by TMRC, the joint venture may also elect to build and operate processing facilities to separate and purify mixed rare earth concentrates into individual purified rare earth oxides for other rare earth production companies in addition to TMRC.

In early March 2015, we conducted a trial mining test during which we mined 500 tonnes of rhyolite, transported and crushed the ore to 80% passing a 1 ј inch screen. This rock is now stockpiled and will be used in the Stage 2 pilot plant development, as described in greater detail below under the section heading “Item 2. Properties – Round Top Project – Metallurgy”.in 2021.

On May 26, 2015, we announced that K-tech had successfully produced a low cerium concentrate solution employing their CIX/CIC process. This concentrate solution was separated from crushed Round Top rhyolite leached in 8 inch by 8 foot columns. If precipitated, dried and calcined, this concentrate would be salable in the present rare earth market. Neither uranium nor thorium was detected in the rare earth concentrate. Further test work has shown that it is possible to remove both uranium and thorium from the spent solution from the REE extraction plant. Production of the low cerium concentrate essentially completed Phase 2 of Stage 1 of our development process, with the production of final purified elemental oxides being the only step remaining to complete Phase 2 of Stage 1.

Cautionary Note

On April 6, 2015, we announced the execution of a uranium offtake agreement with UG USA, a subsidiary of Areva. According to the agreement, TMRC will supply up to 300,000 pounds of natural uranium concentrates (U308) per year based upon a pricing formula indexed to U308 spot prices at the times of delivery. The Agreement is for a term of five years commencing in 2018 or as soon thereafter, contingent upon development and production at its Round Top project. Other terms and conditions of the Agreement reflect industry standards. According to Ux Consulting, a leading uranium industry data provider, the closing spot price of U308 on March 30, 2015 was $39.50 per pound.

On July 15, 2015, we entered into an operating agreement (“Operating Agreement”) with K-Tech, to formalize our joint venture company, Reetech, LLC, a Delaware limited liability company (the “Reetech”), for the purposes of developing, refining and marketing K-Tech’s CIX/CIC process pursuant to the February 24, 2015 letter of intent with K-Tech. On October 18, 2015, we entered into an amendment agreement to the Operating Agreement, expanding the way in which we can earn percentage membership interests in Reetech in exchange for granting K-Tech changes in the management of Reetech and TMRC’s license from Reetech to use K-Tech’s CIX/CIC process for its properties.

The operating agreement between TMRC and K-Tech is still in effect, but due to the inactivity of our Round Top project, there has been no ongoing advancement under the operating agreement as of August 31, 2017.

See “Item 2. Properties – Metal Recovery Methods” for a more detailed description of the Reetech joint venture.

On September 25, 2015, we announced that Reetech was awarded a Broad Agency Announcement (BAA) research contract by the United States Defense Logistics Agency (DLA) Strategic Materials Division. The Defense Logistics Agency is the Department of Defense’s largest logistics combat support agency, providing worldwide logistics support in both peacetime and wartime to the military services as well as several civilian agencies and foreign countries. The DLA Strategic Materials Division is charged with maintaining cognizance of worldwide strategic and critical material’s supply chain from the source to final assembly, evaluating the capability of these supply chains to support national defense and essential civilian industries, and developing mitigation solutions when access to materials are insufficient to provide support for national defense and emergency response.

Reetech will conduct research to demonstrate, at the bench scale level, the ability to separate and refine yttrium (Y) oxide to a minimum of 99.999% purity, ytterbium (Yb) oxide to a minimum of 99.99% purity and a third rare earth oxide, which is not being publicly disclosed, to a minimum 99.999% purity level, using continuous ion exchange (CIX) and continuous ion chromatography (CIC).

Cautionary Note to Investors:The PEA and Revised PEA have beendated August 16, 2019 was prepared in accordance with Canadian National Instrument 43-101 — Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) —CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended.The Company has voluntarily had the PEA and Revised PEA prepared in accordance with NI 43-101 but the Company is not subject to regulation by Canadian regulatory authorities and no Canadian regulatory authority has reviewed the PEA or Revised PEA or passed upon its accuracy or compliance with NI 43-101. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with NI 43-101. These definitions differ from the definitions in SEC Industry Guide 7Item 1300 of Regulation S-K under the United States Securities Act of 1933, as amended (the “Securities Act”). Under SEC Industry Guide 7Item 1300 of Regulation S-K standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” arewhile defined in NI 43-101; however, these terms are not defined terms under SEC Industry Guide 743-101 and Item 1300 of Regulation S-K are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that all or any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7Item 1300 of Regulation S-K standards as in place tonnage and grade without reference to unit measures. Accordingly, information in the PEA and Revised PEA contains descriptions of our mineral deposits that may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder. Our projectThe Round Top Project as described in the PEA and Revised PEA currently does not contain any known proven or probable oremineral reserves under SEC Industry Guide 7Item 1300 of Regulation S-K reporting standards. U.S. investors are urged to consider closely the disclosure in the Registrant’s latest reports and registration statements filed with the SEC.U.S. Investors are cautioned not to assume that any defined resources in these categories will ever be converted into SEC Guide 7Item 1300 of Regulation S-K compliant reserves.

