UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

þ☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20162018.

OR

¨☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 000-10822001-36530

One Horizon Group, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 46-3561419 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

Miami | ||

| (Address of principal executive offices) | (Zip Code) |

+353-61-5184771 (305) 420-6640

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, Par Value $0.0001

(Title of Class) None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨☐ No þ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨☐ No þ☑

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ☑ No ¨☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ☑ No ¨☐

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”filer,” “smaller reporting company,” and “smaller reporting“emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | Accelerated filer |

| Non-accelerated filer | Smaller reporting company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨☐ No þ☑

The aggregate market value of the 35,347,283 shares ofregistrant’s voting and non-voting common equity stock held by non-affiliates of the registrant was approximately $ 26.8613.5 million as of June 30, 2016,29, 2018, the last business day of the registrant’s most recently completed second fiscal quarter, based on the last sale price of the registrant’s common stock on such date of $0.76$0.535 per share, as reported on Nasdaq. The Nasdaq Stock Market.

As of April 3, 2017, 37,316,71410, 2019, 88,401,431 shares of the registrant’s common stock, par value $0.0001, were outstanding.

TABLE OF CONTENTS

Introductory Note

Unless otherwise noted, references to the “Company” in this Report include One Horizon Group, Inc. and all of its subsidiaries.

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

The statements made in this Report, and in other materials that the Company has filed or may file with the Securities and Exchange Commission, in each case that are not historical facts, contain “forward-looking information” within the meaning of the Private Securities Litigation Reform Act of 1995, and Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, both as amended, which can be identified by the use of forward-looking terminology such as “may,” “will,” “anticipates,” “expects,” “projects,” “estimates,” “believes,” “seeks,” “could,” “should,” or “continue,” the negative thereof, and other variations or comparable terminology as well as any statements regarding the evaluation of strategic alternatives. These forward-looking statements are based on the current plans and expectations of management, and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those reflected in such forward-looking statements. Among theseThese risks include, but are not limited to, risks and uncertainties are the competition we face;relating to our abilitycurrent cash position and our need to adaptraise additional capital in order to rapid changes in the market for voice and messaging services;be able to continue to fund our operations; our ability to retain customersour managerial personnel and to attract new customers;additional personnel; competition; our ability to establish and expand strategic alliances; governmental regulation and related actions and taxes in our international operations; increased market and competitive risks, including currency restrictions, in our international operations; risks related to the acquisition or integration of future businesses or joint ventures; our ability to obtain or maintain relevantprotect intellectual property rights; intellectual propertyrights, and any and other litigation that may be brought against us; failure to protect our trademarks and internally developed software; security breaches and other compromises of information security; our dependence on third party facilities, equipment, systems and services; system disruptions or flaws in our technology and systems; uncertainties relating to regulation of VoIP services; liability under anti-corruption laws; results of regulatory inquiries into our business practices; fraudulent use of our name or services; our ability to maintain data security; our dependence upon key personnel; our dependence on our customers' existing broadband connections; differences between our service and traditional phone services; our ability to obtain additional financing if required; our early history of net losses and our ability to maintain consistent profitabilityfactors, including the risk factors identified in the future. documents we have filed, or will file, with the Securities and Exchange Commission.

In light of these assumptions, risks and uncertainties, the results and events discussed in the forward-looking statements contained in this report or in any document incorporated herein by reference might not occur. Investors are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the respective dates of this report or the date of the document incorporated by reference in this report. We expressly disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by federal securities laws.

These and other matters the Company discusses in this Report, or in the documents it incorporates by reference into this Report, may cause actual results to differ from those the Company describes. The Company assumes no obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

One Horizon Group, Inc. and its Subsidiaries (the “Company”) is the inventor of the patented SmartPacketTM Voice over Internet Protocol (“VoIP”) platform. Our software is designed to capitalize on numerous industry trends, including the rapid adoption of smartphones, the adoption of cloud based Internet services, the migration towards all IP voice networks and the expansion of enterprise bring-your-own-device to work programs.

The Company designs, develops and sells white label SmartPackettm software and services to large Tier-1 telecommunications operators. Our licensees deliver an operator-branded mobile Internet communication solution to smartphones including VoIP, multi-media messaging, video, and mobile advertising; and the Business to Business (“B2B”) business. Current licensees include some of the world’s largest operators such as Singapore Telecommunications and Philippines Smart Communication.

The SmartPacket™ platform, significantly improves the efficiency by which voice signals are transmitted from smartphones over the Internet resulting in a 10X reduction in mobile bandwidth and reduced battery usage while transmitting a VoIP call on a smartphone. This is of commercial interest to operators that wish to have a high quality VoIP call on congested metropolitan networks and on legacy 2G and 3G cellular networks.

By leveraging its SmartPacketTM solution, the Company is also a VoIP as a Service (“VaaS”) cloud communications leader for hosted smartphone VoIP that run globally on the Microsoft Azure cloud. The Company sells its software, branding, hosting and operator services to smaller telecommunications operators, enterprises, operators in fixed line telephony, cable TV operators and to the satellite communications sector; and the “VaaS” business. Our existing licensees come from around the world including Zimbabwe, Ghana, China, United Kingdom, Singapore, Canada and Hong Kong.

Based on the SmartPacketTM solution, the Company is the sole owner and operator of its own branded retail smartphone VoIP, messaging and advertising service in the People’s Republic of China called AishuoTM; the “Aishuo” business. Since its inception in the second quarter of 2015 Aishuo has been downloaded over 40 million times since 2015 and has produced revenues throughout 2016. Aishuo offers subscribers very competitive telephone call rates and a virtual number rental service plus additional innovative smartphone social media features. Aishuo has been made available to users across 25 Chinese Android app stores and through iTunes. Aishuo subscribers pay for VoIP or can have a free VoIP call sponsored by advertisers. Aishuo supports top-up payment services inside the smartphone app including China UnionPay, Apple In-App Purchases, Alibaba’s Alipay and Tencent’s Wechat Wallet.

Our business model is focused on winning new B2B Tier-1 telecommunications operators, winning new VaaS subscribers and driving Aishuo retail revenues. We are also commercially focused on expanding sales of new and existing licensed products and services to existing customers, and renewing subscriptions and software support agreements. We target customers of all sizes and across a broad range of industries.

We are an ISO 9001a holding company which, through our operating subsidiaries, is engaged in the digital media, entertainment and ISO 20000-1 certified company with assets and operations in Switzerland, Ireland, the United Kingdom, China, India, Russia, Hong Kong and Latin America.secure messaging businesses, described below.

Current Structure of the Company

The Company has the following wholly owned subsidiaries:

| % Owned |

| 51% |

| One Horizon Hong Kong Ltd | 100% |

| Horizon Network Technology Co. Ltd | 100% | ||

| ● | Love Media House, Inc. (acquired March 2018) | 100% | |

| ● | Browning Productions & Entertainment, Inc. (acquired October 2018) | 51% |

In addition to the subsidiaries listed above, Suzhou Aishuo Network Information Co., Ltd (“Suzhou Aishuo”) is a limited liability company, organized in China and controlled by us via various contractual arrangements. Suzhou Aishuo is treated as one of our subsidiaries for financial reporting purposepurposes in accordance with generally accepted accounting principles in the United States (“GAAP”).

Current Business OperationsSummary Description of Businesses

In 2015, we announcedWe have the rollout of our platform in China, brand namedAishuo(http://www.ai-shuo.cn/). This rollout entailed multiple strategies including advertisements, search engine optimization, press releases, event marketing, business-traveler direct marketing, as well as on and off-line promotions and leveraging the brand new One Horizon Sponsored-Call platform. Based on the SmartPacketTM solution, we are the owner and operator of this retail smartphone VoIP, messaging and advertising service in the People’s Republic of China.

