This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which reflect our current views with respect to, among other things, future events, operations and financial performance. You can identify these forward-looking statements by the use of forward-looking words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “predicts,” “intends,” “plans,” “estimates,” “anticipates”“anticipates,” “foresees” or the negative versionversions of those words, other comparable words or other statements that do not relate to historical or factual matters. The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. Such forward-looking statements are subject to various risks and uncertainties and assumptions relating to our operations, financial results, financial condition, business prospects, growth strategy and liquidity. Some of these factors are described in this Annual Report on Form 10-K for the year ended December 31, 2020,2023, under the headings “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “ Item“Item 1A. Risk Factors”.Factors.” These factors should not be construed as exhaustive and should be read in conjunction with the risk factors and other cautionary statements that are included in this report and in our other periodic filings. If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, our actual results may vary materially from those indicated in these forward-looking statements. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Therefore, you should not place undue reliance on these forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. We do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

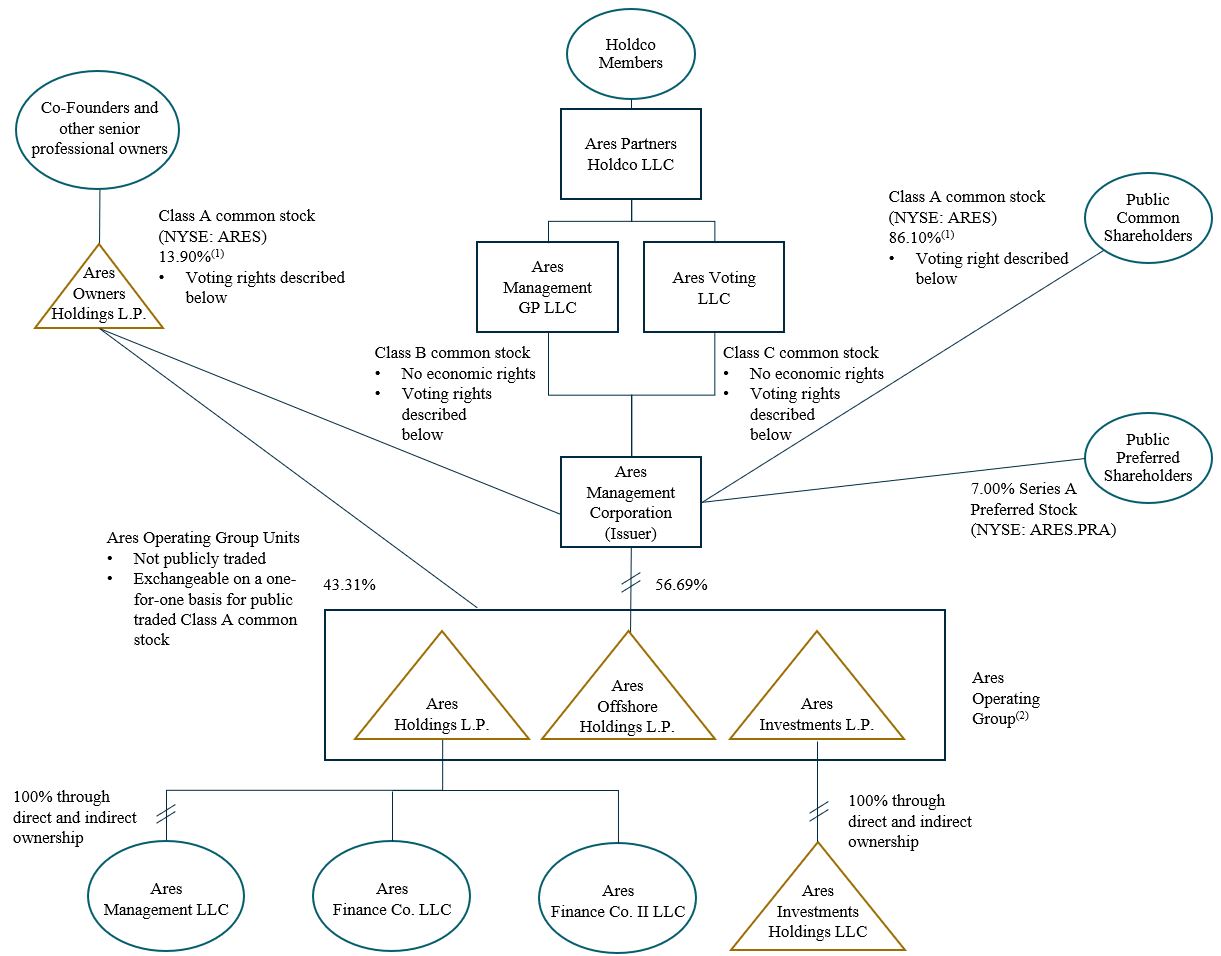

References in this Annual Report on Form 10-K to the “Ares Operating Group” refer to collectively, Ares Holdings L.P. (“Ares Holdings”), Ares Offshore Holdings L.P. (“Ares Offshore”) and Ares Investments L.P. (“Ares Investments”). References in this Annual Report on Form 10-K to an “Ares Operating Group Unit” or an “AOG Unit” referrefers to collectively, a partnership unit in each of the Ares Operating Group entities. entity.

The use of any defined term in this report to mean more than one entities, persons, securities or other items collectively is solely for convenience of reference and in no way implies that such entities, persons, securities or other items are one indistinguishable group. For example, notwithstanding the use of the defined terms “Ares,” “we” and “our” in this report to refer to Ares Management Corporation and its subsidiaries, each subsidiary of Ares Management Corporation is a standalone legal entity that is separate and distinct from Ares Management Corporation and any of its other subsidiaries.

In this Annual Report on Form 10-K, in addition to presenting our results on a consolidated basis in accordance with GAAP, we present revenues, expenses and other results on aa: (i) “segment basis,” which deconsolidates the consolidated funds and removes the proportional results attributable to third-party investors in the consolidated joint ventures, and therefore shows the results of our reportableoperating segments without giving effect to the consolidation of these entitiesentities; and (ii) “unconsolidated reporting basis,” which shows the results of our reportableoperating segments on a combined segment basis together with our Operations Management Group. In addition to our reportableoperating segments, we have an Operations Management Group (the “OMG”). The OMG consists of shared resource groups to support our reportableoperating segments by providing infrastructure and administrative support in the areas of accounting/finance, operations, information technology, legal, compliance, human resources, strategy and relationship management legal, compliance and human resources.distribution. The OMG includes Ares Wealth Management Solutions, LLC (“AWMS”) that facilitates the product development, distribution, marketing and client management activities for investment offerings in the

•“2024 Senior Notes” refers to senior notes issued by a wholly owned subsidiary of Ares Holdings in October 2014 with a maturity in October 2024; and

•“2028 Senior Notes” refers to senior notes issued by the Company in November 2023 with a maturity in November 2028;

•“2030 Senior Notes” refers to senior notes issued by a wholly owned subsidiary of Ares Holdings in June 2020 with a maturity in June 2030.2030;

•“2051 Subordinated Notes” refers to subordinated notes issued by a wholly owned subsidiary of Ares Holdings in June 2021 with a maturity in June 2051; and

•“2052 Senior Notes” refers to senior notes issued by a wholly owned subsidiary of Ares Holdings in January 2022 with a maturity in February 2052.

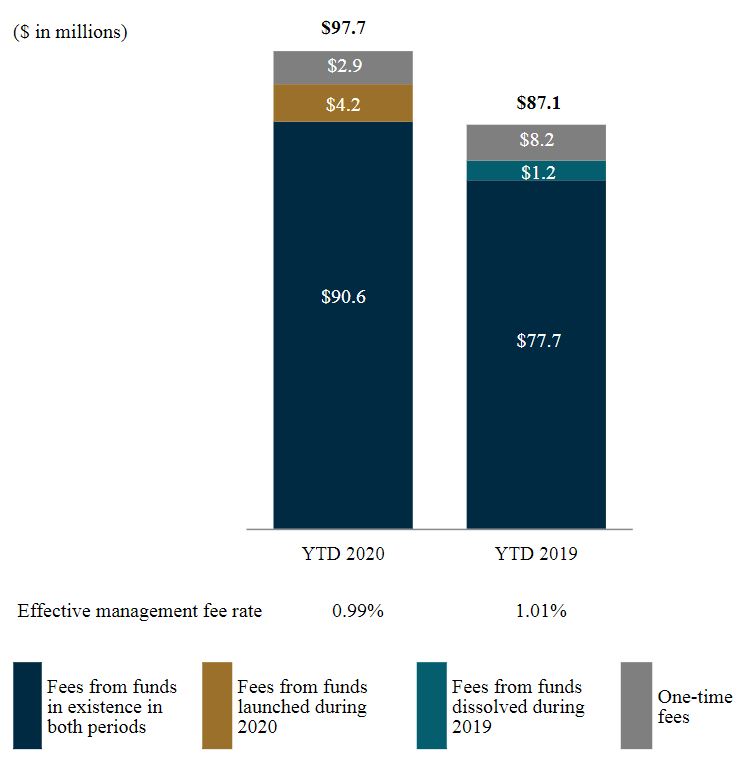

Many of the terms used in this report, including AUM, FPAUM, FRE and RI, may not be comparable to similarly titled measures used by other companies. In addition, our definitions of AUM and FPAUM are not based on any definition of AUM or FPAUM that is set forth in the agreements governing the investment funds that we manage and may differ from definitions of AUM or FPAUM set forth in other agreements to which we are a party or definitions used by the SEC or other regulatory bodies. Further, FRE and RI are not measures of performance calculated in accordance with GAAP. We use FRE and RI as measures of operating performance, not as measures of liquidity. FRE and RI should not be considered in isolation or as substitutes for operating income, net income, operating cash flows, or other income or cash flow statement data prepared in accordance with GAAP. The use of FRE and RI without consideration of related GAAP measures is not adequate due to the adjustments described above. Our management compensates for these limitations by using FRE and RI as supplemental measures to our GAAP results. We present these measures to provide a more complete understanding of our performance as our management measures it.

Amounts and percentages throughout this report may reflect rounding adjustments and consequently totals may not appear to sum.

