This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which reflect our current views with respect to, among other things, our operations and financial performance. You can identify these forward-looking statements by the use of words such as "outlook," "believe," "expect," "potential," "continue," "may," "should," "seek," "approximately," "predict," "intend," "will," "plan," "estimate," "anticipate,"“outlook,” “believe,” “expect,” “potential,” “continue,” “may,” “should,” “seek,” “approximately,” “predict,” “intend,” “will,” “plan,” “estimate,” “anticipate,” the negative version of these words, other comparable words or other statements that do not relate strictly to historical or factual matters. By their nature, forward-looking statements speak only as of the date they are made, are not statements of historical fact or guarantees of future performance and are subject to risks, uncertainties, assumptions or changes in circumstances that are difficult to predict or quantify. Our expectations, beliefs and projections are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that management'smanagement’s expectations, beliefs and projections will result or be achieved and actual results may vary materially from what is expressed in or indicated by the forward-looking statements.

Except where the context requires otherwise, the terms "Company," "we," "us," "our" and "KREF" refer to KKR Real Estate Finance Trust Inc., a Maryland corporation, and its subsidiaries; "Manager" refers to KKR Real Estate Finance Manager LLC, a Delaware limited liability company, our external manager; and "KKR" refers to KKR & Co. L.P.Inc., a Delaware limited partnership,corporation, and its subsidiaries.

PART I.

ITEM 1. BUSINESS

Our Company

KREF is a real estate finance company that focuses primarily on originating and acquiring acquiring transitional senior loans secured by institutional-quality Commercial Real Estatecommercial real estate ("CRE") properties that are owned and operated by experienced and well-capitalized sponsors and located in liquidtop markets with strong underlying fundamentals. Our target assets also include mezzanine loans, preferred equity and other debt-oriented instruments with these characteristics. Our investment objective is capital preservation and the generation of attractive risk-adjusted returns for our stockholders over the long term, primarily through dividends.

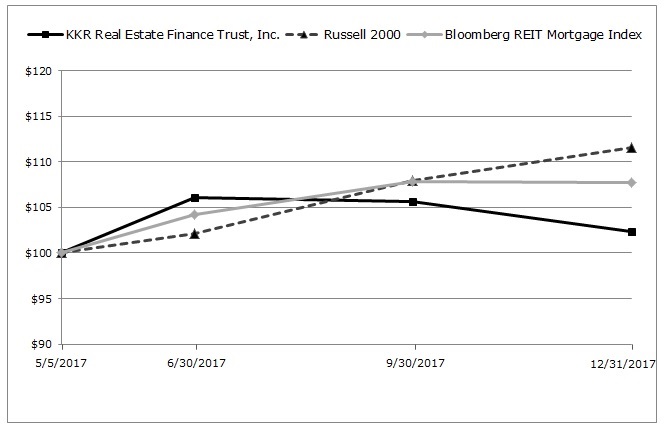

We began our investment activities in October 2014 with an initial commitment of $400.0 million from KKR. We raised an additional $438.1 million in equity commitments from third-party investors and certain current and former employees of, and consultants to, KKR that brought our total committed capital base to $838.1 million, which was fully drawn prior to our initial public offering ("IPO") that generated net proceeds of $225.9 million on May 5, 2017. We had a common book value of $1,059.1$1,077.0 million as of December 31, 20172023 and established a diversified investment portfolio of diversified investments,which totaled $7,752.3 million, consisting primarily of performing senior loans,and mezzanine loans, preferred equity and commercial mortgage-backed securities ("CMBS") B-Pieces, which had a value of $2,083.1 million.real estate loans.

We are organized as a holding company externally managed by our Manager, an indirect subsidiary of KKR, & Co. L.P., and operate our business primarily through various subsidiariessubsidiaries in a single segment that originates, acquires, and finances our target assets.

We conduct our operations as a REIT for federal income tax purposes while seekingoperating our business in a manner that allows us to avoidmaintain an exclusion from registration under the Investment Company Act of 1940, as amended, (the "Investment Company Act"). We generally will not be subject to U.S. federal income taxes on the portion of our annual net taxable income that we distribute to stockholders if we maintain our qualification as a REIT.

We are traded on the NYSE under the symbol “KREF.” We were incorporated in Maryland on October 2, 2014, and our principal executive offices are located at 9 West 57th Street,30 Hudson Yards, New York, New York.

Our Manager and KKR

We are externally managed by our Manager, an indirect wholly owned subsidiary of KKR, & Co. L.P., a leading global investment firm that offers alternative asset management as well as capital markets and insurance solutions, with a 40-yearan over 45-year history of leadership, innovation and investment excellence. KKR manages multiple alternative asset classes includingsponsors investment funds that invest in private equity, energy, infrastructure,credit and real estate,assets, and credit, withas strategic manager partnershipspartners that manage hedge funds. KKR & Co. L.P. is listed on the NYSE (NYSE: KKR )KKR) and reported $168.5$552.8 billion of assets under management ("AUM") as of December 31, 2017.2023. KKR's "One-Firm" culture encourages collaboration and leveraging resources and relationships across KKR to help find creative solutions for clients seeking capital and strategic partnerships. We believe our Manager's relationship with KKR and its differentiated global investment management platform provides us with significant advantages in sourcing, evaluating, underwriting and managing our investments.

In connection with the performance of its duties, our Manager benefits from the resources, relationships and expertise of KKR's real estate group ("KKR Real Estate"), which provides equity and debt capital across a variety of real estate sectors and strategies. Established in 2011 under the leadership of Ralph F. Rosenberg, Global Head of KKR Real Estate and Chairman of our board of directors, KKR Real Estate had $6.4over $68 billion of AUM as of December 31, 2017.2023. Mr. Rosenberg, who has 29over 35 years of real estate equity and debt transactiontransactions experience, is supported at KKR Real Estate by a team of over 50approximately 150 dedicated investment and asset/portfolio management professionals across seven16 offices globally. We believe that KKR Real Estate's global relationships with property owners, managers, lenders, brokers and advisors and real-time knowledge derived from its broadly diversified real estate holdings provide our Manager with access to sourcing channels as well as operational and strategic insights to help our Manager evaluate and monitor individual investment opportunities. Additionally, our Manager leverages the proprietary information available to us through KKR's global investment platforms to conduct thorough underwriting and due diligence and develop a deeper understanding of the opportunities, risks and challenges of the investments that we review. Further, our Manager benefits from KKR Credit & Markets,KKR's capital markets team, comprised of a team of over 40 investmentapproximately 70 professionals that advise KKR's investment teams and portfolio companies on executing equity and debt capital markets solutions.

Our Manager is led by an experienced team of senior real estate investment professionals, including Christen E.J. Lee and Matthew A. Salem, our Co-ChiefChief Executive Officers and Co-Presidents,Officer, and W. Patrick Mattson, our President and Chief Operating Officer,

who collectively averageeach has over 1825 years of CRE experience. Our Manager's senior leadership team is supported by 1256 other investment professionals with significant expertise in executing our investment strategy. Our Manager's investment committee, which is comprised of Messrs.Ralph Rosenberg, KKR’s Global Head of Real Estate and Chairman of our board of directors, Chris Lee, Co-President of KKR Real Estate and Vice Chairman of our board of directors, Matt Salem, Head of KKR’s Real Estate Credit and Chief Executive Officer of KREF, Patrick Mattson, Chief Operating Officer of KKR’s Real Estate Credit and Jamie M. Weinstein, GlobalPresident and Chief Operating Officer of KREF, Joel Traut, Partner & Head of Originations, Jenny Box, Co-Head of KKRKKR’s Special Situations, Billy Butcher, Co-President of KKR Real Estate, Roger Morales, Head of KKR's Real Estate Acquisitions Americas and Justin Pattner, Head of KKR's Real Estate Equity Americas, advises and consults with our Manager and its investment professionals with respect to our investment strategy, portfolio construction, financing and investment guidelines and risk management and approves all of our investments.

Our Investment Strategy

Our investment strategy is to originate or acquire transitional senior loans collateralized by institutional-quality CRE assets that are owned and operated by experienced and well-capitalized sponsors and located in liquidtop markets with strong underlying fundamentals. We also intend to invest in mezzanine loans, preferred equity and other debt-oriented instruments with these characteristics. Through our Manager, we have access to KKR's integrated, global real estate investment platform and its established sourcing, underwriting and structuring capabilities to develop our own view on value and evaluate and structure credit risk from an owner's and a lender's perspective. In addition, we believe that we benefit from our access to KKR's global network and real estate and other investment holdings, which provide our Manager with access to information and market data that is not available to many of our competitors. In many instances, we are able to make investments where we believe we have a sourcing, underwriting or execution advantage by leveraging the KKR brand, industry knowledge and proprietary relationships.

