EXPLANATORY NOTE

This Amendment No. 1 on Form10-K/A

(this “Amendment”)

are incorporated herein by reference in Part III of thisamends our Annual Report on Form

10-K to

for the

extent stated herein. Such Proxy Statement will beyear ended December 31, 2023, originally filed with the Securities and Exchange Commission

(the “SEC”) on February 26, 2024 (the “Original Filing”). We are filing this Amendment pursuant to General Instruction G(3) of Form10-K

to include the information required by Part II and Part III of Form10-K

that we did not include in the Original Filing, as we do not intend to file a definitive proxy statement for an annual meeting of stockholders within 120 days of the

Registrant’send of our fiscal year ended December 31,

2022.2023. In addition, in connection with the filing of this Amendment and pursuant to Rule12b-15

under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), we are including with this Amendment new certifications of our principal executive officer and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Item 15 of Part IV has been amended to reflect the filing of these new certifications. Except

as described above, no other changes have been made to the Original Filing. The Original Filing continues to speak as of the date of the Original Filing, and we have not updated the disclosures contained therein to reflect any events which occurred as of any date subsequent to the filing of the Original Filing. Unless otherwise noted or the context indicates otherwise, the terms “Shockwave,” the “Company,” “we,” “us,” and “our” refer to Shockwave Medical, Inc., a Delaware corporation, together with respect to information specifically incorporated by reference in this Annual Reportits consolidated subsidiaries.

As previously announced, on

Form 10-K,April 5, 2024, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Johnson & Johnson, a New Jersey corporation (“Parent”), and Sweep Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Merger Sub”), providing for the

Proxy Statement shall not be deemed to be filedmerger of Merger Sub with and into the Company (the “M

erger”), with the Company surviving the Merger as

part hereof.a wholly owned subsidiary of Parent.

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains statements relating to our expectations, projections, beliefs, and prospects, which are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify these statements by forward-looking words such as “believe,” “will,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “might,” “plan,” “expect,” “predict,” “could,” “potentially”or the negative of these terms or similar expressions. You should read these statements carefully because they may relate to future expectations around growth, strategy, and anticipated trends in our business, contain projections of future results of operations or financial condition, or state other “forward-looking” information. These statements are only predictions based on our current expectations, estimates, assumptions, and projections about future events and are applicable only as of the dates of such statements. Forward-looking statements contained in this Annual Report on Form 10-K include, but are not limited to, statements about:

•our ability to design, develop, manufacture and market innovative products to treat patients with challenging medical conditions, particularly in peripheral artery disease, coronary artery disease and aortic stenosis;

•our ability to successfully execute our commercialization strategy for our approved or cleared products;

•our expected future growth, including growth in international sales;

•the size and growth potential of the markets for our products, and our ability to serve those markets;

•the rate and degree of market acceptance of our products;

•coverage and reimbursement for procedures performed using our products;

•the performance of third parties in connection with the development of our products, including third-party suppliers;

•the impact of government laws and regulatory developments in the United States and foreign countries;

•our ability to obtain and maintain regulatory approval or clearance of our products on expected timelines;

•our ability to scale our organizational culture of cooperative product development and commercial execution;

•the expected timing for completion and benefits of our proposed acquisition of Neovasc Inc., a corporation existing under the Canada Business Corporations Act;

•the development, regulatory approval, efficacy and commercialization of competing products;

•our ability to develop and maintain our corporate infrastructure, including our internal controls;

•our estimates regarding expenses, future financial performance and capital requirements;

•our expectations regarding our ability to obtain and maintain intellectual property protection for our products, as well as our ability to operate our business without infringing the intellectual property rights of others; and

•the impact of macroeconomic conditions, including inflation, rising interest rates and volatile market conditions, and global events, including the COVID-19 pandemic, on our operations, financial results, liquidity and capital resources, sales, expenses, supply chain, manufacturing, research and development activities, clinical trials and employees.

We caution you that the foregoing list may not contain all of the forward-looking statements made in this Annual Report on Form 10-K. We have based these forward-looking statements on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties, and assumptions and other factors that could cause our actual results, level of activity, performance, or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements, including those described in the sections titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors”. There may also be additional risks of which we are not presently aware or that we currently believe are immaterial which could have an adverse impact on our business. Although we believe the expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee future results, level of activity, performance, or achievements. Except to the extent required by law, we undertake no obligation to update any of these forward-looking statements after the date of this Annual Report on Form 10-K to conform our prior statements to actual results or revised expectations.

RISK FACTOR SUMMARY

The following is a summary of the principal risks to which our business is subject. This summary is not complete, and the risks summarized below are not the only risks we face. You should review and carefully consider the risks and uncertainties described in more detail in the section titled “Risk Factors” of this Annual Report on Form 10-K, which includes a more complete discussion of the risks summarized below as well as a discussion of other risks related to our business and an investment in our common stock.

•We depend upon third-party suppliers and contract manufacturers, including single source component suppliers and a third-party contract manufacturer that produces a portion of our demand for certain catheters, making us vulnerable to supply problems and price fluctuations.

•We may require additional capital to finance our planned operations, and may not be able to raise capital when needed, which could force us to delay, limit, reduce or eliminate our product development programs, commercialization efforts or other operations.

•We are highly dependent on our senior management team and key personnel, and our business could be harmed if we are unable to attract and retain personnel necessary for our success.

•We have increased the size of our organization and expect to further increase it in the future, and we may experience difficulties in managing this growth. If we are unable to manage the anticipated growth of our business, our future revenue and results of operations may be adversely affected.

•We currently manufacture and sell products that are used in a limited number of procedures and for only certain specified indications, which could negatively affect our operations and financial condition.

•Our long-term growth depends on our ability to enhance our products, expand our indications and develop and commercialize additional products in a timely manner. If we fail to identify, acquire and develop other products, we may be unable to grow our business over the long-term.

•If our products are not approved for planned or new indications, our commercial opportunity will be limited.

•If our clinical trials are unsuccessful or significantly delayed, or if we do not complete our clinical trials, our business may be harmed.

•We have limited commercial manufacturing experience and may experience development or manufacturing problems or delays in producing our products and planned or future products that could limit our potential revenue growth or increase our losses.

•If we do not effectively hire, integrate, train, manage and retain additional sales personnel, and expand our sales, marketing and distribution capabilities, we may be unable to increase our customer base, achieve broader market acceptance of our products, or increase our global sales.

•Our success depends in large part on our IVL technology (our “IVL Technology”). If we are unable to successfully market and sell products incorporating our IVL Technology, our business prospects will be significantly harmed, and we may be unable to achieve revenue growth.

•Unfavorable global economic conditions could adversely affect our business, financial condition, or results of operations.

•We currently manufacture and sell products that are used in a limited number of procedures and there is a limited total addressable market for our products. The sizes of the markets for our current and future products have not been established with precision and may be smaller than we estimate.

•The market in which we participate is highly competitive, and if we do not compete effectively, our business, operating results, and financial condition could be adversely impacted.

•In the future our products may become obsolete, which would negatively affect operations and financial condition.

•Adequate reimbursement may not be available for the procedures that utilize our products, which could diminish our sales or affect our ability to sell our products profitably.

•We intend to continue to expand sales of our products internationally, but we may experience difficulties in obtaining regulatory clearance or approval or in successfully marketing our products internationally

even if approved. A variety of risks associated with marketing our products internationally could materially adversely affect our business.

•If we fail to comply with U.S. federal and state and international fraud and abuse and other healthcare laws and regulations, including those relating to kickbacks and false claims for reimbursement, we could face substantial penalties and our business operations and financial condition could be adversely affected.

•Regulatory compliance is expensive, complex and uncertain, and a failure to comply could lead to enforcement actions against us and other negative consequences for our business.

