UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________________________________

FORM 10-K

_________________________________________________________ |

| | | | |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20172023

OR

| | | | | |

| ☐ | |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-8174001-08174

_________________________________________________________ DUCOMMUN INCORPORATED

(Exact name of registrant as specified in its charter)

_________________________________________________________ | | | | | | | | |

| Delaware | | 95-0693330 |

| | |

Delaware | | 95-0693330 |

(State or other jurisdiction of

incorporation or organization)

| | (I.R.S. Employer

Identification No.)

|

| |

200 Sandpointe Avenue, Suite 700, Santa Ana, California | | 92707-5759 |

| (Address of principal executive offices) | | (Zip code) |

Registrant’s telephone number, including area code: (657) 335-3665

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $.01 par value per share | | DCO | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:_________________________________________________________

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| | | | | |

| Large accelerated filer | | ¨ | Accelerated filer | | x |

| | | |

| Non-accelerated filer | | ¨ | Smaller reporting company | | ¨☐ |

| | | | | |

| | | Emerging growth company | | ¨☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨☐ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price of which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter ended July 1, 20172023 was $357$635 million.

The number of shares of common stock outstanding on February 14, 201815, 2024 was 11,340,653.14,641,154.

DOCUMENTS INCORPORATED BY REFERENCE

The following documents are incorporated by reference:

(a) Proxy Statement for the 20182024 Annual Meeting of Shareholders (the “2018“2024 Proxy Statement”), incorporated partially in Part III hereof.

DUCOMMUN INCORPORATED AND SUBSIDIARIES

| | | | | | | | |

| | |

| | Page |

|

| | |

| | |

| | |

| Item 1. | | |

| | |

| Item 1A. | | |

| | |

| Item 1B. | | |

| | |

Item 2.1C. | | |

| | |

| Item 2. | | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

|

|

| | |

| Item 5. | | |

| | |

| Item 6. | | |

| | |

| Item 7. | | |

| | |

| Item 7A. | | |

| | |

| Item 8. | | |

| | |

| Item 9. | | |

| | |

| Item 9A. | | |

| | |

| Item 9B. | | |

| | |

| Item 9C. | | |

|

|

| | |

| Item 10. | | |

| | |

| Item 11. | | |

| | |

| Item 12. | | |

| | |

| Item 13. | | |

| | |

| Item 14. | | |

| |

|

| | |

| Item 15. | | |

| | |

| Item 16. | | |

| | |

| | |

FORWARD-LOOKING STATEMENTS AND RISK FACTORS

This Annual Report on Form 10-K (“Form 10-K”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be preceded by, followed by or include the words such as “could,” “may,” “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate”“estimate,” “expect,” “would,” or similar expressions. These statements are based on the beliefs and assumptions of our management.management at the time such statements are made. Generally, forward-looking statements include information concerning our possible or assumed future actions, events or results of operations. Forward-looking statements specifically include, without limitation, the information in this Form 10-K regarding: future sales, earnings, cash flow, revenue recognition, uses of cash and other measures of financial performance, projections or expectations for future operations, including costs to complete contracts, goodwill impairment evaluations, useful life of intangible assets, unrecognized tax benefits and effective tax rate, environmental remediation costs, insurance recoveries, industry trends and expectations, including ramp up times for build rates, our plans with respect to restructuring activities, capital expenditures, completed acquisitions, future acquisitions and dispositions, and expected business opportunities that may be available to us.

Although we believe that the expectations reflected in the forward-looking statements are based on reasonable assumptions, these forward-looking statements are subject to numerous factors, risks and uncertainties that could cause actual outcomes and results to be materially different from those projected. We cannot guarantee future results, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. All written and oral forward-looking statements made in connection with this Form 10-K that are attributable to us or persons acting on our behalf are expressly qualified in their entirety by “Risk Factors” contained within Part I, Item 1A of this Form 10-K and other cautionary statements included herein. We are under no duty to update any of the forward-looking statements after the date of this Form 10-K to conform such statements to actual results or to changes in our expectations.

The information in this Form 10-K is not a complete description of our business. There can be no assurance that other factors will not affect the accuracy of these forward-looking statements or that our actual results will not differ materially from the results anticipated in such forward-looking statements. While it is impossible to identify all such factors, some factors that could cause actual results to differ materially from those estimated by us include, but are not limited to, those factors or conditions described under Risk Factors contained within Part I, Item 1A of this Form 10-K and the following:

•our ability to manage and otherwise comply with our covenants with respect to our outstanding indebtedness;

•our ability to service our indebtedness;

•our acquisitions, business combinations, joint ventures, divestitures, or restructuring activities may entail certain operational and financial risks;

•the cyclicality of our end-use markets and the level of new commercial and military aircraft orders;

•industry and customer concentration;

•production rates for various commercial and military aircraft programs;

•the level of U.S. Government defense spending, including the impact of sequestration;spending;

•compliance with applicable regulatory requirements and changes in regulatory requirements, including regulatory requirements such as the Cybersecurity Maturity Model Certification (“CMMC”), applicable to government contracts and sub-contracts;sub-contracts, and the Securities and Exchange Commission’s (“SEC”) “Cybersecurity Risk Management, Strategy, Governance, and Incident Disclosure” rule;

•further consolidation of customers and suppliers in our markets;

•product performance and delivery;

•start-up costs, manufacturing inefficiencies and possible overruns on contracts;

•increased design, product development, manufacturing, supply chain and other risks and uncertainties associated with our growth strategy to become a Tier Two supplier of higher-level assemblies;

•our ability to manage the risks associated with international operations and sales;

possible goodwill and other asset impairments;

•economic and geopolitical developments and conditions;conditions, including supply chain issues and rising or higher interest rates;

•environmental, social, and governance (“ESG”) developments and their related impact;

•pandemics, such as the COVID-19 pandemic, significantly impacting the global economy and most significantly, the commercial aerospace end-use market;

•disasters, natural or otherwise, damaging or disrupting our operations;

•unfavorable developments in the global credit markets;

•our ability to operate within highly competitive markets;

•technology changes and evolving industry and regulatory standards;

•possible goodwill and other asset impairments;

•the risk of environmental liabilities;

•the risk of cybersecurity attacks, along with a potential significant ransom demand, or our inability to detect such attacks; and

•litigation with respect to us.

We caution the reader that undue reliance should not be placed on any forward-looking statements, which speak only as of the date of this Form 10-K. We do not undertake any duty or responsibility to update any of these forward-looking statements to reflect events or circumstances after the date of this Form 10-K or to reflect actual outcomes.except as required by law.

PART I

ITEM 1. BUSINESS

GENERAL

Ducommun Incorporated (“Ducommun,” “the Company,” “we,” “us” or “our”) is a leading global provider of engineering and manufacturing services for high-performance products and high-cost-of failure applications used primarily in the aerospace and defense (“A&D”), industrial, medical and other industries (collectively, “Industrial”). Ducommun differentiates itself as a full-service solution-based provider, offering a wide range ofinnovative, value-added proprietary products and servicesmanufacturing solutions to our customers in our primary businesses of electronics, structures, and integrated solutions. We operate through two primary business segments: Electronic Systems and Structural Systems. We are the successor to a business that was founded in California in 1849 and reincorporated in Delaware in 1970.

ACQUISITIONS

Acquisitions have been an important element of our growth strategy. We have supplemented our organic growth by identifying, acquiring and integrating acquisition opportunities that result in broader, more sophisticated product and service offerings while diversifying and expanding our customer base and markets.

