UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| | | | | |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20212023 | | | | | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________________ to________________

Commission file number 001-38248

RumbleOn, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Nevada | | 46-3951329 |

(State or other jurisdiction of

| | (I.R.S. Employer

|

901 WW. Walnut Hill Lane, Suite 110A Irving, Texas | | 75038 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(214) 771-9952

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of exchange on which registered |

| Class B Common Stock, $0.001 par value | | RMBL | | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ¨ | Accelerated filer | x |

| Non-accelerated filer | ¨ | Smaller reporting company | x |

| | | Emerging growth company | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report Yes ☒ No ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of June 30, 2021,2023, the aggregate market value of shares of common stock held by non-affiliates of the registrant was approximately $119.6$120.0 million.

The number of shares of Class B Common Stock, $0.001 par value, outstanding on April 5, 2022March 18, 2024 was 15,930,74035,153,241 shares. In addition, 50,000 shares of Class A Common Stock, $0.001 par value, were outstanding on April 5, 2022.March 18, 2024.

Portions of the registrant’s proxy statement relating to its 20222024 Annual Meeting of Stockholders to be filed with the SEC within 120 days after the end of the year ended December 31, 20212023 are incorporated herein by reference in Part III.

Annual Report on Form 10-K

for the Year Ended December 31, 20212023

Table of Contents

| | | | | | | | |

| | |

| | |

| | |

| Unresolved Staff Comments | |

| Item 1C. | Cybersecurity | |

| | |

| | |

| | |

| | |

| | |

| [Reserved.] | |

| | |

| | |

| | |

| | |

| | |

| Other Information. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Annual Report on Form 10-KPART I

for the Year Ended December 31, 2021

ITEM 1. BUSINESS.

InUnless the context otherwise requires, all references in this Annual Report on Form 10-K for the year ended December 31, 2021 (the "2021 Form 10-K"), "we," "our," "us," "RumbleOn,"section to “we,” “our,” “us,” “RumbleOn,” and the "Company"“Company” refer to RumbleOn, Inc. and its consolidated subsidiaries at December 31, 2021, unless the context requires otherwise.2023.

Forward-Looking and Cautionary Statements

This 20212023 Form 10-K contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally can be identified by words such as "anticipates," "believes," "estimates," "expects," "intends," "plans," "predicts," "projects," "will“anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “will be," "will” “will continue," "will” “will likely result,"” and similar expressions. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially from those reflected in forward-looking statements. Factors that could cause or contribute to such differences in our actual results include, but are not limited to, those discussed in this 20212023 Form 10-K, and in particular, the risks discussed under the caption "Risk Factors"“Risk Factors” in Item 1A and those discussed in other documents we file with the Securities and Exchange Commission (the "SEC"“SEC”). Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. We undertake no obligation to revise or update forward-looking statements, except as required by law.

Market and Industry Data

Some of the market and industry data contained in this 20212023 Form 10-K areis based on independent industry publications or other publicly available information. Although we believe that these independent sources are reliable, we have not independently verified and cannot assure you as to the accuracy or completeness of this information. As a result, you should be aware that the market and industry data contained herein, and our beliefs and estimates based on such data, may not be reliable.

Our Company

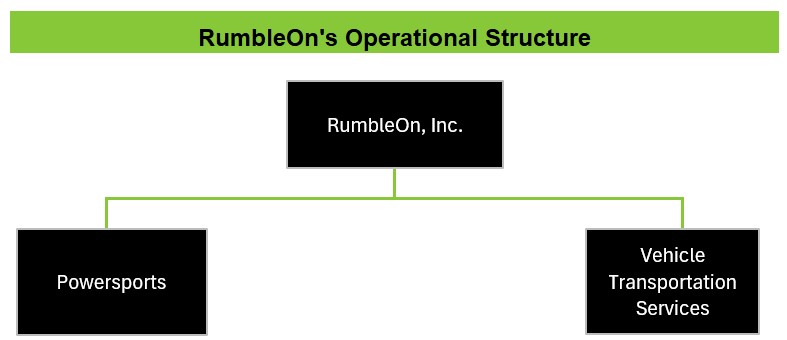

RumbleOn, Inc. operates primarily through two operating segments: our powersports dealership group and our transportation services entity, Wholesale Express, LLC (“Express”). We were incorporated in 2013. We have grown primarily through acquisitions, the largest to date being our 2021 acquisition of the RideNow business followed by our 2022 acquisition of the Freedom Entities. These acquisitions added 54 powersports dealerships to our Company.

During 2023, we experienced significant changes to our management team and board of directors. During the year we added several qualified non-employee directors, including the two co-founders of the RideNow business. On November 1, 2023, Michael Kennedy, an accomplished powersports industry veteran with over three decades of experience in strategy, commercial operations, financial management, and manufacturing at leading powersports companies, joined the Company as chief executive officer and director. In addition, we implemented a series of plans to reduce our outstanding debt and announced several cost savings initiatives, including an organizational restructuring and reduction in headcount.

Powersports Segment

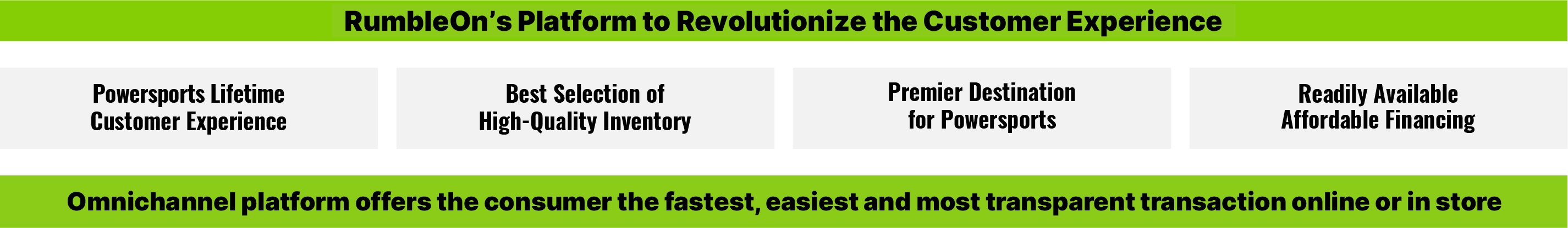

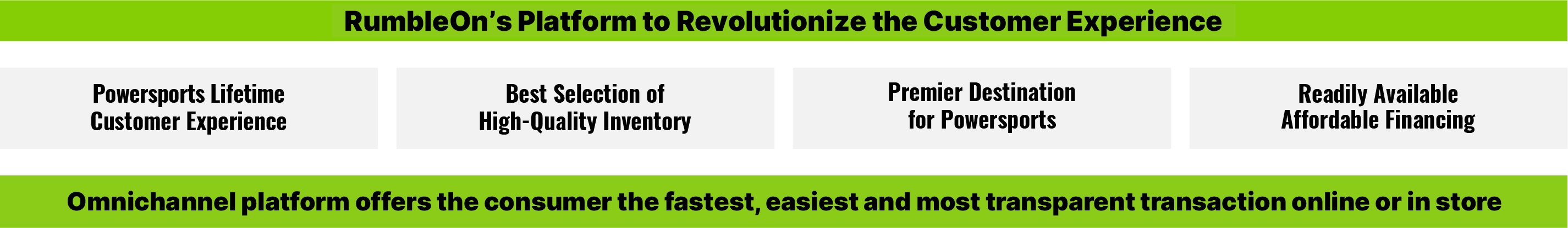

Our powersports business is the nation's first, largest and only publicly-traded, technology-based Omnichannel platformpowersports retail group in the powersports industry. Headquartered in the Dallas Metroplex, RumbleOn is revolutionizing the customer experience for outdoor enthusiasts across the countryUnited States (as measured by reported revenue, major unit sales and making powersport vehicles accessible to more people in more places than ever before. We are transforming the powersports customer experience by giving consumers what they want—dealership locations), offering a wide selection great valueof new and quality, transparency,pre-owned motorcycles, all-terrain vehicles (“ATV”), utility terrain or side-by-side vehicles (“SXS”), personal watercraft (“PWC”), snowmobiles, and an easy, friction-free transaction. Every elementother powersports products. We also offer parts, apparel, accessories, finance & insurance products and services, and aftermarket products from a wide range of our business, from inventory procurement to fulfillment to overall easemanufacturers. Additionally, we offer a full suite of transactions, whether online or on-site at onerepair and maintenance services.

