Item 2. Properties.Properties

Item 3. Legal Proceedings

We are involved in lawsuits, claims and proceedings arising in the ordinary course of business. These matters may involve personnel and employment issues, personal injury, contractcontracts and other proceedings arising in the ordinary course of business, which have not resulted in any material losses to date.business. Although we do not expect the outcome of these proceedings to have a material adverse effect on our financial condition or results of operations, litigation is inherently unpredictable. Therefore, we could incur judgments or enter into settlements or claims that could materially impact our results.

Item 4. Mine Safety Disclosures.Disclosures

Not applicable.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

We currently do not pay dividends and have not paid any cash dividends on our common stock to date.

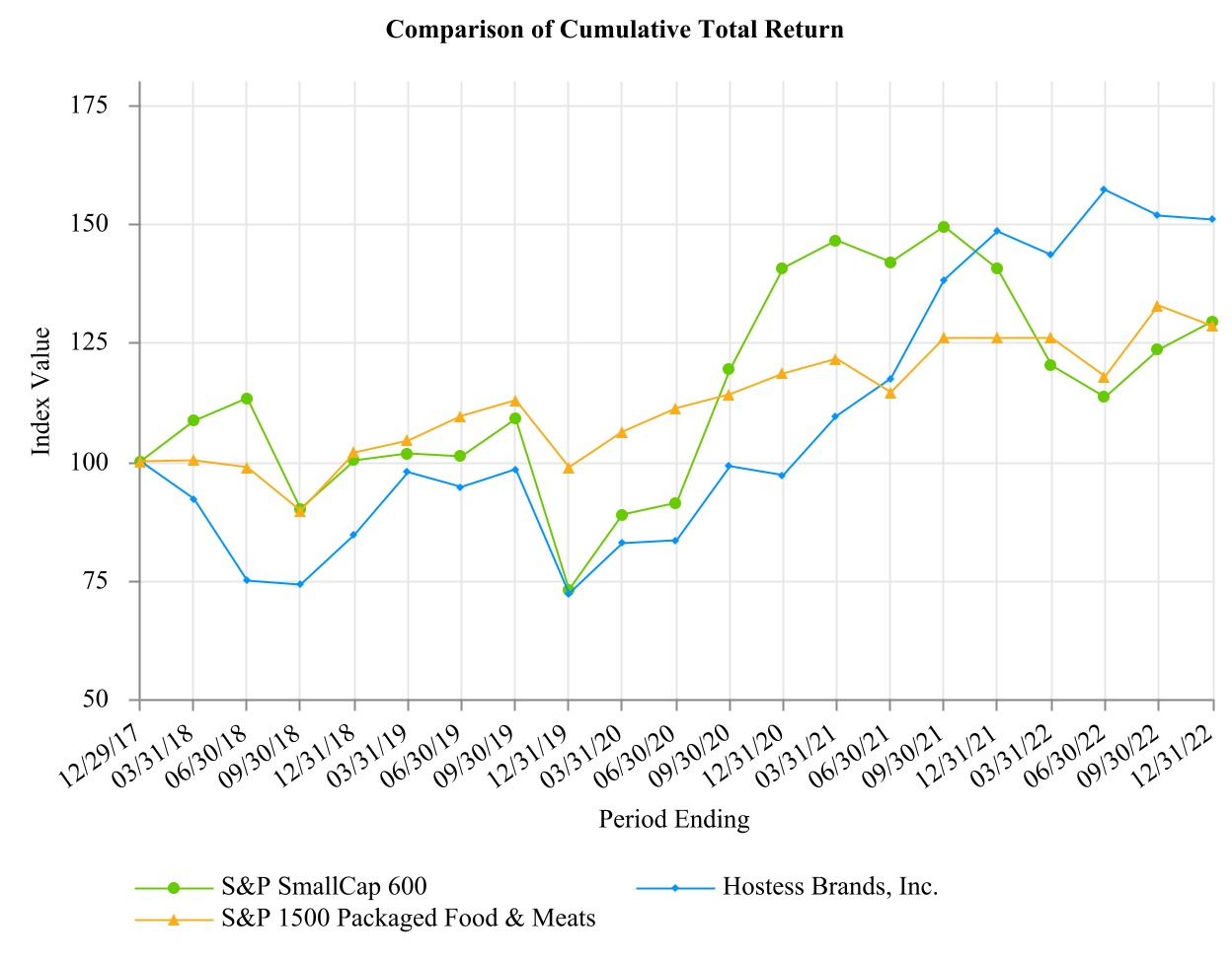

The following graph and related information shall not be deemed “soliciting material” or be deemed to be “filed” with the Commission, nor shall such information be incorporated by reference into any future filing, except to the extent that we specifically incorporate it by reference into such filing.

The stock price performance below is not necessarily indicative of future stock price performance.

Item 6. Selected Financial Data[RESERVED]

The following table sets forth our net revenues, operating costs and expenses attributable to our operations.

As a result of the Business Combination, we are the acquirer for accounting purposes and Hostess Holdings is the acquiree and accounting predecessor. Our financial statement presentation includes the financial statements of Hostess Holdings as “Predecessor” for periods prior to the Closing Date and of us for periods after the Closing Date, including the consolidation of Hostess Holdings. Also see “Item 7-Management’s Discussion and Analysis of Financial Condition and Results of Operations-Supplemental Unaudited Pro Forma Combined Financial Information” for supplemental pro forma combined information for 2016 that gives effect to the Business Combination as if such transaction had been consummated on January 1, 2016.

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Statement of Operations Data |

| (In thousands except for share and per share data) | Year Ended December 31, 2017 | | From November 4, 2016

through December 31, 2016 | | | From January 1, 2016

through November 3, 2016 | | | Year Ended December 31, 2015 | | Year Ended

December 31, 2014 | | February 6, 2013 (Inception) through December 31, 2013 |

| | (Successor) | | (Successor) | | | (Predecessor) | | | (Predecessor) | | (Predecessor) | | (Predecessor) |

| Net revenue | $ | 776,188 |

| | $ | 111,998 |

| | | $ | 615,588 |

| | | $ | 620,815 |

| | $ | 554,695 |

| | $ | 237,418 |

|

| Gross profit | 326,898 |

| | 38,714 |

| | | 266,529 |

| | | 262,203 |

| | 233,932 |

| | 91,920 |

|

| Operating income (loss) | 233,992 |

| | (9,607 | ) | | | 122,872 |

| | | 155,908 |

| | 119,467 |

| | 23,330 |

|

| Income (loss) before income taxes | 190,904 |

| | (16,247 | ) | | | 60,864 |

| | | 88,760 |

| | 81,464 |

| | (5,594 | ) |

| Net income (loss) | 258,108 |

| | (8,485 | ) | | | 60,425 |

| | | 88,760 |

| | 81,464 |

| | (5,594 | ) |

| Net income (loss) attributable to the non-controlling interest | 34,211 |

| | (4,081 | ) | | | 3,214 |

| | | 4,507 |

| | 4,267 |

| | — |

|

| Net income (loss) attributable to Class A shareholders | $ | 223,897 |

| | $ | (4,404 | ) | | | $ | 57,211 |

| | | $ | 84,253 |

| | $ | 77,197 |

| | $ | (5,594 | ) |

| Earnings (loss) per Class A share: |

|

| | | | | | | | | | | | |

| Basic | $ | 2.26 |

| | $ | (0.05 | ) | | | | | | | | | | |

| Diluted | $ | 2.13 |

| | $ | (0.05 | ) | | | | | | | | | | |

| Weighted-average shares outstanding: | | | | | | | | | | | | | |

| Basic | 99,109,629 |

| | 97,791,658 |

| | | | | | | | | | |

| Diluted | 105,307,293 |

| | 97,791,658 |

| | | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash Flow Data |

| (In thousands) | | Year Ended December 31, 2017 | | From November 4, 2016 through December 31, 2016 | | | From January 1, 2016 through November 3, 2016 | | Year Ended December 31, 2015 | | Year Ended December 31, 2014 | | February 6, 2013 (Inception) through December 31, 2013 |

| | | (Successor) | | (Successor) | | | (Predecessor) | | (Predecessor) | | (Predecessor) | | (Predecessor) |