•Our products may be subject to recalls after receiving U.S. Food and Drug Administration (“FDA”) or foreign approval or clearance, or may cause or contribute to a death or a serious injury or malfunction in certain ways prompting voluntary corrective actions or agency enforcement actions, which could divert managerial and financial resources, harm our reputation, and adversely affect our business.

•If we are unable to obtain and maintain patent or other intellectual property protection for our products, or if the scope of the patent and other intellectual property protection obtained is not sufficiently broad, our competitors could develop and commercialize products and technology similar or identical to ours, and our ability to successfully commercialize any products we may develop, and our technology, may be adversely affected.

•Patents covering our products could be found invalid or unenforceable if challenged in court or before administrative bodies in the United States or abroad.

•We may be subject to claims challenging the ownership or inventorship of our patents and other intellectual property and, if unsuccessful in any of these proceedings, we may be required to obtain licenses from third parties, which may not be available on commercially reasonable terms, or at all, or to cease the development, manufacture, and commercialization of one or more of our products.

•Third-party claims of intellectual property infringement, misappropriation or other violation against us or our collaborators may prevent or delay the sale and marketing of our products.

•We may become involved in lawsuits to protect or enforce our patents and other intellectual property rights, which could be expensive, time-consuming and unsuccessful.

PART I

Item 1. Business.

Company Overview

We are a medical device company focused on developing products intended to transform the way calcified cardiovascular disease is treated. We aim to establish a new standard of care for the treatment of calcified cardiovascular disease (“atherosclerosis”) through our differentiated and proprietary local delivery of sonic pressure waves, which we refer to as intravascular lithotripsy (“IVL”). Our IVL system (our “IVL System”), which leverages our IVL technology (our “IVL Technology”), is a minimally invasive, easy-to-use, and safe way to improve outcomes for patients with calcified cardiovascular disease.

Our Products and Product Pipeline

Our IVL catheters are cleared or approved for use in a number of countries and development programs are underway to expand indications and geographies. We are currently selling the following products in countries where we have applicable regulatory approvals:

Products for Treatment of Peripheral Artery Disease (“PAD”):

•Our Shockwave M5 IVL catheter (“M5 catheter”) and Shockwave M5+ IVL catheter (“M5+ catheter”) are five-emitter catheters for use in our IVL System in medium-diameter vessels for the treatment of PAD. The M5 catheter was CE-Marked in April 2018 and cleared by the U.S. Food and Drug Administration (“FDA”) in July 2018. The M5+ catheter was CE-Marked in November 2020 and cleared by the FDA in April 2021. In May 2022, we obtained regulatory approval, through our joint venture with Genesis MedTech International Private Limited (“Genesis”), from the China National Medical Products Administration (“NMPA”) to sell our M5 catheter in the People’s Republic of China, excluding the Special Administrative Regions of Hong Kong and Macau (the “PRC”).

•Our Shockwave S4 IVL catheter (“S4 catheter”) is a four-emitter catheter for use in our IVL System in small-diameter vessels for the treatment of PAD. The S4 catheter was CE-Marked in April 2018. The second version of our S4 catheter was cleared by the FDA in August 2019 and accepted by our EU notified body in May 2020 for use in our IVL System. In May 2022, we obtained regulatory approval, through our joint venture with Genesis, from the NMPA to sell our S4 catheter in the PRC.

•Our Shockwave L6 IVL catheter (“L6 catheter”) is a six-emitter catheter for use in our IVL System in large diameter vessels for the treatment of PAD. Our L6 catheter was cleared by the FDA in August 2022 for use in our IVL System. We commenced a U.S. limited market release for our L6 catheter in the fourth quarter of 2022.

Product for the Treatment of Coronary Artery Disease (“CAD”):

•Our Shockwave C2 IVL catheter (“C2 catheter”) and Shockwave C2+ IVL catheter (“C2+ catheter”) are two-emitter catheters for use in our IVL System for the treatment of CAD. The C2 catheter was CE-Marked in June 2018. In August 2019, we received the Breakthrough Device Designation from the FDA for our C2 catheter using our IVL System for the treatment of CAD. We received FDA approval of our C2 catheter in February 2021. In March 2022, we received regulatory approval in Japan for our C2 catheter and commenced a limited market release in Japan in May 2022 followed by a full market release in January 2023. In May 2022, we obtained regulatory approval, through our joint venture with Genesis, from the NMPA to sell our C2 catheter in the PRC. The C2+ catheter was CE-Marked in August 2022 and approved by the FDA in December 2022. In the fourth quarter of 2022, we commenced a limited market release for our C2+ catheter in select international locations.

Our differentiated range of IVL catheters enables delivery of IVL therapy to diseased vasculature throughout the body for calcium modification. Our IVL catheters resemble in form a standard balloon angioplasty catheter, the device most commonly used by interventionalists. This familiarity makes our IVL System easy to learn, adopt and use on a day-to-day basis.

Since inception, we have focused on generating clinical data to demonstrate the safety and effectiveness of our IVL Technology. These studies have consistently shown low rates of complications regardless of which vessel was being studied. In addition to supporting our regulatory approvals or clearances, the data from our clinical studies strengthen our ability to drive adoption of our IVL Technology across multiple therapies in existing and new market segments. Our past studies have also guided optimal IVL procedure technique and informed the design of our IVL System and future products in development. In addition, we have ongoing clinical programs across several products and indications, which, if successful, could allow us to expand commercialization of our products into new geographies and indications.

During 2022, we were engaged in the following CAD clinical trials:

•DISRUPT CAD III: This global study was designed to support our PMA application and, together with the DISRUPT CAD IV study, our Shonin submission in Japan, for our C2 catheter. In October 2018, we received staged investigational device exemption (“IDE”) approval for our DISRUPT CAD III global study. We began enrollment in the DISRUPT CAD III global study in 2019 and completed enrollment in March 2020. We submitted CAD III data to the FDA to support PMA application approval. We commenced the U.S. launch of our C2 catheter following FDA approval in February 2021. In 2022, final two-year data had been presented and the DISRUPT CAD III study is in the process of study close-out.

•DISRUPT CAD IV: This study is designed, along with DISRUPT CAD III, to support our Shonin submission in Japan for our C2 catheter. We began enrollment in the DISRUPT CAD IV Japan study in 2019 and completed enrollment in April 2020. We submitted CAD III and CAD IV data to support our Shonin submission in March 2021 and received regulatory approval of our C2 catheter in Japan in March 2022.

•DISRUPT CAD III Post-Approval Study (CAD PAS): This is a required post-approval study in the United States for our C2 catheter. We began the initial collection of data in the last quarter of 2021 and concluded in January 2023.

In addition, we were engaged in the following PAD clinical trials in 2022:

•DISRUPT PAD III. This global study was a prospective, multicenter, randomized study designed to demonstrate the safety and effectiveness of IVL as a vessel preparation procedure in moderate to severely calcified superficial femoral and popliteal lesions, followed by a drug-coated balloon or stent. We began enrollment in the DISRUPT PAD III study in February 2017 and completed enrollment in May 2020. We disclosed the 30-day results of the study in November 2020, and the 1-year results in May 2022. Our PAD III study is the largest randomized study in heavily calcified femoropopliteal lesions to date and demonstrated that our IVL Technology was superior to balloon angioplasty. PAD III also has an observational registry component. The additional registry data demonstrates that IVL reduces residual stenosis and vascular complications in a variety of peripheral lesions including calcified infrapopliteal PAD, and successfully facilitates large bore access for transcatheter aortic valve implantation procedures. Enrollment in the registry portion was completed in June 2021 and results were disclosed in October 2022.