We pursue opportunities for which we believe that we are lending at a substantial discount to our Manager's view of intrinsic real estate value, which our Manager substantiates through an independent assessment of value. We also seek investment opportunities where there is the potential to increase the value of the underlying loan collateral through improving property management or implementing strategic capital improvement initiatives, and as such, focus on lending to sponsors with histories of successful execution in their respective asset classes or markets. Additionally, we endeavor to make loans with covenants and structural features that align the incentives of us and our borrowers to the extent that the operating performance of the underlying collateral deteriorates.

Our financing strategy and investment process are discussed in more detail in "—Our"Our Financing Strategy" and "—Investment"Investment Guidelines" below.

Our Target Assets

Our target assets primarily include transitional senior loans, as well as mezzanine loans, preferred equity and other debt-oriented investments:

| |

• | •Senior Loans—We focus on originating and acquiring senior loans that are secured by CRE properties and evidenced by a first-priority mortgage. The loans may vary in duration, bear interest at a fixed or floating rate and amortize, and typically require a balloon payment of principal at maturity, but are typically anticipated to be floating rate and shorter-term duration. These investments may include whole loans or pari passu participations within such senior loans.

•We focus on originating and acquiring senior loans that are backed by CRE properties. These loans are secured by real estate and evidenced by a first-priority mortgage. The loans may vary in duration, bear interest at a fixed or floating rate and amortize, and typically require a balloon payment of principal at maturity, but are typically anticipated to be floating rate and shorter-term duration. These investments may include whole loans or pari passu participations within such senior loans. |

| |

• | Mezzanine Loans—We may syndicate senior participations in our originated senior loans to other investors and retain a subordinated debt position for our portfolio, typically a mezzanine loan. We may also directly originate or acquire mezzanine loans. These are loans (including pari passu participations in such loans) made to the owner of a mortgage borrower and secured by a pledge of equity interests in the mortgage borrower. These loans are subordinate to a senior loan, but senior to the owner's equity. These loans may be tranched into senior and junior mezzanine loans, with the junior mezzanine lenders secured by a pledge of the equity interests in the more senior mezzanine borrower. The mezzanine lender typically has different rights as compared to the more senior lenders, including the right to cure defaults under the senior loan and any senior mezzanine loan and purchase the senior loan and any senior mezzanine loan, in each case under certain circumstances following a default on the senior loan. Following a default on a mezzanine loan, and subject to negotiated terms with the mortgage lender or other mezzanine lenders, the mezzanine

lender generally has the right to foreclose on its equity interest and become the owner of the property, directly or indirectly, subject to the lien of the senior loan and any other debt senior to it including any outstanding senior mezzanine loans.

•Preferred Equity—We may make investments that are subordinate to any mortgage or mezzanine loan, but senior to the common equity of the mortgage borrower or owner of a mortgage borrower, as applicable. Preferred equity investments typically pay a preferred return from the investment's cash flow rather than interest payments and often have the right for such preferred return to accrue if there is insufficient cash flow for current payment. These interests in the mortgage borrower. These loans are subordinate to a senior loan, but senior to the owner's equity. These loans may be tranched into senior and junior mezzanine loans, with the junior mezzanine lenders secured by a pledge of the equity interests in the more senior mezzanine borrower. The mezzanine lender typically has additional rights as compared to the more senior lenders, including the right to cure defaults under the senior loan and any senior mezzanine loan and purchase the senior loan and any senior mezzanine loan, in each case under certain circumstances following a default on the senior loan. Following a default on a mezzanine loan, and subject to negotiated terms with the mortgage lender or other mezzanine lenders, the mezzanine lender generally has the right to foreclose on its equity interest and become the owner of the property, directly or indirectly, subject to the lien of the senior loan and any other debt senior to it including any outstanding senior mezzanine loans. |

| |

• | Preferred Equity—We may make investments that are subordinate to any mortgage or mezzanine loan, but senior to the common equity of the mortgage borrower or owner of a mortgage borrower, as applicable. Preferred equity investments typically pay a preferred return from the investment's cash flow rather than interest payments and often have the right for such preferred return to accrue if there is insufficient cash flow for current payment. These interests

|

are not secured by the underlying real estate, but upon the occurrence of a default, the preferred equity provider typically has the right to effect a change of control with respect to the ownership of the property.

| |

• | CMBS B-Pieces (New Issue)—We may also make investments that consist of below investment-grade bonds comprising some or all of the BB-rated, B-rated and unrated tranches of a CMBS securitization pool. The underlying loans are typically aggregated into a pool and sold as securities to different investors. Under the pooling and servicing agreements that govern these pools, the loans are administered by a trustee and servicers, who act on behalf of all investors and distribute the underlying cash flows to the different classes of securities in accordance with their seniority. The below-investment grade securities that comprise each CMBS B-Piece have generally in the past been acquired in aggregate. Due to their first loss position, these investments are typically offered at a discount to par. These investments typically carry a 10-year weighted average life due to prepayment restrictions. We generally intend to hold these investments through maturity, but may, from time to time, opportunistically sell positions should liquidity become available or be required. Under the risk retention rules under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act") that went into effect in December 2016, CMBS B-Piece investments may also include BBB-rated securities and are subject to certain additional restrictions that, among other things, prohibit hedging CMBS B-Pieces or selling CMBS B-Pieces for a period of at least five years from the date the investment was made. We currently expect to make our CMBS B-Piece investments indirectly through our investment in an aggregator vehicle alongside KKR Real Estate Credit Opportunity Partners L.P. ("RECOP"), a recently established KKR-managed investment fund. See Part II, Item 7. "Management's Discussion and Analysis of Financial Condition and Results of Operations—Our Portfolio."

|

| |

• | Other Real Estate Securities—We may make investments in real estate that take the form of CMBS (other than CMBS B-Pieces) or Collateralized Loan Obligations ("CLO") that are collateralized by pools of real estate debt instruments, often senior loans. We may also acquire the debt securities of other REITs or other entities engaged in real estate operating or financing activities, but generally not for the purpose of exercising control over such entities.

|

Our Portfolio

We began operations in October 2014 and have established a portfolio of diversified investments, consisting primarily of performing senior loans,and mezzanine loans and CMBS B-Pieces, which had a value of $2,083.1 millionloans. Our aggregate investment portfolio totaled $7.8 billion as of December 31, 2017.2023, which is primarily comprised of $7.6 billion of total outstanding principal of senior and mezzanine CRE loans, $158.6 million net investment in real estate owned assets (“REO”), and a $35.7 million investment in CMBS B-Pieces (indirectly-owned through RECOP I). We believe our current portfolio, comprised of target assets representative of our investment philosophy, validates our ability to execute on our stated market opportunity and investment strategy, including lending against high-quality real estate in liquidtop markets with strong fundamentals to experienced and well-capitalized sponsors. AsSince our IPO, we have continued to execute on our primary investment strategy of originating floating-rate transitional senior loans and, as we continue to scale our portfolio, we expect that our originations will continue to be heavily weighted toward floating-rate loans. We expect the majority of our future investment activity to focus on originating floating-rate senior loans that we finance with our repurchase facilities with a secondary focus on originatedand non-mark-to-market financing including term lending arrangements, asset based financing and collateralized loan obligations. In addition, we originate floating-rate loans for which we syndicate a senior position and retain a subordinated interest for our portfolio. As a result, we expect that the percentage of our target portfolio comprised of CMBS B-Pieces will decrease over time and the percentage of floating-rate investments, including senior loans, will increase over time. As of December 31, 2017, our portfolio had experienced no impairments and did not contain any legacy assets that were originated prior to October 2014. As of December 31, 2017,2023, all of our investments were located in the United States.

The following charts illustrate the size of our portfolio and related compound annual growth rate ("CAGR") and common book value, over the years ended December 31, 2023 and the preceding four years (dollars in millions):

(A) Common book value as of December 31, 2023 includes the impact of a CECL allowance of $212.5 million.