Net cash provided by (used in) operating activities | | $ | 163,685 |

| | $ | 13,611 |

| | | $ | 102,221 |

| | $ | 132,972 |

| | $ | 108,329 |

| | $ | (29,672 | ) |

| Net cash provided by (used in) investing activities | | (35,209 | ) | | (428,196 | ) | | | (76,579 | ) | | 17,880 |

| | (91,393 | ) | | (422,498 | ) |

| Net cash provided by (used in) financing activities | | (19,630 | ) | | (232,345 | ) | | | (31,596 | ) | | (296,002 | ) | | (9,769 | ) | | 654,626 |

|

|

| | | | | | | | | | | | | | | | | | | | | | |

| Balance Sheet Data |

| (In thousands) | | December 31, 2017 | | December 31, 2016 | | | December 31, 2015 | | December 31, 2014 | | February 6, 2013 (Inception) through December 31, 2013 | |

| | | (Successor) | | (Successor) | | | (Predecessor) | | (Predecessor) | | (Predecessor) | |

| Cash and cash equivalents | | $ | 135,701 |

| | $ | 26,855 |

| | | $ | 64,473 |

| | $ | 209,623 |

| | $ | 202,456 |

| |

| Property and equipment, net | | 174,121 |

| | 153,224 |

| | | 128,078 |

| | 112,732 |

| | 88,269 |

| |

| Total assets | | 2,966,275 |

| | 2,847,892 |

| | | 643,529 |

| | 765,494 |

| | 683,678 |

| |

| Long-term debt and capital lease obligation | | 987,920 |

| | 993,374 |

| | | 1,193,667 |

| | 473,175 |

| | 479,602 |

| |

| Non-controlling interest | | 342,240 |

| | 334,192 |

| | | (37,991 | ) | | 4,267 |

| | — |

| |

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

Other Financial Data (1) |

| (In thousands) | | Year Ended December 31, 2017 | | From

November 4, 2016 through

December 31, 2016 | | | From

January 1, 2016 through November 3, 2016 | | Year Ended

December 31, 2015 | | Year Ended

December 31, 2014 | | February 6, 2013 (Inception) through December 31, 2013 |

| | | (Successor) | | (Successor) | | | (Predecessor) | | (Predecessor) | | (Predecessor) | | (Predecessor) |

| Adjusted EBITDA | | $ | 230,212 |

| | $ | 31,894 |

| | | $ | 183,409 |

| | $ | 177,930 |

| | $ | 145,343 |

| | $ | 40,285 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Gross Profit and Adjusted Gross Margin |

| (In thousands) | Year Ended December 31, 2017 | | From November 4, 2016

through December 31, 2016 | | | From

January 1, 2016

through November 3, 2016 | | Year Ended December 31, 2015 | | Year Ended

December 31, 2014 | | February 6, 2013 (Inception) through December 31, 2013 |

| | (Successor) | | (Successor) | | | (Predecessor) | | (Predecessor) | | (Predecessor) | | (Predecessor) |

| Net revenue | $ | 776,188 |

| | $ | 111,998 |

| | | $ | 615,588 |

| | $ | 620,815 |

| | $ | 554,695 |

| | $ | 237,418 |

|

| Cost of goods sold | 449,290 |

| | 73,284 |

| | | 346,864 |

| | 355,963 |

| | 320,763 |

| | 145,498 |

|

| Special employee incentive compensation | — |

| | — |

| | | 2,195 |

| | 2,649 |

| | — |

| | — |

|

| Gross Profit | $ | 326,898 |

| | $ | 38,714 |

| | | $ | 266,529 |

| | $ | 262,203 |

| | $ | 233,932 |

| | $ | 91,920 |

|

| | | | | | | | | | | | | |

| Add back: | | | | | | | | | | | | |

| Special employee incentive compensation (i) | — |

| | — |

| | | 2,195 |

| | 2,649 |

| | — |

| | — |

|

| Inventory fair value adjustment (ii) | — |

| | 8,914 |

| | | — |

| | — |

| | — |

| | — |

|

| Adjusted Gross Profit | $ | 326,898 |

| | $ | 47,628 |

| | | $ | 268,724 |

| | $ | 264,852 |

| | $ | 233,932 |

| | $ | 91,920 |

|

| | | | | | | | | | | | | |

| Gross Margin - GAAP | 42.1 | % | | 34.6 | % | | | 43.3 | % | | 42.2 | % | | 42.2 | % | | 38.7 | % |

| | | | | | | | | | | | | |

| Adjusted Gross Margin | 42.1 | % | | 42.5 | % | | | 43.7 | % | | 42.7 | % | | 42.2 | % | | 38.7 | % |

(i) For the Predecessor period January 1, 2016 through November 3, 2016, a special bonus payment of $2.2 million was paid to employees at the bakery facilities as compensation for their efforts in the Business Combination. For the year ended December 31, 2015, a special bonus payment of $2.6 million was paid to employees at the bakery facilities as compensation for their efforts in the recapitalization of Hostess.

(ii) For the Successor period November 4, 2016 through December 31, 2016, the Company remeasured inventory at fair value at the Business Combination date, resulting in additional non-cash cost of goods sold of $8.9 million.

(1) Adjusted EBITDA is defined and explained in more detail in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, which contains a reconciliation to the most comparable GAAP measure. Adjusted EBITDA is a non-GAAP financial measures commonly used by securities analysts, investors and other interested parties in their evaluation of the operating performance of companies in industries similar to ours. However, Adjusted EBITDA should not be construed as an alternative to net income as an indicator of operating performance or as an alternative to cash flow provided by operating activities as a measure of liquidity (each as determined in accordance with GAAP). Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies. We have included Adjusted EBITDA because we believe it provides management and investors with additional information to measure our performance.

Adjusted Gross Profit and Adjusted Gross Margin are non-GAAP financial measures commonly used in our industry, however they should not be construed as an alternative to gross profit and gross margin as an indicator of operating performance. Adjusted Gross Profit and Adjusted Gross Margin may not be comparable to similarly titled measures reported by other companies. We have included Adjusted Gross Profit and Adjusted Gross Margin because we believe they provide management and investors with additional information to measure our performance. We believe the presentation of Adjusted Gross Profit and Adjusted Gross Margin is useful to investors because it is consistent with our definition of Adjusted EBITDA.

See Item 7-Management’s Discussion and Analysis of financial Condition and Results of Operations-Adjusted EBITDA Reconciliation.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our Consolidated Financial Statementsconsolidated financial statements and related notes included in Item 8 of this Annual Report on Form 10-K. This discussion contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those discussed below. Factors that could cause or contribute to such differences include, but are not limited to, those identified below and those discussed in Item 1A “Risk Factors” of this Annual Report on Form 10-K.

For a comparison of our results of operations for the fiscal years ended December 31, 2021 and December 31, 2020, see “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our annual report on Form 10-K for the fiscal year ended December 31, 2021, filed with the SEC on March 1, 2022.

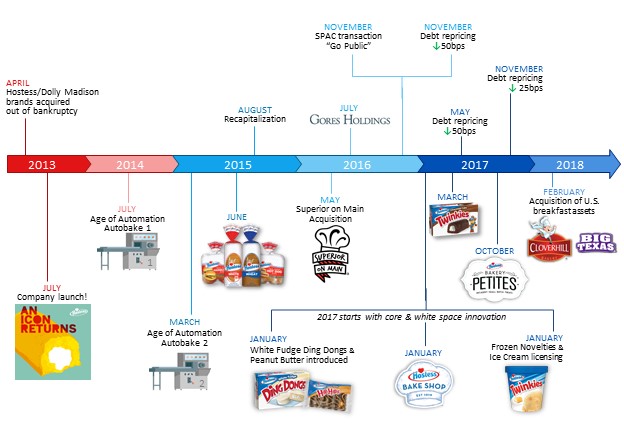

Overview

We are a leading United States packaged foodsweet snacks company focused on developing, manufacturing, marketing, selling and distributing fresh sweet baked goods coast-to-coast,snacks in North America, providing a wide range of snack cakes, donuts, sweet rolls, breakfast pastries, cookies, snack pies and related products. We acquired the Hostess® brand and certain strategic assets out of the bankruptcy liquidation proceedings of Old HB Inc., its prior owner, free and clear of all past liabilities, in April 2013, and relaunched the brand later that year.

As of December 31, 2017,2022, we operate five bakeriesbaking facilities and three centralizedutilize distribution centers.centers and third-party warehouses to distribute our products. Our direct-to-warehouse (“DTW”)Direct-to-Warehouse product distribution system allows us to deliver to our customers’ warehouses. Our customers in turn distribute to their retail stores and/or distributors.

We have two reportable segments: “Sweet Baked Goods” In 2022, we purchased a facility in Arkadelphia, Arkansas. The facility will become our sixth bakery upon completion of capital investments to install production lines and “In-Store Bakery”. A changeother necessary improvements needed to make the facility operational. The facility is expected to open in the Company’s internal reporting structure during the lastfourth quarter of 2017 caused the2023.

The Company to reassess itshas one reportable segments. Sweet Baked Goodssegment: Snacking. The Snacking segment consists of fresh and frozen sweet baked goods, cookies, bread and bread productsbuns that are sold under the Hostess®, Voortman®, Dolly Madison®, Cloverhill® and Dolly Madison®Big Texas® brands. In-Store Bakery consists of certain Superior and Hostess® branded eclairs, madeleines, brownies, and iced cookies sold in the bakery section of grocery and club stores.

Hostess® is the second leading brand by market share within the Sweet Baked Goods (“SBG”(“SBG”) category, according to Nielsen U.S. total universe. For the 52-week period ended December 30, 201731, 2022 our branded SBG products’ (which include Hostess®, Dolly Madison®, Cloverhill®, and Big Texas®) market share was 17.2%21.2% per Nielsen’s U.S. SBG category data. We have aOur Hostess® branded products include the #1 leading market positioncupcake and mini donut products within the two largest SBG Segments; Donut Segmentcategory and Snack Cake Segment, The Donutour Voortman® branded products include the #1 creme wafer and Snack Cake Segments together account for 49% ofsugar free cookie products within the Sweet Baked Goods category’s total dollar sales.