For example, in September 2017,on April 25, 2023, we acquired all100% of the outstanding equity interests of Lightning Diversion Systems, LLC (the “LDS Acquisition”BLR Aerospace L.L.C. (“BLR”), a worldwide leader in lightning protectionprivately-held leading provider of aerodynamic systems servingthat enhance the aerospaceproductivity, performance, and defense industries for $60.0safety of rotary and fixed-wing aircraft on commercial and military platforms. The initial purchase price was $115.0 million, (netnet of cash acquired), funded by drawing down on our revolving credit facility.acquired. We paid a gross aggregate of $117.0 million in cash upon the closing of the transaction. We utilized the 2022 Revolving Credit Facility (as defined below) to complete the acquisition. The LDS Acquisition is partacquisition of BLR adds to our strategy to enhance revenue growth by focusing on advanced proprietary technology on various aerospacediversify and defense platforms.offer more customized, value-driven engineered products with aftermarket opportunities, and was included in our Structural Systems segment.

PRODUCTS AND SERVICES

Business Segment Information

We operate through two primary strategic businesses, Electronic Systems and Structural Systems, each of which is a reportable segment. The results of operations among our operating segments vary due to differences in competitors, customers, extent of proprietary deliverables and performance. Electronic Systems designs, engineers and manufactures high-reliability electronic and electromechanical products used in worldwide technology-driven markets including A&D and Industrial end-use markets. Electronic Systems’ product offerings primarily range from prototype development to complex assemblies as discussed in more detail below. Structural Systems designs, engineers and manufactures large,various sizes of complex contoured aerostructure components and assemblies and supplies composite and metal bonded structures and assemblies. Structural Systems’ products are primarily used on commercial aircraft, military fixed-wing aircraft and military and commercial rotary-wing aircraft.

Electronic Systems

Electronic Systems has multiple major product offerings in electronics manufacturing for diverse, high-reliability applications: complex cable assemblies and interconnect systems, printed circuit board assemblies, higher-level electronic, electromechanical, and mechanical components and assemblies, and lightning diversion systems. Components, assemblies, and

lightning diversion products are provided principally for domestic and foreign commercial and military fixed-wing aircraft, military and commercial rotary-wing aircraft and space programs. Further, we provide select industrial high-reliability applications for the industrial, automation and medical, and other end-use markets. We build custom, high-performance electronics and electromechanical systems. Our products include sophisticated radar enclosures, aircraft avionics racks and shipboard communications and control enclosures, printed circuit board assemblies, cable assemblies, wire harnesses, and interconnect systems, lightning diversion strips, surge suppressors, conformal shields and other high-level complex assemblies. Electronic Systems utilizes a highly-integrated production process, including manufacturing, engineering, fabrication, machining, assembly, electronic integration, and related processes. Engineering, technical and program management services including design, development, and integration and testing of circuit card assemblies and cable assemblies, are provided to a wide range of customers.

In response to customer needs and utilizing our in-depth engineering expertise, Electronic Systems is also considered a leading supplier of engineered products including, illuminated pushbutton switches and panels for aviation and test systems, microwave and millimeter switches and filters for radio frequency systems and test instrumentation, and motors and resolvers for motion control.

control, and lightning diversion systems.

Electronic Systems also provides engineering expertise for aerospace system design, development, integration, and testing. We leverage the knowledge base, capabilities, talent, and technologies of this focused capability into direct support of our customers.

Structural Systems

Structural Systems has three major product offerings to support a global customer base: commercial aircraft, military fixed-wing aircraft, and military and commercial rotary-wing aircraft. Our applications include structural components, structural assemblies, and bonded (metal and composite) components.components, precision profile extrusions and extruded assemblies, ammunition handling systems, magnetic seals, and aerodynamic systems. In the structural components products, Structural Systems designs,provides design services, engineers, and manufacturesmanufacturing of large complex contoured aluminum, titanium and Inconel® aerostructure components for the aerospace industry. Structural assembly products include winglets, engine components, and fuselage structural panels for aircraft. Metal and composite bonded structures and assemblies products include aircraft wing spoilers, large fuselage skins, rotor blades on rotary-wing aircraft and components, flight control surfaces, engine components, ammunition handling systems, magnetic seals, and engine components.aerodynamic systems. To support these products, Structural Systems maintains advanced machine milling, stretch-forming, hot-forming, metal bonding, composite layup, and chemical milling capabilities and has an extensive engineering capability to support both design services and manufacturing.

AEROSPACE AND DEFENSE END-USE MARKETS OVERVIEW

Our largest end-use markets are the aerospace and defense markets and our revenues from these markets represented 90%94% of our total net revenues in 2017.2023. These markets are serviced by suppliers which are stratified, from the lowesthighest value provided to the highest,lowest, into four tiers: Tier Three, Tier Two, Tier One and original equipment manufacturers (“OEMs”)., Tier One, Tier Two, and Tier Three. The OEMs provide the highest value and are also known as prime contractors (“Primes”). We derive a significant portion of our revenues from subcontracts with OEMs. As the prime contractorPrimes for various programs and platforms, the OEMs sell to their customers, who may include, depending upon the application, the U.S. Federal Government, foreign, state and local governments, global commercial airline carriers, regional jet carriers and various other customers. The OEMs also sell to global leasing companies that lease commercial aircraft. A significant portion of our revenues is earned from subcontracts with the Primes. Tier ThreeOne suppliers principally provide components or detailed parts.manufacture aircraft sections and purchase assemblies. Tier Two suppliers provide more complex, value-added parts and may also assume more design risk, manufacturing risk, supply chain risk and project management risk than Tier Three suppliers. Tier OneThree suppliers manufacture aircraft sections and purchase assemblies.principally provide components or detailed parts. We currently compete primarily with Tier One, Tier Two, and Tier Three suppliers. Our business growth strategy is to differentiate ourselves from competitors by providing more complex assemblies to our customers as a Tier Twohigher value added supplier.

