UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ | |

ANNUAL REPORT PURSUANT TO SECTION 13 OR | |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR |

For the Transition Periodtransition period from ___ to ___

Commission file number

333-191083RASNA THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

Nevada | 39-2080103 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

420 Lexington Ave, Suite 2525, New York, NY 10170

(Address of principal executive offices) (Zip Code)

Telephone: (646) 396-4087

(Registrant’s telephone number)

Securities registered pursuant to Section 12(b)12(b) of the Act: None.

Securities registered pursuant to Section 12(g)12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes

Indicate by check if the registrant is not required to file reports pursuant to Section 13 or Section 15(d)15(d) of the Act. Yes

Indicate by check mark whether the registrant (1)(1) has filed all reports required to be filed by Section 13 or 15(d)15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) (2)has been subject to such filing requirements for the past 90 days. Yes

Indicate by check mark whetherwhether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or informationinformation statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-212b-2 of the Exchange Act. (Check one)one):

Large accelerated filer | Accelerated filer |

Non-accelerated filer | Smaller reporting company |

(Do not check if a smaller reporting company) | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financialfinancial accounting standards provided pursuant to Section 13(a)13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-212b-2 of the Act). Yes

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was $10,336,200 as of September 30, 2019, based upon the closing price on the OTCQB market reported for such date.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 68,046,465 68,908,003 shares of common stock were issued and outstanding as of June 28, 2017.

DOCUMENTS INCORPORATED BY REFERENCE: None

| 1 |

Forward Looking Statements.

This annual report contains forward-looking statements within the meaning of Section 27A27A of the Securities Act of 1933, as amended, and Section 21E21E of the Securities Exchange Act of 1934, as amended. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors”, any of which may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks include, by way of example and not in limitation:.

This list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements.

Forward looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common stock” refer to the common shares in our capital stock.

As used in this annual report, the terms “we”, “us”, “our”, “Rasna” and the “Company” mean Rasna Therapeutics, Inc. unless the context clearly requires otherwise.

General.

We are a highly experienced industry team together with field-leading scientists, to focus onleukemia-focused biotechnology company that has been developing therapeutics to address the unmet need that exists for Acute Myloid Leukemia ("AML")acute myeloid leukemia, or AML, and other forms of leukemia and lymphoma.lymphoma. AML is generally a disease of older adults, with onset typically after the age of 45 (average patient age approximately 68 years old). Our strategy is to develop small molecule drug candidates targeting two genes: NPM1 and LSD1, which are considered to control major pathways underlying etiology of majority of AML sub-types.

RASP-101 is our lead compound and is a controlled release, nanoparticulate, intravenous formulation of dactinomycin, which is an established anticancer therapeutic.Our consultants, Prof. Falini and Prof. Martelli conducted a Phase 2 clinical trial usingunformulated free dactinomycin, or ACT D, in refractory/relapse (R/R) AML patients carrying NPM1 gene mutation.Treatment with ACT D at 15 µg/kg/day for 5 days every 28 days induced CR in 4 out of the 9 evaluable patients (44.4%) with only 1 or 2 cycles of therapy. We believe these results demonstrated proof-of-concept for therapy with ACT D for NPM1 gene mutated AML patients. However, intravenous treatment with ACT D treatment also produced severe dose-limiting oral mucositis.Pursuant to a license agreement with Prof. Falini and Prof. Martelli, we have developed RASP-101 which is a nanoparticle controlled release formulation of ACT D which we believe will maximize therapeutic effectiveness while minimizing oral mucositis. After completion of animal safety toxicity and pharmacokinetic, or PK,studies in animals, we are planning to conduct a Phase 1 safety and PK study, followed by a single, bridging Phase 3 trial in AML patients to support a 505(b)(2) submission for registration (subject to FDAapproval), offering a shortened approval pathway by the end of 2023.

RASP-201 is a novel, orally dosed, selective reversible inhibitor of lysine specific demethylase, or LSD1, a pathway that blocks differentiation and confers a poor prognosis to AML. We expect RASP-201 to display a safer metabolic profile than competitor irreversible inhibitors such as GSK2879552 (GlaxoSmithKline) and ORY-1001 (Oryzon/Roche).RASP-201 when dosed orally shows in vivo therapeutic utility in murine (mouse) models of AML.

| 3 |

RASP-301 is our innovative, first- in-class, oral, small molecule inhibitor that in preclinical studies has been shown to disrupt NPM1 oligomerization (aggregation of individual subunits) and has the potential to treat refractory AML with reduced toxicity at low dose levels.RASP-301 exhibits cytotoxic effects at nanomolar concentrations against AML cells in culture and was not cytotoxic to normal cells at the same concentrations.In vivo usefulness of these compounds in AML murine models has been evaluated confirming the druggability of the target and its potential to treat refractory AML.

Our primary indication is AML which may be fatal within weeks to months, has a 5-year5-year survival rate of only about 25%25% and very poor prospects for long-term survival of patients.

Leukemia Overview and user-friendly information on activity-based travel.

Leukemia is a cancer of the blood or bone marrow involving abnormal proliferation of white blood cells, called WBCs or leukocytes. Leukemia is caused by a mutation of the DNA in bone marrow stem cells resulting in the abnormal multiplication of leukocytes. If untreated, surplus leukocytes will overwhelm the bone marrow, enter the bloodstream and eventually invade other parts of the body, such as the lymph nodes, spleen, liver, and central nervous system. In this way, the behavior of leukemia is different from that of other cancers, which usually begin in major organs and ultimately spread to the bone marrow. Leukemia is an umbrella term covering a large group of blood cancers.

All leukemia arises from mutations or damage to the DNA within the blood cells. These mutations may occur spontaneously or as a result of exposure to radiation or carcinogenic substances. Ionizing radiation, as well as exposure to chemicals such as benzene, increases the risk of AML, while agricultural chemicals have been linked to an increased incidence of chronic lymphoctic Leukemia (“CLL”).lymphocytic leukemia, or CLL. A weak immune system, some virus forms such as human T-cell Leukemia virus I (“HTLV-1”), or HTLV-1, genetic predisposition, cigarette smoking, and reactions to some therapeutic drugs are also implicated in the etiology of leukemia.

Diagnosis, Treatment, and Management

The first symptoms of leukemia are often vague and are correlated with other disorders. Common symptoms include fatigue and malaise, excessive bruising, and abnormal bleeding due to low platelet count. Further symptoms can include weight loss, bone and joint pain, infection and fever, and an enlarged spleen, lymph nodes and liver. After a blood test, several blood abnormalities such as anemia, or leucopenia may be observed, and in most cases a bone marrow test is required to confirm the diagnosis.

The preliminary diagnostic test for leukemia is a blood cell count, which is followed by immune-phenotyping to assess whether the abnormal lymphocyte levels are caused by inflammation or cancer. The physician may also require additional confirmatory tests such as cytogenetic analysis or bone marrow sampling.

The specific variety and combination of anticancer drugs prescribed depends on the form and stage of the disease. For example, treatment for AML, the most common form of leukemia, usually involves chemotherapy with cytotoxic cytarabine in conjunction with an anthracycline such as daunorubicin or idarubicin. Because of the severity of the cytotoxic treatment, bone marrow transplants, (“BMTs”)or BMTs are sometimes necessary. By transplanting healthy bone marrow into the body, BMTs help rebuild tissue damaged by the treatment. Interferon, (“INF”)or INF, therapy, particularly with INF-alpha, is an alternative or additional treatment offered to almost all newly diagnosed patients in these markets. However, it is very difficult to cure, even though early treatment indicates it will help people to live longer.

The standard first-line treatment strategy for CLL: PatientsCLL for patients who might not be able to tolerate the side effects of strong chemotherapy (chemo) are oftenis to be treated with chlorambucil alone or with a monoclonal antibody like rituximab (Rituxan) or obinutuzumab (Gazyva). Other options include ibrutinib (Imbruvica), rituximab alone, or a corticosteroid like prednisone.

