TABLE OF CONTENTS

Index

| GLOSSARY OF TERMS | |||||

| PART I | |||||

| Item 1 — Business | |||||

| Item 1A — Risk Factors | |||||

| Item 1B — Unresolved Staff Comments | |||||

| Item 2 — Properties | |||||

| Item 3 — Legal Proceedings | |||||

| Item 4 — Mine Safety Disclosures | |||||

| PART II | |||||

| Item 5 — Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |||||

| Item 6 — Selected Financial Data | |||||

| Item 7 — Management's Discussion and Analysis of Financial Condition and Results of Operations | |||||

| Item 7A — Quantitative and Qualitative Disclosures About Market Risk | |||||

| Item 8 — Financial Statements and Supplementary Data | |||||

| Item 9 — Changes in Disagreements With Accountants on Accounting and Financial Disclosure | |||||

| Item 9A — Controls and Procedures | |||||

| Item 9B — Other Information | |||||

| PART III | |||||

| Item 10 — Directors, Executive Officers and Corporate Governance | |||||

| Item 11 — Executive Compensation | |||||

| Item 12 — Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |||||

| Item 13 — Certain Relationships and Related Transactions, and Director Independence | |||||

| Item 14 — Principal Accounting Fees and Services | |||||

| PART IV | |||||

| Item 15 — Exhibits, Financial Statement Schedules | |||||

| EXHIBIT INDEX | |||||

| Item 16 — Form 10-K Summary | |||||

2

GLOSSARY OF TERMS

When the following terms and abbreviations appear in the text of this report, they have the meanings indicated below:

| 2020 Convertible Notes | ||||||||

| 2024 Senior Notes | $500 million aggregate principal amount of 5.375% unsecured senior notes due 2024, issued by | |||||||

| 2025 Senior Notes | $600 million aggregate principal amount of 5.750% unsecured senior notes due 2025, issued by Clearway Energy Operating LLC | |||||||

| 2026 Senior Notes | $350 million aggregate principal amount of 5.00% unsecured senior notes due 2026, issued by | |||||||

| ARO | Asset Retirement Obligation | |||||||

| ASC | The FASB Accounting Standards Codification, which the FASB established as the source of authoritative GAAP | |||||||

| ASU | Accounting Standards Updates – updates to the ASC | |||||||

| ATM | At-The-Market Equity Offering | |||||||

| Title 11 of the U.S. Code | ||||||||

| Bankruptcy Court | U.S. Bankruptcy Court for the Northern District of California | |||||||

| Buckthorn Solar Drop Down | ||||||||

| A non-GAAP measure, Cash Available | ||||||||

| Carlsbad Drop Down | The acquisition by the Company of the Carlsbad Energy Center, a 527 MW natural gas fired project located in Carlsbad, CA | |||||||

| Right of First Offer Agreement, entered into as of August 31, 2018, by and between Clearway Energy Group LLC and Clearway Energy, Inc., and solely for purposes of Section 2.4, GIP III Zephyr Acquisition Partners, L.P., as amended by the First Amendment dated February 14, 2019, the Second Amendment dated August 1, 2019, the Third Amendment dated December 6, 2019 and the Fourth Amendment dated November 2, 2020 | ||||||||

| Clearway, Inc. | Clearway Energy, Inc., the holder of the Company's Class A and Class C units | |||||||

| Clearway Energy Group LLC | The holder of Clearway, Inc.'s Class B and Class D common shares and the Company's Class B and Class D units | |||||||

| Clearway Energy Operating LLC | The holder of the project assets that are owned by Clearway Energy LLC | |||||||

| COD | Commercial Operation Date | |||||||

| Code | Internal Revenue Code of 1986, as amended | |||||||

| Company | ||||||||

| CVSR | California Valley Solar Ranch | |||||||

3

| CVSR Holdco LLC, the indirect owner of CVSR | ||||||||

| DGPV Holdco | ||||||||

| DGPV Holdco 2 and DGPV Holdco 3 | ||||||||

| DGPV Holdco 1 | ||||||||

| DGPV Holdco 2 | DGPV Holdco 2 LLC | |||||||

| DGPV Holdco 3 | ||||||||

Distributed Solar | Solar power projects, typically less than 20 MW in size, that primarily sell power produced to customers for usage on site, or are interconnected to sell power into the local distribution grid | |||||||

| Drop Down Assets | Collectively, assets under common control acquired by the | |||||||

| Economic Gross Margin | ||||||||

| United States Environmental Protection Agency | ||||||||

| EPC | ||||||||

| Engineering, Procurement and Construction | ||||||||

ERCOT | Electric Reliability Council of Texas, the ISO and the regional reliability coordinator of the various electricity systems within Texas | |||||||

| EWG | Exempt Wholesale Generator | |||||||

| Exchange Act | The Securities Exchange Act of 1934, as amended | |||||||

| FASB | Financial Accounting Standards Board | |||||||

| FERC | Federal Energy Regulatory Commission | |||||||

| FPA | Federal Power Act | |||||||

| GAAP | Accounting principles generally accepted in the U.S. | |||||||

| GenConn | GenConn Energy LLC | |||||||

| GHG | Greenhouse gas | |||||||

| Global Infrastructure Management, LLC | ||||||||

| GIP | Collectively, Global Infrastructure Partners III-C Intermediate AIV 3, L.P., Global Infrastructure Partners III-A/B AIV 3, L.P., Global Infrastructure Partners III-C Intermediate AIV 2, L.P., Global Infrastructure Partners III-C2 Intermediate AIV, L.P. and GIP III Zephyr Friends & Family, LLC. | |||||||

| GIP Transaction | ||||||||

| HLBV | Hypothetical Liquidation at Book Value | |||||||

| IRS | Internal Revenue Service | |||||||

| ISO | Independent System Operator, also referred to as an RTO | |||||||

| ITC | Investment Tax Credit | |||||||

| kWh | Kilowatt Hour | |||||||

| LIBOR | London Inter-bank Offered Rate | |||||||

| MBTA | Migratory Bird Treaty Act | |||||||

| MMBtu | Million British Thermal Units | |||||||

| MW | Megawatt | |||||||

| MWh | Saleable megawatt hours, net of internal/parasitic load megawatt-hours | |||||||

| MWt | Megawatts Thermal Equivalent | |||||||

| NERC | North American Electric Reliability Corporation | |||||||

| Net Exposure | Counterparty credit exposure to Clearway Energy LLC, net of collateral | |||||||

4

NOx | Nitrogen Oxides | |||||||

| NPNS | Normal Purchases and Normal Sales | |||||||

| NRG | NRG | |||||||

| NRG Power Marketing | ||||||||

| NRG TSA | Transition Services Agreement, entered into as of August 31, 2018, by and between NRG | |||||||

| Other comprehensive income/loss | ||||||||

| O&M | Operations and Maintenance | |||||||

| PG&E Bankruptcy | On January 29, 2019, PG&E Corporation and Pacific Gas | |||||||

| PJM Interconnection, LLC | ||||||||

| PPA | Power Purchase Agreement | |||||||

| PTC | Production Tax Credit | |||||||

| PUCT | Public Utility Commission of Texas | |||||||

| PUHCA | Public Utility Holding Company Act of 2005 | |||||||

| PURPA | Public Utility Regulatory Policies Act of 1978 | |||||||

| QF | Qualifying Facility under PURPA | |||||||

| ROFO | Right of First Offer | |||||||

| RPS | Renewable Portfolio Standards | |||||||

| RTO | Regional Transmission Organization | |||||||

| SCE | Southern California Edison | |||||||

| SEC | U.S. Securities and Exchange Commission | |||||||

| Senior Notes | Collectively, the 2024 Senior Notes, the 2025 Senior Notes, the 2026 Senior Notes and the 2028 Senior Notes | |||||||

SO2 | Sulfur Dioxide | |||||||

| SREC | Solar Renewable Energy Credit | |||||||

| Thermal Business | The Company's thermal business, which consists of thermal infrastructure assets that provide steam, hot water and/or chilled water, and in some instances electricity, to commercial businesses, universities, hospitals and governmental units | |||||||

| UPMC Thermal Project | The University of Pittsburgh Medical Center Thermal Project, a 73 MWt district energy system that allows ECP to provide steam, chilled water and 7.5 MW of emergency backup power service to UPMC | |||||||

| U.S. | United States of America | |||||||

| U.S. DOE | U.S. Department of Energy | |||||||

| Utah Solar Portfolio | Collection consists of Four Brothers Solar, LLC, Granite Mountain Holdings, LLC, and Iron Springs Holdings, LLC, which are equity investments owned by Four Brothers | |||||||