Commercial Aerospace End-Use Market

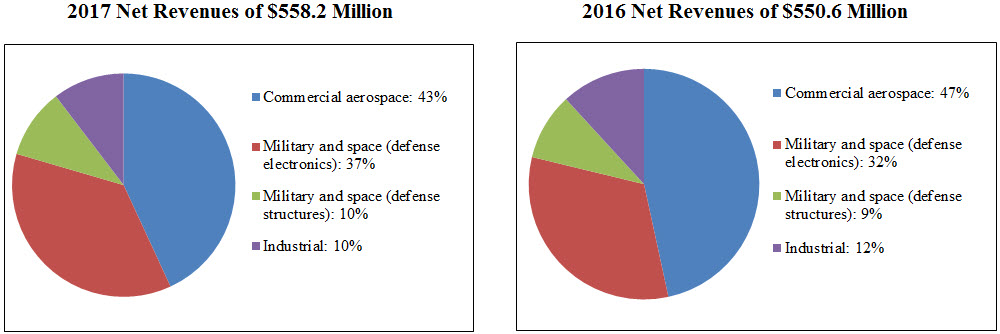

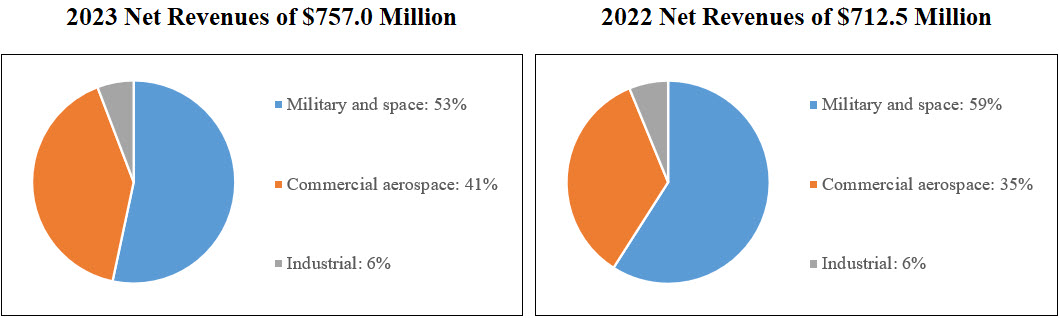

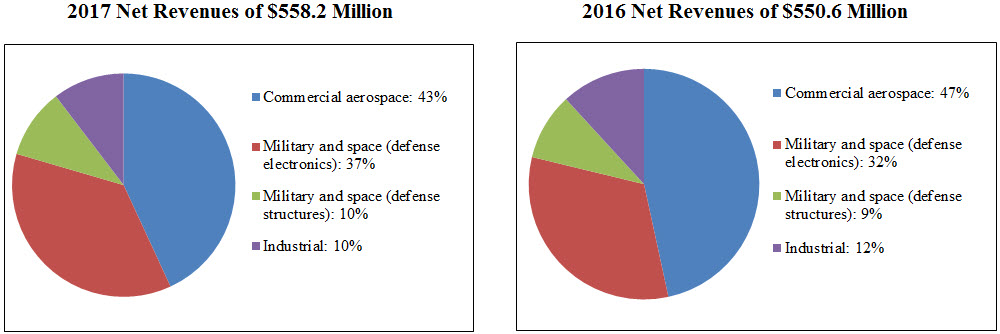

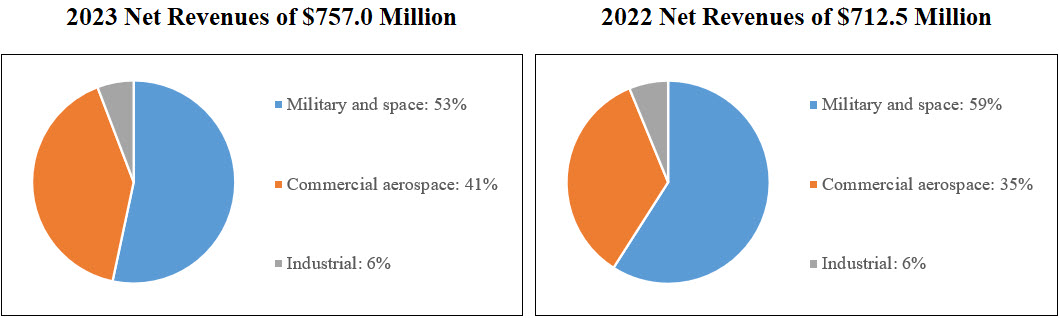

The commercial aerospace end-use market is highly cyclical and is impacted by the level of global air passenger traffic in general, which in turn is influenced by global economic conditions, fleet fuel and maintenance costs, geopolitical developments, pandemics, supply chain issues, and geopolitical developments.inflationary forces. Revenues from the commercial aerospace end-use market represented 43%41% of our total net revenues for 2017.2023.

Global economic growth,The residual effects of the COVID-19 pandemic and the resulting inflation, rising or high interest rates, supply chain issues, geopolitical developments, and other events have contributed and/or continues to contribute to a primary drivergeneral slowdown in the global economy and most significantly, the adverse impact on demand for civil air travel,travel. Further, one of our largest customers, The Boeing Company (“Boeing”), was notified by the Federal Aviation Administration (“FAA”) in early January 2024 it has returnedinitiated an investigation into Boeing’s quality control system. This was followed by the FAA announcing actions to increase its oversight of Boeing as well as not approving production rate increases or additional production lines for the long-term annual average737 MAX until it is

satisfied that Boeing is in 2017 is estimated to grow by more than seven percent, exceeding the long-term trend of approximately five percent.full compliance with required quality control procedures. While growth was strong across all major world regions, there continues to be variation between regionsuncertainty, Boeing is continuing to work with airlines and airline business models. Airlines operatinggovernment officials on delivery timing and expect to deliver most of the aircraft in inventory by the Asia Pacific regionsend of 2024. The combination of these factors has, in turn, created a significant challenge for some of our customers and Europe, as well as low-cost-carriers globally, are currently leading the growth in passenger traffic.

In addition, airlineentire commercial aerospace manufacturing and services sector. Airline financial performance, which also plays a role in the demand for new capacity. Airlines continuecapacity, has been adversely impacted by the COVID-19 pandemic and aforementioned issues. According to focusthe International Air Transport Association (“IATA”), it is estimating industry-wide profits of $23.3 billion for 2023, an increase from its forecast of $4.6 billion a year ago. For 2024, IATA is forecasting $25.7 billion in profits for the industry globally. Thus, the overall outlook continues to stabilize as we face uncertainties in the environment in the near-to medium-term as airlines are facing persistently high and volatile cost of fuel and tight labor conditions. The global economy is expecting an easing of inflation and interest rates, with regional economic and geopolitical difficulties adding uncertainty to the outlook and the financial viability of some airlines and regions.

In The Boeing Company’s (“Boeing”) 2023 Annual Report on increasing revenue through alliances, partnerships, new marketing initiatives,Form 10-K filed with the Securities and effective leveraging of ancillary servicesExchange Commission (the “SEC”), they indicated that in 2023, global air traffic largely recovered to 2019 levels with domestic travel continuing to be the most robust and related revenues. Airlines are also focusing on reducing coststhe single-aisle market following closely. International travel has mostly recovered and renewing fleetsthe wide-body market continues to leverage more efficient airplanes. Net profitsbe paced by the international travel recovery. The transition in 2017 are expectedthe international commercial market from recovery to approximate $35 billion, consistent with 2016.

Further, the availability of internal or external funding impacts commercial aircraft build rates. Failure of ournormal market conditions is progressing slowly as China international travel remains below 2019 levels. Overall, Boeing is experiencing strong demand from its airline customers to obtain financing may result in cancellation or deferral of orders.globally.

The long-term outlook for the industry continues to remainremains positive due to the fundamental drivers of air travel growth:demand: economic growth, and the increasing propensity to travel due to increased trade, globalization, and improved airline services driven by liberalization of air traffic rights between countries. The Boeing Company’s (“Boeing”)Boeing’s commercial market outlook forecast projects a three and a half percent growth rate in the global fleet over a 20 year forecast projections in their 2017 Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) projects a long-term average growth rate of almost five percent per year for passenger traffic and more than four percent for cargo traffic. This is basedperiod. Based on long-term global economic growth projections of almost threetwo and six tenths percent average annual gross domestic product (“GDP”) growth, Boeing projects a $6 trillion marketdemand for more than 41,00042,595 new airplanes over the next 20 years. However, the industry remains vulnerable to various developments including fuel price spikes, credit market fluctuations, acts of terrorism, natural disasters, conflicts, epidemics, pandemics, and increased global environmental regulations. We believe we are well positioned given our product capabilities, investment in inventories and contract assets, and our initiatives to increase operating efficiencies to participate in the steadynear term recovery and the long term projected growth rate for commercial air traffic and build rates for large commercial aircraft for the airframe manufacturing industry.

If the recovery is slower than anticipated or any of those various developments occur, it could have a material adverse effect on our results of operations, financial position, and/or cash flows.

Defense End-Use Market

Our defense end-use market includes products used in military and space, including technologies and structures applications. The defense end-use market is highly cyclical and is impacted by the level of government defense spending. Government defense spending is impacted by national defense policies and priorities, political climates, fiscal budgetary constraints, U.S. Federal budget deficits, projected economic growth and the level of global military or security threats, or other conflicts. Revenues from the military and space end-use market in 20172023 represented 47%53% of our total net revenues during 2017.2023.

In November 2017,The U.S. government is currently operating under a continuing resolution (“CR”) to keep the government funded while the Congress passed the National Defense Authorization Act forworks to enact full year fiscal year 20182024 (“FY2018”FY24”), appropriation bills. Under the Fiscal Responsibility Act of 2023, which authorizes a U.S. Department of Defense (“U.S. DoD”) budget topline higher than the administration’s budget request from May. While the appropriations process for FY2018 remains incomplete, both the House and Senate appropriations committees have also produced bills that increase the U.S. DoD budget topline above the administration’s request. On February 9, 2018, Congress passed a fifth Continuing Resolution that maintains current funding levels through March 23, 2018 and includes increases to the Budget Control Act capsimposes limits on discretionary spending for defense and non-defense spendingprograms in exchange for FY2018 and FY2019. However, the Budget Control Act continues to mandate limits on U.S. government discretionary spending and remains in effect. As a result, continued budget uncertainty and the risk of future sequestration cuts will remain unless Congress acts to repeal or suspend this law.

