Table of Contents

4 | ||||||||

16 | ||||||||

| ||||||||

36 | ||||||||

37 | ||||||||

37 | ||||||||

37 | ||||||||

39 | ||||||||

40 | ||||||||

41 | ||||||||

61 | ||||||||

62 | ||||||||

96 | ||||||||

96 | ||||||||

98 | ||||||||

98 | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | |||||||

100 | ||||||||

100 | ||||||||

100 | ||||||||

101 | ||||||||

101 | ||||||||

103 | ||||||||

106 | ||||||||

| ||||||||

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the fiscal year ended December 31 2020

or

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from from_________to_________.

to .

TAYLOR MORRISON HOME CORPORATION

(Exact name of registrant as specified in its charter)

Delaware | 83-2026677 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

4900 N. Scottsdale Road, Suite 2000, Scottsdale, Arizona85251

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (480) (480) 840-8100

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Common Stock, $0.00001 par value | TMHC | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ýYes ☒ No ☐¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ ¨No No ☒ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ýYes ☒ No ☐¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ýYes ☒ No ☐

¨

Large accelerated filer |

| Accelerated filer | ☐ | ||||||||

Non-accelerated filer | ☐ | Smaller reporting company | ☐ | ||||||||

Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ý☒

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

ý

The number of shares outstanding of the issuer’s common stock, as of February 24, 202121, 2024:

:

Class | Outstanding | |||||||

Common Stock, $0.00001 par value |

| |||||||

Documents Incorporated by Reference

Portions of Part III of this Form 10-K are incorporated by reference from the registrant’s definitive proxy statement for its 20212024 annual meeting of shareholders to be filed with the Securities and Exchange Commission no later than 120 days after the end of the registrant’s fiscal year.

TAYLOR MORRISON HOME CORPORATION

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2020

Table of Contents

4 | ||||||||

16 | ||||||||

| ||||||||

36 | ||||||||

37 | ||||||||

37 | ||||||||

37 | ||||||||

39 | ||||||||

40 | ||||||||

41 | ||||||||

61 | ||||||||

62 | ||||||||

96 | ||||||||

96 | ||||||||

98 | ||||||||

98 | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | |||||||

100 | ||||||||

100 | ||||||||

100 | ||||||||

101 | ||||||||

101 | ||||||||

103 | ||||||||

106 | ||||||||

| ||||||||

i

Available Information

TAYLOR MORRISON HOME CORPORATION 10-K

1

Summary ofOf Material Risks

As you read this Annual Report and other reports or public statements, you should understand that statements made herein are not guarantees of performance or results. They are subject to known and unknown risks, uncertainties and assumptions including those described under the heading “Risk Factors” in Part I, Item 1A and elsewhere in this Annual Report. Although we believe that our forward-looking statements are based upon reasonable assumptions, you should be aware that many factors, including those described under the heading “Risk Factors” in Part I, Item 1A, and elsewhere in this Annual Report, could affect our actual financial results or results of operations and could cause actual results to differ materially from those in the forward-looking statements. Such risks and uncertainties include, but are not limited to, the following:

• | changes in general and local economic conditions; | • | our concentration of significant operations in certain geographic areas; | |

• | slowdowns or severe downturns in the housing market; | • | risks associated with our unconsolidated joint venture arrangements; | |

• | increases in interest rates or government fees; | • | information technology failures and data security breaches; | |

• | tax increases and changes in tax rules; | • | costs to engage in and the success of future growth or expansion of our operations or acquisitions or disposals of businesses; | |

• | homebuyers’ ability to obtain suitable financing; | • | damages associated with any major health and safety incident; | |

• | shortages in, disruptions of and cost of labor; | • | our ownership, leasing or occupation of land and the use of hazardous materials, and any related liabilities; | |

• | higher cancellation rates of existing home sales contracts; | • | negative publicity or poor relations with the residents of our communities; | |

• | raw materials and building supply shortages and price fluctuations; | • | new or changing government regulations and legal challenges; | |

• | inflation or deflation; | • | existing or future litigation, arbitration or other claims; | |

• | competition in our industries; | • | our compliance with environmental laws and regulations regarding climate change; | |

• | any increase in unemployment or underemployment; | • | utility and resource shortages or rate fluctuations; | |

• | the seasonality of our business; | • | our ability to sell mortgages we originate and claims on mortgages sold to third parties; | |

• | the physical impacts of climate change and the increased focus by third-parties on sustainability issues; | • | governmental regulation applicable to our financial services and title services business; | |

• | our ability to obtain additional performance, payment and completion surety bonds and letters of credit; | • | the loss of any of our important commercial lender relationships; | |

• | significant home warranty and construction defect claims; | • | constriction of the capital markets; | |

• | our reliance on subcontractors; | • | risks related to our substantial debt ; | |

• | failure to manage land acquisitions, inventory and development and construction processes; | • | restrictive covenants in agreements governing our revolving credit facility; | |

• | availability of land and lots at competitive prices; | • | the discontinuation of LIBOR and its impact on our borrowing costs; | |

• | decreases in the market value of our land inventory; | • | provisions in our charter, bylaws and Delaware Law that may delay or prevent an acquisition by a third party; and | |

• | our ability to use deferred tax assets; | • | provision in our charter that provides that the Court of Chancery of the State of Delaware will be the exclusive forum for certain legal actions between us and our stockholders. |

•2the scale and scope of the novel coronavirus (“COVID-19”) global pandemic;

Part I | |||||||

4 | Item 1. | ||||||

16 | Item 1A. | ||||||

36 | Item 1B. | ||||||

36 | Item 1C. | ||||||

37 | Item 2. | ||||||

37 | Item 3. | ||||||

37 | Item 4. | ||||||

| |||||||

General Overview

We have historically operatedoperate under thevarious brand names including Taylor Morrison, Darling Homes Collection by Taylor Morrison, and Darling Homes brand names. During 2020, we completedEsplanade. We also leverage our core homebuilding and land development expertise in alternative ways by operating the acquisition of William Lyon Homes (“WLH”), and as a result we also operate under the William Lyon Signature brand name. As part of our acquisition, we also acquired Urban Form Development, LLC (“Urban Form”), which primarily develops and constructs multi-use properties consisting of commercial space, retail, and multi-family properties. In addition, we provide financial services to customers through our wholly owned mortgage subsidiary, Taylor Morrison Home Funding, INCfollowing strategic real estate related businesses:

• | We provide financial services to customers through our wholly owned mortgage subsidiary, Taylor Morrison Home Funding, Inc. (“TMHF”), title insurance and closing settlement services through our title company, Inspired Title Services, LLC (“Inspired Title”), and homeowner’s insurance policies through our insurance agency, Taylor Morrison Insurance Services, LLC (“TMIS”). | |

• | We operate a “Build-to-Rent” homebuilding business under the brand name Yardly. We serve as a land acquirer, developer, and homebuilder in addition to leasing and management functions. | |

• | Through a wholly-owned subsidiary, we also develop and construct multi-use properties consisting of commercial space, retail, and multi-family properties under the Urban Form brand name. |

TAYLOR MORRISON HOME CORPORATION 10-K

4

Our business is organized into multiple homebuilding operating components and a financial services component, which are managed as multiple reportable segments, as follows:

Business Strategy and corporate reorganization expenses on the Consolidated Statement of Operations for the year ended December 31, 2018.