USA Rare Earth Agreement

In August 2018, the Company and Morzev Pty. Ltd. (“Morzev”) entered into an agreement (the “2018 Option Agreement”) whereby Morzev was granted the exclusive right to earn and acquire a 70% interest in the Round Top Project by financing $10 million of expenditures in connection with the Round Top Project, increasable to an 80% interest, for an additional $3 million payment to the Company. Morzev began engaging in business as USA Rare Earth and in May 2019 notified the Company that it was nominating USA Rare Earth, LLC (“USARE”) as the optionee under the terms of the 2018 Option Agreement. In August 2019, the Company and USARE entered into an amended and restated option agreement as further amended on June 29, 2020 (the “2019 Option Agreement” and collectively with the 2018 Option Agreement, the “Option Agreement”), whereby the Company restated its agreement to grant USARE the exclusive right to earn and acquire a 70% interest, increasable to an 80% interest, in the Round Top Project.

In May 2021, and in accordance with the terms of the Option Agreement, the Company and USARE entered into a contribution agreement (“Contribution Agreement”) whereby the Company and USARE contributed assets to Round Top, at the time a wholly-owned subsidiary of the Company, in exchange for their initial ownership interests in Round Top, of which the Company initially owned a membership interest equating to 20% of Round Top and USARE initially owned a membership interest equating to 80% of Round Top. Concurrently therewith, the Company and USARE as the two members entered into a limited liability company agreement (“Operating Agreement”) governing the operations of Round Top which contains customary and industry standard terms as contemplated by the Option Agreement. USARE serves as manager of Round Top.

7

Current

Upon entry into the Contribution Agreement, the Company assigned the following contracts and Planned Exploration Activitiesassets to Round Top in exchange for its initial 20% membership interest in Round Top:

| ● | the assignment and assumption agreement with respect to the mineral leases from the Company to Round Top; |

Stage 1

| ● | the assignment and assumption agreement with respect to the surface lease from the Company to Round Top; |

| ● | the assignment and assumption agreement with respect to the surface purchase option from the Company to Round Top; |

| ● | the assignment and assumption agreement with respect to the water lease from the Company to Round Top; and |

| ● | the bill of sale and assignment agreement of existing data and other relevant contracts and permits with respect to Round Top owned by the Company. |

and USARE assigned the following assets to Round Top (or the Company, as applicable) for its initial 80% membership interest in Round Top:

| ● | cash to Round Top to continue to fund Round Top operations in the amount of approximately $3,761,750 comprising the balance of the $10 million required expenditure to earn a 70% interest in Round Top; |

| ● | cash in the amount of $3 million to the Company upon exercise of the USARE option to acquire from the Company an additional 10% interest in Round Top, resulting in the aggregate ownership interest of 80% in Round Top; |

| ● | bill of sale and assignment agreement of the Pilot Plant and other relevant contracts and permits to Round Top; and |

| ● | bill of sale and assignment agreement of existing data and intellectual property owned by USARE to Round Top. |

On June 26, 2023, the Company, USARE and the manager amended and restated the Operating Agreement and the following material amendments to the Operating Agreement were adopted:

Cash Calls.

On the basis of the adopted program and budget (sometimes referred to as the “Budget”) then in effect, the manager will submit to each member monthly cash calls at least 10 days before the last day of each month, and within 10 days of receipt, (a) USARE will pay to RTMD, as an additional capital contribution, its proportionate share of the estimated cash requirements based on its interest and (b) the Company will either (i) pay to RTMD, as an additional capital contribution, its proportionate share of the estimated cash requirements based on its interest, or (ii) deliver to RTMD a written notice indicating what amount, if any, of the applicable estimated cash requirements that the Company will contribute (the “Notice of Non-Contribution”). Failure by the Company to deliver payment of its proportionate share of the estimated cash requirements, as an additional capital contribution, or to deliver a Notice of Non-Contribution within the 10 day period shall automatically be considered a “Deemed Non-Contribution” and shall have the same effect as if the Company provided a timely Notice of Non-Contribution with respect to non-contribution of its entire proportionate share of the applicable cash call.