Utility Scale Solar | Solar power projects, typically 20 MW or greater in size (on an alternating current, or AC, basis), that are interconnected into the transmission or distribution grid to sell power at a wholesale level | |||||||

| VaR | Value at Risk | |||||||

| VIE | Variable Interest Entity | |||||||

5

PART I

Item 1 — Business

General

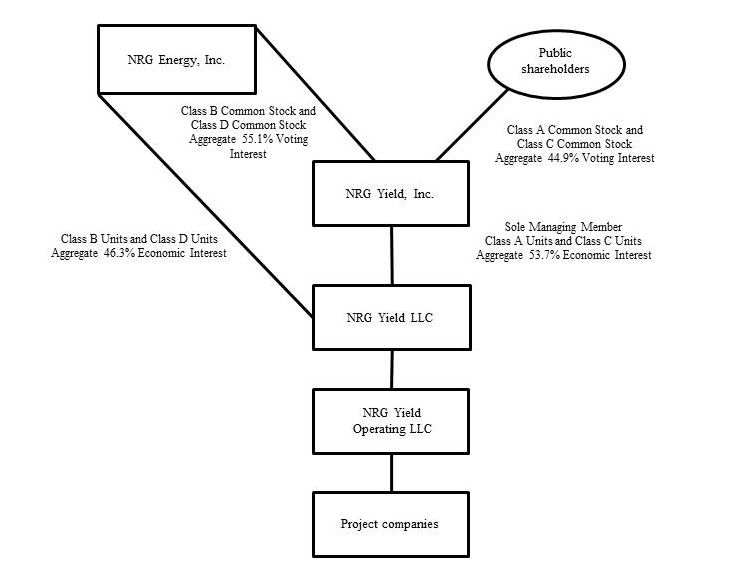

The Company is one of the primary vehicle through which NRG owns, operates and acquires contracted renewable and conventional generation and thermal infrastructure assets. On February 6, 2018, Global Infrastructure Partners, or GIP, entered into a purchase and sale agreement with NRG, or the NRG Transaction, for the acquisition of NRG’s full ownership interest in NRG Yield, Inc. and NRG’slargest renewable energy development and operations platform. The Company believes it is well positioned to be a premier company for investors seeking stable and growing dividend income from a diversified portfolio of lower-risk, high-quality assets.

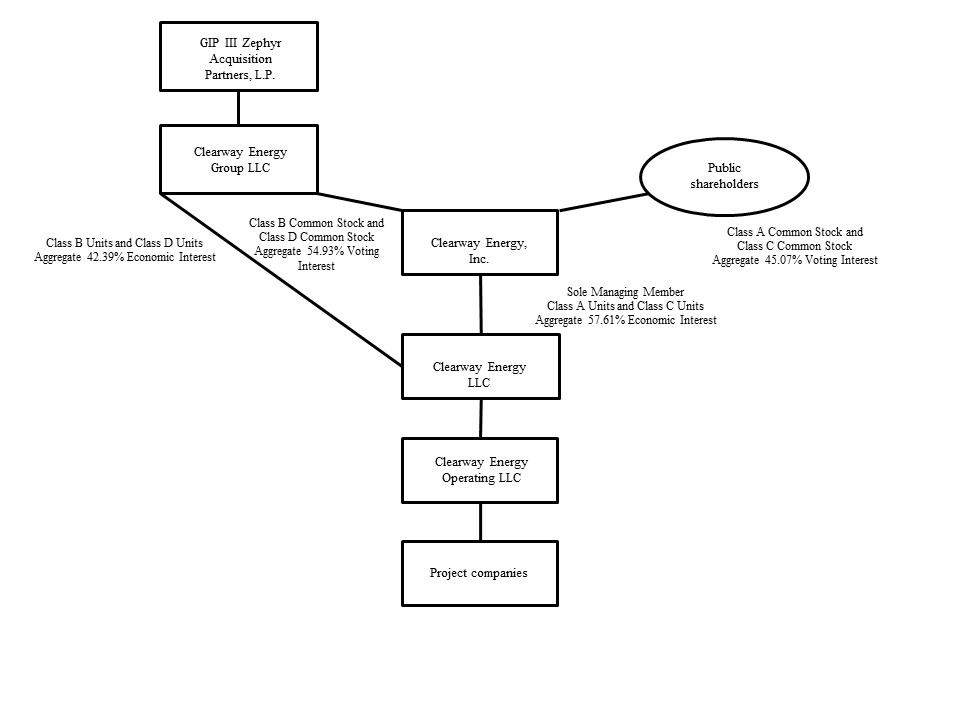

As of December 31, 2020, GIP indirectly owns 42.39% of the economic interests in the Company also owns thermal infrastructure assets with an aggregate steam and chilled water capacity54.93% of 1,319 net MWt and electric generation capacity of 123 net MW. These thermal infrastructure assets provide steam, hot and/the voting interests in Clearway Energy, Inc., or chilled water, and, in some instances, electricity, to commercial businesses, universities, hospitals and governmental units in multiple locations, principally through long-term contracts or pursuant to rates regulated by state utility commissions.Clearway, Inc.

A complete listing of the Company's interests in facilities, operations and/or projects owned or leased as of December 31, 20172020 can be found in Item 2 — Properties.Properties.

History

The Company was formed as a Delaware limited liability company by NRG on March 5, 2013. On July 22, 2013, Yield,August 31, 2018, NRG transferred its full ownership interest in Clearway, Inc. closedand its subsidiaries to CEG, the initial public offeringholder of 22,511,250 sharesNRG's renewable energy development and operations platform, and subsequently sold 100% of its Class A common stock for net proceeds, after deducting underwriting discounts, of $468 million, of which Yield, Inc. used $395 millioninterest in CEG to purchase 19,011,250 of the Company's Class A units from NRG and $73 million to purchase 3,500,000 of the Company's Class A units directly from the Company. On July 29, 2014, Yield, Inc. issued 12,075,000 shares of Class A common stock for net proceeds, after underwriting discounts and expenses, of $630 million and utilized the proceeds of the offering to acquire 12,075,000 additional Class A units of the Company.

The Company is a holding company for the companies that directly and indirectly own and operate Yield,Clearway, Inc.'s business. As of December 31, 2017, NRG continues to control Yield,2020, GIP, through CEG, controls Clearway, Inc., and Yield,Clearway, Inc. in turn, as the sole managing member of the Company, controls the Company and its subsidiaries.

As of December 31, 2020, GIP, through CEG, owned 42,738,750 of each of the Company's Class B units and Class D units and Clearway, Inc. owned 34,599,645 of the Company's Class A units and 81,558,845 of the Company's Class C units. Clearway, Inc., through its holdings of Class A units and Class C units, has a 57.61% economic interest in the Company. GIP, through CEG's holdings of Class B units and Class D units, has a 42.39% economic interest in the Company.

6

The diagram below depicts the Company’s organizational structure as of December 31, 2017:2020:

Business Strategy

The Company's primary business strategy is to focus on the acquisition and ownership of assets with predictable, long-term cash flows in order that it may be able to increase the cash distributions to Yield,Clearway, Inc. and NRG over time without compromising the ongoing stability of the business.

The Company's plan for executing thisits business strategy includes the following key components:

Focus on contracted renewable energy and conventional generation and thermal infrastructure assets.The Company owns and operates utility scale and distributed renewable energy and natural gas-fired generation, thermal and other infrastructure assets with proven technologies, low operating risks and stable cash flows. The Company believes by focusing on this core asset class and leveraging its industry knowledge, it will maximize its strategic opportunities, be a leader in operational efficiency and maximize its overall financial performance.