• | strategic land initiatives to mitigate risk and enhance capital efficiency; | |

• | process and product optimization to promote operational effectiveness; | |

• | product innovation and standardization to drive operating efficiencies and cost reduction; | |

• | balancing sales pace and price on a community-by-community basis to maintain targeted sales volume; |

TAYLOR MORRISON HOME CORPORATION 10-K

5

ITEM 1 streamlining our processes to build operational effectiveness, including our recent acquisitions;

• | balancing our inventory of homes under construction and our pace of new construction starts; | |

• | optimizing, at a community level, the intentional balance of to-be-built and quick-move-in homes; | |

• | ability to swiftly adjust our pricing, discounts/incentives, or financial services product offerings based on our customers' needs; | |

• | continuing to enhance the customer experience; and | |

• | further scaling our Build-to-Rent operations to meet the need for rental households. |

•

continuing to enhance the customer experience; and

•

• | opportunistic land acquisition of prime assets in core locations; | |

• | building distinctive communities driven by consumer preferences; resulting in a balanced portfolio which can withstand multiple economic cycles; | |

• | consistent delivery of competitive financial metrics; | |

• | innovative digital marketing capabilities; | |

• | maintaining a cost-efficient operating structure and culture; and | |

• | disciplined capital allocation with a focus on strong liquidity and balance sheet stewardship. |

opportunistic land acquisition of prime assets in core locations;

•building distinctive communities driven by consumer preferences;

• | reinvest in core homebuilding operations; | |

• | seek additional growth opportunities through mergers, acquisitions, organic growth into adjacent markets, opportunistic land investment and joint venture strategies; | |

• | optimize debt leverage; | |

• | reinvest in ancillary business opportunities within the industry; and | |

• | returning capital to shareholders (i.e. share repurchase programs). |

•Optimizing our existing land supply through enhanced product offerings;

Community development includes the acquisition and development of land, which may include obtaining significant planning and entitlement approvals and completing construction of off-site and on-site utilities and infrastructure. We generally operate as community developers, buthowever in some communities we operate solely as merchant builders, in which case we acquire fully entitled and developed lots.

TAYLOR MORRISON HOME CORPORATION 10-K

6

In order to maximize our risk-adjusted return, the allocation of capital for land investment is performed at the corporate levelas part of a centralized process with a disciplined approach to overall portfolio management. Our portfolio investment committee of senior executives meets on a regular basis. Annually, our operating divisions prepare a strategic plan for their respective geographies. Macro and micro indices, including but not limited to employment, housing starts, new home sales, re-sales and foreclosures, along with market related shifts in competition, land availability and consumer preferences, are carefully analyzed to determine our land and homebuilding strategy. Supply and demand are analyzed on a consumer segment and submarket basis to ensure land investment is targeted appropriately. Our long-term plan is compared on an ongoing basis to current conditions in the marketplace as they evolve and is adjusted to the extent necessary. Strategic decisions regarding community positioning are included in the decision making and underwriting process and are made in consultation with senior executives of our management team.

As a party to various land banking arrangements, which allow us towe acquire land in staged takedowns, while limitingwhich limits risk and retaining cash.defers cash outflows. These third-party entities use equity contributions from their owners and/or incur debt to finance the acquisition and development of the land. Such lots are included in our controlled lots for the year ended December 31, 2020.

| As of December 31, 2020 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Owned Lots | Controlled Lots | Owned and Controlled Lots | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Raw | Partially Developed | Finished | Long- Term Strategic Assets | Total | Total | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| East | 5,900 | 10,223 | 6,822 | 158 | 23,103 | 3,937 | 27,040 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Central | 3,162 | 4,658 | 5,734 | — | 13,554 | 9,650 | 23,204 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| West | 3,268 | 4,614 | 8,840 | — | 16,722 | 8,318 | 25,040 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | 12,330 | 19,495 | 21,396 | 158 | 53,379 | 21,905 | 75,284 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| As of December 31, 2019 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Owned Lots | Controlled Lots | Owned and Controlled Lots | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Raw | Partially Developed | Finished | Long- Term Strategic Assets | Total | Total | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| East | 10,155 | 7,764 | 7,349 | — | 25,268 | 4,213 | 29,481 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Central | 2,621 | 1,511 | 4,497 | — | 8,629 | 2,945 | 11,574 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| West | 1,028 | 4,023 | 3,658 | — | 8,709 | 4,115 | 12,824 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | 13,804 | 13,298 | 15,504 | — | 42,606 | 11,273 | 53,879 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | As of December 31, 2020 | As of December 31, 2019 | |||||||||||||||||||||

| Development Status | Owned Lots | Book Value of Land and Development | Owned Lots | Book Value of Land and Development | |||||||||||||||||||

| Raw | 12,330 | $ | 356,681 | 13,804 | $ | 477,997 | |||||||||||||||||

| Partially developed | 19,495 | 1,215,419 | 13,298 | 914,689 | |||||||||||||||||||

| Finished | 21,396 | 2,388,177 | 15,504 | 1,559,291 | |||||||||||||||||||

| Long-term strategic assets | 158 | 13,462 | — | — | |||||||||||||||||||

| Total | 53,379 | $ | 3,973,739 | 42,606 | $ | 2,951,977 | |||||||||||||||||

| Allocation of Lots in Land Portfolio, by Year Acquired | As of December 31, 2020 | As of December 31, 2019 | |||||||||

| Acquired in 2020 | 39 | % | — | % | |||||||

| Acquired in 2019 | 17 | % | 20 | % | |||||||

| Acquired in 2018 | 34 | % | 57 | % | |||||||

| Acquired in 2017 | 3 | % | 8 | % | |||||||

| Acquired in 2016 and earlier | 7 | % | 15 | % | |||||||

| Total | 100 | % | 100 | % | |||||||

|

| As of December 31, 2023 |

| As of December 31, 2022 |

Acquired in 2023 |

| 24% |

| 0% |

Acquired in 2022 |

| 16% |

| 18% |

Acquired in 2021 |

| 20% |

| 27% |

Acquired in 2020 |

| 7% |

| 12% |

Acquired in 2019 and prior |

| 33% |

| 43% |

|

| 100% |

| 100% |

| As of December 31, 2020 | As of December 31, 2019 | ||||||||||||||||||||||||||||||||||||||||||||||

Sold Homes in Backlog(1) | Models | Inventory to be Sold | Total | Sold Homes in Backlog(1) | Models | Inventory to be Sold | Total | ||||||||||||||||||||||||||||||||||||||||

| East | 2,835 | 230 | 473 | 3,538 | 1,816 | 223 | 1,076 | 3,115 | |||||||||||||||||||||||||||||||||||||||

| Central | 2,398 | 160 | 134 | 2,692 | 1,655 | 142 | 391 | 2,188 | |||||||||||||||||||||||||||||||||||||||

| West | 3,170 | 378 | 406 | 3,954 | 1,240 | 139 | 307 | 1,686 | |||||||||||||||||||||||||||||||||||||||

| Total | 8,403 | 768 | 1,013 | 10,184 | 4,711 | 504 | 1,774 | 6,989 | |||||||||||||||||||||||||||||||||||||||

TAYLOR MORRISON HOME CORPORATION 10-K

7

ITEM 1 | BUSINESS

Actual life cycle will vary based on the size of the community, the sales absorption rate, and whether we purchased the property as raw land or as developed lots.

Our dedication to service defines our customer experience and acknowledges homeowners’ suggestions to incorporate style, quality and sustainability into every community we completedevelop. We offer a range of award-winning and innovative designs with a number of features such as single-story, multi-story, multi-family, higher density living, ranch style living, split bedroom plans and first floor master bedroom suites to appeal to diverse buyer needs. We engage architectural firms and utilize internal architectural resources to develop and augment existing plans in order to ensure that our homes reflect current and local consumer tastes. We engineer our homes for energy-efficiency and cost savings to reduce the constructionimpact on the environment. Our TM LiveWell program provides homeowners with a robust suite of a typicalhealthy home in approximately six months.

Based on local market practices, we either directly, or indirectly through our subcontractors, purchase drywall, cement, steel, lumber, insulation and the other building materials necessary to construct a home. While these materials are generally widely available from a variety of sources, from time to time we experience material shortages on a localized basis which can substantially increase the price for such materials and our construction process can be slowed. As a result of the COVID-19 pandemic, we experienced a few supply chain disruptions with delays from certain national vendors on specific items and certain vendors in certain locations; however, such delays did not generally slow down or prevent our home closings schedule.