The map below illustrates the geographic distribution of the properties securing our loan portfolio as of December 31, 2023:

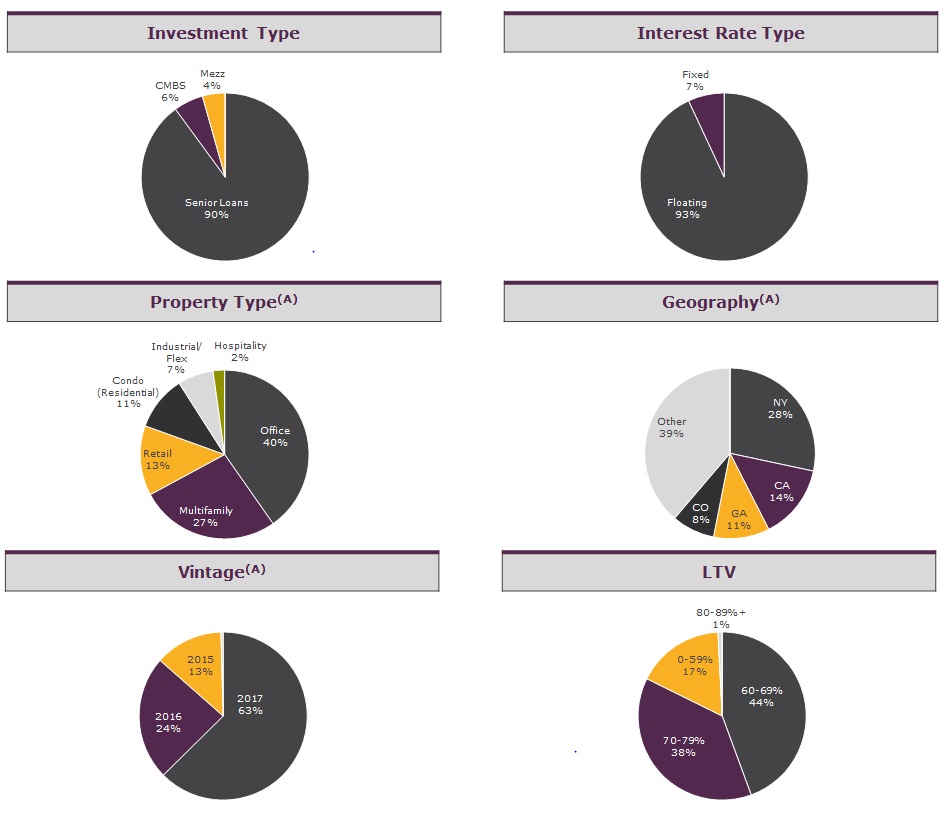

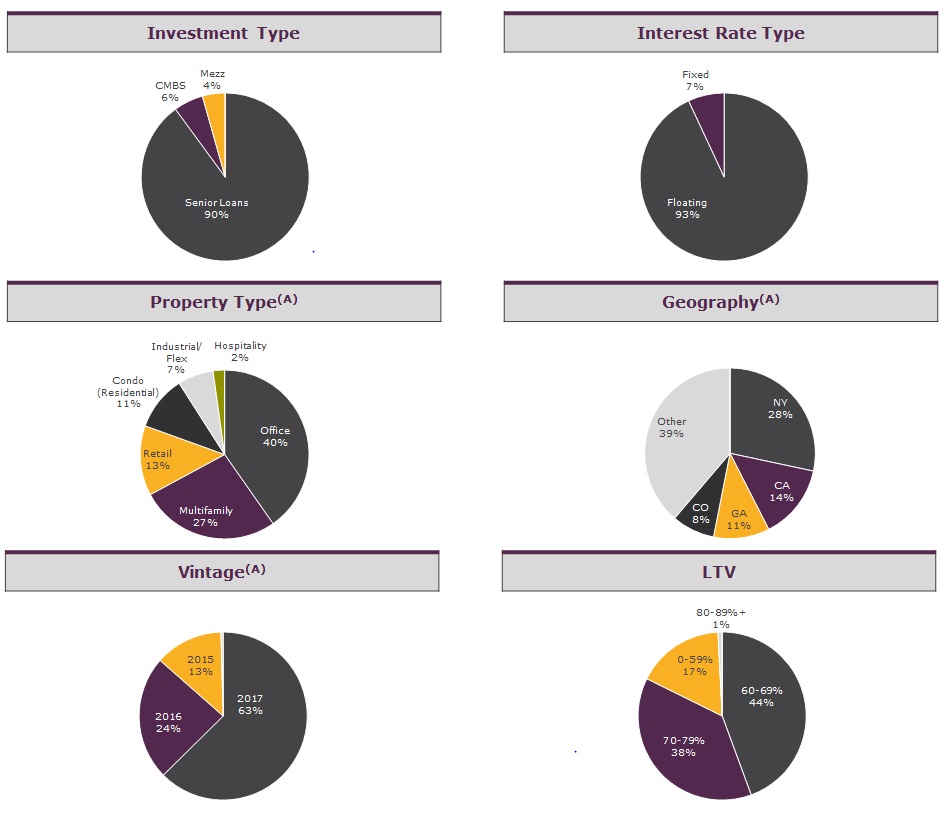

The following charts illustrate the diversification of our loan portfolio(A), based on type of investment, interest rate, underlying property type, and geographic location, vintage and loan to value ("LTV") as of December 31, 2017:2023:

The charts above are based on total assets. Total assets reflectloan exposure of our commercial real estate loans. (A) Excludes: (i) REO with net carrying value of $158.6 million, (ii) CMBS B-Piece investments held through an equity method investment and (iii) fully written off risk-rated 5 loans with a combined outstanding principal balance of $45.5 million.

(B) Senior loans include senior mortgages and similar credit quality loans, including related contiguous junior participations in senior loans where we have financed a loan with structural leverage through the non-recourse sale of a corresponding first mortgage.

(C) We classify a loan as life science if more than 50% of the gross leasable area is leased to, or will be converted to, life science-related space.

(D) Other property type includes Condo (Residential) (2%), Self-Storage (2%), Student Housing (1%) and Single Family Rental (1%).

(E) LTV is generally based on the initial loan amount divided by the as-is appraised value as of the date the loan was originated or by the current principal amount as of ourthe date of the most recent as-is appraised value. Weighted average LTV includes non-consolidated senior interests and mezzanine loans; and (ii) the cost basis of our CMBS B-Pieces, net of variable interest entity ("VIE") liabilities. In accordance with GAAP, we carry our CMBS B-Pieces at fair value, which we valued above our cost basis asexcludes risk-rated 5 loans.

Our senior loans as of December 31, 2017.

| |

(A) | Excludes CMBS B-Pieces. Our CMBS B-Piece portfolio diversification is as follows and is inclusive of our $14.0 million investment in RECOP, an unconsolidated VIE of which KREF is not the primary beneficiary: |

| |

• | Property Type: Office (26.7%), Retail (24.9%), Hospitality (15.2%), Multifamily (10.4%), and Other (22.8%). As of December 31, 2017, no other individual property type comprised more than 10% of our total CMBS B‑Piece portfolio.

|

| |

• | Geography: California (23.1%), Texas (12.0%), New York (10.2%), Illinois (6.6%), Florida (5.4%), and Other (42.7%). As of December 31, 2017, no other individual geography comprised more than 5% of our total CMBS B‑Piece portfolio.

|

| |

• | Vintage: 2015 (58.5%), 2016 (30.6%), and 2017 (10.9%).

|

Our senior loans2023 had a weighted average loan to value ratio ("LTV")LTV of 67% as of December 31, 2017,66%, and we have focused our portfolio on senior positions in the capital structure where the sponsor has meaningful cash or imputed equity subordinated to our position to provide what we believe is downside protection in the event of credit impairment at the asset level. As of December 31, 2017, we maintained a controlling position in all of our senior loans and subordinate debt positions (subject to the terms of our master repurchase agreements, as applicable).

For additional information regarding our portfolio as of December 31, 2017,2023, see Part II, Item 7. "Management's Discussion and Analysis of Financial Condition and Results of Operations."