Growing the business through acquisitions of contracted operating assets. The Company believes that its base of operations and relationship with NRG provideprovides a platform in the conventional and renewable power generation and thermal sectors for strategic growth through cash accretive and tax advantaged acquisitions complementary to its existing portfolio. In addition to acquiring renewable generation, conventional generation and thermal infrastructure assets from third parties where the Company believes its knowledge of the market and operating expertise provides it with a competitive advantage, the Company entered into a Right of First Offer Agreement with NRG, or the NRGCEG ROFO Agreement. Under the NRGCEG ROFO Agreement, NRGCEG has granted the Company and its affiliates a right of first offer on any proposed sale, transfer or other disposition of certain assets of NRGCEG, or the CEG ROFO Assets, until February 24, 2022. NRGAugust 31, 2023. CEG is not obligated to sell the remaining NRGCEG ROFO Assets to the Company and, if offered by NRG,CEG, the Company cannot be sure whether these assets will be offered on acceptable terms, or that the Company will choose to consummate such acquisitions. The Company and CEG work collaboratively in considering new assets to be added under the

7

CEG ROFO Agreement or to be acquired by the Company outside of the CEG ROFO Agreement. The assets listed in the table below represent the NRGCompany's currently committed investments in projects with CEG and the CEG ROFO Assets:

Committed Investments and CEG ROFO Assets

| Asset | Fuel Type | Rated Capacity (MW)(a) | COD | |||

| Agua Caliente | Solar | 102 | 2014 | |||

| Ivanpah | Solar | 196 | 2013 | |||

Hawaii(b) | Solar | 80 | 2019 | |||

Distributed Solar (up to $190 million of equity in distributed solar generation portfolio(s)(b) | Solar | various | various | |||

Buckthorn Solar(c) | Solar | 154 | 2018 | |||

Carlsbad (d) | Conventional | 527 | 2018 | |||

Puente/Mandalay(e) | Conventional | Project not expected to move forward | ||||

| Community | Wind | Sold to third party | ||||

| Jeffers | Wind | Sold to third party | ||||

| Minnesota Portfolio | Wind | Sold to third party | ||||

| Asset | Technology | Gross Capacity (MW) | State | COD | Status | |||||||||||||||||||||||||||

| Pinnacle Repowering | Wind | 55 | WV | 2021 | Committed | |||||||||||||||||||||||||||

Mesquite Sky (a) | Wind | 345 | TX | 2021 | Committed | |||||||||||||||||||||||||||

Black Rock (a) | Wind | 110 | WV | 2021 | Committed | |||||||||||||||||||||||||||

Mililani I (a) | Solar | 39 | HI | 2022 | Committed | |||||||||||||||||||||||||||

Waiawa (a) | Solar | 36 | HI | 2022 | Committed | |||||||||||||||||||||||||||

Daggett (a) | Solar | 482 | CA | 2022 | Committed | |||||||||||||||||||||||||||

| Wildflower | Solar | 100 | MS | 2023 | ROFO | |||||||||||||||||||||||||||

(a)Represents the maximum, or rated, electricity generating capacity of the facilityProjects included in MW multiplied by NRG's percentage ownership interest in the facility as of December 31, 2017.a co-investment partnership with Hannon Armstrong Sustainable Infrastructure Capital, Inc

Primary focus on North America.The Company intends to primarily focus its investments in North America (including the unincorporated territories of the U.S.). The Company believes that industry fundamentals in North America present it with significant opportunity to acquire renewable, natural gas-fired generation and thermal infrastructure assets,grow its portfolio without creating significant exposure to currency and sovereign risk. By primarily focusing its efforts on North America, the Company believes it will best leverage its regional knowledge of power markets, industry relationships and skill sets to maximize the performance of the Company.

Maintain sound financial practices to grow the distributions. The Company intends to maintain a commitment to disciplined financial analysis and a balanced capital structure to enable it to increase its distribution over time and serve the long-term interests of its stockholders. The Company's financial practices include a risk and credit policy focused on transacting with creditworthy counterparties; a financing policy, which focuses on seeking an optimal capital structure through various capital formation alternatives to minimize interest rate and refinancing risks, ensure stable distributions and maximize value. The Company intends to evaluate various alternatives for financing future acquisitions and refinancing of existing project-level debt, in each case, to reduce the cost of debt, extend maturities and maximize CAFD. The Companybelieves it has additional flexibility to seek alternative financing arrangements, including, but not limited to, debt financings and equity-like instruments.

Competition

Power generation is a capital-intensive business with numerous and diverse industry participants. The Company competes on the basis of the location of its plants and on the basis of contract price and terms of individual projects. Within the power industry, there is a wide variation in terms of the capabilities, resources, nature and identity of the companies with whom the Company competes with depending on the market. Competitors for energy supply are utilities, independent power producers and other providers of distributed generation. The Company also competes to acquire new projects with renewable developers who retain renewable power plant ownership, independent power producers, financial investors and other dividend, growth-oriented companies. Competitive conditions may be substantially affected by capital market conditions and by various forms of energy legislation and regulation considered by federal, state and local legislatures and administrative agencies, including tax policy. Such laws and regulations may substantially increase the costs of acquiring, constructing and operating projects, and it could be difficult for the Company to adapt to and operate under such laws and regulations.

The Company's thermal businessThermal Business has certain cost efficiencies that may form barriers to entry. Generally, there is only one district energy system in a given territory, for which the only competition comes from on-site systems. While the district energy system can usually make an effective case for the efficiency of its services, some building owners nonetheless may opt for on-site systems, either due to corporate policies regarding allocation of capital, unique situations where an on-site system might in fact prove more efficient or because of previously committed capital in systems that are already on-site. Growth in existing district energy systems generally comes from new building construction or existing building conversions within the service territory of the district energy provider.

8

Competitive Strengths

Stable, high quality cash flows. The Company's facilities have a stable, predictable cash flow profile consisting of predominantly long-life electric generation assets that sell electricity under long-term fixed priced contracts or pursuant to regulated rates with investment grade and certain other credit-worthycreditworthy counterparties. Additionally, theThe Company's facilities have minimal fuel risk. For the Company's conventional assets, fuel is provided by the toll counterparty or the cost thereof is a pass-through cost under the CfD.Contract for Differences. Renewable facilities have no fuel costs, and most of the Company's thermal infrastructure assets have contractual or regulatory tariff mechanisms for fuel cost recovery. The offtake agreements for the Company's conventional and renewable generation facilities have a weighted-average remaining duration, based on CAFD, of approximately 1513 years as of December 31, 2017, based on CAFD,2020, providing long-term cash flow stability. The Company's generation offtake agreements with counterparties for whom credit ratings are available have a weighted-average Moody’s rating of A3Ba1 based on rated capacity under contract. All of the Company's assets are in the U.S. and accordingly have no currency or repatriation risks.

Environmentally well-positioned portfolio of assets. The Company's portfolio of electric generation assets consists of 3,1734,208 net MW of renewable generation capacity that are non-emitting sources of power generation. The Company's conventional assets consist of the dual fuel-fired GenConn assets as well as the Carlsbad, Marsh Landing and Walnut Creek simple cycle natural gas-fired peaking generation facilities and the El Segundo combined cycle natural gas-fired peaking facility. The Company does not anticipate having to expend any significant capital expenditures in the foreseeable future to comply with current environmental regulations applicable to its generation assets. Taken as a whole, the Company believes its strategy will be a net beneficiary of current and potential environmental legislation and regulatory requirements that may serve as a catalyst for capacity retirements and improve market opportunities for environmentally well-positioned assets like the Company's assets once its current offtake agreements expire.

High quality, long-lived assets with low operating and capital requirements. The Company benefits from a portfolio of relatively younger assets, other than thermal infrastructure assets. The Company's assets are comprised of proven and reliable technologies, provided by leading original solar and wind equipment manufacturers such as General Electric, Siemens AG, SunPower Corporation, or SunPower, First Solar Inc., or First Solar, Vestas, Mitsubishi, Trina Solar, JA Solar and Siemens Gamesa. Given the modern nature of the portfolio, which includes a substantial number of relatively low operating and maintenance cost solar and wind generation assets, the Company expects to achieve high fleet availability and expend modest maintenance-related capital expenditures.

Significant scale and diversity. The Company owns and operates a large and diverse portfolio of electric generation and thermal infrastructure assets. As of December 31, 2020, the Company owns and operates a portfolio of 6,690 net MW of primarily contracted renewable and conventional generation assets which benefit from significant diversification in terms of technology, fuel type, counterparty and geography. The Company's Thermal Business consists of thirteen operations, seven of which are district energy centers that provide steam and chilled water to approximately 695 customers, and six of which provide generation. The Company believes its scale and access to best practices across the fleet improves its business development opportunities through enhanced industry relationships, reputation and understanding of regional power market dynamics. Furthermore, the Company's diversification reduces its operating risk profile and reliance on any single market.