Other drugs or combinations of drugs may also be also used. If the only problem is an enlarged spleen or swollen lymph nodes in one region of the body, localized treatment with low-dose radiation therapy may be used. Splenectomy (surgery to remove the spleen) is another option if the enlarged spleen is causing symptoms.

In addition, very high numbers of leukemia cells in the blood causes problems with normal circulation. This is called leukostasis. Leukapheresis is also sometimes used before chemochemotherapy if there are very high numbers of leukemia cells (even when they aren’t causing problems) to prevent tumor lysis syndrome.

| 4 |

Upon the failure of first line therapy, the standard therapy is usually to administer many of the drugs and combinations listed above as potential second-line treatments. For many people who have already had fludarabine, alemtuzumab seems to be helpful as second-line treatment, but it carries an increased risk of infections. Other purine analog drugs, such as pentostatin or cladribine (2-CdA)(2-CdA), may also be tried. Newer drugs such as ofatumumab, ibrutinib, idelalisib (Zydelig), and venetoclax (Venclexta) may be other options. If these types of chemotherapy fail, the next option is usually a bone marrow transplant. A stem cell transplant is a third treatment option depending on leukemia response.

Market Potential

According to the American Cancer Society, it is estimated that approximately 21,000 new AML cases will be diagnosed in the US each year and the projected cost of drug therapy for each patient over the course of one year of the disease is approximately $280,000 for chemotherapy alone (Preussler et. al. Biol. Blood Marrow Transplant 23 (2017) 1021-1028) amounting to a total cost of approximately $5.9 billion. Of this it is estimated that 50% of the costs are attributable to standard of care chemotherapy. Thus, the assessment is that the U.S. market potential for AML is approximate $3 billion annually. The rest of the world is estimated to constitute 50% of the AML market; thus, the total annual world market is approximately $6 billion. If our NPM1 targeted therapy proves beneficial to only the 20% of AML patients with mutated NPM1 genes, the addressable market will be diminished but we believe that our NPM1 targeted therapy would then be the only therapy to address that sub-population.

Table 1Total Estimated Number of New Leukemia Cases in

the United States for2017*

| |||||||

|

|

|

|

|

|

|

|

Type | Total | Male | Female |

| |||

Acute Lymphocytic Leukemia |

| 5,970 |

| 3,350 |

| 2,620 |

|

Chronic Lymphocytic Leukemia |

| 20,110 |

| 12,310 |

| 7,800 |

|

Acute Myeloid Leukemia |

| 21,380 |

| 11,960 |

| 9,420 |

|

Chronic Myeloid Leukemia |

| 8,950 |

| 5,230 |

| 3,720 |

|

Other Leukemia |

| 5,720 |

| 3,440 |

| 2,280 |

|

Total Estimated New Cases |

| 62,130 |

| 36,290 |

| 25,840 |

|

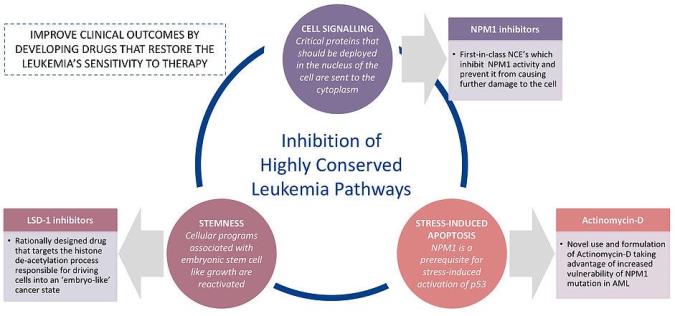

Figure 1Three Druggable Intervention Points for Developing AML Therapies

| 5 |

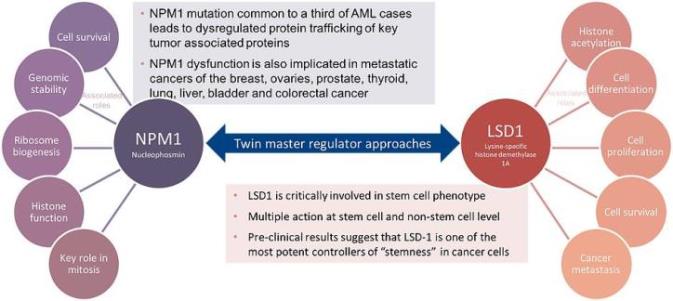

Our business strategy focuses on differentiated targeted therapies for genetic pathways which are known to be involved in etiologies of number of leukemia and other cancers. Our clinical program is based around three druggable intervention points with potential to improve safety and efficacy of current AML therapies, namely “stemness” (activation of stem cell-like growth patterns), cell signaling (between nucleus and cytoplasm) and stress-induced apoptosis (programmed cell death) (Figure 1). Our focus is to target two specific genetic pathways NPM1 and LSD1, which are known to be associated with etiologies of a number of cancers, including AML (Figure 2).

Figure 2Key Regulators for Developing Targeted AML Therapies

Roles of NPM1 and LSD1 in Tumorigenesis

Leukemia arises due to DNA damage or mutations. Chromosomal aberrations involving NPM1 wereNPM1 and LSD1 have been found in patients with non-Hodgkin lymphoma, acute promyelocytic leukemia, myelodysplastic syndrome, and AML. NPM1 has been foundThus, targeting NPM1 and LSD1 is an appropriate approach for treatment of AML. In addition, combination of therapies targeting these two genes could also be effective in the cytoplasm in patients with primarytreatment of relapse AML.

The NPM1 gene is up-regulated, mutated and chromosomally translocated in many tumor types. NPM1NPM1 is transferred from nucleolus to nucleoplasm and cytoplasm by anticancer drugs. When expressed at high level, NPM1NPM1 could promote tumor growth by inactivation of tumor suppressor p53/p53/ARF pathway; when expressed at low level, NPM1NPM1 could suppress tumor growth by inhibition of centrosome duplication. NPM1NPM1 is haplo insufficient in hemizygous mice that are vulnerable to tumor development. NPM1c+NPM1c+ (cytoplasm form) translocation into cytoplasm could serve as an AML remission signal. NPM1NPM1 forms a pentamer that could serve as a potential anticancer target.

The histone H3K4/K9 demethylase LSD1 can regulate gene activation and repression in epigenetic regulation and is a key effector of the differentiation block in MLL-rearranged leukemia. High LSD1 expression blocks differentiation and is associated with a poor prognosis in AML. LSD1 can be targeted by tranylcypromine analogs or downregulated by RNA interference which induces differentiation of MLL-rearranged leukemic cells. A number of different small molecular inhibitors of LSD1 have been in clinical evaluation. While this class of inhibitors has shown clinical activity in AML patients, toxicities associated with irreversible inhibitors prohibited their further development. Reversible inhibitors of LSD1 have shown good potential for further development.

Other Leukemias

Differences between the NPM1 mutation and possiblydifferent leukemias are dependent on the types of cells involved.Myeloid leukemias originate in the broader NPM1 population.bone marrow and involve granulocytes, white and red blood cells.Lymphoid leukemias, including lymphomas, originate in the lymph nodes and lymphoid tissue but involve immune cells including lymphocytes, T cells and B cells.MDS are group of bone marrow failure disorders that have various subtypes with variable onsets, prognoses and risks of developing leukemia.

| 6 |

RASP-101

Prof. Brunangelo Falini, Dr. Lorenzo Brunetti, and Prof. Maria Paola Martelli (N Engl J Med, 2015 373(12), 373(12):1180-2)1180-2) hypothesized that NPM1-mutatedNPM1-mutated AML cells might be vulnerable to a drug like dactinomycinthat triggers a nucleolar stress response. In an initial evaluation, a single patient was treated for six cycles of five consecutive daily intravenous doses of 12.5 µg/kg at intervals of 3 to 4 weeks. Morphologic and immunohistochemical complete remissionCR, was evident after the fourth cycle, and an assay for mutant copies of NPMA showed molecular complete remission after the fourth cycle. In a subsequent Phase II2 clinical trial (EudraCT number 2014-000693-18), completed in two and a half years,refractory/relapse (R/R) AML patients carrying NPM1 gene mutation, treatment with refractory or relapsed NPM1-mutated AML were treated with dactinomycinAct D at 15 µg/kg/day for 5 days every 28 days induced CR in4 out of the 9 evaluable patients (44.4%) with only 1 or 2 cycles of 5 consecutive days.therapy. One patient underwent haploidentical allogeneic peripheral blood stem cell, or PBSC, transplantation at 3 months after CR achievement and is alive in molecular CR [minimal residual disease (MRD)-negative] after 24 months..