PART I

Item 1. Business

BUSINESS

Overview

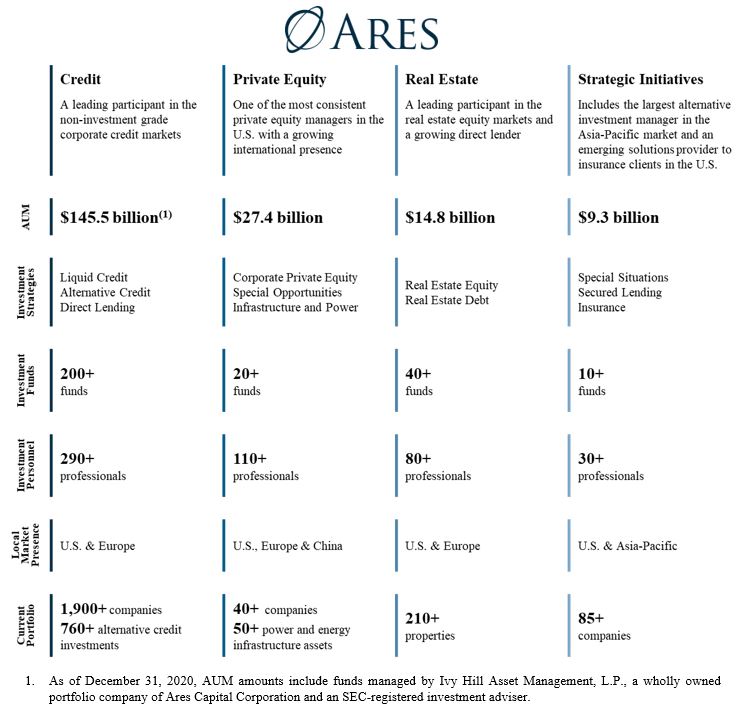

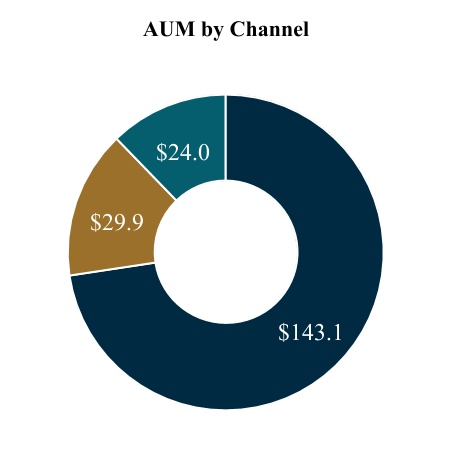

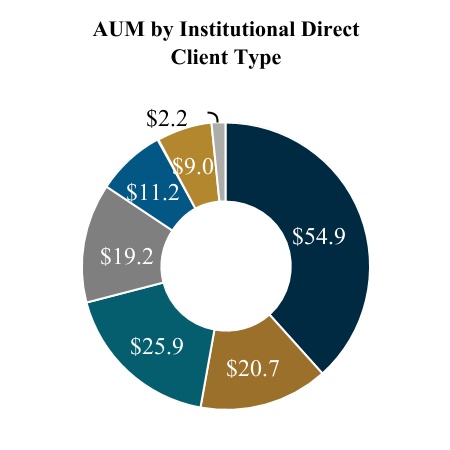

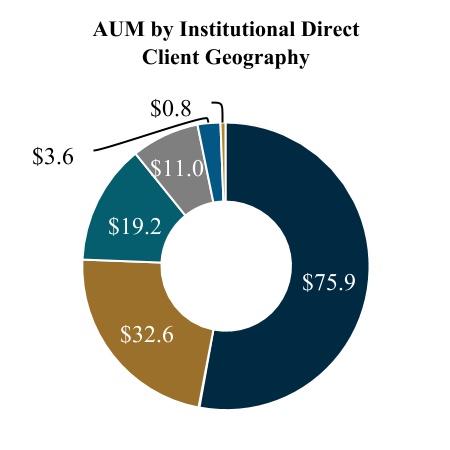

Ares is a leading global alternative investment manager with $197.0$418.8 billion of assets under management and over 2,8501,450 employees in over 2535 offices in more than 1015 countries. We offer our investors a range of investment strategies and seek to deliver attractive performance to an investor base that includes over 1,0902,300 direct institutional relationships and a significant retail investor base across our publicly tradedpublicly-traded funds, sub-advised accounts and sub-advised funds.non-traded vehicles. Since our inception in 1997, we have adhered to a disciplined investment philosophy that focuses on delivering strong risk-adjusted investment returns through market cycles. Ares believes each of its distinct but complementary investment groups in Credit, Private Equity, Real EstateAssets and Strategic InitiativesSecondaries is a market leader based on assets under management and investment performance. We believe we create value for our stakeholders not only through our investment performance, but also by expanding our product offering, enhancing our distribution channels, increasing our global presence, investing in our non-investment functions, securing strategic partnerships and completing strategic acquisitions and portfolio purchases.

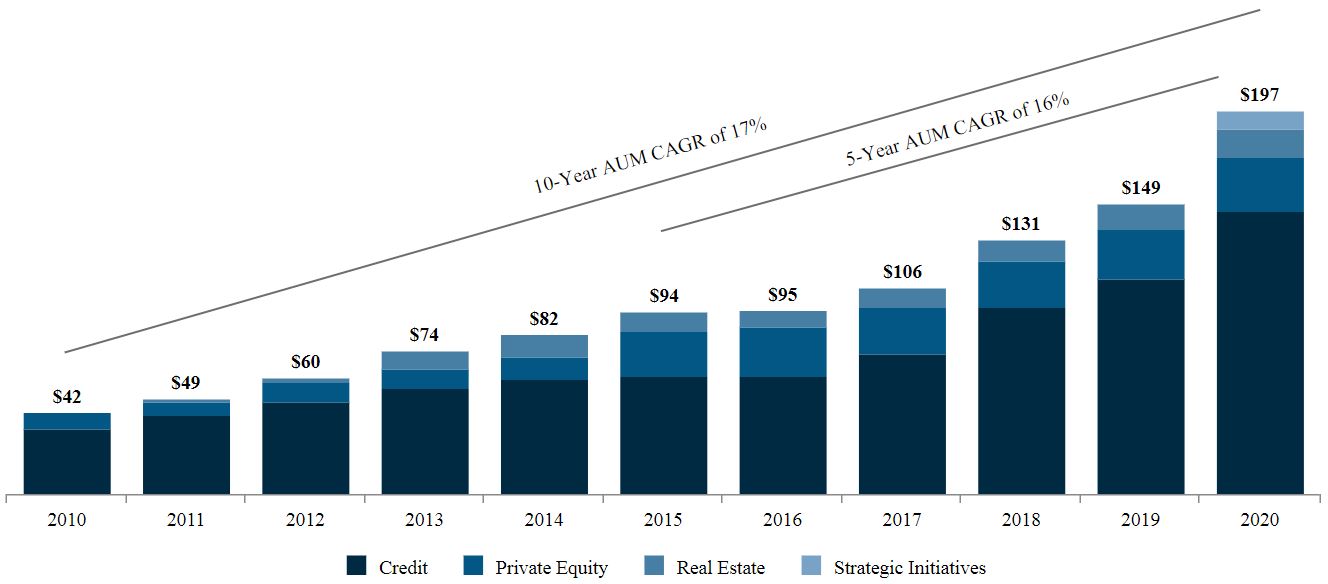

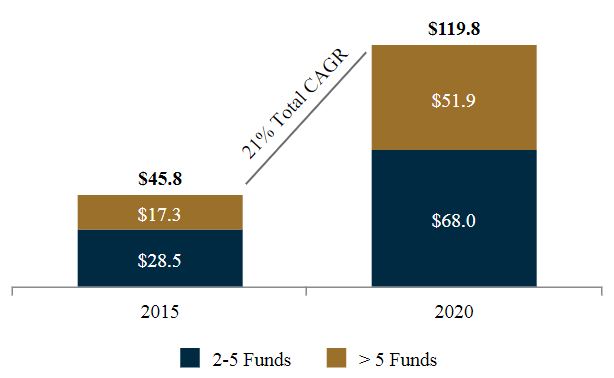

Our AUM has grown to $197.0418.8 billion as of December 31, 20202023 from $42.0$74.0 billion a decade earlier. As shown in the chart below, over the past five and ten10 years, our assets under management have achieved a compound annual growth rate (“CAGR”) of 16%26% and 17%19%, respectively ($ in billions):

We have an established track record of delivering strong risk-adjusted returns through market cycles. We believe our consistent and strong performance in a broad range of alternative investments has been shaped by several distinguishing features of our platform:

•Comprehensive Multi-Asset Class Expertise and Flexible Capital: Our proficiency at evaluating every level of the capital structure, from senior debt to common equity, across companies, structured assets, real estate projects, and infrastructure power and energy assets and real estate projects enables us to effectively assess relative value. This proficiency is complemented by our flexibility in deploying capital in a range of structures and different market environments to maximize risk-adjusted returns.

•Differentiated Market Intelligence: Our proprietary research on over 55 industries and insights from a broad, global investment portfolio enable us to more effectively diligence and structure our products and investments.

•Consistent Investment Approach: We believe our rigorous, credit-oriented investment approach across each of our investment groups is a key contributor to our strong investment performance and ability to expand our product offering.

•Robust Sourcing Model: Our investment professionals’ local market presence and ability to effectively cross-source for other investment groups generates a robust pipeline of high-quality investment opportunities across our platform.

•Talented and Committed Professionals: We attract, develop and retain highly accomplished investment professionals who not only demonstrate deep and broad investment and non-investment expertise but also have a strong sense of commitment to our firm.

•Collaborative Culture: We share ideas, relationships and information across our investment groups, which enables us to more effectively source, evaluate and manage investments. We also leverage the OMG to help drive the efficiencies across the platforms and support our investment process.

Integrated Investment Platform and Process

We operate our firm as an integrated investment platform with a collaborative culture that emphasizes sharing of knowledge and expertise. We believe the exchange of information enhances our ability to analyze investments, deploy capital and improve the performance of our funds and portfolio companies. We have established deep and sophisticated independent research capabilities in over 55 industries and insights from active investments in over 2,0251,800 companies, over 7601,400 alternative credit investments, over 505 properties, over 65 infrastructure assets and over 210 properties. In order to better collaborate on the information insights we possess across our investment platform, we formed a Global Markets Committee that meets monthly to share investing activities and market insights across our investment groups and the impact these market trends are having on our global investment strategies. Our extensive network of investment professionals includes local and geographically positioned individuals with the knowledge, experience and relationships that enable them to identify and take advantage of a wide range of investment opportunities.900 limited partnership interests.

Our investment process leverages the power of the Ares platform and an extensive network of professionals across our investment areas to identify and source attractive risk adjusted return opportunities while emphasizing capital preservation. We utilize our collective market and company knowledge, proprietary internal industry and company research, third partythird-party information and financial modeling to drive fundamental credit analysis and investment selection. We are able to invest up and down a company’s capital structure, which we believe helps us capitalize on out-performance opportunities and assess relative value for a particular investment. The investment committees of our investment groups review and evaluate investment opportunities in a framework that includes a qualitative and quantitative assessment of the key risks of each investment. We do not have a centralized investment committee and instead our investment committees are structured with overlapping membership from different investment groups to ensure consistency of approach, and shared investment experience.experience and collaboration across our platform. Our extensive network of investment professionals includes local and other individuals based in our markets with the knowledge, experience and relationships that enable them to identify and take advantage of a wide range of investment opportunities. In addition, our investment vehicles have investment policies and procedures that generally contain requirements and limitations, such as concentrations of securities, industries, and geographies in which such investment vehiclevehicles will invest, as well as other limitations required by law.

•Credit: Our experienced team takes a value-oriented approach which, among other factors, considers industry and market analysis, technical analysis, fundamental credit analysis and in-house research to identify investments that offer attractive value in comparison to the perceived credit risk profile. We use our longstanding relationships, considerable scale, research, industry knowledge, structuring expertise and often our self-origination capabilities to invest actively across capital structures with a focus on selecting the best risk adjustedrisk-adjusted returns for our investors, while also seeking to provide our borrowers a valued capital solution. Each investment decision involves an intensive due diligence process that is generally focused on evaluating the target company and its current and future prospects, its management team and industry, its ability to withstand adverse conditions and its capital structure, sponsorship and structural protection, among others. Credit now includes the APAC credit platform. In connection with a merger agreement, we rebranded Ares SSG Capital Holdings Limited and its operating subsidiaries (“SSG” and subsequently rebranded as “Ares SSG”) as Ares Asia and the Ares SSG credit business as Asia credit, which was subsequently rebranded as APAC credit. APAC credit makes credit and special situations investments through its local originating presence across Asia-Pacific (“APAC”) on behalf of its institutional client base.

•Private Equity: Our private equity professionals have a demonstrated the ability to deploy flexible capital which allows them to stay both active and disciplined inacross various market environments.environments at attractive rates of return through control and non-control transactions. At the center of our investment process is a systematic approach that emphasizes rigorous due diligence at the company and market levellevels in addition to assessing attractive relative value. We seek to be a risk-adjusted return value assessment. Ourprivate equity partner of choice and believe our partnership

mentality well-positions our investments for long-term success, whereby management teams gain access to our expertise and extensive internal and external networks from diligence to exit. In addition to focusing on generating strong returns for our investors, we are simultaneously focused on driving positive change by helping to promote diversity, inclusivity and social responsibility in the companies in which we invest, which we believe benefits the businesses as a whole in addition to its employees, communities and stakeholders. In addition, we completed the acquisition of the investment processmanagement business and related operating entities collectively doing business as Crescent Point Capital on October 2, 2023 (the “Crescent Point Acquisition”), a leading Asia-focused private equity firm. The acquired business is comprised of a five-part process: (1) generate robust pipeline, (2) perform initial screening, (3) conduct due diligence, (4) seek investment approval, and (5) use a systematic approach to value creation. Ourpresented within the Private Equity Group employs a “pull model” with portfolio management whereby a team can access the Ares network for any number of value-creating levers that have been identified.as APAC private equity.

