UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-K10-K/A

Amendment No. 1

(Mark One) | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED December 31, 2021.2022.

OR | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission file number: 000-17820

LAKELAND BANCORP, INC.

(Exact name of registrant as specified in its charter) | | | | | |

| New Jersey | 22-2953275 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification No.) |

250 Oak Ridge Road, Oak Ridge, New Jersey 07438

(Address of principal executive offices and zip code)

(973) 697-2000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of exchange on which registered |

| Common Stock, no par value | | LBAI | | The Nasdaq Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer ☒ Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by a check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2021,2022, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $846,945,000,$901,705,000, based on the closing sale price as reported on the NASDAQ Global Select Market.

The number of shares outstanding of the registrant’s common stock, as of February 22, 2022,April 10, 2023, was 64,648,502.65,018,978.

DOCUMENTS INCORPORATED BY REFERENCE:

None

INDEX

DOCUMENTS INCORPORATED BY REFERENCE:

Lakeland Bancorp, Inc. Proxy Statement for its 2022 Annual Meeting of Shareholders (Part III).

LAKELAND BANCORP, INC.

Form 10-K Index | | | | | | | | | | | |

| | PAGE |

|

| | |

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

|

Item 5. | | |

Item 6. | | |

| | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

Item 9C. | | |

|

Item 10. | | | |

| | | | |

| | | | |

| | | | |

| | | | |

PART I

ITEM 1 - Business.

GENERALEXPLANATORY NOTE

This Amendment No. 1 to the Annual Report on Form 10-K (this “Amendment”) amends the Annual Report on Form 10-K for the fiscal year ended December 31, 2022, originally filed on February 28, 2023 (the “Original Filing”) by Lakeland Bancorp, Inc. (the “Company” or “Lakeland Bancorp”) is, a bank holding company headquartered in Oak Ridge, New Jersey. The Company was organized in March 1989 and commenced operations on May 19, 1989, upon the consummation of the acquisition of all of the outstanding stock of Lakeland Bank, formerly named Lakeland State BankJersey corporation (“Lakeland” or the “Bank”“Company”). Lakeland is filing this Amendment to present the information required by Part III of Form 10-K as the Company will not file its definitive annual proxy statement within 120 days of the end of its fiscal year ended December 31, 2022.

Pursuant to Rule 12b-15 under the Securities Exchange Act of 1934, as amended, this Amendment also contains new certifications by the principal executive officer and the principal financial officer as required by Section 302 of the Sarbanes-Oxley Act of 2002. Accordingly, Item 15(a)(3) of Part IV is amended to include the currently dated certifications as exhibits. Because no financial statements have been included in this Amendment and this Amendment does not contain or “Lakeland Bank”amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certifications have been omitted.

On September 26, 2022, the Company entered into definitive merger agreement with Provident Financial Services, Inc. ("Provident"). pursuant to which the companies will combine in an all-stock merger. The transaction was approved by each of the Company’s shareholders and Provident's stockholders on February 1, 2023. The completion of the merger remains subject to receipt of the requisite regulatory approvals and other customary closing conditions. As a result, the Company does not anticipate holding an annual meeting of February 28, 2022, Lakeland operates 69 branch offices located throughout northernshareholders prior to closing.

Except as described above or as expressly noted in this Amendment, no other changes have been made to the Original Filing. The Original Filing continues to speak as of the date of the Original Filing, and central New Jersey and in Highland Mills, New York; six New Jersey regional commercial lending centers strategically located in our market area and one New York commercial lending center to serve the Hudson Valley region. Lakeland offers an extensive suite of financial products and services for businesses and consumers.

The Company has grown through a combination of organic growth and acquisitions. Since 1998, the Company has acquired nine community banksnot updated the disclosures contained therein to reflect any events which occurred at a date subsequent to the filing of the Original Filing.

PART III

ITEM 10 – Directors, Executive Officers and Corporate Governance.

Lakeland’s Board of Directors currently consists of 12 members and is divided into three classes, with an aggregate asset totalone class of approximately $4.16 billion, includingdirectors elected each year. Each of the 12 members also serves as a director of Lakeland Bank. The Company maintains a mandatory retirement age for its most recent acquisitiondirectors, which requires that any director who turns 72 during their term must retire at the next Annual Meeting of 1st Constitution BankShareholders. To provide for continuity with shareholders, customers and its parent, 1st Constitution Bancorp ("1st Constitution Bancorp"), which was completed on January 6, 2022. Atassociates and, in order to further ensure the success with respect to all aspects of the January 6, 2022, 1st Constitution Bancorp had approximately $1.88 billion in assets, $1.12 billion in loansmerger and $1.65 billion in deposits. Allintegration, the Board approved a specific exception to its mandatory retirement age policy so as to allow Robert F. Mangano, who was then age 76, to join the Boards of Lakeland and Lakeland Bank at legal close and to continue thereafter for an additional one-year term from the 2022 Annual Meeting of Shareholders, subject to shareholder approval.

The Company's goal is to have a Board of Directors whose members have diverse professional backgrounds and have demonstrated professional achievement with the highest personal and professional ethics and integrity and whose values are compatible with those of Lakeland. In 2021, the Board's Nominating and Corporate Governance Committee established a diversity definition, goals and timeframe for increased Board member diversity, which was informed by and aligned with an updated skills assessment. The Board recognized that the Company benefits from a Board whose members possess a diversity of business experience and demographic backgrounds and seek to identify nominees with a range of background and experience. In addition to a deep understanding of the acquired banks have been merged intobanking industry and the communities served by Lakeland Bank, important factors considered in the selection of nominees for director include experience in positions that develop good business judgement, that demonstrate a high degree of responsibility and independence and that show the individual's ability to commit adequate time and effort to serve as a director.

Directors and Executive Officers of Lakeland Bancorp

The following table states our directors' names, their ages as of March 15, 2023, the years when they began serving as directors of Lakeland and when their current terms expire.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| Name | | Position(s) Held With Lakeland Bancorp | | Age | | Director

Since | | Expiration

of Term | | | | | | | | | | | | |

| Bruce D. Bohuny | | Director | | 54 | | 2007 | | 2024 | | | | | | | | | | | | |

| Mary Ann Deacon | | Chair of the Board | | 71 | | 1995 | | 2024 | | | | | | | | | | | | |

| Brian Flynn | | Director | | 63 | | 2010 | | 2024 | | | | | | | | | | | | |

| Mark J. Fredericks | | Director | | 62 | | 1994 | | 2023 | | | | | | | | | | | | |

| Brian A. Gragnolati | | Director | | 65 | | 2020 | | 2024 | | | | | | | | | | | | |

| James E. Hanson II | | Director | | 64 | | 2018 | | 2023 | | | | | | | | | | | | |

| Janeth C. Hendershot | | Director | | 68 | | 2004 | | 2023 | | | | | | | | | | | | |

| Lawrence R. Inserra, Jr. | | Director | | 65 | | 2016 | | 2025 | | | | | | | | | | | | |

| Robert F. Mangano | | Director | | 77 | | 2022 | | 2023 | | | | | | | | | | | | |

| Robert E. McCracken | | Director | | 65 | | 2004 | | 2025 | | | | | | | | | | | | |

| Robert B. Nicholson, III | | Director | | 58 | | 2003 | | 2023 | | | | | | | | | | | | |

| Thomas J. Shara | | Director, President and Chief Executive Officer | | 65 | | 2008 | | 2025 | | | | | | | | | | | | |

The following information describes the business experience of each of Lakeland Bancorp's directors.

Mr. Bohuny currently is President at Brooks Builders. Mr. Bohuny’s over 20 years of experience in the residential and commercial construction and real estate development fields, and his prior work experience in the equity and fixed income markets and service on various educational and philanthropic boards including the StonyBrook School, Eastern Christian School, Christian Healthcare Center, New Canaan Society and NextGen Board Leaders Advisory Council, led the Board to conclude that this individual should serve as a director of Lakeland and Lakeland Bank.