RASP-101 is a nanoparticle-based formulation program that focuses on control release of ACT D to achieve therapeutic benefit.ACT D was previously approved by the FDA for treatment of Wilm’s Tumor, Ewing’s Sarcoma, Metastatic Nonseminomatous Testicular Cancer, Gestational Trophoblastic Neoplastic, Childhood Rhabdomyosarcoma and Regional Perfusion in Locally Recurrent and Locoregional Solid Malignancies under the trade name, Cosmegen® (Ovation Pharmaceuticals). Our approach is to reformulate ACT D with a nanoparticle-based formulation to reduce toxicity and maximize efficacy. We believe RASP-101 is a candidate for submission via the 505(b)(2) regulatory pathway for approval, which has shortened approval timelines for regulatory pathway for repurpose of already approved drugs for other disease indications.

RASP-101 is based on encapsulated polymeric nanoparticles with desirable safety and PK profile.Preclinical animal studies with all four prototypes were conducted to evaluate drug release profile, PK and tolerability side by side with unformulated ACT D.

The maximum plasma concentration of ACT D was higher for the encapsulated polymeric nanoparticle formulations compared to free ACT D dosing.Although the observed plasma concentration for the free ACT D was lower than the formulated versions, higher mortality was observed in the free drug group of animals.After 24 hours, substantial plasma levels were observed in nanoparticle formulations A complete responseand C.Formulation A had highest systemic levels of ACT D and minimal adverse effects and was achievedselected as the lead formulation.

A decrease in 40%body weights of animals dosed with free ACT D was recorded subsequent to dosing and animal did not recover from body weight loss even at 7 days post-dosing.Dosing with nanoparticle-formulated ACT D at the same dose showed no drug-related body weight loss.

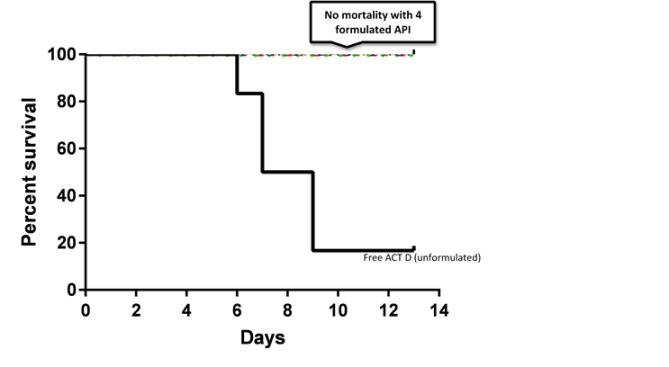

The rationale for developing RASP-101 was to permit weekly or biweekly dosing to limit drug toxicity associated with daily dosing in human subjects. Animal studies performed to date suggest that at the dose at which 80% of rats die within 13 days of administering unformulated RASP-101, no mortality was observed in groups of animals administered the same dose of RASP-101 formulated with polymeric nanoparticles (Figure 3). Only 1 animal in the unformulated group of animals survived at day 13.

Figure 3Survival of Rats Administered free ACT D or nanoparticle formulated ACT

The total accumulation of ACT D in tissues was less than 2% of the patients.

RASP-201 (LSD1)

LSD1 is an enzyme that demethylates (remove methyl groups) lysine side chain of histones. The levels of LSD1 are elevated (overexpressed) in several human cancers as compared to healthy normal adults. In 2012, a paper publishedAML, elevated levels of LSD1 are observed in Nature Medicine established thatless differentiated blood cells (immature cells). Inhibition of the enzyme activity was found to promote differentiation. Hence, inhibitors of an enzyme involved in the epigenetic regulation of gene expression known as LSD1 or KDM1ALSD1 are promising therapeutic candidates that can make drug-insensitive forms of AML, due to reduced levels of methylated histones, responsive to treatment with all-trans-retinoic acid, (ATRA).or ATRA isan agent that induces differentiation (maturation)and used to treat a subtype of AML called acute promyelocytic leukemia, (APL), but it is normally not effective in non-APL AML because the drug does not cause proper transcriptional activation of retinoic acid receptor target genes. This is a result of reduced methylation (specifically histone 3lysine 4 (H3K4) demethylation) on the promoter regions of these target genes. Therefore, the authors of the article hypothesized that inhibiting LSD1 might facilitate ATRA-induced differentiation of AML cells, which is known to halt the division of these cells. The research highlights a crosstalk between the ATRA-induced myeloid differentiation pathway and H3K4 methylation, and suggests that ATRA combined with LSD1 inhibitors might be therapeutically beneficial in AML.

Working from this premise, Dr. Pelicci’s groupwe executed a research agreement with TES Pharma for screening of compounds and to conduct animal studies to identify lead compounds with suitable druggability properties. TES Pharma has developedscreened ~34000 compounds across 4 chemical series for their ability to inhibit LSD1in vitro. The hit rate was ~1%. The hits from this assay were expanded and IC50 (half maximal inhibitory concentration) values were determined for 115 compounds. One chemical class namely, Thienopyrrole series was prioritized for further expansion and in vitro characterization.

We have filed patent applications covering this novel irreversible and reversible LSD1 regulators which have shown appropriatepotent inhibitor class. The current lead compound DDP_43242 inhibitory effect on the LSD1 gene

These studies have facilitated the selection of aDDP_43242 as the current lead compound. Additional absorption, distribution, metabolism and then aexcretion, or ADME, and selectivity characterization is underway for drug candidate selection for clinical trials by Rasna.trials. We anticipate filing an investigation new drug application, or IND, in 2019. We believe that this breakthrough program may have significant benefits across all forms of leukemia.

RASP-301 (NPM1)

The NPM1 gene provides instructions for making a protein called nucleophosmin (NPM) which is found in a small region inside the nucleus of the cell called the nucleolus.Nucleophosmin shuttles back and forth between the nucleus and the fluid surrounding it (the cytoplasm).Nucleophosmin helps to transport other proteins from ribosomes (sites of protein synthesis) through the membrane surrounding the nucleus.The NPM-1 gene is mutated in approximately 35% of new cases of AML. However, mutations in the NPM1 gene, result in dislocation of NPM1 protein in the cytoplasm. NPM1 mutation may be an early event in development of leukemia.Given that NPM1 is thought to have a tumor-suppressor function, alterations in its localization in the cell (from the nucleus to the cytoplasm) may be crucial for the cell to change from normal to cancerous state. Our approach is to identify small molecule drugs that physically interfere with the aggregation of NPM1 which is important for normal function. RASP-301 is our innovative, first- in-class, oral, small molecule, potent inhibitor that disrupts NPM1-1 oligomerization (aggregation of individual subunits) and has the potential to treat refractory (resistant to treatment) AML with reduced toxicity at low dose levels The current lead candidate, TES-2169, exhibits cytotoxic (toxic to cancer cells) effects at nanomolar concentrations against AML cells in culture and was not cytotoxic to normal cells at the same concentrations.In vivo usefulness of these compounds in AML murine (mouse) models has been evaluated confirming the druggability of the target and its potential to treat refractory AML.