Cookie category.

Principal Components of Operating Results

Net Revenue

We generate revenue primarily through selling sweet baked goods and other products under the Hostess® group of brands,packaged snacks, which includesinclude iconic products such as Donettes®, Twinkies®, CupCakes, Ding Dongs®, Zingers®, HoHos®Danishes, Honey Buns and Donettes®,Coffee Cakes under the Hostess® brand, as well as cookies, wafers and sugar free products under the Voortman® brand. We also sell products under the Dolly Madison® brand , Cloverhill® and the Superior on Main® brand (e.g., eclairs, madeleines, brownies and iced cookies).Big Texas® brands along with private label products. Our product assortment is solddelivered to customers’ warehouses and distribution centers by the case or in display readydisplay-ready corrugate units. Retailers display and sell our products to the end consumer in single-serve, multi-pack or club-pack formats. We sell our products primarily to supermarket chains, national mass merchandisersretailers and convenience stores, along with a smaller portion of our product sales going to club, dollar and drug stores, the vending club,channel, and other retail outlets.

Our revenues are driven by average net price and total volume of products sold. Factors that impact unit pricing and sales volume include product mix, the cost of ingredients, theinputs, promotional activities, implemented by the Company and its competitors, industry capacity, new product initiatives and quality and consumer preferences. We do not keep a significant backlog of finished goods inventory, as our fresh baked products are promptly shipped to our distribution centers after being produced and then distributed to customers.

Cost of Goods Sold

Cost of goods sold consists of ingredients, packaging, labor, energy, and other production costs, as well as warehousing and transportation costs for theincluding in-bound freight, inter-plant transportation and distribution of our products to our customers. The cost of ingredients and packaging represent the majority of our total costs of goods sold. All costs that are incurred at the bakeries, including the depreciation of bakery facilities and equipment, are included in cost of goods sold. We do not allocate any corporate functions into cost of goods sold.

Our cost of ingredients consists principally of cooking oil, sugar, coatings, flour sweeteners, edible oils and cocoa,eggs, which are subject to substantial price fluctuations, as is the cost of paper, corrugate, films and plastics used to package our products. The prices for raw materials are influenced by a number of factors, including the weather, crop production, transportation and processing costs, inflation,

government regulation and policies and worldwide market supply and demand. We also rely on fuel products, such as natural gas, diesel, propane and electricity, to operate our bakeries and produce our products. Fluctuations in the prices of the raw materials or fuel products used in the production, packaging or transportation of our products affect the cost of products sold and our product pricing strategy. We utilize forward buying strategies through short-term and long-term advance purchase contracts to lock in prices for certain high-volume raw materials, packagedpackaging components and certain fuel inputs. Through these initiatives, we believe we are able to obtain competitive pricing.

Advertising and Marketing

Our advertising and marketing expenses relate to our advertising campaigns, which include social media, print, online advertising, local promotional events and monthly agency fees. We also invest in wire racks and corrugate displays delivered to customers to display our products off shelf, field marketing and merchandising services to reset and check theour store inventory on a regular basisbasis. We also invest in advertising campaigns, which include social media, print, online advertising, local promotional events, monthly agency fees and marketing employmentpayroll costs.

Selling Expense

Selling expenses primarily include sales management, employment,sales employee-related expenses, travel, and related expenses, as well as broker fees. We utilize brokers for sales support, including managing promotional activities and order processing.

General and Administrative

General and administrative expenses primarily include employee and related expenses for the accounting, planning,finance, customer service, legal, human resources, corporate operations, research and development, purchasing, logistics and executive functions. Also included are professional service fees related to audit and tax, legal, outsourced information technology functions, transportation planning, headquarters and corporate siteother office sites and insurance costs.costs, as well as the depreciation and amortization of corporate assets.

Other Expense

Related Party Expenses

Related party expenses consistedOther expense primarily includes interest paid on our term loan offset by interest income earned on investments as well as a gain in 2022 from receipt of insurance proceeds under the normal annual cash payments associatedrepresentation and warranty insurance policy purchased in connection with our employment arrangements with Mr. Metropoulos as Chief Executive Officer and/or Executive Chairman.

Non-Controlling Interest

Mr. Metropoulosthe Voortman acquisition and the Metropoulos Entities hold their equity investmentchange in us primarily through Class B limited partnership units in the Company’s subsidiary, Hostess Holdings (“Class B Units”),fair value of our liability-classified public and an equal number of shares of the Company’s Class B common stock (“Class B Stock”). Our Class B Stock has voting, but no economic rights, while Hostess Holdings’ Class B Units have economic, but no voting rights. Each Class B Unit, together with a share of Class B Stock held by the Metropoulos Entities, is exchangeable for a share of the Company’s Class A common stock (or at the option of the Company, the cash equivalent thereof). The Company holds 100% of the general partnership interest in Hostess Holdings and a majority of the limited partnership interests and consolidates Hostess Holdings in the Company’s consolidated financial statements. The interest of the Metropoulos Entities in Hostess Holdings’ Class B Units is reflected in our consolidated financial statements as a non-controlling interest.

For periods prior to the Business Combination, Hostess Holdings consolidated the financial position and results of operations of New Hostess Holdco, LLC. The portion of New Hostess Holdco, LLC not owned by Hostess Holdings (which constituted a profits interest plan for management) was recognized as a non-controlling interest in its consolidated financial statements.

Factors Impacting Recent Results

Long-term Debt Refinancing and Interest Rate Risk Management

To manage the risk related to our variable rate debt, during the year ended December 31, 2017, we entered into an interest rate swap contract with a counter party to make a series of payments based on a fixed interest rate of 1.78% and receive a series of payments based on the greater of LIBOR or 0.75%. Both the fixed and floating payment streams are based on a notional amount of $500 million at the inception of the contract and will be reduced by $100 million each year of the five year contract.

On November 20, 2017 and May 19, 2017, our first lien term loan was amended resulting in a decrease of 0.25% and 0.50%, respectively, to the margin applied to our variable rate. The maturity date of August 3, 2022 remained unchanged.

Seasonality

Sweet baked goods revenues tend to be moderately seasonal, with declines during the early winter period, which we believe are attributable to altered consumption patterns during the holiday season. We expect this trend to continue and continue to be applicable to our business. We strive to mitigate the seasonality by running certain targeted promotional campaigns.

Note on Financial Presentation

As a result of the completion of the Business Combination on November 4, 2016, our Consolidated Financial Statements included elsewhere in the Annual Report are presented: (i) as of December 31, 2017 andprivate placement warrants for the year ended December 31, 2017 (Successor); (ii) as2021.

Factors Impacting Recent Results

Supply Chain

We believe volatility in certain aspects of the global supply chain have had a continued impact on our operations, including the cost and availability of labor, transportation and raw materials. Various macro factors, including, but not limited to, the COVID-19 pandemic, labor market trends, rising fuel and transportation costs, currency exchange rate, the conflict in Ukraine, the Avian Influenza and overall elevated demand for goods, have led to fragility in the supply chain.

We continue to experience increased labor costs, raw materials costs and transportation costs in the current economic climate. Given the fragility of the global supply-chain environment, our ability to source raw materials for our production facilities or produce and ship products to meet the needs of our customers may be materially impacted. We continue to work closely with all of our vendors, distributors, contract manufacturers, and other external business partners to ensure availability of our products for our customers and consumers.

In response to the inflationary costs described above, we have implemented price increases and may implement additional price increases in the future. Customers may not accept price increases or we may face competitive pressure that leads to price reductions for certain products.

Acquisition

On January 3, 2020, we completed the acquisition of all of the shares of the parent company of Voortman Cookies Limited (“Voortman”), a manufacturer of premium, branded wafers and cookies, including sugar free products. By adding the Voortman® brand, we believe we have greater growth opportunities provided by a more diverse portfolio of brands and products.

In December 31, 20162020, the Company asserted claims for indemnification against the sellers under the terms of the Share Purchase Agreement pursuant to which the Company acquired Voortman (the “Agreement”). The claims arose out of alleged breaches by the sellers of certain representations, warranties and forcovenants contained in the period November 4, 2016Agreement relating to December 31, 2016 (Successor); (iii) forperiods prior to the period January 1, 2016closing of the acquisition. The Company also submitted claims relating to November 3, 2016 (Predecessor);these alleged breaches under the representation and (iv) forwarranty insurance policy (“RWI”) it purchased in connection with the acquisition. In June 2022, the RWI insurers agreed to pay the Company $42.5 million CAD (the RWI coverage limit) (the “Proceeds”) related to these breaches. During the year ended December 31, 2015 (Predecessor). For comparative purposes, we also present supplemental unaudited pro forma combined Statements2022, the Company received the Proceeds and recognized a gain of Operations$42.5 million CAD ($33.0 million) in other expense (income) on our consolidated statement of operations. Per agreement with the RWI insurers, under no circumstances will the Company be required to return the Proceeds.