Funding timeliness also remains a risk. If Congress is unable to pass appropriations bills or an omnibus spending bill before the expirationlifting of the current Continuing Resolution, a government shutdown could result which may have impacts abovedebt ceiling in June 2023, if Congress fails to enact all appropriation bills by April 30, 2024, then the budget caps will be reduced and beyond those resulting fromcorresponding automatic reductions to agency budget cuts, sequestration impacts or program-level appropriations. For example, requirements to furlough employees in the U.S. DoD, the Department of Transportation, or other government agencies could result in payment delays, impair our ability to perform work on existing contracts, and/or negatively impact future orders.

In addition, there continues toaccounts will be uncertainty with respect to program-level appropriations for the U.S. DoD and other government agencies, including the National Aeronautics and Space Administration (“NASA”), within the overall budgetary framework described above.enforced through sequestration. Future budget cuts or investment priority changes, including changes associated with the authorizations and appropriations process, could result in reductions, cancellations, and/or delays of existing contracts or programs. Any of these impacts could have a material effect on theour results of our operations, financial position, and/or cash flows. For additional information related to our revenues from customers whose principal sales are to the U.S. Government and our direct sales to the U.S. Government, see “Risk Factors” contained within Part I, Item 1A of this Annual Report on Form 10-K (“Form 10-K”).

INDUSTRIAL END-USE MARKETS OVERVIEW

Our industrial, medical and other (collectively, “Industrial”) end-use markets are diverse and are impacted by the customers’ needs for increasing electronic content and a desire to outsource. Factors expected to impact these markets include capital and industrial goods spending and general economic conditions. Our products are used in heavy industrial manufacturing systems and certain medical applications. Revenues from the Industrial end-use markets were 10%6% of our total net revenues during 2017.2023.

We believe our business in these markets has stabilizedin the long-term, is stable and we are well positioned forin these markets.markets even though the residual effects of the COVID-19 pandemic and the resulting inflation, rising or high interest rates, and supply chain issues has had and will continue to have an impact on our business.

SALES AND MARKETING

Our commercial revenues are substantially dependent on airframe manufacturers’ production rates of new aircraft. Deliveries of new aircraft by airframe manufacturers are dependent on the demand and financial capacity of its customers, primarily airlines and leasing companies, to purchase the aircraft. Thus, revenues from commercial aircraft could be affected as a result of changes in new aircraft orders, or the cancellation or deferral by airlines of purchases of ordered aircraft. Further, our revenues from commercial aircraft programs could be affected by changes in our customers’ inventory levels and changes in our customers’ aircraft production build rates. In recent years,rates as a result of changing demand by their end customer or in order to comply with regulatory requirements. Due to the effects from the lingering COVID-19 pandemic or regulatory compliance requirements, while both major large aircraft manufacturers, Boeing and Airbus SE (“Airbus”), have announced higherimproved build rates, dueit will take longer to increasesreach pre-COVID-19 pandemic levels. While the ramp up in production of existing programs, including more fully-developed models, and bydemand will be slower in the introduction of new platforms.near and medium future, we will continue to identify opportunities to expand our presence and offerings with both major large aircraft manufacturers and their supply chain.

Military components manufactured by us are employed in many of the country’s front-line fighters, bombers, rotary-wing aircraft and support aircraft, as well as land and sea-based applications. Our defense business is diversified among a number of military manufacturers and programs. In the space sector, we are expanding our presence with unmanned aerial vehicles and continue to support various unmanned launch vehicle and satellite programs.

Our sales into the Industrial end-use markets are customer focused in the various markets and driven primarily by their capital spending and manufacturing outsourcing demands.

We continue to broaden and diversify our customer base in the end-use markets we serve by providing innovative product and service solutions throughby drawing on our core competencies, experience and technical expertise. Net revenues related to military and space, (defense technologies and defense structures), commercial aerospace, and Industrial end-use markets in 20172023 and 20162022 were as follows:

Many of our contracts are firm fixed price contracts subject to termination at the convenience of the customer (as well as for default). In the event of termination for convenience, the customer generally is required to pay the costs we have incurred and certain other fees through the date of termination.termination, plus a reasonable profit. Larger, long-term government subcontracts may have provisions for milestone payments, progress payments or cash advances for purchase of inventory.

Our marketing efforts primarily consist of developing strong, long-term relationships with our customers, which provide the basis for future sales. These close relationships allow us to gain a better insight into each customer’s business needs, identify ways to provide greater value to the customer, and allow us to be designeddesignated early in early inthe design process for various products and/or high volume products.

SEASONALITY

The timing of our revenues is governed by the purchasing patterns of our customers, and, as a result, we may not generate revenues equally during the year. However, no material portion of our business is considered to be seasonal.

MAJOR CUSTOMERS

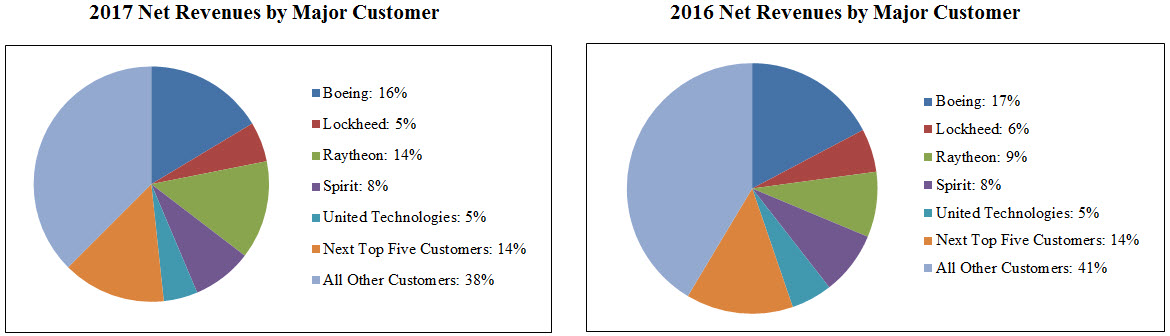

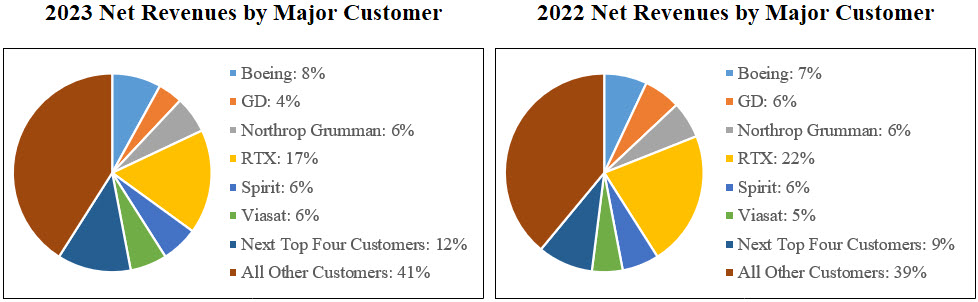

We currently generate the majority of our revenues from the aerospace and defense industries. As a result, we have significant revenues from certain customers. Boeing and RTX Corporation (f/k/a Raytheon CompanyTechnologies Corporation) (“Raytheon”RTX”) were each greater than 10 percentour largest customers, with Boeing generating 8.2% and Lockheed Martin Corporation (“Lockheed Martin”), Spirit AeroSystems Holdings, Inc. (“Spirit”), and United Technologies Corporation (“United Technologies”) each were greater than five percentRTX generating 16.8% of our 20172023 net revenues. Revenues from our top ten

10 customers, including Boeing Raytheon, Lockheed Martin, Spirit, and United Technologies,RTX, were 62%59% of total net revenues during 2017.2023. Net revenues by major customer for 20172023 and 20162022 were as follows:

Net revenues from our customers, except the U.S. Government, are diversified over a number of different military and space, commercial aerospace, industrial, medical and other products. For additional information on revenues from major customers, see Note 1816 to our consolidated financial statements included in Part IV, Item 15(a) of this Form 10-K.

