UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | | | | | | | | | | | | | |

| (Mark One) | | | | |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | | | |

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 20172020

OR

| | | | | | | | | | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | | | |

For the transition period to

Commission file number: 001-36290

MALIBU BOATS, INC.

(Exact Name of Registrant as specified in its charter)

|

| | | | | | | | | | | | | | | | | | | |

| Delaware | | 5075 Kimberly Way,

Loudon, Tennessee 37774 | Loudon, | Tennessee | 37774 | | 46-4024640 |

(State or other jurisdiction of

incorporation or organization)

| | (Address of principal executive offices,

including zip code)

| | | | | (I.R.S. Employer

Identification No.)

|

| | (865) 458-5478 | | |

| | (Registrant’s telephone number,

including area code)

| | |

|

| | | | |

Securities Registered Pursuant to Section 12(b) of the Act:(865) | 458-5478 |

| (Registrant’s telephone number, including area code) | |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Class A Common Stock, ($0.01 par value per share)$0.01 | MBUU | NASDAQNasdaq Global Select Market |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨þ No þ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in the definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☑ | | Accelerated filer | | ☐ |

| | | | | | |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | | | | |

| Emerging growth company | | ☐ | | | | |

| | | | | | |

Large accelerated filer | | ¨ | | Accelerated filer | | þ |

| | | |

Non-accelerated filer | | ¨ (Do not check if a smaller reporting company)

| | Smaller reporting company | | ¨ |

| | | | | | |

Emerging growth company | | þ | | | | |

| | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. þ¨ | | | | | | |

| | | | | |

| Indicate by a check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. | ☑ |

| | | | | | | | | | | | | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | Yes ¨ | ☐ | Noþ | ☑ |

As of December 31, 2016,2019, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate value of the registrant’s common stock held by non-affiliates was approximately $303.0 $830.9 million, based on the number of shares of Class A common stock held by non-affiliates as of December 31, 20162019 and the closing price of the registrant’s Class A common stock on the NASDAQNasdaq Global Select Market on December 31, 2016.2019. Shares held by each executive officer, director and by each person who owns 10% or more of the outstanding Class A common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes. The number of outstanding shares of the registrant’s Class A common stock, par value $0.01 per share, and Class B common stock, par value $0.01, as of September 6, 2017August 28, 2020 was 20,287,03020,620,752 and 18, 13, respectively.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for the 20172020 Annual Meeting of Stockholders are incorporated into Part III of this Annual Report on Form 10-K where indicated. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended June 30, 2017.2020.

TABLE OF CONTENTS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. All statements other than statements of historical facts contained in this Form 10-K are forward-looking statements, including statements regarding expected benefitsthe effects of our acquisition of Cobalt Boats, LLC,the COVID-19 pandemic on us; demand for our products and expected industry trends, our business strategy and plans, our prospective products or products under development, our vertical integration initiatives, our acquisition strategy and management’s objectives for future operations. In particular, many of the statements under the headings “Item 1A. Risk Factors,” “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Item 1.”

Business” constitute forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” the negative of these terms, or by other similar expressions that convey uncertainty of future events or outcomes to identify these forward-looking statements. These statements are only predictions, involving known and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Such factors include, but are not limited to: the successful integrationeffects of Cobalt Boats, LLC into our business;the COVID-19 pandemic on us; general industry, economic and business conditions; significant fluctuations in our annual and quarterly financial results; unfavorable weather conditions;conditions, policies impacting access to waterways and shelter-in-place orders; our reliance on our network of independent dealers and increasing competition for dealers; the financial health of our dealers and their continued access to financing; our obligation to repurchase inventory of certain dealers; the success of our failureengine integration strategy; our reliance on certain suppliers for our engines and outboard motors; our reliance on third-party suppliers for raw materials and components and any interruption of our informal supply arrangements; our ability to managemeet our manufacturing levels while addressing the seasonal retail pattern forworkforce needs; exposure to workers' compensation claims and other workplace liabilities; our products;ability to grow our business through acquisitions and integrate such acquisitions to fully realize their expected benefits; our growth strategy which may require us to secure significant additional capital; our large fixed cost base; intense competition within our industry; increased consumer preference for used boats or the supply of new boats by competitors in excess of demand; the successful introduction of new products; the success of our engines integration strategy; competition with other activities for consumers’ scarce leisure time; the continued strength of our brands; our ability to execute our manufacturing strategy successfully; our ability to meet our manufacturing workforce needs; our reliance on third-party suppliers and ability to obtain adequate raw materials and components; our exposure to claims for product liability and warranty claims; our dependence on key personnel; our ability to grow our business through acquisitions or strategic alliances and new partnerships; our growth strategy which may require us to secure significant additional capital; our ability to protect our intellectual property; disruptions to our network and information systems; exposure to workers' compensation claims and other workplace liabilities; risks inherent in operating in foreign jurisdictions; rising concern regarding international tariffs; changes in currency exchange rates; an increase in energy and fuel costs; any failure to comply with laws and regulations including environmental and other regulatory requirements; a natural disaster, global pandemic or other disruption at our manufacturing facilities; increases in income tax rates or changes in income tax laws; covenants in our credit facilitiesagreement governing our revolving credit facility and term loan which may limit our operating flexibility; our variable rate indebtedness which subjects us to interest rate risk; our status as an “emerging growth company”; and any failure to maintain effective internal control over financial reporting or disclosure controls or procedures.

We discuss many of these factors, risks and uncertainties in greater detail under the heading “Item 1A. Risk Factors” and elsewhere in this Form 10-K. These factors expressly qualify as forward-looking statements attributable to us or persons acting on our behalf.

You should not rely on forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Actual results may differ materially from those suggested by the forward-looking statements for various reasons, including those discussed under “Item 1A. Risk Factors” in this Form 10-K. Except as required by law, we assume no obligation to update forward-looking statements for any reason after the date of this Form 10-K to conform these statements to actual results or to changes in our expectations.

PART I.

Item 1. Business

Unless otherwise expressly indicated or the context otherwise requires, in this Annual Report on Form 10-K:

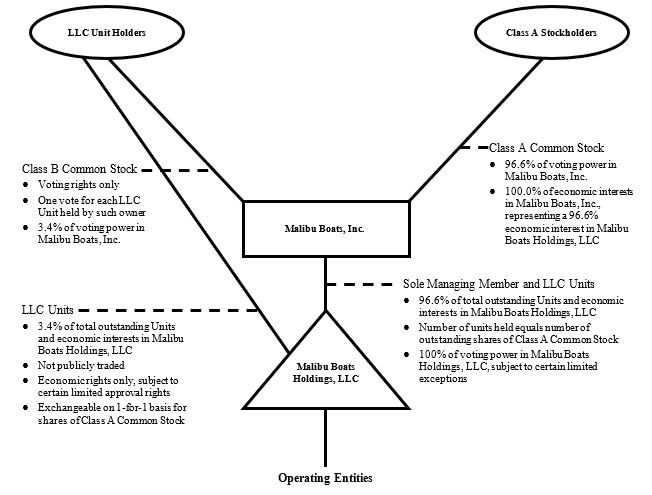

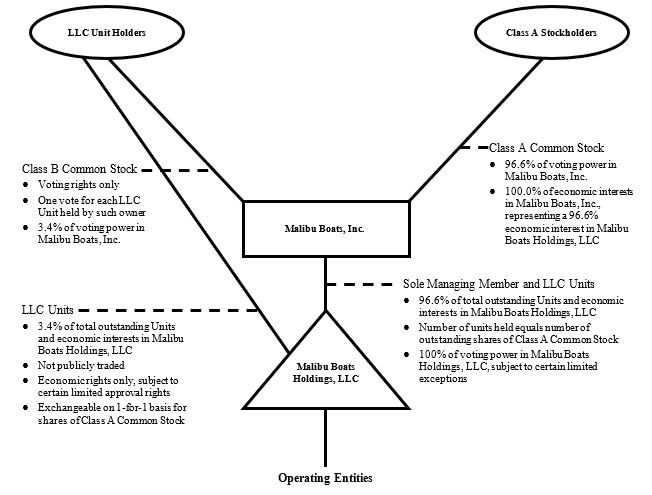

•we use the terms “Malibu Boats,” the “Company,” “we,” “us,” “our” or similar references to refer (1) prior to the consummation of our IPO on February 5, 2014, to Malibu Boats Holdings, LLC, or the LLC, and its consolidated subsidiaries and (2) after our IPO, to Malibu Boats, Inc. and its consolidated subsidiaries;