On November 3, 2022, pursuant to the agreement with the RWI insurer, Voortman brought claims in the Ontario (Canada) Superior Court of Justice (the “Claim”), related to the breaches against certain of the sellers from whom Voortman was acquired. The Claim alleges the seller defendants made certain non-disclosures and misrepresentations to induce the Company to overpay for Voortman. The Company is seeking damages of $109 million CAD representing the yearamount of the aggregate liability of the sellers for indemnification under the Agreement, $5.0 million CAD in punitive or aggravated damages, interest, proceedings fees and any other relief the presiding court deems appropriate. A portion of any recovery will be shared with the RWI insurers. Although the Company strongly believes that its Claim against the sellers is meritorious, no assurance can be given as to whether the Company will recover all, or any part, of the amounts it is pursuing.

Change in Fair Value of Warrant Liabilities

During the years ended December 31, 20162021 and 2020, there were fluctuations in the table belowmarket price of our publicly traded warrants. These fluctuations created significant gains and losses on the discussion that follows. See “-Supplemental Unaudited Pro Forma Combined Financial Information.”remeasurement of certain warrants which are recognized as “change in fair value of warrant liabilities” within other expense on our consolidated statement of operations. The warrants expired on November 4, 2021 and are no longer outstanding.

Results of Operations

Comparison of Results of Operations for the Year Ended December 31, 2017 (Successor), From November 4, 2016 through December 31, 2016 (Successor), From January 1, 2016 through November 3, 2016 (Predecessor) and the Year Ended December 31, 2015 (Predecessor)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | 2017 | | 2016 | | | | 2015 |

(In thousands, except share and per share data) | Year Ended December 31 | | %

of Net Revenues | | From November 4 through December 31 | | %

of Net Revenues | | | From January 1 through November 3 | | %

of Net Revenues | | Year Ended December 31 | | %

of Net Revenues |

| | (Successor) | | | | (Successor) | | | | | (Predecessor) | | | | (Predecessor) | | |

| Net revenue | $ | 776,188 |

| | 100.0 | % | | $ | 111,998 |

| | 100.0 | % | | | $ | 615,588 |

| | 100.0 | % | | $ | 620,815 |

| | 100.0 | % |

| Cost of goods sold | 449,290 |

| | 57.9 |

| | 73,284 |

| | 65.4 |

| | | 346,864 |

| | 56.3 |

| | 355,963 |

| | 57.3 |

|

| Special employee incentive compensation | — |

| | — |

| | — |

| | — |

| | | 2,195 |

| | 0.4 |

| | 2,649 |

| | 0.4 |

|

| Gross profit | 326,898 |

| | 42.1 |

| | 38,714 |

| | 34.6 |

| | | 266,529 |

| | 43.3 |

| | 262,203 |

| | 42.2 |

|

| Operating costs and expenses: | | | | | | | — |

| | | | | — |

| | | | — |

|

| Advertising and marketing | 33,004 |

| | 4.3 |

| | 5,245 |

| | 4.7 |

| | | 30,626 |

| | 5.0 |

| | 31,967 |

| | 5.1 |

|

| Selling expense | 32,086 |

| | 4.1 |

| | 5,033 |

| | 4.5 |

| | | 25,730 |

| | 4.2 |

| | 29,484 |

| | 4.7 |

|

| General and administrative | 52,943 |

| | 6.8 |

| | 7,322 |

| | 6.5 |

| | | 38,391 |

| | 6.2 |

| | 31,531 |

| | 5.1 |

|

| Special employee incentive compensation | — |

| | — |

| | — |

| | — |

| | | 2,503 |

| | 0.4 |

| | 1,274 |

| | 0.2 |

|

| Amortization of customer relationships | 23,855 |

| | 3.1 |

| | 3,922 |

| | 3.5 |

| | | 1,185 |

| | 0.2 |

| | 851 |

| | 0.1 |

|

| Impairment on property and equipment | 1,003 |

| | 0.1 |

| | — |

| | — |

| | | 7,300 |

| | 1.2 |

| | 2,700 |

| | 0.4 |

|

| Loss on sale/abandonment of property and equipment, and bakery shutdown costs (recoveries) | (144 | ) | | — |

| | — |

| | — |

| | | 2,551 |

| | 0.4 |

| | 4,182 |

| | 0.7 |

|

| Business combination transaction costs | — |

| | — |

| | — |

| | — |

| | | 31,832 |

| | 5.2 |

| | — |

| | — |

|

| Related party expenses | 381 |

| | — |

| | 26,799 |

| | 23.9 |

| | | 3,539 |

| | 0.6 |

| | 4,306 |

| | 0.7 |

|

| Tax receivable agreement liability remeasurement | (50,222 | ) | | (6.5 | ) | | — |

| | — |

| | | — |

| | — |

| | — |

| | — |

|

| Total operating costs and expenses | 92,906 |

| | 12.0 |

| | 48,321 |

| | 43.1 |

| | | 143,657 |

| | 23.3 |

| | 106,295 |

| | 17.1 |

|

| Operating income | 233,992 |

| | 30.1 |

| | (9,607 | ) | | (8.6 | ) | | | 122,872 |

| | 20.0 |

| | 155,908 |

| | 25.1 |

|

| Other expense: | | | | | | | — |

| | | | |

|

| | | |

|

|

| Interest expense, net | 39,174 |

| | 5.0 |

| | 6,649 |

| | 5.9 |

| | | 60,384 |

| | 9.8 |

| | 50,011 |

| | 8.1 |

|

| Loss (gain) on modification of debt | 2,554 |

| | 0.3 |

| | (763 | ) | | (0.7 | ) | | | — |

| | — |

| | 25,880 |

| | 4.2 |

|

| Other expense (income) | 1,360 |

| | 0.2 |

| | 754 |

| | 0.7 |

| | | 1,624 |

| | 0.3 |

| | (8,743 | ) | | (1.4 | ) |

| Total other expense | 43,088 |

| | 5.6 |

| | 6,640 |

| | 5.9 |

| | | 62,008 |

| | 10.1 |

| | 67,148 |

| | 10.8 |

|

| Income before income taxes | 190,904 |

| | 24.6 |

| | (16,247 | ) | | (14.5 | ) | | | 60,864 |

| | 9.9 |

| | 88,760 |

| | 14.3 |

|

| Income tax expense (benefit) | (67,204 | ) | | (8.7 | ) | | (7,762 | ) | | (6.9 | ) | | | 439 |

| | 0.1 |

| | — |

| | — |

|

| Net income (loss) | 258,108 |

| | 33.3 |

| | (8,485 | ) | | (7.6 | ) | | | 60,425 |

| | 9.8 |

| | 88,760 |

| | 14.3 |

|

| Less: Net income attributable to the non-controlling interest | 34,211 |

| | 4.4 |

| | (4,081 | ) | | (3.6 | ) | | | 3,214 |

| | 0.5 |

| | — |

| | — |

|

| Net income attributable to Class A shareholders | $ | 223,897 |

| | 28.8 | % | | $ | (4,404 | ) | | (3.9 | )% | | | $ | 57,211 |

| | 9.3 | % | | $ | 88,760 |

| | 14.3 | % |

| | | | | | | | | | | | | | | | | |

| Earnings per Class A share: | | | | | | | | | | | | | | | | |

| Basic | $ | 2.26 |

| | | | $ | (0.05 | ) | | | | | | | | | | | |

| Diluted | $ | 2.13 |

| | | | $ | (0.05 | ) | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Weighted-average shares outstanding: | | | | | | | | | | | | | | | | |

| Basic | 99,109,629 |

| | | | 97,791,658 |

| | | | | | | | | | | |

| Diluted | 105,307,293 |

| | | | 97,791,658 |

| | | | | | | | | | | |

As discussed above, the financial information presented herein for periods prior to the completion of the Business Combination is of our accounting Predecessor, Hostess Holdings, and, for periods from and after the Business Combination, is of Hostess Brands, Inc.

The financial information for the year ended December 31, 2016 is divided into Predecessor and Successor periods and is not comparable to the full year ended December 31, 2017 (Successor) and the full year ended December 31, 2015 (Predecessor). Accordingly, such periods are presented on a historical stand-alone basis without comparison. In addition, we have presented comparative results of operations for the year ended December 31, 2017 (Successor) compared to the pro forma combined year ended December 31, 2016 and of such pro forma combined year ended December 31, 2016 compared to the year ended December 31, 2015 (Predecessor).

| | | | | | | | | | | | | | | |

| | | |

(In thousands, except per share data) | Year Ended December 31, 2022 | | Year Ended

December 31,

2021 | | | | |

| Net revenue | $ | 1,358,207 | | | $ | 1,142,036 | | | | | |

| | | | | | | |

| | | | | | | |

| Gross profit | 465,679 | | | 409,983 | | | | | |

| As a % of net revenue | 34.3 | % | | 35.9 | % | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Total operating costs and expenses | $ | 245,401 | | | $ | 209,245 | | | | | |

| Operating income | 220,278 | | | 200,738 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Total other expense | 8,994 | | | 40,926 | | | | | |

| | | | | | | |

| Income tax expense | 47,089 | | | 40,513 | | | | | |

| Net income | $ | 164,195 | | | $ | 119,299 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Earnings per Class A share: | | | | | | | |

| Basic | $ | 1.20 | | | $ | 0.91 | | | | | |

| Diluted | 1.19 | | | 0.86 | | | | | |

| | | | | | | |

Results for the Year Ended December 31, 2017 (Successor)2022 Compared to Results for the Year Ended December 31, 2021

Net Revenue Cost of Goods Sold and Gross Profit

Net revenue was $776.2 million for the year ended December 31, 2017 (Successor), with cost of goods sold of $449.3 million and gross profit of $326.92022 increased $216.2 million, or 42.1% as a percentage18.9%, compared to the year ended December 31, 2021. Contribution from pricing actions and favorable product mix provided 16.3% of the growth, while higher volumes accounted for 2.6% of the growth. Sweet baked goods revenue increased $185.0 million or 18.0%, while cookies net revenue increased $31.2 million or 26.8%.