9

Relationship with GIP and CEG. The Company believes that its relationship with GIP and CEG provides significant benefits. GIM, the manager of GIP, is an independent infrastructure fund manager that invests in infrastructure assets and businesses in both the Organization for Economic Co-operation and Development and select emerging market countries. GIM has a strong track record of investment and value creation in the renewable energy sector. GIM also has extensive experience with publicly traded yield vehicles and development platforms, ranging from Europe's first application of a yield company/development company model to the largest renewable platform in Asia-Pacific. Additionally, the Company believes that CEG provides the Company access to a highly capable renewable development and operations platform that is aligned to support the Company's growth.

Thermal infrastructure business has high entry costs. Significant capital has been invested to construct the Company's thermal infrastructure assets, serving as a barrier to entry in the markets in which such assets operate. As of December 31, 2017, the Company's thermal gross property, plant, and equipment was approximately $473 million. The Company's thermal district energy centers are located in urban city areas, with the chilled water and steam delivery systems located underground. Constructing underground delivery systems in urban areas requires long lead times for permitting, rights of way and inspections and is costly. By contrast, the incremental cost to add new customers in existing markets is relatively low. Once thermal infrastructure is established, the Company believes it has the ability to retain customers over long periods of time and to compete effectively for additional business against stand-alone on-site heating and cooling generation facilities. Installation of stand-alone equipment can require significant modification to a building as well as significant space for equipment and funding for capital expenditures. The Company's system technologies often provide economies of scale in terms of fuel procurement, ability to switch between multiple types of fuel to generate thermal energy, and fuel conversion efficiency.

Segment Review

The following tables summarize the Company's operating revenues, net income (loss) and assets by segment for the years ended December 31, 2017, 20162020, 2019 and 2015,2018, as discussed in Item 15 — Note 12, Segment Reporting, to the Consolidated Financial Statements. All amounts

| Year ended December 31, 2020 | |||||||||||||||||||||||||||||

| (In millions) | Conventional Generation | Renewables | Thermal | Corporate | Total | ||||||||||||||||||||||||

| Operating revenues | $ | 437 | $ | 569 | $ | 193 | $ | — | $ | 1,199 | |||||||||||||||||||

| Net income (loss) | 140 | (108) | 3 | (87) | (52) | ||||||||||||||||||||||||

| Total assets | 2,575 | 7,157 | 627 | 129 | 10,488 | ||||||||||||||||||||||||

| Year ended December 31, 2019 | |||||||||||||||||||||||||||||

| (In millions) | Conventional Generation | Renewables | Thermal | Corporate | Total | ||||||||||||||||||||||||

| Operating revenues | $ | 346 | $ | 485 | $ | 201 | $ | — | $ | 1,032 | |||||||||||||||||||

| Net income (loss) | 135 | (104) | (5) | (127) | (101) | ||||||||||||||||||||||||

| Total assets | 2,753 | 6,186 | 633 | 33 | 9,605 | ||||||||||||||||||||||||

| Year ended December 31, 2018 | |||||||||||||||||||||||||||||

| (In millions) | Conventional Generation | Renewables | Thermal | Corporate | Total | ||||||||||||||||||||||||

| Operating revenues | $ | 337 | $ | 523 | $ | 193 | $ | — | $ | 1,053 | |||||||||||||||||||

| Net income (loss) | 135 | 86 | 29 | (115) | 135 | ||||||||||||||||||||||||

Policy Incentives

Policy incentives in the U.S. have been recast to include the effect of making the acquisitionsdevelopment of renewable energy projects more competitive by providing credits and other tax benefits for a portion of the Drop Down Assets,development costs. A loss of or reduction in such incentives could decrease the attractiveness of renewable energy projects to developers, including CEG, which were accountedcould reduce the Company's future acquisition opportunities. Such a loss or reduction could also reduce the Company's willingness to pursue or develop certain renewable energy projects due to higher operating costs or decreased revenues under its PPAs.

U.S. federal, state and local governments have established various incentives to support the development of renewable energy projects. These incentives include accelerated tax depreciation, PTCs, ITCs, cash grants, tax abatements and RPS programs. Pursuant to the U.S. federal Modified Accelerated Cost Recovery System, or MACRS, wind and solar projects are generally fully depreciated for as transferstax purposes over a five-year period (before taking into account certain conventions) even

10

though the useful life of entities under common control.such projects is generally much longer than five years. The accounting guidance requires retrospective combinationTax Act also provides the ability for wind and solar projects to claim immediate expensing for property acquired and placed in service after September 27, 2017, and before January 1, 2023.

Owners of utility-scale wind facilities are eligible to claim an income tax credit (the PTC, or an ITC in lieu of the entitiesPTC) upon initially achieving commercial operation. The PTC is determined based on the amount of electricity produced by the wind facility during the first ten years of commercial operation. This incentive was created under the Energy Policy Act of 1992 and has been extended several times. Alternatively, an ITC equal to a percentage of the cost of a wind facility may be claimed in lieu of the PTC. In order to qualify for all periods presented asthe PTC (or ITC in lieu of the PTC), construction of a wind facility must begin before a specified date and the taxpayer must maintain a continuous program of construction or continuous efforts to advance the project to completion. The Internal Revenue Service, or IRS, issued guidance stating that the safe harbor for continuous efforts and continuous construction requirements will generally be satisfied if the combination has beenfacility is placed in effect sinceservice no more than four years after the inceptionyear in which construction of common control. Accordingly, the Company prepared its consolidated financial statementsfacility began. In response to reflect the transfers as if they had taken place fromCOVID-19 pandemic, the IRS extended this safe harbor by one year for facilities that began construction in 2016 or 2017. The IRS also confirmed that retrofitted wind facilities may re-qualify for PTCs or ITCs pursuant to the beginning construction requirement, as long as the cost basis of the financial statements period or from the date the entities were under common control (if later than the beginningnew investment is at least 80% of the financial statements period). facility’s total fair value.

Owners of solar projects are eligible to claim an ITC for new solar projects. Tax credits for qualifying wind and solar projects are subject to the following phase-down schedule.

| Year ended December 31, 2017 | |||||||||||||||||||

| (In millions) | Conventional Generation | Renewables | Thermal | Corporate | Total | ||||||||||||||

| Operating revenues | $ | 336 | $ | 501 | $ | 172 | $ | — | $ | 1,009 | |||||||||

| Net income (loss) | 120 | 9 | 25 | (92 | ) | 62 | |||||||||||||

| Total assets | 1,897 | 5,811 | 422 | 24 | 8,154 | ||||||||||||||

| Year construction of project begins | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

PTC (a) | 100 | % | 100 | % | 80 | % | 60 | % | 40 | % | 60 | % | 60 | % | — | % | — | % | — | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

On Shore Wind ITC (b) | 30 | % | 30 | % | 24 | % | 18 | % | 12 | % | 18 | % | 18 | % | — | % | — | % | — | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Solar ITC(c) | 30 | % | 30 | % | 30 | % | 30 | % | 30 | % | 26 | % | 26 | % | 26 | % | 22 | % | 10 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year ended December 31, 2016 | |||||||||||||||||||

| (In millions) | Conventional Generation | Renewables | Thermal | Corporate | Total | ||||||||||||||

| Operating revenues | $ | 333 | $ | 532 | $ | 170 | $ | — | $ | 1,035 | |||||||||

| Net income (loss) | 153 | (86 | ) | 29 | (81 | ) | 15 | ||||||||||||

| Total assets | 1,993 | 6,114 | 426 | 212 | 8,745 | ||||||||||||||

| Year ended December 31, 2015 | |||||||||||||||||||

| (In millions) | Conventional Generation | Renewables | Thermal | Corporate | Total | ||||||||||||||

| Operating revenues | $ | 336 | $ | 458 | $ | 174 | $ | — | $ | 968 | |||||||||

| Net income (loss) | 156 | (18 | ) | 22 | (65 | ) | 95 | ||||||||||||

(b) The Taxpayer Certainty and investments by providing,Disaster Tax Relief Act of 2020 provides for example, loan guarantees, cash grants, favorable tax treatment, favorable depreciation rulesa new 30% ITC for offshore wind projects that begin construction before January 1, 2026.