Our Financing Strategy

AsWe raise capital through offerings of our equity and debt securities to fund future investments. In addition, as part of our mortgageportfolio financing strategy, we may use both direct and structural leverage. Our use of direct leverage includes the utilization of repurchase facilities.facilities, term lending arrangements, asset based financing, collateralized loan obligations, secured term loan and revolving credit agreements. Term lending arrangements, asset based financing and collateralized loan obligations provide us with Non-Mark-to-Market financing sources, which reduces our exposure to market fluctuations. These Non-Mark-to-Market financing sources, which represented 76% of our secured financing as of December 31, 2023, are not subject to credit or capital markets mark-to-market provisions. The remaining 24% of our secured borrowings, which is primarily comprised of three master repurchase agreements, are only subject to credit marks. In addition, we may use structural leverage by syndicating senior mortgage interests in our originated senior loans to other investors and creatingcreate a subordinated interest that we retain for our portfolio. When utilizing direct leverage, our investment is secured by a first-mortgage lien on the real property underlying the loan and is subject to partial recourse by our lender under the repurchase facility. When utilizing structural leverage, our retained interest is generally a mezzanine loan, secured by a pledge of 100% of the equity ownership interests in the owner of the real property and is generally not subject to recourse. Our retained interest when utilizing structural leverage is subordinate to the lien of the third-party lender that owns the senior interest.

Master Repurchase Agreements

We have master repurchase agreements with Wells Fargo, Morgan Stanley,

During the year ended and Goldman Sachs, which provided us with advances of up to $1.8 billion in the aggregate as of December 31, 2017. See Part II, Item 7. "Management's Discussion2023, we:

•Extended a $600.0 million master repurchase agreement and Analysisa $500.0 million warehouse facility maturity date to March 2026

•Upsized a $240.0 million master repurchase agreement to $400.0 million and extended the final maturity date to December 2027

•Repaid $143.8 million convertible notes in cash

•Had no corporate debt or final facility maturities due until the first quarter of Financial Condition and Results2026

As a result, our Non-Mark-to-Market financing was $4.8 billion as of Operations—Liquidity and Capital Resources" for a summaryDecember 31, 2023, representing 76% of our master repurchase agreementssecured financing.

The following table details our outstanding financing arrangements as of December 31, 2023 (amounts in thousands):

| | | | | | | | | | | | | | |

| | Portfolio Financing Outstanding Principal Balance | | Maximum Capacity |

| Master repurchase agreements | | $ | 1,477,227 | | | $ | 2,000,000 | |

| Collateralized loan obligation | | 1,942,750 | | | 1,942,750 | |

| Term lending agreements | | 1,329,390 | | | 1,977,399 | |

| Term loan facility | | 561,377 | | | 1,000,000 | |

| Asset specific financing | | 266,072 | | | 490,625 | |

| Warehouse facility | | — | | | 500,000 | |

| Secured term loan | | 343,000 | | | 343,000 | |

| Revolving credit agreement | | 160,000 | | | 610,000 | |

| Non-consolidated senior interests | | 188,611 | | | 188,611 | |

| Total portfolio financing | | $ | 6,268,427 | | | $ | 9,052,385 | |

The following chart illustrates our progress in diversifying our financing sources and otherexpanding our non-mark-to-market financing arrangements.sources to reduce our exposure to market volatility:

(1) Based on outstanding principal amount of secured financing, including non-consolidated senior interests, that resulted from non-recourse sales of senior loan interest in loans we originated

Financing Risk Management

The amount of leverage employed on our assets will depend on our Manager's assessment of the credit, liquidity, price volatility and other risks of those assets and the financing counterparties and availability of particular types of financing at any given time.

We plan to maintain leverage levels appropriate to our specific portfolio. On average, we are targeting a leverage ratio on our senior loansAs of 3-to-1 on a debt to equity basis, as compared toDecember 31, 2023, our total leverage ratio of 1-to-1 as of December 31, 2017.was 4.2-to-1. We will endeavor to match the terms and indices of our assets and liabilities and will also seek to minimize the risks associated with mark-to-market and recourse borrowing.

Investment Guidelines

Under the management agreement with our Manager, our Manager is required to manage our business in accordance with certain investment guidelines, which include:

•seeking to invest our capital in a broad range of investments in or relating to CRE debt;

•not making investments that would cause us to fail to qualify as a REIT for U.S. federal income tax purposes;

•not making investments that would cause us or any of our subsidiaries to be required to be registered as an investment company under the Investment Company Act;

•allowing allocation of investment opportunities sourced by our Manager to one or more KKR funds advised by our Manager or its affiliates in addition to us, in accordance with the allocation policy then in effect, as applied by our Manager in a fair and equitable manner;

•prior to the deployment of capital into investments, causing our capital to be invested in any short-term investments in money market funds, bank accounts, overnight repurchase agreements with primary federal reserve bank dealers collateralized by direct U.S. government obligations and other instruments or investments reasonably determined by our Manager to be of high quality; and

•investing not more than 25% of our "equity" in any individual investment without the approval of a majority of our board of directors or a duly constituted committee of our board of directors (it being understood, however, that for purposes of the foregoing concentration limit, in the case of any investment that is comprised (whether through a structured investment vehicle or other arrangement) of securities, instruments or assets of multiple portfolio issuers, such investment for purposes of the foregoing limitation will be deemed to be multiple investments in such underlying securities, instruments and assets and not such particular vehicle, product or other arrangement in which they are aggregated).

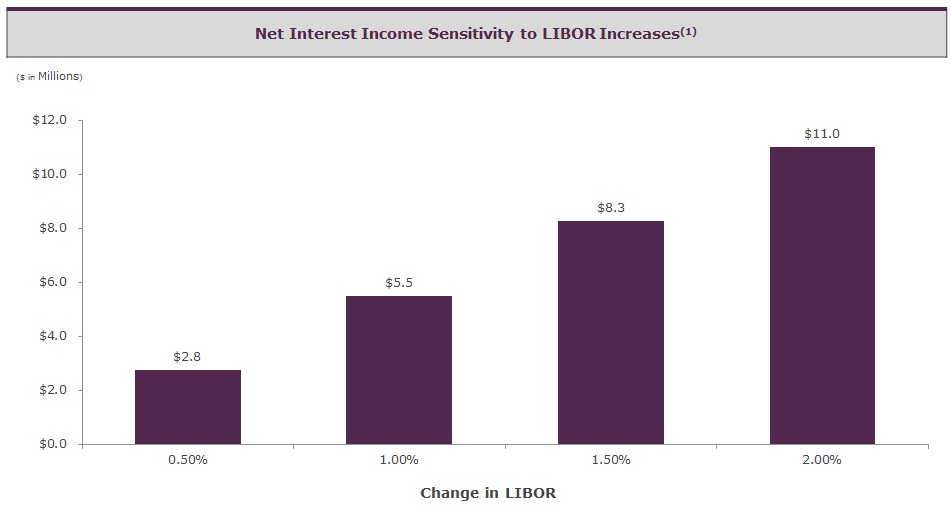

Impact of Rising Interest RatesRate Environment

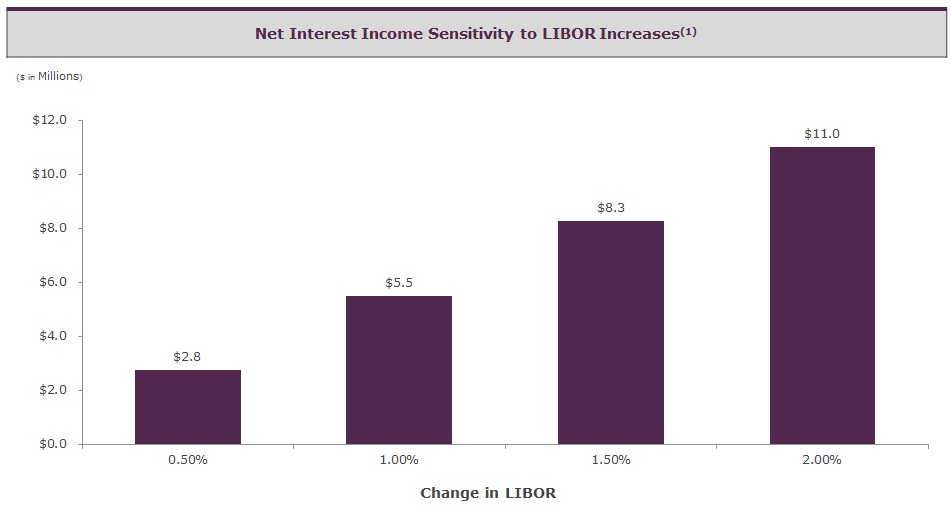

Generally, our business model is such that rising interest rates will result in an increase to our earnings and dividend yield.net income, while declining interest rates will decrease our net income. As of December 31, 2017, 93.1%2023, 99.0% of our investments based on net equityloans by total loan exposure earned a floating rate of interest over a floating-rate index and of those investments that were financed, all were financed with liabilities that pay interest over a floating-rate index, which resulted in a positive correlationindexed to rising interest rates for our company.Term SOFR.