Gross Profit

Gross profit increased 13.6% and was 34.3% of net revenue.

Net revenue for the Sweet Baked Goods segment was $733.8 million for the year ended December 31, 2017 (Successor), with2022, a decrease of 161 basis points from a gross profitmargin of $316.9 million, or 43.2% of net revenue, while net revenue for the In-Store Bakery segment was $42.4 million35.9% for the year ended December 31, 2017, with2021. The decrease in gross profit of $10.0 million, or 23.6% of net revenue.margin was due to inflation and supply-chain inefficiencies, partially offset by favorable price/mix, including revenue growth management initiatives, and productivity initiatives.

Operating Costs and Expenses

AdvertisingOperating costs and Marketing, Selling Expense, and General and Administrative

For the year ended December 31, 2017, advertising and marketing expenses were $33.0 million, selling expenses were $32.1 million, while general and administrative expenses were $52.9 million.

Amortization of Customer Relationships

Amortization of customer relationships was $23.9 million for the year ended December 31, 2017.

Impairment, Loss on Sale/Abandonment of Property and Equipment, and Bakery Shutdown Costs

During2022 increased by 17.3% from the year ended December 31, 2017, we idled a production line2021. The increase was primarily attributed to higher investments in our Columbus, Georgia facilityworkforce, as well as higher advertising and transitioned the production to a third party. We recognized an impairment loss of $1.0 million.

Related Party Expenses

Related party expenses were $0.4 million for the year ended December 31, 2017. These expenses represent payments made to Mr. Metropoulos under the terms of his employment arrangements.

Tax Receivable Agreement Liability Remeasurement

For the year ended December 31, 2017, we adjusted the value of the Tax Receivable Agreement due to a lower projected future cash tax savings rate as a result of the Tax Cuts and Jobs Act. This adjustment resulted in a gain of $51.8 million. A similar adjustment was made due to a change in a state tax law and resulted in a loss of $1.6 million.depreciation expense.

Operating Income

Operating income for the year ended December 31, 20172022 was $234.0 million.

Interest Expense, net

Our interest expense was $39.2$220.3 million compared to $200.7 million for the year ended December 31, 2017.2021. The increase in gross profit contributed to the higher operating income in the current year partially offset by higher operating costs.

Loss on Modification of debtOther Expense

DuringOther expense for the year ended December 31, 2017, we expensed $1.62022 was $9.0 million of previously capitalized debt financing charges for a total loss of $2.6 million. The remaining loss of $1.0 million was relatedcompared to the May and November 2017 repricing transactions. See Note 1- “Summary of Significant Accounting Policies” to the consolidated financial statements included in Part II, Item 8 of this Annual Report on Form 10-K.

Income Taxes

The income tax benefit of $67.2$40.9 million for the year ended December 31, 2017 includes a benefit of approximately $111.3 million2021. The decrease in other expense was primarily due to a revaluationgain from receipt of insurance proceeds of $33.0 million under the representation and warranty insurance policy (purchased in connection with the Voortman acquisition). Interest expense related to our term loan was $42.4 million and $38.6 million for the years ended December 31, 2022 and December 31, 2021, respectively.

Income Taxes

Our effective tax rate was 22.3% for the year ended December 31, 2022 compared to 25.4% for the year ended December 31, 2021. The effective tax rate for the year ended December 31, 2022 was impacted favorably by the $33.0 million non-taxable gain related to receipt of proceeds under the representation and warranty insurance policy. Additionally, the effective tax rate for both periods reflect a tax benefit related to revaluing our deferred tax liabilityliabilities due to reflect lower future U.S. corporate income tax rates caused by the Tax Cuts and Jobs Act. The tax provision also includes a $1.7 million expense caused by a change in the estimated state tax rates. The remaining tax expense of $42.4 million represents an effective tax rate of 30.1%, giving effect to the non-controlling interest, a partnership for income tax purposes and excluding the impact of the remeasurement of the tax receivable agreement.rate.

Net Income

For the year ended December 31, 2017, the Company had2022, net income of $258.1 million.

Earnings Per Share

For the year ended December 31, 2017, earnings per class A share was $2.26 (basic) and $2.13 (dilutive).

Results for the Successor period November 4, 2016 through December 31, 2016 and Predecessor period January 1, 2016 through November 3, 2016

Net Revenue

Net revenues in the Successor period from November 4, 2016 through December 31, 2016 were $112.0$164.2 million compared to $615.6 million for the Predecessor period from January 1, 2016 through November 3, 2016. During the Predecessor period, we acquired Superior on May 10, 2016 and reported net revenues of $19.9 million from Superior from the date of acquisition through November 3, 2016. During the Successor period, the net revenues for Superior were $6.8 million.

Cost of Goods Sold

In the Successor period, as a result of the Business Combination, we recorded a one-time inventory fair value step-up of $8.9 million that was charged to cost of goods sold. Excluding the impact of the inventory fair value step-up, cost of goods sold in the Successor period would have been 57.5% of net revenues.

Special Employee Incentive Compensation

For the Predecessor period January 1, 2016 through November 3, 2016, we made a special bonus payment to certain employees at our bakery facilities as compensation for their efforts in connection with the Business Combination. Payment of $2.2 million of this special bonus was recorded as a separate line item reducing gross profit.

Gross Profit

For the Predecessor period January 1, 2016 through November 3, 2016, gross profit, including the effect of the special employee incentive compensation discussed above, was $266.5 million, or 43.3% of net revenue. Excluding this item, gross profit would have been $268.7 million, or 43.7% of net revenue.

For the Successor period November 4, 2016 through December 31, 2016, gross profit was $38.7 million, or 34.6% of net revenue. Excluding the impact of the inventory fair value step up discussed above, adjusted gross margin for the Successor period was 42.5% of net revenue. Adjusted gross margin for the Successor period compared to the gross margin for the Predecessor period declined slightly due to overall changes in mix of products sold.

Operating Costs and Expenses

Advertising and Marketing

For the Predecessor period January 1, 2016 through November 4, 2016, advertising and marketing expenses were $30.6 million, or 5.0% of net revenue.

For the Successor period November 4, 2016 through December 31, 2016, advertising and marketing expenses were $5.2 million, or 4.7% in net

revenue.

Advertising and marketing expenses as a percentage of net revenue were lower in the Successor period primarily due to higher field marketing costs in the Predecessor Period.

Selling Expense

For the Predecessor period January 1, 2016 through November 4, 2016, selling expenses were $25.7 million, or 4.2% of net revenue.

For the Successor period November 4, 2016 through December 31, 2016, selling expenses were $5.0 million, or 4.5% in net revenue.

General and Administrative

For the Predecessor period January 1, 2016 through November 4, 2016, general and administrative expenses were $38.4 million, or 6.2%, of net revenue.

For the Successor period November 4, 2016 through December 31, 2016, general and administrative expenses were $7.3 million, or 6.5% of net revenue.

Special Employee Incentive Compensation

For the Predecessor period January 1, 2016 through November 3, 2016, we paid a special bonus payment of $2.5 million to certain corporate

employees as compensation for their efforts in connection with the Business Combination. This payment to corporate employees was recorded under operating costs and expenses.

Amortization of Customer Relationships

For the Predecessor period January 1, 2016 through November 3, 2016, amortization of customer relationships was $1.2 million, or 0.2% of net revenue.

For the Successor period November 4, 2016 through December 31, 2016, amortization of customer relationships was $3.9 million, or 3.5% of net revenue.

Amortization of customer relationships in the Successor period was significantly higher than in the Predecessor period primarily due to the higher fair value measurement at November 4, 2016 as a result of the Business Combination compared to the overall fair value of the customer relationships in the Predecessor period. There were no significant changes in the nature of the customer relationships, including overall useful lives in the comparative periods.

Impairment of Property and Equipment

For the Predecessor period January 1, 2016 through November 3, 2016, impairment of property and equipment was $7.3 million, or 1.2% of net revenue. During the Predecessor period, we closed multiple production lines at our Indianapolis, Indiana bakery, and transitioned production to other facilities.

There were no such impairments in the Successor period November 4, 2016 through December 31, 2016.

Loss on Sale/Abandonment of Property and Equipment and Bakery Shutdown Costs

For the Predecessor period January 1, 2016 through November 3, 2016, we recorded a charge for loss on sale/abandonment of property and bakery shutdown costs of $2.6 million, or 0.4% of net revenue, primarily due to utilities, insurance, taxes and maintenance expenses related to the Schiller Park, Illinois bakery.