As of our now 55December 31, 2023, we operated 54 retail locations or experience centers, has been built forthat offer a singular purpose – creating a customer experience without peerwide variety of brands. Collectively, our dealerships represent over 500 powersports franchises representing 52 different brands of motorcycles, ATVs, SXSs, PWCs, snowmobiles, and other powersports products. Our dealerships are located in the powersports industry.Alabama, Arizona, California, Florida, Georgia, Kansas, Nevada, North Carolina, Ohio, Oklahoma, South Dakota, Texas, and Washington.

AlthoughWe source high quality pre-owned inventory online via our primary focus is on disrupting the customer experience in the powersports industry, we participate in the automotive industry through our wholly-owned distributors of used automotive inventory, Wholesale, Inc. ("Wholesale Inc") and Got Speed, Inc. (“Got Speed”). Our logistics services company, Wholesale Express, LLC ("Wholesale Express"), provides freight brokerage services facilitating transportation for dealers andproprietary Cash Offer technology, which allows us to purchase pre-owned units directly from consumers.

Incorporated in Nevada in 2013 as a development stage company, we have been building the RumbleOn brand and vision since 2016. Led by our co-founder, chairman, and Chief Executive Officer Marshall Chesrown, we have achieved and built upon key milestones:

•April 2017: launched RumbleOn.com.

•October 2017: celebrated our initial listing on The Nasdaq Stock Market.

•October 2018: acquired Wholesale Inc and Wholesale Express.

•August 2021: acquired the RideNow companies (the “RideNow Transaction”), a collection of 41 retail powersports locations with a geographic footprint spanning primarily the Sunbelt.

•

September 2021: processed the first powersports vehicle

Vehicle Transportation Services Segment

Express provides asset-light transportation brokerage services facilitating automobile transportation primarily between and among dealers. We provide services focused on pre-owned vehicles to clients in all 50 states through our Orlando Fulfillment Center.established network of pre-qualified carriers.

•February 2022: completedFormer Operations

Through June 2023, we participated in the initial funding of our captive consumer finance facility for RumbleOn Finance.

•February 2022: acquired Freedom Powersports (the “Freedom Transaction”), adding ten retail locations in Texas, one in Alabama and two in Georgia.

•February 2022: appointed seasoned finance executive, Narinder Sahai, as Chief Financial Officer and appointed RumbleOn’s President, Peter Levy, to President and Chief Operating Officer.

•February 2022: unveiled the regional management structure, anchored by tenured team members of RideNow.

These key events well-position RumbleOn as the first mover in transforming the powersportswholesale automotive industry through our customer experience focused, technology-based, Omnichannel platform.wholly owned distributor of pre-owned automotive inventory, Wholesale, Inc. and our exotics automotive retailer, AutoSport USA, Inc., which did business under the name Got Speed. We completed the wind down of our wholesale automotive business on June 30, 2023, and financial information attributed to it is reflected as discontinued operations.

On December 29, 2023, the Company sold its consumer loans portfolio underwritten by its subsidiaries, RumbleOn Finance, LLC and ROF SPV I, LLC.

Our Industry and Opportunity

We operate primarily in the powersports industry through our 54 dealership locations, offering significant scale and breadth of products and our Omnichannel platform from which we will provide our only of its kindservices. The powersports customer experience. From our view, powersports includes motorcycles, side-by-sides, ATV, UTV, snowmobile, and personal watercraft ("PWC"). Add in boats and traditional RVs and, according to the US Census Bureau, the total value of the powersports market for traditional retail dealers was approximately $70 billion in 2017. Notably, however, the Census Bureau statistics do not account for a huge peer-to-peer market in used powersports, which RumbleOn believes represents up to 70% of used powersports transactions, providing RumbleOn an outstanding inventory sourcing opportunity and creating a total addressable powersports market in excess of $100 billion.

The powersports marketplace in the United States is highly fragmented.fragmented with over 8,500 dealership locations--most of which are owned by a single entity. We face competition from traditional franchised dealers who sell both new and used vehicles;pre-owned vehicles, independent usedpre-owned powersports dealers; online and mobile sales platforms;dealers, and private parties. We believe that the principal competitive factors in our industry are delivering an outstanding consumer experience competitive sourcing of(sales, delivery, service and after sales care) and quality, inventory, breadth and depth of product selection,selection. Our Cash Offer technology is a point of differentiation that enables us to purchase pre-owned inventory online.

Express operates in the U.S. transportation services industry, which is highly fragmented. We compete against many transportation services companies, including trucking companies, freight brokers, freight forwarders, and value pricing.

Our competitors vary in size and breadth of their product offerings.other brokers. We believe that our principal competitive advantagesdedication to quality, simple and hassle-free transportation services, and our focus on customer relationships drive our business.

Vision 2026

We expect to create long-term per-share value for our shareholders by operating the best performing, most profitable powersports retail group in powersports salesthe United States. In pursuit of these objectives, we have outlined our Vision 2026 plan, which includes the following goals and strategies. In addition to these activities, we continue to focus on reducing our abilitycorporate cost structure by identifying and eliminating expenses that do not further our strategic goals.

Leverage our national scale to run the best performing dealerships in America

We seek to provide customers with a high degreeseamless experience, broad selection, and access to our specialized and experienced team members, including sales staff and technicians. Our network of customer satisfaction withconvenient retail locations allows us to offer services throughout the buying experience by virtuepowersports vehicle life cycle. Our team members are the heart of our Omnichannel platform.operation. Our incentive-based compensation encourages our dealership general managers to think and behave like owners and to focus on profitable operations and great customer experiences. We provide customerssource new inventory from original equipment manufacturers (“OEMs”), and we invest our resources to align with their brand standards and performance objectives. We believe that leveraging our inventory within our large network is a competitive advantage in the opportunityhighly fragmented powersports market with respect to experience RumbleOn's offerings online, in-store,OEMs and throughconsumers. We have also centralized certain activities and decisions with respect to our mobile app, or any combinationinventory mix and supply.

Use our proprietary Cash Offer technology to accelerate growth of those three options. Our ability to make a cash offer to purchase a vehicle with our customer-friendly purchase process, and our breadth ofpre-owned inventory

An expansive selection of the most popular makes and models available online and in-store provides a competitive sourcing and sales.

RumbleOn's Solution - Creating the Future of Powersports

RumbleOn is creating a best-in-class experience in powersports for our customers. Doing so requires offering an unmatched choice and selection and replicating an outstanding customer experience throughout the lifecycle of powersports ownership, one customer at a time.

Customers come to RumbleOn's 55 retail locations as well as our more than 60 websites to shop for new and quality used powersports products and soon for parts, accessories and merchandise. We address the entire powersports market. We are reimagining and revolutionizing the customer experience on the technology-led Omnichannel RumbleOn platform, and we are doing so for everyone — from the enthusiast to the novice, and everyone in between – with a focus on four key initiatives:

•Creating an end-to-end ownership experience enables building lifelong connectivity to our customers in several ways, and the experience we are building is not just about the initial transaction. We are also focused on the touch points that continue to keep our customers engaged throughout their powersports ownership experience. Quality assurance, clear and consistent pricing, professional pickup and delivery, customization, after sale service, and guarantees are just a few of the ways we are building a reliable and consistent customer experience. Our offerings —and our entire customer experience —are designed to turn a single transaction into a lifetime relationship.

•Providing the best selection of high-qualitypre-owned inventory enables us to address the 'wants' of all powersports customers coast to coast. We are well-positioned to acquire high-quality used vehicles through the strength of our online Cash Offer Tool, a unique and important competitive advantage for RumbleOn. Affording our consumers the ability to visit a retail location and receive cash for their used powersports unit instantaneously gives them peace of mind, and provides us the opportunity to drive a meaningful amount of incremental used inventory onto our platform. We are also leveraging robust data from the Cash Offer Tool and now from 55 RideNow and Freedom Powersports retail locations to ensure that the right vehicle is in the right place at the right time —with the right price.

