Item 2. Properties.Properties

Item 3. Legal Proceedings

We are involved in lawsuits, claims and proceedings arising in the ordinary course of business. These matters may involve personnel and employment issues, personal injury, contract and other proceedings arising in the ordinary course of business, which have not resulted in any material losses to date.business. Although we do not expect the outcome of these proceedings to have a material adverse effect on our financial condition or results of operations, litigation is inherently unpredictable. Therefore, we could incur judgments or enter into settlements or claims that could materially impact our results.

Item 4. Mine Safety Disclosures.Disclosures

Not applicable.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

We currently do not pay dividends and have not paid any cash dividends on our common stock to date.

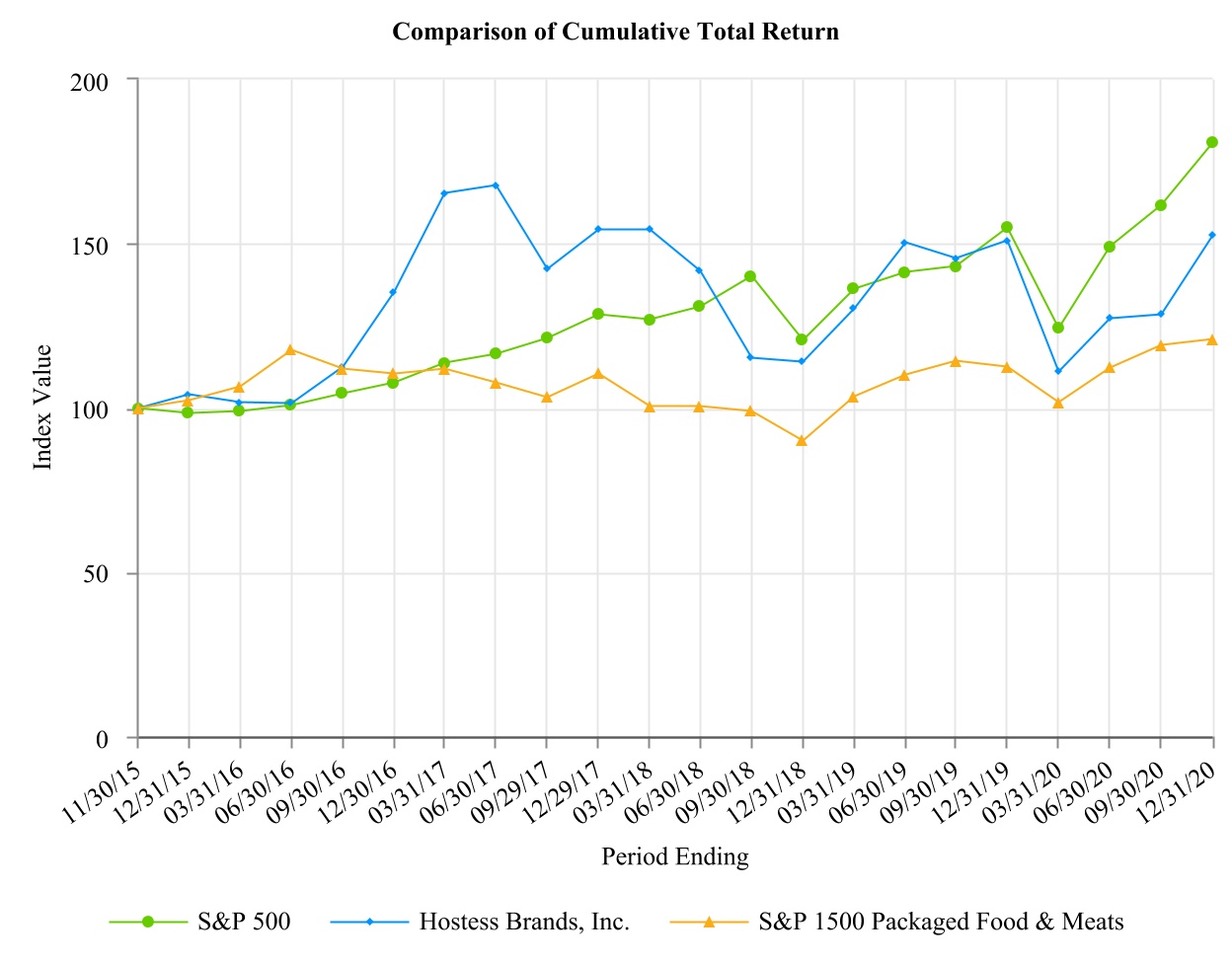

The following graph and related information shall not be deemed “soliciting material” or be deemed to be “filed” with the Commission, nor shall such information be incorporated by reference into any future filing, except to the extent that we specifically incorporate it by reference into such filing.

The following stock performance graph compares, for the period November 30, 2015 (the first day our common stock was traded following our initial public offering) through December 29, 201731, 2020 (the last trading day of our fiscal year), the cumulative total stockholder return for (1) the Company’s common stock, (2) the Standard & Poor’s 500 and (3) the Standard & Poor’s 500composite 1500 Packaged Foods and Meats Index.Sub-Index. The graph assumes the value of the investment in our common stock and each index was $100.00 on November 30, 2015 and assumes reinvestment of any dividends.

The stock price performance below is not necessarily indicative of future stock price performance.

Item 6. Selected Financial Data

The following table sets forth our net revenues, operating costs and expenses attributable to our operations.Not applicable.

As a result of the Business Combination, we are the acquirer for accounting purposes and Hostess Holdings is the acquiree and accounting predecessor. Our financial statement presentation includes the financial statements of Hostess Holdings as “Predecessor” for periods prior to the Closing Date and of us for periods after the Closing Date, including the consolidation of Hostess Holdings. Also see “Item 7-Management’s Discussion and Analysis of Financial Condition and Results of Operations-Supplemental Unaudited Pro Forma Combined Financial Information” for supplemental pro forma combined information for 2016 that gives effect to the Business Combination as if such transaction had been consummated on January 1, 2016.

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Statement of Operations Data |

| (In thousands except for share and per share data) | Year Ended December 31, 2017 | | From November 4, 2016

through December 31, 2016 | | | From January 1, 2016

through November 3, 2016 | | | Year Ended December 31, 2015 | | Year Ended

December 31, 2014 | | February 6, 2013 (Inception) through December 31, 2013 |

| | (Successor) | | (Successor) | | | (Predecessor) | | | (Predecessor) | | (Predecessor) | | (Predecessor) |

| Net revenue | $ | 776,188 |

| | $ | 111,998 |

| | | $ | 615,588 |

| | | $ | 620,815 |

| | $ | 554,695 |

| | $ | 237,418 |

|

| Gross profit | 326,898 |

| | 38,714 |

| | | 266,529 |

| | | 262,203 |

| | 233,932 |

| | 91,920 |

|

| Operating income (loss) | 233,992 |

| | (9,607 | ) | | | 122,872 |

| | | 155,908 |

| | 119,467 |

| | 23,330 |

|

| Income (loss) before income taxes | 190,904 |

| | (16,247 | ) | | | 60,864 |

| | | 88,760 |

| | 81,464 |

| | (5,594 | ) |

| Net income (loss) | 258,108 |

| | (8,485 | ) | | | 60,425 |

| | | 88,760 |

| | 81,464 |

| | (5,594 | ) |

| Net income (loss) attributable to the non-controlling interest | 34,211 |

| | (4,081 | ) | | | 3,214 |

| | | 4,507 |

| | 4,267 |

| | — |

|

| Net income (loss) attributable to Class A shareholders | $ | 223,897 |

| | $ | (4,404 | ) | | | $ | 57,211 |

| | | $ | 84,253 |

| | $ | 77,197 |

| | $ | (5,594 | ) |

| Earnings (loss) per Class A share: |

|

| | | | | | | | | | | | |

| Basic | $ | 2.26 |

| | $ | (0.05 | ) | | | | | | | | | | |

| Diluted | $ | 2.13 |

| | $ | (0.05 | ) | | | | | | | | | | |

| Weighted-average shares outstanding: | | | | | | | | | | | | | |

| Basic | 99,109,629 |

| | 97,791,658 |

| | | | | | | | | | |

| Diluted | 105,307,293 |

| | 97,791,658 |

| | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash Flow Data |

| (In thousands) | | Year Ended December 31, 2017 | | From November 4, 2016 through December 31, 2016 | | | From January 1, 2016 through November 3, 2016 | | Year Ended December 31, 2015 | | Year Ended December 31, 2014 | | February 6, 2013 (Inception) through December 31, 2013 |

| | | (Successor) | | (Successor) | | | (Predecessor) | | (Predecessor) | | (Predecessor) | | (Predecessor) |