•Real EstateAssets: With our experienced team, along with our expansive network of relationships, our Real EstateAssets Group invests in opportunities across both real estatemanages equity and debt investing.strategies across real estate and infrastructure investments. Across our real estate equity and debt investment strategies, our Real Estate Groupteam differentiates itself through its cycle-tested leadership, demonstrated performance across market cycles, access to real-time property market and corporate trends, and proven ability to create value through a disciplined investment process. TheOur real estate activities of our Real Estate Group are managed by dedicated equity and debt teams in the U.S. and Europe.Europe, along with our vertically-integrated operating platform. These individuals collaborate frequently within and across

strategies to enhance sourcing, exchange information to inform underwriting and leverage relationships to drive pricing power. Our Real Estate Group'sreal estate equity and debt teams have the flexibility to invest across the risk-return spectrum through core/core-plus, value-add and opportunistic investment strategies.

The infrastructure strategy focuses on debt and equity in essential infrastructure assets and companies with stable cash flow profiles through long-term contracts and high barriers to entry, and may demonstrate a lower correlation to public markets and potential for inflation projection. Across our infrastructure opportunities and debt investment strategies, we have a long-tenured global team utilizing deep local sourcing capabilities and extensive sector experience to originate and manage diverse, high-quality investments in private infrastructure assets across the globe. We have dedicated direct infrastructure opportunities and debt teams that collaborate to share market insights, support underwriting and enhance origination. Our infrastructure opportunities strategy focuses on value-add equity with a flexible mandate in climate infrastructure. Our infrastructure debt strategy targets global assets and opportunistic investing, while our Real Estate Group’s debt team focuses on directly originated commercial mortgage investmentsbusinesses with defensive characteristics across the risk spectrum.digital, transport, energy and utility sectors. Leveraging the established long-standing relationships, the strategy seeks to generate exclusive deal flow and high-quality investment opportunities.

•Strategic Initiatives:Secondaries: Our strategic initiatives team executes investmentinvests in secondary markets across a range of alternative asset class strategies, that expand our reachincluding private equity, real estate, infrastructure and scale in newcredit. Our secondary funds acquire interests across a range of partnership vehicles, including funds, multi-asset portfolios and existing global markets. Strategic Initiatives includes the Ares SSG platform subsequent to the completion ofsingle asset joint ventures. These strategies involve the acquisition on July 1, 2020. Ares SSG makes creditof interests from investors in existing funds as well as recapitalizing and special situations investments through its local originating presence across Asia-Pacific on behalf of its institutional client base. Strategic Initiatives also includesrestructuring the funds, including transactions that can address pending fund maturity, strategy change or the need for additional equity capital.

•Our other businesses include: (i) Ares Insurance Solutions (“AIS”),; and (ii) activities from our dedicated in-house teamcompany sponsored special purpose vehicles that provides solutions to insurance clients includingare formed for the purpose of effecting a merger, share exchange, asset management, capital solutions and corporate development.acquisition, share purchase, reorganization or similar business combination.

We also recognize the importance of considering environmental, social and governance (“ESG”) factors in our investment process and have adopted an ESG policya Responsible Investment Program for the conduct of our business. We work collaboratively with our various underwriting, asset management, legal and compliance teams to appropriately integrate relevant ESG considerations into our investment process.

In addition, as part of our growth strategy, we may from time to time engage in discussions with counterparties with respect to various potential strategic transactions, including potential investments in, and acquisitions of, other companies or assets. In connection with evaluating potential strategic transactions and assets, weWe may incur significant expenses for the evaluation, and due diligence investigation and negotiation of any potential transaction.strategic transactions.

Breadth, Depth and Tenure of our Senior Management

Ares was built upon the fundamental principle that each of our distinct but complementary investment groups benefits from being part of our broader platform. We believe that our strong performance, consistent growth and high talent retention through economic cycles is due largely to the effective application of this principle across our broad organization of over 1,4502,850 employees. The management of our operating businesses is currently overseen by our Executive Management Committee which typically meets weeklyfrequently to discuss strategy and operational matters, and includes as representatives our Holdco Members and other senior leadership from our investment groups and business operations team. We also have a Partners Committee comprised of senior leadership from across the firm that meets periodically to discuss our business, including investment and operating performance, fundraising, market conditions, strategic initiatives and other firm matters. Each of our investment

groups is led by its own deep leadership team of highly accomplished investment professionals, who average approximately 25 years of investment experience in managing, investments in, advising, underwriting and restructuring companies. While primarily focused on managing strategies within their own investment group, these senior professionals are integrated within our platform through economic, cultural and structural measures. Our senior professionals have the opportunity to participate in the incentive programs of multiple investment groups to reward collaboration across our investment activities. This collaboration takes place on a daily basis and is formally promoted through internal systems and widely attended weekly or monthly meetings.

Human Capital

We believe that our people and our culture are the most critical strategic drivers of our success as a firm. Creating a welcoming and inclusive work environment with opportunities for growth and development is essential to attracting and retaining a high-performance team, which is in turn is necessary to drive differentiated outcomes. We believe that our unique culture, which centers upon values of collaboration, responsibility, entrepreneurialism, self-awareness and trustworthiness makes Ares a preferred place for top talent at all levels to build a long-term career within the alternative asset management industry. WeTo foster this culture, we invest heavily in our human capital efforts, including:

Talent Management: As of December 31, 2020,2023, we had over 1,4502,850 full-time employees, comprised of over 525approximately 1,000 professionals in our investment groups and over 9251,850 operations management professionals, located in over 2535 offices in more than 1015 countries. We provide a comprehensive set of programs, policies and benefits to enable team members to thrive, grow and contribute to their highest potential.

•Governance and Policies: Ares is committed to providing a work environment in which all individuals are treated with respect and dignity. While our culture is the foundation of our work environment, our equal opportunity employment, diversity, anti-harassment and anti-harassment/anti-discrimination policies reinforce a professional atmosphere.

•Recruiting and Onboarding: We pursue several strategic paths to hire top talent, including campus and lateral recruiting efforts, and focus on diversity. We prioritize making all new team members feel welcome and seek to set

them up for success through onboarding training, peer advisor programs, ongoing touchpoints, and connecting them with our employee resource groups (“ERGs”), which are grassroots, employee-led, executive-sponsored groups and open to all team members.

•Internship Training Program: Ares offers a formal internship program for students between their junior and senior years of college with the possibility of conversion to a full-time position in our analyst program upon graduation. Available roles span our investment and operations management teams.

•Mentoring, Training and Employee Engagement: We provide formal and informal mentoring, learning and development, and employee engagement opportunities. We conduct periodic pulse surveys,host frequent townhall meetings hosted by senior leadership and events to foster belonging. We also conduct anonymous firmwide surveys at least annually to evaluate employee morale, productivity and overall well-being.

•Education Sponsorship Program: Employees are encouraged to participate in degree programs, business-related seminars, workshops, ad-hoc academic courses, continued education seminars to maintain job-related licenses and other outside training courses to facilitate professional development, the cost of which is reimbursed to the employee by Ares.

•Internal Training and Development Programs: We continue to foster an environment that cultivates company and employee growth through educational programs focused on professional development, mandated training and other learning opportunities that are offered in person or online. Our team is focused on the training and development of our employees and has invested in a learning management system to facilitate this initiative.

•Performance Management: We take an ongoinga continuous feedback approach to performance management, encouraging leaders and team members to participate in goal setting and ongoing feedback discussions throughout the year, inyear. Our formal, firm-wide annual review process includes a self-assessment, a 360-degree feedback component, calibration and round table discussions, and year-end evaluations provided by managers to employees. In addition to our firm-wide 360the annual review, we also conduct mid-year performance reviews that are less formal and serve to evaluate progress against goals and as an opportunity to discuss specific career development objectives that were identified in the annual assessment. Training is provided for each phase of our performance assessment process.

•Retention, Rewards and Recognition: We provide competitive compensation and benefits toto: (i) attract and retain andtalent; (ii) align the incentives of our employees with our investors and stakeholders.stakeholders; and (iii) support our employees across many aspects of their lives. We also have programs that seek to recognize significant team member contributions at the firm level.

Environmental, Social and Governance: We believe that ESG is integral to driving long-term success for our business. We pursue a strategy that is designed to address ESG issues most relevant to our business, starting with a corporate sustainability program focused on our corporate operations and then scaling through a responsible investment program that focuses on our investment platform.

•In order to continuously improve our ESG integration processes, we have defined three tiers of roles and responsibilities for oversight and implementation: (i) Oversight Responsibility; (ii) Defining Implementation; and (iii) Driving Implementation. The Oversight Responsibility tier is led by our Global Head of ESG and consists of our most-senior managers and decision-making bodies, including our Executive Management Committee and board of directors. Next, our ESG team is responsible for Defining Implementation steps and processes in partnership with ESG champions embedded within each business line to adapt the Ares firm-wide approach to strategy-specific implementation steps. We focus on Driving Implementation through all levels of investment professionals and management to promote the integration and scalability of our approach.

•Where appropriate, we aim to engage with industry organizations to help shape emerging areas of ESG practice. For example, Ares is the Chair of the UN Principles for Responsible Investing (“UNPRI”) Private Debt Advisory Committee, which aims to define and promote best practices for ESG integration within the direct lending market. Ares is also a public supporter of the Financial Stability Board Taskforce on Climate-related Financial Disclosures (“TCFD”). We believe the TCFD recommendations provide a useful framework to increase transparency on climate-related risks and opportunities within financial markets. In addition, we engage with the ESG Data Convergence Initiative, Partnership for Carbon Accounting Financials and Initiative Climat International to improve consistency and transparency in our ESG and climate disclosures.

•As part of our efforts to manage the risks and opportunities associated with the energy transition, we seek to engage our portfolio companies on greenhouse gas emissions measurement and support them in their emissions reduction strategies. We are committed to measuring and reporting on our greenhouse gas emissions. We aim to minimize our own corporate footprint through initiatives to reduce operational emissions and by addressing residual, harder-to-abate emissions with tools such as renewable energy certificates and the purchase of carbon credits we believe to be high-quality.

Diversity, Equity and Inclusion: We invest heavily in diversity, equity and inclusion (“DEI”) as a strategic pillar that integrates with all talent processes and global business practices. In partnership with our Human ResourcesOur human resources function, our global DEI Council implementsand team led by our Chief Diversity, Equity, and Inclusion Officer and business leaders across the Ares platform work in partnership to implement a strategic framework to attract, engage, develop engage and advance diverse talent within an inclusive and welcoming environment.environment, as well as to support DEI best practices across our investment portfolios and through our broader involvement in our communities.

•Recruiting:People and Culture: We prioritize growing diversityAs part of our ongoing effort to foster an inclusive culture built on apprenticeship, we support the growth and advancement of talent through various mentorship and professional development programs. In line with our campus recruiting efforts,continued commitment to seek to provide an environment where all team members experience a genuine sense of belonging, we hold educational trainings and employee engagement events, often in partnership with our eight ERGs that help to drive our DEI strategy and enhance the employee experience for underrepresented groups, allies and diverse talent more broadly. To create more transparency, we also aim to conduct periodic reviews with business leadership to assess our people, progress, metrics and strategies to enable the long-term success of diverse talent at Ares. In addition, as well aspart of our early pipeline programscommitment to educate womenequitable pay for all employees, we monitor and minorities on the industry. We are focused on building relationshipsassess total compensation to help ensure we have alignment with diversity-focused recruiting agenciesrole responsibilities and deepening diversity partnerships.contributions.