•Becoming the premier destination for used powersports vehicles and introducing more used inventory into our showrooms as well as online attracts new customers to our platform and, most importantly, new riders to the industry due to affordability. On a comparable pro forma basis in Q4 2021, we increased the number of used retail powersport units sold by 87% year-over-year at the RideNow locations. We are focused on both new and used; however, the opportunity to dramatically increase the number of used retail powersports units presents our greatest near-term opportunity. In the current new vehicle supply-constrained environment, we can better control used inventory than new because used is not dependent on a manufacturer's production or distribution constraints. In fact, our broad access to used inventory is — and will continue to be— an important differentiator for RumbleOn in any market environment.

•Offering powersports financing through our wholly-owned captive consumer finance subsidiary RumbleOn Finance is another way we are making powersports ownership easy and accessible to more of our customers. RumbleOn Finance provides an opportunity to bring new entrants to the powersports space by offering competitive financing solutions, especially for those customers for whom financing from traditional financial institutions or manufacturers is not readily available. In the future, our paperless online transactions will further enhance our unmatched, true Omnichannel experience and create incremental sales with no geographic boundaries.

Our Growth Strategies

The key metric to our powersports business is retail vehicle unit sales, both online or in-store. Unit sales drives revenue and provides the opportunity to build additional revenue through financing, parts, merchandise, and accessories, each of which are higher margin revenue streams. As we mature, and expand our Omnichannel customer experience, we will create

additional opportunities to expand revenue streams. However, additional revenue opportunities begin with retail vehicle unit sales and, as a result, our growth strategy is focused on this metric.

Our ability to increase vehicle unit sales is a function of our market penetration in existing markets, the number of markets we operate in, and our ability to build and maintain our brands by offering great value, transparency, and an outstanding customer experience.

Optimize Our Inventory Selection and Centralization

We will continue to optimize and broaden the selection of new and used powersports vehicles we make available to our customers. Expanding our inventory selection enhances the customer experience by ensuring each visitor either online or in-store, findscan find a powersports vehicle that matches his or her preferences. Optimizing our new inventory significantly depends on the allocations of our manufacturers ("OEM"). Optimizing our used inventory selection depends on our ability to source and acquire a sufficient number of appropriate used vehicles, including acquiring more vehicles directly from our customers.

We are also implementing a fulfillment system with near real-time inventory replenishment to make the right powersports unit available in the right quantities at the right locations. This centralization of inventory will launch company-wide virtual selling through access to all company-owned inventory and not just what might be available at an individual location. This will increase the probability that our customers can find their powersports unit on our platform, thereby enhancing the customer experience while eliminating geographic boundaries. With digital inventory integration and over 60 individual websites that share content, RumbleOn will be top-of-mind for powersports searches. All of the technology infrastructure required is under development and will be implemented throughout 2022 and beyond.

Continue to Innovate and Extend Our Technology Leadership

We will continue to make significant investments in improving and adding to our online customer offering. We believe that the complexity of the traditional powersports retail transaction provides substantial opportunity for technology investment and that our leadership and continued growth will enable us to responsibly invest in further enhancing the customer experience.

From our founding, we have been laying the groundwork to offer a friction-free and fully integrated customer experience both online and in-store. We are building the technology engine to enable this integration, while methodically expanding our retail footprint. We plan to begin rolling out our new and innovative technology throughout 2022 and will continuously make improvements to our technology offering.

In order to truly rebuild the customer experience, we are investing to build the technology engine across the organization.preference. Our Cash Offer Tool is supplying proprietary data on hundreds of thousands of unique Vehicle Identification Number (VIN) inputs, in addition to actual retail salestechnology directly connects us with consumers and transaction data from RideNow and Freedom Powersports' databases. Marrying this data creates a data-driven "market maker" that does not exist in the industry today. Integrating real-time pricing and sales data from in-store transactions will also enableallows us to further optimize offersacquire high-quality, pre-owned powersports vehicles at scale. This proprietary technology is a fast and pricing.

Expandefficient mechanism to offer cash for pre-owned vehicles and provides us with a unique source of market data. Our Geographic Markets

Beyond innovativeCash Offer technology is a point of differentiation that enables us to access a nationwide market of pre-owned vehicles and inventory integration, we will useintroduces us to customers outside of our retail locations to augment the online experience—and vice versa —to offer a simple, friction-free customer experience. A key component to transforming the customer experience to support our growth strategy is enhancing the in-store experience and we are strategically expanding our geographicphysical retail footprint. Since the business combination with RideNow, we have acquired 14 additional retail locationsFollowing our organizational restructuring, our pre-owned inventory strategy, including our Cash Offer technology, is led by an experienced senior leader utilizing a centralized set of standards for acquisitions made online, in stores and are currently operating in 55 retail locations, as shown below.

We employ three primary considerations for expanding our bricks-and-mortar presence: (1) find great people, (2) identify desired geography, and (3) implement appropriate and balanced brand mix.

Finding Great People. We believe any great customer experience in powersports begins with great people providing consumers the opportunity to fulfill their passion. From our executive team to our customer facing professionals to our back-office and corporate personnel, the RumbleOn team is singularly focused on transforming the customer experience in powersports, both online and in-store. As we expand our physical presence, whether through new retail locations or as we build out our fulfillment “experience” centers, finding great people who believe in our mission.

Identifying Desired Geography. We believe desired geography means more than finding new markets; it also means making sure we can put the right powersports vehicle in the right place at the right price to maximize our return on the asset. This is a key goal of our fulfillment “experience” centers and we anticipate to roll out two such centers during 2022, first in the Dallas Metroplex and then potentially in Arizona, Nevada, Northeast or Florida markets. And of course, we are always looking for strategic acquisition candidates, whether a large group such as Freedom Powersports or a key tuck-in opportunity to improve the capabilities of an existing location.

Implementing Appropriate Brand Mix. Powersports retail provides the opportunity to put many different new brands under one roof along the proper mix of used inventory. Of course, having that opportunity and taking advantage of that opportunity correctly are two different things. In this current supply-constrained environment, we can better control used inventory than new because used is not subject to manufacturers’ production or distribution constraints. We intend to leverage our key used inventory sourcing advantage to keep our retail locations fully stocked with the right mix of preferred brands based on market share, and thereby further enhance the customer experience.

Develop Broad Consumer Awareness of Our Brand

Important to the future of RumbleOn's brand is creating a unified customer experience across all locations, and the foundation will be our technology, our infrastructure, and our corporate culture. We recently unveiled our new regional management structure, with a new National Senior Vice President of Retail overseeing six Regional Directors who will lead the daily operations of multiple facilities primarily based on geographic location. These Regional Directors will share best practices

in customer serviceGrow organically and general operationsthrough strategic acquisitions

Our Vision 2026 plan includes growing our powersports segment both organically by adding new customers through our online and in-store locations, by adding brands to enhance the overall performance of ourexisting locations and by acquiring new strategic retail locations. This new regional management structure is well-aligned withOur team has substantial experience in identifying suitable acquisition candidates, negotiating purchase terms and conditions and integrating newly acquired businesses. We identify acquisition candidates based on a variety of factors, including authorized brands, geographic location and service offerings. Acquiring additional locations also helps us further leverage our growth initiativescorporate cost structure. We are continually evaluating our dealer footprint and will provide a stable footingmay divest locations that are no longer accretive for our continued growth. We are in the early daysbusiness.