| 8 |

Strategy

Our strategy is to target master regulators of cancer through deep knowledge of highly conserved pathways that are estimatedcommon to leukemia sub-types. Employing a multi-pronged approach, our programs are focused on three druggable intervention points with a potential to improve safety and efficacy of current AML mono and/or combination therapies. For the RASP-101 program, We plan to seek approval from FDA for submission via the 505 (b)(2) regulatory pathway employing a single Phase 1 study and a bridging Phase 3 pivotal study.For the RASP-201 program, the lead reversible LSD-1 candidate has been identified and manufacturing will be scaled for production of cGMP supplies for animal safety/toxicology studies, Phase 1, Phase 2 and Phase 3 clinical studies to support submission via the traditional 505(b)(1) regulatory pathway used for new chemical entities, or NCEs.We expect to use a similar pathway for the RASP-301 program, following identification of the lead drug candidate.

| ● | Rapidly develop and seek approval for our lead drug candidate, RASP-101 taking advantage of shortened timelines associated with the 505(b)(2) regulatory pathway. Schedule meeting with FDA to discuss suitability for this pathway. The 505(b)(2) pathway is applicable to reformulation of an approved drug used for a different disease indication. RASP-101 is a nanoparticulate reformulation of Cosmegen ® (Ovation Pharamaceutical) used for treatment of Wilm’s tumor and other cancers. Development and approval via the 505(b)(2) pathway can result in shortened timelines (3-4 years from development to approval in some instances) compared to the traditional 505(b)(1) pathway used for regulatory approval of NCEs (10-15 years). | |

| ● | Determine feasibility of Orphan Drug Designation for RASP-101 and other pipeline products used for treating AML. Schedule meeting with FDA to discuss suitability for this pathway.Orphan Drug Designation provides special status for drug products used to treat rare disease (“orphan indications”) defined as affecting fewer than 200,000 people in US and less than 5 per 10,000 people in EU. Incentives for developing orphan drugs include periods of marketing exclusivity (7 years exclusivity in US, 10 years in EU), tax credits up to 50% of development costs, waived FDA fees and other clinical trial tax incentives. | |

| ● | Determine feasibility of Breakthrough Therapy and Accelerated Approval for RASP-101 and other pipeline products. Schedule meeting with FDA to discuss suitability for this pathway. Breakthrough therapy designation is available from the FDA to drugs or drug combinations used to treat serious or life-threatening disease conditions based on preliminary clinical evidence that the drug may offer substantial improvement over existing therapies.FDA may grant priority approval to breakthrough drug indications.FDA may also grant accelerated approval and priority review for drugs that fill an unmet medical need. An advantage to this designation is that clinical trials may use surrogate endpoints to predict clinical benefit, requiring less time than other objective endpoints such as overall survival, or OS. | |

| ● | Complete development of orally-available, small molecule, highly-selective, reversible inhibitor of LSD1 (RASP-201) and file IND by 2019. Manufacture of the lead RASP -201 candidate will be scaled to supply animal safety/toxicology studies and Phase 1, 2 and 3 clinical studies following the traditional 505(b)(1) pathway used for marketing approval of NCEs. | |

| ● | Selection of a lead candidate for first in class NPM1 inhibitor (RASP-301) by the first quarter of 2019. | |

| ● | Evaluate strategic opportunities to accelerate development timelines and maximize the commercial potential of the drug candidates. Such opportunities may include partnering to achieve business objectives and achieve maximum return on investment. |

License Agreement

On November 10, 2016, Prof. Brunangelo Falini and Prof. Maria Paola Martelli and us entered into an exclusive license agreement pursuant to which we licensed certain patent rights owned by Prof. Falini and Prof. Martelli related to the use or reformulation of ACT D for the treatment of cancer.The agreement provides for up to €500,000 of milestone payment to be approximately 19,000paid upon achievement of clinical and regulatory milestones.In addition, the agreement provides for a low single digit royalty to be paid on net sales.The agreement may be terminated by us at any time upon 90 days prior written notice.In addition, each party to the agreement may terminate the agreement at any time upon a material breach of the agreement by the other party; provided that the other party shall have a 90 day period to cure the material breach.

Research Agreement

On December 17, 2013 TES Pharma S.R.L. (“TES”) and our predecessor, Arna Therapeutics Limited, entered into a research agreement pursuant to which TES agreed to perform research related to the development of products and services associated with NPM1 and AML.The initial term of the agreement was for two years and was extended by amendment on May 3, 2016 for an additional year.On September 8, 2016, the agreement was assigned to our subsidiary, Rasna Research, Inc.The agreement was further extended on March 24, 2017 until August 30, 2017. We are currently in discussions with TES Pharma S.R.L, profiling the next stage of research activity to be included in a new AML casesresearch agreement.

Manufacturing

Wedonothaveanymanufacturingfacilitiesorpersonnel.Wecurrentlyrely,andexpecttocontinuetorely,onthird partiesforthemanufacturingofourproductcandidatesforpreclinical as wellasforcommercial manufacturing if our product candidatesreceive marketingapproval.

Commercialization

We plan to retain our worldwide commercialization rights for some of our key product candidates while for other product candidates we might consider partnership opportunities to maximize returns.

While we currently have no sales, marketing or commercial product distribution capabilities and have no experience as a company in commercializing products, we intend to build our own commercialization organization and capabilities over time. When appropriate, we will decide whether to build a specialty sales force to manage commercialization for these product candidates on our own or in combination with a larger pharmaceutical partner, to maximize patient coverage in the United States each year and to support global expansion especially as our programs have substantial opportunity for additional follow-up indications alone or in combinations.

As product candidates advance through our pipeline, our commercial plans may change. Clinical data, the projected cost of treatment attributable to drug administrations for each patient over the coursesize of the disease can be estimated at US $100,000 per patient or US $1,900,000,000development programs, the size of the target market, the size of a commercial infrastructure and manufacturing needs may all influence our United States, European Union and rest-of-world strategies

Government Regulation

The FDA and comparable regulatory authorities in state and local jurisdictions and in other countries impose substantial and burdensome requirements upon companies involved in the aggregate from the different treatment cycles. Of this it is estimated that 50%clinical development, manufacture, marketing and distribution of the costs will continue to be attributable to standard of care chemotherapy. Thus, it is estimated that the US market potential for AML is $1 billion annually. The rest of the world is estimated to constitute 50% of the AML market; thus, the total annual world market is estimated to be $2 billion. If Rasna’s NPM1 targeted therapy proves beneficial to only that 20% of AML patients with mutated NPM1 genes, the addressable market will be diminished. However, in that event, Rasna’s NPM1 targeted therapy would then be the only therapy which address that sub-population and may command higher pricing and reimbursement.

| Type | Total | Male | Female | |||||||||

| Acute Lymphoblasti Leukemia | 6,020 | 3,140 | 2,880 | |||||||||

| Chronic Lymphocytic Leukemia | 15,720 | 9,100 | 6,620 | |||||||||

| Acute Myeloid Leukemia | 18,860 | 11,530 | 7,330 | |||||||||

| Chronic Myeloid Leukemia | 5,980 | 3,130 | 2,850 | |||||||||

| Other Leukemia | 5,800 | 3,200 | 2,600 | |||||||||

| Total Estimated New Cases | 52,380 | 30,100 | 22,280 | |||||||||

U.S. Government Regulation of Drug Products

In the United States, the FDA regulates drugs under the Federal Food, Drug, and exportCosmetic Act, or FDCA, and its implementing regulations. The process of pharmaceutical products.obtaining regulatory approvals and the subsequent compliance with applicable federal, state, local and foreign statutes and regulations requires the expenditure of substantial time and financial resources. Failure to comply with the applicable U.S. requirements at any time during the product development process, approval process or after approval, may subject a companyan applicant to a variety of administrative or judicial sanctions, such as FDAthe FDA’s refusal to approve pending new drug applications, or NDAs, or biologic license applications, or BLAs,withdrawal of an approval, imposition of a clinical hold, issuance of warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, refusals of government contracts, restitution, disgorgement or civil penalties, andor criminal prosecution.penalties.