•Education, CelebrationBusiness Processes and Belonging:Investment Platform: We focusseek to embed DEI best practices into our business and investment diligence processes as both a reflection of our values and to drive innovation and returns. We have identified DEI champions within each investment group to develop bespoke strategies focused on holding educationalrepresentation, DEI governance, equitable access, and employee engagement events, including many in partnership withand equity ownership, which we intend to integrate into our six ERGs, which are grassroots, employee-led, executive-sponsored groups that seek to enhance DEI and support minority team members.business plans each year. In addition, we conduct regular mandatory anti-harassmentare focused on supporting vendor and unconscious bias training.supplier diversity in our procurement practices. In 2022, we also introduced sustainability-linked pricing to our Credit Facility, tying a portion of our borrowing costs

to certain ESG and DEI-related targets. Due to the achievement of the ESG-related targets in 2023, our base rate and unused commitment fee on our Credit Facility have been reduced from July 2023 through June 2024. We also partner with select Ares private equity portfolio companies to understand the current state of their DEI efforts, as well as to share best practices and establish mutually agreed strategies for driving DEI improvements in parallel with our internal efforts.

•Equity:Communities: We strivepartner with organizations to ensure pay equity, regardlessfoster diversity within our communities and promote corporate citizenship through charity and volunteerism, much of gender or race/ethnicity,which targets historically underrepresented and have undertaken pay equity studies foreconomically disadvantaged populations. We also participate in DEI-focused industry groups in an effort to identify and advance best practices more broadly within alternative asset management. In partnership with our employees in the U.S. and the U.K.ERGs, we donated to various community organizations that support diverse communities.

Health and Wellness: Wellness: We believe that healthy team members are more productive, and we invest heavily in benefits and initiatives to support our working families. In addition to medical, dental, vision, life insurance, disability insurance and retirement benefits, we provide generous primary and non-primary caregiver leave, domestic partner health and life insurance, adoption and reproductive assistance, family care resources (including back-up care benefits and baby baskets for new parents) and mental health benefits. We also provide employees with access to a medical advisory team and concierge service at no cost to help them navigate complex health situations and concerns. We also host several wellness-related events throughout the year on topics such as nutrition and stress management.

During the COVID-19 pandemic, we have invested further inFlexibility: We believe that our employees’ health and well-being. We pivoted to remote work early in the pandemic and have utilized technology to enable remote productivity. We implemented safety policies and controlsculture benefits from people collaborating in-person in our offices, for team members who wishwhile also recognizing the value of flexibility. We are committed to come onsite. We communicate frequentlyproviding flexibility to our employees, and have made available no-cost home fitness and mental health resources,in 2023, we continued to offer business group flexibility frameworks as well as webinarsour summer “Work From Anywhere” program, which allows people to work virtually for up to a maximum of three weeks. We will continue to offer a flexible working structure in 2024, while evaluating the ongoing effectiveness and expert speakers to keepdetermining what works best for our employees engaged and inspired.organization.

Philanthropy: AcrossWe strive to be a force for good and to be a leader in our global locations,approach to giving and engagement. Our core values are to be collaborative, responsible, entrepreneurial, self-aware and trustworthy. These core values motivate us to seek innovative yet practical solutions to some of society’s most pressing concerns. Empathy and compassion guide our approach to “doing good” such that our charitable efforts aim to help improve people’s quality of life. Philanthropy at Ares In Motion program reflects our commitment to corporate citizenship and supporting our local communities through a wide range of philanthropic and volunteerism efforts, including corporate sponsorships and partnerships, a global volunteer program and employee donation matching program.includes:

Ares’ directed charitable giving•Ares Charitable Foundation (the “Ares Foundation”):A 501(c)(3) qualifying organization sponsored by the firm, the Ares Foundation envisions a world in 2020 centered upon COVID-19 relief, including significant donationswhich people benefit from equitable access to hospitalsknowledge, resources and opportunities so that they can achieve their full potential. Launched in Los Angeles, New York, and London,2021, the Ares Foundation’s mission is to help accelerate equality of economic opportunity by supporting nonprofit organizations focused on health equity and disproportionately impacted groups,initiatives that provide career preparation and reskilling, encourage entrepreneurship and deepen individuals’ understanding of personal finance.

We fund and work alongside high-quality nonprofit organizations to devise inspired solutions to critical societal issues. Our employee-directed grants support initiatives that, for example, help low-income women in Singapore transition out of poverty, examine barriers to young people’s workforce entry in the U.K. and catalyze intergenerational entrepreneurship in the U.S. Our signature initiatives seek to address pervasive challenges through large-scale funding commitments that reflect our desire to improve the lives of current and future generations. Our commitments include Climate-Resilient Employees for a Sustainable Tomorrow (“CREST”), a five-year $25.0 million commitment that aims to close the gap between the demand for a skilled workforce for green jobs and the number of people ready for these opportunities in the U.S. and India, and AltFinance, a 10-year $30.0 million commitment to help equip Historically Black College and University students for careers in alternative investment management.

Ares is committed to donating a portion of our annualized carried interest allocations and incentive fees from certain funds supporting portfolio companies’to the Ares Foundation, which helps further align the firms’ investment and charitable activities. Moreover, the Ares Foundation benefits from the generosity of Ares employees who have been affectedare able to donate cash, equity or a portion of the realized proceeds from carried interest in certain funds.

•Pathfinder and Other Funds:In addition, Ares has committed to donate a minimum of 10% of the carried interest generated from Ares Pathfinder Fund, L.P. (“Pathfinder I”) and Ares Pathfinder Fund II, L.P. (“Pathfinder II”) and 5% of the incentive fees generated from an open-ended core alternative credit fund to global health and education charities, contributed by the crisis.firm and our team members. We believe that Pathfinder I is the first institutional private investment fund to utilize a predefined structure to make a substantial commitment to charitable activities.

2020•Ares in Motion (“AIM”): Our signature platform for employee engagement has empowered our team members to support local communities and nonprofit organizations since 2012. AIM engages employees in grassroots volunteerism, encourages their service with nonprofit boards and other pro bono opportunities, and amplifies their personal donations with charitable matches. Furthermore, employees who volunteer as AIM Champions enjoy opportunities to organize and lead volunteer activities in the U.S., Europe and Asia-Pacific to benefit the communities in which they live and work.

Our annual Summer of Service engages Ares employees around the world in both service-and skills-based “give back” opportunities. In addition, our nonprofit board training and placement program provides a way for team members to make a difference in their communities beyond firm-sponsored volunteer activities. AIM also helps bring our team members into thoughtful dialogue with nonprofit leaders through virtual fireside chat events so that employees can learn more about their organizations, understand the purpose and significance of their work, and glean valuable insights to apply professionally and personally.

Furthermore, we leverage AIM to sponsor and match team members’ support of charitable causes like crisis relief, social justice, mental health and DEI. In addition, we offer matching funds to augment team members’ sponsorship of nonprofits’ mission-driven events. The firm also sponsors these kinds of events through our business lines, and offers opportunities for employees to participate in these funded activities.

2023 Highlights

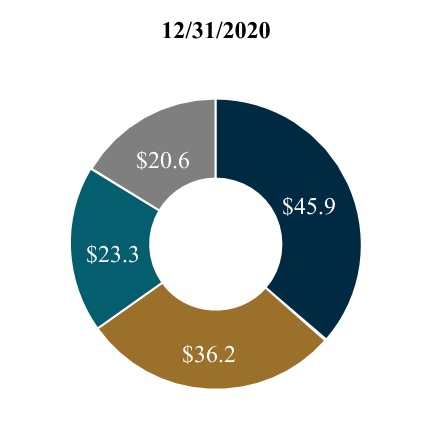

Fundraising

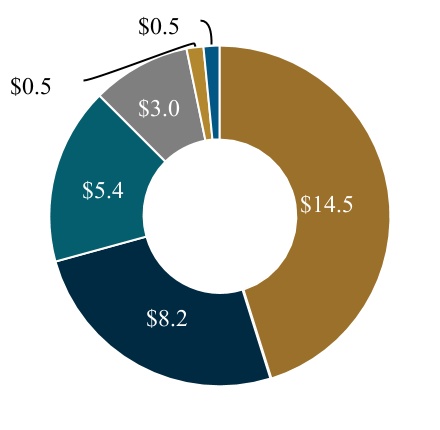

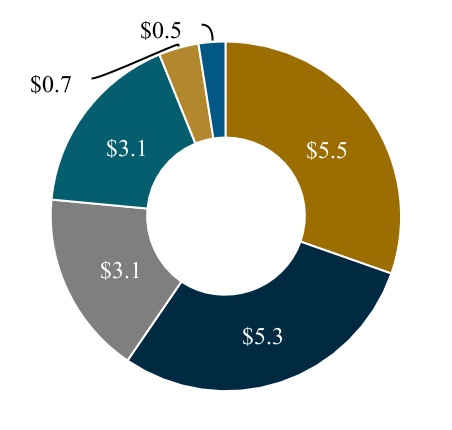

In 2020,2023, we raised $41.2$74.5 billion in gross new capital commitments for more than 85125 different investment vehicles. Of the $41.2$74.5 billion, $34.7$65.9 billion was raised directly from 358over 625 institutional investors (203(over 325 existing and 155approximately 300 new to Ares) and $6.5$8.6 billion was raised through intermediaries. The charts below summarize our gross new capital commitments by investment group and strategy ($ in billions):

| | | | | | | | | | | | | | | | | | | | |

| | Credit: $32.1$55.4 | | | Private Equity: $6.2$1.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | U.S. Direct Lending | | European Direct Lending | | U.S. Direct Lending | | Alternative Credit | | | | | | Corporate Private Equity | | Special OpportunitiesOther | | Infrastructure & Power | |

| | | | | | | | | | | | | | |

| | Syndicated Loans | | Multi-AssetLiquid Credit | | High YieldAPAC Credit | | Other | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Real Estate: $2.7Assets: $6.9 | | | Strategic Initiatives: $0.2Secondaries: $3.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Real Estate Debt | | U.S. Real Estate Equity | | Infrastructure Opportunities | | European Real Estate Equity | | | | | Asian Secured LendingCredit

Secondaries | | Real Estate Secondaries | | Infrastructure Secondaries |

| | | | | | | | | | | | | | | |

| | Real Estate Debt | | Infrastructure Debt | | | | | | | Private Equity Secondaries | | Other | | |

The chart below summarizes gross new capital raised from existing and new direct institutional investors for the year endedDecember 31, 2023:

| | | | | | | | | | | | | | | | | | | | |

| | Existing -

Re-Up | | Existing - New Product | | New |

In 2023, 88% of our fundraising from direct institutional investors was from existing investors that either committed to a new product or re-upped their commitment to a subsequent fund vintage within the same product. We believe the fundraising from existing investors demonstrates our investors’ satisfaction with our performance, disciplined management of their capital and diverse product offering.