Since its commercial availability in the second quarter of 2015, Aishuo has to date, been downloaded over 43 million times. Aishuo offers subscribers very competitive telephone call rates and a virtual number rental service plus lots of innovative smartphone social media features. Aishuo has been made available to users across 25 Chinese Android app stores and through iTunes. Aishuo subscribers pay for VoIP or can have a VoIP call sponsored by advertisers. Aishuo supports top-up payment services inside the smartphone app including China UnionPay, Apple In-App Purchases, Alibaba’s Alipay and Tencent’s Wechat Wallet.

Aishuo is operated by, Suzhou Aishuo Network Information Co., Ltd. a Chinese company controlled by us and headquartered in Nanjing, China.

Figure 1. Aishuo Retail

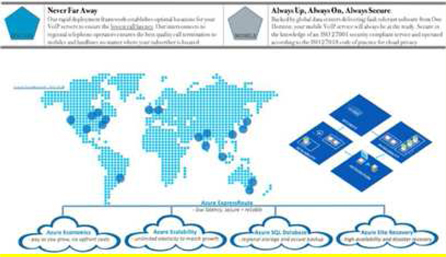

At the end of Q1 2017, we announced the rollout of our VoIP as a Service “VaaS” platform on the Microsoft Azure cloud. We sell our software, branding, hosting and operator services to smaller telecommunications operators, enterprises, operators in fixed line telephony, cable TV operators and to the satellite communications sector. The Company was showcased by Microsoft Corp. for its Azure technology (https://customers.microsoft.com/en-us/story/onehorizon).

Figure 2. VaaS Hosted Offering

Figure 3. Cloud-based Secure, Fault Tolerant and Low Latency Architecture

Figure 4. Microsoft Showcases One Horizon Group Inc.

OurB2B platform is being used by a pre-paid VoIP Smartphone application launched by different carriers respectively, some of which are listed as follows:following three core businesses:

| 123Wish, Inc. formerly Once In A Lifetime, LLC (“123Wish”) – an experience based platform where subscribers have a chance to play and win experiences from celebrities, athletes and artists. |

| ● |

The Company is based in the United States of America, Hong Kong, Singapore, China and the United Kingdom.

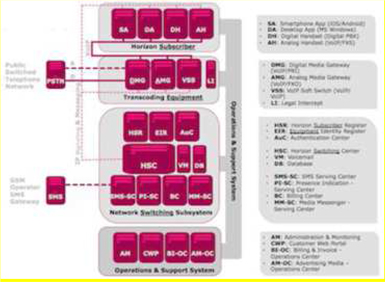

Figure 1. Horizon B2B Operator Core NetworkEntertainment Production Services (Love House and Browning Productions)

OfferingThe primary business of Love House and Market RelatedBrowning Productions are entertainment production services. Video projects are divided into four parts: (i) pre-production, (ii) production, (iii) post-production and (iv) distribution. During pre-production, the client describes the need and the purpose of the production. Production is the part of the process where raw materials that will be formed into the final product are created. Post-production is where the first rough cut of the final product is created. Client input is then used to create the final version of the production.

Video production services through Browning Productions include production of television shows, commercials, corporate videos, music videos, film, motion pictures (full length features), make-up and hair, casting, writing, producing, directing, stunts, post production services, graphic design (animation and special effects), audio production, and audio mastering and integration. Music production services through Love House include recording (including music production, arranging, mixing and mastering), songwriting (arranging writing sessions with experienced and multi-platinum writers), artist development, digital distribution, billboard chart promotion, branding and advertising, video and photo production, and consulting and life coaching.

Browning Productions has produced and has ownership rights to dozens of national and international television programs currently airing on a number of the most recognized television networks including A&E, FYI and History Channel. Browning Productions distributes content on a proprietary Internet/Over-The-Top (“OTT”) content platform that operates in conjunction with Verizon Digital Media Services (“VDMS”). Current productions of Browning Productions include “Wine Warriors”; the spin-off “Whisky Warriors, for which Browning Productions recently secured the Big Sky Film Grant from the State of Montana’s Film Office, “Training Grounds”; a new docuseries called “The Cryptos,” unveiling the inner workings of the cryptocurrency industry, soon to be distributed on one of the world’s most widely recognized global business news networks; and “America’s Crowdfunding,” an equity crowd-funding television series (the concept is “Shark Tank” meets “America’s Got Talent,” where the viewers vote with their wallets for equity stakes in the featured companies) in conjunction with Equity Bender, among others.

We also provide through Browning Productions marketing services and branded entertainment. Branding and name recognition is generally achieved through exposure in repetition. Through branded entertainment, a product or service stands out throughout a television series in precise placement from segment to segment for each viewer to see or hear, where the product or service is referred or mentioned by the celebrity cast. The pinnacle of all product or service inclusion into television is to allow for a full integration into the storyline and scripting of the segments centering the brand in the show content, which we believe is one of the best forms of marketing for any product or service.

The recording studio of Love House is a facility for sound recording and mixing. Ideally both the recording and monitoring spaces are specially designed by an acoustician to achieve optimum acoustic properties (acoustic isolation or diffusion or absorption of reflected sound that could otherwise interfere with the sound heard by the listener). The typical recording studio consists of a room called the "studio" or "live room", where instrumentalists and vocalists perform; and the "control room", where sound engineers sometimes with producer(s) as well operate either professional audio mixing consoles or computers with specialized software suites to manipulate and route the sound for analogue or digital recording. Often, there will be smaller rooms called "isolation booths" present to accommodate loud instruments such as drums or electric guitar, to keep these sounds from being audible to the microphones that are capturing the sounds from other instruments, or to provide "drier" rooms for recording vocals or quieter acoustic instruments.

Our recording studios through Love House may be used to record musicians, voice-over artists for advertisements or dialogue replacement in film, television or animation, foley, or to record their accompanying musical soundtracks.

Competitive Strengths

We believe our competitive strengths through Browning Productions include:

Excellent reputation: We believe we have earned an excellent reputation for our creative ability, innovation, execution and on-time delivery of complex and challenging media content.

Our creative storytelling capabilities: We believe our creative content turns ideas into visual, relatable stories that resonate with consumers and influences their behavior. We believe that our years of experience and access to creative talent allow us to tell compelling stories whether in seconds or minutes.

Diverse, creative talent base: We employ or represent directors and designers, technical directors and other artists who we believe deliver a unique combination of creative direction (character, world and story development) and execution (unique and high quality imagery and related production content).

Strong relationships with advertising agencies and brands: We have produced highly successful and creative advertising campaigns for our customers, many of which are global brands which we believe have allowed us to develop long-standing, strong relationships with leading advertising agencies and brands. We are often commissioned to create multiple campaigns for brands over many years, acting as the go-to production company for these clients. In September 2016,addition, despite that some of our competitors are larger than us, we have been able to compete effectively with them and win projects from new and existing clients.

End-to end solution: We have developed in-house production processes that enable us to serve as a one-stop-shop, providing a full suite of solutions to the advertising industry and brands. We are able to conduct a project from concept through design and all stages of production using in-house and contracted creative talent when necessary.