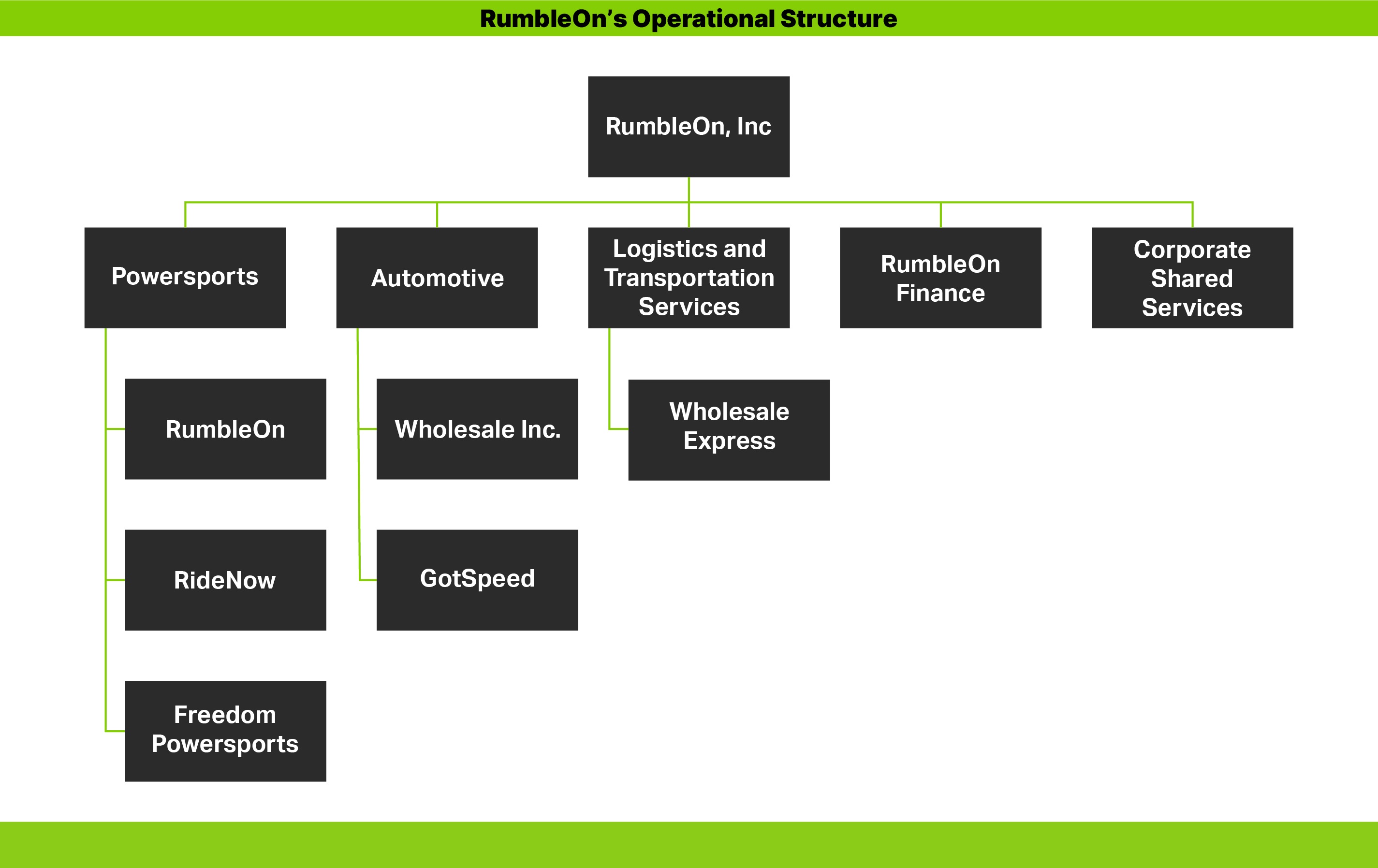

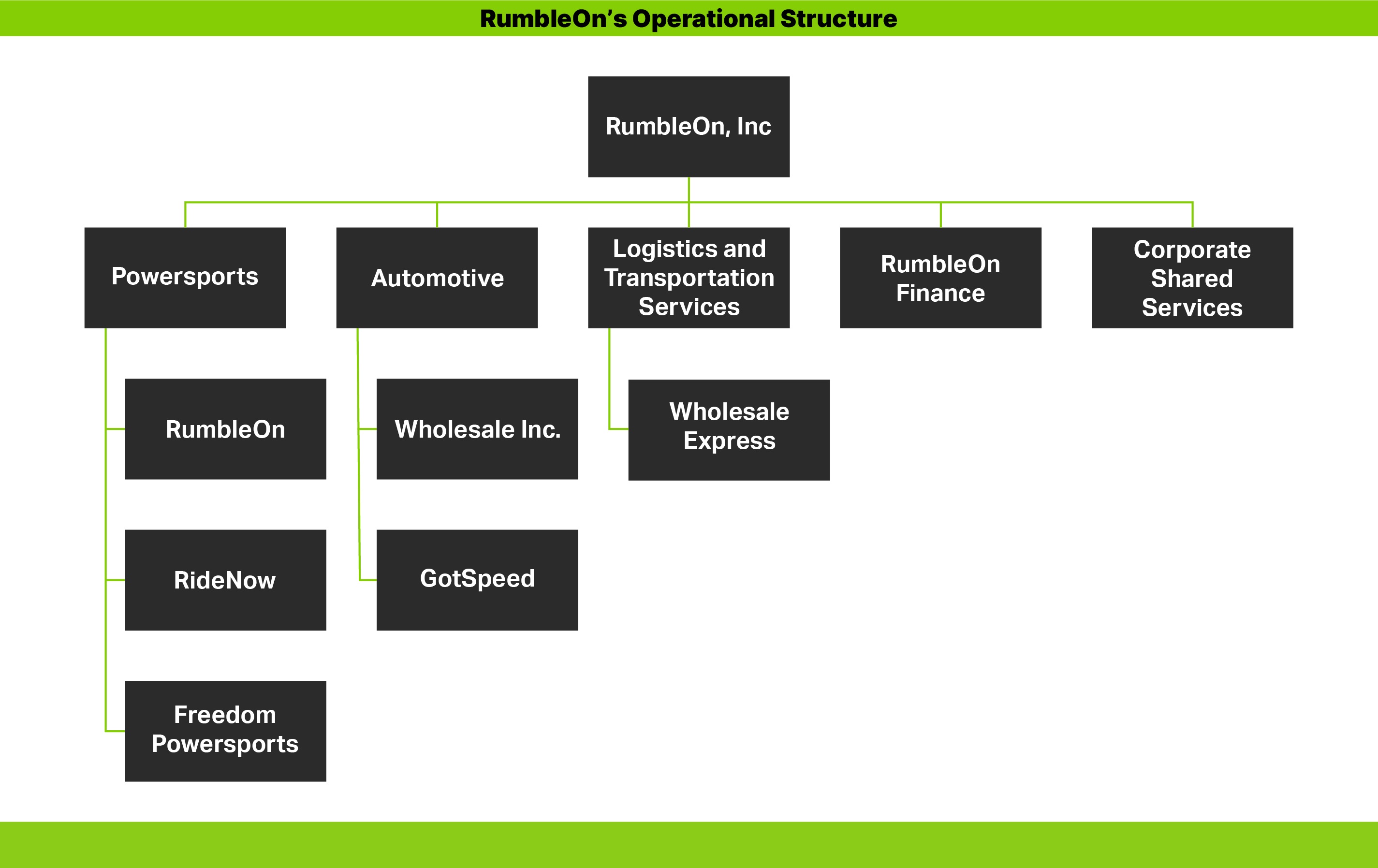

Organizational Structure

The following chart summarizes our organizational structure as of the rollout, but we are encouragedDecember 31, 2023. This chart is provided for illustrative purposes only and does not reflect all legal entities owned or controlled by the impact on performance and the excitement it has clearly created.us:

RumbleOn Technology

Innovative technology continues to underpin every endeavor at RumbleOn through our ongoing mission to disrupt the powersports industry and our focus on the customer experience. We leverage technology and data to drive change. At a high-level, we believe there are two main areas where leveraging these innovations provides us a competitive advantage and improves the customer experience: (1) our proprietary supply chain and distribution software and (2) our Omnichannel and mobile-first web application.

(1) RumbleOn's proprietary supply chain and distribution software:

•Looks at the overall supply chain and reconfigures inventory for the purpose of acquisition and distribution. Our technology aggregates multiple data sources in real-time, tracking and cataloging inventory across the country.

•Analyzes real-time market data to inform our acquisition decisions, continually capturing and archiving such data using advanced algorithms to calibrate pricing and estimate freight and reconditioning expenses. The values are then used in our Cash Offer Tool to quickly determine a fair and reasonable, non-negotiable offer.

(2) RumbleOn's Omnichannel and mobile-first web application strategy:

•Enhances our website and mobile application to provide a compelling customer experience, from the front-end user interface and powerful search tools to enabling secure data, document, and payment exchanges between parties. We also optimize search engine marketing to provide a lower overall cost of customer acquisition.