Ms. Deacon is the current Board Chair of Lakeland Bancorp, Inc. and Lakeland Bank, as well as Secretary/Treasurer of Deacon Homes, Inc. Ms. Deacon’s over 40 years of extensive experience in the real estate development process, building contracting, property management and sales, her service to a number of community associations, her reputation in the broader business community as well as in the local real estate markets and her dedication to Lakeland and Lakeland Bank led the Board to conclude that this individual should serve as a director of Lakeland. Ms. Deacon is responsible for the planning and administration of numerous operating companies and four condominium associations. Her past participation in the state and local real estate associations includes leadership positions and committee experience in ethics, professional standards, strategic planning and governance. Ms. Deacon is committed to enhancing her professional participation as a director of Lakeland and frequently attends continuing education seminars and institutes applicable to directors of banks and bank holding companies. During her 28-year tenure at Lakeland, she has served on every committee of the Board. In January 2010, she was elected Vice Chair of the Board of Lakeland and Lakeland Bank and, in May 2011, she was elected Board Chair of Lakeland and Lakeland Bank.

Mr. Flynn is a Partner at PKF O’Connor Davies, LLP, one of the largest regional accounting firms in the tri-state area. He received his Bachelor of Science Degree, cum laude, from Monmouth College. With over 30 years of experience as a practicing CPA, Mr. Flynn brings in-depth knowledge of generally accepted accounting principles and auditing standards to our Board. He has worked with audit committees and boards of directors in the past, including previously serving on the Boards of TD Banknorth, Inc. and Hudson United Bancorp, and provides Lakeland’s Board of Directors and its Audit Committee with extensive experience in auditing and preparing financial statements. For these reasons, the Board has concluded that this individual should serve as a director of Lakeland and Lakeland Bank.

Mr. Fredericks’ experience in business, banking and real estate, as well as his extensive knowledge of the communities in which Lakeland operates, has led the Board to conclude that this individual should serve as a director of Lakeland and Lakeland Bank. Mr. Fredericks has served as a director of Lakeland since 1994 and his knowledge of banking comes his tenure as a director, during which he has served on several committees. Mr. Fredericks owns and operates three businesses in Lakeland’s markets: he is the president and CEO of Fredericks Fuel and Heating Services, as well as president of Keil Oil Inc. and F&B Trucking Inc. He also is the managing partner of several real estate partnerships in the area. Mr. Fredericks is a lifetime resident and active participant in the communities served by Lakeland, and has been a member of numerous charitable, civic and business organizations over the years. These include his prior service as Trustee of Chilton Memorial Hospital; member and past president of the West Milford Education Foundation and member and past president of the West Milford Rotary Club.

Mr. Gragnolati has served as the President and CEO of Atlantic Health System since 2015. Atlantic Health System is a not-for-profit private healthcare company that operates hospitals and health care facilities throughout New Jersey. He also serves as a Past Chairman of the Board of the American Hospital Association, a nationwide organization that represents and advocates on behalf of hospitals, health care systems, networks, other providers of care and individual members. He also previously served on the board of Paper Mill Playhouse and is a proponent of their work in arts accessibility, which makes theater available to audience members with cognitive and developmental disabilities.Prior to joining Atlantic Health System, Mr. Gragnolati

served as Senior Vice President, Community Division of Johns Hopkins Medicine, and President and CEO of Suburban Hospital and, before that, held executive positions at WellSpan Health, the Medical Center Hospital of Vermont, and Baystate Medical Center in Springfield, Massachusetts. Mr. Gragnolati holds a bachelor’s degree in Health Systems Analysis from the University of Connecticut, an MBA from Western New England College, and an Executive Leadership Certificate from the JFK School at Harvard University. Mr. Gragnolati’s experience in business, executive management and finance, as well as his familiarity with and leadership of not-for-profit organizations, has led the Board to conclude that this individual should serve as a director of Lakeland and Lakeland Bank.

Mr. Hanson has served as President and CEO of The Hampshire Companies, a full service, private real estate investment firm with assets valued at more than $2.3 billion, based in Morristown, New Jersey, since 2005. Mr. Hanson also serves as a non-executive director of United-Hampshire US REIT Management PTE LTD., a Singapore company REIT Manager (50% of which is owned by The Hampshire Companies) that operates as a real estate investment trust that owns and operates U.S.-based shopping, storage, grocery and necessity-based retail properties and which is listed on the Singapore Exchange. He holds a number of leadership positions, both professionally and philanthropically. Mr. Hanson also serves as a Member of the New Jersey State Investment Council since 2010. Mr. Hanson has served as a Commissioner of the Palisades Interstate Park Commission since 1995. Mr. Hanson presently serves as President of the Commission, a position that he previously held between 2000 and 2005 and to which he was re-appointed in September 2021. Mr. Hanson holds a law degree from Vermont Law School, graduating Magna Cum Laude, and a Bachelor of Arts from Hope College, and subsequently served in a variety of leadership roles at each institution, including as Trustee. Mr. Hanson’s extensive knowledge of the commercial real estate markets, his proven business experience and philanthropic leadership led the Board to believe that this individual should serve as a director of Lakeland and Lakeland Bank.

Ms. Hendershot has had significant experience in the leadership and management of various corporate entities and operations. She also has experience in managing and controlling risk-taking operations within the insurance industry, and in IT strategy and developments. This experience, as well as her educational background including a degree in economics from Cornell University, led the Board to conclude that this individual should serve as a director of Lakeland and Lakeland Bank.

Lawrence R. Inserra, Jr. joined the Lakeland and Lakeland Bank Boards of Directors upon the closing of the mergers with Pascack Bancorp, Inc. and Pascack Community Bank in 2016, at which he previously had served as a director. Mr. Inserra is Chairman of the Board and CEO of Inserra Supermarkets, Inc., a family-owned business founded in 1954 and one of the largest supermarket chains in the metropolitan area, which owns and operates numerous ShopRite stores throughout New Jersey and New York. Mr. Inserra also holds a number of leadership positions, both professionally and philanthropically, including board member and treasurer of Wakefern Food Corporation. In 2013, he was named Chairman of the Board of Governors at Hackensack University Medical Center (HUMC) after serving as First Vice Chairman and Chairman of the Human Resources Committee at HUMC. Mr. Inserra received a Bachelor of Science in business and economics from Lehigh University. Mr. Inserra’s business experience, philanthropic endeavors and knowledge of Lakeland’s markets led the Board to believe that this individual should serve as a director of Lakeland and Lakeland Bank.

Robert F. Mangano joined the Lakeland and Lakeland Bank Boards of Directors on January 6, 2022 upon the closing of the mergers with 1st Constitution Bancorp and 1st Constitution Bank at which he had served as a director, President and Chief Executive Officer. Mr. Mangano serves on the Board of Trustees of Englewood Hospital Medical Center and its parent board and is Chairman of its Audit Committee. Mr. Mangano's business skills and experience, his extensive knowledge of financial and operational matters acquired holdingduring his career working for several banks in increasingly senior roles and leadership positions and his thorough understanding of 1st Constitution Bank's markets led the Board to conclude that this individual should serve as a director of Lakeland and Lakeland Bank.

Robert E. McCracken is the sole managing member and owner of REM, GC LLC, the manager of Wood Funeral Home and Smith-McCracken Funeral Home. Mr. McCracken’s knowledge of the banking industry, his over 15 years of service on the boards of various banks (including serving on Lakeland’s Board since 2004 and Lakeland Bank’s Board since 2008), his business experience as an owner and operator of various businesses and real estate within Lakeland’s footprint, his reputation in the community as a lifelong resident within Lakeland’s footprint, his many long standing relationships with Lakeland’s non-institutional shareholder base and his involvement in many non-profit and local charities, including serving as former Board Chairman of Newton Memorial Hospital, now known as the Newton Medical Center, and presently as Chairman of the Atlantic Health System Board, as well as on the boards of other local organizations, led the Board to conclude that this individual should serve as a director of Lakeland and Lakeland Bank.