Additionally, floating-rate senior loans typically have lower interest rate sensitivity and less susceptibility to price declines than fixed-rate investments when short-term rates rise. As a result, we believe that our investment strategy, which is primarily focused on originating or acquiring LIBOR-basedfloating-rate senior loans, strategically positions our portfolio to earn attractive risk-adjusted yields in a rising interest rate environment.

With respect In a rising interest environment, our interest income on our current portfolio is expected to increase as rates increase. In a declining interest rate environment, our interest income is expected to decrease as index rates decrease; in certain circumstances, however, rate floors relating to our fixed-rate exposure in ourloan portfolio an increase in long-term interest rates could have a negativemay offset some of the impact on the market value of those investments. Several factors would impact the ultimate market value, including but not limited to, the remaining duration, underlying LTV and credit profile today, credit spreads and other factors.from declining rates.

With respect to our fixed-rate CMBS portfolio indirectly held through an equity method investment, rising interest rates could have a negative effect on the value of the securities in our portfolio. OurSuch CMBS securities are purchased at a substantial discount to their faceprincipal amount and are much more sensitive to changes in the underlying credit of the securities and credit

spreads than to fluctuations in interest rates. However, an increase in long-term rates, with other factors held constant, may have a negative impact on the market value of the CMBS portfolio.

(1) Assumes loans are drawn up to maximum approved advance rate based on current principal amount outstanding as of December 31, 2023.

| |

(1) | As of December 31, 2017. Assumes loans are drawn up to maximum approved advance rate based on current principal amount outstanding as of December 31, 2017. |

For a further discussion, see Part II, Item 7. "Management's Discussion and Analysis of Financial Condition and Results of Operations—Quantitative and Qualitative Disclosures About Market Risk—Interest Rate Risk."

On March 5, 2021, the Financial Conduct Authority of the U.K. (the “FCA”), which regulates LIBOR, announced (the “FCA Announcement”) that all relevant LIBOR tenors would cease to be published or would no longer be representative after June 30, 2023. The FCA Announcement coincided with the March 5, 2021 announcement of LIBOR’s administrator, the ICE Benchmark Administration Limited (the “IBA”), indicating that, as a result of not having access to input data necessary to calculate relevant LIBOR tenors on a representative basis after June 30, 2023, the IBA would have to cease publication of such LIBOR tenors immediately after the last publication on June 30, 2023. Further, on March 15, 2022, the Consolidated Appropriations Act of 2022, which includes the Adjustable Interest Rate (LIBOR) Act, was signed into law in the United States. This legislation established a uniform benchmark replacement process for financial contracts maturing after June 30, 2023 that do not contain clearly defined or practicable fallback provisions. The legislation also created a safe harbor that shields lenders from litigation if they choose to utilize a replacement rate recommended by the Board of Governors of the Federal Reserve.

The Federal Reserve, in conjunction with the Alternative Reference Rate Committee, a committee convened by the Federal Reserve that includes major market participants, identified the Secured Overnight Financing Rate, or SOFR, an index calculated by short-term repurchase agreements, backed by Treasury securities, as its preferred alternative rate for LIBOR. There are significant differences between LIBOR and SOFR, such as LIBOR being an unsecured lending rate while SOFR is a secured lending rate, and SOFR is an overnight rate while LIBOR reflects term rates at different maturities. The differences between LIBOR and SOFR, could result in higher interest costs for us, which could have a material adverse effect on our operating results.

As of December 31, 2023, our floating-rate loan portfolio and financing arrangements were all indexed to Term SOFR.

Taxation of the Company

We elected to be treated as a REIT for U.S. federal income tax purposes commencing with our taxable year ended December 31, 2014 and expect to continue to operate so as to qualify as a REIT. So long as we qualify as a REIT, we generally

will not be subject to U.S. federal income tax on net taxable income that we distribute annually to our stockholders. In order to qualify as a REIT for U.S. federal income tax purposes, we must continually satisfy tests concerning, among other things, the real estate qualification of sources of our income, the composition and values of our assets, the amounts we distribute to our stockholders and the diversity of ownership of our stock. In order to comply with REIT requirements, we may need to forego otherwise attractive opportunities and limit our expansion opportunities and limit the manner in which we conduct our operations.

See Part I, Item 1A. "Risk Factors—Risks Related to our REIT Status and Certain Other Tax Considerations."

Competition

We are engaged in a competitive business. In our lending and investing activities, we compete for opportunities with a variety of institutional lenders and investors, including other REITs, specialty finance companies, public and private funds (including funds that KKR or its affiliates may in the future sponsor, advise and/or manage), commercial and investment banks, commercial finance and insurance companies and other financial institutions. Several other REITs have raised, or are expected to raise, significant amounts of capital, and may have investment objectives that overlap with ours, which may create additional competition for lending and investment opportunities. Some competitors may have a lower cost of funds and access to funding sources that are not available to us. Many of our competitors are not subject to the operating constraints associated with REIT rule compliance or maintenance of an exclusion from registration under the Investment Company Act. In addition, some of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of loans and investments, offer more attractive pricing or other terms and establish more relationships than us. Furthermore, competition for originations of and investments in our target assets may lead to the yields of such assets decreasing, which may further limit our ability to generate satisfactory returns.

In addition, changes in the financial regulatory regime could decrease the current restrictions on banks and other financial institutions and allow them to compete with us for investment opportunities that were previously not available to them. See Part I, Item 1A. "Risk Factors—Risks Related to Our Company—Changes in laws or regulations governing our operations, changes in the interpretation thereof or newly enacted laws or regulations and any failure by us to comply with these laws or regulations, could require changes to certain of our business practices, negatively impact our operations, cash flow or financial condition, impose additional costs on us, subject us to increased competition or otherwise adversely affect our business."

We believe access to our Manager's and KKR's professionals and their industry expertise and relationships provide us with competitive advantages in assessing risks and determining appropriate pricing for potential investments. We believe these relationships will enable us to compete more effectively for attractive investment opportunities. However, we may not be able to achieve our business goals or expectations due to the competitive risks that we face. For additional information concerning these competitive risks, see Part I, Item 1A. "Risk Factors—Risks Related to Our Lending and Investment Activities—We operate in a competitive market for lending and investment opportunities, and competition may limit our ability to originate or acquire desirable loans and investments or dispose of assets we target and could also affect the yields of these assets and have a material adverse effect on our business, financial condition and results of operations."

EmployeesHuman Capital

We do not have any employees. We are externally managed by our Manager pursuant to the management agreement between our Manager and us. Our executive officers are employees of our Manager or one or more of its affiliates. See "—Our"Our Manager and KKR."

Additional Information Available

Our website address is www.kkrreit.com. Information on our website is not incorporated by reference herein and is not a part of this Annual Report on Form 10-K. We make available free of charge on our website or provide a link on our website to our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after those reports are electronically filed with, or furnished to, the SEC. To access these filings, go to the “Investor Relations” page on our website, then click on “SEC Filings”. You may also read and copy any document we file at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, DC 20549. Please call the SEC at 1-800-SEC-0330 for further information on the Public Reference Room. Our SEC filings are also available to the public from the SEC’s internet site at http://www.sec.gov.

From time to time, we may use our website at www.kkrreit.com as a channel of distribution of material information. Financial and other material information regarding our company is routinely posted and accessible on our website. In addition, you may automatically receive e-mail alerts and other information about our company by enrolling your e-mail address by visiting the “E-mail Alerts” section of the “Investor Relations” page on our website.

ITEM 1A. RISK FACTORS

The following risks could materially and adversely affect our business, financial condition, and results of operations, and the

trading price of our common stock could decline. These risk factors do not identify all risks that we face, and our operations

could also be affected by factors that are not presently known to us or that we currently consider to be immaterial to our

operations. Due to risks and uncertainties, known and unknown, our past financial results may not be a reliable indicator of

future performance, and historical trends should not be used to anticipate results or trends in future periods. Refer also to the

other information set forth in this Annual Report on Form 10-K, including “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” and our financial statements and the related notes thereto.

Risks Related to Our Lending and Investment Activities

We operate in a competitive market for lending and investment opportunities, and competition may limit our ability to originate or acquire desirable loans and investments or dispose of assets we target and could also affect the yields of these assets and have a material adverse effect on our business, financial condition and results of operations.