Net cash provided by (used in) operating activities | | $ | 163,685 |

| | $ | 13,611 |

| | | $ | 102,221 |

| | $ | 132,972 |

| | $ | 108,329 |

| | $ | (29,672 | ) |

| Net cash provided by (used in) investing activities | | (35,209 | ) | | (428,196 | ) | | | (76,579 | ) | | 17,880 |

| | (91,393 | ) | | (422,498 | ) |

| Net cash provided by (used in) financing activities | | (19,630 | ) | | (232,345 | ) | | | (31,596 | ) | | (296,002 | ) | | (9,769 | ) | | 654,626 |

|

|

| | | | | | | | | | | | | | | | | | | | | | |

| Balance Sheet Data |

| (In thousands) | | December 31, 2017 | | December 31, 2016 | | | December 31, 2015 | | December 31, 2014 | | February 6, 2013 (Inception) through December 31, 2013 | |

| | | (Successor) | | (Successor) | | | (Predecessor) | | (Predecessor) | | (Predecessor) | |

| Cash and cash equivalents | | $ | 135,701 |

| | $ | 26,855 |

| | | $ | 64,473 |

| | $ | 209,623 |

| | $ | 202,456 |

| |

| Property and equipment, net | | 174,121 |

| | 153,224 |

| | | 128,078 |

| | 112,732 |

| | 88,269 |

| |

| Total assets | | 2,966,275 |

| | 2,847,892 |

| | | 643,529 |

| | 765,494 |

| | 683,678 |

| |

| Long-term debt and capital lease obligation | | 987,920 |

| | 993,374 |

| | | 1,193,667 |

| | 473,175 |

| | 479,602 |

| |

| Non-controlling interest | | 342,240 |

| | 334,192 |

| | | (37,991 | ) | | 4,267 |

| | — |

| |

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

Other Financial Data (1) |

| (In thousands) | | Year Ended December 31, 2017 | | From

November 4, 2016 through

December 31, 2016 | | | From

January 1, 2016 through November 3, 2016 | | Year Ended

December 31, 2015 | | Year Ended

December 31, 2014 | | February 6, 2013 (Inception) through December 31, 2013 |

| | | (Successor) | | (Successor) | | | (Predecessor) | | (Predecessor) | | (Predecessor) | | (Predecessor) |

| Adjusted EBITDA | | $ | 230,212 |

| | $ | 31,894 |

| | | $ | 183,409 |

| | $ | 177,930 |

| | $ | 145,343 |

| | $ | 40,285 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Gross Profit and Adjusted Gross Margin |

| (In thousands) | Year Ended December 31, 2017 | | From November 4, 2016

through December 31, 2016 | | | From

January 1, 2016

through November 3, 2016 | | Year Ended December 31, 2015 | | Year Ended

December 31, 2014 | | February 6, 2013 (Inception) through December 31, 2013 |

| | (Successor) | | (Successor) | | | (Predecessor) | | (Predecessor) | | (Predecessor) | | (Predecessor) |

| Net revenue | $ | 776,188 |

| | $ | 111,998 |

| | | $ | 615,588 |

| | $ | 620,815 |

| | $ | 554,695 |

| | $ | 237,418 |

|

| Cost of goods sold | 449,290 |

| | 73,284 |

| | | 346,864 |

| | 355,963 |

| | 320,763 |

| | 145,498 |

|

| Special employee incentive compensation | — |

| | — |

| | | 2,195 |

| | 2,649 |

| | — |

| | — |

|

| Gross Profit | $ | 326,898 |

| | $ | 38,714 |

| | | $ | 266,529 |

| | $ | 262,203 |

| | $ | 233,932 |

| | $ | 91,920 |

|

| | | | | | | | | | | | | |

| Add back: | | | | | | | | | | | | |

| Special employee incentive compensation (i) | — |

| | — |

| | | 2,195 |

| | 2,649 |

| | — |

| | — |

|

| Inventory fair value adjustment (ii) | — |

| | 8,914 |

| | | — |

| | — |

| | — |

| | — |

|

| Adjusted Gross Profit | $ | 326,898 |

| | $ | 47,628 |

| | | $ | 268,724 |

| | $ | 264,852 |

| | $ | 233,932 |

| | $ | 91,920 |

|

| | | | | | | | | | | | | |

| Gross Margin - GAAP | 42.1 | % | | 34.6 | % | | | 43.3 | % | | 42.2 | % | | 42.2 | % | | 38.7 | % |

| | | | | | | | | | | | | |

| Adjusted Gross Margin | 42.1 | % | | 42.5 | % | | | 43.7 | % | | 42.7 | % | | 42.2 | % | | 38.7 | % |

(i) For the Predecessor period January 1, 2016 through November 3, 2016, a special bonus payment of $2.2 million was paid to employees at the bakery facilities as compensation for their efforts in the Business Combination. For the year ended December 31, 2015, a special bonus payment of $2.6 million was paid to employees at the bakery facilities as compensation for their efforts in the recapitalization of Hostess.

(ii) For the Successor period November 4, 2016 through December 31, 2016, the Company remeasured inventory at fair value at the Business Combination date, resulting in additional non-cash cost of goods sold of $8.9 million.

(1) Adjusted EBITDA is defined and explained in more detail in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, which contains a reconciliation to the most comparable GAAP measure. Adjusted EBITDA is a non-GAAP financial measures commonly used by securities analysts, investors and other interested parties in their evaluation of the operating performance of companies in industries similar to ours. However, Adjusted EBITDA should not be construed as an alternative to net income as an indicator of operating performance or as an alternative to cash flow provided by operating activities as a measure of liquidity (each as determined in accordance with GAAP). Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies. We have included Adjusted EBITDA because we believe it provides management and investors with additional information to measure our performance.

Adjusted Gross Profit and Adjusted Gross Margin are non-GAAP financial measures commonly used in our industry, however they should not be construed as an alternative to gross profit and gross margin as an indicator of operating performance. Adjusted Gross Profit and Adjusted Gross Margin may not be comparable to similarly titled measures reported by other companies. We have included Adjusted Gross Profit and Adjusted Gross Margin because we believe they provide management and investors with additional information to measure our performance. We believe the presentation of Adjusted Gross Profit and Adjusted Gross Margin is useful to investors because it is consistent with our definition of Adjusted EBITDA.

See Item 7-Management’s Discussion and Analysis of financial Condition and Results of Operations-Adjusted EBITDA Reconciliation.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our Consolidated Financial Statementsconsolidated financial statements and related notes included in Item 8 of this Annual Report on Form 10-K.10-K/A. This discussion contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those discussed below. Factors that could cause or contribute to such differences include, but are not limited to, those identified below and those discussed in Item 1A “Risk Factors” of this Annual Report on Form 10-K.10-K/A.

Overview

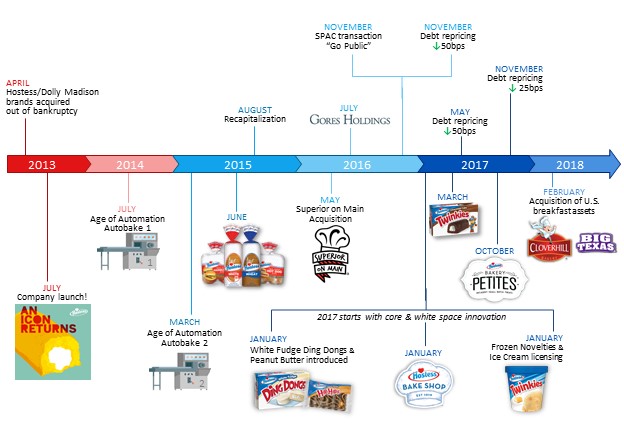

We are a leading United States packaged food company focused on developing, manufacturing, marketing, selling and distributing fresh sweet baked goods coast-to-coast,snack products in North America, providing a wide range of snack cakes, donuts, sweet rolls, breakfast pastries, cookies, snack pies and related products. We acquired the Hostess® brand and certain strategic assets out of the bankruptcy liquidation proceedings of Old HB Inc., its prior owner, free and clear of all past liabilities, in April 2013, and relaunched the brand later that year.

As of December 31, 2017,2020, we operate five bakeriesbaking facilities and three centralizedutilize distribution centers.centers and third-party warehouses to distribute our products. Our direct-to-warehouse (“DTW”)DTW product distribution system allows us to deliver to our customers’ warehouses. Our customers in turn distribute to their retail stores and/or distributors.

We haveThe Company has one reportable segment: Snacking (formerly referred to as Sweet Baked Goods, or “SBG”). The Snacking segment consists of sweet baked goods, cookies, bread and buns and frozen retail products that are sold under the Hostess®, Dolly Madison®, Cloverhill®, Big Texas®, and Voortman® brands. Through August 30, 2019, we operated in two reportable segments: “Sweet Baked Goods”SBG and “In-Store Bakery”In-Store Bakery (“ISB”). A change in the Company’s internal reporting structure during the last quarterThe In-Store Bakery segment consisted of 2017 caused the Company to reassess its reportable segments. Sweet Baked Goods consists of freshSuperior on Main® and frozen sweet baked goods and breadprivate label products sold underthrough the Hostess® and Dolly Madison® brands. In-Store Bakery consists of certain Superior and Hostess® branded eclairs, madeleines, brownies, and iced cookies sold in thein-store bakery section of grocery and club stores. The Company divested its In-Store Bakery segment's operations on August 30, 2019.