RESEARCH AND DEVELOPMENT

We perform concurrent engineering with our customers and product development activities under our self-funded programs, as well as under contracts with others. Concurrent engineering and product development activities are performed for commercial, military and space applications.

RAW MATERIALS AND COMPONENTS

Raw materials and components used in the manufacturing of our products include aluminum, titanium, steel and carbon fibers, as well as a wide variety of electronic interconnect and circuit card assemblies and components. These raw materials are generally available from a number of suppliers and are generally in adequate supply. However, from time to time, and due to the lingering effects from the COVID-19 pandemic, we have experienced increases in lead times for and limited availability of various items including aluminum, titanium and certain other raw materials and/or components. Moreover, certain components, supplies and raw materials for our operations are purchased from single source suppliers and occasionally, directed by our customers. In such instances, we strive to develop alternative sources and design modifications to minimize the potential for business interruptions.

COMPETITION

The markets we serve are highly competitive, and our products and services are affected by varying degrees of competition. We compete worldwide with domestic and international companies in most markets. These companies may have competitive advantages as a result of greater financial resources, economies of scale and bundled products and services that we do not offer. Additional information related to competition is discussed in Risk Factors contained within Part I, Item 1A of this Form 10-K. Our ability to compete depends principally upon the breadth of our technical capabilities, the quality of our goods and services, competitive pricing, product performance, design and engineering capabilities, new product innovation, the ability to solve specific customer needs, and customer relationships.

PATENTS AND LICENSES

We have several patents, but we do not believe that our operations are dependent upon any single patent or group of patents. In general, we rely on technical superiority, continual product improvement, exclusive product features, superior lead time, on-time delivery performance, quality, and customer relationships to maintain our competitive advantage.

REMAINING PERFORMANCE OBLIGATIONS AND BACKLOG

We define backlogperformance obligations as customer placed purchase orders (“POs”) and long-term agreements (“LTAs”) with firm fixed price and firm delivery dates. The majority of the long-term agreements (“LTAs”) we enter into do not meet the definition of a contract under Accounting Standards Codification 606 (“ASC 606”) and thus, the backlog amount may or may not be greater than the remaining performance obligations amount as defined under ASC 606. Revenue based on remaining performance obligations is subject to delivery delays or program cancellations, which are beyond our control. Remaining performance obligations were $963.5

million at December 31, 2023. We anticipate recognizing an estimated 70% or $674.0 million of our remaining performance obligations during 2024.

We define backlog as potential revenue that is based on customer placed POs and LTAs with firm fixed price and expected delivery dates of 24 months or less. Backlog is subject to delivery delays or program cancellations, which are beyond our control. Backlog is affected by timing differences in the placement of customer orders, and tends to be concentrated in certainseveral programs and customers.to a greater extent, than our net revenues. As a result of these factors, trends in our overall level of backlog may not be indicative of trends in our future net revenues. Backlog was $726.5$993.6 million at December 31, 2017,2023, compared to $641.3$960.8 million at December 31, 2016.2022. The increase in backlog was primarily in the commercial aerospace and military and space end-use markets, partially offset by a decrease in the commercial aerospace end-use markets and the industrial end-use markets. $544.0 million of total backlog is expected to be delivered during 2018.

ENVIRONMENTAL MATTERS

Our business, operations and facilities are subject to numerous stringent federal, state and local environmental laws and regulations issued by government agencies, including the Environmental Protection Agency (“EPA”). Among other matters, these regulatory authorities impose requirements that regulate the emission, discharge, generation, management, transport and disposal of hazardous and non-hazardous materials, pollutants and contaminants. These regulations govern public and private response actions to hazardous or regulated substances that threaten to release,could be or have been released tointo the environment, or endanger human health, and they require us to obtain and maintain licenses and permits in connection with our operations. We may also be required to investigate and remediate the effects of the release or disposal of materials at sites associated with past and present operations. Additionally, this extensive regulatory framework imposes significant compliance burdens and risks on us. For example, California recently passed two wide-reaching bills that will impose significant and mandatory climate-related reporting requirements for large public and private companies doing business in the state. The bills will ultimately require annual disclosure of audited Scope 1, 2, and 3 greenhouse gas (“GHG”) emissions and biennial disclosure related to certain climate risks beginning in January 2026. We anticipate that capital expenditures will continue to be required for the foreseeable future to upgrade and maintain our environmental compliance efforts, however, we currently do not expect such expenditures to be material in 20182024 and the foreseeable future.near term.

Structural Systems has been directed by California environmental agencies to investigate and take corrective action for groundwater contamination at its facilities located in Adelanto (a.k.a., El Mirage) and Monrovia, California. Based on currently available information, we have accrued $1.5 million at December 31, 2023 for our estimated liabilities related to these sites. For further information, see Note 1715 in the accompanying notes to consolidated financial statements included in Part IV, Item 15(a) of this Form 10-K. In addition, see Risk Factors contained within Part I, Item 1A of this Form 10-K for certain risks related to environmental matters.

HUMAN CAPITAL

EMPLOYEESOur employees are critical to our success. We promote a culture of honesty, respect, trust, and teamwork through our Code of Business Conduct. Also, we have been engaged in a number of social matters and issues, both within the Company in our management of human capital, and externally with our community based initiatives.

Employee Safety and Health

The safety of our workforce remains our highest priority as evidenced by our response to the COVID-19 pandemic over the last four years. To this end, we continue to focus on protecting the health and safety of our employees and maintaining a safe work environment, including during the COVID-19 pandemic where we followed the COVID-19 safety guidelines provided by state and local governments and the Centers for Disease Control and Prevention at all of our facilities.

We implemented the use of employee health and safety key performance indicators (“KPIs”) that were regularly communicated to our employees by senior management to improve safety outcomes. In 2023, we continued to invest in infrastructure to improve internal safety protocols related to key processes and refined our health and safety software tools to track and engage our performance centers to further reduce our lost time and total recordable incident rates.

Diversity and Inclusion

Diversity and inclusion has been and will continue to be important to our success. As part of our continuing improvement in this area, we implemented diversity and inclusion initiatives in 2019 to help accelerate the process of developing diverse, and qualified talent and applicant pools. To that end, we are seeing an increase in the number of women and individuals from underrepresented communities being promoted on merit into leadership roles. In 2020, we partnered with the Fund II Foundation to utilize its innovative internX platform to provide access to highly qualified and diverse science, technology, engineering and math (“STEM”) students. We believe that broadening the diversity of our pool of potential qualified applicants at the intern level will support our efforts at a diverse workforce reflective of the population and help us continue to develop a more diverse leadership team as our interns continue in their careers.

Talent Acquisition, Retention, and Development

We attract, develop, and retain employee talent by offering competitive compensation packages and fostering a culture of care about their well-being. In addition, we endeavor to be a proactive corporate citizen by being responsive and supportive of the needs of our employees to attract qualified talent. We strive to provide equal opportunities for qualified members of underrepresented communities and women for advancement within our company and award merit-based scholarships to the children and grandchildren of our employees so that they may develop the skills that will support their entry into the workforce. In addition, in 2018, we implemented an Employee Stock Purchase Plan (“ESPP”) to provide employees the opportunity to share in the ownership of our company and benefit from our performance through the purchase of our company’s stock. The ESPP allows eligible employees to accumulate contributions through after-tax payroll deductions to purchase shares of our Company’s stock at a 15% discount and serves as one of the key retention mechanisms for our human capital.

Workforce Demographics

As of December 31, 2017,2023, we employed 2,600 people,had a highly skilled workforce of 2,265 employees, of which 360368 are subject to collective bargaining agreements expiring in April 2025 and June 20182024. However, the Monrovia, California performance center that employs 97 of our collective bargaining employees that are covered by an agreement expiring in June 2024 will be ceasing production and January 2019. Wethe facility will close by the middle of 2024. See Note 3 to our consolidated financial statements included in Part IV, Item 15(a) of this Form 10-K for further discussion. Historically, we have been successful in negotiating renewals to expiring agreements without material disruption of operating activities, and believe our relations with our employees are good. See Risk Factors contained within Part I, Item 1A of this Form 10-K for additional information regarding certain risks related to our employees.