A number of entities compete with us to make the types of loans and investments we seek to originate or acquire. Our profitability depends, in large part, on our ability to originate or acquire target assets on attractive terms. In originating or acquiring target assets, we compete with a variety of institutional lenders and investors, including other REITs, specialty finance companies, public and private funds (including funds thatsponsored, advised and/or managed by KKR or its affiliates may in the future sponsor, advise and/or manage)affiliates), commercial and investment banks, commercial finance and insurance companies and other financial institutions. Several other REITs have raised, or are expected to raise, significant amounts of capital, and may have investment objectives that overlap with ours, which may create additional competition for lending and investment opportunities. Some competitors may have a lower cost of funds and access to funding sources that are not available to us, such as the U.S. government. Many of our competitors are not subject to the operating constraints associated with REIT rule compliance or maintenance of an exclusion from registration under the Investment Company Act. In addition, some of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of loans and investments, offer more attractive pricing or other terms and establish more relationships than us. Furthermore, competition for originations of and investments in our target assets may lead to the yields of such assets decreasing, which may further limit our ability to generate satisfactory returns. In addition, changes in the financial regulatory regime resulting from the current administration could decrease the current restrictions on banks and other financial institutions and allow them to compete with us for investment opportunities that were previously not available to them. "—RisksSee “Risks Related to Our Company—Changes in laws or regulations governing our operations, changes in the interpretation thereof or newly enacted laws or regulations and any failure by us to comply with these laws or regulations, could require changes to certain of our business practices, negatively impact our operations, cash flow or financial condition, impose additional costs on us, subject us to increased competition or otherwise adversely affect our business."business” below.

As a result of this competition, desirable loans and investments in our target assets may be limited in the future and we may not be able to take advantage of attractive lending and investment opportunities from time to time. We can provide no assurance that we will be able to identify and originate loans or make investments that are consistent with our investment objectives. We cannot assure you that the competitive pressures we face will not have a material adverse effect on our business, financial condition and results of operations.

In addition, our investment strategy with respect to certain types of investments may depend, in part, on our ability to enter into satisfactory relationships with joint ventures, operating partners and/or strategic co-investors. There can be no assurance that current relationships with such parties such as SteepRock, will continue (whether on currently applicable terms or otherwise) or that we will be able to establish relationships with other such persons in the future if desired and on terms favorable to us.

Our loans and investments expose us to risks associated with debt-oriented real estate investments generally.

We seek to invest primarily in debt investments in or relating to real estate assets. Any deteriorationDeterioration of real estate fundamentals generally, and in the United States in particular, could negatively impact our performance, increasehas increased the default risk applicable to borrowers, and/or makeand made it relatively more difficult for us to generate attractive risk-adjusted returns.returns and comtinue to negatively impact our performance. Changes in general economic conditions will affecthave affected the creditworthiness of borrowers and/orand the value of underlying real estate collateral relating to our investmentsinvestments. Such changes and have included and/or may in the future include economic and/or market fluctuations, increases in remote working arrangements, changes in environmental, zoning and other laws, casualty or condemnation losses, regulatory limitations on rents, decreases in property values, changes in the appeal of properties to tenants, changes in supply and demand of real estate products, fluctuations in real estate fundamentals (including average occupancy and room rates for hotel properties), energy and supply shortages, various uninsured or uninsurable risks, natural

disasters, terrorism, acts of war, outbreaks of pandemic or contagious diseases such as COVID-19, changes in government regulations (such as rent control), political and legislative

uncertainty, changes in monetary policy, changes in real property tax rates and operating expenses, changes in interest rates, changes in the availability of debt financing and/or mortgage funds which may render the sale or refinancing of properties difficult or impracticable, increased mortgage defaults, increases in borrowing rates, escalating global trade tensions, the conflict between Russia and Ukraine, deteriorating geopolitical conditions in the Middle East, the adoption or expansion of economic sanctions or trade restrictions, negative developments in the economy that depress travel activity, adverse changes in demand and/or real estate values generally and other factors that are beyond our control. In addition, our investments may be exposed to new or increased risks and liabilities associated with global climate change, such as increased frequency or intensity of adverse weather and natural disasters, which could negatively impact our and our borrowers' businesses and the value of the properties securing our investments.

We cannot predict the degree to which economic conditions generally, and the conditions for real estate debt investing in particular, will improve or decline. Any future declines in the performance of the U.S. and global economies or in the real estate debt markets could have a material adverse effect on our business, financial condition, and results of operations.

MezzanineFluctuations in interest rates and credit spreads could reduce our ability to generate income on our loans preferred equity and other investments, that are subordinated or otherwise juniorwhich could lead to a significant decrease in an issuer's capital structureour results of operations, cash flows and that involve privately negotiated structures expose us to greater riskthe market value of loss.

We invest in debt instruments (including CMBS B-Pieces)our investments and preferred equity that are subordinated or otherwise junior in an issuer's capital structure and that involve privately negotiated structures. Our investments in subordinated debt and mezzanine tranches of a borrower's capital structure andcould materially impair our remedies with respect thereto, including the ability to foreclosepay distributions to our stockholders.

Our primary interest rate exposures relate to the yield on our loans and other investments and the financing cost of our debt, as well as any collateral securinginterest rate swaps that we may utilize for hedging purposes. Changes in interest rates and credit spreads will affect our net income from loans and other investments, which is the difference between the interest and related income earned on interest-earning investments and the interest and related expense incurred in financing these investments. As of December 31, 2023, our floating-rate loan portfolio and financing arrangements were all indexed to Term SOFR. In a declining interest rate environment, our interest income generally decreases as index rates decrease. Also, in a declining interest rate environment, the value of our fixed-rate investments may increase and if interest rates were to increase, the value of these fixed-rate investments may fall; however, the interest income generated by these fixed-rate investments would not be affected by market interest rates. The interest rates we pay under our current financing facilities are floating-rate. Accordingly, our interest expense will generally increase as interest rates increase and decrease as interest rates decrease. Generally, the composition of our investments is such that rising interest rates will increase our net income, while declining interest rates will decrease our net income. However, rate floors relating to our floating-rate loans may offset some of the impact from declining rates. There can be no assurance that we will continue to utilize rate floors.

In recent years, interest rates had remained at relatively low levels on a historical basis. However, since January 2022, in light of increasing inflation, the U.S. Federal Reserve increased interest rates eleven times. These increases have increased our borrowers interest payments, and adversely affected commercial real estate property values, and could result in higher borrower default rates.

Notwithstanding the current period of relatively high interest rates, the U.S. Federal Reserve has indicated that it may decrease interest rates in 2024. In a period of declining interest rates, our interest income on floating-rate investments would generally decrease, while any decrease in the interest we are charged on our floating-rate debt may be subject to floors and may not compensate for such decrease in interest income. However, rate floors relating to our loan portfolio may offset some of the rights of any senior creditors and, to the extent applicable, contractual intercreditor and/or participation agreement provisions. Significant losses related toimpact from declining rates. In addition, interest we are charged on our fixed-rate debt would not change. Any such loans or investmentsscenario could adversely affect our results of operations and financial condition.

InvestmentsOur operating results depend, in subordinated debt involve greaterpart, on differences between the income earned on our investments, net of credit risk of defaultlosses, and our financing costs. The yields we earn on our floating-rate assets and our borrowing costs tend to move in the same direction in response to changes in interest rates. However, one can rise or fall faster than the senior classes ofother, causing our net interest margin to expand or contract. In addition, we could experience reductions in the issue or series. As a result, with respect toyield on our investments and an increase in CMBS B-Pieces, mezzanine loans and other subordinated debt,the cost of our financing. Although we would potentially receive payments or interest distributions after, and must bear the effects of losses or defaults on the senior debt (including underlying senior loans, senior mezzanine loans, B-Notes, preferred equity or senior CMBS bonds, as applicable) before, the holders of other more senior tranches of debt instruments with respectseek to such issuer. Asmatch the terms of suchour liabilities to the expected lives of loans andthat we acquire or originate, circumstances may arise in which our liabilities are shorter in duration than our assets, resulting in their adjusting faster in response to changes in interest rates. For any period during which our investments are subjectnot match-funded, the income earned on such investments may respond more slowly to contractual relationships among lenders, co-lending agentsinterest rate fluctuations than the cost of our borrowings. Consequently, changes in interest rates, particularly short-term interest rates, may immediately and others, they can vary significantly decrease our results of operations and cash flows and the market value of our investments. Interest rate and credit spread fluctuations resulting in their structural characteristicsour interest and other risks.