•we refer to our initial public offering of Class A common stock on February 5, 2014, as our “IPO”;

•we refer to the owners of membership interests in the LLC immediately prior to the consummation of the IPO, collectively, as our “pre-IPO owners”;

•we refer to owners of membership interests in the LLC (the "LLC Units"), collectively, as our “LLC members”;

•references to “fiscal year” refer to the fiscal year of Malibu Boats, which ends on June 30. Fiscal year 2013 for the LLC ended on June 30 2013. Fiscal years 2014, 2015, 2016of each year;

•we refer to our Malibu branded boats as "Malibu", our Axis Wake Research branded boats as "Axis", our Cobalt branded boats as "Cobalt", and 2017 ended on June 30, 2014, 2015, 2016 and 2017 respectively;our Pursuit branded boats as "Pursuit";

•we use the term “recreational powerboat industry” to refer to our industry group, which includes performance sport boats, sterndrive and outboard boats;

•we use the term “performance sport boat category” to refer to ourthe industry category, consisting primarily of fiberglass boats equipped with inboard propulsion and ranging from 19 feet to 26 feet in length, which we believe most closely corresponds to (1) the inboard ski/wakeboard category, as defined and tracked by the National Marine Manufacturers Association, or NMMA, and (2) the inboard skiboat category, as defined and tracked by Statistical Surveys, Inc., or SSI;

•we use the terms “sterndrive” and “outboard” to refer to our newly expandedthe industry category, consisting primarily of sterndrive and outboard boats ranging from 20 feet to 40 feet, which most closely corresponds to (1) the sterndrive and outboard categories, as defined and tracked by NMMA, and (2) the sterndrive and outboard propulsion categories, as defined and tracked by SSI; and

•references to certain market and industry data presented in this Form 10-K are determined as follows: (1) U.S. boat sales and unit volume for the overall powerboat industry and any powerboat category during any calendar year are based on retail boat market data from the NMMA; (2) U.S. market share and unit volume for the overall powerboat industry and any powerboat category during any fiscal year ended June 30 or any calendar year ended December 31 are based on comparable same-state retail boat registration data from SSI, as reported by the 50 states for which data was available as of the date of this Form 10-K; and (3) market share among U.S. manufacturers of exports to international markets of boats in any powerboat category for any period is based on data from the Port Import Export Reporting Service, available through March 31, 2017,2020, and excludes such data for Australia and New Zealand.

This Annual Report on Form 10-K includes our trademarks, such as “Surf Gate,” “Wakesetter,” “SurfBand,” “Swim Step,” and “TrueWave” which are protected under applicable intellectual property laws and are the property of Malibu Boats. This Form 10-K also contains trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this Form 10-K may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names.

Our Company

We are a leading designer, manufacturer and marketer of a diverse range of recreational powerboats, including performance sport boats, sterndrive and outboard boats.boats under four brands—Malibu, Axis, Cobalt, and Pursuit. We have the #1 market share position in the United States in the performance sport boat category through our Malibu and Axis Wake Research (“Axis”) brands. With our recent acquisition of Cobalt Boats, LLC (“Cobalt”) in July 2017, we also havebrands and the #1 market share position in the United States through our Cobalt brand in the 24’—29’ segment of the sterndrive category.category through our Cobalt brand, and we are among the leading market share positions in the fiberglass outboard fishing boat market with our Pursuit brand. Our boatsproduct portfolio of premium brands are used for a broad range of recreational boating activities including, among others, water sports includingsuch as water skiing, wakeboarding and wake surfing, as well as general recreational boating.boating and fishing. Our passion for consistent innovation, which has led to propriety technology such as Surf Gate, has allowed us to expand the market for our

products by introducing consumers to new and exciting recreational activities. We believe we have been a consistent innovator in the recreational powerboat industry, designingdesign products that appeal to an expanding range of recreational boaters and water sports enthusiasts whose passion for boating and water sports is a key aspect of their lifestyle. We believe many of our innovations, such as our

proprietary Surf Gate technology launched in 2012, expand the market for our products by introducing consumers to newlifestyle and exciting recreational activities. We also added another strong brand in Cobalt with a versatile lineup of boats, further deepening our product portfolio, expanding our addressable market, and ultimately, our ability to provide consumers with a better customer-inspired experience. We believe that theWith performance, quality, value and multi-purpose features, of our boats positionproduct portfolio has us well positioned to broaden our addressable market and achieve our goal of increasing our market share in the expanding recreational boating industry.

We sell our boats under three brands—Malibu; Axis; and Cobalt. Our flagship Malibu boats offer our latest innovations in performance, comfort and convenience, and are designed for consumers seeking a premium performance sport boat experience. Retail prices of our Malibu boats typically range from $50,000 to $180,000. We launched ourOur Axis boats in 2009 to appeal to consumers who desire a more affordable performance sport boat product but still demand high performance, functional simplicity and the option to upgrade key features. Retail prices of our Axis boats typically range from $50,000 to $95,000. Our Cobalt boats consist of mid to large-sized luxury cruisers and bowriders that we believe offer the ultimate experience in comfort, performance and quality. Our Pursuit boats expand our product offerings into the saltwater outboard fishing market and include center console, dual console and offshore models. Retail prices for our Cobalt boats typicallyboat models range from $50,000 $60,000 to $700,000.$800,000.

Our boats are constructed of fiberglass, available in a range of sizes, hull designs and propulsion systems (i.e., inboard, sterndrive and outboard). We employ experienced product development and engineering teams that enable us to offer a range of models across each of our brands while consistently introducing innovative features in our product offerings. Our engineering teamteams closely collaboratescollaborate with our manufacturing personnel in order to improve product quality and process efficiencies. The results of this collaboration are reflected in our receipt of numerous industry awards, including the "WSIA Innovation of Year"Boating Industry Magazine's "Top Product" award for the Malibu Command CenterM240 in 20172020, Pursuit S 378 in 2020, Malibu 25 LSV in 2019, Surf Band in 2018 and the Boating Industry's "Top Product Award" for theour Integrated Surf Platform ("ISP") in 2016.2016, as well as the Boating Industry's Best New and Innovative Products in 2019 for the Cobalt A29. We have also been recognized as Sounding Trade Only Today’s “2019 Top Most Innovative Marine Companies,” and we earned the honors of "WSIA Innovation of Year" award for our Malibu M240 M-Line Hull with Surf Gate Fusion in 2020, Malibu Monsoon Engines in 2019 and our Malibu Command Center in 2017.

We sell our boats through a dealer network that we believe is the strongest in the recreational powerboat industry. As of July 1, 2017,2020, our Malibu and Axis brand distribution channel consisted of 126 independent dealers operating in 146 locations in North America and we had 59 independentover 350 dealer locations across 40 countries outside of North America, including Australia. Our Malibu and Axis brand boats are the exclusive performance sport boats offered by the majority of our dealers. Our acquisition of Cobalt has allowed us to expand into Cobalt’s strong network which consists of 111 independent dealers operating 142 locations worldwide with a large percentage of those dealers having the #1 or #2 market share in their respective markets. The acquisition of Cobalt has increased our total independent dealer network to over 300 locations globally. Our dealer base is an important part of our consumers’ experience, our marketing efforts and our brands. We devote significant time and resources to find, develop and improve the performance of our dealers and believe our dealer network gives us a distinct competitive advantage.