We believe our competitive strengths through Love House include:

High quality services: We provide high quality sound recording and audio production services. We have a high end recording and production studio for use for customers. Use of the studio is billed on an hourly basis plus fees relating to the rental of the studio. Reproduction of recorded materials will also be sold 198,413to customers. The benefits that are afforded to clients in our studio include:

| ● | a convenient, reasonably priced recording studio. |

| ● | a comfortable studio experience that allows artists to record their music while being in an inviting atmosphere. |

| ● | high end audio equipment that will make high quality sound recordings for our clients. |

| ● | professional and expert staff members that will help artists mix and produce their albums with minimal hassle. |

Supplemental Services to Music Production: We also provide songwriting (arranging writing sessions with experienced and multi-platinum writers), artist development, digital distribution, billboard chart promotion, branding and advertising, video and photo production.

Competition

The team at Love Media House, headed by Chis Rodriguez, has worked with many famous artists and achieved many Billboard numbers giving Love House an important edge in promoting new talent. The team at Browning Productions, headed by William Browning, has produced and has ownership rights to dozens of national and international television programs currently airing on a number of the most recognized television networks including A&E, FYI and History Channel. Notwithstanding, the entertainment marketplace is highly competitive. There are few barriers of entry in the business and level of competition is extremely high. There are many video production companies and recording studios in United States. Many of these companies may have a greater, more established customer base than us.

Our Industry

We create branded advertising and entertainment content primarily for television, digital and other platforms.

The global advertising market is large and growing. Global advertising spending was a $591 billion global market in 2017, projected to grow to $724 billion in 2020, according to eMarketer. The U.S. is currently Browning Productions’ customers’ primary target market. eMarketer forecasts that the U.S. will have the largest share of global advertising spending in 2020, which it estimates will be $243 billion. As Browning Productions’ business grows, we expect to capitalize on the large and expanding demand for services such as Browning Productions.

Television spending continues to be strong. Television has historically been the single largest advertising medium worldwide. Zenith forecasts that television advertising in the U.S. peaked in 2017 at $69 billion and will decline slightly to $66 billion in 2020. Television and online video together are becoming more important to advertisers seeking to build brands than either form alone.

Digital advertising spending is increasing. Digital technologies have transformed media consumption, viewing habits and social interaction. Content is being viewed at ever-increasing rates on wired and wireless smart devices across the globe. In 2017, global digital advertising spending surpassed global television advertising spending for the first time, according to MAGNA. MAGNA projects that, in 2018, U.S. digital advertising spending will exceed $100 billion and will account for half of total U.S. advertising sales for the first time. MAGNA projects that U.S. digital advertising sales will be $163 billion by 2023.

Creative short-form video content attracts audiences. Given the proliferation of entertainment channels, capturing the attention of audiences is becoming increasingly challenging. We believe that brands are seeking creative content in short-form video that includes animation and mixed media to evoke emotions that resonate with viewers. According to AOL Advertising, while online video consumption is increasing across all video lengths, short-form video is growing the fastest. According to AOL Advertising, 59% of consumers watch videos that are under one minute long every day.

Our Growth Strategy

We intend to build upon our proven ability to aggregate large audiences for brands by continuing to make compelling content that is viewable on both traditional and new platforms. We have begun to implement the growth strategies described below, and expect to continue to do so over the several years following this offering. Although the net proceeds of this offering will be available to assist us to implement our growth strategies, we cannot estimate the ultimate amount of capital needed to achieve our expected growth. We may need additional capital to implement these strategies, particularly in the event we pursue acquisitions of complementary businesses or technologies.

We intend to grow our business by:

Capitalizing on market trends in advertising and digital media: We believe our long history of creating award-winning content for television provides us with the expertise to continue to capture television advertising spending. We also believe our expertise in delivering entertaining, narrative-based short-form video content positions us well for the expected growth in digital advertising. We intend to build our core business by leveraging the increased use of animation and visual effects to differentiate marketing messages and capture audiences in the growing digital media market.

Implementing client service teams: We believe we can increase recurring work from our existing clients with a more client-focused approach to delivering our services. We are hiring account directors with knowledge of the needs of brands in key industries so that we can collaborate more closely with brands and the advertising agencies. By doing so, we believe we can get involved earlier and more intimately in a particular pitch.

Expanding direct-to-brand sales: Brands are increasingly working directly with content creators, bypassing advertising agencies. We believe this industry disruption is being caused by the desire of brands to obtain greater cost-effectiveness, transparency and control over customer data. We believe that we can increase our direct-to-brand sales by increasing business development efforts with brands. We recently reorganized our sales organization to include a specific focus on brand management.

7

Growing through acquisitions:We believe that the highly fragmented content creation media industry, which is comprised primarily of small-to-medium-sized private companies, provides us with significant opportunities to grow our business through acquisitions. We intend to pursue acquisitions that provide services within our current core product offerings, extend our geographic reach and expand our product offerings.

Cross-selling services: Our ability to produce diverse, engaging content across various media platforms allows us to offer clients a one-stop-shop for all of their content needs. We intend to cross-sell our various capabilities to drive additional revenue from existing clients and to seek to win new clients.

Further developing intellectual property: We intend to build upon our success in developing original series that we own and license to brands, networks and major and new digital media studios. When we develop an original series, we retain the copyright of that content. By licensing to other platforms portions of the content from original series that we develop, we can create additional revenue streams from development fees, brand license fees, distribution license fees and ancillary sources (such as from foreign viewership).

Expanding our geographic presence: We believe that by expanding our physical presence into select international regions, we will be better able to attract and retain internationally-based brands as clients. With a physical presence outside of the U.S., we believe we can provide better customer service and offer local talent who can work more intimately with internationally-based brands than we can from our offices in the U.S.

Expanding our talent roster: We intend to continue to seek to attract and retain world-class creative and technical talent, thereby increasing our ability to win jobs and build brand equity through additional high quality creative content. We believe that our reputation and our client base will allow us to continue to attract top creative talent.

Celebrity Experience Marketplace (123Wish)

123Wish, available in the Apple App Store, Google Play and www.123wish.com, is a subscription-based, experience marketplace that focuses on providing users with exclusive opportunities to enjoy personalized, dream experiences with some of the world’s most renowned social media influencers including Super Influencer Jake Paul and Team 10 as well as celebrities, professional athletes, fashion designers, and artists while supporting a diverse range of charities.

123Wish provides experiences to fans of high profile celebrities but with the ability to ensure charities can benefit from proceeds of subscriptions paid. 123Wish is a super fan platform bringing fans closer to their favorite influencers, celebrities, musicians and more. 123Wish offers its users unique experiences, face time sessions, weekly giveaways, limited edition merchandise, VIP events, video shouts and exclusive video content.

The influencer or celebrity for each 123Wish experience selects a philanthropic cause to benefit or is randomly matched to a non-profit organization. Once the charitable contribution goal for an experience has been met and the designated timeframe for entry has expired, 123Wish randomly selects the winner who receives exclusive access to interact with the influencer or celebrity. Yet, everyone who enters wins a specialized gift for participation, which may include limited edition merchandise, gift cards or personalized video or voice messages from experience contributors.

Each 123Wish subscriber will soon have a digital wallet and will receive four digital coins each month that his or her subscription remains active, which the subscriber may contribute to charity. 123Wish are committed to making at least $1,000,000 in digital coin value available for charitable contribution premised on the number of subscribers. Development for inclusion of the coin technology is underway and we will be providing blockchain integration.

Competitive Strengths

We believe our competitive strengths through 123Wish include:

Excellent reputation: We believe we have earned an excellent reputation for providing users with exclusive opportunities to enjoy personalized, dream experiences with celebrities.

Contacts with Celebrities: We have successfully established relationships with a number of social media influences, music artists and other celebrities to ensure the success of our experience marketplace.