•PAD+: This was a prospective, multi-center, single-arm study to assess the safety and performance of the M5+ catheter in our IVL System to treat calcified peripheral arteries. PAD+ is intended to support approval in pre-market countries, and to assess continued safety and effectiveness in the United States. We began enrollment in the PAD+ study in February 2021 and completed enrollment in September 2021. Initial results were disclosed in April 2022.

•BTK II: This is a post-market, prospective, multi-center, single-arm study to assess the effectiveness of IVL for treatment of BTK PAD. We began enrollment in the BTK II study in November 2021, and study enrollment is ongoing.

•Mini S Feasibility: This is a prospective, multi-center, single-arm feasibility study to assess the safety and performance of the Shockwave Medical Mini S Peripheral IVL System for the treatment of heavily calcified, stenotic peripheral arteries. We began enrollment in January 2022 and enrollment is ongoing.

A development program is also currently underway to explore the ability of our IVL Technology to directly treat calcified aortic valves to safely reduce the symptoms of aortic stenosis (“AS”).

The Opportunity

Atherosclerosis is a common disease of aging in which arteries become narrowed (“stenotic”) and the supply of oxygenated blood to the affected organ is reduced by the progressive growth of plaque. Atherosclerotic plaque is comprised of fibrous tissue, lipids (fat) and, when it progresses, calcium. This calcium is present both deep within the walls of the artery (“deep” or “medial” calcium) and close to the inner surface of the artery (“superficial” or “intimal” calcium).

The first two indications that our IVL System addresses are PAD, the narrowing or blockage of vessels that carry blood from the heart to the extremities, and CAD, the narrowing or blockage of the arteries that supply blood to the heart. In the future, we see significant opportunity in the potential treatment of AS, a condition in which the heart’s aortic valve becomes increasingly calcified with age, causing it to narrow and obstruct blood flow from the heart.

We estimate the market opportunity for use of IVL in the treatment of PAD and CAD can generally be defined as interventional procedures performed to treat those diseases where severe or moderate arterial calcium is present. In addition, IVL is utilized in so called “large bore” endovascular procedures such as transcatheter aortic valve replacements (“TAVR”) and endovascular aortic aneurysm repair (“EVAR”) to treat calcified arteries along the access route, typically the common femoral or iliac arteries, where calcification can hinder the advancement of large-sized sheaths required to deliver these large-sized heart valves or endovascular grafts. The number of interventional procedures and prevalence of severe or moderate calcium vary by arterial segment, but we believe the aggregate addressable market for IVL is estimated to be over $8.5 billion.

Coronary IVL is utilized to treat patients with CAD undergoing a percutaneous coronary intervention (“PCI”) who have severe or moderate arterial calcium that hinder a balloon angioplasty and subsequent stent implantation. According to Clarivate, over six million PCI procedures will be performed in 2023 in the markets we serve. A study published in the American Journal of Cardiology in 2014 demonstrated that more than 30% of patients undergoing PCI have severely or moderately calcified lesions and this percentage is growing. Minimizing complications is particularly important in the coronary vessels, and alternative plaque modification devices to IVL are used somewhat sparingly in PCI procedures in patients with calcified coronary artery disease, which we believe is likely due to safety risks and the inherent challenges associated with their use. Despite significant under-penetration of the market, these devices still represented a market of $200 million in 2022 within the United States alone, according to Clarivate; we believe this market is significantly larger globally. We believe the safety, ease of use and efficient impact on calcium of our IVL System resulted in the adoption and market expansion in markets where our C2 catheter was introduced. We believe there is an over $3.6 billion total addressable market opportunity for our IVL System to treat CAD.

The population of patients suffering from PAD in the United States has been estimated to be at least eight million people, according to the National Institutes of Health. Globally over 1.9 million interventions are performed annually to treat symptomatic occlusive PAD. The presence of severe and moderate calcium ranges between 50 – 70% in the iliac, femoropoliteal and infrapopliteal arterial beds that are treated as part of PAD interventions. Current technologies are often not able to safely and effectively treat heavily calcified vessels. Accordingly, we believe our IVL system to treat symptomatic occlusive PAD has a total addressable market opportunity of $1.9 billion.

In addition to PAD treatment, lower extremity arteries are sometimes treated with IVL as part of separate endovascular procedures, specifically TAVR or abdominal or thoracic EVAR (“TEVAR”) procedures, where the iliac or common femoral arteries along the access vascular route are blocked by a calcified narrowing that prevents these relatively large catheters from passing from the lower extremities into the aorta to deliver their respective lifesaving therapies. In 2023 Clarivate estimates that 260,000 TAVR procedures will be performed globally and up to 20% of these procedures are at risk for barriers to transfemoral access due to calcium. Similarly, Clarivate estimates that 215,000 EVAR and TEVAR procedures are performed globally with up to 20% of procedures at risk due to calcified lower extremity arteries. IVL is able to treat these calcified arteries and enable these so-called large bore procedures to be performed via standard transfemoral access technique, thereby reducing a risk of increased complications due to alternative access methods. We estimate that in aggregate large bore access procedures represent an additional addressable market opportunity of over $200 million.

The global market for aortic valve replacement (“AVR”), the main treatment for AS, is growing rapidly, and is dominated by the emergence of TAVR devices. TAVR has rapidly developed into a multibillion-dollar market globally. According to an article published in the Journal of Thoracic Disease in 2017, the global market for TAVR was anticipated to be over 175,000 procedures performed worldwide in 2020 and is expected to grow to over 400,000 by 2028. We believe our IVL System may be able to improve the treatment of AS among patients in whom currently available solutions are

inadequate. We are currently working to develop an IVL catheter which we believe can safely and effectively treat patients with AS. If successful, we believe this represents a potential total addressable market of over $3 billion for our IVL System to treat AS.

Current Challenges

The primary approaches to treat cardiovascular disease are angioplasty balloons (“balloons”), drug-coated balloons (“DCB”), bare metal stents, and DES. These devices all work by using pressurized balloons to expand the diseased blood vessels. Calcified plaque creates challenges for these therapies in achieving optimal outcomes in treating PAD and CAD because the calcified vessels fail to expand under safe pressures. This, in turn, can lead to acute failure, damage to the blood vessel, which increases the rate of restenosis (re-occlusion of the vessel following endovascular treatment) or complications requiring adjunctive tools, future re-interventions or conversion to bypass surgery. These complications are significantly increased when treating calcified cardiovascular disease and include dissections, embolization, restenosis, vessel perforations and vessel recoil.

Plaque modification devices (including atherectomy and specialty balloons) have enhanced the treatment of some moderately calcified cardiovascular lesions by improving the ability of stent and balloon therapies to effectively expand in the vessel. Atherectomy devices are designed to break or remove superficial calcium by cutting or sanding the calcium in order to improve vessel expansion. Specialty balloon devices incorporate metallic elements like wires and cutting blades onto standard balloons; these devices are intended to make discreet cuts into the calcified plaque and surrounding tissue in order to improve vessel expansion. Despite improvements in plaque modification devices, significant limitations remain, including being difficult to use and creating complications and inconsistent efficacy. Further, because medial calcium is encased in the peripheral vessel wall, and coronary arteries often feature thick layers of calcium, existing plaque modification devices are unable to impact calcium in these anatomies without damaging the vessel. Combined, these limitations decrease the utilization of plaque modification devices for treating calcified cardiovascular disease, thereby reducing the clinical benefit of angioplasty and stent therapies compared to their use in non-calcified anatomies.