Mr. Nicholson’s business experience with Eastern Propane Corporation, including having served as president and CEO of that entity for 29 years, his educational background in finance and business management, his experience in buying and selling companies if applicable, haveand commercial real estate properties and his reputation in the business and local community led the Board to conclude that this individual should serve as a director of Lakeland and Lakeland Bank. Mr. Nicholson has been merged intohonored with the Outstanding Citizen of the Year award from Sparta Township, as a Distinguished Citizen by the Boy Scouts of America, Patriots Path Council, the Distinguished Alumni Award from Florida Southern College for outstanding service to his professions and community and is the Past Chairman of the board of trustees for the Sussex County New Jersey Chamber of Commerce.

Thomas J. Shara’s over 30 years of experience in the banking industry, his stature and reputation in the banking and local community, and his service as President and CEO of Lakeland and Lakeland Bank since April 2008 led the Board to conclude that this individual should serve as a director of Lakeland and Lakeland Bank. His knowledge and understanding of all facets of the business of banking, the leadership he has demonstrated at Lakeland and at prior institutions and his involvement in charitable and trade organizations make him extremely valuable as a Board member. Mr. Shara serves as a member of the New Jersey Bankers Association Board of Directors, on the Board of Directors of the Commerce and Industry Association of New Jersey, the Board of Trustees of the Boys and Girls Club of Paterson and Passaic, New Jersey and the Board of Trustees of the Chilton Hospital Foundation. He also serves on the Board of Governors of the Ramapo College Foundation. Mr. Shara earned a Master’s Degree in Business Administration and a Bachelor of Science Degree from Fairleigh Dickinson University. Mr. Shara previously served as the Chairman of New Jersey Bankers Association.

In addition to Mr. Shara, whose qualifications are listed above, the following describes the business experience of each the Company's Executive Officers.

Thomas F. Splaine, 57, a Certified Public Accountant, has been Executive Vice President and Chief Financial Officer of the Company and the Bank since March 2017. He joined Lakeland in 2016 as First Senior Vice President and Chief Accounting Officer of the Company and the Bank. Prior to joining Lakeland, Mr. Splaine was employed at Investors Bancorp, Inc. since 2004 and served in roles as Senior Vice President - Chief Financial Officer, Financial Planning and Analysis and Investor Relations of Investors Bancorp, Inc.

Ronald E. Schwarz, 68, has served as Senior Executive Vice President and Chief Operating Officer of the Company and the Bank since 2017. Since joining the Company in 2009, Mr. Schwarz has served as Senior Executive Vice President and Chief Revenue Officer of the Company and the Bank and Executive Vice President and Chief Retail Officer of the Company and the Bank.

Timothy J. Matteson, Esq., 53, has served as Executive Vice President, Chief Administrative Officer, General Counsel and Corporate Secretary of the Company since 2017. In 2012, Mr. Matteson was named Executive Vice President, General Counsel and Corporate Secretary of the Company. He joined the Company in 2008 as Senior Vice President and General Counsel.

James M. Nigro, 55, joined Lakeland in 2016 and serves as Executive Vice President, Chief Risk Officer of the Company. Previously, Mr. Nigro was Senior Vice President and Credit Risk Manager of The Provident Bank from 2013 to 2016.

Paul Ho Sing Loy, 62, is Executive Vice President and Chief Information Officer of the Company since 2019 and, of the Bank, since 2017. Previously Mr. Ho Sing Loy served as Senior Vice President and Director of Business Solutions of Associated Bank since 2012.

Ellen Lalwani, 59, has served as Executive Vice President and Chief Banking Officer of the Company and the Bank since 2020. Employed by the Bank since 2008, Ms. Lalwani has served as Executive Vice President and Chief Retail Officer of the Company and the Bank and Senior Vice President and Director of Retail Sales of the Bank.

John F. Rath, III, 64, has served as Executive Vice President and Chief Lending Officer of the Company and the Bank since 2018. Mr. Rath has been with the Bank since 2015, having served as First Senior Vice President, Commercial and Industrial Lending Group Manager and Senior Vice President, Commercial and Industrial Lending, Hudson Valley, New York.

Board of Directors Meetings and Committees

The Board of Directors of Lakeland Bancorp had total consolidated assetsand Lakeland Bank each held 12 meetings during 2022. The Board of $8.20 billion, total consolidated deposits of $6.97 billion, total consolidated loans, netDirectors currently maintains the following committees: the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee, the Loan Review Committee, the Policy Committee and the Risk Committee.

No director attended fewer than 75% of the allowancetotal number of Board meetings held by the Lakeland Bancorp and Lakeland Bank Boards of Directors and all committees of the Boards on which they served (for the period they served) during 2022. All Lakeland Bancorp directors attended the annual meeting of shareholders held on May 17, 2022.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Committees |

| Name | | | | | | | | | | Audit | | Compensation | | Nominating and Corporate Governance | | Loan Review | | Policy | | Risk |

| Bruce D. Bohuny | | | | | | | | | | Member | | Member | | | | Chair | | | | |

| Mary Ann Deacon | | | | | | | | | | | | | | | | | | | | |

| Brian Flynn | | | | | | | | | | Chair (1) | | | | | | | | | | Member |

| Mark J. Fredericks | | | | | | | | | | Member | | | | | | Member | | Member | | |

| Brian A. Gragnolati | | | | | | | | | | Member (1) | | | | Member | | | | Member | | |

| James E. Hanson II | | | | | | | | | | | | | | Member | | | | | | Member |

| Janeth C. Hendershot | | | | | | | | | | | | | | | | Member | | | | Chair |

| Lawrence R. Inserra, Jr. | | | | | | | | | | | | Member | | | | Member | | Chair | | |

| Robert F. Mangano | | | | | | | | | | | | | | | | Member | | | | Member |

| Robert E. McCracken | | | | | | | | | | | | Chair | | Member | | | | | | |

| Robert B. Nicholson, III | | | | | | | | | | | | Member | | Chair | | | | Member | | |

| Thomas J. Shara | | | | | | | | | | | | | | | | | | | | |

(1) The Board considers Messrs. Flynn and Gragnolati each an "audit committee financial expert."

Director Skills

The Nominating and Corporate Governance Committee Charter describes the minimum qualifications for credit lossesnominees and the qualities or skills that are necessary for directors to possess. Each nominee:

•must satisfy any legal requirements applicable to members of the Board;

•must not serve on loans,the board of $5.92 billionany other financial institution, bank or savings and total consolidated stockholders’ equityloan company in the Company’s market area;

•must have business or professional experience that will enable such nominee to provide useful input to the Board in its deliberations;

•must have a willingness and ability to devote the time necessary to carry out the duties and responsibilities of $827.0 million.Board membership;

This•must have a desire to ensure that the Company’s operations and financial reporting are affected in a transparent manner and in compliance with applicable laws, rules and regulations;

•must have a dedication to the representation of the best interests of the Company and all of its shareholders;

•must have a reputation, in one or more of the communities serviced by Lakeland and its subsidiaries, for honesty and ethical conduct;

•must have a working knowledge of the types of responsibilities expected of members of the board of directors of a public corporation and particularly, a bank holding company;

•must have experience, either as a member of the board of directors of another public or private corporation or in another capacity that demonstrates the nominee’s capacity to serve in a fiduciary position;

•must recognize and fulfill her/his fiduciary responsibility as a representative of the shareholders in the role of director; have a working knowledge of the business, economic, social, charitable and professional attributes of the communities serviced by the Company and its subsidiaries; and

•must diligently and honestly administer the affairs of the Company and Lakeland Bank.