To deliver our supply chain software and Omnichannel strategies, RumbleOn leverages its proprietary and exclusive-use technology portfolio, which includes:

•a series of modeling tools & technologies for consolidating internal and external data to provide profitability estimates for inventory available for purchase;

•a proprietary series of inventory management and business intelligence technologies that tracks the lifecycle of a vehicle from acquisition through delivery;

•an automated photography technology that combines high-quality photos to produce an interactive, 360-degree virtual tour of the vehicle;

•a catalog of website that includes advanced filtering and search technology that assist multi-lead generation across participating partners;

•a dedicated financing company for leveraging leads for faster turn on sales and delivery; and

•a proprietary transportation management system and assignment technology to optimize the transport of purchased inventory for acquisition and dealer distribution.

In addition to our proprietary/exclusive use technology, we also rely on third party technology, including the following:

•a cloud based network infrastructure for hosting websites and inventory data;

•software libraries, development environments, and tools;

•services to allow customers to digitally sign contracts; and

•customer service call center management software.

In short, our business is driven by data and technology at all stages of the process, from acquisition, inventory purchasing, reconditioning, photography, transportation, and annotation through physical through online merchandising, sales, financing, trade-ins, logistics, and delivery.

We protect our technology and other intellectual property through a combination of trademarks, domain names, copyrights, trade secrets, patented technology, and contractual provisions and restrictions on access and use of our proprietary information and technology. We have a portfolio of trademark registrations in the United States, including registrations for "RumbleOn,"“RideNow,” the RumbleOnRideNow logo, "RideNow,"“RumbleOn,” and the RideNowRumbleOn logo. We are the registered holder of a variety of domestic and international domain names, including "rumbleon.com."

Operational Structure

The following chart summarizes our organizational structure as of December 31, 2021, but includes Freedom Powersports, which we acquired on February 18, 2022. This chart is provided for illustrative purposes only and does not reflect all legal entities owned or controlled by us:

Seasonality

Historically, both theThe powersports and automotive industries have beenindustry is a seasonal business with traffic and sales strongest in the spring and summer quarters. Sales and traffic are typically slowest in the winter quarter but increase typically in the spring season, coinciding with tax refunds and improved weather conditions.months. Given this seasonality, we expect our quarterly results of operations, including our revenue, gross profit, net income (loss), and cash flow to vary accordingly. Over time, we expect to normalize to seasonal trends in both segments, using data and logistics to move inventory to the right place, at the right time, at the right price.

Government Regulation

Various aspects of our business are or may be subject directly or indirectly, to U.S. federal and state laws and regulations.regulations, including state and local dealer licensing requirements, federal and state consumer finance laws, the United States Department of Transportation motor-carrier rules and regulations, federal, state and local environmental laws and regulations, including the U.S. Environmental Protection Act, federal, state, and local wage and hour and anti-discrimination laws, and antitrust laws. Failure to comply with such laws or regulations may result in the suspension or termination of our ability to do business in affected jurisdictions or the imposition of significant civil and criminal penalties, including fines or the award of significant damages against us and our dealers in class action or other civil litigation.

Vehicle Sales. Our sale and purchase of vehicles, both new and pre-owned, related products and services and third-party finance products, are subject to the state and local dealer licensing requirements in the jurisdictions in which we have retail or wholesale locations. Regulators of jurisdictions where our customers reside, but in which we do not have a dealer or financing license could require that we obtain a license or otherwise comply with various state regulations. Despite our belief

that we are not subject to the licensing requirements of those jurisdictions in which we do not have a physical presence, regulators may seek to impose punitive fines for operating without a license or demand we seek a license in those jurisdictions, any of which may inhibit our ability to do business in those jurisdictions, increase our operating expenses and adversely affect our financial condition and results of operations.

Consumer Finance. The financing we offer customers is subject to federal and state laws regulating the advertising and provision of consumer finance options, the collection of consumer credit and financial information, along with requirements related to online payments and electronic funds transfers, of whether RumbleOn Finance or a third-party is the entity extending credit to such customers. Most states regulate retail installment sales, including setting a maximum interest rate, caps on certain fees, or maximum amounts financed. In addition, certain states require that finance companies file a notice of intent or have a sales finance license or an installment sellers license in order to solicit or originate installment sales in that state.

Logistics and Transportation. Our Wholesale Express logistics operations, which brokers and facilitates the transportation of vehicles primarily between and among dealers, is subject to motor-carrier rules and regulations promulgated by the United States Department of Transportation ("DOT") and the states through which their customers' vehicles are transported. Additionally, the vendors whom Wholesale Express relies upon are subject to federal and state regulation concerning transport vehicle dimensions, transport vehicle conditions, driver motor vehicle record history, driver alcohol and drug testing, and driver hours of serves. More restrictive limitations on vehicle weight and size, condition, trailer length and configuration, methods of measurement, driver qualifications, or driver hours of service may increase the costs charged to Wholesale Express by its vendors, which may adversely affect our financial condition, operating results, and cash flows. If we fail to comply with the DOT regulations or if those regulations become more stringent, we could be subject to increased inspections, audits, or compliance burdens. Regulatory authorities could take remedial action including imposing fines, suspending, or shutting down our Wholesale Express operations.

Environmental Laws and Regulations. We are subject to a variety of federal, state, and local environmental laws and regulations that pertain to our operations. The regulations concern material storage, air quality, waste handling, and water pollution control. The regulations also regulate our use and operation of gasoline storage tanks, gasoline dispensing equipment, oil tanks, and paint booths among other things. Our business involves the use, handling, and disposal of hazardous materials and wastes, including motor oil, gasoline, solvents, lubricants, paints, and other substances. We manage our compliance through permitting and operational control.

Facilities and Personnel. Our facilities and business operations are subject to laws and regulations relating to environmental protection and health and safety, and our employment practices are subject to various laws and regulations, including complex federal, state, and local wage and hour and anti-discrimination laws. We may also be liable for employee misconduct and violations of laws or regulations to which we are subject.

Federal Advertising Regulations. The Federal Trade Commission ("FTC") has authority to take actions to remedy or prevent advertising practices that it considers to be unfair or deceptive and that affect commerce in the United States. If the FTC takes the position in the future that any aspect of our business constitutes an unfair or deceptive advertising practice, responding to such allegations could require us to pay significant damages, settlements, and civil penalties, or could require us to make adjustments to our products and services, any or all of which could result in substantial adverse publicity, loss of participating dealers, lost revenue, increased expenses, and decreased profitability.

Federal Antitrust Laws. The antitrust laws prohibit, among other things, any joint conduct among competitors that would lessen competition in the marketplace. Some of the information that we may obtain from dealers may be sensitive and, if disclosed inappropriately, could potentially be pre-owned by dealers to impede competition or otherwise diminish independent pricing activity. A governmental or private civil action alleging the improper exchange of information, or unlawful participation in price maintenance or other unlawful or anticompetitive activity, even if unfounded, could be costly to defend and adversely impact our ability to maintain and grow our business.

In addition, governmental or private civil actions related to the antitrust laws could result in orders suspending or terminating our ability to do business or otherwise altering or limiting certain of our business practices, including the manner in which we handle or disclose pricing information, or the imposition of significant civil or criminal penalties, including fines or the award of significant damages against us in class action or other civil litigation.

Other. In addition to these laws and regulations that apply specifically to our business, we are also subject to laws and regulations affecting public companies, including securities laws and the listing rules of The Nasdaq Stock Market ("Nasdaq"(“Nasdaq”).

The violation of any of these laws or regulations could result in administrative, civil, or criminal penalties or in a cease-and-desistcease- and-desist order against our business operations, any of which could damage our reputation and have a material adverse effect on

our business, sales and results of operations. We have incurred and will continue to incur capital and operating expenses and other costs to comply with these laws and regulations.

The foregoing description of laws and regulations to which we are or may be subject is not exhaustive, and the regulatory framework governing our operations is subject to continuous change. The enactment of new laws and regulations or the interpretation of existing laws and regulations in an unfavorable way may affect the operation of our business, directly or indirectly, which could result in substantial regulatory compliance costs and civil or criminal penalties, including fines, adverse publicity, loss of participating dealers, lost revenue, increased expenses, and decreased profitability. Further, investigations by government agencies, including the FTC, into allegedly anticompetitive, unfair, deceptive or other business practices by us, could cause us to incur additional expenses and, if adversely concluded, could result in substantial civil or criminal penalties and significant legal liability.penalties.