Calcified iliac and femoral arteries can hinder the delivery of large endovascular devices for other catheter-based procedures, including those that treat aortic aneurysms (endovascular aneurysm repair and thoracic endovascular aneurysm repair procedures), severe AS treated with TAVR, and cardiac support devices for high-risk PCI (e.g., Johnson & Johnson/Abiomed’s Impella). The standard practice for these procedures is to gain vascular access in the femoral artery and insert large diameter sheaths that facilitate the delivery of the treatment devices to the aorta or the heart. However, when significant calcium is present in these arteries, it can prevent delivery of the devices, and thus may require more invasive treatments, increase complications or prevent the device from being used altogether. For example, in up to 20% of patients, the transfemoral approach through the iliac and femoral arteries is not viable for TAVR delivery or creates risk of vessel trauma due to the extent of vascular calcification, according to a 2018 study in the Journal of the American College of Cardiology.

Our Solution

We have adapted the use of lithotripsy, which has been used to successfully treat kidney stones (deposits of hardened calcium) for over 30 years, to the cardiovascular field with the aim of creating what we believe is the safest, most effective means of addressing the growing challenge of cardiovascular calcification. By integrating lithotripsy into a device that resembles a standard balloon catheter, physicians can prepare, deliver, and treat calcified lesions using a familiar form factor, without disruption to their standard procedural workflow. Our differentiated IVL System works by delivering shockwaves through the entire depth of the artery wall, modifying both deep wall and thick calcium, not just at the thin, superficial most intimal layer. The shockwaves crack this calcium and enable the stenotic artery to expand at low pressures, thereby minimizing complications inherent to traditional balloon dilations, such as dissections or perforations. Preparing the vessel with IVL facilitates optimal outcomes with other adjacent therapies, including stents and drug-eluting technologies. Using IVL also avoids complications associated with atherectomy devices such as dissection, perforation, and embolism.

Our IVL System

(Left) Our IVL System consisting of a generator, connector cable and IVL catheter. (Right) Our IVL System delivering lithotripsy directly to a calcified vessel.Our IVL System includes a generator, connector cable, and a variety of IVL catheters designed to treat PAD and CAD. The IVL catheter is advanced to the target lesion and the integrated balloon is inflated with fluid at a low pressure to make contact with the arterial wall. IVL is then activated through the generator with the touch of a button, creating a small bubble within the catheter balloon which rapidly expands and collapses. The rapid expansion and collapse of the bubble creates sonic pressure waves that travel through the vessel and crack the calcium, allowing the blood vessel to expand under low static pressure.

We believe there is a significant opportunity to apply our IVL Technology as a platform to treat a wide array of indications throughout the cardiovascular system. Ultimately, our plan is to have a broad portfolio of IVL catheters that can treat calcium-related diseases across a wide variety of vasculatures and structures.

Why Shockwave?

Safe – Simple – Effective.

•Treatment calcium throughout the coronary and peripheral arteries.

•Improved safety of these challenging procedures through a unique mechanism of action.

•Seamless integration into interventional practice with exceptional ease-of-use.

•Ensure complex procedures can be performed in a predictable manner.

•Expanded access to interventional techniques for patients.

Our Growth Strategy

Our mission is to provide safe, effective, and easy-to-use treatments to optimize outcomes for calcified cardiovascular disease. We believe the following strategies will advance our mission and will contribute to our future success and growth.

•Address unmet clinical needs in multiple large markets.

•Advance our IVL System as a common treatment for calcified PAD and CAD.

•Grow our specialized sales force across indications and geographies to foster deep relationships with physicians and drive revenue growth.

•Execute on our clinical program to expand indications and build a robust body of clinical evidence.

•Leverage our IVL Technology and our experienced team to develop new products that satisfy significant unmet clinical needs.

•Drive profitability by scaling our business operations to achieve cost and production efficiencies.

On January 16, 2023, we entered into an arrangement agreement to acquire Neovasc Inc., a company focused on the minimally invasive treatment of refractory angina (“Neovasc”), pursuant to which we will acquire all outstanding Neovasc shares for an upfront cash payment of $27.25 per share, corresponding to an enterprise value of approximately $100 million, inclusive of certain deal-related costs. Neovasc shareholders will also receive a potential deferred payment in the form of a non-tradable contingent value right entitling the holder to receive up to an additional $12 per share in cash if certain regulatory milestones are achieved. The transaction will be effected by way of a court-approved plan of arrangement pursuant to the Canada Business Corporations Act, and is subject to customary closing conditions, including requisite Neovasc shareholder approval. We expect to complete the transaction in the first half of 2023.

Research and Development

We invest in research and development efforts that advance our IVL Technology and related technologies with the goal to expand and improve upon our existing product offerings.

We believe our ability to rapidly develop innovative products is attributable to the dynamic product innovation process that we have implemented, the versatility and leveragability of our core technology and the management philosophy behind that process. We have recruited and retained engineers and scientists with significant experience in the development of medical devices. We have a pipeline of products in various stages of development that are expected to provide additional commercial opportunities. Our research and development efforts are based in Santa Clara, California.

Manufacturing

The manufacturing of our IVL catheters is principally done at our facilities in Santa Clara, California, except that a portion of demand for certain catheters is manufactured by a third-party contract manufacturer in Costa Rica. In 2022, we entered into a land purchase agreement and certain other related agreements for the purchase of real property in Costa Rica, where we are in the process of building a new manufacturing facility.

We stock inventory of raw materials, components and finished goods at our facilities in California and finished products with our distribution warehouses and third-party logistics providers. We also stock inventory of finished products with our direct sales representatives, who travel to our hospital customers’ locations as part of their sales efforts. In addition, our contract manufacturer holds an inventory of raw materials, components, and finished goods at its manufacturing facility in Costa Rica as necessary to support our catheter production requirements.

Our electronics (i.e., our generators and connector cables) are produced by original equipment manufacturing partners using our design specifications. We rely on a single or limited number of suppliers for certain raw materials and components, and we generally have no long-term supply arrangements with our suppliers, as we order on a purchase order basis. Under our contract manufacturing arrangements with our catheter contract manufacturer, however, we make binding one-year purchase commitments, subject to certain adjustment mechanisms specified in the contract manufacturing agreement.

We generally ship our IVL products from our manufacturing sites to either our third-party logistics providers, who then ship the products directly to hospital customers or distributors, or directly to hospital customers or distributors. We also sell our IVL products directly to our hospital customers through our direct sales representatives, who deliver such products to hospital customers in the field. We have offered consignment sales arrangements to certain customers, including some customers in Germany, Austria, Switzerland, France, Ireland and the United Kingdom (the “UK”) who we ship to on a consignment basis from our third-party logistics provider located in the Netherlands. Our catheter contract manufacturer generally ships all products to our facility in Santa Clara, where the products are held in inventory until ready to be shipped to U.S. or international customers.

Our rigorous quality control management programs have earned us a number of quality-related manufacturing designations. Our manufacturing facilities are compliant with International Organization for Standardization (“ISO”) 13485:2016. In 2014, we achieved compliance with the European Union’s (the “EU”) Medical Device Directive (93/42/EEC) (the “MDD”). In January 2021, our quality system was successfully audited and deemed compliant with the EU’s new Medical Devices Regulation (Regulation 2017/745) (the “MDR”), and we received our first device approval under the MDR for our C2+ catheter in August 2022. We are working to achieve compliance for our other IVL catheters under the MDR, which supersedes the MDD, subject to certain transition provisions contained in the MDR. We use regular internal audits to help ensure strong quality control practices. An internal, on-going staff training, and education program contributes to our quality assurance program and training is documented and considered part of the employee evaluation

process. We are also subject to periodic audits by regulatory agencies. We have received a Medical Device Single Audit Program (“MDSAP”) certification, which certifies that we meet the regulatory requirements of multiple geographies (Australia, Brazil, Canada, Japan and the United States) and bundles the surveillance of our quality management system into a single, annual audit conducted by our notified body.