Mezzanine loans are by their nature structurally subordinatedrelated expense exceeding interest and related income would result in operating losses for us, and any such reduction in our net interest income could materially impair our ability to more senior property-level financings. If a borrower defaults on our mezzanine loan or on debt seniorpay distributions to our loan,stockholders. Changes in the level of interest rates and credit spreads may also affect our ability to make loans or if the borrower is in bankruptcy, our mezzanine loan will be satisfied only after the property-level debtinvestments and other senior debt is paid in full. As a result, a partial loss in the value of the underlying collateral can result in a total loss of the value of the mezzanine loan. In addition, even if we are able to foreclose on the underlying collateral following a default on a mezzanine loan, we would be substituted for the defaulting borrower and, to the extent income generated on the underlying property is insufficient to meet outstanding debt obligations on the property, may need to commit substantial additional capital and/or deliver a replacement guarantee by a creditworthy entity, which could include us, to stabilize the property and prevent additional defaults to lenders with existing liens on the property.

Investments in preferred equity involve a greater risk of loss than conventional debt financing due to a variety of factors, including their non-collateralized nature and subordinated ranking to otherour loans and liabilitiesinvestments.

Furthermore, increases in which such preferred equity is held. Accordingly, if the issuer defaults on our investment, we would only be able to proceed against such entity in accordance with the terms of the preferred equity,interest rates and/or credit spreads may negatively affect demand for loans and not against any property owned by such entity. Furthermore, in the event of bankruptcy or foreclosure, we would only be able to recoup our investment after all lenders to, and other creditors of, such entity are paid in full. As a result, we may lose all or a significant part of our investment, which could result in significant losses.higher borrower default rates, while decreases in interest rates and/or credit spreads may decrease our interest income on floating-rate investments and may lead to higher prepayment rates on our loans.

In addition, our investments in senior loans may be effectively subordinated to the extent we borrow under a warehouse loan (which can be in the form of a repurchase agreement) or similar facility and pledge the senior loan as collateral. Under these arrangements, the lender has a right to repayment of the borrowed amount before we can collect on the value of the senior loan, and therefore if the value of the pledged senior loan decreases below the amount we have borrowed, we would experience a loss.

We may not have control over certain of our loans and investments.

Our ability to manage our portfolio of loans and investments may be limited by the form in which they are made. In certain situations, we may:

•acquire investments subject to rights of senior classes, special servicers or collateral managers under intercreditor, servicing agreements or securitization documents;

•pledge our investments as collateral for financing arrangements;

•acquire only a minority and/or a non-controlling participation in an underlying investment;

•co-invest with others through partnerships, joint ventures or other entities, thereby acquiring non-controlling interests; or

•rely on independent third-party management or servicing with respect to the management of an asset.

Therefore, we may not be able to exercise control over all aspects of our loans or investments. Such financial assets may involve risks not present in investments where senior creditors, junior creditors, servicers or third partiesthird-party controlling investors are not involved. Our rights to control the process following a borrower default may be subject to the rights of senior or junior creditors or servicers whose interests may not be aligned with ours. A partner or co-venturer may have financial difficulties resulting in a negative impact on such asset, may have economic or business interests or goals that are inconsistent with ours, or may be in a position to take action contrary to our investment objectives. In addition, we will generally pay all or a portion of the expenses relating to our joint ventures and we may, in certain circumstances, be liable for the actions of our partners or co-venturers.

CRE-related investments that are secured, directly or indirectly, by real property are subject to delinquency, foreclosure and loss, which could result in losses to us.

CRE debt instruments (e.g., mortgages, mezzanine loans and preferred equity) that are secured by commercial property are subject to risks of delinquency and foreclosure and risks of loss that are greater than similar risks associated with loans made on the security of single-family residential property. The ability of a borrower to repay a loan secured by an income-producing property typically is dependent primarily upon the successful operation of the property rather than upon the existence of independent income or assets of the borrower. If the net operating income of the property is reduced, the borrower'sborrower’s ability to repay the loan may be impaired. Net operating income of an income-producing property can be affected by, among other things:

•tenant mix and tenant bankruptcies;

•success of tenant businesses;

•property management decisions, including with respect to capital improvements, particularly in older building structures;

•property location and condition;

•competition from other properties offering the same or similar services;

•changes in laws that increase operating expenses or limit rents that may be charged;

•any liabilities relating to environmental matters at the property;

•changes in global, national, regional or local economic conditions and/or specific industry segments;

•increases in remote working arrangements and the subsequent effect on demand for CRE;

•global trade disruption, supply chain issues, significant introduction of trade barriers and bilateral trade frictions;

•labor shortages and increasing wages;

•higher inflation rates;

•declines in global, national, regional or local real estate values;

•declines in global, national, regional or local rental or occupancy rates;

•changes in interest rates and in the state of the credit and securitization markets and the debt and equity capital markets, including diminished availability or lack of debt financing for CRE;

•changes in real estate tax rates and other operating expenses;

•changes in governmental rules, regulations and fiscal policies, including environmental legislation, income tax regulations and environmentalother tax legislation;

•outbreaks of contagious or pandemic diseases, including COVID-19;

•acts of God, natural disasters, climate change related risks, terrorism, social unrest and civil disturbances, which may decrease the availability of or increase the cost of insurance or result in uninsured losses; and

•adverse changes in zoning laws.

In addition, we are exposed to the risk of judicial proceedings with our borrowers and entities in which we invest, including bankruptcy or other litigation, as a strategy to avoid foreclosure or enforcement of other rights by us as a lender or investor. In the event that any of the properties or entities underlying or collateralizing our loans or investments experiences any of the foregoing events or occurrences, the value of, and return on, such investments could decline and could adversely affect our results of operations and financial condition.

Fluctuations in interest rates could reduce our ability to generate income on our loans and other investments, which could lead to a significant decrease in our results of operations.

Our primary interest rate exposures will relate to the yield on our investments and the financing cost of debt, as well as any interest rate swaps that we utilize for hedging purposes. Changes in interest rates will affect our net income from loans and other investments, which is the difference between the interest and related income earned on interest-earning investments and the interest and related expense incurred in financing these investments. Interest rate fluctuations resulting in our interest and related expense exceeding interest and related income would result in operating losses for us. Changes in the level of interest rates may also affect our ability to make loans or investments and the value of our loans and investments. Changes in interest rates may also negatively affect demand for loans and could result in higher borrower default rates.

Loans on properties in transition will involve a greater risk of loss than conventional mortgage loans.

We mayprimarily invest in transitional loans to borrowers who are typically seeking short-term capital to be used in an acquisition or rehabilitation of a property. The typical borrower under a transitional loan has usually identified an undervalued asset that has been under-managed and/or is located in a recovering market. If the market in which the asset is located fails to improve according to the borrower'sborrower’s projections, or if the borrower fails to improve the quality of the asset'sasset’s management and/or the value of the asset, the borrower may not receive a sufficient return on the asset to satisfy the transitional loan, and we bear the risk that we may not recover some or all of our investment.

Furthermore, the renovation, refurbishment or expansion of a property by a borrower involves risks of cost overruns and noncompletion. Estimates of the costs of improvements to bring an acquired property up to standards established for the market position intended for that property may prove inaccurate. Other risks may include rehabilitation costs exceeding original estimates, possibly making a project uneconomical, environmental risks, delays in legal and other approvals (e.g., for condominiums) and rehabilitation and subsequent leasing of the property not being completed on schedule. If such renovation is not completed in a timely manner, or if it costs more than expected, the borrower may experience a prolonged reduction of net operating income and may not be able to make payments on our investment on a timely basis or at all, which could result in significant losses.

In addition, borrowers usually use the proceeds of a conventional mortgage to repay a transitional loan. Transitional loans therefore are subject to risks of a borrower'sborrower’s inability to obtain permanent financing to repay the transitional loan.loan and to the broader availability of conventional mortgages at amenable rates. In the event of any default under transitional loans that may be held by us, we bear the risk of loss of principal and non-payment of interest and fees to the extent of any deficiency between the value of the mortgage collateral and the principal amount and unpaid interest of the transitional loan. To the extent we suffer such losses with respect to these transitional loans, it could adversely affect our results of operations and financial condition.