Capital Deployment

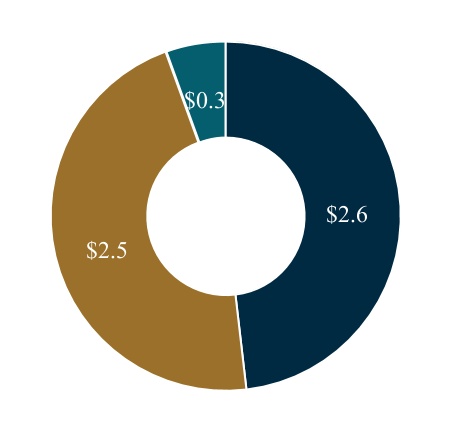

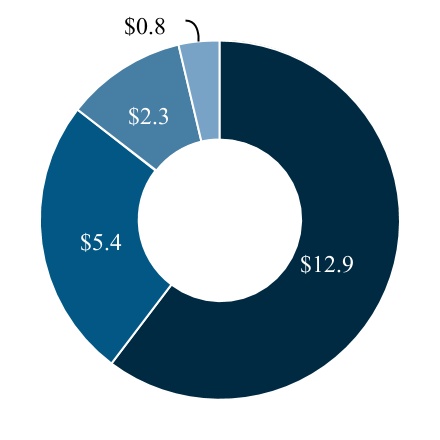

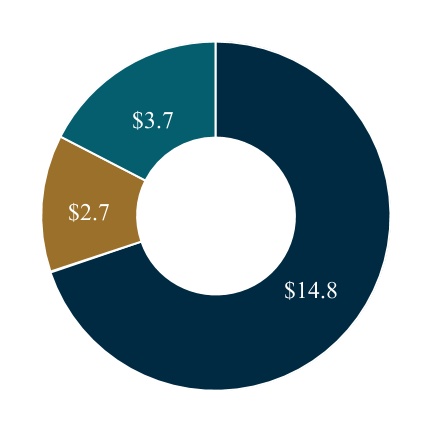

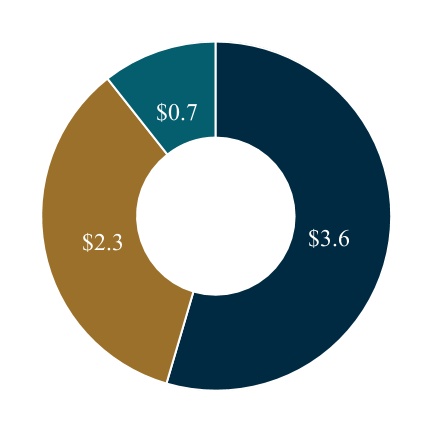

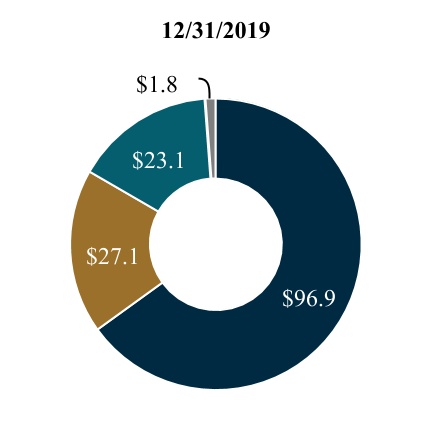

WIn 2023, we took advantage ofinvested $68.1 billion across our diverse global platform to invest more than $26.7 billion (excluding permanent capital) globally in 2020 as shown in the following charts ($ in billions):

| | | | | | | | | | | | | | |

| Credit $18.2$53.2 | | Private Equity: $5.4$4.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. Direct Lending | | Alternative Credit | | European Direct Lending | | | U.S. Direct LendingSpecial Opportunities | | Alternative Credit | | | Corporate Private Equity | | Special Opportunities | | Infrastructure and Power | |

| | | | | | | | | | |

| Syndicated Loans | | Multi-AssetLiquid Credit | | High YieldAPAC Credit | | | | | | | | |

| | | | | | | | | | | | | | |

| Real Estate:Assets: $7.6 |

| Secondaries: $2.3 | | Strategic Initiatives: $0.8

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | U.S. Real Estate DebtEquity | | European Real Estate Equity | | Infrastructure Debt | | | | | U.S. Private Equity Secondaries | | Real Estate EquitySecondaries |

| | | | | | | | | | | | |

| Infrastructure Opportunities | | | | | | Asian Secured LendingReal Estate Debt | | | | | | | Asian Special SituationsInfrastructure Secondaries | | Credit

Secondaries |

Of the $26.7$68.1 billion invested, $21.4$42.5 billion was tied to our drawdown funds. Our capital deployment in drawdown funds was comprised of the following ($ in billions):

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Credit | | Private Equity | | Real EstateAssets | | Secondaries | | Strategic Initiatives |

Investment Groups

Each of our investment groups employs a disciplined, credit-oriented investment philosophy and is managed by a seasoned leadership team of senior professionals with extensive experience investing in, advising and underwriting and restructuring companies, power and energy assets and real estate properties.held by our funds.

(1)As of December 31, 2023, AUM amounts include vehicles managed by Ivy Hill Asset Management, L.P., a wholly owned portfolio company of ARCC and an SEC-registered investment adviser (“IHAM”).

(2)$56.9 billion in AUM represents investments by insurance companies in various Ares’ funds, SMAs and co-investments versus one discrete insurance platform.

Credit Group

Our Credit Group is one of the largest managers of credit strategies across the non-investment grade credit universe, with $145.5$284.8 billion of AUM and over 200270 funds as of December 31, 20202023. The Credit Group provides solutions for investors seeking to access a wide range of credit assets, including liquid credit, alternative credit products and direct lending products. The Credit Group capitalizes on opportunities across traded and non-traded corporate and consumer debt across the U.S. and European markets, providing investors access to directly originated fixed and floating rate credit assets along with the ability to capitalize on illiquidity premiums across the credit spectrum. Our U.S. and European direct lending strategies are among the largest in their respective markets. We are also a leading global manager of syndicated bank loans.

The Credit Group offers the following credit strategies across the liquid and illiquid spectrum:

Liquid Credit: Our liquid credit investment solutions help traditional fixed income investors access the syndicated loan and high yield bond markets among other asset categories. We focus on capitalizingin North America and Europe and capitalize on opportunities across traded corporatemulti-asset credit. As of December 31, 2020, our liquid credit team managed $33.8 billion of AUM in over 85 funds and separately managed accounts (“SMAs”).

•Syndicated Loans: OurThe syndicated loans strategy delivers a diversified portfolio of liquid, traded non-investment grade secured loans to corporate issuers. We focusfocuses on evaluating individual credit opportunities related primarily to non-investment grade senior secured loans and primarily targettargets first lien senior secured debt,loans, with a secondary focus on second lien senior secured loans and subordinated and other unsecured loans. These capabilities have supported our long history as leading manager and issuer of CLOs which hold syndicated loans.

•High Yield Bonds: OurThe high yield bondsbond strategy employs a value-driven philosophy, utilizing fundamental researchseeks to identify non-investment grade corporate issuers. We primarily seekdeliver a diversified portfolio of liquid, traded non-investment grade corporate bonds. This approach incorporatesbonds, including secured, unsecured and subordinated debt instruments of issuers in both North America and Europe.

•Multi-Asset Credit: Our multi-assetinstruments. Multi-asset credit strategy combines both syndicated loans and high yield bonds, as well as other asset categories including structured credit, special situations and related credit instruments intois a single portfolio. These portfolios are“go anywhere” strategy designed to offer investors a flexible solution to global credit investing by allowing us to tactically allocate between multiple asset classes in various market conditions. This strategy invests globally, can be highly customized,conditions. As of December 31, 2023, our liquid credit team managed $47.3 billion of AUM in over 110 funds and is designed to “go anywhere” within the liquid, non-investment grade credit universe.separately managed accounts (“SMAs”).

Alternative Credit: Our alternative credit strategy seeks to capitalize on asset-focused investment opportunities that fall outside of traditional, well-defined markets such as corporate debt, real estate and private equity. As of December 31, 2020,2023, our dedicated team of over 3065 professionals managed $12.9$33.9 billion inof AUM in over 2025 private funds and SMAs for a global investor base. Our alternative credit strategy emphasizes downside protection and capital preservation through a focus on investments that tend to share the following key attributes: asset security, covenants, structural protections and cash flow velocity.velocity and other features designed to capture value and minimize risk to principal. Our investment approach is designed to capture and create value by leveraging our firm'sfirm’s platform insights to assess risk and relative value.

Direct Lending: Our direct lending strategy is one of the largest self-originating direct lenders to the U.S. and European markets, with $98.8$191.4 billion of AUM in over 8590 funds and investment vehicles as of December 31, 20202023. We manage various types of direct lending vehicles within our U.S. and European direct lending teams including commingled funds, SMAs for large institutional investors seeking tailored investment solutions and joint venture lending programs. As of December 31, 2023, we managed over 55 SMAs across our direct lending strategy.

Our direct lending team has a multi-channel origination strategy designed to address a broad set of investment opportunities in the middle market. We focus on being the lead or sole lender to our portfolio companies which we believe allows us to exert greater influence over deal terms, capital structure, documentation, fees and pricing, while securing our position as a preferred source of financing for our transaction partners. The team maintains a flexible investment strategy with the capability to invest in first lien senior secured loans (including “unitranche” loans which are loans that combine senior and subordinated debt, generally in a first lien position), second lien senior secured loans, subordinated debt, preferred equity and non-control equity co-investments in private middle market companies.

U.S. Direct Lending: Our leading U.S. team is comprised of over 145180 investment professionals that cover more than 525650 financial sponsors and provide a wide range of financing solutions to middle market companies that typically range from

$10 $10 million to $250over $500 million in earnings before interest, tax, depreciation and amortization (“EBITDA”). As of December 31, 20202023, our U.S. direct lending team and its affiliates managed $56.5$123.1 billion inof AUM in over 60approximately 55 funds and investment vehicles. Our U.S. team manages corporate lending activities primarily through our inaugural vehicle and publicly tradedpublicly-traded business development company (“BDC”), ARCC, our non-traded BDC, ASIF, as well as private commingled funds and SMAs. Primary areas of focus for our U.S. Direct Lendingdirect lending teams include:

•Ares Capital Corporation: ARCC is a leading specialty finance company focused on providing direct loans to and making other investments toin private middle market companies in the U.S. ARCC has elected to be regulated as a BDC and iswas the largest publicly-traded BDC by market capitalization in the U.S. as of December 31, 2020.2023.

•Ares Strategic Income Fund: ASIF is a closed-end investment company focused primarily on providing direct loans to private middle market companies in the U.S., and to a lesser extent, broadly syndicated loans and

other more liquid credit opportunities, including in publicly-traded debt instruments. ASIF has elected to be regulated as a BDC.

•U.S. Commingled Funds and SMAs: Outside of ARCC, U.S. direct lending also generates fees from other funds, including:including the following fund families: Ares Private Credit Solutions, which focusesfocus on junior debt investments in upper middle market companies; Ares Senior Direct Lending Fund, which focusesfocus on first lien senior secured loans to North American middle market companies; and Ares Commercial Finance, which focuses on asset-based and cash flow loans to middle market and specialty finance companies; as well asand SMAs for large institutional investors.

European Direct Lending: Our leading European direct lending team is comprised of over 6590 investment professionals thatwith the ability to invest across the capital structure and across several geographies in Europe. The team cover approximately 300covers over 395 financial sponsors, offers self-originated, flexible and is one ofscaled debt capital to predominantly the most active participants in the European middle market. The team offers a wide range of financing opportunities to middle market and large capitalization companies with EBITDA typically ranging from €10 million to €100over €300 million. As of December 31, 2020,2023, our European direct lending team managed $42.368.3 billion inof AUM in over 2535 funds, including our flagship European direct lending commingled funds, other various funds and SMAs.

APAC Credit: Our APAC credit team manages credit, private equity and special situations investments in the APAC region. Our APAC special situations strategy focuses on primary and secondary special situations, primarily targeting restructuring-related situations, deep value acquisitions and distressed financing. Our APAC private credit strategy targets privately sourced loans in high quality businesses across the region. The team consists of approximately 70 investment professionals. APAC credit benefits from having an on-the-ground presence in offices across the APAC region and a comprehensive range of local market licenses and entities to provide our clients with an extensive regional investment platform. APAC credit primarily employs a direct origination model and aims to provide flexible capital solutions to its investee companies and compelling risk-reward investment opportunities to our investors. As of December 31, 2023, APAC credit had $11.9 billion of AUM in over 15 funds and related co-investment vehicles.