Board Leadership Structure

The Company currently has, and historically has had, a Board Chair separate from the Chief Executive Officer. The Board believes it is important to have an independent director in a Board leadership position at all times. The Board Chair provides leadership for the Board. Having an independent Board Chair enables non-management directors to raise issues and concerns for Board consideration without immediately involving management. The Board Chair also serves as a liaison between the Board and senior management. The Company’s Board has determined that the current structure, an independent Board Chair, separate from the Chief Executive Officer, is the most appropriate structure at this time, as it ensures that, at all times, there will be an independent director in a Board leadership position.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines, a copy of which is available on our website, https://investorrelations.lakelandbank.com/corporate-governance. The Corporate Governance Guidelines set forth the functions, composition, committees and operations followed by the Board of Directors including, among other things:

•Criteria for composition of the Board and selection of new directors;

•Assessment of the Board's performance;

•Formal evaluation of the CEO;

•Succession planning and management development;

•Strategic reviews;

•Board and management compensation reviews;

•Non-delegable actions of the Board;

•Size and composition of the Board;

•Independence determination of the Board;

•Manner of notification of changes of director job responsibilities;

•Director tenure;

•Director retirement age

•Director resignations;

•Board and committee membership limitations;

•Stock ownership requirements;

•Anti-pledging policy of Company securities; hedging prohibited;

•Number of committees, reporting by committees and assignment and rotation of committee membership;

•Non-executive Board Chair;

•Lead director;

•Executive sessions for non-management directors;

•Committee and Board agendas;

•Board and committee materials and presentations;

•Regular attendance of non-directors at Board and committee meetings;

•Board access to senior management;

•Confidentiality of information;

•Board access to outside resources;

•Director orientation and continuing education;

•Code of Business Conduct and Ethics; and

•Repricing of stock options.

The Board maintains an Independent Directors Committee, consisting of independent non-management directors, which met seven times in 2022.

Anti-Pledging Policy and Anti-Hedging Policy

In March 2013, Lakeland’s Board adopted an anti-pledging policy that prohibits future pledging of Lakeland common stock by Lakeland’s executive officers and directors. The policy does not require pre-existing pledges to be unwound. Hedging transactions involving the Company's securities by directors, officers and employees are also prohibited.

Stock Ownership Requirements

Although the Company’s by-laws provide that the minimum value of Lakeland common stock to be held by directors is $1,000, the Board has adopted Corporate Guidelines that establish a goal that directors own or otherwise control, at a minimum, the number of shares or share equivalents of Lakeland common stock equal to approximately five times (5x) the directors’ annual retainer fee, with new directors attaining that goal within five years. The Compensation Committee periodically reviews this stock ownership goal and has determined that all directors have attained the prescribed goal.

Nominating and Corporate Governance Committee

Each member of theNominating and Corporate Governance Committee is considered independent as defined in the Nasdaq corporate governance listing rules. The Nominating and Corporate Governance Committee’s Charter is posted on the Investor Relations page of Lakeland Bank's website, https://investorrelations.lakelandbank.com/corporate-governance.

As noted in the Nominating and Corporate Governance Committee Guidelines, the purpose of the committee is to assist the Board in identifying individuals to become Board members, determine the size and composition of the Board and its committees, monitor Board effectiveness and implement the Corporate Governance Guidelines.

In furtherance of this purpose, the Committee, among other things, shall:

•Lead the search for individuals qualified to become members of the Board of Directors and develop criteria (such as independence, experience relevant to the needs of the Company, leadership qualities, diversity, stock ownership) for board membership;

•Make recommendations to the Board concerning Board nominees and shareholder proposals;

•Develop, recommend and oversee the annual self-evaluation process of the Board and its committees;

•Develop and annually review corporate governance guidelines applicable to the Company; and

•Review and monitor the Board's compliance with Nasdaq corporate governance listing rules for independence.

The Company's bylaws and the Nominating and Corporate Governance Committee’s charter describe the procedures for nominations to be submitted by shareholders and other third parties for consideration at an annual meeting, other than candidates who have previously served on the Board or who are recommended by the Board. Shareholders recommending a director candidate to the Committee may do so by submitting the candidate's name, resume and biographical information to the attention of the Chair of this Committee in accordance with procedures listed in this Amendment No. 1 to the Annual Report on Form 10-K contains certain forward-looking statements within(also available on Lakeland's website). All shareholder recommendations for director candidates that the meaningChair of the PrivateCommittee receives in accordance with these procedures will be presented to the Committee for its consideration. The Committee's recommendations to the Board are based on its determination as to the suitability of each individual, and the slate as a whole, to serve as directors of Lakeland.

The Nominating and Corporate Governance Committee and the Board recognize that it is important for the Company's directors to possess a diverse array of backgrounds and skills, including executive management experience, financial services experience and educational and professional achievement. When considering new candidates, the Nominating and Corporate Governance Committee, with input from the Board, will seek to ensure that the Board reflects a range of talents, ages, skills, diversity and expertise, particularly in the areas of accounting and finance, management, regulatory and risk management and leadership sufficient to provide sound and prudent guidance with respect to our operations and interests. In addition, the Nominating and Corporate Governance Committee considers diversity in demographic and professional backgrounds among the factors used to identify nominees for directors. The goal of the Nominating and Corporate Governance Committee is to assemble and maintain a Board comprised of individuals with a broad spectrum of skills, experience and expertise combined with a reputation for integrity to carry out the Board's responsibilities with respect to oversight of the Company's operations.

Criteria for Election

Candidates to serve on the Board will be identified from all available sources, including recommendations made by shareholders. As indicated above, the Nominating and Corporate Governance Committee’s charter provides that there will be no differences in the manner in which the Committee evaluates nominees recommended by shareholders and nominees recommended by the Committee or management, except that no specific process shall be mandated with respect to the nomination of any individual who has previously served on the Board. The evaluation process for individuals other than existing Board members includes:

•a review of the information provided to the Nominating and Corporate Governance Committee by the proponent;

•a review of references from at least two sources determined to be reputable by the Nominating and Corporate Governance Committee; and

•a personal interview of the candidate, as appropriate, for candidates determined to be qualified,

together with a review of such other information as the Nominating and Corporate Governance Committee shall determine to be relevant.

Procedures for the Nomination of Directors by Shareholders

Although, the Company does not anticipate holding an annual meeting of shareholders in 2023, the Nominating and Corporate Governance Committee has adopted procedures for the consideration of Board candidates submitted by shareholders. Shareholders can submit the names of candidates for director by writing to the Chair of the Nominating and Corporate Governance Committee, at Lakeland Bancorp, Inc., 250 Oak Ridge Road, Oak Ridge, New Jersey 07438. The submission must include the following information:

•a statement that the writer is a shareholder and is proposing a candidate for consideration by the Nominating and Corporate Governance Committee;

•the name and address of the nominating shareholder as he or she appears on Lakeland's books and the number of shares of Lakeland common stock that are owned beneficially by such shareholder (if the shareholder is not a holder of record, appropriate evidence of the shareholder's ownership will be required);

•the name, address and contact information for the nominated candidate, and the number of shares of Lakeland Bancorp common stock that are owned by the candidate (if the candidate is not a holder of record, appropriate evidence of the shareholder's ownership should be provided);

•the qualifications of the candidate and why this candidate is being proposed;

•a statement of the candidate's business and educational experience;

•such other information regarding the candidate as would be required to be included in a proxy statement pursuant to SEC Regulation 14A;

•a statement detailing any relationship between the candidate and the Company and/or Lakeland Bank and between the candidate and any customer, supplier or competitor of the Company and/or Lakeland Bank;

•detailed information about any relationship or understanding between the proposing shareholder and the candidate; and

•a statement that the candidate is willing to be considered and willing to serve as a director if nominated and elected.

A nomination submitted by a shareholder for presentation by the shareholder at an annual meeting of shareholders must comply with the procedural and informational requirements described in "Advance Notice of Business to be Conducted at an Annual Meeting."

Shareholder Communication with the Board

The Board of Directors has established a procedure that enables shareholders to communicate in writing with members of the Board. Any such communication should be addressed to the Board Chair and should be sent to such individual c/o Lakeland Bank, 250 Oak Ridge Road, Oak Ridge, New Jersey 07438. Any such communication must state, in a conspicuous manner, that it is intended for distribution to the entire Board of Directors. Under the procedures established by the Board, upon the Board Chair’s receipt of such a communication, Lakeland’s Secretary will send a copy of such communication to each member of the Board, identifying it as a communication received from a shareholder. Absent unusual circumstances, at the next regularly scheduled meeting of the Board held more than two days after such communication has been distributed, the Board will consider the substance of any such communication.

Code of Ethics

The Company has adopted a code of ethics that applies, among others, to its principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions, a copy of which is posted on our website, https://investorrelations.lakelandbank.com/corporate-governance.