Remedies for Failure to Meet Cash Calls

Non-Contribution. Capital contributions only will be made to fund programs and budgets. If the Company does not contribute all or any portion of any additional capital contribution that it is required to contribute pursuant to a Notice of Non-Contribution or a Deemed Non-Contribution (such unfunded amount shall be deemed the “Shortfall Amount”), then USARE shall fund the entire Shortfall Amount within 5 business days after the Notice of Non-Contribution or Deemed Non-Contribution.

Dilution. Upon receiptthe contribution of adequatethe Shortfall Amount by USARE, the interests of the members will be recalculated based on the adjustment provision set forth below in the sub-heading “– Adjustment of Interests”.

Maximum Dilution. The dilution of the Company shall not fall below a 3% interest in RTMD (the “Minimum Percentage Interest”). Upon the contribution by USARE of a Shortfall Amount which otherwise would result in a dilution of the Company below the Minimum Percentage Interest, USARE will receive a priority distribution of available cash, in addition to a distribution of available cash to which USARE otherwise is entitled to receive as a result of its proportionate additional capital contribution pursuant to the applicable cash call request, up to the Shortfall Amount that would have resulted in the Company’s interest being further diluted but for the Minimum Percentage Interest (the “Priority Distribution”). The Priority Distribution will continue until USARE has been reimbursed for its contribution of the Shortfall Amount that would have resulted in the Company having an interest below the Minimum Percentage Interest, after which time the members shall receive distributions of available cash pro rata in proportion to their respective interests.

8

Adjustment of Interests.

If USARE contributes the Shortfall Amount, then the then current interest of the Company will be reduced (subject to the Minimum Percentage Interest), effective as of each cash call under an additional capital contribution for the applicable program and budget, by a fraction, expressed as a percentage:

| ● | the numerator of which equals the Shortfall Amount actually funded by USARE; and |

| ● | the denominator of which equals the market capitalization of the Company. |

For example, the dilution with respect to the December 2023 Round Top cash call notice that was sent on November 16, 2023 was calculated as follows: (A) the USARE ownership interest in Round Top at October 27, 2023 was 80.274% and the Company’s ownership interest in Round Top at October 27, 2023 was 19.726%; (B) the December 2023 Round Top cash call noticed on November 16, 2023 was for an aggregate amount of $726,188, of which $582,939 is to be contributed by USARE and $143,249 is to be contributed by the Company; (C) the Company provided a Notice of Non-Contribution stating that it will not contribute the $143,249 which then became the Shortfall Amount; (D) USARE will contribute its $582,939 plus the Shortfall Amount; and (E) the Company as of the date of the Notice of Non-Contribution had a market capitalization of $24,585,099. Accordingly, the Shortfall Amount equaled 0.583% of the Company’s market capitalization, and the Company’s percentage Interest in the Company was reduced to 19.611%.

Distributions

Cash in excess of authorized reserves will be distributed to the members pro-rata in proportion to their respective interests on a periodic basis as determined by the management committee. RTMD will be required to make tax distributions to each member. Once USARE has been paid the Priority Distribution, if applicable, all distributions made in connection with the sale or exchange of all or substantially all of RTMD’s assets and all distributions made in connection with the liquidation of RTMD will be made to the members pro-rata in accordance with their respective interests.

Other material terms of the Operating Agreement that remain unchanged are as follows:

Management.

A management committee will make the major decisions of RTMD, such as approval of the respective program and budget, and the manager will implement such decisions. The management committee consists of three representatives of the members, with two being appointed by USARE and one by the Company which is Dan Gorski. The representatives vote the ownership percentage interests of their appointing member.

Management Committee Meetings.