For the Successor period November 4, 2016 through December 31, 2016, there were no such charges.

Business Combination Transaction Costs

For the Predecessor period January 1, 2016 through November 3, 2016, business combination transaction costs were $31.8 million, or 5.2% of net revenue. This consisted of professional and legal costs associated with the Business Combination, and transactional costs attributable to the acquisition of Superior in May 2016.

For the Successor period November 4, 2016 through December 31, 2016, there were no such charges.

Related Party Expenses

For the Predecessor period January 1, 2016 through November 3, 2016, related party expenses were $3.5 million, or 0.6% of net revenue. These amounts represent the normal annual cash payments associated with our employment arrangements with Mr. Metropoulos as Chief Executive Officer and/or Executive Chairman.

For the Successor period November 4, 2016 through December 31, 2016, the Company expensed $26.8 million, or 23.9% of net revenue, as a result of a grant of stock awarded to Mr. Metropoulos as required under his new employment arrangements.

Operating Income (Loss)

For the Predecessor period January 1, 2016 through November 3, 2016, total operating costs and expenses were $143.7 million, or 23.3% of net revenue, and operating income was $122.9 million, or 20.0% of net revenue.

For the Successor period November 4, 2016 through December 31, 2016, total operating costs and expenses were $48.3 million, or 43.1% of net revenue, and operating loss was $9.6 million or 8.6% of net revenue.

Operating loss for the Successor period was significantly impacted by the related party expense discussed above.

Interest Expense, net

For the Predecessor period January 1, 2016 through November 3, 2016, interest expense, net was $60.4 million, or 9.8% of net revenue. For the Successor period November 4, 2016 through December 31, 2016, interest expense, net was $6.6 million, or 5.9% of net revenue.

The lower interest expense in the Successor period is a result of the reduced applicable interest rates following the debt refinancing discussed below.

Gain on Debt Extinguishment

For the Successor period November 4, 2016 through December 31, 2016, in connection with the refinancing of existing debt with the new first lien term loan we recorded a net gain on a partial extinguishment of debt in the amount of $0.8 million. The gain consisted of the write-off of approximately $4.0 million of debt premium and deferred financing costs, partially offset by prepayment penalties of $3.0 million and the write-off of deferred financing costs of $0.2 million.

Other Expense

For the Predecessor period January 1, 2016 through November 3, 2016, other expense was $1.6 million, or 0.3% of net revenue. This consisted of professional and transactional costs for acquisition activity which has since been abandoned, partially offset by a gain from the settlement in connection with product recall matter with one of our suppliers of approximately $0.8 million.

For the Successor period November 4, 2016 through December 31, 2016, other expense was $0.8 million, or 0.7% of net revenue.

Income (Loss) Before Income Taxes

For the Predecessor period January 1, 2016 through November 3, 2016, income before income taxes was $60.9 million, or 9.9% of net revenue.

For the Successor period November 4, 2016 through December 31, 2016, loss before income taxes was $16.2 million or 14.5% of net revenue.

Income Tax Expense

For the Predecessor period January 1, 2016 through November 3, 2016, the Company was a series of limited liability companies and, therefore, had no tax expense or benefit, except insignificant amounts for Superior, a C corporation.

For the Successor period November 4, 2016 through December 31, 2016, income tax benefit was $7.8 million or 6.9% of net revenue. This represented an effective tax rate of 47.8% which exceeds the statutory rates primarily due to the reversal of a previously recorded valuation allowance.

Results for the Year Ended December 31, 2015 (Predecessor)

Net Revenue, Gross Profit and Cost of Goods Sold

Net revenue was $620.8$119.3 million for the year ended December 31, 2015, with cost of goods sold of $356.0 million, and gross profit of $264.9 million, excluding the impact of a $2.6 million special employee incentive compensation payment. Cost of goods sold was impacted by higher ingredient costs2021. Net income increased due to an outbreakhigher gross profits and the $33.0 million gain from receipt of avian influenza which led to reduced availability of eggs, which increased egg ingredient prices to record high levels.

Special Employee Incentive Compensation

Forinsurance proceeds under the year ended December 31, 2015, a special bonus payment was paid to employees at our bakery facilities as compensation for their effortsrepresentation and warranty insurance policy purchased in connection with the recapitalization of our Company of which $2.6 million was recorded on a separate line in our Consolidated Statements of Operations as a deduction from gross profit.

Operating Costs and Expenses

Advertising and Marketing

Advertising and marketing expenses were $32.0 million, selling expenses were $29.5 million, and general and administrative expenses were $31.5 millionVoortman acquisition for the year ended December 31, 2015.2022, partially offset by higher operating costs and higher interest expense.

Special Employee Incentive CompensationEarnings Per Share

For the year ended December 31, 2015, a special bonus payment of $1.3 millionOur earnings per Class A share was paid to corporate employees as compensation for their efforts in the recapitalization of the Company.

Amortization of Customer Relationships

Amortization of customer relationships was $0.9 million$1.20 (basic) and $1.19 (dilutive) for the year ended December 31, 2015.

Loss on Sale/Abandonment of Property2022, compared to $0.91 (basic) and Equipment and Bakery Shutdown Costs

For the year ended December 31, 2015, we incurred a loss on sale/abandonment of property and equipment and bakery shutdown costs of $4.2 million.

Related Party Expenses

Related party expenses were $4.3 million$0.86 (dilutive) for the year ended December 31, 2015. Mr. Metropoulos serves as our Executive Chairman and expenses associated with his employment agreements are recorded in related party expenses.

Operating Income (Loss)

For the year ended December 31, 2015, total operating costs and expenses were $106.3 million. Operating income was $155.9 million for the year ended December 31, 2015.

Interest Expense, net

Interest expense for the year ended December 31, 2015 was 50.0 million.

Loss on Debt Extinguishment

We extinguished the Term Loan dated April 9, 2013 (the “2013 Term Loan”) through early principal payments of $343.8 million and $150.0 million on August 3, 2015 and June 4, 2015, respectively. As part of this debt extinguishment and in accordance with its contractual terms, we expensed 2% prepayment penalties of $9.9 million, as well as $16.0 million of amortization to write-off the remaining deferred financing costs. For the year ended December 31, 2015, the total loss on debt extinguishment was $25.9 million.

Other Income

For the year ended December 31, 2015, other income consisted of $12.0 million of proceeds from the sale of foreign trademark rights and certain “know how” in certain countries in the Middle East, partially offset by $3.3 million for professional service fees related to the pursuit of potential sale transactions.

Income Taxes

For the year ended December 31, 2015, the Company was a series of limited partnerships and, therefore, had no income tax expense or benefit.

Supplemental Unaudited Pro Forma Combined Financial Information

For comparative purposes, we are presenting a supplemental unaudited pro forma combined statement of operations for the year ended December 31, 2016, and we discuss such pro forma combined results compared to the Successor’s full year 2017, and the Predecessor’s full year 2015 results below.

The unaudited pro forma combined statements of operations for the year ended December 31, 2016 presents our consolidated results of operations giving pro forma effect to the Business Combination as if it had occurred as of January 1, 2016. The pro forma combined adjustments are based on available information and upon assumptions that our management believes are reasonable in order to reflect, on a pro forma combined basis, the impact of these transactions on the historical financial information of our Predecessor and Successor entities, as applicable.

The Business Combination was accounted for using the acquisition method of accounting. The final fair values of the acquired assets and assumed liabilities as of the Closing Date, which are based on the consideration paid and our estimates and assumptions, are reflected herein. As explained in more detail in Note 2 in the accompanying Notes to the Consolidated Financial Statements, the total purchase price to acquire Hostess Holdings has been allocated to the assets acquired and assumed liabilities of Hostess Holdings, based upon the fair values at the Closing Date. We utilized third-party valuation specialists to assist our management in determining the fair values of the acquired assets and liabilities assumed. As of November 3, 2017, management determined that the allocation of the purchase price for the Business Combination is final.

The unaudited pro forma combined financial information contains a variety of adjustments, assumptions and estimates, is subject to numerous other uncertainties and the assumptions and adjustments as described in the accompanying notes hereto and should not be relied upon as being indicative of our results of operations had the Business Combination occurred on January 1, 2016. The unaudited pro forma combined financial information also does not project our results of operations for any future period or date. The unaudited pro forma combined financial information for the year ended December 31, 2016 includes results of the Superior acquisition and its related operations from May 10, 2016, the date of acquisition, through December 31, 2016. We evaluated the impact of the Superior acquisition on the Company’s financial statements and concluded that the impact was not significant and did not require nor separately warrant the inclusion of pro forma combined financial results assuming the acquisition of Superior at January 1, 2016 under applicable SEC rules and regulations or under GAAP. In addition, we evaluated the impact of the refinancing of existing debt pursuant to the New First Lien Term Loan, completed on November 18, 2016, and concluded that the impact was not significant and did not require nor separately warrant the inclusion of pro forma combined financial results assuming the completion of the refinancing on January 1, 2016. The pro forma combined adjustments give effect to the items identified in the pro forma combined table below in connection with the Business Combination.