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Litigation ReformExchange Act of 1995 (“Forward-Looking Statements”). Such statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected in such Forward-Looking Statements. Certain factors which could materially affect such results1934, as amended, and the futurerules and regulations promulgated thereunder require Lakeland’s directors, executive officers and 10% shareholders to file with the SEC certain reports regarding such persons’ ownership of Lakeland’s securities. Lakeland is required to disclose any failures to file such reports on a timely basis. Based solely upon a review of the copies of the forms or information furnished to Lakeland, Lakeland believes that during 2022, all filing requirements applicable to its directors and executive officers were satisfied on a timely basis.

Risk Oversight Matters

The full Board of Directors is responsible for and regularly engages in discussions about risk management and receives reports on this topic from executive management and other officers of the Company. The Board established a separate standing Risk Committee to assist and facilitate its risk oversight responsibilities, including overseeing the Company’s enterprise-wide risk management framework and monitoring certain risk management activities designed to ensure the Company operates within risk parameters established by the Board.

The Board's Role in Cybersecurity Oversight

Maintaining the security, availability and integrity of our customers' private information is of paramount importance to our entire Lakeland team. We have integrated corporate policies and operating procedures that govern how we collect, use, retain and protect private and personal data of our customers and other stakeholders; manage and monitor third-party risk; and ensure operational continuity and recovery through resiliency planning and testing.

With oversight from our Board, directly and through its Risk Committee chaired by an independent director, Lakeland’s cybersecurity program utilizes multiple levels of preventive and detective tools, rigorous systems testing, vulnerability and software patch management, and a dedicated information security team led by our Chief Information Security Officer, who reports to our Chief Risk Officer.

Activities within our information security program include engaging third parties to conduct internal and external system penetration testing and internal security risk assessments; updating our incident response program to ensure a coordinated response by internal and external team members to mitigate the impact of, and recover from, any cyber-attacks, including communications to internal and external customers and other stakeholders; mandatory annual training in information security for our associates; and periodically conducting exercises to raise data security awareness.

Audit Committee Matters

The Board has determined that each member of the Audit Committee is independent as defined in the Nasdaq corporate governance listing rules and under SEC’s Rule 10A-3. The Board has determined and considers that Mr. Flynn, the Chair of the Audit Committee, and Mr. Gragnolati are each an "audit committee financial expert" as that term is used in the rules and regulations of the SEC.

The Audit Committee performed its duties during 2022 under a written charter approved by the Board of Directors. A copy of the current Audit Committee charter is available to shareholders on the Company’s website, https://investorrelations.lakelandbank.com/corporate-governance.

As noted in the Audit Committee Charter, the primary purpose of the Audit Committee is to assist the Board:

•Assume direct responsibility for the appointment, compensation and oversight of the work of the Company's independent auditors, including resolution of any disagreements that may arise between the Company's management and the Company's independent auditors regarding financial reporting. Assume direct responsibility for the termination of the Company's independent auditors, if necessary.

•Monitor the integrity of the Company's financial reporting process and systems of internal controls regarding finance, accounting and legal compliance.

•Monitor the independence and performance of the Company are describedCompany's independent auditors.

•Provide an avenue of communication among the independent auditors, management and the Board of Directors.

•Encourage adherence to, and continued improvement of, the Company's accounting policies, procedures, and practices at all levels; review of potential significant financial risk to the Company; and monitor compliance with legal and regulatory requirements.

•Monitor the performance of the Company's internal audit function.

In furtherance of this purpose, this committee, among other things, shall:

•Review the integrity of the Company's internal control over financial reporting, both internal and external, in Item 1A - Risk Factorsconsultation with the independent registered public accounting firm and the internal auditor.

•Review the financial statements and the audit report with management and the independent registered public accounting firm.

•Review earnings and financial releases and quarterly and annual reports filed with the SEC.

•Approve all engagements for audit and non-audit services by the independent registered public accounting firm.

The Audit Committee reports to the Board of Directors on its activities and findings.

Audit Committee Report

Pursuant to rules and regulations of the SEC, this Audit Committee Report shall not be deemed incorporated by reference by any general statement incorporating by reference this Amendment No. 1 to the Annual Report on Form 10-K.

Commercial Bank Services

Through Lakeland,10-K into any filing under the Company offers a broad rangeSecurities Act of lending, depository, and related financial services to individuals and small to medium sized businesses located primarily in northern and central New Jersey,1933, as amended, or the Hudson Valley region in New York and surrounding areas. In the lending area, these services include commercial real estate loans, commercial and industrial loans, short and medium term loans, linesSecurities Exchange Act of credit, letters of credit, inventory and accounts receivable financing, real estate construction loans, residential mortgage loans, Small Business Administration (“SBA”) loans and merchant credit card services. The Company participated in the SBA's Paycheck Protection Program ("PPP") beginning in April 2020. Through Lakeland’s equipment finance division, the Company provides a financing solution to small and medium-sized companies that prefer to lease equipment over other financial alternatives. Lakeland’s asset-based loan department provides commercial borrowers with another lending alternative.

Depository products include demand deposits,1934, as well as savings, money market and time accounts. Lakeland offers online banking, mobile banking and wire transfer servicesamended, except to the business communityextent that Lakeland Bancorp specifically incorporates this information by reference, and municipal relationships. In addition, Lakeland offers cash management services, such as remote captureotherwise shall not be deemed "soliciting material" or to be "filed" with the SEC subject to Regulation 14A or 14C of deposits and overnight sweep repurchase agreements.

Consumer Banking

Lakeland also offers a broad range of consumer banking services, including checking accounts, savings accounts, interest-bearing checking accounts, money market accounts, certificates of deposit, online banking, secured and unsecured loans, consumer installment loans, mortgage loans, and safe deposit services.

Other Services

Investment advisory services for individuals and businesses are also available. Additionally, the Bank provides commercial title insurance services through Lakeland Title Group LLC and life insurance products through Lakeland Financial Services Agency, Inc.

Competition

Lakeland faces intense competition in its market areas for deposits and loans from other depository institutions. Many of Lakeland’s depository institution competitors have substantially greater resources, broader geographic markets, and higher lending limits than Lakeland and are also able to provide more services and make greater use of media advertising. In recent years, intense market demands, economic pressures, increased customer awareness of products and services and the availability of electronic services have forced banking institutions to diversify their services and become more cost-effective.

Lakeland also competes with credit unions, brokerage firms, insurance companies, money market mutual funds, consumer finance companies, mortgage companies, fintechs and other financial companies, some of which are notSEC or subject to the same degreeliabilities of regulationSection 18 of the Exchange Act.

Management has the primary responsibility for Lakeland Bancorp's internal control and restrictions asfinancial reporting process, and for making an assessment of the effectiveness of Lakeland Bancorp's internal control over financial reporting. The independent registered public accounting firm is responsible for performing an independent audit of Lakeland's consolidated financial statements in attracting depositsaccordance with standards of the Public Company Accounting Oversight Board (United States) ("PCAOB") and making loans. Interest ratesto issue an opinion on deposit accounts, conveniencethose financial statements, and for providing an opinion on the Company's internal control over financial reporting. The Audit Committee's responsibility is to monitor and oversee the processes.

As part of facilities, productsits ongoing activities, the Audit Committee has:

•reviewed and services, and marketing are all significant factors indiscussed the competition for deposits. Competition for loans comes from other commercial banks, savings institutions, insurance companies, consumer finance companies, credit unions, mortgage banking firms,audited consolidated financial technology and other institutional lenders. Lakeland primarily competes for loan originations through its structuring of loan transactionsstatements and the overall qualityinternal control procedures of service it provides. Competition is affectedLakeland for the year ended December 31, 2022 with Lakeland’s management and the independent registered public accounting firm;

•discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 1301;

•received and reviewed the availability of lendable funds, generalwritten disclosures and local economic conditions, interest rates, and other factors that are not readily predictable. The Company expects that competition will continue or intensify in the future.

Concentration

The Company is not dependent on deposits or exposedletter from Lakeland’s independent registered public accounting firm mandated by loan concentrations to a single customer or a few customers, the loss of any one or more of which would have a material adverse effect upon the financial conditionapplicable requirements of the Company.PCAOB regarding the independent registered public accounting firm's communications with the Audit Committee concerning independence, and has discussed with the independent registered public accounting firm its independence from Lakeland.