Sales and Marketing

We market our IVL System to hospitals whose interventional cardiologists, vascular surgeons and interventional radiologists treat patients with PAD and CAD. We have dedicated meaningful resources to establish direct sales capability in the United States, Germany, Austria, Switzerland, France, Ireland, Japan and the UK which we have complemented with distributors actively selling in over 55 countries in North and South America, Europe, the Middle East, Asia, Africa, and Australia/New Zealand. We are continuing to add new U.S. sales territories and are actively expanding our international field presence through new distributors, as well as additional sales and clinical personnel and expanded direct sales territories.

Our sales representatives and sales managers generally have substantial and applicable medical device experience, specifically in the vascular space and market our products directly to interventional cardiologists, vascular surgeons and interventional radiologists who treat patients with PAD and CAD. We are focused on developing strong relationships with our physician and hospital customers in order to educate them on the use and benefits of our products. Similarly, our marketing team has a significant amount of domain expertise and a strong track record of success.

In the United States, our IVL generators and connector cables may be sold, rented or loaned to hospital customers, while our disposable IVL catheters are sold to hospital customers or may be provided, in limited circumstances, on a consignment basis whereby title to such catheters passes to the hospital once they are used in a clinical procedure. In the consignment model, following such use, we charge the hospital a predetermined set fee for each IVL catheter, which fee may be determined based on the hospital’s overall use of our IVL catheters.

In addition to our direct sales organizations, we sell to distributors in certain geographies outside the United States where we have determined that selling through third party distributors is the best way to optimize our opportunities and resources. We select distribution partners who have deep experience in our markets, have strong customer relationships and have a demonstrated track record of launching innovative products.

Our IVL System is simple, intuitive, and easy to install and use. This provides value to our customers, but also makes our sales model a source of competitive advantage. Lower service burden means we can develop a cost-efficient sales model by optimizing a mix of clinical specialists and salespeople. Moreover, our coronary and peripheral IVL catheters have similar call points, meaning we can further leverage our field sales team.

Reimbursement

In the United States, our products are generally purchased by hospitals, which in turn normally bill various third-party payors, including government programs, such as Medicare and Medicaid, and private health insurance plans, for the healthcare services required to treat each patient. The applicable third-party payors determine whether to provide coverage for a particular procedure or product, and, if so, the amount for which the provider will be reimbursed for treatment. In the United States, there is no uniform system among payors for making coverage and reimbursement decisions. In addition, the process for determining whether a payor will provide coverage for a product or service may be separate from the process for setting the price or reimbursement rate that the payor will pay for the product or service once coverage is approved. Payors may limit coverage to specific products or services on an approved list, or formulary, which might not include all of the FDA-approved or -cleared products for a particular indication.

Medicare has established dedicated coding and payment for peripheral IVL procedures performed in the hospital inpatient, hospital outpatient and ambulatory surgical settings of care. Coronary IVL is an FDA-designated Breakthrough Device with coding and payment established under the New Technology Add-On Payment (NTAP) and Transitional Pass Through Payment (TPT) programs for procedures performed in the hospital inpatient and hospital outpatient settings respectively.

Outside the United States, reimbursement levels vary significantly by country, and by region within some countries. Reimbursement is obtained from a variety of sources, including government-sponsored and private health insurance plans, and combinations of both.

Competition

The medical device industry is intensely competitive, subject to rapid change and significantly affected by new product introductions and other market activities of industry participants. We compete with manufacturers and distributors of cardiovascular medical devices. The industry in which we operate is highly competitive, and our products may compete with products manufactured or reportedly under development by other companies, including Boston Scientific Corporation, Cardiovascular Systems, Inc. (“CSI”), Medtronic plc, Philips N.V. and Abbott Laboratories. Some of these competitors are large, well-capitalized companies with greater market share and resources than we have. As a consequence, they may be able to spend more on product development, marketing, sales and other product initiatives than we can. We may also compete with smaller medical device companies that have single products or a limited range of products. Some of our competitors have:

•significantly greater name recognition;

•broader or deeper relations with healthcare professionals, customers, and third-party payors;

•more established distribution networks;

•additional lines of products and the ability to offer rebates or bundle products to offer greater discounts or other incentives to gain a competitive advantage;

•greater experience in conducting research and development, manufacturing, clinical trials, marketing and obtaining regulatory clearance or approval for products; and

•greater financial and human resources for product development, sales and marketing and patent prosecution.

We believe that our proprietary IVL Technology, focus on calcified cardiovascular disease and organizational culture and strategy will be important factors in our future success. In response to attempts by companies to claim their products are competitive, we emphasize that our products are unique and designed to treat patients with calcified cardiovascular disease safely, easily and effectively, with improved outcomes. Our continued success depends on our ability to:

•develop innovative, proprietary products that can cost-effectively address significant clinical needs in a manner that is safe and effective for patients and easy to use for physicians;

•continue to innovate and develop scientifically advanced technology;

•obtain and maintain regulatory clearances or approvals;

•demonstrate efficacy in our sponsored and third-party clinical trials and studies;

•obtain and maintain adequate reimbursement for procedures using our products;

•apply technology across product lines and markets;

•attract and retain skilled research and development and sales personnel; and

•cost-effectively manufacture and successfully market and sell products.

We believe our products fare favorably when compared with those of other companies on the basis of the factors described above.

Intellectual Property

Our success depends in part on our ability to obtain, maintain, protect and enforce our proprietary technology and intellectual property rights, in particular, defend our patent rights, preserve the confidentiality of our trade secrets, and operate without infringing the valid and enforceable patents and other proprietary rights of third parties. We rely on a combination of patent, trademark, trade secret, copyright and other intellectual property rights and measures to protect the intellectual property rights that we consider important to our business. We also rely on know-how and continuing technological innovation to develop and maintain our competitive position.

We seek to protect our proprietary rights through a variety of methods, including confidentiality agreements and proprietary information agreements with suppliers, employees, consultants and others who may have access to our

proprietary information. However, trade secrets and proprietary information can be difficult to protect. While we have confidence in the measures we take to protect and preserve our trade secrets and proprietary information, such measures can be breached, and we may not have adequate remedies for any such breach. In addition, our trade secrets and proprietary information may otherwise become known or be independently discovered by competitors.

As of December 31, 2022, we owned 55 issued U.S. patents and 88 issued foreign patents, 20 pending U.S. non-provisional patent applications and 41 pending foreign patent applications (including five Patent Cooperation Treaty applications). In addition, we own or have rights to trademarks and domains in the United States and select locations internationally that we use in connection with the operation of our business.

U.S. Pat. No. 8,956,371, which is one of our issued U.S. patents relating to our current IVL Technology, remains the subject of an inter partes review (“IPR”) proceeding filed by CSI, one of our competitors. On March 9, 2022, the Patent Trial and Appeal Board (the “PTAB”) issued an order authorizing us to file a motion for additional discovery. On March 23, 2022, we filed a motion for additional discovery, relating to additional information publicized by CSI after the PTAB's decision on the patents. On February 2, 2023, the PTAB denied the motion for additional discovery and issued a final decision, ruling again that Claim 5 is valid and that all other claims are invalid. For more information regarding these proceedings, see the section titled “Legal Proceedings.”

These issued patents, and any patents granted from such applications, are expected to expire between 2029 and 2041, without taking potential patent term extensions or adjustments into account. The term of individual patents depends upon the legal term for patents in the countries in which they are granted. We aim to protect our innovation with patents, but we cannot be sure that any applications we file will issue as patents, that any patents we obtain will withstand challenge or invalidation, or that we will obtain sufficient patent protection for innovation that turns out to be more important than anticipated.