Meetings will be held every three months unless otherwise agreed. For matters before the management committee that require a vote, voting is by simple majority except for certain “major decisions” that require a unanimous vote. So long as the Company maintains a 15% or greater ownership interest, the nine decisions identified in the bullet points below require unanimous approval. If the Company’s ownership interest falls below 15%, the number of unanimous decisions is reduced to five (being the first five bullet points below). If the Company is acquired by a REE mining company or sells its ownership interest to a REE mining company, in each case who elects a majority of the Company’s board, this unanimous approval requirement can be suspended by USARE, at its option. The major decisions requiring unanimous approval, as set forth above, are:

| ● | approval of an amendment to any program and budget that causes the program and budget to increase by 15% or more, except for emergencies; |

| ● | other than purchase money security interests or other security interests in RTMD equipment to finance the acquisition or lease of RTMD equipment used in operations, the consummation of a project financing or the incurrence by RTMD of any indebtedness for borrowed money that requires the guarantee by any member of any obligations of RTMD; |

| ● | substitution of a member under certain circumstances and dissolution of RTMD; |

| ● | the issuance of an ownership interest or other equity interest in RTMD, or the admission of any person as a new member of RTMD, other than in connection with the exercise of a right of first offer by a member; |

| ● | the redemption of all or any portion of an ownership interest, except for limited circumstances provided for in the Operating Agreement; |

9

| ● | a decision to grant authorization for RTMD to file a petition for relief under any chapter of the United States Bankruptcy Code, to consent to such relief in any involuntary petition filed against RTMD by any third party, or to admit in writing any insolvency of RTMD or inability to pay its debts as they become due, or to consent to any receivership of RTMD; |

| ● | acquisition or disposition of significant mineral rights, other real property or water rights outside of the area of interest as set forth in the Operating Agreement or outside of the ordinary course of business; |

| ● | the merger of RTMD into or with any other entity; and |

| ● | the sale of all or substantially all of RTMD’s assets. |

Manager.

The manager will manage, direct and control operations in accordance with program and budget, will prepare and present to the management committee a proposed program and budget, and will generally oversee and implement all of the day to day activities of RTMD. The manager will conduct necessary equipment and materials procurement and property and equipment maintenance activities, with all operations to be conducted in accordance with adopted program and budget.

Permitted Transfers.

Certain transfers are permitted under the Operating Agreement, including transfers to affiliates or through certain mergers or other forms of business reorganization. A member may also encumber its ownership interest provided that if the ownership interest is foreclosed upon, the other member has a pre-emptive right to acquire such ownership interest at the foreclosure sale. If the transfer is a “permitted transfer,” the transferee is automatically admitted as a member; otherwise unless the other member agrees, the transferee is only an economic interest holder with no voting or other rights held by a member.

Right of First Offer.

If a member desires to transfer all or a portion of its ownership interest to a third party (other than a permitted transfer), it may do that without the consent of the other member so long as it gives the other member the first right to purchase its ownership interest on the same terms. If the other member does not elect to purchase the ownership interest on such terms, the member may sell its ownership interest on such terms and the transfer will be a permitted transfer.

Drag-Along Right.

If USARE accepts a bona fide offer to purchase its entire ownership interest and all other rights under the Operating Agreement from an unrelated third party, the Company will then be obligated to sell its entire ownership interest and all other rights under the Operating Agreement to the unrelated third party on the same terms and conditions as are accepted by USARE.

Current Ownership in Round Top.

Pursuant to the Operating Agreement, USARE initially owned membership interests equating to 80% of Round Top and the Company initially owned membership interests equating to 20% of Round Top. These ownership interests have been and will be adjusted further under a variety of circumstances, including a decision by us not to fund in cash our portion of a Budget. USARE’s contribution of approximately $3,761,750 in cash to Round Top in May 2021 was used first to fund operations pursuant to the initial Budget. Currently, USARE and the Company are obligated, subject to an election by the Company not to fund in cash its portion of a Round Top cash call and in lieu thereof to incur dilution to its membership interests, to fund further expenditures in proportion to their respective ownership interests. We funded $386,400 in cash during the fiscal year ended August 31, 2023 and elected not to fund $448,800 which resulted in the dilution of our Round Top membership interest to 19.874% at August 31, 2023. Subsequent to September 1, 2023 through the date of this Annual Report, we plannotified USARE that we had elected not to completecontribute in cash our proportionate interest in aggregate cash calls of $396,249 which reduced our RTMD ownership interest to 19.611% as of the developmentdate of this Annual Report pursuant to the dilution mechanism in the June 2023 amended Operating Agreement. USARE has advised us that the preliminary estimate of the Round Top Budget for the fiscal year ending August 31, 2024, is currently anticipated to be between $15 million to $20 million, with the Company’s portion currently being estimated to be between $3 million to $4 million. It is possible that the Round Top Budget for the current fiscal year could increase and it should be expected that in future periods the Round Top Budget will be higher. The Company likely will decide to incur dilution to its then current membership interest in lieu of funding in cash its Round Top Budget obligations during this fiscal year, as it currently does not have sufficient capital to fund its currently expected cash calls and general and administrative expenses during the fiscal year ending August 31, 2024; consequently our ownership interest in the Round Top Project will likely be further diluted during this current fiscal year. In future periods, we will be required to raise additional capital to fund future cash calls from Round Top (unless we elect in lieu of making cash contributions to dilute our membership interest percentage, which dilution could be significant), and there can be no assurance that we will be able to raise the necessary capital to fund our Round Top cash calls. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources.”