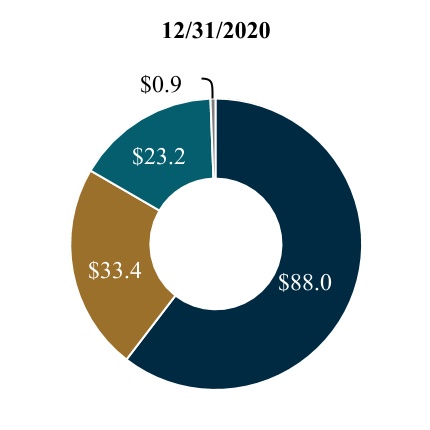

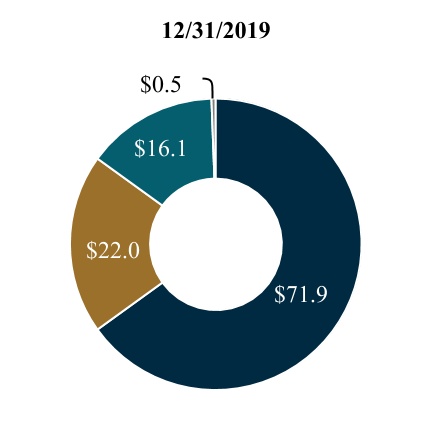

The following charts present the Credit Group’s AUM and FPAUM as of December 31, 20202023 by investment strategy ($ in billions):

| | | | | | | | | | | | | | |

| AUM: $145.5$284.8 | | FPAUM: $88.0$176.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. Direct Lending | | European Direct Lending | | Syndicated LoansLiquid Credit | | Alternative Credit | | High YieldAPAC Credit | | Multi-Asset CreditOther |

| | |

Private Equity Group

Our Private Equity Group has achieved compelling investment returns for a loyal and growing group of high profileits limited partners and, as of December 31, 20202023, had $27.4managed $39.1 billion of AUM. Our Private Equity GroupAUM in over 65 funds. The group broadly categorizes its investment activitiesstrategies into three strategies: Corporate Private Equity, Special Opportunitiescorporate private equity, special opportunities and Infrastructure and Power.APAC private equity. Our private equity professionals have a demonstrated ability to deploy flexible capital across market environments, which allows them to stay both active and disciplined in various market environments.their assessment of the best relative value opportunities. The group manages funds focused primarily on investing in North America, and, to a lesser extent, Europe and China.Asia-Pacific.

Corporate Private Equity: Certain of our senior private equity professionals have been working together since 1990 and raised our first corporate private equity fund in 2003. Our team has grown to consists of overover 75 55 investment professionals based primarily in Los

Angeles, Chicago, London, Shanghai,market volatility and Hong Kong. Indislocation. We seek to invest in high-quality middle market companies in the U.S.core industries of healthcare, services, industrials and London,consumer across North America and Europe, where we pursue four principal transactions types: prudently leveraged control buyouts, growth equity, rescue/deleveraging capitalcan utilize the team’s extensive growth-oriented investing experience, dedicated value creation system and ability to flex into distressed buyouts/discounted debt accumulation.to target attractive returns across market environments. This flexible capital approach,differentiated strategy, together with the broad resources of the Ares platform, widens our universe of potential investment opportunities and allows us to remain active in different marketsacross various market environments and to be highly selective in making investments across various market environments.by identifying the most attractive relative value opportunities.

Special Opportunities: Our special opportunities team hasconsists of more than 15over 25 investment professionals and employs aan “all weather” flexible capital strategy to targetfinance debt and non-control positions across a broad spectrum ofequity solutions in healthy, stressed and distressed middle market companies undergoing transformational change. Our team partners with companies in North America and opportunistic situations. We target businesses undergoing stress or transformational change that we believe present asymmetric risk/reward opportunities that offer strong downside protectionEurope to enhance enterprise values, filling the void between for-control private equity and the potential for significant upside participation. We employ our deep credit expertise, proprietary research and robust sourcing modeltraditional private debt. The strategy seeks to capitalize on current market trends. This opportunistic approach allows us toconsistently invest in both private and public transaction types across a broad range of industries, asset classesprivate, special-situation opportunities and geographies.flex into distressed public market debt when attractive. We believe the special opportunities team benefits from: (i) advantaged sourcing; (ii) private equity integration, with an ability to leverage the deep industry experience of the corporate private equity professionals; (iii) an extensive network and information edge; and (iv) an experienced team utilizing a consistent and repeatable investment process.

InfrastructureIn February 2024, we announced that our special opportunities strategy, historically reported as a component of our Private Equity Group, will be integrated into the Credit Group to align management of this strategy and Power:Our infrastructure and power team has more than 15will form the foundation for a new opportunistic credit strategy. The change will be presented in our results beginning in 2024. Adjusted for this change, as of December 31, 2023, the Credit Group managed $299.4 billion in AUM with approximately 490 investment professionals and takes a value-added approach that seeksthe Private Equity Group managed $24.5 billion in AUM with approximately 85 investment professionals, with both groups continuing to source and structure essential infrastructure assets with strong downside protection and potential for capital appreciation throughout the climate infrastructure, natural gas generation, and energy transportation sectors. We utilize a broad origination strategy, flexible investment approach, and leverage industry relationships and the Ares platform to seek attractive risk-adjusted returnsmanage investments across the infrastructureU.S., Europe and power industry. WeAsia-Pacific.

APAC Private Equity:The APAC private equity strategy was established in connection with the Crescent Point Acquisition, investing in industry leading consumer companies in seven core sectors that we believe benefit disproportionately from higher disposable income levels. The strategy focuses on primarily pursuing structured growth equity investments in control, joint control and minority ownership formats. Our APAC private equity team consists of over 25 investment professionals and focuses on investing in companies that give us exposure to increasing consumer spending and urbanization in our experience acrosstarget markets. In times of economic dislocation, we also seek to invest opportunistically where the asset life cycle, flexible capitalfocus is on dislocations and catalysts that lead to high-quality assets becoming available for purchase at deeply discounted prices. While we look for deep value opportunities in consumer-driven companies, our deep value approach and broad infrastructure expertise positions us well to take advantage of the transitioning infrastructure industry.often includes asset-oriented opportunities.

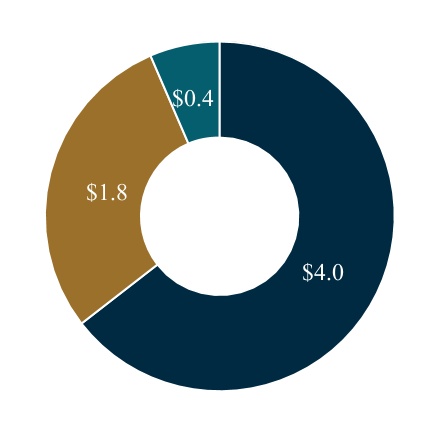

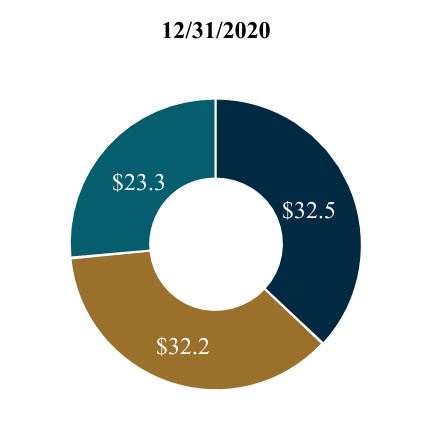

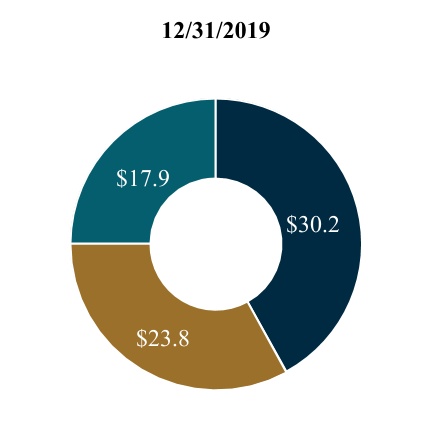

The following charts present the Private Equity Group’s AUM and FPAUM as of December 31, 20202023 by investment strategy ($ in billions):

| | | | | | | | | | | | | | | | | | | | | | | |

| Corporate

Private Equity | | Special Opportunities | | APAC Private Equity | | Infrastructure and PowerOther |

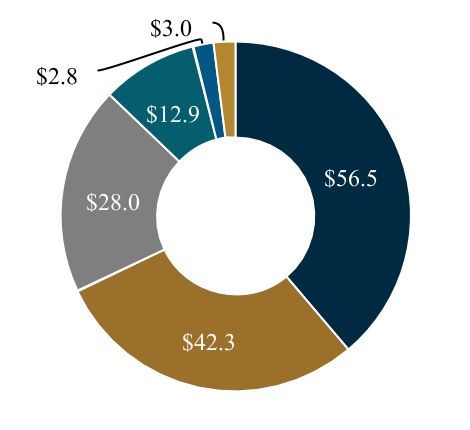

Real EstateAssets Group

Our Real EstateAssets Group manages comprehensive public and private equity and debt strategies with $14.8$65.4 billion of assetsAUM in over 65 under managementinvestment vehicles as of December 31, 2020.2023. With our experienced team, along with our expansive network of relationships, our Real EstateAssets Group capitalizes on opportunities across both real estatein equity and debt investing. investing across real estate and infrastructure investment strategies.

Real Estate: Our real estate equity investments focus on implementing hands-on value creation initiatives to mismanaged and capital-starved assets, platform-level investments, as well as new development,developments, ultimately selling stabilized assets back into the market. Our real estate debt strategies leverage the Real Estate Group’sutilize diverse sources of capital to directly originate and manage commercial mortgage investmentsloans on properties that range from stabilized to those requiring hands-on value creation. The Real Estate GroupOur real estate platform has achieved significant scale in a short period ofover time through both organic fundraising efforts as well as various acquisitions and successful fundraising efforts.acquisitions. Today, the group provideswe provide investors access to itsour real estate investment capabilities through several vehicles: closed-end U.S. and European real estatediversified equity commingled funds, an open-end U.S. real estateindustrial-focused equity fund, open-end U.S. and European debt commingled funds, real estate

equity and real estate debt SMAs, our non-traded REITs, Ares Real Estate Income Trust, Inc. (“AREIT”) and a publicly tradedAres Industrial Real Estate Income Trust, Inc. (“AIREIT”), and our publicly-traded commercial mortgage REIT, ACRE. The group’s activities are managed by dedicated equity and debt teams in the U.S. and Europe.

Real Estate Equity: Our real estate equity team, with over 55220 investment professionals, has extensive real estate private equity experience in the United StatesU.S. and Europe. Our team primarily acquires standing assets and improves assetsthem through renovations,renovating, repositioning and retenanting as well as selective developmentsand selectively developing assets in the United States and Europe.supply-constrained markets. As of December 31, 2020,2023, our real estate equity team managed $9.2$38.6 billion inof AUM in over 3540 investment vehicles. Primary areas of focus for our Real Estate Groupreal estate equity teams include:

•Real Estate Equity Value-AddCore/Core-Plus: Our U.S. core/core-plus real estate strategy focuses on the acquisition of assets with strong long-term cash flow potential and durable tenancy diversified across end-user industries and

geographies. We deploy capital across all major property types, with a strong focus on industrial and multifamily assets located in top-tier primary and regional distribution markets across the U.S.