(c) ITC is limited to 10% for projects not placed in service before January 1, 2026.

RPS, currently in place in certain states and territories, require electricity providers in the state or territory to meet a certain percentage of their retail sales with energy from renewable sources. Additionally, other incentives.states in the U.S. have set renewable energy goals to reduce GHG emissions from historic levels. The Company cannot predictbelieves that these standards and goals will create incremental demand for renewable energy in the effects that the current U.S. presidential administration will have on government incentives.future.

Regulatory Matters

As owners of power plants and participants in wholesale and thermal energy markets, certain of the Company's subsidiaries are subject to regulation by various federal and state government agencies. These agencies include FERC and the PUCT, as well as other public utility commissions in certain states where the Company's assets are located. Each of the Company's U.S. generating facilities qualifies as an EWG or QF. In addition, the Company is subject to the market rules, procedures and protocols of the various ISO and RTO markets in which it participates. Likewise, certain of the CompanyCompany's subsidiaries must also comply with the mandatory reliability requirements imposed by NERC and the regional reliability entities in the regions where the Company operates.has generating facilities subject to NERC's reliability authority.The Company's operations within the ERCOT footprint are not subject to rate regulation by FERC, as they are deemed to operate solely within the ERCOT market and not in interstate commerce. These operations are subject to regulation by PUCT.

FERC

FERC, among other things, regulates the transmission and the wholesale sale of electricity in interstate commerce under the authority of the FPA. The transmission and sale of electric energy occurring wholly within ERCOT is not subject to FERC’s jurisdiction under Sections 203 or 205 of the FPA.jurisdiction. Under existing regulations, FERC determineshas the authority to determine whether an entity owning a generation facility is an EWG, as defined in the PUHCA. FERC also determineshas the authority to determine whether a generation facility meets the ownership and technicalapplicable criteria of a QF under the PURPA. Each of the Company’s non-ERCOTU.S. generating facilities qualifies as either an EWG.EWG or QF.

The FPA gives FERC exclusive rate-making jurisdiction over the wholesale sale of electricity and transmission of electricity in interstate commerce of public utilities (as defined by the FPA). Under the FPA, FERC, with certain exceptions, regulates the owners and operators of facilities used for the wholesale sale of electricity or transmission in interstate commerce as public utilities, and establishesis charged with ensuring that market rules that are just and reasonable.

11

Public utilities are required to obtain FERC’s acceptance, pursuant to Section 205 of the FPA, of their rate schedules for the wholesale sale of electricity. AllSeveral of the Company's QF generating facilities and all of the Company’s non-QF generating entitiesfacilities located in the U.S. outside of ERCOT make sales of electricity pursuant to market-based rates, as opposed to traditional cost-of-service regulated rates. Every three years FERC will conductconducts a review of the Company’s market basedmarket-based rates of Company public utilities and potential market power onevery three years according to a regional basis.schedule established by FERC.

In accordance with the Energy Policy Act of 2005, FERC has approved the NERC as the national Energy Reliability Organization, or ERO. As the ERO, NERC is responsible for the development and enforcement of mandatory reliability standards for the wholesale electric power system. In addition to complying with NERC requirements, each entity must comply with the requirements of the regional reliability entity for the region in which it is located.

The PURPA was passed in 1978 in large part to promote increased energy efficiency and development of independent power producers. The PURPA created QFs to further both goals, and FERC is primarily charged with administering the PURPA as it applies to QFs. Certain QFs are exempt from regulation, either in whole or in part,certain regulations under the FPA as public utilities.FPA.

The PUHCA provides FERC with certain authority over and access to books and records of public utility holding companies not otherwise exempt by virtue of their ownership of EWGs, QFs, and Foreign Utility Companies. The Company is exempt from many of the accounting, record retention, and reporting requirements of the PUHCA.

Environmental Matters

The Company is subject to a wide range of environmental laws induring the development, construction, ownership and operation of projects.facilities. These existing and future laws generally require that governmental permits and approvals be obtained before construction and maintained during operation of facilities. The Company is also subjectobligated to comply with all environmental laws regardingand regulations applicable within each jurisdiction and required to implement environmental programs and procedures to monitor and control risks associated with the protectionconstruction, operation and decommissioning of wildlife, including migratory birds, eagles, threatened and endangered species.regulated or permitted energy assets. Federal and state environmental laws have historically become more stringent over time, although this trend could change with respect toin the future.

A number of regulations that may affect the Company are either recently effective for 2021 or under review for potential revision or rescission in 2021, including the Affordable Clean Energy (ACE) rule, state solar photovoltaic module (solar panel) disposal and recycling regulations, and federal laws underMigratory Bird Treaty Act, or MBTA, incidental take regulations. Government leaders have also considered proposed MBTA legislation. The Company will evaluate the current U.S. presidential administration.impact of the legislation and regulations as they are revised but cannot fully predict the impact of each until anticipated revisions and legal challenges are resolved. To the extent that proposed legislation and new or revised regulations restrict or otherwise impact the Company's operations, the proposed legislation and regulations could have a negative impact on the Company's financial performance.

Affordable Clean EnergyRule— The attention in recent years on GHG emissions has resulted in federal regulations and state legislative and regulatory action. In October 2015, the EPA finalized the Clean Power Plan, or the CPP, addressingwhich addressed GHG emissions from existing EGUs. On February 9,electric utility steam generating units. The CPP was challenged in court and in 2016 the U.S. Supreme Court stayed the CPP. In 2019, the EPA published the Affordable Clean Energy, or ACE, rule to replace the CPP. The D.C.ACE rule establishes emission guidelines for states to develop plans to address greenhouse gas emissions from existing power plants. The ACE rule also reinforces the states’ broad discretion in establishing and applying emissions standards to new emission sources. However, on January 19, 2021, the U.S. Court of Appeals for the District of Columbia Circuit heard oral argumentissued a judgment vacating and remanding the ACE rule. The CPP is currently expected to become effective in 2021, barring additional action by the Biden Administration or the U.S. Supreme Court. The reimplementation of the CPP, or a potential replacement of the CPP by the Biden Administration with another program regulating GHG emissions could result in increased operating costs or capital expenses for our conventional power generating facilities.

Proposed and Final State Solar Photovoltaic Module Disposal and Recycling Regulations —On October 1, 2015, California enacted SB 489, which authorized California’s Department of Toxic Substances Control ("DTSC") to adopt regulations to designate discarded photovoltaic modules, which are classified as hazardous waste, as universal waste subject to universal waste management. On April 19, 2019, the department proposed regulations that would allow discarded photovoltaic modules to be managed as universal waste. The final regulations were approved by the CA Office of Administrative Law in September 2020 and became effective January 1, 2021. DTSC issued the final regulatory text in April 2020 and the regulations became effective January 1, 2021.

12

In January 2021, the State of Hawaii issued a public notice of proposed rule changes which amongst other items, include proposed new solar panel universal waste rule. This proposed rule would create a new universal waste category for solar panels and allow solar panel waste management to be conducted under the existing regulatory framework.

Proposed Federal MBTA Incidental Take Legislation and Regulations — On January 15, 2020, the House Natural Resources Committee voted to advance a bill that would reinstate the interpretation that incidental take is prohibited under the MBTA, overriding the Trump-administration Solicitor’s Opinion M-37050 that held the MBTA only applies to intentional takings.The bill also develops a general permitting program that covers incidental take of migratory birds. To the extent that electric generation takes migratory birds, it typically is incidental to its operations.

On January 7, 2021, the U.S. Fish and Wildlife Service (“FWS”) published a final rule codifying the Solicitor’s Opinion M-37050 defining the scope of certain prohibitions under the MBTA.The final rule clarifies that criminal liability for pursuing, hunting, taking, capturing, or killing or attempting to take, capture or kill migratory birds is limited to actions directed at migratory birds, their nests, or their eggs.Under the final rule, these prohibitions do not extend to actions that only incidentally take or kill migratory birds as a result of otherwise lawful activities.However, the final rule and the underlying Solicitor’s Opinion have both been subject to legal challenges.On August 11, 2020, the Southern District Court in New York vacated the Solicitor's Opinion, finding there was not an adequate legal basis for the policy changes articulated in the guidance document.In addition, on January 19, 2021, environmental groups filed a lawsuit in the U.S. District Court for the Southern District of New York arguing that the FWS’s January 2021 final rule improperly relied on the legal challengesvacated Solicitor’s Opinion, violates the MBTA, and should be vacated. Finally, on January 20, 2021, President Biden issued an executive order to review and consider suspending, revising, or rescinding agency actions taken between January 20, 2017 and January 20, 2021 determined to be inconsistent with certain public health and environmental goals.This includes a review of both the Solicitor’s Opinion and the FWS’s January 2021 final rule.In response to this directive, on February 9, 2021, the FWS delayed the effective date of the January 2021 final rule until March 8, 2021 and requested public comment to inform its review and a potential extended delay. A return to the CPPposition that incidental take is prohibited under the MBTA, or the development of legislation or regulations contrary to the FWS’s January 2021 rule, could increase potential liability and impose additional permitting requirements on our operations.