For more information regarding the risks related to our intellectual property, including the above referenced IPR proceedings, see the section titled “Risk Factors—Risks Related to Our Intellectual Property.”

Government Regulation

Our products are medical devices subject to extensive laws, rules and regulations of various U.S. federal and state, and international regulatory bodies in each of the markets in which we sell or distribute our products. These laws, rules and regulations govern, among other things, product design and development, pre-clinical and clinical testing, manufacturing, packaging, labeling, advertising, storage, record keeping and reporting, clearance or approval, marketing, distribution, promotion, import and export, pricing and discounts, post-marketing surveillance and interactions with healthcare professionals. Failure to comply with applicable requirements may subject us or one or more of our products to a variety of sanctions, such as loss of product approvals/clearances/certifications, issuance of warning letters, untitled letters, civil monetary penalties and judicial sanctions, such as product seizures, injunctions or criminal prosecution.

United States

FDA’s Premarket Clearance and Approval Requirements. Each medical device we seek to commercially distribute in the United States will require either a prior 510(k) clearance, unless it qualifies for an exemption as outlined below, De Novo authorization, or a PMA from the FDA. Medical devices are classified into one of three classes—Class I, Class II or Class III—depending on the degree of risk associated with the medical device and the extent of regulatory control needed to provide reasonable assurance of safety and effectiveness.

•Class I devices are deemed to be low risk and are subject to the general controls of the U.S. Federal Food, Drug and Cosmetic Act (the “FD&C Act”), such as provisions that relate to adulteration, misbranding, registration and listing, notification (including repair, replacement, or refund), records and reports, and good manufacturing practices. Most Class I devices are classified as exempt from the premarket notification requirement under Section 510(k) of the FD&C Act, and therefore may be commercially distributed without obtaining 510(k) clearance from the FDA.

•Class II devices are subject to both general controls and special controls to provide reasonable assurance of safety and effectiveness. Special controls may include performance standards, post-market surveillance, patient registries, and guidance documents. It is typical for Class II devices to be subject to a requirement for clearance under Section 510(k) of the FD&C Act.

•Class III devices are those deemed by the FDA to pose the greatest risk, such as life-sustaining, life-supporting or implantable devices, or devices deemed not substantially equivalent to a previously cleared 510(k) device. In general, a Class III device cannot be marketed in the United States unless the FDA approves the device after review of a PMA application. The FDA can also impose sales, marketing or other restrictions on Class III devices to ensure that they are used in a safe and effective manner.

510(k) Clearance Pathway. When a 510(k) clearance is required, we must submit a premarket notification to the FDA demonstrating that our proposed device is “substantially equivalent” to a predicate device, which is a previously cleared and legally marketed 510(k) device or a device that was in commercial distribution before May 28, 1976. By regulation, a premarket notification must be submitted to the FDA at least 90 days before we intend to market a device, and we must receive 510(k) clearance from the FDA before we actually market the device. The Medical Device User Fee Amendments performance goal for a traditional 510(k) clearance is 90 days. As a practical matter, however, clearance often takes longer, because the review clock is paused by the FDA to allow time to resolve any questions the FDA may have. To demonstrate substantial equivalence, we must show that the proposed device (1) has the same intended use as the predicate device, and (2) it either has (a) the same technological characteristics as the predicate device or (b) if the proposed device has different technological characteristics than the predicate device, that the device is equally safe and effective and does not raise different questions of safety and effectiveness. The FDA may require further information, including clinical data, to make a determination regarding substantial equivalence. If the FDA determines that the device, or its intended use, is not substantially equivalent to a previously cleared device or use, the FDA will place the device into Class III.

After a device receives 510(k) clearance, any modification that could significantly affect its safety or effectiveness, or that would constitute a major change in its intended use, requires a new 510(k) or possibly a PMA. The FDA requires each manufacturer to make this determination initially, but the FDA can review any such decision and can disagree with a manufacturer’s determination. If the FDA disagrees with our determination not to seek a new 510(k) clearance for any particular device, the FDA may retroactively require us to seek 510(k) clearance or possibly a PMA. The FDA could also require us to cease marketing and distribution and/or recall the modified device until 510(k) clearance or a PMA is obtained. Also, in these circumstances, we may be subject to significant regulatory fines and penalties.

De Novo Classification Pathway. If a novel device is low risk but lacks a predicate device, it may be eligible for de novo classification. In this process, the FDA by order creates a new classification regulation placing the novel device in Class I or II. This process is lengthier and more expensive than a 510(k) review. For instance, the FDA requires that the premarket notification be submitted 150 days, rather than 90 days, before the day that the device is intended to be marketed. This process is, however, quicker and less expensive than the PMA pathway described below. Once the classification regulation is established, subsequent devices in this type can use the 510(k) pathway.

Premarket Approval Pathway. A PMA application under Section 515 of the FD&C Act must be submitted to the FDA for Class III devices that support or sustain human life, are of substantial importance in preventing impairment of human health, or which present a potential, unreasonable risk of illness or injury. The PMA application process is much more demanding than the 510(k) premarket notification process. The granting of a PMA is based on a determination by the FDA that the PMA application contains sufficient valid scientific evidence to ensure that the device is safe and effective for its intended use(s).

After a PMA application is submitted, the FDA has 45 days to determine whether the application is sufficiently complete to permit a substantive review and thus whether the FDA will file the application for review. The FDA has 180 days to review a filed PMA application, although the review of an application generally occurs over a significantly longer period of time. During this review period, the FDA may request additional information or clarification of the information already provided. Also, an advisory panel of experts from outside the FDA may be convened to review and evaluate the application and provide recommendations to the FDA as to the approvability of the device. Although the FDA is not bound by the advisory panel decision, the panel’s recommendations are an important factor in the FDA’s overall decision-making process. In addition, the FDA may conduct a preapproval inspection of the manufacturing facility to ensure compliance with the Quality System Regulation (“QSR”). The FDA also may inspect one or more clinical sites to ensure the validity of the data and compliance with applicable FDA regulations.

Upon completion of the PMA application review, the FDA may: (i) approve the PMA which authorizes commercial marketing with specific prescribing information for one or more indications, which can be more limited than those originally sought; (ii) issue an “approvable letter” which indicates the FDA’s belief that the PMA application is approvable and states what additional information the FDA requires, or the post-approval commitments that must be agreed

to prior to approval; (iii) issue a “not approvable letter” which outlines steps required for approval, but which are typically more onerous than those in an approvable letter, and may require additional clinical trials that are often expensive and time consuming and can delay approval for months or even years; or (iv) deny the application. If the FDA issues an approvable or not approvable letter, the applicant has 180 days to respond, after which the FDA’s review clock is reset.

Some changes to an approved PMA device, including changes in indications, labeling, or manufacturing processes or facilities, require submission and FDA approval of a new PMA application or PMA supplement, as appropriate, before the change can be implemented. Supplements to a PMA often require the submission of the same type of information required for an original PMA application, except that the supplement is generally limited to that information needed to support the proposed change from the device covered by the original PMA. The FDA uses the same procedures and actions in reviewing PMA supplements as it does in reviewing original PMA applications.

Clinical Trials. Clinical trials are almost always required to support a PMA and are sometimes required for 510(k) clearance. In the United States, for significant risk devices, these trials require submission of an application for an IDE to the FDA. The IDE application must be supported by appropriate data, such as animal and laboratory testing results, showing that it is safe to test the device in humans and that the testing protocol is scientifically sound. The IDE must be approved in advance by the FDA for a specific number of patients at specified study sites.