•Real Estate Value-Add: Our U.S. and European value-add investment activities focusreal estate strategy focuses on the acquisition of underperforming,undermanaged and underfunded income-producing institutional-quality assets that our team believes can be improved through select value-creation initiatives. We target the majoracross various property sectors including residential, industrial, office and select other property types acrossin the U.S. and Europe. The strategy seeks to create value and generate stable and growing distributions to investors by buying properties at attractive valuations, implementing asset management initiatives to increase income and identifying multiple exit strategies upfront.

•Real Estate Equity OpportunisticOpportunistic:: Our U.S. and European opportunistic real estate investment activities focusstrategy capitalizes on capitalizingincreased investor demand for developed and stabilized assets by focusing on the repositioning of assets, capitalization of distressed and special situations, repositioning underperformingand development of core-quality assets and undertaking select development and redevelopment projects. We target theacross all major property sectors, including residential, industrial and officetypes, as well as select retail, hospitality and other niche asset classes acrossadjacent sectors, throughout the U.S. and Europe.

Real Estate Debt: Our real estate debt team, with over 2535 professionals, primarily focuses on directly originating and investing in a wide range of financing opportunities in the U.S. and Europe. As of December 31, 2020,2023, our real estate debt team managed $5.6$11.1 billion inof AUM in five investment vehicles. In addition to managing private commingledglobally through open-end funds, SMAs and SMAs, our real estate debt team also invests through a specialty finance company, ACRE, which invests in a diversified portfolio of real estate debt investments.ACRE. By investing through multiple investment vehicles, our real estate debt team has the ability to provide flexible financing across the capital structure. While our real estate debt strategies focus predominantly on directly originated transactions, we also selectively pursue secondary market acquisitions and syndicated transactions.

Infrastructure: Our long-tenured global infrastructure team utilizes deep local sourcing capabilities and extensive sector experience to seek to originate and manage diverse, high-quality investments in private infrastructure assets across the globe and, as of December 31, 2023, managed $15.7 billion of AUM in over 15 investment vehicles.

•Infrastructure Opportunities: Our infrastructure opportunities team consists of over 30 investment professionals and managed $6.3 billion of AUM in more than ten investment vehicles as of December 31, 2023. We utilize a broad origination strategy, flexible investment approach, and leverage industry relationships and the Ares platform to seek attractive risk-adjusted returns across the climate infrastructure market. We believe our experience as value-add investors, flexible approach, and broad infrastructure experience positions us well to take advantage of the transitioning infrastructure industry.

•Infrastructure Debt: Our global infrastructure debt team consists of over 20 investment professionals and sources assets and businesses across regions with defensive characteristics across the digital, transport, energy and utility sectors. As of December 31, 2023, our global infrastructure debt team managed $9.4 billion of AUM in more than five investment vehicles. We employ a direct origination and tailored structuring approach to provide borrowers with flexible financing solutions. We aim to deliver attractive risk adjusted returns focused on cash yield by targeting infrastructure debt investments with defensive characteristics that have the potential to perform across different market cycles. Our structuring experience helps enhance cash yield and reduce downside risks in a core asset class.

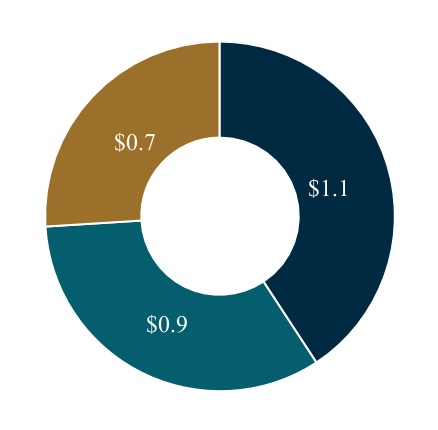

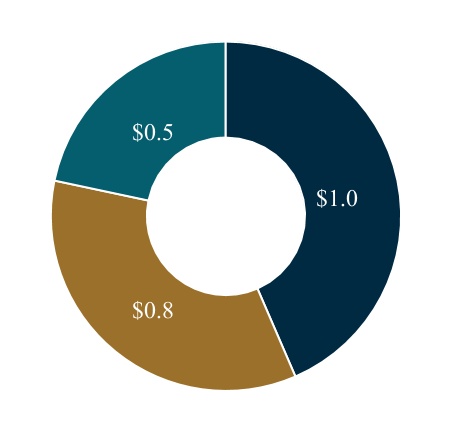

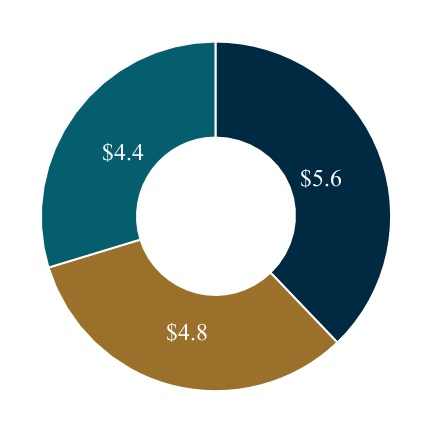

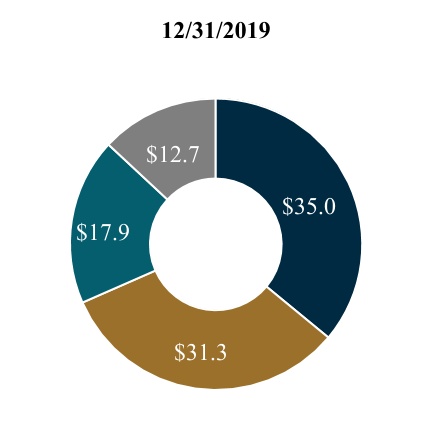

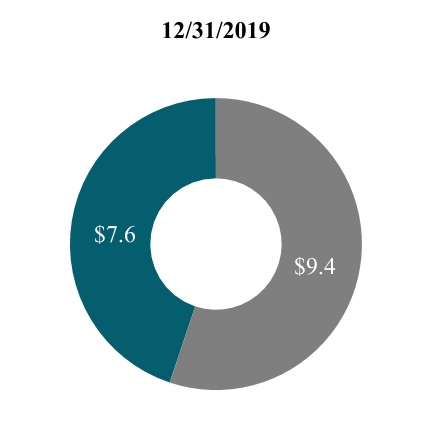

The following charts present the Real EstateAssets Group’s AUM and FPAUM as of December 31, 20202023by investment strategy ($ in billions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. Real Estate Equity | | Real Estate Debt | | European Real Estate Equity | | Infrastructure Debt | | Infrastructure Opportunities |

Secondaries Group

Our Secondaries Group invests in secondary markets across a range of alternative asset class strategies, including private equity, real estate, infrastructure and credit, with $24.7 billion of AUM in over 75 funds as of December 31, 2023. The team has extensive experience investing across the secondaries market primarily in North America. We have established ourselves among the most active secondary investors engaged in recapitalizing and restructuring existing limited partnership interests in funds with a focus on transactions that can address pending fund maturity, strategy change or the need for additional equity capital.

Private Equity Secondaries: Our private equity secondaries teamhas an established track record of providing customized private equity transaction solutions to institutional limited partners and general partners. As of December 31, 2023, our private equity secondaries team of more than 35 investment professionals managed $13.1 billion of AUM in approximately 35 funds and open-end accounts. Our private equity secondaries team acquires interests across a range of partnership vehicles, including private equity funds, multi-asset portfolios, as well as single asset joint ventures. The private equity secondaries strategy seeks to achieve attractive secondary cash flow and diversification characteristics by investing across the spectrum of private equity secondaries transactions, including through APMF, a closed-end interval fund. We continue to maintain a differentiated investment strategy that utilizes our skills in fundamental manager and portfolio analysis, our quantitative research capabilities and the support and insights from the wider Ares platform with the aim to generate strong risk-adjusted returns.

Real Estate Secondaries: Our real estate secondaries team has a track record of innovation through customized transaction solutions tailored to meet the needs of limited partners and general partners. As of December 31, 2023, our real estate secondaries team of more than 25 investment professionals managed $7.8 billion of AUM in approximately 30 funds and related co-investment vehicles. Our real estate secondaries team acquires interests across a range of partnership vehicles, including private real estate funds, multi-asset portfolios and single property joint ventures. Our team seeks broad diversification by property sector and geography and to drive investment results through underwriting, transaction structuring and portfolio construction.

Infrastructure Secondaries: Our infrastructure secondaries team has a strong track record of providing customized infrastructure transaction solutions tailored to meet the needs of limited partners and general partners. As of December 31, 2023, our infrastructure secondaries team of more than ten investment professionals managed $2.4 billion of AUM in ten funds and related co-investment vehicles. The infrastructure secondaries strategy seeks to accelerate the benefits of traditional infrastructure by providing diversified low risk exposure through preferred structure, traditional limited partnership and general partner led continuation vehicle transactions. Our team focuses on achieving diversification through building a portfolio that provides inflation protection and exposure to uncorrelated assets.

Credit Secondaries: Our credit secondaries strategy seeks to create a highly diversified portfolio of primarily senior secured private credit interests across North America and Europe, acquired directly or indirectly through secondary market

transactions. As of December 31, 2023, our credit secondaries team of ten investment professionals managed $1.4 billion of AUM in four funds and related co-investment vehicles.

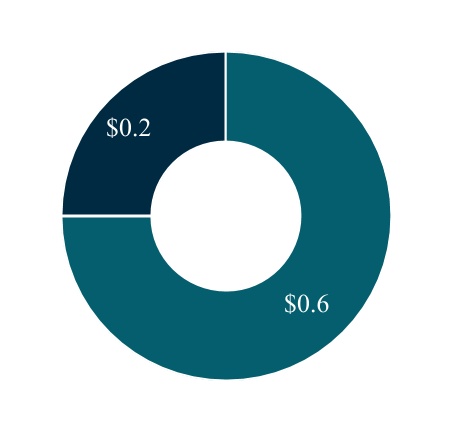

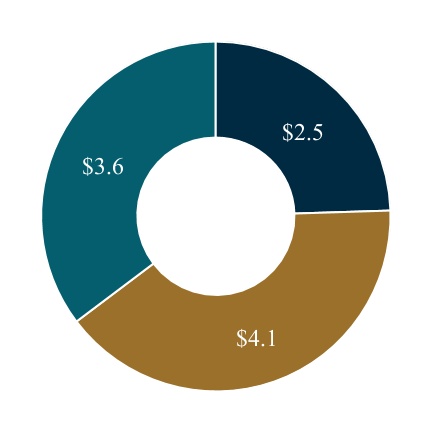

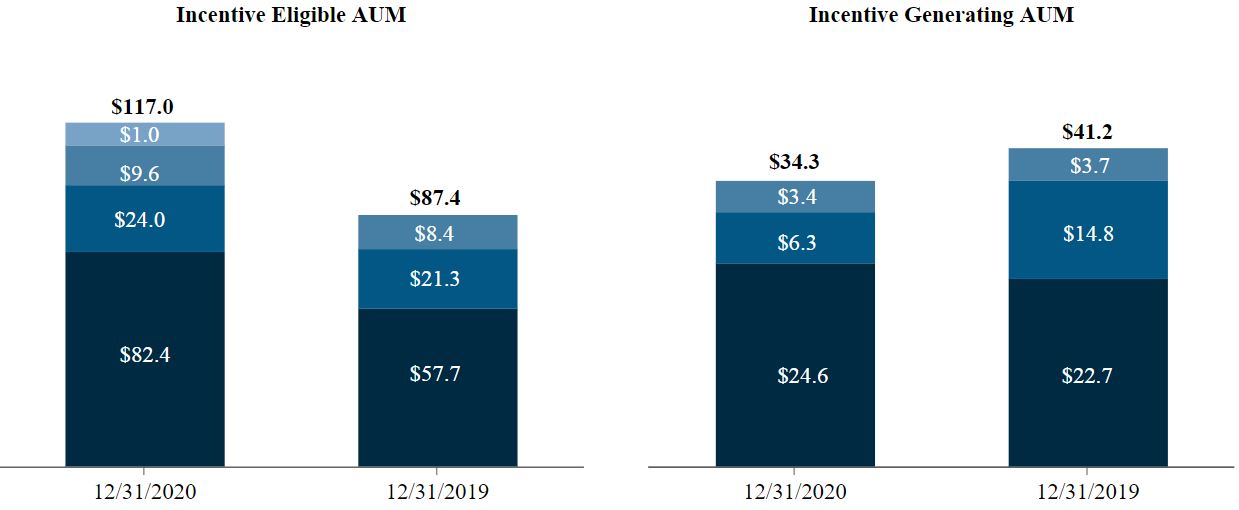

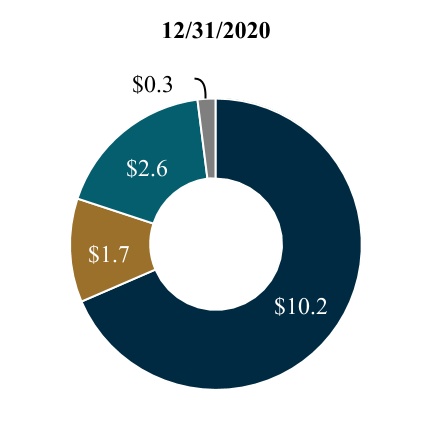

The following charts present the Secondaries Group’s AUM and FPAUM as of December 31, 2023 by investment strategy ($ in billions):