Employees

As of December 31, 2021,2023, we had approximately 1,9492,357 full time and 7055 part-time employees.

Available Information

Our Internet website is www.rumbleon.com.located at www.rumbleon.com. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities and Exchange Act of 1934, as amended (the "Exchange Act"“Exchange Act”), are available free of charge, under the Investor Relations tab of our website as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Additionally, the SEC maintains a website located at www.sec.gov that contains the information we file or furnish electronically with the SEC.

ITEM 1A. RISK FACTORS.

Described below are certain risks to our business and the industry in which we operate. You should carefully consider the risks described below, together with the financial and other information contained in this 20212023 Form 10-K and in our other public disclosures. If any of the following risks occurs, our business, financial condition, results of operations, cash flows, or prospects could be materially and adversely affected. As a result, our future results could differ materially from historical results and from guidance we may provide regarding our expectations for future financial performance and the trading price of our Class B common stock could decline.

Business and Operational Risks Relating to Our Business

We are subject to the auditor attestation requirement on the assessment of our internal control over financial reporting for our year ended December 31, 2021 and

In recent periods, we and our auditors have identified a number of material weaknesses in our internal control over financial reporting as disclosed in this 2021 Form 10-K.

The Company is now subject to the requirement to include in this 2021 Form 10-K our auditor’s attestation report on its assessment of our internal control over financial reporting pursuant to Section 404 of the Sarbanes-Oxley Act (“SOX”). We and our auditors have identified deficiencies in our internal control over financial reporting as disclosed in this 2021 Form 10-K as required under Section 404 of SOX. As some of these deficiencies are deemed material weaknesses in internal control over financing reporting, our auditors have issued an adverse opinion in their assessment of our internal control over financial reporting. The issuance of an adverse opinion regarding our internal control over financial reporting could adversely impact investor confidence in the accuracy, reliability, and completeness of our financial reports.

WeMost recently, we have identified material weaknesses in our internal control over financial reporting.two areas, as disclosed in this 2023 Form 10-K. If we are unable to effectively remediate these material weaknesses and maintain an effective system of internal control over financial reporting, we may not beable to accurately report our financial results or prevent fraud. As a result, investors could lose confidence in our financial and other public reporting, which would harm our business.

Effective

We are required to comply with Section 404 of the Sarbanes-Oxley Act (“SOX”), which requires public companies to maintain effective internal control over financial reporting (“ICOFR”). In particular, we must perform system and process evaluation and testing of our ICOFR to allow management to report on the effectiveness of our ICOFR. In addition, we are required to have our independent registered public accounting firm attest to the effectiveness of our ICOFR. The standard of effectiveness for ICOFR is necessary for us to provide reliable financial reports and, together with adequate disclosurethat we have controls and procedures is designed to prevent fraud. In connection with the preparation of our consolidatedin place that provide “reasonable assurance that we can produce accurate financial statements ason a timely basis.” This process of December 31, 2021implementation, evaluation, and 2020attestation is costly and for the years then ended, we identified material weaknesses intime-consuming. We have hired and may need to continue to employ both internal and external resources with appropriate public company experience and technical accounting knowledge to maintain and evaluate our internal control over financial reporting. ICOFR.

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting,our ICOFR, such that there is a reasonable possibility that a material misstatement of the Company’sour annual or interim financial statements will not be prevented or detected on a timely basis. The followingWe have identified material weaknesses in our internalICOFR in recent periods. For example, we identified and disclosed a material weakness in our 2022 Form 10-K, which has been partially remediated. In addition, as discussed in this 2023 Form 10-K, we have identified material weaknesses in our ICOFR for the year ended December 31, 2023. These material weaknesses relate to (i) an insufficient number of accounting resources to facilitate an effective control over financial reporting have been identified:

•Information technology general controls particularly as such controls related toenvironment following the integration of the RideNow business and incorporation of that business into the Company’s control environment and (ii) user access program change management, and ineffective complementary user-organization controls, which limited management’s ability to rely on technology dependent controls relevant to the preparation of our financial statements.

•Controls over the period end close process, including the review and approval process of journal entries, balance sheet account reconciliations, segregation of duties conflicts, and consolidation of intercompany entries.

•Documentation and design of controls over the recording and reconciliation of inventory.

•Review of key assumptions and estimates related to purchase accounting for significant acquisitions.

•The control environment, risk assessment, control activities,certain information and communication, and monitoring components oftechnology systems that support the Company’s internal control frameworkfinancial reporting processes. As a result of these identified material weaknesses, our disclosure controls and procedures as of December 31, 2023 and 2022, respectively, were determined not to be effective at a reasonable assurance level as of each of those dates.

Part II, Item 9A of this 2023 Form 10-K describes the remediation plan for the material weaknesses affecting our ICOFR as of December 31, 2023. We cannot assure that the measures we are taking to remediate these material weaknesses will be sufficient or that such that internal control weaknesses were not detected, communicated, addressed with mitigating control activities, or remediated in a timely manner.

measures will prevent future material weaknesses. If we are unable to effectively remediate these material weaknesses and maintain effective internal control over financial reporting,ICOFR, we may fail to prevent or detect material misstatements in our financial statements, in which case investors may lose confidence in the accuracy and completeness of our financial statements.

The RideNow and Freedom Powersports entities we acquired were not subject to SOX regulations and they may lack the internal control over financial reporting required of a public company, which could ultimately affectOur success depends in part on our ability to ensure compliance withgrow our business both organically and through strategic acquisitions, and our plans and strategies may not be realized.

Our strategic plan includes leveraging our nation-wide network of dealerships, using our proprietary Cash Offer technology to grow our pre-owned inventory, reducing our cost structure, and acquiring strategic retail locations. The identification of suitable acquisition candidates can be difficult, time-consuming and costly, and we may not be able to successfully complete identified acquisition opportunities. These activities can divert management time and focus from operating our business to addressing acquisition challenges. We may encounter unforeseen expenses, difficulties, complications, and delays relating to the requirementsdevelopment and operation of Section 404 of SOX.

The RideNow and Freedom Powersports entities we acquired were not previously subject to SOX regulations and accordingly were not required to establish and maintain an internal control infrastructure meeting the standards promulgated under SOX. Our management's assessment of internal control over financial reportingour business and the auditor attestation, both includedexecution of our business plan, including our organic and acquisition growth strategies. Achieving the anticipated benefits of acquisitions depends in significant part upon our integrating any acquired entity’s businesses, operations, processes, and systems in an efficient and effective manner. We have incurred, and expect to continue to incur, a number of non-recurring costs associated with our

in this 2021 Form 10-K, did not include

acquisitions. Our failure to identify, acquire or address the internal control environment of the RideNow entities, which were acquired during the quarterly period ended September 30, 2021, or the Freedom entities, which were acquired during the quarterly period ending March 31, 2022.

We are in the process of integrating our internal control over financial reporting and our other control environments with those of the acquired RideNow and Freedom Powersports entities. In the course of integration, we may encounter difficulties and unanticipated issues combining our respective accounting systems due to the complexity of our financial reporting processes. We may also identify errors or misstatements thatsuccessfully integrate additional retail locations could require accounting adjustments. If we are unable to integrate and maintain effective internal control over financial reporting, timely or at all, we may fail to prevent or detect material misstatements in our financial statements, in which case investors may lose confidence in the accuracy and completeness of our financial reports and the market price of our Class B common stock may decline.

Powersports consumers may not accept our transformative business model.

As described throughout this 2021 Form 10-K, we are transforming the traditional powersports customer experience and building the first and only true Omnichannel experience in the industry. If customers do not accept our products, services, and offerings we may not benefit from the investments needed to build this transformative customer experience to the extent anticipated or at all. Also, in building the first and only true Omnichannel experience, we expect to incur significant expenses and face various other challenges, such as expanding our customer experience team and building out a fulfillment and logistics network. Any of these risks, if realized, could materially and adversely affect our business, financial condition, and results of operations.operation.

We may not be able to acquire the number of powersports vehicles to satisfy consumer demand or our expectations for the business.