During the trial, the sponsor must comply with the FDA’s IDE requirements for investigator selection, trial monitoring, reporting, and recordkeeping. The investigators must obtain patient informed consent, rigorously follow the investigational plan and study protocol, control the disposition of investigational devices, and comply with all reporting and recordkeeping requirements. Clinical trials for significant risk devices may not begin until the IDE application is approved by the FDA and the appropriate IRBs at the clinical trial sites. An IRB is an appropriately constituted group that has been formally designated to review and monitor medical research involving subjects and which has the authority to approve, require modifications in, or disapprove research to protect the rights, safety and welfare of human research subjects. A nonsignificant risk device does not require FDA approval of an IDE; however, the clinical trial must still be conducted in compliance with various requirements of the FDA’s IDE regulations and be approved by an IRB at the clinical trials sites. We, the FDA or the IRB at each site at which a clinical trial is being performed may withdraw approval of a clinical trial at any time for various reasons, including a belief that the risks to study subjects outweigh the benefits or a failure to comply with FDA or IRB requirements. Even if a trial is completed, the results of clinical testing may not demonstrate the safety and effectiveness of the device, may be equivocal or may otherwise not be sufficient to obtain approval or clearance of the product.

Sponsors of clinical trials of devices are required to register with clinicaltrials.gov, a public database of clinical trial information. Information related to the device, patient population, phase of investigation, study sites and investigators, and other aspects of the clinical trial is made public as part of the registration.

Ongoing Regulation by the FDA. Even after a device receives clearance or approval and is placed on the market, numerous regulatory requirements will apply. These include:

•establishment registration and device listing;

•the QSR, which requires manufacturers, including third-party manufacturers, to follow stringent design, testing, control, documentation, and other quality assurance procedures during all aspects of the manufacturing process;

•labeling regulations and the FDA prohibitions against the promotion of products for uncleared, unapproved or “off-label” uses, and other requirements related to promotional activities;

•corrections and removal reporting regulations, which require that manufacturers report to the FDA field corrections or removals if undertaken to reduce a risk to health posed by a device or to remedy a violation of the FD&C Act that may present a risk to health; and

•post market surveillance regulations, which apply to certain Class II and Class III devices when necessary to protect the public health or to provide additional safety and effectiveness data for the device.

In addition, the FDA's medical device reporting laws and regulations require us to provide information to the FDA when we receive or otherwise become aware of information that reasonably suggests that one of our devices may have caused or contributed to a death or serious injury, or information that reasonably suggests a device malfunction that likely

would cause or contribute to death or serious injury if the malfunction were to recur. Our approach has been to file such reports with the FDA even in cases where reporting might not otherwise be required out of an abundance of caution.

The FDA also prohibits an approved device from being marketed for off-label use. The FDA and other agencies actively enforce the laws and regulations prohibiting the promotion of off-label uses, and a company that is found to have improperly promoted off-label uses may be subject to significant liability, including substantial monetary penalties and criminal prosecution.

Newly discovered or developed safety or effectiveness data may require changes to a product’s labeling, including the addition of new warnings and contraindications, and also may require the implementation of other risk management measures. Also, new government requirements, including those resulting from new legislation, may be established, or the FDA’s policies may change, which could delay or prevent regulatory clearance or approval of our products under development.

FDA regulations require us to register as a medical device manufacturer with the FDA. Additionally, the California Department of Health Services (“CDHS”) requires us to register as a medical device manufacturer within the state. Because of this, the FDA and the CDHS inspect us on a routine basis for compliance with the QSR. These regulations require that we manufacture our products and maintain related documentation in a prescribed manner with respect to manufacturing, testing and control activities. We have undergone and expect to continue to undergo regular QSR inspections in connection with the manufacture of our products at our facilities. Further, the FDA requires us to comply with various FDA regulations regarding labeling. Failure by us or by our suppliers to comply with applicable regulatory requirements can result in enforcement action by the FDA, CDHS or other state authorities, which may include any of the following sanctions:

•warning or untitled letters, fines, injunctions, consent decrees and civil penalties;

•customer notifications, voluntary or mandatory recall or seizure of our products;

•operating restrictions, partial suspension, or total shutdown of production;

•delay in processing submissions or applications for new products or modifications to existing products;

•withdrawing approvals/clearances that have already been granted; and

•criminal prosecution.

Anti-Kickback Statute. The U.S. federal Anti-Kickback Statute (the “Anti-Kickback Statute”) prohibits, among other things, persons or entities from knowingly and willfully soliciting, offering, receiving or paying any remuneration, directly or indirectly, overtly or covertly, in cash or in kind, in exchange for or to induce either the referral of an individual for the furnishing or arranging for a good or service, or for the purchasing, leasing, ordering, or arranging for or recommending any good, facility, service or item for which payment may be made in whole or in part under federal healthcare programs, such as the Medicare and Medicaid programs. The term “remuneration” expressly includes kickbacks, bribes, or rebates and also has been broadly interpreted to include anything of value, including, for example, gifts, discounts, the furnishing of supplies or equipment, credit arrangements, payments of cash, waivers of payments, ownership interests and providing anything at less than its fair market value. The Anti-Kickback Statute is broad and prohibits many arrangements and practices that are lawful in businesses outside of the healthcare industry.

There are a number of statutory exceptions and regulatory safe harbors protecting certain business arrangements from prosecution under the Anti-Kickback Statute, however, those exceptions and safe harbors are drawn narrowly, and there may be no available exception or safe harbor for many common business activities, such as reimbursement support programs, educational and research grants, or charitable donations. Practices that involve remuneration to those who prescribe, purchase, or recommend medical devices, including discounts, providing items or services for free or engaging such individuals as consultants, advisors, or speakers, may be subject to scrutiny if they do not fit squarely within an exception or safe harbor and would be subject to a facts and circumstances analysis to determine compliance with the Anti-Kickback Statute. Some of our practices, such as the loaning of generators or consignment of catheters, may not in all cases meet all of the criteria for statutory exception or regulatory safe harbor protection from anti-kickback liability.

The government can establish a violation of the Anti-Kickback Statute without proving that a person or entity had actual knowledge of the statute or specific intent to violate it. A claim including items or services resulting from a violation of the Anti-Kickback Statute constitutes a false or fraudulent claim for purposes of the federal civil False Claims Act (the “False Claims Act”), which is discussed below. Penalties for violations of the Anti-Kickback Statute include, but are not

limited to, criminal, civil and/or administrative penalties, damages, fines, disgorgement, individual imprisonment, possible exclusion from Medicare, Medicaid and other federal healthcare programs, and the curtailment or restructuring of operations. Various states have adopted laws similar to the Anti-Kickback Statute, and some of these state laws may be broader in scope in that some of these state laws extend to all payors and may not contain safe harbors. In addition, many foreign jurisdictions in which we operate have similar laws and regulations.

Federal Civil False Claims Act. The False Claims Act prohibits, among other things, persons, or entities from knowingly presenting or causing to be presented a false or fraudulent claims for payment of government funds or knowingly presenting or causing to be presented a false record or statement material to an obligation to pay money to the government or knowingly and improperly avoiding, decreasing, or concealing an obligation to pay money to the federal government. Many pharmaceutical and medical device manufacturers have been investigated and have reached substantial financial settlements with the federal government under the False Claims Act for a variety of alleged improper activities, including causing false claims to be submitted as a result of the marketing of their products for unapproved and thus non-reimbursable uses and interactions with prescribers and other customers, including those that may have affected their billing or coding practices and submission of claims to the federal government.

Suits filed under the False Claims Act, known as “qui tam” actions, can be brought by any individual on behalf of the government. These individuals, sometimes known as “relators” or, more commonly, as “whistleblowers,” may share in any amounts paid by the subject entity to the government in fines or settlement. The number of filings of qui tam actions has increased significantly in recent years, causing more healthcare companies to have to defend cases brought under the False Claim Act. If an entity is determined to have violated the False Claims Act, it may be required to pay up to three times the actual damages sustained by the government, plus civil penalties for each separate false claim. Various states have adopted laws similar to the False Claims Act, and many of these state laws are broader in scope and apply to all payors, and therefore, are not limited to only those claims submitted to the federal government.