10

Operations of the Round Top Project

During the fiscal year ending August 31, 2024, Round Top is currently anticipated to fund the expenditure of between $15 million to $20 million to optimize the leaching and developing of the CIX/CIC processing of the Round Top primary leach solution. The bench scale testing of thisProject. Initial process Stage 1, was divided into two phases. Phase 1, now completed, was to purify the primary leach solution and produce a concentrated, low flow rate feedstock suitable for further processing by CIX/CIC. Development has now progressed into Phase 2 which is to effect a separationdesign work will be carried out at USARE’s facility in Wheat Ridge, Colorado. Pending completion of the rare earth elements into groups for final refinement. In work completedinitial process development, this facility will either be relocated to date, we have producedor replicated at USARE’s Oklahoma facility where a concentrated solution from which we have removed the low value elements lanthanum and cerium. The resulting solution containing the high value rare earth elements could be precipitated into a marketable concentrate if so desired.

Work now is in progress to make the final purified elemental oxides, thereby completing Stage 1 bench scale testing. This work is being done in conjunction with the contract from the Defense Logistics Agency to produce the highly purified yttrium, ytterbium and other element products.

Stage 2

Stage 2 will consist of the pilot plant scale testing of the process proven most effective by Stage 1, and will consist of the work requiredis expected to bring the processing plant into full feasibility with capital and operating costsbe established. It is estimated to an accuracy range of 10 -15%. Stage 2 will also develop the heap leach procedure to pre-feasibility level with capital and operating estimated to an accuracy of 25 - 35%. Environmental base line studies and initial co-ordination with the Texas regulatory agencies will be included in this stage.

Stage 3

Stage 3 will bringthat the Round Top Project will require additional time and further expenditure to fullcomplete a bankable feasibility level with all electrical power and water needs developed, final engineering of heap leach systems, mine design and engineering, geotechnical drilling and construction planning, and permitting in place. Additional drilling to bring all ofstudy. As such, it is possible that the rock includedRound Top Budget will increase in the 20current fiscal year. In accordance with the current Round Top Budget, the Company does not have sufficient capital to fund its total cash calls (currently anticipated to be between $3 million to $4 million) and expected general and administrative expenses (of not less than $600,000) during the fiscal year pitending August 31, 2024; accordingly, we expect to a measured or indicated resourced category.incur dilution to our then current membership interest in lieu of funding our Round Top cash calls.

Trends – Rare-Earth MarketMarkets

Rare earth elements, (or “REEs”)or REEs, are a group of chemically similar elements that usually are found together in nature;nature – they are referred to as the “lanthanide series.” These individual elements have a variety of characteristics that are important in a wide range of technologies, products, and applications and are critical inputs in existing and emerging applications including: computer hard drives, cell phones, clean energy technologies, such as hybrid and electric vehicles and wind power turbines; multiple high-tech uses, including fiber optics, lasers and hard disk drives; numerous defense applications, such as guidance and control systems and global positioning systems; and advanced water treatment technology for use in industrial, military and outdoor recreation applications. As a result, global demand for REE is projected to steadily increase due to continuing growth in existing applications and increased innovation and development of new end uses. Interest in developing resources domestically has become a strategic necessity as there is limited production of these elements outside of China. Our ability, if any, to raise additional funds in order to completefund our plan of exploration and, if warranted, development at the Round Top Projectexpected cash calls in RTMD may be impacted by future prices for REEs.

Rare earth prices are extremely depressed at this time. It is thought that the liquidation of excessive inventories in China is causing these depressed prices. Chinese sources observe that most of the Chinese primary producers are not showing profit at this time. However, demand for rare earth products continues to grow at a healthy rate. We believe that the present prices will likely prevail for the next year at least until the surplus Chinese product is absorbed by the market.