We operate a “Build-to-Rent” homebuilding business under the brand name Yardly. Taylor Morrison serves as a land acquirer, developer, and Construction

We source projects in multiple markets including Austin, Charlotte, Dallas, Houston, Orlando, Phoenix, Raleigh, Tampa, and Sarasota. These communities can be executed as wholly-owned or with capital partners and bank financing. We completed the lease-up process and associated asset sale for our initial community in late 2022. Sourcing, development and leasing related to our acquired companies. Any covered item will be repairednumerous communities is ongoing with continued evaluation of hold or replaced to conform to approximately the original quality standards of the home at the time of closing. We also currently provide third-party warranty coverage on homes where required by Federal Housing Administration (“FHA”) or Veterans Administration (“VA”) regulations. From time to time, we evaluate our warranty offerings, including third-party warranty coverage, taking into account market changes and regulatory requirements.exit investment strategies.

TAYLOR MORRISON HOME CORPORATION 10-K

8

Sales and Marketing

These tools have proved to be instrumental to our online/virtualonline sales success in 2020 and beyond.success. Shoppers can seamlessly continue their experience by visiting one of our quick-move-in and/or model homes via a self-guided or in-person tour. Customers may also use the website to make inquiriesschedule a phone appointment and to receive a prompt response from one of our “Internet Home Consultants.” This platform was centralized in 2020, providing coverage for all divisions seven days a week—improving our customers' experience and developing consistency across the

We also benefit from a centralized approach to in-house creative, paid and social media resulting in annual savings that is reinvested in additional media and high performing influencer campaigns to increase brand positioning and awareness campaign in 2019, in 2020,awareness. Additionally, we launched a national brand campaign aimed at consumers in the discovery phase. The objective of this campaign is to further raise brand awareness and to position Taylor Morrison as an industry leader.

TAYLOR MORRISON HOME CORPORATION 10-K

9

storefront that conveys the customer preferences we have identified. Our Canvas program includes curated design collections, which are created based on consumer preference, take rate analytics, and product procurement availability. This standardized approach not only allows us to create more predictable results, but also time synergies, cost benefits, and support of our digital online sales strategy. We also use our Canvas program in our quick-move-in homes. We shifted our strategy for quick-move-in homes by releasing them for sale further along in the build cycle which allowed us to maximize margins. As of December 31, 2023 and 2022 we had 3,225 and 2,288 quick-move-in homes in inventory, respectively. From a sales operations perspective, our focus on business simplification and standardization was paramount in 2023 and we intend to continue these efforts in 2024. Operational efficiencies have included standardized processes, disciplined strategic activities, and execution of national programs.

Our homes are sold by our commissioned team members who work from sales offices generally located within our model homes. During the pandemic, we employed many virtual tools and safety precautions so that home shoppers could safely view our model homes and communities. Our goal is to ensure our sales force has extensive knowledge of ourthe homes, including our energy efficientenergy-efficient features, sales strategies and incentives, mortgage options, and community dynamics. To achieve this goal, we have on-goingongoing training for our sales team and conduct regular meetings to keep them abreast of the latest promotions, options, and sales techniques, and discuss geographic competition. Our sales team members are licensed real estate agents, where required by law, and assist our customers in adding design features to their homes, which we believe appeal to local consumer preferences. Third-party brokers who sell our homes are generally paid a sales commission based on the price of the home. In some of our divisions, we contract with third-party design studios that specialize in assisting our homebuyers with options and upgrades to personalize their homes. Utilizing these third-party design studios allows us to manage our overhead and costs more efficiently. We may also offer various sales incentives, including price concessions, assistance with closing costs, interest rate locks, interest rate buy downs, and landscaping or interior upgrades. The use, types, and amount of incentives dependsdepend largely on existing economic and local competitive market conditions.

Competition

We operate in a very competitive environment and compete with large national and regional homebuilding business is highly competitivecompanies and fragmented.with smaller local homebuilders for land, financing and related services, raw materials, skilled management, volume discounts, and local realtor and labor resources. We also compete with the sale of existing homes, whether by a homeownerresale, or by a financial institution that has acquired a“previously owned,” home through a foreclosure or for investment. Numerous homebuilders of varying sizes, ranging from local to national, some of which have greater sales and financial resources than us, also provide competition. We compete primarily onmarket, as well as other housing alternatives such as the basis of location, design, quality, service, value and reputation.

• | the timing of the introduction and start of construction of new projects; | • | the condition of the real estate market and general economic conditions in the areas in which we operate; | ||

• | the timing of sales; | • | mix of homes closed; | ||

• | the timing of closings of homes, lots and parcels; | • | construction timetables; |

•10the timing of the introduction and start of construction of new projects;

• | the timing of receipt of regulatory approvals for development and construction; | • | the cost and availability of materials and labor; and | ||

• | weather conditions in the markets in which we build. |

•

the cost and availability of materials and labor; and

| Three Months Ended, | Three Months Ended, | |||||||||||||||||||||||||||||||||||||||||||||||||

| 2020 | 2019 | |||||||||||||||||||||||||||||||||||||||||||||||||

| March 31 | June 30 | September 30 | December 31 | March 31 | June 30 | September 30 | December 31 | |||||||||||||||||||||||||||||||||||||||||||

| Net homes sold | 23 | % | 23 | % | 29 | % | 25 | % | 25 | % | 27 | % | 24 | % | 24 | % | ||||||||||||||||||||||||||||||||||

| Home closings revenue | 22 | % | 25 | % | 28 | % | 25 | % | 19 | % | 27 | % | 23 | % | 31 | % | ||||||||||||||||||||||||||||||||||

Income before income taxes(1) | (9) | % | 26 | % | 46 | % | 37 | % | 21 | % | 34 | % | 28 | % | 17 | % | ||||||||||||||||||||||||||||||||||

Net income(1) | (12) | % | 27 | % | 46 | % | 39 | % | 20 | % | 32 | % | 26 | % | 22 | % | ||||||||||||||||||||||||||||||||||

for additional information.

|

| Three Months Ended | ||||||||||||||||||||||

|

| 2023 |

|

| 2022 | |||||||||||||||||||

|

| March 31 |

|

| June 30 |

|

| September 30 |

|

| December 31 |

|

| March 31 |

| June 30 |

| September 30 |

| December 31 | ||||

Net homes sold |

|

| 26 | % |

|

| 28 | % |

|

| 24 | % |

|

| 22 | % |

| 32% |

| 27% |

| 22% |

| 19% |

Home closings revenue |

|

| 22 | % |

|

| 28 | % |

|

| 23 | % |

|

| 27 | % |

| 21% |

| 24% |

| 25% |

| 30% |

Income before income |

|

| 25 | % |

|

| 31 | % |

|

| 22 | % |

|

| 22 | % |

| 17% |

| 28% |

| 29% |

| 26% |

Net income |

|

| 25 | % |

|

| 31 | % |

|

| 22 | % |

|

| 22 | % |

| 17% |

| 28% |

| 29% |

| 26% |

Financial Services

• | to utilize mortgage finance as a sales tool in the home sale process to ensure a consistent customer experience and assist in maintaining home production efficiency; and | |

• | to control and analyze our sales order backlog quality and to manage projected home closing and delivery dates for our customers. |

•

to utilize mortgage finance as a sales tool in the home sale process to ensure a consistent customer experience and assist in maintaining home production efficiency; and