Results of Operations

Comparison of Results of Operations for the Year Ended December 31, 2017 (Successor), Unaudited Pro Forma Combined Year Ended December 31, 2016, and the Year Ended December 31, 2015 (Predecessor)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Historical(i) | | | | | | | | |

| | 2017 | | 2016 | | | | 2016 | | | | 2015 |

(In thousands, except share and per share data) | Year Ended December 31 | | From November 4 through December 31 | | | From January 1 through November 3 | | Pro Forma Adjustments | | (Unaudited) Year Ended December 31 | | % of Net Revenues | | Year Ended December 31 |

| | (Successor) | | (Successor) | | | (Predecessor) | | | | Pro Forma

Combined | | | | (Predecessor) |

| Net revenue | $ | 776,188 |

| | $ | 111,998 |

| | | $ | 615,588 |

| | $ | — |

| | $ | 727,586 |

| | 100.0 | % | | 620,815 |

|

| Cost of goods sold | 449,290 |

| | 73,284 |

| | | 346,864 |

| | (8,541 | ) | ii | 411,607 |

| | 56.6 |

| | 355,963 |

|

| Special employee incentive compensation | — |

| | — |

| | | 2,195 |

| | (2,195 | ) | iii | — |

| | — |

| | 2,649 |

|

| Gross profit | 326,898 |

| | 38,714 |

| | | 266,529 |

| | 10,736 |

| | 315,979 |

| | 43.4 |

| | 262,203 |

|

| Operating costs and expenses: | | | | | | | | | | | | — |

| | |

| Advertising and marketing | 33,004 |

| | 5,245 |

| | | 30,626 |

| | — |

| | 35,871 |

| | 4.9 |

| | 31,967 |

|

| Selling expense | 32,086 |

| | 5,033 |

| | | 25,730 |

| | — |

| | 30,763 |

| | 4.2 |

| | 29,484 |

|

| General and administrative | 52,943 |

| | 7,322 |

| | | 38,391 |

| | (3,902 | ) | iv | 41,811 |

| | 5.7 |

| | 31,531 |

|

| Special employee incentive compensation | — |

| | — |

| | | 2,503 |

| | (2,503 | ) | iii | — |

| | — |

| | 1,274 |

|

| Amortization of customer relationships | 23,855 |

| | 3,922 |

| | | 1,185 |

| | 20,050 |

| v | 25,157 |

| | 3.5 |

| | 851 |

|

| Impairment on property and equipment | 1,003 |

| | — |

| | | 7,300 |

| | — |

| | 7,300 |

| | 1.0 |

| | 2,700 |

|

| Loss on sale/abandonment of property and equipment, and bakery shutdown costs (recoveries) | (144 | ) | | — |

| | | 2,551 |

| | — |

| | 2,551 |

| | 0.4 |

| | 4,182 |

|

| Business combination transaction costs | — |

| | — |

| | | 31,832 |

| | (31,257 | ) | vi | 575 |

| | 0.1 |

| | — |

|

| Related party expenses | 381 |

| | 26,799 |

| | | 3,539 |

| | (26,747 | ) | vii | 3,591 |

| | 0.5 |

| | 4,306 |

|

| Tax receivable agreement liability remeasurement | (50,222 | ) | | — |

| | | — |

| | — |

| | — |

| | — |

| | — |

|

| Total operating costs and expenses | 92,906 |

| | 48,321 |

| | | 143,657 |

| | (44,359 | ) | | 147,619 |

| | 20.3 |

| | 106,295 |

|

| Operating income | 233,992 |

| | (9,607 | ) | | | 122,872 |

| | 55,095 |

| | 168,360 |

| | 23.1 |

| | 155,908 |

|

| Other expense: | | | | | | | | | | | | — |

| | |

| Interest expense, net | 39,174 |

| | 6,649 |

| | | 60,384 |

| | (15,592 | ) | viii | 51,441 |

| | 7.1 |

| | 50,011 |

|

| Loss (gain) on modification of debt | 2,554 |

| | (763 | ) | | | — |

| | — |

| | (763 | ) | | (0.1 | ) | | 25,880 |

|

| Other expense | 1,360 |

| | 754 |

| | | 1,624 |

| | — |

| | 2,378 |

| | 0.3 |

| | (8,743 | ) |

| Total other expense | 43,088 |

| | 6,640 |

| | | 62,008 |

| | (15,592 | ) | | 53,056 |

| | 7.3 |

| | 67,148 |

|

| Income before income taxes | 190,904 |

| | (16,247 | ) | | | 60,864 |

| | 70,687 |

| | 115,304 |

| | 15.8 |

| | 88,760 |

|

| Income tax expense (benefit) | (67,204 | ) | | (7,762 | ) | | | 439 |

| | 40,185 |

| ix | 32,862 |

| | 4.5 |

| | — |

|

| Net income (loss) | 258,108 |

| | (8,485 | ) | | | 60,425 |

| | 30,502 |

| | 82,442 |

| | 11.3 |

| | 88,760 |

|

| Less: Net income attributable to the non-controlling interest | 34,211 |

| | (4,081 | ) | | | 3,214 |

| | 29,565 |

| x | 28,698 |

| | 3.9 |

| | 4,507 |

|

| Net income attributable to Class A shareholders | $ | 223,897 |

| | $ | (4,404 | ) | | | $ | 57,211 |

| | $ | 937 |

| | $ | 53,744 |

| | 7.4 | % | | $ | 84,253 |

|

| | | | | | | | | | | | | | | |

| Earnings per Class A share: | | | | | | | | | | | | | | |

| Basic | $ | 2.26 |

| | $ | (0.05 | ) | | | | | | | $ | 0.55 |

| | | | |

| Diluted | $ | 2.13 |

| | $ | (0.05 | ) | | | | | | | $ | 0.54 |

| | | | |

| | | | | | | | | | | | | | | |

| Weighted-average shares outstanding: | | | | | | | | | | | | | | |

| Basic | 99,109,629 |

| | 97,791,658 |

| | | | | (180,000 | ) | xi | 97,611,658 |

| | | | |

| Diluted | 105,307,293 |

| | 97,791,658 |

| | | | | 2,393,000 |

| xii | 100,184,658 |

| | | | |

| |

i. | The amounts in these columns represent the Successor’s and Predecessor’s historical results of operations for the periods reflected. |

| |

ii. | Approximately $8.9 million of this adjustment reflects the non-cash impact of the remeasurement of inventory at fair value as a result of the Business Combination. In addition, the adjustment reflects the incremental depreciation expense associated with the allocation of purchase price to property and equipment and is recorded in cost of goods sold. |

| |

iii. | For cost of goods sold, this adjustment represents special payments we made to certain employees at our bakery facilities of $2.2 million and for the operating costs this adjustment represents special payments to corporate employees of $2.5 million as compensation for their efforts in connection with the Business Combination. |

| |

iv. | Represents compensation for management profits interest plan of approximately $3.9 million that was recognized as part of the Business Combination. See Note 3 to the Consolidated Financial Statements for additional information. |

| |

v. | Represents additional amortization expense associated with the fair value recognized for customer relationships in connection with the Business Combination. |

| |

vi. | This adjustment consists primarily of legal and professional fees, and other costs associated with the Business Combination. |

| |

vii. | Represents non-cash expenses incurred by Successor for stock awarded to Mr. Metropoulos as required under his new employment arrangements. |

| |

viii. | Represents the reduction in interest expense due to the repayment of a portion of Hostess Holdings debt as part of the Business Combination. |

| |

ix. | Represents the effective income tax rate of 28.5% for the Successor, giving effect to the non-controlling interest, and not giving effect to the adjustment made to the valuation allowance on the Company’s historical deferred tax assets. |

| |

x. | Represents the elimination of historical income attributable to the non-controlling interest and attributes a portion of the pro forma income to the non-controlling interest created in the Business Combination. Income is allocated to the non-controlling interest based on its pro rata share of the total equity of Hostess Holdings. |

| |

xi. | This adjustment annualized the basic weighted average number of Class A shares outstanding. |

| |

xii. | This adjustment includes the dilutive impact of the outstanding warrants that are considered anti-dilutive on a historical basis. |

Results for the Year Ended December 31, 2017 compared to the Pro Forma Combined Year Ended December 31, 2016

Net Revenue

Net revenue was $776.2 million for the year ended December 31, 2017, compared to $727.6 million for the pro forma combined year ended December 31, 2016, an increase of 6.7%, or $48.6 million. Growth in net revenue for the year ended December 31, 2017 from current year new product initiatives was $62.5 million, led by Chocolate Cake Twinkies®, Golden Cupcakes, White Fudge Ding Dongs®, and Peanut Butter HoHo’s®. Additionally, there was an $11.9 million increase in net sales attributed to the acquisition of Superior in May 2016. These increases were offset primarily by a decrease in net revenue from 2016 product innovations and discontinued items.

Cost of Goods Sold and Gross Profit

Cost of goods sold for the year ended December 31, 2017 of $449.3 million represents an increase of $37.7 million, or 9.2%, from the pro forma combined cost of goods sold of $411.6 million for the year ended December 31, 2016. The increase for the year ended December 31, 2017 from the pro forma combined year ended December 31, 2016 is primarily attributed to higher shipping costs and increased sales volume.