| 10 |

The process required by the FDA before product developmentcandidates may be marketed in the United States typicallygenerally involves preclinical laboratory and animal tests, the following:

- submission to the

FDA/EMAFDA of anInvestigational New Drug (IND)IND application which must become effective before human clinical trials may begin and must be updated annually; - completion of extensive preclinical laboratory tests and preclinical animal studies, all performed in accordance with the FDA’s GLP regulations. Preclinical testing generally includes evaluation of our products in the laboratory or in animals to characterize the product and determine safety and efficacy;

- approval by an independent institutional review board, or IRB, at each clinical site before each trial may

commence, andbe initiated; - performance of adequate and well-controlled human clinical trials in accordance with good clinical practice, or GCP,requirements to establish the safety and

effectiveness of the drug or biologic for each indication for which FDA/EMA approval is sought. Satisfaction of FDA/EMA pre-market approval requirements typically takes many years (typically between 5-7 years post an IND submission) and the actual time required may vary substantially based upon the type, complexity and noveltyefficacy of the product candidate for each proposed indication; - submission to the FDA of a NDA after completion of all pivotal clinical trials;

- a determination by the FDA within 60 days of its receipt of an NDA to accept the filing for review;

- satisfactory completion of an FDA advisory committee review, if applicable;

- satisfactory completion of an FDA pre-approval inspection of the manufacturing facilities at which the active pharmaceutical ingredient, or

disease.

Preclinical testsstudies include laboratory evaluation of product chemistry, toxicity and formulation, as well as animal trialsstudies to assess potential safety and efficacy. An IND is a request for authorization from the characteristicsFDA to administer an investigational drug product to humans. The central focus of an IND submission is on the general investigational plan and potential pharmacology and toxicity of the product.protocol(s) for human studies. The conduct of the preclinical tests must comply with federal regulations and requirements including good laboratory practices. TheIND also includes results of preclinical testing are submittedstudies or other human studies, as appropriate, as well as manufacturing information, analytical data and any available clinical data or literature to support the use of the investigational new drug. An IND must become effective before human clinical trials may begin. An IND will automatically become effective 30 days after receipt by the FDA, unless before that time the FDA raises concerns or questions related to the proposed clinical trials. In such a case, the IND may be placed on clinical hold and the IND sponsor and the FDA as partmust resolve any outstanding concerns or questions before clinical trials can begin. Accordingly, submission of an IND along with other information, including information about product chemistry, manufacturing and controls, andmay or may not result in the FDA allowing clinical trials to commence. As a proposed clinical trial protocol. Long term preclinical tests, such as animal tests of reproductive toxicity and carcinogenicity, may continue after the IND is submitted.

Clinical trials involve the administration of the new investigational drug to healthy volunteers or patientshuman subjects under the supervision of a qualified investigator.investigators in accordance with GCPs, which include the requirement that all research subjects provide their informed consent for their participation in any clinical trial. Clinical trials must beare conducted in compliance with federal regulations and good clinical practices, or GCP, as well as under protocols detailing, among other things, the objectives of the trial,study, the parameters to be used in monitoring safety, and the effectivenessefficacy criteria to be evaluated. EachA protocol involving testing on U.S. patientsfor each clinical trial and any subsequent protocol amendments must be submitted to the FDA as part of the IND.

Additionally, approval must also be obtained from each clinical trial site’s Institutional Review Board, or IRB, before the trials may be initiated, and the IRB must monitor the study until completed. There are also requirements governing the reporting of ongoing clinical trials and clinical trial results to public registries.

The clinical investigation of a drug is generally divided into three phases. Although the phases are usually conducted sequentially, they may overlap or be combined. The three phases of an investigation are as follows:

| 1. | Phase 1. Phase 1 includes the initial introduction of an investigational new drug into humans. Phase 1 clinical trials are typically closely monitored and may be conducted in patients with the target disease or condition or in healthy volunteers. These studies are designed to evaluate the safety, dosage tolerance, metabolism and pharmacologic actions of the investigational drug in humans, the side effects associated with increasing doses, and if possible, to gain early evidence on effectiveness. During Phase 1 clinical trials, sufficient information about the investigational drug’s pharmacokinetics and pharmacological effects may be obtained to permit the design of well-controlled and scientifically valid Phase 2 clinical trials. | |

| 2. | Phase 2. Phase 2 includes controlled clinical trials conducted to preliminarily or further evaluate the effectiveness of the investigational drug for a particular indication(s) in patients with the disease or condition under study, to determine dosage tolerance and optimal dosage, and to identify possible adverse side effects and safety risks associated with the drug. Phase 2 clinical trials are typically well-controlled, closely monitored, and conducted in a limited patient population. |

| 11 |

| 3. | Phase 3. Phase 3 clinical trials are generally controlled clinical trials conducted in an expanded patient population generally at geographically dispersed clinical trial sites. They are performed after preliminary evidence suggesting effectiveness of the drug has been obtained, and are intended to further evaluate dosage, clinical effectiveness and safety, to establish the overall benefit-risk relationship of the investigational drug product, and to provide an adequate basis for product approval. |

A pivotal study is any clinical study, which adequately meets regulatory agency requirements for the evaluation of a drug candidate’s efficacy and safety such that it can be used to justify the approval of the product. Generally, pivotal studies are Phase 3 studies but may also be Phase 2 studies if the trial design provides a well-controlled and reliable assessment of clinical benefit, particularly in situations where there is an unmet medical need.

Progress reports detailing the results of the clinical trials must be submitted at least annually to the FDA and more frequently if serious adverse events occur. Phase 1, Phase 2 and Phase 3 clinical trials may not be completed successfully within any specified period, or at all.The FDA, the IRB, or the clinical trial sponsor may order the temporarysuspend or permanent discontinuation ofterminate a clinical trial at any time or impose other sanctions if it believeson various grounds, including a finding that the research subjects are being exposed to an unacceptable health risk. Additionally, some clinical trials are overseen by an independent group of qualified experts organized by the clinical trial issponsor, known as a data safety monitoring board or committee. This group provides authorization for whether or not being conducteda trial may move forward at designated check points based on access to certain data from the study. We may also suspend or terminate a clinical trial based on evolving business objectives and/or competitive climate.

Assuming successful completion of all required testing in accordance with FDAall applicable regulatory requirements, or presents an unacceptable riskdetailed investigational drug product information is submitted to the clinical trial patients. FDA in the form of an NDA requesting approval to market the product for one or more indications.

The clinical trial protocolapplication includes all relevant data available from pertinent preclinical and informed consent information for patients in clinical trials, must also be submittedincluding negative or ambiguous results as well as positive findings, together with detailed information relating to an institutional review board,the product’s chemistry, manufacturing, controls and proposed labeling, among other things. Data can come from company-sponsored clinical trials intended to test the safety and effectiveness of a use of a product, or IRB, for approval. An IRB may also require the clinical trial at the site to be halted, either temporarily or permanently, for failure to comply with the IRB’s requirements, or may impose other conditions.

In most cases, the submission of an NDA is subject to a substantial application user fee. Under the Prescription Drug User Fee Act, or PDUFA, guidelines that are currently in effect, the FDA has a goal of ten months from the date of “filing” of a standard NDA for a particular indication or indications, dosage tolerancenew molecular entity to review and optimum dosage, and identify common adverse effects and safety risks. Inact on the case of product candidates for severe or life-threatening diseases such as pneumonia,submission. This review typically takes twelve months from the initial human testingdate the NDA is often conducted in patients rather than in healthy volunteers.