TAYLOR MORRISON HOME CORPORATION 10-K

11

Regulation, Environmental, Health and Safety Matters

ENVIRONMENTAL LAWS | We are subject to a variety of local, state and federal statutes, ordinances, rules and regulations concerning protection of public health and the environment (collectively, “environmental laws”). For example, environmental laws may affect: how we manage stormwater runoff, wastewater discharges, and dust; how we develop or operate on properties on or affecting resources such as wetlands, endangered species, cultural resources, or areas subject to preservation laws; and how we address contamination. The particular environmental laws that apply to any given community vary greatly according to the location and environmental characteristics of the site and its present and former uses. Complying with these environmental laws may result in delays, may cause us to incur substantial compliance and other costs, and/or may prohibit or severely restrict development in certain environmentally sensitive regions or areas. Noncompliance with environmental laws could result in fines and penalties, obligations to remediate, permit revocation, and other sanctions; and contamination or other environmental conditions at or in the vicinity of our developments could result in claims against us for personal injury, property damage, or other costs. | |

EVALUATION | We manage compliance with environmental laws at the division level with assistance from the corporate and regional legal departments. As part of the land acquisition due diligence process, we utilize environmental assessments to identify environmental conditions that may exist on potential acquisition properties. To date, environmental site assessments conducted at our properties have not revealed any environmental liability or compliance concerns that we believe would have a material adverse effect on our business, liquidity or results of operations, nor are we aware of any material environmental liability or concerns. | |

COMMUNITY | We believe we have the responsibility of creating communities and neighborhoods which will have long-lasting, positive impacts on their environments and the people who live in them. As such, we are committed to integrating sustainable values into all aspects of our business. This commitment to sustainability, our communities and our team is highlighted in our latest Environmental, Social and Governance (ESG) Report available on our website. Our ESG report is not considered part of this Annual Report. | |

HEALTH AND SAFETY | We are committed to maintaining high standards in health and safety at all of our sites. We have a health and safety audit system that includes comprehensive twice-yearly independent third-party inspections of selected sites covering all aspects of health and safety. Key areas of focus are on site conditions meeting exacting health and safety standards, and on subcontractor performance throughout our operating areas meeting or exceeding expectations. All of our team members must complete an assigned curriculum of online safety courses each year. These courses vary according to job responsibility. In addition, groups such as construction and field personnel are required to attend additional health and safety related training programs. | |

13

ITEM 1 | BUSINESS

We have a centralized information technology organization with its core team located at our corporate headquarters in Scottsdale, Arizona, augmented with field support technicians in key locations across the U.S. Our approach to information technology is to continuously simplify our information technology platform and consolidate and standardize applications. We believe a common application platform enables the sharing of ideas and rapid implementation of process improvements and best practices across the entire company. Our back-office operations use a fully integrated, industry recognized enterprise resource planning package. Marketing and field sales utilize a leading CRM solution that tracks leads and prospects from all sources and manages the customer communication process from lead creation through the buying process and beyond the post-warranty period. Field operations teams collaborate with our supply chain management to schedule and manage development and construction projects with a set of standard and widely used homebuilding industry solutions.

As of December 31, 2020, we2023, none of our employees were not subject tocovered by collective bargaining agreements. We act solely as a general contractor, and all construction operations are supervised by our project managers and field superintendents who manage third party subcontractors. We use independent consultants and contractors for some architectural, engineering, advertising and legal services, and we strive to maintain good relationships with our subcontractors and independent consultants and contractors.

TAYLOR MORRISON HOME CORPORATION 10-K

14

ITEM 1 | BUSINESS

DEI, and our leadership team hosts town hall meetings within the organization to ensure employees have a voice awareness, and commitmentare aware and committed to DEI. In addition, we have established subcommittees consisting of diverse team members who meet quarterly to help inform our National DEI Committee’s agenda, as well as our overall DEI strategy. Our leadership team is committed to creating a collaborative and inclusive work environment and continues to develop initiatives, policies and procedures to foster greater DEI. At December 31, 2020,See below for highlights and key developments relating to our workforce consisted of approximately 46% females and of these 19% were in managerial roles. The Company has and will continue to demonstrate that there is an open door and a path to leadership for all team members at any level of our company. Accordingly, we are proud to have been included for the third consecutive year as one of only 380 companies, and the only U.S. homebuilder, on the 2021 Bloomberg Gender-Equality Index (GEI), fostering greater transparency and an inclusive work environment in a traditionally male-dominated industry.

|

KEY DEVELOPMENT The Company has and will continue to demonstrate that there is an open door and a path to leadership for all team members at any level of our company. Accordingly, we are proud to have been included for the sixth consecutive year as the only U.S. homebuilder on the 2024 Bloomberg Gender-Equality Index (GEI), fostering greater transparency and an inclusive work environment in a traditionally male-dominated industry. |

TAYLOR MORRISON HOME CORPORATION 10-K

15

• | increases in short- and long-term interest rates; |

• | high inflation; |

• | supply-chains and the cost or availability of building materials; |

• | the availability of subcontractors, vendors or other third parties; |

• | housing affordability; |

• | the cost and availability of suitable land and lots for the development of our communities; |

• | the availability and cost of financing for homebuyers; |

• | federal and state income and real estate tax laws, including limitations on, or the elimination of, the deduction of mortgage interest or property tax payments; |

• | employment levels, job and personal income growth and household debt-to-income levels; |

• | consumer confidence generally and the confidence of potential homebuyers in particular; |

• | the ability of homeowners to sell their existing homes at acceptable prices; |

• | the U.S. and global financial systems and credit markets, including stock market and credit market volatility; |

• | inclement weather and natural disasters, including risks associated with global climate change, such as increased frequency or intensity of adverse weather events; |

• | civil unrest, acts of terrorism, other acts of violence, threats to national security, escalating global trade tensions, the adoption of trade restrictions, or a public health issue such as COVID-19 or other major epidemic or pandemic; |

• | mortgage financing programs and regulation of lending practices; |

• | housing demand from population growth, household formations and demographic changes (including immigration levels and trends or other costs of home ownership in urban and suburban migration); |

• | demand from foreign buyers for our homes; |

• | the supply of available new or existing homes and other housing alternatives; |

• | energy prices; and |

• | the availability of developable land in our markets and in the United States generally. |

TAYLOR MORRISON HOME CORPORATION 10-K

16

ITEM 1A | RISK FACTORS

be able to recover these increased costs by raising prices because of weak market conditions and because the price of each home we sell is usually set several months before the home is delivered, as many customers sign their home purchase contracts before construction begins. The potential difficulties described above could impact our customers’ ability to obtain suitable financing and cause some homebuyers to cancel or refuse to honor their home purchase contracts altogether.

Increases in interest rates or government fees could prevent potential customers from buying our homes and adversely affect our business or financial results.

Increases in interest rates as a result of changes to monetary policy could significantly increase the costs of owning a home or result in existing homeowners with low interest rates choosing to remain in their current homes rather than purchase a new home in a higher interest rate environment. This, in turn, could adversely impact demand for, and sales prices of, homes and the ability of potential customers to obtain financing and adversely affect our business, financial condition and operating results. Interest rates had been at historic lows for the last several years, which had made the homes we sell more affordable. During 2020 and 2021, the Federal Reserve took several steps to protect the economy from the impact of COVID-19, including reducing interest rates to new historic lows. However, in 2022 and 2023, in light of increasing inflation, the Federal Reserve increased interest rates 11 times, which caused buyer apprehension and affordability concerns, resulting in an increase in cancellations and a negative impact on our net sales orders in 2022. To mitigate these impacts we began to adjust pricing, primarily by offering finance incentives, as well as home discounts and other pricing reductions during the second half of 2022. While these pricing adjustments and incentives helped drive an increase in sales orders and a gradual normalization in cancellations beginning in 2023, there is no guarantee that these adjustments will continue to be offered or be as effective in the future. Rising interest rates also negatively impact demand for mortgage financing, which may result in lower home mortgage originations for our TMHF business. In January 2024, the Federal Reserve announced that it decided to hold interest rates at the current level and has indicated that it expects to begin cutting interest rates in 2024. Any additional increases in interest rates could negatively affect mortgage rates, real estate property values, sales orders and increase cancellations which could adversely affect our business.