Federal Civil Monetary Penalties Statute. The federal Civil Monetary Penalties Statute, among other things, imposes fines against any person who is determined to have presented, or caused to be presented, claims to a federal healthcare program that the person knew, or should have known, was for an item or service that was not provided as claimed or is false or fraudulent.

Sunshine Act. The Affordable Care Act also included a provision, commonly referred to as the Sunshine Act, which requires that any manufacturer of drugs, devices, biologics or medical supplies for which payment is available under Medicare, Medicaid or the Children’s Health Insurance Program to report annually, with certain exceptions, to the Centers for Medicare & Medicaid Services (“CMS”), information related to payments or other “transfers of value” made to physicians and teaching hospitals, and requires applicable manufacturers and group purchasing organizations to report annually to CMS ownership and investment interests held by physicians and their immediate family members, with the reported information made public on a searchable website. Such reporting requirement was expanded by the SUPPORT for Patients and Communities Act, which requires manufacturers, beginning January 1, 2021, to report payments or transfers of value to physician assistants, nurse practitioners, clinical nurse specialists, certified registered nurse anesthetists, and certified nurse midwives in addition to physicians and teaching hospitals. Similar laws have been enacted at the state level and in foreign jurisdictions, including France.

Health Insurance Portability and Accountability Act of 1996. The federal Health Insurance Portability and Accountability Act (“HIPAA”) imposes criminal liability for, among other things, knowingly and willfully executing, or attempting to execute, a scheme to defraud any healthcare benefit program, including private third-party payors, or knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false, fictitious or fraudulent statement in connection with the delivery of or payment for healthcare benefits, items or services. In addition, HIPAA and its implementing regulations impose certain requirements relating to the privacy, security and transmission of individually identifiable health information, which are applicable to “business associates”—certain persons or entities that create, receive, maintain or transmit protected health information in connection with providing a specified service or performing a function on behalf of covered entities, which are healthcare providers, health plans and healthcare clearinghouses.

Other Laws, Rules and Regulations. We are also subject to a variety of other U.S. federal, state, and local laws and regulations and foreign laws, rules, and regulations, including:

•analogous state and foreign law equivalents of each of the above U.S. federal laws, such as anti-kickback and false claims laws which may apply to items or services reimbursed by any third-party payor, including commercial insurers;

•state and foreign laws that require medical device companies to comply with the industry’s voluntary compliance guidelines and the applicable compliance guidance promulgated by the federal government or otherwise restrict payments that may be made to healthcare providers and other potential referral sources;

•state beneficiary inducement laws, which are state laws that require medical device manufacturers to report information related to payments and other transfers of value to physicians and other healthcare providers or marketing expenditures;

•federal, state and foreign laws governing the privacy and security of personal information in general and health information in certain circumstances, many of which differ from each other in significant ways and may not have the same effect, thus complicating compliance efforts; and

•federal, state, local and international laws relating to relating to safe working conditions, laboratory, and manufacturing practices.

International

Regulation of medical devices in general. In addition to the rules and regulations described above, international sales of medical devices are subject to a variety of foreign government regulations, which may vary substantially from country to country. We expect this global regulatory environment will continue to be complex and evolving, which could impact the cost, the time needed to approve, and our ability to maintain existing approvals or obtain future approvals for our products, and require extensive compliance and monitoring obligations in the countries where we sell or distribute our products.

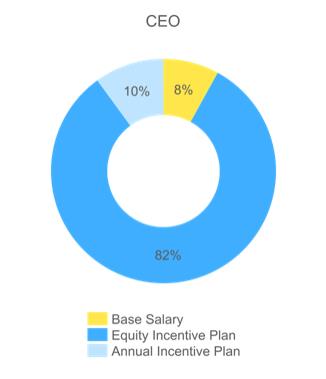

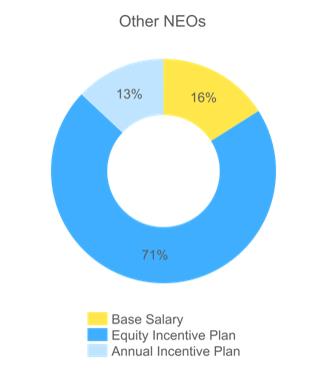

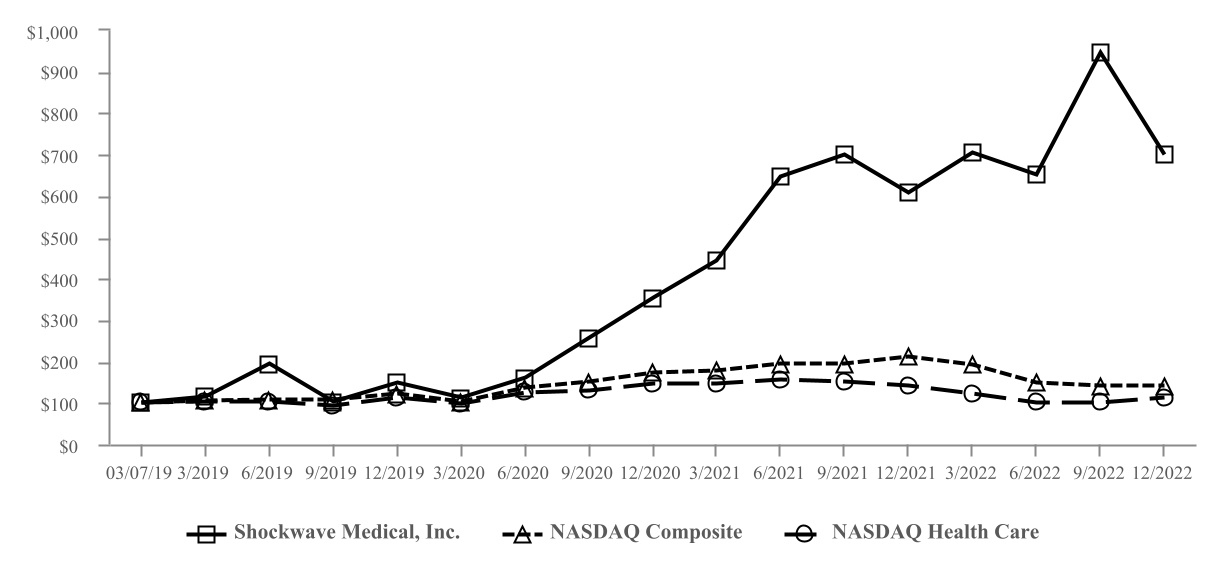

European Union. The EU has adopted numerous regulations and standards harmonizing the requirements for the design, manufacture, clinical trials, labeling and adverse event reporting for medical devices. Our products are regulated in the EU as medical devices per the MDR, which was published in May 2017 and came into application in May 2021, and which replaced, subject to certain transition provisions contained in the MDR, the MDD. Conformity with the MDD or MDR, as applicable, is indicated by the CE mark, which can be affixed by the manufacturer after a certificate of conformity is issued by the applicable Notified Body following the successful satisfaction of a variety of requirements. These requirements depend on the class of the product, but normally involve a combination of: (a) preparation of a design dossier; (b) self-assessment by the manufacturer; (c) a third-party assessment, which generally consists of an audit of the manufacturer’s quality system and manufacturing site by a Notified Body; and (d) review of the design dossier, which may include safety and technical information, by the Notified Body. Our ability to affix the CE mark is contingent upon continued compliance with the applicable regulations and standards, including compliance with ISO 13485 and applicable vigilance and post-market surveillance.