Financial Information About SegmentsImpact of COVID-19 Pandemic

We currently reportThe COVID-19 pandemic has significantly impacted health and economic conditions throughout the United States and world, and it had a significant impact on our operations and financial results for fiscal year 2020. On March 24, 2020, we elected to suspend operations at all of our facilities, and we subsequently resumed operations at our facilities in late April and May 2020. As a result of the suspension of our production of boats, our net sales declined by $30.9 million, or 4.5%, and our unit sales decreased by 918 units, or 12.5%, for fiscal year 2020 compared to fiscal 2019. However, sales at our dealers, while impacted negatively by COVID-19 in late March and through April, improved materially from May through July 2020 and that increase has depleted inventory at our dealers.

For more information on how the COVID-19 pandemic has impacted us and may continue to impact us, see the risk factor “The COVID-19 pandemic is adversely affecting, and is expected to continue to adversely affect, our operations, and those of our dealers and suppliers, thereby adversely affecting our business, financial condition and results of operationsoperations.” under two reportable segments called U.S.Part I. Item 1A. of this Form 10- K, and Australia segments based on their respective geographic manufacturing footprints. Each segment participates in the manufacturing, distribution, marketing“Management’s Discussion and saleAnalysis of MalibuFinancial Conditions and Axis performance sport boats. The U.S. operating segment primarily serves markets in North America, South America, Europe, and Asia while the Australia operating segment principally serves the Australian and New Zealand markets. The segment and geographic information required herein is contained in Note 17 - Segment Reporting, in the notes to our consolidated financial statements.

We acquired Cobalt in July 2017, and asResults of Operations--Impact of the dateCOVID-19 Pandemic” under Part I., Item 7. of this report, we have not made a final assessment as to the number of reportable segments the Company will have in accordance with Accounting Standards Codification ("ASC") 280, Segment Reporting, going forward.Form 10-K.

Our Market Opportunity

During calendar year 2016,2019, retail sales of new recreational powerboats in the United States totaled $8.2$11.3 billion. Of the recreational powerboat categories defined and tracked by the NMMA, our core market corresponds most directly towe serve the inboard ski/wakeboard category, which we refer to as thetop three categories of outboard, sterndrive and performance sport boat category. We serve this categoryrepresenting an addressable market of nearly $9.8 billion in retail sales through our Malibu, Axis, Cobalt, and CobaltPursuit brands. Through our Cobalt brand, we also now directly access the larger outboard and sterndrive categories, which together accounted for $5.5 billion in retail sales in calendar year 2016. Combined, our product portfolio allows us to meaningfully access an addressable market that represented nearly $6.6 billion of sales in 2016. The following table illustrates the size of our addressable market in units and retail sales for calendar year 2016:2019:

|

| | | | | | | |

| Powerboat Category | | Unit Sales | | Retail Sales |

| | | | | (Dollars in millions) |

| Outboard | | 160,900 |

| | $ | 4,659 |

|

| Sterndrive | | 12,200 |

| | 878 |

|

| Performance sport boat | | 8,700 |

| | 818 |

|

| Jet boat | | 5,000 |

| | 205 |

|

| Total addressable market | | 186,800 |

| | $ | 6,560 |

|

We believe we are well-positioned to benefit from trends in our addressable market, including:

Improving Macroeconomic Environment Driving Increased Consumer Demand for Boats. Following the economic downturn, the recreational powerboat industry has grown and is projected to continue to recover by the NMMA. While domestic sales of recreational powerboats in 2016 grew to approximately 186,800 units, they remained 37% below the historical peak 2006 sales volume of approximately 298,000 units. Within our primary category, performance sport boats, units grew to approximately 8,700 in 2016, 34% below the category's historical peak 2006 sales volume of 13,100, We believe there remains significant opportunity for growth from increased consumer demand in the recreational powerboat industry as the economy improves, but there are numerous variables that have potential to impact future growth.

Size and Strong Growth of Outboard Category. The outboard category of the recreational powerboat industry is the largest category, measured both by unit sales and retail sales. In 2016, outboard boats represented approximately 86% of total units sold and approximately 71% of total retail sales in the United States. Additionally, the outboard category has been one of the strongest performers of the recreational powerboat industry over the past several years. The chart below illustrates the performance of the outboard category based on retail sales since 2010, growing, on average, 7.7% in each of the past six years:

With our recent Cobalt acquisition, we now have a product line designed specifically to target the outboard category of the recreational powerboat industry. We believe the outboard category will continue to be the largest and one of the strongest categories of the recreational powerboat industry, and that significant opportunity remains for us to enhance our outboard product portfolio and dealer distribution network to capitalize on the outboard category’s performance.

Increasing Ages of Used Boats Driving New Boat Sales. In 2016, according to NMMA retail sales data, new recreational powerboats accounted for approximately one out of five recreational powerboat sales in the United States compared to an average of approximately one out of four between 2002 and 2008. We believe the shift toward purchasing more used boats during the economic downturn helped cause the average age of recreational powerboats in use to increase from 15 years in 1997 to over 21 years today. We believe that as the recreational powerboat industry continues its ongoing recovery and older boats reach the end of their usable lives, we expect consumer purchases of new boats to shift back toward historic levels benefiting new boat manufacturers. | | | | | | | | | | | | | | |

| Recreational Powerboat Category | | Unit Sales | | Retail Sales |

| | | | (Dollars in millions) |

| Outboard | | 172,700 | | | $ | 7,656 | |

| Sterndrive | | 10,100 | | | 883 | |

| Performance sport boat | | 11,100 | | | 1,232 | |

| Jet boat | | 5,900 | | | 289 | |

| Cruisers | | 1,600 | | | 1,269 | |

| Total addressable market | | 201,400 | | | $ | 11,329 | |

Our Strengths

#1Leading Market Share Position in Performance Sport Boat CategoryPositions. According to SSI, we have held the number one market share position, based on unit volume, in the United States among manufacturers of performance sport boats for each calendar yearsyear since 2010 including 2016.2019. We have grown our U.S. market share in this category through our Malibu and Axis brands from 24.4%24.5% in 2010 to 33.0%32.7% in 2016. The following table reflects our U.S.2019. Furthermore, we also hold the number one market share in the performance sport boat category compared to the market share of our competitors for the periods shown:

|

| | | | | | | | | | | | | | | | | | | | | |

| | | U.S. Market Share in Performance Sport Boat Category |

| Manufacturer/Brand(s) | | 2010 | | 2011 | | 2012 | | 2013 | | 2014 | | 2015 | | 2016 |

| | | | | | | | | | | | | | | |

| Malibu Boats/Malibu and Axis | | 24.4 | % | | 29.0 | % | | 30.8 | % | | 33.0 | % | | 32.0 | % | | 32.0 | % | | 33.0 | % |

Correct Craft, Inc./Nautique1 | | 23.1 |

| | 19.9 |

| | 19.6 |

| | 20.6 |

| | 23.0 |

| | 21.6 |

| | 21.9 |

|

| MasterCraft Boat Company, LLC/MasterCraft | | 23.3 |

| | 23.9 |

| | 21.8 |

| | 20.0 |

| | 20.5 |

| | 21.7 |

| | 21.5 |

|

| Skier's Choice, Inc./Supra and Moomba | | 16.7 |

| | 15.6 |

| | 14.7 |

| | 12.6 |

| | 12.0 |

| | 12.8 |

| | 12.2 |

|

| All others | | 12.5 |

| | 11.6 |

| | 13.1 |

| | 13.8 |

| | 12.5 |

| | 11.9 |

| | 11.4 |

|

| Total | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

|

| | |

(1) | | In June 2015, Correct Craft acquired majority interest in both Centurion Boats and Supreme Boats. Accordingly, market share for Ski Supreme, Centurion, and Nautique Boat Company, Inc. ("Nautique") are reflected combined here for all periods for better comparison. |

In addition, our 48% market share of performance sport boat exports to international markets for the 12 months ended March 31, 2017 was the highest among U.S. manufacturers and was more than the market share of our top two competitors combined.