Human Capital Resources

AtBased on the review and discussions referred to above, the Audit Committee has recommended to Lakeland's Board of Directors that the audited consolidated financial statements for the year ended December 31, 2021,2022 be included in Lakeland's Annual Report on Form 10-K for filing with the Company employed 717 associates, including 36 part-time associates,SEC. In addition, the Audit Committee approved the re-appointment of which approximately 68% are women. The Company employed 711 associates, including 43 part-time associates atKPMG LLP as the independent registered public accounting firm for December 31, 2020. As a financial institution, approximately 52% of our associates are located at branch or loan production offices and the remainder are located at our administrative offices.2023.

By: The success of our business is highly dependent on our associates, who are dedicated to our mission to inspire and enable the communities we serve to achieve financial stability and success. We seek to hire well-qualified associates to sustain and build on our culture of service and performance. Our selection and promotion processes are without bias and include the active recruitment of minorities and women. None of our associates are covered by a collective bargaining agreement.

We encourage the growth and development of our associates and, whenever possible, seek to fill positions by promotion and transfer from within the Company. Continual learning and career development is advanced through annual performance and development conversations between associates and their managers, internally developed training programs, customized corporate training engagements and educational reimbursement programs. Our Leader Engagement and Development (LEAD) Program was launched in 2018 to foster leadership abilities and cultivate effective management approaches. To date, 51 associates have completed the program. Reimbursement is available to associates enrolled in pre-approved degree or certification programs at accredited institutions that teach skills or knowledge relevant to our business, in compliance with Section 127Audit Committee of the Internal Revenue Code, and for seminars, conferences and other training events associates attend in connection with their job duties or professional certification requirements.Board of Directors:

The safety, health and wellness of our associates is a top priority. The COVID-19 pandemic presented unique challenges with regard to maintaining associate safety while continuing successful operations. We instituted remote working plans at the start of the pandemic and were able to transition, over a short period of time, many of our eligible associates to effectively working from remote locations. We ensured a safely-distanced working environment for associates performing customer-facing activities at branches and operations centers, closing branch lobbies as necessary. All associates are prohibited from working on-site when they, or a close family member, experience symptoms of a possible COVID-19 illness and generally used their paid time off to cover compensation during such absences. On an ongoing basis, we further promote the health and wellness of our associates by strongly encouraging work-life balance, offering flexible work schedules, keeping the associate portion of health care premiums to a minimum and sponsoring various wellness programs, whereby associates are encouraged to incorporate healthy habits into their daily routines. Brian Flynn, Chair

In 2020, we appointed our first Chief Diversity Officer, with a mandate to focus on workforce diversity, vendor/supplier diversity and cultivating more diverse leadership, among other vital issues. We sponsor Share Your Voice “listening” roundtables for associates, with the assistance of outside experts. A Diversity Task Force was created to give associates more opportunity for input into relevant issues. We provided associates with access to information and assistance on topics ranging from diversity to wellness, parenting and other personal issues and concerns. Bruce D. Bohuny

Associate retention helps us operate efficiently and achieve our business objectives. We provide competitive wages, annual bonuses, stock awards, a 401(k) Plan with an employer matching contribution in addition to a discretionary employer annual contribution, healthcare and insurance benefits, health savings, flexible spending accounts, paid time off, family leave and an employee assistance program. At December 31, 2021, approximately 29% of our current staff had been with us for 10 years or more.Mark J. Fredericks

Brian A. Gragnolati

SUPERVISION AND REGULATION

GeneralCompensation Committee Matters

The CompanyBoard has determined that each member of the Compensation Committee is a registered bank holding company underindependent as defined in the Federal Bank Holding Company ActNasdaq corporate governance listing rules and SEC Rule 10C-1. The Compensation Committee's Charter is posted on the Investor Relations page of 1956, as amended (the “Holding Company Act”),Lakeland Bancorp's website, https://investorrelations.lakelandbank.com/corporate-governance.

Authority, Processes and Procedures. Our Compensation Committee is required to file with the Federal Reserve Board an annual reportresponsible for administering our employee benefit plans, for establishing and such additional information as the Federal Reserve Board may require pursuantrecommending to the Holding Company Act.Board the compensation of our President and Chief Executive Officer (CEO) and for reviewing and recommending to the Board for approval the compensation programs covering our other executive officers. Our Compensation Committee also establishes policies and monitors compensation for our employees in general. While the Compensation Committee may, and does in fact, delegate authority with respect to the compensation of employees in general, the Compensation Committee retains overall supervisory responsibility for employee compensation. With respect to executive compensation, the Compensation Committee receives recommendations and information from senior staff members. Mr. Shara (our President and CEO) participated in Committee deliberations regarding the compensation of other executive officers, but did not participate in deliberations regarding his own compensation. The Company has also elected financial holding company status underCEO; Chief Operating Officer (COO); Chief Administrative Officer, General Counsel and Corporate Secretary; and Chief Human Resources Officer assist the Modernization Act, as further discussed below. The Company is subject to examinationCompensation Committee in recommending agenda items for its meetings and by gathering and producing information for these meetings. As requested by the Federal Reserve Board.Compensation Committee, the CEO and COO participate in Committee meetings to discuss executive compensation, evaluate the performance of both the Company and individual executives, and provide pertinent financial or operational information. The Compensation Committee also has the authority to hire compensation consultants and other professionals to assist it in carrying out its duties.

Lakeland isConsultants. During our fiscal year ended December 31, 2022, the Compensation Committee retained the services of Aon Human Capital Solutions (formerly known as McLagan), a state chartered commercial bank subjectdivision of Aon PLC ("Aon"), to supervisionprovide independent executive compensation advice and examination by the Department of Bankingmarket compensation information. See "Executive Compensation - Compensation Discussion and InsuranceAnalysis" for a description of the State of New Jersey (the “Department”)services provided by Aon during 2022. The Compensation Committee is responsible for assisting the Board in carrying out the Board's overall responsibility relating to executive compensation, incentive compensation and the Federal Deposit Insurance Corporation (the “FDIC”). The regulationsequity and non-equity-based benefit plans.

Compensation Committee Interlocks and Insider Participation

No member of the StateCompensation Committee is or has been an officer or employee of New Jersey and FDIC govern most aspects of Lakeland’s business, including reserves against deposits, loans, investments, mergers and acquisitions, borrowings, dividends, and location of branch offices. Lakeland is subject to certain restrictions imposed by law on, among other things, (i) the maximum amount of obligations of any one person or entity which may be outstanding at any one time, (ii) investments in stock or other securitiesCompany. In addition, no executive officer of the Company orserved on the board of directors of any subsidiaryentity whose executive officers included a director of the Company.

Item 11. Executive Compensation

Director Compensation

Director Fees

Each of the individuals who serve as a director of Lakeland Bancorp also serves as a director of Lakeland Bank. The Boards of Directors of Lakeland Bank and the Company hold combined meetings and no additional fees were paid for attending the Lakeland Bank Board meetings. The employee director is not compensated for serving as a director.

During 2022, each non-employee director received: (i) a $40,000 per annum retainer, payable in quarterly increments of $10,000 each; (ii) $3,000 per Board meeting attended; (iii) $30,000 in restricted stock granted at the beginning of the year with a vesting period of one year, except Mrs. Deacon who received $50,000 in restricted stock (having opted to receive $20,000 of the $100,000 Chair stipend in the form of restricted stock, rather than receiving the full amount in cash); and (iv) a $5,000 annual fee for the chairs of the Directors' Loan Review Committee, Policy Committee and Risk Committee and a $7,500 annual fee for the chair of the Audit Committee, Nominating and Corporate Governance Committee and the Compensation Committee. No fees were paid to non-chair Board committee members for committee service.

Additionally, the Board liaisons to the Executive Loan Committee, a management committee, each received $5,000 annual stipends for such service.

Directors are also reimbursed for expenses for attending seminars and conferences that relate to continuing director and governance education.