Regulatory Status

Certain jurisdictions, including California where 123 Wish maintains it principal offices, have regulations that require 123 Wish to register as a commercial fundraiser and notify governmental authorities of events that it is sponsoring. The failure to comply with applicable regulations could subject 123 Wish to fines and other penalties, including being enjoined from conducting solicitation activities for charitable purposes within the jurisdiction and other civil remedies provided by law.

CORPORATE HISTORY

We were initially incorporated in Pennsylvania in 1972 as Coratomic, Inc. We changed our name five times thereafter, with the last name change in 2012 to One Horizon Group, Inc.In addition, we changed our domicile from Pennsylvania to Delaware in 2013.

Our authorized capital is 200,000,000 shares of Common Stock, par value $0.0001 per share (the “Common Stock”), and 50,0000,000 shares of preferred stock, par value $0.0001 per share (the “Preferred Stock”). The designation of rights including voting powers, preferences, and restrictions shall be determined by the Board of Directors before the issuance of any shares. As of the date hereof, 88,401,431 shares of our Common Stock are issued and outstanding and no preferred stock is issued and outstanding.

Acquisition of a Controlling Interest in Once In A Lifetime LLC

On February 22, 2018, we acquired 51% of the membership interests in Once In A Lifetime LLC, a Florida limited liability company d/b/a/ 123 Wish (“123 Wish”), pursuant to an Exchange Agreement dated January 18, 2018, with 123 Wish and its members in consideration for 1,333,334 shares of our common stock, plus an additional number of shares of our common stock based upon the net after tax earnings of 123 Wish during the six month periods ending six and twelve months after the completion of the acquisition. Once In A Lifetime LLC has been merged into our newly formed majority-owned Delaware subsidiary, 123 Wish, Inc.

123 Wish is a subscription-based, experience marketplace that focuses on providing users with exclusive opportunities to enjoy personalized, dream experiences with social media influencers, including Jake Paul and Team 10, as well as celebrities, professional athletes, fashion designers and artists, while supporting a diverse range of charities.

Acquisition of C-Rod, Inc.

On March 20, 2018, we acquired C–Rod, Inc., including its record label, Velveteen Entertainment, and media division, Mues Media (collectively, the “C-Rod Companies”) pursuant to an Exchange Agreement dated February 27, 2018 with C-Rod, Inc., Christopher Rodriguez and Patricia Rodriguez, in consideration for $150,000, 1,376,147 shares of our common stock issued to Cap United LLC, plus an additional number of shares of our common stock based upon the net after tax earnings of C-Rod during the two years ending after the completion of the acquisition. On May 2, 2018, we amended the articles of incorporation of C-Rod, Inc. to change its corporate name to Love Media House, Inc.

C-Rod, Inc., a music production company founded in 2002 by Grammy-nominated, multi-platinum producer and composer Christopher Rodriguez, regularly works with artists, which have included many celebrity acts.

Acquisition of a Controlling Interest in Banana Whale Studios Pte. Ltd.

On May 18, 2018,we entered into and consummated an Exchange Agreement (the “Exchange Agreement”) with Banana Whale Studios Pte. Ltd., a Singapore corporation (“Banana Whale”), and the founding shareholders of Banana Whale (the “Banana Whale Stockholders”), pursuant to whichwe acquired 51% of the outstanding shares (“Controlling Interest in Banana Whale”) ofBanana Whale in exchange for a number of our shares of common stock to be based upon the earnings of Banana Whale. Banana Whale is a B2B software provider in the $100+ billion-dollar gaming industry focusing on innovation and next generation games and entertainment. As a condition to closing the acquisition, Banana Whale Stockholders demanded and we deposited in escrow for their benefit 7,383,000 shares of our common stock (“OHGI Shares”) with a fair value of $4,983,000 as security for our obligation to issue such shares to which they may become entitled. If the number of shares to which the Banana Whale Stockholders become entitled is less than 7,383,000, the excess shares will be returned to us for cancellation. We also granted Banana Whale the right to use our secure messaging software.

Acquisition of 123Wish Software

Pursuant to the terms of that certain institutional investors atAgreement on Sale of 123Wish Software dated September 27, 2018 (“Software Sale Agreement”), among us, Once in a purchase priceLifetime Platform LLC (“OIALP”), and One Horizon Hong Kong Limited (“OHHK”), OIALP sold and assigned to OHHK eighty percent (80%) of $0.63the intellectual property rights to OIALP’s software platform and App that underlies 123Wish’s business in exchange for aggregate gross proceedsour making an additional investment of $125,000$100,000 into 123Wish without requiring the minority shareholders in 123Wish (some of whom are members of OIALP) to put up matching funds and our issuing 3,000,000 shares of its common stock to members of OIALP.

Acquisition of a Controlling Interest in Browning Productions& Entertainment, Inc.

On October 22, 2018, we entered into an Exchange Agreement (“Browning Exchange Agreement”) pursuant to which we acquired a securities purchase agreement. majority of the outstanding shares (the “Controlling Interest in Browning”) of Browning Productions& Entertainment, Inc., a Florida corporation (“Browning Productions”), from William J. Browning, the sole stockholder of Browning. Browning Productions produces television programs which have aired internationally as well as nationally.

In connection withexchange for the purchase of common stock the purchasers received a warrantcontrolling interest in Browning Productions, we paid Mr. Browning $10,000 and issued to acquire 148,810him 150,000 shares of common stock, atand agreed to issue to him an exerciseadditional 150,000 shares of common stock following completion of the audit of Browning Productions’ financial statements, plus an additional number of shares of common stock which can be up to a maximum of 17,000,000 shares, determined by dividing two and a half times the net after tax earnings of Browning Productions during the twelve month period ending December 31, 2019 by the average of the closing price of $0.819 per share. The warrants became exercisable onour common stock during the dateten consecutive trading days immediately preceding the end of issuance2019. To the extent the number of shares which we are obligated to issue to Mr. Browning exceeds 13,553,506 shares, representing 19.99% of our outstanding shares of common stock immediately prior to the acquisition (the “Excess Shares”), instead of issuing the Excess Shares to Mr. Browning we will pay him an amount in cash for a three-year term.

In October 2016, we sold 320,512the Excess Shares. We had previously paid Mr. Browning $10,000 and issued 35,000 shares of common stock to certain institutional investors athim upon execution of a purchase pricenon-binding letter of $0.39intent for aggregate gross proceedsthe acquisition of $125,000 pursuant to a securities purchase agreement.. In connection with the purchase of common stock the purchasers received a warrant to acquire 240,385 shares of common stock at an exercise price of $0.5616 per share. The warrants became exercisableBrowning Productions on the date of issuance for a three-year term.May 10, 2018.

In December 2016,Though the terms of this transaction only required a $20,000 cash payment ($10,000 in cash under the non-binding letter of intent and $10,000 in cash under the Browning Exchange Agreement) to Mr. Browning, we sold 500,000 shares of common stockwere required to certain institutional investors atprovide Browning Productions with a purchase price of $0.30 for aggregate gross proceedsworking capital loan in an initial amount of $150,000, pursuantwhich is to a securities purchase agreement. . In connection withbe repaid out of the purchasepost-closing net profit of common stockBrowning Productions as well as earmark an additional $150,000 in cash for future investment in Browning Productions (to assist in funding the purchasers received a warrant to acquire 375,000 sharesfuture operations of common stock at an exercise price of $0.35 per share. The warrants became exercisable on the date of issuance for a three-year term.