AVAILABLE INFORMATION

General information about us can be obtained from our website address at www.ducommun.com. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports, if any, are available free of charge on our website as soon as reasonably practicable after they are filed with or furnished to the SEC. Information included inon our website is not incorporated by reference in this Annual Report on Form 10-K. The SEC also maintains a website at www.sec.gov that contains reports, proxy statements and other information regarding SEC registrants, including our company.

ITEM 1A. RISK FACTORS

Our business, financial condition, results of operations and cash flows may be affected by known and unknown risks, uncertainties and other factors. We have summarized below the significant, known material risks to our business. Additional risk factors not currently known to us or that we currently believe are immaterial may also impair our business, financial condition, results of operations and cash flows. Any of these risks, uncertainties and other factors could cause our future financial results to differ materially from recent financial results or from currently anticipated future financial results. The risk factors below should be considered together with the information included elsewhere in this Annual Report on Form 10-K (“Form 10-K”) as well as other required filings by us towith the SEC.

RISKS RELATED TO OUR CAPITAL STRUCTURE RISKS

Our indebtedness could limit our financing options, adversely affect our financial condition, and prevent us from fulfilling our debt obligations.

In July 2015,2022, we completed thea refinancing of our then existing debt by entering into a new term loan (“2022 Term Loan”) and a new revolving credit facility to replace the existing credit facilities. This credit facility consists of(“2022 Revolving Credit Facility”). The 2022 Term Loan is a $275.0$250.0 million senior secured term loan whichthat matures on June 26, 2020 (“Term Loan”), andin July 2027. The 2022 Revolving Credit Facility is a $200.0 million senior secured revolving credit facility (“that matures in July 2027. The 2022 Term Loan and 2022 Revolving Credit Facility”), which matures on June 26, 2020 (collectively,Facility, collectively are the “Creditnew credit facilities (“2022 Credit Facilities”). The terms of the 2022 Term Loan require us to make installment payments of 0.625% of the initial outstanding principal balance on a quarterly basis during years one and two, 1.250% during years three and four, and 1.875% during year five, on the last business day of each calendar quarter. In addition, the undrawn portion of the commitment of the 2022 Revolving Credit Facility is subject to a commitment fee ranging from 0.175% to 0.275%, based upon the consolidated total net adjusted leverage ratio.

At December 31, 2017,2023, we had a total of $218.1$266.0 million of outstanding long-term debt which was comprised of $160.0 million under the Term Loan and $58.1 million under the Revolving2022 Credit Facility.Facilities. The total long-term debt was primarily the result of our acquisitions, LaBarge Inc. in 2011 and LDSincluding Lightning Diversion Systems, LLC (“LDS”) in September 2017. There are no further required payments under the Credit Facilities until June 2020.2017, Certified Thermoplastics Co., LLC (“CTP”) in April 2018, Nobles Worldwide, Inc. (“Nobles”) in October 2019, and BLR Aerospace, L.L.C. (“BLR”) on April 25, 2023.

Our ability to obtain additional financing or complete a debt refinancing in the future may be limited, as discussed below in this risk factor. Welimited. Should we not have ready access to capital markets, we may have to undertake alternative financing plans, such as selling assets; reducing or delaying scheduled expansions, acquisitions and/or capital investments; or seeking various other forms of capital. Our ability to complete reasonable alternative financing plans may be affected by circumstances and economic events outside of our control. We cannot ensure that we would be able to refinance our debt or enter into alternative financing plans in adequate amounts on commercially reasonable terms, terms acceptable to us or at all, or that such plans guarantee that we would be able to meet our debt obligations.

Our level of debt could:

•limit our ability to obtain additional financing to fund future working capital, capital expenditures, investments or acquisitions or other general corporate requirements;

•require a substantial portion of our cash flows to be dedicated to debt service payments instead of other purposes, thereby reducing the amount of cash flows available for working capital, capital expenditures, investments or acquisitions or other general corporate purposes;

•increase our vulnerability to adverse changes in general economic, industry and competitive conditions;

•place us at a disadvantage compared to other, less leveraged competitors;

•expose us to the risk of increased borrowing costs and higherrising or high interest rates as approximately 40%a portion of our current borrowings under our 2022 Credit Facilities bear interest at variable rates (our interest rate swaps, with an aggregate total notional amount of $150.0 million and seven year tenor, became effective on January 1, 2024), which could further adversely impact our cash flows;

•limit our flexibility to plan for and react to changes in our business and the industry in which we compete;

•restrict us from making strategic acquisitions or causing us to make non-strategic divestitures;acquisitions;

•expose us to risk of unfavorable changes in the global credit markets; and

•make it more difficult for us to satisfy our obligations with respect to the 2022 Credit Facilities and our other debt.

The occurrence of any one of these events could have an adverse effect on our business, financial condition, results of operations and ability to satisfy our obligations in respect of our outstanding debt.

We require a considerable amount of cash to servicerun our indebtedness.business.

Our ability to make payments on our debt in the future and to fund planned capital expenditures and working capital needs, will depend upon our ability to generate significant cash in the future. Our ability to generate cash is subject to economic, financial, competitive, legislative, regulatory and other factors that may be beyond our control.

The terms of the 2022 Term Loan require us to make installment payments of 0.625% of the initial outstanding principal balance on a quarterly basis during years one and two, 1.250% during years three and four, and 1.875% during year five, on the last business day of each calendar quarter. In addition, the undrawn portion of the commitment of the 2022 Revolving Credit Facilities bear interest, at our option, atFacility is subject to a rate equal to either (i) the Eurodollar Rate (defined as a London Interbank Offered Rate [“LIBOR”]) plus an applicable margincommitment fee ranging from 1.50%0.175% to 2.75% per year or (ii) the Base Rate (defined as the highest of [a] Federal Funds Rate plus 0.50%0.275%, [b] Bank of America’s prime rate, and [c] the Eurodollar Rate plus 1.00%) plus an applicable margin ranging from 0.50% to 1.75% per year, in each case based upon the consolidated total net adjusted leverage ratio, typicallyratio.

On April 25, 2023, we acquired 100% of the outstanding equity interests of BLR for an initial purchase price of $115.0 million, net of cash acquired, all payable quarterly. in cash. We paid a gross aggregate of $117.0 million in cash upon the closing of the transaction. We utilized the 2022 Revolving Credit Facility to complete the acquisition. See Note 2 to our consolidated financial statements included in Part IV, Item 15(a) of this Form 10-K for further discussion.

In October 2015,July 2022, as a result of completing a refinancing of our existing debt, we were required to complete an amendment of all the forward interest rate swaps (“Amended Forward Interest Rate Swaps”) we entered into interestin November 2021 that were based on U.S. dollar-one month London Interbank Offered Rate (“LIBOR”) to be based on one month Term Secured Overnight Financing Rate (“SOFR”) as borrowings can only be based on SOFR. The Amended Forward Interest Rate Swaps, with an aggregate total notional amount of $150.0 million and all with a seven year tenor, became effective on January 1, 2024. The weighted average fixed rate cap hedges designated as cash flow hedges, with maturity dates of June 2020 and notional value in aggregate, totaling $135.0 million.the Amended Forward Interest Rate Swaps was 1.7%. At December 31, 2017,2023, the outstanding balance on the 2022 Credit Facilities was $218.1$266.0 million with an average interest rate of 3.73%7.53%. Should interest rates increase significantly, even though $135.0 million of our debt was hedged, our debt service cost on the variable portion of our debt will increase. Any inability to generate sufficient cash flow could have a material adverse effect on our financial condition or results of operations. See Note 1 and Note 9 to our consolidated financial statements included in Part IV, Item 15(a) of this Form 10-K for further discussion.