Hostess® is the second leading brand by market share within the Sweet Baked Goods (“SBG”("SBG") category, according to Nielsen U.S. total universe. For the 52-week period ended December 30, 201726, 2020 our branded SBG products (which include Hostess®, Dolly Madison®, Cloverhill®, and Big Texas®) market share was 17.2%19.5% per Nielsen’s U.S. SBG category data. We have aOur Voortman® branded products include the #1 leading market positioncreme wafer and sugar-free cookie products within the two largest SBG Segments; Donut Segment and Snack Cake Segment, The Donut and Snack Cake Segments together account for 49% of the Sweet Baked Goods category’s total dollar sales.

larger cookie category.

Principal Components of Operating Results

Net Revenue

We generate revenue primarily through selling sweet baked goods and other productspackaged snacks under the Hostess® group of brands, which includes iconic products such as CupCakes, Twinkies®, CupCakes,Donettes®, Ding Dongs®, Zingers®, HoHos®Danishes, Honey Buns and Donettes®,Coffee Cakes, as well as cookies, wafers and sugar-free products under the Voortman® brand. We also sell products under the Dolly Madison® brand , Cloverhill® and the Superior on Main® brand (e.g., eclairs, madeleines, brownies and iced cookies).Big Texas® brands along with private label products. Our product assortment is sold to customers’ warehouses and distribution centers by the case or in display readydisplay-ready corrugate units. Retailers display and sell our products to the end consumer in single-serve, multi-pack or club-pack formats. We sell our products primarily to supermarket chains, national mass merchandisers and convenience and dollar stores, along with a smaller portion of our product sales going to dollarclub stores, vending, club,drug, and other retail outlets.

Our revenues are driven by average net price and total volume of products sold. Factors that impact unit pricing and sales volume include product mix, the cost of ingredients, the promotional activities, implemented by the Company and its competitors, industry capacity, new product initiatives and quality and consumer preferences. We do not keep a significant backlog of finished goods inventory, as our fresh baked products are promptly shipped to our distribution centers after being produced and then distributed to customers.

Cost of Goods Sold

Cost of goods sold consists of ingredients, packaging, labor, energy, other production costs, warehousing and transportation costs for theincluding in-bound freight, inter-plant transportation and distribution of our products to our customers. The cost of ingredients and packaging represent the majority of our total costs of goods sold. All costs that are incurred at the bakeries, including the depreciation of bakery facilities and equipment, are included in cost of goods sold. We do not allocate any corporate functions into cost of goods sold.

Our cost of ingredients consists principally of flour, sweeteners, edible oils and cocoa,compound coating, which are subject to substantial price fluctuations, as is the cost of paper, corrugate, films and plastics used to package our products. The prices for raw materials are influenced by a number of factors, including the weather, crop production, transportation and processing costs, government regulation and policies and worldwide market supply and demand. We also rely on fuel products, such as natural gas, diesel, propane and electricity, to operate our bakeries and produce our products. Fluctuations in the prices of the

raw materials or fuel products used in the production, packaging or transportation of our products affect the cost of products sold and our product pricing strategy. We utilize forward buying strategies through short-term and long-term advance purchase contracts to lock in prices for certain high-volume raw materials, packaged components and certain fuel inputs. Through these initiatives, we believe we are able to obtain competitive pricing.

Advertising and Marketing

Our advertising and marketing expenses relate to our advertising campaigns, which include social media, print, online advertising, local promotional events and monthly agency fees. We also invest in wire racks and corrugate displays delivered to customers to display our products off shelf, field marketing and merchandising services to reset and check theour store inventory on a regular basisbasis. We also invest in advertising campaigns, which include social media, print, online advertising, local promotional events, monthly agency fees and marketing employmentpayroll costs.

Selling Expense

Selling expenses primarily include sales management, employment, travel, and related expenses, as well as broker fees. We utilize brokers for sales support, including managing promotional activities and order processing.

General and Administrative

General and administrative expenses primarily include employee and related expenses for the accounting, planning, customer service, legal, human resources, corporate operations, research and development, purchasing, logistics and executive functions. Also included are professional service fees related to audit and tax, legal, outsourced information technology functions, transportation planning, headquarters and corporate siteother office sites and insurance costs.costs, as well as the depreciation and amortization of corporate assets.

Related PartyOther Expenses

Related partyOther expenses consistedprimarily include interest paid on our Term loan as well as the change in fair value of the normal annual cash payments associated with our employment arrangements with Mr. Metropoulos as Chief Executive Officer and/or Executive Chairman.

liability-classified public and private placement warrants.

Non-Controlling Interest

During the years ended December 31, 2020 and 2019, Mr. Metropoulos and the Metropoulos Entities hold theirheld equity investment in us primarily through Class B limited partnership units in the Company’s subsidiary, Hostess Holdings (“Class B Units”), and an equal number of shares of the Company’s Class B common stock (“Class B Stock”). Our Class B Stock hashad voting, but no economic rights, while Hostess Holdings’ Class B Units havehad economic, but no voting rights. Each Class B Unit, together with a share of Class B Stock held by the Metropoulos Entities, iswas exchangeable for a share of the Company’s Class A common stock (or at the option of the Company, the cash equivalent thereof). The Company holds 100% of the general partnership interest in Hostess Holdings and, a majoritysince the final exchange described below, all of the limited partnership interests and consolidates Hostess Holdings in the Company’s consolidated financial statements. The interest of the Metropoulos Entities in Hostess Holdings’ Class B Units prior to the final exchange is reflected in our consolidated financial statements as a non-controlling interest.

For periods prior to The Metropoulos Entities have eliminated their ownership through a series of exchanges of shares of Class B Stock and Class B Units for an equal number of Class A shares. As part of the Business Combination, Hostess Holdings consolidatedfinal exchange, we repurchased 0.4 million shares of Class A common stock from the financial position and resultsMetropoulos Entities. The remaining shares were purchased by third parties. At December 31, 2020, there were no outstanding shares of operations of New Hostess Holdco, LLC. The portion of New Hostess Holdco, LLC not owned by Hostess Holdings (which constituted a profits interest plan for management) was recognized as a non-controlling interest in its consolidated financial statements.

Class B common stock.

Factors Impacting Recent Results

COVID-19

Long-term Debt RefinancingThe acute and Interest Rate Risk Management

To managefar-reaching impact of the risk relatedCOVID-19 pandemic and actions taken by governments to contain the spread of the virus have impacted our variable rate debt,operations during the year ended December 31, 2017,2020. As consumers prepared for extended stays at home, we enteredexperienced an increase in consumption during the first and second quarters, particularly in our multi-pack products sold through grocery and mass retailer channels. Conversely, we experienced lower consumption of single-serve products, often consumed away from home. This trend has moderated during the remainder of the year; however, we cannot predict if these trends will sustain or reverse in future periods.

We have established a COVID-19 task force to monitor the rapidly evolving situation and recommend risk mitigation actions as deemed necessary. To date, we have experienced minimal disruption to our supply chain or distribution network, including the supply of our ingredients, and packaging or other sourced materials, though it is possible that more significant disruptions could occur if the COVID-19 pandemic continues to impact markets around the world. We are also working closely with all of our contract manufacturers, distributors and other external business partners. As a food producer, we are an essential service and our production and distribution facilities continue to operate. To protect our employees and ensure continuity of operations, we have implemented additional safety and sanitation measures in all of our facilities. We are monitoring our employees’ health and providing additional resources and protocols to enable effective social distancing and adherence to our stringent internal

food safety guidelines, industry best practices and evolving CDC and other governmental guidelines. Although our corporate headquarters and other offices have remained open with additional safety and sanitation protocols, many non-production and warehouse team members, including sales, marketing and corporate employees, are adhering to social distancing guidelines by working from home and reducing person-to-person contact while supporting our ability to bring products to consumers.

We have adequate liquidity to pay for the costs associated with these additional measures while servicing our on-going operating and capital needs. However, we continue to actively monitor and will take action, as necessary, to preserve adequate liquidity and ensure that our business can continue to operate in this dynamic environment.

On March 27, 2020, the Coronavirus Aid, Relief, and Economic Security (“CARES”) Act was signed into an interest rate swap contract withlaw. The CARES Act provided a counter partysubstantial stimulus and assistance package intended to make a seriesaddress the impact of payments based on a fixed interest ratethe COVID-19 pandemic, including tax relief and government loans, grants and investments. Under the provisions of 1.78%this act, we were able to defer the payment of $5.6 million of 2020 employer payroll taxes until 2021. Apart from this deferral and receive a series of payments basedtheir impact on the greater of LIBOR or 0.75%. Bothgeneral economy, including the fixedlabor market and floating payment streams are basedconsumer demand, neither the CARES Act nor any other government program intended to address COVID-19 had any material impact on a notional amount of $500 million at the inception of the contract and will be reduced by $100 million each year of the five year contract.

On November 20, 2017 and May 19, 2017, our first lien term loan was amended resulting in a decrease of 0.25% and 0.50%, respectively, to the margin applied to our variable rate. The maturity date of August 3, 2022 remained unchanged.

Seasonality

Sweet baked goods revenues tend to be moderately seasonal, with declines during the early winter period, which we believe are attributable to altered consumption patterns during the holiday season. We expect this trend to continue and continue to be applicable to our business. We strive to mitigate the seasonality by running certain targeted promotional campaigns.