The above financings are conducted as at-the-market shelf-take down under our registration statement on Form S-3 (File No. 333-205049)Browning Productions).

On August 10, 2015,We have agreed to register for resale the initial 150,000 shares issued to Mr. Browning.

We have a right of first refusal to purchase the remaining shares of Browning Productions.

Proposed Acquisition of a Controlling Interest in connection with an UnderwritingMaham

Pursuant to the terms of a definitive Exchange Agreement, dated August 4, 2015February 20, 2019, among us, Maham LLC (“Maham”), the members of Maham, and Mr. Hauswirth (the “Underwriting“Maham Exchange Agreement”) with Aegis Capital Corp. (“Aegis”), as representative of the several underwriters named therein (the “Underwriters”), we closed a firm commitment underwritten public offeringagreed to (i) issue to the members of 1,714,286Maham unregistered shares of Common Stock equal to (a) 25% of the dollar value the Members have invested in Maham to date, with all non-cash investment based equity owned by members will be exchanged at the same valuation as the valuation of Maham at the time that such non-cash investment based equity was issued, divided by (b) the market value of OHGI Common Stock, determined in accordance with the terms of the Exchange Agreement, as of the closing date (the “Initial Shares”), and warrants to purchase(ii) upon completion of the second 12-month period following the closing, issue up to an aggregatea maximum of 857,14317,000,000 unregistered shares to the members of Maham on a pro-rata basis based on their holdings, which number of additional shares will be equal to two-and-a-half times (2.5x) the net after-tax earnings of Maham for the First Adjustment Period (as defined in the Maham Exchange Agreement), divided by the market value of our Common Stock. Upon the closing of the Maham transaction, we will own 51% of the issued and outstanding interests in Maham.

Adoption of One Horizon Group, Inc. Amended and Restated 2018 Equity Incentive Plan

Our board of directors and shareholders adopted and approved on November 2, 2018 and December 27, 2018, respectively, the One Horizon Group, Inc. Amended and Restated 2018 Equity Incentive Plan, effective December 27, 2018, under which stock options and restricted stock may be granted to officers, directors, employees and consultants. Under the Plan, 15,000,000 of Common Stock, at a combined offering price of $1.75par value $0.0001 per share, are reserved for issuance, subject to increase pursuant to the terms and accompanying Warrant.conditions as set forth in the Plan.

Recent Developments

Disposition of a Controlling Interest in Banana Whale Studios Pte. Ltd.

On February 4, 2019, we entered into and consummated an agreement (the “Agreement”) with Banana Whale and the Banana Whale Stockholders, pursuant to which we sold the Controlling Interest in Banana Whale in exchange for $2,000,000, consisting of $1,500,000 in cash and a $500,000 promissory note bearing interest at 5% per annum payable on December 31, 2019 (the “BWS Note”). Under the BWS Note, Banana Whale can prepay the BWS Note in whole or in part without premium or penalty. Pursuant to the UnderwritingBWS Note, the Banana Whale Stockholders agreed to guarantee the payments of all amounts due thereunder on a limited-recourse basis. On February 4, 2019, we also entered into a Pledge and Escrow Agreement with the Banana Whale Stockholders pursuant to which the Banana Whale Stockholders agreed to place the Controlling Interest in Banana Whale in escrow as security for payment of the BWS Note.

The Agreement also terminated certain of the remaining obligations under the Exchange Agreement which was previously entered into by us and the Banana Whale Stockholders, releasing us, Banana Whale and the Banana Whale Stockholders from their remaining obligations thereunder. Pursuant to the Exchange Agreement, we had agreed to acquire the Controlling Interest in Banana Whale in exchange for a number of our shares to be based upon the earnings of Banana Whale. Under the Agreement, the Underwriters exercisedCompany agreed to leave the OHGI Shares in escrow and together with the Banana Whale Stockholders, to instruct the escrow agent that the OHGI Shares will remain in escrow for a period of at least 90 days pending an option to purchase 151,928 additional sharesabsence of asserted claims under the Agreements indemnification provisions.

Recent Voluntary Termination By OHGI of Listing of Common Stock and 75,964 additional warrants. The net proceeds fromon the offering were approximately $2.89 million, after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

The warrants offered have a per share exercise price of $2.50 (subject to adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting our Common Stock and also upon any distributions of assets, including cash, stock or other property to our stockholders), are exercisable immediately and will expire three years from the date of issuance. Subject to applicable laws, the warrants may be offered for sale, sold, transferred or assigned without our consent.Nasdaq Capital Market

Recent Developments

Notice of Delisting or Failure to Satisfy a Continued Listing Rule

Our common stock commenced trading on the Nasdaq Capital Market (“Nasdaq”) on July 9, 2014 under the ticker symbol “OHGI”. On August 30, 2016,May 10, 2018, the Company received a written alertnotice (the “Notice”) from Nasdaq Listing Qualifications that our listed security has not regained compliance with the minimum $1 bid price per share requirement, within the 180 calendar days. However, the Staff has determinedindicating that the Company is eligible for an additional 180 calendar day period, pursuant toCompany’s common stock did not meet the continued listing requirement as set forth in Nasdaq Listing Rule 5810(c)(3)(a). If at any time during this 180 day period5550(a)(2) based on the closing bid price of ourthe common stock is at least $1 for a minimum of ten consecutivethe preceding 30 business days, we will regain compliance. In order to regain compliance, we may have to affect a reverse stock-split. If we are required to effect a reverse stock-split, it would have to be completed at least 10 days prior to the expiration of the date by which we must regain compliance with Rule 5550(a)(2).days.

On February 28, 2017,Under Nasdaq Listing Rule 5810(c)(3)(A), the Company received a notice180-calendar day grace period from The Nasdaq Stock Market LLC (“Nasdaq”) Listing Qualifications Staff (the “Staff”) stating that the Staff has determined, unlessdate of the Notice to regain compliance by meeting the continued listing standard of a minimum closing bid price of at least $1.00 per share for 10 consecutive business days during the 180-calendar day grace period ended on November 6, 2018. During the grace period, the Company timely requests an appeal of the Staff’s determination, before Nasdaq’s Hearing Panel (the “Panel”), by March 7, 2017, to delist the Company’s common stock from the Nasdaq Capital Market because the Company is not in compliance with the $1.00 minimum bid price requirement (the “Minimum Bid Price”) for continued listing set forth in the Nasdaq Listing Rule 5550(a)(2).The Company filed a request for a hearing before the Panel, on March 2, 2017, which request will stay any delisting or suspension action by the Staff pending the issuance of the Panel’s decision and the expiration of any extension granted by the Panel.

On March 3, 2017, the Staff informed the Company that they were granted a hearing to be held on April 20, 2017 (the “Hearing”). As such, the delisting action, referenced above, has been stayed, pending a final written decision by the Panel at the Hearing.

At the Hearing, we will present its planwas unable to regain compliance with the Minimum Bid Price by effectingminimum bid price standard.

In accordance with NASDAQ Listing Rule 5810(c)(3)(A), in addition to such initial grace period, the Company could be afforded an additional 180-calendar day compliance period, provided that on the 180th calendar day of the initial grace period, the Company (i) met the applicable market value of publicly held shares requirement for continued listing and all other applicable requirements for initial listing on the Nasdaq (except for the bid price requirement) and (ii) notified Nasdaq of its intent to cure the minimum bid price deficiency. Prior to expiration of the initial grace period, the Company requested an additional 180-calendar day compliance period and notified Nasdaq of the Company’s compliance with the stated listing standards and its intent to cure the minimum bid price deficiency through a reverse stock split.split, if necessary. On November 7, 2018, the Company received written notification from Nasdaq granting an additional 180-calendar day period, which expires on May 6, 2019, to regain compliance with the minimum bid price requirement described above. This second 180-calendar day period relates exclusively to the bid price deficiency and we could be delisted during the 180-calendar day period for failure to maintain compliance with any other listing requirements that occurs during the 180-calendar day period.