Tax increases and changes in tax rules may adversely affect our financial results.

We are exposed, both directly and indirectly, to the effects of changes in U.S., state and local tax rules. For example, if federal or state laws are changed to eliminate or reduce the income tax benefits associated with homeownership, such as personal tax deductions for mortgage loan interest costs and real estate taxes, the after-tax cost of homeownership could measurably increase and diminish interest in buying a home. Additionally, increases in property tax rates by local governmental authorities can adversely affect the ability of potential customers to obtain financing or their desire to purchase new homes. Fees imposed on developers to fund schools, open spaces, road improvements and/or provide low and moderate income housing, could increase our costs and have an adverse effect on our operations. In addition, increases in sales taxes could adversely affect our potential customers who may

TAYLOR MORRISON HOME CORPORATION 10-K

17

consider those costs in determining whether or not to make a new home purchase, potentially reducing our customer base and reducing sales revenue.

Recently, the Biden administration has announced, and in certain cases has enacted, a number of tax proposals to fund new government investments in infrastructure, healthcare, and education, among other things. Certain of these proposals involve an increase in the domestic corporate tax rate, which if implemented could have a material impact on our future results of operations and cash flows.

If homebuyers are not able to obtain suitable financing, our results of operationssales may decline.

TAYLOR MORRISON HOME CORPORATION 10-K

18

Labor shortages can be further exacerbated as demand for housing increases. Any of these circumstances could give rise to delays and increased costs developing one or more of our communities and building homes. In addition, the vast majority of our work carried out on site is performed by subcontractors. In the past, reduced levels of homebuilding in the United States has led to some skilled tradesmen leaving the industry to take jobs in other sectors. If subcontractors are not able to recruit sufficient numbers of skilled employees, our development and construction activities may suffer from delays and quality issues, which would also lead to reduced levels of customer satisfaction.satisfaction and increased home warranty and construction defect claims. Further, the cost of labor may also be adversely affected by inflation and changes in immigration laws and trends in labor migration. We may not be able to recover increased costs by raising our home prices because the price for each home is typically set months prior to its delivery pursuant to sales contracts with our homebuyers. In such circumstances, our operating results could be adversely affected. Additionally, market and competitive forces may also limit our ability to raise the sales prices of our homes.

TAYLOR MORRISON HOME CORPORATION 10-K

19

ITEM 1A | RISK FACTORS

cost inflation and negatively impact the timing of our closings and the pace of our sales. In particular, shortages and fluctuations in the price of concrete, drywall, lumber or other important raw materials could result in delays in the start or completion of, or increase the cost of, developing one or more of our residential communities. Our lumber needs are highly competitiveparticularly sensitive to shortages and ifrelated cost increases. We may also face increased future home warranty and construction defect claims associated with substitute products or materials used in some instances to address supply shortages in certain served markets or communities. See – “Homebuilding is subject to home warranty and construction defect claims in the ordinary course of business that can lead to significant costs for us” below. In addition, the cost of petroleum products, which are used both to deliver our competitors are more successful or offer better valuematerials and to transport workers to our customers, our business could decline.

We are particularly exposed to offer more attractive financing to potential customers.

The homebuilding and mortgage and title services industries are highly competitive and if our competitors are more successful or offer better value to our customers, our business could decline.

We operate in a very competitive environment with competition from a number of other homebuilders in each of our markets. We compete with large national and regional homebuilding companies and with smaller local homebuilders for land, financing and related services, raw materials, skilled management, volume discounts, local realtor and labor

TAYLOR MORRISON HOME CORPORATION 10-K

20

resources. We also compete with the resale, or “previously owned,” home market, as well as other housing alternatives such as the rental housing market. Additionally, some of our competitors have longstanding relationships with subcontractors and suppliers in markets in which we operate and others may have greater financial resources or lower costs than us. Competitive conditions in the homebuilding industry could make it difficult for us to acquire suitable land at acceptable prices, cause us to increase selling incentives, reduce prices and/or result in an oversupply of homes for sale. These factors have adversely affected demand for our homes and our results of our operations in the past and could do so again in the future.

Additionally, our mortgage and title services businesses compete with other mortgage lenders and title companies, including national, regional and local mortgage banks and other financial institutions, some of which may be subject to fewer government regulations or, in the case of mortgage lenders, may have a greater range of products, greater access to or a lower cost of capital or different lending criteria and may be able to offer more attractive financing to potential customers.

If we are unable to compete effectively in our homebuilding and mortgage and title services markets, our business could decline disproportionately to our competitors, and our results of operations and financial condition could be adversely affected.

Any increase in unemployment or underemployment may lead to an increase in the number of loan delinquencies and property repossessions and have an adverse impact on us.

According to the U.S. Bureau of Labor Statistics (“BLS”), the U.S. unemployment rate was 3.7% as of December 2023, and the labor force participation rate was 62.5% which is 0.9 percentage points lower than the participation rate in February 2020. While the relatively low unemployment rate is an encouraging sign, a substantial portion of new jobs created have been relatively low-wage jobs or part-time jobs. People who are not employed, are underemployed, who have left the labor force or are concerned about low wages or the loss of their jobs are less likely to purchase new homes, may be forced to try to sell the homes they own and may face difficulties in making required mortgage payments or qualifying for new mortgage financing. Therefore, any increase in unemployment or underemployment may lead to an increase in the number of loan delinquencies and property repossessions and have an adverse impact on us both by reducing demand for the homes we build and by increasing the supply of homes for sale.

Our quarterly operating results may fluctuate because of the seasonal nature of our business and other factors.

TAYLOR MORRISON HOME CORPORATION 10-K

21

ITEM 1A | RISK FACTORS

increasing stress on our supply chain and negatively impact the demand for new homes in affected areas, as well as slow down or otherwise impair the ability of utilities and local governmental authorities to provide approvals and service to new housing communities. Furthermore, if our insurance does not fully cover our costs and other losses from these events, including those arising out of related business interruptions, our earnings, liquidity, or capital resources could be adversely affected.

An inability to obtain additional performance, payment and completion surety bonds and letters of credit could limit our future growth.

TAYLOR MORRISON HOME CORPORATION 10-K

22

ITEM 1A | RISK FACTORS

changes in estimates to pre-existing reserves as needed. For the year ended December 31, 2019, we recorded a $43.1 million charge for construction defect remediation isolated to one specific community in the Central region. For the year ended December 31, 2020, no changes in estimates were necessary for this construction defect remediation. This reserve at December 31, 2020 and 2019 was $12.7 million and $36.3 million, respectively. The reserve estimate is based on assumptions, including but not limited to, the number of homes affected, the costs associated with each repair, and the effectiveness of the repairs. Due to the degree of judgment required in making these estimates and the inherent uncertainty in potential outcomes, it is reasonably possible that actual costs could differ from those recorded and such differences could be material, resulting in a change in future estimated reserves. In addition, contractual indemnities with our subcontractors can be difficult to enforce. We may also be responsible for applicable self-insured retentions and some types of claims may not be covered by insurance or may exceed applicable coverage limits. Additionally, the coverage offered by and the availability of products and completed operations excess liability insurance for construction defects is currently limited and costly. This coverage may be further restricted or become more costly in the future.

TAYLOR MORRISON HOME CORPORATION 10-K

23

ITEM 1A | RISK FACTORS

requirements resulting in additional costs. If the rate at which we sell and deliver homes slows or falls, or if our opening of new home communities for sale is delayed, we may incur additional costs, which would adversely affect our gross profit margins and will lead to a longer period of time for us to recover our costs, including those we incurred in acquiring and developing land.

TAYLOR MORRISON HOME CORPORATION 10-K

24

ITEM 1A | RISK FACTORS

number of factors, including applicable rules relating to the permitted carry back period for offsetting certain net operating losses against prior period earnings and the timing and amount of future taxable income. If we are unable to use our net operating losses, we may have to record charges to reduce our deferred tax assets, which could have an adverse effect on our results of operations.