Note on Financial Presentation

As a result of the completion of the Business Combination on November 4, 2016, our Consolidated Financial Statements included elsewhere in the Annual Report are presented: (i) as of December 31, 2017 andconsolidated financial statements for the year ended December 31, 2017 (Successor); (ii)2020. We continue to monitor any effects that may result from the CARES Act and other stimulus programs.

Acquisition

On January 3, 2020, we completed the acquisition of all of the shares of the parent company of Voortman Cookies Limited (“Voortman”), a manufacturer of premium, branded wafers and cookies as well as sugar-free products. By adding the Voortman® brand, we believe we have greater growth opportunities provided by a more diverse portfolio of brands and products. Our consolidated statement of operations includes the operation of these assets from January 3, 2020 through December 31, 2020. In December 2020, we asserted claims for indemnification against the sellers under the terms of the Share Purchase Agreement pursuant to which we acquired Voortman for an aggregate of approximately $90 million Canadian Dollar (“CAD”) in damages arising out of alleged breaches by the sellers of certain representations, warranties and covenants contained in such agreement relating to periods prior to the closing of the acquisition. We have also submitted claims relating to these alleged breaches under the representation and warranty insurance policy we purchased in connection with the acquisition. Such insurance policy has a coverage limit of $42.5 million CAD. Although we strongly believe that our claims are meritorious, no assurance can be given as to whether we will recover all, or any part, of the amounts for which we have made such claims. No gains or receivables have been recognized related to these claims as of December 31, 20162020.

Disposition

On August 30, 2019, we sold the In-Store Bakery operations, including relevant trademarks and forlicensing agreements, to an unrelated party. The In-Store Bakery operations provided products that were primarily sold in the period November 4, 2016in-store bakery section of the U.S. retail channels under the Superior on Main® brand or store-branded. We divested the operations to December 31, 2016 (Successor); (iii) forfocus more on future investment in areas of our business that better leverage our core competencies.

Change in Fair Value of Warrant Liabilities

During the period January 1, 2016 to November 3, 2016 (Predecessor); and (iv) for the yearyears ended December 31, 2015 (Predecessor). For comparative purposes, we also present supplemental unaudited pro forma combined Statements of Operations for the year ended December 31, 20162020, 2019 and 2018, there were fluctuations in the table belowmarket price of our publicly traded warrants. These fluctuations created significant gains and losses on the discussion that follows. See “-Supplemental Unaudited Pro Forma Combined Financial Information.”remeasurement of certain warrants which are recognized as liabilities measured at fair value on our consolidated balance sheet. These remeasurements are recognized as “change in fair value of warrant liabilities” within other expenses on our consolidated statement of operations.

Results of Operations

Comparison of Results of Operations for the Year Ended December 31, 2017 (Successor), From November 4, 2016 through December 31, 2016 (Successor), From January 1, 2016 through November 3, 2016 (Predecessor) and the Year Ended December 31, 2015 (Predecessor)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | 2017 | | 2016 | | | | 2015 |

(In thousands, except share and per share data) | Year Ended December 31 | | %

of Net Revenues | | From November 4 through December 31 | | %

of Net Revenues | | | From January 1 through November 3 | | %

of Net Revenues | | Year Ended December 31 | | %

of Net Revenues |

| | (Successor) | | | | (Successor) | | | | | (Predecessor) | | | | (Predecessor) | | |

| Net revenue | $ | 776,188 |

| | 100.0 | % | | $ | 111,998 |

| | 100.0 | % | | | $ | 615,588 |

| | 100.0 | % | | $ | 620,815 |

| | 100.0 | % |

| Cost of goods sold | 449,290 |

| | 57.9 |

| | 73,284 |

| | 65.4 |

| | | 346,864 |

| | 56.3 |

| | 355,963 |

| | 57.3 |

|

| Special employee incentive compensation | — |

| | — |

| | — |

| | — |

| | | 2,195 |

| | 0.4 |

| | 2,649 |

| | 0.4 |

|

| Gross profit | 326,898 |

| | 42.1 |

| | 38,714 |

| | 34.6 |

| | | 266,529 |

| | 43.3 |

| | 262,203 |

| | 42.2 |

|

| Operating costs and expenses: | | | | | | | — |

| | | | | — |

| | | | — |

|

| Advertising and marketing | 33,004 |

| | 4.3 |

| | 5,245 |

| | 4.7 |

| | | 30,626 |

| | 5.0 |

| | 31,967 |

| | 5.1 |

|

| Selling expense | 32,086 |

| | 4.1 |

| | 5,033 |

| | 4.5 |

| | | 25,730 |

| | 4.2 |

| | 29,484 |

| | 4.7 |

|

| General and administrative | 52,943 |

| | 6.8 |

| | 7,322 |

| | 6.5 |

| | | 38,391 |

| | 6.2 |

| | 31,531 |

| | 5.1 |

|

| Special employee incentive compensation | — |

| | — |

| | — |

| | — |

| | | 2,503 |

| | 0.4 |

| | 1,274 |

| | 0.2 |

|

| Amortization of customer relationships | 23,855 |

| | 3.1 |

| | 3,922 |

| | 3.5 |

| | | 1,185 |

| | 0.2 |

| | 851 |

| | 0.1 |

|

| Impairment on property and equipment | 1,003 |

| | 0.1 |

| | — |

| | — |

| | | 7,300 |

| | 1.2 |

| | 2,700 |

| | 0.4 |

|

| Loss on sale/abandonment of property and equipment, and bakery shutdown costs (recoveries) | (144 | ) | | — |

| | — |

| | — |

| | | 2,551 |

| | 0.4 |

| | 4,182 |

| | 0.7 |

|

| Business combination transaction costs | — |

| | — |

| | — |

| | — |

| | | 31,832 |

| | 5.2 |

| | — |

| | — |

|

| Related party expenses | 381 |

| | — |

| | 26,799 |

| | 23.9 |

| | | 3,539 |

| | 0.6 |

| | 4,306 |

| | 0.7 |

|

| Tax receivable agreement liability remeasurement | (50,222 | ) | | (6.5 | ) | | — |

| | — |

| | | — |

| | — |

| | — |

| | — |

|

| Total operating costs and expenses | 92,906 |

| | 12.0 |

| | 48,321 |

| | 43.1 |

| | | 143,657 |

| | 23.3 |

| | 106,295 |

| | 17.1 |

|

| Operating income | 233,992 |

| | 30.1 |

| | (9,607 | ) | | (8.6 | ) | | | 122,872 |

| | 20.0 |

| | 155,908 |

| | 25.1 |

|

| Other expense: | | | | | | | — |

| | | | |

|

| | | |

|

|

| Interest expense, net | 39,174 |

| | 5.0 |

| | 6,649 |

| | 5.9 |

| | | 60,384 |

| | 9.8 |

| | 50,011 |

| | 8.1 |

|

| Loss (gain) on modification of debt | 2,554 |

| | 0.3 |

| | (763 | ) | | (0.7 | ) | | | — |

| | — |

| | 25,880 |

| | 4.2 |

|

| Other expense (income) | 1,360 |

| | 0.2 |

| | 754 |

| | 0.7 |

| | | 1,624 |

| | 0.3 |

| | (8,743 | ) | | (1.4 | ) |

| Total other expense | 43,088 |

| | 5.6 |

| | 6,640 |

| | 5.9 |

| | | 62,008 |

| | 10.1 |

| | 67,148 |

| | 10.8 |

|

| Income before income taxes | 190,904 |

| | 24.6 |

| | (16,247 | ) | | (14.5 | ) | | | 60,864 |

| | 9.9 |

| | 88,760 |

| | 14.3 |

|

| Income tax expense (benefit) | (67,204 | ) | | (8.7 | ) | | (7,762 | ) | | (6.9 | ) | | | 439 |

| | 0.1 |

| | — |

| | — |

|

| Net income (loss) | 258,108 |

| | 33.3 |

| | (8,485 | ) | | (7.6 | ) | | | 60,425 |

| | 9.8 |

| | 88,760 |

| | 14.3 |

|

| Less: Net income attributable to the non-controlling interest | 34,211 |

| | 4.4 |

| | (4,081 | ) | | (3.6 | ) | | | 3,214 |

| | 0.5 |

| | — |

| | — |

|

| Net income attributable to Class A shareholders | $ | 223,897 |

| | 28.8 | % | | $ | (4,404 | ) | | (3.9 | )% | | | $ | 57,211 |

| | 9.3 | % | | $ | 88,760 |

| | 14.3 | % |

| | | | | | | | | | | | | | | | | |

| Earnings per Class A share: | | | | | | | | | | | | | | | | |

| Basic | $ | 2.26 |

| | | | $ | (0.05 | ) | | | | | | | | | | | |

| Diluted | $ | 2.13 |

| | | | $ | (0.05 | ) | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Weighted-average shares outstanding: | | | | | | | | | | | | | | | | |

| Basic | 99,109,629 |

| | | | 97,791,658 |

| | | | | | | | | | | |

| Diluted | 105,307,293 |

| | | | 97,791,658 |

| | | | | | | | | | | |

As discussed above, the financial information presented herein for periods prior to the completion of the Business Combination is of our accounting Predecessor, Hostess Holdings, and, for periods from and after the Business Combination, is of Hostess Brands, Inc.