During subsequent interactions between the Company and the Nasdaq it became apparent that the Nasdaq may make a finding of noncompliance with the stockholder approval requirements of Nasdaq Listing Rule 5635 and may initiate delisting proceedings against the Company.

As a result of the foregoing, on February 26, 2019, Martin Ward, Chief Financial Officer of the Company, approved the voluntary termination of the listing of OHGI’s common stock on the Nasdaq. On March 20, 2017,8, 2019, the Company filed a definitive proxy statementan application on Form 25 with the Securities and Exchange Commission in connection with special meetingSEC to voluntarily terminate its Nasdaq listing. The delisting from the Nasdaq became effective on March 8, 2019. As of stockholders (the “Stockholders’ Meeting”) to be heldMarch 8, 2019, the Company’s common stock is quoted on April 14, 2017. The proposal being submitted is for a votethe OTCQB tier of the stockholders atOTC Markets under the Stockholders’ Meeting isticker symbol “OHGI.” The transition from the approval of a 6Nasdaq to 1the OTCQB did not materially affect the Company’s business operations.

Reverse Stock Split

A reverse stock split of all(“Reverse Stock Split”) of the issued and outstanding shares of the Company’s common stock. Management believes that effectingCommon Stock in the reverse stock split will allow our common stockrange from one-for-two (1-for-2) to regain compliance with Nasdaq Listing Rule 5550(a)(2)one-for-fifty (1-for-50), which should allowratio will be selected by the Company’s common stock to continue to trade on the Nasdaq Capital Market. Assuming the reverse stock split proposal isBoard of Directors was approved by our Board of Directors and by our shareholders at the Company’s stockholders,annual meeting of the Company’s board of directors currently intendsshareholders held on December 27, 2018 as described in that proxy statement on that certain Definitive Schedule 14A filed with the SEC on November 28, 2018. We will announce publicly our plans to effect the reverse stock split immediately afterReverse Stock Split once the Stockholders’ Meeting, unless it determines that doing so would not have the desired effectBoard of satisfying the Minimum Bid Price requirement.

IndustryDirectors makes its determination.

Rapid Growth in Global Mobile Voice over IP Service MarketCorporate Information

We aimOur principal executive offices are located at 649 NE 81st Street, Miami, Florida 33138, and our telephone number at that location is (305) 420-6640. The URL for our website is www.onehorizongroup.com. The information contained on or connected to deliver our patented smartphone software towebsite is not incorporated by reference into, and you must not consider the ever expanding mobile Voice over IP (“mVoIP”) user. By 2019 there are expected to be over 2.7 billion smartphones consumers, or more than one-third of all people worldwide (Source: https://www.statista.com/statistics/330695/number-of-smartphone-users-worldwide. Each new smartphone represents an opportunity for us to deliver our innovative mobile VoIP, Messaging over IP and Advertising over IP solution in whatever mobile app brand is attractive to the end user throughout the globe.

By partnering with national carriers and delivering our solution as a licensed service to regional mobile operators, we leverage the power of their brand and join them to fight back against already lost revenues, or potential revenue loss, to network bandwidth-intensive Over The Top (“OTT”) VoIP apps; such as SkypeTM in the USA or LineTM in Japan and the like.

In the past mobile operators relied upon blocking VoIP on their networks but they have realized that this is no longer a viable option. They must embrace innovations in VoIP software, especially on the smartphone, from businesses like ours. Not only can we offer a multi-media, multi-faceted software solution to smartphones, but we are the only company that offers a package that aids the operators in the rollout, expansion, maintenance and upgrade of their mobile network in metro and rural areas to cater for smartphones.

From the beginning of the first smartphones in 2008, our software was specifically targetedinformation to be a disruptive technology, which was and has been explicitly designed, and patented, to workpart of, this Annual Report on congested wireless Internet connections; the absolute fundamental basis of mobile phones in 2016 and beyond.Form 10-K.

As moreDuring the year ended December 31, 2017, we restructured our operations and more smartphones come online, each one places a significantly higher loadsimplified and strengthened our capital structure by:

| ● | Selling certain of our operating subsidiaries (the “Discontinued Entities”) to our former Chief Executive Officer pursuant to a Stock Purchase Agreement entered into August 10, 2017, in consideration for the forgiveness of $1,968,243 payable to our former CEO. |

| ● | Issuing: (A) (i) 13,000,000 shares of our common stock in exchange for $3,000,000 principal amount of an outstanding subordinated debenture in the principal amount of $3,500,000 and the forgiveness of accrued and unpaid interest thereon, and (ii) our 7% promissory note in the principal amount of $500,000 for the surrender of the remaining principal amount of the debenture; (B) 4,000,000 shares of our common stock and our 7% promissory note in the principal amount of $500,000 for all of the outstanding shares of our Series A-1 Convertible Preferred Stock; and (C) 859,802 shares of our common stock to our Chief Financial Officer in exchange for $662,048 of indebtedness payable to him. |

The restructuring and simplification and strengthening of our capital structure has allowed us to concentrate on the existing cellular infrastructure;developing our secure messaging business, which has focused on gaming, educational and security applications in China and Hong Kong, while seeking acquisition opportunities. In September 2017, Mark White who had previously served as smartphone users now use smartphoneour Chief Executive Officer, was appointed Chief Executive Officer to check for emails, surf the Internet, check the weather, read the news, etc. while in the past, all a mobile phone did was callingdevelop and Short Messaging (SMS). In order for carriers to keep up with the explosive growth of smartphones and their increased network consumption they are in need of any possible tool to assist them in managing their network and maintaining relevance on the users’ device.implement our acquisition strategy.

We offer operators a mobile VoIP call that has ten (10) times less bandwidth than a standard telephone call over GSM or legacy mobile VoIP solutions such as Session Initiation Protocol (“SIP”). This gives operators a higher quality call on busy and legacy networks such as 2G, 3G and congested metro-based 4G using less bandwidth; meaning more bang for their “spectrum buck”. We will not replace traditional calls nor prevent the delivery of newer call types such as Voice over LTE (“VoLTE”) etc., but we give operators yet another tool in their arsenal to deliver the best quality voice, for the best value, for their diversified customer bases.

Our Technology

Our TechnologyStrategy

We have a very detailed knowledge of these wireless data network issues and have invented a totally new solution to successfully deliver a high quality voice call over a wireless Internet connection. Our solution is designed specifically to address such issues as call latency (i.e. delay) and network jitter (i.e. lost data) in a way that achieves a much higher likelihood of a voice packet (i.e. tiny piece of recorded voice) arriving in time and not being lost or delayed. Our awareness of these problems led us to develop a completely new algorithm for sending and receiving (and ordering) voice packets so as to reduce the likelihood of packet loss due to congestion, which we call SmartPacket™; and to the end user this just means near HD audio at a fraction of the cellular consumption.