| | | | | | | | | | | | | | |

| AUM: $14.8$24.7 | | FPAUM: $10.2$19.1 | |

| | | | | | | | | | | | | | | | | |

| Real Estate Debt | | European Real Estate Equity | | U.S. Real Estate Equity |

| | |

Strategic Initiatives | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Private Equity Secondaries | | Real Estate Secondaries | | Infrastructure Secondaries | | Credit

Secondaries | | |

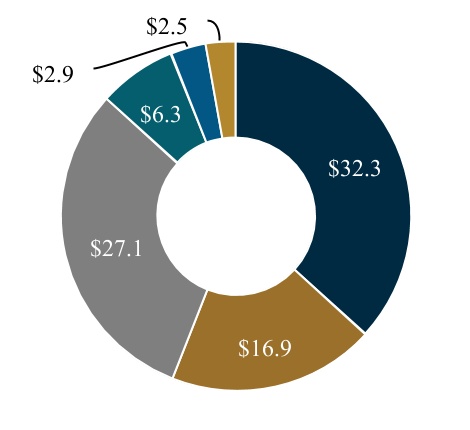

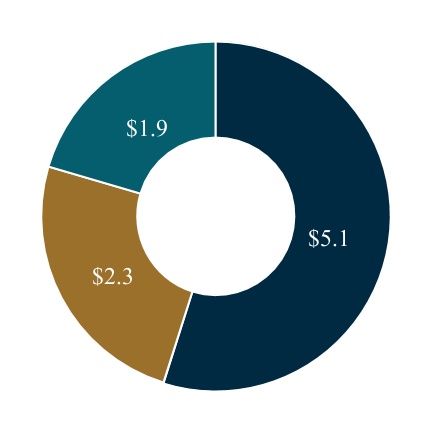

Other Businesses

Strategic Initiatives representsCertain operating segments and strategic investments thatgrowth opportunities have not reached the scale and magnitude to be presented individually; therefore, we present the results for these businesses collectively. These strategies seek to expand the Company’sour reach and its scale in new and existing global markets including Ares SSG as well as Ares Insurance Solutions (“AIS”).

Ares SSG: Ares SSG is a highly differentiated investment manager making credit, special situations and private equity investments in the Asia-Pacific region. The team of over 30 investment professionals has an extensive history of investing in Asian markets. Ares SSG benefits from having an on-the-ground presence in offices across Asia Pacificinclude AIS and a comprehensive

range of local market licenses and entities to provide our clients with an extensive regional investment platform. Ares SSG has $7.0 billion in AUM across over 10 funds as of December 31, 2020 and primarily employs a direct origination model and aims to provide flexible capital solutions to its investee companies and compelling risk-reward investment opportunities to our investors.

•Asian Special Situations: Our Asian special situations strategy focuses on primary and secondary special situation across the Asia Pacific region. Our team primarily targets restructuring-related situations, deep value acquisitions and last-mile financing.

•Asian Secured Lending: Our Asian secured lending strategy targets high quality, privately sourced direct lending loans that do not exhibit financial strain. Our team primarily targets investments in secured loans, growth capital financing and acquisition financing, leveraging our deep set of relationships and coverage to enable direct origination across the Asia Pacific region.SPACs.

Ares Insurance Solutions: AIS is Ares Management'sAres’ dedicated, in-house team that provides solutions to insurance clients including asset management, capital solutions and corporate development. AIS strives to provide insurers with attractive risk and capital adjusted return profiles that fit within regulatory, rating agency and other counterparty guidelines. Leveraging over 525approximately 1,000 investment professionals across the firm’s investment groups, AIS creates tailored investment solutions that meet the unique objectives of our insurance clients. AIS strives to provide insurers with differentiated investment solutions with attractive risk and capital adjusted return profiles that fit within regulatory, rating agency and other counterparty guidelines. AIS is overseen by an experienced management team with direct insurance industry experience in many areas directly applicable to AIS and our insurance company clients. Members of the Ares team have previously held senior positions at leading insurers. AIS acts as the dedicated investment manager, capital solutions and corporate development partner to Aspida Life Insurance Company (“Aspida Life”) and Aspida Life Re Ltd. (“Aspida”Aspida Re”), an. Aspida Life and Aspida Re are insurance companycompanies that focusesfocus on the U.S. life and annuity insurance and reinsurance markets. In addition, AIS provides key strategic advantages to Aspida, including insurance investment experience, differentiated asset origination, asset-liabilitymanages $12.5 billion of AUM as of December 31, 2023, of which $8.2 billion is sub-advised by Ares vehicles and capital solutions and access to capital.included within other strategies.

Ares Acquisition Corporation: Ares Acquisition Corporation (formerly NYSE: AAC) (“AAC I”) was a SPAC sponsored by Ares and formed in 2020 for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination. AAC I did not complete a business combination within the time period required by its amended and restated memorandum and articles of association, and in the fourth quarter of 2023, the remaining outstanding Class A ordinary shares of AAC I were redeemed in full and AAC I ceased all operations other than legal dissolution.

Ares Acquisition Corporation II: Ares Acquisition Corporation II (NYSE: AACT) (“AAC II”) is a SPAC sponsored by Ares and formed in 2021 for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination. AAC II is seeking to pursue an initial business combination target in any industry or sector in North America, Europe or Asia.

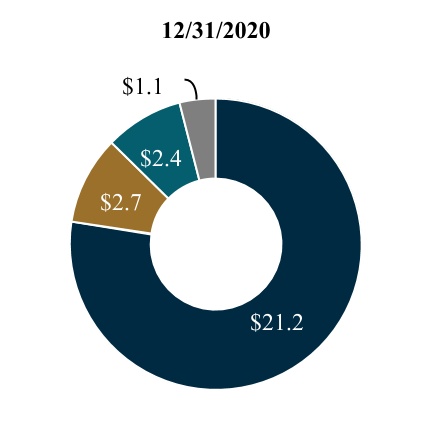

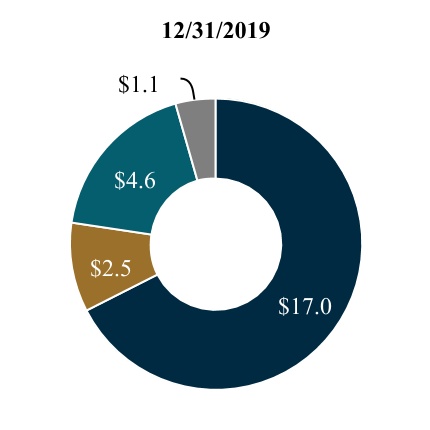

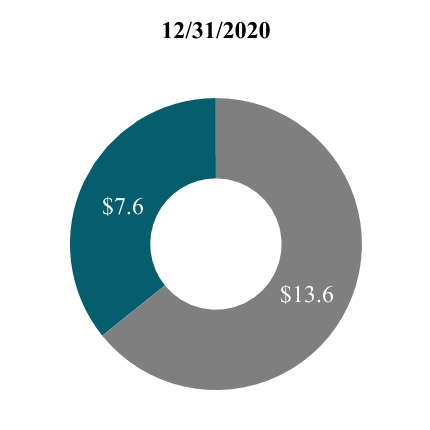

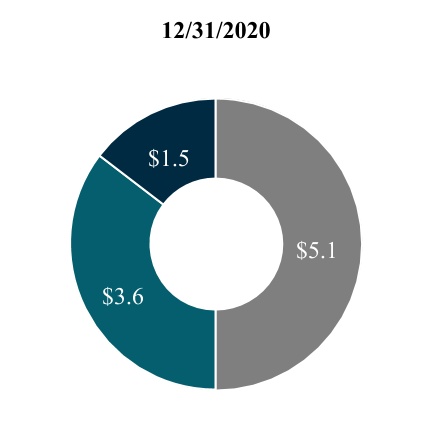

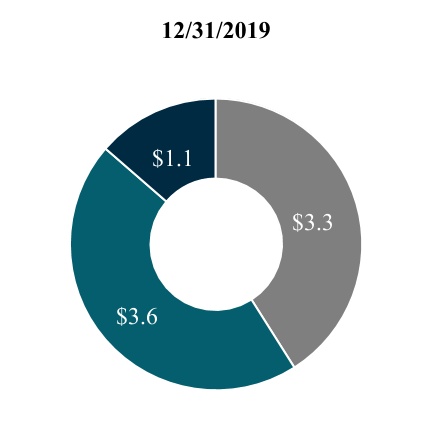

The following charts present Strategic Initiatives’Other Businesses AUM and FPAUM as of December 31, 20202023 by investment strategy ($ in billions):

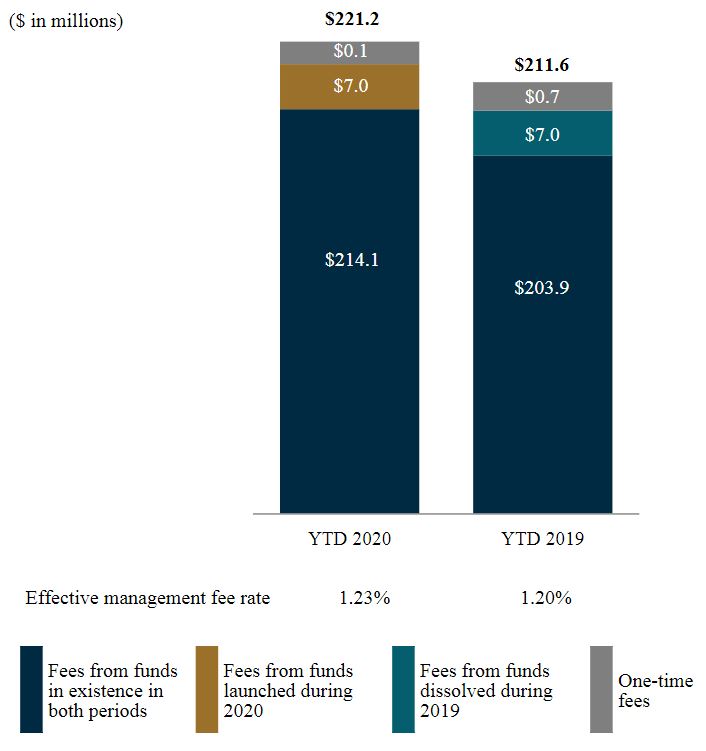

| | | | | | | | | | | | | | |