In addition, under the overall benefit-risk relationshipPediatric Research Equity Act of 2003, or PREA, as amended and reauthorized, certain NDAs or supplements to an NDA must contain data that are adequate to assess the safety and effectiveness of the investigational drug for the claimed indications in all relevant pediatric subpopulations, and to provide adequate informationsupport dosing and administration for each pediatric subpopulation for which the product is safe and effective. The FDA may, on its labeling.

The FDA also may require submission of a risk evaluation and mitigation strategy, or REMS, plan to ensure that the benefits of the product may begin in the United States.drug outweigh its risks. The marketing application mustREMS plan could include the resultsmedication guides, physician communication plans, assessment plans, and/or elements to assure safe use, such as restricted distribution methods, patient registries, or other risk minimization tools.

The FDA conducts a preliminary review of all preclinical, clinical and other testing and a compilation of data relating toNDAs within the product’s pharmacology, chemistry, manufacture, and controls.

The FDA will not approve an application unless it determines that the manufacturing processes and facilities are in compliance with cGMP requirements and adequate to assure consistent production of the product within required specifications. Additionally, before approving a marketing application,an NDA, the FDA will typicallymay inspect one or more clinical trial sites to assure compliance with GCP.

| 12 |

After the FDA evaluates the NDA or BLA and theconducts inspections of manufacturing facilities where the drug product and/or its active pharmaceutical ingredient, or API, will be produced, it issuesmay issue an approval letter or a complete response letter. A complete response letter outlines the deficiencies in the submission and may require substantial additional testing or information in order for the FDA to reconsider the application. If and when those deficiencies have been addressed in a resubmission of the marketing application, the FDA will re-initiate review. If the FDA is satisfied that the deficiencies have been addressed, the agency will issue an approval letter. The FDA has committed to reviewing such resubmissions in two or six months depending on the type of information included. It is not unusual for the FDA to issue a complete response letter because it believes that the drug product is not safe enough or effective enough or because it does not believe that the data submitted are reliable or conclusive.

After regulatory approval of a drug product is obtained, a company is required to comply with a number of post-approval requirements. As a holder of an approved NDA, we would be required to report, among other things, certain adverse reactions and production problems to the FDA, to provide updated safety and efficacy information, and may imposeto comply with requirements concerning advertising and promotional labeling for any of our products. Also, quality control and manufacturing procedures must continue to conform to cGMP after approval to ensure and preserve the long-term stability of the drug product. In addition, drug manufacturers and other conditions, including labeling restrictions, which can materially affectentities involved in the product’s potential marketmanufacture and profitability. Once granted, product approvals may be withdrawn ifdistribution of approved drugs are required to register their establishments with the FDA and state agencies, and are subject to periodic unannounced inspections by the FDA and these state agencies for compliance with cGMP requirements. In addition, changes to the manufacturing process are strictly regulated, and, depending on the significance of the change, may require prior FDA approval before being implemented. FDA regulations also require investigation and correction of any deviations from cGMP and impose reporting and documentation requirements upon us and any third-party manufacturers that we may decide to use. Accordingly, manufacturers must continue to expend time, money and effort in the area of production and quality control to maintain compliance with cGMP and other aspects of regulatory standards is not maintainedcompliance.

We rely, and expect to continue to rely, on third parties for the production of clinical and commercial quantities of our product candidates. Future FDA and state inspections may identify compliance issues at our facilities or at the facilities of our contract manufacturers that may disrupt production or distribution, or require substantial resources to correct. In addition, discovery of previously unknown problems are identified following initial marketing.

| • | restrictions on the marketing or manufacturing of the product, complete withdrawal of the product from the market or product recalls; | |

| • | fines, warning letters or holds on post-approval clinical trials; | |

| • | refusal of the FDA to approve pending NDAs or supplements to approved NDAs, or suspension or revocation of product approvals; | |

| • | product seizure or detention, or refusal to permit the import or export of products; or | |

| • | injunctions or the imposition of civil or criminal penalties. |

Newly discovered or developed safety or effectiveness data may require changes to a product’s approved labeling, including the addition of new warnings and contraindications, and also may require the implementation of other risk management measures. The FDA closelystrictly regulates the post-approval marketing, labeling, advertising and promotion of therapeutic products including standards and regulations for direct-to-consumer advertising, off-label promotion, industry-sponsored scientific and educational activities and promotional activities involvingthat are placed on the internet.

Marketing Exclusivity

Market exclusivity provisions under the FDCA also can delay the submission or the approval of certain applications. The FDCA provides a five-year periodofnon-patentmarketingexclusivitywithintheUnitedStatestothefirstapplicanttoobtainapprovalofanNDAforanewchemicalentity.Adrugis a new chemical entity if the FDA has not previously approved any other new drug containing the same active moiety, which is the molecule or ion responsiblefortheactionofthedrugsubstance.Duringtheexclusivityperiod,theFDAmaynotacceptforreviewanabbreviatednewdrugapplication,or ANDA, or a 505(b)(2) NDA submitted by another company for another version of such drug where the applicant does not own or have a legal right of referencetoallthedatarequiredforapproval.However,anapplicationmaybesubmittedafterfouryearsifitcontainsacertificationofpatentinvalidityor non-infringement. The FDCA also provides three years of marketing exclusivity for an NDA, 505(b)(2) NDA or supplement to an approved NDA if new clinical investigations, other than bioavailability studies, that were conducted or sponsored by the applicant are deemed by the FDA to be essential to the approval of the application, for example, for new indications, dosages or strengths of an existing drug. This three-year exclusivity covers only the conditions associated with the new clinical investigations and does not prohibit the FDA from approving ANDAs for drugs containing the original active pharmaceuticalingredient.Five-yearandthree-yearexclusivitywillnotdelaythesubmissionorapprovalofafullNDA;however,anapplicantsubmitting a full NDA would be required to conduct or obtain a right of reference to all of the preclinical studies and adequate and well-controlled clinical trials necessarytodemonstratesafetyandeffectiveness.

The Hatch-Waxman Amendments: 505(b)(2) approval process

Section 505(b)(2) of the FDCA provides an alternate regulatory pathway to FDA approval for new or improved formulations or new uses of previously approved drug products. Specifically, Section 505(b)(2) permits the filing of an NDA where at least some of the conditions established ininformation required for approval comes from studies not conducted by or for the applicant and for which the applicant has not obtained a right of reference. The applicant may rely upon the FDA’s findings of safety and effectiveness for an approved product that acts as the Reference Listed Drug, or RLD. If the 505(b)(2) applicant can establish that reliance on FDA’s previous findings of safety and effectiveness is scientifically appropriate, it may eliminate the need to conduct certain preclinical or clinical studies of the new product. The FDA may also require 505(b)(2) applicants to perform additional studies or measurements to support the change from the RLD. The FDA may then approve the new product candidate for all or some of the labeled indications for which the referenced product has been approved, as well as for any new indication sought by the Section 505(b)(2) applicant.

In seeking approval for a drug through an NDA, including a 505(b)(2) NDA, applicants are required to list with the FDA certain patents whose claims cover the applicant’s product. Upon approval of an NDA, each of the patents listed in the application including changesfor the drug is then published in indications, labeling, or manufacturing processes or facilities, require submission and FDAthe Orange Book. Any applicant who files an ANDA seeking approval of a generic equivalent version of a drug listed in the Orange Book or a 505(b)(2) NDA referencing a drug listed in the Orange Book must certify to the FDA that (1) no patent information on the drug product that is the subject of the application has been submitted to the FDA; (2) such patent has expired; (3) the date on which such patent expires; or (4) such patent is invalid or will not be infringed upon by the manufacture, use or sale of the drug product for which the application is submitted. This last certification is known as a paragraph IV certification. A notice of the paragraph IV certification must be provided to each owner of the patent that is the subject of the certification and to the holder of the approved NDA to which the ANDA or 505(b)(2) application refers. The applicant may also elect to submit a ‘‘section viii’’ statement certifying that its proposed label does not contain (or carves out) any language regarding the patented method-of-use rather than certify to a listed method-of-use patent. If the reference NDA holder and patent owners assert a patent challenge directed to one of the Orange Book listed patents within 45 days of the receipt of the paragraph IV certification notice, the FDA is prohibited from approving the application until the earlier of 30 months from the receipt of the paragraph IV certification expiration of the patent, settlement of the lawsuit or a decision in the infringement case that is favorable to the applicant.The ANDA or 505(b)(2) application also will not be approved until any applicable non-patent exclusivity listed in the Orange Book for the branded reference drug has expired.