The financial information for the year ended December 31, 2016 is divided into Predecessor and Successor periods and is not comparable to the full year ended December 31, 2017 (Successor) and the full year ended December 31, 2015 (Predecessor). Accordingly, such periods are presented on a historical stand-alone basis without comparison. In addition, we have presented comparative results of operations for the year ended December 31, 2017 (Successor) compared to the pro forma combined year ended December 31, 2016 and of such pro forma combined year ended December 31, 2016 compared to the year ended December 31, 2015 (Predecessor).

| | | | | | | | | | | | | | | | | |

| (As Restated) |

(In thousands, except per share data) | Year Ended

December 31,

2020 | | Year Ended

December 31,

2019 | | Year Ended

December 31,

2018 |

| Net revenue | $ | 1,016,609 | | | $ | 907,675 | | | $ | 850,389 | |

| | | | | |

| | | | | |

| Gross profit | 355,639 | | | 299,834 | | | 267,277 | |

| As a % of net revenue | 35.0 | % | | 33.0 | % | | 31.4 | % |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Operating costs and expenses | $ | 220,329 | | | $ | 163,738 | | | $ | 145,719 | |

| Operating income | 135,310 | | | 136,096 | | | 121,558 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Other (income) expense | 6,608 | | | 100,455 | | | (51,978) | |

| | | | | |

| Income tax expense | 20,405 | | | 16,892 | | | 12,954 | |

| Net income | 108,297 | | | 18,749 | | | 160,582 | |

| | | | | |

| Net income attributable to Class A shareholders | 104,676 | | | 4,299 | | | 142,051 | |

| | | | | |

| Earnings per Class A share: | | | | | |

| Basic | 0.84 | | | 0.04 | | | 1.42 | |

| Diluted | 0.51 | | | 0.04 | | | 0.61 | |

| | | | | |

Results for the Year Ended December 31, 2017 (Successor)2020 Compared to Results for the Year Ended December 31, 2019

Net Revenue Cost of Goods Sold and Gross Profit

Net revenue was $776.2 million for the year ended December 31, 2017 (Successor), with cost of goods sold of $449.3 million and gross profit of $326.92020 increased $108.9 million, or 42.1% as a percentage12.0%, compared to the year ended December 31, 2019. Excluding In-Store Bakery, net revenue increased $137.6 million or 15.7%. The acquisition of Voortman contributed $96.2 million of net revenue. The remaining increase was attributed to higher volume of Hostess® branded multi-pack and bagged-donut products due to strong demand partially offset by lower sales of private label and non-Hostess® branded products. From a sales channel perspective, strong growth in the grocery, convenience and dollar channels was offset by lower sales in the mass channel.

NetGross Profit

Gross profit was 35.0% of net revenue for the Sweet Baked Goods segment was $733.8 million for the year ended December 31, 2017 (Successor), with2020, an increase of 195 basis points from a gross profitmargin of $316.9 million, or 43.2% of net revenue, while net revenue for the In-Store Bakery segment was $42.4 million33.0% for the year ended December 31, 2017, with gross profit of $10.0 million, or 23.6% of net revenue.2019. The increase resulted primarily from the accretion from Voortman and efficiencies from higher sales volume as well as lower promotional activity. These benefits were partially offset by higher operating costs due to COVID-19.

Operating Costs and Expenses

AdvertisingOperating costs and Marketing, Selling Expense, and General and Administrative

For the year ended December 31, 2017, advertising and marketing expenses were $33.0 million, selling expenses were $32.1 million, while general and administrative expenses were $52.9 million.

Amortization of Customer Relationships

Amortization of customer relationships was $23.9 million for the year ended December 31, 2017.

Impairment, Loss on Sale/Abandonment of Property and Equipment, and Bakery Shutdown Costs

During2020 increased by 34.6% from the year ended December 31, 2017, we idled2019. These costs increased primarily due to transition costs incurred to shift Voortman from a production line in our Columbus, Georgia facility and transitioned the productiondirect-to-store delivery operating model to a third party. We recognizeddirect-to-warehouse model including contract termination costs for the independent distributors and severance costs, as well as normal costs of Voortman's continuing operations. 2020 operating costs also increased due to higher employee incentive compensation and an impairment losscharge related to the planned disposition of $1.0 million.

Related Party Expenses

Related party expenses were $0.4production equipment. 2019 operating costs reflect a $7.1 million forgain on the year ended December 31, 2017. These expenses represent payments madevaluation of a foreign currency contract originated to Mr. Metropoulos underhedge the termsJanuary 2020 purchase of his employment arrangements.

Tax Receivable Agreement Liability Remeasurement

For the year ended December 31, 2017, we adjusted the value of the Tax Receivable Agreement due to a lower projected future cash tax savings rate as a result of the Tax Cuts and Jobs Act. This adjustment resultedVoortman in a gain of $51.8 million. A similar adjustment was made due to a change in a state tax law and resulted in a loss of $1.6 million.Canadian dollars.

Operating Income

Operating income for the year ended December 31, 20172020 was $234.0 million.

Interest Expense, net

Our interest expense was $39.2$135.3 million compared to $136.1 million for the year ended December 31, 2017.2019. The additional profits from Voortman's operations and higher Hostess® branded sales volume were offset by transition costs to shift Voortman to a warehouse model and lapping the prior year gain on remeasurement of the foreign currency contract.

LossOther Expense

For the years ended December 31, 2020 and 2019, interest expense related to our term loan was $41.8 million and $43.3 million, respectively. Also during the years ended December 31, 2020 and 2019 we recognized a $39.9 million gain and a $58.8 million loss, respectively, on Modificationthe fair value remeasurement of debt

our liability-classified public and private placement warrants. During the year ended December 31, 2017,2020 we expensed $1.6 million of previously capitalized debt financing charges for a total loss of $2.6 million. The remaining loss of $1.0 million wasalso recognized unrealized losses related to the May and November 2017 repricing transactions. See Note 1- “Summaryremeasurement of Significant Accounting Policies” to the consolidated financial statements included in Part II, Item 8 of this Annual Report on Form 10-K.certain CAD denominated liabilities.

Income Taxes

The incomeOur effective tax benefit of $67.2 millionrate was 15.9% for the year ended December 31, 2017 includes a benefit of approximately $111.3 million due2020 compared to a revaluation of our deferred tax liability to reflect lower future U.S. corporate income tax rates caused by the Tax Cuts and Jobs Act. The tax provision also includes a $1.7 million expense caused by a change in state tax rates. The remaining tax expense of $42.4 million represents an effective tax rate of 30.1%, giving effect to the non-controlling interest, a partnership47.4% for income tax purposes and excluding the impact of the remeasurement of the tax receivable agreement.

Net Income

For the year ended December 31, 2017,2019. The decrease in the Company hadeffective tax rate was due to the remeasurement of fair value of warrants, which significantly impacts our pre-tax net income, of $258.1 million.

Earnings Per Share

Forbut is not taxed as the year ended December 31, 2017, earnings per class A share was $2.26 (basic) and $2.13 (dilutive).

Resultswarrants are considered equity for the Successor period November 4, 2016 through December 31, 2016 and Predecessor period January 1, 2016 through November 3, 2016

Net Revenue

Net revenues in the Successor period from November 4, 2016 through December 31, 2016 were $112.0 million, compared to $615.6 million for the Predecessor period from January 1, 2016 through November 3, 2016. During the Predecessor period, we acquired Superior on May 10, 2016 and reported net revenues of $19.9 million from Superior from the date of acquisition through November 3, 2016. During the Successor period, the net revenues for Superior were $6.8 million.

Cost of Goods Sold

In the Successor period, as a result of the Business Combination, we recorded a one-time inventory fair value step-up of $8.9 million that was charged to cost of goods sold.tax purposes. Excluding the impact of the inventory fair value step-up, cost of goods soldwarrant remeasurement for both the years ended December 31, 2020 and 2019, our effective tax rates were 23.0% and 17.9%, respectively. The increase in the Successor period would have been 57.5% of net revenues.

Special Employee Incentive Compensation

Foreffective tax rate (excluding the Predecessor period January 1, 2016 through November 3, 2016, we made a special bonus payment to certain employees at our bakery facilities as compensation for their efforts in connection with the Business Combination. Payment of $2.2 million of this special bonuswarrant remeasurements) was recorded as a separate line item reducing gross profit.

Gross Profit

For the Predecessor period January 1, 2016 through November 3, 2016, gross profit, including the effect of the special employee incentive compensation discussed above, was $266.5 million, or 43.3% of net revenue. Excluding this item, gross profit would have been $268.7 million, or 43.7% of net revenue.

For the Successor period November 4, 2016 through December 31, 2016, gross profit was $38.7 million, or 34.6% of net revenue. Excluding the impact of the inventory fair value step up discussed above, adjusted gross margin for the Successor period was 42.5% of net revenue. Adjusted gross margin for the Successor period compared to the gross margin for the Predecessor period declined slightly due to overall changes in mix of products sold.