To finance these activities,our joint ventures, our unconsolidated joint ventures often obtain loans from third-party lenders that are secured by the unconsolidated joint venture’s assets. To the extent

TAYLOR MORRISON HOME CORPORATION 10-K

25

ITEM 1A | RISK FACTORS

our best interests. In addition, as our relationships with our partners are contractual in nature and may be terminated or dissolved under the terms of the applicable joint venture agreements, including buy-sell provisions, we may not continue to own or operate the interests or assets underlying such relationship or may need to purchase additional interests or assets in the venture to continue ownership. In the event a joint venture is terminated or dissolved, we could also be exposed to lawsuits and legal costs.

Additionally, state governments, most notably California, Nevada, Texas and Colorado, have enacted or enhanced their data privacy regulations, and other governments are considering establishing similar or stronger protections. These regulations impose certain obligations for securing, and potentially removing, specified personal information in our systems, and for apprising individuals of the information we have collected about them. We have incurred costs in an effort to comply with these data privacy risks and requirements, and our costs may increase significantly as such risks become increasingly complex or if new or changing requirements are enacted, and ultimately based on how individuals choose to exercise their rights. For example, in November 2020, California voters approved Proposition 24 (Consumer Personal Information Law and Agency Initiative), which became effective as of January 1, 2023 and has increased data privacy requirements for our business. Despite our efforts, any noncompliance could result in our incurring substantial penalties and reputational damage.

TAYLOR MORRISON HOME CORPORATION 10-K

26

We may incur a variety of costs to engage in future growth or expansion of our operations or acquisitions of businesses, and the anticipated benefits may never be realized.

• | difficulties in assimilating the operations and personnel of acquired companies or businesses; |

• | diversion of our management’s attention from ongoing business concerns; |

• | our potential inability to maximize our financial and strategic position through the successful incorporation or disposition of operations; |

• | significant liabilities may not be identified in due diligence or may come to light after the expiry of warranty or indemnity periods; |

• | difficulties in the implementation of uniform standards, controls, procedures and policies; and |

• | impairment of existing relationships with employees, contractors, suppliers and customers as a result of the integration of new management personnel and cost-saving initiatives. |

•

difficulties in assimilating the operations and personnel of acquired companies or businesses;

TAYLOR MORRISON HOME CORPORATION 10-K

27

ITEM 1A | RISK FACTORS

hazardous substances) impose strict liability, which

TAYLOR MORRISON HOME CORPORATION 10-K

28

Further, government agencies routinely initiate audits, reviews or investigations of our business practices to ensure compliance with applicable laws and regulations, which can cause us to incur costs or create other disruptions in our business that can be significant. Further, we may experience delays and increased expenses as a result of legal challenges to our proposed communities, whether brought by governmental authorities or private parties.

We are involved in various litigation and legal claims, including actions brought on behalf of various classes of claimants. For example, in 2023 we paid $64.7 million resulting from a judgment in a case in Florida relating to our collection of club membership fees in connection with the use of our club amenities. See Note 14 - Commitments and Contingencies - Legal Proceedings in the Notes to the Consolidated financial statements included in this Annual Report for additional information. We establish liabilities for legal claims and regulatory matters when such matters are both probable of occurring and any potential loss is reasonably estimable. We accrue for such matters based on the facts and circumstances specific to each matter and revise these estimates as the matters evolve. In such cases, there may exist an exposure to loss in excess of any amounts currently accrued. In view of the inherent difficulty of predicting the outcome of these legal and regulatory matters, we generally cannot predict the ultimate resolution, the related timing or the amount of any eventual loss. To the extent the liability arising from the ultimate resolution of any matter exceeds the estimates reflected in the recorded reserves relating to such matter, we could incur additional charges that could be significant. Unfavorable litigation, arbitration or claims could also generate negative publicity in various media outlets that could be detrimental to our reputation.

Regulations regarding environmental matters and climate change may affect us by substantially increasing our costs and exposing us to potential liability.

TAYLOR MORRISON HOME CORPORATION 10-K

29

In addition, there is a growing concern from advocacy groups and the general public that the emission of greenhouse gases and other human activities have caused, or will cause,are causing significant changes in weather patterns and temperatures and the frequency and severity of weather events and natural disasters. There is a variety of legislation and other regulation being implemented or considered, at the federal, state and local level relating to energy and climate change. It involvesThis legislation and these regulations involve matters including carbon dioxide emissions control and building codes that impose energy efficiency standards, as well as standards to improve the resiliency of buildings to climate-related impacts such as flooding, storm surges, severe winds, wildfires and other extreme weather-related stress on buildings. Such requirements could significantly increase our cost to construct homes. Energy-related initiatives affect a wide variety of companies throughout the United States and the world and, because our operations are heavily dependent on significant amounts of raw materials, such as lumber, steel and concrete, they could also have an indirect adverse impact on our operations and profitability to the extent the manufacturers and suppliers of our materials are burdened with expensive cap and trade and similar energy related taxes and regulations.

TAYLOR MORRISON HOME CORPORATION 10-K

30

ITEM 1A | RISK FACTORS

additional capital resources to finance the loans that TMHF is extending. In addition, although mortgage lenders under the mortgage warehouse facilities TMHF currently uses to finance our lending operations normally purchase our mortgages within approximately 20-30 days of origination, if such mortgage lenders default under these warehouse facilities TMHF would be required to fund the mortgages then in the pipeline. In such case, amounts available under our $1 Billion Revolving Credit Facility and $100 Million Revolving Credit Facility (together, the "Revolving Credit Facilities") and cash from operations may not be sufficient to allow TMHF to provide financing required by our business during these times, and our ability to originate and sell mortgage loans at competitive prices could be limited, which could negatively affect our business. Further, an obligation to commit our own funds to long-term investments in mortgage loans could, among other things, delay the time when we recognize revenues from home sales on our statements of operations.

TAYLOR MORRISON HOME CORPORATION 10-K

31

and the market perception of our business. Additionally, if we are unable to originate mortgages for any reason going forward, our customers may experience significant mortgage loan funding issues, which could have a material impact on our homebuilding business and our consolidatedConsolidated financial statements.

• | making it more difficult for us to satisfy our obligations with respect to our debt or to our trade or other creditors; |

• | increasing our vulnerability to adverse economic or industry conditions; |

• | limiting our ability to obtain additional financing to fund capital expenditures and land acquisitions, particularly when the availability of financing in the capital markets is limited; |

requiring us to pay higher interest rates upon refinancing or on our variable rate indebtedness if interest rates rise; | |

• | requiring a substantial portion of our cash flows from operations and the proceeds of any capital markets offerings or loan borrowings for the payment of principal and interest on our debt thus reducing our ability to use our cash flows to fund working capital, capital expenditures, land acquisitions and general corporate requirements; |

TAYLOR MORRISON HOME CORPORATION 10-K

32

ITEM 1A making it more difficult for us to satisfy our obligations with respect to our debt or to our trade or other creditors;

• | limiting our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; and |

• | placing us at a competitive disadvantage to less leveraged competitors. |

•

limiting our ability to obtain additional financing to fund capital expenditures and land acquisitions, particularly when the availability of financing in the capital markets is limited;

• | incur or guarantee additional indebtedness; |

• | make certain investments; |

• | repurchase equity or subordinated indebtedness; |

• | pay dividends or make distributions on our capital stock; |

• | sell assets, including capital stock of restricted subsidiaries; |

• | agree to restrictions on distributions, transfers or dividends affecting our restricted subsidiaries; |

• | consolidate, merge, sell or otherwise dispose of all or substantially all of our assets; |

• | enter into transactions with our affiliates; |

• | incur liens; and |

• | designate any of our subsidiaries as unrestricted subsidiaries. |

•incur or guarantee additional indebtedness;

TAYLOR MORRISON HOME CORPORATION 10-K

33

The discontinuation of LIBOR could affect our borrowing costs.