Prepayment rates may adversely affect the value of our portfolio of assets.

Generally, our borrowers may repay their loans prior to their stated final maturities. In periods of declining interest rates and/or credit spreads, prepayment rates on loans generally increase. If general interest rates orand credit spreads decline at the same time, the proceeds of such prepayments received during such periods are likely to be reinvested by us in assets yielding less than the yields on the assets that were prepaid. We may not be able to reinvest the principal repaid at the same or higher yield of the original investment. Conversely, in periods of rising interest rates, prepayment rates are likely to decrease and the number of our borrowers who exercise extension options, which could extend beyond the term of certain secured financing agreements we use to finance our loan investments, is likely to increase. This could have a negative impact on our results of operations, and in some situations, we may be forced to sell assets to maintain adequate liquidity, which could cause us to incur losses.

In addition, the value of our assets may be affected by prepayment rates on loans. If we originate or acquire mortgage-related securities or a pool of mortgage securities, we anticipate that the underlying mortgages will prepay at a projected rate generating an expected yield. If we purchase assets at a premium to par value, when borrowers prepay their loans faster than expected, the corresponding prepayments on the mortgage-related securities may reduce the expected yield on such securities because we will have to amortize the related premium on an accelerated basis. Conversely, if we purchase assets at a discount to par value, when borrowers prepay their loans slower than expected, the decrease in corresponding prepayments on the mortgage-related securities may reduce the expected yield on such securities because we will not be able to accrete the related discount as quickly as originally anticipated. In addition, as a result of the risk of prepayment, the market value of the prepaid assets may benefit less than other fixed income securities from declining interest rates.

Prepayment rates on loans may be affected by a number of factors including, but not limited to, the then-current level of interest rates and credit spreads, fluctuations in asset values, the availability of mortgage credit, the relative economic vitality of the area in which the related properties are located, the servicing of the loans, possible changes in tax laws, other opportunities for investment, and other economic, social, geographic, demographic and legal factors and other factors beyond our control. Consequently, such prepayment rates cannot be predicted with certainty and no strategy can completely insulate us from prepayment or other such risks. If prepayment rates exceed our expectations, we may have greater difficulty in redeploying the proceeds into new investment opportunities, which may significantly increase our cash balance and exacerbate the risks related to our cash management strategy. For further discussion of the risks related to capital deployment, see “Difficulty in redeploying the proceeds from repayments of our existing loans and investments may cause our financial performance and returns to investors to suffer” below.

Difficulty in redeploying the proceeds from repayments of our existing loans and investments may cause our financial performance and returns to investors to suffer.

As our loans and investments are repaid, we may redeploy the proceeds we receive into new loans and investments, repay borrowings under our credit facilities, pay dividends to our stockholders or repurchase outstanding shares of our common stock. It is possible that we will fail to identify reinvestment options that would provide returns or a risk profile that is comparable to the asset that was repaid. If we fail to redeploy the proceeds we receive from repayment of a loan in equivalent or better alternatives in a timely manner, our financial performance and returns to investors could suffer.

In light of our investment strategy and the need to be able to deployinvest capital quickly to capitalize on potential investment opportunities, we may from time to time maintain cash pending deployment into investments, which may at times be significant. Such cash may be held in an account of ours for the benefit of stockholders or may be invested in money market accounts or other similar temporary investments. While the duration of such holding period is expected to be relatively short, in the event we are unable to find suitable investments, such cash positions may be maintained for longer periods. It is not anticipated that the temporary investment of such cash into money market accounts or other similar temporary investments pending deployment into investments will generate significant interest, and such low interest payments on the temporarily invested cash may adversely affect our financial performance and returns to investors.

In addition, we have also invested in CMBS, and may from time to time invest in CMBS and CRE CLO securities as part of our short-term cash management strategy. Subordinate interests such as CMBS, CRE CLO securities and similar structured finance investments generally are not actively traded and are relatively illiquid investments. Volatility in CMBS and CRE CLO trading markets may cause the value of these investments to decline. In addition, if the underlying mortgage portfolio has been overvalued by the originator, or if the values subsequently decline and, as a result, less collateral value is available to satisfy interest and principal payments and any other fees in connection with the trust or other conduit arrangement for such securities, we may incur significant losses. For further discussion of the risks related to such investments, see “Our investments in CMBS and other similarly structured finance investments, as well as those we structure, sponsor or arrange, would pose additional risks, including the risks of the securitization process, the risk that we will not be able to recover some or all of our investment, the possibility that the CMBS market will be significantly affected by current or future regulation and the risk that we will not be able to hedge or transfer our CMBS B-Piece investments for a significant period of time” below.

The due diligence process that our Manager undertakes in regard to investment opportunities may not reveal all facts that may be relevant in connection with an investment and if our Manager incorrectly evaluates the risks of our investments, we may experience losses.

Before making investments for us, our Manager conducts due diligence that it deems reasonable and appropriate based on the facts and circumstances relevant to each potential investment. When conducting due diligence, our Manager may be required to evaluate a number of important and complexissues, including but not limited to those relating to business, financial, tax, accounting, environmental, social & corporate governance ("ESG"), technology, cybersecurity, legal, regulatory and legal issues.macroeconomic trends. The nature and scope of our Manager’s ESG diligence, if any, will vary based on the investment opportunity, but may include a review of, among other things: energy management, air and water pollution, land contamination, diversity, human rights, employee health and safety, accounting standards and bribery and corruption. Outside consultants, legal advisors, accountants and investment banks may be involved in the due diligence process in varying degrees depending on the type of potential investment. Selecting and evaluating material ESG factors is subjective by nature, and there is no guarantee that the criteria utilized or judgment exercised by our Manager or a third-party ESG specialist (if any) will reflect the beliefs, values, internal policies or preferred practices of any particular investor or align with the beliefs or values or preferred practices of other asset managers or with market trends. The materiality of ESG risks and impacts on an individual potential investment or portfolio as a whole are dependent on many factors, including the relevant industry, country, asset class and investment style.

Our Manager'sManager’s loss estimates based on its due diligence process may not prove accurate, as actual results may vary from estimates. If our Manager underestimates the asset-level losses relative to the price we pay for a particular investment, we may experience losses with respect to such investment. Moreover, investment analyses and decisions by our Manager may frequently be required to be undertaken on an expedited basis to take advantage of investment opportunities. In such cases, the information available to our Manager at the time of making an investment decision may be limited, and it may not have access to detailed information regarding such investment. Further, certain considerations covered by our Manager’s diligence, such as ESG, are continuously evolving, including from an assessment, regulatory and compliance standpoint, and our Manager may not accurately or fully anticipate such evolution. Therefore, we cannot assure you that our Manager will have knowledge of all circumstances that may adversely affect such investment.

In addition, it is difficult for real estate debt investors in certain circumstances to receive full transparency with respect to underlying investments because transactions are often effectuated on an indirect basis through pools or conduit vehicles rather than directly with the borrower. Loan structures or the terms of investments may make it difficult for us to monitor and evaluate investments. Therefore, we cannot assure you that our Manager will have knowledge of all information that may adversely affect such investment.

CMBS B-Pieces, mezzanine loans, preferred equity and other investments that are subordinated or otherwise junior in an issuer’s capital structure and that involve privately negotiated structures expose us to greater risk of loss.

We invest in debt instruments (including, indirectly through RECOP I, in CMBS B-Pieces) and may invest in preferred equity that are subordinated or otherwise junior in an issuer’s capital structure and that involve privately negotiated structures. Our investments in subordinated debt and mezzanine tranches of a borrower’s capital structure and our remedies with respect thereto, including the ability to foreclose on any collateral securing such investments, are subject to the rights of any senior creditors and, to the extent applicable, contractual intercreditor and/or participation agreement provisions. Significant losses related to such loans or investments could adversely affect our results of operations and financial condition.

Investments in subordinated debt involve greater credit risk of default than the senior classes of the issue or series. As a result, with respect to our investments in CMBS B-Pieces, mezzanine loans and other subordinated debt, we would potentially receive

payments or interest distributions after, and must bear the effects of losses or defaults on the senior debt (including underlying senior loans, senior mezzanine loans, B-Notes, preferred equity or senior CMBS bonds, as applicable) before, the holders of other more senior tranches of debt instruments with respect to such issuer. As the terms of such loans and investments are subject to contractual relationships among lenders, co-lending agents and others, they can vary significantly in their structural characteristics and other risks.