Operating Costs and Expenses

Advertising and Marketing

For the Predecessor period January 1, 2016 through November 4, 2016, advertising and marketing expenses were $30.6 million, or 5.0% of net revenue.

For the Successor period November 4, 2016 through December 31, 2016, advertising and marketing expenses were $5.2 million, or 4.7% in net

revenue.

Advertising and marketing expenses as a percentage of net revenue were lower in the Successor period primarily due to higher field marketing costs in the Predecessor Period.

Selling Expense

For the Predecessor period January 1, 2016 through November 4, 2016, selling expenses were $25.7 million, or 4.2% of net revenue.

For the Successor period November 4, 2016 through December 31, 2016, selling expenses were $5.0 million, or 4.5% in net revenue.

General and Administrative

For the Predecessor period January 1, 2016 through November 4, 2016, general and administrative expenses were $38.4 million, or 6.2%, of net revenue.

For the Successor period November 4, 2016 through December 31, 2016, general and administrative expenses were $7.3 million, or 6.5% of net revenue.

Special Employee Incentive Compensation

For the Predecessor period January 1, 2016 through November 3, 2016, we paid a special bonus payment of $2.5 million to certain corporate

employees as compensation for their efforts in connection with the Business Combination. This payment to corporate employees was recorded under operating costs and expenses.

Amortization of Customer Relationships

For the Predecessor period January 1, 2016 through November 3, 2016, amortization of customer relationships was $1.2 million, or 0.2% of net revenue.

For the Successor period November 4, 2016 through December 31, 2016, amortization of customer relationships was $3.9 million, or 3.5% of net revenue.

Amortization of customer relationships in the Successor period was significantly higher than in the Predecessor period primarily due to the higher fair value measurement at November 4, 2016Class B for Class A share exchanges during 2019 and 2020. Subsequent to these exchanges, more income from Hostess Holdings, L.P was allocated to Hostess Brands, Inc. This increase was partially offset by state tax credits generated in 2020.

Net Income

For the year ended December 31, 2020, net income was $108.3 million compared to $18.7 million for the year ended December 31, 2019. Excluding the $39.9 million gain and $58.8 million loss on remeasurement of warrant liabilities for the years ended December 31, 2020 and 2019, respectively, net income increased as a result of the Business Combination comparedhigher gross margin due to the overall fair valueaccretion of Voortman and the customer relationships in the Predecessor period. There were no significant changes in the naturebenefit of the customer relationships, including overall useful lives in the comparative periods.

Impairment of Property and Equipment

For the Predecessor period January 1, 2016 through November 3, 2016, impairment of property and equipment was $7.3 million, or 1.2% of net revenue. During the Predecessor period, we closed multiple production lines at our Indianapolis, Indiana bakery, and transitioned production to other facilities.

There were no such impairments in the Successor period November 4, 2016 through December 31, 2016.

Loss on Sale/Abandonment of Property and Equipment and Bakery Shutdown Costs

For the Predecessor period January 1, 2016 through November 3, 2016, we recorded a charge for loss on sale/abandonment of property and bakery shutdown costs of $2.6 million, or 0.4% of net revenue, primarily due to utilities, insurance, taxes and maintenance expenses related to the Schiller Park, Illinois bakery.

For the Successor period November 4, 2016 through December 31, 2016, there were no such charges.

Business Combination Transaction Costs

For the Predecessor period January 1, 2016 through November 3, 2016, business combination transaction costs were $31.8 million, or 5.2% of net revenue. This consisted of professional and legal costs associated with the Business Combination, and transactional costs attributable to the acquisition of Superior in May 2016.

For the Successor period November 4, 2016 through December 31, 2016, there were no such charges.

Related Party Expenses

For the Predecessor period January 1, 2016 through November 3, 2016, related party expenses were $3.5 million, or 0.6% of net revenue. These amounts represent the normal annual cash payments associated with our employment arrangements with Mr. Metropoulos as Chief Executive Officer and/or Executive Chairman.

For the Successor period November 4, 2016 through December 31, 2016, the Company expensed $26.8 million, or 23.9% of net revenue, as a result of a grant of stock awarded to Mr. Metropoulos as required under his new employment arrangements.

Operating Income (Loss)

For the Predecessor period January 1, 2016 through November 3, 2016, total operating costs and expenses were $143.7 million, or 23.3% of net revenue, and operating income was $122.9 million, or 20.0% of net revenue.

For the Successor period November 4, 2016 through December 31, 2016, total operating costs and expenses were $48.3 million, or 43.1% of net revenue, and operating loss was $9.6 million or 8.6% of net revenue.

Operating loss for the Successor period was significantly impacted by the related party expense discussed above.

Interest Expense, net

For the Predecessor period January 1, 2016 through November 3, 2016, interest expense, net was $60.4 million, or 9.8% of net revenue. For the Successor period November 4, 2016 through December 31, 2016, interest expense, net was $6.6 million, or 5.9% of net revenue.

The lower interest expense in the Successor period is a result of the reduced applicable interest rates following the debt refinancing discussed below.

Gain on Debt Extinguishment

For the Successor period November 4, 2016 through December 31, 2016, in connection with the refinancing of existing debt with the new first lien term loan we recorded a net gain on a partial extinguishment of debt in the amount of $0.8 million. The gain consisted of the write-off of approximately $4.0 million of debt premium and deferred financing costs,higher Hostess® branded sales volume partially offset by prepayment penalties of $3.0costs incurred to transition Voortman DSD to warehouse distribution. In 2020, we also lapped the $7.1 million foreign currency contract remeasurement gain in 2019.

Earnings Per Share

Our earnings per Class A share was $0.84 (basic) and $0.51 (dilutive) for the write-off of deferred financing costs of $0.2 million.

Other Expense

For the Predecessor period January 1, 2016 through November 3, 2016, other expense was $1.6 million, or 0.3% of net revenue. This consisted of professional and transactional costs for acquisition activity which has since been abandoned, partially offset by a gain from the settlement in connection with product recall matter with one of our suppliers of approximately $0.8 million.

For the Successor period November 4, 2016 through year ended December 31, 2016, other expense was $0.8 million, or 0.7% of net revenue.

Income (Loss) Before Income Taxes

For2020, compared to $0.04 (basic) and $0.04 (dilutive) for the Predecessor period January 1, 2016 through November 3, 2016, income before income taxes was $60.9 million, or 9.9% of net revenue.

For the Successor period November 4, 2016 through year ended December 31, 2016, loss before income taxes2019. The increase in basic and diluted earnings per share was $16.2 million or 14.5% of net revenue.

Income Tax Expense

For the Predecessor period January 1, 2016 through November 3, 2016, the Company was a series of limited liability companies and, therefore, had no tax expense or benefit, except insignificant amounts for Superior, a C corporation.

For the Successor period November 4, 2016 through December 31, 2016, income tax benefit was $7.8 million or 6.9% of net revenue. This represented an effective tax rate of 47.8% which exceeds the statutory rates primarily due to the reversal of a previously recorded valuation allowance.net income impacts noted above.

Results for the Year Ended December 31, 2015 (Predecessor)

Net Revenue, Gross Profit and Cost of Goods Sold

Net revenue was $620.8 million for the year ended December 31, 2015, with cost of goods sold of $356.0 million, and gross profit of $264.9 million, excluding the impact of a $2.6 million special employee incentive compensation payment. Cost of goods sold was impacted by higher ingredient costs due2019 Compared to an outbreak of avian influenza which led to reduced availability of eggs, which increased egg ingredient prices to record high levels.

Special Employee Incentive Compensation

For the year ended December 31, 2015, a special bonus payment was paid to employees at our bakery facilities as compensation for their efforts in the recapitalization of our Company of which $2.6 million was recorded on a separate line in our Consolidated Statements of Operations as a deduction from gross profit.

Operating Costs and Expenses

Advertising and Marketing

Advertising and marketing expenses were $32.0 million, selling expenses were $29.5 million, and general and administrative expenses were $31.5 million for the year ended December 31, 2015.

Special Employee Incentive Compensation

For the year ended December 31, 2015, a special bonus payment of $1.3 million was paid to corporate employees as compensation for their efforts in the recapitalization of the Company.

Amortization of Customer Relationships

Amortization of customer relationships was $0.9 million for the year ended December 31, 2015.

Loss on Sale/Abandonment of Property and Equipment and Bakery Shutdown Costs

For the year ended December 31, 2015, we incurred a loss on sale/abandonment of property and equipment and bakery shutdown costs of $4.2 million.

Related Party Expenses

Related party expenses were $4.3 million for the year ended December 31, 2015. Mr. Metropoulos serves as our Executive Chairman and expenses associated with his employment agreements are recorded in related party expenses.

Operating Income (Loss)

For the year ended December 31, 2015, total operating costs and expenses were $106.3 million. Operating income was $155.9 million for the year ended December 31, 2015.

Interest Expense, net

Interest expense for the year ended December 31, 2015 was 50.0 million.