The London Interbank Offered Rate (“LIBOR”) was the primary basis for determining interest payments on borrowings under each of our warehouse facilities and our Revolving Credit Facilities. On March 5, 2021, ICE Benchmark Administration (“IBA”) confirmed it would cease publication of Overnight, 1, 3, 6 and 12 month US Dollar LIBOR settings immediately following the LIBOR publication on June 30, 2023. The Alternative Reference Rates Committee, which was convened by the Federal Reserve Board and the New York Federal Reserve, has identified the Secured Overnight Financing Rate (“SOFR”) as the recommended risk-free alternative rate for US Dollar LIBOR. In response to the planned discontinuation of LIBOR, our warehouse facilities agreements as well as our Revolving Credit Facilities have been restructured to use SOFR as the primary basis for determining interest payments.

At this time, it is not possible to predict the full effect that the discontinuance of LIBOR, or the establishment of alternative reference rates such as SOFR, will have on us or our borrowing costs. SOFR is a relatively new reference rate and its composition and characteristics are not the same as LIBOR. Given the limited history of these rates and potential volatility as compared to other benchmark or market rates, the future performance of these rates cannot be predicted based on historical performance. The consequences of using SOFR could include an increase in the cost of our variable rate indebtedness.

Risks related to our organization and structure

• | the sole ability of the Board of Directors to fill a vacancy created by the expansion of the Board of Directors; |

• | advance notice requirements for stockholder proposals and director nominations; |

• | limitations on the ability of stockholders to call special meetings and to take action by written consent; |

• | in certain cases, the approval of holders of at least three-fourths of the shares entitled to vote generally on the making, alteration, amendment or repeal of our certificate of incorporation or by-laws will be required to adopt, amend or repeal our bylaws, or amend or repeal certain provisions of our certificate of incorporation; and |

• | the ability of our Board of Directors to designate the terms of and issue new series of preferred stock without stockholder approval, which could be used, among other things, to institute a rights plan that would have the effect of significantly diluting the stock ownership of a potential hostile acquirer, likely preventing acquisitions that have not been approved by our Board of Directors. |

•

the sole ability of the board of directors to fill a vacancy created by the expansion of the board of directors;

TAYLOR MORRISON HOME CORPORATION 10-K

34

Under our Revolving Credit Facility,Facilities, a change of control would be an event of default, which wouldcould therefore require a third-party acquirer to obtain a facility to refinance any outstanding indebtedness under the Revolving Credit Facility.Facilities. Under the indentures governing our Senior Notes, if a change of control were to occur, we would be required to make offers to repurchase the Senior Notes at prices equal to 101% of their respective principal amounts. These change of control provisions in our existing debt agreements may also delay or diminish the value of an acquisition by a third party.

Our charter provides to the fullest extent permitted by law that unless we consent in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware will be the sole and exclusive forum for any (i) derivative action or proceeding brought on behalf of the Company, (ii) any action or proceeding asserting a claim of breach of a fiduciary duty owed by any of our directors, officers, employees or stockholders, (iii) any action or proceeding asserting a claim arising pursuant to any provision of the General Corporation Law of the State of Delaware, as amended from time to time, or (iv) any action or proceeding asserting a claim governed by the internal affairs doctrine. The choice of forum provision may increase costs to bring a claim, discourage claims or limit a stockholder’s ability to bring a claim in a judicial forum that it finds favorable for disputes with the Company or our directors, officers or other employees, which may discourage such lawsuits against us or our directors, officers and other employees. Alternatively, if a court were to find the choice of forum provision contained in our charter to be inapplicable or unenforceable in an action, we may incur additional costs associated with resolving such action in other jurisdictions. The exclusive forum provision in our charter will not preclude or contract the scope of exclusive federal or concurrent jurisdiction for actions brought under the federal securities laws including the Exchange Act or the Securities Act or the respective rules and regulations promulgated thereunder.

Any of the above risks could have a material adverse effect on your investment in our Common Stock.common stock.

TAYLOR MORRISON HOME CORPORATION 10-K

35

ITEM 1B | UNRESOLVED STAFF COMMENTS

Cybersecurity Risk Management and Strategy

We maintain a comprehensive cybersecurity program, including policies and procedures designed to protect our systems, operations, and data. We perform risk assessments on a quarterly basis to identify and remediate potential cybersecurity threats and vulnerabilities. In connection with our assessment of potential cybersecurity risks, our Information Technology ("IT") team engages in threat modeling, vulnerability scanning and penetration testing. For each identified risk, our IT team will estimate the likelihood of occurrence and potential impact, which will guide the Company in assessing and prioritizing risks. We have also implemented a process to evaluate and review potential cybersecurity risks arising from our use of third-party vendors. As part of our vendor engagement protocols, we will consider, among other things, each potential vendor’s data backup procedures, incident reporting protocols and data privacy and encryption practices. Once a new vendor is onboarded, we monitor their cybersecurity posture utilizing a third-party cybersecurity ratings provider.

In addition to our internal exercises to test aspects of our cybersecurity program, we engage independent third parties semi-annually to assess the risks associated with our IT resources and information assets. Among other matters, these third parties analyze information on the interactions of users of our information technology resources, including employees, and conduct penetration tests and scanning exercises to assess the performance of our cybersecurity systems and processes. Annually, we examine our cybersecurity program with these third parties, evaluating its effectiveness in part by considering industry standards and established frameworks, such as the National Institute of Standards and Technology ("NIST"), as guidelines. As a mortgage company, we are also associated with the Federal Financial Institutions Examination Council.

For material cybersecurity risks, we’ve developed mitigation plans to reduce the risk’s likelihood of occurrence and/or its expected impact. Such mitigation plans have involved, among other things, implementing additional technology controls or policies, increased training for company personnel or obtaining additional insurance for the identified risk. Our IT team monitors material risks over time and updates the Company’s mitigation plans as appropriate. IT also regularly reports to the leadership team on the status of material risks, mitigation plans and incidents related to such risks.

We also maintain a data breach response plan, which is intended to be aligned with the NIST framework, and which is reviewed annually and conveyed to our team members through our mandatory cybersecurity training. We also retain experienced cybersecurity consultants that can assist us in the event of a serious breach, and maintain a cyber insurance policy.

For a discussion of how risks from cybersecurity threats affect our business, see “Part 1. Item 1A. Risk Factors – Risk Related to our Business – Information technology failures and data security breaches could harm our business” in this Annual Report on Form 10-K.

Cybersecurity Governance

Management is responsible for ongoing assessment and oversight of cybersecurity risks that could significantly impact our operations, finances or reputation. This includes identifying information assets and data systems that are

TAYLOR MORRISON HOME CORPORATION 10-K

36

ITEM 1B THROUGH ITEM 4

critical to business functions, determining the vulnerability of those systems to potential cyberattacks, and developing comprehensive protections and response plans.

To fulfill these responsibilities, management relies on IT and cybersecurity leadership who possess specialized expertise in relevant areas. Our cybersecurity team is led by our Chief Information Officer ("CIO"), who has more than 25 years of experience working in information technology, of which more than 20 have been with Taylor Morrison. With over ten years of experience developing cybersecurity programs, the CIO leads security control implementation, risk and compliance monitoring, security tool management, and incident response planning.

Reporting to the CIO, the Director of Information Security possesses expert knowledge in threat modeling and vulnerability testing methodologies. The Director of Information Security leads efforts to build security into all IT processes and procedures to protect against risks related to data leakage, broken authentication, injection flaws, improper encryption, and attacks on other application vulnerabilities.