Gross profit was $326.9 million for the year ended December 31, 2017, an increase of $10.9 million, or 3.5%, compared to pro forma gross profit of $316.0 million for the year ended December 31, 2016. The increase for the year ended December 31, 2017 from pro forma combined year ended December 31, 2016 was primarily attributed to an increase in sales.

Gross margin was 42.1% for the year ended December 31, 2017, compared to gross margin of 43.4% for the pro forma combined year ended December 31, 2016 . The decrease in margin for the year ended December 31, 2017 from pro forma combined gross margin for the year ended December 31, 2016 was primarily due to higher shipping costs which caused a 70 basis point decrease in gross margin. The decrease in margin was also attributed to a shift in our product mix due to higher growth in multi-pack, club-pack than other pack types, and additional In-Store Bakery sales.

Gross profit for the Sweet Baked Goods segment for the year ended December 31, 2017 was $316.9 million or 43.2% of net revenue, compared to gross profit of $309.8 million, or 44.2% of net revenue, for the pro forma combined year ended December 31, 2016. Gross margin decreased 120 basis points due to higher shipping costs. Gross margin was also affected by a shift in product mix due to higher growth in multi-pack sales than other pack types.

Gross profit for the In-Store Bakery segment for the year ended December 31, 2017 was $10.0 million, or 23.6% of net revenue, compared to pro forma combined gross profit of $6.1 million, or 23.0% of net revenue, for the year ended December 31, 2016. Gross profit increased primarily due to increased revenue.

Operating Costs and Expenses

Advertising and Marketing

Advertising and marketing expenses for the year ended December 31, 2017 of $33.0 million represent a decrease from pro forma combined advertising and marketing expenses of $35.9 million, or 8.0% for the year ended December 31, 2016 as a result of reduced permanent wire display deployment.

Selling Expense

Selling expense was $32.1 million, or 4.1% of revenue for the year ended December 31, 2017, compared to $30.8 million, or 4.2% of revenue on a pro forma combined basis for the year ended December 31, 2016.2021. The increase in selling expense is reflective of the increase in sales volume during the year.

Generalbasic and Administrative

General and administrative expenses for the year ended December 31, 2017 of $52.9 million represent an increase of $11.1 million, or 26.6%, over the pro forma combined general and administrative expenses of $41.8 million for the year ended December 31, 2016. The increase is attributed to increased non-cash share-based compensation of $7.4 million, additional professional and administrative costs of $3.5 million due to public company compliance, and a $2.0 million litigation settlement.

Amortization of Customer Relationships

Amortization of customer relationshipsdiluted earnings per share was $23.9 million for the year ended December 31, 2017, compared to pro forma combined customer relationships amortization of $25.2 million for the year ended December 31, 2016. For the year ended December 31, 2016 on a historical basis, amortization expense was based on the valuation of customer relationships acquired from Old HB Inc. in 2013. The amortization expense for the year ended December 31, 2017 and the year ended December 31, 2016 on a pro forma combined basis reflects the new valuation of the customer relationships acquired through the Business Combination.

Impairment, Loss on Sale/Abandonment of Property and Equipment, and Bakery Shutdown Costs

During the year ended December 31, 2017, an impairment loss of $1.0 million was recognized when we idled a production line in our Columbus, Georgia facility and transitioned the production to a third party. During the pro forma combined year ended December 31, 2016, we recorded an impairment of $7.3 million when we closed multiple production lines at the Indianapolis, Indiana bakery and transitioned production to other facilities in preparation to convert the bakery to a nut facility. In addition, we incurred a loss on sale/abandonment of property and equipment, and bakery shutdown costs of $2.6 million primarily due to utilities, insurance, taxes and maintenance expenses related to the Schiller Park, Illinois bakery.

Related Party Expenses

Related party expenses were $0.4 million for the year ended December 31, 2017 compared to pro forma combined expenses of $3.6 million for the year ended December 31, 2016. These expenses represent payments made to Mr. Metropoulos under the terms of his employment arrangements, which changed as part of the Business Combination.

Tax Receivable Agreement Liability Remeasurement

For the year ended December 31, 2017, we adjusted the value of the Tax Receivable Agreement due to a lower projected future cash tax savings rate as a result of the Tax Cuts and Jobs Act. This adjustment resulted in a gain of $51.8 million. A similar adjustment was made due to a change in a state tax law and resulted in a loss of $1.6 million.

Operating Income

The $65.6 million increase in operating income from pro forma combined operating income of $168.4 million for the year ended December 31, 2016 to $234.0 million for the year ended December 31, 2017 is primarily attributed to the gain on the remeasurement of the tax receivable agreement, higher sales volume, and lower impairment/abandonment costs.

Interest Expense, net

Our interest expense decreased $12.3 million from $51.4 million for the pro forma combined year ended December 31, 2016 to $39.2 million for the year ended December 31, 2017 primarily due to the pay down of our Second Lien Term Loan in November 2016, and three repricing transactions between November of 2016 and November of 2017 which collectively reduced the effective interest rate on our first lien term loan by 1.25%.net income impacts noted above.

Loss on Modification of debt

During the year ended December 31, 2017, we recognized $2.6 million of losses related to the repricing transactions on our first lien term loan, of which $1.6 million was attributed to previously capitalized charges. See Note 1- “Summary of Significant Accounting Policies” to the consolidated financial statements included in Part II, Item 8 of this Annual Report on Form 10-K.RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

Income Taxes

The income tax benefit of $67.2 million for the year ended December 31, 2017 includes a benefit of approximately $126.4 million due to a revaluation of our deferred tax liability to reflect lower future U.S. corporate income tax rates caused by the Tax Cuts and Jobs Act (“Tax Reform”). This benefit was partially offset by a tax expense of $15.1 million due to the remeasurement of the tax receivable agreement also due to Tax Reform. The tax provision also includes a $1.7 million expense caused by a change in state tax rates. The remaining tax expense of $42.4 million represents an effective tax rate of 30.1%, giving effect to the non-controlling interest, a partnership for income tax purposes and excluding the impact of the remeasurement of the tax receivable agreement. Income tax expense for the pro forma combined year ended December 31, 2016 was $32.9 million, representing an effective tax rate of 28.5%. After accounting for tax law changes, our effective tax rate for 2017 was higher than the pro forma combined 2016 due to a higher statutory rate for one of the states in which we operate.

Results of Operations for the Pro Forma Combined Year Ended December 31, 2016 compared to the Year Ended December 31, 2015 (Predecessor)

Net Revenue

Net revenue increased $106.8 million, or 17.2%, to $727.6 million, for the pro forma combined year ended December 31, 2016, compared to $620.8 million for the year ended December 31, 2015, primarily due to new product launches in 2016 of $44.0 million and contribution of Superior net revenue of $26.7 million from the date of its acquisition. New products in 2016 included Deep Fried Twinkies®, Hostess Sweet Shop™ brownies, plus the relaunch of Suzy Qs®

Cost of Goods Sold and Gross Profit

Cost of goods sold increased $55.6 million, to $411.6 million, for the pro forma combined year ended December 31, 2016, compared to $356.0 million, for the year ended December 31, 2015, primarily due to the increase in volume.

As a percentage of net revenue, pro forma combined cost of goods sold was 56.6%, compared to 57.3% of net revenue for the year ended December 31, 2015. The decrease in cost of goods sold from the year ended December 31, 2015 to the pro forma combined for the year ended December 31, 2016, is primarily due to higher ingredient costs in 2015. An outbreak of avian influenza in 2015 led to reduced availability of eggs, which increased egg ingredient prices to record high levels.

Pro Forma combinedAdjusted gross profit, was $316.0 million for the year ended December 31, 2016, compared to $262.2 million for the year ended December 31, 2015.

Gross margin was 43.4% for the pro forma combined year ended December 31, 2016, compared to historicaladjusted gross margin, of 42.2% for the year ended December 31, 2015. The increase in gross profit was driven primarily by commodity cost decreases and improved bakery costs.

Operating Costs and Expenses

Advertising and Marketing

Advertising and marketing expenses for the year increased 12.2% on a pro forma combined basis for the year ended December 31, 2016, to $35.9 million, compared to $32.0 million for the year ended December 31, 2015. The increase was primarily attributable to planned expansion of field marketing activities.

Selling Expense

Selling expense increased $1.3 million, or 4.3%, to $30.8 million, during the pro forma combined year ended December 31, 2016, compared to $29.5 million for the year ended December 31, 2015, primarily due to increases in sales management expense and broker fees.

General and Administrative

General and administrative expenses increased 32.6%, to $41.8 million, on a pro forma combined basis for the year ended December 31, 2016, compared to $31.5 million for the year ended December 31, 2015. The increase is primarily due to increased incentive compensation related to improvedadjusted operating performance and the addition of Superior’s operations.

Special Employee Incentive Compensation

A special bonus payment of $1.3 million was paid during the year ended December 31, 2015 to corporate employees as compensation for their efforts in the recapitalization of the Company. There was no special employee incentive compensation for the pro forma combined year ended December 31, 2016.

Amortization of Customer Relationships