A material part of our plan is predicated on being able to have sufficient inventory of powersports vehicles, both new and used,pre-owned, to satisfy customer demand or meet our financial objectives. New inventory is ultimately controlled by our OEMs and their willingness to allocate inventory to us and their ability to manufacture and distribute a sufficient number of vehicles given a current environment of manufacturing slowdowns, computer chip shortages, and logistic/transportation challenges (collectively, the “Demand/Supply Imbalances”). Usedpowersports vehicles. Pre-owned inventory is acquired directly from consumers via our onlineproprietary Cash Offer Tooltechnology or consumer trade-in transactions.transactions or auctions. If either channelthe channels for usednew or pre-owned vehicle acquisition were disrupted, for example as a result of another COVID-like lockdown, technology challenges, continued acceptancecustomers holding onto their vehicles due to significant valuation decreases and negative equity positions, non-acceptance of online transactions, poor customer ratings, or other such events, the Company may not have enough used vehiclesinventory to meet customer demand, which may adversely affect our business, financial condition, and results of operations.

We have and may continue to acquire strategic retail locations and other complementary businesses and technologies, which could divert management's attention, result in additional dilution to our stockholders, and otherwise disrupt our operations and impact our operating results.

Our success will depend, in part, on our ability to grow our business in response to the demands of consumers, other constituents within the powersports industry, and competitive pressures. In the past, we have met these demands in part by acquiring complementary businesses and technologies.

The identification of suitable acquisition candidates can be difficult; time-consuming, and costly, and we may not be able to successfully complete identified acquisition opportunities. The risks we face in connection with our acquisition strategy include:

•diversion of management time and focus from operating our business to addressing acquisition integration challenges;

•integration of the acquired company's accounting, management information, human resources, and other administrative systems;

•coordination of technology, research and development, and sales and marketing functions;

•retention of employees from the acquired company;

•cultural challenges associated with integrating employees from the acquired company into our organization;

•the need to implement or improve controls, procedures, and policies at a business that before the acquisition may have lacked effective controls, procedures, and policies;

•potential write-offs of intangibles or other assets acquired in such transactions that may have an adverse effect on our operating results in a given period; and

•liability for activities of the acquired company before the acquisition.

Our failure to address these risks or other matters encountered in connection with future acquisitions and investments could cause us to fail to realize the anticipated benefits of these acquisitions or investments, cause us to incur unanticipated liabilities, and harm our business generally. Future acquisitions could also result in dilutive issuances of our equity securities, the incurrence of debt, contingent liabilities, amortization expenses, or the impairment of goodwill, any of which could harm our financial condition.

We may require additional financing or capital to pursue our growth challenges or unforeseen circumstances. If financing or capital is not available on terms acceptable to us or at all, we may not be able to develop and grow our business as anticipated and our business, operating results, and financial condition may be harmed.

We intend to continue to make investments to support the development and growth of our business, including expanding our inventory base and growing our RumbleOn Finance business. Additional financing or capital may not be available when we need it, on terms that are acceptable to us, or at all.

If we raise additional capital through issuances of equity or debt, our existing stockholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences, and privileges superior to those of holders of our common stock. If we are unable to obtain adequate financing or financing on terms satisfactory to us, when we require it, our ability to continue to pursue our business objectives and to respond to business opportunities, challenges, or unforeseen circumstances could be significantly limited, and our business, operating results, financial condition, and prospects could be adversely affected.

Investments made in the development, growth, and expansion of our business may not yield our expected results and may not result in successful growth of our business.

We expect to make significant investments in the further development and expansion of our business and these investments may not result in the development, growth or expansion of our business on a timely basis or at all. We may not generate sufficient revenue and we may incur significant losses in the future for several reasons, including a lack of demand for our products and services, increasing competition, and weakness in the powersports industry generally. We may encounter unforeseen expenses, difficulties, complications, and delays, relating to the development and operation of our business as well as our organic and acquisition growth strategies. Accordingly, we may not be able to successfully develop, grow, and expand our business, generate revenue, or achieve and maintain profitability.

We may experience difficulties integrating acquired businesses.

Achieving the anticipated benefits of our acquisitions will depend in significant part upon our integrating any acquired entity's businesses, operations, processes and systems in an efficient and effective manner. We may not be able to accomplish the integration process smoothly, successfully, or on a timely basis, which may result in unforeseen expenses or the failure to recognize the anticipated benefits of acquired businesses. The necessity of coordinating geographically separated organizations, systems of controls, and facilities and addressing possible differences in business backgrounds, corporate cultures, and management philosophies may increase the difficulties of integration. Companies operate numerous systems and controls, including those involving management information, accounting and finance, legal and regulatory compliance, inventory intake and control, sales, billing, employee benefits, and payroll. The integration of an acquired company's operations requires the dedication of significant internal and external resources, which may divert management’s attention from the day-to-day business of the company and be costly. Employee uncertainty and lack of focus during the integration process may also disrupt the business of the Company. Any inability of management to successfully and timely integrate an acquired company could have a material adverse effect on the business and results of operations of the Company and result in not achieving the anticipated benefits of the acquisition.

To the extent we acquire additional businesses, we may incur substantial costs.

We have incurred, and expect to continue to incur, a number of non-recurring costs associated with our acquisitions. The substantial majority of these non-recurring costs will consist of transaction and regulatory costs related to acquisitions. We will also incur transaction fees and costs related to formulating and implementing integration plans, including system consolidation costs and employment-related costs. We continue to assess the magnitude of these costs, and additional

unanticipated costs may be incurred from the acquisitions and integration. Although we anticipate that the elimination of duplicative costs and the realization of other efficiencies and synergies related to the integration should allow us to offset integration-related costs over time, this net benefit may not be achieved in the near term, or at all.

We have incurred significant indebtedness, which could adversely affect us, including our business flexibility, and will increase our interest expense.

We have substantially increased indebtedness following completion of the RideNow and Freedom transactions, which could have the effect, among other things, of reducing our flexibility to respond to changing business and economic conditions and increasing our interest expense. We also incurred various costs and expenses related to the financing of the RideNow and Freedom transactions. The increased levels of indebtedness following completion of the RideNow and Freedom transactions, including the applicable interest payments, could also reduce funds available for working capital, capital expenditures, and other general corporate purposes, and may create competitive disadvantages for us relative to other companies with lower debt levels. If we do not achieve the expected synergies and cost savings from the RideNow and Freedom transactions, or if our financial performance does not meet our current expectations, then our ability to service the indebtedness may be adversely impacted.

We depend on key personnel to operate our business, and if we are unable to retain, attract, and integrate qualified personnel, our ability to develop and successfully grow our business could be harmed.

We believe our success will depend on the efforts and talents of our executives and employees, including Marshall Chesrown,Michael Kennedy, our Chairman and Chief Executive Officer.chief executive officer. In addition, the loss of any senior management regional directors, or other key employees could materially adversely affect our ability to execute our business plan and strategy, and we may not be able to find adequate replacements on a timely basis, or at all. Our future success depends on our continuing ability to attract, develop, motivate, and retain highly qualified and skilled employees. Qualified individuals are in high demand, and we may incur significant costs to attract and retain them. A limited number of our employees are subject to employment agreements that include restrictive covenants. We cannot ensure that we will be able to retain the services of any members of our senior management or other key employees. If we fail in attractingto attract well-qualified employees or retainingretain and motivatingmotivate existing employees, our business could be materially and adversely affected.

Our annual and quarterly operating results may fluctuate significantly or may fall below the expectations of investors or securities analysts, each of which may cause our stock price to fluctuate or decline.

We expectrely on third-party financing providers to finance a substantial portion of our operating resultscustomers' powersports vehicle purchases and to be subject to annual and quarterly fluctuations, and they will be affected by numerous factors, including:

•a change in consumer discretionary spending;

•a shift in the mix and type of vehicles we sell which could result in lower sales price and lower gross profit;

•the timing and cost of development and operating activities relatingsupply extended protection products (“EPP”) to our business, which may change from time to time;customers.

•expenditures that we will or may incur to advance our growth strategies; and

•future accounting pronouncements or changes in our accounting policies.

If our annual or quarterly operating results fall below the expectations of investors or securities analysts, the price per share of our Class B common stock could fluctuate or decline substantially. We believe that annual and quarterly comparisons of our financial results are not necessarily meaningful and should not be relied upon as an indication of our future performance.