SmartPacket™ Technology

The core of the Horizon solutionCompany’s strategy is our truly innovative, and patented, SmartPacket™ technology. This enables VoIP from only 2 kilobytes/second (kbps) compared to around 8kbps and upwards from other VoIP platforms available today. This industry-leading solution has been developed in-house and is fully compatible with digital telecommunications standards. This technology is capable of interconnecting any phone system over IP - on mobile, fixed and satellite networks. Our SmartPacket™ technology is not based on legacy SIP (Session Initiation Protocol) or RTP (Real-time Transport Protocol). Rather, the Horizon signaling protocol is much simpler and benchmark testing has shown that it consumes significantly less bandwidth for the same audio quality score. Our SmartPacket™ technology is the world’s most bandwidth efficient IP communication platform designed for mobile communications. The technology optimizes voice flow, delivery and playback and delivers excellent call quality, reduced delays and drops. As amake further illustration, the technology is considerably more efficientacquisitions in the way it handles silence. Traditional VoIP calls senddigital media and entertainment space, while continuing to trade in the same amount of datasecure messaging business in both directions, regardless of whether or not someone is speaking. SmartPacket™ technology is designed to detect silencegaming, educational and send tiny “indications of silence”, rather than the silence itself. This massively reduces the amount of data transmitted, lowers the load on the cellular infrastructure which, in turn, means that more data can get through. This results in higher audio quality and a better user experience.security segments.

Our Benchmark Testing: Horizon vs the biggest smartphone VoIP technologies in the world

University published testing has shown that Horizon is up to 8.8 times more efficient, depending on which one of our voice compression settings is selected by the user.

Proprietary Technology

The Horizon Platform has been developed entirely in-house, patented, and is fully compatible with digital telecommunications standards. It is capable of interconnecting any phone system over IP – on mobile, fixed and satellite networks.

The Horizon Platform was initially developed for the burgeoning smartphone market and the challenging mobile VoIP over satellite market by Abbey Technology to make the best use of the limited wireless bandwidth available and to minimize the amount of data consumed.

We further developed the Horizon Platform for the broader telecommunications market on Apple’s iOS, Google’s Android and a Windows PC client focusing on the mobile Internet sector. This sector also benefits from our optimized mobile VoIP as it allows voice calls over new and legacy cellular telecom data networks. With the explosive growth in smartphone sales and increased usage of mobile data services, mobile operators face the challenge of dealing with increasingly congested networks, more dropped calls and rising levels of churn. Since the wireless spectrum is a finite resource, it is not always possible, or can be cost prohibitive, to increase network capacity. For these reasons, we believe that the demand for solutions to optimize the use of IP bandwidth will inevitably increase.

Our Strategy

We have developed a mobile application template called “Horizon Call,” that enables highly bandwidth-efficient VoIP calls over a smartphone using a 2G/EDGE, 3G, 4G/LTE, WiFi or Satellite connection. Our Horizon Call application is currently available for the iPhone and for Android handsets and we use it to showcase all of our functions, features, our call quality and the level of software innovation that we can brand for our potential clients.

Unlike the majority of mobile VoIP applications, Horizon Call creates a white-label business-to-business solution for mobile operators. Telecommunications operators are able to license from us, brand with us and deploy with us a completely new “white-labeled” solution so that they can optimize their highly pressurized mobile internet bandwidth and deliver innovation that in turn brings them new smartphone users. The operators decide how to integrate our application within their portfolio, how to offer it commercially and can customize it according to their own branding. Our solution helps them to manage increased traffic volumes while combating the competitive threat to their voice telephony revenues from other mobile VoIP applications by giving its mobile data customers a more efficient mobile VoIP solution that adds value to their mobile data network.

We are positioning ourselves as an operator-enabler by licensing our technology to mobile operators in a manner that can be fully customized to the needs of their subscribers. As shown below, operators are able to offer our platform to deliver branded smartphone applications to their existing customers to reduce lost Voice/Text revenue and minimize customer churn.

By offering Horizon Call to their existing customer base, our customers can offer innovative data-based voice and data services that are different from the existing Over The Top (“OTT”) data applications running on their networks. OTT refers to voice and messaging services that are delivered by a third party to an end user’s smartphone, leaving the mobile network provider responsible only for transporting internet data packets and not the value-added content. The Horizon Call voice services allow mobile operators’ customers to make VoIP calls under mobile operators’ call plans, thereby allowing mobile operators to capture value-added content, including voice calls, text messaging, voice messaging, group messaging, multimedia messaging, and advertising, that would have otherwise gone to the providers of other OTT services.

Horizon Call runs on both smartphone and tablet devices and, as networks become more congested, software services such as Horizon Call become ever more relevant. We believe that although more network capacity will eventually come on stream with 4G/LTE, it, like all other highways, will quickly become congested and this is why we believe that Horizon Call is ideally placed to add value to mobile data networks.

Incumbent mobile operators are suffering a reduction in revenue per user due to the OTT software services on mobile devices. OTT applications, such as Skype and Line, can negatively impact mobile operators’ traditional revenue streams of voice and SMS (short message service). As shown below, the Horizon Platform positions the Company to enable mobile operators to operate their own OTT solution branded in their image allowing use on all mobile data networks.

In addition to delivering new data services to their existing customers, mobile operators can offer their brand of Horizon Call on anyother operators’ handsets. Because the Horizon Call application can be installed on the smartphone from the Internet, the potential customer base for the operators’ data application surpasses the customer base that they can reach through traditional mobile phone SIM card distribution. We believe that this service innovation, coupled with the fact that the Horizon Call application can also use existing mobile operator pre-paid credit redemption and distribution services, presents a very compelling service against OTT services.

We believe that emerging markets represent a key opportunity for Horizon Call because these are significant markets with high population densities, high penetration of mobile phones, congested mobile cellular networks and high growth in the adoption of smartphones. It is forecast that over 2.7 billion people will use smartphones in 2019. Asia-Pacific will account for over half of all smartphone users in 2016, estimated at 1.1 billion users. Globally, China is the largest smartphone market with an estimated 563.1 million handsets. These factors will put increased pressure on mobile operators to manage their network availability.

In this context, where necessary, we have created our own brand in China, called Aishuo, formed a number of strategic ventures with local partners in regions of various emerging markets to seize upon this opportunity.

Marketing

Our marketing objective is to become a broadly adopted solution in the regions of the world with large concentrations of smartphone users and high network congestion. We aim at becoming the preferred solution for carriers who wish to deploy branded VoIP solutions that enable them to minimize revenue erosion, reduce churn, increase the effective capacity of their network infrastructure and improve user experience. We employ an integrated multi-channel approach to marketing, whereby we evaluate and focus our efforts on selling through telecommunications companies to enable them to provide the Horizon Platform to their customers. We routinely evaluate our marketing efforts and try to reallocate budgets to identify more effective media mixes.

We conduct marketing research to gain consumer insights into brand, product, and service performance, and utilize those findings to improve our messaging and media plans. Market research is also leveraged in the areas of testing, retention marketing, and product marketing to ensure that we bring compelling products and services to market.

Sales

Direct Sales. Our primary sales channel for the products and services of Horizon Platform is the sale of Horizon Platforms to Tier 1 and Tier 2 telecommunications companies to enable them to provide the product and services to their customers. We continue our efforts to develop new customers globally but particularly in Asia, Africa and Latin America.

Strategic Ventures.In addition to our direct sales channel, we also offer increased sales through our strategic venture channel. In this context, as mentioned above, we are working towards forming a number of strategic ventures in areas where regulatory issues require local representation.

Target Markets. The markets for our primary and joint venture channels will have high population density, high penetration of mobile phones, congested mobile cellular networks and high growth in the adoption of smartphones.