State Migratory Bird Incidental Take Legislation and Regulations —In 2019, Assembly Member Kalra introduced AB 454 to protect migratory bird species in September 2016. AtCalifornia. This new bill was intended to backstop the EPA's request,MBTA. The bill, which sunsets on January 20, 2025, makes it unlawful to take or possess any migratory bird in California except as provided by pre-2017 federal guidance. The bill was approved by the D.C. Circuit agreed on April 28, 2017 to hold the caseState Legislature and signed into law by Governor Newsom in abeyance. On October 16, 2017, the EPA proposed a rule to repeal the CPP. Accordingly, the Company believes the CPP is not likely to survive.2019.

Customers

The Company sells its electricity and environmental attributes, including RECs, primarily to local utilities under long-term, fixed-price PPAs. During the year ended December 31, 2017,2020, the Company derived approximately 41%34% of its consolidated revenue from Southern California Edison, or SCE, and approximately 23%18% of its consolidated revenue from Pacific Gas and Electric, or PG&E.

The Company focuses on attracting, developing and retaining a team of highly talented and motivated employees. The majorityCompany regularly conducts assessments of its compensation and benefit practices and pay levels to help ensure that staff members are compensated fairly and competitively. The Company devotes extensive resources to staff development and training, including tuition assistance for career-enhancing academic and professional programs. Employee performance is measured in part based on goals that are aligned with the Company's annual objectives. The Company recognizes that its success is based on the talents and dedication of those it employs, and the Company is highly invested in their success. See "Environmental, Social and Governance (ESG)" below for a discussion of the Company's commitment to the health and safety of the Company's employees.

The Company is committed to maintaining a workplace that acknowledges, encourages, and values diversity and inclusion. The Company believes that individual differences, experiences, and strengths enrich the culture and fabric of its organization. Having employees with backgrounds and orientations that reflect a variety of viewpoints and experiences also helps the Company to better understand the needs of its customers and the communities in which it operates.

13

By leveraging the multitude of backgrounds and perspectives of its team and developing ongoing relationships with diverse vendors, the Company achieves a collective strength that enhances the work place and makes the Company a better business partner for its customers and others with a stake in the Company’s success.

In 2020, the Company launched its Equity, Partnership & Inclusion Council, or EPIC. As part of its commitment, the Company provides education on topics related to diversity, inclusion, and anti-racism. The Company also identified three areas of focus – Our People, Our Product & Customers and Our Purchasing. With the involvement of its employees, EPIC is advancing efforts in each of these areas to identify and implement opportunities for the Company to address equity, partnership and inclusion issues in our business activities.

Our People focuses on education and training; diversity, equity and inclusion policies and recruitment strategies; community and industry partnerships; and maintaining high employee engagement and retention.

Our Product & Customers focuses on identifying and eliminating any sales practices that could have a discriminatory impact and creating program development for low-income customers.

Our Purchasing focuses on establishing a non-discriminatory practices standard for the Company’s suppliers, diverse vendor sourcing and benchmarking.

In addition to the personnel who manageof CEG, the Company relies on other third-party service providers in the daily operations of certain of the Company's renewable and conventional facilities.

Environmental, Social and Governance (ESG)

The Company is committed to engaging with its stakeholders on environmental, social and governance, or ESG, matters in a proactive, holistic and integrated manner. The Company strives to provide recent, credible and comparable data to ESG agencies while engaging institutional investors and investor advocacy organizations around ESG issues. The Company's Corporate Governance, Conflicts and Nominating Committee reviews developing trends and emerging ESG matters, as well as the Company’s strategies, activities policies and communications regarding ESG matters, and makes recommendations to the Company's Board of Directors regarding potential actions by the Company.

The Company has issued $1.1 billion of corporate green bonds under a green bond framework that applies the net proceeds to finance or refinance, in part or in full, new and existing projects and assets meeting certain criteria focused on the supply of energy from renewable resources, including solar energy and wind energy. The Company's projects and alignment of its Green Bond Principles (2018) are reviewed by Sustainalytics, an outside consultant with recognized expertise in ESG research and analysis.

The Company includes safety performance goals in the annual incentive plan for its management and the Company arehad zero fatalities in 2020. In response to the ongoing coronavirus (COVID-19) pandemic, the Company has implemented preventative measures and developed corporate and regional response plans to protect the health and safety of its employees, customers and other business counterparties, while supporting the Company’s suppliers and customers’ operations to the best of NRG or third parties managedits ability in the circumstances. The Company also has modified certain business practices (including discontinuing all non-essential business travel, implementing a temporary work-from-home policy for employees who can execute their work remotely and encouraging employees to adhere to local and regional social distancing, more stringent hygiene and cleaning protocols across the Company’s facilities and operations and self-quarantining recommendations) to support efforts to reduce the spread of COVID-19 and to conform to government restrictions and best practices encouraged by NRG,governmental and their services are providedregulatory authorities. The Company continues to evaluate these measures, response plans and business practices in light of the evolving effects of COVID-19.

As discussed in greater detail above, the Company has focused its diversity, equity and inclusion efforts in three areas – Our People, Our Product & Customers and Our Purchasing – through its launch of EPIC. With the involvement of the Company’s employees, EPIC is advancing efforts in each of these areas to identify and implement opportunities for the Company's benefit under the Management Services AgreementCompany to address equity, partnership and project operations and maintenance agreements with NRG as describedinclusion issues in Item 15 —Note 13, Related Party Transactions, to the Consolidated Financial Statements.its business activities.

14

Available Information

The Company's annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to section 13(a) or 15(d) of the Exchange Act are available free of charge through Yield,the "Investor Relations" section of Clearway, Inc.'s website, www.nrgyield.comwww.clearwayenergy.com, as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. The Company also routinely posts press releases, presentations, webcasts, and other information regarding the Company on Yield,Clearway, Inc.'s website. The information posted on Yield,Clearway, Inc.'s website is not a part of this report.

Item 1A — Risk Factors

Summary of Risk Factors

The Company’s business is subject to numerous risks and uncertainties, discussed in more detail in the following section. These risks include among others, the following key risks:

Risks Related to the Proposed NRG TransactionCompany’s Business

•The ongoing coronavirus (COVID-19) outbreak or any other pandemic could adversely affect the Company’s business, financial condition and results of operations.

•Certain facilities are newly constructed and may not perform as expected.

•The Company's ability to grow and make acquisitions through cash on hand could be limited.

•The Company may not realizebe able to effectively identify or consummate any future acquisitions on favorable terms, or at all.

•Counterparties to the anticipated benefitsCompany's offtake agreements may not fulfill their obligations and, as the contracts expire, the Company may not be able to replace them with agreements on similar terms in light of increasing competition in the markets in which the Company operates.

•The Company’s ability to effectively consummate future acquisitions will also depend on the Company’s ability to arrange the required or desired financing for acquisitions.

•Even if the Company consummates acquisitions that it believes will be accretive to CAFD per share of Class A common stock and Class C common stock, those acquisitions may decrease the CAFD per share of Class A common stock and Class C common stock as a result of incorrect assumptions in the Company’s evaluation of such acquisitions, unforeseen consequences or other external events beyond the Company’s control.

•The Company’s indebtedness could adversely affect its ability to raise additional capital to fund the Company’s operations or pay dividends, and its debt may be adversely affected by changes to, or replacement of, the NRG Transaction.London Interbank Offered Rate, or LIBOR.

•The operation of electric generation facilities depends on suitable meteorological conditions and involves significant risks and hazards customary to the power industry that could have a material adverse effect on the Company's business, financial condition, results of operations and cash flows. These facilities may operate without long-term power sales agreements.