Our current and anticipated product candidates will be based on already approved active pharmaceutical ingredients, orAPIs, rather than new BLAchemical entities, and a formulation that has been through Phase 1 studies. Accordingly, we expect to be able to rely on information from previously conducted formulation studies involving our clinical development plans and our NDA submissions. For product candidates that involve novel fixed-dose combinations of existing drugs or BLA supplement, before the change can be implemented. A BLA supplement for studies of an existing product or product candidate in a new indication, typically requires clinical data similarwe believe we generally will be able to that in the original application, andinitiate Phase 2/3 studies without conducting any new non-clinical or Phase 1 studies, though the FDA uses the same proceduresmay not agree with our conclusions and actions in reviewing BLA supplements as it does in reviewing BLAs. We cannot be certain that the FDAmay require us to conduct additional clinical or anypreclinical studies prior to initiating Phase 3 or other regulatory agency will grant approval forpivotal clinical trials. In those instances where our product candidates for any other indications or any other product candidate for any indication onis a timely basis, if at all.

U.S. Foreign Corrupt Practices Act

The U.S. Foreign Corrupt Practices Act, to cGMPs after approval. Manufacturers and certain of their subcontractors are required to register their establishments with the FDA and certain state agencies, andwhich we are subject, prohibits corporations and individuals from engaging in certain activities to periodic unannounced inspections byobtain or retain business or to influence a person working in an official capacity. It is illegal to pay, offer to pay or authorize the FDA during which the agency inspects manufacturing facilitiespayment of anything of value to assess compliance with cGMPs. Accordingly, manufacturers must continueany foreign government official, government staff member, political party or political candidate to expend time, money and effortobtain or retain business or to otherwise influence a person working in the areas of production and quality control to maintain compliance with cGMPs. Regulatory authorities may withdraw product approvals or request product recalls if a company fails to comply with regulatory standards, if it encounters problems following initial marketing, or if previously unrecognized problems are subsequently discovered.

Federal and State Fraud and Abuse Laws

Healthcare providers, physicians and third-party payors play a primary role in the recommendation and prescription of drug and biologic product candidates which obtain marketing approval. In addition to FDA restrictions on marketing of pharmaceutical products, severalpharmaceutical manufacturers are exposed, directly, or indirectly, through customers, to broadly applicable fraud and abuse and other types of statehealthcare laws and federal laws have been applied to restrict certain marketing practices inregulations that may affect the biopharmaceuticalbusiness or financial arrangements and medical device industries in recent years.relationships through which a pharmaceutical manufacturer can market, sell and distribute drug and biologic products. These laws include, anti-kickback statutes and false claims statutes.

The federal health care program anti-kickback statuteAnti-Kickback Statute which prohibits, any person or entity from, among other things, knowingly and willfully offering, paying, soliciting, or receiving any remuneration, directly or indirectly, overtly or covertly, in cash or in-kind, to induce or in returnreward either the referring of an individual for, or the purchasing, leasing, ordering, or arranging for the purchase, lease, or order of any health carehealthcare item or service reimbursable, in whole or in part, under Medicare, Medicaid, or any other federally financed healthcare programs.program. The term “remuneration” has been broadly interpreted to include anything of value. This statute has been interpreted to apply to arrangements between pharmaceutical manufacturers on one hand and prescribers, purchasers, and formulary managers on the other.other hand. Although there are a number of statutory exemptions and regulatory safe harbors protecting certain common activities from prosecution, the exemptions and safe harbors are drawn narrowly, and practices that involve remuneration intended to induce prescribing, purchases, or recommendations may be subject to scrutiny if they do not qualify for an exemption or safe harbor. Our practices may not in all cases meet all of the criteria for safe harbor protection from anti-kickback liability.

The federal false claims and civil monetary penalty laws, prohibitincluding the Federal False Claims Act, which imposes significant penalties and can be enforced by private citizens through civil qui tam actions, prohibits any person or entity from, among other things, knowingly presenting, or causing to be presented, a false, fictitious or fraudulent claim for payment to the federal government, or knowingly making, using or causing to be made, a false statement or record material to get a false or fraudulent claim paid.to avoid, decrease or conceal an obligation to pay money to the federal government. In addition, a claim including items or services resulting from a violation of the federal Anti-Kickback Statute constitutes a false or fraudulent claim for purposes of the False Claims Act. As a result of a modification made by the Fraud Enforcement and Recovery Act of 2009, a claim includes "any request or demand" for money or property presented to the U.S. government. In addition, manufacturers can be held liable under the False Claims Act even when they do not submit claims directly to government payors if they are deemed to "cause" the submission of false or fraudulent claims. Criminal prosecution is also possible for making or presenting a false, fictitious or fraudulent claim to the federal government. Recently, several pharmaceutical and other health carehealthcare companies have been prosecuted under these laws for allegedly providing free product to customers with the expectation that the customers would bill federal programs for the product. Other companies have been prosecuted for causing false claims to be submitted because of the Company’scompany’s marketing of the product for unapproved, and thus non-reimbursable, uses.

The majorityfederal Health Insurance Portability and Accountability Act of states also have statutes1996, or HIPAA, which, among other things, imposes criminal liability for executing or attempting to execute a scheme to defraud any healthcare benefit program, including private third-party payors, knowingly and willfully embezzling or stealing from a healthcare benefit program, willfully obstructing a criminal investigation of a healthcare offense, and creates federal criminal laws that prohibit knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false, fictitious or fraudulent statements or representations, or making or using any false writing or document knowing the same to contain any materially false, fictitious or fraudulent statement or entry in connection with the delivery of, or payment for, benefits, items or services.

HIPAA, as amended by the Health Information Technology and Clinical Health Act of 2009, or HITECH, and its implementing regulations, similarwhich impose certain requirements relating to the privacy, security, transmission and breach reporting of individually identifiable health information upon entities subject to the law, such as health plans, healthcare clearinghouses and healthcare providers and their respective business associates that perform services for them that involve individually identifiable health information. HITECH also created new tiers of civil monetary penalties, amended HIPAA to make civil and criminal penalties directly applicable to business associates, and gave state attorneys general new authority to file civil actions for damages or injunctions in U.S. federal courts to enforce the federal HIPAA laws and seek attorneys' fees and costs associated with pursuing federal civil actions.

The federal physician payment transparency requirements, sometimes referred to as the “Physician Payments Sunshine Act,” and its implementing regulations, which require certain manufacturers of drugs, devices, biologics and medical supplies for which payment is available under Medicare, Medicaid or the Children’s Health Insurance Program (with certain exceptions) to report annually to the United States Department of Health and Human Services, or HHS, information related to payments or other transfers of value made to physicians (defined to include doctors, dentists, optometrists, podiatrists and chiropractors) and teaching hospitals, as well as ownership and investment interests held by physicians and their immediate family members.

State and foreign law equivalents of each of the above federal laws, such as anti-kickback law and false claims laws, whichthat may impose similar or more prohibitive restrictions, and may apply to items andor services reimbursed under Medicaidby non-governmental third-party payors, including private insurers.