#1 Market Share Position in the 24’—29’ Segment of the Sterndrive Boat Category. Our recent acquisition of Cobalt has established us as a market leader in the sterndrive category. According to SSI, our Cobalt brand holds the highest market share for sterndrive boatsposition in the 24’—29’ segment a segment that we believe isof the largest segment within the overall sterndrive boat category, by retail sales dollars. Since 2010,through our Cobalt brand according to SSI. Cobalt has expanded its market share in this segment from 14.2% in 2010 to 29.2%35.0% in 2016. The following table reflects2019. With our U.S.Pursuit brand we hold the number two market share position in the offshore boat category for calendar year 2019. Pursuit has expanded its market share in the 24’—29’this segment of the sterndrive boat category comparedfrom 17.7% in 2010 to the market share of our competitors for the periods shown (certain totals for the table below will not sum to exactly 100% due to rounding):18.8% in 2019.

|

| | | | | | | | | | | | | | | | | | | | | |

| | | U.S. Market Share in Sterndrive 24'-29' Segment |

| Manufacturer/Brand(s) | | 2010 | | 2011 | | 2012 | | 2013 | | 2014 | | 2015 | | 2016 |

| (units sold) | | | | | | | | | | | | | | |

| Cobalt Boats | | 14.2 | % | | 18.3 | % | | 18.1 | % | | 21.0 | % | | 27.0 | % | | 27.8 | % | | 29.2 | % |

| Sea Ray | | 18.6 |

| | 20.7 |

| | 20.6 |

| | 17.2 |

| | 16.6 |

| | 16.5 |

| | 15.4 |

|

| Chaparral | | 12.7 |

| | 16.7 |

| | 15.7 |

| | 18.0 |

| | 16.1 |

| | 14.9 |

| | 14.0 |

|

| Regal Boats | | 5.1 |

| | 5.9 |

| | 7.5 |

| | 8.1 |

| | 6.9 |

| | 9.3 |

| | 8.9 |

|

| Crownline | | 6.4 |

| | 6.7 |

| | 8.5 |

| | 7.5 |

| | 6.9 |

| | 7.5 |

| | 8.4 |

|

| Monterey | | 3.6 |

| | 4.9 |

| | 5.6 |

| | 6.7 |

| | 6.1 |

| | 6.4 |

| | 6.9 |

|

| All Others | | 39.4 |

| | 26.8 |

| | 24.0 |

| | 21.6 |

| | 20.4 |

| | 17.7 |

| | 17.1 |

|

| Total | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

Industry-leading Product Design and Innovation. We believe that our innovation in the design of new boat models and new features has been a key to our success, helping us increase our market share within our categories and generally broaden the appeal of our products among recreational boaters. As a result of the features we have introduced, we believe thatsuch as our Integrated Surf Platform which includes patented Surf Gate and Power Wedge technology along with tailored swim steps and hard tank ballast, our boats arecan be used for an increasingly wide range of activities andactivities. At the same time they are increasingly easier to use, while maintaining the highhighest level of performance characteristics that consumers expect. Additionally, by introducing new boat models across our portfolio of brands in a range of price points, sizes, bow and hull designs, engine propulsion, and optional performance features, we believe we have enhanced consumers’ ability to select a boat suited to their individual preferences. Our commitment to and consistency in, developing new boat models and introducing new features are reflected in several notable achievements, including:

release of our patented Surf Gate technology in 2012, which allows users to surf on either side of the boat’s wake, generates a better quality surf wavefact we consistently and was the WSIA Innovation of the Year in 2013;

launch of the Axis brand of boats in 2009, designed from the ground up to be an entry-level product, which has already captured a 11.3% share of the U.S. market in our category as of December 31, 2016;

evolution of our patented Power Wedge, introduced in 2006 into the industry leading Integrated Surf Platform that includes an array of exclusive Malibu technology—Power Wedge II, Surf Gate, Surf Band and Command Center—and provides our consumers with the ability to customize the size and shape of their wakes and waves;

successfulsuccessfully bring multiple new model introductions eachyear after year. For model year 2017, we launched four new Malibu models: the Malibu Wakesetter 24 MXZ, the Malibu Wakesetter 22 MXZ, and the Malibu Wakesetter 21 VLX were all launched in the summer of 2016; and the Malibu Response TXi was launched in November of 2016. For model year 2017, five new Cobalt models were launched: the Gateway Series CS1, the A Series A36, the SD-SC Series 23SC and 25SC Outboards, and the WSS Surf Series CS3WSS Surf; and

a strong new expected product lineup for model year 2018 that includes a new Axis T22, a new Axis A24, an unidentified Malibu introduction and the launch of the new Wakesetter 23 LSV. In addition, Cobalt expects to announce three new models for model year 2018.

Focus on VerticalVertical Integration Opportunities. We have vertically integrated severala number of key components of our manufacturing process, including the manufacturing of our own engines, boat trailers, towers and tower accessories, machined and billet parts, and tooling. Most recently, we announced anWe began including our engines, branded as Malibu Monsoon engines, in our Malibu and Axis boats for model year 2019. We believe our engine marinization initiative to vertically integratewill reduce our reliance on our previous engine marinizationsuppliers for our Malibu and Axis brands.brands while reducing the risk that a change in cost or production from any engine supplier for such brands could adversely affect our business. Recently we began producing soft grip flooring for our Malibu, Axis and new Cobalt models. Vertical integration of key components of our boats gives us the ability to increase incremental margin per boat sold by reducing our cost base and improving the efficiency of our manufacturing process. Additionally, it allows us to have greater control over design, consumer customization options, construction quality, and our supply chain. For example, if our engine marinization initiative is implemented, our reliance on our two engine suppliers for Malibu and Axis will be significantly diminished, reducing the risk that a change in cost or production from any engine supplier could adversely affect our business. We continually review our manufacturing process to identify opportunities for additional vertical integration investments.investments across our portfolio of premium brands.

Intellectual Property. A key element of our growth and increased market share has been our intellectual property, which we believe is the best in our industry. Among the most innovative and sought after features on our boats has been Surf Gate. Together with Power Wedge and Surf Band, we believe that these patented technologies will continue to drive demand for our

products and increased margins. Withincrease margins across our brands. In fiscal 2018 we acquired Swim Step, through our acquisition of Cobalt we have acquired additional valuable intellectual property, such as Swim Step,which further increasingincreases the appeal of our product portfolio. Consequently, there is an increased need to vigorously defend our patents and other intellectual property to ensure we maintain our competitive edge. Because of the appeal of these technologies, we have entered into agreements to license them to other manufacturers within the performance sport boat category. We believe licensing our products provides us with a significant strategic advantage over our competitors by allowing us to expand into other markets and broadening the appeal of these technologies into segments that would not otherwise have them, thereby eventually creating a path to a Malibu purchase.

Strong Dealer Network. We have worked diligently with our dealers to developcultivate one of the strongest distribution networks in the recreational powerboat industry. We believe that our Malibu and Axis brand distribution network of 146 North American dealer locations and 59 international dealer locations as of July 1, 2017 allows us to distribute our performance sport boat products more broadly and effectively than our competitors. For calendar year 2016, our Malibu and Axis brand dealers held or tied for the #1 market share position for the performance sport boat category in 70 of 119 U.S. markets. Our Cobalt distribution network includes 142 worldwide dealer locations. Of those, 22 Cobalt dealers are ranked in Boating Industry’s Top 100 Dealers survey, with six Cobalt dealers ranked in the top 10. We continually review our geographic coverage to identify opportunities for expansion and improvement, and will, where necessary, add dealer locations to address previously underserved markets or replace underperforming dealers.

Highly Recognized Brands. We believe our Malibu, Axis, Cobalt and CobaltPursuit brands are widely recognized in the recreational powerboat industry, which helps us reach a growing number of target consumers. For over 30 years, our Malibu brand has generated a loyal following of recreational boaters and water sports enthusiasts who value the brand’s premium performance and features. Ourfeatures, while our Axis brand has grown rapidly as consumers have been drawn to its more affordable price point and available optional features. Our newly-acquiredWe also acquired two well-known brands in Cobalt brandand Pursuit. Cobalt has developed into one of the industry’s most recognizable and respected brands over its 50-year history. We believe thatFor over the appeal of our superior performancepast 40 years, Pursuit has established a premium brand through its extensive dealer network and innovative products combined with our history with boating enthusiasts and professional water sports athletes contributeslongstanding commitment to our brand awareness with dealers and consumers.customers. We are able to build on thisour brand recognition and support through a series of marketing initiatives coordinated with our dealers or executed directly by us. Our marketing efforts are conducted using an array of strategies, which include digital advertising, social media engagement, advertisements in endemic media and the sponsorship of grass-roots boating and watersport events. Additionally, our boats, their innovative features, our sponsored athletes and our dealers all frequently win industry awards, which we believe further boosts our brand recognition and reputation for excellence. We believe our marketing strategies and accomplishments enhance our profile in the industry, strengthen our credibility with consumers and dealers, and increase the appeal of our brands.

Diverse Product Offering. Our acquisition of Cobalt broadens our product portfolio, allowing usWe are able to engage consumers inacross multiple categories within the recreational powerboat industry. Malibu operatesand Axis are market leaders in the performance sport boat category, controlling the highest market share. Cobalt is the market leaderoperates in the 24’—29’ segment of the sterndrive category and has recentlyalso expanded its product portfolio beyond traditional sterndrive boats with the introduction of itsinto wake surfing and outboard product lines, increasing Cobalt’s addressable market. Overall, we believe our acquisition of Cobalt diversifies our product offering and consumer base, while simultaneously building a collectively strongerPursuit competes in the saltwater outboard fishing boat manufacturer.

Compelling Marginsmarket with center console, dual console and Cash Flow. Our net income margin was 8.0% and 11.0% for fiscal years 2016 and 2017, respectively. Our adjusted EBITDA margin was 19.1% and 19.8% for fiscal years 2016 and 2017, respectively. For the definition of adjusted EBITDA margin and a reconciliation to net income, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations - GAAP Reconciliation of Non-GAAP Financial Measures.” We also produced $35.6 million and $35.9 million of net cash from operating activities for fiscal years 2016 and 2017, respectively. We have previously executed, and continue to execute, on an array of initiatives focused on reducing our costs and improving the efficiency of our manufacturing process, enabling us to maintain attractive margins and strong cash flows. These efforts include vertical integration of engines, trailers, towers and tower accessories production, giving us the ability to increase incremental margin per boat sold. In addition, our low capital expenditure requirements and highly efficient working capital cycle have allowed us to generate significant excess cash flow from operations, excluding one-time litigation costs incurred in each of fiscal years 2016 and 2017. We believe our strong cash flow increases our financial stability and provides us with more flexibility to invest in growth initiatives. We further believe our experience implementing operational improvements and vertical integration initiatives to expand margin will positively impact the performance of our recently acquired Cobalt subsidiary. Significant opportunities for operational and financial improvement exist within the Cobalt business and include sourcing and procurement, lamination, assembly processes personnel management, and vertical integration.

Highly Experienced Management Team. Our experienced management team has demonstrated its ability to navigate various economic cycles, identify, create and integrate new product innovations, improve financial performance, optimize operations, enhance our distribution model and recruit top industry talent. Our Chief Executive Officer, Jack Springer, joined Malibu Boats in 2009 and has assembled an executive team with strong, complementary talents and experience. This team has

led a workforce that we believe has produced superior results, including market share gains, sales growth and profitability improvement.offshore models.

Our Strategy

We intend to capitalize on the recovery in the recreational powerboat industry through the following strategies:

Continue to Develop New and Innovative Products in Our Categories. We intend to continue developing and introducing new and innovative products—both new boat models to better address a broader range of consumers and new features to deliver better performance, functionality, convenience, comfort and safety to our consumers. We believe that new products and features are important to the growth of our market share, the continued expansion of our categories and our ability to maintain attractive margins.

Our product development strategy consists of a two-pronged approach. First, we seek to introduce new boat models to target unaddressed or underserved segments of the recreational powerboat industry, while also updating and refreshing our existing boat models regularly. For example, we introduced Axis-branded boats starting in 2009 to address the entry-level segment of the performance sport boat category, we launched the Malibu Wakesetter MXZ product line in 2012 to enter the premium “picklefork” bow design segment of the performance sport boat category, and we released the Malibu M235 in 2016 to deliver luxury and performance in the ultra-premium segment of the performance sport boat category. Second, we seek to develop and integrate innovative new featuresor enhanced optional feature offerings into our boats, such asboats. For our Malibu and Axis brands this includes Surf Gate, Malibu Touch Command Center, Power Wedge III, Tower Mister, Fast Fill Ballast System, G5 Tower and Power Wedge. Overintegrated flip down Swim Step. For Cobalt, it includes outboard propulsion models to expand its addressable market. Cobalt has been able to achieve growth in recent years partly by pivoting and expanding into the past two years, westerndrive surfing category through its Cobalt Surf series, which now features Surf Gate. In addition, other new features have continued these strategies by introducing eightincluded Splash and Stow and a new models,electronic flip down Swim Step for model year 2021 boats. For the Pursuit brand, the focus has been on expanding our award winning Dual Console, Sport and Offshore product offerings that continue to combine innovative features and dependable performance in refined designs that accommodate a broad array of activities on the water, including three in the Axis line, and we have enhanced our optional feature offerings withElectric Sliding Entertainment Center on the new Power Wedge II and the industry’s first 12-inch touchscreen dash system. For our 2017 model year, we released the Wakesetter 22 MXZ, the Wakesetter 24 MXZ, the Wakesetter 21VLX and the Malibu Response TXi.S 378. We intend to continue releasing new products and features multiple times during the year, which we believe enhances our reputation as a leading-edge boat manufacturer and provides us with a competitive advantage. For our 2018 model year, which began July 1, 2017, we released the newly redesigned Wakesetter 23 LSV, Axis T22 and the Axis A24 and, in November 2017, we expect to launch a new Malibu model. In addition, our initiative to produce our own engines, announced in November 2016, is well underway and we expect to continue our vertical integration strategy focused on delivering better quality and value to our consumers while enhancing margins.

Our recent acquisition of Cobalt is consistent with this strategy, given Cobalt’s strong track record of producing innovative new products and refreshing existing boat models. Cobalt has established a leading market position in the sterndrive category, having progressively updated its portfolio with new models in line with emerging industry trends. In 2017, Cobalt launched a series of Cobalt-branded outboard propulsion models to expand its addressable market. Cobalt has been able to achieve growth in recent years partly by pivoting and expanding into the performance sport boat category through its new Cobalt Surf series, combining new surf features into successful preexisting CS3, R3, R5 and R7 models.

Further Strengthen Our Dealer Network. Our goal is to achieve and maintain leading market share in each of the categories in which we operate. We continually assess our distribution network and believe we take the actions necessary to achieve our goal. We intend to strengthen our current footprint by selectively recruiting market-leading dealers who currently sell our competitors’ products. In addition, we plan to continue expanding our dealer network in certain geographic areas to increase consumer access and service in strategic markets. Our recent acquisition of Cobalt improves our overall dealer network, as Cobalt distributes through a large percentage of dealers with #1 or #2 market share in their respective markets. We believe our targeted initiatives to enhance and grow our dealer network organically andacross all of our integration of Cobalt’s dealer networkbrands will increase unit sales in the future.

Continue to Seek Vertical Integration Opportunities. Over the past several years, we have focused on expanding our vertical integration capabilities, having brought in-house the production of towers and tower accessories, trailers, machined and billet parts, and, most recently, we announced an initiative to begin marinizingproducing our own engines for our Malibu and Axis brand boats. boats and soft grip flooring for our Malibu, Axis and new Cobalt models. Additional vertical integration opportunities exist across our product portfolio and we are aggressively monitoring these opportunities. With our recent acquisition of Cobalt, we believe opportunities exist to leverage Malibu’s vertical integration investments, including manufacturing towers and tower accessories, trailers, and machined and billet parts for Cobalt boats.

Selectively Pursue Strategic Acquisitions. One of our growth strategies is to drive growth in our business through targeted acquisitions that add value while considering our existing brands and product portfolio. We have focused on growth through acquisitions both domestically and abroad, as evidenced by our recentacquisition of Pursuit in October 2018, our acquisition of Cobalt in July 2017 and our October 2014 acquisition of our Australian licensee.licensee in October 2014. The primary objectives of our acquisitions are to expand our presence in new or adjacent categories, to expand into other product lines and business that may benefit from our

operating strengths, and to increase the size of our addressable market. When we identify potential acquisitions, we attempt to target companies with a leading market share, strong cash flows, and an experienced management team and workforce that provide a fit with our existing operations. After completing an acquisition, we focus on integrating the company with our existing business to provide additional value to the

combined entity through cost savings and revenue synergies, such as the optimization of manufacturing operations, improved processes around product development, enhancement of our existing dealer distribution network, administrative cost savings, shared procurement, vertical integration and cross-selling opportunities.

Accelerate International Expansion. Based on our U.S. leadership position, brand recognition, diverse, innovative product offering and distribution strengths, we believe that we are well-positioned to increase our international sales. Our 48% market share of performance sport boat exports to international markets for the twelve months ended March 31, 2017 was the highest among U.S. manufacturers and is supported by an extensive international distribution network of 59 international dealer locations for our Malibu and Axis brand boats. We believe we can increase our international sales both by promoting our products in developed markets where we have a well-established dealer base, such as Western Europe, and by penetrating new and emerging markets where we expect rising consumer incomes to increase demand for recreational products, such as Asia and South America. Our recent acquisition of Cobalt also expands the product offering that we may offer to dealers and allows us the ability to cross-sell into our existing dealer networks where appropriate.

Our Products and Brands

We design, manufacture and sell recreational powerboats, including performance sport boats, sterndrive and outboard boats thatacross four world-renowned brands: Malibu, Axis, Cobalt and Pursuit. We believe we believe deliver superior performance for general recreational purposes with a significant focus on water sports, including wakeboarding, water skiing and wake surfing. We market our boats under three brands:surfing

Malibu, our flagship brand, dates to our inception in 1982, primarily targeting consumers seeking a premium7

as well as general recreational boating experience and offering our latest innovations in performance, comfort and convenience;

Axis, which we launched as a new brand in 2009, targets a younger demographic and provides them with a more affordably priced, entry-level boat that provides high performance, functional simplicity and the option to upgrade key features; and

Cobalt, which we acquired in July 2017, has built a longstanding culture of excellence throughout its 50-year history by providing a range of luxury sterndrive and outboard boats.

fishing. In addition, we also offer various accessories and aftermarket parts.

Boat Models

We believe our boats are renowned for their performance, design, innovative technology, quality and ability to provide consumers a high-quality boating experience at varying price points. We currently offer a number of recreational powerboat models across our three brands, which provide consumers with a variety of options across length, hull type, bow type, horsepower and seating capacity in addition to customizable designs and features available for upgrade across our models. The following table provides an overview of our most popular product offerings by brand: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Brand | | Number of

Models | | Lengths | | Retail Price

Range

(In thousands) | | Description |

| Malibu | | 11 | | 20'-25' | | $60-$210 | | Founded in 1982, Malibu targets consumers seeking a premium boating experience with our latest innovations in performance, comfort and convenience. Malibu is comprised of three product lines: |

| | | | | |

Brand | | Number• Wakesetter Series - Our line of

Models

| Lengths | Propulsion Types | Bow Types | Retail Price

Range

(In thousands) highly-customizable boats offering our most innovative technologies and premium features, with the newest color options and interior finishes.

|

Malibu | 11 | 20'-25' | Inboard | Traditional, Picklefork | $50-$180 | | | • M Series - Our line of ultra-premium towboats, featuring the Malibu M240, loaded with every technologically innovative feature we offer including our Integrated Surf Platform, premium luxury interiors, most advanced helm in the industry, and our most powerful engine. |

Axis | 5 | 20’-24’ | Inboard | Traditional,

Picklefork | $50-$95 | | | • Response Series - Our line of high-performance water ski focused towboats completely redesigned in 2017. |

CobaltAxis | 18 | 20’-40’5 | Sterndrive/Outboard | Traditional20’-24’ | | $50-65-$700115 | | Launched in 2009, Axis was formed to target a younger demographic by providing a more affordably priced, high quality, entry-level boat with high performance, functional simplicity and the option to upgrade key features such as Surf Gate. Axis currently features five models. |

| Cobalt | | 16 | | 20’-36’ | | $60-$450 | | Founded in 1967, Cobalt is a premium luxury sterndrive and outboard boat manufacturer available in five product lines: |

| | | | | | | | • Gateway Series - Our entry level fiberglass sterndrive sporting the refined quality of Cobalt boats. The Gateway series is designed to allow for the comfort, convenience, and performance typically found on much larger Cobalt boats while allowing for an “athletic” use. |

| | | | | | | | • R Series - Our mid-range premium fiberglass sterndrive boat in the largest segment that has a sleek, powerful look with a smooth ride and exceptional performance. |

| | | | | | | | • A Series - Our super premium fiberglass sterndrive boat that blends yacht-like qualities with a unique, powerful look as well as a smooth ride and exceptional performance. |

| | | | | | | | • SC Series - Our line of outboard boats designed for increased saltwater durability and ease of maintenance. |

| | | | | | | | • Surf Series - Focused on watersports and based on our Gateway Series and R Series. Features a sport tower for higher tow point, storage racks, integrated billet board racks, optional tower lights, ballast, surf systems and directional speakers with a look designed to appeal to our youngercustomers |

| Pursuit | | 15 | | 22'-44' | | $80-$800 | | Launched in 1977, Pursuit is a premium brand of saltwater outboard fishing boats available in three product lines: |

| | | | | | | | • Sport Center Console Series - Our center console series provides a central helm and open hull to provide 360-degree access to thewater and is ideal forfishing. |

| | | | | | | | • Dual Console Series - Our dual console series offers a versatile design ideal for casual cruising and entertainment provided by the superior and comfortable seating yet makes for an ideal fishing boat. |

| | | | | | | | • Offshore Series - Our offshore series combines seaworthiness and fishability with the luxury of a cruiser and is designed for the conditions of the open sea and rigged with equipment for offshore fishing trips. |

Malibu Brand. Malibu is our flagship line of performance sport boats offering eleven models through three product series: the Wakesetter series, the M series, and the Response series. The Wakesetter series is our premium, top selling series designed for consumers seeking the highest-performance water sport boat and a luxury boating experience. Wakesetters offer consumers a highly-customizable boat with our most innovative technologies and premium features, with the newest color options and interior finishes. The M series, featuring the Malibu M235, is our line of ultra-premium towboats, built from the ground up by a team of our designers, engineers, and athletes, and designed to provide consumers with a seamless blend of beauty, luxury, and power. The M series is loaded with every technologically innovative feature we offer including our Integrated Surf Platform, premium luxury interiors, most advanced helm in the industry, and our most powerful engine. The Response series, completely redesigned in 2017, was designed for consumers who desire a high-performance water ski focused boat. Primarily because of its direct

drive engine setup, the Response series produces the smallest wake of any of our boats and is designed to accommodate both professional and recreational skiers by allowing for an athlete’s best performance at a range of boat speeds and line lengths.

AxisBrand. After the continued success with our Wakesetter series, we identified a market opportunity in entry-level performance sport boats and, in 2009, launched our Axis brand. We designed Axis for consumers who desire a lower price point, but who still demand high performance, functional simplicity and the option to upgrade their boats to have key features such as Surf Gate. The Axis series currently has five available models and we plan to refine these models continually as well as add new ones as we build out the brand. We believe the Axis series successfully provides consumers with a high quality water sport and boating experience at an attractive price, as evidenced by its #4 market position in the performance sport boat category after only seven years on the market.

Cobalt Brand. Cobalt is our premium line of luxury sterndrive and outboard boats available in five product lines: the Gateway Series, the R series, the A series, the SD-SC series, and the WSS/Surf Series. The Gateway series is an entry level fiberglass sterndrive boat designed for budget-conscious consumers who desire the refined quality of Cobalt boats, but at shorter lengths and a lower price point. The Gateway series is designed to allow for the comfort, convenience, and performance typically found on much larger Cobalt boats while allowing for an “athletic” use. The R series, the brand’s largest segment, is a mid-range premium fiberglass sterndrive boat constructed using a composite Kevlar and a Z-thane barrier coat that blends a sleek, powerful look with a smooth ride and exceptional performance. The combination of innovative features, performance, and design have enabled Cobalt to achieve the #1 market share with the R5. The A series is our super premium fiberglass sterndrive boat line constructed using a multi-part hull mold in composite Kevlar and with a Z-thane barrier coat that blends yacht-like qualities with a unique, powerful look as well as a smooth ride and exceptional performance. The SD-SC series includes outboard boats designed for increased saltwater durability and ease of maintenance to better penetrate saltwater markets. The WSS Surf series is an offering focused on watersports and is based on our Gateway Series and R Series featuring a sport tower for higher tow point, storage racks, integrated billet board racks, optional tower lights, ballast, surf systems and directional speakers with a look designed to appeal to our younger customers.

Innovative Features

In addition to the standard features included on all of our boats, we offer consumers the ability to upgrade our base models by adding certaina full selection of our full line of innovative optional features designed to enhance performance, functionality and the overall boating experience. We believe our innovative features drive our high average selling prices. Some of these include:

Among our most successful and most innovative has been Surf Gate.Gate. Introduced in July

2012 and initially patented in September 2013, Surf Gate is available as an optional feature on all Malibu Wakesetter models and Axis brand boats. Surf Gate has revolutionized the increasingly popular sport of wake surfing. Prior to Surf Gate, boaters needed to empty ballast tanks on one side of the boat and shift passengers around to lean the boat to create a larger, more pronounced surf-quality wake. By employing precisely engineered and electronically controlled panels, Surf Gate alleviates this time-consuming and cumbersome process, allowing boaters to easily surf behind an evenly weighted boat without the need to wait for ballast changes. Recent enhancements to Surf Gate have improved upon the system’s actuators, allowing for easier and faster transfer, as well as the installation of an indicator horn and optional light signaling, which alert riders to wave transfers. For the 2016 model year, we introduced our patented Surf Band technology that allows the rider to control the surf wave, shape, size and side. In 2013,Some of our other notable innovations include Power Wedge III, G5/GX Tower, Electronic Dashboard Controls, Swim Step, Tower Mister, Splash and Stow and TrueWave. We won the WatersportsBoating Industry Association namedMagazine's "Top Product" award for the Malibu M240 in 2020, Pursuit S 378 in 2020, Malibu 25 LSV in 2019, Surf GateBand in 2018 and for our Integrated Surf Platform ("ISP") in 2016, as well as the Boating Industry's Best New and Innovative Products in 2019 for the Cobalt A29. We have also been recognized as Sounding Trade Only Today’s “2019 Top Most Innovative Marine Companies,” and we earned the honors of "WSIA Innovation of Year" award for the Year.

Manual Wedge/Power Wedge. Our patented Manual Wedge and Power Wedge allow riders to customize their wakes by simulating up to 1,200 pounds of ballast weight in the transom of their boats. Used in conjunctionMalibu M240 M-Line Hull with Surf Gate wake surfers are able to customize the sizeFusion in 2020, Malibu Monsoon Engines in 2019 and shape of the wave. The Manual Wedge is available on all Malibu and Axis brand boats. Unlike our Manual Wedge, the Power Wedge, available exclusively on our Malibu line, is fully automated and integrated within the Malibu Touch Command system, increasing functionality and ease-of-use for the driver. Re-engineered for model year 2015, we released the Power Wedge II. It features a larger foil and a 21% surface-area increase, which equates to an additional 300 pounds of simulated ballast, for a total of 1,500 pounds of wake-creating water displacement. In addition, a new upward angle increases lift, allowing the driver to achieve a fully loaded boat planing much faster.

G3/G4 Tower. Our G3 Towers, available on Malibu brand boats, are fully customizable with speakers, power lights and racks, enhancing the overall style, performance and functionality of our boats. Our G3 Tower can easily be folded down by one person with its weightless, gas spring-assisted design, making the G3 Tower safe and easy to store. We are the only manufacturer of performance sport boats that produces towers in-house, allowing us to control this critical design element of our boats. For model year 2015, we offered a new G4 Tower featuring aerospace aluminum and an

internal honeycomb structure to provide the optimal strength-to-weight ratio, making the G4 three times more rigid than its predecessor. The new design contains automatic visible locks, a fully integrated wiring harness, Z5 Bimini compatibility, and zero pinch points. The new G4 has an aggressive design yet preserves ease of use by taking less than 30 pounds of force to lift, lower, and latch.

Electronic Dashboard Controls. Every boat in our Wakesetter series is equipped with our MaliView and Malibu Touch Command ("MTC") systems, which function as an electronic command center that enhances the driver’s experience by providing simple and quick control of all systems on board, including the Power Wedge and Surf Gate systems, rider presets, music, lighting and navigation. For the model year 2015, we were first to market with a 12-inch touchscreen. It joined our seven-inch MTC to form the display for our new Command Center giving the driver endless data in an easy-to-navigate interface. Every major feature is on the home screen, menu paths have been streamlined and each component meets IP60 water-intrusion standards. Built with more processing power, higher levels of integration, a feature-packed new operating system and powerful wireless connectivity, the new Command Center represents the most advanced screen technology available on performance sport boats.

Surf Band. Malibu’s exclusive, patented Surf Band allows a rider to strap a buoyant, hi-viz wristband and tap a simple, intuitive remote interface to take command of all aspects of the rider's surfing experience. At the same time, the interface enables the driver to monitor the rider through alerts on the electronic command center, eliminating the need for hand-signals to the spotters or driver. If the rider is wakeboarding, the Surf Band lets the rider adjust the Power Wedge II and control speed.

Swim Step. Cobalt's patented Swim Step deploys and retracts in seconds. It is outfitted in electropolished 316 stainless steel. The design provides a safe anchor for all water borne activities.

TrueWave. Every boat in Cobalt’s WSS Surf line comes with TrueWave technology, a feature that is currently patent pending. TrueWave is an automated control surf system that adjusts the bi-axis surf tabs to create the optimum surf wake either on the left or right side. TrueWave creates a fully customizable wake that provides smooth transitions, a wide push zone, and a solid pop, helping keep the boat evenly weighted and allows boaters to switch from each side in seconds without the need to re-distribute ballast and people.

2017.We also offer an array of less technological, but nonetheless value-added boat features such as gelcoat upgrades, upholstery upgrades, engine drivetrain enhancements (such as silent exhaust tips, propeller upgrades and closed cooling engine configuration), sound system upgrades, Biminibimini tops, boat covers and trailers which further increase the level of customization afforded to consumers.

Our Dealer Network

We rely on independent dealers to sell our products. We establish performance criteria that our dealers must meet as part of their dealer agreements to ensure our dealer network remains the strongest in the industry. As a member of our network, dealers in North America may qualify for floor plan financing programs, rebates, seasonal discounts, promotional co-op payments and other allowances. We believe our Malibu and Axis dealer network is the most extensive in the performance sport boat category. We recently established aIn Europe, dealers may qualify for floor plan financing program for our dealers in Europe, which weprograms. We expect this will strengthen our dealers ability to sell our products in Europe. The majorityWe believe our dealer network is the most extensive in the market.

North America

As of July 1, 2020, our Malibu and Axis dealers, including nine in our top ten markets, are exclusive to Malibu and Axis brand boats withindealer network consisted of over 250 dealer locations servicing the performance sport boat, category, highlightingsterndrive, and outboard markets strategically located throughout the commitmentU.S. and Canada. Approximately 50% of our key dealers to our boats. Similarly, many Cobalt dealers have long-standing relationships with Cobalt and derive a significant portion of their income from the Cobalt brand.

North America

In North America, we had a total of 146 dealer locations for our Malibu and Axis brands as of July 1, 2017. Of these locations, 17% sell our products exclusively, 65% are multi-line locations that only carry non-competitive brands and products and 17% sell our brands as well as other performance sport boat brands. Approximately 32% of our Malibu and Axis dealer locations have been with us, or with Cobalt and Pursuit prior to our acquisition of them, for over ten years. For calendarOur top ten dealers represented 38.5%, 39.6% and 37.8%, of our net sales for fiscal year 2016, our2020, 2019 and 2018, respectively. The top ten dealers for each of Malibu, and Axis dealers held or tied for the #1 market share position for the performance sport boat category in 70 of 119 U.S. markets. In July 2017, we acquired Cobalt and added their dealership network. OurPursuit represented approximately 45.8%, 45.3% and 82.7%, respectively, of net sales in fiscal year 2020. The top ten dealers for each segment are not the same across all segments. Sales to our dealers under common control of OneWater Marine, Inc. represented approximately 15.2%, 15.1% and 10.7% of consolidated net sales in fiscal years 2020, 2019, and 2018 respectively including approximately 7.6%, 15.7% and 34.5% of consolidated sales in fiscal year 2020 for Malibu, Cobalt distribution network includes 115 North American dealer locations. Of those, 22 Cobalt dealers are ranked in Boating Industry’s Top 100 Dealers survey, with six Cobalt dealers ranked in the top 10.and Pursuit, respectively.

We consistently review our distribution network to identify opportunities to expand our geographic footprint and improve our coverage of the market. We believe that our diverse product offering and strong market position in each region of the United States helped us capitalize on growth opportunities as our industry recovered from the economic downturn. We have the ability to opportunistically add new dealers and new dealer locations to previously underserved markets and use data and performance metrics to monitor dealer performance. We believe our outstanding dealer network allows us to distribute our products more efficiently than our competitors.

We do not have a significant concentration of sales among our dealers. For fiscal year 2017, our top ten Malibu and Axis brand dealers accounted for 40.6% of our units sold and none of our dealers accounted for more than 6.8% of our total sales volume.

We believe that our strong market position in each region of the United States will help us capitalize on growth opportunities as our industry continues to recover from the economic downturn. In particular, we expect to generate continued growth in the southwestern United States (which includes California), a region that experienced the most pronounced decline in sales of new performance sport boats and where we have our highest regional market share.

International

We have an extensive international distribution network for our Malibu, Axis, Cobalt and CobaltPursuit brands. As of July 1, 2017, we had 59 international2020, our dealer network consisted of over 100 dealer locations in 40 countries, includingthroughout Europe, Asia, Middle East, South America, South Africa, and Australia/New Zealand for our Malibu and Axis brands.Zealand. We service our independent dealers in the Australian and New Zealand markets who sell our Malibu and Axis brand boats through our Australian operations acquired in October 2014. Including our Australia operations, international unit volumes for Malibu and Axis brands accounted for approximately 9.0% and 8.0% of our total unit volume for fiscal years 2017 and 2016, respectively. Our Cobalt brand, which was acquired in July 2017, has 27 dealer locations in 24 countries, including Europe, South America, South Africa, Australia, and China.

Dealer Management

Our relationship with our dealers is governed through dealer agreements. Each dealer agreement has a finite term lasting between one and three years. Our dealer agreements also are typically terminable without cause by the dealer at any timewith 60 days’ prior notice and by us with 90 days’ prior notice.for a dealer failing to meet performance criteria. We may also generally terminate these agreements

immediately for cause upon certain events. Pursuant to our dealer agreements, the dealers typically agree to, among other things:

•represent our products at specified boat shows;

•market our products only to retail end users in a specific geographic territory;

•promote and demonstrate our products to consumers;

•place a specified minimum number of orders of our Malibu, Axis and/or Cobalt brand products during the term of the agreement in exchange for rebate or discount eligibility that varies according to the level of volume they commit to purchase;

•provide us with regular updates regarding the number and type of our products in their inventory;

•maintain a service department to service our products, and perform all appropriate warranty service and repairs; and

•indemnify us for certain claims.

Our dealer network, including all additions, renewals, non-renewals or terminations, is managed by our sales personnel. Our Malibu and Axis sales team operatesteams operate using a semi-annual dealer review process involving our senior management team. Each individual dealer is reviewed semi-annually with a broad assessment across multiple key elements, including the dealer’s geographic region, market share and customer service ratings, to identify underperforming dealers for remediation and to manage the transition process when non-renewal or termination is a necessary step. The Cobalt sales team manages their dealer network in a similar manner that is less formal than our Malibu and Axis process.

We have developed a system of financial incentives for our dealers based on customer satisfaction and achievement of best practices. Our brands employ dealer incentive programs that have been refined through decades of experience at each brand and may, from time to time, include the following elements:

•Rebates and DiscountDiscounts. Our domestic dealers agree to annual commitment volumesvolume commitments that places each dealer into a certain rebateare used to determine applicable rebates or discount tier and determines its prospective rebate or discount amount.discounts. The structure of the dealer incentive depends on the brand represented. If a dealer meets its annual commitment volume commitments as well as other terms of the rebatedealer performance program, the dealer is entitled to the specified amounts subject to full compliance with our programs. Failure to meet the commitment volume or other terms of the program may result in partial or complete forfeiture of the dealer’s rebate or discount.

•Co-op. Dealers of the Malibu, Axis and AxisPursuit product line may earn certain co-op reimbursements upon reaching a specified level of qualifying expenditures.

•Free flooring. Our dealers that take delivery of current model year boats in the offseason, typically July through spring,April, are entitled to have us pay the interest to floor the boat until the earlier of (1) the retail sale of the unit or (2) a date near the end

of the current model year. This program is an additional incentive to encourage dealers to order in the offseason and helps us balance our seasonal production.

Our dealer incentive programs are also structured to promote more evenly distributed ordering throughout the fiscal year, which allows us to achieve better level-loading of our production and thereby generate plant operating efficiencies. In addition, these programs may offer further rewards for dealers who are exclusive to our brands.

Floor Plan Financing