•Supplier and/or customer concentration at certain of the Company's facilities may expose the Company to significant financial credit or performance risks. The Company's operations also depend on key personnel.

•The Company currently owns, and sale agreement with NRG for the acquisition of NRG’s full ownership interest in the Company and NRG’s renewable energy development and operations platform. Also on February 6, 2018,future may acquire, certain assets in which the Company entered into a consenthas limited control over management decisions and indemnity agreement with NRGits interests in such assets may be subject to transfer or other related restrictions.

•The Company's assets are exposed to risks inherent in the use of interest rate swaps and GIP in connection with theforward fuel purchase and sale agreement between NRG and GIP. The consent and indemnity agreementcontracts and the purchase and sale agreement are collectively referredCompany may be exposed to asadditional risks in the NRG Transaction. Consummationfuture if it utilizes other derivative instruments.

•The Company does not own all of the NRG Transactionland on which its power generation or thermal assets are located, which could result in disruption to its operations.

•The Company's businesses are subject to physical, market and economic risks relating to potential effects of climate change.

•Risks that are beyond the Company's control, including but not limited to acts of terrorism or related acts of war, natural disaster, hostile cyber intrusions or other catastrophic events, could have a material adverse effect on the business, financial condition, results of operations and cash flows.

•The operation of the Company’s businesses is subject to cyber-based security and integrity risk.

•The Company relies on electric distribution and transmission facilities that it does not own or control and that are subject to transmission constraints within a number of conditions,the Company's regions.If these facilities fail to provide the Company with adequate transmission capacity, it may be restricted in its ability to deliver electric power to its customers and may either incur additional costs or forego revenues.

•The Company's costs, results of operations, financial condition and cash flows could be adversely impacted by the disruption of the fuel supplies necessary to generate power at its conventional and thermal power generation facilities.

16

Risks Related to the Company’s Relationship with GIP and CEG

•GIP, through its ownership of CEG, is the Company's controlling stockholder and exercises substantial influence over the Company.The Company is highly dependent on GIP and CEG.

•The Company may not be able to consummate future acquisitions from CEG.

•The Company may be unable to terminate the CEG Master Services Agreement, in certain circumstances.

•If CEG terminates the CEG Master Services Agreement or defaults in the performance of its obligations under the agreement, the Company may be unable to contract with a substitute service provider on similar terms, or at all.

•The Company is a “controlled company," controlled by GIP, and as a result, is exempt from certain corporate governance requirements that are designed to provide protection to stockholders of companies that are not controlled companies.

Risks Related to Regulation

•The Company's business is subject to restrictions resulting from environmental, health and safety laws and regulations.

•The electric generation business is subject to substantial governmental regulation, including receiptenvironmental laws, and may be adversely affected by changes in laws or regulations, as well as liability under, or any future inability to comply with, existing or future regulations or other legal requirements.

•Government regulations providing incentives for renewable generation could change at any time and such changes may negatively impact the Company's growth strategy.

•The profitability of certain contractual consentsof the Company's Thermal assets is dependent on regulatory approval.

Risks Related to the Company's Business

The ongoing coronavirus (COVID-19) pandemic or any other pandemic could adversely affect the Company’s business, financial condition and results of operations.

The ongoing coronavirus (COVID-19) outbreak, which the World Health Organization declared as a pandemic on March 11, 2020, has reached every region of the world and has resulted in widespread adverse impacts on the global economy. In response, the Company has modified certain business and workforce practices (including discontinuing all non-essential business travel, implementing a temporary work-from-home policy for employees who can execute their work remotely and encouraging employees to adhere to local and regional social distancing, more stringent hygiene and cleaning protocols across the Company’s facilities and operations and self-quarantining recommendations) to conform to government restrictions and best practices encouraged by governmental and regulatory approvals from certain regulatory agencies, including approval by FERC and approvals from certain state regulatory agencies. Whileauthorities. However, the parties have begunquarantine of personnel or the processinability to access the Company’s facilities or customer sites could adversely affect the Company’s operations. Also, the Company has a limited number of notifying agencies and obtaining regulatory approvals and consents,highly skilled employees for some of its operations. If a large proportion of the Company’s employees in those critical positions were to contract COVID-19 at the same time, the Company would rely upon its business continuity plans in an effort to continue operations at its facilities, but there is no assurancecertainty that the partiessuch measures will be ablesufficient to obtainmitigate the requisite regulatory approvalsadverse impact to its operations that could result from shortages of highly skilled employees.

There is considerable uncertainty regarding how long the COVID-19 pandemic will persist and affect economic conditions, as well as whether governmental and other measures implemented to try to slow the spread of the virus, such as large-scale travel bans and restrictions, border closures, quarantines, shelter-in-place orders and business and government shutdowns that exist as of the date of this report will be effective or consentswhether new measures will be implemented or reinstated. Restrictions of this nature may cause the Company, its suppliers and other business counterparties to experience operational delays and delays in the delivery of materials and supplies and may cause milestones or deadlines relating to various projects to be missed. As a result, the Company could experience reductions in its sales and corresponding revenues in future periods. In addition, worsening economic conditions could result in the Company’s customers being unable or unwilling to fulfill their contractual obligations over time, or as contracts expire, to replace them with agreements on similar terms, which would impact the Company’s future financial performance. A significant decline in sales for the output the Company generates, whether due to decreases in consumer demand or disruption to its facilities or otherwise, would have a material adverse effect on the Company’s financial expectations, its financial condition, results of operations and cash flows, its ability to make distributions to its stockholders, the market prices of its common stock and its ability to satisfy its debt service obligations.

As of the closing conditions. date of this report, the Company's efforts to respond to the challenges presented by the conditions described above have allowed the Company to minimize the impacts to its business.

17

Additionally, the NRG Transaction requireseffects of COVID-19 or any other pandemic on the global economy could adversely affect the Company’s consent which is conditioned upon a numberability to access the capital and other financial markets, and if so, the Company may need to consider alternative sources of items, allfunding for some of its operations and for working capital, which may not be metincrease its cost of, as well as adversely impact its access to, capital. These uncertain economic conditions may also result in the inability of the Company’s customers and other counterparties to make payments to the Company, on a timely basis or at all.

Certain facilities are newly constructed and may not perform as expected.

Certain of the Company's conventional and renewable assets are newly constructed. The ability of these facilities to meet the Company's performance expectations is subject to the risks inherent in newly constructed power generation facilities and the construction of such facilities, including, but not limited to, degradation of equipment in excess of the Company's expectations, system failures, and outages. The failure of these facilities to perform as the Company expects could have a material adverse effect on the Company's business, financial condition, results of operations, cash flows and its ability to pay distributions to Yield,Clearway, Inc. and NRG.CEG.

Pursuant to the Company's cash distribution policy, the Company intends to distribute a significant amount of the CAFD through regular quarterly distributions, and the Company's ability to grow and make acquisitions through cash on hand could be limited.

The Company expects to distribute a significant amount of the CAFD each quarter and to rely primarily upon external financing sources, including the issuance of debt and equity securities and, if applicable, borrowings under the Company's revolving credit facility to fund acquisitions and growth capital expenditures. The Company may be precluded from pursuing otherwise attractive acquisitions if the projected short-term cash flow from the acquisition or investment is not adequate to service the capital raised to fund the acquisition or investment, after giving effect to the Company's available cash reserves. The incurrence of bank borrowings or other debt by NRG YieldClearway Energy Operating LLC or by the Company's project-level subsidiaries to finance the Company’s growth strategy will result in increased interest expense and the imposition of additional or more restrictive covenants, which, in turn, may impact the cash distributions the Company makes to Yield,Clearway, Inc. and NRG.

CEG.

The Company may not be able to effectively identify or consummate any future acquisitions on favorable terms, or at all.

The Company's business strategy includes growth through the acquisitions of additional generation assets (including through corporate acquisitions). This strategy depends on the Company’s ability to successfully identify and evaluate acquisition opportunities and consummate acquisitions on favorable terms. However, the number of acquisition opportunities is limited. In addition, the Company will compete with other companies for these limited acquisition opportunities, which may increase the Company’s cost of making acquisitions or cause the Company to refrain from making acquisitions at all. Some of the Company’s competitors for acquisitions are much larger than the Company with substantially greater resources. These companies may be able to pay more for acquisitions and may be able to identify, evaluate, bid for and purchase a greater number of assets than the Company’s financial or human resources permit. If the Company is unable to identify and consummate future acquisitions, it will impede the Company’s ability to execute its growth strategy and limit the Company’s ability to increase the amount of dividends paid to holders of Yield,Clearway, Inc.'s common stock.