The Board of Directors establishes non-employee director compensation based on recommendations of the Compensation Committee. The Compensation Committee, on not less than an annual basis, engages the services of a compensation consultant and its external surveys to assist in the Committee's review of director compensation.

Stock Option and Stock Award Program

The shareholders of the Company approved the 2018 Omnibus Equity Incentive Plan, as described below in "Compensation Discussion and (iii)Analysis" at the takingannual meeting of suchshareholders on May 9, 2018. Directors are eligible to participate in the 2018 Omnibus Equity Incentive Plan. Under this plan, officers and directors are eligible to receive awards of restricted stock or securitiesand stock options to purchase shares of Lakeland Bancorp common stock (at an exercise price of no less than the market price of the common stock at the time of grant). During the year ended December 31, 2022, directors received restricted stock as collateral for loans to any borrower.described in the table below. No stock options were granted during 2022.

Director Deferred Compensation Plan

The HoldingBoard of Directors maintains the Directors’ Deferred Compensation Plan, for eligible directors who became members of the Board on or before December 31, 2008. The plan provides that any director having completed five years of service on Lakeland’s Board of Directors may retire and continue to be paid for a period of ten years at a rate ranging from $5,000 to $17,500 per annum, depending upon years of credited service. This plan is unfunded. Despite serving as a director of the Company Actsince April 2008, Mr. Shara elected not to participate in the Directors’ Deferred Compensation Plan.

Summary of Directors' Compensation

The Holdingfollowing table sets forth certain information regarding the compensation paid to each non-employee director of the Company Act limitsduring 2022. See the activities“Summary Compensation Table” for information regarding Mr. Shara's compensation.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name | |

Fees Earned

or Paid in Cash

($) | |

Stock Awards

($) (1) | | Change in

Pension Value

and Nonqualified

Deferred

Compensation Earnings

($) (2) | |

All

Other

Compensation

($) (3) | |

Total

($) |

| | | | | | | | | | |

| Bruce D. Bohuny | | 81,000 | | | 30,000 | | | 2,032 | | | 866 | | | 113,898 | |

| Mary Ann Deacon | | 156,000 | | | 50,000 | | | 4,995 | | | 1,443 | | | 212,438 | |

| Brian Flynn | | 83,500 | | | 30,000 | | | — | | | 866 | | | 114,366 | |

| Mark J. Fredericks | | 76,000 | | | 30,000 | | | 1,567 | | | 866 | | | 108,433 | |

| Brian A. Gragnolati | | 76,000 | | | 30,000 | | | — | | | 866 | | | 106,866 | |

| James E. Hanson II | | 81,000 | | | 30,000 | | | — | | | 866 | | | 111,866 | |

| Janeth C. Hendershot | | 81,000 | | | 30,000 | | | 3,697 | | | 866 | | | 115,563 | |

| Lawrence R. Inserra, Jr. | | 81,000 | | | 30,000 | | | — | | | 866 | | | 111,866 | |

| Robert F. Mangano | | 76,000 | | | 30,000 | | | — | | | 866 | | | 106,866 | |

| Robert E. McCracken | | 83,500 | | | 30,000 | | | 3,738 | | | 866 | | | 118,104 | |

| Robert B. Nicholson, III | | 83,500 | | | 30,000 | | | 2,685 | | | 866 | | | 117,051 | |

(1) The aggregate grant date fair value in accordance with FASB ASC Topic 718.

(2) The aggregate change in the present value of each director’s accumulated benefit in our Directors’ Deferred Compensation Plan from the measurement date used for preparing our 2021 year-end financial statements to the measurement date used for preparing our 2022 year-end financial statements. The Directors’ Deferred Compensation Plan is our only defined benefit and actuarial plan in which directors participated in 2022. There were no above-market earnings on such deferred compensation in 2022.

(3) Cash dividends paid on restricted stock for each director.

At December 31, 2022, each of the non-employee directors in the table above held the following aggregate number of restricted stock awards. The shares of restricted stock in the table below vested in full on January 19, 2023.

| | | | | | | | | | |

| Name | | | | Stock Awards |

| | | | |

| Bruce D. Bohuny | | | | 1,519 | |

| Mary Ann Deacon | | | | 2,532 | |

| Brian Flynn | | | | 1,519 | |

| Mark J. Fredericks | | | | 1,519 | |

| Brian A. Gragnolati | | | | 1,519 | |

| James E. Hanson II | | | | 1,519 | |

| Janeth C. Hendershot | | | | 1,519 | |

| Lawrence R. Inserra, Jr. | | | | 1,519 | |

| Robert F. Mangano | | | | 1,519 | |

| Robert E. McCracken | | | | 1,519 | |

| Robert B. Nicholson, III | | | | 1,519 | |

Other Matters

The Board believes its directors should have a financial investment in Lakeland Bancorp to further align their interests with shareholders. Directors are expected to own or otherwise control, at a minimum, the number of shares or share equivalents of Lakeland common stock equal to approximately five times (5x) the directors’ annual retainer fee, with new directors attaining that goal within five years.

Securities Authorized for Issuance Under Equity Compensation Plan

The following table provides information about the Company’s common stock that may be engagedissued upon the exercise of options under the 2018 Omnibus Equity Incentive Plan as of December 31, 2022. This plan was the Company’s only equity compensation plan in existence as of December 31, 2022.

| | | | | | | | | | | | | | | | | | | | |

| Plan Category | | (a)

Number Of Securities To Be Issued Upon Exercise Of Outstanding Options, Warrants and Rights | | (b)

Weighted-Average Exercise Price Of Outstanding Options, Warrants and Rights | | (c)

Number Of Securities Remaining Available For Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected In Column (a)) |

| | | | | | |

| Equity Compensation Plans Approved by Shareholders | | 607,142 | | | $ | — | | | 918,217 | |

| Equity Compensation Plans Not Approved by Shareholders | | — | | | — | | | — | |

| Total | | 607,142 | | | $ | — | | | 918,217 | |

Compensation Discussion and Analysis

Overview

The following discussion provides an overview and analysis of the Compensation Committee’s philosophy and objectives in designing the Company’s compensation programs as well as the compensation determinations relating to our Named Executive Officers, or NEOs. This discussion should be read together with the compensation tables for our NEOs, which can be found following this discussion.

For 2022, our NEOs were:

| | | | | | | | |

| Name | | Title |

| | |

| Thomas J. Shara | | President and Chief Executive Officer of Lakeland and Lakeland Bank |

| Thomas F. Splaine, Jr. | | Executive Vice President and Chief Financial Officer of Lakeland and Lakeland Bank |

| Ronald E. Schwarz | | Senior Executive Vice President and Chief Operating Officer of Lakeland and Lakeland Bank |

| Timothy J. Matteson | | Executive Vice President, Chief Administrative Officer, General Counsel and Corporate Secretary of Lakeland and Lakeland Bank |

| James M. Nigro | | Executive Vice President, Chief Risk Officer of Lakeland and Lakeland Bank |

| | |

Executive Summary

Our 2022 performance highlights include:

•Net income for the year ended December 31, 2022 was $107.4 million, or $1.63 per diluted share, compared to $95.0 million, or $1.85 per diluted share, for 2021. Financial results for 2022 were favorably impacted by an increase in net interest income of $77.8 million.

•For the Companyyear ended December 31, 2022, our return on average assets was 1.04%, our return on average equity was 9.80% and its subsidiariesour efficiency ratio was 51.79%.

•At December 31, 2022, loans totaled $7.87 billion, an increase of $1.89 billion from December 31, 2021 and included acquired loans totaling $1.10 billion.

•Deposits totaled $8.57 billion, increasing $1.60 billion, or 23%, from December 31, 2021, to thoseDecember 31, 2022, primarily due to deposits acquired from 1st Constitution.

•We maintained and improved our strong capital position.

•The Company's net interest margin was 3.24% for 2022 compared to 3.13% for 2021.