Pricing for REEs has experienced significant volatility over the past several years, but current prices for all REEs remain significantly higher than pre-2010 levels, although they have fallen from the peak levels seen in 2011. According to www.metal-pages.com (“Metal-Pages”) REE prices increased from mid-2010 to mid-2011 approximately 2,000 to 3,000 percent, depending on the element, and then REE prices began decreasing through the end of 2011. REO prices of individual oxides increased considerably during the first two quarters of 2011 but declined thereafter through to the end of the year. Beginning in the second quarter of 2012, REE prices have decreased significantly for all REEs.

Pricing is affected by a number of factors, including the general health of the global economy, efforts to institute greater environmental reforms in China, industry consolidation, stockpile build-ups in China and by consumers and governments, lack of certainty regarding future REE production, development and continued use of REE technologies, potential oversupply, potential substitution of other metals, and potential for recycling REEs.

REE supply markets continue to be dominated by China, which produced an estimated 86% of the global REE production in 2012. IMCOA forecasts that global rare earth supply will increase to 180,000 mt in 2016, with China producing approximately 65% of that total. In relation to global REE demand, based on the IMCOA Report, REE total demand is forecasted to increase from 115,000 tonnes in 2012 to 162,500 tonnes in 2016. It is forecasted that the demand for REE will increase at a rate of eight to 10 percent per year for the next five to 10 years, but this is dependent on continued development and use of REEs in new technologies.

We plan on focusing primarily on so-called “heavy” rare earth elements (HREE). The supply market for HREEs is dominated by the Chinese who control approximately 99% of the market. In addition to the pricing influences mentioned above applicable to all REEs, pricing of HREEs in the future is expected to be highly influenced by China policies of HREE supply and China stockpile buildups.

Sources and Availability of Raw Materials

We areThe Round Top Project is currently in the exploration stage and as such we doRound Top does not require any significant raw materials in order to carry out ourits primary operating activities. Our primary operating objectiveThe goal of RTMD is to explorecontinue to fund the exploration and developdevelopment of the Round Top Project. For at least the next year, we expectProject to continue to require the usedetermine whether it is commercially feasible, of contract drilling services in order to obtain additional geological information. In the past year we have been able to secure contract drilling services without excessive delay and costs. We expect the contract drilling services will continue towhich there can be available over the next year.

no assurance. The raw materials that ourthe current operations of Round Top rely onupon are gasoline and diesel fuel for the exploration vehicles and for the heavy equipment required to build roads and conduct drilling operations. Water is expected to be provided per service contract by Eagle Mountain Gang which is used for the drilling operations.or through other sources.

Seasonality

Seasonality in the State of Texas is not a material factor to our operations for our project.

Competition

The mining industry is highly competitive. We competeRound Top competes with numerous companies, substantially all withof which have greater financial resources available to them. WeRound Top is, therefore, are operating at a significant disadvantage in the course of acquiring mining properties and obtaining materials, supplies, labor, and equipment. Additionally, Round Top is and we are and will continue to be an insignificant participant in the business of exploration and mineral property development. A large number of established and well-financed companies are active in the mining industry and will have an advantage over usRTMD and the Company if they are competing for the same properties. Nearly all such entities have greater financial resources, technical expertise and managerial capabilities than ourselves and, consequently, weRTMD and the Company will be at a competitive disadvantage in identifying possible mining properties and procuring the same.

China accounts for the vast majority of rare earth element production. While rare earth element projects exist outside of China, very few are in actual production. Further, given the timeline for current exploration projects to come into production, if at all, it is likely that the Chinese will be able to dominate the market for rare earth elements into the future. This gives the Chinese a competitive advantage in controlling the supply of rare earth elements and engaging in competitive price reductions to discourage competition. Any increase in the amount of rare earth elements exported from other nations, and increased competition, may result in price reductions, reduced margins and loss of potential market share, any of which could materially adversely affect our profitability.operations. As a result of these factors, weRTMD and the Company may not be able to compete effectively against current and future competitors.

Government Approvals

The exploration, drilling and mining industries operate in a legal environment that requires permits to conduct virtually all operations. Thus permits are required by local, state and federal government agencies. Local authorities, usually counties, also have control over mining activity. The various permits address such issues as prospecting, development, production, labor standards, taxes, occupational health and safety, toxic substances, air quality, water use, water discharge, water quality, noise, dust, wildlife impacts, as well as other environmental and socioeconomic issues.