While we expect to meet all of our financial obligations, we cannot ensure that our business will generate sufficient cash flow from operations in an amount sufficient to enable us to pay our debt or to fund our other liquidity needs.

We require a considerable amount of cash to fund our anticipated voluntary principal prepayments on our Credit Facilities.

Our ability to continue to reduce the debt outstanding under our 2022 Credit Facilities through voluntary principal prepayments will be a contributing factor to our ability to meet the leverage ratio covenant and keepingkeep our interest rate towards the lower end of the interest rate range as defined in the 2022 Credit Facilities. Our ability to make such prepayments will depend upon our ability to generate significant cash in the future. We cannot ensure that our business will generate sufficient cash flow from operations to fund any such prepayments.

The covenants in theour credit agreement to our Credit Facilitiesfacilities impose restrictions that may limit our operating and financial flexibility.

We are required to comply with a leverage covenant as defined in the credit agreement to the2022 Credit Facilities. The leverage covenant is defined as Consolidated Funded Indebtedness less unrestricted cash and cash equivalents in excess of $10.0$5.0 million, divided by consolidated earnings before interest, taxes and depreciation and amortization (“EBITDA”). The leverage covenant decreases over the term of the Credit Facilities, which will require us to lower our outstanding debt or increase our EBITDA in the future. We believe the voluntary prepayments on the Credit Facilities will help reduce our leverage, as defined in the credit agreement. and other adjustments.

At December 31, 2017,2023, we were in compliance with the leverage covenant under the 2022 Credit Facility.Facilities. However, there is no assurance that we will continue to be in compliance with the leverage covenant in future periods.

Our credit agreement to theThe 2022 Credit FacilitiesFacilities’ agreements contains a number of significant restrictions and covenants that limit our ability, among other things, to incur additional indebtedness, to create liens, to make certain payments, to make certain investments, to engage in transactions with affiliates, to sell certain assets or enter into mergers.

These covenants could materially and adversely affect our ability to finance our future operations or capital needs. Furthermore, they may restrict our ability to expand, pursue our business strategies and otherwise conduct our business. Our ability to comply with these covenants may be affected by circumstances and events beyond our control, such as prevailing economic conditions and changes in regulations, and we cannot ensure that we will be able to comply with such covenants. These restrictions also limit our ability to obtain future financings to withstand a future downturn in our business or the economy in general.

A breach of any covenant in credit agreement to the 2022 Credit Facilities wouldcould result in a default under the 2022 Credit Facilities agreement.Facilities. A default, if not waived, could result in acceleration of the debt outstanding under the agreement. A default could permit our lenders to foreclose on any of our assets securing such debt. Even if new financing were available at that time, it may not be on terms or amounts that are acceptable to us or terms as favorable as our current agreements. If our debt is in default for any reason, our business, results of operations and financial condition could be materially and adversely affected.

The typical trading volume of our common stock may affect an investor’s ability to sell significant stock holdings in the future without negatively impacting stock price.

The level of trading activity may vary daily and typically represents only a small percentage of outstanding shares. As a result, a stockholder who sells a significant amount of shares in a short period of time could negatively affect our share price.

Our amount of debt may require us to raise additional capital to fund operations.acquisitions.

We may sell additional shares of common stock or other equity securities to raise capital in the future, which could dilute the value of an investor’s holdings.

BUSINESS AND OPERATIONAL RISKS RELATED TO OUR BUSINESS

Our end-use markets are cyclical.

We sell our products into aerospace, defense, and industrial end-use markets, which are cyclical and have experienced periodic declines. Our sales are, therefore, unpredictable and may tend to fluctuate based on a number of factors, including global economic conditions, U.S. defense budgetary spending, geopolitical developments and conditions, pandemics, supply chain shortages, rising or high interest rates and other developments affecting our end-use markets and the customers served. Consequently, results of operations in any period should not be considered indicative of the operating results that may be experienced in any future period.

We depend upon a selectedselect base of industries and customers, which subjects us to unique risks which may adversely affect us.

We currently generate athe majority of our revenues from customers in the aerospace and defense industry. Our business depends, in part, on the level of new military and commercial aircraft orders. As a result, we have significant sales to certain

customers. Sales to theThe Boeing Company and(“Boeing”), Spirit AeroSystems Holdings, Inc. (“Spirit”), and Viasat, Inc. (“Viasat”) comprise the majoritya significant portion of our commercial aerospace end-use market.market in 2023. A significant portion of our net sales in our military and space end-use markets are made under subcontracts with OEMs,original equipment manufacturers (“OEMs”), under their prime contracts with the U. S. Government. We had significant sales to Lockheed MartinGeneral Dynamics Corporation (“GD”), Northrop Grumman Corporation (“Northrop”), and RTX Corporation (f/k/a Raytheon Company, and United Technologies CorporationCorporation) (“RTX”) in 20172023 in our defense technologies end-use market.

Our customers may experience delays in the launch and certification of new products, labor strikes, diminished liquidity or credit unavailability, weak demand for their products, or other difficulties in their business. In addition, sequestration and a shiftshifts in government spending priorities have caused and may continue to cause additional uncertainty in the placement of orders.

Our sales torevenues from our top ten customers, which represented 62%59% of our total 20172023 net revenues, were diversified over a number of different aerospace and defense and Industrial products. Any significant change in production rates by these customers would have a material effect on our results of operations and cash flows. There is no assurance that our current significant customers will continue to buy products from us at current levels, or that we will retain any or all of our existing customers, or that we will be able to form new relationships with customers upon the loss of one or more of our existing customers. This risk may be further complicated by pricing pressures, intense competition prevalent in our industry and other factors. A significant reduction in sales to any of our major customers, the loss of a major customer, or a default of a major customer on accounts receivable could have a material adverse impact on our financial results.

In addition, weBoeing was one of our largest customers in 2023, and the 737 MAX was one of our highest commercial end use market revenue platforms. While Boeing has received approval from all the major civil aviation regulators around the world for its 737 MAX to return to service, our production rates are still below pre-COVID-19 pandemic levels. Further, as noted earlier, in early January 2024, the FAA initiated an investigation into Boeing’s quality control system. This was followed by the FAA announcing actions to increase its oversight of Boeing as well as not approving production rate increases or additional production lines for the 737 MAX until it is satisfied that Boeing is in full compliance with required quality control procedures. Revenue growth with our other commercial customers, including Airbus SE (“Airbus”), and continued solid demand from defense OEMs (also known as prime contractors) have helped to mitigate a significant portion of this risk for the time being. However, the residual effects of the COVID-19 pandemic along with inflationary forces, supply chain issues, and rising or high interest rates continues to dampen civil air travel demand in various segments and markets, and if traveler demand does not return in the near future, it may make it difficult to continue to offset a significant portion of this risk.

We generally make sales under purchase orders and contracts that are subject to cancellation, modification or rescheduling. Changes in the economic environment and the financial condition of the industries we serve could result in customer cancellation of contractual orders or requests for rescheduling. Some of our contracts have specific provisions relating to schedule and performance, and failure to deliver in accordance with such provisions could result in cancellations, modifications, rescheduling and/or penalties, in some cases at the customers’ convenience and without prior notice. While we have normally recovered our direct and indirect costs plus profit, such cancellations, modifications, or rescheduling that cannot be replaced in a timely fashion, could have a material adverse effect on our financial results.

A significant portion of our business depends upon U.S. Government defense spending.

We derive a significant portion of our business from customers whose principal sales are to the U.S. Government and from direct sales by us to the U.S. Government. Accordingly, the success of our business depends upon government spending

generally or for specific departments or agencies in particular. Such spending, among other factors, is subject to the uncertainties of governmental appropriations and national defense policies and priorities, constraints of the budgetary process, timing and potential changes in these policies and priorities, and the adoption of new laws or regulations or changes to existing laws or regulations.