Competition

Our direct competitors for its technology primarily consist of systems integrators that combine various elements of SIP (Session Initiation Protocol) dialers and media gateways. Other dial-back solutions exist but they are not IP-based. Because SIP dialers and media gateways currently are unable to provide a low bandwidth solution, they do not currently compete with the Company’s technology in those markets in which their high bandwidth needs are unsupported by the existing cellular networks. They do, however, compete in those markets where the cellular networks are accessible by those SIP dialers and gateways.

We license the Horizon Platform to mobile operators, who in turn may offer the application to their end-user subscribers. The Company’s principal competitors for the mobile operators’ end-users are Skype, Viber, WeChat, and WhatsApp. Having a mobile operator’s subscriber opt to use the operator’s (branded) Horizon Call service instead of existing OTT services means that the mobile operator will gain market share of some of the OTT voice and messaging traffic. We are currently unaware of any other companies that seek to license VoIP technology directly to mobile operators.

One of our key competitive advantages is that we are not a threat to mobile operators. Rather, the Company’s Horizon Platform is a tool that can be used by mobile operators to compete against the OTT provider’s applications that are running on their networks. Through the Horizon Platform, mobile operators are able to compete directly with OTT services that, by their design, divert voice and messaging services away from mobile operators. The solution is delivered completely and is easy to install and operate. This means that a mobile operator has a turnkey mobile voice and messaging solution to deploy to its customer (i.e., the end-user).

The turnkey Horizon software platform and the Horizon SmartPacket™ technology give us a competitive advantage by managing credit, routing, rating, security, performance, billing and monitoring. Horizon SmartPacket™ is the world’s lowest bandwidth voice compression and transmission protocol and is 100% developed and owned by the Company. Though other software companies can offer part of this solution space, we believe none offers it in such a complete and integrated fashion as we do. We believe it will take a substantial number of years to copy/replicate the Horizon Platform in its entirety, by which time we believe the Horizon Platform will have improved and further distanced itself from potential competition.

Intellectual Property

Our strategy with respect to our intellectual property is to patent our core software concepts wherever possible. The Company’s current software patent has been approved in the United States and is pending in other jurisdictions around the world. Our patent strategy serves to protects the Horizon Platform and the central processing service of the Horizon Platform.

The Company endeavors to protect its internally developed systems and technologies. All of our software is developed “in-house,” and then licensed to our customers. We take steps, including by contracts, to ensure that any changes, modifications or additions to the Horizon Platform requested by our customers remain the sole intellectual property of the Company.

Research and Development and Software Products

We have spent approximately $0.5 million on capitalizable research and development during 2016.

Throughout 2016 we continued with our focus on innovation and our research and development teams (“R&D”) brought us software that allows our customer to offer call and messaging Bundles. This is a common feature for SIM cards and popular with mobile subscribers whereby the user pre-purchases bulk minutes at a lower per minute rate that when they pay for a call minute by minute. The Company now offers such innovations to its subscribers right inside the operators’ smartphone app supplied to Company thereby driving up the operator’s revenue per user.

We also expanded our R&D effort into the cellular operators' core network with a feature set that allows our service to directly connect to an operators Unstructured Supplementary Service Data (USSD) service thereby allowing all mobile prepaid subscribers to add credit to their mobile account in a traditional way and then allowing this USSD top up to be applied to a mobile VoIP smartphone app, an industry first.

The Cyber-Security R&D team also delivered a cyber-secure VoIP service that leverages the low bandwidth benefits of Company’s patented technology to allow VoIP over the strongest security protocols on the Internet. By leveraging the power of Virtual Private Networks (VPN) native client on the smartphone the Company’s VoIP protocols work where other traditional VoIP solutions cannot due to call quality issues with high data consumption protocols. Management expect this platform to drive a new revenue stream for Cyber Secure VoIP.

Also in 2016 our Cyber-Security R&D team delivered a stand alone version of our optimized VoIP core network server software for vertical markets covering Government, Banks and Small to Medium Enterprises that ensures privacy of their internal voice and messaging services in a cryptographically secure way. Our stand alone service can be installed on-site at the customer and requires minimal operational support thereby delivering secure communications in a cost efficient manner.

R&D also delivered a standalone Lawful Intercept module for operators that are legally required to have call recording features. This service is capable of recording calls from VoIP application on the handset to another handset or to the traditional telephone network. Such features are required by regulators in certain jurisdictions around the world. This feature also allows our mobile solution to internet connect with Microsoft's Skype for Business Unified Communication platform.

R&D also delivered a complete mobile app telephone conferencing service where a user of our VoIP service can bring in other parties to an on-going call, an ad-hoc conference. This feature is targeting the B2B user that may need multi-party calls on lower quality or congested mobile data networks.

R&D delivered a complete integration into one of Africa's largest micropayments platforms, Ecocash. App users can now securely pay for their calls from inside the app using this widely used payment solution.

Cyber-Security team delivered a completely new security messaging solution with external key-broker for the ultimate in message security. Using our solution, not even the service-host can decrypt the app-app messages as the keys are not available inside the core network. Our distributed key broker can be located anywhere in the world, independent of the service-host passing messages thereby guaranteeing message security for the end to end communication.

R&D delivered a bespoke real-time network quality monitor that automatically adjusts the bandwidth consumed by a handset for a VoIP call depending out network strength. This allow for a much smoother call with reduced jitter and enhanced user acceptance.

R&D commenced the development work on iOS for the latest Apple CallKit service.

Cyber-Security R&D team commenced development on an encrypted call solution that can avail of the independent key broker service for the ultimate in VoIP security.

Employees

As of December 31, 2016,2018, we had 2313 employees, all of whom were full-time employees.

RISKS RELATED TO OUR BUSINESS

We incurred a net loss in 2018 and 2017 with negative cash flows and we cannot assure you as to when, or if, we will become profitable and generate positive cash flows.

We incurred a net loss of $13.8 million for the year ended December 31, 2018 and a net loss of $7.5 million for the year ended December 31, 2017 and negative cash flows from operations of $3.0 million for the year ended December 31, 2018 and $0.4 million for the year ended December 31, 2017. Such losses have historically required us to seek additional funding through the issuance of debt or equity securities. Our long term success is dependent upon among other things, achieving positive cash flows from operations and if necessary, augmenting such cash flows using external resources to satisfy our cash needs.

We may be unable to effectively manage our planned expansion.

Our planned expansion may strain our financial resources. In addition, any significant growth into new markets may require an expansion of our employee base for managerial, operational, financial, and other purposes. During any growth, we may face problems related to our operational and financial systems and controls. We would also need to continue to expand, train and manage our employee base. Continued future growth will impose significant added responsibilities upon the members of management to identify, recruit, maintain, integrate, and motivate new employees.

If we are unable to successfully manage our expansion, we may encounter operational and financial difficulties which would in turn adversely affect our business and financial results.

We may require additional funding for our growth plans, and such funding may result in a dilution of your investment.

We have estimated our funding requirements in order to implement our growth plans. If the costs of implementing such plans should exceed these estimates significantly or if we come across opportunities to grow through expansion plans which cannot be predicted at this time, and our funds generated from our operations prove insufficient for such purposes, we may need to raise additional funds to meet these funding requirements.

These additional funds may be raised by issuing equity or debt securities or by borrowing from banks or other resources. We cannot assure you that we will be able to obtain any additional financing on terms that are acceptable to us, or at all. If we fail to obtain additional financing on terms that are acceptable to us, we will not be able to implement such plans fully if at all. Such financing even if obtained, may be accompanied by conditions that limit our ability to pay dividends or require us to seek lenders’ consent for payment of dividends, or restrict our freedom to operate our business by requiring lender’s consent for certain corporate actions.