State and foreign laws that require pharmaceutical companies to implement compliance programs, comply with the pharmaceutical industry’s voluntary compliance guidelines and the relevant compliance guidance promulgated by the federal government, or to track and report gifts, compensation and other remuneration provided to physicians and other healthcare providers, and other federal, state programs,and foreign laws that govern the privacy and security of health information or personally identifiable information in several states, apply regardlesscertain circumstances, including state health information privacy and data breach notification laws which govern the collection, use, disclosure, and protection of the payor. Sanctions under these federalhealth-related and state laws may include civil monetary penalties, exclusionother personal information, many of a manufacturer’s productswhich differ from reimbursement under government programs, criminal fines,each other in significant ways and imprisonment.

Because of the breadth of these laws and the narrowness of the safe harbors, it is possible that some of our business activities couldcan be subject to challenge under one or more of such laws. SuchThe scope and enforcement of each of these laws is uncertain and subject to rapid change in the current environment of healthcare reform, especially in light of the lack of applicable precedent and regulations.Federal and state enforcement bodies have recently increased their scrutiny of interactions between healthcare companies and healthcare providers, which has led to a challengenumber of investigations, prosecutions, convictions and settlements in the healthcare industry.

Ensuring that business arrangements with third parties comply with applicable healthcare laws and regulations is costly and time consuming. If business operations are found to be in violation of any of the laws described above or any other applicable governmental regulations a pharmaceutical manufacturer may be subject to penalties, including civil, criminal and administrative penalties, damages, fines, disgorgement, individual imprisonment, exclusion from governmental funded healthcare programs, such as Medicare and Medicaid, contractual damages, reputational harm, diminished profits and future earnings, additional reporting obligations and oversight if subject to a corporate integrity agreement or other agreement to resolve allegations of non-compliance with these laws, and curtailment or restructuring of operations, any of which could adversely affect a pharmaceutical manufacturer’s ability to operate its business and the results of its operations.

Healthcare Reform in the United States

In the United States, there have been, and continue to be, a material adversenumber of legislative and regulatory changes and proposed changes to the healthcare system that could affect the future results of pharmaceutical manufactures’ operations. In particular, there have been and continue to be a number of initiatives at the federal and state levels that seek to reduce healthcare costs. Most recently, the Patient Protection and Affordable Care Act, or PPACA, was enacted in March 2010, which includes measures to significantly change the way healthcare is financed by both governmental and private insurers. Among the provisions of the PPACA of greatest importance to the pharmaceutical and biotechnology industry are the following:

•an annual, nondeductible fee on any entity that manufactures or imports certain branded prescription drugs and biologic agents, apportioned among these entities according to their market share in certain government healthcare programs;

•implementation of the federal physician payment transparency requirements, sometimes referred to as the “Physician Payments Sunshine Act”;

•a licensure framework for follow-on biologic products;

•a new Patient-Centered Outcomes Research Institute to oversee, identify priorities in, and conduct comparative clinical effectiveness research, along with funding for such research;

•establishment of a Center for Medicare Innovation at the Centers for Medicare & Medicaid Services to test innovative payment and service delivery models to lower Medicare and Medicaid spending, potentially including prescription drug spending;

•an increase in the statutory minimum rebates a manufacturer must pay under the Medicaid Drug Rebate Program, to 23.1% and 13% of the average manufacturer price for most branded and generic drugs, respectively and capped the total rebate amount for innovator drugs at 100% of the Average Manufacturer Price, or AMP;

•a new methodology by which rebates owed by manufacturers under the Medicaid Drug Rebate Program are calculated for certain drugs and biologics, including our product candidates, that are inhaled, infused, instilled, implanted or injected;

•extension of manufacturers’ Medicaid rebate liability to covered drugs dispensed to individuals who are enrolled in Medicaid managed care organizations;

•expansion of eligibility criteria for Medicaid programs by, among other things, allowing states to offer Medicaid coverage to additional individuals and by adding new mandatory eligibility categories for individuals with income at or below 133% of the federal poverty level, thereby potentially increasing manufacturers’ Medicaid rebate liability;

•a new Medicare Part D coverage gap discount program, in which manufacturers must agree to offer 50% point-of-sale discounts off negotiated prices of applicable brand drugs to eligible beneficiaries during their coverage gap period, as a condition for the manufacturer’s outpatient drugs to be covered under Medicare Part D; and

•expansion of the entities eligible for discounts under the Public Health program.

Some of the provisions of the PPACA have yet to be implemented, and there have been legal and political challenges to certain aspects of the PPACA. Since January 2017, President Trump has signed two executive orders and other directives designed to delay, circumvent, or loosen certain requirements mandated by the PPACA. Concurrently, Congress has considered legislation that would repeal or repeal and replace all or part of the PPACA. While Congress has not passed repeal legislation, the Tax Cuts and Jobs Act of 2017 includes a provision repealing, effective January 1, 2019, the tax-based shared responsibility payment imposed by the PPACA on certain individuals who fail to maintain qualifying health coverage for all or part of a year that is commonly referred to as the “individual mandate”. Congress may consider other legislation to repeal or replace elements of the PPACA.

Many of the details regarding the implementation of the PPACA are yet to be determined, and at this time, the full effect that the PPACA would have on oura pharmaceutical manufacturer remains unclear. In particular, there is uncertainty surrounding the applicability of the biosimilars provisions under the PPACA. The FDA has issued several guidance documents, but no implementing regulations, on biosimilars. A number of biosimilar applications have been approved over the past few years. The regulations that are ultimately promulgated and their implementation are likely to have considerable impact on the way pharmaceutical manufacturers conduct their business and may require changes to current strategies. A biosimilar is a biological product that is highly similar to an approved drug notwithstanding minor differences in clinically inactive components, and for which there are no clinically meaningful differences between the biological product and the approved drug in terms of the safety, purity, and potency of the product.

Individual states have become increasingly aggressive in passing legislation and implementing regulations designed to control pharmaceutical and biological product pricing, including price or patient reimbursement constraints, discounts, restrictions on certain product access, and marketing cost disclosure and transparency measures, and to encourage importation from other countries and bulk purchasing. Legally mandated price controls on payment amounts by third-party payors or other restrictions could harm a pharmaceutical manufacturer’s business, results of operations, financial condition and prospects. In addition, regional healthcare authorities and individual hospitals are increasingly using bidding procedures to determine what pharmaceutical products and which suppliers will be included in their prescription drug and other healthcare programs. This could reduce ultimate demand for certain products or put pressure product pricing, which could negatively affect a pharmaceutical manufacturer’s business, results of operations.

In addition, given recent federal and state government initiatives directed at lowering the total cost of healthcare, Congress and state legislatures will likely continue to focus on healthcare reform, the cost of prescription drugs and biologics and the reform of the Medicare and Medicaid programs. While no one cannot predict the full outcome of any such legislation, it may result in decreased reimbursement for drugs and biologics, which may further exacerbate industry-wide pressure to reduce prescription drug prices. This could harm a pharmaceutical manufacturer’s ability to generate revenue. Increases in importation or re-importation of pharmaceutical products from foreign countries into the United States could put competitive pressure on a pharmaceutical manufacturer’s ability to profitably price products, which, in turn, could adversely affect business, results of operations, financial condition and prospects. A pharmaceutical manufacturer might elect not to seek approval for or market products in foreign jurisdictions in order to minimize the risk of re-importation, which could also reduce the revenue generated from product sales. It is also possible that other legislative proposals having similar effects will be adopted.

Furthermore, regulatory authorities’ assessment of the data and results required to demonstrate safety and efficacy can change over time and can be affected by many factors, such as the emergence of new information, including on other products, changing policies and agency funding, staffing and leadership. No one can be sure whether future changes to the regulatory environment will be favorable or unfavorable to business prospects. For example, average review times at the FDA for marketing approval applications can be affected by a variety of factors, including budget and funding levels and statutory, regulatory and policy changes.

International Regulations

In addition to regulations in the European Union