Loss on Debt Extinguishment

We extinguished the Term Loan dated April 9, 2013 (the “2013 Term Loan”) through early principal payments of $343.8 million and $150.0 million on August 3, 2015 and June 4, 2015, respectively. As part of this debt extinguishment and in accordance with its contractual terms, we expensed 2% prepayment penalties of $9.9 million, as well as $16.0 million of amortization to write-off the remaining deferred financing costs. For the year ended December 31, 2015, the total loss on debt extinguishment was $25.9 million.

Other Income

For the year ended December 31, 2015, other income consisted of $12.0 million of proceeds from the sale of foreign trademark rights and certain “know how” in certain countries in the Middle East, partially offset by $3.3 million for professional service fees related to the pursuit of potential sale transactions.

Income Taxes

For the year ended December 31, 2015, the Company was a series of limited partnerships and, therefore, had no income tax expense or benefit.

Supplemental Unaudited Pro Forma Combined Financial Information

For comparative purposes, we are presenting a supplemental unaudited pro forma combined statement of operations for the year ended December 31, 2016, and we discuss such pro forma combined results compared to the Successor’s full year 2017, and the Predecessor’s full year 2015 results below.

The unaudited pro forma combined statements of operations for the year ended December 31, 2016 presents our consolidated results of operations giving pro forma effect to the Business Combination as if it had occurred as of January 1, 2016. The pro forma combined adjustments are based on available information and upon assumptions that our management believes are reasonable in order to reflect, on a pro forma combined basis, the impact of these transactions on the historical financial information of our Predecessor and Successor entities, as applicable.

The Business Combination was accounted for using the acquisition method of accounting. The final fair values of the acquired assets and assumed liabilities as of the Closing Date, which are based on the consideration paid and our estimates and assumptions, are reflected herein. As explained in more detail in Note 2 in the accompanying Notes to the Consolidated Financial Statements, the total purchase price to acquire Hostess Holdings has been allocated to the assets acquired and assumed liabilities of Hostess Holdings, based upon the fair values at the Closing Date. We utilized third-party valuation specialists to assist our management in determining the fair values of the acquired assets and liabilities assumed. As of November 3, 2017, management determined that the allocation of the purchase price for the Business Combination is final.

The unaudited pro forma combined financial information contains a variety of adjustments, assumptions and estimates, is subject to numerous other uncertainties and the assumptions and adjustments as described in the accompanying notes hereto and should not be relied upon as being indicative of our results of operations had the Business Combination occurred on January 1, 2016. The unaudited pro forma combined financial information also does not project our results of operations for any future period or date. The unaudited pro forma combined financial information for the year ended December 31, 2016 includes results of the Superior acquisition and its related operations from May 10, 2016, the date of acquisition, through December 31, 2016. We evaluated the impact of the Superior acquisition on the Company’s financial statements and concluded that the impact was not significant and did not require nor separately warrant the inclusion of pro forma combined financial results assuming the acquisition of Superior at January 1, 2016 under applicable SEC rules and regulations or under GAAP. In addition, we evaluated the impact of the refinancing of existing debt pursuant to the New First Lien Term Loan, completed on November 18, 2016, and concluded that the impact was not significant and did not require nor separately warrant the inclusion of pro forma combined financial results assuming the completion of the refinancing on January 1, 2016. The pro forma combined adjustments give effect to the items identified in the pro forma combined table below in connection with the Business Combination.

Results of Operations

Comparison of Results of Operations for the Year Ended December 31, 2017 (Successor), Unaudited Pro Forma Combined Year Ended December 31, 2016, and the Year Ended December 31, 2015 (Predecessor)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Historical(i) | | | | | | | | |

| | 2017 | | 2016 | | | | 2016 | | | | 2015 |

(In thousands, except share and per share data) | Year Ended December 31 | | From November 4 through December 31 | | | From January 1 through November 3 | | Pro Forma Adjustments | | (Unaudited) Year Ended December 31 | | % of Net Revenues | | Year Ended December 31 |

| | (Successor) | | (Successor) | | | (Predecessor) | | | | Pro Forma

Combined | | | | (Predecessor) |

| Net revenue | $ | 776,188 |

| | $ | 111,998 |

| | | $ | 615,588 |

| | $ | — |

| | $ | 727,586 |

| | 100.0 | % | | 620,815 |

|

| Cost of goods sold | 449,290 |

| | 73,284 |

| | | 346,864 |

| | (8,541 | ) | ii | 411,607 |

| | 56.6 |

| | 355,963 |

|

| Special employee incentive compensation | — |

| | — |

| | | 2,195 |

| | (2,195 | ) | iii | — |

| | — |

| | 2,649 |

|

| Gross profit | 326,898 |

| | 38,714 |

| | | 266,529 |

| | 10,736 |

| | 315,979 |

| | 43.4 |

| | 262,203 |

|

| Operating costs and expenses: | | | | | | | | | | | | — |

| | |

| Advertising and marketing | 33,004 |

| | 5,245 |

| | | 30,626 |

| | — |

| | 35,871 |

| | 4.9 |

| | 31,967 |

|

| Selling expense | 32,086 |

| | 5,033 |

| | | 25,730 |

| | — |

| | 30,763 |

| | 4.2 |

| | 29,484 |

|

| General and administrative | 52,943 |

| | 7,322 |

| | | 38,391 |

| | (3,902 | ) | iv | 41,811 |

| | 5.7 |

| | 31,531 |

|

| Special employee incentive compensation | — |

| | — |

| | | 2,503 |

| | (2,503 | ) | iii | — |

| | — |

| | 1,274 |

|

| Amortization of customer relationships | 23,855 |

| | 3,922 |

| | | 1,185 |

| | 20,050 |

| v | 25,157 |

| | 3.5 |

| | 851 |

|

| Impairment on property and equipment | 1,003 |

| | — |

| | | 7,300 |

| | — |

| | 7,300 |

| | 1.0 |

| | 2,700 |

|

| Loss on sale/abandonment of property and equipment, and bakery shutdown costs (recoveries) | (144 | ) | | — |

| | | 2,551 |

| | — |

| | 2,551 |

| | 0.4 |

| | 4,182 |

|

| Business combination transaction costs | — |

| | — |

| | | 31,832 |

| | (31,257 | ) | vi | 575 |

| | 0.1 |

| | — |

|

| Related party expenses | 381 |

| | 26,799 |

| | | 3,539 |

| | (26,747 | ) | vii | 3,591 |

| | 0.5 |

| | 4,306 |

|

| Tax receivable agreement liability remeasurement | (50,222 | ) | | — |

| | | — |

| | — |

| | — |

| | — |

| | — |

|

| Total operating costs and expenses | 92,906 |

| | 48,321 |

| | | 143,657 |

| | (44,359 | ) | | 147,619 |

| | 20.3 |

| | 106,295 |

|

| Operating income | 233,992 |

| | (9,607 | ) | | | 122,872 |

| | 55,095 |

| | 168,360 |

| | 23.1 |

| | 155,908 |

|

| Other expense: | | | | | | | | | | | | — |

| | |

| Interest expense, net | 39,174 |

| | 6,649 |

| | | 60,384 |

| | (15,592 | ) | viii | 51,441 |

| | 7.1 |

| | 50,011 |

|

| Loss (gain) on modification of debt | 2,554 |

| | (763 | ) | | | — |

| | — |

| | (763 | ) | | (0.1 | ) | | 25,880 |

|

| Other expense | 1,360 |

| | 754 |

| | | 1,624 |

| | — |

| | 2,378 |

| | 0.3 |

| | (8,743 | ) |

| Total other expense | 43,088 |

| | 6,640 |

| | | 62,008 |

| | (15,592 | ) | | 53,056 |

| | 7.3 |

| | 67,148 |

|

| Income before income taxes | 190,904 |

| | (16,247 | ) | | | 60,864 |

| | 70,687 |

| | 115,304 |

| | 15.8 |

| | 88,760 |

|

| Income tax expense (benefit) | (67,204 | ) | | (7,762 | ) | | | 439 |

| | 40,185 |

| ix | 32,862 |

| | 4.5 |

| | — |

|

| Net income (loss) | 258,108 |

| | (8,485 | ) | | | 60,425 |

| | 30,502 |

| | 82,442 |

| | 11.3 |

| | 88,760 |

|

| Less: Net income attributable to the non-controlling interest | 34,211 |

| | (4,081 | ) | | | 3,214 |

| | 29,565 |

| x | 28,698 |

| | 3.9 |

| | 4,507 |

|

| Net income attributable to Class A shareholders | $ | 223,897 |

| | $ | (4,404 | ) | | | $ | 57,211 |

| | $ | 937 |

| | $ | 53,744 |

| | 7.4 | % | | $ | 84,253 |

|

| | | | | | | | | | | | | | | |

| Earnings per Class A share: | | | | | | | | | | | | | | |

| Basic | $ | 2.26 |

| | $ | (0.05 | ) | | | | | | | $ | 0.55 |

| | | | |

| Diluted | $ | 2.13 |

| | $ | (0.05 | ) | | | | | | | $ | 0.54 |

| | | | |

| | | | | | | | | | | | | | | |

| Weighted-average shares outstanding: | | | | | | | | | | | | | | |

| Basic | 99,109,629 |

| | 97,791,658 |

| | | | | (180,000 | ) | xi | 97,611,658 |

| | | | |

| Diluted | 105,307,293 |

| | 97,791,658 |

| | | | | 2,393,000 |

| xii | 100,184,658 |

| | | | |

| |

i. | The amounts in these columns represent the Successor’s and Predecessor’s historical results of operations for the periods reflected. |