Supporting the CIO and Director of Information Security is a team of IT Security professionals who collectively hold the following degrees and certifications: Master’s degree in cybersecurity; Certified Information Systems Security Professional; Certified Ethical Hacker; Security +; Microsoft Certified Professional; Microsoft Certified Solutions Associate; and Microsoft Certified Systems Engineer.

Supported by these skilled leaders, management conducts quarterly cyber risk reviews, maintains a cybersecurity risk register, authorizes risk mitigation budgets and activities, and ensures appropriate resources are devoted to protecting against rapidly evolving cyber threats. The Audit Committee and the Board of Directors are also regularly updated on cybersecurity risk assessments, policy changes, significant incidents, and preparedness levels. This enables management to provide oversight, set risk tolerances, and support a comprehensive cybersecurity program that manages material cyber risks to the organization.

The CIO updates the Board of Directors biannually on the state of the cybersecurity program, which includes a discussion of the most important cybersecurity risks facing the Company, an update on notable cybersecurity incidents and recent threats, and a summary of the results of the Company’s recent independent cybersecurity assessments, among other items. In addition, the Audit Committee of the Board of Directors receives quarterly cybersecurity updates, which include reports on key cybersecurity metrics, cybersecurity headlines, current risks and mitigation strategies.

ITEM 2 | PROPERTIES

We lease office facilities for our homebuilding and financial services operations. We lease our corporate headquarters, which is located in Scottsdale, Arizona. At December 31, 2020,2023, the lease on this facility covered a space of approximately 25,000 square feet and expires in December 2027. We have approximately 4946 other leases for our other division offices and design centers. For information on land owned and controlled by us for use in our homebuilding activities, please refer to Item 1 — Business — 1—Business—Business Strategy and Operations — Land and Development Strategies and Note 4—Real Estate Inventory .in the Notes to the Consolidated financial statements included in this Annual Report.

37

Part II | ||||||||

39 | Item 5. | |||||||

40 | Item 6. | |||||||

41 | Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | ||||||

61 | Item 7A. | |||||||

62 | Item 8. | |||||||

96 | Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | ||||||

96 | Item 9A. | |||||||

98 | Item 9B. | |||||||

98 | Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | ||||||

| ||||||||

ITEM 5 | | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

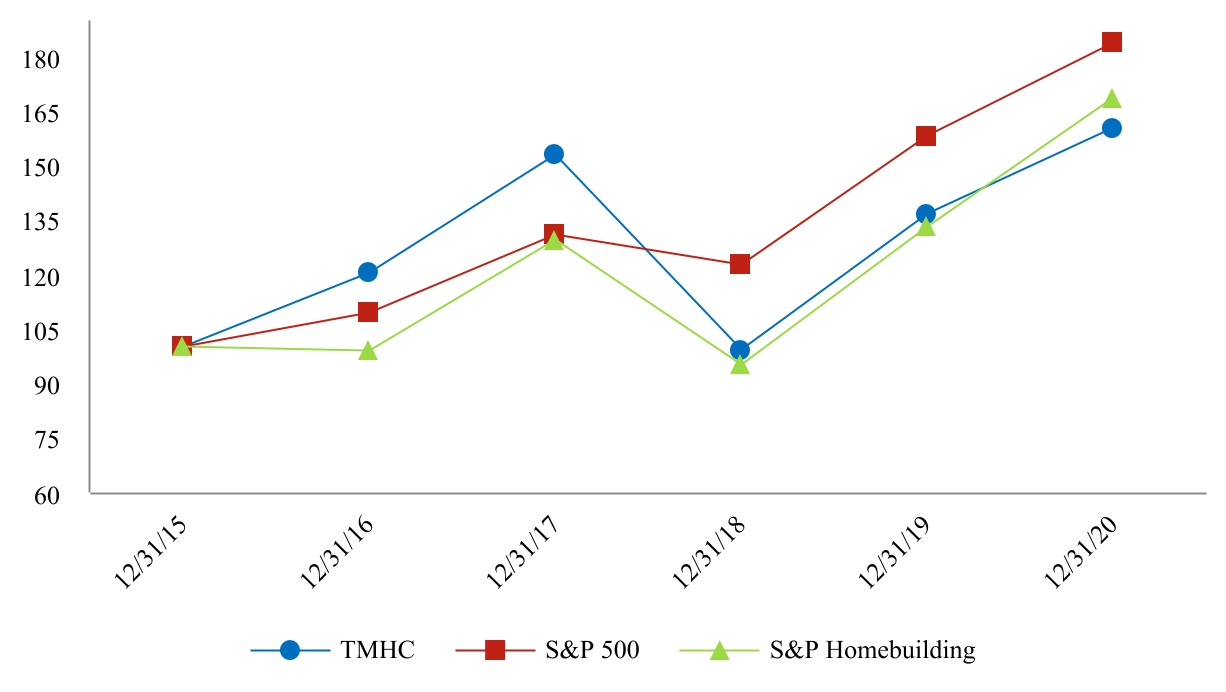

Stock Performance Graph

|

| 12/31/2018 |

|

| 12/31/2019 |

|

| 12/31/2020 |

|

| 12/31/2021 |

|

| 12/31/2022 |

|

| 12/31/2023 |

| ||||||

TMHC |

| $ | 100.00 |

|

| $ | 137.48 |

|

| $ | 161.32 |

|

| $ | 219.87 |

|

| $ | 190.88 |

|

| $ | 335.53 |

|

S&P 500 |

|

| 100.00 |

|

|

| 128.88 |

|

|

| 149.83 |

|

|

| 190.13 |

|

|

| 153.16 |

|

|

| 190.27 |

|

S&P Homebuilding Index |

|

| 100.00 |

|

|

| 139.94 |

|

|

| 177.24 |

|

|

| 263.78 |

|

|

| 185.49 |

|

|

| 294.16 |

|

| 12/31/2015 | 12/31/2016 | 12/31/2017 | 12/31/2018 | 12/31/2019 | 12/31/2020 | ||||||||||||||||||||||||||||||

| TMHC | $ | 100.00 | $ | 120.38 | $ | 152.94 | $ | 99.38 | $ | 136.63 | $ | 160.31 | |||||||||||||||||||||||

| S&P 500 | 100.00 | 109.54 | 130.81 | 122.65 | 158.07 | 183.77 | |||||||||||||||||||||||||||||

| S&P Homebuilding Index | 100.00 | 99.03 | 129.49 | 95.14 | 133.15 | 168.64 | |||||||||||||||||||||||||||||

Dividends

We currently anticipate that we will retain all available fundsintend to use our future earnings to develop our business and for use in operationsworking capital needs and general corporate purposes, to fund our growth, to repay debt and possibly to repurchase shares of our common stock, and do not anticipate paying any cash dividends in the foreseeable future. See Item 7 — Management’s Discussion and Analysis of Financial Condition and Results of Operations. TMHC hasWe have not previously declared or paid any cash dividends on our Common Stock.common stock.

| Total number of shares purchased | Average price paid per share | Total number of shares purchased as part of a publicly announced plan or program | Approximate dollar value of shares that may yet be purchased under the plan or program | ||||||||||||||||||||

| (in thousands) | |||||||||||||||||||||||

| October 1 to October 31, 2020 | — | — | — | $ | 9,837 | ||||||||||||||||||

| November 1 to November 30, 2020 | — | — | — | $ | 9,837 | ||||||||||||||||||

December 1 to December 31, 2020(1) | 504,845 | 26.09 | 504,845 | $ | 96,668 | ||||||||||||||||||

| Total | 504,845 | ||||||||||||||||||||||

Period |

| Total number of shares purchased |

|

| Average price paid per share |

|

| Total number of shares purchased as part of publicly announced plans or programs(1) |

|

| Approximate dollar value of shares that may yet be purchased under the plans or programs |

| ||||

|

|

|

|

|

|

|

|

|

|

| (in thousands) |

| ||||

October 1 to October 31, 2023 |

|

| — |

|

|

| — |

|