11

Prior to receiving the necessary permits to explore or mine, the operator must comply with all regulatory requirements imposed by all governmental authorities having jurisdiction over the project area. Very often, in order to obtain the requisite permits, the operator must have its land reclamation, restoration or replacement plans pre-approved. Specifically, the operator must present its plan as to how it intends to restore or replace the affected area. Often all or any of these requirements can cause delays or involve costly studies or alterations of the proposed activity or time frame of operations, in order to mitigate impacts. All of these factors make it more difficult and costly to operate and have a negative and sometimes fatal impact on the viability of the exploration or mining operation. Finally, itIt is possible that future changes in these laws or regulations could have a significant impact on our business as well as RTMD’s business, causing those activities to be economically reevaluated at that time.

Effect of Existing or Probable Government and Environmental Regulations

Mineral exploration, including mining operations are subject to governmental regulation. OurThe Round Top operations may be affected in varying degrees by government regulation such as restrictions on production, price controls, tax increases, expropriation of property, environmental and pollution controls or changes in conditions under which minerals may be marketed. An excess supply of certain minerals may exist from time to time due to lack of markets, restrictions on exports, and numerous factors beyond our control. These factors include market fluctuations and government regulations relating to prices, taxes, royalties, allowable production and importing and exporting minerals. The effect of these factors cannot be accurately determined, and we are not aware of any probable government regulations that would impact the Company.determined. This section is intended as a brief overview of the laws and regulations described herein and is not intended to be a comprehensive treatment of the subject matter.

Overview.Like all other mining companies doing business in the United States, we areRound Top is subject to a variety of federal, state and local statutes, rules and regulations designed to protect the quality of the air and water, and threatened or endangered species, in the vicinity of its operations. These include “permitting” or pre-operating approval requirements designed to ensure the environmental integrity of a proposed mining facility, operating requirements designed to mitigate the effects of discharges into the environment during exploration, mining operations, and reclamation or post-operation requirements designed to remediate the lands affected by a mining facility once commercial mining operations have ceased.

Federal legislation in the United States and implementing regulations adopted and administered by the Environmental Protection Agency, the Forest Service, the Bureau of Land Management, the Fish and Wildlife Service, the Army Corps of Engineers and other agencies—in particular, legislation such as the federal Clean Water Act, the Clean Air Act, the National Environmental Policy Act, the Endangered Species Act, the National Forest Management Act, the Wilderness Act, and the Comprehensive Environmental Response, Compensation and Liability Act—have a direct bearing on domestic mining operations. These federal initiatives are often administered and enforced through state agencies operating under parallel state statutes and regulations.

The Clean Water Act. The federal Clean Water Act is the principal federal environmental protection law regulating mining operations in the United States as it pertains to water quality.

At the state level, water quality is regulated by the Environment Department, Water and Waste Management Division under the Water Quality Act (state). If our exploration or any future development activities might affect a ground water aquifer, it will have to apply for a Ground Water Discharge Permit from the Ground Water Quality Bureau in compliance with the Groundwater Regulations. If exploration affects surface water, then compliance with the Surface Water Regulations is required.

The Clean Air Act. The federal Clean Air Act establishes ambient air quality standards, limits the discharges of new sources and hazardous air pollutants and establishes a federal air quality permitting program for such discharges. Hazardous materials are defined in the federal Clean Air Act and enabling regulations adopted under the federal Clean Air Act to include various metals. The federal Clean Air Act also imposes limitations on the level of particulate matter generated from mining operations.

National Environmental Policy Act (NEPA). NEPA requires all governmental agencies to consider the impact on the human environment of major federal actions as therein defined.

Endangered Species Act (ESA). The ESA requires federal agencies to ensure that any action authorized, funded or carried out by such agency is not likely to jeopardize the continued existence of any endangered or threatened species or result in the destruction or adverse modification of their critical habitat. In order to facilitate the conservation of imperiled species, the ESA establishes an interagency consultation process. When a federal agency proposes an action that “may affect” a listed species, it must consult with the USFWSUnited States Fish and Wildlife Service (“USFWS”) and must prepare a “biological assessment” of the effects of a major construction activity if the USFWS advises that a threatened species may be present in the area of the activity.

National Forest Management Act. The National Forest Management Act, as implemented through title 36 of the Code of Federal Regulations, provides a planning framework for lands and resource management of the National Forests. The planning framework seeks to manage the National Forest System resources in a combination that best serves the public interest without impairment of the productivity of the land, consistent with the Multiple Use Sustained Yield Act of 1960.

12

Wilderness Act. The Wilderness Act of 1964 created a National Wilderness Preservation System composed of federally owned areas designated by Congress as “wilderness areas” to be preserved for future use and enjoyment.