These and other factors could cause the government and government agencies, or prime contractors that use us as a subcontractor, to reduce their purchases under existing contracts, to exercise their rights to terminate contracts at-willfor convenience or to abstain from exercising options to renew contracts, any of which could have a material adverse effect on our business, financial condition and results of operations.

Further, the levels of U.S. Department of Defense (“U.S. DoD”) spending in future periods are difficult to predict and are impacted by numerous factors such as the political environment, U.S. foreign policy, macroeconomic conditions and the ability of the U.S. Government to enact relevant legislation such as the authorization and appropriations bills. The Budget ControlFor instance, the U.S. government is currently operating under a continuing resolution (“CR”) to keep the government funded while the Congress works to enact full year fiscal year 2024 (“FY24”) appropriation bills. Under the Fiscal Responsibility Act (“2011 Act”) establishedof 2023, which imposes limits on U.S. government discretionary spending includingfor defense and non-defense programs in exchange for the lifting of the debt ceiling in June 2023, if Congress fails to enact all appropriation bills by April 30, 2024, then the budget caps will be reduced and corresponding automatic reductions to agency budget accounts will be enforced through sequestration which could have a reduction

material effect on our results of operations, financial position, and/or cash flows. Further, there continues to be uncertainty with respect to future program-level appropriations for the 2012U.S. DoD and 2021 U.S. Governmentother government agencies for fiscal years.year 2025 and beyond. Accordingly, long-term uncertainty remains with respect to overall levels of defense spending and it is likely that U.S. Government discretionary spending levels will continue to be subject to pressure.

WeExports of certain of our products and our production facility in Guaymas, Mexico are subject to extensive regulationvarious export control regulations and audit byauthorizations, and we may not be successful in obtaining the Defense Contract Audit Agency.

The accuracy and appropriateness of certain costs and expenses used to substantiate our direct and indirect costs for thenecessary U.S. Government contractsapprovals and related export licenses for proposed sales to certain foreign customers.

We must comply with numerous laws and regulations relating to the export of some of our products before we are subjectpermitted to extensive regulationsell or manufacture those products outside the United States. Compliance often entails the submission and audit by the Defense Contract Audit Agency, an armtimely receipt of the U.S. DoD. Such audits and reviews could result in adjustments to our contract costs and profitability. However, we cannot ensure the outcome of any future audits and adjustments may be required to reduce net salesnecessary export approvals, licenses, or profits upon completion and final negotiation of audits. If any audit or review were to uncover inaccurate costs or improper activities, we could be subject to penalties and sanctions, including termination of contracts, forfeiture of profits, suspension of payments, fines and suspension or prohibitionauthorizations from conducting future business with the U.S. Government. Over the last several years, the U.S. export licensing environment for munitions has been adversely affected by a number of factors, including, but not limited to, the changing geopolitical environment and heightened tensions with other countries (which shift and evolve over time). Accordingly, we can give no assurance that we will be successful in obtaining, in a timely manner or at all, the approvals, licenses or authorizations we need to sell or manufacture our products outside the United States, which may result in the cancellation of orders and significant penalties to our customers if we do not make deliveries and fulfill our contractual commitments. Any such outcomesignificant delay in, or impairment of, our ability to sell products outside of the United States could have a material adverse effect on our business, financial results.

We are subject to a numbercondition and results of procurement laws and regulations. Our business and our reputation could be adversely affected if we fail to comply with these laws.

We must comply with and are affected by laws and regulations relating to the award, administration and performance of U.S. Government contracts. Government contract laws and regulations affect how we do business with our customers and impose certain risks and costs on our business. A violation of specific laws and regulations, by us, our employees, others working on our behalf, a supplier or a venture partner, could harm our reputation and result in the imposition of fines and penalties, the termination of our contracts, suspension or debarment from bidding on or being awarded contracts, loss of our ability to export products or services and civil or criminal investigations or proceedings.

In some instances, these laws and regulations impose terms or rights that are different from those typically found in commercial transactions. For example, the U.S. Government may terminate any of our government contracts and subcontracts either at its convenience or for default based on our performance. Upon termination for convenience of a fixed-price type contract, we normally are entitled to receive the purchase price for delivered items, reimbursement for allowable costs for work-in-process and an allowance for profit on the contract or adjustment for loss if completion of performance would have resulted in a loss.operations.

Contracts with some of our customers, including Federal government contracts, contain provisions which give our customers a variety of rights that are unfavorable to us and the OEMs to whom we provide products and services, including the ability to terminate a contract at any time for convenience.

Contracts with some of our customers, including Federal government contracts, contain provisions and are subject to laws and regulations that provide rights and remedies not typically found in commercial contracts. These provisions may allow our customers to:

•terminate existing contracts, in whole or in part, for convenience, as well as for default, or if funds for contract performance for any subsequent year become unavailable;

•terminate existing contracts if we are suspended or debarred from doing business with the federal government or with a governmental agency;

•prohibit future procurement awards with a particular agency as a result of a finding of an organizational conflict of interest based upon prior related work performed for the agency that would give a contractor an unfair advantage over competing contractors; and

•claim rights in products and systems produced by us; and

control or prohibit the export of the products and related services we offer.us.

If the U.S. Government terminates a contract for convenience, the counterparty with whom we have contracted on a subcontract may terminate its contract with us. As a result of any such termination, whether on a direct government contract or subcontract, we may recover only our incurred or committed costs, settlement expenses and profit on work completed prior to the termination. If the U.S. Government terminates a direct contract with us for default, we may not even recover those amounts and instead may be liable for excess costs incurred by the U.S. Government in procuring undelivered items and services from another source.

In addition, the U.S. Government is typically required to open all programs to competitive bidding and, therefore, may not automatically renew any of its prime contracts. If one or more of our customers’ government prime or subcontracts is terminated or canceled, our failure to replace sales generated from such contracts would result in lower sales and could have an adverse effect on our business, results of operations and financial condition.

Further consolidation in the aerospace industry could adversely affect our business and financial results.

The aerospace and defense industry is experiencing significant consolidation, including our customers, competitors and suppliers. Consolidation among our customers may result in delays in the awarding of new contracts and losses of existing business. Consolidation among our competitors may result in larger competitors with greater resources and market share, which could adversely affect our ability to compete successfully. Consolidation among our suppliers may result in fewer sources of supply and increased cost to us.

Our growth strategy includes evaluating selected acquisitions, which entails certain risks to our business and financial performance.

We have historically achieved a portion of our growth through acquisitions and expect to evaluate selected future acquisitions as part of our strategy for growth. Any acquisition of another business entails risks and it is possible that we willmay not realize the expected benefits from an acquisition or that an acquisition willcould adversely affect our existing operations. Acquisitions entail certain risks, including:

•difficulty in integrating the operations and personnel of the acquired company within our existing operations or in maintaining uniform standards;

•loss of key employees or customers of the acquired company;

•the failure to achieve anticipated synergies;

•unrecorded liabilities of acquired companies that we fail to discover during our due diligence investigations or that are not subject to indemnification or reimbursement by the seller; and

•management and other personnel having their time and resources diverted to evaluate, negotiate and integrate acquisitions.

We may not be successful in achieving expected operating efficiencies and sustaining or improving operating expense reductions, and may experience business disruptions associated with restructuring, facilityperformance center consolidations, realignment, cost reduction, and other strategic initiatives.

Over the past year,In recent years, we have implemented a number of restructuring, realignment, and cost reduction initiatives, including facilityperformance center consolidations, organizational realignments, and reductions in our workforce. While we have realized some efficiencies from these actions, we may not realize the benefits of these initiatives to the extent we anticipated. Further, such benefits may be realized later than expected, and the ongoing difficulties in implementing these measures may be greater than anticipated, which could cause us to incur additional costs or result in business disruptions. In addition, if these measures are not successful or sustainable, we may have to undertake additional realignment and cost reduction efforts, which could result in significant additional charges. Moreover, if our restructuring and realignment efforts prove ineffective, our ability to achieve our other strategic and business plan goals may be adversely affected.

We rely on our suppliers to meet the quality and delivery expectations of our customers.