| |

ii. | Approximately $8.9 million of this adjustment reflects the non-cash impact of the remeasurement of inventory at fair value as a result of the Business Combination. In addition, the adjustment reflects the incremental depreciation expense associated with the allocation of purchase price to property and equipment and is recorded in cost of goods sold. |

| |

iii. | For cost of goods sold, this adjustment represents special payments we made to certain employees at our bakery facilities of $2.2 million and for the operating costs this adjustment represents special payments to corporate employees of $2.5 million as compensation for their efforts in connection with the Business Combination. |

| |

iv. | Represents compensation for management profits interest plan of approximately $3.9 million that was recognized as part of the Business Combination. See Note 3 to the Consolidated Financial Statements for additional information. |

| |

v. | Represents additional amortization expense associated with the fair value recognized for customer relationships in connection with the Business Combination. |

| |

vi. | This adjustment consists primarily of legal and professional fees, and other costs associated with the Business Combination. |

| |

vii. | Represents non-cash expenses incurred by Successor for stock awarded to Mr. Metropoulos as required under his new employment arrangements. |

| |

viii. | Represents the reduction in interest expense due to the repayment of a portion of Hostess Holdings debt as part of the Business Combination. |

| |

ix. | Represents the effective income tax rate of 28.5% for the Successor, giving effect to the non-controlling interest, and not giving effect to the adjustment made to the valuation allowance on the Company’s historical deferred tax assets. |

| |

x. | Represents the elimination of historical income attributable to the non-controlling interest and attributes a portion of the pro forma income to the non-controlling interest created in the Business Combination. Income is allocated to the non-controlling interest based on its pro rata share of the total equity of Hostess Holdings. |

| |

xi. | This adjustment annualized the basic weighted average number of Class A shares outstanding. |

| |

xii. | This adjustment includes the dilutive impact of the outstanding warrants that are considered anti-dilutive on a historical basis. |

Results for the Year Ended December 31, 2017 compared to the Pro Forma Combined Year Ended December 31, 20162018

Net Revenue

Net revenue was $776.2 million for the year ended December 31, 2017, compared to $727.6 million for the pro forma combined year ended December 31, 2016, an increase of 6.7%, or $48.6 million. Growth in net revenue for the year ended December 31, 2017 from current year new product initiatives was $62.52019 increased $57.3 million, led by Chocolate Cake Twinkies®or 6.7%, Golden Cupcakes, White Fudge Ding Dongs®, and Peanut Butter HoHo’s®. Additionally, there was an $11.9 million increase in net sales attributedcompared to the acquisition of Superior in May 2016. These increases were offset primarily by a decrease in net revenue from 2016 product innovations and discontinued items.

Cost of Goods Sold and Gross Profit

Cost of goods sold for the year ended December 31, 20172018. Excluding the impact of $449.3 million represents an increase of $37.7the In-Store Bakery disposition in 2019, net revenue increased $72.0 million, or 9.2%, from the pro forma combined cost of goods sold of $411.6 million for the year ended December 31, 20168.6%. The increase for the year ended December 31, 2017 from the pro forma combined year ended December 31, 2016 is primarilyin net revenue was attributed to higher shipping costsvolume growth in our core products across multiple customer channels, the introduction of our breakfast innovation products, including Danishes and increased sales volume.Cinnamon Rolls, and the impact of pricing actions implemented in the fourth quarter of 2018.

Gross Profit

Gross profit was $326.9 million for the year ended December 31, 2017, an increase of $10.9 million, or 3.5%, compared to pro forma gross profit of $316.0 million for the year ended December 31, 2016. The increase for the year ended December 31, 2017 from pro forma combined year ended December 31, 2016 was primarily attributed to an increase in sales.

Gross margin was 42.1% for the year ended December 31, 2017, compared to gross margin of 43.4% for the pro forma combined year ended December 31, 2016 . The decrease in margin for the year ended December 31, 2017 from pro forma combined gross margin for the year ended December 31, 2016 was primarily due to higher shipping costs which caused a 70 basis point decrease in gross margin. The decrease in margin was also attributed to a shift in our product mix due to higher growth in multi-pack, club-pack than other pack types, and additional In-Store Bakery sales.

Gross profit for the Sweet Baked Goods segment for the year ended December 31, 2017 was $316.9 million or 43.2% of net revenue, compared to gross profit of $309.8 million, or 44.2% of net revenue, for the pro forma combined year ended December 31, 2016. Gross margin decreased 120 basis points due to higher shipping costs. Gross margin was also affected by a shift in product mix due to higher growth in multi-pack sales than other pack types.

Gross profit for the In-Store Bakery segment for the year ended December 31, 2017 was $10.0 million, or 23.6% of net revenue, compared to pro forma combined gross profit of $6.1 million, or 23.0%33.0% of net revenue for the year ended December 31, 2016.2019, an increase of 160 basis points from a gross margin of 31.4% for the year ended December 31, 2018. Gross profit increased primarily due to increased revenue.in 2019 benefited from pricing actions, higher sales volume and bakery savings initiatives executed across all bakeries, particularly in our Chicago bakery. These benefits were partially offset by higher input costs.

Operating Costs and Expenses

AdvertisingOperating costs and Marketing

Advertising and marketing expenses for the year ended December 31, 20172019 increased by 12.4% from the year ended December 31, 2018. During 2019, we recognized a $7.1 million gain on the valuation of $33.0a foreign currency contract originated to hedge the January 2020 purchase of Voortman in Canadian dollars. During 2018, we recognized a $3.3 million represent a decreaseimpairment charge related to our In-Store Bakery assets, which were sold in August 2019. Excluding these costs, operating costs and expenses increased due to additional expense related to incentive and stock compensation, additional payroll to execute strategic corporate initiatives, transaction costs related the sale of In-Store Bakery and the acquisition of Voortman, and facility transition costs to relocate our primary distribution center as well an increase from pro forma combined advertising and marketing expenses the remeasurement of $35.9 million, or 8.0%the Tax Receivable Agreement.

Operating Income

Operating income for the year ended December 31, 2016 as a result of reduced permanent wire display deployment.

Selling Expense

Selling expense2019 was $32.1$136.1 million or 4.1% of revenue for the year ended December 31, 2017, compared to $30.8 million, or 4.2% of revenue on a pro forma combined basis for the year ended December 31, 2016. The increase in selling expense is reflective of the increase in sales volume during the year.

General and Administrative

General and administrative expenses for the year ended December 31, 2017 of $52.9 million represent an increase of $11.1 million, or 26.6%, over the pro forma combined general and administrative expenses of $41.8$121.6 million for the year ended December 31, 2016.2018. The increase isin operating income was attributed to increased non-cash share-basedhigher sales volume, the impact of pricing actions and bakery operating efficiencies as well as the gain on the foreign currency contract. These increases to operating income were partially offset by higher incentive and stock compensation, transaction and facility transition costs as well an increase from the remeasurement of $7.4the Tax Receivable Agreement.

Other Expense

For the years ended December 31, 2019 and 2018, interest expense related to our term loan was $43.3 million, additional professional and administrative costs$41.3 million, respectively. During the year ended December 31, 2019, we recognized a loss of $3.5$0.5 million duerelated to public company compliance,the refinancing of our term loan. Also during the year ended December 31, 2018, we recognized a $12.4 million gain related to the buyout of the Tax Receivable Agreement. Additionally, during the years ended December 31, 2019 and 2018 we recognized a $58.8 million loss and a $2.0$79.2 million litigation settlement.gain, respectively, on the remeasurement of our liability-classified public and private placement warrants.

Income Taxes

Amortization of Customer Relationships

Amortization of customer relationshipsOur effective tax rate was $23.9 million47.4% for the year ended December 31, 2017,2019 compared to pro forma combined customer relationships amortization of $25.2 million7.5% for the year ended December 31, 2016. For2018. The increase in the yeareffective tax rate was primarily due to the change in fair value of warrants, which significantly impacts our pre-tax net income, but is not taxed. Excluding the impact of the warrant remeasurement for both the years ended December 31, 2016 on a historical basis, amortization expense2019 and 2018, our effective tax rates were 17.9% and 13.7%, respectively. The increase in the effective tax rate (excluding the warrant remeasurement) was based onprimarily due to the valuation of customer relationships acquiredClass B for Class A share exchanges during 2019. Subsequent to these exchanges, more income from Old HBHostess Holdings, L.P. was allocated to Hostess Brands, Inc. in 2013. The amortization expenseeffective tax rate for the year ended December 31, 20172018 reflects the tax impact of the gain on the buyout of the Tax Receivable Agreement and the tax benefit related to revaluing our deferred tax liabilities due to a change in our estimated state tax rate.

Net Income

For the year ended December 31, 2016 on a pro forma combined basis reflects the new valuation of the customer relationships acquired through the Business Combination.

Impairment, Loss on Sale/Abandonment of Property and Equipment, and Bakery Shutdown Costs