The Comprehensive Environmental Response, Compensation and Liability Act (CERCLA). CERCLA imposes clean-up and reclamation responsibilities with respect to discharges into the environment, and establishes significant criminal and civil penalties against those persons who are primarily responsible for such discharges.

The Resource Conservation and Recovery Act (RCRA). RCRA was designed and implemented to regulate the disposal of solid and hazardous wastes. It restricts solid waste disposal practices and the management, reuse or recovery of solid wastes and imposes substantial additional requirements on the subcategory of solid wastes that are determined to be hazardous. Like the Clean Water Act, RCRA provides for citizens’ suits to enforce the provisions of the law.

National Historic Preservation Act. The National Historic Preservation Act was designed and implemented to protect historic and cultural properties. Compliance with the Act is necessary where federal properties or federal actions are undertaken, such as mineral exploration on federal land, which may impact historic or traditional cultural properties, including native or Indian cultural sites.

In the fiscal year ended August 31, 2017, we2023, RTMD incurred minimal costs in complying with environmental laws and regulations in relation to ourits operating activities.

Employees

Employees

Including our executive officers, we currently have three fulltimetwo full-time employees. Salaries for these three employees are in arrears and are accrued monthly. We also utilize the services of qualified consultants with geological and mineralogical expertise as well as individualsan individual for accounting services.

Investment Company Act Exclusion

Section 3(c)(9) of the Investment Company Act of 1940, as amended (“1940 Act”), provides that a company “substantially all of whose business consists of owning or holding oil, gas, or other mineral royalties or leases, or fractional interests therein, or certificates of interest or participation in or investment contracts relative to such royalties, leases, or fractional interests” is not an investment company within the meaning of the 1940 Act. The Company has determined that this exemption applies to it giving consideration to the following four factors:

| ● | whether the exempted activity constitutes “substantially all” of our business; |

| ○ | The Company has owned mineral leases since 2010, all of our business to date has been comprised of owning and developing the mineral leases and, after the May 2021 “farm-down” of its 100% interest in the mineral leases, substantially all of our business continues to be comprised of owning and holding a certificate of interest and a participation in the mineral leases owned by Round Top. The Company’s mineral assets historically, as well as the value of the certificate of interest at August 31, 2023, have been booked at cost in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). We have an accumulated deficit of approximately $42.7 million at August 31, 2023 as a result of owning and developing the Round Top Project. |

| ● | whether we own or trade in the mineral leases; |

| ○ | The Company has owned the mineral leases, which are now owned by Round Top, since 2010 and neither the Company nor Round Top is in the business of dealing or trading in the mineral leases. |

| ● | what qualifies as an eligible asset for purposes of the exception; and |

| ○ | The statute specifically references mineral leases and our mineral leases were owned by the Company and are now owned by Round Top. In accordance with Regulation S-K Item 1300 that governs disclosure by registrants engaged in mining operations, the definition of mineral resource is “a concentration or occurrence of material of economic interest in or on the Earth’s crust.” Our rare earth elements and minerals underlying the mineral leases meet that definition, as well as does coal, silver, gold and other material mined for economic value by registrants involved in mining operations. The SEC staff has recognized that an excepted entity can also engage in related business activities such as exploring, developing, and operating the eligible assets. |

13

| ● | what qualifies as a “certificate of interest or participation in” or an “investment contract relative to” the eligible assets. |

| ○ | The statute allows a Company to own a “certificate of interest” or “participation in” the mineral leases. The SEC staff has advised that limited partnership interests and/or similar securities issued by entities that themselves own the leases constitute “certificate of interest or participation in or investment contracts” related to such leases. The Company’s 20% membership interest in Round Top constitutes a “certificate of interest” and a “participation in” the mineral leases that are owned by Round Top. |

The Company intends to continue to conduct its business operations in order to continue to be excluded from the definition of an “investment company” under the 1940 Act.

Available Information

We make available, free of charge, on or through our Internet website, at www.TMRC.com our Annual Reportannual reports on Form 10-K, our quarterly reports on Form 10-Q and our current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. Our Internet website and the information contained therein or connected thereto are not intended to be, and are not incorporated into this Annual Report.

Our filings can also be viewed at our corporate offices, located at 539 El Paso Street, Sierra Blanca, Texas 79851. Our reports, registration statements and other information can be inspected on the SEC’s website at www.sec.gov and such information can also be inspected and copies ordered at the public reference facilities maintained by the SEC at the following location: Judiciary Plaza, 100 F Street NE, Washington, D.C. 20549.

Executive Officers of the Company

The following table sets forth certain information regarding our executive officers as of December 11, 2017: