UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20172021

or

o☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____ to ____

Commission File Number: 001-36316

AgroFresh Solutions, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

| | | | | | | |

Delaware | | 46-4007249 |

| (State or other jurisdiction of incorporation) | | 46-4007249

(IRS Employer Identification Number) |

One Washington Square

510-530 Walnut Street, Suite 1350

Philadelphia, PA 19106

(Address of principal executive offices)

(267) 317-9139

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | | AGFS | | The NASDAQ Global Select Market |

Warrants to purchase shares of Common Stock | | The NASDAQ Global Market | | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o☐ Yes ý☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act o☐ Yes ý☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý☒ Yes o☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ý☒ Yes o☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S—K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10—K or any amendment to this Form 10—K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of large accelerated filer,” “accelerated filer” andfiler,” “smaller reporting company”

and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one): |

| | | | | | | | | | | | | |

Large accelerated filer o☐ | Accelerated filer x☐ | Non-accelerated filer o☒ (Do not check if a

smaller reporting company)

| Smaller reporting company o ☒ | Emerging growth company o ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act). o☐ Yes ý☒ No

As of June 30, 2017,2021, the aggregate market value of the common stock held by nonaffiliates of the registrant, based on the $7.81$2.08 closing price of the registrant’s common stock as reported on the NASDAQ Global Select Stock Market on that date, was approximately $170$44.5 million. For purposes of this computation, all officers, directors and 10% beneficial owners of the registrant are deemed to be affiliates. Such determination should not be deemed to be an admission that such officers, directors or 10% beneficial owners are, in fact, affiliates of the registrant.

The number of shares of the registrant’s common stock outstanding as of March 9, 20181, 2022 was 50,903,047.52,417,390.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this annual report on Form 10-K, to the extent not set forth in this Form 10-K, is incorporated herein by reference from the registrant’s definitive proxy statement relating to the annual meeting of stockholders to be held in 2018, to be filed with the Securities and Exchange Commission within 120 days after the end of the registrant’s fiscal year ended December 31, 2017.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain of the statements contained in this annual report on Form 10-K constitute “forward-looking statements” for purposes of federal securities laws. Our forward-looking statements include, but are not limited to, statements regarding our or our management’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would,” “will” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this report may include, for example, statements relating to:

•our future financial performance;

•growth plans and opportunities, including planned product and service offerings;

•our expectations regarding the impact of COVID-19 on our business;

•changes in the markets in which we compete;

•our ability to increase brand loyalty and awareness;

•our ability to enter into alliances and complete acquisitions of other businesses;

•protection of our intellectual property rights; and

•the outcome of any known and unknown litigation.

The forward-looking statements contained in this report are based on our current expectations and beliefs concerning future developments and their potential effects on us. Future developments affecting us may not be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described under the heading “Risk Factors” elsewhere in this report. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

PART I

ITEM 1. BUSINESS

Overview

AgroFresh Solutions, Inc. (the “Company”, “AgroFresh”, “we”, “us” or “our)“our”) is aan agriculture technology (AgTech) innovator and global leader in delivering innovativewhose mission is to prevent food preservationloss and waste reduction solutions for fresh produce. The Company is empoweringand conserve the food industry with Smarter FreshnessTM,planet’s resources by providing a range of integratedscience-based solutions, designed to helpdata-driven digital technologies and high-touch customer services. AgroFresh supports growers, packers and retailers improve produce freshnesswith solutions across the food supply chain to enhance the quality and quality while reducing waste. AgroFresh’s solutionsextend the shelf life of fresh produce. The AgroFresh organization has 40 years of post-harvest experience across a broad range from pre-harvestof crops, including revolutionizing the apple industry with HarvistaTM and LandSpringTM to its marqueeSmartFreshTMthe SmartFresh™ Quality System whichmore than 20 years ago. The AgroFresh platform is powered by our comprehensive portfolio that includes SmartFreshTM, AdvanStoreTMplant-based coatings, equipment and ActiMistTM, working togetherproprietary solutions that help improve the freshness supply chain from harvest to maintain the qualityhome.

AgroFresh’s market leadership is underpinned by our global footprint, extensive applied scientific and regulatory expertise, customer intimacy and growing portfolio of stored produce.value-added solutions and mission-critical advisory services. Our key products are sold in approximately 50 countries, and we support customers by protecting an estimated 25,000 fruit storage rooms globally. In addition, we provide in-depth plant physiology expertise and offer a comprehensive list of solutions spanning from near-harvest to post-harvest, and from storage through retail. More importantly, AgroFresh has been able to gain a controlling interest in Tecnidex Fruit Protection, S.A.U. (“Tecnidex”),high level of trust from our customers, which is built on four decades of interaction and support. Our direct market approach, high touch customer service and science-based model best position us to address our customers’ needs and differentiates us from other companies.

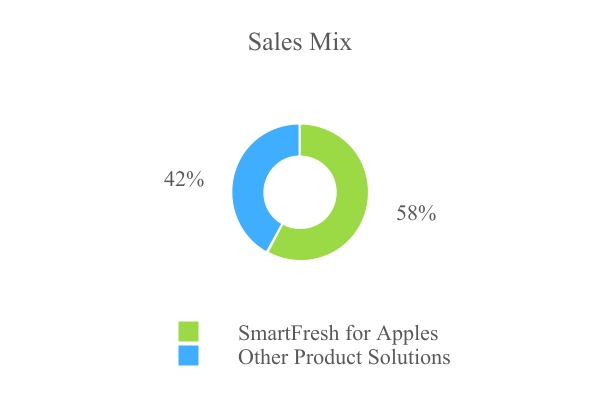

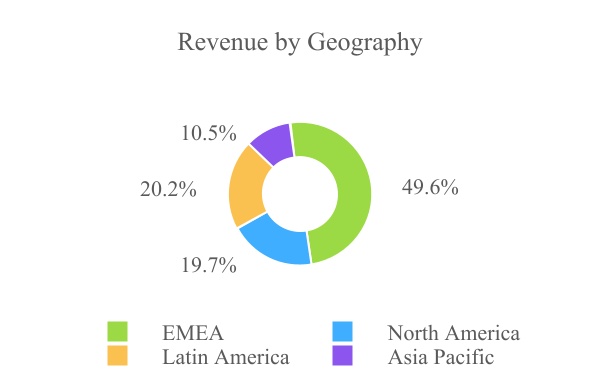

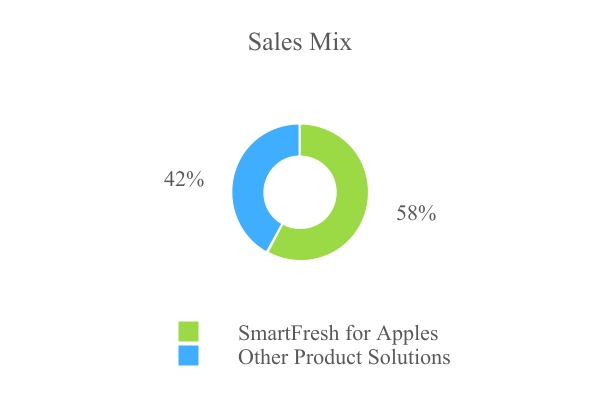

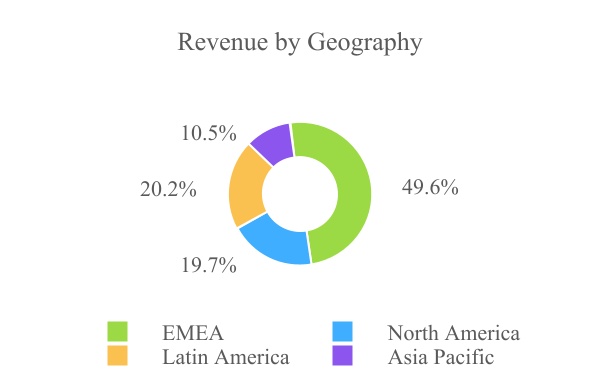

The following tables present a leading providerbreakdown of post-harvest fungicides, waxesour revenue based on crops and biocidesgeography for the year ended December 31, 2021.

Note: “Other Product Solutions” include revenue from citrus, market. Additionally,pears, kiwifruit and other crops. “EMEA” comprises Europe, the company’s initial retail solution, RipeLockTM, optimizes banana ripening for the benefit of retailersMiddle East and consumers. AgroFresh has key products registered in over 45 countries, supports approximately 3,700 direct customers and services over 25,000 storage rooms globally.Africa.

AgroFresh usesgot its start in January 1996. With the acquisition of rights in proprietary 1-MCP (1-Methlycycloproprene) technology, to regulate the ripening effectsCompany pioneered the development and commercialization of SmartFresh. This groundbreaking ethylene the naturally occurring plant hormone that triggers ripening in certain fruits and vegetables. Our portfolio of products, that span the supply chain of fresh produce, from orchard to retail shelves, differentiates us compared to other companies that have more narrow product offerings. The active ingredient of several of our products, 1-Methylcyclopropene ("1-MCP"), blocks the effects of ethylene. All of AgroFresh’s 1-MCP products are naturally biodegradable and leaves no detectable residue, which has significant consumer appeal.

We believe that SmartFresh our current principal product preserves the texture, firmness, taste, and appearance of produce during storage, transportation, and retail display. SmartFresh allows growers and packers to deliver “just harvested” freshness on a year-round basis, and enables retailers to increase customer satisfaction with fresh, high quality produce. An integral part of the SmartFresh sales processmanagement solution is a direct service model providing customersplant-growth regulator that revolutionized the apple industry by allowing for long-term storage. By 2002, SmartFresh received its first registration for commercial use in Chile, with on-site applicationsthe U.S. following shortly thereafter. The benefits of this technology now serve multiple crops in all key growing regions, and have helped reduce apple waste by nearly 260,000 metric tons from 2002 to 2018 in the U.S., France and Italy. In the past several years, AgroFresh expanded beyond SmartFresh at their storage facilities together with value-added advisory services.

AgroFresh has two solutions for the pre-harvest market. Our Harvista™ technology isintroduction of Harvista, a proprietary 1-MCP formulation used in pre-harvest management of pomethe orchard for near-harvest application in apples. Harvista helps to maximize peak ripening and fruit such as apples and pears. Just as we believe SmartFresh revolutionized post-harvest apple storage, we believe Harvista can have a similar impact in the orchard. Harvista slows ripening (starch conversion), reduces fruit drop, and holdsquality. It also allows for an expanded harvest window by keeping fruit on the tree longer to promote betterachieve optimal color, size and fruit size, therebyfirmness bringing the added benefit of helping growers to optimize labor management. Harvista is now approved for use in apples, pears, cherries, and blueberries. AgroFresh further expanded into new benefits tocrops and post-harvest offerings with the grower and the retailer. It also extends the harvest window to allow growers maximum flexibility in harvest timing while providing peace2017 acquisition of mind. LandSpring isTecnidex, now integrated into AgroFresh as AgroFresh Fruit Protection S.A. ("AgroFresh Fruit Protection"), a plant-growth regulator ("PGR") for pre-transplant use on seedlings to help them withstand transplanting and other stresses encounteredleader in the field. 2017 was the first year of sales for LandSpring and it received positive reaction from key launch customers.

Our range of solutions for packers and distributors includes innovative storage monitoring systems, StorEdge and AdvanStore, as well as a new delivery system for fungicides, ActiMist. StorEdge and AdvanStore provide customers insights into their storage rooms to help them better manage their storage inventory. Through its novel thermofogging application, ActiMist introduces a better and more efficient way to apply fungicides to stored apples that saves customers money and reduces the complexity of their fungicide protocols. Tecnidex broadens our portfolio of products to post-harvest fungicides, waxes, and biocides, primarily for the citrus market.

RipeLock, a solution designed to improve the quality and consumer appeal of bananas, combines proprietary modified atmosphere packaging and 1-MCP. RipeLock is sold to retailers and enables them to offer consumers bananas that are in better condition and hold the consumer-preferred color longer, reducing shrink and increasing sales. AgroFresh also has a commercial agreement with Food Freshness Technology Holdings Limited ("FFT") that permits us to offer retailers their It’s Fresh!TM ethylene absorbing filters, another novel technology to preserve the freshness of produce at retail.

History

We are a former blank check company that completed our initial public offering on February 19, 2014. On July 31, 2015 (the “Closing Date”), we consummated a business combination (the “Business Combination”) pursuant to a Stock Purchase Agreement, dated April 30, 2015 (the “Purchase Agreement”), with The Dow Chemical Company (“Dow”), providing for the acquisition by us of the AgroFresh business from Dow, resulting in AgroFresh Inc. becoming our wholly-owned, indirect subsidiary. On the Closing Date, we changed our name from Boulevard Acquisition Corp. to AgroFresh Solutions, Inc. Prior to

the closing of the Business Combination, the business that now comprises our business was operated through a combination of wholly-owned subsidiaries and operations of Dow, including through AgroFresh Inc. in the United States.

In December 2017, AgroFresh acquired a controlling interest in Tecnidex, a leading provider of post-harvest fungicides, waxes, and biocides for the citrus market. With this acquisition, AgroFresh expanded its industry-leading post-harvest presence into additional crops, and increased its penetration of the produce market in southern Europe, Latin America and Africa.

For over 35 years, Tecnidex has been helping fruit and vegetable producers offer clean, safe and high-quality products to customers in 18 countries. Through its portfolio of post-harvest products, technology, consulting, and after-sale services, Tecnidex improves the quality and value of its clients’ fruit and vegetables while respecting the environment. Tecnidex isindustry based in Valencia, Spain.Spain, which diversified the business into fungicides, coatings, and disinfectants. As a further step towards its long-term diversification strategy, the Company launched its digital solution in 2018 with the release of FreshCloud™, its insights and analytics platform.

In DecemberAgroFresh’s portfolio of 2017, AgroFresh invested approximately $10 million for an approximate 15% ownership stake in and entered into a commercial agreement with FFT, providersolutions to extend the shelf life of the award-winning It’s Fresh! ethylene removal filters in North America, Europe, the Middle East and Africa (“EMEA”) and Latin America. The proprietary active ingredient of It’s Fresh! has been found to be 100 times more powerful than any other ethylene-absorbing substances, providing a powerful tool to preserve food freshness. We expect It’s Fresh! to complement the RipeLockTM Quality System, our retail solution for extending the freshness of bananas. Through our commercial agreement with FFT, AgroFresh will market It’s Fresh! for high value crops such as berries, stone fruit, avocadoes, tomatoes and cherries, and open up new opportunities to address food waste in retail. FFT’s filters create a protective "Freshasphere"TM around fruit and vegetables to significantly improve their quality, reduce waste and increase sales. Although both companies will continue to operate independently, a key goal of the mutual collaborationfresh produce is to increase penetration of each company’s respective technology at leading retailers. Where FFT has developed strong retailer relationships, it will serve as a sales agent for AgroFresh’s RipeLock program and AgroFresh will perform the same role for FFT’s It’s Fresh!TM filters with AgroFresh’s retail partners.

We are subject to extensive national, state and local government regulations. We haveThe Company has completed more than 400 comprehensive international health and environmental tests that have shown the AgroFresh family ofits products, including SmartFresh and Harvista, to be safe for consumers, workers and the environment. 1-MCP, the active ingredient in the AgroFresh products is metabolized by the natural processes in fruits and leaves no residue. The AgroFresh products have been approved by over 50 authorities, including the U.S. Environmental Protection Agency and the European Commission.

Competitive Strengths

We believe that the following strengths differentiate us from our competitors and serve as the foundation for our continued growth:growth through diversification strategy:

GlobalLeading Agricultural Innovator and Solutions Provider with Proprietary Technical Know-HowKnow-How. Since our inception, AgroFresh has been at the forefront of fresh produce preservation solutions thanks to a research and Solutions. We are an agricultural innovator with operations in over 45 countries. Our scientists and research staffdevelopment team who are leaders in the fieldfields of plant post-harvest physiology. Sincephysiology and material science. The acquisition of AgroFresh Fruit Protection added significant scientific capabilities to R&D in the launcharea of coatings, fungicides and application equipment.Beginning with our creation of the commercial market for 1-MCP (a plant growth regulator, or "PGR") applications under the SmartFresh brand for use in 2002,the preservation of apples and other crops, we have developedcompiled an extensive and exclusive database onof produce physiology and preferences ofconsumer preferences. Building on our approximately 3,700 customers. Using this extensive proprietary technical expertise, AgroFresh providesknowledge, we have developed an intellectual property portfolio, including over 375 granted and pending patents, that has enabled us to provide comprehensive and innovative solutions to a range of integrated solutions.global customer base. SmartFresh delivers a step-changesubstantial improvement in storage solutions for apples, pears and pears,other crops, allowing for significantly less waste and greater productivity, as well as a constant supply of high qualityhigh-quality fruit throughout the year. We believe Harvista hasIn the potentialU.S., we estimate that 90% of stored apples are treated with 1-MCP, and our SmartFresh technology continues to significantly impact the pre-harvest stage, allowing apple and pear growers to better manage their harvest, reduce waste and improve fruit quality. With StorEdge and AdvanStore, we expect to be able to provide packers unparalleled information about the conditionenjoy a strong leadership position in this treatment protocol. Our recent launch of their fruit while in cold storage using novel monitoring technologies. The introduction of ActiMist, a fungicide platform delivered via thermofogging offers a more efficient and quicker application of fungicides in storage rooms, simplifying operations and reducing complexity. The combination of Harvista, SmartFresh, ActiMist, StorEdge and AdvanStore offers apple and pear growers a unique solution to improve the results they are able to deliver to their customers. LandSpring is an additional pre-harvest technology that benefits seedling growers by making the seedlings less sensitive to stresses such as heat, cold and flooding. RipeLock is an innovative fruit quality management system for bananas, offering flexibility and consistency to growers, ripeners and retailers to deliver bananas at a ripeness preferred by consumers. We believe that our storage solutions and portfolio of pre- and post-harvest services are well positioned to help address customer needs. The acquisition of a controlling interest in Tecnidex and the investment in FFT reflect our ability to expand beyond 1-MCP solutions and develop additional sources of revenue through a variety of crops.

Compelling Benefits for Value Chain. Consumer surveys have found that freshnessVitaFresh™ Botanicals, is the most important driverlatest milestone in our new product innovation. VitaFresh Botanicals is a range of satisfaction withplant-based, edible coatings that keeps produce purchased at retail. The ability to store produce longer while preserving just-harvested quality allows growersfresh and packers to extend their marketing windowhelps reduce food loss and capitalize on seasonal pricing trends. We believe that SmartFresh revolutionized the apple industrywaste by allowing growerslimiting fruit dehydration and packers to meet year-round consumer demand for just-harvested quality. Thisextending freshness preservation.

extension of post-harvest life substantially increases the value of produce that is harvested on a seasonal basis but is sold to consumers throughout the year, particularly during the summer months when apple prices have historically peaked. The cost of SmartFresh translates into less than one cent per pound of apples, and can provide up to a 20-fold increase in value to the grower or packer over the cost of the service. Due to its high effectiveness and low cost relative to the value of the crop treated, we believe that SmartFresh provides compelling benefits across the value chain, from grower to retailer.

Unique Business Model with Sustainable Competitive Strengths. AgroFresh’s direct service model comprises not only product applications but also “mission critical” advisory services. Diversified Global Presence Across All Major Growing Regions. We have established a global footprint with operationskey products approved in over 4550 countries allowing usthat supports customers with approximately 25,000 storage rooms globally. Our top ten customers represent less than 15% of the Company's total revenue, a sign of the strength and resilience of our business. The Company's global commercial platform is unique in the post-harvest industry, positioned across six continents, bringing a full suite of AgroFresh solutions and high-touch advisory services to make over 38,000 monitoredcustomers in every key produce-growing region. Our ability to deliver in-depth technical services and products is a fundamental competitive advantage. We believe our global footprint provides not only a platform for growth but also greater diversification. As part of the diversification efforts, SmartFresh can optimize the consumer experience for a wide range of crops including pears, kiwis, avocado, broccoli, melon, tomato, mango and stone fruit. Our participation in a wide range of markets protects the business from crop size fluctuations in any particular market. For the year ended December 31, 2021, EMEA, North America, Latin America and Asia Pacific (including China and India) represented 49.6%, 19.7%, 20.2% and 10.5% of sales, respectively. AgroFresh Fruit Protection meaningfully contributes to our global diversification efforts.

Service-Oriented Business Model. AgroFresh’s direct service model provides a combination of product applications with mission-critical technical advisory services, which together support our above industry average margin profile. Our sales and technical support personnel maintain direct interaction with our customers in areas of SmartFresh in 2017. Weproduct selection, product application best practices, contract negotiations and overall customer service. Furthermore, we currently have approximatelyover 40 employees indedicated research and development scientists, about half with advanced degrees, working in seven AgroFresh locations around the world, andincluding at numerous research institutes and customer sites. This infrastructure investment has allowed us over the past decade, to amass a proprietary database of technical data regardingof applied plant physiology collected throughout our more than 40-year history. In 2021, we made approximately 36,000 monitored applications of SmartFresh. Our proprietary database gives us important insights into the causes of produce spoilage for various crops varieties in different regions as well as best practices for the effective use of SmartFresh and other quality preserving solutions. As a result, our local sales and technical service teams are best positioned to provide custom advice and solutions, giving our customers confidence and peace of mind throughout the year. Furthermore, we believe FreshCloud can further bolster our integrated offerings with a wide rangethe addition of apple varieties in variable conditions. Our advisory services utilize this informationdata-backed solutions to assistmonitor produce quality across the supply chain. FreshCloud is designed to deliver timely, predictive insights that will help our customers in maximizingimprove efficiency and enhance produce freshness.

Diversification and Growth Opportunities Across the profitability of their operations.Produce Supply Chain. We believe thatthere are significant growth opportunities to expand and diversify our direct service model, extensive technical know-how,business, supported by our track record of new product introductions and brand loyalty will continuemarket penetration.

One key initiative is to sustain our competitive strengths. The credibility and trust this business model has created positions AgroFresh well to provideincrease penetration of existing technologies into current and new customers with other solutions such as storage monitoringgeographic markets. While many apple growers and fungicides.

Multiple Drivers of Future Growth.packers in the U.S. and globally have adopted SmartFresh, there is potential for further growth. The market penetration of apples treated with SmartFresh outside the U.S. has been growing internationally but has not yet reachedremains below the levels achieved in the U.S. We have also concentrated on accelerating penetration of SmartFresh into pears, plums, kiwifruit and persimmons. Based on successful trials with customers, we are increasingalso expanding our salescommercial activities for SmartFresh to increase its use on avocados, melons, tomatoes, broccoli and marketing efforts in non-U.S. regions to seek to capture these penetration opportunitiesmangos, where we believe SmartFresh can optimize the consumer experience for ripeness, color, taste and texture, especially during times when the supply-chain is elongated or challenged.

Harvista is another key product where we are actively working to increaseexpand geographic and crop regulatory approvals. As of December 31, 2021, Harvista is registered in eleven countries and we are currently working to obtain registrations in more than eight additional countries including the European Union (the "EU"). In the past few years, we received regulatory approval to apply Harvista to cherries and blueberries in the U.S., blueberries in Chile, and apples in Australia, Brazil and New Zealand, and our team is working to achieve similar registrations in other markets. In 2021, we secured emergency use permits in eight European markets so that growers could utilize and take advantage of the benefits of Harvista ahead of the first approvals expected by the end of 2024 in the Netherlands and the beginning of 2025 for other EU countries and we are seeking to have these emergency uses renewed in 2022. The main limitation to accelerated growth of Harvista is the long regulatory approval cycle in important markets like the EU.

The addition of fungicides, disinfectants and coatings has helped us to diversify our crop exposure and reduce revenue seasonality and provided new growth opportunities via cross-pollination of these technologies into AgroFresh core fruit categories. As a result of all these initiatives, we have successfully diversified our proportion of SmartFresh for apples sales from nearly 78% in 2016 down to approximately 58% as of December 31, 2021.

Building on other crops, including pears, kiwifruit, plums,these growth initiatives, we continuously seek opportunities to leverage our research and bananas. Harvista extendsdevelopment ("R&D") capabilities to register and commercialize new products for currently unserved markets. At the same time, we are evaluating mergers and acquisition ("M&A") opportunities similar to AgroFresh Fruit Protection (formerly Tecnidex), as another key strategy to enhance our value proposition and drive diversified growth.

Long-Standing Relationships with Highly Diverse Customer Base. We believe our direct service model coupled with our proprietary technology into pre-harvest managementsolutions have helped us develop deep, trusted and long-tenured relationships with a diverse array of applesglobal customers including packers, growers and pears. Harvista is undergoing an expandedretailers. For over 40 years, we have operated a large team of commercial launchand technical experts located in key geographies around the U.S. We also currently sell Harvista in Turkey, Argentinaworld to provide on-site custom advisory services. This infrastructure helps us maintain intimate and Israel, and plan further launches in South Africa and Chile soon. In addition, we are investing in and launching new solutions that we anticipate will drive continued business growth. LandSpring is another pre-harvest application approved for use on tomato and pepper seedlings and 14 other crops. It is applied to seedlings prior to transplant from the plant house to the field because transplanting is a stress event that causes the plant to produce ethylene. LandSpring blocks the negative effects of ethylene and allows for increased plant vigor including better root establishment, development of greater leaf surface, and less susceptibility to disease which all can lead to better yields. StorEdge and AdvanStore offer atmospheric monitoring that storage operators are not capable of achieving with existing controlled atmosphere (“CA”) technology. This advanced monitoring system is being developedconsistent interaction with our extensive understanding of fruit physiology, fruit respiration, current CA technology, and new proprietary diagnostic tools for measuring fruit volatiles and is designed to provide solutions to customers to help them protect the value of their crops. ActiMist is a platform for delivering fungicides in the storage rooms via thermofogging which enable packhouses to get their storage rooms to desired conditions faster and with less complexity. RipeLock combines 1-MCP with modified atmosphere packaging designed specifically for preserving the quality of bananas during transportation and extending their yellow shelf life for retailers and consumers.

High Customer Touch and Retention. Our personnel interact with our customers face to face throughout the year to addressunderstand all aspects of post-harvestharvest operations, andaddress a variety of customer specificcustomer-specific issues, toand ultimately improve the economics for growers, packers and retailers across the supply chain. As a result of growersour unique service model and packers.comprehensive solutions, we have developed direct customer relationships in approximately 50 countries, and are working with strategic customers to penetrate new geographies and markets.

“Asset-light, High-touch” Model Generates Strong Profit Margins and Free Cash Flow. Our technical expertise, long-standing customer relationships and asset-light business model drive attractive profit margins. For the year ended December 31, 2021, we generated gross margins and adjusted EBITDA margins1 of 71% and 37%, respectively. In addition, we employ an “asset-light”, outsourced production model. We believe that this, in turn, has produceduse a high level of customer retentionthird-party manufacturer, and trust inhave an approved qualified alternative, for our key active ingredient, 1-MCP, under a long-term contract with strict confidentiality obligations, and several other suppliers to formulate products and provide packaging services. For the manufacturing of coatings, disinfectants and equipment servicing the citrus market, we employ a manufacturing plant in Spain and use several local suppliers to formulate products and assemble equipment. As a result, our manufacturing footprint requires low capital investment. For the year ended December 31, 2021, capital expenditures were $4.0 million, or 2.4% of net sales. Our attractive margin profile coupled with our asset-light strategy result in strong free cash flow, which we expect to use to reinvest in the business and repay debt.

ProvenStrong Management Team with Deep Industry Experience. Our management team has extensive global agricultural and related industry experience long-standing customer relationships, and a longproven track record of success in bringing valuable services andinnovative, value-added solutions to market. Commercialcustomers and technical experts are locatedmarkets around the world. The Company’s management team boasts over 125 years of combined relevant industry experience and is led by Clinton A. Lewis Jr., our chief executive officer, who brings 30-plus years of experience in key geographies worldwide to provide on-site advisory services, which help customers optimize crop potential. We encourage an independentthe life sciences space, serving in a number of national and entrepreneurial spirit amonginternational leadership roles at Pfizer and Zoetis, the world’s largest animal health company.

During the past several years, our management team has effectively launched new products, established new partnerships across the supply chain and employees.implemented a diversification strategy to drive expansion into new crop types, solutions and geographies.

The Company made several appointments to its senior leadership team in 2021 that are intended to position the Company for consistent, profitable growth and to further drive the Company's diversification strategy. We believe our management team has the vision, expertise, and experience to position us for continued success as they implement our growth through diversification strategy.

Industry Overview

Food Preservation and Freshness

1 EBITDA margin is a non-GAAP measure. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Item 7 of this Annual Report on Form 10-K for more information, and for a reconciliation of EBITDA to net loss.

According to the FAO,Food and Agriculture Organization of the United Nations, over 1.3 billion metric tons of food, or approximately one third of the total food produced worldwide, is lost to spoilage or waste each year, including food valued at an estimated $48.3 billion in the U.S. alone. An October 2013 TESCO Consumer Study found that nearly 45%and as much as one half of all fresh fruits and vegetables including 40% of apples and 20% of bananas,perish before being consumed. Euromonitor reports that retailers are lost to spoilage. Loss or waste along theoften judged on their fresh food supply chain has a variety of causes, including degradation of fresh produce during storage and transportation.

Food waste is a major economic cost for retailers.selection. A large percentage of food waste at the retail level is based on qualitative factors related to consumer perception of freshness. AIn the U.S., the Environmental Protection Agency announced in 2015 the first-ever domestic goal to reduce food loss and waste by 50 percent by 2030.

Loss or shrinkage along the food supply chain has a variety of causes, including degradation of fresh produce during storage and transportation.

AgroFresh strives to be the guardian of the world’s fresh produce and stands ready to lead the fresh produce industry into a more sustainable future. In 2019, we completed a detailed sustainability study about the influence of SmartFresh on the apple industry. From 2002 to 2018, we estimate that 260,000 metric tons of apple waste was prevented in the U.S., France and Italy alone. This reduced apple spoilage equates to more than 2.5 million metric tons of water. We estimate that improving the apple supply chain in those three countries alone yielded an annual reduction of 800 thousand metric tons of carbon dioxide out of the air, which is equivalent to taking approximately 170 thousand cars off the road each year. As AgroFresh invests in new technologies and diversifies to an even broader assortment of crops and markets, the Company is poised to make even greater contributions to the world’s sustainable food supply.

The fight against food waste and the conservation of our natural resources drives what we do at AgroFresh. For more than 40 years, we have been delivering innovative solutions that enhance the fresh produce supply chain process of growers, packers, and retailers. In 2021, AgroFresh became a participant of the World Resources Institute’s Champions 12.3 initiative focused on accelerating progress of Target 12.3, which calls for cutting in half per capita global food waste at the retail and consumer survey conductedlevel and reducing food losses along the production and supply chains, including post-harvest losses, by Oliver Wyman and Ipsos Interactive inthe year 2030.

the U.S. in 2007 indicated that freshness is the most important driver of customer satisfaction with a store’s produce department.

Pre-HarvestNear-Harvest Treatments

Pre-harvestWe consider applications in the orchard as “near-harvest” since they are applied right before the fruit is harvested and have synergistic effect with our post-harvest solutions. Near-harvest treatments are commonly used to increaseimprove the valuequality of crops and reduce pre-harvest losses includeharvest losses.The use of Harvista helps pome fruit growers realize better quality and bigger harvests from their orchards, while providing more control over how and when their fruit ripens, which can assist in labor management during the usecritical harvest window. The unique mode of

“plant growth regulators” (“PGRs”). PGRs influence the rate of growth or development of crops or affect their reaction to stress events such as harsh weather. PGRs interact with the biochemical make-up of the plant and work by mimicking or blocking the production of naturally occurring plant hormones, like ethylene. Blocking the production action provides better control of ethylene allows a grower to slow downresponse, so fruit matures on the maturation of fruit to achieve better control overgrower’s schedule, helping expand the timing of harvest. PGRs have a range of effectiveness depending on factors such as environmental conditionsharvest window for optimal color, size and the timing of applicationfirmness.

Post-Harvest Treatments

Post-harvest treatments to maximize quality and reduce loss include treatments to manage the effects of ethylene, and to prevent microbial contamination.contamination and to reduce dehydration. Naturally occurring ethylene triggers the acceleration of ripening in certain crops which results in a reduction of post-harvest life.

One class of post-harvest treatments enhances quality and reduces losses by controlling the environment in which produce is stored. CAControlled Atmosphere ("CA") and Dynamic Controlled Atmosphere (“DCA”) systems are used to keep stored crops within their optimal ranges of temperature and levels of oxygen and carbon dioxide. Specific oxygen and carbon dioxide levels can lower respiration in fresh produce and delay ripening. CA systems have been used for many decades with fruits and vegetables to preserve freshness. DCA, a more recent innovation, seeks to adjust levels of oxygen and carbon dioxide dynamically as the produce in storage breathes and matures. CA and DCA are only effective at preserving freshness while the fruit is kept in cold storage. However, 1-MCP treatments have been found to be complementary to these technologies by helping to better maintain the quality of apples and pears during cold storage and maintaining freshness for up to 90 days after the applesthey are removed from cold storage.

Our Business

We are an agriculturalAgTech innovator in proprietary advanced technologies that enhance the freshness, quality and value of fresh produce. We currently offer SmartFresh applications at customer sites predominately through a direct service model utilizing third-party contractors. We also provide advisory services based on our extensive knowledge on the use of 1-MCP collected through hundreds of thousands of monitored applications done as a part of the service model. Our pricing to customers is based on the service provided, not on the product sold. We operate in over 45approximately 50 countries and derive the majority of our revenue working with customers to protect the value of apples, pears and other produce during storage. We also offer Harvista pre-harvest technologySmartFresh diversification efforts are focused on expanding use in underserved crops and regions, such as the U.S, Argentina, Turkey, Israel, ChileU.S. and South Africa. LandSpring, an additional pre-harvest technologyAmerica. Harvista is approved for seedlings, is being marketed primarilysale in Argentina, Australia, Azerbaijan, Brazil, Canada, Chile, Israel, South Africa, Turkey, the U.S. RipeLock, an innovative quality management system is being marketed in the U.S., EuropeUnited States and Australia.New Zealand. ActiMist a platform of foggable fungicides was launched in the U.S. and is being expandedwe are seeking to expand into other countries subject to regulatory approval. LineIn support of our growth through diversification strategy, line extensions and new services are planned for

introduction to seek to strengthen our global position in post-harvest storage and to capitalize on adjacent growth opportunities in pre-harvestnear-harvest markets.

Tecnidex’s business, focused on citrus, is mainly concentrated in southern Europe and North Africa and expands our product offering into other types of fungicides, as well as waxes and coatings.

1-MCP, the active ingredient in key solutions such as SmartFresh, LandSpring, Harvista and RipeLock,Ethylbloc, is an ethylene action inhibitor with a proven ability to maintain freshness and extend the shelf life of certain fresh produce. The 1-MCP molecule is structurally similarclose to ethylene, a naturally occurring plant hormone that occurs in certain fruits and vegetables. Ethylene helps produce grow and ripen, but it eventually causes over-ripening and spoilage. 1-MCP works by blocking the ethylene receptors in plant cells, which temporarily delays the ripening process, enabling the produce to better maintain the qualities associated with freshness.

Today, two types of SmartFresh formulations are used to deliver 1-MCP into store rooms, powder and tablets. In a typical SmartFresh powder application, an AgroFresh service provider mixes a pouch of water-soluble powder with water in a SmartFresh generator and activates the generator to release the gaseous form of 1-MCP in the sealed storeroom. When using tablets, a service provider adds the tablets into a prepackaged formulated solution, the tablets dissolve in the solution and the gaseous form of 1-MCP is released in the storeroom. The gas released by either process interacts with the stored fruit, and firmly binds to the fruit’s ethylene receptor sites.

Fruits and vegetables are classified as climacteric or non-climacteric, a term referring to the process of fruit maturation. Climacteric fruits can ripen after being picked and produce much more ethylene than non-climacteric fruits, which cannot ripen after harvest. The climacteric event is a stage of fruit ripening associated with higher ethylene production and changes in the fruit including pigment changes and sugar release. The climacteric event marks the peak of edible ripeness, with fruits having the best taste and texture for consumption. The role of SmartFresh is to delay the onset of the climacteric stage until the product is ready for consumption. Apples, pears, kiwifruit, plums, persimmon, bananas, melons, peaches and tomatoes are examples of climacteric fruit. Our managementThe Company continues to evaluate the commercial value of 1-MCP with a range of other climacteric fruit.

AgroFresh extended its post-harvest leadership with the acquisition of AgroFresh Fruit Protection, a leading provider of fungicides, disinfectants and coatings primarily focused on the citrus market. For over 40 years, AgroFresh Fruit Protection has been helping fruit and vegetable producers offer clean, safe and high-quality products to customers in 18 countries with particular strength in the Mediterranean growing region. AgroFresh Fruit Protection helped to expand our R&D capabilities and to enable us to leverage ActiMist, an innovative delivery system of foggable fungicides. Our fungicide and coatings offerings further diversify our revenue by expanding our ability to provide solutions and service to the citrus industry.

SmartFresh Value Proposition

The SmartFreshTM Quality System, our flagship solution, preserves the texture, firmness, taste and appearance of produce during storage, transportation and retail display. Available in “storage room” and “on-the-move” application formats, the SmartFresh Quality System is the original, most recognizable post-harvest choice to maintain consumer-desired produce freshness and quality, and reduce waste. It allows growers and packers to deliver “just harvested” freshness on a year-round basis and enables retailers to increase customer satisfaction with fresh, high quality produce. An integral part of the SmartFresh value proposition is a direct service model providing customers with on-site applications of SmartFresh at their storage facilities together with mission-critical and value-added advisory services. AgroFresh™ Verified is our proprietary analysis and reporting service that provides confirmation of a successful SmartFresh application in storage rooms.

The value of SmartFresh with any crop is determined by both the biological efficacy with that crop and the utility value the application delivers to the customer. The biological efficacy with apples is high; apples are sensitive to ethylene, and SmartFresh is effective at delaying ripening. In addition, SmartFresh brings high utility value by helping to keep apples fresh year-round despite their limitednarrow harvest window.window, effectively extending the marketing window for growers and packers to monetize their crop. This has resulted in the widespread adoption of SmartFresh by apple growers and packers throughout the world. The cost of SmartFresh translates into less than one cent per pound of apples in the United States, which is small relative to both the value of the crop and the importance of maintaining the quality of that crop during storage. Retail prices of apples in the U.S. typically range from $1.30-$4.50 per pound depending on the variety. The use of SmartFresh gives growers and packers the ability to store apples from one season to the next without losing their just picked quality characteristics.

Beneficial effects of SmartFresh have been proven across numerous apple varieties throughout the world. SmartFresh is also effective with other crops that are highly sensitive to ethylene, including pears, kiwifruit, plums, persimmons, avocados, melons, tomatoes and broccoli, each of which requires a different application method and supply chain logistics beyond storage rooms. We also offer a corresponding solution for flowers, the latter marketed under the EthylBloc brand name through two strategic partners that have a strong position in the global flower market.

AgroFresh’s business historically has been highly seasonal, driven by the timing of apple and various private label brands.pear harvests in the northern and southern hemispheres. The first half of the year is when the southern hemisphere harvest occurs, and the second half of the year is when the northern hemisphere harvest occurs. Since the northern hemisphere harvest of our two core crops of apples and pears is typically larger, a significant portion of our sales and profits are historically generated in the second half of the year. In addition to this seasonality, factors such as weather patterns may impact the timing of the harvest within the two halves of the year. Crop diversification is an important strategy to achieve more balanced revenues across the year, and the ability to service the citrus segment provides an opportunity for the Company to increase revenue in the fourth and first quarters, which are the two strongest quarters for citrus crops.

SmartFresh Service Model

We believe that we have developed deep, trusted relationships with our customers by combining our effective SmartFresh product with application expertise and trusted advisory services. Over the past decade we have amassed a valuable proprietary database of technical information on the best practices for the effective use of SmartFresh on a wide range of apple and pear varieties.varieties, since each fruit and fruit variety requires a different treatment protocol. The advisory services component utilizes this information to help maximize the profitability of our customers’ operations.

Seasonality

Our business is highly seasonal, driven by the timing of harvests in the northern and southern hemispheres. The first half of the year is when the southern hemisphere harvest occurs and the second half of the year is when the northern hemisphere harvest occurs. Since the northern hemisphere harvest is typically larger, a significant portion of our sales are historically generated in the second half of the year. In addition to this seasonality, factors such as weather patterns may impact the timing of the harvest within the two halves of the year.

Our Other Products

Harvista

Complementing our post-harvest solutions, Harvista is a pre-harvestused for near-harvest management product that brings ethylene management into orchardsof apples, pears, cherries and fields.blueberries. Our Harvista product line includes several proprietary 1-MCP formulations that are specifically designed to keepslow ripening, reduce fruit drop and hold fruit on the tree longer which allows moreto promote better color and fruit size, developmentwhich are beneficial to the grower. With wide flexibility in application timing, it extends the harvest window by allowing growers to factor in ever-changing weather conditions and reduceslabor availability. We have found that the combination of Harvista in the orchard and SmartFresh in the storage room results in improved fruit stress.

Harvista provides flexibility for fruit harvesters when it is needed the most - within a few days before harvest or when bad weather strikes. Additionally, application prior to, or following, a stress event such as bad weather helps to reduce the incidence of fruit drop or other adverse reactions triggered by these events, which can lower crop yields and cause significant economic loss. We believe the flexibility to apply treatment close to harvest provides growers using Harvista with valuable harvest management benefitsquality metrics compared to competing solutions using older technology that require applications well in advanceuse of harvest.either product individually.

Harvista extends the “ideal harvest window,” the period during which fruit quality is at its peak, by keeping the fruit on the tree longer. For pome fruits, Harvista can extend the length of the harvest windowwindow” for up to an additional 14 days. This added flexibility creates significant benefits both in terms of harvest logistics and crop profitability. Widening the harvest window allows for better scheduling and the optimization of limited resources, such as harvest crews and equipment. The extended harvest window can result in increased average size and weight of fruit. Overall, thecrop value of the crop is enhanced by bigger average sizes,fruit size, better color and fewer defects.

We offer Harvista for apples and pears through a pre-scheduled application service including aerialground and/or ground applications.aerial applications depending on the crop and growing region. Typically, our technical staff designs the protocol in consultation with the customer, and either a third-party service providers makeprovider or the applications. We have also implemented a program to allow customers to make their own applications through AgroFresh-owned sprayers or using kits to modifycustomer makes the customers' own sprayers. This gives orchard operators flexibility to manage the application timing to meet orchard conditions.application.

Harvista is currently available in the U.S., Turkey, Argentina, Australia, Azerbaijan, Brazil, Canada, Chile, Israel, Chile, andNew Zealand, South Africa, Turkey and the Company is currently compiling dataUnited States. In addition to apple and pear crops, Harvista has received approval for registrationsapplications to cherries and blueberries in ten more countries, which are expectedthe U.S. and Chile. We expect to be granted on a country by country basis over the next five years. In 2017, we received regulatory approval to apply Harvista to cherries. Additionalpursue additional registrations and label expansions are expected to be pursued as new formulations and/or crop concepts are validated.

StorEdge & AdvanStoreVitaFresh Botanicals

Our StorEdgeIn 2021, we launched VitaFresh Botanicals, which is a proprietary, plant-based portfolio of coatings solutions for a wide variety of crops including citrus, avocados and AdvanStore platformsmangoes. VitaFresh Botanicals utilize “anti-thirst” technology to boost the skin’s natural protection, creating a “double skin” membrane in fruit that reduces dehydration, maintains weight and locks in produce freshness throughout the supply chain. The solutions are completely turnkey and easy-to-apply as part of regular packinghouse operations. AgroFresh provides customers with all the necessary application equipment and expertise.

VitaFresh Botanicals coatings are sustainably sourced and created using certified ISO 14001 “environmental management system” standards. Excellent crop coverage at low application rates offers better cost efficiencies to operators and gives retailers a much stronger opportunity to market quality produce, while reducing food waste, increasing customer profit potential, and adding the capability to reduce the amount of plastic packaging needed for the produce.

Fungicides, Coatings and Disinfectants

In addition to VitaFresh Botanicals, we also have a complete line of fungicide, coating and disinfectant solutions across a variety of crops and application types.

ActiMistTM / ActiSealTM

Antimicrobial technology is generally delivered by airborne or liquid systems including drenching or tank. ActiMist is a thermo-fogged fungicide that works simultaneously with SmartFresh for convenience and enhanced storage room logistics. ActiSeal, a portfolio of liquid fungicides delivers broad-spectrum protection based on a full portfolio of active ingredients, is delivered via drencher or tank. Together, these fungicides provide control of a broad spectrum of post-harvest diseases and help to protect against a wide range of fungal threats on pome, citrus and stone fruit.

TeycerTM Originals

Teycer Originals includes a full line of coatings to improve produce freshness, quality and appearance, increase shelf life and reduce food loss. These traditional edible coatings, including some with fungal protection, are used primarily for citrus, pome fruit and tropical fruit.

FreshStartTM

FreshStart is a full portfolio of biodegradable detergents and disinfectants for cleaning fruit and packaging equipment in packinghouses and reducing the threat of diseases during storage and transportation for citrus, pome fruit, stone fruit and other crops.They remove traces of sooty mold and other particles from the surface of the fruits as well as help to improve the protection of fruit against most of the main post-harvest diseases. With formulations that include fungicide and fruit preservatives, they also help increase fruit shelf life. The FreshStart line of disinfectants are used on surfaces, boxes, bins and tools in the packinghouse and during transport. FreshStart fruit disinfectants have low impact on the environment as they degrade quickly without leaving residues. They also can help decrease contaminants in water treatment and recycling systems and help make water recycling more efficient and less costly.FreshStart surface disinfectants help keep packinghouses, rooms and processing equipment free of fungus. They are useful for water recycling systems, and they work as a complement to fungicides for optimal rot control.

Control-Tec™

Control-Tec is a leading range of post-harvest systems and equipment for the application of antimicrobials, coatings, detergents and sustainable water management for packinghouses, packing lines and storage rooms. The Control-Tec portfolio also includes controlled-atmosphere solutions including automated ripening and de-greening control.

FreshCloud

We continue to evolve and expand our FreshCloud digital technology service platform of produce monitoring and screening solutions. FreshCloud Quality Inspection is a proprietary cloud-based mobile quality management service that digitizes what was formerly a manual quality control process to capture, organize and analyze quality metrics in monitoringreal time. The service combines digital information from many different physical and digital sources and locations, including analytics, artificial intelligence and machine learning. This allows growers, packers, shippers and retailers to drive accuracy and consistency across their operations. FreshCloud Harvest View is an easy-to-use digital service that complements Harvista. FreshCloud Harvest View captures, organizes and presents fast and easy-to-access data insights on starch hydrolysis progression, thereby enabling growers to make timely decisions on when to apply Harvista, intended to maximize quality and yields for higher profit potential. FreshCloud Storage Insights combines proprietary technology and data analytics in the storage room to offer customers real-time insights into the condition of produce during storage. StorEdge provides confirmation, within days that a SmartFresh application was completed successfully and provides additional data about storage room conditions the customers can use to identify issues. The AdvanStore offering includes on-going monitoring, analytics and feedback to enable the customer to more optimally manage the condition of thetheir stored commodity and receive early notice of conditions present in the room that may be detrimental to the quality of the produce. Through internal innovation, use of sophisticated analysis and external alliances, the AdvanStore platform reflects our strategy to provide proprietary complete storage solutions to customers by leveraging our extensive knowledge of fruit physiology.fruit.

RipeLock

RipeLock is an innovative fruit quality management system specifically designed for the banana industry. The patented RipeLock system combines a specially-engineered, micro-perforated form of Modified Atmosphere Packaging (“MAP”) and our proprietary 1-MCP formulation. The combination of MAP with 1-MCP provides greater control over the ripening progression of bananas during shipping, distribution, and display. We believe that bananas handled with RipeLock technology retain their bright-yellow color, firm texture, fresh taste, and appealing look for significantly longer than untreated bananas. As a result, RipeLock maximizes the marketable “yellow life” of the fruit, providing economic benefits to brand owners and retailers. Commercial launch of RipeLock began in 2015, and it is now generating revenue among ripeners, food service companies and retailers in the U.S., Europe and Central/Latin America.

LandSpring

LandSpring technology is a PGR for use on seedlings to help them withstand transplanting and other stresses encountered in the field. LandSpring’s active ingredient, 1-MCP, prevents the ethylene signals that would prompt a stress event in the seedling and reduce growth. Among the number of protective benefits, this technology makes seedlings less sensitive to stresses such as heat, cold, UV radiation, drought, flooding and salinity that often occur after planting. When applied before transplanting, LandSpring results in greater plant vigor and a healthier crop that is better able to withstand adverse environmental conditions and give growers the opportunity to increase yield.

Growth Strategy

Our mission is to provide technology, service and support targeted at preserving the quality, freshness and value of produce, through the value chain, worldwide. We have a high touch, asset light, technology driven solutions philosophy. We intend to pursue profitable growth by building on our current capabilities and competencies, expanding into adjacent markets and pursuing related, accretive acquisitions.

Our focus is to:

Strengthen our brand awareness and loyalty through customer relationship programs, intellectual property protection and year-round customer engagement. AgroFresh believes this focus, building on its philosophy of customer intimacy and its sustainable competitive advantages, will allow it to secure and grow its current business.

Further penetrate short term cold storage opportunities in all regions. AgroFresh currently provides its offering to over 80% of U.S. apples stored beyond 30 days. This percentage is much lower in Latin America, Asia Pacific and Europe.

Penetration is typically driven by the pace of registrations, which were earliest in the U.S., and AgroFresh sees these other geographies presenting further opportunities for growth moving forward, as well as shorter term apple storage opportunities in all regions with existing customers.

Extend to other produce, including bananas, pears, and other crops that have the ethylene physiology which responds positively to 1-MCP. One example is RipeLock for bananas. AgroFresh believes it will be able to provide a measurable extension of “yellow life” as well as prevent disorders like split-peel, both of which are highly desired value drivers throughout the supply chain, especially at retail and consumer levels where consistent quality is expected to increase sales.

Expand into other segments such as pre-harvest fruit quality management, fungal and microbial control solutions, diagnostics and storage management solutions. Solutions developed in-house include Harvista, LandSpring, ActiMist and AdvanStore.

Diversify and grow via alliances and accretive acquisitions, building on our numerous core competencies. AgroFresh anticipates proactively pursuing these opportunities. Our acquisition of a controlling interest in Tecnidex is one such example facilitating our expansion into fungicides, biocides, waxes and coatings. In addition, we expect our agreement with FFT to complement RipeLock by bringing a new type of freshness solution to the same retailers we are engaging.

Operations

We operate in more than 45 countries around the world. Currently, we use a single third-party manufacturer (and have a second supplier qualified), under a long-term contract that includes strong confidentiality obligations, to manufacture our key active ingredient, 1-MCP, and several other third parties, primarily to manufacture formulated products and provide product packaging services. We have no owned manufacturing facilities or manufacturing personnel.

We use a high-touch service model for our commercially available products including SmartFresh and Harvista. Sales and sales support personnel maintain direct relationships with customers year-round, which our technical sales and support personnel work directly with customers to provide value-added advisory services regarding the application of SmartFresh and Harvista. The actual application of SmartFresh and Harvista is performed by service providers that are typically third-party contractors. In addition to providing Harvista full service at customer orchards in 2017, we provide retrofit kits to customers to allow them to use their own sprayers to make applications themselves.

We have a dedicated customer service organization responsible for fulfilling customer-related requirements as well as coordinating all services being delivered by our service providers. During the harvest season, temporary third-party resources are added to the customer service organization to support the high volume of transactions and activities.

Marketing and Sales

Our success depends on our ability to attract and develop the talent to effectively implement our strategy. AgroFresh changed its organizational structure and leadership team to support its strategic growth and diversification objectives. The goal of the organizational change is to consolidate the Company’s core business units under a global general manager while adding leadership and focus to accelerate new business development activities. Over the past year, we have been strengthening and deepening our management organization. We have hired a vice president and global general manager to lead our post-harvest offerings and a director of global retail solutions to lead the RipeLock commercial opportunities.

The Company’s coreCompany's post-harvest business includes SmartFresh, ActiMist, StorEdge and AdvanStore, allsolutions designed to strengthenimprove yields for growers and packers. These solutions include SmartFresh, Harvista, ActiMist, FreshCloud and a large range of fungicides, disinfectants, coatings, and packinghouse equipment, marketed under the company’s leadership inbrands Actiseal, FreshStart, VitaFresh Botanicals, Teycer Originals and Control-Tec, respectively.

AgroFresh's global sales teams are organized geographically across the post-harvest space. There is one global general manager with separate regional leads forEurope/Middle East, North America, EMEA, LatinSouth America and APAC.Asia Pacific regions designed to drive growth and accelerate diversification.

The 2017 acquisition of Tecnidex was managed as a separate business unit and integration is well under way in 2018.

The technical sales support group housed within the Research and Development organization, supports the sales team. Technical sales supportteam and runs customer-specific trials for local crop varieties or specialized storage and distribution conditions and conducts follow-up with customers. These individuals workThis team works closely with customers to provide advice on appropriate protocols for SmartFresh, Harvista and Harvistaother product applications such as coatings and fungicides depending on crop, variety, region, and climatic conditions. The technical sales support group draws on our extensive knowledge base of 1-MCP applications across all regions and conditions.

Marketing and communications functions areThe marketing function is organized on a global and regional basis. The regionalThis consists of corporate brand/image stewardship and regionally driven marketing management including country-specific marketing strategies, plans and tactics to drive growth and customer penetration. Marketing personnel are embedded within the Company’s operating regions to improve collaboration with local sales teams manage the core post-harvest business's marketing needs, while the Global marketing department is responsible for corporate brand stewardship

and customers and capitalize on business opportunities.

and communications, as well as serving as a center of excellence to support all product launches, advertising and trade shows. The teams reach out to customers to keep them up to date on the latest research and news about AgroFresh products. Market research, including product penetration, collecting competitive intelligence and tracking other relevant market and industry information, is managed globally in conjunction with the regional teams.

No single customer accounted for more than 10% of net sales in 2017, 2016,2021, 2020 or 2015.2019.

Competition

The market for post-harvestPost-harvest solutions is fragmented with various regional suppliers or products.include 1-MCP-based solutions, fungicides and coatings. The market for the use of 1-MCP is evolving and we expecthave faced competition since the expiration of the 1-MCP use patent in 2014. We estimate that citrus post-harvest applications represent approximately 60% of the total core post-harvest market, which is why we are focused on seeking to continue to face growing competitiongrow further in this important crop segment. The market for post-harvest solutions is fragmented with numerous regional suppliers. The four leading providers, including AgroFresh, account for more than half of global post-harvest sales. Other regional and local companies, mainly in citrus, account for the remaining post-harvest sales. Additional key players in the post-harvest industry include fungicide suppliers, such as our key patent expires. We compete with other pre-Syngenta and Janssen PMP, which hold post-harvest crop preservation providers that have similar product claimsregistrations of fungicides previously approved for pre-harvest applications, and offer potential functional substitutes for our products. Current competitors include: dynamic controlled atmosphere storagewhich use post-harvest companies, including Harvest Watch; Janssen Pharmaceutical and Pace International; and 1-MCP generic sellers such as AgroBest, Fitomag and several Chinese companies.AgroFresh, to distribute their products. In the near-harvest segment, ReTainTM is used pre-harvest for extending the harvest season acrossa competitive technology to Harvista that is offered in all regions withexcept for the exception of the European Union.EU. We believe that the principal factors of competition in our industry include reputation, product quality, customer service and customer intimacy, product innovation, technical service and value creation. We believe that we compete favorably with competitors based on the basis of these and other factors. See the subsection titled “Competitive Strengths” above.

Research and Development

Research and development plays an important role at AgroFresh in supportingproviding technical support to our customers as well as building our product pipeline by identifying and developing innovative new offerings and line extensions and newof existing products. ApproximatelyAgroFresh R&D is a global function with less than half of our research and developmentR&D resources are located in facilities in North America, withand the remainder across theour other regions. Approximately 30% of our research and development resources are third-party contractors. During fruit harvest times, (August to November in the Northern Hemisphere and late January to early May in the Southern Hemisphere), we hire additional third-party contract scientists to assist AgroFresh in the execution of experiments involving Harvista, SmartFresh, VitaFresh Botanicals and AdvanStoreActiMist technologies. Most of the regional research and development facilities focus on business aligned research and development initiatives to develop line extensions and create new products. Research and development makes use ofleverage our core competencies in a number of technical areas including post-harvest physiology, analytical chemistry, regulatory sciences, regulatory affairs, formulation science, formulation process development, organic chemistry and delivery systems. Initiatives focused on next generation solutions utilize expertise in material science, molecular biology, postharvestpost-harvest pathology, diagnostics and sensor technology. Our R&D activities have a significant focus on developing sustainable, natural solutions intended to address our customers' current and future challenges.

Intellectual Property

We are a technology-based solutions provider and, as such, rely on a combination of important intellectual property strengths, including licenses, patents, trademarks, copyrights and trade secret protection laws to protect our proprietary technology and our intellectual property. We seek to control access to and distribution of our proprietary information. We enter into confidentiality agreements with our employees, consultants, customers, service providers and vendors that generally provide that any confidential or proprietary information developed by us or on our behalf be kept confidential including, but not limited to, information related to our proprietary manufacturing process and SmartFresh service model. In the normal course of business, we provide access to our intellectual property and/or our products protected by our intellectual property to third parties through licensing or restricted use agreements.

We obtainedToday a majority of our SmartFresh applications use SmartFresh ProTabsTM, an exclusive license from North Carolina State University under the Sisler patent (U.S. 5,518,988) for the use of 1-MCP to delay ripening of fruit and flowers. This patent has expired in the United States and Europe and continues only in Japan until May of 2020. We also acquired the Daly patent (U.S. 6,017,849) for the encapsulation complex of 1-MCP and alpha-cyclodextrin, used as the foundational component in SmartFresh and Harvista. Depending on the country, SmartFresh is currently protected by a patent for the encapsulation complexapplication method patented through 2018 or 2019. We have also generated an impressive portfolio of intellectual property with over 30 patents granted in at least one country (pending in other countries) covering 1-MCP and next generation technologies, most of which do not expire until 2025 or beyond. RipeLock and2022. Harvista formulations are patent protected through at least 2027. We continue to invest in application technologies as a means to provide our customers with the most relevant, convenient and effective solutions for their specific operations.Our portfolio of intellectual property totals more than 375 granted patents and patent applications in over 50 countries.

Regulation and Compliance

We are subject to extensive national, state and local government regulation, and we have an internalthe Company has a regulatory team that we believe is best in class, which leverages a global network of highly-experienced regulatory consultants. Through this network, we have successfully obtained registrations for SmartFresh, Harvista RipeLock, and LandSpring in every country where the review process has been completed, and the registration process for Harvista continues in many additional countries. We have completed more than 400

comprehensive international health and environmental tests that have shown the AgroFresh family of products, including SmartFresh and Harvista, are safe for consumers, workers and the environment. 1-MCP, the active ingredient in themany AgroFresh products, is metabolized by the natural processes in apples and other fruits and leaves no residue.detectable residue when used according to the label instructions. The products have been approved by over 50 authorities including the U.S. Environmental Protection Agency and the European Commission. We do not anticipate any significant

problems in obtaining future required licenses, permits or approvals that are necessary to expand our business. We leverage our regulatory capabilities as we expand the fungicide product lines into new countries.

For a discussion of the various risks we may face from regulation and compliance matters, see “Risk Factors” in Item 1A of this report.

Employees

As of December 31, 2017,2021, we had approximately 284300 full-time employees. None of our employees in North America are members of a union or subject to the terms of a collective bargaining agreement. In certain other countries where we operate (including Brazil, France, Germany, Italy, Netherlands and Spain), employees are members of unions or are represented by works councils. In addition, certain of our activities have been performed historically by seasonal and part-time third-party contingent staff.

Geographic Information