The failure to develop and maintain our brand could harm our ability to grow unique visitor traffic.

Developing and maintaining the RumbleOn brand will depend largely on the success of our efforts to maintain the trust of and deliver value to our users. If our potential users perceive that we are not focused on providing them with a better pre-owned powersports experience, our reputation and the strength of our brand will be adversely affected.

Complaints or negative publicity about our business practices, our marketing and advertising campaigns, our compliance with applicable laws and regulations, data privacy and security issues, and other aspects of our business, irrespective of their validity, could diminish users' confidence in and the use of our products and services and adversely affect our brand. There can be no assurance that we will be able to develop, maintain, or enhance our brand, and failure to do so would harm our business growth prospects and operating results.

If we are not ableWe rely on third-party financing providers to maintainfinance a substantial portion of our customers' powersports vehicle purchases and enhance our retail brands and reputation or to attract consumerssupply EPP products to our own sales channels,customers. Accordingly, our revenue and results of operations are partially dependent on the actions of these third parties. Financing and EPP are provided to qualified customers through several third-party financing providers. If one or if events occur that damagemore of these third-party providers cease to provide financing or EPP to our retail brands, reputation,customers, provide financing to fewer customers or sales channels,no longer provide financing on competitive terms, make changes to their products or no longer provide their products on competitive terms, it could have a material adverse effect on our business, sales, and financial results may be harmed.

Our continued success will dependof operations. Additionally, if we were unable to replace the current third-party providers upon the occurrence of one or more of the foregoing events, it could also have a material adverse effect on our ability to maintainbusiness, sales, and enhance the valueresults of our retail brands across all of our sales channels, including in the communities in which we operate, and to attract consumers to our Omnichannel experience.operations.

Consumers are increasingly shopping for new and used vehicles, vehicle repair and maintenance services, and other vehicle products and services online and through mobile applications, including through third-party online and mobile sales platforms, with which we compete, that are designed to generate consumer sales leads that are sold to vehicle dealers. If we fail to preserve the value of our retail brands, maintain our reputation, or attract consumers to our Omnichannel offering, our business could be adversely impacted.

An isolated business incident at a single store could materially adversely affect our other stores, retail brands, reputation, and sales channels, particularly if such incident results in adverse publicity, governmental investigations, or litigation. In addition, the growing use of social media by consumers increases the speed and extent that information and opinions can be shared, and negative posts or comments on social media about RumbleOn, RideNow, Freedom, or any of our brands, locations, or websites could materially damage our retail brands, reputation, and sales channels.

The success of our business relies heavily on our marketing and branding efforts especially with respect to the RumbleOn website and our branded mobile applications,ability to attract new customers, and these efforts may not be successful.

We believe that an important component of our development and growth will be the business derived from the RumbleOn websiteoperate dealership locations and our branded mobile applications. Because RumbleOn is a consumer brand,Cash Offer technology under our RideNow brand. In addition, we operate certain dealership locations under OEM brands, such as Harley-Davidson, BMW and Indian. Our growth depends on our ability to attract and retain customers to our retail and online locations. We rely heavily on marketing and advertising to increase the visibility of this brandour operations with potential users of our products and services.

Our business model relies on our ability to scale rapidlycustomers and to decrease incremental user acquisition costs as we grow.drive traffic to our retail and online locations. Some of our methods of marketing and advertising may not be profitable because they may not result in the acquisition of sufficient users visiting our website and mobile applications such that we may recover these costs by attaining corresponding revenue growth. If we are unable to recover our marketing and advertising costs, through increases in user traffic and in the number of transactions by users of our platform, it could have a material adverse effect on our growth, results of operations and financial condition.

Our efforts to maintain the trust of and deliver value to our users depend on our ability to develop and maintain our RideNow brand and on the reputation of brands we represent in our dealership locations. If our current and potential customers perceive that we are not focused on providing them with a better powersports experience, our reputation will be adversely affected. Consumers are increasingly shopping for new and pre-owned powersports vehicles, vehicle repair and maintenance services, and other vehicle products and services online and through mobile applications, including through third-party online

and mobile sales platforms, with which we compete. If we fail to preserve the value of our retail brands, maintain our reputation, or attract consumers, our business could be adversely impacted.

Our sales of powersports vehicles and gross profit may be adversely impacted by declining prices for new or pre-owned vehicles and short supply of new or pre-owned vehicles.

We believe when prices for pre-owned powersports vehicles have declined, it can have the effect of reducing demand among retail purchasers for new vehicles at or near manufacturer's suggested retail prices. Further, powersports vehicle manufacturers can and do take actions that influence the markets for new and pre-owned vehicles. For example, introduction of new models with significantly different functionality, technology, or other customer satisfiers can result in increased supply of pre-owned vehicles, and a corresponding decrease in price of pre-owned vehicles. Also, while historically manufacturers have taken steps designed to balance production volumes for new vehicles with demand, those steps have not always proven effective. In other instances, manufacturers have chosen to supply new vehicles to the market in excess of demand at reduced prices which has the effect of reducing demand for pre-owned vehicles.

During COVID-19, we experienced an imbalance in demand and supply for new and pre-owned powersports vehicles and the price for pre-owned vehicles increased. As a result, we acquired certain pre-owned inventory at elevated prices to ensure a continuous level of supply. As supply of new powersports improved and selling prices returned to more normal, pre-pandemic levels, we were impacted by a $12.6 million write-down of inventory to net realizable value in 2023. If we fail to acquire new or pre-owned inventory in sufficient amounts at competitive market pricing, our sales and gross profit could be materially and adversely affected.

Adverse conditions affecting one or more of the powersports manufacturers with which we hold franchises, or their inability to deliver a desirable mix of vehicles could have a material adverse effect on our new powersports vehicle retail business.

Historically, our retail locations have generated most of their revenue through new powersports vehicle sales and related sales of higher-margin products and services, such as finance and insurance products and vehicle-related parts and service. As a result, our business and results of operations depend on various aspects of vehicle manufacturers’ or OEM’s operations, which are outside of our control. Our ability to sell new powersports vehicles is dependent on our manufacturers’ ability to design and produce, and willingness to allocate and deliver to us, a desirable mix of popular new vehicles that consumers demand. Popular vehicles may often be difficult to obtain from manufacturers for several reasons, including the fact that manufacturers generally allocate their vehicles based on sales history. Further, if a manufacturer fails to produce desirable vehicles or develops a reputation for producing undesirable vehicles or produces vehicles that do not comply with applicable laws or government regulations, our revenue could be adversely affected as consumers shift their vehicle purchases away from that brand.

Although we seek to limit dependence on any one OEM, there can be no assurance the brand mix allocated and delivered to us will be sufficiently diverse to protect us from a significant decline in the desirability of vehicles manufactured by a particular manufacturer or disruptions in a manufacturer’s ability to produce vehicles. For the year ended December 31, 2023, OEMs representing 10% or more of RumbleOn’s revenue from new powersports vehicle sales were as follows:

| | | | | | | | |

| Manufacturer (Powersports Vehicle Brands): | | % of Total

New Vehicle Revenue |

| Polaris | | 29.3% |

| BRP | | 25.6% |

| Harley-Davidson | | 11.3% |

In addition, the powersports manufacturing supply chain spans the globe. As such, supply chain disruptions may affect the flow of vehicle and parts inventories to an OEM’s manufacturing partners or to us. Such continued disruptions could have a material adverse effect on our business, results of operations, financial condition, and cash flows.

We are dependent on our relationships with the manufacturers of powersports vehicles we sell and are subject to restrictions imposed by these vehicle manufacturers. Any of these restrictions or any changes or deterioration of these relationships could have a material adverse effect on our business, financial condition, results of operations, and cash flows.

We are dependent on our relationships with the manufacturers of the vehicles we sell, which can exercise a great deal of control and influence over our day-to-day operations, as a result of the terms of our agreements with them. We may obtain new powersports vehicles from manufacturers, service vehicles, sell new vehicles, and display vehicle manufacturers’ trademarks only to the extent permitted under these agreements. The terms of these agreements may conflict with our interests and objectives and may impose limitations on key aspects of our operations, including our acquisition strategy.