Furthermore, the Company’s ability to acquire future renewable facilities may depend on the viability of renewable assets generally. These assets currently are largely contingent on public policy mechanisms including ITCs, cash grants, loan guarantees, accelerated depreciation, RPS and carbon trading plans. These mechanisms have been implemented at the state and federal levels to support the development of renewable generation, demand-side and smart grid and other clean infrastructure technologies. The availability and continuation of public policy support mechanisms will drive a significant part of the economics and viability of the Company’s growth strategy and expansion into clean energy investments.

18

Counterparties to the Company's offtake agreements may not fulfill their obligations and, as the contracts expire, the Company may not be able to replace them with agreements on similar terms in light of increasing competition in the markets in which the Company operates.

A significant portion of the electric power the Company generates is sold under long-term offtake agreements with public utilities or industrial or commercial end-users, with a weighted average remaining duration, based on CAFD, of approximately 13 years. As of December 31, 2020, the largest customers of the Company's power generation assets, including assets in which the Company has less than a 100% membership interest, were SCE and PG&E, which represented 34% and 18%, respectively, of total consolidated revenues generated by the Company during the year ended December 31, 2020. On July 1, 2020, PG&E emerged from bankruptcy.

If, for any reason, any of the purchasers of power under these agreements are unable or unwilling to fulfill their related contractual obligations or if they refuse to accept delivery of power delivered thereunder or if they otherwise terminate such agreements prior to the expiration thereof, the Company's assets, liabilities, business, financial condition, results of operations and cash flows could be materially and adversely affected. Furthermore, to the extent any of the Company's power purchasers are, or are controlled by, governmental entities, the Company's facilities may be subject to legislative or other political action that may impair their contractual performance.

The power generation industry is characterized by intense competition and the Company's electric generation assets encounter competition from utilities, industrial companies and independent power producers, in particular with respect to uncontracted output. In recent years, there has been increasing competition among generators for offtake agreements and this has contributed to a reduction in electricity prices in certain markets characterized by excess supply above designated reserve margins. In light of these market conditions, the Company may not be able to replace an expiring or terminated agreement with an agreement on equivalent terms and conditions, including at prices that permit operation of the related facility on a profitable basis. In addition, the Company believes many of its competitors have well-established relationships with the Company's current and potential suppliers, lenders and customers, and have extensive knowledge of its target markets. As a result, these competitors may be able to respond more quickly to evolving industry standards and changing customer requirements than the Company will be able to. The adoption of more advanced technology could reduce its competitors' power production costs resulting in their having a lower cost structure than is achievable with the technologies currently employed by the Company and adversely affect its ability to compete for offtake agreement renewals. If the Company is unable to replace an expiring or terminated offtake agreement, the affected facility may temporarily or permanently cease operations. External events, such as a severe economic downturn or force majeure events, could also impair the ability of some counterparties to the Company's offtake agreements and other customer agreements to pay for energy and/or other products and services received.

The Company's inability to enter into new or replacement offtake agreements or to compete successfully against current and future competitors in the markets in which the Company operates could have a material adverse effect on the Company's business, financial condition, results of operations and cash flows.

The Company’s ability to effectively consummate future acquisitions will also depend on the Company’s ability to arrange the required or desired financing for acquisitions.

The Company may not have sufficient availability under the Company’s credit facilities or have access to project-level financing on commercially reasonable terms when acquisition opportunities arise. An inability to obtain the required or desired financing could significantly limit the Company’s ability to consummate future acquisitions and effectuate the Company’s growth strategy. If financing is available, utilization of the Company’s credit facilities or project-level financing for all or a portion of the purchase price of an acquisition could significantly increase the Company’s interest expense, impose additional or more restrictive covenants and reduce CAFD. The Company’s ability to consummate future acquisitions may also depend on the Company’s ability to obtain any required regulatory approvals for such acquisitions, including, but not limited to, approval by FERC under Section 203 of the FPA.

Finally, the acquisition of companies and assets are subject to substantial risks, including the failure to identify material problems during due diligence (for which the Company may not be indemnified post-closing), the risk of over-payingoverpaying for assets (or not making acquisitions on an accretive basis) and the ability to retain customers. Further, the integration and consolidation of acquisitions requires substantial human, financial and other resources and, ultimately, the Company's acquisitions may divert management’s attention from the Company's existing business concerns, disrupt the Company's ongoing business or not be successfully integrated. There can be no assurances that any future acquisitions will perform as expected or that the returns from such acquisitions will support the financing utilized to acquire them or maintain them. As a result, the consummation of acquisitions may have a material adverse effect on the Company's business, financial condition, results of operations, cash flows and ability to pay distributions to Yield,Clearway, Inc. and NRG.CEG.

19

Even if the Company consummates acquisitions that it believes will be accretive to CAFD, those acquisitions may decrease CAFD as a result of incorrect assumptions in the Company’s evaluation of such acquisitions, unforeseen consequences or other external events beyond the Company’s control.

The acquisition of existing generation assets involves the risk of overpaying for such projects (or not making acquisitions on an accretive basis) and failing to retain the customers of such projects. While the Company will perform due diligence on prospective acquisitions, the Company may not discover all potential risks, operational issues or other issues in such generation assets. Further, the integration and consolidation of acquisitions require substantial human, financial and other resources and, ultimately, the Company’s acquisitions may divert the Company’s management’s attention from its existing business concerns, disrupt its ongoing business or not be successfully integrated. Future acquisitions might not perform as expected or the returns from such acquisitions might not support the financing utilized to acquire them or maintain them. A failure to achieve the financial returns the Company expects when it acquires generation assets could have a material adverse effect on the Company’s ability to grow its business and make cash distributions to its unitholders. Any failure of the Company’s acquired generation assets to be accretive or difficulty in integrating such acquisition into the Company’s business could have a material adverse effect on the Company’s ability to grow its business and make cash distributions to its unitholders.

The Company’s indebtedness could adversely affect its ability to raise additional capital to fund the Company’s operations or pay distributions. It could also expose the Company to the risk of increased interest rates and limit the Company’s ability to react to changes in the economy or the Company’s industry as well as impact the Company’s results of operations, financial condition and cash flows.

As of December 31, 2017,2020, the Company had approximately $5,899$7,043 million of total consolidated indebtedness, $4,376$5,243 million of which was incurred by the Company's non-guarantor subsidiaries. In addition, the Company’s share of its unconsolidated affiliates’ total indebtedness and letters of credit outstanding as of December 31, 2017,2020, totaled approximately $777$481 million and $98$59 million, respectively (calculated as the Company’s unconsolidated affiliates’ total indebtedness as of such date multiplied by the Company’s percentage membership interest in such assets).

The Company’s substantial debt could have important negative consequences on the Company’s financial condition, including:

•increasing the Company’s vulnerability to general economic and industry conditions;

•requiring a substantial portion of the Company’s cash flow from operations to be dedicated to the payment of principal and interest on the Company’s indebtedness, therefore reducing the Company’s ability to pay distributions to Yield,Clearway, Inc. and NRGCEG or to use the Company’s cash flow to fund its operations, capital expenditures and future business opportunities;

•limiting the Company’s ability to enter into long-term power sales or fuel purchases which require credit support;

•limiting the Company’s ability to fund operations or future acquisitions;

•restricting the Company’s ability to make certain distributions to Yield,Clearway, Inc. and NRGCEG and the ability of the Company’s subsidiaries to make certain distributions to it, in light of restricted payment and other financial covenants in the Company’s credit facilities and other financing agreements;

•exposing the Company to the risk of increased interest rates because certain of the Company’s borrowings, which may include borrowings under the Company’s revolving credit facility, are at variable rates of interest;

•limiting the Company’s ability to obtain additional financing for working capital including collateral postings, capital expenditures, debt service requirements, acquisitions and general corporate or other purposes; and

•limiting the Company’s ability to adjust to changing market conditions and placing it at a competitive disadvantage compared to the Company’s competitors who have less debt.