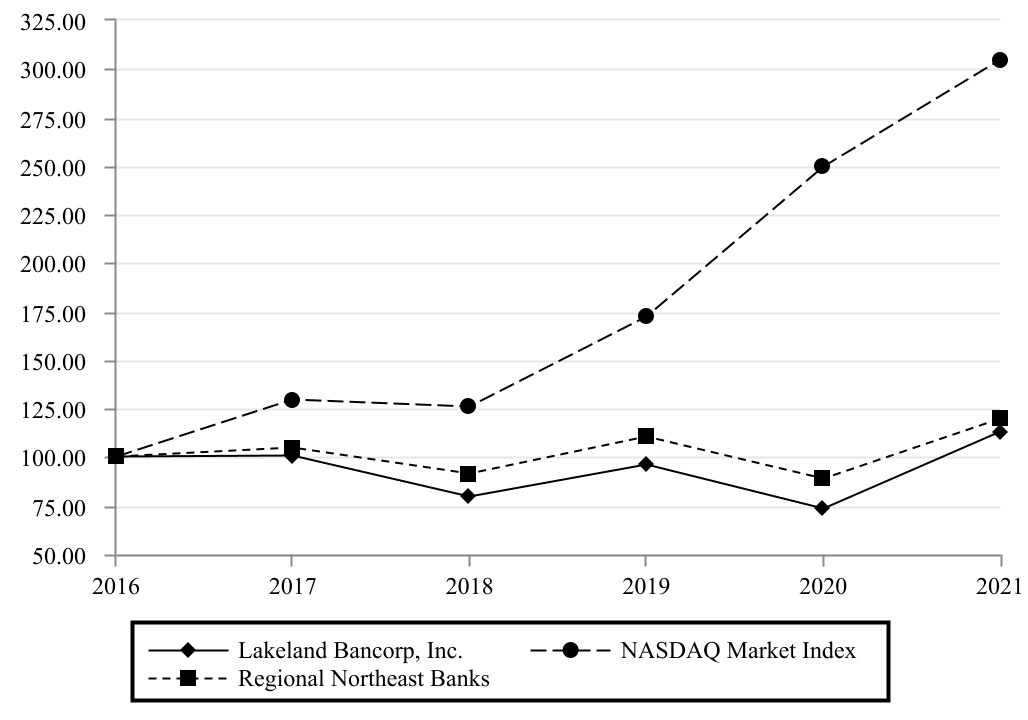

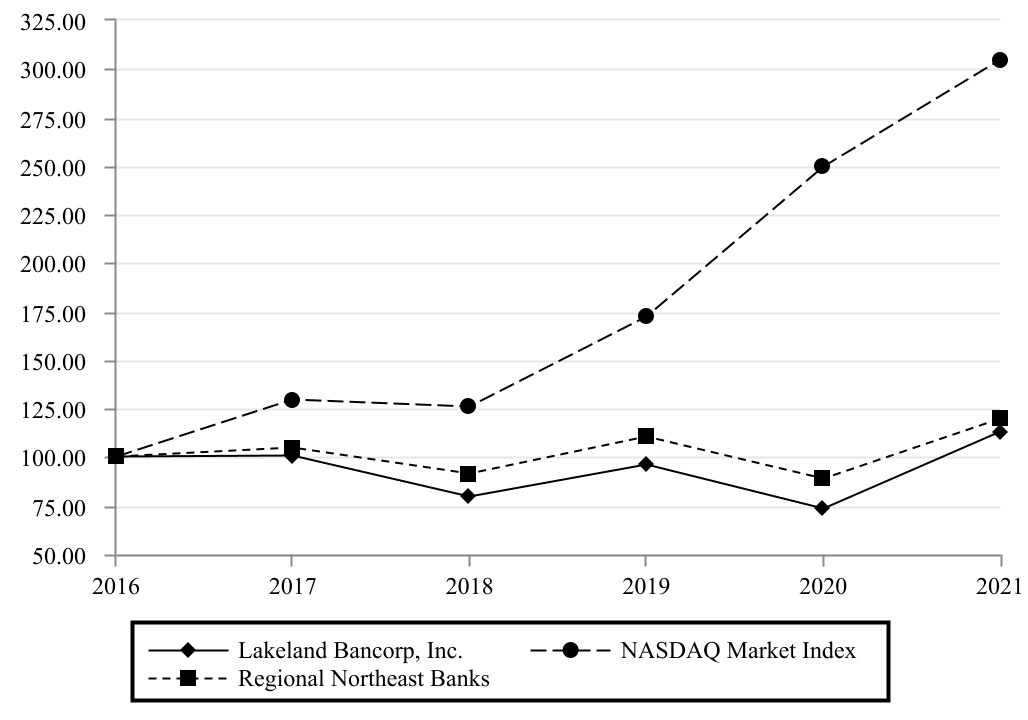

•The following graph of banking,five-year total shareholder return (TSR) compared to our compensation peer group.

Key NEO Compensation Decisions

Our compensation decisions for 2022 reflected the ownershipcontributions by our NEOs to our strong performance during the years 2021 and acquisition of assets2022. Our annual and securities of banking organizations,long-term incentive plans are designed to pay market-competitive incentive compensation while linking our executives' compensation to corporate and individual performance and the managementvalue realized by our shareholders.

Salaries: In recognition of banking organizations,our solid performance in 2021 and to certain non-banking activities which the Federal Reserve Board finds, by order or regulation, to be so closely related to banking or managing or controlling a bank as to be a proper incident thereto.general market movement in executive compensation, base salaries were increased for all NEOs in 2022.

With respect to non-banking activities, the Federal Reserve Board has by regulation determined that several non-banking activities are closely related to banking within the meaningShort-term annual cash incentives: The Company performed at maximum performance levels in 2022 on both of the Holdingobjective corporate performance goals under our 2022 Annual Incentive Plan, which were weighted at 80% of the total plan target. The Company Actalso achieved its performance triggers relating to asset quality and thuscapital levels. In addition, each of our NEOs received a maximum score under the subjective individual performance assessment portion of the plan, which was weighted at 20% of the total plan target. As a result, cash incentive payouts under our 2022 Annual Incentive Plan were at maximum for each of our NEOs.

2022 Long-Term Incentives: In February 2022, we granted RSU awards to each of our NEOs based on a specified plan target percent of salary. 50% of the target RSUs for each NEO vest, if at all, based on the attainment of ROAE and TSR goals, both of which are measured over a three-year period from 2022-2024 against an index of 68 similarly-sized banks.

The remaining 50% of the target RSUs awarded to each NEO vest ratably on each of the first three anniversaries of the grant date. In addition, the number of RSUs granted may be performed by bank holding companies. The Company has also elected "financial holding company" status, which allows it to engageadjusted from anywhere between 75% of the target and 125% of the target RSUs based on the Committee’s evaluation of corporate and individual performance in a broader array of financial activities than a standard bank holding company. Althoughthe previous year. Based on the Company’s management periodically reviews other avenues of business opportunities that are includedstrong financial performance in that regulation,2021, the Company has no present plansCommittee made the determination to engage in any of these activities other than providing investment brokerage services.

With respect togrant the acquisition of banking organizations, the Company is required to obtain the prior approvaltime-vested portion of the Federal Reserve Board before it may,award at 125% of target in 2022.

Say on Pay Vote

The Compensation Committee evaluates the Company’s executive compensation programs in light of market conditions, shareholder views, and governance considerations, and makes changes as appropriate. As required by merger, purchase or otherwise, directly or indirectly acquire all or substantially all of the assets of any bank or bank holding company, if, after such acquisition, it will own or control more than 5% of the voting shares of such bank or bank holding company.

Regulation of Bank Subsidiaries

There are various legal limitations, including Sections 23A and 23B of the Federal Reserve Act, which govern the extent to which a bank subsidiary may finance or otherwise supply funds to its holding company or its holding company’s non-bank subsidiaries. Under federal law, no bank subsidiary may, subject to certain limited exceptions, make loans or extensions of credit to, or investments in the securities of, its parent or the non-bank subsidiaries of its parent (other than direct subsidiaries of such bank which are not financial subsidiaries) or take their securities as collateral for loans to any borrower. Each bank subsidiary is also subject to collateral security requirements for any loans or extensions of credit permitted by such exceptions.

Commitments to Affiliated Institutions